Up-island update

A year ago I wrote an article on the market up-island, showing that the ramp up in activitity and prices that we were seeing in Victoria was also being reflected in markets right up to Campbell River and beyond. What has happened in the ensuing 12 months? Is there any sign of a slowdown in activity? Let’s take a look.

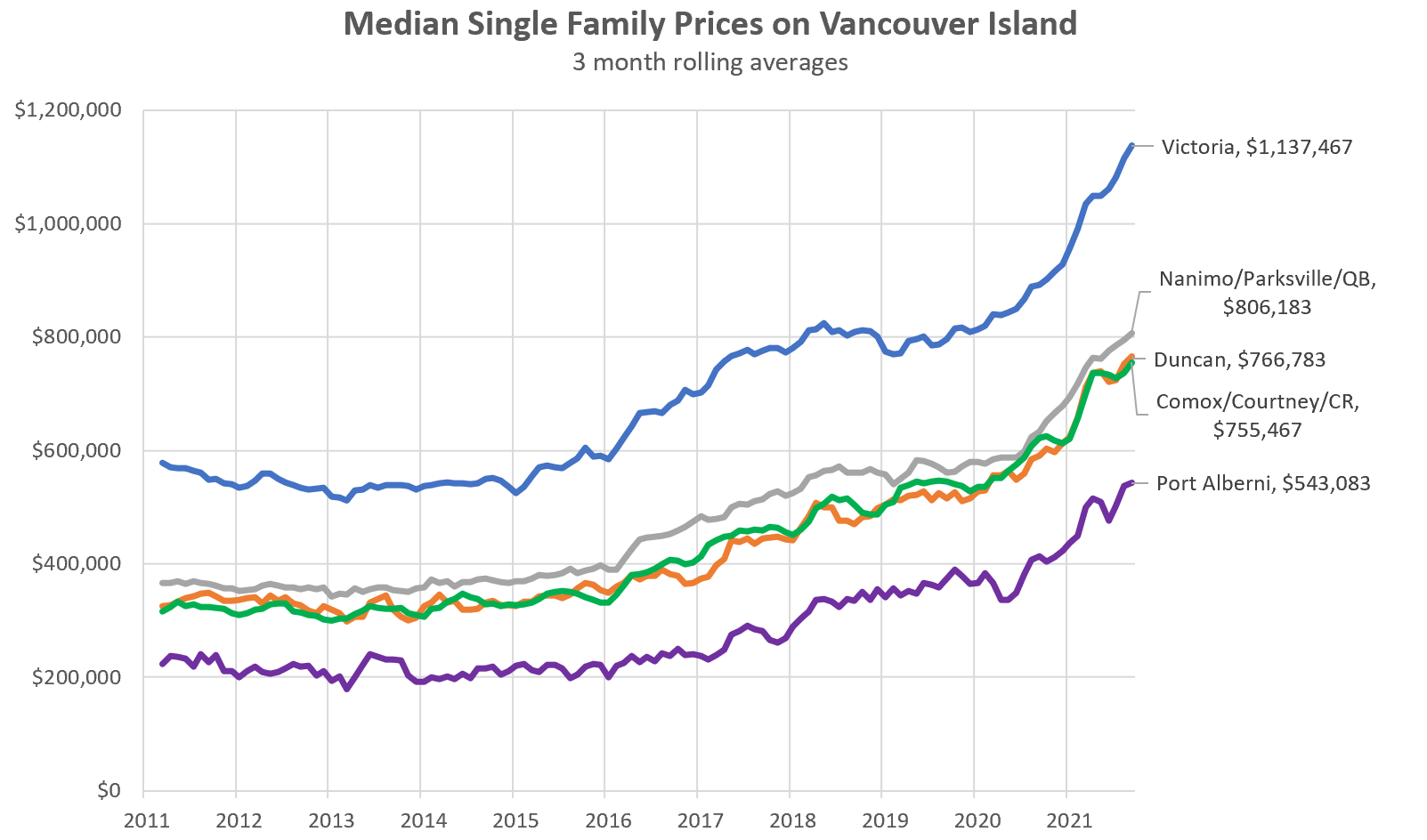

In the last 12 months, prices have exploded upwards in every single market on the island, with the 3 month rolling average up around 25-30% across the board. The cheapest market, Port Alberni, was up the most at +31%.

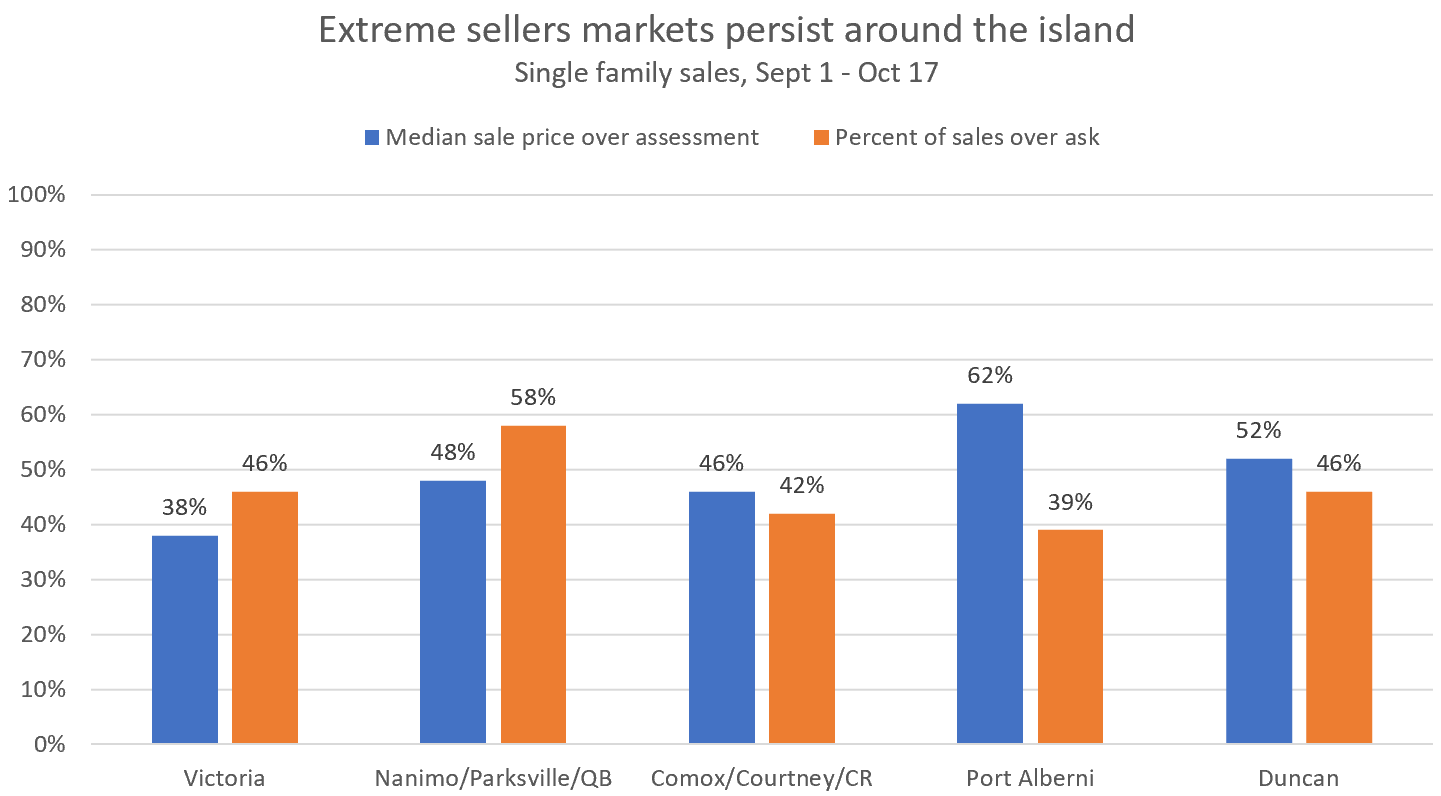

Looking at market conditions, there is also no hint of a significant pullback in activity in any market as of September, with months of inventory between 1 and 2 everywhere, at or close to the lows from March. For buyers, conditions remain extremely competitive in every market, with shockingly high average sales to assessment ratios of over 50% in some markets.

With those market conditions, expect more price gains to come.

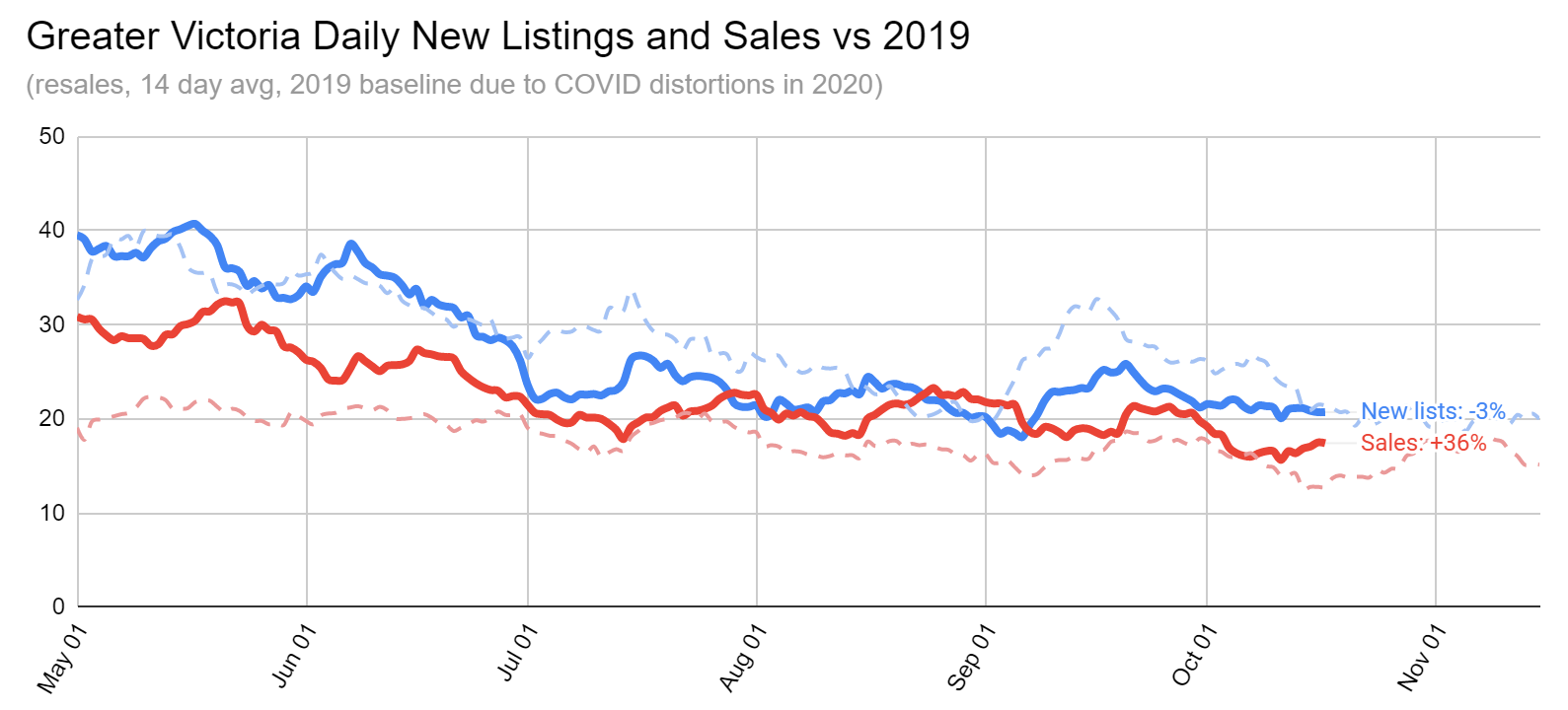

The same conditions continue in Victoria, with no change in the frenetic market last week.

| October 2021 |

Oct

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 220 | 389 | 990 | ||

| New Listings | 288 | 480 | 1162 | ||

| Active Listings | 1130 | 1109 | 2122 | ||

| Sales to New Listings | 76% | 81% | 85% | ||

| Sales YoY Change | -31% | -27% | |||

| Months of Inventory | 2.1 | ||||

The 2 week average of new listings matched the 2019 pace for the first time in 6 weeks, but the additional listings were immediately absorbed. We are now past the end of the fall listings period, so it’s likely to get worse from here on out. Already inventory is dropping week to week.

On another topic, CMHC’s Housing Market Assessments have been back in the news, and the big change for Victoria was that we got a “green” rating for overvaluation. In other words CMHC says that despite some of the largest price gains in Victoria’s history, there is no evidence of overvaluation (meanwhile some of the cheapest markets in the country are apparently highly overvalued). How can that finding be explained? Well I dug through every report they’ve released and assembled the history of their assessments vs prices for the last 5 years. The full article is in the Capital.

Apparently prices were highly overvalued in 2018 at $800k, but not at all overvalued today at $1.1M. I’ve written lots of articles criticizing the analysis in CMHC housing market assessments in the past, so this is just another one to add to the pile. To be very clear, it’s not that their current assessment is necessarily wrong (I agree there is almost no chance of price declines in the near term, and affordability is not in bubble territory), but it’s also clear that these reports don’t have any predictive value. No one has a crystal ball certainly not me, but I think we should expect better from our national housing agency in terms of transparency. Given how much media traction these reports get, the CMHC should at the very least be transparent about the data they use, publish the models themselves, and the backtests that validate them. Otherwise the reports aren’t worth the PDFs they’re written on.

Yup, a frequent occurance at my showings is my clients run into their friends/colleagues/acquaintances viewing the same house before or after us….but it’s the foreigns driving prices up.

Tsk tsk …. um really. Commendable amount of savings. Much respect. But little respect for deeming all recipients from the bank of mom a ‘lazy loser’. I get the angst but certainly shouldn’t be generalized.

Starting page 104 https://www.langford.ca/wp-content/uploads/2021/10/20211018-Special-Agenda-Package-2.pdf

It was 1365, my mistake.

That has a much bigger actual impact then diversionary blaming of the drug money, money laundering schemes and xenophobic foreigner blaming impact combined. When it comes down to it, we only have ourselves to blame for the market inflation by borrowing too much and the family cash gifts. I guess I never stood a chance by saving $200k on my own for a down payment when every lazy loser is just cashing out from mommy and daddy to buy a home.

Where do I find the full application?

CIBC says Vancouver homebuyers receive average of $340,000 gift from mom and dad for property purchase

https://www.straight.com/news/cibc-says-vancouver-homebuyers-receive-average-of-340000-gift-from-mom-and-dad-for-property

Remember when Langford bid to be Amazon’s HQ2?

🙂

Makes sense from a headlines perspective. $12k/unit is nothing and they can claim their 250 ppl helped.

Hard to say it’s bad per se, but it’s sort of like their plan to administer a few dozen COVID tests early in the pandemic. The people getting tested probably appreciated it but it’s not exactly a useful program in the grand scheme of things.

When I said the other development was right on the highway, it is but elevated on a rock outcrop, a bit set back, and the highway facing units are south.

I think this is the only location where 450k for 850 sq/ft would actually be market value. 6 lanes of highway with a crawl all summer long heading north. Literally right on the highway. Eye level with highway. Highway units facing due north. A good way to sell the backside of the building and some free publicity for Stew.

Front south side of the building facing the lake won’t be part of the program.

This is all a non-sense publicity stunt imo, but in general I don’t mind Stew.

1395 Goldstream rezoning application in Langford:

“As part of the PSA for the disposition of the property, the proponent has committing to providing 30% of

the units (which would be 31 of the current 102-unit proposal) towards the City’s Attainable Home

Ownership Program”

So I guess that’s some of the units

They are setting aside $3M for up to 250 families, so that is $12,000 per family. They are counting on most people being in the highest income bracket and thus getting only the 25% down.

“Because they want to stay on Stew’s good side”

I personally think it’s more about publicity for him. Look at how many headlines it’s generated under the theme of “Stew Young saves the day again with his no nonsense approach” even though nothing will actually come of it. He’s a master at getting headlines like this. Can’t believe how much I’ve seen it in the news and especially on any housing related Facebook groups. Good job Langford. This is a good indication he’ll run again in the next election.

Because they want to stay on Stews good side

$1.34M. A very rare substantial under ask sale

Sold price for 1883 hillcrest ave? Thanks!

Welcome to the new normal… $50,000 per year for a dishwasher, no experience or education needed. https://nationalpost.com/news/canada/vancouver-restaurant-facing-worker-shortage-resorts-to-paying-50000-salary-for-dishwasher-position

Vancouver Island teacher salary, starting at $51,000 https://sd84.bc.ca/wp-content/uploads/2021/03/SD84-July-2021-Salary-Grid.pdf

When we bought our place back in 2016, sellers had done a pre-inspection report, which stated that there was no asbestos, and that they had even done testing in attic for vermiculite. I didn’t believe them, given the age and condition of the house, and hired my own asbestos inspector, who found 30 odd different materials with asbestos in it. She didn’t bother testing attic insulation because it was so obvious to her visually that it had asbestos.

The seller inspector also said that the electrical was fine, when we were pretty sure that it wasn’t the case. When we did open up the walls, we found that most circuits had been connected into live knob and tube.

Thankfully, this was in an era when you could still do conditional offers- we bought the place, but felt much better knowing what we were getting into.

We had zero surprises, and 150k later, it’s a great house.

Does anyone know the cost of a high quality custom new build these days ?

Around 700 per sq, or closer to a thousand?

Why would you do this if you can sell out the project at 500k+?

When the market was slower developer thought about things like no PTT up to 750k, etc. Now no need to think about it, everything sells.

Thanks for the up-Island analysis. We left Victoria for greener pastures in 2019 and picked exactly the right time. We couldn’t afford to get in now. I have mixed feelings about this, because I imagine people like us are what’s driving the boom in the central Island region. When people are priced out here where will they go?

SD62 predicted 400-450 new students this year.

It was actually 827, the biggest increase in 30 years.

Record student growth in Sooke School District brings plans for more schools

https://www.timescolonist.com/news/local/record-student-growth-in-sooke-school-district-brings-plans-for-more-schools-1.24365724

Yes you are correct. And like you I looked at some sales/pre-sales and it seems the prices are already above $450k for this product.

So either:

What you can do is apply for the VREB RETS data feed. transactional level data back to 1990. $500/year. All you need to do is convince them you are creating/have a product that has at least one Realtor client at the board. Feel free to send me an email if you like we can chat about it.

Did 309 Bella sell or get removed, a lot of turnover in that area considering the new homeless shelter being built across the road. Crime in vic west has been pretty brutal as of late. Cops called several times on some methed out people trying to break into the church on Raynor. Not to mention the cops getting beat up in bamfield park.

Thanks Leo,

I am not into trading the properties just the data sets. There are so much values in the data sets and it’s sounds like well protected by the boards. I asked around about joining a brokerage , it seems there is a heft fee to pay upfront and write an exam for it… I wonder if there is way to have access to those data without paying the start up costs/. Or a small fee or pay per click fee to exchange the data…. just a wild guess…

I haven’t bothered reading up on it as the product to qualify doesn’t exist, maybe I am misreading something?

“This pilot program provides down payment assistance to families to help them purchase a two-bedroom condo in participating new developments that have a purchase price of no more than $450,000…Each unit will be comprised of the following:

875 sq. ft. – 950 ft2

Minimum of two 10 ft by 10 ft bedrooms excluding the closet;

One bathroom”

This pre-sale on the TransCanada Highway is 519k – https://www.realtor.ca/real-estate/23478288/305-958-pharoah-mews-langford-florence-lake

Anything not on the highway will be more expensive, not less.

Most often, but I’ve also seen it backfire where the inspection discovers a bunch of issues that surpress the price; whereas, without the pre-inspection you may have had unconditional buyers going higher not building the issues into their offer.

I have enough construction and life experience to know quality from garbage when it comes to home inspectors. I’ve been at inspections where I am explaining to the inspector had the sump pump works 🙂

I also know all their angles as well. For example, you have inspectors that cater to agent recommendations; therefore, they sugar coat problems to increase the probability of the transaction going through (make things easier for the agent). This leads to more referrals from the agent. However, to absolve themselves of liability they list the problems in the report.

Others caters to word of mouth from buyers and blow things completely out of proportion/context to show their value to the buyer. “Our inspector saved us from buying a complete disaster,” when everything in their budget is a complex disaster.

I always recommend the best inspector(s) to my clients as my long-term end game is that buyer calls me to re-sell the house down the road. If they move in and discover a bunch of problems because I recommended a crappy inspector, they are probably not calling me back to re-sell.

Conclusion, hire an agent that has enough tangible skills to be able to identify and recommend a quality home inspector and is ethical enough that they won’t suggest the sugar coating inspector to make their life easier.

Seller paying for an inspection. Totally agree with Marko that it’s in the buyer’s interest to do their own due diligence. However, from the seller’s side I believe it’s a good strategy as it may put some buyers more at ease. Also from the buyer’s side while it’s not as good as having your own inspection, given the choice between a no-inspection offer and one that has a seller’s inspection report, I would lean towards the one that has the report. Sure maybe some problems might be consciously or subconsciously minimized, but what are the chances that the house has a massive serious problem that the seller’s inspector covered up or missed? Very small, and if that was the case you might have recourse to go after them. Though the seller and the inspector will try to absolve themselves of liability, that is no excuse for negligence or fraud.

Found ’em! It’s okay everyone… we’ve found the one!

Your point about who’s paying for the inspection is a good one.

However, you say that, like doctors and lawyers, there are better and worse home inspectors. But how does one know that they’ve hired a quality home inspector?

I mean, you’re always making fun of people who hire realtors based on a recommendation from a neighbour or a fellow parent on your kid’s hockey team. But don’t most people find a home inspector in a similar way?

Or I bet many just use the inspector their buying agent recommends (and who knows how skilled and motivated to find problems that inspector is).

@josh I used CoEfficient Building Science – they’re Nanaimo-based but are ramping up their south island presence. I called them in August and got my initial assessment done in 3 weeks. Highly recommended. https://www.coeff.ca/

Marko what are your thoughts on the Langford program? https://www.langford.ca/residents/welcomehome/

Yes, fairly common but I am not a huge fan primarily due to massive discrepecny in skill/knowledge between inspectors. I made a video about it last year -> https://www.youtube.com/watch?v=3iXn2co78JM

I also believe in conscious or unconscious payment bias.

Is this happening much in the Victoria market — sellers buying pre-listing inspections and offering the reports to prospective buyers?

https://docdro.id/e6fw8Mn

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-amid-bidding-wars-buyers-are-omitting-home-inspections-heres-why-thats/?ref=premium

Only for members of the VREB or VIREB.

If your search is somewhat reasonable I can set you up to see the pending sales for properties anywhere on the island just send me an email. Searches are limited to 350 results so would have to be a specific search, not just all properties.

Hard to say. The additional capital may allow more construction if existing owners can sell off to Addy and invest in a new build.

Last sold $169k in 1996. No bites at $975k.

Marketed as an investment property but I wonder what that would rent for. $2500?

is there a way to have access to vancouverislandmls.com? I am so into the data world and like to keep track on the sold history? Any broker that offers that kind of services for non-realtors? sorry, just a dumb question and I hate to bug the realtor friend every time I email him and I feel a little guilty not buying but asking for something for free but it is not free for him( his time and attention). Thank you

What helps renters is building more rentals. Speculative ownership schemes outbidding prospective owner-occupiers of individually titled properties benefit neither prospective owners nor renters.

Anyone been watching 309 Bella? I’m wondering who the buyer would be for this micro house/property vs a condo at that price?

Seems fixed. Thanks!

Hmm. Seems like a bug in the latest comments plugin. Can’t reproduce here but may be fixed now.

This was fixed by the way

Leo, FYI, when I tried to post just now, it said “Nonce is invalid” and it wouldn’t let me post (Chrome browser on desktop). I’m posting these using Microsoft Edge. Can you please look into this? Thanks.

My bad!

Going through it right now, and it’s painful.

I’m booked in with Mark Bernhardt later this month. City Green isn’t taking any applications (not even answering their phone). I got replies from Method and one other place I can’t remember the name of now…

I applied in June and am not yet approved.

Has anyone gone through the Greener Homes Grant? I’m looking for a recommended EnerGuide service organization.

Not saying it is the case here, but this is a way to avoid the vacancy tax as well. “Recently acquired” is an exemption to the spec tax.

Granted a very expensive and not really sensible way to avoid the tax since the PTT is more than the spec tax.

Not according to the MLS listing:

$2,499,000

2505 Cotswold Rd

Oak Bay, British Columbia V8R3S3

I think you are not looking at the correct date, it sold this February for $2,350,000 now asking $2,499,000. https://www.realtor.ca/real-estate/23757792/2505-cotswold-rd-oak-bay-uplands

Hmm. According to the sales history via BC Assessment, the sellers are asking $455K below what they paid for it:

2505 Cotswold Road on the market again. This has been flipped 3 times since 2019 and now it is up for the forth time just $150,000 profit on the table this time. Anyone who thinks this kind of speculation should go unnoticed are supporting the system that is depriving so many young families of establishing themselves for the future.

$811,000

More investment in rental properties will help renters. I’m not seeing anything wrong with that.

https://www.theglobeandmail.com/investing/personal-finance/young-money/article-fractional-real-estate-investing-gets-young-people-into-the-property/

Not to be confused with REIT’s, where you buy a share in a trust that owns a broad portfolio of multi-unit rentals that are held long term. These “fractional ownership” schemes bid up the price of individually titled properties and focus on capital gains rather then rental income. In other words they’re speculative. Government can and should discourage these through tax policy.

1120 Rock St. List 699000 sold ? Leo and Marko thanks for answering my previous enquires

cheers

Leo, thanks for the up island update!

Mixed use lego developments on every lot!

Saw this and it made me think of Leo. WTF is wrong with me? LOL.

Stock markets have public bid and ask and no “list price” at all, nor do brokers have anything to do with setting the sale price. Perhaps a model to emulate. 🙂

Depends. I think there is a case to be made that an engineered bidding war does not provide the conditions necessary for buyers to be sufficiently informed to determine a market value.

Sale and offering of financial assets are highly regulated, I could imagine that there will be more regulations in place for selling property as well at some point to ensure an even playing field.

Maybe you have to ask the question. Can the US Fed reserve afford to goosed the energy market at the moment, because we tend to track the US polices?

Thanks Deb. I realize that the question itself seems loaded, so thanks for this.

“The cost of just about everything that Statistics Canada measures was more expensive in September, pushing headline inflation to its highest in almost two decades and complicating the Bank of Canada’s plans to keep interest rates pinned near zero until well into 2022.

Statistics Canada’s consumer price index (CPI) increased 4.4 per cent from September 2020, the biggest year-over-year increase since the CPI surged to 4.7 per cent in February 2003. The index rose 0.2 per cent from August, matching the previous monthly increase, as prices rose in every major component that the agency watches, led by outsized gains in the cost of transportation and shelter. Food prices also exerted considerable upward pressure on the headline number.”

https://financialpost.com/news/economy/canadas-annual-inflation-rate-hits-4-4-in-september-highest-since-2003

There are currently a grand total of zero new or used condos available for under $450k in Langford. I guess Langford has leaned on them to offer some in new builds?

Ex-CMHC economist got in touch with me “What they won’t admit is the reason it’s green today is because it went red in 2016 and nothing happened. So when they re-estimate the models the following years the models just say “this is normal for this market”

Which I’m not necessarily saying is a bad take, but I’ve never heard an admission from the CMHC that the methodology between housing market assessment reports changes drastically and the old values are useless. And if high prices and strong gains are normal for some markets, then what would ever cause it to go red?

Langford launches fund to help young families buy condos

Langford is tapping into its Affordable Housing Reserve Fund to provide partial downpayments for Langford residents to buy their first homes.

https://www.timescolonist.com/news/local/langford-launches-fund-to-help-young-families-buy-condos-1.24364863

Man, I just finished watching Squid Game but I found the CMHC’s Housing Market Assessment for Victoria more disturbing.

Except they’re not, and you said so yourself. Interest rates are not going down. At best.

That policy would seem to be contrary to the best interests of buyers and sellers, who are entitled between them to determine the selling price. The realtor could face pressure to arrange a sale price below or above market as the case may be, simply to avoid going too far from the list price.

My hunch is that interest rates will go up a little in the next few quarters or stay flat, but not down.

What more important is that housing price is likely to keep on ascending till it double the 2019 price. If all metrics are equal, based on historical trend of money supply and doubling of price every 10 years in Victoria.

The government has printed more money in the last 18 months than a decade previous to 2019, thus SFH in Victoria will likely hit an average of $1.5 million in the near future. And we won’t see a dip or flat line till the market exhaust the money supply.

Quite quickly. I’m torn on where interest rates are going. My baseline assumption is flat for quite some time, but inflation is running hotter for longer than I think most expected. I’ll take a look at the impact on affordability in a future post for various scenarios.

Here’s a comment from someone that was a local realtor for 22 years.

“The VREB used to have a rule that if you listed a home, and it sold for either 10% more, or 10% less than the list price, you could be brought up before the professional conduct committee.”

Pretty interesting policy. It would certainly cut down on engineered bidding wars.

Also in the Times Colonist the following, if you read to the bottom it is clear the First Nations were misled by Douglas.

https://www.timescolonist.com/islander/lost-in-translation-the-douglas-treaties-1.10099656

Here’s the problem James. The First Nations leaders were asked to sign blank documents that were later filled in. The promises vocalised at the time were omitted. Please see attached:

https://temexw.org/moderntreaties/douglas-treaties/

Keep in mind these have distinct governance issues. Jericho Lands is a joint venture by Canada Lands (crown corporation) and three FNs. It is subject to the normal CIty of Vancouver planning process. The same joint venture is also responsible for developing other Federal properties in the City. On the other hand the Burrard St. development is on the restored Kitsilano Indian Reserve (Burrard band I think or whatever it’s called now) and like other IRs it’s not under city jurisdiction. Nothing happening on it yet though as far as I know.

It’s my understanding that the Douglas Treaties make it a lot more complicated than in the rest of BC (where it’s still complicated.) That being said, the Esquimalt are definitely claiming Work Point:

https://www.timescolonist.com/news/local/esquimalt-first-nation-claims-land-water-1.2169194

It’s my understanding that the Douglas Treaties were regularly not followed when it suited the Government of BC a century ago. So yes, might be ceded, but they still probably have some claim to the lands. Honestly, with what is happening to the Jericho Lands and near Burrard St. bridge in Vancouver, this might be a good thing.

Here’s a portion of what the CRD has to say about the Douglas Treaties:

The terms of the Douglas Treaty are hotly debated to this day, with some contending the treaty was a land purchase and long-term use agreement, while others argue the treaty was a peace accord.

For historic, legal, economic, moral and practical reasons, the Province of British Columbia and the Government of Canada began a modern day treaty making process in 1990. It is an interest-based negotiation process which seeks to establish certainty over lands where First Nations claim title.

https://www.crd.bc.ca/project/first-nations-relations/treaties

“Port Alberni median $543K? Would that be this Port Alberni?”

Aside from a few areas that look like Detroit, Port’s really not that bad a town. I couldn’t handle the 100 inches of rainfall per year, but it’s a good spot if you’re into the outdoors. Hottest summers on Vancouver Island too.

Seems to me it’s today’s counterpart to the Lord’s Prayer we had to recite at school.

This is the part I don’t understand about the attributions that we’re supposed to make in our emails or before meetings. Everyone says unceded, but then I actually read the Douglas Treaties, and it was all ceded. No one will ever like you for bringing it up, but the whole thing reeks of the Glorious Loyalty Oath Crusades.

At this point it’s looking like 3 rate hikes in 2022. At what point does the interest rates increasing change that assessment?

Port Alberni median $543K? Would that be this Port Alberni?

https://www.theglobeandmail.com/canada/article-port-alberni-vs-that-ogre-on-the-river-a-new-approach-to-the-opioid/

That’s odd. Thanks for the heads up, looking into it.

Housing density to increase across New Zealand under rare bipartisan solution – https://www.rnz.co.nz/news/political/453824/housing-density-to-increase-across-new-zealand-under-rare-bipartisan-solution

“It includes new intensification rules allowing up to three homes three storeys high to be built on most sites without resource consent, a change from district plans which typically only allow for one home of up to two storeys.”

So if memory serves, since the pandemic started pushing their house prices up the government has:

1.) Added house price affordability to Central Bank mandate

2.) Increased down payment requirement on investor properties (to 40%).

3.) Eliminated interest write offs on rental properties

4.) Increased interest rates (central bank rate from 0.25 to 0.50)

5.) Now changed zoning laws to allow for more density.

Meanwhile our liberals have… Voted against banning foreign buyers when the conservatives brought it up for a vote in the house and then thought it was a good plan a few months later and ran it as one of their campaign promises.

Hopefully the changes will have meaningful impacts on affordability and other countries can use it as a guide.

off the topic, the “Tool” on top seems require me to sign in to access it, and I have already signed in.. Looking for a rent and hold analysis… Thanks Leo

Wow! “Otherwise the reports aren’t worth the PDFs they’re written on” haha nicely worded!