Economy on FIRE

Yesterday Langford council voted to ask the province to be exempted from the Speculation Tax. Stu Young, the mayor, said that 60 per cent of people who work in Langford are homeowners “because they have actual jobs now in the trades industry — good jobs”. Langford staff argued that people who were buying properties to leave empty would be hit by the tax, an outcome they clearly want to avoid. It seems that the argument against the spec tax has shifted from pointing out unintended collateral damage to arguing against its primary purpose. However it demonstrates that as the economy becomes more and more dependent on the construction and FIRE (Finance, Insurance, Real Estate) industries, the resistance against any attempts to reverse that course will become stronger as well.

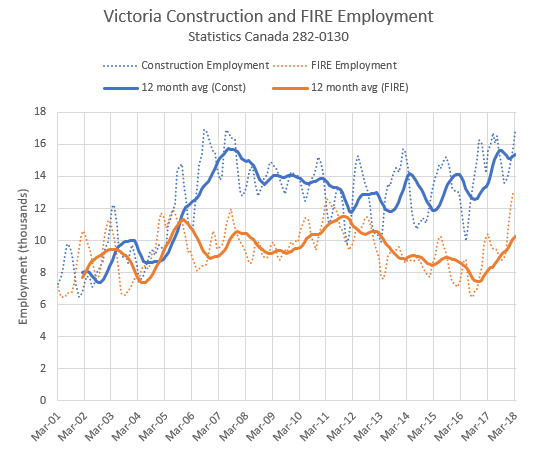

In Victoria, both construction and FIRE industry employment has been on an upswing lately and is at or near previous peaks.

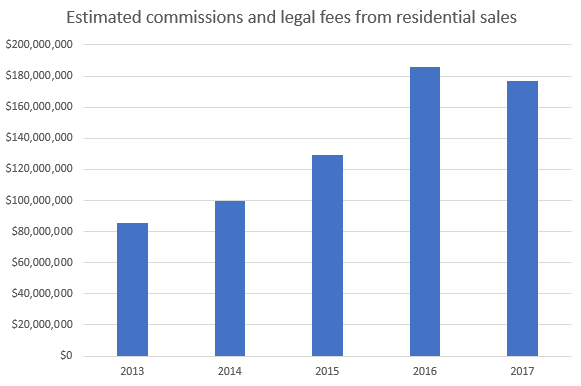

Outside of employment, there is also the impact on the economy from the uptick in both prices and sales activity in the last few years. I’m not going to attempt to tally up all the economic activity generated, but just looking at transaction costs we already get into astronomical sums. Taking into account a typical real estate commission, lawyer fees, and mortgage commissions, we can estimate how much money is being generated just from sales.

Because commissions are usually set on a percentage basis, the increase in sales combined with the increase in valuations has approximately doubled the sector’s output since 2013. One can imagine that there is going to be significant interest in fighting any measures that threaten that increased revenue. In addition, the sector is large enough that it is tightly coupled to the economy as a whole, and any slowdown will put a substantial drag on future growth.

Thanks for posting drew. I actually completely agree with you. I am not saying the reliance on the FIRE sector is bad, just that the amount of money explains the strength of the lobbying and that it means the economy is ever more tightly linked to the real estate industry.

Careful what you wish for. If you are counting other people’s money you better be prepared to have your money counted too.

Nice discussion but most people here are missing the point unfortunately. We are becoming a nation of ‘government employees’. Rather than discounting the value of private sector you should be supporting it before its gone, whether its FIRE related or not. Soon there will be the ‘government employee’ pushing paper and making self-serving policy awaiting a fat LIFETIME pension, and there will be the rest of the country working 70 hour weeks and filling out one dumb form after another. The sad thing is that we have gone too far now. We can’t dismantle the insane infrastructure because that would put hundreds of thousands of unemployable bureaucrats out of work.

That’s doesn’t mean ‘development at any cost’. That is another discussion altogether. But from a pure ‘cost’ perspective you must account for the bureaucratic, regulation, tax and reporting costs that are now baked-in to this whole industry. If you make $1 as an entrepreneur in this country you are lucky to take home 15 cents. FIRE is NOT just supporting the private sector, but the only wages that will come down in a downturn are in the private sector. Government employees NEVER take a pay cut, whether they break the economy or not.

In England typical estate agent commission is 1.25%. Can’t understand what value is being added here.

Sounds like Metchosin is the place to live!

Well, we might! 😉

But thanks for the context on the article.

The other point to make with Langford – 20% growth is very large proportionally, but in raw numbers it’s actually quite small. The population of Langford CMA is less than 36,000 people. If you presumed that value constantly over the last 5 years, that’s about 1,200 people per year. Consider that number over the entirety of Greater Victoria (which is what I was referring to in the first place) and it kind of puts the dramatic headline into perspective.

I mean from off the island, Grant. Langford is a local flight to affordability more than anything – people aren’t coming from all over Canada and the world, to Langford.

Errr, Langford’s population grew 20% in five years!

http://www.timescolonist.com/business/langford-s-population-grows-by-20-9-in-five-years-highest-in-region-1.9748691

Barrister your comment about retirees with their deep pockets moving to Victoria matches what Leo has aptly called “pure demand”. The other forces behind pure demand are “foreign buyers who don’t get tagged as foreign” and to a lesser extent, individuals such as myself who aren’t dependent on the Victoria economy for a job in order to move to the island. These together really counterbalance the possible downward pressures that may otherwise hit a RE market – such as affordability, over indebtedness and rising interest rates. On the topic of affordability, Introvert posted a link below to an interview with the Chief Economist of the BC Real Estate Association. In relation to median incomes and affordability he said:

“.. home prices to incomes are often misunderstood.. in Victoria you need to look at the distribution of sales… you have to look at the wealth of retirees and baby boomers who have a vast amount of equity… so you really need to look at the bottom 25% of the housing market, is this market affordable for first time buyers…. those who have low equity and down payments… yes affordability is eroding in that segment but the number of homes in that category are satiating the demand.”

His comment that the availability of supply in the bottom 25% of the market is satiating demand of first time buyers doesn’t really pass the smell test for me, or perhaps more accurately I think he underestimates the stresses new buyers are putting themselves into by trying to become homeowners. Regardless, Victoria’s overall affordability scale doesn’t appropriately take into account the amount money for property purchases that isn’t dependent on a Victoria based income.

Me too! 🙂

Yes. If SFH demand is very high, administrative restriction will have a stronger effect on prices than if demand for SFH’s is lower.

Definitely. All we know is what’s happening now. For the moment, the difference between US and Canadian rates are unfavorable for the CAD and consumers relying on imports (less discretionary spending). It is also favorable for inflation.

The contemplation was academic; what matters practically is that low inventory is unlikely to persist. If you look at historical inventory levels in our market, something drastic has occurred in the last 2 years in terms of existing home owners who are willing to sell. It’s critical to note that a large degree of the supply equation depends on the amount of new listings coming up from within the existing housing inventory. If sellers ain’t selling, builders can’t really build fast enough to compensate – especially with the red tape here. That last point is also a part of the problem, but IMO, is not the problem.

Ergo, I would surmise (guess) that the low inventory levels are more a function of market psychology than anything else. Relatively sudden, severely low inventory is also one of the features of a housing bubble, though that dynamic in and of itself doesn’t conclusively demonstrate one as such.

Victoria is growing, but I don’t think there’s been any prolonged, sustained increase in the amount of net-migration to the area. Victoria’s isolated position on an island places some limits on its appeal as an economic migration hub, and this has been the case since they decided to end the CPR at Burrard Inlet in 1886. The very recent migration to Victoria from the Vancouver region has been a phenomenon that much of the satellite markets around Vancouver have experienced; I don’t think it’s adequate to say, “it’s just ’cause Victoria’s desirable”.

CMHC’s most recent quarterly reports on Victoria’s market conditions clearly states that price growth cannot be explained by fundamentals such as income, demographics, or net-migration to the area. Housing starts while always occurring, are at or near historical highs. Retirees are a factor, but that has always been the case. I haven’t seen any evidence that we’ve experienced any “wave” of retirees beyond that which we historically experience, but I could be convinced if data indicated otherwise.

The unwind is usually measured in years, with the amount of leverage being one of the larger actors. A sudden, catastrophic implosion in RE prices is rare and usually means either an intrastate crisis or some kind of environmental/geopolitical disaster.

Grant:

I am probably as unbiased as anyone on this blog since I really dont care if the market here goes up or down. I should point out that we are considering selling and moving out of country late this summer but the sale price of the house is not a major or even minor concern for us. One of the few advantages of being old is that you no longer have to plan for the long run. I have been on the island for five years now and I tend to view the market here perhaps in a different way than many others here.

First let me acknowledge that I am about to over simplify matters but it helps to see the bigger picture fundamentals. Basically from the demand side we have two major groups of purchasers in greater Victoria :- locals and retirees from off the island. In addition, there are investors both local and foreign which I will deal with separately.

There are almost two Victoria real estate markets roughly divided into two geographic groupings. On the one hand there is the West Shore, Esquimalt, View Royal and parts of the Peninsula such as Brentwood Bay. On the other hand, there is Oak Bay, Fairfield, Rockland and James Bay and other parts of the Peninsula that are dominated by retirees. When I first arrived on the island in January of 2013 areas such as Fairfield and James Bay where affordable to a significant tranche of locals and Oak Bay was generally affordable to a significant segment of local incomes. The major change that occurred was not direct purchases by foreign buyers but a major number of retirees resettling here particularly from Vancouver. Because of the ballooning of prices in Vancouver the nature, number and financial quality of the retirees was very different than in previous years. Not only did the retirees come with deep pockets but they came in numbers great enough that they where bidding against each other for a limited number of houses. This is important to understand because they set the price point for houses in general for both out of town buyers and for locals in those areas.

The obvious argument is that with the collapse of prices in Vancouver we should see a major reduction of retirees coming to Victoria.Basically not only a reduction in demand but also a major reduction of buyers with deep pockets. And I think we are indeed seeing that.

I dont think that reduction of the Vancouver hoard will bring down prices any time soon. The baby boomers are really just starting to retire and a lot of them have significantly deep pockets. Victoria, it is to be remembered has a pretty small inventory of SFH in the premium areas. The second factor which I would suggest is overlooked often is the flood of retirees from Vancouver were comparatively young, many in their early fifties. They retired early because of the outrageous prices they could get for houses in Vancouver, buying here for 1.5 million and putting a couple of million in the bank.

This is significant because it seriously impacts the supply side of the equation in Victoria. Most of the Vancouver retirees see this as their last purchase and plan on staying in these homes until death or nursing home beckons. Statistically this group has a comparatively low divorce rate. In short, a large percentage of these homes will be off the market for decades.

Back to your original question, of whether the new tax measures will have a major impact on inventory or affordability for locals. First the increased foreign buyer tax might reduce some demand

in Victoria. its greater impact will be on Vancouver prices and hence should reduce both the number of transplants from the mainland and the depth of their pockets. Since the flood has been reduced already this will be a minor impact on the market but perhaps a significant but not overwhelming one.

The vacation home tax is hard to predict since we dont have any real grasp of the numbers involved.

My guess is that it will bring far more condos on the market than SFH particularly in the core. People who bought houses here with a view to retiring here are mostly older and within a few years of either the husband or wife retiring and will probably elect to keep the house and pay the tax for four or five years. You only need to have one spouse to move here permanently for the house to become the principal residence. But there will be some increase in inventory. We should also see a number of the SFH homes, particularly waterfront in the Peninsula come on the market. I suspect that the numbers will be low and spread over a few years. But it will reduce future demand and also increase some inventory. In terms of SFH I suspect that you will see little impact in the core, more impact in terms of condos.

Overall the increase in interest rates will have a much larger impact but predominantly in the local market.

Guilty as charged – or rather for me I plan to live in Victoria and continue working remotely.

Why I am not surprised about the “news” 😉 ? Because it has been like this for a long time.

But the rating is based on local income. For people who can work remotely, e.g. have Seattle or SF level of salary and live in Victoria, it is probably still affordable? 🙂

Regarding affordability of Victoria, apparently it was rated at 8.1 (severely unaffordable), which would place it just outside the top 10 of least affordable cities in North America.

https://infogram.com/housing-affordability-in-north-america-1g502y9ylv3dpjd

@ Local Fool, good stuff this is the kind of discussion I like to sink my teeth into.

In the immediate term, barring a large uptick in people moving to Victoria I think this force will be somewhat muted on the prices at any given time, but it will provide a steady wall against which prices will gain support.

The interest rate game is really difficult to gauge, and interestingly the argument about Canada following the US is a bit of a double edged sword. Trump has lobbed a lot of bombs into the world trade markets, and that has rattled Canadian markets and expectations on growth. And even if NAFTA gets ratified in a successful manner for Canada, the latest tax cuts in the US made investment there far more attractive. “Those tax cuts worry the Bank of Canada. The central bank assumes only a “small” benefit for the country because any increase in demand for exports will be almost completely offset by lost investment. That possibility will put pressure on Finance Minister Bill Morneau and the provinces to counter Trump with tax measures of their own. And maybe they will. But until they do, one thing that might keep investors interested in Canada is the prospect of lower interest rates. The Bank of Canada made clear that it is prepared to do what it can; the politics of the Trump era has left it little choice.”

http://business.financialpost.com/news/economy/bank-of-canada-raises-interest-rate-to-1-25-highest-in-almost-a-decade

I will agree though the new mortgage stress rules are clearly an attempt to telegraph that rates must return to normal, and that to the extent they can the hope is to generate a soft landing in real estate.

But how much does it matter why the inventory is low? People want to live in Victoria, more all the time. If supply isn’t increasing, prices can generally only go in one direction.

I’m not arguing, but do you have a citation for this? Anecdotally I’ve heard and read that supply in Victoria is not keeping up with “regular” growth.

All valid points – and since we know that the real estate market has definite cycles, I believe the key is how fast, or slow, that unwinding is. If it’s over many years, then to me the debate becomes, will the unwinding more or less offset the blow of constrained supply. (Note that I’m focusing entirely on SFH)

The owner is not required to pay the buyer’s agents’ commission. Realtors have agreements to share commissions, no buyer’s agent and the listing realtor keeps 100% of the commission or could agree to reduce their commission, but they don’t have to.

Don’t worry about this. Just make an offer and make it lower if you think you can get it lower because you are not represented. Unlikely in this market but if the market changes you’d have more leverage.

From Steve Saretsky (I also read an article outlining the same thing)

If you want to understand the Vancouver housing market, or for that matter the Toronto housing market, you have to get inside the heads of investors, or in this case, speculators.

Per a recent report from CIBC and Urbanation there is an increasing amount of speculation in Toronto’s pre sale condo market. The report concluded that 44% of investors with a mortgage that took possession in 2017 are in a negative cash flow position in which rental income falls short of mortgage payment and condo maintenance fees. With close to 30% of those investors carrying an interest rate higher than 6%.

While carrying a negative cash flow goes against conventional wisdom, the returns on this trade have been far from conventional. Pre sale buyers made an average return of 51% after completing on the unit and re selling it on the open market. However, because most pre sales only require a 20% down payment prior to closing, that return on investment is actually closer to 155%.

The pre sale condo trade has worked wonders in an environment with a shortage of supply, rising sales, and ever higher prices. But those conditions appear to be changing. Per TREB, Condo sales in the Greater Toronto Area declined 33% on an annual basis for the month of March, with inventory steadily climbing.

The original report has a lot more details and is worth a read

https://www.urbanation.ca/sites/default/files/Urbanation-CIBC%20Condo%20Investor%20Report.pdf?mc_cid=92561b47fb&mc_eid=fb2e5b89c6

Close to 30% of investors had an interest rate of more than 6% and 13% had rates that were higher than 9% (goes to prove people are taking on more and more private lenders for mortgages)

They interviewed multiple agents that specialized in condo investments

Most of the agents reported that international buyers represented less than 10% of their clients. All agreed that local immigrants represent a significant share of investors. Many of the agents’ investor clients are repeat buyers and some hold multiple units as rentals.

In general, investors are between the ages of 40 and 60 with discretionary wealth, and often approach condo investing as part of their retirement savings strategy or as a plan to help their children get into the market. For most investors, the goal is to put down 20% on a pre-sale unit, experience price appreciation over the course of development, and rent the unit upon completion at a level that covers holding costs and pays down mortgage principal. >

I have noticed multiple people talking about this on Garth’s blog where they have a negative cashflow on condos. I believe a lot of people looked to either HELOC or private lenders for taking on more and more “investment” condos or housing for speculation purposes. I continue to read about them and also see marketing material on facebook and youtube about this type of practice because it “always goes up”.

Harp what are you trying to do?

Are you trying to have the buyers commission paid to you on closing for not using a realtor?

Are you thinking if the seller doesn’t have to pay the buyer agent you can get it for cheaper?

Why would you not just go with a 50% cash back agent? That way you get 50% back on commission.

If owners/sellers like, it should be them to specify with their agent that they wouldn’t pay buyer agent’s fee if the buyer has no agent, as the commission is coming directly from the sellers’ proceed.

Of course, you can specify any demand in your offer, but if there are other offers give the seller and the seller’s agent the same proceed after the commission and the same fee, why would they take yours but not the other offers who have buyer agent (= less work and less risk for them) ??

Basically your offer is of “high risk” to sellers due to no agent (and not from local?). So your method could work, only if your offer is much better or if there is no other offer. I knew cases that seller even accepted lower offer from local buyer/no condition/better closing date, than a few thousands $ higher offer from out-of-town buyers/with conditions/no-convenient closing date.

Like I said, wouldn’t work in this market. Doesn’t mean it won’t work in a different market though. Depends on how interested they are in making a deal.

Another option is to look into private sales or post an add for a private sale (and what you’re looking for) on Craigslist or/and facebook or just door knock/ leave notes at homes in the neighborhood you’re interested in; know a few people that worked for.

+1, if you don’t like the mls system go private.

Leo S , do you mean write an offer with a lawyer or by myself if I get the form from the lawyer, and on the form somewhere says owenr or buyer don’t pay buyer agent’s commission? Is there somewhere on the form I can put a note to remove the buyer agent’s commission?

This is an incredibly dumb real life approach imo as you are trying to interfere with an agreement between the seller and the agent that has nothing to do with you…seller can pay 25% commission if they want. Most sellers/agents will be turned off by this as they will figure you are a complicated individual.

Better real life approach…..lowball the price with an unconditional offer directly through the listing agent and hope that listing agent is motivated to make more $$$ or he or she decreases the gross commission with no buyer’s agent involved to make the numbers work. Either can lead to a favorable outcome and not really important for you to know which scenario played out as long as you get the deal.

@Harp Echo

Another option is to look into private sales or post an add for a private sale (and what you’re looking for) on Craigslist or/and facebook or just door knock/ leave notes at homes in the neighborhood you’re interested in; know a few people that worked for.

“Make the offer contingent on seeing proof the buyer’s agent commission was struck out”

Leo S , do you mean write an offer with a lawyer or by myself if I get the form from the lawyer, and on the form somewhere says owenr or buyer don’t pay buyer agent’s commission? Is there somewhere on the form I can put a note to remove the buyer agent’s commission?

I don’t need to arrange a viewing , I went to open house and asked listing agent to write an offer. They refused me.

Doesn’t surprise me…..I had an unrepresented buyer that booked a showing on one of my listings in Colwood on Saturday at 1:30 pm and surprise they didn’t show up….ohh wait, I am not surprised because this happens all the time with unrepresented buyers.

There is just so many bad unrepresented buyers out there that it is difficult to take the legit ones seriously as there is no way of qualifying them.

If I find a lawyer to write an offer

I always encourage this…if someone is willing to drop a few hundred for the forms at the lawyers I figure they must be at least somewhat serious.

So is there good realtors out there that could write an offer and help on the process to close the deal for a small flat fee like the mere listing fees?

There is a huge difference between mere postings and representing buyers. With a mere posting I know I am getting paid $899+GST irrelevant of whether the house sells or not.

I fell for negotiating the cash back up-front probably 50+ times before a learned my lesson and stopped doing it. I think maybe ONCE on a house in Gordon Head the buyer actually bought the only home they wanted me to write up an offer on. Remaining 98% of the time you end up showing 20+ houses, buyer collapses offer on the house after inspection, buyer gets outbid 10x in row (yes, that did happen to two buyer clients in 2016), in slower markets you don’t end up agreeing on price, etc.

I would write up offers for an up-front fee no problem with an added fee for all the showings; however, to agree to work for a small fee only payable on completion not worth the risk.

Leo S

I don’t need to arrange a viewing , I went to open house and asked listing agent to write an offer. They refused me.

What is that policy that the buyer agents commission will be drastically reduced? Can you give me more information on this?

What does that mean realtor can not be paid for real estate services? How about that 3% 1.5% commission they get paid? What is a brokerage? If I find a lawyer to write an offer, can they help me for the process to close the deal for a small fee? I know lawyers can write an offer, but can they help with the rest of the process?

Technical stock traders are a bit worried this weekend. Monday and Friday might be very interesting this week.

But we covered this last time. If you send them a written offer they must present it to the seller. They have no choice in the matter.

How to get a written offer? Talk to a lawyer. They can give you the forms and you can either get them to draft it or you write them and get them to double check. When we did this they didn’t charge us anything (we used them for the deal so of course they ended up getting paid in the end).

Unfortunately there is no way to avoid this unless you

a) Make the offer contingent on seeing proof the buyer’s agent commission was struck out (unlikely anyone will go for this until the market cools further) or

b) Go with a cash back realtor.

If it’s a case of 1st offer is accepted perhaps you can even negotiate on the amount of cash back. You will notice some realtors have different levels of cash back depending on how many showings there are or some other measure.

One other inkling I have is to purchase gold and silver, both are undervalued. Raw, certificates and even stocks for mining companies. This would be like me going back to 2014 and telling you to buy here in the CRD. And NO I do not want your money to invest. You work too hard for it!

For suggestions I would say that the current means of pre-qualifying buyers needs to be looked at and adjusted. It was coming to the point where I almost required a minimum $10K deposit submitted with any offer…this is well before the conditions are to be removed. After all, each time an offer collapsed my property price dropped $10K.

totoro,

I have tried many times with many listing agents, they don’t let me make an offer with them. They would ask me to get a realtor or they arrange a buyer’s agent from their office, why would I pay for buyer’s commission for someone that is completely on their side (I know it is the seller pay for buyer’s commission, but I am the one that providing the money, and seller will calculate the net profit they can get).

Leo S said it is because I didn’t offer at market value, it is not like that, sometimes I didn’t mention how much I was going to offer, I just asked them if I could make an offer directly with the listing agent, some listing agent would tell me right off the bat that I need to get a buyer’s agent or they provide me one. I didn’t discuss commission with listing agents too, it is not about commission that listing agent refuse me to make an offer with them.

I don’t want to find a 50% cash back agent either, 50% of commission is way too much for writing an offer. I don’t want listing agent to double dip the commission either (again I didn’t mention commission with them, this is not the reason they refuse me).

So is there good realtors out there that could write an offer and help on the process to close the deal for a small flat fee like the mere listing fees? I will find a house my self so there is not much to be done by the realtor, I just want to pay a small fee. Or do you suggest a lawyer can do this and help on the process for a small fee?

Lost Soul, thanks for sharing what’s been undoubtedly a very stressful situation.

Do you have any suggestions for others reading here, coming from your experience?

Oh and thank you to everyone for their condolences.

I was a bit worried about renewing but then my bank called me and offered an early renewal and waved the fee. Go figure.

Yes, something bigger at play is “OFSI regulated” lenders opportunistically using rising interest rates to pad their coffers. Private lenders are even worse, having to go to them indicates there is no more “shopping around”. This has nothing to do with credit score, those who believe this are deeply misinformed. As rates rise lenders will continually headlock anyone who doesn’t own their home into paying more come renewal time until they either give up and sell or default due to astronomically high monthly payments. It’s bad now, only wait until rates rise 2 more points and you are on your lenders chopping block. The worst part is if you combine this with property value depreciation then the only way out may be debt settlement or consumer proposal.

All offers on my property were submitted through a buyers agent and were screened to ensure pre-qualification. It will take me years to put myself through the punishment of selling again.

We discussed the pros and cons of going in unrepresented in a previous post but happy to chat about this more if you like. Drop me a line leo.spalteholz@gmail.com

Some regulatory issues make the “pay to write up an offer” difficult (realtors cannot be paid for real estate services, only brokerages can be). Also realistically you would want to view the property beforehand and while you can arrange that through the listing realtor many will have a policy that the buying side commission is drastically reduced if the buyers realtor does not make the first introduction.

“I will say my realtor mentioned the collapsed offers due to financing trend was common right across the CRD. Scary. I have been a property owner for the last 10 years and am renting now because I strongly feel depreciation in home values will be much greater than the cost of renting.”

Lost Soul,

Sorry to hear of your experience. With the increased rate that buyers are getting rejected, you will be buying back sooner than you think, but in the meantime keep renting, saving, and investing.

The odds of a major tanking are stronger than 2008 and will be much deeper with so much employment in Victoria tied to the construction industry. If the stock markets go for a crap too then the tech industry could get a real shake up as well.

Hey Grant.

Good points. I’m not unbiased, but neither is anyone else here. So, let me have a go 😀

Agreed that policies that restrict SFH development are likely to be an upward force in that market segment. I probably don’t agree with some others over how much force that has.

On interest rates, I would say that the BoC has less power over rates than some think. Generally, we follow the US. One of the indicators of what’s going on down there is the US 10 year bond yield. Right now, rates are largely expected to go up, meaning that will add pressure on Canada to do the same.

Also, a large segment of the Canadian mortgage market is driven by the bond market, which is of course impacted by the above and has nothing to do with the BoC. If folks want to go to a variable mortgage instead, they do run the risk of having a higher rate at any time. People are in disagreement right now over what Canada will do next – some even say we might go with negative rates. Personally I doubt it.

As far as low inventory, its hard to know what exactly is making it low at any given time. “Nothing for potential buyers to buy” is a bit circular, IMO. I tend to think that people are in one of three camps. They either cannot afford to move (my guess is, a lot of people fall into this camp), or, they are sitting on their properties longer to squeeze out more gains. I think there’s less people in the latter camp, while those in the former elect to do renos instead. Others may be simply afraid of being a buyer in this market.

One thing is certain. Our market, as well as any other market in Canada that I’m aware of, has not had a historical supply shortage in most segments (dedicated rentals aside, and I don’t believe this has caused the price inflation we’ve seen). We’ve always built enough relative to organic growth and in fact we still are. But when people started viewing homes as a mode to quick and easy riches, a “supply issue” ensued, and no amount of building would be enough. However at some point, the gains begin to taper off, demand drops and we enter into a period of excess supply. That’s when things get interesting.

Sellers will not be able to hold off indefinitely. In any selling cohort, some of them need to sell at any price due to personal circumstances, then that sets the bar lower, etc etc. It’s exactly the reverse of the run-up. The market eventually finds a floor, and then we begin again.

I don’t agree with you that affordability issues are a non-factor in this market. In fact, if you look at Victoria-centric data for the last 35 or so years (one of Leo’s charts, actually) you can see that once unaffordability hits a certain ceiling, prices have invariably dropped off until they were affordable again. While there are a few on this board that think, “this time is different”, I don’t think history or mathematics supports that contention. I don’t think the consumer debt issue should be understated as an unfortunate side issue. It’s a substantive one IMO, and one that will have a magnifying impact on the unwinding phase.

The more I read from a variety of sources, the more I’m starting to question some of the soft conclusions I’d previously come to about how vulnerable the Victoria market may be.

On the demand side, particularly NDP’s tax changes:

1) The foreign buyer’s tax increased from 15% to 20%, however, the number of foreign buyers who actually pay this is very small. Impact on Victoria market? Negligible.

True saavy foreign buyers, those who have PR or citizenship, don’t get tagged on the foreign buyers tax… examples such as where the student/wife is on the title. Making matters worse, on a sale they get to claim the principle residence tax exemption – so the incentives for these people to invest are even greater. That foreign money is still there, still coming. In fact, with the federal government wanting to greatly increase immigration, it’ll probably only increase.

2) Speculation tax. Others call this a vacationer’s tax and really that might most be the appropriate name. I hear speculator and I think investor, but most investors are not going to let a property sit empty, they are going to rent it, so they won’t be subject to the speculation tax. Those who have 2nd and 3rd homes certainly will be subject to it, but that portion of the market is very small. That, plus the exemptions the NDP are now granting, means the impact will be even lower.

So the NDP changes to reduce demand sound nice but in reality are rather impotent. So what additional headwinds are we left with? Well affordability, interest rates rising and general over indebtedness. On affordability, it is not uncommon for there to be markets where the real estate prices are generally unaffordable for the majority of locals, so it’s (sadly) more or less a none factor. Interest rates – Hawk has looked into his crystal ball and sees nothing but up, but all one needs to do is read the Bank of Canada’s own most recent statement on interest rates to see that it is being extremely cautious. It’s way too soon to say one way or the other what BoC will do, and anyone who claims otherwise should put their money where their talk is. Indebtedness is to me the biggest concern nationally, however I really question how big a factor this is for Victoria where there seems to be a lot of well heeled purchasers of property. Yes, we hear stories (even on this particular post) of people not being to keep their home, but my guess is that as a percentage those numbers are low. I tend to agree with Totoro that failure to obtain a renewal is generally indicative of something bigger at play.

On the supply side:

1) It’s now a bylaw of the CRD that SFH growth in particular will be constrained. They acknowledge this will put pressure on SFH prices.

2) The stats don’t lie – inventory levels remain at really low levels.

I don’t think you can look at those supply/demand factors and feel confident that a large or even moderate market correction is coming anytime soon. I’d love to hear unbiased arguments otherwise..

You don’t need a buyer’s realtor to write an offer. Just contact the listing realtor and make an offer directly. If you want a form and the listing realtor doesn’t provide one, which is unlikely, then perhaps contact a lawyer if you are uncomfortable tracking one down yourself.

Taking things with a grain of salt, prices in Victoria are not dropping drastically and a failure to obtain a renewal would generally point to an extremely low credit score and a history of not making mortgage payments. If you have a good credit score and have been making payments renewals with the same lender do not require re-qualification and should not be an issue.

Marko

You offer a flat fee for mere listings, do you also offer a small flat fee for buyers, if they found the house themselves just wanted to make an offer?

Or is there any realtors out there that can offer a small flat fee to write an offer if the buyer found a house themselves? I think even with 50% commission, it is still way too much for writing an offer.

Mario,

I really appreciate your detailed information.

By the way what do you mean you get the commission if you buy pre sale yourself? Do you mean you don’t pay buyer’s agent’s commission, you just pay seller’s agent’s commission?

I don’t have the skills to sell or fix up a house, but what I do have are a very particular set of skills. Skills I have acquired over a very long career.

Marko, if you buy a pre-sale for yourself, do you still get the commission?

Yes, I do.

When I wasn’t so busy I had other spinoffs activities as well. For example, on completion I would rent out my unit and then I would go on the strata council (i.e., I stand up at the first AGM and say “Hi, my name is Marko, I am a REALTOR® and I would love to be on the council for X,Y,Z reasons).

This would lead to a lot of re-sales in that building. For example, I own a unit at the 834 and I’ve sold 15 condos in that building. When I was on the council I was moving quite a few.

Lately I’ve been too busy/lazy to do any of the spinoff activities. Unfortunately, strata meetings that I feel should last 45 minutes end up being 2 to 3 hours.

It is important to use your skillset for the spinoffs. If I was a carpenter, I wouldn’t be buying pre-sales condos… instead maybe an old house with multiple suites and use my skills to fix it up/add value.

I just bought a bunch of cheese for $5.80 a block. Deflation baby!

Marko, if you buy a pre-sale for yourself, do you still get the commission?

How do you find a unit that is 10-15% below market value?

It is pretty simple. For example, at 881 Short I take a look at what is available and look for what I think might be the best value. There is a unit which is a 640 sq/ft one bedroom with parking on the second floor with a 150 balcony priced at $375,000 GST included.

Then I search for what I feel are the closest but ever so slightly inferior comprables to allow margin of error in judgement.

I would come up with

302 – 3815 Rowland at 638 sq/ft, 2015 build, smaller balcony, less privacy, louder just sold for $415,000

or 205 – 745 Travino at 629 sq/ft, less frontage in terms of windows, further away from town for $409,000.

Therefore, I would conclude that the completed unti in 2020, assuming a flat market, would re-sell for approximately $410,000 to $420,000.

Most people are mis-informed and don’t even consider pre-sales over various concerns like they will lose their deposit if it doesn’t get built (false, protected in BC) or they are concerned the market will drop in those two years which would ONLY make sense if they weren’t buying a re-sale as a substitute, but they are and somehow the re-sale is not impacted by a dropping market 🙂

You can’t get a deal on pre-sales everywhere. In Vancouver in some areas you pay MORE for a pre-sale which is totally nuts. Here in Victoria there are a developments where you are paying completed market value….those I don’t bother with. I pick my spots.

Of course sooner or later I’ll get completely crushed on a pre-sale purchase but if I buy consistently under current market value the odds favor making money (i.e., the odds of the market staying flat or going up are higher than it dropping).

Lost Soul, that’s harsh. Did you come out alright in the end? Was your LTV super high so you couldn’t shop around?

Leo: “Lost Soul that is quite the experience. I don’t really understand why the lender would not renew.’

<<<<<<<<<<<<<<<<<<<<<<<<

Change in LTV. Heloc that hasn’t been paid. Credit change.

It’s more not knowing how to interpret it. Heck we can’t predict major recessions in developed markets with endless data available on what is going on. Trying to predict the same meltdowns in an economy that is extremely opaque and where statistics are of questionable accuracy is even more fruitless I imagine

Local Fool: “Let it burn” in that context seemed to imply, “Let the market stupidity get its comeuppance” rather than “I want families to be destroyed”. People get hurt either way, crash or mania.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

I couldn’t say it better LF. Everyone does have to remember that blogs like this provide the only outlet for “Schadenfreude”. The “bulls” have had their party for a long time and the “bears” want their honey.

Any reasonable and intelligent person wouldn’t dare to suggest: ” I told you so.” in the “real world”.

Bragging about gains hurts nobody.. sort of. Bragging about a housing crash when friends and family are going to suffer is reserved for online anonymous venting.

Lost Soul that is quite the experience. I don’t really understand why the lender would not renew. If you are renewing now then I imagine you bought a few years ago and the property would have certainly appreciated. So why not renew if the lender was willing to make the initial loan with a much higher loan to value?

Mario,

What is the price at 881 uptown? When it will be completed?

“Asking Peter German to take on a second round of investigation and review, this time around, money laundering in real estate, given a number of serious concerns that we have that have come out of his work and out of some media reports on that.”

http://www.news1130.com/2018/04/08/debate-money-laundering-expected-legislature-resumes-week/

Nice to see this happening, look forward to seeing what the findings are.

I recently sold my property in greater Victoria and it was a complete nightmare. I was forced to sell after secondary lender would not renew for a reasonable rate and term. I won’t even get into what my private lender offered. So yes, I was offered a renewal but it was so outrageous, default and bankruptcy by depreciation were staring me down like the grim reaper.

It was a forced sale, with four collapsed offers that rolled in due to buyer financing. I will say my realtor mentioned the collapsed offers due to financing trend was common right across the CRD. Scary. I have been a property owner for the last 10 years and am renting now because I strongly feel depreciation in home values will be much greater than the cost of renting. I may not purchase a property again for 15-20 years.

*I can only share my experience to help others make a decision to protect their livelihood.

BUY GOLD IN 2018/2019!!!!

Mario,

Would that company that bought up the whole condo building be foreign owned, or have a hidden foreign owenership? Why would a company buy up a whole condo building, to resale/flip in the future to make money?

How do you find a unit that is 10-15% below market value?

Love it! I must disagree with your morally virtuous hope that that poster and his family gets hurt, though.

“Let it burn” in that context seemed to imply, “Let the market stupidity get its comeuppance” rather than “I want families to be destroyed”. People get hurt either way, crash or mania.

Kinder Morgan to halt spending on Trans Mountain pipeline due to B.C. opposition

Kinder Morgan is halting all “non-essential activities and related spending” on the Trans Mountain pipeline project due to B.C. opposition, it was announced Sunday.

“In keeping with that commitment, we have determined that in the current environment, we will not put KML shareholders at risk on the remaining project spend.”

Kean’s statement goes on to note that while the project has support from the federal government and the provinces of Alberta and Saskatchewan, the province of British Columbia and its government has continued to be a barrier to the project’s progress.

“A company cannot resolve differences between governments. While we have succeeded in all legal challenges to date, a company cannot litigate its way to an in-service pipeline amidst jurisdictional differences between governments,” said Kean.

http://www.timescolonist.com/news/b-c/kinder-morgan-to-halt-spending-on-trans-mountain-pipeline-due-to-b-c-opposition-1.23259849

@ Barrister

I have to say that your comment has disappointed and lowered my respect for you.

@Barrister

I think there’s 2 sides to this coin. If the market crashes it will hurt a lot of people, but unfortunately, the market should have never been allowed to have gotten to this state of things in the first place. As we’ve seen (Van is a prime example), when you have a run up in houses and commercial like we have had, people move away, businesses shut down, jobs are also lost, homelessness increases, communities are hollowed out and it hurts a lot of people. It’s not wise to have an economy so heavily dependent on the real estate sector.

Victoria Born:

You might be right about steps needed to be taken about the housing bubble. But, if there are job losses involved I really hope that it hits you and your family first since you dont seem to have much sympathy for the people that it will hurt. A major housing crash will have far more impact than most people seem to realize. Who mostly gets hurt in these types of crashes are the little guys. Of coarse if you have a nice protected government job, as so many do in this town, then you probably dont care.

Personally I will not be really effected whether house prices crash or not. But there is a certain callous, self centered streak that runs through many Victorians who justify it by wrapping themselves in a cloak of moral virtue which mostly hides their own self interest.

Langford’s request is patently silly. It translates to, “hey, wait a minute, you are targeting the evils of what we are doing, which is the foundation of the problem you have identified, and we should be excluded from the medicine”. NDP needs to stay the course.

Let it burn. Let it burn. Let it burn.

It doesn’t happen to very many people because high ratio mortgages have to be insured and in that case the lender is guaranteed their money back anyway. On the other end if equity is very high the lender probably won’t worry too much either. And of course prices have risen a lot lately which means anyone renewing today will have more equity.

But what if they stop rising. For example, someone buys with 20% DP and gets an uninsured mortgage. Prices may fall or the lender may simply get nervous and at end of term demand refinancing to an insured mortgage which the borrower may not qualify for.

Interesting. It snowed in Calgary last April 25th, and May regularly gets snow too. I was there 20 years ago in April and guess what ? It snowed. Simply amazing. Spread the news. Old news. 😉

http://www.cbc.ca/news/canada/calgary/alberta-weather-spring-snow-calgary-april-1.4084586

“with 7 rate rises coming,

Hate to break it to you, but those haven’t happened yet—and may not.”

You’ve been saying that the past 4 hikes and they happened.

If it doesn’t then you’re effed which means recession is coming. If it does, you’re effed as highest affordability level since 1981 crashes the markets. It’s already spiked huge in a short period meaning high risk alerts to credit lending markets.

1 in 5 can’t get a mortgage and rising. But you said that would never happen either cause it’s sunny here every day.

As per Victoria private lender:

More and more mortgages being denied by big banks

“Private lender Fisgard Asset Management Corporation in Victoria is seeing an influx of borrowers and “better quality business”, said Hali Noble, its senior vice president of residential mortgage investments and broker relations.

“A lot of these people should be bankable,” Noble told The Canadian Press. “But they’re not.”

https://www.mortgagebrokernews.ca/news/alternative-lending/more-and-more-mortgages-being-denied-by-big-banks-237393.aspx

“Faked income? Oh brother.”

Guess you don’t like to read the real news, just the weather reports from your homeland where snow is normal even in April.

Evidence of mortgage fraud in Canada raises red flag at credit rating giant

S&P Global Ratings warns it expects to see more evidence of fraud in Canadian residential mortgages amid high home prices and high household debt

http://business.financialpost.com/news/fp-street/mortgage-fraud-prompts-sp-to-lower-canada-bank-risk-metric

Low inflation? You mean low index change. My Armstrong cheddar index always reveals the truth. Price hasn’t changed much but the block is half as big. So it’s all good. I just eat less cheese…

Another way to put this question, is “where do I think prices in the core will be in several years?”

The answer is of course, I don’t know. Cycles are not hard to follow and predict. Year to year is. I think Victoria is facing less risk than Vancouver is. But, I don’t believe we will get to 3-5 times median income (long term) if interest rates don’t change. Determining that depends a lot on the USA – of course people are projecting inflation, and reduced Canadian competitiveness but who knows. I think rates will increase, though.

I also don’t think this is like 1981. In some ways the problem is “better” now than then (low inflation) and in others, it’s a lot worse (consumer debt). The latter I think poses greater downside risks. I think speculation in the RE market has been greater than normal, given the magnitude and time frame of the price increases. If a RE market has encountered a lot of speculation, you don’t actually need an interest rate spike to have house prices tumble. You just need speccers to exit left.

If interest rates don’t change, I would guess we’re going to see a notable correction in this market over the next little while as deleveraging really begins. However, after bottoming out, low interest rates could encourage another aggressive upswing again, as it was when they dropped rates to the floor in 2012 (you can actually see that effect in the chart I posted). In other words, our market may become more volatile than it has historically been. Less desirable markets may not see that – for instance the crazy run ups in Brampton, Mississauga etc.

If interest rates are back to 5-6%, then I believe we will go back to our long term averages, adjusted for inflation. Two forces would be at work there – the greater cost of borrowing, and a reduced willingness of the population to devote the economy to housing. That would be a rocky transition back, but certainly not armageddon. Would homes in the core go to, and stay at 500k? Unlikely, IMO. Regardless, everything I just said will probably be wrong one way or another.

What do you think will happen?

What is happening to the pre-sale condo market? Are the developers still getting a premium or has there been a chill in this market?

Difficult to say as there hasn’t been a fresh launch in a while. There was supposed to be a pre-sale downtown but a company came in and bought the entire building before the launch even though it is starta condos (i.e. you pay a massive premium compared to an apartment building).

All the others have seen delays due to city bureaucracy (Bayview Place, Ironworks, Hudson Place, etc.) I maybe see Hudson Place getting sales going this year but all the other the city will drag well into next year.

Land prices, construction costs, city BS are limiting product to market.

The only recent smaller launch is http://www.the881.com/ and it is approximately 5 to 7% below similar re-sales which is kind of what I would expect.

When I isolate a unit in a development 10 to 15% below market that is usually when I go for it.

Look at all the flowers blooming in the prairies!

Full disclosure: you’ve been saying that for years, to no avail.

Hate to break it to you, but those haven’t happened yet—and may not.

I’m a total idiot.

Faked income? Oh brother.

To be honest, I don’t think this happens to very many people.

“Intro, you can’t argue like that. ”

Intorovert will argue til the last buyer has left the barn because narcs are never wrong, meanwhile the slashes are stacking up by the day.

The RBC chart clearly shows affordability levels now exceeding 2008 levels with 7 rate rises coming, the highest level since 1981. You have to be a total idiot to not see this is going to continue to kill sales and prices in the coming months.

Credit is tightening by the day and the 47% of refinancings will have a major effect this summer as the rubber meets the road on HELOC debt and those who faked income.

“You should also be aware that whenever your mortgage term is up, your lender will reassess your financial health by reviewing your credit report and credit score. Doing this tells them if you’ve been having debt or other financially related problems, and how much of a default or bankruptcy risk you’ll be in the near future. So, even if you’ve been keeping up with your monthly payments, if you’re showing signs of financial distress, your mortgage renewal could be denied.”

https://loanscanada.ca/mortgage/can-my-mortgage-renewal-be-denied/

Local Fool, where do you suspect median or average house prices in the core will land at the very bottom of this cycle (I know how much you love the concept of the cycle).

This will help me understand by how much we disagree.

Intro,

This is not the graph Leo posted or average prices, but it’s a bit closer to what I was referring to. This is from the most recent RBC affordability report.

I looked at two houses just under a million and two others around 1.5. Depends on what you call expensive these days. personally I thought that they were really overpriced but I sort of feel that about most of the Victoria market.

Marko:

What is happening to the pre-sale condo market? Are the developers still getting a premium or has there been a chill in this market?

@caveat emptor

Oof! That’s just savage.

Who needs sun when Hawk’s posts are always like a ray of sunshine.

Barrister

Perhaps you were looking at the higher end of houses? perhaps there would be more showings at the lower end? Which neighbourhood of open houses did you go?

I personally went to a lots of open houses last year, this year I probably only went to one. When I saw that high listing price I don’t feel like wasting my time and gas to go there.

Thanks for the heads up, will look into it

Hey, Leo. Your graph is busted:

Please fix soon. Also, updated numbers would be handy 🙂

This is true, but without context very misleading. Berkshire Hathaway has over $100 billion in cash but it’s not like they have given up on the market, they are just looking for their usual good deals before spending that cash. They are notorious deal seekers.

http://money.cnn.com/2018/02/26/news/companies/warren-buffett-airline/index.html

@Mooselessness

If it were me, I’d go with a good property management company; they’ll find the tenants and take care of repairs etc so they don’t have to stress about things while they’re gone.

Intro, you can’t argue like that. You need to either use inflation adjusted numbers, or mortgage costs/income. That’s just raw numbers – in that sense RE almost always goes up due to the nature of fiat money.

The last update I saw where Leo provided such a chart, I think was some time in 2016. You can see what Hawk is talking about pretty clearly. Having said that, Victoria hasn’t had a significant one in 35 years.

Hawk, look at all those reversions!

Friends of ours are planning to rent out their furnished home for one year while they travel. Any advice on finding good short-term tenants or otherwise managing the situation wisely?

Muir is the biggest con in the bizz. He’ll never say the prices will go down.

“The reality is that national debt doesn’t matter very much.”

Were you whacked out on ecstasy in 2008 ? Millions in the US lost their homes or went bankrupt. Big Short 2 coming soon to Victoria.

The credit cycle is over, nowhere to go but down when 1 in 5 can’t get a mortgage and rates going up 7 more times.

Who knows when the music will stop. I think the can can be kicked quite a bit further down the road, but I can’t see how anyone with a bit of fiscal sense can rationalize how insane asset prices have become. Beyond all the analysis, I tend to stick with my common sense indicator. The current environment is truly head-shaking. It is telling that the Oracle of Omaha has moved over 100 billion into cash.

Here’s Cameron Muir, Chief Economist, BC Real Estate Association, discussing real estate with Adam Stirling on CFAX yesterday.

Sorry, Marko. It’s 19 minutes long.

http://bmradio-a.akamaihd.net/media/Cfax1070/1522956916_cameron_muir__chief_economist__bc_real_estate_association.mp3

“Same story in Victoria. Sales down 40% compared to 2016 but prices hitting record highs and when the Uplands market eventually turns doubt a half decent livable Oaklands Bungalow will revert from $800 to $550k again.”

Everything reverts to the mean eventually. Oaklands is so over rated, with shitty small shacks with poorly paved bumpy roads. I recall that area being where are all the dope dealers lived, and probably still do. Now moving into Golden Head with the gang bangers.

San Fransisco looks like a disaster waiting to happen. Who wants to live in a “cesspool”? At the rate downtown Victoria is going it won’t be long til the same terms are used here.

Vacant Businesses Rising in San Francisco, Real Estate Agents Believe ‘Dirty Streets’ Partly to Blame

Commercial real estate brokers tell the Investigative Unit their agents are having a harder time selling San Francisco in light of the amount of the trash, feces, and used needles scattered along the city’s streets and sidewalks.

“”They’re telling us that the city is filthy, that they don’t want to be there,” said Hans Hansson, a native of San Francisco who owns Starboard, the city’s largest independently owned commercial real estate firm.”

https://www.nbcbayarea.com/news/local/Vacant-Businesses-Rising-in-San-Francisco-Real-Estate-Agents-Believe-Dirty-Streets-Partly-to-Blame-479041303.html

“Wow…first time I’ve looked at his channel and who has time to watch 15-30 min videos? ”

By the sounds of Barrister’s post, maybe at your next open house. 😉

China’s total national debt is just over $4 Trillion USD.

American national debt is $20 Trillion plus another $35++ Trillion in unsecured, unbudgetted obligations.

While I agree the US is headed for a fiscal cliff if they do not change course, the comparison you are making is not the complete picture. The US situation is more of that of a wealthy gambling addict while China is like the street-thug-turned-millionaire throwing cash at hookers and blow and has no idea what’s left in the bank account. There are a number of important differences:

The numbers you are quoting are government debt totals, not an accurate picture of each country’s total debt to GDP, which is the more important figure. China’s debt-to-GDP is closing in on 300%. The USA is about half that.

China’s debt to GDP is in the territory of an advanced economy. The problem is that it is not an advanced economy. The USA is one of the greatest economic empires in world history. It is fundamentally a different animal. It is the technological and educational centre of the world and there is no single country that comes anywhere close to it.

No one with any fiscal sense believes any official numbers to come out of China. I’ve read estimates that the shadow banking sector is on the hook for anywhere from 7-40 trillion USD. No one really knows. And we are not likely to know until some inevitable black swan shows up. Only then can we rationalize how insane this fiscal environment really is.

Per capita income is not comparable.

I do, and with sales apparently down 40%, so do you. And if what he says is unfamiliar territory to you, you’d be well advised to understand some of the principles he talks about. None of it’s rocket science. What goes on in the nation’s credit markets goes on in Victoria. We don’t live in isolation from everything else. If all you’re interested in is what houses in Oaklands are doing, you’re missing a very big part of an interconnected picture.

You’ve been responding to my posts a bit more often lately and I am starting to notice you seem to consistently respond as though I am raising a different argument than I actually am. I don’t know if you have trouble understanding what I write, or it’s a strategy to best me in a debate. Current price movements aren’t what the video was talking about, and only a fool would expect sales to slow and prices to simply collapse immediately thereafter. Ain’t gonna happen. Nevertheless, if you believe our economy, or an external economy, supports current valuations over the long term – good luck to you.

https://www.paragon-re.com/trend/san-francisco-home-prices-market-trends-news

More than anything, I found his back-and-forward head leaning tic quite distracting.

Well, that’s exactly what happened during the last slowdown in Victoria.

Oh, wait. That didn’t happen at all.

Went through open houses this afternoon and what really struck me was the total lack of people looking. Maybe just my timing but it sure made me wonder in terms of what it was like this time last year. Absolutely nothing scientific about my observation

Recent Vancouver West Side sales:

33′ lot for $2.4 million……where do I sign?

One of Steve Saretzky’s best videos yet. I continue to appreciate his big-picture perspective that he brings, both in terms of RE but also where it fits in to well established patterns of debt expansion and deleveraging.

Wow…first time I’ve looked at his channel and who has time to watch 15-30 min videos? 🙂 I tought Owen Bigland was long at 8-15 minutes.

First comment to the video is spot on….

Sure the sales are down big time but prices have barely moved anywhere I’ve looked (under $1.6M)

Same story in Victoria. Sales down 40% compared to 2016 but prices hitting record highs and when the Uplands market eventually turns doubt a half decent livable Oaklands Bungalow will revert from $800 to $550k again.

“Remember a few years ago with Greece? It ended up being basically fine”

Greece is not fine at all. Keep in mind the basic problem was that their debt was in Euros which they could not control. Countries with their own currencies can devalue them.

https://www.nytimes.com/2017/04/16/business/fewer-children-in-greece-may-add-to-its-financial-crisis.html?_r=0

One of Steve Saretzky’s best videos yet. I continue to appreciate his big-picture perspective that he brings, both in terms of RE but also where it fits in to well established patterns of debt expansion and deleveraging.

Saretzky: You Can’t Reignite Canadian Real Estate This late in the Credit Cycle

https://www.youtube.com/watch?v=ToD-dg4OjZI

It is true that the central banks have been getting very good at papering over debt problems. Who knows how long that can work, but so far so good.

The reality is that national debt doesn’t matter very much.

All countries are in debt. Even when countries get into trouble, nothing too bad happens. Remember a few years ago with Greece? It ended up being basically fine. Japan? Fine. Italy? Fine.

Argentina even defaulted in 2001 and it wasn’t the end of the world. Sure, there were some riots in response to radical austerity measures leading up to the default, but at least the people were rioting over something a little more consequential than losing Game 7 of the Cup Finals.

Given the dramatic way you’ve presented it, yes, I agree China will not be “disintegrated”. But their debt problems appear extremely serious and systemic across multiple sectors of the economy. The amount of liar loans that appear to be in the system (particularly using one piece of property-based collateral multiple times by multiple people to get multiple loans) is breathtaking. IMO they have a substantial capital misallocation problem, and part of it’s both due to their inability to invest in many different sectors as well as them not really ever seeing a real market correction (the market thing and home ownership there is pretty new).

But it’s true, it’s much harder to say for certain with China than with here. While media here loves to cherry pick and mislead based on whatever slant they gravitate to, we at least have reliable data. The numbers over there are often impossible to trust. A lot of what we hear is anecdote or measurement by proxy.

Not to forget their system is built on nothing but lies.

The flimsy finances behind China’s miracle

“Local governments have encouraged over-investment in industry to generate tax revenue. They also need to achieve a targeted level of GDP growth. At times, the numbers are simply made up: “villages lie to townships, townships lie to counties, and so on all the way up to the State Council,” McMahon writes. Every province produces a growth number that is higher than China’s national GDP growth rate – a statistic which even Premier Li Keqiang described as “man-made”, according to a leaked diplomatic cable.”

https://www.reuters.com/article/us-china-economy-breakingviews/breakingviews-review-the-flimsy-finances-behind-chinas-miracle-idUSKCN1GL1Y6

LeoM,

You are ignoring the millions of bad loans bet upon more millions of bad loans that would never be repaid. It makes the Big Short look like child’s play. It’s a house of cards waiting to get blown down with the shadow banking out of control.

China debt bomb will cause a blow up in the US and globally.

http://www.thetechnicaltraders.com/wp-content/uploads/2018/04/Karn-Brij_Whats-the-deal-with-Chinas-Debt_02.jpg

I doubt if there’s a debt bomb in China waiting to disintegrate the country.

China’s total national debt is just over $4 Trillion USD.

American national debt is $20 Trillion plus another $35++ Trillion in unsecured, unbudgetted obligations.

World debt clock:

http://www.usdebtclock.org/world-debt-clock.html

Chinese debt per citizen is: $3,400

American debt per citizen is: $65,000

American unsecured debt per citizen:$120,000+

China has over $4 Trillion cash stashed in treasury bonds throughout the world plus they have a huge stash of gold bullion.

If there is a debt bomb waiting to explode, it’s the USA not China.

LF,

Agreed, many don’t think it could effect them and it’s human nature to shrug off outside forces.

Charlie,

Good link. Credit counselors have been seeing it in Victoria too for the longest time. Just look at the chart, it’s off the rails on those who borrowed to buy toys or pay off debts, or be property kings to negative equity real estate. $30 billion plus the last 2 years alone, that’s insane.

Awhile back I predicted that Victoria’s unemployment rate and vacancy rate would increase based on my observation in the decline in house sales.

According to what Introvert just wrote – I would be wrong. But I have not seen the stats. Maybe someone could verify and post them.

I think Stu,’s point is a lot of jobs for people in Langford depend on construction (elsewhere)

From the G&M, no additional commenting required.

Title: “Home truths: The financial product that turned into a $207-billion debt trap”

“How a generation of Canadians bit into home-equity lines of credit and ended up renting their homes from the banks, living beyond their means and sacrificing their nest eggs”

“The chief executive officer of Toronto-based Credit Canada Debt Solutions, a not-for-profit agency that provides free financial counselling, says she fears that problems for the most vulnerable borrowers will crystallize this spring as a wave of mortgages come up for renewal. Some of her agency’s clients plan to list their houses to repay debts, and she is concerned they will not get the price they need in the soft Toronto market.

“It makes me feel a little bit nauseous – I just think we’re in a really dangerous situation right now.”

https://www.theglobeandmail.com/business/article-the-rise-of-helocs/

Hawk, yes my mistake.

Credit given as due. Thing is, people may know about the China dynamic and not care. I guess humans are like that. So long as it doesn’t affect me and my family right now, who cares?

Fair enough I guess, you can’t worry about everything.

Stu needs to get a grip on reality. Who wants to move their family to Westshore so the house next door sits empty till summer when the Albertans decide to roll in ? Greed goes to these guys heads when the power gets too much and don’t want the party to end.

With lack of qualified tradesmen, substandard construction is not what I would want for my legacy.

Condo listings up 60% the last few weeks ? What’s the deal there ? Albertans fleeing ?

BTW, Since everyone suddenly stopped talking about the beautiful weather the past few days multiple times a day, I just heard thunder and see torrential downpours. Looks like prime golfing weather for the doctor and his friends…for the next week and beyond. 😉

https://weather.gc.ca/city/pages/bc-85_metric_e.html

This China chart looks ominous.

http://www.thetechnicaltraders.com/wp-content/uploads/2018/04/chinas-housing-market-is-bursting-again-should-you-be-worried-this-time.jpg

LF,

I have been bringing up China debt/real estate bomb on a regular basis but no one wants to discuss the elephant in the room, partly out of fear but mostly out of ignorance. If they go down, its all over for everyone.

They will sell BC real estate and stocks en masse and interest rates will spike faster than 1981. Trump playing this psycho game of chicken with them is insane as it could push it all over the cliff very fast.

Real estate sales there have been tanking since the New Year and bad debts are rising faster than ever. They won’t be able to just write them off, there will be a reckoning to pay them off.

March unemployment numbers are out: B.C. had the lowest unemployment of any province or territory, and Victoria had the third-lowest unemployment of any Canadian city.

Thanks for the post, Beancounter.

The topic of China rarely comes up here except in the context of “foreign buyers”.

I actually don’t think many people on main street realize how big a threat a faltering China is to our economic well being, and how precarious China’s position has become financially. It makes our record smashing consumer debt and real estate bubble, look quaint by comparison. Even the BoC has labelled the “China factor” as one of the most significant macro threats to Canada.

Donald Trump applying pressure to that already wobbling system and the likely inflation that will follow is something that really has a great deal of potential to impact Canadians, real estate being only one part of the equation. I’ll certainly say “it’s different this time”, as in I don’t think China can now experience a significant disruption in its economy without the whole western world catching a cold as well.

Speaking of China, now available on Netflix is The China Hustle. Well worth the watch.

While we are the topic of Ponzi schemes, here’s a humorous yet informative piece on the historic, unprecedented Ponzi scheme on the other side of the pond:

http://davidstockmanscontracorner.com/not-your-grandfathers-trade-war-the-revenge-of-bad-money-part-1/

Interesting times ahead once the music stops and the funny money spigots are shut off.

“For crying out loud, in three recent years China used more cement than did the United States during the entire 20th century!

China has been on a wild tear heading straight for the economic edge of the planet—-that is, monetary Terra Incognito—based on the circular principle of borrowing, building and borrowing. In essence, it is a giant re-hypothecation scheme where every man’s “debt” become the next man’s “asset”.

Thus, local government’s have meager incomes, but vastly bloated debts based on the collateral of stupendously over-valued inventories of land—-valuations which were established by earlier debt financed sales to developers.

Likewise, coal mine entrepreneurs face not only collapsing prices and revenues, but also soaring double digit interest rates on shadow banking loans collateralized by over-valued coal reserves. Shipyards have empty order books, but vast debts collateralized by soon to be idle construction bays. Speculators have collateralized massive stock piles of copper and iron ore at prices that are on the way to becoming ancient history.

So China is indeed the greatest Ponzi scheme in recorded history. And it is that house of cards that the Donald has now frontally attacked.

More hideous still, it is that house of cards that the robo-machines brought with malice aforethought this afternoon, reversing the Dow’s overnight drop by nearly 750 points.

Bad money has rarely been so insouciant; the revenge never so certain.”

Good post Leo.

Just saw this on today’s TC. Looks like a flipper (with possibly over 35% gain for just 7 months) and feed to the FIRE:

Historic downtown bank building on the block for $15.98 million:

“Architect Francis Mawson Rattenbury designed the two-storey structure, which has been an anchor on the busy corner of Douglas and Yates streets for 111 years. It runs 120 feet along Douglas Street and 90 feet along Yates Street. It was renovated in 2009. The building is 100 per cent leased to the Bank of Montreal

Douglas Street Holdings Ltd. of Vancouver owns the property. The building most recently changed hands in August 2017 for $11.809 million .”

http://www.timescolonist.com/business/historic-downtown-bank-building-on-the-block-for-15-98-million-1.23259049

Who are the condo investors in Toronto? A new study sheds some light.

https://www.thestar.com/amp/business/real_estate/2018/04/06/who-are-the-foreign-condo-investors-in-toronto-a-new-study-sheds-some-light.html

It was an attempt at humour Harp Echo – the context of Leo’s post was those in FIRE are making out like bandits in (what many describe is) an overheated market. Or we could lather on the snarkiness and say the pigs at the trough want more slop. Ergo they are the ones who can afford those beautiful yet ultra expensive properties along the ocean in Oak Bay. Yet I have a suspicion that my post didn’t really need explanation.

“Well I guess now I know who lives in those multi million dollar ocean front Oak Bay homes I drove past.”

Who lives in those houses then, Grant?

Thanks for posting that, Local Fool. Great summary there

Recent Vancouver West Side sales:

Well kept, nice looking homes:

44 x 120, Kitsilano

Just sold $2,888,000

Tax Assessed July 2017 $3,322,000

Tax Assessed July 2016 $3,473,000

*Nice looking house. Well kept, good shape. 2 story.

* SOLD $434,000 under assessed

50 x 130 lot, MacKenzie Heights, Vancouver West

Just sold $3,250,000

Tax Assessed July 2017 $3,774,000

Tax Assessed July 2016 $4,133,000

* Nice looking house, well kept, good shape. 2 story.

* SOLD $525,000 below assessed.

Older (ie 1950’s, heritage) homes:

50 x 108 lot, Dunbar

Just sold $2,498,000

Tax assessed July 2017 $2,949,100

Tax assessed July 2016 $2,989,000

* Looks like a 1950s box build.

* SOLD $451,100 under assessed.

Single family home. Heritage home.

33 x 130 lot, Dunbar

Just sold $2,400,000

Tax Assessed July 2017 $2,818,800

Tax Assessed July 2016 $2,944,500

* Heritage home, decent interior.

* SOLD $418,800 under assessed.

70 x 122 lot

Dunbar, Vancouver West

Just sold $2,970,000

Tax Assessed July 2017 $3,404,000

Tax Assessed July 2016 $3,669,100

*Looks like a 1950s built house, nothing special.

* SOLD $434,000 under assessed.

Let it burn… Unbelievable price drops. Ha! Parabolic increases are not sustainable unless it’s different this time?

“We are seeing unbelievable price drops,” said David Richardson, a veteran agent with Re/Max Crest Westside. He estimated some Kitsilano detached house sellers listing in the $2 to $3 million range have taken a 20 per cent to 25 per cent haircut on recent prices compared to two years ago.