Strata insurance hikes: nothingburger or crisis?

Strata insurance hikes have been in the news for a couple years now, with stories of devastating insurance hikes causing individual projects to rapidly hike strata fees. The cause of the crisis have been speculated on for just as long. Is it badly maintained buildings? Irresponsible owners? Shoddy construction? Climate change? Greedy insurance companies? There’ve been lots of theories and speculation but little evidence in most of the coverage of this issue.

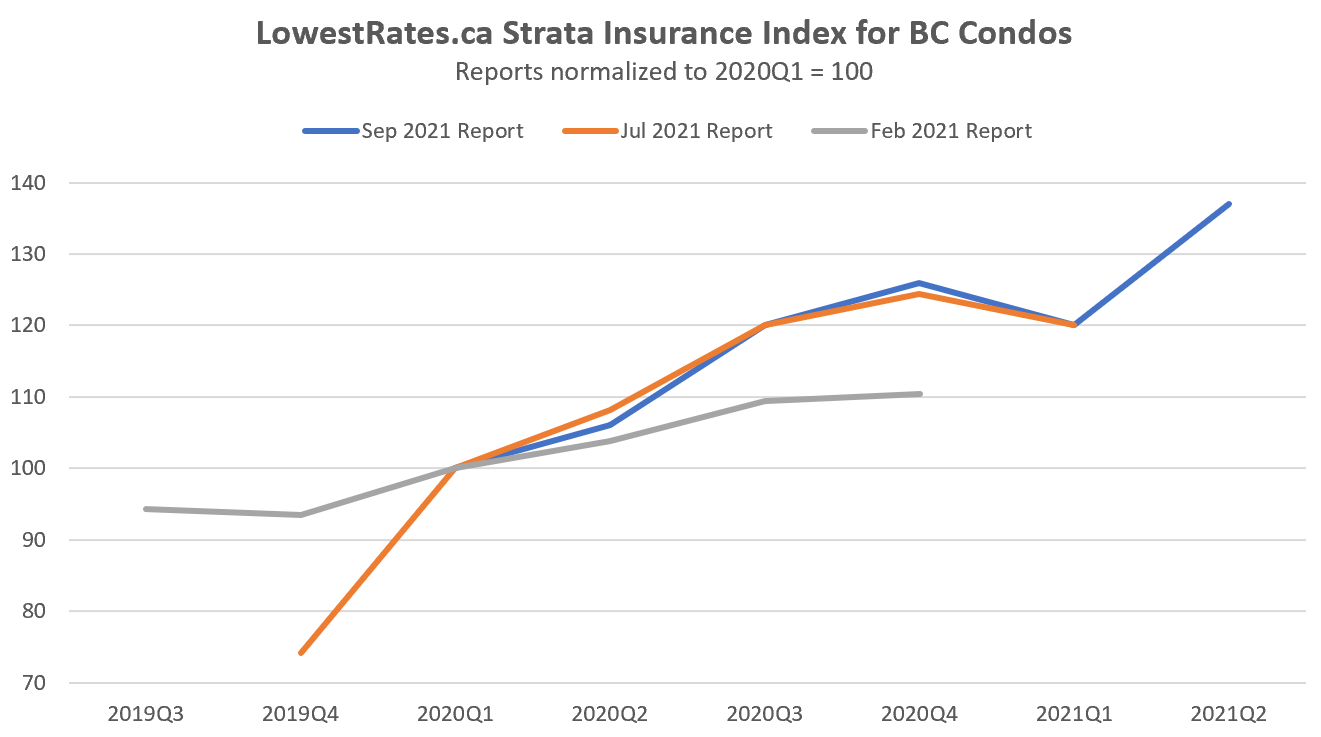

Other than anecdotes about large increases, several stories have cited insurance data from lowestrates.ca which released three reports in 2021 computing a strata insurance “index” purportedly computed from thousands of insurance quotes requested through that site. What’s not been mentioned by those citing it is that there’s some reason to doubt the index, given that they change the baseline quarter every time, and the index computed in the first report shows completely different data than the other two. I’ve combined the three to show this in the chart below. Grain of salt in hand, the two most recent reports agree that there was a 20% increase in strata insurance between the first quarter of 2021 and 2020, and perhaps as much as an 85% increase from the last quarter of 2019 to the second quarter of 2021.

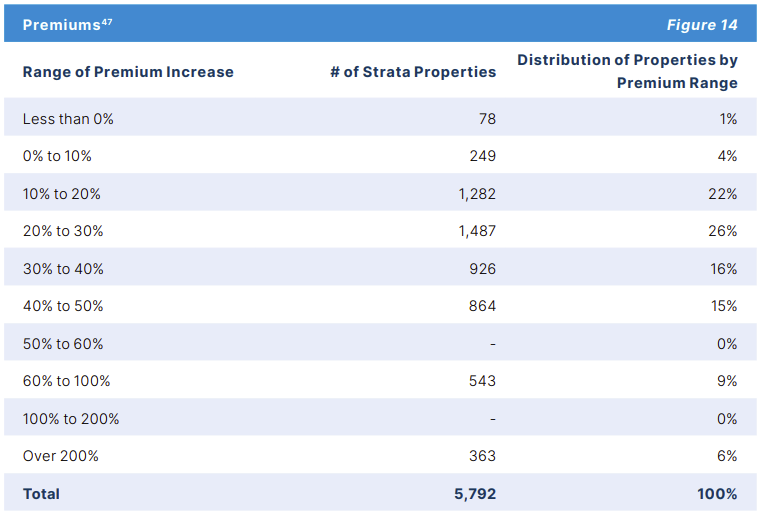

Perhaps more reliably, the BC Financial Services Authority released a report last December containing data on year over year insurance increases from the Canadian Council of Insurance Regulators. That analysis showed that the median strata experienced an increase in insurance premiums of about 30% by early 2020, and if the data about is correct, they may have seen another 30% the following year.

From their data, that ~30% increase translated to about an extra $15/month for the median unit in the data set, so add another $15 to that from 2020 to 2021 and we might be looking at around an extra $360/year in insurance for the typical condo unit.

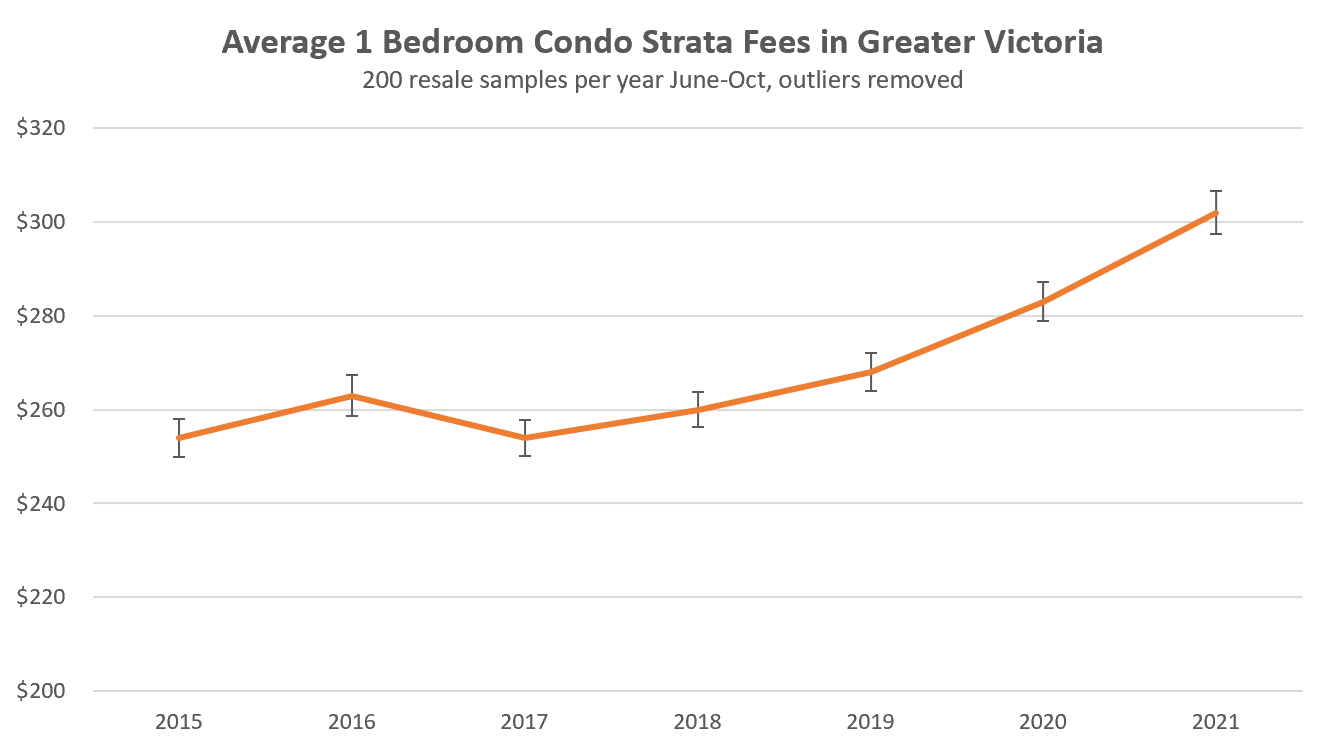

To sanity check that, let’s take a look at strata fees in Victoria and see how they’ve changed in response to the hike in insurance costs. To reduce variability from unit types, I looked at a sample of 200 one bedroom condo sales in each of the last 6 years to get a sense of where average strata fees have gone.

After little change from 2015 to 2018, average strata fees have indeed turned upwards in recent years, increasing by $15/month in 2020 and $19/month in 2021 which is in line with estimates of insurance hikes in that time.

What does it mean for condo buyers?

Owning a condo has gotten more expensive in the last few years, and there is no indication that these prices will reverse in the future. No one knows exactly if more increases are coming, though there is some hope from the BCFSA report that reforms by the BC government and simply the improvement to insurer profitability from the past increases may temper future ones. However the data for Victoria showing average increases of about $35/month in strata fees should provide some counterpoint to the individual cases of catastrophic insurance hikes that have dominated the media coverage.

What is not captured in the increased insurance costs and associated strata fee increases are the increased deductibles. The BCFSA report indicates that deductibles increased by an average of 130% year over year. That means any future claims will mean higher amounts for the strata to absorb before the insurer pays. While that should help with claims costs and price pressure on the insurer side, it also increases the chance of special assessments for condo owners in case of large claims.

The real solution requires building changes

As was raised by Marko Juras on this blog, the underlying problem is how easy it is for condos to suffer from water damage. BCFSA acquired data showed that between 2015 and 2019, 68% of insurance claims were due to water damage. No amount of regulatory reform to the insurance industry will prevent prevent an absent-minded owner from flooding their bathtub or pipes from occasionally bursting in the walls. Instead, buildings should be more resistant to water damage from one unit spreading to others and causing large claims. That may be as simple as floor drains in baths, kitchens, and near wet appliances, or as sophisticated as smart leak detection and unusual flow sensing systems. These systems aren’t commonly used yet, but could be built into building codes and incentivized through insurance discounts.

For example, there is no reason a leak the magnitude of the one that flooded 9 floors of the new luxury Vancouver House development could not have been detected by a smart leak detection system and shut off before it could cause 7 or 8 figure damages. If we want to attack the root cause of the problem, we’ll have to make our buildings a lot more resilient.

On to a glance at market conditions, I recently had a dream that I was reading a Facebook post where a local realtor was asking if anyone else had noticed how the market had just completely dried up in the last week. Unfortunately for house hunters that was just a dream, and looking at the data little changed in the market last week.

| October 2021 |

Oct

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 220 | 990 | |||

| New Listings | 288 | 1162 | |||

| Active Listings | 1130 | 2122 | |||

| Sales to New Listings | 76% | 85% | |||

| Sales YoY Change | -31% | ||||

| Months of Inventory | 2.1 | ||||

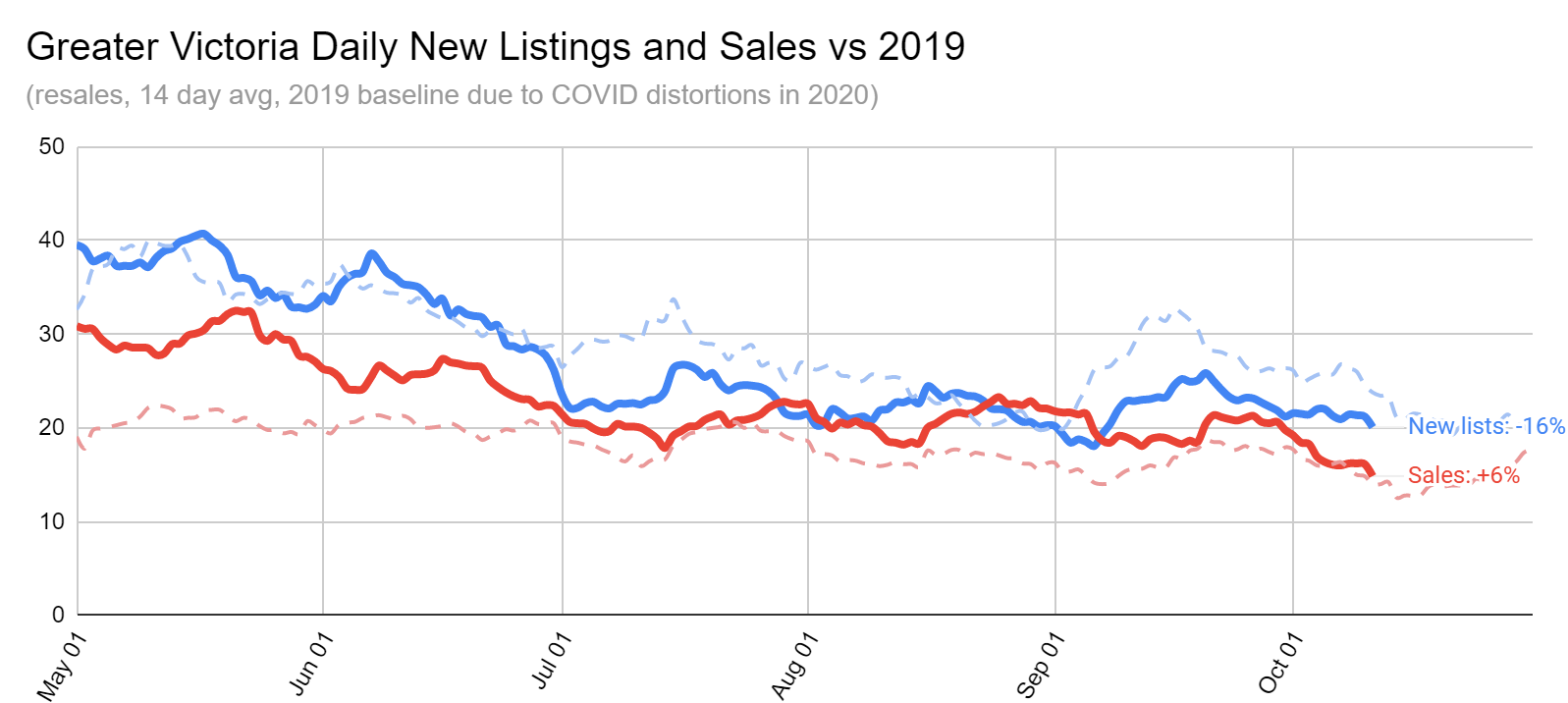

We’re nearly a third below the sales pace from last year, but still running somewhat ahead of the 2019 pace. That’s pretty impressive with nearly 60% less inventory on the market compared to that time. New lists continue to lag as they have been for the last 3 months.

The big over-asks continue with a house going $450k and another going $250k over ask last week. But that doesn’t mean everything is going over the asking price. As in any market, there continue to be under ask sales as well, mostly for properties that have been on the market for a longer period. The peak in over asks is in properties listed under a week, reflecting the common practice of listings coming online Thursdays with artificially low asking prices for offers on Monday. After 2 weeks the average drops to the asking price, and declines further until about the two month mark when many properties get a price cut in order to sell.

New post: https://househuntvictoria.ca/2021/10/18/up-island-update

Listing withdrawn

Can anyone tell me what 3367 Curlew St sold for (or was it taken down)? The sale price of $1,469,000 was astounding!

The psychology is the worst part of it even from professionals in the field. When renewing my pre-approval, my broker said you can be approved for so much more than what your asking (I stayed with my budget). Also, my realtor said I just should start throwing more offers around (I have made 2 offers in the 18 months and stopped a third when there didn’t seem to be point). I decided if I am going to overpay and push back a retirement date, it’s going to be for something I want to be in (and works for my family in the long term), not forced to because it’s the only thing I can get.

I’ve probably said this 10 times in the last 18 months but I think the market is now the worst I’ve seen it. Messages received this afternoon…

House that needs to be gutted….”Hi everyone, thank you all very much for your time in putting together your offers. We received 16 in total”

2 bed 2 bath 15 yr old condo “Thank you all! Unconditional AO and Sale will be posted upon confirmation of Deposit. There was a total of 19 Offers.”

SE Vancouver Island, unlike most of the rest of BC, was ceded by the First Nations by treaty before the union with the mainland.

Monday numbers:

389 sales (down 27% from last year)

480 new listings

1109 active listings (down 51% from last year, and about a quarter of those are not residential).

New post tonight, but in the meantime you may be interested in my article bagging on the CMHC (a favourite activity) in the capital: https://www.capitaldaily.ca/news/victoria-overpriced-real-estate-cmhc

Maybe the non-market centrally planned socialism, but social democracies are definitely a brand of socialism, and we all participate in them.

The only reason our country functions is because of these things, roads, health care, fire, education, sewage, there’s also the social companies like the co-ops, and credit unions. Mind you centrally planned seems to be working for China currently. The main issue that places like the Soviet union have had trade wise is that they were excluded from trading with the richest countries on earth which means technologically you get left in the dirt, as soon as you don’t have that problem (China, Vietnam), it functions.

Has anyone visited Work Point near Esquimalt? Incredibly underutilized federal land 5 minutes from downtown. Likely will take it being transferred to the Songhees or Esquimalt before anything gets done with it.

“I get that you own a house on the island, but have you ever actually been here?”

As soon as i see frank’s name, i instantly ignore the post. Dont waste your time reading his nonesense, this is the same chump that said a bunch of anti vaxx crap that wasnt flagged on this site. Luckily, the average reader on this site is relatively intelligent and informed.

I get that you own a house on the island, but have you ever actually been here?

There’s 850 000 people on a 32,134 sq. km island. Most of which are on the southern tip. The upper half of the island is basically unpopulated. The whole west coast as well. The North island of New Zealand is more densely populated than Vancouver island. Honshu in Japan is 20 times more densely populated, and you have cities there that are giving their houses away for free, one is even part of greater Tokyo (Okutama).

Yep. Plenty of potential for the city to create these opportunities. There is no shortage of land, only a shortage of political will.

See this thread from someone that works in affordable housing development https://twitter.com/helen_lwilson/status/1449892348360486912?s=21

There is a lot of provincially and municipally owned serviced land that would be well suited to affordable housing. Affordability of land also becomes less critical when the project is funded via capital gains taxes and administered by a non-profit as there is no developer needing to recoup costs, only the need to pay for ongoing maintenance and repairs and admin.

Let’s face it, there is no affordable land on the Island to build affordable housing. Even millions of acres of Prairie farmland is expensive. You can buy a good size (50’x150’) lot with a tear down cottage where our family cottage is in Manitoba for $50,000 and build a nice home near a great beach. Only problem is there is no sewer system and you rely on a holding tank that gets pumped out regularly for $85. Taxes are extremely low and there is no garbage pickup. If you like peace and quiet with no homeless people roaming around, and no drug problem, this is an alternative people should consider. One other problem, there are very few properties for sale since the pandemic.

I’d be in favour of taxing primary residence gains above a certain amount. Non primary residences are already subject to capital gains taxes. Use the money to fund purpose-built non profit run affordable and subsidized housing.

I’m not too worried about socialism since we are just talking about shifting some taxes.

I think this is exactly why we need additional sources of tax revenue . Taxing the money people inherit or make from owning things, particularly housing, will help pay for our social programs, most notably health care, which will be even more valuable and needed with an aging population.

Yes that’s what I meant

Eat the rich mantra hasn’t got any socialist or communist society anywhere, so why are we skirting around the real issue and that is population growth and dependency?

IMHO, the idea of socialism as we know it is dead, therefore it is high time that we put an in-depth look into our policies, otherwise it will be like a cancer and eat away at our country and society.

When the noble idea of social programs were put in place the workers to seniors dependency ratio were 7:1, but now we are standing at 4:1 and facing 3:1 in the next 2 decades. So, how much can we tax the dwindling number of workers to support the forever increasing lifespan of the populous?

And, what more frightening is that we have a sharp increased of 70-74 years old since 2010.

Age dependency ratio, old (% of working-age population) – Canada — https://tinyurl.com/2ar3wfnc

I see what you’re saying. That makes more sense.

I don’t think that’s what he saying. I think he’s saying that land tax revenues could be used to pay for an income tax cut for everyone, regardless of their land ownership. And that’s something I’m in favour of.

I like the idea that income tax could be deducted from a land value tax as it adds fairness.

I think the idea of raising the GST should be considered. Higher income earners already pay large taxes, hence the need for wealth taxes. Otherwise we have highly trained medical professionals and others getting highly taxed while people earning wealth from sitting in a house makes millions tax free.

None of the above relates to taxing housing wealth. If rich people (local and foreign) stop buying multiple properties and using housing as a means to store wealth or launder money then all the better. They won’t be missed.

The NDP “tax the rich” ideas won’t work for at least these reasons:

Rich people are very mobile.

Rich people disproportionally have their assets in productive business assets. Overtaxing those will stifle the economy and will actually result in less tax revenue.

Risk taking will be discouraged which will impair competitiveness of our country.

Punishing productivity will never have a good outcome.

But I would think they were on the conservative side last year, too. If they are always, say, 10% low a 30% increase in market will get you a 30% increase in assessment.

Even though prices have increased 30% (or whatever), I don’t think assessments will match that. Assessments generally seem to be on the conservative side (perhaps to discourage appeals).

How come all we hear is “tax the rich” ideas, that conveniently don’t apply to the people proposing them? Where are all the good tax the middle class tax ideas? Increase sales tax, general tax rates etc.

It’s fantasy land to think that tax the rich is going to be all that’s needed to pay for the huge debt and deficits we’ve created. As well as aging population, new social programs, climate change etc.

Land value tax is one of the most efficient. Impossible to shift offshore, progressive, encourages optimal land use. I really hope that at some point we will find a political party courageous enough to propose it (pairing it with a large income tax cut). https://en.wikipedia.org/wiki/Land_value_tax

Luckily you can dispute yours. I’ve successfully had mine lowered by about $40k by correcting some info they had (they thought it was larger than it was). If you don’t want to go through the work there’s even a company that will do it for you, though I can’t find it right now. It was launched by Andrew Wilkinson about a year or two ago.

Tax policy is complicated and becomes very tricky and tends to fail when attempting to engineer a social outcome. Cumbersome and complicated tax policy usually end negatively impacting the good they were meant to achieve. Taxing wealth is very complicated since that wealth can fluctuate. For example, wealth gained through asset growth is taxed at it’s valued gained annually results in a big tax windfall, however, the following year that person’s wealth takes hit in by a 1/3rd because of a down year. Then you are looking at a taxes rebate back based on the decrease in wealth, the sword with any kind of wealth tax would need cut both ways for it to be implemented. As well, you would be calculating assets against liabilities, someone may have millions in assets, but also may have millions in liabilities, so then you will be allowing tax write downs based on debt. That’s why the tax is usually applied at the point the gain is actualized in it’s conversion to cash. Don’t forget the negative impact that estate taxes had on family business and farms back I the 80s (in the US). Yes, there was millions in property, but only generated small annual incomes; but the tax load on the estate caused such a negative impact, it drove many family businesses and farms into tax foreclosure. Some good came of it, it gave John Cougar Mellencamp something to sing about.

Yes, that would be interesting.

This year we should expect SFH assessment increases to match the price increase (about 30%). But the variability could be huge. For example, if your assessment goes up 40%, and your friend a few streets over goes up 20%, you’ll end up paying 20% higher tax increase than him. That’d be fine if the assessments were accurate, but my understanding is they just estimate from limited data points.

Thank you Leo!

Pretty variable because of unique properties and few sales (41 sales year to date).

Of the sales since August, average sale is 49% over assessment (median 50% over).

However what I haven’t spent a lot of time on is whether certain types of properties are systematically undervalued by BC Assessment. After reading this article about the attrocious inequity in New York assessments, it’s on my list of things to explore. https://www.bloomberg.com/graphics/2021-new-york-property-tax-benefits-rich/?utm_content=citylab&utm_campaign=socialflow-organic&utm_source=twitter&utm_medium=social

Any idea how prices are in Metchosin? Is the selling price vs. assessment ratio roughly the same as in Victoria core?

Nice!

Are you referring to 2.4.5.1(3)?

Why do you need a trap primer? 2.4.5.5.(1.c) states that alternate acceptable methods exist and references note A-2.4.5.5.(1) which states

“Periodic manual replenishment of the water in a trap is considered to be an equally effective means of maintaining the trap seal in floor drains in residences. Under pressure differential conditions, special measures are necessary to maintain trap seals”

Are waterless p-traps not allowed because they’re not UL/CSA stamped? These are what are used in high-efficiency houses in Europe (and on high-end HRVs locally, and when we hit step 5 we’ll want to be using these too).

“Bathroom Floor Drain”

The BC Building and Plumbing Codes don’t really talk about emergency floor drains for residential bathrooms but with the issues around insurance costs for floods I think they should. I often see them in other countries. The lack of direction in the codes would let a plumbing inspector (I am one) permit one in a residential bathroom without sloping the floor and/or creating a lip to control overflow. It would require a trap, venting and a trap primer. These aren’t huge costs but trap primers do use water and often stop working so that the lovely sewage smell floats into your bathroom. There is a way to run your shower/bath water through this trap and avoid a primer but that isn’t identified in the code yet (should be).

The government and Bank of Canada have created billions in wealth for asset owners but hardly tax it. Perhaps one way to help pay for all the health care costs of an aging society would be to add wealth taxes such as an estate tax and possibly land value tax or capital gains tax on primary residence sales (at least above a certain amount) as well as taxing house flipping and adding a federal foreign buyers tax. This could help pay for an increase in health transfers from the federal government to the provincial government. Although I am generally not a fan of conservative governments I was impressed that O’Toole suggested increasing federal health transfers to provinces from current 3% to 6%.

Right now we tax wages which have not kept up with cost of living. Also with less people working this source of tax will lessen even more.

Interesting comp to 1841 penshurst is 1829 4 doors down. Sold in April this year for $1.175M

Not much of an uptick on the 1841 sale.

I think someone living in Victoria might get a distorted view of the number of civil servants. At the BC provincial level there are about 30,000 of them.

$1.181M

Does anyone know what 1841 penthurst went for? It was 989 list.

People have placed bets on technology and automation for the last 50 years to reduce the need of workers, and so as the paperless society that hasn’t come to fruition but infact created more paper works and wastage, increased IT supports, finances, lawyers, and civil servants.

Canada government and countless number of very smart people have spend much time finding ways to mitigate the incoming onslaught of elderly on pension and health care system as described below, and so far the most humane solution that the experts came up with is immigration. And, please share if anyone have a solution to our predicament.

All the reasons why Canada needs immigration — and more of it — https://tinyurl.com/ccjj7rtk

Canada 2040. No Immigration Versus More Immigration — https://tinyurl.com/5day275a

Greater Victoria house prices up 27.7 per cent over the last year, survey finds

https://www.timescolonist.com/real-estate/greater-victoria-house-prices-up-27-7-per-cent-over-the-last-year-survey-finds-1.24364218

The survey noted the median price of a single-family detached home in the region increased 34 per cent to $1,135,700 over the last year …

Comment: CRD will need North Saanich’s food production

https://www.timescolonist.com/opinion/op-ed/comment-crd-will-need-north-saanich-s-food-production-1.24364270

Good question: why are they trying to densify a community outside the Urban Containment Zone?

On second thought, Victoria approves 42-unit rental project in Fairfield

https://www.timescolonist.com/news/local/on-second-thought-victoria-approves-42-unit-rental-project-in-fairfield-1.24364264

The problem is: where are all these labourers we so desperately need going to live on the paltry wages we are going to pay them? 10,000 out of 42,000 health care workers are not vaccinated in Manitoba and are not being allowed to work on Monday. They are sending elderly PCH residents back to their children to care for them. I wonder why doctors and nurses are refusing to get the vaccine?

QT> Actually our labour demands in most productive sectors have greatly reduced. Our manufacturing output has remained about the same for the last ten to twenty years yet the manufacturing labour force has reduced by half. Same numbers in agriculture and forestry. With autodriving trucks coming into play in the next ten years the number of truck drivers needed will also decline.

Automation is also reducing the need for workers in both banking and many retail operations,

I will admit that we might have to seriously reduce the number of civil servants at some point. Technology is reducing the need for labour at a much higher pace than our population is aging. If it brings you joy a large part of the baby boom cohort will have transitioned to celestial housing within the next ten years. At that point you might consider a Logans slow walk.

It’s absolutely correct that we are facing a housing problem, but the fact remain that we are facing an ageing population crunch, which require services and pension with extremely low birthrate. Therefore something have to give.

In order to level out our housing supply to match the G7 and support an aged population we have several options:

a. Increase retirement age to 74.

b. Immediately implement the Logan’s Run Carrousel rite, and eliminate 10 years worth of elderly death or roughly 3 million people.

c. Continue on the collision course of importing labours into Canada to support the elderly.

Not having to built homes for an extra 450k every year over the next ten years because of immigration would definitely make it easier to catch up on the housing crunch. (thats an extra 4,6 million population demand right there.)

Our immigration numbers basically requires that we build a city the size of Victoria each and every year. . As pointed out we would need to build for about ten years to just raise us up to the average number of homes in the G7.

Adding 450k people every year is making that goal even harder to reach and making it harder for your children to afford that house. Pretending that 450k immigration each year does not create enormous demand pressure is just unrealistic. The ones that are here this year we have to deal with to provide housing but the real question is should we be bringing in 4.5 million or more over the next ten years.

I would like someone to clarify this.

Would a floor drain in a private residential bathroom elevate the building code to a public bathroom code, that required sloping floor, membrane, flashing, and curb?

I remember writing a post here recommending this about ten years ago. At that time it was not well-received, but here we are and more to come on fractional ownership imo:

https://www.businessinsider.com/millennials-buying-homes-friends-communes-housing-crisis-2021-10

Ahhh that makes sense now, my bathrooms in Croatia do have a small lip. Entire time I was thinking wtf, the rest of the build(s) is impeccable how did they screw this elevation/lip up 🙂

Canada’s insatiable housing demand comes from a long standing, ongoing shortage of homes in Canada compared to other G7 countries. And it will continue, with high demand and pressure on higher prices for many years to come.

Canada has the fewest homes per capita of the G7 Countries. Canada would need to build 1.8 million homes to get to the average of the G7 countries. And 1.8 million homes is 10 years worth of completions. Since there’s 2.5 people per household, that means Canada’s population could fall by up to 4.5 million people (1.8m x 2.5=4.5m) and we would still have below average number of homes per capita in G7.

And Canada’s housing shortage per capita worsens as the population ages, because household size falls. In an aging population, with no population growth at all, you’ll still need more homes for them, because household size falls with age. Seniors (>65) have a household size of 1.7, compared to GenX of 3.0. If 100 people in genx families move to Victoria, they need 100/3=33 homes. If 100 seniors move here, we need 100/1.7=60 homes – almost double for the same population.

So no, a 1 year drop in immigration isn’t going to move the needle there.

Homes per thousand people in G7 countries.

France 540 (homes per thousand people)

Germany 508

Japan 494

** Average of G7 = 471

UK 433

USA 427

Canada 424

Vancouver 406

Toronto 360

https://www.scotiabank.com/ca/en/about/economics/economics-publications/post.other-publications.housing.housing-note.housing-note–may-12-2021-.html

“ The number of housing units in Canada falls quite a bit short relative to most other countries as is clear from chart 2. Across the G7, the average number of housing units per 1,000 residents is 471. To put our number in perspective, it would take an additional 1.8 million homes in Canada to achieve this level of supply of housing relative to population. Simply catching up to the UK, which has 433 units per thousand citizens, would require roughly an additional 250 thousand homes in Canada. Catching up to the US, we would require another 99 thousand units. To put these gaps in perspective, we have averaged 188 thousand home completions in the last 10 years.”

I don’t think it would be a big deal. No need for slope, just a small lip at the door and some tile baseboard. Already is a requirement for a GFCI receptacle, so just wire any others downstream of that plug. Waterless P-traps would need to become approved (the only change I see).

Just run a 14-50 or 6-50, or conduit. Problem solved. Not sure an engineered drawing has ever been required for an EV circuit (residential). At least I didn’t need one and haven’t heard of anyone else needing one.

Population growth in Canada since the start of the pandemic has been the slowest in decades. Since the start of the pandemic the population has grown by all of 0.89%. That’s not the annual rate, that’s the total growth. Looking at immigration numbers over the same period doesn’t tell the whole story, since an unusually high number of immigrants were already living in Canada.

There has also been a big runup in prices in many markets that saw no population growth at all. So where’s the demand coming from? More money available to buy with, and the greater part of that is debt. Remember in economic terms demand isn’t just the number of people willing to buy, it’s the number of people willing to buy at what price.

https://www.theglobeandmail.com/investing/personal-finance/article-these-numbers-show-how-the-wealth-of-your-parents-is-a-deal-breaker/?ref=premium

Reality of the situation is immigration is not being pared back thought…Canada is set to hit the 400k target this year based on YTD numbers.

Only solution is build more. Doesn’t matter if rentals or condos but 500k (add birth rate) extra people per year need a place to live. Not sure how to simplify the concept any further than 500,000 people every year need a place to live and spec tax/everything else has clearly shown that there isn’t mass vacant accomodation that can be freed with government policy.

More supply is great in theory, but where are you going to build? New areas require all the services installed, roads, etc… In a country with a low birth rate, it’s obvious where the demand is coming from. I’m not against immigration, but numbers should be pared back significantly. We can’t provide everyone on the planet a prosperous lifestyle, that ship has sailed.

I agree that we have an over burden bureaucracy exacerbate delay and housing price. However, adding an EV plugin or floor drain would introduce more bureaucracy and costs.

Floor drain would change the bathroom code from a simple dry room into a complicated wet room. That flooring materials and protection will have to change (building code and insurance), slopping floor tolerance, threshold curb/s, trap primer, electrical receptacles would have to be GFI and moisture protected, etc…

EV plug in so far has no standard therefore you will have to get an engineered drawing for residential application, and that will introduce a string of paper trail.

Not a who. It is what factors are at play to create these conditions. Most significant is likely lack of supply.

Just like with rentals, if demand exceeds supply then the renter/buyer is at a disadvantage and market conditions promote multiple offers or rising rents.

The tendency to blame and complain about individual actions is pretty ineffective. Yes, you’ll have landlords wanting to boot tenants paying under market out in these conditions and you’ll have buyers paying over ask. The real question is what are is the government doing that will encourage more supply and will the market shift without more supply if the economy declines.

I had thought that prices would go down rather than up during the pandemic, but it seems like home became even more important.

We are experiencing some covid impacts on the economy now imo with supply chain disruptions and some businesses just disappearing. I went to go back to my yoga studio and they are now permanently closed. Several of the restaurants we frequented are gone. And many more people now use online shopping.

If you shop around you certainly can, but people are dumb. I went to a listing presentation in Oak Bay earlier this year. It was a type of house that would sell in a bidding war so I told the sellers list on Thursday at x price, offers Monday, it will most likely sell between x and x, and I’ll offer you 10k listing portion (around 0.75%) + 1.5% coop. I get an email back “it was really nice meeting you but we decided to go with an agent that offers more marketing.” Home gets listed for x price that I also suggested, delayed until Monday and sells right in the middle of the range I suggested, but the sellers spent an extra 14k on fees for more “marketing.”

Common sense is just so incredibly poor that it is very easy to sell high commissions.

Seller: “Can you lower your commission given how hot the market is?”

Agent: “If I can’t negotiate my own commission how am I going to best represent you when we are dealing with a 10 offer situation on your property?”

Seller: “Makes sense.”

Reality….you just pick the highest unconditonal offer.

I could give 100s of examples someone with common sense could read right through, most peple can’t. Real estate fees very high as a result.

That’s a great post Marko.

But most people who aren’t RE agents wouldn’t understand steps like “list your property”, “offer reasonable cooperating commission”, “take offers”.

There must be some middle ground between the $3,000 do-it-yourself sale, and the $20K full service fee. For example, for $8,000 can you get someone to do all the steps you outlined for you? Do any agents operate on a per hour basis, like lawyers or accountants?

What I don’t understand is literally everyone complains about real estate fees and then no one does anything about it? Complain complain complain, hire some random agent because your kids play hockey with her kids and pay $39,000+GST to sell your average house. Then complain about how much you paid for your home to sell in four days.

I posted this in January

Bam you just saved 20k. Buy 20k worth of Telus, Fortis, whatever stock and in 25 yrs including dividends you are 200k richer.

I bet at least 10+ people read that on HHV in January and then engaged an agent at 6%100+3%balance (***commissions may vary) to sell their home in the last 10 months.

I think there is good and bad in all industries. But I have to say as a buyer over the last year in this market I’m appalled at the unprofessional behaviour I’ve experienced from some agents. I’m not a first time buyer and purchased before in calmer markets and there’s a world of difference. Agents have refused to answer basic questions as they have so many showings they don’t feel the need, refused to send needed paper work, not returned phone calls, shady behaviour in bidding wars is common and there’s no way to prove it but it’s obvious. Again I’m not saying all agents are this way but there’s enough out there to make the whole industry look bad.

https://www.cbc.ca/news/canada/marketplace-real-estate-agents-1.6209706

“Buyer’s agents” refusing to show properties with low sales commissions. Note this is an Ontario story, any relevance to BC?

Who really is to blame for the bidding wars occurring in hot markets? Real estate agents who are deliberately underpricing properties, the sellers who want more than their property is worth or the buyers who allow themselves to behave irrationally. Buyers simply have to stop playing the game and stay out of the market. Look for a more affordable city, stay where you are, or refuse to offer more than the asking price. If people want a bidding war, they should list their properties on an online auction site (many exist but are not utilized) and leave real estate agents out in the cold. That would ensure transparency, increase exposure and create a more equitable (less manipulated) market. I don’t know what’s taking so long. Almost every auction business has moved to online sales due to the pandemic and most will not be returning to live auctions.

Yet another underpriced home 4228 Ponderosa Cres. Oh my, will it go for $200,000 to $300,000 over ask, you betcha! Got to keep the hype going.

Problem is a lot of people renting also don’t understand extremely simple supply and demand concepts you can teach a 10 year old.

Someone posts a new project on FB and it is all “rents will be $2,000/month, developers getting rich, Victoria is being ruined, how can anyone live in a condo, etc., etc.”

As Leo pointed out these unethical landlord issues wouldn’t exist if the market was balanced, but it isn’t as there is more demand than supply.

Don’t hate the player; hate the game.

Another renter story on reddit Victoria: “We had our landlords ask us to voluntarily raise our rent well above the legal limit, we said no and the next month they told us they were moving in. (Proper notice and such)”. These threads are getting tons of comments and interest. https://www.reddit.com/r/VictoriaBC/comments/q7p3lj/renters_of_victoria/

A couple of the condos where I own rentals in Victoria are switching over to braided washing machine hose to mitigate water loss risk.

Both of my places in Croatia have these bathroom drains -> https://youtu.be/3S1e2KXogsA?t=102

Water shutoffs also much better design/location -> https://youtu.be/3S1e2KXogsA?t=142

There is so much bureaucracy here when it comes to building anything, but we can’t get simple stuff that would be useful right. Instead of a completely useless Owner Builder Exam department at BC housing the money would be way better spendt giving developers incentives to install an EV rough-in into every single parking spot, etc. Instead as a developer you spend money on 14 consultants and other non-sense, but you can build a building without any EV charging even thought at this point is is extremely obvious in 10-15 years the majority of cars will be EV.

910k

Hi folks, could someone tell what 935 Lakeview sold for. It was listed at around 799 k

Thanks guys

There has been three major water damage incidents Yates on yates… 1 – Someone from PML didn’t shut off a water valve that destroyed a lot of units. 2 – Someone left door open in snow storm and when the snow melted it damaged several units. 3 – Faulty plumbing fittings made in china had hidden quality control issues that caused leaks that destroyed several units. The plumbing fitting problem has been an issue and caused leeks on a few other buildings – Dockside green synergy and the ERA are a few off the top that had significant damages due to poor plumbing fittings.

The BCFSA report talks a bit about this, and says that buildings that have faced a lot of small water claims are those that have seen the biggest increases. Not sure if that’s the only reason, but I wonder if the insurance companies are taking that as either a sign of careless owners or undiscovered more serious problems with maintenance that could turn into a big claim any time.

I think it’s twofold: cost + risk both increased from the insurance hikes.

Everyone gets an increase in strata fees, and there’s a risk that your building will be one of the ones hit by several-fold increases in insurance where it could be $100+ extra month. Also as the deductibles increase, there’s an increased risk of special assessments.

My guess, building a 2500 sq. ft. house today would be around $1,000,000, plus another $500,000 for psychological therapy.

Almost everyone’s attention on strata insurance appears to be focused on condominium apartment-style buildings, however similar insurance rate & product availability issues affect other types of stratas, particularly bare land stratas.

As everyone here is aware, strata housing is more than just condominium apartment buildings.

Strata housing can also include duplexes, townhouses, fractional vacation properties, and even single-family homes in bare land strata corporations.

The bare land strata concept can be described as a larger piece of land that has been subdivided into several strata lots. The roadways within the development are common property. In addition to owning their own lot, all of the strata owners thus have a proportionate share of ownership in those roadways and any other common property such as the sidewalks, curbs, sewer, water, electrical infrastructure and any shared amenity facilities.

In a regular strata, all of the lots share land and walls, as well as common property.

In a bare land strata, each lot is individual and may house a single-family self-contained home while sharing common property.

Issue #1: What common property assets require full insurance coverage?

In a bare land strata, common property is typically less about a physical building’s structure and more concentrated on basic outdoor infrastructure assets with long lifespans.

Despite the differences in the physical nature of common property condominium apartment-style stratas compared to bare land stratas, the Strata Property Act’s property insurance requirements do not adequately differentiate between strata types or common property asset types and require all to be insured on the basis of full replacement value.

This requirement leads to some practical questions such as:

Do asphalt-paved roadways need to be insured at full replacement value?

How about other common property assets such as concrete sidewalks, curbs, precast road barriers, fences, retaining walls, street lighting, underground infrastructure, etc.?

Under what circumstances would an insurer even cover an insurance claim for such an asset?

The Government should really consider what common property requires full replacement value coverage.

Issue #2: Blanket Insurance Coverage

Issue #1 might not be as major of a concern if insurance policies adequately differentiated between various asset types but unfortunately this is not typically the case.

Many insurance policies cover a wide range of assets (even if the strata does not have most of the covered assets) and limit coverage of certain asset types.

For example, a bare land strata might be offered a common property insurance policy that covers a long list of assets (including full coverage of common property buildings such as a community centre which it does not have) – yet limits coverage on assets it does have (such as $50,000 on roadways when it has $200,000 worth of roadways). Such blanket insurance coverage offerings combined with the full replacement value insurance requirement results in the strata paying for more insurance than it needs.

Insurance providers should be required to provide more bespoke coverage options that are based on an individual strata’s requirements and priced on the individual asset category’s risk profile (i.e. transportation infrastructure such as roadways, sidewalks, curbs should not be priced at the same $x per $1,000 of coverage as a community centre).

Issue #3: The Depreciation Report Requirement

Under the Strata Property Act and regulations, strata corporations with five or more strata lots must obtain depreciation reports every three years. This includes bare land strata corporations despite many of them not having much in the way of common property or assets with short or medium lifespans. Strata corporations may waive the legal requirement to obtain a depreciation report, or defer updating a depreciation report, by passing an annual 3/4 vote however under current legislative and market expectations, stratas feel pressured to obtain one regardless of the true value these reports provide to stakeholders. Unfortunately, the cost of a depreciation report can be significant, especially for small bare land stratas.

Depreciation reports can be a useful tool however most reports are unfortunately very generic, providing very little insight into the actual state of a strata’s assets due to the lack of requirements to conduct truly investigative diagnoses. As a result, most depreciation reports are nothing more than a document summarizing a quick visual inventory and generic accounting exercise while being a significant and frequent expense to a strata, which places a considerable strain on the budgets of small stratas, leading to owners having to choose between spending money on proper preventative maintenance or fulfilling a legislative requirement.

Rather than just removing loopholes for avoiding depreciation reports, the quality and depth of depreciation reports needs to be significantly improved and their value to particular types of stratas needs to be considered.

Different levels of depreciation reports (i.e. based on a detailed inspection vs. general observations vs. quantitative update to a previous version) need to be introduced.

Depreciation report requirements and their frequency need to account for:

The strata concept type (i.e. condominium apartment-style building vs. townhouses vs. bare land strata with only single-family homes vs. bare land strata with homes with shared amenity facilities (such as pools, clubhouses, etc.) vs. land-only strata, etc.);

The appraised value of the strata’s common property assets (i.e. $1 million or less, $1 million to $1.5 million, $1.5 million to $2.5 million, $2.5+ million, etc. indexed to the inflation rate of an appropriate asset-related index); and

The number of strata lots (i.e. 10 or less, 11 to 20, 21 to 50, 50+, etc.).

Depreciation report professionals must be required to perform the following for detailed inspections:

Conduct more in-depth, invasive inspections of the common property assets to identify potential issues earlier;

Use current local vendor quotes to determine the true replacement costs; and

Provide less generic opinions of the assets’ condition.

When the BC Government considers measures to improve provincial legislation and strata housing affordability, it needs to look beyond condominium apartment-style buildings and improve their awareness on issues that affect other types of stratas, particularly bare land stratas, by identifying the above three issues and considering the suggested solutions.

Judging by the reduced comments I am beginning to think that a lot of people have given up on buying a house and just went out and bought a monopoly game.

🙂

I’m considering buying a private sale lot that has an older home on it approx. 1940s. It’s in very poor disrepair so not sure if we could save it or if it’s a teardown. I have been told the ask would be around a million. Which seems reasonable given what I am hearing/seeing in Cook Street Village. My number one questions is, does anyone know what the current cost to build in Victoria is right now and what the timeframe with permitting is? Thinking about a 2500 sqft house, medium to high end finishing’s with an optional in-laws suite.

Thanks,

Leo – nice discussion. I wonder if you’re focussing on the wrong number though. Rates go up, fair enough, but I can’t see anyone really panicking over a strata fee increase of $15 a month. Your stats table shows a certain percentage of properties facing rate increases of over 200%, far higher than the median value. You later hint about the prevalence of water damage claims. Are those two linked? Do you know if the properties with the highest rate increases are those with large recent claims (for any reason, water or other), or are they unexplained?

Thanks Leo. The last thing that should happen is for government to step into the condo insurance market and subsidize both cheapskate developers and those who have bought their product. Go after the root cause.