Dec 18 Market Update

Weekly sales numbers courtesy of the VREB.

| Dec 2017 |

Dec

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 60 | 168 | 274 | 471 | |

| New Listings | 46 | 198 | 328 | 392 | |

| Active Listings | 1704 | 1684 | 1656 | 1493 | |

| Sales to New Listings | 130% | 84% | 84% | 120% | |

| Sales Projection | — | 390 | 390 | ||

| Months of Inventory | 3.2 | ||||

Seems like that little pre-stress test bounce is officially dead. All year we were tracking some 10-20% below the sales rate of 2016 until November surprised with sales suddenly jumping up. However it didn’t last and now we’re back to our previous trend.

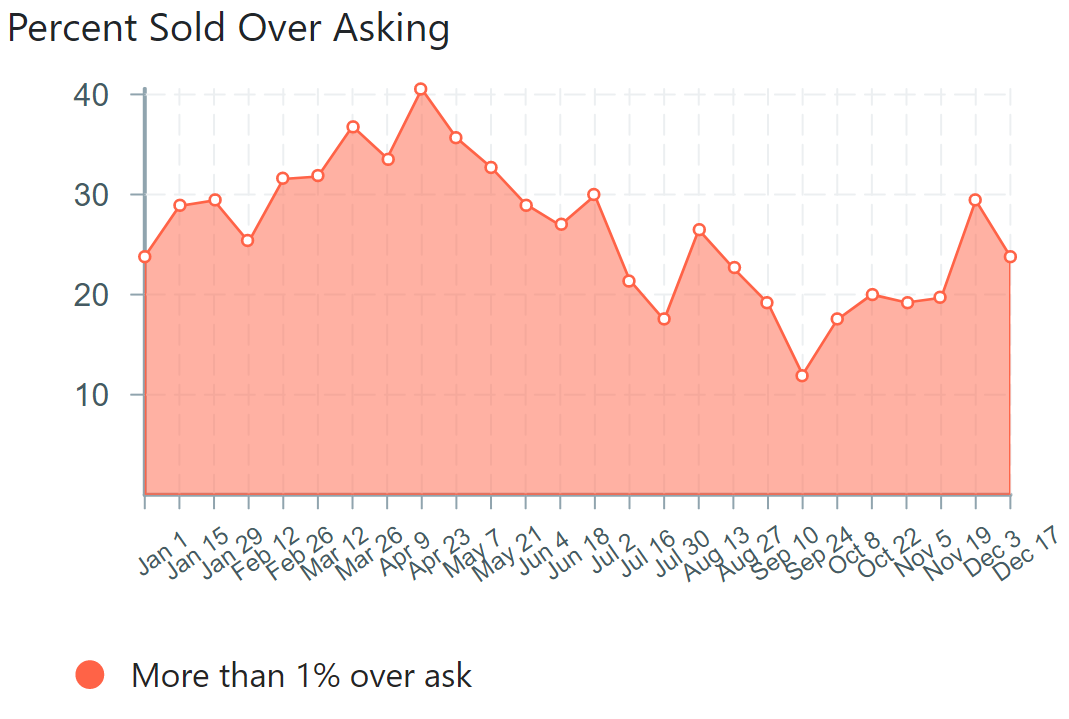

It hasn’t made a huge difference to the percentage of places selling over ask yet, that figure is still at about 25% for the core.

There are many things that the city can do under the Municipal Act.

And it isn’t bitterness on my part because I don’t these people. If it were happening to me, I would just pay the tax. Relative to the price of the land it is a small price to pay to have my kids have a bigger yard to play in. In the end it will only get more valuable and I’ll have more to pass on to my children.

New post. Thanks to Marko for the idea on this one.

https://househuntvictoria.ca/2017/12/21/the-value-of-rentals-a-case-study/

UK housing market taking a beat down. Can’t happen here though, we’re special.

Desperate UK homeowners are cutting prices, says Zoopla

Price cutting by homeowners desperate to shift their property in a slowing market has reached the highest levels in six years, according to an analysis by website Zoopla.

Just over 35% of the homes marketed on the site have marked down their price in the hope of achieving a sale, with the biggest discounts in the London property market.

https://www.theguardian.com/business/2017/dec/18/desperate-uk-homeowners-are-cutting-prices-warns-zoopla

@ Leo, exactly! Let this one go or you have trouble. It’s too violating and not the intent behind the tax.

@LF still BS. You need a permit to demolish so there is an immediate gate plus it’s expensive. It would make no sense to spend 200k to save 30k a year.

This is out of line and a terribly slippery slope if accepted. But it wont be. Like I said it’s a marketing case so many law firms would take it on. It’s also a likely win.

How about taxing properties that could have more density on them? Got a 10,000 sqft lot? Too bad. You gotta build a duplex on it or pay the price. Got a SFH without a suite? Too bad. Better put one in or BAM higher taxes. Nope. Not the level of government intervention I am comfortable with….

Not necessarily, if you look at a tax as a way of promoting or discouraging certain behaviours. In this case, taxing empty land was almost certainly deliberate on the City’s part. I suspect the thinking is if they don’t tax empty lots zoned for residential use, or they have lower taxes on them, a speculator may be more inclined to demolish any house that exists on the land.

Of course, this only is an issue in a rising market…

Well, they could just make an exception on this one and move on. How many lots are there in Vancouver where no one is going to develop them? Probably just this one.

@ JD that’s a sign of some bitterness. There is no way it is fair that that empty lot be taxed at that rate. If they don’t fix it it will compromise their entire program. I am sure there will be lawyers lining up for this case…. Taxing nothing is plain BS no matter if you hate them for owning or not.

LeoS, not if you are going to instill new rules. That’s a double standard. If Introvert insists on attacking almost every post I make with an ignorant post then the occasional insult will be slung.

Our property tax system is a progressive system. The more you improve your property the more taxes you’ll pay. Such a system rewards those that own derelict and vacant properties so that they can afford to keep the houses empty or the site unimproved with lower taxes.

The empty house tax addresses this loop hole in the system. And while I think this is a tax grab, it is a necessary one. As the needs of the society out weigh those of the individual.

I don’t think they are super stupid. Just not knowledgeable.

You see it all the time on this blog. People rely on the agents to price the property fairly. They assume the agent or developer would not inflate their prices. And if a buyer challenges the sales person they simply show that the last five properties in the complex sold at full price. I’ve spoken about this on this blog before. Pre-sales are contract prices that may or may not be at market value. When one person (the developer) controls the sales of all the units in the complex then people that want to live in that building have to pay the developers price. That’s not a free or open market.

The bank understands this and that’s why they have lending regulations in-place instructing the appraiser not to use more than one (1) sale in the complex. If the contract price can not be substantiated by sales from different complexes then that contract price is not at market value.

I don’t suppose The City of Vancouver could be obligated to buy Jane Macdougall’s lot at assessed value and develop it themselves. Maybe a nice tower for the ‘hard to house’.

@Hawk. Difference between using the word and insulting someone with them.

Foreign investment makes sense, bank of mom and dad makes zero sense. So people with down payment gifts from mom and dad are somehow super stupid and paying a huge premium for presale to speculate? Doesn’t hold up.

Ian Watt is still my favourite realtor video blogger though.

https://m.youtube.com/watch?v=22O6Nmjt-mw

That would be a bear market.

https://info.bcassessment.ca/about-us/about-BC-Assessment

Sorry, I thought BC assessment was gov. My bad.

LOL. And now the city wants to charge an empty home tax.

Because that was the fair market value at the time of assessment. I doubt BC assessment is politically motivated.

Vancouver woman being charged Empty Homes Tax for land with no home on it

Jane Macdougall is scratching her head about why she’ll be saddled with a [empty home] tax bill of between $40,000 and $60,000.

Not only does her plot of land at 6161 Macdonald St. not have an empty home, it’s never had anything built on it at all.

She contacted the city and said she was told she would have to pay the tax, since the land could be used for housing.

“I said, ‘But there’s no home on this property, there’s never been a home on this property.’

And they said ‘well then, you have to build one.’”

https://globalnews.ca/news/3923582/vancouver-woman-being-charged-empty-homes-tax-for-land-with-no-home-on-it/

If the government doesn’t want to pump the bubble why have BC assessment boost the value by 30%?

A record high of 61% since they started their tracking but no one wants to talk about it as it surpasses 2007 and 2009 crash levels. Tick tock.

From today’s RBC report:

This sustained intense upwardprice pressure through the third quarter of 2017 kept housing affordability on a sharply deteriorating trend. RBC’s aggregate affordability measure

rose for a 10th consecutive time last quarter, jumping by 2.7 percentage points to a record-high of 61.5%. Victoria’s measure, in fact, recorded the second-largest increase relative to a year ago (7.2 percentage points) among the markets we track in Canada after Toronto. Deteriorating affordability no doubt weighs on home resale activity in area. Resales fell nearly 18% year over year in the third quarter.

“This is a desperate bear classic: throw a bunch of data into a bowl, stir well, and declare it a foolproof recipe for a crash.

But up to now, the recipe has been wrong every time. So they must cook on!”

The same type of data was shown before the US housing crash and the 2008 financial crash.

Insults removed. Keep it civil- admin“Vs your what? intuition? past makes future?”

The pumpers only have one line : “because it hasn’t happened, therefore it never will”… AKA the next generation of bagholders , bankruptcy cases or stone broke losers who thought it would never end. It gets pretty lame with debt loads hitting the stratosphere.

Notice all the shiny new pickups every block that cost $50K and most of the drivers are under 35 with not a piece of dirt on them to show they are being used for a job ? Yeah, the US is showing us another catalyst for the coming tank job.

Subprime Auto Defaults Are Soaring, and PE Firms Have No Way Out

Delinquencies on subprime loans made by non-bank lenders are soaring toward crisis levels. Fresh investment has dried up and some of the big banks, long seen as potential suitors, have pulled back from the auto lending business. To top it off, state regulators are circling the industry, asking whether it preyed on borrowers and put them in cars they couldn’t afford.

https://www.bloomberg.com/news/articles/2017-12-21/subprime-auto-defaults-are-soaring-and-pe-firms-have-no-way-out

That’s quite a different argument from the one where the condo makes sense as a rental. You’ve gone from a rental investment to a speculative one.

Nothing makes sense as a rental right now (at current purchase prices) but we’ve seen markets sustain for long periods of time not making sense in relation to rentals. Vancouver for one and Croatia (where I am from) you can easily rent a 200,000 to 300,000 Euro condo for less than 500 Euros per month. It has always been like that.

In my case I believe I am speculating based on the market staying flat which I think is a 50/50 coin flip at this point.

There is a difference between speculating in Coal Harbour where pre-sales go for 10% more than re-sales and you would bleed cash every month versus buying something you feel is 15% less than re-sales and you could get to relatively close to cash flow netural/slightly negative if you ended up stuck with it.

This is a good video on Vancouver pre-sales selling for more than re-sales -> https://www.youtube.com/watch?v=UH9wYc6Rukc

Property tax deferral is a provincial program. You can do it here. Most do it under the seniors program, but families with children can also do it (at a slightly higher rate). https://househuntvictoria.ca/2016/10/19/delayed-taxification/

I’m sorry, Local Fool. I don’t know that much about it, because I’ve never looked into it. I’m sure others here know way more.

There’s this:

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/annual-property-tax/defer-taxes

It’s a bit academic since selling a house after one year (or two, or three) is a terrible idea in almost every market. Personally the conditions in 2013 were extremely comfortable to buy in. Endless inventory, sellers getting worried, time to ponder and time to put in most any condition. 2014 was also good but if you look at inventory of SFH in the core it was already starting to draw down substantially by then. You had to act quicker as a buyer.

Introvert,

Do you know if Victoria does PT deferrals like Vancouver or if they would apply to stratas?

Not owning property, I always have trouble understanding how it works. It seems some people get nailed by tax increases while others just pay it when they move, and I don’t know what the difference is.

Whether people like it or not, I do think the recent headwinds that have been slowly percolating in the domestic RE market are growing and are probably going to continue to grow. The passing of the tax reform in the USA is something I’ve been watching a little bit and I think has implications for us by way of rising interest rates.

Although Poloz keeps asserting Canada’s own path, I think he’ll full of baloney. At some point US pressure will force Canada to hike upwards, and 2018 looks to provide plenty of that pressure. A pitifully low dollar isn’t likely to boost our exports, at least I don’t believe it has so far. Plus it makes imports cost more, on a population already mired in record amounts of debt.

In any case, we’re not business as usual as far as consumers go. We’ve put our economy and financial well being on the edge of a sword and the sharper that blade gets, the more precarious things are. This is why our central bank is saying that virtually anything can topple our RE markets now. It’s that wobbly – and thinking it’s only a problem for those poor people who don’t already own homes is just foolishness, IMO.

B.C. Assessment warns 67,000 homeowners of big increases

B.C. Assessment has issued 67,000 notices to homeowners throughout the province whose homes will see an above-average increase in value. Some homes are set to increase by 30 per cent or more.

“The majority of letters are being sent to residential strata properties, because this is the market that’s been most robust over last year’s assessment,” said Tina Ireland, an assessor with B.C. Assessment.

http://www.cbc.ca/news/canada/british-columbia/b-c-assessment-warns-67-000-homeowners-of-big-increases-1.4459410

Vs your what? intuition? past makes future?

Realizing that predicting the future is not his forte, Just Jack turns to predicting the past.

As Canadian public schools look to Asia for extra cash, one Chinese authority is publicly seeking to open its own school in British Columbia, sparking concerns over Beijing’s intentions in expanding its presence – and political agenda – overseas

https://www.theglobeandmail.com/news/world/as-canadian-public-schools-look-to-asia-for-cash-chinese-authority-plans-school-inbc/article37401027/

Dead horse…. meet your flogger.

This is a desperate bear classic: throw a bunch of data into a bowl, stir well, and declare it a foolproof recipe for a crash.

But up to now, the recipe has been wrong every time. So they must cook on!

Classic. Are you listed on the stock exchange yet?

Sure I will—I’ve been studying Just Jack’s techniques.

If you purchased a house in the core in 2013 and sold one year later your annual return would have been 1.7%

If you bought in 2014 and sold one year later it would have been 8.25%

If you bought in 2015 and sold one year later it would have been 19.2%

If you bought in 2013 and sold three years later then your simple rate of return over three years would have been 31%

So when would have been the best time to buy a house in the core?

It comes down to how much your time is worth to you. To me making 19.2% in one year is better than 31% over three years.

Just let us know how to give you money.

House Hunt Victoria is changing its name to Blockchain Hunting Victoria.

http://www.cbc.ca/news/business/long-island-iced-tea-blockchain-1.4460502

Right. But neither may be a good investment.

That’s quite a different argument from the one where the condo makes sense as a rental. You’ve gone from a rental investment to a speculative one.

Victoria breaks above 2007 & 2009 affordability levels over 60% as per RBC. With rates on the rise with increased inflation numbers out today it’s going to take more than a cyclical job related to the construction bizz to keep this bubble from exploding.

4 US interest rate hikes coming on top of Canada’s should do it. Toss in new spec taxes and OSFI you didn’t have in the mid 2000’s when Harper was handing out 40 year mortgages and you can stick a fork in this bloated pig.

http://www.rbc.com/newsroom/_assets-custom/pdf/20171221-ha.pdf

Teslas are still noisy.

I ride 20km a day (10km each way), barely any exhaust because the majority of my ride is goose/lochside, or side streets with little traffic.

I like the argument about rental yields much better. That makes sense to me. If the rents make sense it doesn’t matter what the market does, you have a decent investment.

Making the argument that one condo is better than others doesn’t have any of the same fundamentals to it. It might be the best deal of the bunch but that doesn’t mean either price is justified.

Problem is rental yield makes no sense anymore as Joe, the unsophisticated investory, has piled into the space squeezing the yield. A one bedroom with parking downtown is now $450k+GST; therefore, need to look for other opportunities.

Condos you can break down objectively; odds are a concrete building with 9′ ceilings, windows to the ceilings, and gas fireplace will be more attractive than a wood-framed condo with 8′ ceilings, small windows, and electric fireplace.

You would have more that tripled your 25% deposit if you pit it into a 3x etf for the nasdaq

I was talking about a hypothetical scenario scenario where prices remained flat which they haven’t. The 25% deposit on $193,000 and $300 per month cash flow positive is now a 25% deposit on $193,000 but the place is now worth over $330,000 and the cash flow positivity is close to $500 per month as it has been re-rented twice.

I’ve done really well in my self-managed RRSPs but the absolute amounts are much smaller than RE as there is no leverage.

Only if you sold in 2017.

You’re never going to be able to live down these words.

I like the argument about rental yields much better. That makes sense to me. If the rents make sense it doesn’t matter what the market does, you have a decent investment.

Making the argument that one condo is better than others doesn’t have any of the same fundamentals to it. It might be the best deal of the bunch but that doesn’t mean either price is justified.

Not saying condos are necessarily overpriced, but the nature of the argument is quite different. It could equally be used in Vancouver to buy a condo at $1000/sqft instead of $1050.

Maybe we need an HHV index that is easier to interpret.

Something like the average yearly change in re-sale purchase price, and the percentage of homes are re-selling below purchase price?

Definitely.

John Drake-

You are confusing the Teranet HPI and the VREB Index. Vreb’s index does indeed appear to be based on regression models, which you correctly point out lack meaning where the data are scarce (eg townhouse prices in Oak Bay).

Teranet, on the other hand, which is what Caveat Emptor was referring to, is indeed a true repeat sales measure. Their detailed methodology is pretty simple and described in the Teranet website. They used to publish the actual number of repeat sales per month, but now I believe you have to ask for it specifically. In any case, Teranet has the downside of referring to Greater Vic as one market, which makes sense for economists, but isn’t very helpful if you’re actually in the market to buy or sell a single home.

I’m surprised there’s any debate about this- I clearly remember lots of debate on this blog about how 2013 was in retrospect the best time to buy, and Leo lucked out (or showed his genius) by buying his own place at just that time.

Leo- can you show us the annual graph again? Oh maybe we’ll have to wait until near New Years: I believe that’s the tradition.

Where do you get that kind of return on the 15% deposit and that kind of monthly dividend on the 25% down payment?

You would have more that tripled your 25% deposit if you pit it into a 3x etf for the nasdaq

https://finance.yahoo.com/quote/tqqq

1 in 5 condos in Vancouver are owned by foreign owners…. I’m sure that number is actually higher since there are ways to hide it as well.

Total crazy IMO

http://www.cbc.ca/beta/news/canada/british-columbia/vancouver-non-residents-statistics-canada-figures-1.4456657

I rent out a suite in my house.

My bad, I thought that at one time you told us you had a rental property.

I guess I was “steered” wrong on that one.

I take no offense to that remark. It’s very true that I don’t have the balls (risk tolerance) to do what Marko does.

I probably will, however, take a good look at buying an income property once our principal residence is completely paid off.

I can’t comment on Vancouver, I don’t know that market.

Looks like the days of bidding wars on homes in Vancouver are gone. 77% of single family homes in metro Vancouver sold below asking in November

https://thinkpol.ca/2017/12/20/3-4-metro-vancouver-homes-sold-asking-november/

Before we move on do you want to confirm or retract this statement referencing the Victoria and Vancouver markets?

Also do you still believe that 2015 was overall a better time to buy than 2013 in Vancouver and Victoria?

So you bought nothing during the time you thought it was the greatest time to be bullish on real estate.

I signed a pre-sale contract earlier this year at Lyra and I certainly don’t think prices have room to the upside.

Are you suggesting it’s a good time to buy now? Or would you wait? Are you bearish or bullish?

I don’t believe that one can predict the market; it is like flipping a coin. If I had to guess I would say the market fill be flat or drop 1 to 3% in the next 12 months possibly followed by another 1 to 3% drop the following year until some affordability returns to the market place. I certainly don’t see prices going up but I’ve been very wrong for a number of years on that front.

Given that I don’t believe I can predict or time the market I just focus on finding what I think are great deals within the existing market.

For example, if 1 to 5 year old woodframed middle of the road finishing condos in Saanich are selling for $475 to $575 and I can buy into a premium concrete building for $465 a foot I go for it. Hence why I bought a pre-sale here -> http://www.lyraresidences.com

My rational is there is a 50/50 chance of pricing going up or down and if I always buy below the existing market on average I’ll be ahead.

When I bought my building lot in 2013 I figured lot + construction would be $200,000 less than purchasing a similar completed home at that time hence I went for it. I didn’t overanalzye the fact that the market was crap and the lot I was buying had been sitting on the market for three years.

You can control the individual property you purchase, but impossible to predict/control some of the external forces influencing the market as a whole.

When the market in Vancouver started taking off and Victoria was still lagging I don’t remember a single genius on this blog coming up with the theory of Vancourites cashing out and buying here. Never crossed my mind either, but it really shaped the market appreciation in Victoria in 2016.

So you bought nothing during the time you thought it was the greatest time to be bullish on real estate.

Are you saying that going against the trends is right? Because it hasn’t worked out that way. But time heals most wounds. So if you over bought in one year, 10 years later the prices will likely be higher. That didn’t make it a good deal when you over bought in the first place.

Real estate always goes up in price, except when it doesn’t. Take for instance yourself. How many years have you been dissing the bears on this blog but you’ve never bought significantly into the market? That’s a bull without balls.

“Over 20% of new condos in Vancouver and Richmond owned by non-residents”

20% of empty ghost houses in Golden Head most likely owned by non-residents as well. When Horgan introduces the new spec tax , and they have to show their real names, residency and incomes the walls will cave in. They buy in herds, they sell in herds, that’s their nature.

But how long are you willing to wait for prices to go up? A year, two years, five years? Waiting five years for prices to go up is a lost opportunity to invest outside of real estate.

I signed my Promontory pre-sale contract in 2011 and the building was finished in 2014. During this time the market for condos dropped; however, my specific Promontory unit was still better than anything outside of real estate. The pre-sale contract was $193,000 and I figure it was worth $230,000 on completion; my deposit was 15% and I ended up doing a 25% down payment for financing. Had 10+ people lined up to rent it at over $300 cash flow positive per month. Where do you get that kind of return on the 15% deposit and that kind of monthly dividend on the 25% down payment? Doesn’t factor in principal re-payment or potential price appreciation which I was lucky to fall into. This all happened in a down/flat market.

I’ve bought 6 pre-sales + built my house. If the market was flat I would have bought 5 pre-sales + built my house. I think you can do well in a flat market doing smart deals. Unlike the stock market in real estate your are competing with buyers/sellers who are often making really poor choices.

I’m giving you the stuff now. Now what level of active listings is enough, too little or too much?

If you were to see active listings go to 1,000 would that make you bearish or bullish on the market? There is more selection at 1,000. But if you were to see a hundred real estate signs sprout up in your hood tomorrow – you might be worried.

I know. That’s bonkers.

And I think there’s a strong possibility that five years from now, we’ll look back at some of these 2017 sales and react similarly.

Over 20% of new condos in Vancouver and Richmond owned by non-residents

The 15 percent foreign buyers tax has minimal effect.

The wealthy either find a workaround, hey anyways as it’s the cost of doing business or don’t care because they need to launder their money somewhere

http://www.cbc.ca/news/canada/british-columbia/vancouver-non-residents-statistics-canada-figures-1.4456657

Your guesses were mostly wrong for many years.

In the last couple of years, however, you’ve made fewer guesses and/or more cautious ones.

I don’t really understand your point Marko. Because buying anytime in the past would have been a good time to buy as long as prices went up. But how long are you willing to wait for prices to go up? A year, two years, five years? Waiting five years for prices to go up is a lost opportunity to invest outside of real estate.

Are you suggesting it’s a good time to buy now? Or would you wait? Are you bearish or bullish?

Readers can check Leo’s great market summary to confirm that yes, active listings were also higher in 2013 than 2015.

2013 was the best year to buy imo….represented 39 buyers that year and a couple have called me to sell; a SFH in Broadmead bought in 2013 for $635,000 and sold for $920,000 in 2016 and a near new SFH in Langford bought for $479,000 in 2013 and sold this summer for $689,000.

Some of my 2013 buyer deals are insane looking back….like a livable SFH in 10 mile point on a 16,000 sq/ft lot for $680k.

By the time mid 2014 rolled around you could sense things changing.

You didn’t refute. You suggested that there was more selection in 2013 then 2015. But you didn’t show this was true. The months of inventory doesn’t tell you how much selection there is. The number of Active Listings does.

Really Caveat, I can’t respond to nonsensical statements all day long.

-Don’t bring a knife to a gunfight (is that easier without pictures)

I sense a pattern:

1) Make a bold claim without looking at data (2015 was a better time to buy in Vic and Van than 2013).

2) Idiots like me respond with data refuting the claim.

3) Continue to hold claim/Cast doubt on conflicting data.

4) Introduce irrelevant detail/change subject to avoid admitting the original claim was wrong

5) finish with a youtube link

6) QED

It’s not a repeat sales index. It’s a hedonic regression analysis that obtains estimates of the contributory value of the physical aspects of properties. That’s why it can estimate a value for town houses in Oak Bay when there have not been any direct sales of town homes for years.

It isn’t an acceptable method of valuation by international valuations standards or any appraisal institute in the world. Courts won’t accept it because it isn’t based on comparable sales of properties.

Neither does it indicate how a market is increasing or decreasing as it only relates to a hypothetical home of a certain size, age, utility and condition. What it does have is a lot of statistical analysis which impresses most people that just made it out of grade 10 math class.

You know what it purports to be – a repeat sale index. I am sure it has its issues (some of which you have pointed out in the past), as does the MLS index. Using medians/averages also has its issues. Fact is that the HPI has correlated pretty well with other measures of the market**. Don’t dismiss it just to defend an erroneous statement about the Victoria and Vancouver markets.

YES. Thanks to our most excellent blog host and RE analyst I don’t even have to leave the site to check MOI. And yes it was higher in 2013 than 2015. Some googling got me a chart of Vancouver MOI and yes it was higher in 2013 than 2015

2015 had higher prices and less selection than 2013. By most people’s definition 2013 was a better time to buy. Feel free to continue arguing this point.

The only major respect I can think of that made 2015 a slightly better time to buy was that mortgage rates were marginally lower in 2015 than in 2013. Fixed were slightly lower and discounts to prime on variable were slightly higher.

** check out Leo’s market summary for another indication that prices were higher in 2015 than in 2013

Do you consider me a bully still Anna because I was gonging you for the Lisa Helps BS? It’s all relative because I thought I was

a. Being funny with the gong

b. I Thought I was righteous because I was going against the online “bully” campaign to falsely discredit Lisa H even thought I didn’t vote for her….

And then they just go to the next kid and bully them. Sometimes you just gotta stand up to them and take their hits.

My opinion is that you single out the ring leader and walk up to him and punch him right in the nose and you do that every day for a week. Then they’ll leave you alone and swarm the next kid. But then you stand between them and that kid.

This by the way is an allegory, I’m not suggesting that you physically harm anyone.

https://youtu.be/Ms6xVl-cbQ4

Explain what the HP Index represents and how it is derived then I might agree with you.

I don’t know if your assumption that there was less selection in 2015 is accurate or even relevant. I would have to check the months of inventory – did you?

“There were properties selling over 30% off their peak price like Haultain (some ~50% off like Swanwick).”

Sure Mike, one example and now a new one. A rare case and was not the norm at the time but its good for a pumper post to regurgitate when evidence is mounting of a major correction with new NDP spec laws coming and stress tests eventually killing the spring market now. Having a hard time selling those shacks I take it.

2018 will be the year they will all be saying: “Should have listened to Hawk and sold back in the spring of 2017 when he told us to take the money and run”. 😉

My mom told me that if you ignore the bullies they get bored and go elsewhere.

I’ll let you decide who the bullies are on HHV.

That just isn’t true for either Vic or Van. Looking at just one set of data. Teranet HPI was up an average of 16% in Vancouver over those two years and 5% in Victoria. Plus of course selection fell by 2015.

2014 was in retrospect a great time to be bullish. People don’t time the market with a stopwatch. If you bought in 2014 you had great selection and a buyers market and you made a massive paper profit within three years. 2015 and 16 were OK times to be bullish but inferior to 2014.

Say what? People aren’t bullish or bearish based on the last 12 months. They are bullish or bearish based on future expectations.

We’re in partial agreement here. I’m moderately bearish for the next while at least. That said I’d be more bearish on the suburbs and exurbs than on the core. Supply of houses 45 minutes from downtown can increase substantially. 10 minutes from downtown – not so much.

Children play nice;

@john Drake: Be good or “Rover” will be bouncing on you. Regarding the prisoner right at the opening we have him asking “Who is number one”. The monotone answer is “you are number six” but put some punctuation in there and you have the answer to the show:- “You are, number six”. It would be a great place to build twenty eight floor condos.

On a more serious note, what are everyone’s predictions as to what steps the NDP is going to take in Feb. What are the rumors in the grapevine.

But how many years would you have had to wait to see a positive return? That money could have been used in other investments for more than two years and make a positive return rather than costing you money each month. And still you could have bought for the same price in 2015 as you could in 2013.

Real estate always goes up in price. – except when it’s not.

Peoples opinions change. Predictions don’t come true. So what, we’re all human. I’m lucky in that you have to go way way back to 2009 to find an opinion that can be used to discredit what I’m writing today.

As for predictions, I rarely make them because they are only reliable for the immediate future of 90 days or less and assume that there will be no significant change in the market forces.

Real estate markets rarely change overnight unless there is a black swan effect such as the credit crisis a decade ago or the collapse in oil a couple years back. Otherwise it is simply watching how the velocity of price appreciation is changing.

Like a financial ship sailing the sea, it takes time to slow the ship down before it can reverse its direction. And that’s why I’m right most of the time, I just follow the trends.

I just put what Introvert and some others say down to jealousy.

https://youtu.be/mYKWch_MNY0

The best time to be bullish for Vic & Van was 2013, when the bears, magazines & media were proclaiming imminent disaster (burning houses on Maclean’s cover).

There were properties selling over 30% off their peak price like Haultain (some ~50% off like Swanwick).

Time to buy has been every ~14 yrs (roughly 10 up, 4 down):

1971, 1985, 1999, 2013

If you’re talking stocks that would be true but the movement in real estate is months not days. 30 years from now real estate prices will most likely be higher does it then make sense to be bullish today?

-You time the stock market with a watch and real estate with a calendar.

The time to be bullish on real estate was in the last half of 2015, six months before the big run up in the Spring of 2016. 2014 was a good time to put money in the stock market and make a reasonable return and not real estate that was flat and costly to buy and hold and most likely you would have lost money if you had to sell. I and most others would have made more money in bank mutual funds that year than in real estate.

Let’s look at this years house prices in the core. They have been flat for 12 months. Should you be bullish or bearish on next year’s market? According to your statement you should be buying. I’m not sure that is the right course, so I’m bearish on house prices in the core until I start to see things change.

Being bearish or bullish is more to do with the confidence that you have in the market for the upcoming months. Most if not all of the posts I’ve read on this blog lately are bearish for the new year. Of course we could have another black swan event as we did with oil. But I don’t know and neither does anyone else what that event might be.

“Makes you wonder what the panic was to get in the market in November though.”

Sounds like another banker ploy to suck in the masses to help year end sales then reel in the rest of the FOMO who backed off and are on the fence. Bankers are out to make money, not be your friend.

A certain amount of lawlessness is what keeps it entertaining around here. If it was civil and stuck to the script it would be way too repetitive and boring. Leo’s line is in the right zone IMO. Introvert does walk it and sometimes crosses it. I have never been shocked by anything she has posted about Just. Her attacks do tend to stick to the data after all. I actually don’t see too many personal attacks. There is no profanity or threats or insults just an ever present calling him out on his past. Some boards don’t allow “calling out” no matter if there is truth behind it or not. That is too civilized. A smack is fine no need to rewrite the HHV constitution.

I agree with LeoS. It is also disheartening that the board seems to degenerate into polarized camps of bears and bulls. I don’t mind “spirited” debate, but a lot of this seems to be the same tired song over and over on both sides.

Lets stick with talking about the data rather than insulting the other board members.

I’m with totoro on this one:

Changing your views – totally cool especially when you can articulate what caused the change

Changing your views and appearing to disown previous opinions and predictions – less cool and liable to get you called out by long time lurkers or posters.

That said I think the current incarnation of Just Jack brings tons of value to the discussion in terms of data and informed opinion and analysis.

I’m also with LeoS, we should strive for maximum civility, so when we are calling out perceived BS it can be done without attacking the person.

The MPC report estimated about 7% of buyers being sidelined and not being able to make adjustments like find a cheaper place or up their down payment. However we have fewer first time buyers and more cash buyers, so likely doesn’t entirely translate to Victoria.

Financially speaking it is more beneficial to be bullish before everyone else rather than jumping on the train after it has left the station and is halfway to the next destination.

I wonder if the effects of the stress test will be delayed until after the spring if what the brokers are saying is correct?

It isn’t just this………other factors too

Van City, Coast Capital, etc., not impacted.

My understanding is you can stress test at a 30 year amort (Mike, correct me if I am wrong). Given 81% of buyers (20%+ down) were going with a 25 year amort wouldn’t that mean 4/5 could mitgagte the impact of the stress test by changing the amort?

Individuals putting down 20%+ on these prices likely have some leeway on the deposit amount. I’ve had lots of individuals over the years put down 20% on the dot and keep other funds invested, etc.

I don’t think this stress test is a straight up 18% drop in borrowing power.

What we really need is for interest rates to start trending upwards. The problem with all these mortgage regulations is the monthly payment remains the same for X amount borrowed (with maybe exception of increased CHMC insurance fees last year) so people always find a way to borrow.

Or, perhaps future local politician?

https://www.youtube.com/watch?v=66hLNY-D13A

2018 may be a watershed in the market so I might change my handle again to reflect a possible change in my stance from being bullish to bearish. Johnny Dollar was good for a bull run. John Drake was good for investigating the market. Just Jack was good for learning the nuances of supply and demand.

Help me out hear Barrister as I think you are the only one who knows where I’m getting these handles from.

-maybe something along the lines of a former government agent who abruptly resigns from his job and has been imprisoned in a beautiful and charming-yet-bizarre and enigmatic community — a mysterious seaside “village” that is isolated from the mainland by mountains and the sea.

….. “Number Six”

Yeah that was news to me for sure. Thanks to Mike for bringing that up.

Steve Saretsky just emailed with essentially the same message.

“For those who will be looking to buy into the new year with 20% or more down, we do have access to lenders that will honour pre-approvals submitted prior to the end of this year. This will allow buyers to qualify under the current guidelines for a period of 120 days from submission and allow them time to bypass the stress test. As an example, if someone came to us for a pre-approval this week and ended up getting an accepted offer on a place in the next 120 days, they wouldn’t be subject to the stress-test. Thus, they would qualify for 20% more than if they look at starting the financing process in the new year. A pre-approval does not commit the buyer to anything. If it is not used and the 120 days lapse, the buyer would then be subject to qualifying with the stress test”

Makes you wonder what the panic was to get in the market in November though.

2014 was a flat year for house prices in the core. Not until the last half of 2015 did house prices start to rise. So being bearish on houses in 2014 wasn’t wrong. The rapid rise in house prices in February 2016 did catch me by surprise. House price rose by almost $100,000 in four weeks. Trying to predict that one was like trying to predict the crash in oil prices. Which was the cause of the spike.

At that time I was also writing about the substitution effect on the market. As house prices in the core would plateau and prospective purchasers would choose alternatives to a house in the core as either a house in the Westshore or a condominium and that would make houses in the Westshore and condos in the core the real estate to buy. And that’s what happened.

Back in 2014 and 2015 I was also writing that it wasn’t Vancouverites driving up our prices it was ourselves. And only recently did CMHC study publish a study saying the same. Man did some of you guys get upset when I used the phrase property hoarders.

For most of 2017 I’ve been talking about a balanced market as supply and demand has been in equilibrium (balance) at the current prices. Even though our months of inventory is low, and the sales to listings ratio is high and the days on market is low. And that ladies and gentlemen is a price ceiling. The only way to break through that price ceilings is with bigger down payments, but wait how about those OSFI regulations that are about to come into play? Bigger down payments enough to offset OSFI and push the market higher isn’t going to happen.

And what about inventory? Well house prices for new homes are $800,000 all the way out to Goldstream now. And there ain’t much vacant serviced land left and what little there is is too costly for developers to make a buck. And if prices remain stagnate builders are going to shelve projects. About 25% of our jobs are now related directly or indirectly to real estate.

Maybe some of you carpenters should be thinking about taking a microsoft course.

“However, I’m generally going to keep doing what I’ve been doing for many years now, and, Leo, you do what you gotta do.”

LeoS, maybe you could insert an ignore/ block button? That would end the majority of this B.S.

After some consideration, I see now that this wasn’t a clear-cut case of Just Jack trying to revise his own history, of which we have seen examples.

So, this time, I may have been too hasty.

However, I’m generally going to keep doing what I’ve been doing for many years now, and, Leo, you do what you gotta do.

I said I don’t check in. Doesn’t mean I don’t read. Just have nothing to say that hasn’t already been said. Probably like a lot of folks.

“As for money laundering, there is no credible data I can find to show a widespread pattern of behaviour.”

Actually there was lots of data and it was coming out on a daily basis via Sam Cooper and other investigative journalists. Some like you chose to stick your head in the sand to protect your investment. Sorry Saul.

Oh come on. Introvert is the worst for instigating! For what it’s worth when I moved into my current rental in 2012 they were giving renters free months rent and dropping prices to entice tenants. That is 2-3 years after Just Jack’s prediction. Not saying he was always right but I may have made that same prediction back then. I’m looking to buy a house with a suite but after living through this period of high vacancy I plan to be picky in chosing the suite. The last few years people have been able to rent any crap hole for what seemed like an ever increasing amount of money but from what I can see lately rental prices have levelled off and there is a bit more available. Who knows what will happen but if for some reason house prices drop or there is a higher vacancy rate it may be tough for some people to rent out their crappy suites. And then how do they pay their mortgage when they bought at the peak of the market and need that rental income? I’m probably just too cautious about this whole house buying thing it just seems so risky to me.

I wonder if the effects of the stress test will be delayed until after the spring if what the brokers are saying is correct? I guess we will have to wait a little longer to see if there was any impact.

“That’s what I’m talking about though. The out of the blue “attack” from Introvert started it and then the conversation degraded on all sides.”

This is also the problem when someone says they haven’t been reading the blog in a long time then tries to paint a picture of someone else’s innocence. Just like giving an opinion on a video they never watched. Better call Saul.

Since I have a few minutes, here is my actual statement once we take the Hawk-coloured glasses off:

Slightly less dramatic than presented 🙂

“I do recall that you made statements that were proven incorrect, or were not based on an accurate assessment of the facts, ”

It’s funny to see someone come to Introvert’s defence when he’s been in full attack mode much more lately as the irrefutable statistics/facts of household debt and increasing odds of a major correction/crash increase. Government wouldn’t be stepping in if it wasn’t fact.

I do recall totoro stating once when I brought up the news of money laundering in BC real estate being rampant and now getting exposed, and her reply was that it wasn’t rampant and that any that existed was well under control by “the authorities”. Well we know that was out to lunch.

Just an example that the bulls have been wrong on many things as well as the few bears. Who knows, maybe I’ll buy a huge spread next summer for cash and blow you all away. 😉

Yeah, I see what you are trying to get out, just seems like responders are adults who have an equal responsibility to stick to whatever rules of engagement you are setting out and they are getting a pass. Plus introvert is not always the instigator, others like to fling some zingers once in a while too, although usually with less flair.

ER is good. Not bored at all, although the transition was rough for about a year as I’m too young to join in the retiree games and all the cool kids my age are out changing the world – or something like that. I’m engaged in other fun projects now so it is not an issue.

That’s what I’m talking about though. The out of the blue “attack” from Introvert started it and then the conversation degraded on all sides. We went from reasonable comments to youtube links in a couple hours. It don’t see a big attempt to revise history in this case. JD said he was bearish in 2014, which was probably one of the worst times to be bearish in recent history. If that is an attempt at revising history it missed the mark.

This is why I try not to moderate very often though. 🙂

How’s early retirement treating you? Not bored yet?

Not sure about hundreds, but early on you were a renter not an owner and you did not have the years of experience you have now gained as an owner or a master of data ;). I do recall that you made statements that were proven incorrect, or were not based on an accurate assessment of the facts, but that has really changed over time. And the service you provide here is much appreciated.

I can think of a number of posters who have been far more accurate than not, or who have not engaged in predictions at all but have been consistent and logical in their analysis and positions.

Why pick out Introvert’s comments when there are others doing exactly the same thing and getting a pass? I can read down this thread alone and pick out actively hostile comments that add nothing imo by others that have not been singled out. If you are going to use actively hostile or adds nothing to the conversation as the benchmark shouldn’t it be applied equally to all?

Also, I agree that people can change their opinions over time. That is a good thing because it shows they are open to assessing new information. Holding the same opinion no matter what is a credibility issue. What Introvert might be reacting to with JD is the new identity plus denial of prior opinions, however JD has definitely made an attempt to provide more reliable analysis in recent years.

“Maybe a decade or so ago, I hurt Introvert and Totoro’s feelings and they just haven’t gotten over it. I’ll let them stew in their own hate.”

There’s that old saying JD. They can dish it out but they can’t take it, AKA thin skin.

“The exhaust won’t be a problem in 10 years.”

I agree it will be great to see EV’s dominating the gas guzzling pick ups and beaters. But you’ll be increasing your odds of lung cancer by that time sucking in 3 times the CO levels of non bikers.

@ rush4life

I didn’t hear this. I was notified through lender-broker channels that this is how the changes are being implemented.

Here’s the exact text:

Pre Approvals:

Any pre approval committed prior to January 1st will remain valid for 120 days from the date of the original approval. Any extensions of an expired pre approval after December 31, 2017 must be qualified using the qualifying rate based on the new rules.

Should a pre approval that was committed in 2017 turn into a real deal, the old rules apply even if the closing date of the new purchase is greater than the expiry date of the pre approval, but no greater than 120 days from the date of the commitment for the real deal.

Example: A pre approval committed prior to January 1st expires March 15, 2018. Borrowers purchase a property closing May 1, 2018. If the real deal is committed on/before March 15th, we still qualify the deal using the old qualifying rate rule. The rate is no longer protected as the closing is beyond the expiry date of the pre approval, however the old rules still apply for qualification, as long as the deal closes within 120 days.

Not through a sense of community service to you jerks though 🙂

I’m just a bad businessman with a data fetish. Who knows maybe that leads to money at some point. I’m not holding my breath.

I admit I change my opinion. As I said sometimes I’m bullish and sometimes I’m bearish. It depends on what the market is doing.

I don’t even vote for the same political parties. I’ve voted Conservative, Liberal and NDP all in the last decade too. You’d have to be a pretty boring person to decide that you’ll be one or the other all of your life.

Maybe a decade or so ago, I hurt Introvert and Totoro’s feelings and they just haven’t gotten over it. I’ll let them stew in their own hate.

As Obama said…

https://youtu.be/kzXcNgCr0nk

Yep can’t wait. Buses switching over, car adoption accelerating.

I think this will make inner cities even more attractive to people. Take away 90% of the pollution and noise and it becomes easier to live downtown.

I support Leo’s comments about the nature of some of the activity going on here and the value in keeping conversation reasonably civil. I think he’s been pretty forgiving and I don’t think that taking an “enough is enough” approach is a bad thing. His warning was far from arbitrary, IMO.

This all comes down to respect if not for each other, than to Leo who has to manage this site. He does this work for you, for free. He does the research, writes the articles, and plunks the data in to get helpful graphs to provide fodder for us to talk about.

If posters are just personally attacking one another, it falls to him to have to act whether it’s to bark at someone, delete a post, stick someone in moderation or ban them. He’s already got a wife and kids; don’t make him have to referee here too.

If you appreciate Leo’s work – show it by not acting in a manner that causes him to feel compelled to respond to your behaviour. Since I’ve been here, I’ve never seen him scold people that didn’t deserve it.

Cheers

I’m sure you could find hundreds of predictions I’ve made over the years that were wrong in retrospect.

I do agree with this though. More data does not nevessarily mean predictions will improve.

Many people have succumbed to decision paralysis over time.

Quite possible, but the line has always been fuzzy. I see it quite simply. Does it encourage conversation or not? Does it have an actively hostile flavour to it?

These are things that I feel are quite different from your previous grammar correcting posts that did not have an actively hostile flavour to them and weren’t always targeted at one person.

Pretty clear to me that it degrades the conversation and discourages people from posting. I don’t see that to be in anyone’s interest.

“I appreciate Introvert’s comments as they tend to be accurate and wickedly funny.”

“Hawk may have a place in the dark side of the dialogue, but humour isn’t his strong suit. ”

This is the point LeoS was trying to make that totoro obviously misses the boat on and wishes to “antagonize” and keep the screws turning when there was a positive turn in the discussion pre-Introverts personal attacks.

“wickedly funny” ….ummm really ?? where ?? Coming from the poster with zero sense of humor, we shouldn’t be surprised.

If you don’t find JD’s videos humorous, you got a major burr up your ass. Some don’t click on them out of spite for JD, or that it may just make them crack a smile for once in their life. Sad.

I think that’s fair. I do question the data to some extent, though. While I believe it is locals more than anything, I think the numbers of people who are buying with money earned outside of the economy is a bit of a dark number as we don’t collect the right data. That cohort could easily count as a PR or a citizen – so it’s technically a domestic buyer even though for all intent and purposes, the purchase itself is not.

I don’t check in much anymore because I don’t have much to add to the conversation that hasn’t already been said, but I’ve been around for years. This is my take on matters fwiw.

Introvert’s comments have always been responses to antagonistic and weirdly polarized comments as far as I can recall – mostly by Hawk and JD. I appreciate Introvert’s comments as they tend to be accurate and wickedly funny. I say this even though sometimes we have different perspectives on things such as the new Liberal government corporate tax measures. Hawk may have a place in the dark side of the dialogue, but humour isn’t his strong suit. JD seems to rely on youtube links instead of logic imo, but he still has some good points on appraisals and has learned to stick more to logic than fancy as the years have gone by.

On the positive side of hanging around here for years I can recall a lot of revisionist statements from JD. Hawk has been pretty consistent in his sky is falling opinions.

No they couldn’t. Many posters have been consistent, perhaps the majority.

Feels more like a reality check to me.

It is true that I have always been hostile to Just Jack’s pretending that he has a good track record on where the housing market is going.

I’m terribly confused. I’ve been operating in the same fashion on here for many years, but today I’ve somehow crossed a line. I’m pretty sure you arbitrarily moved the line, Leo, as what I have said today about Just Jack is not particularly devastating.

That’s fine that you’re bored by this type of contribution of mine. If being repetitive now warrants stern lectures then I’ll refer you to Hawk’s posts.

That would be quite interesting, and I invite anyone who’s bored to do this.

Local Fool,

I think we need a clear understanding of “foreign” wrt RE.

Foreign is defined (in Vancouver foreign buyer tax) as non Canadian Citizen or landed immigrate, so foreign student have to pay foreign buyer tax if they buy properties in Vancouver.

For new StatsCan report, it is for non-resident (regardless citizenship), foreign students who own houses here is NOT part of that number, as long as they fill Canadian tax return and thus are residents.

Not sure why everyone uses “foreign” to replace “non-resident” for StatsCan report, the two terms are not the same!

3 crappy car roads with one where bikes breathe exhaust.

The exhaust won’t be a problem in 10 years. Some awesome second generation electric cars coming out such as the new Nissan Leaf. I really anticipate absorption picking up early into 2019.

There’s a difference between a debate and antagonism. You are solidly in the latter and pointless attacks have always been off limits as they kill more interesting conversation. As for “revisionist” history, I don’t see it. Both statements were subjective “I believe we are” and “We may be looking at”. Even if they weren’t it is understood that what you write here is your own opinion.

If anyone else had too much time on their hands they could also sift through the tens of thousands of comments over the years and make the same points about anyone. All this feels like a personal vendetta rather than a discussion.

A Christmas present for you Introvert

https://youtu.be/hhgrG_pVBlY

An interesting piece from Steve Saretzky, responding to the first Statscan report on foreign ownership of Canadian residential RE.

…the numbers suggest egregious house prices may be more local than we want to believe. After all, Canadians are the most indebted of any advanced economy and 40% of all home loans are now blended with a Home Equity Line of Credit.

That being said, as many pundits have suggested, and as I have witnessed on the ground many “foreign buyers” are not actually foreign, they own Canadian passports.

Lastly, of the official 7.6% of foreign ownership in Vancouver how many are productively renting them out vs. how many are simply using Vancouver real estate as a hedge against inflation and a preservation of wealth…This is data Stats Canada should begin tracking.

http://vancitycondoguide.com/foreign-ownership-numbers/

Link to Statscan report:

http://www.statcan.gc.ca/daily-quotidien/171219/dq171219b-eng.htm

That was posted during the monetary crash in 2009.

Did you know that the Canadian government through CMHC was going to bail out the banks? No you didn’t and neither did anyone else. Did you know that CMHC was going to increase their level of mortgages from $200,000,0000,000 to $600,000,000,000.

Look what happened in the states and only now a decade later are they emerging from the crash.

Come on Grampa troll – try another one! Maybe you’ll get lucky.

So countering a person’s revisionist history with actual evidence is now off-limits?

No point in this valueless antagonism and future posts will be deleted. Turns out people’s opinions of where the market is going aren’t always accurate. Whoop de doo great discovery Introvert. What is of value is the opinion so that each person can decide for themselves whether they feel it is well supported or likely. Only attacking opinions doesn’t further the conversation.

You could dig up all the industry forecasts from the past years and point out where they’ve been off the mark as well.

Is 9.7% a meltdown?

Also, I’m curious: what has been the trajectory of prices since you made that prediction?

OK.

Nothing to see here folks.

@j_mcelroy

“Of the 6,009 condos in the City of Vancouver worth over $1.5 million, 19% are owned by non-Canadians.”

Prices declined in 2011. Median house prices in the core fell from $634,000 in January to $575,000 in December of 2011.

Jan $634,000

Feb $615,000

Mar $597,800

Apr $595,000

May $616,250

Jun $620,000

Jul $582,000

Aug $580,000

Sep $599,900

Oct $573,950

Nov $563,750

Dec $575,000

Not bad for 6 years ago, want to try another relic from the past, loser.

Barrister,

While I’m not one of the “better brains”, I’ll throw in on it because I think they’re interesting questions that lots of people are probably asking.

I don’t think they’re considering either course. They know there’s a problem, and they also know that at least a fair bit of their votes in south western BC came from folks wanting action on the housing crisis. They also know what proportion of people already own, and that cohort is more likely to vote.

I don’t think it’s pricing policy they’re contemplating, I think it’s a “prevention of force and fraud” policy. If correct, that suggests speculation taxes, better info required at all stages of the LTO process, and to shine the light on dirty money coming into the market. I doubt you’re going to see a lot else, but I could be wrong.

I doubt even more that those hoping that they’ll be able to afford a home at market rates due to NDP policies alone, are going to get what they want. It just isn’t the role of our government to force prices to fall directly. Will a spec tax dampen the market? That’ll depend on what they do: they campaigned on a 2% tax, but I don’t know what that 2% refers to or under what conditions it would be applied. It certainly doesn’t sound major, but who knows. And market shocks can promote premature conclusions (think, FB tax right after it was implemented).

More of their efforts are probably going to be biased to the supply side, creating social housing and more rental accommodation. Necessary in any case, so, yay.

I think things to look for in terms of RE influence are more macrofinancial, not political – BC NDP policies are certainly not the highest on my list of things to consider.

Let me toss this question out for the better brains here.

The NDP has already announced that they are bringing in new measures to moderate the housing market. I have two questions.

1) What specific measures does everyone here thing might be brought in by the government.

2) What are the actual goals of the government. Is it to slow the increase of prices or actually try to avoid any increase. Alternatively are they hoping to drop the price of housing. If so, then what sort of drop are they targeting? 10%, 20% or even having prices roll back to 2014. (If 2014 what do you do with all the first time buyers over the last three years whose equity has been wiped out or who would actually be underwater?). If the goalwas to make house prices affordable again one would almost have to roll back prices to 2014 in light of the fact that interest rates are rising.

For those of you who have your ear to the ground, what are you hearing?

Hawk, I’m sorry your bearish buddy’s 2011 prediction was a little off.

I don’t think so. But then again, I thought he wouldn’t become president, so my track record on Trump isn’t so hot.

(I bet many people thought Trump wouldn’t get elected, but now most of them are like, “Oh yeah, I knew Trump would win.)

Dasmo, I agree that it is terrible for both the Bikes and Cars through that stretch in particular. A major problem is that the Saanich road system has no easy parallel paths in many places. However, there are really only three N/S car options there: Richmond, Shelbourne and Cedar Hill.

I would rather have 2 good car roads and one dedicated bike road than 3 crappy car roads with one where bikes breathe exhaust. If they could sort out the stretch from Cedar Hill X Road to McKenzie, I would say they should make Richmond bike-only. The only downside is the additional hill that Shelbourne doesn’t have.

” was bullish in 2016 and bearish in 2014.

And dead wrong in 2011″

Says the Sean Hannity of HHV. Whataboutisms are popular today when in denial of bloated debt markets like 2007.

When Trump gets the cuffs then the stock market will lead down the whole house of cards.

I don’t think more data necessarily means better predictions. It does in the realm of science. But economics is not a science.

And dead wrong in 2011:

@Mike Grace

“-When was this posted? ”

It was posted by the mortgage broker on Dec 7.

Whether it is a crash or a blip may depend on where you are sitting. If the market fell 20% over the next few years that would be a blip for a lot of people that bought before 2015, but it might feel like a crash to folks that bought recently.

I am not overly bearish on Vic RE but given how fast the market has risen it doesn’t seem out of the question that some of the gains could be given back if there is a recession or if governments get overly enthusiastic with their market-taming measures.

Totally agree with your advice. It’s too late for FOMO. At this point you are unlikely to lose much by waiting and could benefit from a better buyer’s market next spring.

Indeed. The problem with that argument though, is that the relevant points get so bogged down in minutia it becomes reductionistic and we lose all sight of what we’re arguing.

If we attach an air hose to a tire and keep inflating it, we know that eventually, excess air pressure is going to weaken the tire’s structure and cause it to burst. It isn’t helpful to most to know the atomic nature of the rubber to determine when, where and how it will tear open, because in the end it doesn’t really tell us anything beyond the basic point: if we keep inflating it beyond a certain limit, at some point it breaks.

The common thread to nearly all financial crises is excessive debt, especially those who use it to acquire suddenly illiquid assets. Debt matters little so long as the asset your acquiring with it is rising in value and readily sellable. In a reversal, or even a stall, that spells trouble. That’s what caused the tulipmania crash, the south sea bubble, great depression, dot com bubble, etc.

Deleveraging is inevitable. It’s absolutely going to happen to us. There’s an enormous amount of debt consumers now have in Canada, the likes of which we’ve never seen. It’s just a question of whether the debt is paid back over a long period while the economy suffers over time, or whether the debt is written off more quickly (crash) and recovery begins faster.

I disagree, considering the limited resources that the bloggers have had access to, I’d say this little blog has done very well in its discussions and predictions.

Of course the more data we have the better the predictions have become. It has also been a learning curve over the last 11 years for all of us. 11 years ago we were not looking at months of inventory or sales to listings ratios or even days on market. Today it is mainstream knowledge that most of the readers on this blog are comfortable with.

I know that some want to pit bulls against bears on this blog. In my opinion that is just a distraction from what this blog does well and that is presenting a collection of thoughts and opinion from many different contributors that have changed with time.

Even with my comments I will some times lean to a bearish position and other times more bullish. It really depends on what the market was doing then and now.

Back in 2016 I was showing that condos were good buys and would increase in price. In contrast a few years before I thought there would be little growth in the prices and there was none. I was bullish in 2016 and bearish in 2014.

It’s been 80 years and economists are still debating what caused the Great Depression…

I don’t think so. The vast majority of Gordon Head (everyone east of Shelbourne) won’t notice any difference. However, those who live in and around Hopesmore Dr and Arrow Rd will probably see increased traffic on Cedar Hill Rd, which they won’t like.

I do hope the new University Heights will avoid the main issue with Tuscany Village: it’s too squishy for vehicles to comfortably enter, park, and exit.

If I was buying today I would definitely wait and see what happens in the spring. I believe it’s smart to check the market response to the stress test and February budget changes before jumping in. You just have to keep an open mind and watch the market. Don’t get fixated on these changes causing a crash, they may just pass by with a blip.

But blips are opportunities. There are always people desperate to sell in any market, and if the market is shocked with buyers siting on the sidelines, that means there are opportunities to lowball. The mistake would be assuming that the opportunity will only arrive later. Keep your eyes open if you are looking in the spring, we will see some (comparatively) good deals.

@ Once and Future, Because then it wouldn’t solve the problem of bikes slowing Shelbourne down. It’s a brutal road to bike on but the other paths kinda suck so people still ride it. Richmond is the only real alternative but it’s too narrow.

“More lender info is coming out regarding each lenders implementation of the B20 changes. A couple of interesting points:

1) TD Canada Trust is allowing pre-approvals completed before January 1st (and using contract rate qualification) to transfer to live deals as long as the completion date fits within the pre-approvals 120 day timeframe. -So TD is in effect delaying implementation of B20 for an additional potential 120 days.

2) Other lenders are being more lenient than this even: Pre-approvals being completed prior to January 1st using contract rate qualification can be converted to live deals and underwriting can occur under the old guidelines, as long as the accepted offer is in place within the pre-approval time period – 120 days from the original pre-approval date. The completion date can then happen an additional 120 days from the date of the accepted offer. In effect this delays B20 implementation by a potential 240 days if completely maxed out.

So… ‘as immediate as possible’, kind of but not really.

-Mike”

Mike where did you hear this? When the rules first came out I wrote OSFI about this and they told me mortgages after Jan 1 had to obey by the new rules. Maybe another broker here wants to confirm?

“The new owner of University Heights mall wants to redevelop the whole shopping area (except for Home Depot) as well as add 350 rental units.”

There goes the neighborhood.

I think you’d have to be pretty foolish to step into the market in the next couple months as a buyer, you owe it to yourself to wait and see what the NDP has in store in February (likely FBT for Victoria) and the impact of B-20.

Seemed super foolish to be buying January 2009 and the market bounced back more than 20% by the end of the year. January 2009 also happened to be the slowest month on record; therefore, very few bought when the opportunity to buy presented itself.

It also seemed super foolish to buy in the middle of 2016 when everything was going totally nuts….yet it continued.

I think Jan-Feb-March 2018 are going to be very slow in terms of sales as buyers take a wait and see approach; however, if absolute demand isn’t impacted then you’ll see everyone piling pack in in April/May once a conclusion is reached that the world isn’t ending and prices aren’t going to tank.

Trying to predict markets is near impossible I’ve we’ve seen by 11 years of commentary on this blog.

“Shelbourne got bad a decade ago long before bike lines. Having lived in the hood and struggled with biking it this lane is a huge plus, especially with some more urban density like this.”

This is why this is so screwed up. They should have converted View St and Broughton into bike lanes just like Saanich should use Scott St and similar parallel streets like Cedar Hill Rd as bike routes and ban them from the main drags and save millions. Ass backwards thinking by this city planners.

“We already saw this report a few months ago, but Better Dwelling covered it again. Really fascinating to see the evidence that subprime borrowers did not cause the US meltdown, rather it was speculators.”

It was speculators using ninja loans just like speculators here are using HELOC’s and private alternative lending. It’s all the same shit and not going to end well.

There seems to be more intelligent discourse on this blog than several others, so help me out.

It’s been somewhat accepted that Chinese investors have driven the high end of the housing market in Vancouver and Toronto but does anyone here actually believe that they have created the housing markets we have today?

To do so, in my mind, suggests acceptance of the “trickle down” theory of economics. Give the rich more and we all prosper. Lol.

If there is a different theory on how all those multimillion dollar purchases in the high end of the market created this bubble, I’m all ears.

Any news report (on CMHC and Statistics Canada recent survey) using “Foreign ownership” instead of “Non-resident ownership” is very misleading. I have just complained it to G&M. CBC report is correct.

Dasmo, I think I agree with everything you wrote. However, I still don’t understand why we can’t put the bike lanes on a quieter parallel street instead of on the busiest street in the area.

That would be safer for the bikes and not require losing lanes on our primary car arteries. Look at the accident statistics for intersections like Shelbourne/McKenzie. It is scary.

https://www.saanichnews.com/news/saanichs-most-dangerous-intersections/

We already saw this report a few months ago, but Better Dwelling covered it again. Really fascinating to see the evidence that subprime borrowers did not cause the US meltdown, rather it was speculators.

https://betterdwelling.com/forget-subprime-canadian-real-estate-buyers-investors-crashed-the-us-market/

Kind of casts doubt on the common dismissal that Canada is different than the US because we don’t have NINJA loans. Turns out they may not have played as large of a role as we were told.

“To the agency, a non-resident is either a Canadian citizen who no longer lives in the country (but still owns real estate) or a non-citizen who owns property in Canada without living in the country as a primary residence.”

Note this stats is not about “Foreign ownership”, but “non-resident ownership”. As the survey is based on title and tax fillings, international students probably would be considered as residents as majority of them do fill income taxes (to get tuition credit), and they are tax-resident by CRA definition.

So property owned by these students probably are not included in these stats, even the money came from their parents who are not primary residence.

This report covers the condo market. The jist of the report is, the activity recorded by our metrics indicates that foreign activity in residential RE is relatively low and stable. Where it does exist, it tends to concentrate in condos in urban cores. Montreal has experienced some statistically significant growth in foreign ownership in areas, but it is still a small portion of activity. On Montreal activity, there is no meaningful difference in overbidding behaviours on homes between local and foreign buyers.

Like a few of us have said – the Chinese aren’t going to hold this bloated bag of a market up for us. We brought it here on our own on a fixed, false belief that prices only go up, the GFC in the USA didn’t cause our housing market to fizzle so nothing ever will, everyone wants to be here, no more land… all buoyed by low interest rates, speculation, and a mountain of debt, debt and more debt.

Congratulations – we’re just as foolish as our southern neighbours, if not worse. Merry Christmas!

Haven’t read this yet but: CMHC and Statistics Canada examine non-resident ownership

https://www.cmhc-schl.gc.ca/en/hoficlincl/observer/observer_222.cfm?obssource=observer-en&obsmedium=email&obscampaign=obs-20171219-hmi-foreign-buyers

Because bikes were slowing it all down…. The entire neighbourhood needs to be more bike and pedestrian friendly so less people drive 1km to do their groceries or 3km to go to work. There has been a shadow density in this neighbourhood going on for a long time. Shelbourne got bad a decade ago long before bike lines. Having lived in the hood and struggled with biking it this lane is a huge plus, especially with some more urban density like this.

That will have an interesting impact on the neighbourhood. The rumours have certainly been around that this was coming. It is prime land.

My main worry is about the increase in traffic. Saanich is planning on squeezing Shelbourne down to two lanes just south of McKenzie. I am a big believer in bike lanes, but Saanich and Victoria have been doing some interesting things with the roads.

Can anyone tell me why Saanich puts bike lanes on the busiest streets? In Vancouver, they used to have bike routes on quieter streets, like “off Broadway.” Why the push here to put the bikes through the most hazardous intersections?

@Andy7

“Interesting. This was posted by a mortgage broker:

New Mortgage Rules take effect Jan. 1st – but the deadline for submitting Applications to lenders is Dec 15th!!”

-When was this posted? Without official lender implementation notifications, which generally come out with very little notice and very close to the implementation dates, it’s really hard to know exactly when and how lenders are going to react.

While I believe that you’re inferring the mortgage broker was being misleading and salesy, (which nobody is ever a huge fan of), it’s my take that the post can actually be considered prudent advice given the lack of lender implementation notes, AND the fact a live deal usually takes a business week to approve/underwrite. With the Christmas week being a complete write off – this brings the broker’s theoretical deadline back to December 15th.

Not terrible advice considering all the above.

RE: Implementation of B20 changes

More lender info is coming out regarding each lenders implementation of the B20 changes. A couple of interesting points: