The specuvestors

Despite several million thoughts on the matter, it seems that we haven’t been able to agree on what a speculative investment in real estate actually is, let alone how a tax might be designed to stop it. The discussion in the previous thread has revolved largely around owners of vacation properties in areas covered by the new speculation tax that don’t have a housing problem but may still get unfairly caught in it

While it’s critical to ensure that any anti-speculation measure is well thought out, I do think this is somewhat missing the point, since these people are obviously not the target of the tax. Hopefully changes will be made to avoid this kind of collateral damage, and it seems that is happening already. That said there will be unintended consequences no matter how much they try to fine tune it and it is still up in their air whether this tax will be effective and whether it will be politically favourable for the NDP.

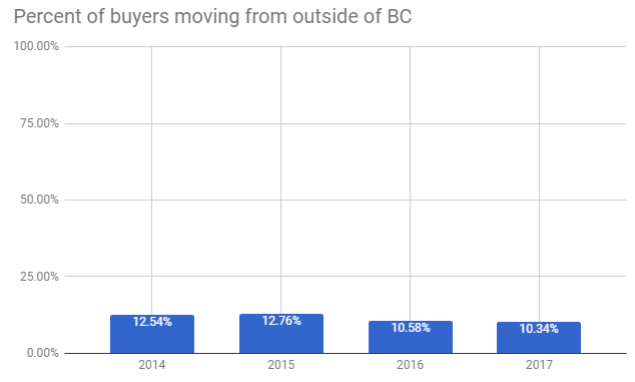

So who is the real target? Premier Horgan has said that BC residents are not so I believe we can be fairly confident that the poor schoolteachers out there with a few vacation homes will fall under one of the special case exemptions. How many out of country and out of province speculators are there that the NDP are trying to target? The truth is, we really don’t know. We know that the rate of out of province buyers (at least those moving directly from out of province to Victoria) is relatively low, at about 11%.

That doesn’t really tell us a lot. People are moving here, but it seems to be relatively constant and who knows if they are buying second houses or moving their principal residence.

Luckily there is a another data point to investigate. After every sale, REALTORs® are asked to fill out a survey about the buyers they were dealing with. That started in 2010 and while back then there were only 1300 responses to the survey (a response rate of about 20%) it has been improving recently to being collected on nearly 50% of sales. I am not qualified to tell you whether the survey is statistically valid, and the way the questions are worded certainly leaves something to be desired, but it’s the best we’ve got.

We’ve looked at financing data from this survey before, which illustrated how the 2016 stress test forced more people out of high ratio and into conventional mortgages in order to qualify.

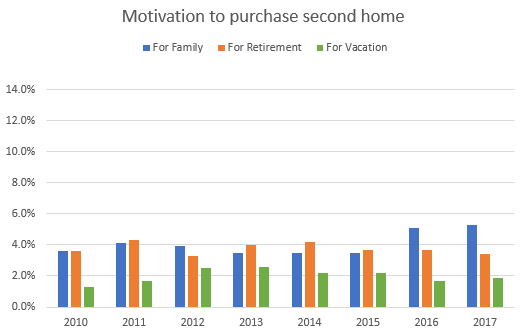

Another question asks: What was the primary motivation of the buyer(s)? Outside of things like wanting to enter the housing market or upgrading/downsizing there are also several categories for second home purchases:

- Buying a second home for use by family member(s),

- Buying a second home for future retirement,

- Buying a second home for vacation use, and

- Buying a revenue property as an investment

The percentages of the first three categories have been pretty constant over the last 8 years. Purchases for family have ticked up a bit in the last couple but overall vacation home purchases are less than 2% of the market and a second home to retire in around 3.5% of sales.

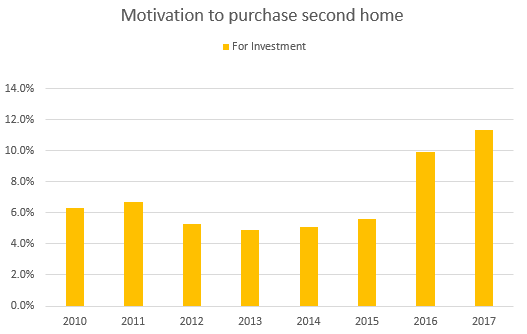

Then we get to the investment category and things look a little different.

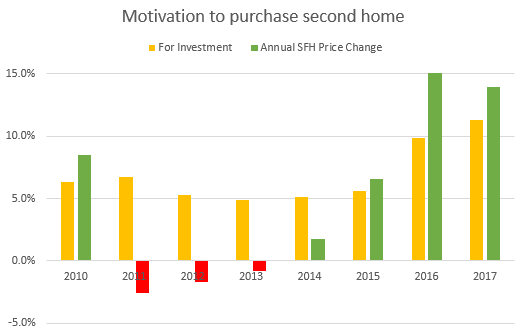

From a rate of about 5% of purchases being for investment purposes from 2010 to 2015 we jumped to 11.3% in 2017. Investment has been a big part of the market in 2016 and 2017.

If we look at what happened to house prices in this period, we can see that investors are reactive to market conditions. That is investment purchases were depressed when the market was slow, and they picked up only after it was clear that prices had taken off. A less polite way to say this is that sheep follow the herd.

The line between speculation and investment is usually defined by the expectations of the investor. If your return depends on prices continuing to rise then you are a speculator while if you are buying a house and the rents alone give a good return then you are an investor. Given the big increase in “investors” during a time when the investment case actually deteriorated in Victoria, I would speculate that most of that increase comes from speculators.

What’s interesting is that rental vacancy didn’t increase despite all that investment, so either the new rentals are being soaked up by increased demand, or many of these investments aren’t landing as rentals.

It still doesn’t tell us how many of these new found investors may find themselves facing a speculation tax, but the number of new listings going forward should give us a clue on that front.

By the way, should we have another HHV meetup now that the market is giving us something to talk about?

You don’t have to live in a house for it to be a primary residence. You or your family just have to occupy it at any time of year. If you move out and rent your home, you can continue to treat the house as your principal residence for four additional years. The rules are pretty generous.

People who live in and renovate and sell houses after less than two years and have a pattern of doing this run the risk of losing the exemption and being treated as a business.

Interesting article on Chinese real estate buyers and avoiding taxes.

https://www.theglobeandmail.com/real-estate/vancouver/out-of-the-shadows/article31802994/

As I mentioned before I’m sure lots of people are marking their homes as primary residences even if they do not live their to avoid taxes.

On the tax front, records suggest that the clients classify some of the properties as their principal residences, even though they do not live in them. That’s despite the fact that Canadian rules stipulate that a taxpayer cannot call a home a principal residence and sell it tax-free, unless they purchased it to live in it, and didn’t sell it within the same year.

“If you are buying and selling these homes as a business practice, that is business income and it’s taxable,” says Toronto-area accountant David Cramer, one of several experts The Globe consulted while reporting this story. He suggests that both Mr. Gu and his clients should be declaring that income. “If these guys paid proper taxes, these transactions would not go on as they do,” he explains. “It wouldn’t be nearly as profitable as it is.”

Tax lawyer Jonathan Garbutt estimates that the tax revenue lost through such activity is massive, particularly in pricey Toronto and Vancouver. “I think this is yet another example of non-enforcement of penalties under the law. It’s pervasive and it’s systematic,” Mr. Garbutt says. “Unless it changes, this will get worse. We will have a corrupt system.”

Yeah great weather. Was so nice I didn’t even read any comments all weekend.

Weak sales though. 158 shown as pending for the week at the moment rather than the ~180ish I’ve been seeing lately. Should be increasing, not decreasing.

Victoria borrowing awesomeness on the decline as the credit noose tightens. Investment in western Canada on the decline and pouring into US via BNN.

Via Steve Saretsky this morning :

“What the bank failed to mention was that mortgage growth not only decelerated over the past three months it actually turned negative in January, dipping 0.012% for the first time in six years. Suggesting a declining willingness of households to borrow, or from banks supplying less credit. “

As we all wait for the Monday numbers.

How great was the weather this weekend!

Pure Victoria awesomeness.

I also think the two houses are overpriced, particularly the one on Moss. But I am not an expert. What part of town do you think you might be working in. I also would wait to see if there is a price correction or at least better selection as the summer goes on. People on here and some knowledge people I have talked to really question the quality of some of the new builds.

“Hi all, I’m looking to move from Vancouver for a job in Victoria. My wife is interested in a new home in Victoria and we are looking at a couple options in the core.”

I’m not an RE agent so my 2 cents may not worth much.

It is essential for you to get a house in Victoria Core, near bus routes, school, shopping, hospital, and parks important to you? These are the questions that you might want address when look for a house.

Like others has mentioned that is to rent for a few months. Wait and see which direction the market is heading to, and more importantly is that it give you time to find the neighborhood that suit your lifestyle.

As for the houses in the links you provided. IMHO, they are over priced.

Advice for fair price

Hi all, I’m looking to move from Vancouver for a job in Victoria. My wife is interested in a new home in Victoria and we are looking at a couple options in the core.

House 1: 106 Moss Street $2,048,880

https://www.rew.ca/properties/388322/106-moss-street-victoria-bc

House 2: 1513 Bank Street $1,598,000 (recent price drops)

https://www.rew.ca/properties/388556/1513-bank-street-victoria-bc

We are looking more at the 1.2-1.4 range but was wondering what everyone thinks a fair price for these properties would be since some of you have already seen the places in Open Houses? With the new NDP rules on real estate, it seems like prices should come down more? I know the Bank Street place has had a few price drops already.

Another good reason for the suite upstairs is for a distant owner living there when they visit and the rest of the house is rented out.

Suite near (right above, right under, or right next to) main house bedroom is a terrible design, unless you have super sound proof installation or concrete floor/barrier. That is one of the main reasons we stay away from condo living so far, not because the size, but the noise (= sounds you don’t want to hear or don’t want others to hear).

You seperate the two by putting the staircases back to back and the other side you seperate with laundry/bathroom. The seperation in a solid design is two staircases, ensuite, walk-through closet and the master on the very back.

As for condo living. In three years at the Bayview I literally never heard any of my neighbours once and it wasn’t top floor or corner unit. If you buy in a quality building privacy is excellent in my opinion. Far better than a new SFH subdivision where you can’t wash your car without everyone staring at you.

Totoro, you are right. I will be interested to hear the actual breakdown when they have better numbers.

http://www.cbc.ca/news/canada/british-columbia/empty-homes-tax-1.4566199

This says there are roughly 200k residences and, even if the end number is half of the 8000 that didn’t get an immediate exemption, that is roughly a “empty home” rate of 2%. How many of those will be pushed back to market?

It will be interesting to see if the benefit to the housing supply is worth the pain for legitimate homeowners. Especially considering that in most areas of the city, the “empty home” rate is far lower than that.

It is too bad that we didn’t wait to see the results in Vancouver before pushing it over larger areas of BC.

Suite near (right above, right under, or right next to) main house bedroom is a terrible design, unless you have super sound proof installation or concrete floor/barrier. That is one of the main reasons we stay away from condo living so far, not because the size, but the noise (= sounds you don’t want to hear or don’t want others to hear).

Unoccupied/underutilized is inaccurate. It includes exempt properties (someone died/in hospital/can’t be rented under strata bylaws) and the 2500 owners who did not respond and were deemed vacant, as well as whatever owners declared vacancy.

We won’t have final figures until the fall. They should have released the number of actual vacant properties vs. exempt vs. undeclared and not included them in the same category for greater accuracy imo and that would have been an easy thing to do.

Right now no conclusion can be drawn about the numbers except they are far lower than projected.

where they put the suite upstairs! I can’t think of many things worse than having your tenants or in-laws upstairs on the same floor as your bedrooms!!! Those developers were sniffing glue when they came up w/ those designs. Are you f*king kidding me?

I absolutely love the suites upstairs. If I ever build a house again 100% going suite upstairs. It is much easier to insulate for sound horizontally versus vertically. If the suite is upstairs you place it above the garage/office or den. You still get main floor living in the main part of the home. You keep the home two level so you don’t need sewage/storm ejections pumps, etc., etc.

Not to mention the suite itself is a lot nicer.

Interesting numbers out as part of Vancouver’s Empty Home Tax declaration.

The majority of the 8,481 unoccupied/under-utilized properties are condominiums, which account for 60.6 per cent of this figure. Single-family residential properties account for 33.5 per cent and multi-family/other properties for 5.9 per cent.

http://mayorofvancouver.ca/news/more-98-cent-homeowners-declared-empty-homes-tax-deadline

Went to the open at Moss St. yesterday – fish bowl living and also is just like 1513 Bank St. which still won’t sell btw, where they put the suite upstairs! I can’t think of many things worse than having your tenants or in-laws upstairs on the same floor as your bedrooms!!! Those developers were sniffing glue when they came up w/ those designs. Are you f*king kidding me?

Try going to bed early for work the next day to pay for your flat roof $2m crap box while your tenants are creating a racket next to your bedrooms?! WTF!

Sorry, just getting through my first cuppa this morning… but… WTF!

Penguin:

I had a friend in Toronto who started with a 1950 box house who lovingly transformed it into a very beautiful home (albeit with years of labour). He always said that the basic secret was to start with the right lot. There is little point in trying to transform a house if you are sitting in the middle of a row of 1950 boxes. Some of the things he did were cleaver and not outrageously expensive. The example that stuck in my mind was when he added shutters to the windows but he put in full length shutters that ran from the top of the window to almost ground level. Under the window he put in a decorative wood panels (painted white) that where made from plywood and molding trim. It virtually transformed a boring box into a much more elegant feel. By the way he built the panels himself.

For all you flippers out there it looks like someone gutted an OB house at 640 Oliver St and is possibly stuck financially. Just got relisted and slashed $139K to $1.26 mill. Bring in your low balls.

Someone here was wincing at the cost of a new roof the other day. To correct a number (but not all) of the design and load-bearing errors at Falling Water the bill was $11,500,000.

Frank is my favourite, but the man knew absolutely nothing about engineering.

Barrister:

I’m a millennial but those are my tastes too. I would love an old character home. Unfortunately the 50s -70s tear down is in my future. I would take old over new any day. I would love to see your house. I’m sure it’s beautiful!

Haha. I had heard the balconies needed some re-engineering as well. I do admit that it is still very pretty, even if Frank Lloyd Wright didn’t have the engineering knowledge to make it work to modern standards. Such is the curse of creating a new style.

I think this is often the tension between architects and engineers. One dreams up the art, the other has to make it stand up and stay dry. Lots of respect for both professions.

While I appreciate a lot of different styles, what I want isn’t really common in Victoria:

https://www.google.ca/search?q=traditional+japanese+house&tbm=isch

The owners of “Falling Water” said that the name was appropriate because, in spite of countless repairs, the roof was always leaking.

My tastes simply never ran to modern but different strokes for different folks. One of the nicest looking houses in Victoria in my mind is Fairholme Manor. Elegant yet bright and airy.

@Barrister

I totally agree with you. I’m feeling less pressure right now anyway. I also feel like it wouldn’t be so bad renting for a while longer because the alternative is an 800k tear down that would make my life much more difficult than it is now. Hopefully new inventory brings out some better selection. I wouldn’t hesitate buying if something came along for the ride to price though but those properties get snatched up pretty quick currently due to lack of inventory in this price range. I was definitely seeing a change until the crazy end of the year scramble hit and new rules kicked in.

Wow. Thanks for the link, CS.

Barrister, very few modern designs are as nice as some of those iconic originals. I occasionally see some impressive newer ones but, while I can appreciate them, my tastes run in other directions. It is remarkable what a huge influence Frank Lloyd Wright has had on modern architecture.

Nice to meet you too Barrister, and your lovely wife.

True we all have flaws. Even me 😉

True, your predictions of RE demise have been wrong for a long time but perhaps your day has finally dawned!? There are so many new Government engineered headwinds I’m going to be surprised if Victoria RE continues to gain. How well will it hold up is what I’m wondering? Given the continuing scarcity of anything decent, continued population growth, and the economic conditions and living standards here, if one can afford it, continue to exceed the rest of the country.

Nice to meet you Paul and thanks for your opinion on the open house.

Penguin:

No science to it, but I generally found that the best house deals were in October and November but, on the other hand, the selection is the left overs from the summer. At this point I suspect that there is a stronger chance for prices to decline than to climb. But it really is a bit of a guessing game.

I was having mega FOMO the last year but I’m actually happy I didn’t jump in to anything. I’m also thinking it may be wise to wait until at least next spring. How much higher can prices really go? Lots of inventory coming on and looks like there are some hopeful sellers. They won’t be getting my business though. Maybe some of these houses will still be for sale next year for a discount…

The two flat roof boxes where at 106 Moss St asking 2,050,000 and at 2413 Mowat at 1.950.

Neither of these seem as charming as Falling Water to me but others might differ.

@ 1 and F

“I would pay 2 million for this flat roof box”

Amazingly, you can buy a bunch of genuine Frank Lloyd Wright houses for a bit less than 2 million a piece.

https://www.elledecor.com/celebrity-style/luxury-real-estate/g9917182/frank-lloyd-wright-houses/

Looking at prices of new listings in OB confirms that hope springs eternal. No. 6 says inventory is rising, which suggests that some vendors face disappointment. But insofar as folks are buying, it suggests declining confidence in the Federal Government’s competence to manage the economy, which is understandable in view of the botched China trade deal, which failed because of Canada’s absurd insistence on dictating China’s gender equity policy, the uncertainty about NAFTA, the flourishing Trudeau budget deficits, the diplomatic failure in India coincident with an increased tax on chickpeas, a slumping loonie, and a BoC Governor clearly intent on letting the dollar find its own level while promising to go easy on the BoC rate as the US Fed rate climbs.

In short, I suspect that some people are expecting financial and economic Hell to come and have lost confidence in both cash and stocks, and thus are opting for boxes with flat topsies, or just about anything else with a land component, at just about any price.

So you speculate that most of the increase in investors is actually speculation caused by speculators? 🙂 Sorry – couldn’t help myself. Thanks for the great website. I have been really enjoying it for many years. Very useful.

“Btw – has Hawk ever admitted to being wrong? ”

All the time Luke if you read my posts. Unlike many others here who can’t under any circumstances. No one is perfect.

Grant,

5 year fixed in particular are tied to US bond rates. It’s been well documented on many financial websites, no smell test required.

Interesting I was reading that even if your bank gives you a rate deal, the stress test is done based on 2 points above the posted fixed rate not at your deal rate.

“And that’s where we are going this year unless there is a substantial rally in the market”

I agree. I think we have now passed a “Point of no Return”. It is very difficult to imagine an existing positive force that could reverse or even stall the negative forces that have started to move against the real estate market in this country, including Victoria.

Curious Barrister where are these? There’s one on Mowat in North OB just came up on only a 4720 sq ft lot. For $1.95m + GST!

There’s often predictions the loonie goes lower. This could mean more FB interest despite taxes and closing loopholes. Esp if it goes to 60 cents.

Re Narrcism. Not sure if Introvert is one but if you ever have the misfortune of running into these people who can never be wrong it’s just best to avoid them as much as possible…

Btw – has Hawk ever admitted to being wrong?

Payout ratio’s a little high. If you’re buying, I’d protect yourself with a stop loss somewhere under gap support, which is at ~31 on nyse.

Last month the months of inventory on Salt Spring Island was 11.0. In the Malahat area it was 5.4 and in Sooke it was 4.9. Most often a market will contract from the outer areas into the inner core over time. As home prices in the different neighborhood are relative to each other, as prices decline in the outer areas that decline ripples back into the core areas.

We also have a price ceiling in the premium areas that is causing inventory at the high end of the market to increase. Victoria, Oak Bay and Saanich East had 4.3 months of inventory last month. As prices decline in the high end that will put pressure on homes lower down on the property ladder to decline as well.

And that’s where we are going this year unless there is a substantial rally in the market. And that’s a good thing as prospective purchasers will have lower prices and more selection.

And so the market pendulum swings.

Well, I would pay 2 million for this flat roof box:

https://en.wikipedia.org/wiki/Fallingwater

Yes, you’re correct. Early Saturday am, and no coffee. Besides, in my post below, I just wanted to say the word “poppycock”.

Doesn’t a weak dollar boost our exports?

One would have to be pretty naive to think that Canada will not raise bond yields if the US continues to do so. If Canada does not follow the US then our entire economy is at risk. Canada has to follow the US in order to maintain foreign investment.

“Bond Yields and Fixed Rates (Positive Relationship)

Generally fixed rates have a positive relationship with bond yields and increase and decrease along with bond yields. In other words, when bond yields increase, fixed rates increase, and when bond yields decrease, fixed rates decrease.”

Canada’s 5-year bond yields have been on the rise for the past year to follow the US. Yes, I agree, the BOC is between a rock and a hard place. But for the most part, they will have to follow the US lead. Mortgage rates will rise potentially devastating the Canadian real estate market. IMHO the Canadian real estate market is already in correction/crash mode and has been for some time.

If a tree falls in a forest and nobody is around to hear it does it make a sound? Well, the entire forest is falling but nobody is listening……yet.

This is one of a few reasons that, “they won’t raise rates because no one will be able to afford their homes” is essentially poppycock. It proceeds from at least two false assumptions namely, that the BoC operates in isolation and wields the ultimate power in what interest rates are, and, that the rates they do post are made to ensure that folks that overpaid on homes will still be able to make those payments. History actually demonstrates this is not the case.

We are the little guys being pulled around by Uncle Sam. If they go up, soon after we will too. Poloz will deny that, and that “Canada will chart its own course”. And here and there, we will. Last Wednesday was an example. But it won’t diverge much, for long. The boost effect to our imports from a cratering dollar didn’t really happen, and I’m not sure there’s any evidence to suspect that that will somehow reverse itself now. Canada is becoming less competitive, not more.

I did not, and should have, but it would have a pretty minor impact on the overall results.

I wasn’t aware of it… sounds like me to re-invent the wheel when other resources are available! That spreadsheet is pretty slick and useful.

I noticed that a couple of new built, flat roof boxes have come in the market. What struck me is that they are listed for over two million. Not on the water, in fact not even a glimpse of the water. Small lots. Has the world turned insane. Who in their right minds would pay two million for these.

My first reaction to Hawk’s comment that Canadian “mortgage rates are controlled by US bond prices” was that it didn’t pass the smell test. However, it turns out to be more or less correct:

Fixed rate mortgages would rise as they are tied to long term Canadian bond prices, which are ultimately tied to the long term U.S. bond prices. If the U.S. Federal Reserve raises rates, bond prices would fall. Banks sell bonds to raise money to lend to customers in need of mortgages. In the past, bond rates in Canada have risen when there has been a rate hike in the U.S.”

https://www.ratesupermarket.ca/blog/what-can-happen-if-the-u-s-raises-interest-rates-before-canada/

Richard,

If Trump blows up NAFTA which has high possibility, the loonie will go to record lows along with instant recession and rates won’t matter. Don’t think many understand the implications.

“I think track records are more useful than you wish.

I don’t wish anything. Just don’t see the connection between a price prediction and a discussion on, say, whether a spec tax is or is not fair and reasonable.”

Looks like Intorovert’s narcissism is out of control again and needs a therapy session. Narcs cannot handle being wrong,ever. They actually get extremely scary when threatened they are proven wrong or soon will be.

“I”m right,I’ve always been right and always will. Please Marko tell me the numbers I want to hear so I can prove again I am right again”.

Pretty sick.

@Hawk

“US bond market controls Canadian 5 year rates and they are hiking 4 more times this year.”

Yes Canada most times follows the Fed. But I predict they won’t this time. If the Fed goes 4X I predict BOC will only go 2. By the time the Fed is on 3 or 4 our economy will have seriously deteriorated and BOC will let our $ slide to give some support to our exports which is predominantly for Ontario/Quebec where the recession will be felt the most. The housing crisis in Ontario will be so dire by then not only because of OSFI but the repercussions of the Ontario16 point plan and the hydro fiasco that there will be immense pressure to avoid further disaster by minimizing the impact of BOC rate increases. Let’s face it Ontario drives BOC policy. Yes and as I said before this is the reason why I predict our $ tanking to 70c range and possibly lower.

Genworth doesn’t need backing by the US government but for some reason a company providing high ratio insurance in Canada has to be backed by our government. And that’s money into the federal governments purse while protecting the Canadian banks from a high ratio insurer going bankrupt.

Sweet deal.

And yet there is no private competition to CMHC (no, Genworth is not private).

So it seems the ripoff in fees is still below what the free market is willing to price the risk as.

Right. And you are free not to buy into the argument. If it ends up being incorrect then clearly there was some factor not taken into account.

I don’t wish anything. Just don’t see the connection between a price prediction and a discussion on, say, whether a spec tax is or is not fair and reasonable.

Absolutely, CMHC fees are horrendous. And unlike in the USA, if in three years you refinance down to a conventional size mortgage you are NOT reimbursed for the remaining unused years of insurance. In the USA they rebate the unused portion.

High ratio insurance fees are a total rip off in Canada.

Oh Leo. Some people have been logically reasoning that prices will decline a lot for a decade now (they haven’t).

Many people here have written brilliantly supported theses on the future of this market—and been totally and utterly wrong.

I think track records are more useful than you wish.

Grant,

Did you factor in yearly rent increases (normally allowed max is 2%+inflation, so 4% for 2018, and …) in your sheet?

CS:

Older is better is one of the things we tell ourselves as we age to make ourselves feel better. But you gave me a smile today and cheered up the day.

Like I said, track records have no bearing on the validity of an argument based on logical reasoning. The argument either makes sense or it doesn’t on it’s own merits. The nice thing is that people with very poor track records also often make very poorly supported arguments.

Now if someone is making an assertion without any evidence or reasoning, then you would look at their track record to determine their believability

Grant, have you seen the wait or buy spreadsheet on this page? https://househuntvictoria.ca/resources-2/ Bottom of the page.

It’s a few years old at this point but should all still work. It does very similar things to what you have presented. I find it very useful because in reality most people want to determine whether to buy now or buy later, not whether to buy now or buy never which is how most calculators are structured.

@ Barrister

“I am still amazed at the price that people will pay for a tear down.”

It’s like the difference between and ten-year-old Saab with 50K on the clock and a new Honda Fit at twice the price. Most people, for some reason, prefer new stuff. Age is probably a factor in such choices. The older one gets, the better old stuff may seem.

If you don’t feel comfortable answering it, that’s fine, but please let me know so I’m not waiting endlessly.

Let me put it this way. I see CMHC files so rarely that I fall out of my seat when I do see one because of the insurance fee amounts. The insurance fees are insane with the last increase we had. Last one I saw last year was something like 18k. Makes sense to get gifted money from family.

Hi Marko. Could you please answer my question when you get a sec? Here it is again:

If you don’t feel comfortable answering it, that’s fine, but please let me know so I’m not waiting endlessly.

Looking back to last year it doesn’t look like anyone called the election and its final outcome right – I thought the Liberals would squeak through with a majority myself. So let those who always predict correctly throw the first stone.

Richard,

US bond market controls Canadian 5 year rates and they are hiking 4 more times this year. Recession is inevitable and part of the business cycle of 8 to 10 years. We’re there now.

@Grant

“Now for guessing what the Victoria market will do, I took the (majority) expectation of slowly rising interest rates,”

I do not agree that interest rates will continue to rise. They may go up a maximum of 1/2% over the next 6-8 months and then they will fall as the new OSFI rules take us into recession. Rates will then come down to try and buoy up the economy. The OSFI regs are taking 20-25% of RE activity out of the market……that is huge.

It is not just buyers, sellers and RE agents that will feel this slowdown, lawyers, home inspectors, surveyors, mortgage Co’s photographers, staging Co’s, reno and furnishing, tradespeople, advertising, etc. etc. also less funds into Provincial coffers from the PTT.

A made in Canada recession……..I would wait till fall before even thinking buying.

“So much of building a home is a complete expensive joke. Of course we are all distracted by foreigners driving up prices.”

Ah Marko you are so right. Before I got into selling RE I had a renovation Co. It was so easy and comparitively inexpensive then. I blame it on ever increasing bureaucracy which is built upon layer on layer of nonsense, the end result taking the cost of housing out of the reach of many.

To show how far this has come go to the Legislature Building and look for the less than dozen drawings mounted on the walls which show the complete architectural drawings back in the day for that amazing building.

Big comment warning!

If anyone is interested, I’ve just given myself a big headache by creating a spreadsheet of data that is specific to my situation and the current Victoria real estate (buy&rent) market.

My ultimate question was, purely from a financial standpoint is it better to buy now or rent initially and see what the market does over the next 1/2/3 years?

House 1: Buy a house @ $950,000, 3yr fixed at 3.44%. $380K down.

House 2: Rent a similar house as the 950K one, similar area, for $3100/month

House 3: Rent a nicer house for $4000/month

Now for guessing what the Victoria market will do, I took the (majority) expectation of slowly rising interest rates, added in the new mortgage qualification requirements & importantly the BC tax changes. All of these IMO, lead to significant headwinds facing the Victoria real estate market. I came up with the following 5 scenarios:

Scenario 1: Market shows incredible resilience and has an increase 2.5% year 1, increase 2.5% year 2, flat year 3

Scenario 2: Market is flat for 3 years

Scenario 3: Market corrects, -2.5% year 1, -2.5% year 2, flat year 3

Scenario 4: Market corrects, -5% year 1, -5% year 2, flat year 3

Scenario 5: Market corrects, -10% year 1, -10% year 2, flat year 3

Now given what has happened recently Scenario 5 may seem drastic, but that is the scenario that returns the Victoria market median values back to where they were from 2008-2015.

My buy vs sell spreadsheet looked at if I’d be better off after 1, 2 and 3 year intervals. Importantly I didn’t add realtor fees (to sell) in to the buy scenario. (For instance, to sell and exit the Victoria market.)

Also, for renting, I added in a 5% interest gain on my current equity, then subtracted taxes from the gain and the net went towards the monthly rent.

It goes without saying that in all scenarios it’s significantly better for me to buy where the market increases by 5% over 3 years.

With a flat market, it’s still better to buy in all scenarios, but they are almost equal in the first year! Year 2 and 3 the rental costs eat up what I would have otherwise been gaining in the slowly increasing principal payments.

As soon as we introduce even a small 5% correction over 2 years, the scenarios start to change quickly. The largest savings are in year 1 (a whopping $1728/month). Again in years 2 and 3 the rental costs eat into principal payments, but even so renting is still cheaper!

Now if we take a 10% correction, buying looks downright stupid – major losses. It’s a $3700/month difference in the first year, and still at $1500/month by year 3. Even with a $4000 rental I come out ahead by renting in all scenarios.

If we go with the 20% correction, my gosh, the blood letting is on. Here I can rent for $5000 and still come out way ahead.

Of course the assumption in the above is that not only am I taking a beating on drop in value of the house, but if I rent I’m continuing to earn money on the original equity. That may or may not be the case, but if interest rates are rising, in general my equity would benefit even more.

Perhaps some of you aren’t surprised by these numbers, but as a guy who has always owned and looked at rent as the dummies way to pay someone else’s mortgage, these calculations were a shock for me.

“Michael

What your opinion on Enbridge and that yield?”

Ask him about GE and its 50% tank job after gauranteeing it. Only needs 100% gain to break even. I think it’s going under.

Yep, My engineers took my overbuilt house and over-engineered it. Engineering costs $5k (maybe more, I haven’t done the math). But…. Their specs added construction costs. maybe 20k over and above what I actually wanted and what was necessary? I have twice the steel of any other ICF wall that my builder has ever done. My deck is better built than Market Square’s. Y’all know where to host the elephant party. So it’s not just the engineering cost. It’s a ripple effect. Same goes with having more expensive windows. More expensive things are more expensive to install. Unless you do it yourself but the HPO aims to prevent that. This step code has nothing to do with the environment and is just another mechanism to put more control and more money into the industry big players by making a house even more complicated to build.

Don’t get me started on rain gardens in Saanich. Somehow a home in Saanich requires a 20k rain garden but City of Victoria doesn’t….you know because the weather and soil conditions are so much different.

Basically a bunch of staff from Saanich went to some European city where they saw rain gardens while the staff from City or Victoria were in China scoping out the bridge progress.

Saanich requires interior suite access, City of Victoria doesn’t….etc, etc, it is like they just make up crap as they go.

Colwood now has a $2,800 development permit on lots less than 6,000 sqft or something close to that. It is the most ridiculous thing I ever heard of. Introduced recently. Not just just the $2,800 and a couple of months delay to building permit but now you need a designer that is going to do color renderings, 3d, etc…obviously will charge more.

the engineers to make sure it doesn’t fall down

There is no need for an engineer on a two story home on a level lot. How many character homes have randomly collapsed and killed people.

What is the point of a city inspector if he or she can’t inspect framing on a basic house.

And what’s the big deal with saving each individual tree….forest fires every year burn down half of BC and then you throw a homeowner under the bus with this arborist bs with one tree.

Etc., etc.

they throw up their arms and tell you it must be compliant (or hire an engineer to take the liability).

Been there many times and each time you can see the engineer smirking as they pretend to look at the “issue” and they hit you up for $1,000 for three sentences and a stamp the city doesn’t even read.

So much of building a home is a complete expensive joke. Of course we are all distracted by foreigners driving up prices.

Look for places like this to start killing traditional construction: http://www.bcpassivehouse.com/

While I totally agree, what can we get rid of? Need the arborists to protect the trees, the inspectors to make sure you build it right, the engineers to make sure it doesn’t fall down, the utility crews to make sure the underground stuff is correct etc. HPO is a joke.

Part of the problem, imho, is the liability mentality where everyone wants to deflect any liability to someone else. You see it in the engineering where we now have massive safety factors…because why wouldn’t an engineer totally cover themselves if there is no additional cost to them. You see it in the inspectors where if something makes total common sense but doesn’t match the letter of the BC building code, they throw up their arms and tell you it must be compliant (or hire an engineer to take the liability).

Well the step code will only add one more consultant. I would like to see the municipalities either take on this work themselves or offer reduced permitting rates to make it a wash.

Aren’t we already there (or pretty close)? Unless you’ve got an in with the trades, not many people can afford a 50K roof, 50K drywall etc.

I personally see some disruption coming to the construction industry. Mainly, factory-built structures will become more common and far less expensive. I see the market moving to a much more vertical structure where you hire a single company which does the blueprints, engineering, modelling, in-factory construction, and then on-site assembly. It’s already happening in the states and Europe. Even larger buildings can be pre-fabbed using CLT panels. If I had a bunch of cash I’d be starting one these up on the island.

A bit like some of the ‘medical’ practices you see these days where they have many practices under one roof (GP, Physio, Chiro etc.)

Yes, and we keep waiting on that downturn, don’t we?

Productivity is subjective.

It certainly doesn’t, but different people have different prediction track records.

Leo, do you like to pretend that track records don’t exist, or only that they are completely valueless?

While there is always HHV special from Mike G, if CIBC is not competitive.

Tell them you are an influential real estate blogger and perhaps they will offer you a loss leader rate!

Marko:

Soon you will need six consultants to plant a garden.

There are already energy efficiency incentives for retrofits. Thing is doesn’t make much sense to increase those when everyone is off the hook busy. You release those when construction slows down to smooth out the dip.

Also what I haven’t seen discussed too much is the new building step code that will be coming into effect and create a heck of a lot of engineering and building science work in the next decade.

Piling on legislation to make new homes only for the 1%ers.

Soon you will need 15 consultants to build a garden suite.

The thing I don’t get it will be impossible to build a new home economically but you drive down streets in some neighbourhoods and half the houses half single pain windows. Wouldn’t it make sense to try and address that as the delta between updating an old home is much higher than trying to make already energy efficient new homes even more energy efficient.

CS:

I am still amazed at the price that people will pay for a tear down. We seriously looked at tear downs in the Uplands about four and a half years ago. They were running between 650 and 800. That they have tripled in such a short time frame amazes me.

We chose to buy an old heritage house (all new wiring, new high efficiency furnace, new plumbing and up dated bathrooms) because at $208 it was simply much cheaper than building. Salaries have not gone up much and interest have remained steady up until recently so why the huge jump in real estate?

It’s a reverse form of appeal to authority and equally as flawed. If someone has been right in the past that doesn’t mean their current arguments are good, and the reverse. A logical fallacy either way.

As for construction, I talk to a lot of those companies and they are booked years ahead right now. Yes not all those projects are guaranteed to go ahead but most will even if there is a pullback in the market. So a slowdown will take while to play out.

Also what I haven’t seen discussed too much is the new building step code that will be coming into effect and create a heck of a lot of engineering and building science work in the next decade. Consultants in town are already having a very hard time finding engineers, that will only get harder when every house requires a lot more design.

Thing is, I think there is a significant slowdown underway right now that is being hidden by the spring market, but every day I see the long run positive signs for the local economy that are underpinning prices. Doesn’t mean they haven’t overshot right now, but I suspect stagnation or small (10%) decline is a lot more likely than a big one. The changes are shocking the market for sure, but I don’t think it is enough of a shock to get from extreme sellers market to extreme buyers market. Probably just from sellers to roughly balanced.

Michael

What your opinion on Enbridge and that yield?

@ Barrister

“Re:Burdick sale.

What price point do you think the builder needs to break even?”

I don’t know much about construction costs, although I’d have thought the kind of ugly flat-roofed houses that seems popular in North Oak Bay (see two on Dewdney, two on Lincoln with another on Lincoln about to begin construction) would offer a reasonable return to the builder at a sale price of around 2.3 million.

However, I would guess that a reasonably high end custom home would cost a bit more, which would still not look bad considering that the tear-down on half an acre just up the street on Nottingham is offered at $2.6 million ($300K more than it sold for in the fall), suggesting that a new house there would run to somewhere close on $5 million (versus $6 million being asked for a yet to be built house across the park on Midland).

So yeah, my thinking is in line with Grant’s.

Accountability is not usually the goal of that type of commentary. People should understand that kind of silliness will inevitably become a two-way street. There are a few, “it’s different here, different this time” posters on this board, who have written a tonne of juicy quotes that in the event of a downturn, will demonstrate the same fallibility as those who previously challenged their views.

And it’s pointless, IMO. I think it’s more productive to focus on the market now.

Grant:

You seem to have answered my question, even as I was asking it.

CS:

Interesting take on the Burdick sale. What price point do you think the builder needs to break even?

CS

Well, you guys certainly are in a better position than me to know the market. It sure seems expensive and risky, so I did some calculations.

They are already in for $1.3M. Let’s ignore tear down costs. A new (probably higher end) 4000/5000 sqft house is going to be about, what, a minimum of $300/sqft to build? (For rough numbers I took an average from this reference https://www.vancouverhome.builders/how-much-cost-to-build-house/#So_How_Much_Will_it_Really_Cost) Given what others have said about lack of trades in Victoria, it’s probably higher, but let’s go with that. So they are looking at another $1.2 million to $1.5M just in construction costs. Now they are in for $2.5M to $2.8M. Looking at realtor.ca for comps in that price range, based on current market conditions perhaps that isn’t as expensive and risky as I originally thought. Bump the build cost to $400/sqft and it’s a total of $2.9M to $3.3M.

You’re cruel, Michael—holding people accountable.

Don’t worry comrades, patriotz will soon confirm for us that prices will continue to decline 🙂

@! Patriotz:

“Just consumer inflation the next time”

Depends. If Trump follows through on his promise to bring the jobs home, heap tariffs on China, and maybe Europe, then labor in America will once again have a strong bargaining position. And Canada will most likely follow whatever lead America provides.

@ Grant

Re: Burdick Avenue sale over list

” But there is no way that purchase was anything other than a speculative buy, or given the amount over list, a foreigner parking funds in Canada. ”

Not so sure. Most likely it will be torn down, and a new 4/5000 footer built, whatever the zoning allows.

That anyway is the rule in that area. Around the corner on one block of Lincoln Avenue to the North and the South of Burdick, five of the last six houses sold were torn down — the sixth was stripped to the studs and reconstructed. Same pattern on both Dewdney Avenue, and Musgrave.

So we’re seeing lots of new construction but no addition to the housing stock, merely renewal of the housing stock.

What people are getting is the convenience, the efficiency and the personalization of a new house for the price of the lowest end home on the other side of Uplands Park, but without the high taxes and landscaping costs, and arguably in a better location (closer to the beach, Oak Bay High, the rec. center, and Oak Bay Village.

So probably an over-ask sale on Burdick is not indicative of the general market trend.

Marko, in terms of clients buying SFHs who send you their mortgage documents, what kind of principal is typical? $700K or $400K?

Keep us posted.

“I think alot of people are about to find the next 10-15 years super interesting with regards to wage & consumer inflation.”

Just consumer inflation the next time. Workers have lost too much bargaining power to keep up.

“Not many alive even remember what an extended period of inflation is like.”

Come on, the 70’s and 80’s weren’t that long ago.

I think alot of people are about to find the next 10-15 years super interesting with regards to wage & consumer inflation. Not many alive even remember what an extended period of inflation is like.

the lower end of this range (800-1.1 maybe..?) would include move up buyers in the 150-200k family income range, would it not? those with equity for a large downpayment.

Speaking of construction and how crazy things are. My friends have a large home in Rockland that needs a new roof (relatively steep pitch but nothing super crazy). Multiple companies (including two of the largest in Victoria) have not provided quotes as they have easier jobs lined up and are not interested. The one quote they did receive >50k.

If we see a slowdown we basically go back to companies actually giving out quotes and the price dropping to $40k. I don’t think we ever go back to people driving around looking for worn roofs knocking on doors looking for work. Not because the economy might not slow down but due to absolute lack of tradespeople.

Marko:

Thank you for giving us your on the ground observations. I always find them very interesting since they provide a feel to the market that raw statistics often overlook.

Typically, the reverse happens. As the housing market slows and prices begin to fall, the wider economic slowdown follows soon after. Given the outsized contribution of RE to the economy as of late, the broader economic slowdown in the event of a RE market reverting to fundamentals could be quite substantial.

I am jaded by real life experiences a bit…..when I started building my home in 2014 it was super difficult to get tradespeople to come out and even give me quotes. I have this feeling that the construction boom has created labourer and low skilled jobs in the $20 to $30 range and those individuals aren’t even close to being able to afford real estate. Those jobs will disappear in a slowdown.

As construction reverts back to the mean my gut feel is that those that participate in real estate will still be able to participate due to fundamental lack of trades. Those that really do get the short end of the stick and are hard working will just go work in potash or Alberta.

Same with my industry…..the huge increase in transaction volume has gone to the top 10% which were already doing well prior to the run up in the market anyway. It isn’t like the RE boom allowed 100-200 newbie agents to buy homes.

I haven’t had many clients in recent years getting into real estate as a result of RE related success. Your typical couple is one government work and a computer programmer (oversimplification).

Going for an early renewal appt with CIBC next week. We’ll see what they offer.

Typically, the reverse happens. As the housing market slows and prices begin to fall, the wider economic slowdown follows soon after. Given the outsized contribution of RE to the economy as of late, the broader economic slowdown in the event of a RE market reverting to fundamentals could be quite substantial.

For some reason a lot of my clients send me their mortgage documents (I think they think I need to see them when they are removing their financing subject or similar).

Anyway, the one thing that I find super interesting is I haven’t had anyone bring up the fact the rates have gone up substantially. Most of the actual rates my clients have obtained in the last month have been 3.34% or 3.39% and people are just rolling with it. I would have thought some people would be along the line of “man, could have got 2.49% last summer,” but not a peep out of anyone. Certainly don’t see anyone changing their purchasing decision on the interest rate factor.

My on the ground impression so far is that the market is reverting to fundamentals. The $800,000 to $1,500,000 is not flying off the shelf and the <$800,000 in the core still attracts big crowds with multiple offers assuming half decent liveable.

Two bedroom two baths core condos in the 500k range still super hot; although condo sellers have caught up to pricing so versus listing for 449k and it selling for 501k my impression is in the last few weeks more sellers are taking the approach of list for 525k and sell for 510k.

I do think fundamentals are changing and you have a greater absolute number of families with household income of 150k-200k which is what I think will set a floor on the sub <$800,000; people simply need a place to live. For a correction in this segment I think we need mortgage rates to jump up around another 0.6% or an economic slowdown.

$800,0000 – $1,500,000 will be an interesting market segment as I feel it could feel the pinch of the foreign buyer tax (probably around 6% of this market segment), Vancouver slowdown, etc. and as for fundamentals there can’t be too many families in the 200k-300k household income bracket in Victoria.

LF,

True for gentlemen and gentlewomen only.

By my math, using my current apartment as an example, I would need a 50% downpayment to have my rent match the mortgage, and that’s assuming interest rates stay at 2.55% for all 25 years.

Depends on what you are renting. If higher end for sure renting is much cheaper; however, I ran the numbers with one of my tenants downtown and it would be cheaper for him on a monthly cash flow basis to buy at Vivid with 20% down. Given he has been renting my unit for 5 years I think the purchase would make sense.

A ban on foreign ownership may well be effective

Foreign ownership is banned in Croatia; however, you can set up a company and then buy through the company. At least this way accountants and lawyers are making some easy money every year when you file your minutes, etc., plus the initial setup fee.

Anyone with a home, spouse or dependent family in Canada is considered resident for income tax purposes and taxable on world wide income. If you taxed all citizens on world wide income it would simply create headaches for other people who aren’t part of the problem.

https://www.canada.ca/en/revenue-agency/services/tax/international-non-residents/information-been-moved/determining-your-residency-status.html

What do the listings usually run at this time of year?

While this sounds interesting on the surface, it makes the US a horrible country to be an expat citizen. I have helped a few people renounce their US citizenship because of the evil reporting requirements. I wouldn’t wish that on anyone. No other 1st world country does it.

Case in point. Don’t have a Canadian resident US citizen be a signing authority on the bank account for your company, charity or strata. By law, they have to report the account and its activity to the US govt.

Even if you moved to Canada at age 2, they treat any Canadian bank account you touch as if you are a criminal billionaire hiding money in Switzerland.

New listings picking up. 320 new listings, 169 sales in the last 7 days. That is pretty weak.

Once and Future:

We should consider following the lead of the US and tax citizens on world wide income. If they decide to give up citizenship then they are banned from Canada for life. Only a partial solution but it works.

Hope everyone has had a wonderful day by the way.

Barrister, I think your ideas have real merit. There is an issue, though, that the NDP are trying to catch people who have passports but don’t really treat Canada as home.

Also, while they will be trying hard to bring more transparency to land ownership and blind trusts, it may take a while to figure out how to identify a lot of foreign ownership.

My guess is that they thought the empty house tax would catch everyone and force people who wanted an exemption to either live in the house, rent it out, or pay tax in BC. I admit it is an attractive idea.

However, like all new taxes, I think the net ends up catching a lot more people than they planned. We can hope that they will fix it before it becomes law, but I am not holding my breath.

I have to admit, as Hawk says, the blowhards in Alberta politics make me want to change my mind about exempting them from the tax credit.

Freedom,

Both of those leaders are smarter and more calculating than most people think – ridiculous, petty bombasticism aside.

I think that’s a great development. Harder to nuke someone you’ve sat down and had tea with.

News: “Kim Jong-un and Donald Trump to meet”.

http://www.cbc.ca/news/world/kim-jong-un-donald-trump-meeting-1.4568583

Although from very different backgrounds and cultures, they are probably a good match on multiple levels, e.g. name calling to each other, unpredictable, hunger for loyalty …. Haha

p.s. Sorry for off housing topic.

I guess they realized that “not buying electricity” was hollow threat:

https://www.neb-one.gc.ca/nrg/ntgrtd/mrkt/snpsht/2017/03-03lctrctxprtbcclfrn-eng.html

While it would make sense to better interconnect the two provinces, it would have minimal effect on BC Hydro. Very little of our power goes to Alberta and there is a very thirsty neighbour to the south.

“Overqualified immigrants do drive taxis – though not all of them are physicians.”

I’ve yet to meet one here. Usually old white guys with drinking problems or crazy immigrant drivers who almost kill me.

I guess Notley doesn’t like her vaycay shack taxed. Talk about going back to the dark ages. Now I feel zero pain for rich Albertans coming here.

Alberta threatens to cut off oil exports to B.C. if Trans Mountain obstruction continues

http://business.financialpost.com/commodities/energy/alberta-threatens-to-cut-off-oil-exports-to-b-c-if-trans-mountain-obstruction-continues

“QT, you are right and this has been a problem for a long time. I have heard that BC is one of the worst at recognizing international qualifications (Medical, Engineering, etc.).

We definitely need more doctors, so I hope it is fixed. I had not heard of the program Andy7 mentioned, but we need a lot more of that kind of thing.

These are exactly the people we want immigrating to Canada, and we need them to be successful. It improves things for all of us.”

The Globe And Mail among many other publications also point out that we have a poor system.

“Overqualified immigrants do drive taxis – though not all of them are physicians.”

https://www.theglobeandmail.com/globe-debate/editorials/overqualified-immigrants-really-are-driving-taxis-in-canada/article4106352/

QT, you are right and this has been a problem for a long time. I have heard that BC is one of the worst at recognizing international qualifications (Medical, Engineering, etc.).

We definitely need more doctors, so I hope it is fixed. I had not heard of the program Andy7 mentioned, but we need a lot more of that kind of thing.

These are exactly the people we want immigrating to Canada, and we need them to be successful. It improves things for all of us.

Great to hear your daughter likes Vic High Anna Edwards. One of my daughters went there after being at more preppy school and not being happy.. She loved VH. The teachers are super supportive and nonjudgmental. It has a real family atmostsphere. All kinds of kids go there and I wanted my daughter to mix with all sorts of people.

Anyway great choice!

Seattle smelling like 2007 all over again. Big Short Part 2 coming up.

Household debt grows at fastest rate in 11 years

https://www.marketwatch.com/story/household-debt-grows-at-fastest-rate-in-11-years-2018-03-08?mod=econpol_twitter_new&link=sfmw_tw

Andy7,

Thank you so much for the information. We would definitely look into it.

QT

I have friends who are doctors in Canada who were trained outside of Canada. They had to follow a process, but when they did, they were able to practice here.

You may be interested in this:

About halfway through Anmar Salman’s attempts to become a doctor in Canada, he almost gave up.

After studying medicine in his native Iraq and doing a master’s in public health in the U.K., he immigrated to Canada, found a job at the Ontario Ministry of Health, passed the necessary tests and applied twice to be matched to a residency. But both times he was unsuccessful.

“When I finished my exams and I wasn’t hearing back from any program, I thought, well maybe I need to be content with what I have. Because I know a lot of [foreign-trained doctors] who are doing menial jobs, driving cabs, pizza delivery,” he says.

Then a friend told him about Saskatchewan’s new recruitment program, SIPPA. He passed the exams and assessment, and is now a practising family doctor in the province.

Salman is one of many doctors trained abroad, known as international medical graduates. They are a well-established part of Canadian health care, with governments using them to add doctors to the workforce and ease shortages in underserved areas.

The landscape for them is becoming more competitive, thanks to an increase in the number of new doctors graduating from Canadian universities and rising numbers of international medical graduates trying to enter Canada. At the same time, Canadians who have gone abroad to study medicine are making up a larger percentage of the international group.

source: http://healthydebate.ca/2014/06/topic/international-medical-graduates-canada

Smith lived 250 years ago in Scotland. Things were a bit different back then.

Had Smith lived today I suspect, based on his writings, he would not be in favour of any intervention in the housing market at all.

“I don’t think they sell beverage gas tanks but I get my fills at Crest Fire on Burnside Rd E. Might want to ask the good folks on the Brew Vic facebook group. I’m still looking for a place that sells nitro.”

Another place might be of interest is Praxair at the corner of Fairview Rd. and Devonshire Rd. in Esquimalt.

” The family home is where most of the money is “parked” in Canada. You’d like to change that?

Yes. If everyone’s nest egg is parked in the same market category, that’s a precarious situation. You don’t want to change that?”

That true, hence some savvy investors would borrow against their house (secure credit) invest in the stock market to diverse their position.

Except I didn’t. I quoted Smith in response to your claim below. He took the opposite view.

“The wealthy immigrant program and Quebec’s equivalent really threw a wrench into that. It makes it harder to distinguish locals from foreigners when the foreigners hold Canadian passports. The answer is a property tax tied to income tax, which is exactly what’s happening. I went to school in Hong Kong with kids that were indistinguishable from Canadians because daddy parked his money in a safe Canadian investment. As a reward, they get to send their kids to Canadian universities without paying foreigner tuition, use our healthcare system and get 20% gains from Vancouver houses all while paying less in income tax than any other migrant who actually works in Canada. It was a total no-brainer for them and a shotgun blast to the foot for us. They literally called Vancouver “Hong Kong II”. Man that program was a bad idea.”

I agree that the immigrant investor program is a bad idea, so as federal skilled worker program. There are 2 sides of the coin in this matter and I do feels that people shouldn’t have Canadian benefits if they don’t pay taxes here.

Many honest immigrant investor that come here to Canada don’t have an idea of how our market work and with out any guidance or help from the government, they would sink all of their saving into a local business that bankrupt them after 5 years just so they can stay in Canada.

Overseas skilled immigrants are encouraged by our government to immigrate to Canada due to skill shortage but they can’t find work, because they find resistant by our licensing system and education system that favor Canadian born citizen first before immigrant. My wife is a physician and her/my friends are experienced engineers/physicians and the likely hood that they ever get a job beyond being a cleaner or nurses aid is extremely slim. Hence, many people go back to their original country to work so they can make money to provide for their family. For an example, my wife wanted to go back to Vietnam to work this spring just so she can keep her medical license valid. By the summer her license will expired, because she hasn’t practice medicine for 5 years since she been here in Canada.

In away Canada is destroying people lives promising people great things till they come here and it become broken dreams, and that will feed into criminal activities that we are now discovering in the housing market among many other things.

As someone considering moving to Victoria to live and work, and as a guy who has owned my primary residence for all but a few years when I got out of university, that’s both incredibly disappointing but oddly very helpful. Paying over list isn’t uncommon or necessarily unhealthy in hot markets, I saw it first hand more than once in the SF Bay Area. But there is no way that purchase was anything other than a speculative buy, or given the amount over list, a foreigner parking funds in Canada. Victoria is too small a market to sustain that kind of speculation. I know.. I’m preaching to the choir.

Wow! $240k over asking but it was listed under assessment… the thing that perplexes me a bit is it needs lots of renovations – kitchen looks like it is original from WWII era.

It does have what, sort of, looks like a suite or suite-able. But maybe w/ a concrete floor?

9000 sq ft lot somewhat generous – and the area near Uplands is popular and quiet. This does contrast sharply to the recent Bowker Sale but imo that house was way over priced.

Maybe the buyers should’ve been reading this blog?

Yeah, that’s a good point.

But I still see a lotta good.

You mean the fellow who advocated for free trade within and without a country with little or no government restrictions? The one who said the most efficient markets are based on the realization of self-interest? He held that free markets, private property rights, voluntary exchange, and greed produce preferable outcomes most times and under most conditions.

I suspect Smith would be turning in his grave if he knew he was being quoted in relation to supporting heavy-handed government intervention in individual choice in investing in the housing market.

Wow someone wanted 2751 Burdick Ave in Oak Bay

$1310k sale at 1070k list

Maybe you should read what he said in bold font below, comrade patriotz. If that ain’t the words of a covetous socialist, I don’t know what is.

” It only takes a couple billionaires to almost single handedly inflate a market.

Do you have some math behind that?”

I haven’t heard of a single handed person that infated the housing market, but certainly stock market it has been done.

George Soros benefited a billion British pound by created the Black Wednesday crash in the UK. If I remember correctly Soros and a few of his associates successfully crashed the pound. Soros made it out like a bandit with 1 billion pound gain, and cashed in (short covering) his short the next day after Black Wednesday. And, apparently he also short the US dollar but lost, however he successfully bet against the Japanese yen and Thai baht.

Well Andy7, ‘successful’ is subjective. My def. is different than anyone else’s. Everyone has different needs and requirements. Generally it’s having a full-filling family life that works for you, full-filling career, good social life with positive people that help lift you up, and stable happy healthy home/housing to live in that meets or exceeds one’s needs. It’s also about having time to do what you need to do whatever works for you. Far too many people it seems are unable to full-fill one or all of these needs these days.

To me, it appears that many Canadians – esp. the younger set – are no longer able to achieve success in their lives. They go to long years at University – only to be stuck in a low paying career/job they didn’t intend to have and still living w/ the parents in their 30’s. Not being able to afford a home even if they get a high paying job doesn’t help either, and many don’t even have that.

Consider that my perception may be somewhat skewed as I work w/ the most disenfranchised folks in our society, but there is a complex problem in our society where more balance is required. Younger Canadians do need to be more explorative as well – not only willing to be more mobile within Canada but also- get out and explore the world! Not everything will be handed to them on a silver platter. I think they also need to be more willing to take jobs that might not fit their dream, but still full-fill needs. It can be tough out there at times, but often, with a bit of tenacity – you can and will eventually get there if you try!

We have Godwin’s Law for Hitler comparisons. Maybe we need one for people who think it’s communism whenever a left-wing party is in power or implements a policy they don’t like.

The patron saint of capitalism was a socialist? That’s not the only thing you got backwards. In his day – the pre-industrial era – people were rich simply because they owned land. The people who actually produced things had to pay part of their earnings to these rich landowners who did nothing. Smith rightly recognized this as an impediment to the development of industry.

We’re not there yet but when I talk about Canada as if it’s ‘Canadistan’ what I mean is the direction we seem to be heading in sometimes. What we now have is a very socialist Gov’t and there’s lots of similarities between socialism and communism. While we have much inequality in our society that needs to be more balanced it doesn’t mean we should be dictating what people who are Canadian residents do with private prop. through very high taxation does it? Private residents shouldn’t be ‘made’ to rent out housing or face high taxation should they? Its not up to Private residents to solve the rental housing problem is it? 2% could just be the start and they might expand to more areas. So, we are forcing people to sell vacation homes in places like the Gulf Islands? How does that help solve the housing problem?

Have a look at this article… https://www.livescience.com/42980-what-is-communism.html

“The working class — or “proletariat” — must rise up against the capitalist owners, or “bourgeoisie,” according to the ideals of communism, and institute a new society with no private property, no economic classes and no profits.”

OK, so that’s more extreme than what’s happening w/ the Spec Tax but it’s about attacking private property usage so I have some problem with that. They didn’t define ‘Speculation’ properly I don’t think by going after vacation homes.

However – we may see the tweaks on the Spec Tax will resolve this issue and it’s not ‘Canadistan’ after all? Time will tell…

Wow! This blog has been busy – take one night off and the comments keep coming – lots to talk about right now though w/ all the new measures coming from the Gov’t. Interesting they will tweak some things and I’m looking forward to seeing how that all pans out. They’re taking some steps in the right direction but some on here may be correct that a foreign buyer ban is what’s really needed.

Then we even need to force sales of homes owned by non-residents – but that will never happen.

https://www.eprop.co.za/commercial-property-news/item/21075-strong-house-price-rises-continue-in-europe-us-canada-and-parts-of-asia.html

Yep – I saw this under const. on the last several visits to HK. Very mysterious seeing such a long bridge disappear into the mists of the Pearl delta. Made me think could it be done from VI to Van? We know of course that’s not happening – again – same as the train – not enough population.

The JSB is such a joke for taking so long – and they had to get the steel from China too (we can’t make it here?). Oh well, despite the cost and boondoggle, it will be a complement to the city sky-scape compared to the monstrosity it’s replacing! I look forward to driving across it…

Adam Smith was also a socialist that believed in redistributing wealth from productive people to the large group of unproductive (Jerry’s word, not mine 🙂 ).

“The necessaries of life occasion the great expense of the poor. . . . The luxuries and vanities of life occasion the principal expense of the rich, and a magnificent house embellishes and sets off to the best advantage all the other luxuries and vanities which they possess. . . . It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion.”

Adam Smith, “Wealth of Nations”

Thanks to those who mentioned the schools. My daughter was trying to choose between Oak Bay High and Vic High. We went to their open houses and really liked the feel of Vic High. She choose Vic High.

The problem with focussing on individual listings is that there are good deals (usually weird, not broadly appealing properties) and bad deals (usually the textbook sfh on a quiet street) to be found in any market. That’s partly why the monthly numbers jump around so much. Things like wood stoves, pools, sun rooms, large numbers of bedrooms (vs only 2 or 3) are a plus to some buyers and a minus to others.

The Robinwood place looks like one of these – kinda funny-looking, very 70s design, only 2 beds. Still looks like an ok deal at asking price for a GH sfh. No sign of bad windows in the pics, anyway.

“The stock that is laid out in a house, if it is to be the dwelling-house of the proprietor, ceases from that moment to serve in the function of a capital, or to afford any revenue to its owner. A dwelling-house, as such, contributes nothing to the revenue of its inhabitant; and though it is, no doubt, extremely useful to him, it is as his clothes and household furniture are useful to him, which, however, makes a part of his expence, and not of his revenue.If it is to be let to a tenant for rent, as the house itself can produce nothing, the tenant must always pay the rent out of some other revenue which he derives either from labour, or stock, or land. Though a house, therefore, may yield a revenue to its proprietor, and thereby serve in the function of a capital to him, it cannot yield any to the public, nor serve in the function of a capital to it, and the revenue of the whole body of the people can never be in the smallest degree increased by it.”

Adam Smith, “Wealth of Nations”

Smith is saying that housing adds nothing to the productive capacity of a nation. Parking household wealth in housing deprives productive industries of capital. Industries then have to depend on foreign capital, which these days increasingly means China. Which means ultimately the nation becomes poorer, the illusion of high house prices notwithstanding.

@ O and F

“. All the window seals were broken and there was condensation between the glass. The new pictures show the blinds all semi-closed which makes me think they didn’t even bother fixing them.”

Wow. So whether a lick of paint and the passage of six months, adds something like $135 K to the value will provide one clue as to the direction of the market.

Anyone hear about this?

https://www.vanguardngr.com/2018/01/china-completes-worlds-longest-sea-bridge/

China just finished spending $16 Billion on a 55 km bridge that connects Macau and Hongkong. Ignoring all sorts of variables, that equates to roughly 1/6 the cost per meter of our new Johnson Street bridge and took roughly the same time – 8 years. They even built an island half way across. Pretty incredible stuff.

I could be wrong but I don’t think Leo is looking to refill the bottles? I think he is looking for the large size CO2 tanks to do this:

http://www.frugalwoods.com/2014/08/11/how-to-cheap-homemade-seltzer-with-a-modified-sodastream/

I wish I could figure that out 🙂

No.

I have a hard time following your logic.

This is where most net worth is but most homeowners have pensions and other investments.

You need to live somewhere. You can’t live in a mutual fund or rent it out and a rental doesn’t provide the same benefit for many with kids and dogs and personal hobbies and tastes. A primary residence with a capital gains tax exemption, insurance, a proven long term return rate of 4%, forced monthly savings, and a preferred lending rate in a desirable area is the lowest risk for return long-term investments that works for most that I can think of. Secondary residence, not as much so.

Leo I heard the same thing about crest fire as Josh said. Apparently there are two types of soda stream nozzles and you never know which one you’ll get from the box. Only one of them can be refilled. You’d think there would be some kind of adapter you could buy but I haven’t looked into it.

I’d love to go to a meetup but not sure I would have anything to contribute to the conversation.

Or the story of the overseas lady who called up a RE agent and asked to see 20 homes (in Vic) one day. Assuming she was looking for a single house they went and visited them all. At the end of the day, she bought all 20.

So the tax may bring a bunch of upper end properties onto the market. I suppose a glut of upper end places will drive prices down somewhat.

Leo S