How long do overheated markets last?

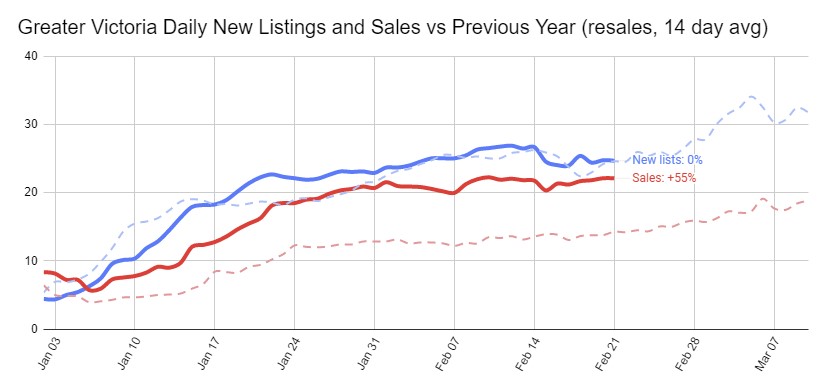

The market for detached properties is clearly overheated out there. With about half of houses going in bidding wars and the median sale at 26% above assessed value so far in February, it’s an incredibly stressful time to be house hunting. That stress is starting to take a toll, with some buyers are dropping out and waiting until things calm down. In Toronto there are reports of that starting to have an impact on the market, with properties set for bidding wars not selling, then being relisted at the higher price that the sellers wanted all along which is leading to building inventory. Normally I’d say the Toronto market has no impact on ours, but with the astonishing amount of synchronization we’ve seen in markets across North America during the pandemic, it may be a sign of things to come. We aren’t yet seeing that here though with sales still some 50-60% ahead of this time last year, while new listings are unchanged.

Before we can answer the question of how long this market can persist, we have to differentiate ordinary sellers markets from overheated markets like we are currently in. Neither of these are strictly defined terms, but sellers markets mean rising prices and occur when there are less than about four months of inventory. A balanced market has about 5-6 months of inventory with prices expected to match inflation, while a buyers market has higher months of inventory and prices are flat or falling.

What’s an overheated market? Well again there is no precise definition out there, but in my mind it’s a market where:

- A large percentage of properties are going over ask.

- It’s difficult to determine market value. Properties are selling without enough market exposure and without enough information for buyers to determine it.

- Prices are rising extremely rapidly.

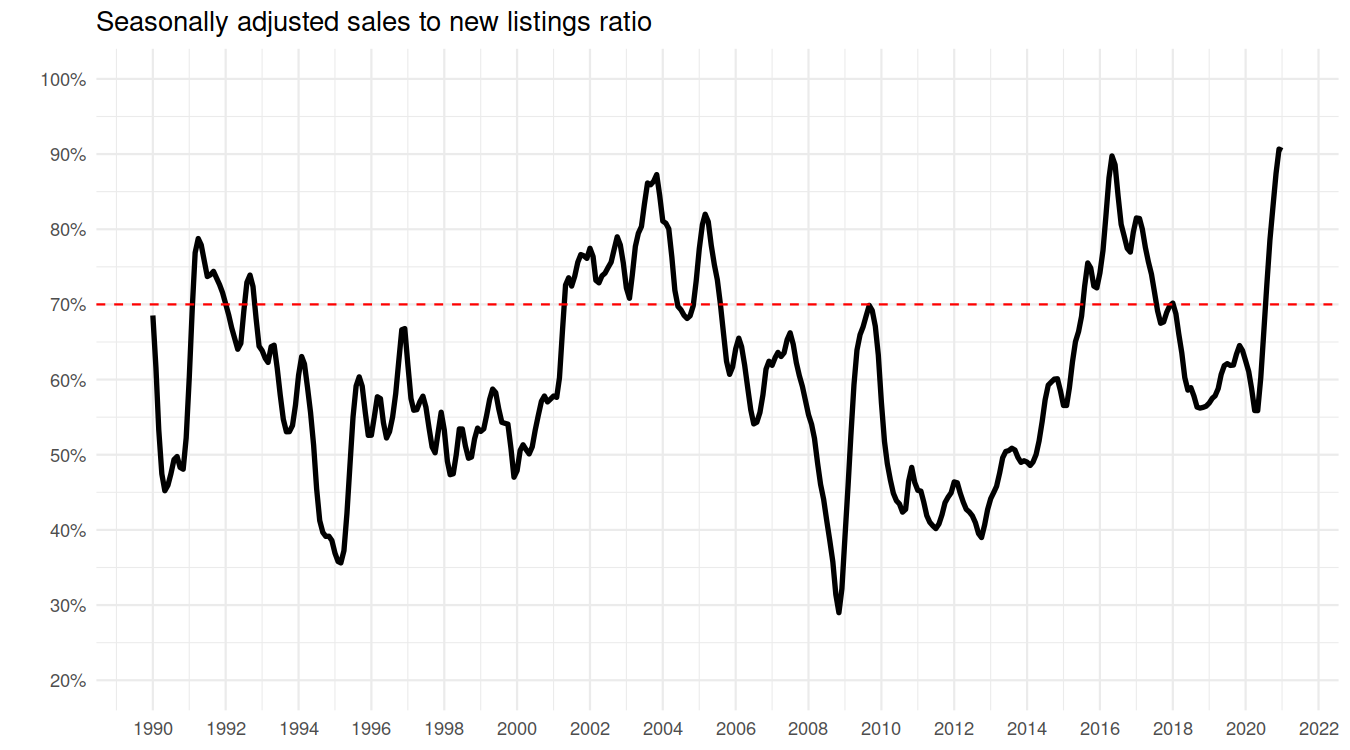

CMHC defines an overheated market as one with a sales to new listings ratio of above 70%. And while they’re not great at forecasting they do know a thing or two about housing markets, so let’s start with that definition. Sales to new listings ratio is extremely seasonal, so to make sense of it we first have to adjust for seasonality. It looks like this.

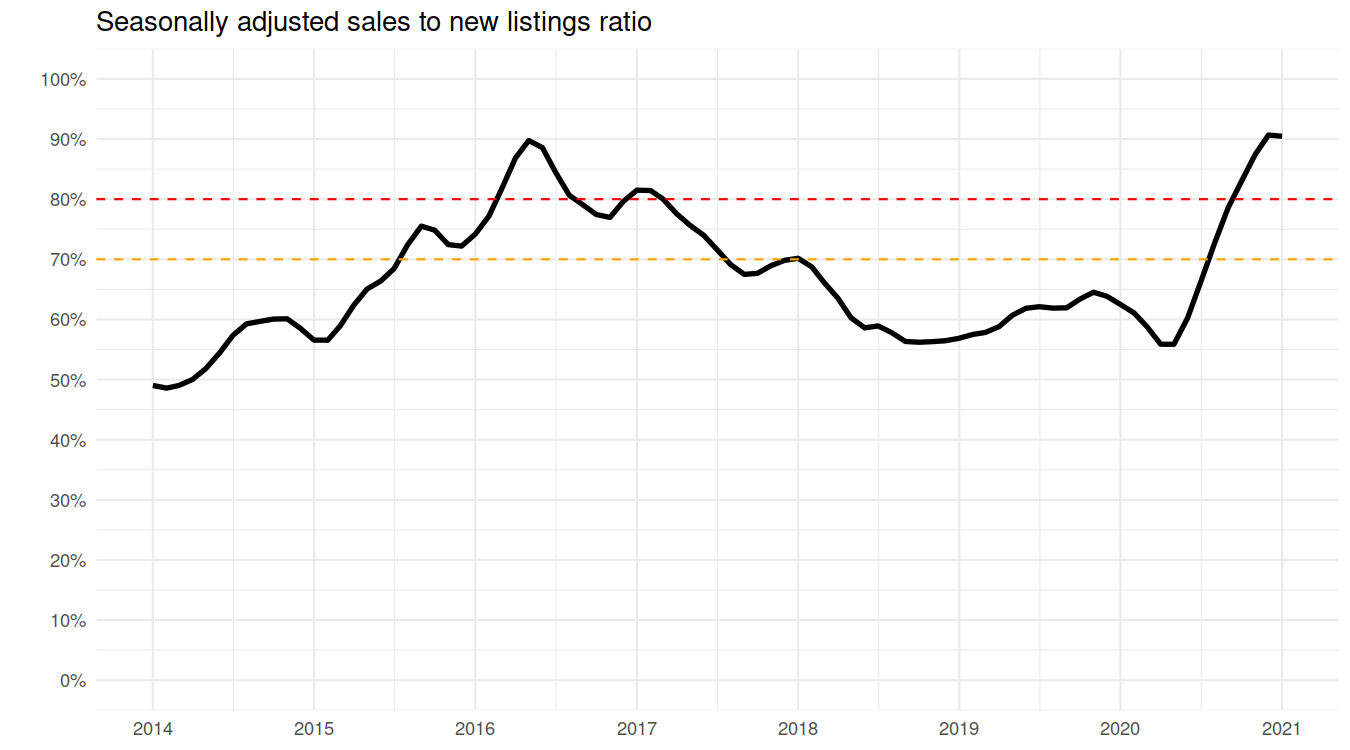

By that measure, Victoria’s market has been in overheating territory 4 times since 1990. In 1991, from 2001 to 2006, around 2016, and now. I think this chart shows that CMHC’s measure of overheating is somewhat too conservative for our market. While the market was certainly hot between 2001 and 2006, it was not overheating or exhibiting the symptoms of irrational exuberance that we’re seeing now. Looking at the last hot market, we didn’t see the true crazyness hit until early 2016 when the sales to list ratio crossed over 80% and stayed there for 6 months. Currently we have been above 80% for 4 going on 5 months.

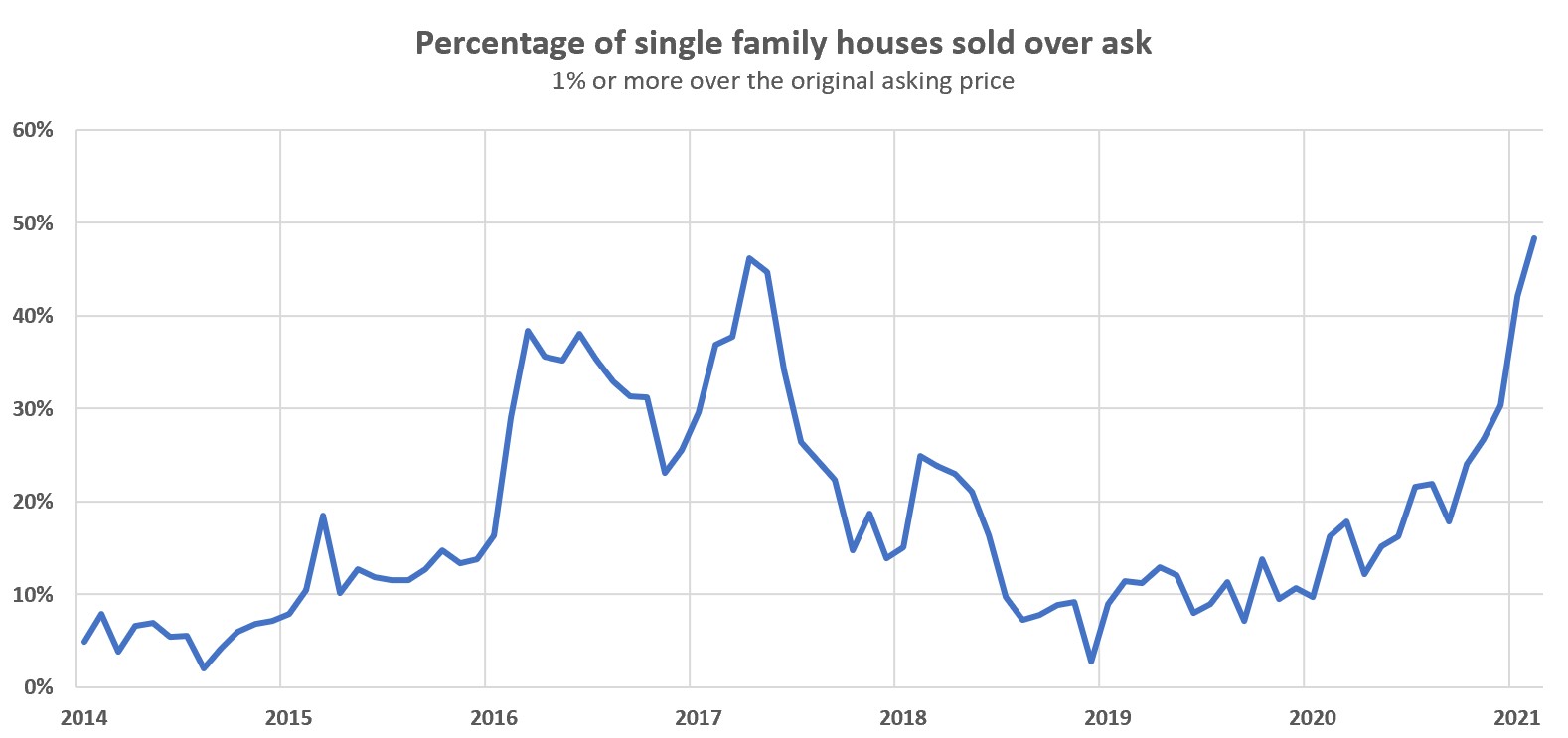

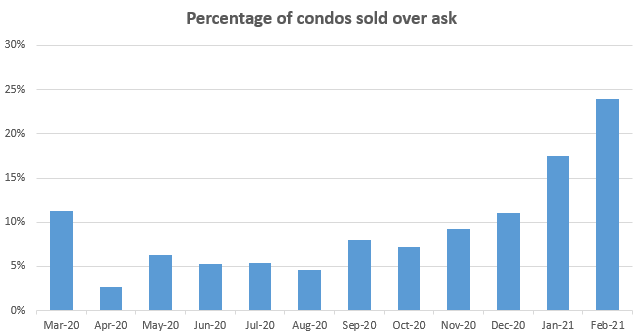

Another way to look at it is with over-ask sales. In 2016 those stayed pretty high for over a year, but at that point we were at comparatively favourable affordability levels and had more room to run from a price perspective. Today we are at much more strained affordability levels that should be putting the brakes on the market soon.

So when will the crazy end? I think we have another month or two of this ahead of us, but probably not much more than that before the market settles back a bit, at least for detached properties. Buyer fatigue is setting in, mortgage rates may be creeping up a bit, and prices are going beyond local ability to pay. That will likely still leave us in a hot market because it takes a lot more time to build inventory back, but I think we’ll soon be back to less risky conditions for buyers.

Also the weekly numbers, courtesy of the VREB:

| Feb 2021 |

Feb

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 205 | 452 | 640 | 563 | |

| New Listings | 272 | 546 | 753 | 1027 | |

| Active Listings | 1368 | 1365 | 1348 | 2127 | |

| Sales to New Listings | 75% | 83% | 85% | 55% | |

| Sales YoY Change | +33% | +54% | +56% | ||

| Months of Inventory | 3.8 | ||||

Not much to add there, the incredibly strong market continues. We’ve actually seen inventory drop in February which is unheard of in a time of year it should be building up. It is now 35% lower than this week last year. In November I said condos looked set for a price jump soon, and that is really showing in the market now with over asks escalating hard since the start of the year. We’re still short of the levels seen in the detached market, but as usual the condo market lags and the trajectory is clear. Once the detached market slows down, I expect the condo market to remain hot for longer as prices catch up.

$1.375 million, 200k over ask

I think you answered it. Just over 200,000 reasons why…

I wonder why they are selling 3347 Curlew. They purchased the home in early Sept 2019 for $691,379 and now have it listed 18 months later at $899,900. Absolutely no class to the place.

When there is a group setting up a “Rent Bank” specifically designed to loan small amounts to people who are unable to meet rental payments or having to choose between food, prescriptions or homes we are truly in a sad state. These are interest free loans, not just money being handed out. Seriously, how will this things improve things for anyone in this situation on a fixed income. In my opinion it is just pushing the problem down the road where it will be exacerbated by loan repayments on top of regular living expenses.

Fine some will find work but many are retired or just not able to work for what ever reason. I have the feeling there will be many more homeless in the future unless this is addressed in a serious way and not with this kind of bandaid solution.

https://www.timescolonist.com/news/local/rent-bank-launched-to-help-keep-greater-victoria-renters-in-their-homes-1.24288099

Getting updates now on a few homes I showed this weekend…no signs of a slowdown, yet.

You can only verify this via tax records/land title because in the MLS system some are reported with GST and some without GST. There is no consistency.

Stroller, I suspect it partially depends on who is mentioning the selling price. Certainly the land transfer tax is normally not included in the sales price but I am not sure about other taxes.

When a new-home sale price is mentioned here does it include GST? If we hear a new home sold for 800k is the buyer on the hook for 840 or was the sales price actually 762?

The banks have regulatory requirements for lending that they have to meet. Beyond that, it’s not their job to determine if a purchase is a good deal. Similarly, the job of an appraiser is to determine the market price, not whether the market price is a good deal. If the market is dominated by fools you’re going to have a foolish market price.

I do think that government should have brought in stricter lending regulations as lending rates fell. And given that buyers are already living somewhere, they can’t escape blame for inflated prices.

3308 Raymond, Cobble Hill. Anyone know if this one is being snapped up as we speak?

Seems like you and Marko would know but my bank did let me know they had several homes that were appraised below the offer price so it does happen.

Final feb sales: 863 (up 53% from last Feb)

New listings: 1015 (down 1%)

Inventory: 1318 (down 38%)

New post a bit later today

Panko, thanks for your feedback, we have a little bit of slack, yes. The frothy market makes is very difficult to be competitive with any conditions at all. All the homes we’ve bid on this year sold to no condition offers.

Obviously “independent “ appraisers are also complicit in facilitating the financing of bloated offers. What could they possibly base their evaluations on? The banks want the business and residential real estate is their first choice to lend to. Therefore, they are partially responsible for these inflated prices. Also, frustrated real estate agents trying to make a living are encouraging their clients to over bid. The only other explanation is wealthy buyers paying cash and not caring what they pay because they have too much money.

Bluesman, I bought a place in spring 2016 under similarly frothy conditions. Bank appraisal came in ~$30k (5%) less than my offer. So this can happen. I probably could have tried another lender, but there ends up being so little time to mess around after an accepted offer. Best to leave some slack in your budget if you can.

I’m not trying to refute Marko’s much bigger data set. However, neither of the realtors involved were aware of what my bank appraisal came in it. I just gave them the thumbs-up to remove the financing condition and that was that.

I’ve never seen an appraisal screw up an on “MLS deal in my career and that is a sample size of 800. 99% of the time it is within a few % of the accepted offer price.”

In Calgary when house prices dived in 2007 and then again after 2014 about 30% of deals appraised less than the selling price causing most of the deals to crater. There were even cases of homes originally appraising at the selling price at time of offer but then the bank insisting on reappraisal prior to possession and the appraisals coming in lower. Buyers had to come up with the cash difference or walk and you can imagine that created some serious issues and a lot of unhappy people. As a listing realtor it was common practice to accept back up offers.

Hasn’t shown up yet, probably tomorrow if it sold

Anyone know what 5070 lochside sold today for? Thx

Interesting chart

+1

And guess how much business the appraisers get that keep killing deals by having the property not appraise.

The funny thing is that CMHC backed away from many of those loans and decided not to insure big parts of the high-ratio market like they did in the past. This was made up by the private insurers, unfortunately, for some reason, the government is backing the private insurers for the risk that government agency (CMHC) will not accept. I would just like to see the subsidies pulled from the market and the risk removed from the tax payer. I guess it’s good politics to make it look like you’re helping people get houses, but all the steps government takes to increase buying power for the unqualified just inflates the market.

Banks require an independent appraisal if a property is over a million and in some other circumstances.

Yes, banks are complicit and so as CMHC, because many mortgages are insured therefore banks can take higher risks on loans.

The issue of banks lending money in a crazy market is concerning, especially when prices are going hundreds of thousands over asking. Remember when a house was $200,000, not $200,000 over $1,000,000. Are the banks complicit in driving prices higher by lending money so freely without an independent assessment of value? This contributes to the possibility of things blowing up in our faces. Have we forgotten 2008?

Same thing, though. Buyers want a clear and simple number to anchor their analysis.

Question was and almost always is on HHV from a buyer.

I’ve never seen an appraisal screw up an on MLS deal in my career and that is a sample size of 800. 99% of the time it is within a few % of the accepted offer price.

Leo, maybe you should create your own assessment app that a) is more accurate for individual properties than BC Assessment, and b) better reflects current value (i.e., isn’t based on a snapshot taken on July 1st of the previous year).

You could call it “Leossessments.”

I can hear people talking about it now… “Guess what my house was Leossessed at? $950,000!”

Because the assessment is a clear and simple answer to the burning question, “What is my house worth?” (Only the geeks who read this blog understand that the assessment isn’t necessarily very accurate.)

Essentially, people want to know what their house is worth without actually testing the market and selling.

More of the don’t build anything anywhere…

https://www.timescolonist.com/news/local/taller-denser-housing-projects-face-pushback-in-saanich-s-royal-oak-1.24288087

Thanks Leo – your last sentence is spot on – these are exactly my thoughts which is why the wife and I are bit stressed at the moment.

Basically not an issue currently. The appraisers see the accepted offer price and magically nearly always come in at or over. From the brokerage, only one recent sale the appraisal came in a couple percent lower than the sale price. Seems like no appraiser wants to rock the boat here.

Could happen of course. Just because you’re approved for X in financing doesn’t mean you’ll be approved for X on any given property.

Gone I guess. But it’s realtime, you can look at the trailing few weeks of sales and get a good sense, whereas the other measures are a lot noisier.

Where the market is going or where it has gone?

Thanks for your comments Leo and Marko – I’m more concerned over how the bank’s appraisers will look at the property’s value. In this bonkers market how will their appraisers treat the amount of heat in terms off assessing a market value on which to loan against the property. On million dollar properties there isn’t insurance available for any difference. What margin will they put on the sale price if an offer is accepted? Concerned that the market is appreciating so quickly their look back period on comparables (maybe 3-6 months) will show a much lower amount than recent sales of the last month. Really a question for my banker.

Yeah individually they are of almost no use to estimate market value.

Not everyone agrees with me here, but as a group they’re actually not bad as a measure of where the market is

going. Take the median sale / assessed value ratio and it’s a pretty good measure of price change from the assessment date. Tracks very well with price changes and is less susceptible to changes in the sales mix or issues that the repeat sales indexes have (Teranet lags, and MLS HPI is tracking a representative house, not all houses)I personally don’t pay any attention to assessments on individual properties, I still don’t get why people are so obssessed with asessments.

For example, I showed two units yesterday in this building

https://www.realtor.ca/real-estate/22803444/705-838-broughton-st-victoria-downtown

https://www.realtor.ca/real-estate/22790731/1003-838-broughton-st-victoria-downtown

Both have 1 parking spot. 7th floor unit assessed at $483,000 and penthouse assessed at $453,000. How does that make any sense or have any value? Are you going to feel better buying the 7th floor unit because you pay less over assessed?

When it comes to SFHs on individual properties the assessment numbers are even more ridicolous.

Instead of focusing on assessments focus on finding a solid property in-line with comparable sales, imo.

If someone puts in new drain tiles, heating system, windows, and roof. Guess how much their assessment goes up? $0.

$1,620,000

I don’t think people who work for government are bad people but the above sums up the problem. City of Victoria pays their “Strategic Real Estate Advisor” >$150,000/year. Why would he or she care if the COV overpaid by $4 million for the patch of dirt on Pandora? He or she continues to make $150,000/year, flex fridays, paid vacation, pension, etc.

5 months to get a building permit? Who cares, it is actual to the benefit of the muncipal employes the longer it takes for job security.

If you have a private design firm guess what happens? People do not use you and they use a different design firm that will turn building plans around faster.

There may be more in savings accounts but it looks to me like net household indebtedness is up. Some people may have less net debt or more net savings of course, but that doesn’t help those who don’t. That’s not counting government debt which will have to be reckoned with eventually.

https://www.bnnbloomberg.ca/canadian-consumer-debt-tops-2-trillion-equifax-canada-1.1529506

At Home Depot the other day to put in a new door to the home office. Guy there says the supply chain is totally broken and anything not in stock will take 10-15 weeks to get in + surcharge so make it work with what they have. Massive demand spike + supply chain disruptions.

Couple things came to mind there:

Unrelated Covid PSA for those interested.

Just over a year ago there was an argument on this site that covid was just going to impact older people and the business cost wasn’t worth the precautions. As it turns out, we now have the data to show that about 10% of all people diagnosed with covid, including those who are younger and otherwise healthy and those with milder symptoms, turn into “long haulers” suffering longer-term damage to other organs such as brain, heart and lungs. In the case of SARS (also a coronavirus sharing 80% of its DNA with covid but with more severe human health impacts), about half of the patients studied were never able to return to work.

https://www.mayoclinic.org/diseases-conditions/coronavirus/in-depth/coronavirus-long-term-effects/art-20490351

https://www.businessinsider.com/covid-19-long-term-symptoms-sars-chronic-fatigue-2020-8

James….. I’m curious. You say you can’t get “Softy” developers, so I’m wondering if you require them to work in the office or do you encourage people to work from home?

If you do let them work from home, then is it still tough to find people?

Not that weird IMO:

All of this has been pushing tech salaries in Victoria up.

Taller, denser housing projects face pushback in Saanich’s Royal Oak

https://www.timescolonist.com/news/local/taller-denser-housing-projects-face-pushback-in-saanich-s-royal-oak-1.24288087

” As the price of bitcoin skyrocketed over the last year, so has the amount of energy used to mine the cryptocurrency, prompting concerns about its environmental impact.”

Well, there’s the death knell for Bitcoin.

Does anyone know what 1590 Despard sold for?

It’s weird but the labour market for softy developers around these parts is the hottest it’s been. I just engineered a 40% raise and we have been completely unable to backfill 3 positions. Everyone is hiring and recruiters have nothing.

Just go with methodology used on “Who’s Line is it Anyway” for assigning points for best skit and transfer it over to valuing the offer to put on property. That should reflect the current sense for forecasting the value or price on a house in this market.

Another week passes, more viewings of SFD s and now getting ready to submit an offer on Monday. I am still a bit perplexed by the whole offer price versus assessed value ratio. Leo, is it correct that you have indicated that the median sale price over assessed is ~26%.? I am seeing homes in the areas we are looking at with assessments in the $750K – $800K range selling 33%-49% over the assessment. Marko/Leo and any others? What say you?

Wouldn’t it make more sense that equalization and federal taxation should be pared down to minimised big and cumbersome government so that each province have more control over provincial projects?

Another, feat the we must push for is that politicians, and government employees must be tied to projects performance that reflect by their salary. Poor performance equate to lower wage and like wise pay raise with good performance.

Exactly, the mortgage paydown in those 12 years would have meant a higher return than the 1%.

One interesting takeaway from the article:

[Economist Ben] Eisen believes Alberta will soon lose its status as Canada’s richest province – for the first time since the fiscal capacity measurement was invented in 1967 – with British Columbia taking the top spot.

This is one of the best articles explaining/exploring Canada’s equalization program that I’ve ever read.

I uploaded it to docdroid to eliminate the paywall:

https://docdro.id/CMzCVsY

Could be.

TD Bank raising 0.25% from 2.0 to 2.25% means paying 3% more per month to borrow the same amount of money.

That math has helped fuel the home price rises as discounted mortgage rates fell steadily from 2007 (6%) to now (1.36%). https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

But If discounted 5-year rates (now 1.36%) rose back to 2007 levels (6%) , that would raise a mortgage payment by 60% to borrow the same amount of money.

So if you can afford a $1m mortgage now ($4k/month, rates @ 1.36%, 25 year amort.), with a rate rise to 6% you could only afford a $615k mortgage for the same money.

In theory, if interest rates fell to 0%, all mortgage payments would be principal (savings), and house payments would be “free” (except for property taxes, insurance, upkeep etc.), since all of your payments are equity. If you look at it that way (ignoring principal payments), then housing mortgage costs have fallen even more dramatically from 6% interest per year to 1.36% and those interest payment would rise more than 4X if/when rates rise again.

First time buyers seem to be a big jump in 2020, judging buy the surge in BC home ownership in the age 25-35 group.

According to a Royal Lepage survey..

https://globalnews.ca/news/7662252/cda-millennials-homes-real-estate-pandemic/

How the pandemic pushed Canadian millennials to home ownership

“In British Columbia, 49 per cent of residents aged 25 to 35 own their home with 27 per cent having purchased a home since mid-March of 2020.”

I thought 3350 Upper Terrace was on the market for quite a long time in 2019. I recall it was removed from the market then reposted. I could be wrong but I don’t think it was sold in a day. I had been looking at similar homes so am pretty sure.

Former BC Hydro CEO Marc Eliesen said the government is “playing Russian roulette” given the scope and severity of geotechnical problems with the project

“Make no mistake. Premier [John] Horgan will be haunted by his reckless and irresponsible decision. No amount of wishful thinking will make this project safe, and costs will further escalate.”

The most expensive dam in Canadian history: cost of B.C.’s Site C dam balloons to $16 billion

https://thenarwhal.ca/bc-site-c-dam-16-billion-horgan/

That’s what that slide deck is showing you. Field studies by washington state university of a heat pump over the course of a year (at multiple sites). Feel free to dig into the scientific papers if you like (Ken Eklund at WSU was the lead researcher).

I suspect it would not be hard to find recent field studies of ductless mini-splits showing COP above 2.4.

TD becomes first major bank to hike fixed five-year mortgage rates amid surge in bond yields

And just maybe, we’ve seen the end of the greatest decline in rates in history.

What matters is current expenses (interest, taxes, maintenance etc.) versus rent, plus opportunity cost on paid principal. Mortgage paydown is savings, not an expense.

An eye opener, young people are turning down well paying jobs (possible $100-200K per year), because there is a stigma that they have to work with their hands in a dirty job, and God forbid they have to show up to work on time.

PBS: Despite rising salaries, the skilled-labor shortage is getting worse — https://youtu.be/O_iHdmMOHZ0

Sidekick, wake me up when your scale down pool heater gets more than 230-240% effective efficiency in the real world, and not to mention the costs of the unit nor maintenance (efficiency of VW emissions).

Assuming they had a mortgage they probably paid down their mortgage a significant amount vs paying rent to someone else.

Here you go: https://www.phnw.org/assets/2019Conference/Presentations/PHnw2019_Development%20and%20Implementation%20of%20the%20Sanden%20Co2%20Heat%20Pump%20Water%20Heater%20as%20a%20Combi%20for%20Passive%20House%20Buildings_Albert%20Rooks.pdf

So under the worst circumstances, this is more than double the efficiency of the very best mod-con boilers. And at higher outdoor temperatures it’s 3 to 5 times more efficient.

3350 Upper Terrace seems to have sold in one day for full asking of 2.4 million. Suspect they were still waiting to put up the sign.

–

Bought in 2009 for 1.9MM, sold 12 years later for a whopping gain of 25% more like 20 % after transfer tax and selling fees, minus any renovations costs, seller maybe made 1% per year or lost money after inflation. After living in our 2 year old home for 3 days I can see why those nice big older homes just don’t command near the same value per sq foot as higher end never homes.

Add: For the most part, heatpump homeowners should be banking on 180-190% efficiency with regular maintenance, otherwise the homeowner will be very disappointed when find out that their air source heatpump isn’t as efficient as they were lead to believe.

Condensing boiler or furnace are damn close to 100% efficient at 97-99% efficiency. And, I would love for you to find me an air source heatpump system in real life situation (in actual usage) weather it is residential, commercial, or industrial that give you consistency of more than 230-240% efficiency, and not the bloated numbers that you get from the manufactures.

And, just to let you know, Fortis also is an electricity provider.

<– almost 2 decades as an HVAC specialist.

Misleading graphic there. Natural gas is not 100% efficient, whereas use of electricity for heating can be 200-300% efficient via a heat pump.

We are currently paying $0.0935-0.1403/kWh + 2.7% – 0.3% + 3% +14.5% = $0.1132-0.1699 kWh by the time the site complete, however the final cost a lot more than the final estimate.

https://www.bchydro.com/news/press_centre/news_releases/2020/statement-one-per-cent-rate-reduction.html

https://www.nsnews.com/bc-news/province-will-complete-site-c-dam-with-new-16-billion-price-tag-3461456

https://www.fortisbc.com/services/sustainable-energy-options/renewable-natural-gas/renewable-natural-gas-rates

“I would just automatically multiple the quote by 2x to 3x and we would get the job half the time.”

Ain’t that the truth, it’s the same everywhere.

I was working on the design of an office tower and hotel (Sandman Inn) downtown Calgary, and because of the location the City wanted the developer to pay for a +15 pedestrian bridge over a four lane roadway. When asked how much the City wanted them to pay for the bridge, the City came up with an estimate for $1.4 million (this is 1977) The builder said to hell with that, we’ll just build it. They did, for $250,000.

Island time = glacial time.

https://www.realtor.ca/real-estate/22802601/1102-fitzgerald-rd-shawnigan-lake-shawnigan#view=neighbourhood

I’ll go out a limb and say I probably wouldn’t be able to walk to a grocery store from there in my lifetime.

“I drive past that subdivision all the time when I visit friends on the lake…..I’ve never seen any subdivision more in the middle of no where than there. Malahat a pleasant drive with a Dodge Ram riding your *** half the time? No thnx personally, rather live in a microloft at Janion.”

Yes in the middle of nowhere, but for how long?

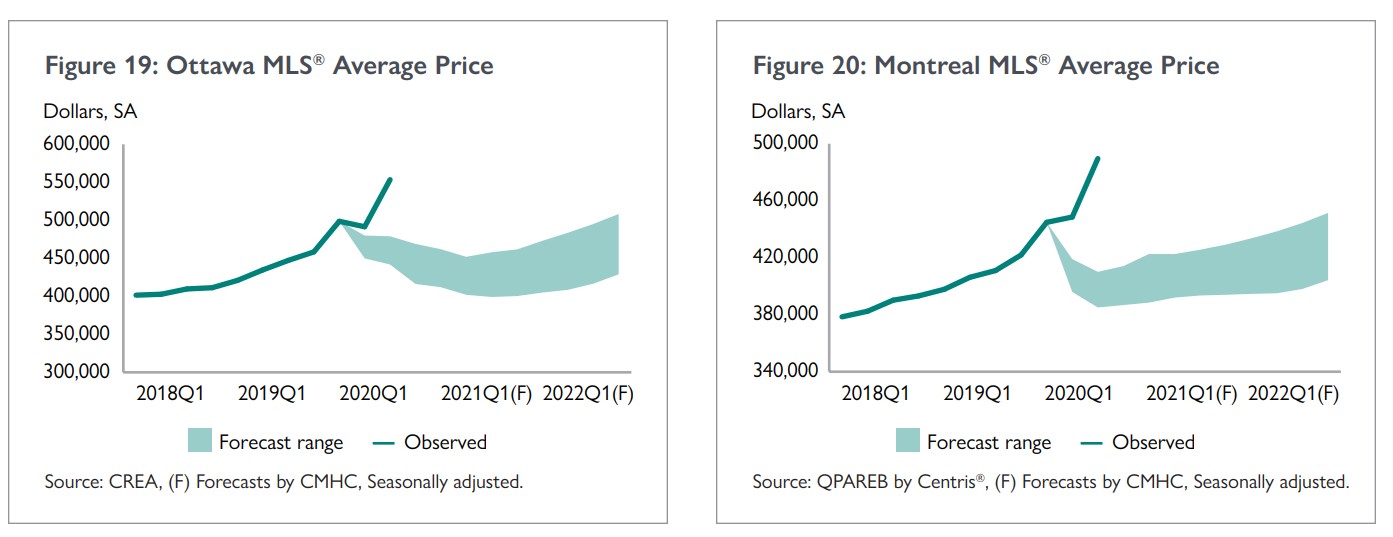

CMHC finally admitting how wrong they were. This must have been a brutal report to write.

https://assets.cmhc-schl.gc.ca/sites/cmhc/data-research/publications-reports/housing-market-insight/2021/housing-market-insight-canada-68469-m0225-2-en.pdf

Nothing wrong with being wrong, forecasting is basically guesswork at the best of times. But it was obvious that that forecast was seriously flawed almost immediately after it was released. Made no sense to me shortly after I saw it, and when I talked to a CMHC economist about it they were scratching their head as well. Seems like it came from corporate with no input from local market economists. Just publish whatever the models spit out without a critical second look.

They acknowledged the unprecedented uncertainty, and then went on to publish a very precise forecast with high/low confidence ranges that was blown out of the water immediately.

Then CEO Evan Siddall went on an attack tour painting anyone that doubted the forecasts as industry shills.

Like if there’s one thing I’ve learned from 10 years of thinking about the markets it’s to be less certain about forecasting and more open to other theories of the market. The market nearly always surprises.

https://twitter.com/trevortombe/status/1365442354677645312

Sigh…

DOM is a bit of a weird measure. Perversely it can go up when there’s a sales surge after stagnation as a bunch of stale stuff sells.

DOM here is 24 for single family, 27 for condos. That’s the average though which isn’t that useful. Median is 8/14 for SFH/condos.

Interesting, thanks.

I see that average DOM there is now 46 (from 58). That still seems pretty high.

What’s Victoria’s average DOM, Leo?

Seems like around 13-15 cents/kWh going by previous estimates.

I drive past that subdivision all the time when I visit friends on the lake…..I’ve never seen any subdivision more in the middle of no where than there. Malahat a pleasant drive with a Dodge Ram riding your *** half the time? No thnx personally, rather live in a microloft at Janion.

Government always gets hosed. When I was a teenager working for my father in the stone masonry business I started doing estimates at 17 yrs old and anything to do with ICBC/military/BC Hydro/municipality/etc., I would just automatically multiple the quote by 2x to 3x and we would get the job half the time. Once on a $5,000 municipal job I submitted something like $15,380 (you want to make it look like you actually gave it some thought) and we got it.

This is why I am so strongly opposed to government building housing, just buy the end product of private developers. They can’t even seem to do that properly given COV paid $10 million for a patch of dirt on Pandora worth $5 to $6 million at most.

So what’s the LCOE at a $16B price?

Tough decision, but it’s an indictment of the catastrophic state of project management in large infrastructure.

Surprised I haven’t seen Introvert mention the Site C project moving forward with a new expected price of 16B. Wonder what the resulting hydro increases will be.

I had heard that one of the reasons for Site C was to provide cheap power for fracking. I wondering if nat. gas. prices will increase with increasing hydro costs.

What do you expect when every province and federal government are spending like there is no tomorrow since 2008 market crash.

Government getting bigger and bigger in Canada — https://www.fraserinstitute.org/article/government-getting-bigger-and-bigger-in-canada

@cadbro – fair enough.

Truth is that Totoro is right, we really don’t know. I was certain that I had bought at the top of the market(closed May 2017), and yet here we are.

An added benefit for us was that we were also undisciplined spenders back then(we have two children in ft daycare now, so we’ve become disciplined), so the 53k that we’ve paid in principle on the house has helped make for a fair bit of long term peace of mind.

Good luck on the hunt!

We just don’t know. What I thought was reasonable in 2012 going forward did not happen. Personally I think I’d rather have a townhouse than rent and, even more, co-own (with good agreement and separate living spaces) something suitable with another family in the interim ie. create your own duplex or triplex situation that offers a lot more than a townhouse:

https://www.realtor.ca/real-estate/22740609/3527-richmond-rd-saanich-mt-tolmie

https://www.realtor.ca/real-estate/22787665/844-pintail-pl-langford-bear-mountain

https://www.realtor.ca/real-estate/22779931/3195-woodridge-pl-highlands-eastern-highlands

Introvert did you see the 180 on Calgary real estate? Flying off the shelves… There goes my plan D

https://globalnews.ca/news/7643677/calgary-resale-housing-market-rebound/amp/

Newhomeowner congrats on your gain but I do not think its reasonable to expect townhomes to increase 150k-200k over the next 3 years with interest rates nowhere to go but up or stagnant. If they gain it’ll be at a much lower pace. We’re looking at staying in a home 5-10 years when we buy to ride out a possible decline in value.

Yesterday was budget day for the Government of Alberta.

Of note, royalty revenues from the tar sands ($1.4B) don’t even cover annual provincial debt-servicing costs ($2.7B).

https://calgaryherald.com/opinion/columnists/braid-kenney-is-stuck-in-an-alternate-universe-of-debt-and-possibly-a-new-sales-tax

https://househuntvictoria.ca/2021/02/22/how-long-do-overheated-markets-last/#comment-76547

Check this house, nice area. Only half hour from downtown (most days). The house is on the smaller side but great area for a growing family. Malahat is a pleasant drive, if you are not in rush.

1102 Fitzgerald Road, Shawnigan Lake, BC, V0R 2W3 — $599,000— MLS® Number: 865865

Super odd article . The claim is that inventory is low because people aren’t listing their homes but then they present no evidence for that. Around here new listings are exactly the same as pre-pandemic. It’s sales that are way up which has depleted inventory. Sales up without new listings up, demand has to be from either: first time buyers, out of town buyers, or investors.

The question about whether more people have been hanging on to two homes is interesting though. Unfortunately no time series data on that. That research could be done with the land title database.

3350 Upper Terrace seems to have sold in one day for full asking of 2,4 million. Suspect they were still waiting to put up the sign.

Interesting read in the NYT about the housing supply crunch south of the border. Some of the factors discussed are US-centric, but others likely apply equally well here (especially given Victoria’s demographics). https://www.nytimes.com/2021/02/26/upshot/where-have-all-the-houses-gone.html

Makes me wonder if there could be a burst of “pent up supply” post-pandemic?

Just responding to the bond yields that Rush4life was posting.

The market hinges on ultra low rates. 20% drop in mortgage payments and we saw a 20% jump in prices.

If that interest rate reverses then that would be a big brake on the market.

I still don’t think we’ll see a big jump in interest rates but no one saw this breakout coming either. More surprises coming I’m sure.

Any more details?

US 5 year peaked at 0.836 today, and now down at 0.776

IMHO, the reason for the bonds going up is due to the fact that the Fed is buying $120 billions a month and will not stop till next year, and another factor is that some investors are spooked from the quick rise of equities so they buys bond. Which lead to the assumption that we are seeing a hot recovery and possibly more than healthy inflation. So now we are just waiting for 5 year fixed mortgage rate to follow suit.

Canada 5 year peaked at 1.027 today, and now back down to earth at 0.917.

So you are saying it is always the same % of home owners selling at any given time? ok gotcha.

Actually there are always the same number of buyers and sellers. What people want to brag about may differ though.

Sell when everyone is buying, buy when everyone is selling. If you look back in Leo’s Victoria home price history, this strategy works out pretty good.

Huge breakout. This could really throw a wrench into the market if it persists

5 yr bond yield @ 1.02%. Saw Ron the MTG guy on Twitter saying 5 year was going from 1.49% to 1.99%.

8-1060 Tillicum

Pending for $725k

All this talk of townhouses has got me interested in what the unit beside my in-laws went for at 1060 Tillicum. Not sure of the unit but it was the only one for sale in the complex and listed for 709, I believe.

https://www.cnbc.com/2021/02/25/you-can-now-buy-a-3d-printed-home-heres-a-look-inside.html?fbclid=IwAR1uwroqcPRwddlpeHRXQ25wuBRraSheheeLF0y2U4zzCnBNxXcGuJhohO4

934 Cowichan, almost half a million over assessment, really?

I think he’s simply saying that starting with a townhouse and trading up is worth it. There are capital gains on principal residences, they’re just not taxable.

“newhomeowner” why would there be capital gains on your townhouse? Isn’t it your principal residence? Or is it a rental property?

@cadbro, I’ve been following your posts with a bit of curiosity. I believe I have a similar family makeup and income. And I definitely feel where you are coming from.

Though if the opportunity presents i believe a townhome or duplex is a good option despite your concerns. Truth is that townhouses do generally follow the market and the standard 3b/2ba -1400sq ft can definitely be big enough for a family with two young kids.

I’ve only owned for 3 years and am looking to move up to a freehold. But the capital gains on my townhouse(at this point probably $150k-200k) definitely outweighs the transaction costs of trading up($30k).

What does it cost to build new housing stock? These numbers are for Vancouver, but Victoria would not be too far off. The table/report shows that row townhouses are the cheapest. So there are 4 of you in family and 1500 ft2 is enough space, the cost of a townhouse would be 200,000-300,000$ Build Cost + Land Costs + Fees + Builder’s Profit

https://stevesaretsky.com/vancouver-construction-costs-are-the-highest-in-canada/

SHARE: Regarding Covid and finding the best facial protection, this N95 seems to offer the best protection as it fits over 97% of all faces.

https://www.youtube.com/watch?v=4dGFVeKqu4w&feature=youtu.be

People always will prefer a detached house. Prices demonstrate this. But the upswing in condos has shown that people will buy what is available as well. Problem is there is very limited options for families that can’t afford a detached house. There are very few condos suitable for families, so families are being squeezed out of the ownership market entirely right now.

Rush4life brings up a good point though. Would be interesting to compare affordability of a townhouse vs house with suite. Difference between what you can get approved for and your final outlay of course.

Thanks Leo, wow looks like my co worker made out pretty good with the 800k purchase 7 years ago. I can’t believe someone paid $1.65M for that house…

I’d be fine with a TH, but once you factor in strata and no suite it’s actually more affordable to buy a house with a suite in general.

$1.65M

Did 934 Cowichan already sell? What did it go for?

Langford, Colwood, Sooke will continue to provide more SFH supply.

Net additions to SFH in Vic, Esquimalt and Oak Bay will be negligible. A few old SFHs replaced by apartments, a few new infill SFHs.

Saanich and View Royal should produce a small (net) trickle of new SFHs

I posted awhile back about potentially moving to the cowichan valley. Someone responded with great feedback and mentioned the schools in the Maple Bay Area were not the best. I’m hoping they see this and can give me more detail as to the concerns. And if there is anyone else with knowledge of the area and market up there I’d love to hear what you have to say. Thanks!

Thanks for the kind words Totoro! The sculpture has just been purchased and we have now moved it to a private property in Central Saanich. It now overlooks Brentwood Bay. It’s made out of stainless steel and glass. My wife, Elizabeth, created the piece with input from my son Samuel and myself.

The several acre property has a winding road that leads down through the private forest to the ocean and the main house. It’s an astonishing piece of property and the owners have been lovely to work with. We have installed several of our sculptures in the forest over the past three months.

What’s going on with rates?

https://www.ratespy.com/canadian-rates-go-vertical-022517870

This is something I’ve thought about.

Say Greater Victoria builds a ton a “missing middle” housing, would enough people who want to buy a SFH but can’t afford one happily settle for a townhouse, duplex, triplex, etc.?

As Cadborosaurus demonstrates below, the desire for single-family homeownership is strong.

Alexandracdn that’s a great townhouse, I wish we had had the means to buy one 5 years ago. Its actually at our max affordable with that $356 strata payment, kitchen is great but parking is lacking for commuters. We’re past the point of looking at townhouses today, I feel if we got into one now we’d be stuck in it after outgrowing it (in 5ish yrs) if this market goes south or stagnates. We’re more prepared to weather a downturn in a SFH (for 10+ yrs), where we could expand or tweak the space to fit growing kids and 2 vehicles as we’re commuting to jobs and daycare.

I bitch a bit on this blog about my situation but I also realize I have some privaledged thinking in that i want to skip entry level strata housing and go straight for a (small) SFH. After friends horror stories about strata stress, and our own expirence renting here for 15 years (and being renovicted in 2020 for landlord use of our home) I’m really over sharing walls and decisions with others.

That makes more sense.

A Royal LePage survey reports that young buyers are driving sales in BC (and elsewhere), due to increased savings, low interest rates and increased importance of the home with remote work…

—++- + ++

“In British Columbia, 49 per cent of residents aged 25 to 35 own their home. Of those homeowners, 27 per cent purchased a home since mid-March of last year. Among those who do not currently own a home, 65 per cent say they intend to buy within the next five years.

Strong demand from buyers aged 25 to 35 continues to drive sales in Western Canada. As is the case from coast to coast, many young Canadians in British Columbia (41%) have seen their savings grow since the onset of the pandemic, which has been an important factor in their decision to purchase a home during this time, along with historically low interest rates.”

https://www.newswire.ca/news-releases/royal-lepage-survey-nearly-half-of-canadians-aged-25-to-35-own-their-home-one-quarter-of-these-homeowners-have-purchased-a-property-since-the-onset-of-the-covid-19-pandemic-878974065.html

https://marketing.rlpnetwork.com/Communications/Royal_LePage_2021_Demographic_Survey_table.pdf

Should be read as “Home” prices, not single detached house prices.

Ks112 re: affordability yeah a minor cashflow increase but can buy less house now at our max. The places we looked at in 2019 that were 540k / 15k out of reach would go for 700k+ today, so min. 40k out of reach. IMO our buying power is much less today, despite 5k more annual income + CTB from 1 more kid being factored into approval. and we can’t enter a bid war with financing and inspection conditions. I don’t really care what the list price and interest % is at the end of the day if we can afford it but that affordability is shrinking every month.

One of the task force’s goals is to stabilize house prices?

Good luck with that.

Good question. This was actually an already ongoing initiative and I don’t know the details, but will ask what the plan is there and for the final report to link to more details on those initiatives that are already underway / under consideration

Is building a small apartment on a SF lot considered “gentle density”?

First time in a long time seeing a number of multiple SFD coming on as listings each day over a few day period. Let’s see how fast the come off market.

Cadbro, you now also have higher income so I think your affordability cashflow wise has gone up over all. You were already $75 bucks a month ahead with current assumptions.

Draft Saanich housing task force report to be reviewed at tonight’s meeting. Comments, questions, suggestions for items to raise?

https://saanich.ca.granicus.com/MetaViewer.php?view_id=1&event_id=775&meta_id=33207

Ks112 playing with numbers on my mortgage calculator. CMHC included, PTT and closing costs not included but we’ve have that ready separate from downpayment. Excellent credit scores no other debt or financial factors.

2019

$525,000 house with $30,000 downpayment, at 3.6% interest (idk what it actually was I pulled this from ratehub) = $2611/m

2020

$660,000 house with $50,000 downpayment, at 1.5% interest = $2536/m

So basically the same cost.

Finally a decent paying government job in Victoria, lol whoever gets this just may just be able to afford a decent SFH if they had dual income.

https://www.linkedin.com/jobs/view/associate-project-director-at-transportation-investment-corporation-2405767002/?refId=e4504d94-bee1-4741-90cf-8bf6fbb11875&trackingId=IH%2F7bV2J75rWDrpyM7qwTA%3D%3D&originalSubdomain=ca

Cadborosaurus…I have been reading some of your posts. Have you given any consideration to purchasing a townhome? If so, look at #122-2920 Phipps in Langford. It is listed at $579,900. Over 1700 sq.ft. 3 beds up with two full baths, main floor has bright kitchen with a couple of eating areas, living room with f/p and a powder room. The big plus here is a large family room downstairs (possible bath?) with patio doors leading to a cement patio and small private yard. Pets are allowed. The area is pretty convenient to shopping, buses, schools, library etc. The only drawback is that there is only one parking spot. It has a single garage but it doesn’t look as though you could park a car in the driveway…

Cadbro, so monthly cash flow wise are you neutral to where you were if you were to buy in 2019 compared to now or are you actually better off now? Like the amount of $ you have left after paying housing costs with the $525k approval versus the $660k now (adjusted for wage increase and higher down payment)? I suspect a lot of people are in your situation which may provide a glimpse of what may come.

Ks112 no, our approval in 2019 was for less and we’ve saved more and have had wage increases since then. Combined with lower interest rates we’re approved for a lot more now, I remember being around 525k approval in 2019. Very basic houses in Langford that we looked at at the time were 540/560. Despite this, prices are still just out of reach with the recent increases. I feel we’re lagging 20-50k behind, which would be fine in a normal environment where that may still be a reasonable offer. Its a total waste of time today.

We bank 2k/m to increase our downpayment but thats only possible because one of us is on parental leave. Will change alot with daycare costs ahead.

No spec tax on First Nations land

What’s the spec tax treatment for leaseholds? If the property is vacant, who pays the spec tax – the leaseholder or the owner (that doesn’t control who lives there).

Cadbro,

Cashflow wise would have you have been able to get the house you want with lower prices and higher interest rate if you pulled the trigger in 2019?

Sorry patriotz but I call gobbledygook.

RE rentals are a business. Let’s look at fundamentals. Suppose you net $2K a month renting out the property. I will assume the rent remains the same for 24 years to keep it simple (of course it will go up). Assuming an interest rate of 2% over 24 years present value is $454K. Assuming a rate of 4% PV is $366K. Assuming a rate of 6% PV is $301K. Higher interest rates going forward will correlate with higher inflation and higher rents, thus higher PV than given.

And your ROI is less risky than for a freehold because there’s no uncertainty about the sale price 24 years out. 🙂

That is a beautiful installation Deryk. Where is it?

We were not talking about businesses? Of course with businesses a lease fee might be a better use of limited capital. However, owning your own commercial space on freehold when you have enough capital has often been the path to wealth. It is the only thing that has kept the Hudson Bay going imo.

This is; however, valid for someone looking to buy residential real estate in Victoria to rent out where the land is a leasehold and the lease has 25 years or less. I personally would not buy residential on leasehold land ever myself unless I couldn’t afford freehold. It could be a good deal for some people who just can’t afford anything else and have rental housing insecurity.

That’s not valid a priori for leasehold versus freehold. It depends on the fundamentals. Businesses buy all sorts of investments which they eventually write off.

I think if the BoC keeps rates artificially low (ie inflation hits their target and they keep the overnight lending rate steady) then we could absolutely see the banks just say screw it and bump up variable.

That could throw quite a wrench into the low interest rate story. Of course people could go variable but my understanding is the discounts could get squeezed there too

For those keeping score – the 5 year cracked 90 BPS this AM (94 bps to be exact) and is now down to 87bps. Almost 15 higher than yesterday:

[img [/img]

[/img]

“This type of property makes sense for people who would like some housing security and can’t afford to buy otherwise, but doesn’t make sense if you are looking for the best way to invest.”

Good points!

Patriotz is correct that the downside is lack of capital gains making it an overall poor use of limited capital and credit compared to freehold.

There is only 23 years left on the lease and it will start to depreciate in value. At the end of 23 years if the lease is renewed it will result in a new mortgage at a close to the off-reserve rate of purchase price of the land component.

This type of property makes sense for people who would like some housing security and can’t afford to buy otherwise, but doesn’t make sense if you are looking for the best way to invest.

Based on Barrister’s comments over the years I think he needs a “luxury agent” to market the exceptional high quality of his home. Like someone that will be present for showings, etc., and I don’t have time for that. List, lockbox, and DocuSign offers here.

Why not contact Marko privately to discuss the terms on which he would list? http://markojuras.com/

Congrats, a good accomplishment, especially harder during the pandemic.

We’ve talked about your house many times over the years, I don’t really have anything to add. Interview 3-4 agents and see what they have to say. List at a price you would like and sell. Repeating 100x over that your home is better quality than the new homes isn’t going to change anything.

Barrister, I’m curious….have you thought about selling it privately instead of listing it with an agent? You have the skill set to handle it I’m sure.

Good luck. It’s a beautiful house in a prime location.

In this market and with people having such little choices out there….it seems selling one’s house privately should be more common and an easy thing to do. I’m dumb as hell, as some on this forum will agree:) and yet I’ve done it without any issues. (I’ve also used an excellent agent on some deals.)

By the way, where are you moving to if you don’t mind me asking?

Simple enough as clause 5Aiii, 5Bpartial and 10B deleted in standard listing contract, problem solved.

I don’t think you should list it at $3m in that case though. Because if someone offers you $3m +$1 on an unconditional offer, and you turn it down, I’ve heard that in some cases you might have to still pay your buyer/seller RE agent commission, as they’ve found an unconditional buyer at full listed price for you. (Perhaps someone in the know can verify if that is true, and under what circumstances). If so, you could avoid that by listing it at a higher price and letting the agent know that offers over $3m would be considered.

Good luck with the sale. It seems like an ideal time to be selling. Higher end homes are selling much faster than usual and fetching record high prices.

IMHO the primary motivation for amateur RE investors is capital gains, not rental income. Take away the gains and they’re not interested.

The property in question will result in a capital loss upon the end of lease, or likely if sold earlier. That can’t be written off against ordinary income, but it can be written off against capital gains, which would be a plus for someone with a taxable stock or RE portfolio in a capital gains position.

Marko: I am just wondering how to price my house at this point. Finding comparables in this market is difficult because the house is a bit unique. The good news is that it is a quality hundred year old house while the bad news is that it is a hundred year old house. I am almost tempted to simply say that offers over three million will be considered and leave it at that. I know that is not most listing agents preferred method of sale but I suspect that some agent would take it on that sort of open terms. I am confident of the 3 mil mark since the house has been seriously upgraded and modernized for its mechanicals and it is 8000 sq feet on a 26,000ft lot. We are getting ready to move fairly soon but pricing is difficult. Any suggestions ?

And then there’s a long term trend of gradually fewer new listings in the last 10 years

–

Well one thing as prices have risen so has the cost to move with realtor fees and land transfer taxes taking a much bigger absolute dollar amount.

We spent the last 2 days moving into our new place, I hope to never have to do that again because of the cost and the effort involved, it felt like doing back to back Ironmans. Thanks god for good friends who helped out

Sure, but is that going to be the result? Occasionally someone may get carried away and pay $1.2M. I think that might be the entire reason to do it. Usually you get a similar price to listing it high, but it sells faster, and sometimes you hit the jackpot when a frenzy results in irrationally high purchase price.

Sure, but then it’s not about pricing strategy anymore and just about selling later in a higher market. Could also just hang onto the house and sell it in a bidding war later on.

I would be curious to see the lockdown’s effect on divorce rates.

Leasehold townhome for $264,000. 25 years left on lease.

https://www.royallepage.ca/en/property/british-columbia/view-royal/23-1506-admirals-rd/14233768/mls866048/?fbclid=IwAR2LiBUiUvdYa4ZTo5jLnlmedRD-HvRGbZ__ANL_7PenBIblqYSDYemWz3s

Anyone ever think about buying these for rental investments? No appreciation of course. But $50k down + $900/month mortgage + $500 strata + maybe $100 insurance? $1500/month and 3 bed townhouse should rent for substantially more. Granted it is small.

What am I missing?

Not that I can see. If you go way back there was a big upswing in new listings a few years into the 2000s runup, and you could imagine that perhaps sellers were getting motivated by higher prices, but then new listings drifted downwards in the slow market and didn’t budge at all in 2016/17 when it was off the hook. Bit of an upswing last year from condos but otherwise who knows.

My exact observations. If you overlap with interest rates, I am guessing it shows almost no correlation either?

It’s actually amazing how bang on the new listings are to this time last year. Within a few percent of last year’s pace. Given we have a pandemic now, and a massive price jump, it seems to make absolutely no difference at all. And then there’s a long term trend of gradually fewer new listings in the last 10 years, through hot markets and cold ones. New listing behaviour is a complete mystery. There is no rhyme or reason to how many new listings come along, it just drifts up and down with seemingly no connection to the market.

Well, but will the net result be better?

If you list two identical homes for $1.1 million and $900k and they sell for $1,050,000 and $1,030,000 the higher list price still netted a better result depsite selling 50k under asking and the other one going 130k over asking.

Assuming you don’t have to buy in the same market (obviously a big assumption) wouldn’t it make more sense to go fishing in a super hot market and just let the market catch up to the home?

If you horrifically overpriced a home in November 2020 you are 10% ahead of someone who sold their home in a bidding war in November 2020.

@Marko, great video on the COV permitting process, pretty much nailed it. Hose bib locations lol that’s new, haven’t had to do that yet, that’s one of the biggest problems, there is no consistency at all….

Completely anecdotal but working with a higher than average, for me, divorce situations where couples are selling $1 million +/- and then going into the 600k-800k range separately. So contributing 1 inventory and taking 2 off the market.

From 2013 and the US market.

“We examine whether, and how, listing strategies impact sale prices in residential home sales. On the one hand, housing studies typically treat home prices as an objective function of property and neighborhood characteristics. Yet, the large and robust literature on anchoring effects (Tversky and Kahneman, 1974) suggests a positive relationship between listing prices and sale prices. Finally, evidence from the auctions literature suggests the opposite pattern through herding behaviors. We analyzed more than 14,000 transactions, taking into account observable property heterogeneity, geographical location and timing of the sales. We find that higher starting prices are indeed associated with higher selling prices, consistent with anchoring.”

https://doi.org/10.1016/j.jebo.2013.01.010

That said this is in depressed markets. I feel that a super hot market is a little different. There’s always some chance of it going for well above market in a bidding war, lots of examples of that. Hard to tell if the median sale is better off in a bidding war though. Certainly it’s annoying as hell for buyers.

Very common behaviour for sellers to switch to an auction model during hot markets. That alone may be evidence that the expected sale price is higher using this approach in a hot market. Either that or there is mass irrational behaviour. I could also imagine that in a hot market if people are buying first there is then additional pressure to sell quickly and the auction model facilitates that.

” The basic conjecture is that during normal housing markets or downturns, sellers adopt the standard strategy, resulting in list prices exceeding sales prices. However, during a strong market, sellers switch to an auction-like model where list price is set relatively low and a high arrival rate of buyers is expected. In this case, it is more likely that the sales price will exceed list price.”

https://www.sciencedirect.com/science/article/pii/S1051137713000041?casa_token=k2PCnXfhqtAAAAAA:ioPDOOaHdJhg47es12F82qo8Fp-GNx8X5t7lCtXJtxBtR0gmWepUcpRe6iMAblX6JvuLuygGoWQ

Marko I assume it’s that there’s just so many hundreds of families like mine bursting their rentals at the seams with kids and WFH (I am currently working beside my washer and dryer in the basement with a space heater) and we’re all trying to get a basic home. We’re competing with eachother for the scraps we can afford and it sucks.

Introvert 25yr

Pending at $1.15 (asking price)

Interesting contrast in strategies on two properties in same area reported pending within minutes of eachother tonight.

3959 Wilkinson listed for $1,189,000 and sells for $1,179,000.

3820 Cardie Crt listed for $979,000 and sells for $1,209,000.

If you remove the list prices the cul-de-sac Cardie sold for $1,209,000 and Wilkinson $1,179,000.

Wish there was some studies done to determine is severe underlisting actually nets a better result.

I’ve had a few clients looking in this price range on the Westshore and it is absolutely brutal. A townhome at in Langford today had 12 offers on it.

I’ve had a client outbid on five straight condos in Langford and she has gone above asking price with 4 days for subjects on all of them.

I kind of understand the Oak Bay stuff going 100-200k above ask due to restricted future inventory but the entry level stuff I am seeing in Langford and Sooke is just mind boggling.

There are literally houses that have doubled on the Westhore. A 904 sq/ft home that sold in Kettle Creek subdivison in 2012 for $319,900 just sold in a bidding war for $619,000.

Royal Bay was so massively undervalued; it boggled my mind that is sold for cheaper than Westhills four years ago when I had clients buying homes there for mid 500s on 8,000 sq/ft lots. Video here -> https://www.youtube.com/watch?v=66bbwfW6Td0 I managed to convience three families that called me about Westhills to buy in Royal Bay.

Even two years when we bought lots @ Juras Construction in Royal Bay to build other builders were not interested. I convienced my friend to buy three lots besides us but than the rest sat for a while unti Verity bought them all.

I guess no one could see the potential? I always thought for what it is it was best of the bunch due to subdivision planning and the ocean being across the street.

At this point I don’t know what to make of it. Last house in Royal Bay sold for $985,000 and the GableCraft homes with options will be pushing upwards of $1 million. It isn’t undervalued anymore although I do think the commercial village and the ocean side development across the road will make this a pretty spectacular subdivision, for what it is. It isn’t South Oak Bay and never will be.

Thanks.

Introvert seeing as he has less than 20% down his only amortization option is 25 years.

What does everyone think about the value (current and future) of new houses in the big developments like Royal Bay and Westhills? Is that a better option in this market than bidding wars on older homes? It certainly seems like a less fatigue inducing process.

Interesting articles with stats about the USA housing market. Summary…. It’s a hotter housing market in USA than Canada.. (e.g, 12% price increase vs 10% for Canada, USA house inventory at an all time low of 1.7 months, talk of “running out of houses to sell”.

This is all over the USA (and Canada). Incredible. Unexplainable.

https://www.businessinsider.com/how-2020-broke-the-housing-market-inventory-could-run-out-2020-9

https://www.reuters.com/article/us-usa-economy-housing-idUSKBN29R1UQ

Barrister, one of the the reasons there is not a lot of inventory coming is that if you sell in this market you may have have nowhere to go. A neighbor recently sold to take advantage of the hot market but has been unable to find a suitable house to buy, and has been forced to rent. We have been looking at downsizing, but with such a dearth of listings we don’t want to be left in the same position.

Cadborosaurus, what length amortization are you looking at?

I don’t need to talk to them, because I was living there at the time. I don’t think I will ever see the kind of infaltion again here in Canada that I witness in VN, but we are certainly could get inflation greater than 3% per year that could drive up prices, and that is what I meant in my last post.

Let’s see how much this one will be sold for. It looks like a good deal on today’s market. It was listed for $799,000 in 2019 but no buyer bit.

Very surprised how the market has turned because of COVID and all the printed money flooding the world.

$875,000 MLS® : 865764 15 West Rd View Royal BC

Talk to some of your older relatives from Vietnam and they’ll tell you what hyperinflation is. As for me, I’ve seen the inflation of the 70’s/early 80’s and I don’t think we’ll see the like of that any time soon. Not that I think governments are much smarter now, but workers today have far less bargaining power and supply is much more globalized.

One might speculative that the very high prices would motivate more inventory. But. I am not sure that it will turn out that way. I am still amazed at both prices and volume at this point.

Yeah the way the stress test works is that suite income is only counted at 50% what we could actually rent it for so I’m finding we’re SOL for a suite unless we build one, and nothing available in those parameters in our budget.

We’re renting a 2 bedroom house in the city right now, children could definitely bunk bed for a longer haul in a space this small. But 3 of us are potty trained soon to be 4 and I’m never sharing a bathroom at this ratio again.

I agree that O&G stocks are priced in for now, but don’t forget we are far from a full recovery, and we are facing a hyperinflation. Cars/trucks is only 1/4 of total global oil consumption, and global EVs are forcast to take 7.7% of light vehicle sales by 2025 baring a perfect ramp up of mineral production to satisfy demand. Rise of oil demand would still be on the increased till at least 2025 and perhaps till 2035. EVs will increase demand of electricity, and the bulk of the electric will come from gas turbines so natural gas will go up. Another, metric to look at why O&G stocks are going to increase is that they also are the companies that providing the bulk of green/renewables electrical energy.

Cadbro, if you were stress tested for a 600k mortgage then I think you need to be able to afford $3600/month in mortgage and housing payments? so if your actual payments are $600 a month less than that then you should have some buffer? That is assuming you bought a place for $660k. I didn’t realize you had day care x2, that one hurts.

What about the prospects of buying a place in town with a 2 bedroom basement suite and live in the suite yourself and rent out the upstairs for the first 5 years? You can probably carry a 4500 a month mortgage if u assume you can rent out the upstairs for like $2500 provided you can get around the stress test. Plus you save on the long commute from langford

Ks112 I’m not sure what you mean? We’re not approved for 700k, only 660k. Most of these bottom ladder places start at 700. $2700 might be do-able but it’s a stretch. Thats a good chunk of change when you have to commute from Langford to downtown & UVic for work + daycare x2. Stress test would like us to also be able to afford food. $660k purchase with 50k down, at 1.5% interest is $2536/m.

QT, if I actually had an actual bullish outlook i would be buying OTM calls. I just think given the properties they have ( have been to a few in Cali in previous years) and the type of debt they have (no recourse) with lower interest rates plus with the world coming out of the pandemic, I don’t see it as a likely scenario they will be under 10 bucks in 2023. The most likely scenario is that they will be taken out by another REIT (or maybe brookfield) at a higher price, SPG took out Taubman Centers at a higher multiple back in December so that kind of set the benchmark.

But if i get assigned the shares for some reason then I am more than happy to hold the shares at a net cost of under 7 bucks with a dividend over 4%. Alternatively I could have just closed off my position today for a $750 gain in less than a week instead of waiting until Jan 2023 to make the full $3850 and risking things going side ways.

Markets are forward looking so most likely the future increase in oil prices has been priced into the O&G stocks. Time to buy was when the vaccine news first came out, go have a look at the chart from November to now for all the energy stocks. General theme on the supply side of energy is still the same, the world is going electric/alternative and the middle east still has a crap load of oil they need to unload.

In the next few months there going to be fresh blood jumping into the buying frenzy. I could be wrong but by the look of things there is a good chance that lower than average volume of supply is coming online.

I agree, but we are a long way from fully recovery, because bond price still is at an anemic price.

ks112,

Has MAC made any recent changes to its business model or acquisitions to give you such a bullish out look, because for the last 5 years their profit is flat, with steady drop of revenue, and EPS is on a steady decline?

late30,

Are you talking about MEG Energy?

If that is the case then pretty much most if not all energy companies are doing well because of market recovery. There is potential for oil/gas stocks to rise some more, because the demand is believe to come back to 2016 level by the the third quarter of this year. Current rigs count of 397 hasn’t caught up to pre pandemic level of 800 is one metric to look at on the supply side.

Cadborosaurus I sympathize with you. I’ve also been looking since the fall and the buyer fatigue has set in. I’m tired of bidding wars. I’m also being much more selective of the places I view and have not bothered with a few listings that were clearly priced for bidding wars.

Cadboro, if you were approved for 660k with no suite with the stress test, how can you not float the actual $2700/month?

Buyer fatigue sums up my February. We’re so sick of places selling way over-ask that I’m not booking showings on places I would have looked at in the fall, going to be waiting until probably April / more inventory at this rate before going out again. To answer original question on minimal living space… These 3 cookie cutters in Langford that I’m watching sum up my opinion of a good starter house for a family like mine, 2 working parents and 2 little kids, and it’s what we’re looking for. Min 3 bed, 2 bath, some fenced backyard, 1 car garage, other working class families nearby.

3392 Turnstone Dr (sidenote why are there like 12 unnecessary pics of the boring front of this place?)

3296 Merlin

1019 Oliver

These cookie cutters are 679k – 699k! We’d have gone to see them if they were priced sub 650k. We’re approved for 660k without a suite so not far off but I think going just shy of 700k on these is ridiculous and they may even sell for more. For context my mortgage payment on a 699k house, with 50k down at 1.5% interest (CMHC and PTT incl.) Would be $2700/m plus property tax. The interest rates are low, but the prices are still high enough keeping a lot of good income families out of participating, even on these “cheap” Langford specials.

Very little increase in inventory since early January compared to normal. That said, biggest months for listings still coming and I think evidence of buyer fatigue is building on the sales side.

Was just on the redflagforum mtg rate thread (https://forums.redflagdeals.com/official-mortgage-rates-thread-351105/3544/) they have a bunch of broker quoting rates – rock bottom rates if you want to compare to what your bank is giving you – and apparently rates have already gone up on refi’s and the brokers are telling people to lock in now as rates are going up for new mtgs. Only 10-15 bps on the refis so far but when rates are this low a paltry 50 bps increase means you are paying around 33% more interest on your mortgage. when your mortgage is 1 million the difference between 1.5% and 2.0% is about $240 a month (30 year am). So close to 15gs difference over the 5 year term.

5 year bond yield up to 73 bps – about 42 bps above the bottom set back in August. Rates are doing their job and stimulating the economy along with a the vaccine bringing hope.

https://ca.investing.com/rates-bonds/canada-5-year-bond-yield

[img [/img]

[/img]

Patriotz is right – i worked at a bank and we never considered age. We could have had a 65 year old who was working full time and we would use that income for lending purposes – even though chances are they retire before the first term is up on a mortgage we didn’t care. Just based on what they were doing at that moment – same as anyone else.

no, I use TD direct invest and quest trade. I don’t get heavy into the greeks, i just do what I believe makes sense.

Real high level example, take TD for instance, I can do a put credit spread (sell a put at strike $50 and buy a put at strike $47.50) where my max profit is $66 per contract and my max loss is $184 per contract. All I need is for TD to be higher than $50/share at Jan 2023 to get my max profit, the stock is currently at $63 per share. So if I think there is roughly 75% probability the stock will end up above $50 on Jan 2023 then I have a positive expected outcome. All things remaining the same, as time decay happens I can close off the position prior to expiry for a guaranteed profit (less than max though) if I like, I can also do the same if the stock shoots up more in value.

The best part is that you have only tied up $118 bucks (184-66) of your own capital to make $66 bucks so over 50% return in two years.

Update on the Gordon Head trio of $1.15M listings with delayed offers:

1760 Triest: Pending for $1.294M (54% over assessment!!)

1744 Triest: Still active after Sunday offer date

1861 San Juan: Still active over a week after offer date.

Seems like some seller expectations have outpaced the market.

KS112, do you happen to use Option Play? did you find it helpful?

Thanks

As far as options trading goes, I primarily do it to generate consistent income. Over 75% of options expire worthless so when writing options or credit spreads you essentially act as the casino in which the odds are very much in your favor in the long run. I would not recommend writing naked calls though.

From: https://www.cbc.ca/amp/1.5925073

Sure they are. Like reverse mortgages, for example. More generally, I don’t think they have a problem with consumer loans or mortgages if you meet the same criteria as anyone else. It is the law after all and you know the saying, the banks love to lend money to people who don’t need it.

Just wanted to make it clear that I support the idea of the government handing out relief payments even though we didn’t use them.

Cheaper than paying for the cleanup after.

Same with EV grants of course.

Cheaper to support an industry in it’s early shakey legs phase, than have to move your cities or build breakwaters.

Cheaper to house people and give them the support they need than playing whack a mole with police, ambulance and hospital care etc with no chance of success.

re: option trading..

this morning would be a good opportunity to get some cheap calls for MEG…

There are entirely rational arguments for young people to use leverage when investing (in globally diversified low cost ETFs) when they have strong human capital. Expected return is higher but you need to have a very high tolerance for volatility and be somewhat lucky not to need that money in a downturn

Ah ok that makes sense.

Depends on the terms of your loan and your lender’s flexibility. Refinancing may incur significant costs.

Just not something I would ever consider. The stress cost of doing this would be way to high for me.

Hanson- I ran into the same problem trying get financing to buy the commercial property I was renting for 8 years. It even had a long term tenant that covered most of the property taxes and utilities. I opted to sell my property in Langford and paid cash. Looking back, given I am a nonessential business and was forced to close down, it may have been a bad move. Fortunately, my landlord sold the property far under its actual value. I believe that banks aren’t interested in lending to people over 60, but they would never admit it.

Hey Leo, ” It’s just your money. You could refinance and it would be the same.”

The problem is I can’t refinance them as I am semi-retired don’t make the stress test qualifications and I can’t access my equity. It is truly frustrating. Yes, I could get private money but the rates are way too high. Why the banks can’t lend against 50% property equity is beyond me, it’s crazy, so much wealth is being tied up. Of course they used to, but the system was abused, but 50% should take care of that, there’s hoping anyway.

Unfortunately I should have bought 3 houses instead of one during 2013-15. I be getting ready for retirement by now if I did that.

On a separate noteI don’t think even the biggest realestate bulls on this forum pulled the trigger during the pandemic between March and summer. That’s interesting to see. The bears local fool and Josh timed the market pretty good buying when they bought in 2018/2019.

Congratulations you are well ahead of the game.

Meant to say I typically only write put options on stocks where I think there is asmytrical pricing on premiums or stocks I want to own. My intention is never to manipulate the market.

No I am not a Robinhood newbie, been working in finance for about a decade (not equities or derivatives though). I recently sold puts on MAC last week, got 3.85 for the 10 dollar Jan 2023 puts. I dont believe malls are dead and MAC has mostly class A properties in. I am happy to own them for a net cost of 6.15 if I am ever assigned. If not then that equates to around 38.5% return in slightly less than 2 years. But thanks for proving my point that options trading is highly risky lol.

I do options strategies in my margin account, go long on stocks and options in my TFSA and stick with ETFs in my RRSP. I also have a DB pension plus the house I rent out so overall I think I am decently hedged. I don’t typically write naked options unless I see asymmetrical pricing (never naked calls even then). I typically do credit/debit spread strategies when trading options.

Are you one of those Questrade/Robinhood day trader newbies, and what kind of pennies stocks are you trying to manipulates, at what spread?

Unless you have hundred of millions of dollars in your option account then you can try to manipulate the average stock, otherwise it doesn’t yield results without added risks. And, the risk is puts cover when stock/market take a downturn is one that you may not be aware of.

QT, I have a margin account where I mostly write naked puts on names I want to own. Options trading is infinitely more risky than buying a house and renting it out.

Having bad Tennants can be extremely annoying though.

You are correct that in a normal trading scenario you can’t leverage as much as RE.

However if you have the need for high leverage. You can move into option trading, where it’s standard for the broker to give you a loan 7 times greater than the cash in your account for option trading.

A deposit of $200,000 into an option account will give you the option of hedging up to $1.6 mil.