March 12 Market Update

Weekly sales numbers courtesy of the VREB.

| Mar 2018 |

Mar

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 72 | 235 | 929 | ||

| New Listings | 104 | 424 | 1217 | ||

| Active Listings | 1434 | 1627 | 1556 | ||

| Sales to New Listings | 69% | 55% | 76% | ||

| Sales Projection | — | ||||

| Months of Inventory | 1.7 | ||||

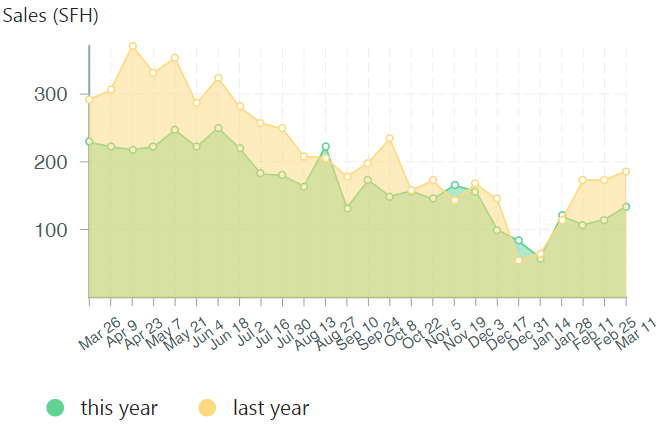

Sales are weak but not catastrophically so, running at about 20% lower than this time last March. If we look at the seasonal pattern, they should continue to pick up for another couple weeks and then stay high for about 6 weeks before starting to decline.

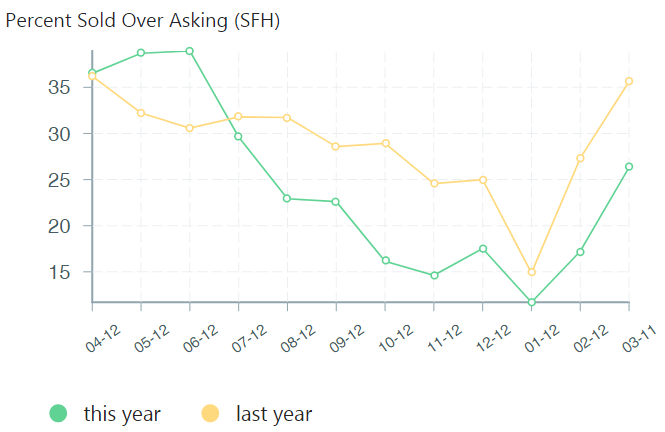

Over asks as well are down from the frantic pace of last year, but still about a quarter of detached houses are going for more than 1% over the asking price. Some of those are intentional underpriced listings intended to incite a bidding war, but I’m seeing a lot fewer of these.

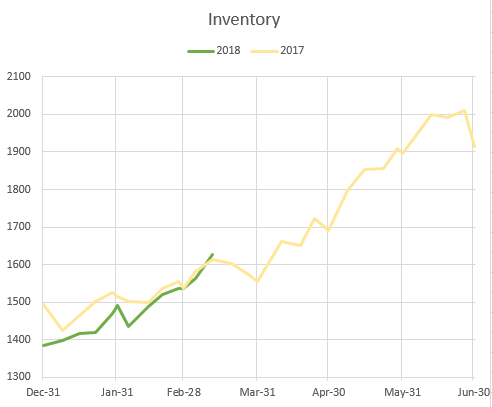

The encouraging news is that we are finally starting to see more of an uptick in inventory, gaining nearly 100 active listings in the past week. Still tracking very closely to where we were last year, but hopefully that will start changing in the coming weeks and bring some more supply on the market.

There are definitely some nervous holders of second properties out there. Remains to be seen how many of these decide to proactively list them vs waiting for the details of the spec tax to be announced. Despite the premier’s assurances that BC residents are not being targeted, there is still a lot of uncertainty about whether they will be exempt from all or just part of the tax.

“Trump is fucking up the whole world trade. Repercussions will not be pleasant. Gas up again, 9 cents yesterday.”

The US polices do affect us, but you can’t solely blaming them for it. To me the fault lay mostly with Canadians, because our policies rely largely on trading with American specially energy. The current price increased is due to refinery shutdown in Washington state where most of our fuels come from. It let the suppliers gouge us because we don’t have enough domestic refineries for the local demand.

I also find it is odd that BCers complaints every time fuel price go up, but at the same time they are pro taxes and protests against all energy developments. An example of price discrepancy between pro tax and low taxes cities from Gasbuddy; Edmonton $1.054-1079, Calgary $1.089-1.126, Vancouver $1.479-1.499, Victoria $1.489-1.499.

@CE

Remember I was giving advice to a “Newbie” and to most of them buying their first house/Condo is “rocket science”

As to the cash back realtors, my point was to get the best realtor as opposed the cheapest, if it happens to be a cash back realtor then good on ya.

New post: https://househuntvictoria.ca/latest

Average commenter,

I am barely in my 30s and only started looking/thinking about buying a house the last 2 years. Not great timing. Im not trying to time the market but there’s nothing to buy. It sounds like you got a great place though. I like the Langford area and would live there if it weren’t for the commute x 2 parents. I would definitely not live in Langford in a 2-4 people per bedroom scenario or by a race track. There are sacrifices and then there is giving up on life as you know it.

Also who said anything about moving into a dream house? I just want a house to fit my family that isn’t falling apart within 30 mins driving from work. With the current state of the market (peak?) if I did buy now it would have to be somewhere I can see myself living for 20-30 years. This is far from dream house status. There are lots of houses I can afford so why not wait for the right one?

Grant you haven’t been following long enough this is pretty tame. Can get pretty rough in the wild HHV forum just you wait 😉

Caveat thanks for admitting it may have been easier in another time regarding education, jobs and housing. It’s also easier for us now in a lot of aspects. A lot of millennials are entitled brats but there are those in every generation. Most of us also haven’t gone to war, lived through much hardship and have equal rights as women. I wouldn’t have my career as a woman if it was 30 years ago and I would probably have been a miserable and horrible housewife. So even if I could go back and be born another time I wouldn’t change a single thing about my life. Maybe even the struggle of wanting to own a home is good for the ol’ character. It all works out in the end.

Counterpoints

1) Buying a property ain’t rocket science.

2) Why would Richard assume that the cash back realtors are less “knowledgeable, experienced, and professional” than any others.

@Newbie

If you are about to make one of the biggest and most important financial decisions of your life I highly recommend you search for the most knowledgeable, experienced and professional Realtor you can find as opposed to one of the cheapest.

HAWK I’ve set it up for you!

Simple. Just search “cash back realtor victoria” and you will find the ones that do it. There are a few.

I can’t tell you how much you would hate me. 😀

My family & I plan on purchasing in 2018 or 2019, we would be low maintenance clients.

I ran a 50% cash back program 2010 to 2015 and there was no way on earth to identify “low maintenance clients.” I tried many strategies such as requiring pre-approval letters and limiting the number of showings for the 50% cash back, etc. No strategy was ever a good predictor. Once I met a tattooed badass looking guy in a Timmies parking lot, no pre-approval of any sort, and I thought to myself “no way this guy buys a 800k home” and literally two days later he buys a 950k home and then refers me to a bunch of his military friends. One of the best clients I’ve ever had.

Other buyers present as “low maintenance” but overanalyze things to death and three years later your are showing them house number 101. The longest buyer I had was five years and I honoured the 50% cash back when they eventually bought. I’ve also had people disappear after 2-3 years because they changed their mind and decided on Comox.

The other thing that happened is it became brutal to work with buyers starting in 2015. It went from helping someone find a home to helping someone find a home plus actually having the winning offer. The real-life problem being there is if someone is coming to you for 50% cash back they are typically financially concious and not willing to go unconditionally to outbid everyone else for their “dream home.” In 2016 I had stretches of writing 15+ offers in a row without acceptance. My luck improved a bit last year with buyers.

If you send me an email at markojuras@shaw.ca I can send you back agents doing cash back in Victoria…it is basically two.

That looks like a good option for many Marko but it seems like word is out!

That was the same story they were selling when I got into the program straight out of Vic High with so so grades. I did a bit of poking around during the program and I think pretty much everyone that applied got it in my year and back then there were only 50 spots.

Universities are a business too….of course they have a ton of applicants because the program is soooo good and they only accept a handful. On a side note, program actually was pretty good.

Ever hear of these guys?

https://housepriceindex.ca/

@Newbie

There is no such thing as a “low maintenance” client! No offence, doesn’t matter how nice, easy going or accommodating you are……it’s all about the deal, and all kinds of things can go wrong there. In my 30 years of selling I’ve had 2 sellers die between the offer and possession, what a mess that creates! How about a house fire, flood, burglary and the list goes on.

@Newbie

Sign a buyer’s contract with your realtor for a flat fee he/she will receive on a completed deal. Specify on any purchase contract you write that the offer is made excluding all “selling realtor’s” commission. This way the home seller knows to negotiate the final price without having to pay a “selling” realtor’s commission.

Note: all commissions are negotiable.

I’d agree with several of the posters that the challenges of buying a house now are greater than they were in the past.

First of all you need more education than ever to get a good job these days. The organization I work in hires Phd’s and MSc’s to do jobs that we used to hire folks with a two year technical diploma for. The job hasn’t changed that much, there is just so much competition that we can hire RIDICULOUSLY qualified people.

Then education has got more expensive so people are likely to graduate with a higher debt load.

Finally houses have become insanely expensive, even in relation to increased wages.

I didn’t have it that hard (early Gen X’er). Education was still dirt cheap. I delayed house buying compared to my peers but still got in to benefit from most of the 2000-2008 run up. Job market was tough for me, but not as tough as it has averaged for the last 10 years or so.

Grant, that report is probably using 3 months previous numbers which would mean last summer. A ton of changes since then.

Does anyone know any buyer’s agents who offer discounted commissions? (i.e. split the commission with you)

My family & I plan on purchasing in 2018 or 2019, we would be low maintenance clients. I have a real problem with the misalignment of incentives where buyer’s agents get paid more the worse the deal their clients get, splitting the commission seems to correct for this, also the amount of work an agent would do on our behalf would not be at all commensurate with the compensation. I know there are a bunch of agents out there who do split commissions with their clients, like Barry McGee in Vancouver who offers $6k flat commissions. As a new arrival in Victoria I’m not as familiar with the agents here.

Thank you in advance.

I don’t know if this has already been covered by Leo, but here is CMHC’s Housing Market Outlook for Victoria as of Fall 2017

https://www.cmhc-schl.gc.ca/odpub/esub/64367/64367_2017_B02.pdf?fr=1521319407175

If you don’t want to read that it can be summarized:

Housing prices are unlikely to decline due to low housing availability. This has led the market to become overheated with accelerated price growth, leaving the market highly vulnerable. Low housing availability is expected to continue due to employment growth and general migration.

Note – Since this was released last Fall there’s no discussion of the new taxes and related possible impacts on the market.

Welcome to the Internet.

By the way, HHV is dinner at Buckingham Palace compared to the conversations being had on most of the rest of the Web.

Yes, this would be extremely interesting.

Someone, please do these comparisons!

The average house price increases in Calgary were insane between 1998 -2007 going up more than 400% I bought a house in 1998 for $142K and could have sold it in 2007 for over $600K. (didn’t) The best way to get a handle on the inflationary changes is to ideally follow the sale price of the same house over the years or comparables. To go by average or median as has been pointed out isn’t really a true perspective as home sizes and finishes in the last 20 years have changed so dramatically.

ĶMany touting continued price rises are in serious denial of the RBC affordability index that just surpassed 2007 and 2009 peaks.

This “everyone works for VIHA or a cop” is so much bullshit. Even the trades guys is hard work and cyclical employment and first to get laid off in a downturn.All are hard jobs that most people wouldn’t be able to stomach. Reality is average families are maxed out on debt or basic affordability.

Thus the sell off in Vancouver is coming here like a tsunami. Debt is debt and trying to spin it into some new norm is even more bullshit. Credit lending is tightening by the day.

The banks know it well which is why private loan sharks are even tightening lending. The cycle is ending so best take off the rose colored glasses.

Rates are going up and credit will only get worse. 20% can’t even qualify today Spec taxes etc are the final nail. Reality sucks eh.

That’s true that houses are bigger nowadays, but this is just VREB core victoria, isn’t it? No way the average is 850k when you include sooke and langford. So that’s Victoria, Vicwest, Oak Bay, Saanich, Esquimalt, and View Royal. How many houses are newly built over the last 10-15 years in those municipalities?

…..now that I type that in I consider how many perfectly usable houses have been sold in Victoria over the last few years as lot value. It’s a blessing and a curse really. When a bare lot is $500k, why not throw in granite countertops, hardwood, and an extra bedroom? It’s essentially a rounding difference on your final price tag.

Average Commenter

I’m sorry that I didn’t factor in the inflation rate. I look at pure dollar value for 10 year trend from 1967 onward for single family dwelling, and 1987/88 for condo/town house. To me it look like the price double roughly very 10 year.

The average price could be skewed for the last 10 years or in your case 6 years with inflation adjustment, but I think the new houses being sold are bigger and/or fancier than the past.

Maybe we could get a clearer picture if the data show how many top 3-5% houses are sold compare to the bottom houses, and perhaps the top 10% of the houses and bottom 10% prices are omit to make a more accurate average graph.

My thoughts too @avgcomm, that data shows a rapid increase in appreciation from 2002 on. What would be interesting (and possibly more instructive) is to compare Victoria’s increases vs other major metros in Canada: Vancouver, Toronto, Montreal and Calgary.

@QT, I’m not sure I understand. I’m just eyeballing the numbers from the chart you posted, so I know these aren’t exact, but:

(using: https://www.bankofcanada.ca/rates/related/inflation-calculator/)

1982 – avg house in victoria = 100k

1992 – avg house in victoria = 200k

adjust for inflation = 26% increase in prices

1992 – avg house in victoria = 200k

2002 – avg house in victoria = 300k

adjust for inflation = 28% increase in prices

2002 – avg house in victoria = 300k

2012 – avg house in victoria = 600k

adjust for inflation = 62% increase in prices

2012 – avg house in victoria = 600k

2018 – avg house in victoria = 850k

adjust for inflation(6 years only) = 30% increase in prices

It is interesting that the price chart from VREB shown that this past decade prices hasn’t risen as quick as the previous 4 decades.

The new tax may dampen demand, but it look like prices in Victoria still have room to grow if history repeat itself.

https://www.vreb.org/media/attachments/view/doc/graa2017/pdf/Annual%20Average%20Selling%20Price%20Graphs

It’s unfortunate that the discourse here is devolving into more personal attacks.

If you could, keep distance from these insensitive/rude people, or ask them where were they in their early 30s next time.

Housing is an issue now for sure, when young professionals with good incomes couldn’t afford to live relatively close to work and have to move away in some cases (like in Vancouver).

That being said, people probably do need to make sacrifices when they first start (without support from parents), even with good incomes. I bought my first house here near General Hospital in 1990 with a nice one-bed suite (plus another bedroom upstairs to a student) that covered big part of the mortgage payment (rate was over 10%), I worked in IT near downtown with good income then . My 2nd home was a new home within biking-distance to work in Ottawa. I had a grad degree (and was a single parent) with very good income, but to get to be near work and a nice home, I chose a townhome and rented out a room for more than 3 years.

Things are tougher now for sure, so in addition of housing tax measurements enforced by government, young people may still need to make similar sacrifices as we did, if not more, to start in the housing market?

@ Average, I hear you. I most likely would not be buying in this market. Prices are insane. But…. just before I bought my house in VicWest I had resigned myself to never owning. I was 30, living with a roommate and saving/investing and pushing hard for raises. I got lucky because I worked with a bunch of Leo types so we were analyzing the market at lunch time. Of course one guy had the rent vs buy spreadsheet. It was better to rent. Some though the bubble would burst. Another had a house with a suite and was touting that. It was basically HHV in meat space. I was happy to rent but was looking at VicWest and saying that was the value spot. Then rates started declining rapidly and the window opened. Then the Railyards sign popped up so I struck fast. The house I bought was sitting on the market for months. An unwanted POS apparently. Another window could open, who knows…. But there is no denying the opportunity is thin compared to the early 2000’s.

Average Commenter, thank you for explaining this hot topic even though it was so “common sense” (as Marko loves to say), because everyone in Victoria easily makes $200.000.

Before we all lose our minds on the public sector salaries, let’s remind everyone. 75% of the BC Public Service makes less then 75k/year. And salaries flatten out hard after that.

I work in government(Finance). In my branch of 85 staff we have about 20 people that make over 75k/year. The breakdown of those 20 people are lawyers(4) accountants(10) non-union management(4) and two senior supervisors. And of those 20 people that make over 75k only 2 make over 100k(both are non-union management who are also accountants and have fancy titles).

While there are standouts(BC Teachers have negotiated very well over the last 15 years) salaries aren’t that crazy. And teachers often spend money on their work(because budgets haven’t covered their 50% pay increase in real dollars, they just took money out of classrooms and put it into salaries) and with police/firemen there’s the hazard pay element to what they do.

That looks like a good option for many Marko but it seems like word is out!

I like this:

Is Canadians’ soaring debt too high? Our government hasn’t a clue

While the household burden is at historic heights a ‘secret document’ reveals Ottawa has no way of knowing whether that’s too high

http://business.financialpost.com/personal-finance/debt/no-way-to-know-if-debt-to-income-ratio-has-climbed-too-high-federal-officials

requires an income of $135k/yr

It isn’t too far fetched though…..I went straight from Vic High into the RT program and I was by no means book smart. I had to drop out of Calculus after getting 20% and 24% on my first two tests.

RT Program -> https://www.tru.ca/science/programs/rt.html

Every hospital I did my practicum at offered me a job @ 20 yrs old (not because I was special, but nature of the profession). Never had to do an interview at VIHA…just started working. Tons of overtime. Gauranteed >75k income in very early 20s assuming you jump right into it after highschool. Lots of other careers out there along these line.

Hook up with a nurse/teacher/police officer/plumber/programmer etc…..and there is your household >150k/year income.

Problem is people are trying to “find themselves” and all this other BS and than they end up in their late 20s before they have a half decent paying job.

There is still a road to home ownership but it no longer includes finishing your Bachelor of English at 25 yrs old and then trying to figure out what to do. Unfortuantely there is no “real talk” to kids in highschools. Wish I could volunteer teaching CAAP or whatever it is called…..

Need to sell a house? Use a mere posting.

Need to invest? Stay clear of MERS.

Etc, etc 🙂

Dasmo:

fair enough. Then again, I’d say you likely have the same coloured goggles that plum has. let’s talk about what your starter home in vicwest cost you vs it’s current value(as a percentage of household income). Houses are pretty durable, I assume that house still exists. If you want to make an apples to apples comparison, let’s look at the value of that house now.

It’s true that we don’t dodge bullets very often in Langford(I’m curious how bad the murder rate was in vicwest back then as well) but that crap townhouse in Bear Mountain is an hour’s drive away in normal traffic conditions. What if you were an hour’s drive away from town back then?

And to plum’s original question: “Are these places not affordable for young couples/families? How much cheaper can we build them?” – 6x household income isn’t cheap.

And I truly am sorry if my post seems aggressive(the language obviously is) – I’m not mad. But this is a conversation I’ve had and rehashed so many times. I have staff that have homes in broadmead, brentwood bay, and oak bay and I often get asked by them why I live where I do when I could have so much more(insert eye roll here).

Husband a police officer, wife a high school teacher, but their combined income is just under 200k before the husband adds in his overtime. I wondered if he was exaggerating their income but I looked it up this morning and on average it is pretty well in that ball park.

I must have posted the VIHA over $75,000 list 20 times between 2012 and 2015. The increases in salary are kind of meaningless right now but when the market is flat like it was over a certain number of years it does improve affordability.

Late 2011 was an eye opener for me when a single parent, government employee, bought a 495k house in Oaklands area and rented the basement suite in one day. Home ownership was cheaper for her on a monthly basis compared to the condo she was renting. Throw in that the VIHA over $75,000 list was growing by few hundred employees every year as I am sure other lists were too (BC Ferries, etc). At that point I was like hmmmm…..maybe the market isn’t going to tank.

Our family’s starter home was a 2 bedroom, 2 bath cutie in a neighborhood of heritage and craftsman bungalows, in a very livable medium sized city in the American southeast (with a major university). Our monthly mortgage was $660! Bought in 1999 for $120k, sold in 2010 for $220k, I just checked and it is now worth 306k. The 2008 crash didn’t really affect prices in our neighborhood at all, but maybe the value would have risen faster between 08 and now if not for the US correction. Needless to say, Victoria prices were a shock when we first looked into moving here.

Most people I know played the property ladder and didn’t just buy their dream home out of the gate. My parents did, my good friend’s parents did. They are an excellent example actually. Started with a trailer in Langford (the 80’s langford) ended up with a house on Gonzales. I started with a fixer upper in VicWest when VicWest was considered gang land. My story ain’t over yet so stay tuned on that… anyway point being that a lot of Boomers earned their houses and had to make sacrifices to get them including some crazy interest rates and turbulent times. Yes the playing field has changed for the worse so it is much harder but you gotta play the cards your dealt as they say. So IMO it’s not unreasonable to get attitude back from the Boomers out there that you should lower your expectations for a starter home.

I’m not saying go out and buy. That is an intensely personal decision and the market is sputtering right now so it’s probably a great time to wait. Then again, who knows…. That doesn’t change the fact that hate for the Boomers and all they have aquifered is misguided.

Penguin,

It’s not really even that. To be honest I’m a lot like Josh(and you?) in that I’m in my early 30s, have a healthy household income, and sat on the sidelines for years waiting for the prices of homes to crash. Turns out that lull from 2010-2013 was the crash, and I missed it. Unlike many people here though, I actually gave up last spring and just spent 500k to buy a place in Colwood. I overthought it for years and this time I just held my breath and took the plunge. As is, from the price of some comparables I’d say I’m already up 10% on last March’s price. Yes a 12% drop would leave me underwater(5% downpayment, but 4% is tacked on by CMHC). But I have a healthy income and my mortgage doesn’t need a renewal for 4 more years. I figured it’s worth the risk. And I just had a baby, I wanted my wife to be able to walk around suburbs and parks with a baby carrier and my kid to have a yard.

a few things that got me about that post are:

condescension: suddenly we can’t understand basic math? It’s common in lots of demographics. They see their struggle, forget their privilege, and then jump to a value judgement. I remember seeing an episode of the ‘Dragon’s Den’ tv show where all these moguls describe their hard luck roots and poverty. Kevin O’Leary takes you to an average house where there’s a basement suite he used to rent and says ‘that’s the 4 billion dollar basement suite.’ Of course what he doesn’t tell you is that his dad was a millionaire CEO who gave him 100k in startup capital. Same thing with some of the older folks kicking around here, hey, sure you struggled, but you were also buying at the right time.

complete lack of understanding of the westshore market. The townhouse he chose truly is garbage. No one who looks at the market seriously would ever really consider buying and holding long term. They look amazing from the inside, but the logistics of the area are trash. That 480k condo with $300/mo in strata fees would be unlikely to rent for more then $17-800 a month because it’s location is so ridiculous. Spend an extra 60k and buy a similar(slightly older) townhouse in Royal Bay or spend 70k more and buy an actual house in Happy Valley and you will be getting WAY better value. Public transit that goes into the city, roads that can fit two cars at the same time, schools nearby, services either already exist or are going in. If you go for the townhouse in Royal Bay you get an ocean view and quiet instead of a race track. And the rents show it. You could rent out the bear mountain townhouse for $1800 a month(but it costs 480k+300mo/strata), or you can rent out a Happy Valley house for $2500 a month(that costs 550k+no strata).

finally, take a look at some of the pictures. That crappy townhouse near bear mountain, look at the nursery. That’s a brand new dutailier nursing chair($600-800) and a fancy hardwood crib($800+). These aren’t the starter homes of poor people. These are people with obvious income or access to money.

Average commenter,

You just can’t reason with these people. They don’t care to see your point of view or how these places aren’t nice places to live. In their mind people need to make sacrifices for home ownership. IMO if the sacrifice is living in places like these I’ll happily rent forever and live a stress-free life with a bunch of money in the bank and a nice place to live. Luckily I’m not priced out of getting what I want yet but there’s no way in hell I would live in the places you described.

@plumwine

I guess you got me. Requiring a home that allows me to walk from my front door makes me a snob. Pardon me for asking for some of the simple pleasures allowed by greater generations like yours that got to buy way back in the late 90s.

Or put this another way: your ‘starter’ townhouse. The one that you are not able to walk to and from and overlooks a literal racetrack. It costs 480k. That townhouse represents a 6x modifier of the median household income in Victoria. Say you have median household income in Victoria(about 80k/yr). You are looking at spending 60-70%+ of your household income on your home alone.

You don’t even need to consider that housing prices have doubled(inflation adjusted) over the last 20 or so years. Just consider the ramifications of pricing out your average household of crappy townhouses an hour’s commute from work.

This increases the likelihood that if the banks are afraid of falling prices they will demand their money back, or that the borrower takes out and pays for CMHC insurance, at renewal time as they have the right to do.

CMHC insurance is paid for at the time the loan is issued and it continues valid for the entire original amortization of the loan, regardless of any change in valuation of the property or circumstances of the borrower. The lender does not have to get approval from CMHC to renew the loan for a new term.

THE DARK SIDE OF CONDO OWNERSHIP

If you have the misfortune of suffering a catastrophic loss as a CONDO owner, the results can be a living nightmare.

http://www.cbc.ca/news/canada/edmonton/condo-owners-consider-bankruptcy-as-lawsuits-plague-one-of-fort-mcmurray-s-largest-rebuilds-1.4575589

@Local Fool – “A 10% drop is a run of the mill correction – the bare minimum for it it be called as such. In a sense, it assumes that the previous mania gains were more or less based on sound fundamentals. They weren’t.”

Okay, but house prices in Victoria doubled in about 5 years preceding 2008. That’s why I was expecting at least a 20% drop after the meltdown, which never happened. Was that run-up based on sound fundamentals? I agree that the factors that caused the recent increases are different, but we haven’t had an economic hit (yet).

Holy Sh!t! I don’t know it is a huge challenge to walk up from garage, no sidewalk (death trap!!!), snow-in here Vic. Hell, I didn’t know Bear Mountain is a shithole as you described.

Damn, it must be tough to buy a starter dream home.

@dasmo “Mandate that evalueBC goes to an index system and not a dollar value system. that alone would have the biggest impact on house prices. Notice how after everyone got the letter that their house was worth 20% more asking prices went up 20%?”

An index system sounds reasonable, but I don’t really see the current method as inflating prices. In the past few years the assessments were lagging the market anyway. In 2016 we paid over assessed for our house, and it wasn’t until this year’s assessment that the value surpassed what we paid. Now I see houses for sale in our vicinity are generally priced slightly above assessed if they are in average condition, but I don’t see asking prices jumping 20% from last fall. I live in Gordon Head so maybe it’s different in other areas.

QT

That’s a very impressive ersatz-oriental patois you have. Are there courses for that or do you just like Charlie Chan movies? I only ask because I occasionally drift about downtown passing myself off as a one-star Michelin chef from Nicef but I am getting caught out on my over-enthusiastic aspirates.

We have a similar rate selling below ask (still 25% over ask which is a good chunk). However the under asks seem to be going for further below ask, up to 20%. Previously they were barely below ask. Still well over assessment though. Only 9% in the last week sold under assessment.

LOL. This one had me giggle.

“Are these places not affordable for young couples/families? How much cheaper can we build them?

https://www.realtor.ca/Residential/Single-Family/19155762/404-821-Goldstream-Ave-Victoria-British-Columbia-V9B2X8

https://www.realtor.ca/Residential/Single-Family/19162269/2113-Greenhill-Rise-Victoria-British-Columbia-V9B0J1”

These were examples of good and cheap family properties.

Ummmm, ok. So first, a 2br/2ba is not a family sized property. Especially when you are looking at a cheap wood construction condo lowrise on a busy street.

The 3br/3ba townhouse on the other hand is excellent… on paper. It is recently built, with good materials. Drawbacks:

-bear mountain. Means it’s a 1hr+commute into town on good days. I would choose Sooke over this.

-Overlooking the racetrack means many hours a week listening to screeching cars tearing about a race track(you can hear them clearly from every room).

-no yard either front or back

-up a tight windy narrow private street with no sidewalks. You are required to use a car to simply leave your house. there is no ability to safely walk out of your home. And even if there was there isn’t a sidewalk for about 2kms until you get to the developed part of millstream(this was the deal breaker, I almost bought one of it’s neighbours last year when it was listed at $419k)

-in the winter the smallest amount of snow or ice will trap you

-Only the garage is on the ground floor. everything is a walk up.

-strata

You might consider $480k cheap, but consider after insurance, current interest rates, strata, and utilities you’re probably looking at closer to $2700-2800/month. To live with all those terrible problems. So that means your ‘cheap’ living requires an income of $135k/yr to come out to 25% of pretax income for housing costs.

Again, I know that most people on this blog are wealthy 1%s like yourself. But mere peasants in the top quintile of Victoria household incomes are excluded from owning that crappy townhouse.

3 out of 4 houses in van selling below ask in Feb; 50% below assessment (according to this article):

https://thinkpol.ca/2018/03/16/nearly-3-4-vancouver-houses-sold-asking-february/

Barrister:

Don’t know about being “disingenuous” or “dense”. I am a scientist by profession.

Richard: Thank you, I was not aware that Alberta limited banks to recovering on the house.

Apparently also Sask.

No, Barrister, please stop twisting words. It is not about what you have seen or not, but what you have believed and promoted as below:

DON”

As to sold under or over statistics, the simple answer is that they have next to no value as I suspect that you well know.

“In Canada, you cannot just give the keys of the house to the bank and walk away from the debt.”

Each Province is different. In Alberta if your mortgage was conventional (not CMHC insured) and all your payments are up to date you can drop off your keys at the bank and walk away, so called “jingle keys.”

Correction:

CMHC cover all cost incurred on the on the loan.

Instead of cover all cost incurred on the property.

Add: CMHC cover for the life time of the loan (25 years amortize, etc…)

QT: My actual question is a bit more subtle. If there has been a major drop in equity, in fact the mortgage is underwater, does CHMC have the right to refuse the bank to carry the insurance upon an attempt to renew.

Not generally how it works. If there was some policy tool that could “deflate it very slowly”, governments would use them to prevent housing bubbles bursting dramatically. It doesn’t work.

Even the vast resources of the United States and the trillions of dollars (yes, with a T) they used to try to stave the RE bleeding in ’08 did nothing to help. It’s because markets are a reflection of human psychology. Sheep following herds – people all want to pile in to expose themselves to a rising market. People then bail en masse when it goes sour. They don’t slowly trickle off over many years; loss aversion is a powerful psychological motivation, much more powerful than the greed that drove it up.

It’s why I kind of chuckle when I see people say, “maybe a 10% drop is coming”. A 10% drop is a run of the mill correction – the bare minimum for it it be called as such. In a sense, it assumes that the previous mania gains were more or less based on sound fundamentals. They weren’t. Our regulatory bodies and even the BoC has repeatedly told us this in the last year and a half, albeit in occasionally slippery language.

We’re misguided if we believe we can have 15-50% gains in a year or two and then call for a “soft landing”. Not saying impossible – but don’t count on it.

I love it! 😀 😀

Can someone please explain why the statistic “Sold over Asking” or “Price Slash” are a logical statistic to judge the markets performance? Realtors and their Clients are very subjective? It’s easy to find a 20% discrepancy in what Realtors and their Clients think a house should be listed at. For some reason people think this has relevance. What happens if all the Realtors that list under value in attempt to create bidding war go on holidays for 3 month? Then that under value sale will be gone and the “Sold Over Asking” will be gone. It has nothing to do with the value of a home and everything to do with the subjective value that the realtors and their clients guess their house is worth.

Conversely property assessments seem to be thought of by some realtors as insignificant. Take a look at the value in Vancouver , Land Value far exceeds the Value of the house on it.

From prior posts : LF Spain was in a financial meltdown and Canadian banks would only do business with Two Spanish Banks, No Greek Banks and No Italian banks—It was not the good/bad weather that made any difference.

RE: HELOC’s in Canada , I know many people who have capitalized on this opportunity. They borrow at the going interest rate ( low) and lend at the best secure bond rate( high) they can change this in 1 second. They are smart and will not be in any trouble in a downturn. This is way different then using your HELOC for going on Vacation or buying as Ski boat as what was happening in the USA before their crisis.

Re: Josh and The Sweeping Generalizations, point taken but there have been other generalizations from the Bear side. Other than sensationalist articles predicting a crash , most logical people I know think prices are going up. Some think the increase in Victoria Housing Prices has not even started. Obviously I am bullish .. just an opinion.

“Now I have a question and I hope someone here actually knows the answer (rather than just guessing at it).”

CMHC cover all cost incurred on the property and pay the bank on your behalf even if the owing money is greater than the original loan, however CMHC will come after you for any lost.

http://www.moneysense.ca/save/debt/your-cmhc-insurance-doesnt-protect-you/

Now I have a question and I hope someone here actually knows the answer (rather than just guessing at it).

Does CHMC insurance just cover the original term of the mortgage or does it also insurance the bank for additional renewals of the original mortgage. Does the bank need to get any approval for renewing the mortgage to continue the CHMC insurance. (Specifically, if the mortgage goes into negative equity does CHMC have a right to refuse a further renewal past the original term?)

I know it is a good question but does anyone know the answer?

“As a “bull” you can be right for 10 straight years and enjoy the ride up when your home goes up by 100%. A “bear” only has to be right once in a “crash” scenario.”

Bang on Oops. The warning bells are ringing but the bulls have their earplugs in tight. 😉

DaveJ.

I am now going to assume that you are being disingenuous which is better than the alternative that you are incredibly dense.

Bizznitch: Unfortunately, I suspect that you might be right. Lets hope you are wrong.

Opps:

Well, technically you are right about being hurt in a crash but I have always had a very old fashioned view of a house as a home. I will be the first to admit that it is a bad way of looking at real estate but frankly I always saw it more like buying a car. If I can get my money out of it, after inflation, I am thrilled. If I lose some then I got the joy of living in the house.

Personally, I never felt that I was smart enough to invest in real estate and certainly not confident enough to sleep well at night. If house prices drop fifty per cent tomorrow it wont change my life at all and I wont lose a night’s sleep over it. I do worry about the younger generation and I still regret that my generation in many ways have failed in our duty to be good stewards.

“CPP is based on contributions and OAS on residency. Citizenship entitles you to neither. You have a point about health care though. ”

I’m talking about OAS and healthcare. They are entitle to receive OAS and healthcare once they move back to Canada to live (as long as they have resided in Canada for 20 years of their live).

Barrister I knew all that. People that went for the max. amount of debt shouldn’t be mentioned here at all. Marko has said numerous times that people that he has worked with never went for the maximum borrowing capacity, so they should be fine in case of an underwater mortgage,in the long term. So, again, are you bulls really worried about the first time homeowners or about your “hard earned equity”?

Barrister:

“How to deal with the housing bubble is the real question. The first step is clearly to stop it expanding any further. The second step is to deflate it very slowly allowing a longer adjustment period where salaries and savings can catch up and cushion the drop of prices.”

I doubt there’s going to be a soft landing here. It’s either going to be a prolonged (3yrs or so), or a quick one (<2yrs). I think it’s going to be prolonged.

“I have a cunning plan which could guarantee a promotion to the Politburo. We create a new tax. At the end of every month any of the workers who have more than $2000 in their bank account must pay 2% to general revenue. As it is patent that these reprobates have acquired far more capital than they need we will call this the Hoarders Tax.”

Great plan you have. What happen to commonsense and be responsibility?

Are you trying to say that we should reward people that spend all their money, and punish those who follow tradition that save 3-6 months of cash for emergency? And, tax people more for saving for their retirement?

As you know, our social system already reward those that don’t save, because they will get more money from old age pension, and those that save will get less money from old age pension.

CPP is based on contributions and OAS on residency. Citizenship entitles you to neither. You have a point about health care though.

Also loads of Canadians who work abroad aren’t dual citizens (e.g. in the US on various visas).

Plumwine and swch25…yea, I thought the same especially the backyard. Wow, what a great place to play tag with your kids in the evenings.

“If first time homeowners are not speculators they will be fine in the long run. Why are we so worried?”

Because, it is another step at eroding our way of life and hurt us economically. This is just another tax grab that the NDP is implementing to pay for all the new pet projects/social programs that they are cooking up instead of balancing the budget, reel in government spending, and promote economic growth.

Not if the mortgage is insured, which is everyone who puts <20% down. You will be unable to move to another lender at renewal though.

“As an American family living in Victoria (PRs, working on becoming dual citizens), I just wanted to chime in that the US policy of taxing its citizens living abroad is horrid.”

Many people from all walk of life that are immigrants and or dual citizens feel the same way as you. However, my wife and the rest of my put our money where our mouth is and we gave up our just so we have only Canadian Citizenship.

I’m sorry but I’m quite draconian on immigration, PR, and dual citizenship, because something have to give otherwise it will erode our way of life. I believe that we should open our arms to take those what willing to come to Canada to live and absorb our culture, language, and pay taxes to be able to enjoy our freedom, social system, and benefit from our health care system.

I think it is unfair to honest tax paying Canadian that people including Canadian citizens work overseas who doesn’t pay Canadian taxes or health benefits, but once they are old they come back to Canada and reap the heath care befits as well as old age pensions. And IMHO, stopping the dual citizenship and put a time limit on PR is the first step of protecting Canadian way of life and slow down the out of control taxes.

Dave J.

Let me explain the problem for first time buyers if there is a major crash by way of example.

You bought a house for $500k putting 50k down in cash and taking a mortgage out for 450k.

The market crashes and drops by 20%. The house is now worth 400k but you still have a mortgage of 450k. Basically it is what is called being underwater. If you have to sell the house you will still own the bank 50k (By the way, if you have been following this blog that CHMC insurance that you paid for does NOT insure you but rather the bank for any mortgage loss).

The answer of coarse is not to sell the house and that works fine right up to the point that you have to renew the mortgage. generally banks will renew a mortgage as long as you have some equity in the house. The situation changes if you owe more on the house than what it is worth. Lets just say that if your house comes up for renewal and you are underwater bad things happen.

While I am addressing the basics here let me clear up a common misconception. In Canada, you cannot just give the keys of the house to the bank and walk away from the debt. (This misconception arises because you can do exactly that in I believe 37 US states but not in Canada). If the house is sold and the mortgage is greater than the proceeds of the sale you still owe the difference.

Part of the concern here is that for most young families that 50k down payment represents years of savings. In my example I chose a 20% drop in house prices but even a 10% drop would wipe out a lot of young peoples equity. A major housing crash can effect far more than just than just individual homeowners particularly in an economy such as BC where so many jobs are tied to the housing industry.

How to deal with the housing bubble is the real question. The first step is clearly to stop it expanding any further. The second step is to deflate it very slowly allowing a longer adjustment period where salaries and savings can catch up and cushion the drop of prices.

I know that I have provided a simple answer to a complex question but I hope it is at least some starting point for you.

Barrister: “But you are absolutely right that I personally will not be affected by a major market crash unlike a lot of people on here who are hoping for a crash because it will benefit them regardless of who else it hurts.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

You are actually touching on the worst part of a housing crash, Barrister. The hard feelings have developed over several years by some hopeful buyers and finally those people, that have been shut out of the market, see a glimmer of hope in the horizon.

Most people, as they move through the various stages of their lives, want to buy a home. There never seems to be anyone getting hurt as the bubble starts to develop and there aren’t a whole bunch of people screaming, “burn the homeowner”. Heck most people who couldn’t buy before interest rates tanked were suddenly buying their “dream” homes. Life is good.

That changed when everyone and their dog become “REIN” wannabees and housing got totally out of reach for the first time buyers. Boomers, who should know better, financed 2nd and 3rd properties with helocs to capture that pot of gold for retirement and the first time and move up buyers resorted to ridiculous mortgages to get on the bandwagon. Oh, and Foreign buyers, as well, Hawk. Lol.

Everyone is a genius for getting in at $400,000/$500,000/$600,000 etc. and they are constantly looking for that next assessment so they can “borrow” a lifestyle that they otherwise couldn’t dream of attaining. Is this generalizing? Absolutely, but our debt levels support that generalization more than the financially adept bloggers that live on this blog.

The interesting thing is that a lot of these people can’t help but brag about it to anyone that will listen. Blogs like this provide a great outlet for “bears”. The “bulls” talk about incredible tax free gains and exhort the “bears” to get into the market but when the market does turn they cry foul and tell everyone that “everyone will suffer and why do you want that to happen?” Sadly, each and every time, they are mostly right. A very small percentage of the population will do well.

When the tide turns it gets ugly and I can assure you that only the dumbest of the dumb are going to say, “I told you so.” to anyone in the “real” world. The harder part for the staunch “bears” that hibernate here is that the “bulls” won’t be back for that online .. “I told you so.”

As a “bull” you can be right for 10 straight years and enjoy the ride up when your home goes up by 100%. A “bear” only has to be right once in a “crash” scenario.

There will not be too many people untouched by the upcoming disaster, including you Barrister. You have been on this blog long enough to get a sense of your equity gains and you have been talking about selling your home for awhile. We are both old hands in the real estate market and it never feels good to leave big gains on the table.

Here’s a gentle reminder for all to enjoy.

http://www.vancourier.com/real-estate/twas-ever-thus-vancouver-real-estate-headlines-30-years-ago-1.23198902

Good luck.

“there is no way back to 1950”

I’m starting to wonder. A lot of seemingly intelligent folks here rattled down to one response to points they disagree with: “Must be a communist!”

Local Fool,

And some increasingly desperate bulls.

Money in bank accounts isn’t hoarded, it’s loaned (i.e. rented out) to those who need capital. Directly analogous to renting out a house to someone who needs a place to live.

Hoarding means keeping something unused.

DaveJ.

Great observation. I think the “concern” for buyers is those who over-extended themselves to get in “before it was too late”. But in such cases, the “concern” would have been more believable and useful had it been shared with such buyers before they scrambled into a frenzied market. But, of course, this time would be different. I was close to being one such buyer.

Freedom:

I absolutely agree that is what politicians should be doing but in my experience I have rarely seen it.

Frankly I suspect that what we are seeing is a badly contrived attempt at popular policy rather than good policy that may be going awry. But, I am willing to see where they go with this.

Local Fool, actually there are quite a few that I know of and with high salaries.

freedom_2008

Very well said.

Is it me or are there a few more bears hanging out here lately? Some of them seem…emboldened.

Anybody here with connections to an NDP cell or perhaps even know one of their commissars?

I have a cunning plan which could guarantee a promotion to the Politburo. We create a new tax. At the end of every month any of the workers who have more than $2000 in their bank account must pay 2% to general revenue. As it is patent that these reprobates have acquired far more capital than they need we will call this the Hoarders Tax.

Patriotz:

The factors you have mentioned are correct but the vast majority of the individuals we are talking about are excluded by the so called treaty “tie breaker” tax rules as to residence. In this case the exception is the general rule since we have tax treaties with the vast majority of relevant countries.

I suspect that we have either confused or bored, or worse both, most of the people reading this blog.

Perhaps we can both agree that there is a problem here that should be addressed but is extremely difficult to address (we have not even broached the issue as to the extent that Federal international treaties can constitutionally limit the provinces taxing powers). How does one spell dog’s breakfast again.

If first time homeowners are not speculators they will be fine in the long run. Why are we so worried?

I have lived long enough to know who I am and I don’t care what you (or anyone else) do or don’t suggest about me at all. I just don’t agree with your opinion that an elected politician should “be focusing on how to expand voter base and the number of seats in the next election”, rather than focusing doing governing work.

I would like to know why is so bad for first timers if the prices go down? You all have said that real estate is a safe long-term investment.

@plumwine great point. Im surprised at how nice those places are. Yes, it would be a commute into the city for work. Every place had trade offs though – even those over 1 million.

Freedom:

It is what lawyers ask when politely dealing with people who they are pretty sure dont have any idea what they are talking about and have not thought something through. Not that I am necessarily suggesting that you dont.

Victoria:

What a nasty little piece of work has developed in your heart. No, due to personal tragedy, I dont have kids although my wife has two that are as close to my own as possible.

Most definitely I have said that there is a lot of money from Vancouver retiring and buying in Victoria. That is because there is a lot of money moving to the island. it is called a fact not some type of opinion. Or are you suggesting that there is a bunch of poor people from Victoria suddenly buying 1.5 million dollar houses in Victoria.

And whether you like it or not, I actually do care what happens to the younger generation particularly the ones who have scrapped up a down payment for a condo or a house on the west shore. i am also concerned about young families that would like to be able to build a future. Just to make my day worse I am starting to get concerned about the level of intelligence and what it may say about the education system here but I will leave that for another day.

But you are absolutely right that I personally will not be affected by a major market crash unlike a lot of people on here who are hoping for a crash because it will benefit them regardless of who else it hurts.

The most important thing to consider when determining your residency status in Canada for income tax purposes is whether or not you maintain, or you establish, residential ties with Canada. Significant residential ties to Canada include:

a home in Canada;

a spouse or common-law partner in Canada; and

dependants in Canada;

https://www.canada.ca/en/revenue-agency/services/tax/international-non-residents/information-been-moved/determining-your-residency-status.html

Once and Future:

I actually do understand our tax system and, I apologize that I made my comments assuming that you do understand the system and were reading my comments in context.

The issue that I was addressing was so called satellite families. You are correct that we tax all Canadian residents on their world wide incomes. The operative word is “residents of Canada”.

The second point that one has to bear in mind is that we dont tax family units under present law but individuals (this is different than deductions for an individual based on dependent family members).

The issue on hand arises from the fact that the income producing spouse is not a resident of Canada

while the family here because the Canadian resident spouse has no income does not pay any income tax while drawing upon services such as health care and education.

It has been proposed that we impose some tax based on the non-residents income in this situation.

It is important to note, as correctly stated, that the non resident spouse who is working abroad is not a resident of BC and often not a resident of Canada and at the moment is legally not subject to any tax. Frankly I find it difficult to fashion a practical solution in identifying and taxing these so called satellite families other than forcing all Canadian citizen living abroad to file an income tax.

For all the wonderful people on line here who leap to assumptions with little or no thought might I remind you that my wife is a natural born American citizen and, yes, even as we speak she is actually upstairs staring on filing out her American tax forms. And yes I am really aware of the problems and inequities caused by this type of tax and there are indeed many inequities in its application. My comment though was directed upon the so called satellite families.

Thanks for the reply Barrister. Sorry haven’t read here for a few days.

We talk about affordability, homes are too expensive for 1st time buyers….

30 seconds on MLS. I found

– 2 bed/ 2 bath top floor for $310k;

– 3 bed / 3 bath townhouse under $500k.

The insides are move-in ready and nicer than most houses in the core under $1M.

Are these places not affordable for young couples/families? How much cheaper can we build them?

https://www.realtor.ca/Residential/Single-Family/19155762/404-821-Goldstream-Ave-Victoria-British-Columbia-V9B2X8

https://www.realtor.ca/Residential/Single-Family/19162269/2113-Greenhill-Rise-Victoria-British-Columbia-V9B0J1

This spec tax does nothing for affordability and it was a failed attempt at appealing to the vengeful millennial’s. I’ll say it again…. Mandate that evalueBC goes to an index system and not a dollar value system. that alone would have the biggest impact on house prices. Notice how after everyone got the letter that their house was worth 20% more asking prices went up 20%?

Change the building code to allow for less expensive building, mandate an up-zoning target for cities where the biggest problems are, remove dollar values from evalueBC, introduce financial transparency into all building projects making their books open to the public. introduce a temporary foreign buyer ban in key cities.

Instead we continue to make building more and more complicated and expensive, we spot zone everything making the process cumbersome, uncertain, unfair and lengthy, we tell everyone there house is worth 20% more this year and then say we have an affordability crisis, we prevent people from building their own homes, and now we will tax the sh*t out of anyone who happens to have a second home, and will further increase the cost of construction buy having the government build mega projects….

B……….S………

“To all those real estate bulls and pumpers out there….

Did you really think that interest rates would stay low and house sales and prices were going to go up forever? Like really? And I am honestly asking.”

Charlie,

They’d rather bicker about the Green/NDP new rules for greater fools, and how they’re praying for their demise so fat-ass Coleman can come back and shut down the casino/real estate money laundering investigations like Trump wants to shut down Mueller. Ain’t gonna happen.

Meanwhile Rome slowly begins to burn with red lights flashing everywhere.

Nice place in Cordova Bay slashed $100K to $1.25 mill.

Weaver is playing on both teams. Complaining and supporting. Complaining and supporting. That will only work so long. If his party is going to be taken serious outside of this Island, he needs to be something other than an NDP clone and supporter. The only seat that is safe is his own. The other 2 could go NDP very quickly and say goodbye to all the goodies the NDP just gave him. One thing about Weaver he is not stupid so he will do what he needs to do politically to prosper. Seeing the NDP crash and burn is a good way forward to that.

Barrister,

Is that what lawyers do: to throw out a vague question for cover themselves when they can’t answer a pointed question?

To answer your question: I am not an economist and I don’t have an ideal target for housing price either. But I (and most other people in BC) know that government has to do something to help fixing our housing issues. These new tax measurements are definitely not perfect, probably has collateral damages, and will be improved over time, but they are a good start for now.

For me, a government doing something on the issue, small or big, perfect or not, is much better than any selfish politicians who are only focused to get more votes.

What he said was that he understood that it was not going to apply to BC residents at all based on Horgan’s and James’ documented comments.

http://www.andrewweavermla.ca/2018/03/08/calling-bc-ndp-botching-tax-measures-nonexistent-legislative-agenda/

The paramount interest of the Greens is in getting PR. Forcing another election under FPTP is not likely to give the Greens a better position than they hold today.

Regarding Weaver’s criticisms of the spec tax, I think he’s angling for the NDP to drop it in the Gulf Islands and up-Island where his supporters are, and he’s likely to get this. Likewise the NDP are not likely to put up a fight over qualifying 8 month a year rentals in Kelowna.

Weaver will bail quickly if the economy and/or BC finances goes south. This is a minority government not held together very well. A recall attempt will be held next year against the speaker. 44 to 42 is not exactly a big margin for error for the NDP where 3 of those 44 are looking out for their own interests.

Are you Barrister really worried about the first timers? You are saying, all the time, how rich people are buying in Victoria, especially recently and now all of a sudden we have to worry about those poor people that could afford to through a million plus dollars..It seems that you don’t have much compassion about the future generations since you don’t even have kids of your own, so just let be sincere now and no more pretending. We all know that you are rich and don’t care and all that story you have told us many times so please, enough!

At the time of the article quoted, February 21, the NDP had not released details of the tax. Once the details were released Weaver:

https://www.straight.com/news/1042541/bc-green-leader-andrew-weaver-eviscerates-ndp-government-tax-policies

All Canadian residents are taxable on world wide income. This includes anyone resident for over 183 days a year regardless of immigration status.

The American model is to require all citizens regardless of residence to file US tax returns, although a non-resident making under $70K or so isn’t taxable and those living in places like Canada will get a foreign tax credit.

Barrister, we do tax worldwide income for Canadian residents. There are tax treaties that allow you to get a credit for taxes already paid in some other countries, but you are still obligated to report it.

Foreign-based multi-house owners pretending to be BC resident and reporting tiny incomes is a failure of enforcement, not a failure of the law.

What the USA does is an abomination. If you were born in the US and moved to Canada at age 2, you still are under their thumb. Do I care if a Canadian moves to France and lives and works there for the rest of their lives? No, and I don’t think we should tax them, either.

From your comments, I don’t think you really understand either our tax system or creepy uncle sam’s.

Here is what the “green guy” had to say about the budget. He said plainly that the NDP did not go far enough.

“It’s clearly a budget that’s meant to put people first and correct some of the perceived wrongs that have happened over the last number of years,” BC Green Party leader Andrew Weaver said Tuesday. “We are very pleased to see a recognition of the housing crisis that’s there. The steps that are brought forward are welcome first steps.”

Weaver was concerned that the foreign buyer and speculation taxes would only apply to specific areas – namely Metro Vancouver, the Fraser Valley, Kelowna, West Kelowna and the Nanaimo and Capital Regional Districts.

https://globalnews.ca/news/4037476/bc-budget-greens-support/

They’re not, there’s a whole set of other measures dealing specifically with “dirty money”. Why not read about it, the links are posted on this forum.

Freedom:

I am curious, what percentage drop in house prices is your ideal target? (Just ball park).is there a point that you think might create either too much hardship on first time buyers or a point where the job losses in construction might get too great. Since government revenues will decline with lower house prices where should the government income shortfalls be made up?

I am not arguing against a correction but rather wondering what the target decline should be.

Comrade Horgan got to play house for a year. He needs to go now before he destroys this Province with permanent damage. Hopefully this speculative tax will be the start of the end for the NDP. Will not take much to send the economy into the toilet. At that point the green guy will have to separate himself from any ndp disaster. Here’s hoping.

Barrister,

As an American family living in Victoria (PRs, working on becoming dual citizens), I just wanted to chime in that the US policy of taxing its citizens living abroad is horrid. I believe the US stands alone in this policy (Eritrea sort of does this, but not to the same degree), which is abusive. The yearly declarations of all our Canadian bank accounts to the IRS, with the potential fine of 10k for each account not properly declared is a nightmare.

Please tell me, If elected politicians only focus on being re-elected, then who will be doing governing???

People vote to get a government to govern. If they do right thing to help the housing market (even if it will impact our own house value), we will vote for them again (our whole family voted for Green last time) .

Sidekick….lots of changes to the program over the last decade or so. I have not heard of that book before but it looks like a good read. Gonna get it. Cheers.

Lief:

I am not near, or affected, by the chicken farm. This obviously is terrorist campaign of harassment that is being waged by this women. Moreover this is not the first time she has reverted to these types of tactics. Her behavior is totally outrageous.

I believe that she also owns a tile and carpet company according to the TC; personally I will make sure never to do business with her.

He’s part of cabinet so naturally has some influence. And of course his ministry is involved with every new piece of legislation, albeit more in the legal sense rather than whether something is good or bad policy.

Also this is a government where one or two disgruntled backbenchers could bring the whole thing down so Horgan has to ensure that his policies have support or acceptance from the whole caucus.

A 10% or 20% drop in values will wipe out a lot of peoples’ total equity especially first time buyers. This is a difficult political balancing act in that the people you benefit will still feel you have not done enough while the people you hurt will never forgive you.

People shouldn’t bank on an asset always rising in value and plan accordingly.

I think there may only be a handful that actually do feel that way about real estate. Almost anyone I talk to in the real world (off this board) think it will only go up. I know about 4 or 5 of us on this board all waiting to buy but calculating this factor in which has put us on pause. As people pointed out this may be detrimental to our overall ownership or it may not. Only time will tell.

Sweet Home:

All the points that you are making about a person on a single income being able to buy a house fifty years ago are true. The only thing you left off is that people are paying a much higher portion of their income in taxes.

For better or worse, it has taken a double income for most people to buy a house for a very long time.

Buying a house is still basically an auction. All else being equal, you will be outbid by the person whose spouse is working and can bid with that second income. House prices, not surprisingly, rose pretty dramatically as two income families became the norm. Some might argue that most of the extra income of a working second spouse has simply been absorbed by the housing market after the cost of child care are taken into account.While an interesting academic argument the fact of the matter is that there is no way back to 1950 where the average single income could both buy a house and support a family.

The other factor of your example in Arbutus is simply population growth in the city. Sooke is now the outskirts of Victoria whereas Arbutus would have been the outskirts before.

My original point, though, is whether house prices are actually as detached from local incomes as some suggest. That they are detached is not disputed but perhaps not as detached as some would suggest. I am not a stats guy but it would appear that public sector jobs, in Victoria, when one includes pensions, may have overtaken private sector jobs in many sectors of the local economy.

I am not denying the major impact of Vancouver money on our market but rather suggesting that its effect might be a bit over rated.

Barrister are you near the 100 chickens going into Rockland 😉

http://www.timescolonist.com/news/local/rockland-coop-d-%C3%A9tat-neighbours-worried-about-plans-for-100-chickens-1.23203551

I believe as well they are doing this to be a problem then allow for rezoning.

Pretty sure. I don’t remember the course but I think 3rd or 4th yr. Would have been ~97?

@Andy7

“the dirty money and the foreign money being parked into real estate that then just sits there empty,”

I addressed the “empty” house situation, as for “dirty” money, that is a completely separate issue and has nothing to do with a “Speculative Tax.” There’s the problem, trying to address both issues with one tax.

100 chickens coming to Rockland by this weekend it looks like ahead of the bylaw change. Story in the times colomonist. Property has an interesting past. Presently a room house for low income people. The property has been rejected by council for rezoning in the past.

Patriotz:

I was not referring to satellite families in terms of immigrants but rather the tax on cottages and second homes. As matters stand, just by way of example, a family moved to Victoria four years ago and bought a house downtown and a small condo in Vancouver because the wife works four days a week in Vancouver. Should they be treated differently than someone who was born in BC and has lived here for thirty years?

As for Satellite families, I agree that taxing them is extremely popular. I am at a bit of a loss as to how to implement this tax fairly. Perhaps we should follow the American model of taxing world wide income for BC residents (we would have to exclude income earned and taxed in the rest of Canada otherwise we would run foul of Constitutional issues). Maybe somebody can suggest how this type of tax could be drafted and implemented (short of creating a bureaucracy that costs more than it collects). Initially, I thought the simple solution would be if your property tax was more than your income but then I realized that would capture a a very large swath of legitimately retired people who are living off capital rather than interest. I am not saying it cannot be done but I am at a loss as to how to do it.

I’m not sure this tax is super popular now that more details are known. Seems to be a lot of opposition to it in areas outside of Vancouver and perhaps Victoria. Maybe if they rework some aspects it would be.

Yes he is, and it’s about time:

“Exemptions will be available for:

– Principal residences (excluding satellite families)

– Qualifying long-term rental

– Certain special cases

Q. Will satellite families have to pay the tax?

A. Yes, satellite families will be required to pay the tax. We will be collecting information from home owners to identify families with high worldwide income. These families will not be eligible for the up-front principal residence exemption. To the extent that they pay tax in BC, they will still be eligible to claim the income tax credit.”

And for those who think this is a “quagmire” – this is one of the most popular policy moves any BC government has ever made. The opposition is coming from the RE industry, those with interests tied to the RE industry (i.e. continued high prices and rents) and the 1% or so of BC voters who would be directly affected – many of whom are using their “second homes” for illegal short term rentals.

David Eby is the AG. He had a lot to critique about housing prior to being appointed but he has a ft job as AG and his ministry doesn’t formulate or weigh in on tax policy. He would deal with money laundering strategies though.

To all those real estate bulls and pumpers out there….

Did you really think that interest rates would stay low and house sales and prices were going to go up forever? Like really? And I am honestly asking.

CREA Now Expects Real Estate Prices And Sales To Fall Across Canada In 2018

“Real Estate Prices Expected To Fall Across Canada, BC, And Ontario”

“Canadian Home Sales Are Expected To Decline”

“Yes, even real estate crazy BC is expected to see home sales decline. CREA is forecasting 2018 will close with 92,400 sales, a 10.95% decline compared to the year before”

https://betterdwelling.com/crea-now-expects-real-estate-prices-and-sales-to-fall-across-canada-in-2018/

@Leif

I totally agree.

@Barrister

I think the NDP threw too much into the fire at once. I think they should have started with the FBT (even though I think it’s sort of useless) back in the fall, waited 6 months and then moved on to other measures/taxes as needs be. Waded into the pool to acclimate the public to these new measures rather than jumping in all at once.

@Richard

That might help decrease flipping, but it’s not going to do anything to stop the dirty money and the foreign money being parked into real estate that then just sits there empty, destroying neighborhoods, jacking the market prices and messing with our housing stock, forcing people to move away because they can’t afford their original city anymore, which then puts pressure on the new area, rinse and repeat. Do I agree with other Canadians buying properties in hot areas and leaving them empty? If our market wasn’t a mess, it would be fine, but considering our housing market is a total disaster, I don’t agree with it.

@Barrister “Husband a police officer, wife a high school teacher, but their combined income is just under 200k before the husband adds in his overtime.”

$75 – $100K a year when an average house costs $800K is not a lot. That still makes a house 8 to 10 times one person’s annual income. I know someone now in their 80s who was a teacher and was able to afford a house in Arbutus on his salary alone. His house is now over $1M.

So, at best, it now takes the income of two people working full-time in better-than-average paying jobs to buy what a single person could 50 years ago. Also, childcare costs could eat into that second salary quite a bit.

House prices have tripled in Victoria since the turn of the century. Whose salary has gone up that much? Yes, interest rates have come down, but if it takes you 35 instead of 25 years to pay off the house, when do you save for retirement? The police officer and teacher I believe have defined benefit pensions, but those are gone for the majority of people.

Eby IMO has been on top of this for a long time and wants to see the change. I look forward to what he brings 🙂

Once and Future:

Even Elby comment is fraught with political danger. It implies that people who are not lifetime residents of BC might be taxed differently. How many permanent residents are there in BC who have moved from Alberta or other Canadian provinces are there in BC. Is he going to be attacking immigrants to Canada as well. The political reality is not just that the NDP has a one seat majority but that there are a substantial number of ridings that were marginal wins. Elby doew point out the pitfalls but seems to ignore that this is not only a political minefield but one also best not entered into in the first place.

Leo S

He just stated the obvious that to make real estate truly “more affordable” you have to drop house

values. A 10% or 20% drop in values will wipe out a lot of peoples’ total equity especially first time buyers. This is a difficult political balancing act in that the people you benefit will still feel you have not done enough while the people you hurt will never forgive you.

From a purely political perspective this has been badly handled. The icing on this cake is calling it a speculator tax and then being forced to admit that it has nothing to do with speculation. That is the sort of cynical deception worthy of Christy Clarke. To do it while balanced on a one seat majority propped up by a coalition seems reckless. Note that I am not arguing as to whether this is a good tax or a bad tax but rather was it a politically sound move. Personally I would have advised them to announce the FB tax which has at least popular support and an additional tax on present foreign owners and left it at that for the moment. There are a number of indications that the market is already starting to slow or at least level out. The last thing I would want as the present government is to be blamed for a major housing correction. The fact that this tax might only have a minor impact on a correction is not relevant to the fact that the present government would be blamed for bursting the bubble. I appreciate that after approving Site C and then appearing to back down on the pipeline that the government felt a need to have a big “win” on housing.But between the foreign buyer tax and the announcement of building thousands of affordable housing units this speculator tax was a bridge too far that could end up hurting the party. If they really felt that they had to go that extra step it would have been far better optics t go after units that are being exclusively used for AirB&B.

If I was Horgan I would be focusing on how to expand my voter base and the number of seats in the next election and I dont see how this tax will add to his voter base.

I would not want anyone to post their home address on such a public forum. However, if you stare hard at maps and know victoria, you may be able to figure it out.

Average Commenter, that is my understanding as well.

Found a commentary by David Eby (undated):

http://davidebymla.ca/newsletter/issue-update-speculation-tax-housing-action-2018/

This is the only clear acknowledgement I have ever seen of the NDP taking issues seriously: