The value of rentals: a case study

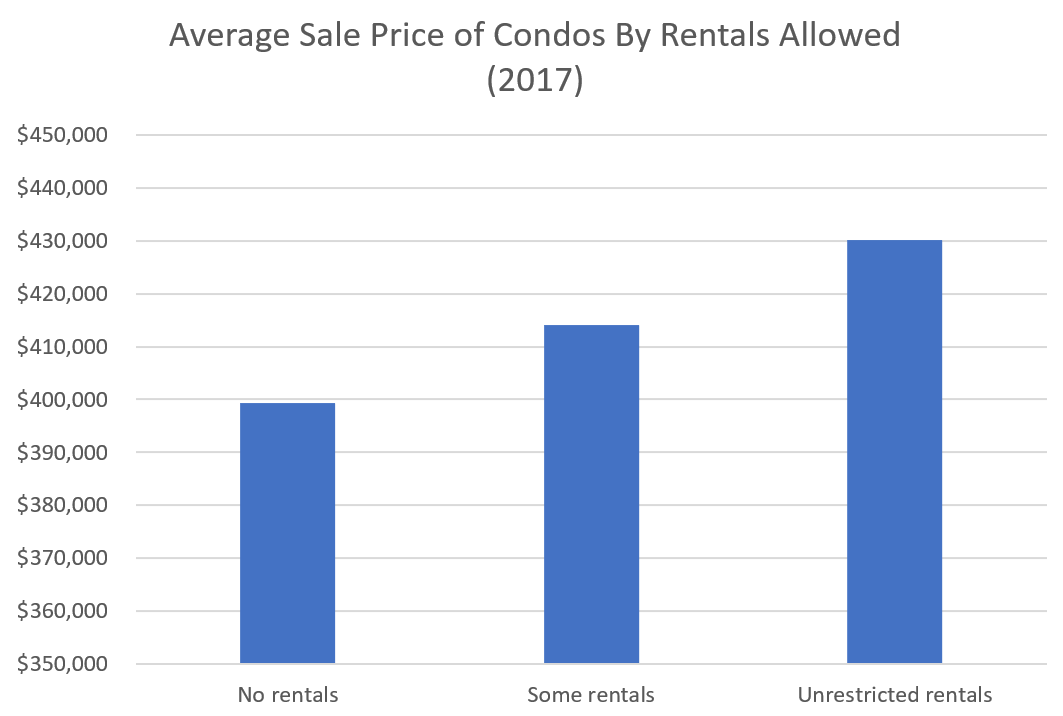

I’ve heard a lot of debate about the impact of rental restrictions in condo buildings over the years. On the one hand, people argue that allowing rentals will attract the investor crowd, make ownership more flexible, and push up market values. On the other hand, allowing those people in will bring down the whole neighbourhood and potential buyers will stay away. About 2780 condos have sold this year, and of those 58% allow rentals with no restrictions, 24% restrict rentals to just a few units in the building, and 18% ban all rentals.

To get a sense of the impact of rental flexibility on market value, we can look at the data in several ways. First off, we can take a simple look at what those places are generally selling for.

Seems like buildings where rentals are allowed are correlated with higher average selling prices. But newer buildings often start off with no rental restrictions so this price difference could be due to type of condo rather than the rental status.

Indeed if we look at when these places were built, the condos with no rental restrictions are on average only 6 years old, while buildings where rentals are banned are on average 25 years old. Maybe some sort of leaky condo induced mold is causing residents of older condos to vote against rentals?

Regardless that line of analysis won’t get us further to the truth about what impact allowing rentals really has.

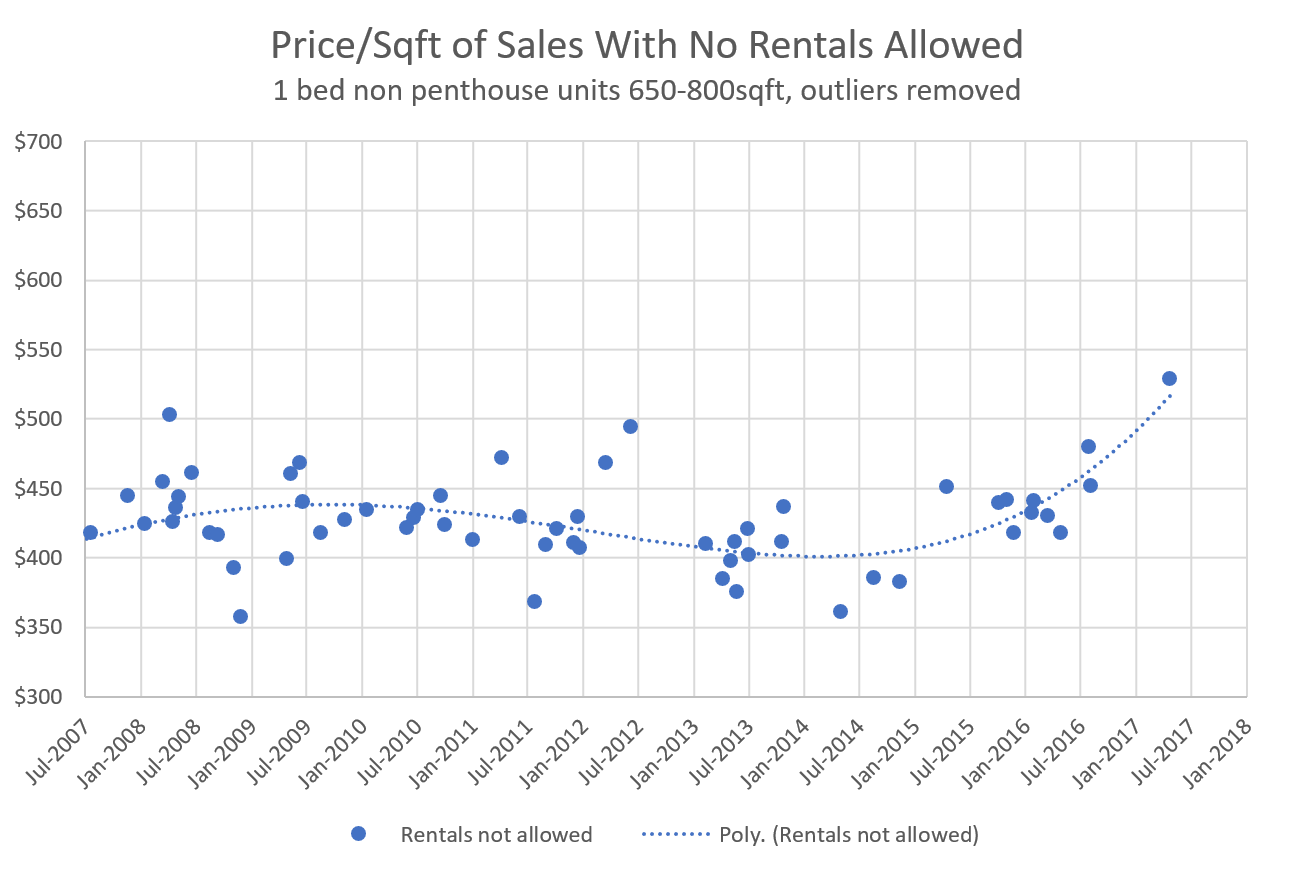

For a better test we need a within-subjects experiment. Luckily the 12 year old mid rise at 160 Wilson is such a building which transitioned from rentals being banned to allowing unrestricted rentals in July. Let’s take a look at what happened to prices. I focused in on 1 bedroom non-penthouse units between 650 and 800 square feet. Here is how those were selling when rentals were banned.

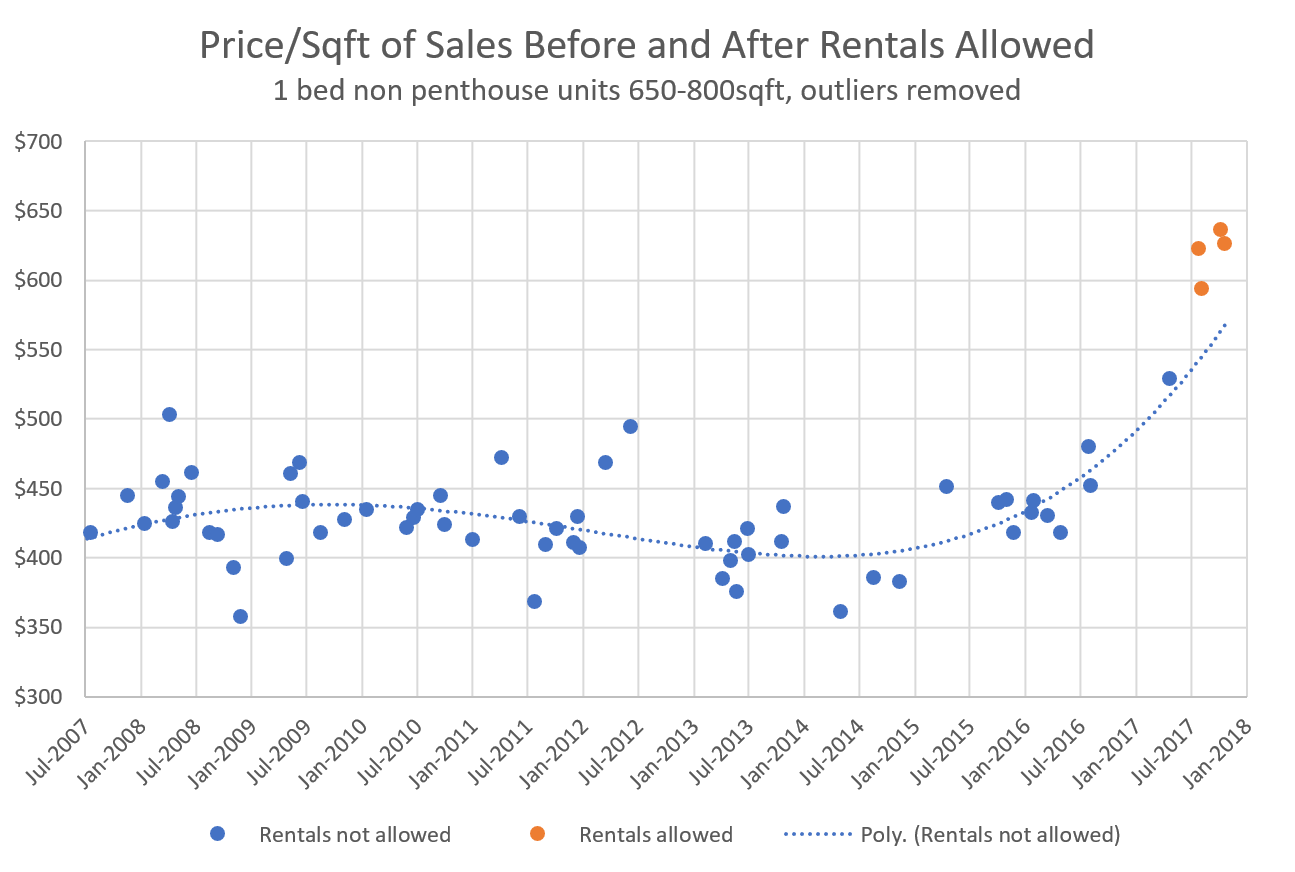

And here’s what happened after rentals were allowed in the building.

There have only been 4 sales of these units after the rental restrictions were lifted but it seems pretty clear to me that there was a quantum jump upward to a new trend line after rentals were allowed. When was the last time a strata vote put $40,000 in your pocket?

In this building, voting to allow rentals increased unit value by about 10% or $65/sqft.

Now we can’t necessarily expect the same magnitude of effect in every building. If units in a building are not suitable for rentals (for example on the very high end), rental restrictions probably will make less of a difference.

So here’s a pro-tip: If you own a condo that doesn’t allow rentals and you’re thinking of selling, bring this article to the strata council and see if you can convince them to lift the restriction. If you’re looking to buy a condo, be wary of those where many owners are considering restricting rentals. Do your due diligence and check those strata meeting minutes folks!

You are correct. I did look at the overall market for similar condos and came to the same conclusion (about 10% uplift from eliminating rental restrictions) as from the difference to trend, however there were very few sales of similar condos nearby to make for a convincing argument so I didn’t do that analysis.

Can you suggest a few buildings that you would consider to be comparable? Then I can take another look. Thanks for commenting and congratulations on managing to convince your strata with a logical argument.

Hi Leo, having had firsthand experience with eliminating the rental restriction bylaw at the Parc, I think your price analysis needs to be put in a broader context. You should be capturing the condo sale price/sf of adjacent Vic West condos where rentals are permitted. This type of analysis was part of our persuasive argument to optimize owners’ property value among other rationale. Our data covered 1-year and 3-year sales data up to July 2016. We compared Parc price/sf against all condos that permitted rentals and steel-concrete condos that permitted rentals. We were selling at a discount of 12-17%. However, the market has become “frothier” price-wise since that time. No question, condo prices went up materially this past year (just see your current BC assessment statement – avg. of 18% in the region) so its important to normalize any price increase at the Parc with price increases in the surrounding neighbourhood. I would be interested to see what you find with more recent market sales data.

Sidekick, I read that article and thought it was very good. However, the “stop over-development” movement should not be the enemy of the millennials. It is true that many people resist change out of reflex, but on the flip side I worry that we are not really planning our cities very well.

I think the increase in density downtown is great. However, if you double the population of every neighbourhood, your city will change so completely, you may not recognize it. We need good planning, not just knee-jerk reactions. I fear the bylaw chainsaw that millennials are pushing for. Change, yes. Hack and slash, no.

Local GDP I agree with. Increasing incomes and increasing population inflows will definitely push up prices. However I am not aware of a measure of GDP for the Greater Victoria area specifically.

2017 and 2018 Predictions thread: https://househuntvictoria.ca/2017/12/28/magic-8-ball-says-predictions-are-difficult

Several folks called the US housing bubble – Dean Baker, Paul Krugman, Bill McBride of Calculated Risk. None of them predicted the financial crisis that ensued, although Bill McBride did point out the vulnerability of several lenders that subsequently went bust.

Dean Baker at least has commented on Canadian house prices and called them a bubble. That was quite a few years back and prices have continued up since he made the call.

You yourself have indicated that you know predictions are essentially worthless, so I don’t know what difference his answer to your question makes.

There’s plenty of real data to argue. That one about the foreign buyer numbers is a good case in point. Lies, damn lies, and stats…or are they?

Which people are those? Please provide us with a pre-financial crisis source proving they predicted the outcome before it occurred, and please point us to where these same people are making similar predictions about Canada. Thanks.

I was actually alluding more to Marko’s predictive abilities.

Also, does this mean you believe the people who called the U.S housing bubble bursting, that are now calling on Canadian market to correct as well?

For detached houses in the core districts this year the market is likely to end with lower median, average prices as well as a lower sales to assessment ratio than we experienced in January.

And during this entire year the months of inventory never exceeded 3.6

The only indicator that showed significant variation was the days-on-market. The average went from a low of 16 to this months high (so far) of 31. And that meant the end of the “deferred listing” or blind auction and that lead to lower median and average prices for houses in the core.

The irrational exuberence in the spring lead to declining median and average prices in the fall as buyers substituted detached homes in the core for lower price homes in Langford and Colwood or condominiums.

However the Westshore has continued to rise and is nearing the affordability ceiling that the core had in the spring. The problem is that there is no viable lower substitute for Westshore housing. This month the median price for a home in Langford/Colwood is $747,400 and the average is $781,000. Which is about $100,000 less that what the core showed before it began to shed value.

The builders are hard pressed to find affordable vacant land to build on in the Westshore. In order to make a decent profit they need a bump in prices during the construction period. If they don’t get that bump then they won’t build. And that just might be the straw that breaks the camel’s back because without construction we would have 25 to 30% fewer jobs in the finance, insurance and real estate sectors.

Apparently I have to say it again. Where did you call the huge increase in 2015-2016-2017?

Here’s a couple of charts depicting Canada’s housing price index alongside the USA’s – which historically, we roughly track. Not so, since about 2008. They had their deleveraging event – we simply doubled down on more debt.

You can see the effect of this in the chart on the right, where there was very little subsequent recession in 2008 to correct RE’s outsized rise in GDP – such as the adjustment which occurred in the early 90’s. As real estate climbs and climbs, more and more people want on the money train, or buy for fear of missing out. The economy begins to rely more and more on real estate, and the issue metastasises into what we have today. We didn’t get lucky in 2008 – we borrowed our way “out”, ie, kicked the can. Whatever you want to call it.

Great paraphrase, and a great book. Two others worth reading are, “House of Debt” and, “This Time is Different: 8 Centuries of Financial Folly”.

You read those and look what’s happening in Canada – makes you realize that nothing in this market hasn’t been seen in some form elsewhere, countless times already. The particulars are always different, but the underlying causes of failure are not. Too many people get hung up on the particulars side, IMO. Cycles repeat, things get stretched as it matures, and at times, speculation really gets a hold.

I agree that’s a fair thing to say in reference to the Victoria market. I think it changes a bit when discussing Vancouver or Toronto – but the problem is, “why does it change”, and the answer is I don’t know. It’s just a degree of a phenomenon – is a little overvaluation a bubble? Is a little speculation a bubble? Add to it, you never really know it’s a bubble till it blows.

I doubt Victoria will ever have enough of a draw to become a full blown, Vancouveresque clown-show of a market. But I do think Victoria’s status as a secondary market to Vancouver, as well as what I perceive to be the perilous state of the latter market, heightens the risk upon our RE market in the event Vancouver suffers a substantial correction.

People’s predictive abilities vary, as history demonstrates. It’s wise to give more weight to predictions coming from those with better track records.

This should be obvious, but on House Hunt Victoria I know it isn’t.

That millennial article was a great read. I have to cringe a little every time I see ‘stop over-development, respect neighbourhoods’ signs as this is exactly the mentality which the article alludes to. It was the same mentality I experienced when I presented a garden suite application to the Fairfield neighbourhood council. People came out of the woodwork telling me I would be tarnishing the neighbourhood and setting a horrible precedent. My neighbor told me he didn’t want to hear people having sex, and therefore was against it (this was after a year of back and forth altering designs and locations).

I guess for the majority of people, neighbourhoods don’t include ethnicity or poor people.

Well, Marko’s predictions for 2017 turned out to be pretty accurate (fast forward to 2:40 if you want to get straight to his predictions):

https://www.youtube.com/watch?v=TXUh2CyK2Nc

I think Galbraith had it right in his book “The Great Crash” and I am paraphrasing here. It is when value detaches from the economic principles of supply and demand and prices are driven by a speculative belief that the commodity will continue upwards in price forever. He put it more eloquently.

@Patrick, that was rather polite. It changes my perception of you. Am I a sucker for politeness? Probably…. Anyway your original question was “why is this considered a bubble”. No one really answered that. Although I myself don’t like the term bubble as it relates to RE since there is intrinsic value and shelter is a need. Now Bitcoin, there is a bubble. A thin veneer filled with absolutely nothing and it’s own expansion will make it burst….

I can however see why many consider this a bubble. Primarily that prices have disconnected from fundamentals, regular people can’t afford to buy housing based on their income alone, debt binging and ultra low interest rates have driven prices up. The activities surrounding buying have gotten dangerous and frenzied (like no conditions and huge over asking bids). It’s reasonable that people would peg this as a bubble. However it’s probably better to use “overvalued” but that is not dramatic enough for most even though it’s closer to the truth.

https://www.theglobeandmail.com/opinion/how-much-real-estate-do-foreigners-really-own-statscan-got-it-wrong/article37439665/

Just as I thought all along… we are wrong on our estimates of foreign ownership of Canadian RE. Who knows how big of a problem this really is? Answer: nobody, and I bet RE agents would prefer it stays that way.

Now, 28 EU countries are moving to a public register of foreign ownership. Question is: How long before something more substantial than an inadequate, incorrectly focused FB tax is concretely done here? An answer I don’t foresee us getting just yet from the NDP come Feb.

This video is sure to brighten anyone’s day:

https://vancouverisland.ctvnews.ca/can-opener-another-truck-falls-victim-to-notorious-vic-west-bridge-1.3737235

Leo: but better to look at the factors that are closer to house prices in the city you are interested in. Population inflows, construction, inventory, affordability, etc. All those will be a much better gauge than GDP for the entire country.

If you read my posts, you will see me refer to local GDP, which is not “GDP for the entire country”.

The factors you list ( local Population inflows, construction, inventory) are highly correlated with local GDP so your “shark attacks to ice cream” point is not accepted here.

Anyway, thanks for the debate, and many thanks for the great work you do here on the forum. Much appreciated!

Anna Edwards, this is right up your alley:

How much real estate do foreigner investors really own? Statscan got it wrong

https://www.theglobeandmail.com/opinion/how-much-real-estate-do-foreigners-really-own-statscan-got-it-wrong/article37439665/

I have to agree with everything Introvert just said. Doesn’t feel as strange as agreeing with Hawk.

We are in for scary times ahead globally, but perhaps some years away just yet. Especially when you add what Trump/ Putin are up to and North Korea to add to climate change, and in general I think unfortunately world instability Is likely to increase.

It appears given that, we’re tucked away in a relatively safe but not immune corner of the globe.

The article on millennials is well worth a read they are so not entitled after reading that. No generation has been less privileged since before WWII. Sadly though, I think the Centennial generation will have even more challenges. Even worse though for those poor Oak Bay girls that won’t even get to grow up

now.

Despite all that don’t give up hope that things can improve and with perseverance we can work towards a better world. Here’s hoping that’s what the New Year brings.

No, but I bookmarked it!

I’m operating under the assumption that we’re going to have relatively huge amounts of social upheaval for the foreseeable future, from things like automation and AI but also and especially from climate change.

Yeah, I think the ship has sailed on Victoria house prices, especially in the core—and the ship ain’t coming back (much). That’s my humble opinion.

And I think people are getting used to the “new” normal of relatively high house prices here.

I think B.C. now stands for Bring Corruption.

The correlation between GDP and house prices is like the correlation between ice cream sales and shark attacks. It exists but can’t be used for anything useful.

GDP increases because of population and productivity increases. Population increases can put upwards pressure on house prices, but doesn’t have to. Just because population increases 50% doesn’t mean house prices have to. Same with productivity increases. Yes if people have more income they may buy higher quality and more expensive houses, but it doesn’t mean that if incomes increase 50% that house prices must also increase 50% (or alternatively, are justified in increasing 50%).

You could try to use GDP as a very rough proxy for house prices.

I’m sure it’s rare that they will go in different directions for a long time, but better to look at the factors that are closer to house prices in the city you are interested in. Population inflows, construction, inventory, affordability, etc. All those will be a much better gauge than GDP for the entire country.

Are you though? Did you read the article on millennials? I think it’s concerning and will lead to a lot of societal upheaval in the future. On the other hand automation and AI will likely be a much more powerful force for upheaval and joblessness so perhaps the gig economy and high house prices aren’t as big of a deal in the long run.

No, you’re confused. Ever since Hawk has predicted price decreases, they have only ever gone up.

For the record, increases in the short term wouldn’t surprise me. But neither would a period of flat or slightly down.

Actually, Marko’s short-term prediction seems quite plausible to me.

Yes, I don’t think the effect is monumental.

But the small minority who come understand that B.C. stands for Bring Cash, and they have some.

I’m getting excited, Leo!

My grammar is not flawless, but thanks for saying so [insert Face Throwing A Kiss emoji].

It’s possible, though, that your writing is less than crystal clear at times. You are a programmer after all.

You make a fair point.

Hey look – it’s the end of the year, and almost time to look at last year’s predictions:

https://househuntvictoria.ca/2016/12/23/2016-predictions-roundup/

I’m happy to have nailed the BoC rate of 0.75, but we’ll have to let Leo crunch the numbers before we figure out the annual averages.

That’s not the case in Saskatchewan though, where there’s more people outside of Saskatoon & Regina than in them.

So you’re the one!

Since Introvert is calling for more increases, naturally, things are going to pot.

I should have an interesting week ahead; I have a friend coming out to Victoria to see if he wants to retire here.It is a preliminary visit for him to get the feel of the city, It will be interesting to get some feedback from outside eyes.

You are correct about the smaller town situation but the bulk of our population lives in medium or larger cities. I respect your opinions James so where do you see things going in the next year?

That may be true for bigger cities, not true for smaller towns(or cities) without home care for the elderly, and better access to hospitals. You of all people here should be aware of that.

Their home cities were the aforementioned. They moved into Saskatoon or Regina when they became infirm.

James:

Regardless of your friends, she is correct that most people do retire and stay in their home city (by home city I mean where they resided most commonly and not where they were born or went to school).

That wasn’t their home city.

They lived in places like Melfort, and Foam Lake, and Hudson Bay, and Porcupine Plain and Wynyard and Moose Jaw.

Your grammar might be flawless, but your reading comprehension sucks.

))) Leo: So if the population in sub-Saharan Africa increases house prices here can also increase.

No. I am referring to Canadian house prices and local GDP. Not Africa, and not population increases. Those are terms that you are introducing. I suppose sub-Saharan house prices could increase if they chose to allow rentals.

Well, seasons greetings from Arizona. I hope everyone had a great Christmas.

I have been reading the blog today and I see that we have someone new offering proof of the Victoria bubble.

Patrick: “Do you take those people with bubble claims to task, and tell them “you have no basis to claim”.

He has very kindly provided the links so we could review the correlation appropriately.

http://www.aabri.com/manuscripts/10490.pdf

“In April 2005 the cost of a median single family home had risen to 15%

more than at the same time in the previous year, which should have been an early indicator of the building “frothiness” in the market and the unsustainable nature of the prices.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Just Jack

March 21, 2016 at 11:15 am

The median price for a house in the combined areas of Saanich East, Victoria and Oak Bay is now $750,000.

Up from $629,000 for the same time period one year ago.

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

I know that this was only a 20% increase in home prices but I’m sure that Leo can provide even higher increases prior to last year ….. your man is right, enough froth for a good latte.

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

“As an economist at Goldman Sachs pointed out at the time, residential investment at 5.75% of GDP was at the higher end of levels from the past four decades (Economist, 2005c). Additonally, as previously mentioned, this percentage soared as high as 6.18 percent later in 2005.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

http://business.financialpost.com/personal-finance/mortgages-real-estate/the-housing-markets-oversized-contribution-to-canadas-economy-is-about-to-shrink

“Real estate and financial services now account for 20 per cent of the economy, levels not seen in the data since the early 1960s.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

“Furthermore, houses were becoming far more expensive due to an increase in the

relation of purchase price to income from 2.75 time median income to 3.4 times median income

(Economist, 2005c).”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

In British Columbia, that relationship has been over 8X since 2013.

https://www.statista.com/statistics/587748/house-price-to-income-ratio-by-province-canada/

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

I’m not even sure that Hawk has provided so much information regarding the Victoria bubble in one link.

However, the disclaimer below provides an out for those adamant “bulls”

“Regression analysis and Pearson’s correlation coefficient utilizing NCSS software were

used to investigate the relationship between the change in HPI and the change in GDP in the U.S.

However, one cannot state, even if there is statistical significance, that one variable causes

another.”

413 sales and 417 listings month to date. 1550 active listings.

Wait, so now Vancouver prices are linked to world GDP? So if the population in sub-Saharan Africa increases house prices here can also increase?

Well I’m off to play in the snow, happy to pick this up later.

I just read the front page of the TC and it left with me immeasurable sadness.

))) Leo: In 2016 the world’s GDP was 55 times higher than 1960. Does it make sense that global house prices should be 55 times higher now than in 1960?

Yes, and they are up by are up by amounts like that. For example, Vancouver up 75 times since 1960 in this study https://vreaa.wordpress.com/2013/01/ that’s 8% per year and much above inflation, and close to GDP rise.

Other countries are similar. https://www.dallasfed.org/~/media/documents/institute/wpapers/2014/0208.pdf Many people mistakenly assume that house prices only match inflation. But a glance at that global study shows that this has not been the case over that last 100 years, and that house prices have risen markedly above inflation.

Can we at least agree that “rentals allowed” had little or no role to play in these huge global increases since 1960?

Interesting Article:

“Navigation Apps Are Turning Quiet Neighborhoods Into Traffic Nightmares”

https://www.nytimes.com/2017/12/24/nyregion/traffic-apps-gps-neighborhoods.html

I fear this is happening a bit around greater Victoria, particularly during the McKenzie/HWY1 construction.

For getting through Vancouver, I admit to driving around back roads in Chilliwack to avoid accidents on the Highway. Municipalities can’t rely on “standard” driver behaviour any more to keep motorists out of quiet areas. Time for some better road planning…

Unfortunately this field is no longer searchable. I will ask if they can bring it back. Report on buyer activity by buyer origin for 2017 should be out soonish (a month or two).

I think from most of the country it’s a trickle and actually won’t have much effect at all. The vast majority won’t come, and the majority of those who want to come can’t afford it. However the huge wildcard is Vancouver retirees. Victoria is close enough to make it work with family and if they own in Vancouver they can own here. Vancouver is also big enough that just boomer retirees from there could severely distort our market for years.

Soper, my dear. Of course the majority of retirees stay put in their home city. But Victoria has to be in the top three places in Canada where retirees who relocate end up. Make sense?

Sounds about right.

I would be very interested to know what this trend has looked like over 2017 – whether it’s the same, less, or more compared to 2016. I recall you saying the proportion of buyers from there had gone back down to historic values (I think) – still curious if they’re continuing to pay more.

Yes, before they made the “buyer origin” field not searchable, I did some quick searches and Vancouver buyers were buying places at some 20% higher average prices than “local” buyers.

Couple things:

1. That increase matched the market increase in condos during that time.

2. The post period is 6 months, not a year.

3. Condos in this building increased about 18% in the post period, but the market increased by about 6%. That’s where the ~10-12% increase above market came from.

Probably should explain this in more detail in the article.

Well if you would like to suggest some other factors that may have lead to a value explosion in this building above market I am all ears. Until then I think the change in rental restrictions represent the best available explanation for this phenomenon.

Yes. I’ve spent a lot of time talking about arguments for and against overvaluation. I have no dog in this race, I am only interested in arguments that stand up to logic.

Well your paper didn’t really go into any detail about it aside from saying there was some correlation. Your claim that I am objecting to is that they should move together. i.e. 50% increase in GDP justifies 50% increase in house prices.

Of course it begs the question, are Halifax prices severely undervalued since they didn’t increase by 50% in that period? If not why not?

In 2016 the world’s GDP was 55 times higher than 1960. Does it make sense that global house prices should be 55 times higher now than in 1960?

I’m not convinced we are. Yes valuations are getting quite stretched from an affordability perspective, but I don’t think it is necessarily a “huge” bubble.

Thought this was interesting on the challenges facing millenials (of which I am one of the older ones although I’m not sure I have much in common with 20 year olds today).

http://highline.huffingtonpost.com/articles/en/poor-millennials/

All my Saskatchewan relatives would travel down to Arizona until they were too old to do it any more, then they stayed in Saskatoon(one went to Regina, because he was from Moose Jaw), because it had the facilities to care for them.

Things just got a whole lot more interesting around here….

Barrister, I’d add one more group to your list of people being added to Victoria’s pool of buyers: Construction Workers and Trades people; some of whom are local young people and others moved here for high paying jobs. In my extended family and their friends and acquaintances, this group of buyers has grown exponentially in the past five years. I’ll give two typical examples: Colonial Countertops on Alpha St lost several solid countertop installers and fabricators during the past year+ who were earning about $17/hr, when these guys got offered $27/hr starting wage plus benefits to walk across Douglas St to the new Mayfair construction site. These guys told their friends who also got hired immediately at Mayfair. Example #2- Trades people in Victoria getting paid union rate plus 20% plus RRSP contributions, plus benefits plus year-end bonuses for staying on the job. Of course these guys tell their rural buddies who drop their tools in small town Canada and move to Victoria.

It’s not just in Victoria, it’s Vancouver, Seattle, Australia, New Zealand, and everywhere with booming cities. Interestingly though, many of those international cities that tracked Vancouver’s boom times are now starting to have RE stagnation or falling prices. Australia and New Zealand have passed their “Spring Rush” and there, it didn’t materialize. Now prices are starting to fall as inventory rises and MOI rises. Quite a few genius speculators in Australia and New Zealand are now getting hammered as they watch their equity disappear.

Using the word “bubble” inflames most home owners. And personally I don’t think there exists a definition from a reliable source, such as a text book on Economics, that defines what a bubble is or isn’t until it pops.

As for the GDP and house prices. You have to wonder if the increase in GDP is largely due to construction. Then it’s difficult to say if GDP is driving prices up or is it real estate driving up the GDP or maybe both. In China, the central government told the cities Mayors that they had to reach a certain GDP. And the way the cities did this was by building residential towers that were left mostly vacant. Construction stimulated the economy and GDP increased and the Mayors kept their jobs.

But the cities ended up with a lot of vacant condominiums that were too expensive for the locals to purchase and were being held vacant for speculation purposes.

Yup, Victoria real estate has always benefited from a steady stream of (mostly well-to-do) retirees moving here. It’s a demographic that Saskatoon and Edmonton can’t attract.

And their moving here represents “pure demand,” which has a bigger effect on the market. What is more, much of this “pure demand” comes from higher-wealth individuals.

I am not sure that Victoria is in a classic bubble. I would speculate that the prices are maintained by a constant flow of off island money pouring into the city. Whether that flow is from Alberta or from Vancouver or retirees in general with some off shore money thrown in the impact changes the traditional view of what creates a real estate bubble. One of the phenomena that I have noticed is that off island buyers trend to create a chain of movement down the property ladder.Vancouver transplants buy in Uplands, the vendors move to Fairfield and those people buy a condo. Obviously this does not happen all the time but off island money represents more buying demand than just the initial purchase.

We still might be in a bubble because house prices probably cannot be supported by local demand. If the stream of off island money is seriously reduced then this market could be in serious crisis. Combine that with a hike in interest rates then we will find ourselves in an interesting situation.

))) Leo: Are you seriously arguing that condos in this building magically jumped 10% higher than market at the same time they got rid of rental restrictions and those things are not related?

Well yes, if magic is the only factor that I’m allowed to use, let’s call it magic. Because the year before the allowing rentals , there was a rise from 420 to 520, which is 20% pre- allowing rentals , and double your 10% post allowing rentals. So If we are only allowing sales price increases to be due to allowing rentals or magic, that must have been magic.

A valuable investing tip: Stay humble. You can be wrong, and it doesn’t take magic to make you wrong. It can simply be other factors that you don’t fully understand or haven’t considered.

))) Leo: That doesn’t mean there is evidence that they should be moving in lockstep though. You have no basis to claim that a 50% increase in GDP should support a 50% increase in house prices

What I’ve seen in this forum, and was responding to, are some claims that we are in a historic bubble in house prices. Do you take those people with bubble claims to task, and tell them “you have no basis to claim”. Only someone who points out that nominal GDP has risen the same amount as house prices is given this treatment!

I believe in the research over the last 100 years showing correlation with house prices and GDP, which I have linked to below. My main point in posting was to provide an argument that house prices have not risen to bubble levels in Victoria by all metrics, certainly not compared to GDP.

I look forward to you challenging the next person who says we’re in a huge house-price bubble to get a similar challenge from you about what basis they are using to make that claim!

Good. That place needs work. Hope they incorporate rental housing into the complex.

I’m not arguing that GDP and house prices aren’t correlated in general. That makes logical sense, especially in situations where the housing market triggered a recession like in the US. That doesn’t mean there is evidence that they should be moving in lockstep though. You have no basis to claim that a 50% increase in GDP should support a 50% increase in house prices.

The explanation for allowing rentals increasing condo price is easy. Are you seriously arguing that condos in this building magically jumped 10% higher than market at the same time they got rid of rental restrictions and those things are not related?

GDP per capita I can buy. GDP in total, no. More linked to population growth than anything else.

Again. What you are after is GDP per capita. Just because GDP is increasing doesn’t mean people have more income for housing.

I guess I would wonder what’s causing GDP to rise. Is it productivity alone, debt alone, or a combo? If a combo, what is that ratio visavis historical norms?

And asking the question about Victoria to the exclusion of our other markets doesn’t really make sense. We’re not a market unto ourselves, we’re a secondary market to Vancouver.

Thirdly, what are people’s incomes doing in any market in comparison to debt carrying costs? So for instance, can 75k per year afford a 500k mortgage at 3% – or whatever number you choose?

Fourthly, while I suspect there is a link between GDP and house prices at the broadest level, I don’t see how it would really apply on the ground. Specifically, if the relationship were that tight, I’d think you would see a bit more uniformity across the country in prices. Is Vancouver’s GDP that much higher than anywhere else in the country? Is Toronto’s GDP second to Vancouver? Is Victoria’s GDP just behind Toronto?

Fifthly, and sort of related to the first point, GDP itself doesn’t talk about what that product is. For instance, if 40% of BC’s GDP is related to FIRE, that is not sustainable. But – let’s say, the GDP has gone up due to the over reliance on RE, but it’s gone up nonetheless, so it justifies the housing prices. More reliance on RE, more related GDP, higher prices, more reliance on RE….etc. It sounds like circular reasoning where one supports the other in an endless cycle of price growth.

Leo: Can you explain why house prices and GDP would move together?

Sure. historically, GDP growth is highly correlated to house price growth, and this has been observed and studied for a century.

“The long standing relationship between a nation’s economic footing as measured by its GDP and housing prices has been observed and studied over the past century by academicians as well as by private and public officials”

http://www.aabri.com/manuscripts/10490.pdf

As to “why that would be the case”, I could ask you the same thing about all of your charts above showing co-relations between house prices and rentals based on tiny data sets. With economics, theories as to “why” are likely the best you get.

As to why a GDP increase would cause house prices to rise, GDP increase means the economy is expanding, and with it, incomes, money supply, (usually) population… all good things for housing price increases. Many measures, such as the federal debt are measured as a percent of GDP, because that’s what the taxpayers can afford. A similar argument can be made for housing prices, as GDP rises, people can afford to pay more for a house.

So if Canadas federal debt has risen 50% in time period where our GDP has also risen 50% – it is considered to be stable, and certainly not a “bubble”. Same reasoning can apply to house prices, because the rise in GDP means proportionally more money in the economy to pay for houses.

People are liking the proposal to redevelop University Heights, if letters to the TC are any indication:

http://www.timescolonist.com/opinion/letters/apartments-above-malls-are-a-good-idea-1.23130486

http://www.timescolonist.com/opinion/letters/mall-makeover-a-great-idea-1.23130485

-43° C with the wind chill. Good grief!

Makes a 2° day like today seem tropical by comparison.

http://leaderpost.com/news/saskatchewan/small-saskatchewan-town-welcomes-stranded-train-passengers-on-christmas-morning

Also, when we combine the years of lower/flat prices (approx. 2010-2014) with the recent run-up, it works out to around 3.75% real annual gain, which matches Victoria’s historical rate (see: https://househuntvictoria.ca/2016/03/17/a-brief-history-of-prices/).

I’m not sure why that would be the case. Can you explain why house prices and GDP would move together?

Canada’s nominal GDP grew by 50% in CAD from 2008 to 2017. http://www.thecanadianencyclopedia.ca/en/article/gross-domestic-product/

Average Victoria house prices grew about 50% in that period too.

http://househuntvictoria.blogspot.ca/2013/12/november-numbers-and-another.html

Why is that considered by some to be a bubble? Isn’t it reasonable that house prices could track GDP (which is more than inflation). ?

Merry Christmas all! Leo, thank you for all of the amazing info you continue to provide us every week. Best wishes to everyone in 2018.

http://nationalpost.com/pmn/news-pmn/canada-news-pmn/b-c-premier-says-housing-top-issue-for-2018-but-much-more-on-ndp-to-do-list

Another nail in the coffin for housing speculators..

Merry Christmas housing geeks! May all your housing wishes come true this year. All the nice ones, anyway.

Local Fool posted this weeks ago but I just got around to reading it. Great read. https://www.moneygeek.ca/weblog/2017/10/16/canadian-housing-market-bubble-interview-seth-daniels-jkd-capital/

“Every bubble is different, and that’s one of the things that people get hung up on. It’s a cliché, but people living in the midst of a bubble think “it’s different here” and “it’s different this time”. They say well, here are all the differences between X and Y. And they generally have convincing sounding reasoning for those differences… On paper, the Spanish economy along with Ireland had been some of the best performing European economies for probably 15 years straight prior to the crisis. Spain had benefitted from a surge in immigration over this time as well. And finally, there was “limited beachfront property” and “nice weather” and the factor that all the Europeans wanted vacation homes in Spain.”

Well said, sir. Enjoy the snow, everyone!

It’s snowing! Merry Christmas

Merry Christmas RE market nerds!

Merry Christmas to all of the interesting people here. It might be a good time to remember that a house might be an investment but that its real value is as a home.

Merry Christmas everyone!

Yes the owner can, if that clause (the tenant has to obey condo bylaws) is written into the rental lease. Normally the strata does ask the owner to write the clause when renting out.

Oops. By rental building I mean an apartment building or similar. All tenants have the same landlord.

Leo S

True, and I’ve heard horror stories regarding problem owners. Luckily I never experienced it.

Throwing out a renter isn’t easy either and in the case of a condo the strata has no power to evict the tenant. They can fine the owner and make suggestions but I don’t think they can legally compel the owner to evict.

Seems a bit easier in a rental building.

I agree. Could be one of many factors. Age definitely seems to be a factor. Any issues in our neighbourhood (e.g. police showing up, arrests made) have been young people and not renters (per se). The renters have been great (even the young university students). Actually one landlord always gets great university students. Best was a bunch of music majors that would sit outside and play music during the day (quietly). Another landlord tends to always get families.

The problem houses have been children living in houses owned by their parents (we had two houses like that in the ‘hood and they both had open police files). They also had buddies living/renting there. Not 100% sure on the situation, doesn’t really matter. Lots of police calls. Some arrests. One sold and I’m sure the neighbourhood collectively sighed in relief.

Not saying pride of ownership has no effect on behaviour, but I don’t think it’s as big a factor as many assume.

Never met a renter that treated moving like something they were looking forward to doing regularly. Reality is you will be living with your neighbours either way for long periods of time.

I’d argue the opposite. Renters can be thrown out. Try throwing out an owner. Next to impossible.

It sounds to me like you had a problem with bad landlords in your building. I can see that it would be difficult for a strata to allow rentals but educate owners on how to screen tenants and educate them on building policy.

Of course there will be a correlation between louder parties and younger people and lower income and things like smoking but I don’t think there are any correlations directly between ownership status and negative behaviour. The good owners were also good renters. The crappy owners used to be crappy renters.

Marko

I don’t think it’s that at all. There’s a difference between owning somewhere and having to look your neighbours in the eye every day vs being somewhat transient. You screw up big time, you just get another rental. My experience with bad renters in a condo is that they had a DGAF attitude. They didn’t care about rules or bylaws, they were generally inconsiderate of others in the building. Bad owners can be the same way, but the consequences are more direct and long term.

We had issues with smoking weed in common areas (so there’s the smoking stereotype), guests of renters not parking in guest spots (i.e. taking registered spots) and/or blocking in residents, prohibited stuff in the garbage (e.g. couches in the garbage and other stuff that would result in a fine/charge from the waste service), noise complaints, leaving exterior doors propped open.. etc etc.

You tell them they can’t do something, they shrug. You fine the owner, they get upset but I don’t think they can even pass the bill on to the renters. Strata can’t evict a bad renter, the owner has to and I’m not even sure breaching condo bylaws or rules is something you can evict for.

In 2 years the only issues I can remember from owners was one elderly person would sometimes be late on strata and one person that collected bottles (and would bring them up to her suite) would sometimes spill wine or beer or WHY. I think we offered her somewhere else to store her bottles so she wouldn’t have to dragged them into the elevator up to her suite. No fines were levied against owner occupied units while I was on council. Nothing came up that warranted it.

Of course that’s just an anecdote. May have had something to do with the building. It was older and we were the youngest owners (late 20s), next youngest was early 40s. Renters were early 20s. Maybe as people age they are a bit more considerate and conscientious? Maybe mils are as horrible as everyone makes them out to be? 😉

“404-490 MARSETT PL, assess 334k, list 397k, sold 476k (20% over list)

404-951 TOPAZ AVE, assess 330k, list 399k, sold 465k

(both older bldgs & rental restricted)”

Tomorrow’s bagholders AKA Greater Fools. Just like bitcoin.

Are all of these situations combined in the category rental restricted?

a. No rentals of any kind allowed

b. Only rentals for 30+ days allowed

c. Only a certain percentage of units can be rented

d. Only rentals to relatives and close friends allowed

e. Short term trades allowed: I trade residences with someone in Yellowknife for three months.

I believe I have heard of all of these.

GR

“For some reason most strata’s have this notion that rentals are somehow an inferior type of people to owners in that they will only party, smoke, own pitbulls, etc…..I don’t buy it.”

Agreed it’s total bullshit. I have professionals/tech/business people all through my building and rarely have an issue unless the odd nut bar slips through the cracks and they’re out within 30 days.

Believe it or not the worst offenders are the rich foreigners who come here with entitlement issues. They have the largest freak outs like spoilt children and have seen the cops called several times for domestic battery issues. Just sayin.

And their condo has cost them more than rent in that time.

I am a bit surprised at this notion as well. My tongue in cheek reference to “those” people is apparently the serious view of lots of people.

Sure I can see if you live in a rundown old building then you may be scraping the bottom of the barrel of tenants and have problems, but in a reasonably maintained building I doubt it’s an issue. Even when we were renting for a long time in cheap 60s apartments we never had any problems with neighbours.

That’s a lot of pancakes…

Makes it pointless to operate a business when the land is worth more than you’ll ever earn.

Been some crazy overs lately on lousy locations:

404-490 MARSETT PL, assess 334k, list 397k, sold 476k (20% over list)

404-951 TOPAZ AVE, assess 330k, list 399k, sold 465k

(both older bldgs & rental restricted)

@sale rings in at $245M… multi-zoned will surely outperform single-zoning going forward

I am totally impressed with all the math junkies here. Looking back, I am kicking myself for wasting all my time skiing with young girls of adventurous virtue instead of learning about the mathematics behind graphs. Had I only known at the time.

Definitely a risk that you may have to sell in a down market, but that’s just something you have to take into consideration.

I’ve seen nothing but bad outcomes with rental restricted condos.

Too many examples to list but here is a classic one I saw over and over again 2011-2015….

Young couple in their early/mid 20s (no children) buys a rental restricted condo in 2007 for $300ish. By 2013/2014 the condo is worth 250ish on a good day. Their incomes have gone up; they have a kid now; but, they’ve lost equity in the condo AND have to sell the condo to buy a home as their is no rental offset for qualification purposes.

vs same scenario but no rental restrictions. Secondary to the relatively stable rental market they rent out the condo, buy a home in 2013/2014 and sell the condo in 2017 for $400,000 after 3-4 years of renting it.

Having the ability to rent really gives you a ton of short term and longer term flexibiliy.

Agreed. I owned a rental restricted building (2 units max out of about 50) and all of our problems came out of the rental units (I was on council). If I were to ever buy a condo as a primary residence I’d want no rentals. Bonus that it’s a deal.

I’ve been on several strata councils in various functions and we’ve had far worse problems with bad owners in the buildings I’ve been in.

I also think there are other factors outside of rental vs non-rental that are much bigger in magnitude. For example, I was on the strata council at the 834 (115 units; about 50% rented) and the Era (157 units; about 50% rented plus about 15% vacation rentals). At the Era we barely had any issues whatsoever the couple of years I was on council. Biggest difference between the two buildings is at the Era we had a full time on site care taker. He has his own suite, an office on the ground floor near the elevators, etc.

Some of the best buildings in Victoria, like the Bayview One, allow rentals. I rented at the Bayview one for three years and never heard anything above me, below me, or to either side. I never made any noise myself either.

For some reason most strata’s have this notion that rentals are somehow an inferior type of people to owners in that they will only party, smoke, own pitbulls, etc…..I don’t buy it.

White Spot site sale rings in at $245M, set for residential development

The White Spot site on West Georgia was sold for $245 million in a deal that ranks among the highest prices paid for residential real estate in Vancouver.

The site is just under 400,000 square feet and was purchased by Carnival International Holdings Ltd., which trades on the Stock Exchange of Hong Kong.

“We haven’t really seen a piece of land that large be sold in downtown Vancouver,” said Tsur Somerville, an associate professor at the University of British Columbia’s Sauder School of Business.

http://www.cbc.ca/news/canada/british-columbia/white-spot-sale-condos-1.4463594

Yes, that’s what I was thinking. Pull up your socks, Leo. 😛

You guys are making me feel dumb. Knock it off!

Right. Makes sense.

Ok, if the trend line is only fitted to the pre-rental data that’s better, but still there’s no reason to assume that a short term trend in data following a complex polynomial pattern (increase, decrease, large increase) could be extrapolated predictively.

A more rigorous approach would be to fit a curve to other rental-restricted sales over the full timeline (GAM would work well I think) and then use that curve to predict price change in the dataset of interest.

Dasmo

Lol, well yeah that’s the assumption, but how bad is it to stay at a crowd sourced hotel long term?

I’d assume that’s the worst case as far as condos go (one step worse than no rental restrictions).

Wow that was just.. wow.

Victoria hits peak dorkiness (fast forward to 9:28):

https://vancouverisland.ctvnews.ca/video?binId=1.1777487

1 bedroom condo prices overall are up 6% since June. Units in this building increased about 18% in that time.

The poly is only on the non-rentable sales. It is not fit to the sales after rentals were allowed.

I don’t understand. I’m trying to show the trend in pricing. I.e. if you draw a best fit line through the sales it would basically be the poly line. How would the bar graph accomplish that?

As for the t-test. While I suppose you could assume normal distribution, the mean is moving as the market appreciates, so how many sales back would you go to calculate stddev?

I want to show the difference to the trend. Comparing pre to post doesn’t work because the market is appreciating. You need to compare post to what it may have been if no changes were made. Hence the poly line. Of course the further out you project the less accurate it will get. However for this small period likely not a big difference. The other way to do it is compare the appreciation in this condo in the 6 months to other similar condos where nothing changed. I did that, but results were basically the same as just using the pre-restrictions trend.

Yes, no rental restriction has more value to buyers, even if they buy for themselves.

But the chart might not be that convincing using price changes versus time. As we all know that 2017 is a banner year for condos (like 2016 for SFHs), so you may see similar price versus time trend for other condos which never have rental restriction.

Nobody lives at Janion. It’s a crowd sourced hotel.

plumwine

Agreed. I owned a rental restricted building (2 units max out of about 50) and all of our problems came out of the rental units (I was on council). If I were to ever buy a condo as a primary residence I’d want no rentals. Bonus that it’s a deal.

Definitely a risk that you may have to sell in a down market, but that’s just something you have to take into consideration.

I wonder what living in the Janion is like.

Leo-

There are two different statistical relationships you’re trying to show on the graph. One is the time series – change in price over time of the non-rentable condos. The second is the change due to change in rental restriction, which has nothing to do with time. That’s a categorical variable with two levels: rentable, non-rentable. A simple bar graph (and t-test if you want a statistical test) would do for he latter. For time series, yes, like stock charting, the main smoothing functions (MA’s) are lagging, but it doesn’t matter, as you’re not trying to show the difference over time, but rather due to rental change.

The fact that the polynomial line (3rd degree?) happens to match the entire dataset is coincidental, and there’s no expectation that it will match in the future (eg, if the whole market declines, both rental and non-rental prices likely drop; that’s the time series influence). The second problem is that the two variables (time and rentability) are confounded in the data points due to non-replication. In other words, you have no data on rentable units prior to the change, nor on non-rentable units afterwards. So there’s not much you’re going to be able to say predictively. You could used the MACD (moving average convergence-divergence index), one of the most common stock charting tools to look at the likely price changes in non-rentable condos, but it’s far from a prefect predictor- mostly used (in the past) to warn of the likelihood of price breakouts (up or down).

I’m also surprised how home owners are aware of the new OSFI regulations coming in. And how they think this will impact the market. If Vancouver agents are seeing this already with home owners reducing prices to under assessed then it might affect Victoria’s complimentary market.

As I’ve said before Victoria is not a substitute for Vancouver but our prices do compliment Vancouver as they do the Fraser Valley and Nanaimo.

However, if this were Victoria then you would have seen the house prices in the core have not changed in almost 12 months. That would indicate that supply and demand are in balance. If the market were to move to a “more balanced” position as described then we would be actually moving out of balance and that would lead to a change in the equilibrium price.

For most of the year our MOI for houses in the core ranged between 2 to 4. Averaged about 3 MOI. If the new OSFI regulation have an effect then we will move outside of that range and the median price for a home will change. The same with the Sales to New Listings ratio and the Days-on-Market indicators.

The first indicator to change is usually the average DOM. Historically the average DOM ranges between 30 to 90 days. But we have not been in a market that has had much in common with historical markets. So at this time I’m guessing that the DOM doesn’t have to be more than 90 days to cause prices to lower.

The public are conditioned to a property selling under 30 days. If that were to go to 60 days the public would be alarmed even though historically 60 days would have been considered normal.

I saw that line, too. It’s pretty meaningless – closer to balanced could mean the market goes up 20% , or drops 20%. Both of those would technically be closer to “balanced” conditions relative to the degree of increases seen in the last year…

“Look for more balanced market conditions in 2018, as a surge in new home completions bolsters supply and eroding affordability tempers demand,” it reads.

Seems Orwellian to say more balanced. But where did I hear this before…..

Who is the poster than has consistently been saying that high prices in the core have been the cause of lower sale volumes in the core and not the low number of listings?

Wait till next year when I explain why the success of the market may be the cause of its failure.

Until then…

https://youtu.be/zalndXdxriI

Yes if only these greater fools knew to look ahead and sell a year ago instead of believing it will never end. Now selling below assessment in Dunbar and other high end areas of Van.

“Some” as in 80% of Van slashing prices.

Some Vancouver houses selling for well below assessed value as prices soften

https://bc.ctvnews.ca/mobile/some-vancouver-houses-selling-for-well-below-assessed-value-as-prices-soften-1.3700386

Many people seem to have trouble thinking beyond one or two years down the road (if even that long), which often results in poor decision-making.

Haha. Yeah that was meant more tongue in cheek. But, clearly in this building they did it. This analysis could be expanded by locating all the other buildings that switched their rental policy and verifying that the effect is the same.

I don’t know if I commented about 160 Wilson on HHV or VV years ago, but I always thought the “no rental” restriction was the explanation for per square foot prices lower than the Railyards which is an inferior product (woodframed, lower-end finishing compared to mid-level, etc.)

The couple of units I had listed at 160 Wilson prior to the bylaw change the vast majority of the calls were along the lines of “is the unit rentable?” After my answer of “no,” the conversation would end.

So here’s a pro-tip: If you own a condo that doesn’t allow rentals and you’re thinking of selling, bring this article to the strata council and see if you can convince them to lift the restriction.

You’ve obviously never been to a strata meeting….you’ll get people standing up “Well, my realtor of 30 years told me that rental restrictions increase re-sale because the building is cared for by owners.”

or

“These are our HOMES, why are we talking about re-sale?”

Then naturally when people go sell EVERYONE wants top dollar plus $5.

It’s like people can’t think ahead.

My god, it’s back to levels unheard of since ….. two weeks ago.

Bitcoin is getting creamed…

https://globalnews.ca/news/3931119/bitcoin-plunges-worst-week-2013/

Shouldn’t a bar graph render good information intuitively?

The base data is that “unrestricted rentals” sell for about 8% more than “no rentals”. With your graph baseline set at $350,000 it gives the instant imprssion that “unrestricted rentals” sell for 60% more than “no rentals”. Issue the graph again with the baseline at $390,000 and suddently “unsrestricted rentals” sell for four times as much as “no rentals”.

Can you link me to an explanation as to why? I realize the projection will get increasingly unreliable, but over just a few months it should be relatively close.

Moving averages are lagging indicators and would not reflect current pricing trend. Perhaps an exponential moving average though.

Will do some reading, thanks.

We sold our condo dirt cheap because of no rental. However, we purchased the condo in the first place because of no rental.

IMO, no rental condo is perfect for primary residence. We enjoyed the peaceful years of living, made lifetime friends, best bang for your buck in great neighborhood.<\i>

Exactly. I highly enjoyed being in a non rental because everyone cared for the place, kept quite, were friendly. The place across the road was all rentals and it was a gong show.

The problem for me though was once I moved I could not rent to anyone but family. I held the property for 8 years 2007 to 2014 and lost money on the sale. All in all I didn’t actually lose since I was living there and it was cheaper than rent but if I had purchased a concrete and steel condo with rentals I would have made about 20% instead of flat lining.

Nice analysis, though the poly line is the wrong smoothing curve for this. This is a time series; ergo, you need time series analysis techniques – moving averages would do, and maybe some of the analysis lines associated with stock charts (MACD, RSI, etc.). A Generalized Additive Model could also work.

Rentals: good.

Good for your friends, I am sure they post their success story on RentingInVic.ca

salesmen? recent clients? pumpers? I thought I am the only one drinking here tonight.

Over 321 rentals in the core for 2 beds and under $2000. That’s almost double the norm for a low vacancy market in typically dead December the last two years. Greater Victoria wide it’s over 2100 listings in all sectors.

Friends scooped a nice apartment within a week in Fairfield for a reasonable price and they even had 2 cats. The rental market is changing IMO.

Plummer, you salesmen are in for a wake up call when your recent clients go negative equity by spring.

You like the other pumpers miss the boat that the same money is being made in the markets if not more.I’m more than happy to be part of that.

We sold our condo dirt cheap because of no rental. However, we purchased the condo in the first place because of no rental.

IMO, no rental condo is perfect for primary residence. We enjoyed the peaceful years of living, made lifetime friends, best bang for your buck in great neighborhood.

Bulls, be nice to the bears. If I

a. Sold my home few years ago betting on falling market;

b. Missed the train, see my purchasing power is gone;

c. Need to wait patiently for another cycle, that may happen in the next 0-10 years* ;

d. all of the above;

then I am also sad and miserable.

Just be nice to the less fortunate.