The drag on the ladder

Ah the property ladder. It’s a simple concept: If you want to get to the top, you start by getting on the first rung (a small condo), then you step to the next one (perhaps a townhouse or rancher) and then you keep stepping up until you get to your dream McMansion or waterfront property.

It makes intuitive sense. After all, as we know real estate only ever goes up and does so much faster than anyone’s income, so you better get on that cash train as quickly as possible. Then when you find a significant other you upgrade to a larger place, then you have kids and upgrade to a larger place, and then you upgrade to make space for the boat. Each time you use your equity (the part that didn’t go into the boat) to finance the next purchase.

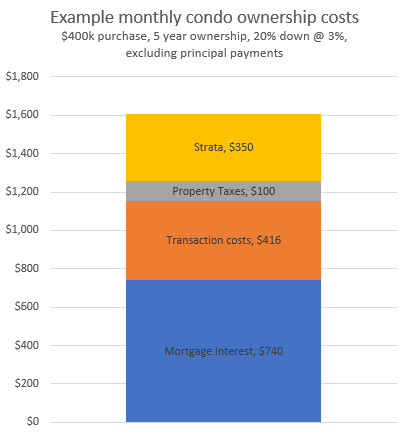

But what does that fairy tale narrative cost you? Well as everyone knows there are quite a few expenses to buying and selling real estate and the problem is that instead of those costs being fixed, they are usually set as a percentage of the cost of the real estate. In a high priced market like ours, that means big money. So let’s take a quick look at an example of Joe buying the median condo today for $400,000 (which gets you a newer 1 bed or older 2 bed unit). 5 years later his circumstances change and he wants to upgrade to a larger place. What does that cost him?

Well on the buying side, unless Joe is a first time buyer it’ll be $6000 in property transfer tax, about $1200 for the lawyer, and around $800 in adjustments and and title insurance. Let’s say 5 years later the market has gone nowhere and he sells for the same $400,000. When selling, the most common commission structure in Victoria is 6% on the first $100k and 3% on the remainder which would be $15,750 once you add the GST. Add another $1000 for the lawyer and we’ll assume Joe’s mortgage is just up for renewal or he’s porting it so no additional penalty there.

Overall that adventure will have cost about $25,000 in fees and taxes. Put another way, it would cost Joe $416/month for 5 years just to buy and sell that condo. That puts transaction costs second only to the interest on the mortgage itself.

Clearly it is advantageous to both maximize the length of time you own a property and minimize transaction costs when you do have to sell. That means looking ahead to where you see yourself being and see if you can take that property ladder two rungs at a time.

Of course life doesn’t often go as planned and in times of very high rates of appreciation it is likely still better to jump in rather than delay until you can hit the second rung. However these times are not as pervasive as the real estate industry would have you believe. Especially because condos have historically done worse in corrections than single family homes in Victoria which makes it particularly disadvantageous to be stuck on the first rung when the ladder is sinking.

Thoughts? For those who started in a condo and upgraded, how long did you stay?

Monday: https://househuntvictoria.ca/2018/03/19/march-19-market-update/

Add in Houston (Harvey), Puerto Rico (Maria), Florida (Irma) on the demand side. Add in 2017 BC Wildfires on the supply side. Add in a softwood lumber trade war and threats to steel that make suppliers raise prices to cover their butt.

But that is OK! According to Hawk, our economy will tank, making Victoria houses affordable for millennials and putting the construction industry out of work (along with everyone else). Then maybe I can afford to build a house? Not sure if the cure is worse than the disease.

Living upisland now I can attest to the strong housing market up here. I think the CV is overpriced for the most part but compared to Victoria it is affordable.

Leaving Victoria is tough though. I miss it every day even though it is beautiful where I now live.

But if you are a young family

struggling to get by in Victoria upisland is a fabulous place to raise children. You can get a large house with a yard for the cost of a condo in the city.

Perhaps the “opportunity” this time is to take advantage of the increasing ability to work remotely and move to a smaller more affordable location. I know so many folks that have moved up island to Comox Valley, Campbell River, Parksville, and even Port freaking Alberni to get out of the Vic and/or Van housing markets. Lots of them still doing the same job as they were in the city. Doesn’t work for all professions obviously.

@ Barrister:

“Has anyone actually calculated the total taxes paid on the construction of a new house. When you add in all the sales taxes, the gasoline taxes to move product and material, the income taxes for the wages paid to labour and the corporate taxes for the companies that sell the material (and all the other taxes I have forgotten) …”

The average Canadian family with a household income of $83,000 pays 42.5% of their income in taxes, according to the Fraser Inst. But if you can afford to buy or build a new house, then your household income is probably several times the average, in which case you are likely paying 60 to 70% of your income in taxes.

Seems a lot, doesn’t it. But then where would we be without government to spend our money for us, ensuring safe drinking water in native communities (or not), sending our F15s to bomb people in the ME, making fancy dresses for the Prime Minister, etc., etc..

Without the government, what would all those permit issuing paper pushers at City Hall, tax inspectors across the land, government advisers, etc., etc., do?

We’d finish up with an economy like Afghanistan or somewhere, with a few billionaire crooks (I guess we have those now) and everyone else hungry, in rags, and without a proper understanding of white privilege.

DaveJ

Do we have actual possums on the island? I am talking about the mammals.

A blogger at Better Dwelling:

“We made buying real estate a game. Fake income. Illegal down payments. Masking leverage through alternative means. No oversight for numbered corps. Taking money out in a mortgage for renovations or a downplay on another property. Now everyone is trying to game and realizing the music has stopped and there aren’t enough chairs. This will be our Subprime and we won’t know how bad it is until it is really bad because it is all dominoes. Pigs and possums. Tick tock.”

Everyone here talks about the commute downtown. There seems to be an underlying assumption that the vast majority of jobs are downtown. I wonder though whether this is actually true and to what degree.

Does anyone know if there is a map showing the concentration of jobs for greater Victoria. Certainly, the west shore has grown a lot in terms of jobs and small businesses. The area around the airport and also in Sidney seems to have had growth. I am not suggesting that the majority of jobs are not downtown but rather everyone here talks like absolutely everyone is heading downtown.

My question is do we actually know or are we all just making assumptions?

I noticed a few new websites which took the original study guide (Marko) and put it in a more public format (https://tinycards.duolingo.com/decks/25wRKcY2/bc-housing-owner-builder-exam-study-guide).

I feel like Leo should post the study guide here somewhere. HHV already shows up in the search results.

and I thought I was bad. Unless they plan on holding up the house with this glass, it looks like a suspiciously high number.

I did this about 10 years ago as I was trying to claim the GST rebate on a new build. It’s a staggering amount percentage-wise. Not only are you taxed on pretty much every transaction, but the supply chain for building materials is pretty bad as well. Manu -> national distributor -> regional distributor -> wholesaler -> retailer etc. Each time there is a nice little price bump. There are some direct-to-consumer places in the states but none I’m aware of here.

Not much, I’d wager. We’d need a serious cooling of the market and a lot of hungry trades. When I built 10 years ago I had trouble keeping the stucco crew away because they had a lull in jobs and needed the $ to keep the crew.

My parents did a major reno last year and the contractor doubled his rates after their job. He said people were still willing to pay. Apparently lots of other contractors (and trades) did the same. I have friends who are doing basement renovations and it’s criminal what they’re being charged (Obvious gouging).

Nasty out there!

Materials are going up because of increased demand (California disasters + building boom) increased greed (might as well raise the price,why let the builders make all the money), and monopolistic control (Titan).

As we all sit here waiting for the Monday numbers to see how the spring is shaping up.

Went to the open house on Pemberton on Sunday. While not totally my taste, I think it was a pretty good house overall with some nice features and a really nice yard (assuming that most people would just turn the dog kennels into a patio area. At 2.5 million it seemed to be priced right compared to what has been selling in the last year.

If this one does not sell by the end of March that should be a heads up as to the market softening.

“Every period of time has its own challenge, but also its unique opportunity.”

Unique in that rates are rising off a record low with a record high household debt load. Best to wait it out into next spring as the fallout from debt bomb, NAFTA changes, and Trump impeachment bomb coming.

Condo listings have really popped, right on track for the condo bubble popping by summer/fall.

Few years ago, my roofer told me shingles went up because of high oil price….. ’cause shingles are made with crude oil….

Re: Ladder

We started our family in 2 bed / 1 bath (yes, very doable. Parks are everywhere, yards are optional). Spacious, but outdated and ugly. Joined the strata council. Spent 3 years diy to make it nice. Connected with trades while doing strata duties. Scouted the neighborhood.

(ie, looking for the cheapest place in the block, while pushing stroller.)

Before listing our places, we moved our stuff to friends’ garages. Stage it, took good pictures, printout 24 months of minutes, by ourselves. Got very nice discount from our realtor, and good cashback from our next home too. (“low maintenance”! buy within 1 month, ducks in a row, etc) Rinse and Repeat.

Every period of time has its own challenge, but also its unique opportunity.

Thank you about the Calgary shingles; what they were saying did not sound right to me.

This is why I asked “How much cheaper can we build them?”, and listed 2bed/2bath 310k; 2000sq townhouse $480k.

(Can we build new houses for new buyers budget, after the land cost.)

Average Commenter typed essay about how angry he is with his parent’s generation. Penguin jumped in saying how shitty that place people are living and call me unreasonable/inconsiderate. wtf? lol!!

I thought you were exaggerating when I read your comments last year but, after doing my own research, the corruption in the HPO is frightening. Even the public talks recorded on Youtube come pretty close to saying that Owner-Builders are all borderline criminals and need to be eliminated from the market.

I can only imagine the damage done to small towns in the interior where most people build their own homes.

I’m not so sure I’d rely on Calgary’s market as a ladder climber. The Calgary market is in many ways on just as shaky ground as markets in Toronto, Vancouver etc., but for different reasons. Calgary doesn’t have the speculation or foreign buyer influence driving prices, and you definitely can get much more house for your $, but Calgary has taken a massive beating economically since 2015. There was a huge glut of new condos that came on the market and prices there are depressed but surprisingly the SFH market has stayed incredibly resilient. Typically in a market that has its economic rug pulled out from under it you would see a big drop in housing prices but that hasn’t happened. It isn’t like supply dried up since 2015 to keep prices afloat so the only thing you can point at are persistently low interest rates keeping demand going and propping up the market.

Interest rates will have to stay low AND since Calgary is still so overly reliant on the O&G industry you’ll need to see a significant rise in the price of oil in order to see any sort of significant price appreciation in Calgary.

I also feel like the government is trying to squeeze out the owner-builder and small mom and pop licenced builder.

Here is a perfect example. In Colwood if a lot is less than <550 m2 you need a development permit for character and form (city has to approve your exterior materials, design, colours, etc., so all the houses don’t look the same) and this development permit costs $2,800 and a couple of months delay in addition to building permit.

However, big subdivision like Royal Bay just get ONE development permit for character and form for the entire subdivision and then build a bunch of homes that look identical.

The municipality screws over the little guy for some BS concept of they don’t want all the homes looking alike but then they allow entire subdivisions where the homes look nothing but identical.

HPO is also trying to kill the small person. If you have a huge company you can send your “nominee” which could be a secretary to take the mandatory education. If you are a small one person show you have to take a week off work for your yearly credits.

And they are obviously out on a mission to completely kill the owner-builder. Two years in and still no study guide….what a joke.

More signs of trouble in paradise. A stream of people desperate for private money and those who believe there is zero risk in real estate only too happy to give it

Same poster has given real estate transaction advice which did not add up and the same goes for these lending claims. If you have that much equity Fisgard or similar companies will lend for much less than 18%.

“that singles all all made in the US and the Canadian peso is mostly the cause.”

IKO has a manufacturing plant in Calgary, has been there for decades.

More signs of trouble in paradise. A stream of people desperate for private money and those who believe there is zero risk in real estate only too happy to give it

https://vibrantvictoria.ca/forum/index.php?/topic/5061-investment-ideas/?p=429931

Has anyone actually calculated the total taxes paid on the construction of a new house. When you add in all the sales taxes, the gasoline taxes to move product and material, the income taxes for the wages paid to labour and the corporate taxes for the companies that sell the material (and all the other taxes I have forgotten) and then calculate the fact that you are paying for this with after tax dollars what percent of the cost of building a new house is actual tax in one shape or another. Then toss in the land transfer tax.

I wonder if anyone has ever calculated this?

Good idea. That is a low risk high opportunity market to buy in for sure.

I talked to a roofer about six months ago and he was mentioning that roof singles have gone up about 40% in the last couple of years. Dont know if this is true but some one mentioned that singles all all made in the US and the Canadian peso is mostly the cause.

Speaking of outrageous construction costs…

I went to an open house in Fairfield near Clover Point and got into a discussion with a neighbour of the seller. Apparently the local rumour says the new box building at 1234 Dallas will have glass walls overlooking Dallas Road and the ocean. Thick structural glass with a price tag of $550,000 just for the glass, for a total construction&land cost of $5.5million. Maybe it’s just a rumour, but imagine paying $550,000 just for your windows!!!

@richardhaysom: “SELL and then come back to Victoria with your 200K equity plus your original deposit and slap it down into the RE market here. There’s always opportunity but sometimes you have to go looking for it.”

This is a risky move. I don’t know the Calgary market, but I know Saskatchewan because I moved from there about 15 years ago. When I left, average house prices here were roughly double ($250K vs $125K). Now it is about 2.5 times (800K vs 300K). Even in a shorter timeline, prices before the 2008 meltdown shot up here and lagged far behind in Saskatchewan (was 3x more at one point).

There is a chance one could come out ahead, but markets in Canada are local, and who knows what the difference will be when you are ready to move back. Also, it is usually hard to move once you put down roots, especially if you have kids and/or your job isn’t very portable.

The best advice someone could have given me 15 years ago is that if you want a SFH and you plan on staying in that city, buy one when you can afford to and don’t hold out for market shifts that may never come. However, I do agree that now many people can’t really “afford” (depends one how you define that) to live in Victoria. For those people, moving elsewhere makes more sense for quality of life, but I wouldn’t count on being able to move back to Victoria.

Not for the faint of heart. Being a Virgo doesn’t help. Nor does trying to build a worthy house that will last.

Marko, I kind of agree. However, there is still a lot you can do that doesn’t fall into the expense trap of granite counters and hydronic heated floors.

Number 6, that is certainly part of it. All the people I have talked to have been very nice and generous with their time and advice, but I can tell that none of them are taking “modest” jobs at the moment. Whether it is a new house or just a kitchen reno, everyone is going upmarket for the newly wealthy boomers fleeing Vancouver.

Unfortunately, I am not sure if a housing slump would do much to “correct” local building costs. In fairness, everyone should be paid decently for their work. Squeezing subtrades ruthlessly is a bad habit to get into, so there is still a limit to how far a builder can sharpen their pencil.

Leo S, I know the feeling!

GETTING UP THE PROPERTY LADDER

Calgary RE prices peaked in 2007, they are still down 10–15% from those highs. I estimate the perfect time to get into the Calgary housing market would be late fall 2018. A first time buyer can buy a really nice house for $400K . As pointed out the soft costs to buying in Alberta are minimal, there are no rules for “empty houses” etc, and no issues with Airbnb.

The unemployment rate continues to fall so more and more prospects for young workers.

If I wanted to start climbing that ladder I would go out to Calgary find a job, buy a house, possibly rent a suite out of the house and after 5 years may well have close to 200K equity with the combination of a rebounded market, equity pay down on the mortgage, extra savings squirrelled away from lower monthly payments plus rental income, SELL and then come back to Victoria with your 200K equity plus your original deposit and slap it down into the RE market here. There’s always opportunity but sometimes you have to go looking for it.

@Grant: TIL what “TIL” means. I had to look up that it means “today I learned”. I still have a flip phone and don’t text.

To your point about the PTT, I agree it doesn’t seem right that transfer taxes and real estate fees should be so much higher in BC. In Saskatchewan there is a title transfer fee of 0.3% and real estate commissions are 6%/4%/2% on the first $100K/ next$100K/ remainder. So, on a $300K house in Regina (slightly above their current benchmark), that’s $900 to the government and $12000 to the agents.

That makes it easier to get up the property ladder and also easier to switch houses if circumstances change (like job location) or you just don’t like what you bought for some reason. Even $1M isn’t really a luxury property here anymore, but the costs are still calculated like it is.

Because the demand for new housing in Victoria is strong, builders are able to make a bigger profit. A custom home of say 1.2 to 1.5 M will have from $150,000 to $200,000 in builder’s profit. In other cities builders make less profit and in bad times just make wages.

Hearing the details about several people’s building projects over the years here has beaten any desire to build a house out of me.

I wish I knew how people build houses for less money in other parts of the country.

Homes in other parts of the country have much less finishing as the land cost is much cheaper. Here you can’t drop 500k on a building lot and then cheap out on the finishing. Other parts of the country builders use pony walls in staircases…when was the last time you saw that here? Almost everyone is using railings with pickets or glass. Pretty much all bathrooms have floor tile versus viynl, etc., etc.

Add absolutely insane regulations. My issue with the regulations is they don’t actually improve the end product.

Add lack of skiller labour and unlike parts of the US we don’t have access to cheap Mexican labour.

Well Barrister, if your wife is both a US citizen and has a controlling interest in a foreign bank, I can’t imagine what the new US “repatriation tax” is going to do to your retirement.

If people had to buy property with their own money, instead of borrowing vast sums of money from lenders, it would be very interesting to see where home prices settled.(?) Imagine…

Dasmo, from the previous thread:

I would like to do what Dasmo is doing and build a house. I don’t want a huge house and would be happy to be far enough out of the core that the land is not stupidly priced. However, after a lot of research, it is looking pretty difficult to build a 2000 sq ft house for even $250/sq ft. I have heard as high as $400/sq ft, even for a basic 2×6 framed box.

A few people I have talked to say that materials have gone up 30% in the last 18 months alone. Even if you get the land for cheap out in Metchosin, you probably have a water well and septic system to build on top of that.

So, all you people who want a real house and a yard bigger than a joke for 500k, I say good luck (and I do wish you luck). We can’t build them for that any more unless they are churned-out spec houses on tiny lots with every corner cut for cost savings.

Do I support the new energy efficiency standards? Yes, but it seems like the govt has made pretty much everything else about building a house an absolute chore.

I wish I knew how people build houses for less money in other parts of the country. (Sorry for the rant)

How many people can afford to carry a $400k condo and a $800k house?

Buy a 275k one bedroom at Vivid….pay down the principal and hopefully you get some sort of family income uplift in 3 to 5 years.

Depends on what prices do in the time period. If you wanted to buy a SFH in 2015 but didn’t have the money it would have been a good time to buy a condo instead. 3 years later even after costs you would be several tens of thousands ahead at least and might be able to swing the house.

Same situation in 2008 and it would make a lot more sense to rent and save.

How many people can afford to carry a $400k condo and a $800k house?

I started in a condo, held it for 5 years and swapped up to a house in Fernwood. I swapped up at the top of the market around 2010, but that’s often the way it is when you need the equity to swap. It still worked out, and I used equity from this peak to buy a brand new townhouse in Nanaimo a year ago. I’m a bit nervous i’m over leveraged now, and considering selling Nanaimo to collect the small profits before rates kill my cash flow.

@josh – Leo is correct. The first time home buyer’s exemption talks about name on title as a primary residence. Marriage to a homeowner doesn’t effect eligibility. Neither does ownership of a property that is not a primary residence.

That doesn’t work if you’re married does it?

I’ve never really understood the property ladder concept.

If you’re on the first rung and prices go up, then your equity position has improved—but prices of properties on the second and third rung have also gone up, so if you “move up” you’re no further ahead. Throw in transaction costs and you’re way behind!

Am I missing something?

I sometimes quip that people spend more time researching their next TV than they do thinking about how to be better parents.

Well you learn something new everyday- TIL about BC’s very pricey PTT. Alberta also has a land transfer tax, but it’s more of a fee than anything else. So a $1,000,000 house sale in BC: $18,000 PTT. Wowza!

Same sale in Alberta has a LTT of $235.

BC (and Victoria in particular) sure are beautiful places but when you add in other taxes like sales tax, you definitely pay for that BC lifestyle.

If buying a non-forever ladder condo buy one that will make the best investment versus the one that you actually want. By far where I saw people get burnt the most in real estate was entering the ladder by buying into a rental restricted complex; good luck selling one of those in a slow market when it is great time to buy a SFH and obviously you can’t rent it either.

Oh and this is less of an issue now that there are no more single family houses under the $500k exemption limit but if you are in a couple, investigate buying in only one of your names so you can still get the first time buyers PTT exemption the second time. As always, talk to your lawyer, I’m not giving advice here.

Great advice from LeoS:

Alternate Plan:

Step 1: Marry a spouse who has a controlling interest in a bank in Lichtenstein.

Step 2: Buy a villa in Tuscany.

Step 3: If after a few years the marriage really sucks be prepared to reduce your lifestyle from extremely rich to just moderately rich.

Sorry, I took a bit of a fall last night and I am hurting all over.

On a bit of a serious note, the single biggest factor for your both your finances and your happiness is not what house you buy but who you marry. Most people spend more effort on picking a house than finding a spouse.