Sold! Sales data going public on realtor.ca

Well that didn’t take long. Only 6 weeks after the Toronto Real Estate Board lost their final appeal against the Competition Bureau’s ruling that forced them to allow the publishing of sales price data, the Canadian Real Estate Association’s national portal, Realtor.ca has announced they will be adding sales data to their site.

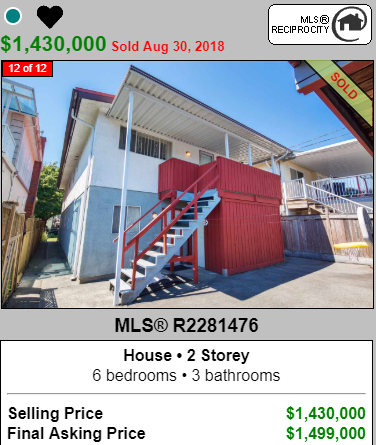

Example sold data in the lower mainland from zealty.ca

This to me is a clearly positive step for consumers and the only sensible decision that CREA could have made. The cat is out of the bag on sales data, and if they don’t add that to their site they will quickly fall into irrelevance as players like Zillow make aggressive moves to expand into Canada. If they had waited any longer they would have found their lunch being eaten by new entrants to the market with the same data access but better tools.

One of the reasons that the real estate market is relatively inefficient compared to financial markets is that there is a high degree of information asymmetry between the consumer and those in the industry. This leads to mispricing, an inability to easily verify what the market is doing, and makes it difficult to break out of the traditional agent/client business model. This is the first step (of many) to open up the data and separate the requirement that the people facilitating transactions are the same as those providing data.

Despite the Toronto Real Estate Board’s arguments in the courts, the battle over sold data was never about protecting privacy (if it were the CREA wouldn’t be making this announcement). It was about protecting a perceived competitive advantage (the data) that REALTORs® had. The reason I say perceived is that the industry should not be afraid of a better educated consumer, and it is very unlikely that this will change much of anything outside of reducing the amount of time agents spend looking up basic data about properties to send to clients. The US has had much more open data for years and average commissions are still higher than here (above 5%). Nor did it encourage people to abandon the use real estate agents (89% apparently use one). Sure if an agent’s only value was that they dispensed data from the database they might be in trouble, but in that case: good riddance.

How long do we have to wait to see the sold data show up? Well the data release in each region is continent on approval from the local board, and I’ll update you when the VREB releases their timeline for when they will send the data over to the national database. The VREB is quite progressive in this regard, and the data feed that I have access to has data back to the 90s so we should get some decent history being fed to the main site. I suspect this will be prioritized and we should see sold data on realtor.ca within a couple months.

However, there is one big caveat in this announcement, and that is that so far they have only decided to publish sold prices, not pending sales. This makes the data far less useful since most people are less interested in what a property sold for 10 years ago, and more interested in seeing what a property sold for now (i.e. when conditions come off), not 2 months from now when the sale completes. They claim that this is to protect privacy, but I believe they will quickly backpedal on this as other sites spring up that include pending sale info and their traffic starts to drop.

If you want to browse pending sale and sold prices in the meantime, you can check out a site called zealty.ca (Vancouver only) or sign up for a private Matrix portal using the form below. This gives you the pending sales and some other info like floor plans for properties you won’t find on realtor.ca yet. The downside is that you need to specify a segment of the market by housing type, region, and price in order to limit results below the 350 maximum the system imposes.

[contact-form-7 id=”2267″ title=”Matrix Access”]

I think the missing middle is exactly the problem. However, eying the established neighbourhoods is piecemeal and way to lengthy to be any sort of solution in our lifetimes. That was the mistake of early planning and now organic growth will evolve these areas. Even if they are up zoned it’s not like they will transform in even 50 years. Look at the Railyards. That wax vacant land and it’s more than 15 years later and it’s not done yet. There are huge tracks of land alongside the E&N that could be built into new neighbourhoods with a Tram link and protected bike path into town. The right away exists, the crossings have all been upgraded and there are no established neighbourhoods in the way…. focus on that if we truly want affordable family housing and transportation….

That is total BS Local Fool. In the US the price crash did not start at the top. It started in marginal areas.

Housing politics of candidates in Saanich/Victoria/Oak Bay https://househuntvictoria.ca/2018/10/04/the-politics-of-housing

That’s one of the causes I like to donate to. 😀

Now I know why you’re so fond of bears. Aww.

Happy to see more I need acreage for my rescue animal sanctuary. Something in Cowichan. But don’t think it will Local. Sticking to the 5 to 10.

Local

No t shirt. We are a 5 to 10% decline on the Bench mark.

Went to see two homes today, one after a price drop (due to a deal collapsing over financing) and the listing agent for the second one said to our realtor they are dropping the price by 51k today. Pretty reasonably priced homes, in good condition, but I think we will pass due to location. Some houses we have viewed have dropped 10-20% from the original list price, and are sitting empty months after we viewed them. They and a ton currently on market will need some significant slashes before buyers like me will revisit or more will come out of the woodwork. Patience, not my greatest virtue…..

Don’t think they’ve changed, have they? I wasn’t saying they have anyways. So, about the shirt?

And quit editing after I responded. Makes me twitchy.

Local

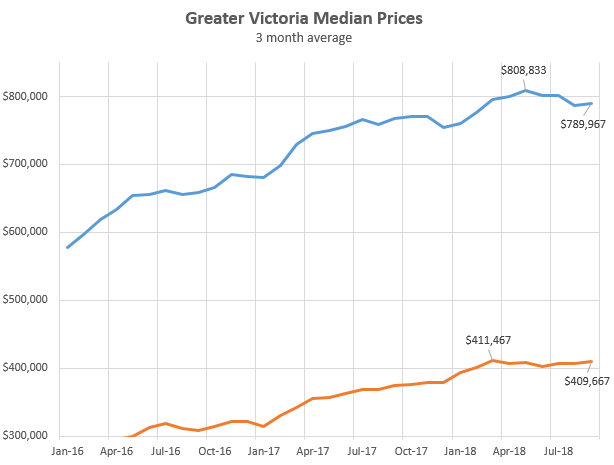

Victoria prices are down on the average sfh in Victoria from last year ????

We don’t live in Vancouver our prices never hit the levels of Vancouver.

Please reality. This is turning into an episode of the twilight zone.

2600 homes on the market is historically low. At 5k we barley moved prices down. I know you guy don’t like reality but just stories to extrapolate to a crashing Victoria market.

Still not a lot of quality homes for sale in Victoria.

That’s because that’s what’s happening, and has been happening for months. Sales activity is down way past 30%, in multiple markets all over British Columbia which is by all accounts a sales crash. And in our leading market, it’s getting worse and worse by the month. Their sales are approaching levels of deprivation not seen in decades, despite way more population and record low unemployment.

In fact, you can even begin to talk price crashes in some sections of West Vancouver. I know that’s still a ways from saying “the entire market”, but a price crash always starts at the top and works its way down, just like the way up. And – it takes quite a while. We’re about 2.5 Y in already.

In order for price declines to be averted from their stratospheric levels, we’re going to have to see a sustained avalanche of capital coming in, and soon.

Gwac, I have still have a bear club t-shirt with your name on it. It’s not too late. Seize the moment, turn over a new leaf. Unless you want to be the grumpy, obstinate caterpillar that refused to moult.

Local

You guys are hilarious. Chest all pumped up declaring crash numbers on any shit that hits the news. Too funny. Charlie 40% is the best.

Ya no, not from rising family income, if the housing market enters into a recession. In fact, exactly the opposite will happen.

Gwac, you love bear posts. It must be our softer fur. You always seem more than delighted to respond to them. Alas, it’s getting a little hard to shrug off what’s going on in BC.

))j Andy7; re USMCA

That clause applies all three, so that Canada could veto a US free trade deal too. Note that it is just a free trade deals, not any trade deal. And any party can just walk away for from USMCA in 6 months anyway. I think it’s a good idea, as it will make the 3 countries more likely to act as a single block in making free trade deals.

Macleans talks about it.. https://www.macleans.ca/politics/how-usmca-could-scuttle-free-trade-with-china/

“Price declines are becoming more prominent. The average sales price of a detached home in Vancouver registered a 19.7% decline in September. The median sales price reported a 7.8% decline, while the MLS benchmark price which tends to be a lagging indicator now shows a 7.6% decline year-over-year. We are seeing detached houses on the west side of Vancouver selling back at 2015 prices, while the East Side has held better, and is off about 10-15% from the peak. Price declines can be hard to quantify given sales volumes are at record lows. ”

Looking forward to 2015 prices of Victoria ever goes back there. Though I think we have had more of a run up in 15/16/17 than Vancouver since there run started earlier.

https://vancitycondoguide.com/vancouver-detached-average-sales-price-in-september/

I read the following comment posted on a Yahoo article titled, USMCA Contains ‘Unprecedented’ Clause Giving U.S. Veto Over Canadian Trade Deals – no idea of the validity of this comment — anyone here know? I can’t seem to find anything online. The comment was…

“There is also a clause in the new USMCA, that gives the US control over our interest rates. It says that there will be a joint committee to decide on the exchange rates between the 3 countries. The exchange rates, are largely set by our interest rates.”

Omg the 2nd to last post is the most dilusional on here since Info. Charlie got a hold of the food stuff

)) charliedontsurf: Where is that additional $250 to come from? The air, apparently.

=======

Not from the air, but from rising family income.

Median family income has been rising 3% per year, which is a rise of about 3% x 83k = $2,500 Per year. That means in 4 years the median family income will be up $10,000 per year. Well able to weather a $250×12= $3,000 yealy rise, especially since it’s a one time rise when rates rise (not a relentless rise every year like rents) ….

Someone renting a $2k per month house pays $24,000 per year, and 3% rise with inflation would be a $720 annual rent increase. In 4 years that would be a $2,900 annual rent increase. That’s about the same as your homeowner example. But while they are equal after 4 years, the next 4 years are different – no new increase for homeowner, but rents continue to rise with inflation.

I

Vancouver real estate?….crash. myrealtycheck.ca is showing an accelerated rate increase towards the negative. Last month total amount of price drops was over 350 million. It has been around a 300 million dollar decrease for the few months prior. Already this month, in 4 days, a perplexing 116 million dollar decrease in list prices. On pace for____ in the month of October? 500 million? The spring market will be a total bloodbath. Time for predictions y’all. From peak market price, I predict that SFH average price in the GVA will decline by more than 50%. For Victoria SFH from peak, a decline of more than 40%.

https://www.google.ca/amp/s/www.cbc.ca/amp/1.4256026

Average mortgage in Canada is 200k

Bears you guys need a support group.

Worth a re-post VB.

“Even using $250 more per month would be a stretch for many, many households. However, using $250,000 for a mortgage is not realistic. Look at the RBC affordability index: for a SFH household in Victoria, 72% of the gross [pre-tax] household income goes for housing [mortgage, insurance and property taxes]; deduct taxes and food – there is $0 left over. Where is that additional $250 to come from? The air, apparently. Now, look at the reality of a $500,000 or $600,000 mortgage…………or higher. Those that bought over the last 3 years are seriously at risk.”

Gwac – “The bears are losing it.”

Introvert – Don’t worry, a recession will save the Victoria housing market.

Michael – No, increasing rates will make it go up 700%.

“Vancouver detached prices sink 19.7% year over year in September. Real Estate Boards official benchmark price shows a 7.6% decline. Tough love either way you slice it.

We are seeing detached houses on the west side of Vancouver selling back at 2015 prices, while the East Side has held better, and is off about 10-15% from the peak. Price declines can be hard to quantify given sales volumes are at record lows.”

https://vancitycondoguide.com/vancouver-detached-average-sales-price-in-september/

Great post VB

US 10 year treasury at highest yield since 2011. Hawk, you hit the nail on the head. The difference though between then and now is that the next move will be up [not down as we saw in 2011 and 2012…]. The US Fed has told you point-blank the direction this is going. Overnight, global rates jumped as ADP and Moody’s gave US job estimates that are above the consensus – global rates rose and today’s stock markets in North America reacted as we expected. Bond market yields rose in North America and, consequently, mortgage rates right here in BC rose. The BOC will hike later this month, is anyone predicting otherwise?

Even using $250 more per month would be a stretch for many, many households. However, using $250,000 for a mortgage is not realistic. Look at the RBC affordability index: for a SFH household in Victoria, 72% of the gross [pre-tax] household income goes for housing [mortgage, insurance and property taxes]; deduct taxes and food – there is $0 left over. Where is that additional $250 to come from? The air, apparently. Now, look at the reality of a $500,000 or $600,000 mortgage…………or higher. Those that bought over the last 3 years are seriously at risk.

And Vancouver? Looks like a desert. Royal LePage is being dishonest. Foreign money, drug money-laundering and historically low interest rates caused this and all 3 are under attack [not to mention the stress test, speculation tax, school tax……]. Victoria lags Vancouver on the way up, and on the way down. No crystal ball, no predictions – concrete and established laws of economics tell us the direction – the magnitude is the issue, not the direction. Think for yourself. Do your own research. And when you do, watch the bulls leaving their wallets at home while they tout “up, up and away………….blue sky…………….”. “Do as I say, not as I do”, the theme song of the bull that we see daily.

Joking aside, the risks outweigh the benefits of buying in to this right now. Raise cash and watch.

As has been pointed out many times on this forum, even in the worst housing crashes most owners aren’t affected. But the vast majority of properties aren’t on the market, voluntarily or otherwise, at any given time. It’s the ones that are on the market that determine prices, and the households who are in the market who are affected, for good or for bad.

The Bears are losing it.

It’s okay Introvert. I’ll get this one. In Canada it is cheque to cheque. Hawk, I love you btw.

One thing that makes me scratch my head is those that say they will never raise interest rates so much that everyone would lose their houses. Obviously this isn’t true but there has to be a bit of truth to it. Is there a point that is reached where the govt intervenes? Did the government do anything to help homeowners in the past when they were losing their houses? Anyone have any good links for me?

The amount the bank is willing to give me seems off. I guess I have daycare costs that they don’t factor in but it seems so high and I’m not comfortable taking anywhere near the max amount they will give me. According to my calculations even a small interest increase and it doesn’t look great in 5 years at renewal time unless our wages increase that amount. This really makes me wonder how much rates will rise for the period of the mortgage. A lot can change over 25 years. I’m really starting to wonder if being a homeowner is not for me at this time. I wonder how many other people will be thinking this when the news comes out that there is a slowdown? Maybe buying a house isn’t such an urgent matter anymore. I really can’t see prices going up once househunters catch on to this. I wish I was able to buy 4 years ago but I’m really glad I didn’t buy a year ago.

Leo can you be in multiple matrix portals?

$250K mortgages?? Try $500K to $600K who bought with almost nothing down the past few years ago and are up for renewal. More like $1000 to $1500 a month. Try coming up with that is no easy feat for most when half of Canadians live check to check.

LOL LeoM ! 🙂

Meanwhile across the Puget Sound in the emerald city things are going south too.

As sales plunge, King County home inventory has biggest jump on record

Sales and inventory numbers are now back to 2012 levels – when the housing market was still buyer-friendly – while prices continue to drop

https://www.seattletimes.com/business/real-estate/as-sales-plunge-king-county-home-inventory-has-biggest-jump-on-record/

Here is a 5 second video of Hawk explaining it to GWAC, and gwac’s reply

https://m.youtube.com/watch?v=Sc9M-YrSfpM

Hmm. I don’t think that’s the market segment of concern.

It’s more what happens among the cohort that have overextended themselves and the knock-off effect they have on the market. And at this point, there’s a lot of them. This is actually where the fear in the housing market lies, as Poloz identified in the BoC’s last financial report.

Woah, 50,000th post!

Just saying:

<<<<<<<<<<<<<<<<<<<<

Staggering share of Canadians fear bankruptcy if interest rates rise …

https://globalnews.ca/news/3962467/credit-card-debt-savings-canadians/

Jan 15, 2018 – READ MORE: Your debt in 2018: The economic trends that could hit your pocketbook … And overall, almost half of Canadians (48 per cent), say they are within $200 of not … they'll face financial difficulty if interest rates go up much more. …. have money to pay for something wait till u have some extra money …

A 250lk mortgage going from 3 to 5%. Goes from 1183 to 1454 so and extra 270 dollars which is like 50 bucks back in 1981. Most people can find that. No starbucks… You guy are really insane,

All it takes is the next recession for interest rates to drop.

Do you guys think we’re not going to have recessions anymore?

leoM and Hawk looks like you guys have gotten an early sample of the legal Marijuana.

Please share with the rest of the bears. May relieve some of the pain you guys are experiencing.

Exactly what I’ve been saying LeoM. You don’t need gwac’s 15 points BS, just a couple of percentage points and its SHTF time.

Did you miss the news today gwac? 7 years is not 5 days. Wakey wakey.

Dow falls the most in 2 months on fears of rising rates as 10-year yield hits highest since 2011

It’s possible, IMO, though beyond the range that I have in mind (not telling, since whatever it is will be wrong anyways). Interestingly, a 41% drop from today’s price levels would actually see houses that remain notably above the national average price, when Vancouver and Toronto are stripped out. They certainly wouldn’t be “cheap” by 2018 dollar/income standards.

Don’t mind the butt-in. Always love to hear real life historical accounts.

Gwhacked needs a history lesson. Coming soon in spades. Look out below. 😉

We may be in the early tages of a ‘persistent rise’ in interest rates

The jump in interest rates on Thursday may just be the beginning, says Jim Grant.

The yield on the benchmark 10-year Treasury reached its highest level since 2011

earlyThursday morning, breaking above 3.2 percent.

“It may just be … that the great bond bull market that began in 1981 ended in July of 2016,” says Grant.

Grant, a frequent critic of the Federal Reserve, blamed central banks for a “huge distortion” of interest rates because they pushed them down for the better part of 10 years.

He thinks that will have consequences for the economy because people have borrowed at false prices.

https://www.cnbc.com/2018/10/04/interest-rates-may-be-in-early-stages-of-a-persistent-rise-jim-grant.html

Hawk might be onto something when he compares now to 1981.

If a $100,000 five year term mortgage was renewed in 1981, the interest rate would have gone from about 11% to 17.5%. The monthly cost of the 11% mortgage would have been $1,000. The renewed mortgage at nearly 18% would have been $1,500 per month, a 50% increase in monthly payments.

Today, a mortgage only needs to increase by 4% to increase monthly payments by 50%.

(Sorry GWAC, you need a remedial math class)

These days, a five year mortgage of $200,000 at 2.2% will have a monthly payment of about $1,000 per month. But, if this mortgage is renewed in 18 months at 6% the new monthly payment will be about $1,450, an increase in monthly payments of 45%.

In 1981 house prices dropped rapidly in tandem with spiking interest rates, but I’m still predicting a slow decline for the next 18 to 24+ months; so, I think Hawk is probably right about the 1981 effect, just in slow-motion this time, unless interest rates spike.

Local Fool: “Do you believe that a correction in Victoria will exceed 41%?”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Sorry to butt into your question for Hawk, LF, but I do have similar experience as Hawk from that housing crash.

We had purchased our second home in 1981, financed with a 6 month builder's mortgage (realtor's suggestion to give interest rates a chance to drop). 5yr mortgage rates peaked at 21% that year and we sold one year later when we couldn't get a mortgage.

We sold in 1982 when mortgage rates were down to 19% and bought the following year when mortgage rates had dropped to 13%. We rented and we were able to re-enter the housing market one year after the fire sale of our house because mortgage rates had dropped significantly.

I think that the challenge that the current housing market will have when it does correct/crash is, quite frankly, what will save it??? Mortgage rates dropped 6% for me which allowed me to get a $70,000 mortgage on our next place.

41% might be all too real and exceeding that a real possibility.

Great point @Leo S that they are not going to publish pending sales prices. I know people who would be in the market if they knew prices were coming down.

@guest_49978 I would send the TC article to the landlords I know, but I wouldn’t share that horror show with my worst enemy. Many people I know have struggled with one bad tenant but this is ridiculous.

@Grace “The Meadows townhouses in Brentwood Bay?” Looks like a great place if someone had a high school student as Stellies has a great reputation. One could also host an international student to bring down the cost if their family wasn’t too big. Easy commute to work for most as well.

Yep Hawk 5 year bond rates in Canada are surging today. Just like 1981 only needs to up 1500 BP. You really are delusional…

Date

Yield

2018-10-03 2.43

2018-10-02 2.39

2018-10-01 2.42

2018-09-28 2.33

2018-09-27 2.32

Great way to save money! Anyone can do it! Get a renter friend to “invite” you to live in their place and you can legally stay there for 30 days for free!

https://www.timescolonist.com/news/local/saanich-landlord-feels-besieged-by-20-campers-vows-to-evict-them-1.23451967

James Soper: ” in what country?”

<<<<<<<<<<<<<<<<<<<<<<

Yesterday's news James.

https://twitter.com/RateSpy

"Don't look now but we're at another 7.5-year high in the 5yr govt yield: http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=TMBMKCA-05Y&insttype=&freq=&show= …

55 lenders have hiked 5yr fixed rates this week, with many more to come."

The latest rates for new 5yr mortgages:

10:11 AM – 3 Oct 2018

Do you believe that a correction in Victoria will exceed 41%?

State TV in Hawklandia is FHawk’s News.

Hawklandia – where yields are always spiking and sales are always tanking.

In what country?

Finance, insurance, real estate, rental and leasing

for BC -> down 7200 year over year

for Alberta -> down 5400 year over year

Ontario is actually up. Can’t believe how many people work in that industry in Ontario., actually bigger as a % than BCs, 7.8% to 6.1%. Construction is bigger in BC though with 9.5% of people employed in Construction vs. only 7% in Ontario.

Bond yields spiking today. Rates are heading up very fast. Two more Canadian hikes by January. Smells like 81 all over again but worse. 😉

For any data nerds…have a gander at this StatsCan piece showing each Province’s breakdown of employment by sector.

https://www150.statcan.gc.ca/n1/daily-quotidien/180907/t006a-eng.htm

Yes, only one day. https://twitter.com/JamesAddison/status/1047600572898013184

Not quite enough to call it a decline… Very curious to see what the spring brings.

Canadian economy facing deep-rooted problems as wages stagnate, household debt mounts

Wages are barely keeping up with the cost of living, business executives complain they can’t compete and households are carrying record levels of debt

https://business.financialpost.com/news/economy/canadian-economy-facing-deep-rooted-problems-as-wages-stagnate-household-debt-mounts

That is in fact, precisely what’s happening. Most sellers are still doing the hold-out routine which IMO, is an increasingly dangerous bet. Dollars are flowing out of BC RE at an increasingly rapid pace yet, many people remain blindly confident, smug, or even oblivious.

Talking to a guy at work yesterday about Vancouver, which is the epicenter of the unfolding correction.

“Ya I hear it’s up big time, apparently there is no upward limit anymore.”

Perhaps he was looking at the data upside down…

GWAC: No wonder people dont want to be a landlord. You can end up living an episode of “Shameless”.

This was on our local news last night about Vancouver tanking.

From red hot to ice cold. Sales “plunged and prices heading in same direction.”

Places slashed hundreds of thousands, under assesments, unhappy sellers waking up to the new reality. Buyers disapearing overnight. Bummer for the pumpers. It’s going to get ugly.

https://bc.ctvnews.ca/mobile/video?clipId=1505583

https://www.timescolonist.com/news/local/landlord-feels-besieged-by-20-campers-vows-to-evict-them-1.23451967

Important article for landlords to understand about invited guests of renters who may not even be on the lease. Seems his son was subletting the rooms including something to his father (land or room).

Leo, shame on you. You missed the big announcement by one of the builders who is adding running water and even an inside privy to its luxury models. We should catch up to the Yanks any day now.

Thanks for all the great work here.

A little bit of Just Jack just died