September: No sign of any relief in the market

Unfortunately the situation did not improve for buyers in September, with new listings continuing to come more slowly than normal for this time of year, while there was plenty of demand to vacuum up anything priced even remotely close to reality.

New listings were second lowest we’ve seen in a September in the last 15 years, and with no shortage of demand residential inventory actually dropped from August (usually it goes up). On a seasonally adjusted basis we must be near effective zero levels of inventory here, but seasonal pressures will likely push them down further towards the end of the year.

One might take a naive look at the sales numbers and conclude that single family activity has dropped off a cliff. In March there were 552 houses that changed hands, while we only saw 313 in September, a drop of over 40%. Of course a big part of that drop is simply a lack of selection in the lower price bands that buyers can afford. I’d tell you how many fewer listings there are under say a million, but some statistics from the board system have been broken since they upgraded it more than a year ago and it still doesn’t return trustworthy numbers. As I write this, there are only 74 active single family listings under $1,000,000 in the region.

Another thing worth mentioning is the huge strength in condo sales that has continued from August into September, matching the all time peak sales from early in the year on a seasonally adjusted basis. Combining all the sales shows how after several months of cooling off from the spring, sales have heated up again in the last two months. Pretty amazing given the lack of both new listings and inventory.

Months of inventory tell the same story. After a brief and tiny reprieve in the summer, we’re back to the hottest levels we’ve seen in Victoria’s market on a seasonally adjusted basis (though we’re slightly higher than March, September MOI is usually a bit higher than in the spring).

Or to put it another way, here’s a market activity gauge inspired by Eric Escobar’s work in Vancouver.

As we know, anytime months of inventory is below 2, we get extensive bidding wars and September was no exception. 44% of detached homes, 51% of townhomes, and 41% of condos went for over the asking price in September.

Taking a look at price measures, we saw across the board price increases for all housing types in September, with the median single family home now selling for 37% above last July’s valuation, while townhouses went for 31% over, and condos 22%. Strained affordability might be pushing buyers from detached to attached housing, but with almost nothing on the market, it doesn’t take a lot of moneyed buyers to move the market higher.

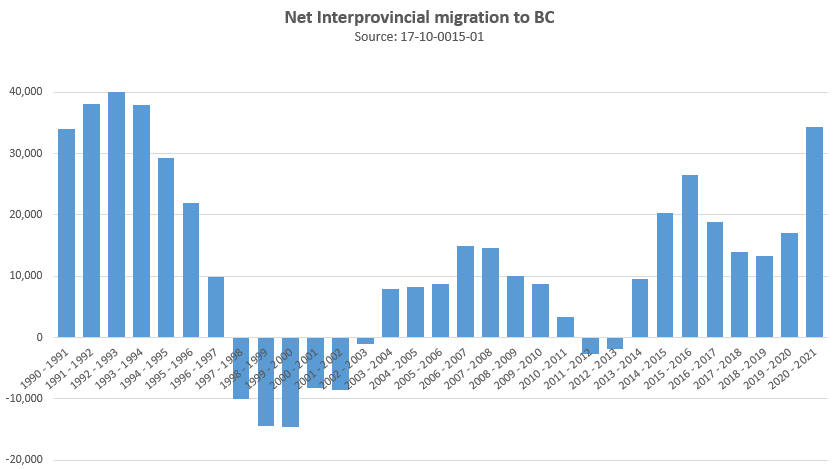

For a long time I wondered why Victoria sales in the 90s were so crazy high. Sales hit an average of over 700 a month back in 1992 and didn’t hit that level again until 2016, when we had a third more people in the city.

Well looking at the interprovincial migration tells part of the story. Back in the early 90s we had a net of between 30,000 and 40,000 people coming to BC every year from other provinces, and apparently many bought in Victoria. In 2021 net interprovincial migration jumped again to levels we hadn’t seen in almost 30 years. Impossible to know how long this will last, but we’re gonna need a lot more homes.

Interestingly enough though, 1994 was the start of a price plateau in Victoria that lasted for nearly a decade, with prices not really turning up again until 2003. Will it happen again despite most signs pointing straight up? No one knows, but as usual projecting current conditions out indefinitely is unlikely to be correct.

New post: https://househuntvictoria.ca/2021/10/12/strata-insurance-hikes-nothingburger-or-crisis/

Thanks, much appreciated.

You’re actually more likely to die from Covid than you were to be paralyzed by Polio.

Black death wiped out a huge number of people. Got lucky that some didn’t get it.

Look at what happened in the America’s to the First Nations when the Europeans came over. Millions died from disease. Whole cultures wiped out without Europeans ever meeting them.

Happy Thanksgiving to one and all.

Good question, as far as I know just as crazy still as before but I don’t keep a close eye on it. I’ll take a look to see what’s happening.

Leo, I am curious to what has happened with the up island numbers and prices. Anecdotally, I noticed some slippage in days on market and prices in a few communities I was tracking (just in case I found employment up there that would allow me to leave Victoria). Where places were selling in days at $900k, the same neighborhoods now has places lasting 2 or 3 months on market and selling around $750k compared to what I was tracking there in July. I am just wondering if the Island outside the Victoria work catchment area is starting soften at a quicker pace?

@Frank

Could I suggest some “non biased” reading Frank! https://www.washingtonpost.com/news/wonk/wp/2015/05/04/a-horrifying-reminder-of-what-life-without-vaccines-was-really-like/

Thousands of healthy children caught polio in Canada, so what exactly is your point? We should ignore viruses unless they wipe out all life on Earth? We should trust our immune systems to deal with a highly transmissible virus that’s killed five million people and counting? We should reject any changes to our daily behaviour even if it means the health system will no longer be usable by anyone, because someone on the internet who believes the earth is flat or the American election was “stolen” told you that you’ll become “addicted” to vaccines?

patriotz- The last case of polio in Canada was recorded in 1994, the vaccine was introduced in 1955, that only took 40 years. I’m also not aware of society being locked down for any length of time at its height. If health people and for that matter all living creatures didn’t have the ability to fight viral infections without vaccines, all life on Earth would have been wiped out a long time ago.

I have a feeling a lot of well to do parents would buy up pre-sales here for their UVIC bound kids so in the grandscheme of things better off as rentals.

You also aren’t going to find any reasonably priced pre-sales anymore. They are all above market pricing right now and buyers are piling in. 2010-2015 you could find a lot of pre-sales at 10% below market and it was crickets in terms of buyers.

https://www.theglobeandmail.com/world/article-california-law-to-soon-ban-gas-powered-lawn-mowers-in-bid-to-cut/

Generators and pressure washers are also included in the ban.

FWIW, I sold my gas lawnmower last spring and bought an Ego. I’m very happy with it — the cut quality is excellent, and I can do my whole property, and then some, on one charge. Recharging takes 20-30 minutes.

“It sounds like rental only: https://universityheightsvictoria.com/”

Thank you. I was hoping there would be some reasonably priced new condo pre-sales that were not in Langford or in the Downtown “Red Zone”. Too bad.

You mean the increases in insurance rates? Had thought about a few times. What parts of that are you interested in?

One day, can you please do an analysis on the BC Strata Insurance hike? I would love to hear your take on it

It sounds like rental only: https://universityheightsvictoria.com/

The replies are interesting:

https://twitter.com/9×19/status/1446902117088718850

https://househuntvictoria.ca/2021/10/0https://househuntvictoria.ca/2021/10/04/september-no-sign-of-any-relief-in-the-market/#comment-825844/september-no-sign-of-any-relief-in-the-market/#comment-82584

Re: University Heights

Does anyone know if they will have strata units for pre-sale in that complex ? Or will it all be rental buildings.

Thank you in advance for your information.

Why not both? To be fair, antibody-dependent enhancement has happened on rare occasions, but there is zero evidence that it is happening with the currently approved covid vaccines (unless you believe Facebook memes from flat earth and QAnon sites). I’ll be getting my booster as soon as it’s offered.

https://health-desk.org/articles/are-covid-19-vaccines-causing-antibody-dependent-enhancement

$230 million redevelopment plan for University Heights going to public hearing

https://www.timescolonist.com/news/local/230-million-redevelopment-plan-for-university-heights-going-to-public-hearing-1.24362969

Wonder why the buyer’s agent mislead. If no other offers asking price unconditional would have a great chance.

$1,405,000

Vaccine dependency and vaccine addiction? Not sure whether to face palm or laugh at that one.

Anyone know what 1023 amphion sold for?

Plenty of healthy people got struck down by polio. Maybe that’s why I don’t remember any anti-vaxxers from when I was a kid.

A healthy lifestyle will help to ward off degenerative diseases in the long run, but don’t kid yourself that it’s going to protect you from viruses.

Many pathogens can linger for months, even years and sometimes forever. This is nothing new. Lyme disease can permanently disable some people while others are barely affected. My neighbor got West Nile several years ago and spent 6 months on the couch, and still hadn’t recovered fully in a year. By the way, 200 cases of West Nile have recently been discovered in the Phoenix area resulting in 12 deaths (that’s 6%). I hope the snowbirds are aware of this. It’s somewhat of a mystery why the same pathogen can have little affect on some while others are devastated. Maintaining a healthy lifestyle is important in responding to the wide variety of pathogens we are exposed to on a daily basis. Too bad our health professionals chose to ignore the importance of this while focusing on artificial pharmaceuticals to solve our health problems. How many and how often do you want to be vaccinated? It seems that we are being led down the path of being vaccine dependent. I wonder if vaccine addiction will become the next societal problem. I also wonder how much this is going to cost before it’s over, if it ever ends.

‘Long COVID’ is painful, expensive – and so far, impossible to cure

https://www.theglobeandmail.com/canada/article-long-covid-is-painful-expensive-and-so-far-impossible-to-cure/

Total COVID cases:

Alberta — 307K

B.C. — 192K

Some of the employment is “zombie jobs”. That is unprofitable companies hit by COVID are able to get CEWS if they keep people employed, usually non-productively.

This makes no sense when, according to statsCan, 800K jobs are being actively recruited now. (StatsCan link is in yahoo link in my previous message).

BNN just reported that Canada has returned to pre-pandemic employment levels. I doubt that.

They planned to end the aid October 23. And then we get the great job report with Canada jobs back to pre Covid (see below). Stats Can reports 800,000 available jobs, many with no applicants. https://globalnews.ca/news/8227364/canada-labour-shortage-ageism/

Yet they are planning to extend all the “stay home, don’t work” benefits. Why?

https://ca.finance.yahoo.com/news/canadas-job-market-comes-roaring-back-to-pre-pandemic-level-in-september-124600668.html

“Canada’s job market is back to where it was before the pandemic.

Statistics Canada says employment returned to its February 2020 level in September, up by 157,000 jobs.

The unemployment rate fell to 6.9 per cent.”

Zero blame should be placed on the buyer for paying too much for a property. Her agent should be sued and license revoked.

But it was a cottage – a luxury purchase she had no basic need for. Surely buyers like her have to be considered part of the problem too.

A central bank is not the government. Don’t know what powers Australia’s central bank has, but the Bank of Canada has no power to set lending standards. That power belongs to OSFI and CMHC.

From: https://reut.rs/3ljyZsk

The debt worries in other western world housing markets affecting the finacial system. The funny part is the line about “urging banks to maintain [sic] discipline”, you’re the government, just regulate the discipline that you want to see.

That is absolutely brutal.

363 Richmond: $1.4M

What did 363 Richmond Ave sell for?

Thanks.

https://www.theglobeandmail.com/politics/article-freeland-signals-openness-to-extending-some-pandemic-support-programs/

Ottawa in discussions to extend pandemic aid beyond Oct. 23 deadline

BCREA report: https://www.bcrea.bc.ca/wp-content/uploads/Way-Out-of-Balance-Housing-Supply-and-Demand-During-the-Pandemic.pdf

Pretty interesting.

“There is no more undersupplied housing market in BC than Vancouver Island, and Victoria in particular.”

“In Victoria, we estimate that at the height of the market, there were nearly nine potential buyers for each available listing, by far the most severe imbalance

of supply and demand of any market in the province.”

Ontario woman bids $230K over ask on cottage, thinking there were multiple offers. She later learns hers was the only bid.

What an end to blind bidding for real estate could look like

https://www.cbc.ca/news/business/blind-bidding-real-estate-1.6191259

I think it happened when 3bdr houses on postage stamp lots in Happy Valley started asking for over a million.

When did four bedroom houses in Sidney, not on the water suddenly start asking 2.2 million?

And there’s the recent Israeli study in the New England Journal

That showed, for people over 60, the booster shot (3rd Pfizer), provided huge benefits compared to those that just had two Pfizers. The booster group (3 pfizers) got 1/10 of the infections/hospitalizations of the non booster (2 Pfizers). This restored protection back to the 95% level.

It seems BC is late to the booster party and behind the curve though. As of yesterday, only severely immune compromised are booster eligible https://www.google.ca/amp/s/globalnews.ca/news/8245423/third-covid-shot-offered-to-immunocompromised-bc-residents/amp/

———-//—-//

https://www.nejm.org/doi/full/10.1056/NEJMoa2114255

“ RESULTS

At least 12 days after the booster dose, the rate of confirmed infection was lower in the booster group than in the nonbooster group by a factor of 11.3 (95% confidence interval [CI], 10.4 to 12.3); the rate of severe illness was lower by a factor of 19.5 (95% CI, 12.9 to 29.5). In a secondary analysis, the rate of confirmed infection at least 12 days after vaccination was lower than the rate after 4 to 6 days by a factor of 5.4 (95% CI, 4.8 to 6.1).

CONCLUSIONS

In this study involving participants who were 60 years of age or older and had received two doses of the BNT162b2 vaccine at least 5 months earlier, we found that the rates of confirmed Covid-19 and severe illness were substantially lower among those who received a booster (third) dose of the BNT162b2 vaccine.”

Thanks – should have read the study rather than an article on the study.

Just to be clear, Pfizer was not shown to decrease so dramatically in terms of hospitalizations and death after 6 months- only infections. Not sure what that actually means practically, but the study did say that effectiveness against hospitalizations is 93% up to the 6 months limit of the study.

https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(21)02183-8/fulltext

I’m starting to wonder if covid is going to “be over” – ie. life will go back to pre-pandemic ways and it will just be like a seasonal flu. There seem to be some realistic alternatives that are less rosy ie. mutations and resistance to current vaccines.

The effectiveness of the Pfizer vaccine in preventing infection drops from 90% to 53% after six months. Booster shots seem inevitable, and a lot of the world has not had first doses. We are going to be wearing masks for a long time imo.

The international supply chain and shipping is now seriously messed up. Do your Christmas shopping early. Prices are rising for many goods and it appears there will be shortages of some things.

I suppose we will adapt in many ways. I do wonder if home is going to become even more important long-term and in person gatherings much less common.

In this rental market, if I decided to sell a property I would make sure my tenants had 3-6 months notice. I once inherited a tenant with a property and let her stay for over a year before informing her the property desperately needed extensive renovations, which it did. This motivated her to purchase a townhouse which has probably tripled in value ( this was around 2003). Win, win all around.

From: https://reut.rs/3Df89HP

Gotta wonder if other central banks are looking at similar pressures and making considerations to start earlier increases. However, NZ has no scale or influence globally since the entire country only has the population of a mid-sized Canadian province and doesn’t really matter in the global economic picture.

“I rent most of my properties furnished to keep the turnover going every few years…”

Good call. I would prefer not to have long term tenants, and I was thinking of doing this if we ever rent our suite again.

“Having dealt with 100s of tenants during the sale process if the tenants want to be complete douchebags, like the landlord, they have endless cards to play here.”

You’re right. The classic douche move is to dispute the notice, don’t show at the hearing, apply for review of the decision, then apply for judicial review of the review decision. Can drag out the process for months on end, at great cost to the landlord, and little cost to the tenant (or no cost if they are indigent.)

Actually, that is rather smart to rent it furnished. Doubt I would have thought of it.

I rent most of my properties furnished to keep the turnover going every few years (odds are someone is not going to stay 10 yrs in a furnished unit). I guess the average is probably 2-3 years but I did have a tenant vacate one of my condos downtown in April after 9+ years. I re-rented the unit for 50% more, but if the existing tenant had stayed I wouldn’t have minded at all. I was in the unit once in 9 yrs, never missed a rent payment, not one complaint from strata, 100% hands off. Maybe at yr 10 I would have started with the annual 1.5 to 2% increases.

I’ve never issued anyone a rent increase, I just go for the correction on the re-rent. I don’t feel bad jacking up the price on the re-rent as no one is forcing your to rent from me, you can look at a 100s of other places and make a decision as to where the best value is.

+1, exactly what I would do

+1

Having dealt with 100s of tenants during the sale process if the tenants want to be complete douchebags, like the landlord, they have endless cards to play here. The day the home is listed advise listing agent they are experiencing cough/fever and will need to arrange for covid testing, stay at home for all the showings and make it extremely dirty/uncomfortable for showings coming through to sabotage the sale/sale price , if they receive 2 months’ notice in the end there is a 95% chance the contract is written with vacant possession; therefore, simply refuse to move out and put the seller into a breach of contract and then demand illegal payment of $10k, much like the landlord demanded illegal rent request increase.

List is endless.

Marko,

On average, how often would you say your rental units turnover?

“So in this case wouldn’t it be in the tenant’s best interest to accept this rent increase and then goto the RTB and present their case?”

Not really. The RTA allows a landlord to request a tenant to agree to a rent increase that is above the annual cap, but there is nothing requiring the tenant to accept it. In this case, I would decline the rent increase, and cross my fingers they are bluffing about selling.

The letter could be used as evidence that the current landlords are not acting in good faith if they attempted later on to evict the tenant for landlord use. However, if they sell the house and the buyer requests the landlord to evict the tenant for landlord use, the question would be whether the buyer is acting in good faith, and so the letter wouldn’t be much help.

Marko: Absolutely agreed that the cost of borrowing has dropped but that really depends how big a mortgage you have,

But you made some good points about how mortgage rates are down combined with high appreciation. Perhaps a large rebate to your tenants along with a two year rent moratorium might be fair since you have made extremely high profits in terms of appreciation?

Will just ignore that the biggest factor, the cost of borrowing, has dropped dramatically? This from TD on one of my rental properties…1.36% without any negotiation.

Marko: Perhaps a bit harsh, maybe a bit of a grey day. Absolutely that these owners would likely make a good profit when they sell and capped rents are a good reason to get out of owning rental property for a lot of people espicially since a number of costs such as property taxes and home insurance have been increasing a lot faster than the increases. Wasn’t last years increase effectively set at zero.

But you are right any possible hardship disappears if they sell the house. Well the tenants might not be thrilled if they have to move out by the new owner. Like I said it seems to be a decision that a number of small landlords made in my neighbourhood and the SFH seem to have all become owner occupier.

Have a day of sunshine Marko.

So in this case wouldn’t it be in the tenant’s best interest to accept this rent increase and then goto the RTB and present their case? Then if they are successful but still evicted afterwards due to a sale or owner reclaiming the property they would have this prior history on file and would help them in this future case?

Looks like the owner has done a foolish thing by putting pen to paper on a rent increase that is outside of the allowable legal limit along with what amounts to be a threat.

This isn’t the landlords primary residence and the property would have increased between 200k and 400k in the last 14 months….what hardship?

Secondly, the tenancy act rules are readily available. If you want to be a landlord maybe a good idea would be to read up on them? Rent increases in BC are capped and if you can’t live with that don’t become a landlord.

$1,050,000

ks112: that is exactly what I am saying. Rent increase limits are set by the province.

This is a perilous coarse of action.

Frankly, we actually have no way of knowing the true motivation of the landlord

(I find that people springing to conclusions one way or the other rather concerning), might be greed or it simply might be increased operating costs make it cash flow negative and a growing hardship. Either way, just sell the house and get rid of the headache might be the easiest coarse. That will probably screw the tenants but it sounds like they have had the benefit of paying under market rents for a few years so perhaps not so bad.

403 simcoe just sold. Didn’t know it was on the market. Any idea how much?

I am sure more than the listed $900k. Always one of my favourite little houses in james bay. Superb architecture, maintanance and garden

I’ve never had a truly bad landlord experience, but I never liked living in basement suites. Even if the landlord follows the RTA, it always felt to me like you were living in someone else’s house.

As for the Reddit letter, there is virtually no chance the RTB would grant the landlord’s request for an additional rent increase for increased operating expenses. The landlord would have to prove the increase in operating expenses was extraordinary, and that they incurred a financial loss as a result. It sounds like the real problem is poor financial management on the part of the landlord.

ks112, because the landlord is attempting to coerce the tenant into accepting the rent increase, the tenant could apply to the RTB after agreeing and argue the term is unconscionable because they agreed to the rent increase under duress.

Barrister, are you saying that the renter could have a legal case against the landlord at the RTB?

The RTB is pretty useful for tenants if they have issues like this. Just follow the rules.

The main issue, as Leo pointed out, is vacancy rates are too low here to maintain a good balance. This landlord knows that the tenants are paying well below market rent and wants to charge more. In this situation, they just can’t and should not be trying underhanded tactics and resorting to guilt/fear as leverage. And the threat to go to the RTB is ridiculous – never going to get that kind of rent increase on those facts -or any increase imo.

You can only get a rent increase above permitted if you show a capital expenditure or extraordinary expense/loss and only under limited circumstances and the increase is going to be really small. There is a calculator for capital expenditures http://www.housing.gov.bc.ca/rtb/WebTools/AdditionalRentIncrease/#Explorer/step1 Policy here: https://www2.gov.bc.ca/gov/content/housing-tenancy/residential-tenancies/during-a-tenancy/rent-increases/additional-rent-increase

I read the Reddit letter, or at least scanned it. First off the landlord should never offer that sort of deal. Even if the tenant agrees they can go back latter and complain to the tenant board that the extra rent was both illegal and illegally obtained.

Either live with the situation or better still just sell the damn house. I have noticed in my neighbourhood that a number of houses that where rentals are now owner occupied. No idea if this is a trend or just fluke.

Our sketchiest landlords were individuals. That said I also got some super cheap places as a student so I wasn’t complaining too much.

Our best landlord was an individual but he owned 2 small apartment buildings so he knew what he was doing. Never raised the rent on anyone so he had a lady living in his place in Sidney that was paying the same rent she was when she moved in in 1980.

I will also agree with Mr. Buddy – having rented for 5 years, i found large professional landlords to be much easier to deal with. They fixed things almost right away, gave proper notice to enter and never showed up unannounced or caused me extra grief.

Just like with stratas- it always helps to have a professional buffer rather than deal with these problems directly and personally.

+1

When it comes to renting residential I would way way rather rent from a large corporation than an individual owner. You know you are never getting displaced and you won’t be harrassed by the landlord like this Reddit thread. My friends just went to Croatia to see family and while they are away they received noticed that the landlords’ daughter is moving back into the condo. Now they will have less than three weeks to move when they come back. Who knows if daughter is actually moving in or not.

1,200 comments on the Reddit thread and it is mind boggling how many people think the landlord is being reasonable. It is exposing how many idiot amateur landlords there are in the YYJ. I bet they all think they are geniuses with the recent market run up as well.

We kind of need a market correction to get people off their highhorse, unfortunately unlikely to happen. Government will continue to reward overleveraged buying at the peak.

When I was a renter, I always preferred renting apartments from a corporate owner, rather than a small landlord renting out a suite, as you tended to have a more professional relationship where both sides knew the rules and expectations.

I imagine you have a chance of having both a really positive experience or a really negative one with a small landlord, but I rarely had either with a professional management company. It was low-risk and predictable.

I think it’s less of a corporate / non corporate issue and more related to tenants having a choice. In the example on Reddit the landlord thought that given the miserable rental market they could pressure the tenant into a bad deal. That whole strategy falls apart with a 4% vacancy rate that keeps rents in check and tenants can just move.

Unethical/unknowledgeable amateur landlords , like myself for the last 32 years, often employ property managers to deal with tenants. This ensures highly professional tenant- landlord relations. Dealing with large corporate entities when renting can be very intimidating for a renter. I know, when I leased my office, dealing with large companies was far less appealing than dealing with an individual owner. We were on equal footing.

Inflation due to excessive money supply.

Canada Money Supply M0 — https://tinyurl.com/hbvphem2

“So even thought it is difficult to phatom risk at this point such as a market correction things can turn around and because we are dealing with such huge numbers plenty of room to lose a lot of money.”

The problem that people are facing right now is that everything is expensive right now: stock, bonds and real estate. Commodities were cheap a year ago, but that shipped has sailed. It’s either you keep your money in cash and time the market, which has been a losing bet over recent years, or invest it and try to get some return. People are literally investing in jpegs right now. Of course risks have increased, but central governments are trying to inflate asset prices.

< This is why we need to build more purpose built rentals. So many unethical/unknowledgable amateur landlords out there.

Lol ok Introvert, that is not being nice to your tenants.

Marko, I am pretty sure you can still go cashflow positive on some houses currently with variable rate. Like this one here:

https://www.realtor.ca/real-estate/23647913/1737-feltham-rd-saanich-lambrick-park

Rent you can probably get $4500-$5000 so it should cover the mortgage, property tax and some maintenance.

Yes, and it’s worse in the USA. With huge companies buying up entire neighborhoods to rent out.

This should be stopped if it comes to Canada.

https://twitter.com/APhilosophae/status/1402434266970140676

Interest rates have gone down, and so has their mortgage since they bought the house, and the price they pay to rent has gone up, there’s no way they’re losing money.

Yes. That landlord letter is an outrage. Especially their comment “we aren’t breaking even”. In a year when house prices rose 25%+.

Yet the city councils allow basement/garden suites in any home, but fight against new builds.

https://www.reddit.com/r/VictoriaBC/comments/q1baxt/a_letter_my_friend_received_from_their_landlord/

This is why we need to build more purpose built rentals. So many unethical/unknowledgable amateur landlords out there.

Yeah, though I’m still banking on condo price increases I’ve concluded it’s not for me. I’m all about derisking and deleveraging to increase flexibility, not increasing it to increase profit

As for your video on presales and the lack of discount to the resale market, that’s the way it’s been in places like Toronto for a long time. Condo presale is basically a futures contract. Developers are pricing them at a premium and people are buying them at a premium thinking that the market will appreciate beyond that by the time they are built (and so then will be at a discount). I guess when you were buying people were banking on condo price drops so the pricing had to be aggressive to get them to buy.

I bought 3 pre-sales condos under 200k. I always figured the risk was low even thought the market sucked at that time…how much can a 200k unit drop? Probably not below 100k. 150-160k mortgage I could always swing, etc. Now the same units are 400-450k….far more room to drop. Mortgages are now 350k which isn’t really a joke even with low interest rates. You still owe 350k. Even thought it makes sense to buy math wise right now I am just sitting on cash for the time being.

I tried to convince a lot of friends/clients to buy at the Era in 2015 and literally I was the only person that bought. 289k 2015 unit just resold a few days ago for 600k (100k above ask) and not renting for that much more than 2015 rents and people are fighting over it.

So even thought it is difficult to phatom risk at this point such as a market correction things can turn around and because we are dealing with such huge numbers plenty of room to lose a lot of money.

For better or worse it seems a lot of people are doing the math I did in the article a few weeks ago. The place is cash flow negative but based on just interest they are ahead. Then toss in the capital appreciation and I can understand the appeal. Instead of having a property that pays you every month the gamble is on a big payout when you sell.

I don’t love it as an investment because it hinges on some pretty big assumptions and you are exposed to a lot of risk if you lose your job, but it’s the reality.

Another thing to consider is that the risk free rate for investments has been grinding down for decades. Must be having an impact on what people are willing to accept on the investment front

Makes sense to me. Appreciation allows refinancing to find the down payment for the next place.

Recency bias makes us think the past performance will continue. And given the market conditions perhaps they are even right on that.

Yup, no risk of interest rates trending upwards, a ton of rental inventory being built, and throw a bad tenant into the mix.

I find it so incredibly ammusing that 2009-2015 when rental properties actually made sense very few people were picking them up. Now, everything is cash flow negative (based on 20% down) and everyone is piling in.

+1, most exciting thing I’ve seen in a while.

Anecdotal story but three separate friends of mine are looking to purchase a new house (move from a starter to a bigger, more expensive property). All three are planning to keep their starter home as a rental. My friend told me she’s received advice that that’s just the ‘thing to do’ these days – that ‘no one sells a house if they don’t have to!’ Given current interest rates, this approach is do-able for a lot of families.

I like to keep an eye on the least coveted part of Gordon Head — Lambrick Park — and this sub area hasn’t had a sale below $1M for a while now, I think.

This area probably has the most non-owner-occupied houses in all of GH, and very likely all of Saanich. I wonder, at $1M, does an investment rental still make financial sense? Does anyone have any idea what kind of rent you could charge six university students living under one roof?

New NDP government? Job confidence among the public service wasn’t too high during the previous regime.

Leo, I love the visual of the Market Activity Gauge. Definitely keep that from now on!

Similar to the restaurant industry 1:6 survived/make all the money. After the pie are divided between agents and companies they are getting an average of roughly $5000 per sale so the agents that make all the money are possibly making $20,000~30,000 per month.

Are sky-high job vacancies in Canada around for a while? — https://tinyurl.com/dxy9arhu

So the indicators suggests that net positive immigration is not going to abate at anytime soon so as housing price.

On a related note, a friend of mine is moving back to Victoria from NB this winter, because she wanted to be near family and friends and for the milder climate. And, my sister temporary tenants are looking for a SFH to purchase here in Victoria.

761 residential sales in September, shared by approximately 1400 agents. Around one sale each on average. How many agents are starving lately with no sales for a month or more?

Well, sucks to be me…lol..