Spec tax: Revised

Today the BC Ministry of Finance made some tweaks to the speculation tax that they are introducing this fall in response to the feedback they have received thus far. Here in summary is how it will work, based largely on the fact sheet of the new tax and some additional statements made by Carole James.

The tax will affect three categories of people: BC residents with secondary properties, Canadians from outside BC with BC properties, and non-Canadian residents with BC properties or satellite families thereof. All primary residences are exempt so this only applies to additional properties. The tax rate starts out at 0.5% in 2018 for all types of owners but since that will only be temporary I have listed the final tax rate that will take effect in 2019.

| Owner Group | Tax Rate | Exemptions/Mitigation |

|---|---|---|

| BC Residents | 0.5% | - Tax credit worth up to $2000 for one property - Long term rentals (6+ months) - Special circumstances |

| Non-BC Canadian | 1% | - Long term rentals (6+ months) - Special circumstances |

| Foreign Owner and Satellite Families | 2% |

Here are some examples of how much different classes of owners of secondary property would pay assuming the property is not exempt.

| Owner Group | Annual Tax on Median Victoria Condo ($400,000) | Annual Tax on Median Victoria House ($800,000) |

|---|---|---|

| BC Resident | $0 | $2000 |

| Non-BC Canadian | $4000 | $8000 |

| Foreign Owner and Satellite Families | $8000 | $16,000 |

A few things to note:

- There was some confusion about the speculation tax not applying to properties under $400,000. This is not true, the figure of $400,000 was merely an example of the highest valued property where a BC resident could get a full tax credit to offset the speculation tax. This is merely more clarity on the extent of the tax credit and is not a new measure in the tax.

- It’s not entirely clear if the income tax credit is available to non-BC Canadians and foreign owners. I would imagine if they are paying BC income tax they can take advantage of the tax credit however this was not clear from the fact sheet.

- It appears (not in the fact sheet but in the Times Colonist article) that existing rental-restricted condos will be grandfathered in. Grandfathering indicates that only existing owners of those condos will be exempted, not new buyers. That would be sensible to avoid distorting the market for rental-restricted condos however we don’t have the final word on this exemption.

- Other exemptions for special circumstances will be available (illness, work travel, death, etc).

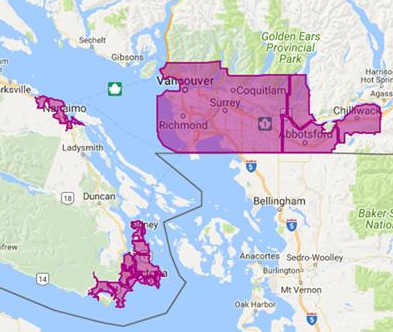

Some of the popular vacation property areas that are not part of urban centres have been removed from the speculation tax, most notably the gulf islands for the CRD. The tax now affects the following regions and Kelowna.

My Take:

I think these are sensible changes to the speculation tax that will address most of the stories that have surfaced in the media. I’m sure that it won’t change the minds of the people that are against the tax, but it does appear to make it more fair. The opposition from the real estate industry will continue which indicates they fear it will be effective. After years of empty and nonsensical promises about addressing affordability but at the same protecting peoples’ equity, it seems there is some political willingness to actually enact changes that will moderate prices in order to improve affordability.

As for the fear that it will put the brakes on new construction, I don’t believe this is likely to happen. Sure it will take some of the pressure off new housing if more existing supply comes on the market, but builders are booked so far out that a little less pressure won’t cause them to cut back starts substantially. This is likely a good time to enact such a change because the industry can absorb it.

There is still a lot of uncertainty as to how it will actually be implemented and a substantial risk that it will be too complicated (and thus contain loopholes) to be effective. However the NDP had a chance to back out of this completely and didn’t take it, which increases the odds that the tax will actually go ahead as planned (at least until the next election). It is interesting how the same people that cheered on government interference to stoke the market on the way up are now suddenly all about letting the free market do its thing. While I agree that less regulation would be better, that horse escaped decades ago.

As for the effect in Victoria, this is impossible to tell at this point. The percentage of sales going to vacation properties is quite low, but the percentage of sales that have gone to investment properties has more than doubled in the last few years. If those are all rented out they won’t be paying the tax, but this level of speculation will increase the magnitude of a correction if one comes about. I’ll be watching the rate of new listings closely to see if there is an uptick, especially of vacant properties.

What has surprised me is that in spite of all the negative press on the speculation tax, if you read the comments on those articles it seems many readers are in support of even the tax as originally formulated. The number of voters negatively impacted by runaway prices seems to be growing, and they are making themselves more heard than the ones that have benefited. We’ll see if that changes if the tax is actually effective at moderating the market.

I’ve sold my vacation place in Victoria and only have one place now in Kelowna BC…. I’ve taken the money from the sale in Victoria and bought a place in Las Vegas where they like my money and I’m taxed fairly… So how does this tax help the economy…. I sure don’t see any benefit of more taxes… I still use the Canadian Gov’t Medical and Dental and Welfare and E.I…. But now I spend very little money in BC… So as you can see it really doesn’t work to ram it to the Residents of BC…

I don’t think what I wanted to say really came across here, but new post all the same. https://househuntvictoria.ca/latest

The Dr. from Winnipeg spends a ton of dough when he is in Sidney. He eats out all the time, brings friends/guests with him, rents a car, flying in and out, playing golf etc. Like most people when on vacation spends way more than when at home. I wonder how many local jobs he supports?

Come on, it is not a peaceful cottage or a cabin on gulf islands, it is a condo in Sidney-by-the-Sea, next to main ferry terminal and airport.

Savings are invested in productive companies. What do you think banks are for?

The spec tax has nothing to do with his earned income, which is taxed in Manitoba not BC. It’s not a disincentive for anyone to work harder. For him and for BC residents as well, the spec tax is an incentive to earn more money by renting the property out.

Just saying, second homes or a Pied-à-terre are places people use to get away…and in most instances these people have the means to do so. It is a sanctuary for them to get away and relax…however, speaking from personal experience, it is also a place to reflect and do some work.

An IT professional can code peacefully, creative types find the excuse and time to innovate, doctors can think of how to treat patients more efficiently…etc… My only point is that these little getaway places from my own experience do create a lot of “value” to the real economy. Not having to share this with anyone else (e.g. a hotel) makes a world difference in terms of both privacy and mindset.

Patriotz you should try it sometime 🙂

We should tax savings since that cash could be invested in productive companies!

The spec tax has nothing to do with his earned income, which is taxed in Manitoba not BC. It’s not a disincentive for anyone to work harder. For him and for BC residents as well, the spec tax is an incentive to earn more money by renting the property out.

It makes very good sense to tax people for holding potential income earning assets off the market.

Seriously? Do you know that women did not get the right to vote country wide until 1991? Do you know that there are hundreds of thousands of people who were born in Switzerland, and whose parents were born there, who are not citizens and who have to go through a very difficult process to become citizens? Do you know about the compulsory military service for all male citizens deemed fit to serve? It’s one of the most conservative countries in Europe.

Should we feel sorry for him? He can afford fly round trip 9 times a year, plus boat maintenance, but can’t afford 1% spec tax on his condo?

In regards to income, top income earners already pay alot of taxes. the top 20 per cent pays 64.4 per cent of all income taxes while earning 49.1 per cent of all income

https://www.fraserinstitute.org/blogs/top-earners-in-canada-pay-a-disproportionate-share-of-canada-s-tax-burden

It doesn’t make sense to tax the top performers even more, it actually makes sense to have them perform even better so they can keep on paying a dis-proportionate % of taxes.

In much of Switzerland, imputed rent is a substitute for property taxes, IIUC (I’m a renter).

Have you lived in Switzerland? The PC culture here — as in much of Europe, but CH is more conservative than most — is a far cry from Canada or even the US. It’s probably more conservative than Germany, especially east of the Röstigraben, and as recently as ten years ago in Germany you could buy hip hop CDs in the “Black” music section and see horrendous buck-toothed, rice-paddy-hat-wearing caricatures featuring prominently in Maggi Asian food adverts).

Moreover, basic electrical and plumbing parts are easily available at Coop Bau und Hobby, let alone Hornbach (the former is more like Sears, the latter akin to Home Depot). Interestingly, here apartments don’t come with light fixtures. When people move, they take theirs with them, and many do the very basic wiring themselves. I always have. Thankfully they don’t take their entire kitchens like in Germany…

Maybe you mistook Switzerland for Sweden?

“I don’t think people who inherit a bunch of $$$$ or their parents help them out with a purchase should be punished.”

But not “punishing” them means that people without that help are being penalized because they are competing for homes against those wealthier people. Any family who has been on the real estate ship the last 15 years has sailed far ahead of one who has not. At the turn of this century, I looked on the MLS website, and there was not a single listing over $1M. Maybe that segment of the market was dead at the time, but for sure the price increases since then have made many homeowners into real estate millionaires.

I guess I’m idealistic, but I wish the opportunity that existed for my grandparents still existed today. They came to Saskatchewan as immigrants from Europe in the early 1950s. They were 40 years old and couldn’t speak English. Doing low-level jobs and saving like crazy, they worked their way into owning a rooming house, then a 6-plex. In the mid-70s, they were able to retire to Victoria and buy a 4-plex.

Today, how does someone who comes here with nothing (or even starts here with nothing because they come from a poor family) compete with all the people whose family has made hundreds of thousands (or even millions) in real estate in the last 15 years?

I guess fundamentally it ticks me off that hard work can’t overcome people just lucking out and watching their houses go up in value more than many people earn in a lifetime. In many cases it was just “lucking out” because it wasn’t done as an investment.

“Seems like we need a cooldown just to bring things back to somewhat normal in terms of the construction labour market.”

I’ll say! I was at Thrifty’s a couple of weeks ago and overheard two guys talking, at least one of whom was a construction worker. He said they are pulling people off the street to do construction. They are hiring from temp services and the guys work a day or two to get enough money to buy “whatever”, then they disappear. How good can the quality be with workers like that?

Last year an acquaintance had her kitchen and bathroom reno’d, and it took much longer than anticipated because the workers weren’t showing up when they were supposed to, and one of the guys doing the bathroom left in the middle of the job because he had something bigger that paid more. Then her new kitchen cabinets got gouged by some untrained guys installing the countertop.

Of course, who said they don’t? My point is no one likes taxes but there is this misconception that taxing new things will eventually tax us to death. Taxes are merely the symptom of government spending. Whacking one tax merely makes it pop up elsewhere like a gopher unless you actually reduce spending.

And if we tax income we discourage people from earning money. And by taxing gasoline we punish people who are poor and have to drive around. Is taxing imputed rent really more invasive than taxing income?

Leo S, that is an uncharacteristically naive comment, coming from you. We could also tax everyone who is a redhead. Or we could have income tax for only people who work standing up.

Taxes have real effects in the world, which is why we have been debating the spec tax here. There are always two competing purposes for a tax: Revenue and behaviour change.

If you tax couples less than singles, more people will get married. If you tax empty homes, less homes will be empty. If you tax property transfers, you get less flipping of properties. If you tax carbon (gas), you make low-carbon alternatives more attractive.

If you tax “imputed rent”, you discourage home-ownership and reward people who own rental properties.

What social effect do you want to come with your tax revenue?

It’s okay Marko. I’m sure you’re good at what you do and have fun doing it.

But I do find that scenario I outlined funny. Everyone knows the stereotype of the lazy government worker and the realtor who does little to earn such a huge commission. Almost sounds like some kind of Monty Python skit.

don’t really do much to enrich or benefit society.

I’ve admitted many times on the blog that I don’t feel that I contribute to society. Problem is my old job where I did something meaningful, in my opinion, didn’t pay enough 🙂 And as I’ve noted before unfortunately society rewards flipping paper, not honest labour/production.

In all fairness I did try to bring change into the marketplace by offering lower fees and alternative services (mere postings). It has failed miserably so I just don’t care anymore if I am overpaid 🙂

Haha probably. Imagine a venue where government workers and realtors are arguing that the other side don’t really do much to enrich or benefit society. It’s actually very funny to contemplate. I guess the point is, we need more government workers about as much as we need more realtors.

This will lead to further class division since only those who come from wealthier families will have parents with enough money to help them purchase. We did not get any money from family to purchase our house, but they do own BC real estate, and there is inheritance potential that would take care of our housing concerns. So, just because we have relatives who purchased here decades ago, we stand to be in a much better position than people from poorer families or from other parts of the country. That’s not fair.

I don’t think people who inherit a bunch of $$$$ or their parents help them out with a purchase should be punished. If people are willing to make sacrifices to help their kids out financially so be it. If your parents can’t help you or they blow all their cash in retirement and leave you with nothing that’s the luck of the draw.

Life is not fair in general. Some people are born to good looking tall parents and well, some aren’t.

Should we feel sorry for him? He can afford fly round trip 9 times a year, plus boat maintenance, but can’t afford 1% spec tax on his condo?

I have a client that owns a business checking in and doing light maintenance on these boats/yachts in Sidney so there are moving parts to the economy in this guy packing up and getting a condo/boat in Mexico. Most of her clients are Albertans.

I also think all these changes could affect the pre-sale market a bit. A lot of these buildings get off the ground based on some degree of speculation. The average Joe or Suzy that needs a place to live isn’t typically willing to risk going in on a pre-sale……slow sales at Vivid being the perfect example. If not enough pre-sale some buildings won’t get out of the ground.

Not really sure what to make of it all.

We do know the spending will go up enforcing all this new crap. Government will probably get some class A officespace downtown and more bureaucrats that of course need flex Fridays to prevent stress.

Spent most of the day on the Westshore today.

Deficiency walk-through with clients on a new home in the Westhills. At least 10 tradespeople trucks on the street with Alberta licence plates.

Then drove down Jacklin and noticed banners on two buildings under construction “Now Hiring, Call XXX-XXX.”

Then I got to my friends’ house in Colwood where three of his tradespeople promised to show up today and no one showed up 🙂

Seems like we need a cooldown just to bring things back to somewhat normal in terms of the construction labour market.

Happy Easter weekend everyone! Hope everyone gets at least a few Cadbury mini eggs to enjoy, or at a distant second and only if resources are scarce…Hershey’s eggies.

https://riskyfuel.com/2016/03/27/cadbury-mini-eggs-versus-hersheys-eggies/

😀 😀

Should we feel sorry for him? He can afford fly round trip 9 times a year, plus boat maintenance, but can’t afford 1% spec tax on his condo?

It’s no surprise that Switzerland uses imputed rent. Switzerland is probably the most anal country on the planet. Everything is judged on ‘fairness’ and the PC culture, both of which invade the lives of all citizens. Many contributors to this blog are handy with tools and DIY projects around the house. Forget that in Switzerland where every aspect of plumbing, electrical, carpentry are regulated to the point where only journeymen trades people are allowed to buy the basic electrical or plumbing parts that every hardware store sells here.

Uber settles with the family who’s wife/mother they murdered. Must have been because no human could have avoided hitting her.

The concept of imputed rent shows how easily ‘logic’ can be manipulated to make insanity appear rational.

Government revenue comes from somewhere. If it’s not taxing imputed rent it’s more income taxes, or sales taxes, or gas taxes. You can make an argument for or against any of them but in the end the revenue will be collected

I call these invasive taxes….

Thank-you for the link, Leo S.

That is one of the most terrifying tax articles I have read in a long time. One of the commenters had a good response:

“Where does it end? If you own a car, would you pay taxes on “renting it” to yourself too? If you own a tuxedo, every time you wear it would you have to pay taxes based on how much it would have cost to rent one instead? One could even go beyond “investments” into labor: how about paying income taxes every time you cook at home or clean your own house, based on how much you would pay at a restaurant or how much would you have to pay a cleaner?”

At the end of the day, this proposal benefits landlords, because it punishes people for owning their own home. Notice that the article author was an advisor to Reagan and Bush Sr.

I doubt there is a big effect here. I like the idea of an index though that just shows your house value relative to other residential properties in your municipality. That would also kill the never ending incorrect idea that when your assessment goes up your taxes go up

You say that as if it’s some completely preposterous notion, but there are good arguments for taking into account imputed rent. Some countries like Switzerland do this https://economix.blogs.nytimes.com/2013/09/03/taxing-homeowners-as-if-they-were-landlords/

Vancouver Detached Home Flipping Hits a 10 Year Low

It appears to be the end of the road for the Vancouver detached housing market. Sales are expected to round out the first quarter of 2018 at their lowest total in twenty years. With that, speculative activity has also dried up.

As of March 29th, Vancouver detached home flipping, (a home bought and resold within 24 months) plummeted to its lowest total since November 2008.

Meanwhile, credit unions have failed to replace the hole left by the big banks following the B-20 mortgage stress test. Per Northcove Advisors analyst Ben Rabidoux on Twitter, “If credit unions are providing a workaround to B-20, it’s sure not showing up in the data yet. Annualized mortgage growth from the end of 2017 is 1/3 that of the banks.”

http://vancitycondoguide.com/detached-home-flipping-10-year-low/

Sure are a lot of blogger here speculating on the Speculation Tax impacts.

The goal of the NDP is to discourage speculation. I hope the Federal Government follows and enacts a few changes at the federal level; for example, come down hard on speculators who buy ‘investment’ rental properties where there is no reasonable expectation of profit. When an ‘investor’ buys a ‘rental’ property where it is impossible to make a profit on the rental income, then the CRA should audit and disallow all expenses, including mortgage interest. People that buy these ‘rental properties’ are not investors, they are speculators.

@Nan

“Vacation properties in urban centers are fine when there is enough to go around but there simply isn’t.”

Well that’s when most of them bought their properties in the first place.

“Move here and pay local taxes or sell so that someone who needs housing here can find a place to live.”

Well if they do move here it sure doesn’t change the vacancy problem.

Isn’t the real problem, and to not fault of the present government, the fact that there has been hardly any low income housing built in the past 20 years? The only way to really solve this problem is for the government to embark on massive low income housing construction and preferably by incentivizing such as a bond with a decent rate of return…..and just watch all the rich folks just pour their money into it…..a win win solution.

Take just a moment’s break from the braying triumphalism. If you the prospect of driving Manitoban doctors out of Sidney makes you giddy, what about your own house? If you have a four bedroom home and only two people reside there, shouldn’t you be taxed unless you take in lodgers? Why not?

The logic here is bizarre. Sidney is within easy commuting distance to Victoria. All the places that will be sold by vacationers will be snapped up by locals. Yes the prices of them may go down a bit but those new full time residents will spend way more money in the local community than the vacationers. Positive for Sidney on all fronts.

Thanks for the opening. Then why not make it an abstract number like the HPI? Why send every household a letter each year telling them their house is worth 20% more? Look at asking prices before and after the letters went out…

The Sidney article is pretty good – lots of wealthy old people complaining because they want to have their cake and eat it too. They take up a family’s worth of space indefinitely for a couple months a year of non-productive vacation time where they buy groceries and the odd trinket or two to take back to wherever they came from while they get to benefit from the nice weather and wealth increases.

Unfortunately, the costs of their desired lifestyle to society increased years ago and now they are finally forced to pay for it instead of having the youngest poorest families burdened with the costs through massive mortgages or inappropriate housing.

Too bad. They can either pay the tax, move to BC and avoid the tax or vacation here as often as they want and rent/ stay in hotels.

Vacation properties in urban centers are fine when there is enough to go around but there simply isn’t. Move here and pay local taxes or sell so that someone who needs housing here can find a place to live.

Being forced to sell because you can’t afford the tax means the new tax is having the desired effect. Those rich retirees from Alberta will be replaced slightly less rich retirees from BC who now have a new place they can move to which may free up RE elsewhere in the province. Sweet.

That’s not how taxes work. You don’t pay more tax just because your assessment went up.

Richard,

Maybe he’ll move here and start a practice.

“Sidney implores B.C. to rethink real estate speculation tax”

I met a Dr. that practices in Winnipeg and every 6 weeks flies out to Sidney to “get a break from the winter and extreme heat in the summer” and relaxes for a week in his waterfront condo before returning. Has a boat at the marina…..

I wonder what he is going to do.

https://www.bcassessment.ca/Property/Info/RDAwMDA1UzBHNw==

Dude saved a million bucks thanks to push back. I see no reason why it would not have paid the 2% if it was still in the spec tax area.

It is a gulf island, but in any case it has no residential properties.

I wonder if golf course island (james)will be paying an extra 1m in taxes under the spec tax. Is that a gulf island?

Sidney implores B.C. to rethink real estate speculation tax

The Town of Sidney is calling on B.C. to take a second look at its contentious speculation tax, warning that many longtime homeowners who contribute to the community are already planning to sell their properties.

“We have some serious concerns about the impact of this tax on our community and its residents who own vacation property or second homes in Sidney,” Mayor Steve Price said in a letter to Premier John Horgan.

http://www.timescolonist.com/news/local/sidney-implores-b-c-to-rethink-real-estate-speculation-tax-1.23244223

@ Curious Cat

Good post. But they’re now asking a decent premium over all of those except for Obed. I’ve walked through the houses on Colquitz and Obed and if memory serves Obed may have been approaching 2x the square footage of Colquitz, and much newer. Parkview much larger as well (with a water glimpse, haha). Anyways, strange market.

@ Curious Cat

Can’t say I follow the logic even more so now that I know it’s been on the market for >1 month.

If it doesn’t’ sell at 699k , why would it sell for 749k?

I’d agree that most of the prices are pretty nuts, but I’ve thought that for a while.

The Colquitz house was listed for 699k 3rd week of February so it’s been on the market for a little while.

Most likely it’s because some recent sales in the neighbourhood:

2851 Parkview Dr listed 649,900 sold 725,000

740 Middleton listed 739,000 sold 727,000

522 Obed listed 675,000 sold 760,000

2885 Dysart listed 649,000 sold 705,000 <— this one shocked me! 2 beds, 1 bath, no basement

This power belongs to municipal governments. In theory the provincial government could take it back, but it would also have to set up a province wide department to enforce it. Doesn’t make much sense. Note however, that short term rentals will be subject to the spec tax.

I’m really confused! There is so much criticism of Airbnb. Airbnb being blamed for rental shortages etc. Airbnb at first was hailed as the new future, an example of the new “sharing economy” which the millennials trumpeted and endorsed. Much like Facebook was initially promoted by the millennials it now is despised by them. Is Airbnb similarly suffering a backlash from the millennials?

I thought that the “sharing economy” was the new future…I’m not so sure anymore. Are the millennials rethinking this? Be interesting to hear millennial opinion on this.

Haven’t Vancouver and Victoria already done this? Do you mean Nanaimo and Kelowna should have been added as well?

Good point.

I have noted the rise of listings in Uplands for the past 2-3 months. Very, very few sales so far. You will note that in 2017, it was a pure desert for listings in Uplands. Now, with the top clearly in the rear view mirror, owners are looking to “cash out”. You will also note that the property tax assessment values are outrageous there [and just about everywhere else in the City] and owners have deluded themselves that those “values” are realistic. 2016 had a lot of listings in Uplands and a lot of sales. For the few listings in 2017, the asking prices were 7-figures above the property tax assessments. Now, the asking prices are a few hundred thousand above – really tells you something.

Frankly, the municipalities throughout the major urban areas have taken advantage of the RE bubble by inflating property tax assessments in order to extort more property taxes. Owners have been lulled in to a false sense of security believing that their “wealth” will continue to grow unabated and have paid the rising property taxes. In Uplands, the assessments values went up a million dollars in 2016 and $500,000 in 2017. That is unrealistic.

In the past few years, homes have sold well, well above the property tax assessments and asking prices. Now, this is changing. So, will the powers that be start to adjust the assessment values down? Taxes follow the ratchet principle [they only go up].

The surge in condo activity seems to be a trend that is consistent in much of the nation’s more inflated markets.

The question I’ve asked before, is what happens broadly once this bottom-segment of the housing market crests and there’s little else in the residential market to speculate on. We already have the high end of the market under significant pressure for various reasons – the mania’s been sucked out.

Aside I confess, I was looking at a listing yesterday and it was tempting. Just one call would do it all… Reminded myself why I stopped looking at listing sites. It worked, thankfully.

We now seem to be up to about 20 properties in Uplands. There may not be a lot of inventory in James Bay and Rockland but Uplands seems to have an unusually large number of houses.

Failed bidding war would be my guess.

Anyone care to comment on this strategy?

2901 Colquitz Ave listed for $699k, after 7 DOM it’s relisted at $749k

I’m seeing very little selling these days but at the same time no great increase in inventory.

Other than GST, local development fees have been seen to be a way for municipalities to recover costs for supplying infrastructure to new dwellings. It looks sensible on paper and, for smaller municipalities, it is pretty important in order to keep new houses from putting everyone else’s property taxes up.

However…

As the article shows, it hits individual home owner-builders much harder than anyone else. Along with the BC owner-builder test, the entire system is stacked against people trying to build houses for themselves.

Everyone accuses developers of making too much money, but this kind of system means that only large-scale developers will build everyone’s houses. I think there should be a range of tax and fee exemptions available to small owner-builders (especially if it is a one-off). Or at least a rebate system upon successful completion of the home.

We want to encourage new homes? There is one way right there.

If the objective is to free up units I suspect that banning all AirB&B type rentals would have put a lot more units on the market particularly condos which comprise the most affordable type of housing.

Assuming the plan does indeed make housing more affordable, that means that prices drop, that also means that the more successful the plan is the less government will collect on Land Transfer tax. Lets say that it is only modestly effective and drops prices 10% overall. Initially some of the drop will be offset by increased volumes and by additional capital gains.

If it is successful in lowering prices will it actually increase or reduce revenue. The simple answer is that the government does not really know the impact because nobody has anything more than a guess as to how many properties are impacted.

I cant help but thinking that if there are enough properties involved so that it impacts the housing market that there will also be a fairly large long term drop in revenue from vacation properties. (The notion that all these vacation home people will simply keep coming to BC by renting is simply fanciful bordering upon the deceitful).

Toronto market pretty interesting http://business.financialpost.com/real-estate/toronto-morphs-into-new-monster-as-houses-slump-condos-soar

So the idea is to try to force a few hundred people to sell property that can’t afford the new tax? Those that can afford the tax? Or who’s income offsets it? Well as they say, the rich get richer….

They said they considered it but they believe it wouldn’t achieve the goals of freeing up existing supply, and may in fact cause people to hang on to properties rather than selling them.

))) assume. The speculation tax won’t cost anywhere near $36m/year to operate. I imagine most of the cost will be in the initial outlay to developers to build the software to automate the whole process(which will cost millions).

…////

That’s a valid point. So maybe it costs less, say only $3 million to operate and they clear $33 million. Most of that money is coming from out of province people. Is there any evidence that a large percent of these people are speculators, other than they own a BC property that isn’t rented out more than 6 months per year? There are lots of other reasons people would be in that situation besides speculation.

This tax is intended to target speculators, and I agree with the idea of taxing speculators. It just seems a poor implementation, that ends up targeting some non-BC groups, of which some are speculators. This leaves BC speculators largely untouched.

Why not target cap gains on short term resales of non principle dwelling – wouldn’t that be a better target to hit speculators?

or paste the link into outline.com

Take the link, go to google, put it in the search box, click the article, and robert’s your mother’s brother.

Hawk, FT always has a pay/sub wall.

There’s no article to see.

Here we go again . The Big Short part 2 coming up. They never learn.

US subprime mortgage bonds back in fashion

Yield-hungry investors turn to assets blamed for financial crisis a decade ago

https://www.ft.com/content/6478a8d6-32c3-11e8-b5bf-23cb17fd1498

In fact house prices in Ottawa are the most affordable of any big city in Canada. It is more than 3x the size of Victoria and has higher incomes, but houses are much cheaper. Median family income is $95K and you can buy a new house for around $400K. That’s not crazy at all. And note that most of that 23% is GST which you pay on anything.

So what accounts for the difference in price between cities? Simply how much the buyer is willing to pay.

This is from 2015 in Ottawa, but you might as well put any city Canada and why new supply SFH are crazily priced. We have even crazier bylaws and permits here in the CRD. The blog is pretty good.

http://www.webuildahome.ca/journal/2015/9/1/city-of-ottawa-development-fees

Here’s an interesting/depressing infographic from GOHBA. It shows that 23% of the cost to build a house in Ottawa goes to fees and taxes. These stats are for a developer home, where the assembly-line style of building keeps actual construction costs considerably lower then a custom home. You can easily double those construction costs for a custom house build. Then you’ll get a sense of what project costs are like. Rather discouraging isn’t it?

Some parts of the BC public service aren’t as inefficient as most people assume.

Sure…sure it is definitely in one of the other infinite costs buckets somewhere.

Average Commenter, thanks for your insight. It is good to know that things are more efficient than they appear, sometimes.

about that speculation tax…

Some parts of the BC public service aren’t as inefficient as most people assume. The speculation tax won’t cost anywhere near $36m/year to operate. I imagine most of the cost will be in the initial outlay to developers to build the software to automate the whole process(which will cost millions).

The lawyers and policy analysts to draft/adjust/defend the tax are mostly existing staff. I would be that the only additional headcount will be for the people auditing and billing. And even that is primarily done by existing departments. The total hiring to manage and enforce the speculation tax will likely be under 15 people and that includes management staff.

And everything involved with it, the staff, billing, auditing, software are likely to be add ons to existing programs. I doubt that anything is being built from the ground up.

LeoS @ 6:51

Welcome. That would be variable, I take it?

We’re looking at HSBC, who have a 2.49 variable listed on their site. Would much rather go with a local credit union, but no luck getting them to match that rate…

@Jerry $1,190,000

Thanks. Renewed mortgage at Prime-0.63 today, 2,82%, CIBC

Would some kind soul publish the sales price of 3805 Ascot Drive, please?

I agree that the CRA and province should have free access to this data, but not make it a publicly searchable database. Otherwise, in your zeal to hunt the guilty, beware of harming the innocent.

Now of all times, with the ongoing Facebook scandals, people should be paying attention to privacy issues.

Sounds like both to me. That is, if X owned a condo in building Y that did not allow rentals on (e.g.) March 15, 2018, that condo is exempt as long as X owns it and Y does not allow rentals. Anything else invites abuse.

Thanks for the info. Sounds like the spec tax exemption for rental-restricted condo grandfathering is building based, not owner based. They should make it clear in their info sheet, if not yet.

Interesting graphics for housing bubbles in the USA:

https://wolfstreet.com/2018/03/27/update-on-the-most-splendid-housing-bubbles-in-the-us/

Once and Future “considering how much personal information is being harvested to manipulate people, I think this would be very dangerous.”

I see it as so much personal information is being hidden to launder money and speculate on real estate. I’m good with some transparency for once.

There sure has been a lot of opposition from the RE interests. Why would they care if it had little impact? I do think they’re just as scared of the anti-fraud and transparency measures, it’s just that the spec tax is the only target where an attack can be made to appear halfway credible.

Lets see what happens next….

Eby at the Standing Committee of Finance.

http://parlvu.parl.gc.ca/XRender/en/PowerBrowser/PowerBrowserV2/20180327/-1/29018?useragent=Mozilla/5.0%20(Macintosh;%20Intel%20Mac%20OS%20X%2010.12;%20rv:59.0)%20Gecko/20100101%20Firefox/59.0

Pretty sure the intial response from police was that she jumped out in front of the car, not crossed 7 lanes of traffic first. “She came from the shadows”, “A human driver would not have been able to prevent this” then the release a terrible dash cam video where it’s much darker than in reality and call it a day. I’d put money on a human driver not hitting the lady, and even if they did, they’d at least have applied the breaks, and tried to avoid the pedestrian instead of plowing right into them. Tempe police are still talking bullshit, and now there are reasons coming out as to why…

Going back to the topic of variable rate mortgages and payments changing (or not) here is a useful article I found on ratespy: https://www.ratespy.com/offers-fixed-payment-variable-mortgages-03275087

It lists which Canadian banks have their variables set up this way (fixed payment) and which don’t. Helpful!

Garbage in garbage out. 🙂

@Patrick

Perhaps they are also accounting for people that will start declaring their rental income due to the Spec tax.

LeoS: . I don’t think it’s important if they end up bringing in $100M vs $200M.

…——//////

It will likely below way below that, about $36million from the spec tax, and will be less than the cost of running it. You should consider that important because they would likely cancel a tax that was losing them money. You should also consider it important because a tax that raises so little money is also going to have very little effect on many people’s behaviour to change how they want to live in their houses.

If you read my projections in the post below, you’ll see that they would likely collect an average 1.5% tax on 4,000 properties (typically from Albertans and Americans). If the average property is $600k, that’s 4000 x $600k x 1.5% = $36 million. That wouldn’t likely cover the costs of running it.

If you dispute my percentages, instead of just complaining, run the numbers yourself based on your percentages of BC vs Foreign ownership and multiply by your estimates of vacant homes. There is good data available from the Vancouver vacant home tax, you can extrapolate from there. I will accept your numbers and you can justify your claim above with numbers showing that they could raise $100-$200 million. Until then, mine are the only estimates posted.

Where did you get that number?

As for revenue projections, i am not privy to the models they used so I have no idea if they are accurate or not. I don’t think it’s important if they end up bringing in $100M vs $200M. The long term better outcome here is less revenue as the number of empty second homes is reduced anyway

Patriotz, you seem to have intimate knowledge of the NDP’s plans. What you said may be true, but I have seen no evidence yet.

Care to share a more substantive link to your claim?

Your comment followed a quote from David Eby regarding the provincial government’s plans. The government is not proposing any such thing.

Can we get off this “cottage” stuff? The tax now applies only to urban areas, period. There may well be some Albertans who are now motivated to sell their condo in Kelowna but I think they would have bought in Arizona in the first place if that was their taste. Lots of condos – and cottages too – nearby in OK that they can buy that aren’t taxed.

Victoria Born:

If Albertans feel like they were forced to sell their cottage because of this tax the last place they are going to think is friendly is BC. If you think that there will not be deep resentment you really dont have a handle on human emotions. The money will probably flow down to the United States if anywhere. We forget that it was not so long ago that BC was encouraging people to buy vacation homes because we needed the jobs and tax revenue. In my experience things can turn faster than people think.

@Patrik, good point, the spec tax might release a few properties to the market one time only. Hardly a big impact on inventory. The Irony is that those hopeful for a crash would have been better off if the speculation got even crazier so we overbuilt to the Spain scale pre financial crisis. As it is the market will fizzle with still low inventory. I’ll keep saying it. The biggest impact on affordability has been evalueBC sending everyone a letter for the last three years telling them their house value has gone up 20%….

Still you

Nothing was hidden with this accident. Everything has been above board with respect to this person dying. Are there problems with the whole program. Maybe. Lidar seems to have some big time issues. This accident will hopefully help or stop the program until they have all the fixes.

That Lady would have been hit no matter who was driving. Not a great idea to J walk across a 7 lane road. Lidar should have stop the car that’s a given.

With regard to Uber killing someone with their self-driving car:

https://www.theguardian.com/technology/2018/mar/28/uber-arizona-secret-self-driving-program-governor-doug-ducey

Who’s the conspiracy nut now?

Thanks patriotz, yes I am already aware of how the LTO works. The way things are now works fine, in my opinion. Adding beneficial ownership and company ownership would help crack down on some abuses. However, I am questioning the demand from some people who want it to be open to full public search by owner’s name.

Considering how much personal information is being harvested to manipulate people, I think this would be very dangerous.

“Allowing strata properties to avoid the speculation tax through no-rental bylaws would create an uneven playing field in the designated urban centres where the tax applies,” the Finance Ministry said in a statement Tuesday.

“To ensure fairness, the province will provide temporary grandfathering for strata properties that prohibit rentals. If a strata council were to pass a new no-rental bylaw, the strata properties will not be eligible for the temporary exemption.”

http://vancouversun.com/news/politics/b-c-dismissed-capital-gains-tax-because-it-wouldnt-help-rentals-says-minister

Having examined the specifics of the speculation tax adjustment by the NDP, I am disappointed. These “exemptions” open the door to abuses. I don’t see the need to lighten the burden on non-BC resident Canadians. If they can’t afford the tax on the vacation home, sell it and then come visit as a renter of a vacation lodge or hotel room – the weather is the same, the lake is the same, and the friendly people of BC are even friendlier because now they have a home in which to raise their families. The 0.5% on BC residents is simply a way to keep votes – property is either a place to live or a speculative investment – which is it? Make up your mind, NDP. Further, the speculation tax on foreigners is too low – these people are in jurisdictions where it is difficult to get their wealth removed and to a safe place [like BC] so, by using foreign banking channels, they will continue to do and continue to buy real estate here – 2% is just a cost of doing business and the price of insurance to protect their wealth from the risk of their native governments. There was a good discussion about this yesterday on BNN – 2% is not going to deter them and the 20% foreign buyers tax is just a one-time cost.

The skeletal framework of the NDP plan allowed hope – now, the exemptions show a crack and it is the beginning of an invitation to abuse the system.

However, it is but one of the many steps being taken, including rising interest rates as I discussed below. The next 18 to 24 months will be interesting.

Leo: I was never expecting it to generate revenue from British Columbians. They said from the beginning that the tax credit would more or less cancel it out for people paying taxes in BC. Whether that is in the form of a larger tax and larger tax credit or smaller tax and smaller credit is immaterial.

.//. =======

The government is still saying, after the amendments, that they expect $200 million from this spec tax. Given that Vancouver found only 4,000 vacant properties in a population of 600K, we can expect about 20,000 vacant properties in the whole affected region (population $3m).

Can you see how absurd a projection of $200m is, given 20,000 vacant properties? That’s $10,000 per property. But at least 80% of those are B.C. residents that (as Leo has said above) won’t generate any revenue. So that leaves 20% or 4,000 properties from Albertans and Americans, and the expectation stated by the govt is that these will generate $200m revenue – that’s $50,000 per property, and if the average tax was 1.5% that would need to be in an average property price of $3.5m.

If you don’t agree, try running some numbers, and see if this $200m latest govt projection makes any sense.

http://www.cbc.ca/news/canada/british-columbia/speculation-tax-government-update-exemptions-james-1.4593681

“James said the government is still forecasting $200 million in revenue from the tax, because the original numbers from the finance department were conservative.’

And so we have 4,000 properties that may get taxed, and how many of those will end up as more supply – maybe 2,000, as a one-time addition. Compare that to the 50K per year new construction, and the absurdity of this tax is clear if you’re expecting it to make a difference to supply, or government revenue.

You are apparently unaware that BC land titles have always been public domain. You could go down to the Land Titles office and for a nominal fee get a copy of the title of any property. For some years now it’s also been online. The only thing the NDP is changing is to make it more difficult for crooks to hide behind shell corporations and trusts.

Note that the database is searchable by property, not owner. You can’t use it to find out what a particular person owns, just who owns a particular property.

https://ltsa.ca/property-information/search-title

Yes, they are supposed to represent everyone’s interests. Harshly punishing some haves for the pleasure of the have nots isn’t really their intended mandate. Going after crime and speculation in the real estate market is….

LeoS said: “Either way, I don’t really see the problem with a government proposing a measure, then adjusting it based on public feedback. What’s the problem exactly?”

I was also wondering why so many people are bitching about this process. That’s how the legislative system often works in Canada, at all three levels of government, especially for proposed legislative changes that impact life-style. Hasn’t anyone heard of the Senate? Or, public consultation? Or lobbyists? Or politicians on a roadshow to small communities to discuss such things. How many times have the marijuana legalization plans changes due to public and business feedback? Dozens of times. Regarding the speculators tax, time is of the essence, consequently the consultation period is brief, but the NDP are obviously listening to rational suggestions, while staying focused on the problem. ( No, I didn’t vote for the NDP)

This many not be a popular opinion, but I am a bit worried about an easily searchable public database of home-owners. There are a lot of non-savvy seniors out there that are ripe for property scams (my relatives included).

I also think that stalking and other privacy issues should be in people’s minds. Should a woman have to worry about her estranged husband easily finding her new home? Or, just wait until the people on 4chan decide to dox you for holding the wrong opinion.

However, I do think it should be completely searchable by both the CRA and the Province (along with corporate share ownership).

Hawk, I can understand your cynicism. However, a consultation doesn’t have to take long. Just a proper chance for people with business and legal background to comment on the change. If I was implementing a new tax, I would want everyone to do free economic and legal analysis for me, even if I knew a lot of it was biased.

As long as you know the bias going in, you can still gather usable information.

Now that is good news. Whatever you think of other kinds of speculation, I hope we can all agree that making BC the money laundering capital of the world was only going to end badly.

@Hawk

Good to hear.

I know they were in a hurry to get something done, but I am curious about why they didn’t do this. Or at least get some proper legal analysis first. What resources do the various ministers have to get economic and legal advice for a proposed new law? Anyone in govt care to comment?

I know that (formal) advice often takes longer than we want, but this tax felt particularly rushed. It really appears like some academic had a great idea on paper and the NDP adopted it with no further research (I have a lot of great academic friends who have great ideas, but law is not a place to do thought experiments).

After the initial flurry, I think what they have now is closer to workable. The details of enforcement still worry me, though.

@Michael

That’s the 3rd one I’ve posted in a week that I’ve come across, and I don’t have access to the data that I’m sure would reveal a lot more. It could be a one off, but the market is looking like it’s starting to show big cracks. Even Allan Angell, the very successful West Van realtor is admitting that market segment is really struggling.

‘Suspicious’ B.C. casino-cash transactions plummeted in February: Eby

In a presentation Tuesday to the House of Commons standing committee on finance, which is receiving input on amendments to the Proceeds of Crime and Terrorist Financing Act, Eby said that suspicious transactions to B.C. casinos had fallen to $200,000 in February from a high of $20 million in July 2015.

“We have reduced it by a factor of 100,” said Eby.

Following the peak in 2015, about $5 million a month in suspicious transactions were recorded, amounting to hundreds of millions of suspicious cash flowing through casinos, he said.

http://vancouversun.com/news/local-news/suspicious-b-c-casino-cash-transactions-plummeted-in-february-eby

“Sure, would have been better for them to launch it as a consultation.”

Of course, let’s have ten committees filled with agents and whining Albertans for 4 years of bullshit where nothing gets done. Doing something now then making adjustments along the way is better than nothing. People voted for change now not later.

It all starts at the top and the bottom. One in five aren’t qualifying for a mortgage and the money launderers cause the top to blow off as we are now seeing in Vancouver as they dump to take the losss because they know what’s coming down the pipe next.

“B.C. is also planning a beneficial ownership database that would require public disclosure of the people behind numbered companies that own property.

“The bottom line for British Columbians is they want to know who owns the property and they want to know where the money’s coming from,” Eby said Tuesday.”

Sure, would have been better for them to launch it as a consultation.

“I don’t really see the problem with a government proposing a measure, then adjusting it based on public feedback. What’s the problem exactly?”

The problem is that people like a steady and predictable environment so that they can plan. Unpredictable government like Donald Trump personality doesn’t help anyone.

Costly complex lawsuits that straddled the FBT and went to BC supreme court. Not market indicative.

https://thinkpol.ca/2017/12/18/flipper-sues-buyer-lost-half-million-selling-waterfront-property-loss/

“Here’s some more recent sales in Van (SFH). Looks like they’re selling below 2017 & 2016 assessed values. Bummer BC assessment doesn’t list 2015 values as well, would be interesting to see what assessment year it’s falling back towards.

Dunbar SFH

Just sold $2,888,000 (sold $525,000 below assessed)

Tax Assessed July 2017 $3,413,000

Tax Assessed July 2016 $3,461,000

5930 Condor Pl, West Van SFH

Assessed July 2017 $3,178,000

Assessed July 2016 $2,927,000

Purchased March 2016 $2,990,000

SOLD Jan 2018 $2,640,000

$350,000 LOSS (sold $538,000 below assessed)”

What a steal, perhaps millennials from Victoria can move over to Vancouver to buy those cheap $3 million dollar homes.

Pure speculation. Who knows what data they are going on.

Either way, I don’t really see the problem with a government proposing a measure, then adjusting it based on public feedback. What’s the problem exactly?

I was never expecting it to generate revenue from British Columbians. They said from the beginning that the tax credit would more or less cancel it out for people paying taxes in BC. Whether that is in the form of a larger tax and larger tax credit or smaller tax and smaller credit is immaterial.

You mean other than supply which is the point of the tax? Remains to be seen how many of those there are.

Looks like Andy’s numbers blows Mike’s fantasy chart out the window. That’s what crashes look like in the beginning.

Yep those Victoria 1790 real estate prices were just killers. Not a seller in sight, buyers too. 😉

Here’s some more recent sales in Van (SFH). Looks like they’re selling below 2017 & 2016 assessed values. Bummer BC assessment doesn’t list 2015 values as well, would be interesting to see what assessment year it’s falling back towards.

Dunbar SFH

Just sold $2,888,000 (sold $525,000 below assessed)

Tax Assessed July 2017 $3,413,000

Tax Assessed July 2016 $3,461,000

5930 Condor Pl, West Van SFH

Assessed July 2017 $3,178,000

Assessed July 2016 $2,927,000

Purchased March 2016 $2,990,000

SOLD Jan 2018 $2,640,000

$350,000 LOSS (sold $538,000 below assessed)

What if you’re already renting your house out for $1 a month to a friend. You can’t legally increase the rent more than a couple percentage points a year. What would happen in that scenario do you think? Maybe you’d have to evict the tenants to bring it up to market rent to be in compliance or whatever.

The whole vacant thing is going to be a very difficult loophole to close. My guess is we’ll see maybe a few thousand victims get nabbed in the first year and if they keep it in force even less the following year assuming the GreenDP remain in power.

The rental availability rate in Kelowna currently sits around 0.2 per cent, making it the hardest city in Canada to find a place to rent.

https://infotel.ca/newsitem/housing-crisis-tearing-kelowna-families-apart/it51230

Yep, trillions of printed dollars that have been idling in bonds, are about to ’emigrate’ into life’s necessities. Time for families to prepare for what comes next. Some may even want to consider stocking up on stuff while still cheap.

+1, and a very important and widely misunderstood point.

From this viewer’s vantage point, the NDP had the right ideas with their first set of 30 tools to tackle the affordability issue that they announced on February 20, 2018. The watered down 2.0 version leaves one wanting. The adjustments are aimed at retaining or gaining votes for the next election, as one must assume that Mr. Weaver may very well cause the government to fall due to the LNG policy of Horgan.

The Victoria RE market is under pressure now and there can be little doubt about that fact as we see active listings rise and ask-price reductions, particularly for the $1 million plus homes. I suspect it will take 18 to 24 months, combined with the impending interest rate increases [Mr. Poloz will pull the trigger at the next meeting, particularly if NAFTA can get done] that we see in the bond market – the US FED is committed to 3 or 4 hikes this year with, what they say, an increased pace in 2019 and 2020. Falling bond prices cause raise interest rates which is what we are seeing. Don’t kid yourself, even if Poloz does not hike next round, the bond market will dictate rising rates for mortgages because that is where banks raise capital to fund mortgages.

Interesting times and long overdue. A RE bubble exists in pockets throughout this country but we all know the identities of the main areas at risk – and our home-town is implicated and at risk. A “soft-landing” is rare and unlikely when there are so many bullets being fired at this balloon. Eventually, POP.

Garth has created a nice balance of incredulity, scorn and contempt while skewering the tax. The vacuity of the premise and the certainty of it being a drain on public finances is well-described.

“richardhaysom@ymail.com” “Yup, that was some rant Oops! Not sure what it was all about though. Whatever FIRE promotes doesn’t excuse Horgan’s government from not undertaking thorough examination of the problem instead of knee-jerk reaction to the media.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

I’ll blame that on your cognitive dissonance, Richard.

Which knee-jerk reaction to the media are you speaking about? The original knee-jerk reaction to the media – speculation tax or the next knee-jerk reaction to the media – reduction in the speculation tax.

Pretty much sounds like every political party. Apparently, they react to news the same way as the citizens.

The developers are only feeding the phony FOMO demand that’s created in a bubble so the next greater fool will hopefully pay more. That point has been maxed out via the RBC affordability index that’s surpassed 2007 /2009 levels.

Yup, that was some rant Oops! Not sure what it was all about though. Whatever FIRE promotes doesn’t excuse Horgan’s government from not undertaking thorough examination of the problem instead of knee-jerk reaction to the media. Clearly they didn’t as proven by their recent reconfigurations and I’m sure much more to follow.

Bottom line is the developers and builders will follow the “easy” money so regrettably many will leave the Province creating a nightmare shortage in years to follow.

I agree, and that’s our fault. Anyone who makes a critical life/financial decision on the basis of such a vested interest option is not employing critical thinking. And yes, suck and blow is all part of the sales game. Speculative mania has a way of bringing out the worst in all of us, including realtors.

I miss your posts, BTW. Always enjoy reading your content.

Well said oops.

The results highlight just how financially stupid Albertans are.

Thanks for the update Leo. So nice to have your interpretation of the RE news!

I have no problems with the tax dinging “vacation homes” in these areas. If someone can afford to leave their place unoccupied they can pay the up to 2% tax. Otherwise, sell the place. I will be so glad to see some of the people I know (and don’t know) forced to declare income from rentals though.

If I was affected by the tax, I would still be worried it could go up in the future. Fed/prov governments, bank, bringing in more and more policy to stop the madness. So if this doesn’t work then why would anyone think they wouldn’t just try the next thing or up the tax?

Local Fool: “Regardless, the real estate industry isn’t to blame IMO, we are.”

<<<<<<<<<<<<<<<<<<<<<

Ultimately, you may be right but haven’t we been taught to review the facts in order to determine a course of action.

When people are buying homes what better source of facts regarding the market than newspapers and T.V. News.

Where do these purveyors of truth get their information? Exactly.

I don’t think “Fake News” even became fashionable until Trump. Yes, some people have the wherewithal to dig a little deeper than Global T.V. and the Times Colonist but evidently not too many.

So yes, the FIRE industry and particularly real estate associations are to blame.

How often have we heard about the “other bid” during a purchase. How about “in this market you had better buy first and then sell your place later. No problems, it will sell.”

The kids today are going to get hit hard and more legislation will be the answer….and that’s rarely positive.

Leo: The most significant amendment was to exempt most rural and vacation areas that were captured by the tax before.

…/////

Well, a much bigger amendment than exempting Gulf Islands was reducing the whole tax by 75% for BC residents and by 50% for other Canadians. The tax is now so small that it will likely generate little to no revenue to the Government after expenses. And the tax is now so small that most will pay it, so that few vacant properties gets freed up anyway. I predict they’ll try it for a year, realize it’s generating and accomplishing nothing, then scrap it.

A few Americans and Albertans will get hit hard with the 2% and sell. That’s BC’s loss, we gain nothing from that.

“The argument that we need immigration to replace dying baby boomers does not hold water because technology is replacing jobs faster than the boomers are retiring.”

Like it or not population in the CRD and the rest of Canada is going to grow as indicated by Statistic Canada. People are living longer hence there will be a need to have younger people to take care of the old folks, and build houses for them to live in.

http://worldpopulationreview.com/world-cities/victoria-population/

https://www.waterloochronicle.ca/opinion-story/8351085-plan-to-live-to-100/

I hear you, but the reality is Richard’s profession is entirely unchanged from what it always was and always will be: an outfit to generate sales by any lawful means that will not draw excess ire from the masses. Add in soothsaying and a sense of urgency, and viola.

Market in a panic? Don’t worry, everything’s fine. A great buying opportunity! Market in a mania? Buy now or be priced out forever!

Ho-hum, tried and true tactics that work great on mindless crowds and the uninitiated. Regardless, the real estate industry isn’t to blame IMO, we are.

Oops,

Best post on here in ages. The pigs at the trough can’t handle the thought the slop has finally run dry and they have to actually get a real job. This is just the beginning.

richardhaysom@ymail.com: “There’s the problem right there, the government is making policies responding to “media stories” instead of getting out there and fact finding for themselves. There is no accounting in the media, they are all about ratings and 24hr. cycles, talk about “tail wagging the dog”.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

C’mon Richard, your professional counterparts can’t suck and blow at the same time. Real Estate Associations have been manipulating the markets through the media since this bubble started forming. Nobody in the FIRE industries were complaining about the “fake news” regarding hired people in lineups for condos or perceived Chinese buyers in a helicopter over White Rock picking out homes from the sky. How many realtors were bleating about the Foreign Buyers tax pushing the “yellow peril” out to the suburbs and wow … guess what happened.

Global T.V. pushed the FOMO that your profession created and blew out of proportion and the Housing market turned into a historical portion of Canada’s GDP.

Now, you are simply reaping the “rewards” of your association’s actions.

The FIRE industry was so convincing in their sell that Canadians took on such historic debt that the Federal Government took action, OSFI took action and now Horgan has listened to the the citizens of B.C. regurgitations of the FIRE industry’s hard sell and he has taken action. Stupid but expected.

I guess he could have simply waited for a little bit and used Alberta as a guide. It sounds like the hard sell was particularly effective there, as well.

http://www.cbc.ca/news/canada/calgary/alberta-debt-survey-mnp-interest-rate-insolvency-worries-1.4488126

“Nearly half of Albertans say they’re $200 away from not being able to pay their bills, survey suggests”

‘The results highlight just how financially vulnerable Albertans are’

@Patriotz

“And if you’re trying to imply that the locals won’t have anyone to build for them, well nobody’s going to turn down business in their own back yard.”

Like it or not, it is basically speculators that get these high rise condos under construction. The builders don’t start till at least 50% are presold usually 60%. Their financing is predicated on that many being presold. I don’t know of too many first time buyers that are prepared to put a deposit down for something that won’t be built till 3 years later.

@Leo

I’m here till April 7 and will be back approx April 24 for 10 days.

He doesn’t have anything I would describe as aggressive or a stance. His ADD is so bad that his policy changes depending on who’s currently speaking to him. Regarding the energy future of the world, I’m actually quite protectionist. It doesn’t make sense to ship energy around the world and deal with all the geopolitical controversy that comes with that when there’s plenty of energy to be had where it’s consumed. Then there’s that whole global warming thing.

Stoked to hear that dollar volume is at 2015 levels.

Sounds like you’re arguing that absentee buyers are major culprits in BC’s overheated RE market. If so, that’s a justification for the tax. And if you’re trying to imply that the locals won’t have anyone to build for them, well nobody’s going to turn down business in their own back yard.

When are you in town?

There were 25,502 empty homes in the census. The methodology included homes that were unoccupied or occupied by temporary or foreign residents. So homes rented out to students who declared a primary residence elsewhere were deemed vacant so the numbers were already off if you are trying to find homes that are actually empty.

https://www.straight.com/news/738256/empty-homes-not-issue-vancouver-urban-futures-think-tank-says

The City of Vancouver projected, based on the census numbers and other data that the tax will raise $2.2 million per year.

Looking at the stats so far it seems that the actual number of non-exempt taxable properties will be in the range of 3000 or so. And you can bet that of those who are assessed, many will find ways to become exempt for the next year. They are not going to cover the costs of set-up and administration imo but we won’t have final numbers until the fall and perhaps the whole program will be replaced by the speculation tax anyway.

Say Leo, anything further on a HHV get together ?

“that will address most of the stories that have surfaced in the media”

There’s the problem right there, the government is making policies responding to “media stories” instead of getting out there and fact finding for themselves. There is no accounting in the media, they are all about ratings and 24hr. cycles, talk about “tail wagging the dog”.

.” If they want a vacation property they can buy in a district which isn’t subject to the tax.”

Yes, well that’s exactly what they did do and then whamo along comes the “Speculator Tax”.

“If there is a real concern perhaps it is that we have a government that is pushing through legislation based on optics rather than any idea of the basic facts”

Absolutely correct….reminds me of Alberta’s Ed Stelmach and his ridiculous autocratic revision of the royalty fees irregardless of existing contracts and then all the oil companies just left the Province for Saskatchewan. With such uncertainty and confusion I suspect many of the builders and developers here in BC will likewise get out of Dodge as a huge portion of their targeted customers won’t be buying out of fear of government overlording.

LeoS:

The policy for the empty home tax was predicated on there being 25,000 empty units and that was how it was presented by the politicians. The legislation though affected less than 3,000 and it leads one to question the necessity and cost of implementing the legislation. The need for the legislation and the bureaucratic machinery put in place was never based on an assumption of 3,000 units.

I am not misrepresenting the fact that the politicians clearly said that they had to address the fact of 25,000 vacant units and that this large number was the reason behind the legislation.

Patriotz pointed out you are misinterpreting the numbers in Vancouver, no spin there, and no rudeness.

The dollar volume of sales has taken a significant hit in the housing market this March. We are now back to about 2015 dollar volumes. That means there is far less money rolling through our local economy than in the last three years.

So allow me to predict that our vacancy rate and unemployment rate will rise slightly in the next few months. They won’t be at disaster levels but I predict they will be higher.

Patriotz:

You are right but, probably unintentional, you are making my point. They are making policy based on figures that they dont understand. Not to be rude, but it is clear that you are an excellent spin doctor.

But lets not get into an argument and I will be polite in future and just skip reading your posts.

Leif:

The basic numbers speak for themselves. We have immigration of about 300,000 which accounts for virtually all of our population growth. We need to build a new city the size of Victoria each and every year to keep up with the growth. It is an inconvenient truth.

The argument that we need immigration to replace dying baby boomers does not hold water because technology is replacing jobs faster than the boomers are retiring. In the last ten years Canada’s manufacturing output has remained stable but the jobs in manufacturing have been almost halved.

One only has to consider the job impact of driverless vehicles to see the impact of technology.

“What sticks in my mind is Vancouver’s empty home tax where the original estimate of 25,000 dwindled down to 3,000.”

These are not measuring the same things. The 25,000 number was for dwelling units that are either vacant or occupied by temporary and foreign residents. A dwelling unit is any place to live with its own entrance. The Vancouver empty home tax applies to vacant properties. A property is something with its own title. For example, a house with an empty basement suite has one empty dwelling, but it’s not an empty property. Likewise a house with a basement suite that’s an illegal short term rental which is officially “empty”.

https://www.straight.com/news/927761/city-vancouver-report-reveals-25495-homes-either-empty-or-used-temporary-and-foreign

What I am finding is that there is a lot of spin from all sides on this issue of the speculation tax. it is mostly spin because nobody knows some of the basic facts such as how many properties are actually owned by foreigners and how many are owned by non BC residents. What sticks in my mind is Vancouver’s empty home tax where the original estimate of 25,000 dwindled down to 3,000.

The government has mad a policy change that vacation homes particularly for non residents and foreigners while be discouraged both for existing owners and future owners. This may be a good or a bad policy decision but to pretend that a lot of these properties where not bought by Americans as vacation homes is simply spin. Moreover, until recently all levels of government were promoting vacation homes in BC. Frankly, ten years ago people would have laughed at the thought that Sidney was part of an urban area.

Lets not pretend that the vast majority of American and ROC buyers bought as anything other than vacation homes. This whole argument as to whether they are speculators is seriously foolish in that it ignores the primary motivation. Nor is it really relevant from an economic point of view. The actual use of these properties is as vacation homes. This does not mean that the policy is either good or bad but rather that there will be economic consequences as we lose these long term tourists. This does not mean that the negative impact of losing some existing long term vacation homes outweighs the advantages of putting more properties on the market. The simple fact of the matter is that this is basically a stab in the dark by the government and I doubt if anyone in the government has a clue as to what the impact will be.

There will also be some impact, be it great or small, outside the designated areas on vacation home sales since we have clearly set a precedent of taxing non residents at a different rate and at a high tax.

Moreover, our precedent clearly does not grandfather foreign purchases. Basically if you are an American that wants to buy a condo in Whistler you should at least take into account that you might be forced out by taxes if the government needs more revenue. Most people on here would argue that this is far fetched but I have spoken with two sets of friends in LA who have actually put their Whistler condos on the market figuring that it is better to sell now before they are taxed out in the future. Again this does not mean that the legislation is bad but there will be some secondary consequences and to pretend otherwise is foolish.At the moment the BC economy is booming and it could well be argued that any secondary impact is trivial. On the other hand should the economy revert to were it was ten years ago the impact might seem less trivial and not easily reversible.

If there is a real concern perhaps it is that we have a government that is pushing through legislation based on optics rather than any idea of the basic facts as to even the number of properties that are involved or any real economic analysis.

A few interesting articles

How is this possible that the entire North American market has entered into a magical low inventory world? The only reason I can see this happening is massive immigration or speculation. As far as I can see supply has been going strong for years but demand is out pacing it. Not demand for liveable houses but demand for an increasing and tangible asset.

“The 20-city composite rose 6.4% from a year ago, and after seasonal adjustment it posted a 0.8% month-over-month increase, beating analysts estimates of 0.6%. Low inventory of homes for sale continued to drive prices.” (USA)

https://finance.yahoo.com/news/home-prices-start-2018-rise-130002195.html

Standard & Poor’s said that its S&P CoreLogic Case-Shiller national home price index posted a 6.2% gain in January.

And

Westbank and bosa sell a property to Hong Kong based company for $105 million.

https://www.theglobeandmail.com/canada/british-columbia/article-105-million-real-estate-deal-reveals-hot-vancouver-markets-inner/

Seems very simple to me. The most significant amendment was to exempt most rural and vacation areas that were captured by the tax before. That doesn’t make it more complicated.

I believe that a vacationer that buys a property in an urban centre is motivated at least partially by speculation. So yes I believe this will target some speculation.

As for better approaches, I don’t know what that would be. A tax on flippers would also have problems (discouraging renovations for example). What would you propose to target speculators?

Yeah that is going to be a huge problem. They can relax regulation to bring down costs but can’t do much about materials.

Seems like all that money sloshing around the world is finally causing what everyone feared a decade ago