Are we out of the rental crisis yet?

For those familiar with Betteridge’s Law of Headlines, you can guess the answer to this question. I’ve written a summary of the rental market for The Capital (link below) but wanted to put special emphasis on a few points here as well. With the most recent rental data out for 2019, I was surprised to see a decrease rather than an increase in the vacancy rate. That was seemingly due to a big mismatch in the number of units built vs the increase in the total rental stock. Despite the construction of around 1600 rental units, rental stock only grew by 583. The missing ~1000 units? Assuming the CMHC data is accurate (I have some doubts there), the only explanation is rental units being retired (torn down, redeveloped, etc) at a much greater rate than in previous years. Here’s hoping that this was a one-off for 2019 and not a new trend in the years ahead.

I’m also concerned about the new max rent increase limits set by the BC Government. While I do appreciate the need to shield people from large increases in rent, I think the new rent increase caps (inflation only instead of inflation plus 2% as it was before) has the potential to hurt rental construction in the long run. Rent control in general has been pilloried as harmful by many economists, but I believe the old system was a good balance of protecting tenants while still allowing landlords to keep existing rents more or less in line with the market (see chart below). Some people have tried to argue that Ontario’s lifting of rent control has led to their construction boom, but we’ve seen the same boom here without relaxing rent control indicating that lifting it was certainly not necessary to stimulate construction. However in 2019 rent caps were changed to just the rate of inflation, and that changes the situation substantially. Looking backwards, we can see that if this policy had been in place, landlords could not have kept existing rents in line with the market (yellow line). That will reduce rental returns and run the risk of cutting investor interest in funding those buildings.

If we want to get back to more comfortable vacancy rates, we are going to have to keep construction high for many years and I hope this policy change doesn’t interfere with that. Of course we could argue that the issue here is not lower rent caps but that rents are increasing so much faster than inflation in the first place. More supply across all price bands would certainly help put on a lid on that appreciation and mitigate any issue with lower caps.

Read my rental market summary in The Capital

Also weekly numbers, courtesy of the VREB.

| January 2020 |

Jan

2019

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 17 | 75 | 171 | 310 | 329 |

| New Listings | 94 | 331 | 493 | 722 | 897 |

| Active Listings | 1794 | 1905 | 1907 | 1922 | 2057 |

| Sales to New Listings | 18% | 23% | 35% | 43% | 37% |

| Sales Projection | — | 300 | 355 | 411 | |

| Months of Inventory | 6.3 | ||||

A strong week in sales, pulling the total up to 25% ahead of last January. Last January was a weak month so year over year sales increases will look bigger, but this is pretty strong sales activity. Right now based on +25% sales rate we would end up at 411 sales strictly mathematically but I bet we get to 450 or above the way things are going. New listings are unchanged, but the strong sales have brought inventory down to 3% less than this time last year. Like I said last week, at this level of activity expect prices in most segments (outside of luxury market) to increase.

Darren: Your comments are completely out of line. Perfectly fine to disagree with Leo make your argument but leave the name calling and Trump like bullying at home.

Thanks for your comment Darren. However I think you missed my point about rent caps. I’m concerned that the new lower limits will make the rental situation worse, not better by stopping new supply.

Also I don’t buy and sell houses, except my own

Arguing against rent increase caps, against rent control…you’re a real jerk. Go buy and sell another house it must be how you get off.

January market update: https://househuntvictoria.ca/2020/02/03/january-market-summary/

Wrote about it here. I still think it’s happening but RE cycles are several times longer than peoples buying window so not that useful. Also stress test stopping prices rising threw some confusion in. Without it prices would be much higher now

https://househuntvictoria.ca/2020/01/20/warning-despite-cooling-cycle-prices-look-set-to-rise-this-year/

Same. Looking closer at condo market at the moment but not keen on anything yet based on returns

Marko, good point about the floor drains in Croatia. I’ve often wondered why this isn’t required here too. If you go to Japan or China and look at either new or old apartments/condos you will not only see floor drains but you will also see the ‘wet areas’ (kitchen, bathroom, laundry areas) have floors that are four inches lower than the main living areas and at least two floor drains in the ‘wet areas’.

Last time I did econ there was a supply side to that equation as well.

and the last 10 years saw market conditions with lead to massive price appreciation.

Went to look at what he had to say

Oh ya…

Back to the strata insurance and water claims issues….the one thing the baffles me is there is so much BS in the building code but so many cheap common sense things are not part of it. For example, my place in Croatia has a drain in the bathroom/laundry room -> http://markojuras.com/wp-content/gallery/zagreb-condo/DSCF9860.jpg (you can see the drain below the vanity).

Looks good, cheap to install, and if your tub or laundry crap out you aren’t flooding the entire building.

I feel terrible for you.

Latest Steve Saretski video suggests Vancouver is re-igniting esp under 1 million and condos. And it seems Victoria is fairly stable and warming up. Whatever happened to the promised cooking cycle?!!!

I own my primary residence but was sitting on the fence re: possible investment properties. I feel like I missed a window. I truly thought prices would soften some more.

Marko: It is always good to get a view from the ground.

I was involved in a few multiple offer situations this week and in my assessment they were not underlisted. Basically, what is hot is 2 bed 2 bath condos under 500k, townhomes under 600k, and SFHs under $1 million in the core and SFHs on the Westshore under 800k. That being said also brand new houses $1.5-$2.0 million in the core have been moving a bit. A couple of sales in Fernwood/Jubilee at $1.5 mill and the one on Bank Street just went north of $1.7 yesterday.

The place on the Westshore was a half duplex and it is a rare one that did have a delay on offers. The other ones I am involved in don’t have delays as sellers/listing agent weren’t anticipating multiples. If the market continues like this the delay strategy will come back.

Buyers aren’t going crazy over ask in the multiple bids and the vast majority of offers are conditional, but that may be a function of the fact that there are not many delayed offers right now (i.e. you don’t have time to do an inspection before the offers are presented).

Also seeing quite a few offers with lower mainland address buyers but being one agent, my sample size is small.

Marko: Is there a major increase in the cost of insurance for condo buildings in Victoria?

Still a poor story….they make zero mention of claim history on the 26-story building or any other factor and then it is followed up by

“It’s important to remember that insurance is about risk, and if individual properties are experiencing significant premium increases, there’s usually some very good reasons behind that.”

You would think the 26-story building didn’t have a backstory they would note “building has not had any significant claim history” or something similar.

Appreciate the boots on the ground input. Some more context and your assessment would be appreciated if you have the time.

SFH or condo? Price range? Listing price low? No offers until certain day?

10 offers could be because of a number of different things.

Marko: Was the westshore property listed seriously under priced?

Given the rate of depreciation, this would effectively be an unsecured loan over most of its duration.

I take it you mean offers with conditions. How many unconditional offers are being made these days?

A bit more background on the strata property insurance situation.

https://www.insurancebusinessmag.com/ca/news/breaking-news/experts-react-to-skyrocketing-condo-insurance-rates-208826.aspx

10 offers tonight on a property in the Westshore…what da.

Dunno. Seems crazy to me but what do I know.

Is it not common to finance RVs 25 to 30 years?

This has been a standard subject in offers all 10 years I’ve been in business.

https://thetyee.ca/News/2018/12/11/Eco-Unbuilding-Demolished-Homes-Reused/

Good reminder to put in subject to buyer obtaining and approving suitable insurance policy in your offers

Yeah they talk about that in the podcast. Only 3 providers of insurance for multifamily and they all have the same rates.

My impression is that the insurance business is not that competitive.

Yes, there are insurance agents all over town, but they’re selling policies from only a few insurance companies. And those companies in turn are getting reinsurance from even fewer.

A disaster on the other side of the world then affects all the local insurance companies and they raise rates wherever they can.

Still unclear to me why the massive shift in insurance landscape. Water damage from

resident error flooding suites has always been an issue. Is there really that many more claims from environmental factors to explain the massive jump?

Still missing part of the story here

Good discussion on the strata insurance situation. They cite a newer Langley building With no claims that had their water deductible go from $5000 to $250,000 and premiums increased 300%.

https://podcasts.apple.com/ca/podcast/vancouver-real-estate-podcast/id1078731249?i=1000464096327

If you thought car financing was insane, apparently boats finance over 20 years

https://twitter.com/BenRabidoux/status/1223655525402976261?s=20

Condo wasn’t NOT under priced based on what an identical unit above it sold for 4 months ago. Building also does not allow rentals; therefore, no investors would be amongst the five offers.

I think at the end of the day people just need a place to live, rents are very expensive, interest rates are still very low and you have a certain percentage of the population that can qualify and they view $2,000/month rent as throwing money away (I am not saying it is, but that is how they view it).

Not an economist but I think population growth and immigration are huge factors in sustaining these prices. I am helping yet another Croatian family looking for a SFH home up to 750k that has been in Victoria less than 12 months. That will bring it up to 10 immigrant Croatian families in the last 2 years…. that’s pure demand. It is not just immigration, but it is highly educated immigration that is often 100k+ family income with a couple of years or sooner.

The strange part in all of this is despite Croatia losing population every year with educated people living real estate prices have gone up in Croatia too.

James Soper said: “See people in Vancouver & area that have bought in the last 4 years being bent over. …”

Yes! And there are many more examples just like that. The trend in Vancouver (particularly the west side) over the last two years is widespread, gigantic price corrections.

But you don’t have to just take me at my word. Anybody can conveniently check out detailed Vancouver listings and sales data for the past two years, over on the Fisherly website.

From an article last year:

““The realtors were the gatekeepers of data,” says Les Twarog, a realtor who owns the popular website BCCondos.net. No more. In March a new website, fisherly.com, started posting real estate sales in the Lower Mainland from the last two years.

“The consumer has to sign in with a name and phone number in order to get access to the sold data,” said Twarog. “My sold history website is fisherly.com/6717000.”

So for anybody interested, just sign in through Twarog, its super easy. You can toggle between current and sold listing for the last two years, see info about renewed listings, etc, etc.

https://vancouversun.com/news/local-news/real-estate-sales-data-now-available-online

Why doesn’t Victoria have something like this that’s as easily accessible?

Sure and the luxury market here has taken a dip, but overall Victoria has had no big price corrections or crashes, despite bear after bear calling for it.

Average price change January: -4.44% two properties up in price and 70 down. According to https://www.myrealtycheck.ca

See people in Vancouver & area that have bought in the last 4 years being bent over.

ie:

I’ve seen bear after bear come and go. Yet, no big price corrections or crashes have occurred. What if the bears just have all of this wrong. What if the fundamentals will continue to support a stable Canadian housing market. See this video as an example:

https://www.bnnbloomberg.ca/video/trends-in-the-canadian-real-estate-market~1889024

Stayed with my parents to save money to buy plane tickets to Canada to visit my Canadian girlfriend (now spouse).

I stand corrected on that. My apologies. Just curious, why live in Rotterdam instead of Delft?

Okay, I guess I still don’t understand how that correlates with high density or congestion/traffic issues. Since with traffic/congestion issues, there’s no speed issues.

Difference between entry level house (meaning SFH) and entry level RE purchase (meaning whole market of condos, townhouses, SFH, etc).

An entry level SFH will likely always be entry level relative to the SFH market, as they’re the lower portion of the market.

An entry level RE purchase will shift over time as median price of the segments change relative to median income (SFHs got increasingly out of reach, more condos/townhouses are the entry level RE purchase)

I am not sure if you use Google maps, but if you do look for directions from 3e Carnissestraat, Rotterdam to Delft University of Technology.

Google says it is a 25 min drive, but back when I went to university they didn’t have as many speed cameras so you could blast through the Maastunnel and you weren’t forced to do 80 km/h on the A13, so it was about 20 mins for me.

Also if you look at the Google maps Public Transport options they are all around 1 hr.

I know it always dangerous to post an article on this forum. There is always something to dispute with it. However, the government did reduce the speed limit to reduce the pollution from traffic. It might not actually help or be enough to reduce the pollution, however it still seemed to support my argument that there are traffic and congestion issues in the Netherlands.

And the body of the article disagrees with it. Why would you trust anything at all from an article that disagrees with it’s own title I don’t know.

I’m sorry, but how does having the same amount of people in a denser area need more farming(or farming that’s more intense!! ) than having them in a live less densely? I’d argue the opposite. Density takes up less land that could be used for farming, therefore it can be less intense.

I’m sorry, but this story isn’t really adding up.

You either lived south of the Het Scheur and it took way longer to drive than 20 minutes in no traffic, or you lived north of it, and getting to delft takes way less time by train, or you lived by a highway out of town like in Hoogvliet. In which case, you’re not living in density at all, and you’re just being pedantic and missing the point entirely.

Yes, that’s what I’ve been saying. More density means public transportation can be built. In densely built small town(ie: at same density as rotterdam the largest town in bc – comox – would be 4 sq km) you’d need one train stop to the outside world, and everyone could walk/bike anywhere they wanted in town. The worse access to public transportation is a downside of less density, not more.

Oh dear.

Three people arrested after stolen SUV gets stuck in the mud in Saanich field

https://www.vicnews.com/news/three-people-arrested-after-stolen-suv-gets-stuck-in-the-mud-in-saanich-field/

I see. For me an entry level house is tied to what a first time home buyer can buy. I agree that the lower end of the SFH market is always the lower end of market, even it is not affordable to a first time buyer but was ten years ago.

That is the root of why we are talking past each other. By entry level home I mean a home in the bottom end of the price distribution. In 2009 for detached properties that was a house in the high 300s, low 400s. Now it is in the 600s. But the house is still an entry level house because it is the entry into the detached housing market. I would say this is the more common definition of “entry level”. Doesn’t make much sense to me that affordability would define whether a house qualifies as entry level, otherwise a depressed market would be filled with nothing but entry level houses.

Distinction without a difference may I suggest? The fact that the house was 11% above median at purchase doesn’t mean that the median home has not experienced similar appreciation over the past ten years.

You stated that an entry level home remains an entry level home and that it takes decades for it not to be anymore. Maybe our definition of entry level is different. I tie mine to what a first-time home buyer could purchase on their income. In 2009 you could purchase an 560k home (the median) with the median family income and a down payment. Today you can’t. That same home is no longer an entry level home that cannot be purchased with a median income.

You are now looking at Langford townhouses for what you can qualify for instead of a SFH in the core. What was an entry level home ten years ago is now only open to move up buyers or those with other sources to pay than an income.

I don’t think the anecdote would be worth mentioning if that was the case. These were known foreign investment firms that were based in China.

I assume either the condo was well under priced or there were 5 uninformed buyers thinking that things are going to take off like crazy again. Either way one bidding war does not a hot market make.

Patrick said:

“if 100 people get evicted from their suites, maybe 20 buy a home and 80 rent, putting upward pressure on BOTH rentals and home prices”

I wonder what the actual numbers are – would be an interesting analysis. But, also:

Some of the evicted people will just move back in with family/mom/dad;

Some will combine with roommates so that they can afford a new rental;

Some will move to another area where they can afford to rent;

Some are retirees that already sold their home and can afford to move to another (higher priced) rental;

For those very few that are ready and willing to buy a home because they were evicted, I’d bet in most cases they were planning to buy a home soon anyways.

I would be surprised if anywhere close to 20% of renters could afford to, or even if they could afford would want to, buy a local home if there were evicted.

I’ve actually had to speak to over a hundred renters over recent years, and look at their confidential data, all of them in rental properties that are in the top half of the lower island rental market prices. Its astonishing to me how, even in that market, so many are living on income assistance — and have been for many years. They’ve also been in their units for many years, so aren’t paying much, but are stuck there because there’s not a chance in hell they can afford to pay new rental rates if they want to move.

Marko said, “Why is everyone so obsessed with assessments? In December I had clients pay 200k over assessed and I had clients pay 80k under assessed. The over assessed purchase was a better market value deal in my opinion.”

Its a blunt tool, but a very useful and necessary tool nonethless. Like it or not, a majority of buyers and sellers put a lot of stock in assessment value, it carries huge weight.

As a very general “view from 10,000” feet, assessed values provide a very useful service. For properties of particularly keen interest, of course the buyer/seller must produce their own recent comparable sales analyses, AND understand what if any unique features results in the ‘true market value’ being less or more than the assessed.

But of course I know that I don’t need to tell you, or any Realtor this. There’s a reason many Realtors include “Priced under assessed value!” in their listing descriptions.

Local Fool said: “Well, here’s a little anecdote for y’all”….”The fact that nearly all of [the offers] were from a group that we’re constantly hearing is gone, causes me to wonder to what extent that’s the case. Obviously I can’t speak to the whole market but I can tell you, Chinese buyers are still here to at least some extent.”

The higher priced Vancouver market has suffered significant declines since the 2017 peak. We’re talking a 16% decline from last year, somewhere around 25% decline compared to the year before, for Vancouver West.

Why is this? It is no coincidence the timing of the drop begins so close to the introduction of the foreign buyer’s tax. Compared to before, there are simply far fewer offshore, non-Canadian, Chinese buyers right now. Nobody wants to pay a huge tax on the purchase of a property, and multimillionaire offshore Chinese businessmen are no exception.

Also, I see your Vancouver anecdote, and I raise you two of my own Vancouver anecdotes, and something that may explain your anecdote(?). 🙂

(1) Two months ago I spoke with a Vancouver developer who had just sold his personal Vancouver West side home. It had been most recently assessed at ~$4M, but after a long and arduous wait, his heavy debt levels meant he had no choice but to take the best offer that came in: $3M

He is adamant that the wealthy offshore Chinese money has mostly dried up. It is hard to argue with an experienced developer with boots on the ground.

(2) I personally know of two other hopeful sellers on Vancouver West side who back up the “offshore money has dried” up observations.()

( Let us not confuse Canadian-Chinese buyers with those that are offshore, non-Canadian Chinese. The former are still making up a huge proportions of sales quite simply because they make up a huge proportion of the Vancouver population. Are Canadian-Chinese what your anecdote was about? The ones with the most money have very often been the foreign Chinese buyers).

(3) New rules are coming into effect as of May 2020 that are intended to crack down on “Hidden Business Ownership” (numbered companies) for real estate.

“Starting in May 2020, private businesses will be required to keep transparency records of their true owners, including people or entities with direct or indirect control of the company or its shares. Finance Minister Carole James said in a statement the records will help drive down B.C.’s real estate market and prevent distortions to the provincial economy.” https://globalnews.ca/news/6087012/bc-hidden-home-ownership/

In recent years, numbered-company purchases of even Vancouver SFHs have not been uncommon. People buying that way have undoubtedly done so because it has given them some advantage, more “value” on their transactions (Maybe taking advantage of tax loopholes? Or evasion? Or at worst, rarely, money laundering, etc). But that extra value is about to disappear.

Some people are wondering if there might be a mini-rush of last minute buyers who want to purchase as a “hidden buyer”, before may. Could that have been what your anecdote was about, especially if it was a commercial or development property?

BTW, I haven’t seen data to predict the magnitude to which the elimination of “hidden buyers” will affect the Vancouver market. However, obviously there is only one direction that it will pressure market prices from May onwards: down.

Perhaps it will mean nothing, but nonetheless it is just one more way (out of several) that Vancouver real estate is less attractive, again, to offshore buyers.

I just think that if an organization is going to present data then it needs to be accurate. Assessments have been widely used by the real estate industry (especially when prices were rising) to help their narrative. It seems they are being downplayed now that it doesn’t suit their narrative. People will always pay over / under assessment depending on the quality / location / style / etc. of a house. But if you look at the stats (which Leo posted last year), most sales fall within a variance of assessed value. That, to me anyway, is an indicator… maybe not a good one but one that along with a bunch of other factors / indicators, can be used to make a decision.

That is why it needs to be accurately portrayed. Saying a house on a listing is “$50 thousand under assessed value” when the assessed value is from last year and has actually dropped by $30 thousand is wrong and misleading.

The accurate data is available. The real estate industry uses assessment data as part of the information they provide on PCS. Ensure it is accurate or don’t post that data at all.

It is about integrity.

Involved in a 5 offer bidding war on a condo two nights ago….surprising market to start the year.

Why is everyone so obsessed with assessments? In December I had clients pay 200k over assessed and I had clients pay 80k under assessed. The over assessed purchase was a better market value deal in my opinion.

Yes the primary source of the nitrogen is farming, however the second highest source is traffic. And the title of the article states that speed limits are being lowered to reduce nitrogen pollution enough, so that they don’t need to halt construction projects.

The discussion was around high density having little to no downsides. So even the pollution from intense farming that is needed to support high density, is a potential downside.

I live in Colwood and grew up in the Netherlands. The Colwood Crawl is nothing compared to the traffic jams around and between the big cities in the Netherlands. At least in the Colwood Crawl your are consistently crawling and not standing still most of the time.

True on certain routes trains are faster and if you live within biking distance it is a great option.

I lived in the South of Rotterdam and went to university in Delft. I had to take a tram, a metro, a train and a bus with 3 changeovers to get to university by public transportation. This would usually take 45 mins to an hour depending on the waiting time between connections. Public transportation is more or less free for students in the Netherlands and as a student I couldn’t afford a car, so that is what I did. However it was only a 20 min drive without traffic, however in morning and afternoon traffic, the commute was similar in length to driving. So when I had access to car and my classes started later I would prefer to drive.

Lots of small towns have worse access to public transportation than my example. Also a large portion of the workforce have a company car as a perk with all their gas paid, so they end up driving even if public transportation is available.

Correct, they have less traffic from grocery shopping and dropping kids off at school.

4692 Hillwood (MLS 420519), 4491 Shore Way (MLS 420536), 3990 Cedarwood (MLS 420449) would indicate otherwise. All fresh today except Cedarwood which is 2 DOM.

Perhaps up to realtor discretion?

2009 is a tricky year because prices were extremely volatile. However the median price for a detached house in 2009 was $524,000. So your $580k house was ~11% above the 50% percentile. What you describe as slightly above entry level was well into the top half of houses available.

Now it is $900k, which is 14% above the median. Allowing for uncertainty in valuation that is no or little change in 10 years. It wasn’t entry level then, and it isn’t now.

How does that change the house at all?

Entry level is still entry level no matter the cost.

That link says that nitrogen levels are high from farming

It says nothing about traffic or congestion issues.

I’ve spent a fair bit of time there. No one sits in traffic jams like the colwood crawl day after day, since if it was faster to take the train, people would take it.

The local grocery store had no parking lot. Everyone would bike or walk. The kids would bike themselves to school all together, from a very young age. Have a counter example?

I don’t think that is correct? The median family income in 2000 was $78,583 . Today it is about $90,000.

I bought a slightly above entry level house in 2009. It was 580k. Today, almost 10 years later it is 900k. Your own home probably has moved beyond most FTBs with median family incomes?

The Netherlands have huge traffic & congestion issues. Yes they also have great infrastructure for bicycles and public transport so for a lot trips you don’t need a car.

However due to the density the nitrogen levels in the air are so bad it is threatening to shut down construction. For reference see: https://www.nytimes.com/2019/11/14/world/europe/netherlands-speed-limit.html

“I don’t understand how density increases any of those but living in close proximity. Look at the Netherlands which is the densest country in Europe, way less traffic & congestion since it’s easier to bike/take the train (building proper infrastructure is much easier with density). There’s less loss of natural habitat since the same amount of people occupy a smaller space.”

That’s true, but it does seem to take awhile for infrastructure to catch up. I’ve lived in established dense neighborhoods and I always got around on foot for day to day shit, which I miss.

And you’re right, density results in less destruction of natural habitat because you’re accommodating growth in the existing city footprint, rather than forcing it out to undeveloped areas.

New listings have the new assessment data. Not sure about when the old ones will get updated.

My reply was in response to James’ point about total inventory, which encompasses all listings at all price ranges and property types. From that perspective the move up buyer is net zero. I’m not making any more specific claims.

I never said anything about demand being alleviated. I just said a move up buyer selling a house (at a lower price point) makes that house available to another buyer.

Houses don’t really change their relative positioning in the price distribution unless renovated. Yes extremely slowly over multiple decades as the city expands, but not substantially. An entry level house 10 years ago is still an entry level house today.

People will always be able to afford a SFH unless there are zero SFH available.

The only question is what percentage of people in the area can afford a SFH. And that percentage will slowly drop as growth in housing stock comes from attached, and SFH make up a smaller and smaller percentage of total stock.

Those would be investors and I never claimed they are net zero.

@Patrick

Clearly not a move-up buyer since they didn’t buy anything.

I created a suite, and then immediately sold the whole building to my significant other.

100% in the clear.

Yes. There were 21,030 multiple property owners in Victoria in 2018. https://www150.statcan.gc.ca/n1/pub/46-28-0001/2019001/article/00001-eng.htm

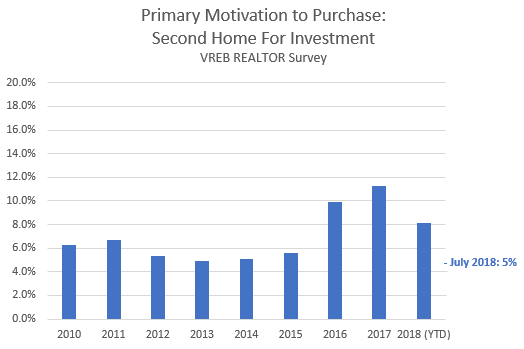

What we don’t have is a trend. However investor interest increases generally when prices increase: https://househuntvictoria.ca/2018/09/17/market-update-investor-interest-declines/

In Toronto with rapidly appreciating prices it would make sense that investor interest is high. Also soaring rental listings there show the same thing.

Hmm. I’d have to do the math to see but it seems inventory has flipped from YoY positive to negative in January so it is dropping. I’m just thinking about whether it would be possible to estimate the proportion of move-up buyers based on how inventory moves relative to new listings, solds, and cancelled listings. Could be.

Vacancy definitely would have increased were it not for massive jump in rental retirements. Entirely unprecedented.

Nothing new there. Still comes down to the three requirements not to claim CCA (no problem), use is ancillary (again likely no issue), and no structural changes (the stickler, since every suite in Victoria has had structural changes to make it into a suite).

Completely disagree with their assessment that you are in the clear if you didn’t make structural changes yourself. Clearly the intent of the regulation is not to slam people who create suites but allow anyone buying a suited home to get away with PRE. That would be a nonsensical policy.

As they say in the article ““Two units will generally be considered one housing unit if they are sufficiently integrated such that one cannot enjoy the living accommodation of one unit without the use and access to the other unit.”. The vast majority of suites are built such that they are entirely separate.

In any case the blanket reassurance that you shouldn’t be concerned is extremely bad advice. Always consult your accountant and get it in writing if possible. So far there has been no crackdown on suites by the CRA and quite likely there never will since it would be politically toxic. But there could be.

2.1 children per woman is replacement-level fertility according to the UN, and we’re below that 🙂

Well, here’s a little anecdote for y’all.

I recently had some peripheral involvement in a land acquisition and sale on the mainland, near the Sunshine Coast. The parcel for sale had a price tag that was 8 digits.

15 bids came in, with 14 of the 15 being Chinese-based investment firms. Only one was local (also an investment firm), and this was notable for a few reasons.

Firstly, it was actually the local investment firm that entered the successful bid, albeit that success was only by the tiniest margin.

The other thing that was interesting, is all 14 of the unsuccessful bids went in under asking, whereas the local buyer offered asking. If that was a strategic move on the part of the latter party, it evidently paid off for them.

I didn’t know what to think, or, if there really was anything to think.

I guess everyone’s heard of the Chinese buyer swooping in and blowing everyone else out of the water, but this was definitely not the case here. Some of them threw in way under. I was nevertheless surprised, given other anecdotes you hear about luxury buying over there being so repressed and with huge losses being incurred for those purchasing recently.

The fact that nearly all of them were from a group that we’re constantly hearing is gone, causes me to wonder to what extent that’s the case. Obviously I can’t speak to the whole market but I can tell you, Chinese buyers are still here to at least some extent.

Says the hypocrite with children.

I don’t understand how density increases any of those but living in close proximity. Look at the Netherlands which is the densest country in Europe, way less traffic & congestion since it’s easier to bike/take the train (building proper infrastructure is much easier with density). There’s less loss of natural habitat since the same amount of people occupy a smaller space.

If those estimates are accurate, that 6,291 people added to Victoria CRD (mentioned in the release) in 2019 would need about 2,500 additional dwellings. Completed construction has been about that (+/-) , but of course other factors are at play (location, rental/sales mix, entry level/luxury). Falling vacancy rate indicates that more construction is needed.

In the sense that we don’t yet have an alternative to capitalism, you’re right. Capitalism seems to require never-ending population growth.

Wealthier neighbourhoods tend to be more NIMBY and better able to resist the density onslaught.

No, I really think moving to a different neighbourhood where NIMBYism is stronger is a good course of action for me.

However, the sky may not be falling. GH may not get as dense, as fast, as I fear.

Let’s be honest, the downsides to density are rarely mentioned, let alone highlighted. But there is a clever one on a blog I know who raises this topic from time to time…

Um, no. Cities adjust themselves, based on input from citizens. The price of admission isn’t total and unquestioning acceptance of everything.

If it’s that close, you might be flying a 737 max.

I was talking about a level playing field for RE taxation, instead of today’s subsidies that encourage wasteful use. You response reminds me a bit of the “up is down” viewpoint of the RE industry that views reduction in such subsidies as “intervention”. But maybe that was your point. 🙂

“From each according to his ability, to each according to his needs” was the precise quote, I believe.

That would discourage investment in rental properties. Also, there’s the issue of rental suites versus rental condos versus purpose built rental buildings. Tax one type less than the other, and you push investment towards it. And that’s most likely to be SFH with suites, which would push SFH prices even higher, which is the last thing we should want.

People who buy houses or condos and rent them out are not the problem. They supply rental accommodation which is badly needed. If you want to change the tax system, quit incentivizing owners to hold houses with more space than they need. Going after absentee owners of empty properties was the right step but they are only a tiny part of the problem. Owner-occupiers are a much bigger part.

Just have a look below at all the SFH’s that were near Hillside and Douglas back in the day (where the Volvo dealership and SG Power is now). The effects of densification over time makes it almost unfathomable that you’d have a SFH there now. Just doesn’t “fit” anymore. Even if there was one, would you really want to live in it there, today?

It was ditto for Blanshard Street. Row after row of SFH’s were there, all now long gone to make room for highway and commercial buildings.

“I think there’s a happy medium when it comes to density. Is that so hard to fathom?”

No, but you have no ability to stop it. The writing may be on the wall with respect to increasing density in Gordon Head, but it’s also on the wall for any neighbourhood in close proximity to town. You can try and outrun it by moving to the next neighbourhood over, but it will just spill over from Gordon Head.

Since you have no ability to stop it, a couple things you could do to hedge against it would be to buy land in the ALR, or move out of town.

“But this idea that density can and should continue forever—and that there are almost no downsides—is folly.”

Who said there are no downsides? Congestion, traffic, loss of natural habitat, living in close proximity to others are all downsides of living in a City. You live in a City. Adjust yourself or get out.

BC population estimates have been released and the CRD grew by 1.5%. About average. Fraser Valley (+2.1%) and Central Okanagan (+1.9%)regional districts experienced the highest relative growth between 2018 and 2019 followed by Strathcona (1.8%) and Nanaimo (1.5%) regional districts. In absolute terms, the Greater Vancouver Regional District saw the largest increase in population in the twelve months ending June 30, 2019 (+39,041), followed by Fraser Valley (+6,810) and the Capital Regional District (+6,291).

https://www2.gov.bc.ca/assets/gov/data/statistics/people-population-community/population/pop_sub-provincial_population_highlights.pdf

I think there’s a happy medium when it comes to density. Is that so hard to fathom?

But this idea that density can and should continue forever—and that there are almost no downsides—is folly.

But really my beef is more with infinite population growth than it is with density.

@Leo S

I was undecided on amalgamation before…

Nice article and a good summary of what we know.

“You cannot make structural changes,” says Chan, “but if you bought a home with a suite already built, you would not run the risk of losing the principal residence exemption [on any part of your home] when you go to sell.”

This is the case for me, and I’m guessing for the majority of homeowners with basement suites in Victoria. The suites were already there when we bought.

Ensure the suite isn’t more than 50% of your home’s square footage, and don’t claim CCA (no competent accountant would let you).

Boom—you maintain the PRE, unless due to bad luck or being suspicious you’re one of those rare cases when CRA decides to put a microscope on your situation.

As the article says, “Remember, the CRA has left wiggle room in the regulation to allow for a case-by-case analysis.”

Edit: Some in Victoria (perhaps many?) aren’t declaring suite income to CRA. This is a bad idea, for at least two obvious reasons.

“They’re all likely going to get denser. You’ll have to retire to Sidney.”

More like Shirley. I’ve never understood why someone who claims to not like density would choose to live in town. Why not move somewhere rural?

On the occasions I fly out of Victoria it seems like the landing gear of my 737 nearly brushes the roofs of some Sidney homes. This is when I make a mental note to avoid living in Sidney.

http://www.goldengirlfinance.com/2020/01/the-lowdown-on-home-rental-suites-and-the-cra/

“The Lowdown on Home Rental Suites and the CRA”

A topic we have discussed a lot here.

Those places I mentioned have good track records in terms of thwarting density, and I see that continuing for the most part.

I’m not a Sidney fan. I find it dreary and oddly lacking in trees.

It’s automatic in that somebody at MLS decides when to press a button that “automatically” updates the figures. 😉

Since this is completely hypothetical.

They might leave Victoria, they might build a new place, they might become homeless, they might buy a place and rent out part of that place. It might put downward pressure on BOTH rentals and home prices.

Well of course, but if 100 people get evicted from their suites, maybe 20 buy a home and 80 rent, putting upward pressure on BOTH rentals and home prices. So yes it is both.

29th of Jan and PCS still doesn’t have this years assessments up to date.

I know its automatic but does anyone know when they were updated last year?

Case in point.

They’re all likely going to get denser. You’ll have to retire to Sidney.

My plan!

But I’m not kicking out my wonderful tenant just yet…

It took 10 years, but my tenant is now paying my mortgage completely. In fact, suite income exceeds the mortgage payment, meaning my tenant is also partially covering my extra mortgage payments.

This is when the mortgage pay-down snowball gets really big, really fast.

On the topic of density, I’ve lately found myself daydreaming about someday “retiring” to Broadmead or Cordova Bay, or even Oak Bay — scenic neighbourhoods that have successfully warded off increased density and probably will continue to do so.

As far as Saanich goes, Gordon Head is already pretty dense, and it’s only going to get denser. I can see the writing on the wall.

I wonder what people on this blog think about taxing rental properties sales at full pop instead of capital gains 50%. I haven’t put a ton of thought into it but it makes sense to me that if someone sells a property that they made 500K on they shouldn’t be paying a lower tax bracket on that amount then someone making 60k a year (or whatever that income bracket works out to). I saw in the Fed election NDP wanted to increase cap gains to 75% from 50%. Is this a crazy idea or does it make sense? This may hinder speculation some as well and increase housing stock. Thoughts?

It’s going to be one or the other. Not both. Also, they might buy a place with a suite that wasn’t rented out previously and rent it out as a mortgage helper.

How do they sell then?

It depends what their “move-up” strategy is. Sometimes they just remove one without adding anything.

Some homeowners “move-up” by taking over their in-house suite (evicting their tenant). This isn’t a “net zero”, it is a “negative”, as it has the same effect as what the spec tax is targeted at – namely one homeowner now occupying two dwellings (in the same house).

This idea isn’t rare, it’s a common house buying plan discussed on this site. Namely buy a house with a “mortgage helper” suite. And then in the future, as the household grows and finances improve, “move-up” by taking over the suite. The evicted tenant has to find a place, either by buying or renting. Removing a rental unit puts pressure on both rental and buying markets (because the evicted tenant may buy instead of renting again).

Federal govt open to public feedback for their expert panel on housing affordability: https://feedback.engage.gov.bc.ca/752829?lang=en

And it still doesn’t make sense to me.

Even if we stick to the example of one sale and repurchase, they are in different purchase price brackets. I don’t know how the market can be treated as a singular entity when one house costs 500k and another 1 million. And the demand is not alleviated by the move-up buyer “freeing up” this housing as we have a supply problem at this level and will, imo, continue to do so as houses get smaller in order to be more affordable. By the time the move up buyer sells their house is often no longer an entry level house. Eventually you get into a situation where people will not be able to afford a SFH no matter how many home owners sell and move up in our market.

Maybe. Your reply sounds a bit condescending, but perhaps it is merely frustration. The site is hard to search for past conversations. I do recall working out that it would be easier to buy with less appreciation in the market in some cases, not all.

>Move up buyers cannot possible increase price of lower end homes because they sell those homes.

Except for the many folks who do keep their first home, remortgage and buy their second home and rent out the first. I think someone raised this below. Or those that later buy an entry level house to rent out with their equity from the more expensive home.

The substitution theory is flawed imo. Equity goes all kinds of places and has all kinds of effects, including on supply and demand. And wages just don’t keep up with appreciation on leveraged funds.

This market isn’t appreciating.

Except that they’re mostly rentals.

I think we have had this discussion many times. When I say it has no effect I mean on the entire market. They add one house to supply and remove one. Net zero. Of course they (usually) shift the price range as I mentioned.

Sure but this has nothing to do with price appreciation. If prices always stayed constant there would still be the same move up buyers, except the equity would come from mortgage paydown. In fact it would be easier to move up since the differential would be less, as we established the last time we had this conversation.

Move up buyers cannot possible increase price of lower end homes because they sell those homes. The only group of buyers that can increase price of low end homes are those that buy them.

I’m posting a link to a presentation done by Brent Johnson of Santiago Capital. I’ve been following him a lot lately and was happy he did a talk on Canada and our current macro outlook.

https://youtu.be/UCnDspyzwrw

I may be missing something, but those who are buying move-up housing with equity do appear to affect the market?

A 600k house has a lot of demand from first-time buyers and investors.

The person who bought five years ago for 400k now has 200k of home equity to put back into the market and perhaps can get a bigger mortgage as well as their income may have increased or they are buying a more expensive home with a suite. Maybe they are now looking in the 900k range, which constitutes new demand for this segment of the market and employs leverage into the market.

Without move-up equity the non-entry levels of the market would not have the demand they do. And later these homeowners may remortgage and buy a rental at the lower end of the market or another even more expensive home.

In an appreciating market, move-up buyers with equity do affect the market significantly imo and increase the demand for more expensive housing which leads to higher prices and even more demand for lower end homes due to worsening affordability.

Interesting anecdotes about Toronto move-up buyers increasingly keeping the first property to rent out, limiting supply at the lower end (but also increasing rental supply):

https://twitter.com/JohnPasalis/status/1220099677120614400

https://twitter.com/BenRabidoux/status/1222169056033361921

Leo, any idea if this is happening here too? Are there stats, e.g. number of people with multiple properties, that would capture such a trend?

Inventory barely budging occurring with high numbers of new stock added (completed construction) suggests high numbers of first time buyers/investors.

I don’t think that’s what you expected when you researched and posted the high monthly construction completion numbers here all last year. By now many bears expected that we would be swimming in high inventory and vacant apartments. It seems that above-expected population growth has absorbed the new supply (2.0% Greater Victoria population growth in 2019 according to the Dec. 2019 Labour Force survey). If our unemployment remains at these ultra-low levels this trend should continue, as people move here for jobs.

Doesn’t inventory barely budging kind of suggest that there’s more trading going on than first time buying and investors?

What’s the likelihood of people who are getting a loan w/ a loan to income ratio over 450% actually getting a 2.69% financing rate?

Depends on if they are move up buyers, first time buyers, or investors. I completely agree that move up buyers have no effect on the market. In fact it would be great if we got more of those because they would free up inventory in the tighter lower end while buying up some inventory in the slow upper end. First time buyers and investors though are the same pure demand as out of town buyers, and they tend to buy more in the lower end which is already the most active.

I find BC Assessment has the most trouble with getting the value right on the extremes. So low end they have trouble differentiating tear downs that are just land value – costs from livable places, and in the high end they have trouble because the places are so unique.

Interesting article. Thanks for posting.

Once again, the past tense of “lead” is “led.”

In case anyone’s wondering what % of income is required to pay the interest on a 2.69% mortgage with a 450% loan to income ratio, it is 450%*2.69%= 12% of annual income. But that’s only year one, and that reduces to zero over the 25 years of the mortgage. All the other mortgage payments are equity pay down (“forced savings”).

That 12% seems like a small % of income. Of course the graph shows that only 18% of new buyers are subject to paying (at least) this, so that 82% of new mortgages are paying less than 12% of their income on mortgage interest.

At least we can hope that noone wants to label that 12% number too as a “crisis”.

I’ve noticed that a SFH (1887 Taylor ) in the Camosun area is priced under assessment but not selling, despite being pretty much the lowest price in that area. Other than it not being so large of a home, and needing some upgrades any thoughts out there on why its sitting?

I do wonder how much actual sales affect prices vs sales from out of town. If there are a bunch of people trading houses, it really shouldn’t put much pressure on prices, where as a bunch of, as you say, pure demand from outside would actually move the needle. 25% more sales, but only 3% less inventory shouldn’t really cause price increases.

In case anyone is wondering why sales are up: Back to debt.

https://www.osfi-bsif.gc.ca/Eng/fi-if/rg-ro/gdn-ort/gl-ld/Pages/b20-nfo.aspx