CMHC: Dedicated rental buildings barely viable

The CMHC posted an interesting report on the results of a study they commissioned on the cost of rental building construction in major centres. Our little vacation backwater is not part of the list of major centres (we never are) but the findings are still interesting. The purpose of the report was to look at the return for developers on constructing dedicated rental buildings, and whether that return was high enough to justify constructing those buildings.

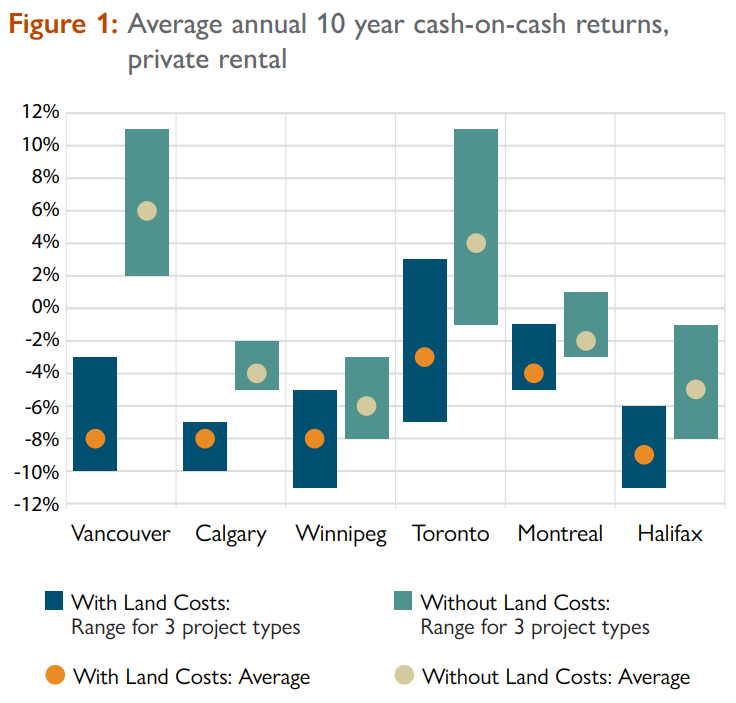

They estimated the return over a 10 year period of a basic, medium, and high end rental building in each market taking into account the cost of land, construction and development costs, financing, and operating costs. The results weren’t exactly promising. In most markets and for most building types, returns were negative when land costs were included.

What’s interesting is that despite sky high land costs, the returns were not worse in Vancouver and Toronto than much cheaper markets like Halifax and Winnipeg. It seems the rents in those high priced markets are proportionately higher as well.

The report doesn’t quite match up with the reality on the ground in Victoria where we have over 1800 new rental units under construction. Obviously those developers are not building those units expecting a negative return, so either the situation for rents is better in Victoria or they are receiving some government subsidies to get those built. Personally I believe that is how it should be. It is in everyone’s interest to have stable long term rental supply and it appears from this report that it will take some land grants or subsidies in most markets to keep that supply healthy.

Aside from rentals though, another interesting result in this report are the costs to build. This includes land, construction, development, and taxes, but not financing.

We hear a lot about how much it costs to build, and that prices are high because development fees are high and land is expensive. Well according to this report, even with the insane land cost in Vancouver, a mid level unit would cost under $600/sqft to build. Meanwhile the average resale condo in Vancouver is selling at $1039/sqft and new builds for much more. On a 700 sqft unit that is a difference of $336,000. Some of that will go into financing, some into marketing, and selling costs, but it seems to blow the idea out of the water that condo prices are high because new construction costs a lot. I believe that is a trope the development industry would love to keep pushing but doesn’t hold up to closer inspection.

Certainly construction costs put a floor under prices. You can’t dip below replacement costs for long unless a city is losing population. However replacement costs are far under what condos are actually selling for out there right now.

Introvert,

I wouldn’t call that very effective advertising if you don’t tell the person who you are. Kind of like handing someone a blank business card and asking them to call you.

The property sold under a court order. It was a home that needed a hundred thousand in repairs and was on acreage in Sooke. One bidder only and the Master of the court took the first and only offer at $223,000. The property supposedly had a rodent problem too. Mention rats to a buyer and watch the dust form from the back of their SUV as they drive away. The acreage properties in that same area have been selling at 20 percent over assessed value.

But this is where you find the deals today. Those properties that are different than what the mainstream buyer is looking to buy. One that needs a lot of work and requires deep pockets which most first time house buyers don’t have. I’m sure the buyer for this property would be able to re-sale after renovating the property in the $500,000 range. Which is viable for a first time house buyer because the home would be completely updated.

It’s difficult to find places to flip these days as there are so many people doing this full time. Even the guy who fixes the photocopier has a business on the side finding and flipping homes.

Hey John,

Do you mind sharing where the property that “One property sold for 35% under assessed value.” was located and what its assessed value was? Did you know the property in question in relation to how it was left etc?

Thank you,

Aaron

Where did I say they have? Things change. That’s what we’ve been discussing all this time.

TonyT linked to a technical interpretation that was very clear (I believe CuriousCat found the same one before). For you to retain your PRE your suite must be ancillary AND no structural changes. I’ve never seen a suite that did not require structural changes like a separate entrance or a new kitchen to create it.

So seems pretty clear that the PRE is not meant to apply to suites. It’s also clear that the CRA has not cared about this in the past (and had no record of sales anyway) and therefore it makes sense that accountants have deemed suites safe.

Maybe they will continue to not care, and maybe they won’t. But now when you sell you will have to declare that it was entirely your PR and sign to that effect, so it’s not as simple as just “forgetting” to let the CRA know.

I just call ’em as I see ’em. You provide endless material.

That didn’t take long for the nuts to fall.

https://youtu.be/QW2HsdWwLCk

Gee, this morning it seemed like you were here to advertise:

Leif, you’ll have to call around the various appraisal companies. There are only a few so if you ask the right questions eventually they’ll send you to me. I’m not here to advertise and I don’t want a few people on this blog to know who I am as I think they’re ….

… nuts.

John Drake how do I get a hold of you? I’d like to put an offer in asap on a place (this evening or tomorrow at the latest)

Im not sure if you can post a number to call or email or email Leo to send to me or how it works.

Thank you

Right. I think LS’s tax comment meant to all, not just the few people who are using tax accountant.

It may take a few more years and more examples and even court cases to get PRE rule on suite more clear, even for accountants.

I don’t know the answer to that. totoro and I do, and her accountant and mine interpret the PRE the same way.

Also, since the beginning of time, we’ve only heard of one person who has ever been denied his/her PRE, and I believe that only occurred in the midst of a larger CRA inquiry into this person’s affairs.

What is the percentage of ordinary people using an accountant for their tax returns? I only used one for US tax returns (due to house selling there).

I disagree, Leo. Landlord homeowners haven’t been “getting away” with not paying CGs thus far; their accountants have verified that they indeed meet the requirements for PRE status.

I hope you’re not suggesting that accountants, en masse, have been committing fraud!

To prepare for the suite CG, it probably a good idea to have your house assessed (by a realtor with paper evaluation) before renting out the suite, as the gain should be part of value difference of selling and the renting out date, not the purchase price. And to keep records of the capital cost (e.g. adding a new bathroom, new appliances) done for the suite and not part of rental expenses, as CG deduction.

I think it’s definitely a combination of the CRA not having a dead simple way to find these homeowners, and a lack of priority. Heck they don’t even have the people to crack down on big real estate fraud in the lower mainland so they’re probably not putting a lot of time into finding individual landlords.

However I think it does change the equation for owning a suite somewhat. Yes you may be able to get away with not paying capital gains, but it’s more similar to how you might be able to get away with not paying income taxes. Not a good idea to try to pull one over the CRA.

Leif, this is what I do for my clients.

I go through the property noting recent improvements and deficiencies along with an estimate of the costs to cure those deficiencies to bring the home up to a condition of similar houses commonly trading in the market.

I do an analysis of similar homes within a half or sometimes a one-kilometer radius of the property that have sold over the last 6 months to determine the typical property and what it sells for. This also provides a high and low end range, the average days on market, and a Sales to Assessment ratio analysis again showing high, low and median ratios.

I then look at the sales history of the property and trend those past sales using a median analysis using 300 to 500 sales in four month periods. This gives me a calculated current value.

I also look for sales of similar properties along the same street or in the same building and determine a calculated current price along the same lines as above and compare that to the property being appraised.

Then I will review a small judgement sample of three recent comparable sales to ensure that the proceeding analysis was reliable and reasonable.

I’ll bring all of those different values together and reconcile them to give a value that would be considered fair to both a buyer and a seller. That would be the price if selling the property in an orderly manner in the open market.

To determine a foreclosure value requires an analysis of how strong or weak the market is for the property you are intending to buy. If the market is strong and heavily in favor of sellers they may not discount the property for their time in doing repairs. In a weak market a prospective purchasers wants to be compensated for the six months or more the home will be under renovations.

There is a lot of contemplation and analysis of how I and the marketplace judge that property. In the end I want to be as objective in my analysis as possible.

I provide you with a dozen page report showing my analysis and estimated fair market value under normal marketing conditions and an estimate of value under less than normal marketing conditions. The latter would be your initial bid that would be accepted by the lender. The Market Value bid is what you could raise your bid to in court if it went to a second bid. Then there is the high end bid which is the maximum that you should pay for the property before it becomes a money loser. This is the “I want this property really really bad” value. The latter helps you determine when to walk away.

All of the above cost $400. If you want me to attend the court proceeding with you and advise you on your bid that’s another $200 to $400 depending on if the sale goes to multiple bids or not.

You can also hire me just to do analysis on multiple properties where there is no need to inspect the property. This is a quick analysis that takes about 20 minutes. No physical inspection, no report just a verbal or email analysis on the most probable or likely value of the property. Depending on how often or how many you want me to do, that’s about $25 to $50 a property. These are not “appraisals” and therefore do not fall under mandatory rules and regulations. This is a consulting service and that’s why there is no inspection, no report and the fee is insanely low. If you’re thinking of buying a home and are unsure of what you should offer or if you just want to know if what you are offering is fair- this inexpensive consulting service is good value for the money before you ink the deal.

Note: there are some properties where the above can’t be done but they are properties that are not commonly offered for sale such as acreage and waterfront.

“Tax evasion of this sort is probably rampant in Victoria, and in Vancouver too.”

I imagine it’s off the charts in Golden Head. The new NDP rules in February should flush them out and could create an unexpected increase in sudden sales.

“I was just pointing out that these high interest alt loans aren’t all “shadow lending”. ”

Dasmo,

The jist of the recent revelations of shadow lending is it is almost as high as conventional bank mortgage lending and many ma and pa’s are getting roped in thinking it’s a slam dunk, when they have no idea who they are lending the money too, other than they are high risk to begin with. The big boys can take the hits, the little guy gets wiped out when markets finally turn south.

Now that one needs to report the sale, CRA could cross-reference the addresses of tenants and homeowners, which could alert CRA to landlords who haven’t been declaring rental income. Tax evasion of this sort is probably rampant in Victoria, and in Vancouver too.

On top of that, CRA could also find that the PRE doesn’t apply to the homeowner/landlord, thus kicking in a CG bill.

Up until now, as far as we can tell, the vast majority of homeowners who have rented out a basement suite haven’t had any issues maintaining PRE status, possibly because the PRE is vague or because CRA hasn’t made enforcement a priority or, most likely, a combination of both.

It will be interesting to see how this all unfolds.

Thanks. My thoughts as well. Pretty sure from all the reading and discussion here that the spirit of the PRE is certainly not to cover most suites that are common in Victoria. However whether there is the political will and resources within the CRA to actually pursue those cases is another matter. In any case I believe it is something all homeowners with a suite should be prepared for when selling.

@Leo- I’m guessing that we will start seeing CRA challenging principal residence sales more often now that taxpayers need to report every principal residence sale, whether or not, any portion of it is taxable.

I think this link is useful (although perhaps not new to anyone)

https://taxinterpretations.com/node/452886

@SS- Agreed, we”ll need to wait until the legislation is released to know for sure. I think the overall understanding now is that it is going to be a passive income threshold annually of $50,000 as opposed to R/E of $50,000. But until the legislation is released there is definetely a lot of uncertainty. The government pulled way back on the original proposed changes to a point where the rules on passive income, which would have affected nearly every small business in Canada, now should/would only affect a small percentage of companies (those who earn over 50k of passive income). For how rushed the government was to make sweeping tax changes, they have not been so quick to provide much clarity on this one. The US is also in the midst of tax reform. For those American’s living in Canada with Canadian corporations, these will be extremely important to monitor.

Hey John,

I’m wondering about an offer on a foreclosure. Do people usually try to go around assessed value or below or how should one strategize an offer. I understand it then goes to an open court where others can bid as well at the court date. I’m just wondering typically what the banks accept.

Thank you

Leif, you likely won’t have them. They are the member to member notes.

John Drake what are you searching for to see the court ordered sales? I am curious 😉

Thanks

okay, gotcha

@LF, there is no disputing the debt explosion and the inherent risks. I was just pointing out that these high interest alt loans aren’t all “shadow lending”. Fisgard is in that biz and has been around a while. To make big projects happen all sorts of alt lending has to occur. So for analysis purposes I was pointing that out.

Anyone know whats up with MLS 385936 – it says it was originally priced at 699K but then changed price to 978K and now is at 999K? Would that be a realtor error in the beginning that had to change the price?

I’m not sure a lack of evidence is demonstrative one way or another. If I pull out a HELOC @ X% and loan it to FOMO Joe @ XX%, how would anyone know? The only thing we could measure would be at the front end, where I’m drawing the equity loan – isn’t that right? We know HELOCs are exploding here in Canada, though it may not always be clear what that’s being spent on.

I recall one piece of data that could measure whether a HELOC was being used for…business or non-business purposes? I don’t recall exactly.

That is assuming these lending vehicles are being abused at a grand scale. There isn’t evidence of that. These high interest loans are used for legit purposes too, like construction. An 8% loan on what is actually drawn during construction is not 8% on the full amount. After construction is done the mortgage converts. I have a stupid mortgage right now. 5% interest only. But that’s construction loans and we are in a boom so of course these funny loans are on the rise….

LF,

Yes they are out to lunch. Look at the broad levels of lending to get that yield. It’s insane one would put their own families and business partners into a bubble top. It’s like the US subprime Canadian style in a $1.1 Trillion shadow lending market.

Lending money to people for downpayments on bloated house prices ? That’s insane and a recipe for total financial disaster.

Risky mortgages, shadow bankers threaten Vancouver housing market’s stability

“For example, the director of a Surrey lumber and real estate investment company explained to Postmedia that his group’s business model consists of pooling the real estate assets of an extended group of family and shareholders, and using these homes as collateral to borrow money from financial institutions. The borrowed capital is then issued in mortgages to home buyers that can’t obtain financing from chartered banks.

In another example researched by Postmedia, lending documents show that controversial “crowdfunding” developers are using single-family homes owned by investors in Vancouver to secure loans from subprime lenders that are active in B.C. in order to fund condo developments in Vancouver and Burnaby.”

“There are four areas across Metro Vancouver in which more than 50 per cent of new high-ratio loans are above 450 per cent loan to income. In an indication of rapid price rises or extreme speculation, South Vancouver, a neighbourhood bordering Granville Street and just north of Richmond, had an explosion in high-ratio loans in 2016, from very few in 2015. The other three areas at the top of Bank of Canada’s risk scale, at over 450 per cent loan-to-income, are Burnaby’s South Slope neighbourhood, a northern part of Richmond, and a northern part of Delta.”

Speaking of China money laundering into BC:

One U.S. hedge fund manager, who did not want to be identified, said: “We all know that the ghost collateral is a huge deal, and we all know that the shadow banking and other Chinese influence in Vancouver is profound. The issue is that the ghost collateral ends up re-hypothecated and laundered. So by the time it shows up in Vancouver, it will likely just look like a rich Chinese cash buyer with a suitcase of money.”

http://vancouversun.com/news/local-news/vancouver-real-estate-in-the-red

Tammi Dimock

Shayne Fedesoka

… not sure of the spelling on their names.

Why loan out your HELOC proceeds at a paltry 10% when you could be using it to buy bitcoin instead?

Irregular lending practices are a bonafide feature of any asset bubble, houses or otherwise. In this case, that would be about the most outrageous thing I’ve seen so far. I actually have a hard time believing this is true, let alone common. People just can’t be that out to lunch…

@TonyT

Welcome to the blog. I see you are a CA. Have you come across anyone selling a principal residence with a suite where the CRA determined they are not eligible for the full primary residence exemption and have to pay partial capital gains?

Do you know any agents in town that specialize and/or have significant experience with foreclosures?

If we’re lucky all the speculators will jump out of RE and into Bitcoin.

I’m not an accountant by any stretch, but what was conveyed to me is that (a) nobody knows exactly because the legislation isn’t out yet, (b) Corporate retained earnings over 50K (I was told they may allow 50K to be retained per year, but that it was for the corp, not p/p) will be extremely heavily taxed. So much so that it makes more sense to take that money as salary at the highest bracket and reduce the corporate net profit down to the minimum 50K level.

They’re also closing the dividend loophole for gifted shareholders (spouses and adult children). So if your spouse owns shares in the corp and they paid an insignificant sum for them ($1) then dividends flowing to them will be taxed at the maximum rate. They will either need to properly work for the corp and take a salary or possibly invest a much larger lump-sum into the company in order to justify the dividend payment. What is ‘reasonable’ nobody yet knows (10%?, 50%)?

Since current retained earnings are grandfathered and dividends are not under the new rules this year, the advice may be to take a big dividend this year, pay the personal tax on it, then re-invest it into the corp in order to show a significant payment for shares – thus justifying future dividend payments.

This is all second hand info as interpreted by me.

Me! I only have an academic understanding of it.

Great! How do I get into this scam??

This was going on back in 2013 when we bought as well but seems like it has ramped up a lot. Our mortgage broker at the time was asking if we were interested in getting involved in private lending and gave some examples of these supposedly super safe high income borrowers that needed bridge loans for short periods.

Seemed fishy at the time, and seems fishier now.

But passive income means the company is no longer active. So you created an investment portfolio within the Corp and income generated from that is what will be hit. Am I interpreting that wrong?

Dummies raiding their HELOC’s for this Ponzi scheme of massive proportions.

Via @steveSaretsky

https://twitter.com/SteveSaretsky/status/939007027925327874

:large

:large

Strange prediction. Anything could happen of course and I don’t personally expect a large price decrease, but I’m pretty confident our inventory will be increasing quite a bit.

Given we can feel how many buyers are being pulled forward by the stress test, it is unavoidable that we will feel the hangover after as those buyers are not buying in the spring (plus all the buyers that just can’t buy because of the stress test and could be delaying their purchase by a year or more).

Dasmo:

The easiest way for a corporation to burn up cash will be to declare dividends to the share holders. I am not sure that this has been really well thought out by the government.

Mortgage stress test: what you need to know if you’re in the market for a home

What will happen to Victoria’s real-estate market as a result of the stress test?

It is difficult to say how the stress test will impact Victoria’s real-estate market. Many purchasers will opt to pursue mortgages with a higher down payment, while others will shift their home purchasing plans in favour of less expensive properties or condominiums in lieu of traditional single-family dwellings.

Although real-estate prices could recede due to a reduction in overall purchasing activity, Victoria’s record-low re-sale housing inventory is expected to remain unchanged over the medium term and could, in fact, buoy prices to keep pace with inflation or maintain a similar price trajectory to that of 2017.

https://victoria.citified.ca/news/mortgage-stress-test-what-you-need-to-know-if-youre-in-the-market-for-a-home/

The airport is doing really well…

Air North to offer flights between Victoria, Whitehorse

Victoria International Airport will likely break all of its passenger-volume records next year, as the airport adds another airline.

Starting May 18, Air North, Yukon’s Airline will fly twice a week between Victoria and Whitehorse. The scheduled service will expand Air North’s route network, which includes Kelowna, Yellowknife, Calgary and Ottawa.

The announcement comes a week after Air Canada Rouge announced it would launch direct seasonal flights between Victoria and Montreal next year.

The Victoria-to-Montreal service will be available from June to October, three times per week.

Geoff Dickson, chief executive of Victoria International, said growth in passenger volume at the airport is about three years ahead of schedule. The airport has recorded 47 consecutive months of record passenger volumes.

http://www.timescolonist.com/business/air-north-to-offer-flights-between-victoria-whitehorse-1.23116675

@SS

My understanding is that you will be able to earn up to 50k of passive income in the corp before you have to worry about this. So yes, people may be inclined to invest in other ‘active’ investments/joint ventures, or perhaps invest in growth investments that wouldn’t immediately produce income to impact this threshold.

But it’s not clear/hasn’t been announced exactly how this 50k exemption will work. Will each individual get the 50k passive income exemption, will each corp get this 50k exemption, if there are spouses do they each get the 50k passive income exemption. So at this point there is still a lot of uncertainty.

Don Beach: The leverage that housing gives is only comparable to currency trading. I never understand anyone that doesn’t believe in leveraging. All the rich people in Wall Street got there by leveraging. In the stock market it works both ways.

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Don, I fully agree with you regarding the use of leverage to purchase a home. That is why it is called a mortgage. You are analogizing a mortgage to an investment in your commentary, subtly suggesting that there are riches to be made by purchasing a home.

Your commentary could easily be construed as an effort to persuade naive buyers that a “home” is the ticket to riches; it is disingenuous.

There are far too many greedy speculators in these markets and they have pushed the prices of homes out of reach of the regular John Doe that would like to mortgage a home.

You are right in your commentary that leverage works both ways. I hope that leverage is going to be your friend because it can be a real bitch otherwise. I believe that the first three months of the New Year will flush a lot of leveraged speculators out. Good luck.

I got a note from my accountant to say move as much as I can through my trust before Dec 31. My corp was a downpayment and retirement savings vehicle and now I think I’m hooped unless the govt will honour my corporate articles.

I guess the only way to make money now is to buy up condo boxes that I can’t live in. gotta go get in line.

@SS you gotta post some info on that! I thought the target was passive corps….

It sounds like corporate retained earnings are going to be a thing of the past starting next year (with the new tax changes coming down the pipe). Net profit over ?50K? will apparently be taxed at roughly 73% and so companies will need to burn their earnings down to near zero each year. I’m not sure how they’ll do this – hire more, increase salaries, purchase active investments (own your building vs rent?).

So it is entirely possible we’ll see salaries tick up.

@JD, thanks for the information as usual. A little cumbersome, but elbow grease always pays off!

There’s a 60 year-old bottle diver comes to my place early mornings who is well dressed, quiet and been doing it for years. More out there than you think. Just like craigslist flippers looking for free stuff to flog for $10.

You’ll need to get an agent as most of the listings don’t say that the property is in foreclosure unless the lender has conduct of sale.

An agent will be able to do some sleuthing through the listings for key words that are associated with properties in foreclosure. For example a signed property disclosure statement. The seller isn’t going to provide one.

Also, the agents are hired by the law firms and most real estate agents will know which agents have a contract with the law firms. So you will have to do some sleuthing yourself. It’s a good idea to use an agent because they will make sure you are registered to bid. It isn’t as easy as showing up in the court room. Although you could but you need to bring a certified cheque with you. Most of the time the lawyer will ask the spectators if they are going to want to bid but not always.

Definitely a good idea to have an agent with you.

When did I say everyone who bottle-picks is dumb? Just the ones who live in million-dollar homes but have to scavenge bottles in order to buy the basics.

JD, we must have been neighbours!!! My neighbour went out for a ‘walk’ everyday…also to collect bottles; everyday, all weather!!

And ‘No’ Introvert, she’s not dumb, they also owned two houses in Vancouver, put their kids through university, and travel… but they were too frugal to hire a gardener and their yard needed a bit of tlc. Quite a contrast to the folks who remortgage each year to a higher amount then blow the equity on shiny new deprecating toys.

JD, for people who would like to research to buy properties out of foreclosure/bankruptcies, what are the steps:

1/ see the lender?

2/ how would initiate the process of finding who to contact

TIA, this might assist people to go this unconventional route to ascertain bargains, if any.

Aside, anyone watching Bitcoin today? Scary. I’d say that’s a case of a pure speculative bubble, with participation on a global scale.

You’re not even investing in anything except a concept, but that concept has been turned on its head in this case (made to be used as money, instead being used to make money).

Does anyone here have any, and disagree?

ICYMI Mike we already are at full employment. The rate is lowest ever if not close to it.

You’re working on the old text book theory when we are in a government intervention market that’s never happened before restricting the buyers pool.

When Trump’s market bubble pops down goes the whole works again. No government based town is getting 10% increases in our lifetime.

This is something that happened in Seattle for example. One issue is that with a large public sector employment base, wages cannot increase that quickly. Tech can only carry so much.

Here’s a heads up on one big factor most will miss in the coming years – affordability will improve as prices continue rising. Sounds crazy, but it’s the same concept everyone’s missing with the stock market the past year. We’re transitioning from a rate-driven bull to an earnings-driven bull. As earnings start to accelerate, expensive stocks get cheaper. My bet is Victoria is about to post a couple years of wage (earnings) growth in the 10% neighbourhood. Wage pressures here are becoming uber intense.

Every expansion follows this same path, only the timing varies. Eventually you reach full employment (record empl. for Vic), then wage inflation takes off. Next up, prices and interest rates launch. With interest rates, CBs are always purposely behind the curve, as to inflate away some of the public debt burden accumulated in the rate-driven phase.

Ya I agree. Leverage is a great way to build wealth. Often the only way. The earlier statement was just spouting off what what I perceived as out-and-out stupidity – borrowing 400k and in 5 years it’s 600k. Who knows, there could be good reasons. It’s not the debt per se I guess, it’s the way it’s being used lately and the belief that underpins a lot of it.

That’s all. We’d have no issues taking the plunge if we felt it was right for us. Kind of depends on your rental situation too. We’ve been really fortunate, so biding time or not making a move works (in most ways) for us but others are facing dynamics that make them feel forced into buying. For the people who really have no options, I wouldn’t know what they’d do. Job and family are sometimes hard things to leave, and yet the same time they may feel they can’t stay. There’s a lot of anger out there, I think.

@ Local Fool

“God forbid home prices stop rising. I cannot imagine ever doing my finances like that. As far as I’m concerned, a mortgage is a liability to be expunged as soon as possible.”

If you want to explunge ASAP, Sell your home then you are not in Debt. Rent wherever you want and be happy. The leverage that housing gives is only comparable to currency trading. I never understand anyone that doesn’t believe in leveraging. All the rich people in Wall Street got there by leveraging. In the stock market it works both ways. I guarantee everyone that shorts uses leveraging. There is no reason not to as long as you are liquid and prudent. Sure , housing is not liquid but if you want to live in a house worth $500K and you only have $100K , your choice is to leverage or keep renting.

If you want to blame something for this go back in time where the goldsmiths that were holding all the gold decided , why have all this gold in here???, I can lend it out for a fee so people can use this to make more gold or whatever they want. It all fell apart at that exact moment. Then The Fractional Reserve Banking System was Born, And that is where we have lived ever since. Give me a lever long enough an I can change the world.

I meant to type tweets not posts.

I follow Scott Terrio and Steve Saretsky on Twitter and their posts about home equity lines of credit in Canada are very interesting.

You don’t have to be smart to own a house. But then there are also those that fall on hard times too.

Car accidents are a good example. The loss of income can quickly eliminate most of that home equity while they’re trying to recover. I wouldn’t call these people dumb for trying to keep their home.

Im scared for that block of Douglas St.

Wasnt there talk of Shoppers moving in to that space?

She’s really dumb.

For one, they could sell and buy in a less expensive neighbourhood or municipality.

These people are also dumb.

Yes Caveat, they are likely to have a lot of equity. But how is that going to help them? That’s a $1000 a month coming out or their pension checks that could be used for better things.

Another example is my neighbor owns a million dollar home and yet she collects bottles to pay for her daily needs.

God forbid home prices stop rising. I cannot imagine ever doing my finances like that. As far as I’m concerned, a mortgage is a liability to be expunged as soon as possible.

I know there’s counterarguments to that (some of them good), but I don’t really care. Just debt, no. What you’ve described sounds completely irresponsible and if that’s systemic, that’s a situation that will amplify and prolong any downturn.

Hawk, it’s not uncommon. Half the re-finances that I do are for debt consolidation. Victorian’s on average don’t make that good of an income and end up living pay check to pay check. They pay for their cars, vacations and toys with credit.

The people that seem to have all the money today are involved with real estate. Most of the buyers at the court house today were house flippers and their real estate agents that were looking for a place to buy, update and re-sell.

For many, real estate seems to be the only way to get ahead in life.

Perhaps not the best financial management. Still if the facts are as you describe this fellow and his wife likely have 500K to 1 M of equity. Hardly teetering on the brink.

JD,

I know a guy who bought a place in late 80’s for $85K. Makes good bucks whole career along with wife, retired last year with a $250K mortgage. It happens all the time but the ignorant don’t want to see it. Plus this guy’s place in a top hood still looks like a 50’s dump inside. Doesn’t even have nice toys either.

New builds in the so called “affordable” range taking some slashes along with many others past few days.

851 Coles St on slash #3 for a $150K loss to $849K.

Royal Bay new build at 368 Osprey Street slashed $25K to $699K.

Custom built at 1487 Mt. Douglas Cross Road slashed $100K to $1.49 million.

2109 Sayward St slashed $25K to $799K.

353 Linden Ave , B condo conversion slashed $40K to $375K.

They’re using their homes as ATM machines. Lots of mortgage re-financing for debt consolidation as people use their credit cards to supplement their life style and then transfer that credit card debt onto their mortgage.

They buy a home for $400,000 and five years later have a mortgage of $600,000.

10% wage hikes Mike ? LOL Lets not bullshit too bad shall we.

Meanwhile on Bear Mountain the rich must be backing off bigtime as 2209 Navigators Rise with as good a view as my place just got whacked $560K. Major ouch for the builder who owns another lot beside it. Big Short at Bear Mountain Part 2 ? 😉

Sorry, I’m not sure I understand what you mean. Could you explain the extra 200k? Are you meaning they are mortgaging second homes?

A quick look on the VREB showed 8 properties advertised as court ordered sales with asking prices ranging from $223,500 to $2,200,000. And listing periods ranging from 31 to 230 days.

Go back a year ago and there were few.

That we are seeing more of them fall into a Conduct of Sale may be indicating a market in transition. What has been happening is that Victorians have been buying homes for $400,000 and then five years later they end up with mortgages of $600,000.

https://youtu.be/O6FaRo4ZwUI

http://www.timescolonist.com/news/local/victoria-has-lowest-unemployment-rate-in-canada-1.23110243

Anyone have stats on how quickly wages are rising in Vic? I saw our province is now jumping 6% yoy, so I’m guessing with the lowest unemployment in country we’d be somewhere around 10% per year.

I don’t find anything wrong with discussing foreclosures. Some people on this blog might want to take advantage of the situation and buy them.

Others on this blog, might be facing foreclosure themselves and want to know more about the procedure and their rights.

How many on this blog would like to know more about the foreclosure process?

Since we’re back to slinging mud and general hatred, thought I’d join in.

It’s just for fun, but have a look at google trends for searches originating in British Columbia.

I put in the word “debt” just to see what its popularity looked like over the last 5 years. I figured that’s better than “bankruptcy” since most people in trouble will (presumably) try lesser ways out before going that far. For instance, debt management, consolidation, counseling etc. Anyways, slow rising trend:

https://trends.google.com/trends/explore?date=today%205-y&geo=CA-BC&q=debt

Probably not surprising, as levels of debt have been rising. The term “foreclosure” however, is the opposite:

https://trends.google.com/trends/explore?date=today%205-y&geo=CA-BC&q=foreclosure

I don’t think that’s a surprise though, in a rapidly rising market. It would have to stop for a period of time, where the highly leveraged speccers would start feeling the pain.

JD,

Intorovert AKA Bubble Defender can’t let anything go that dares threatens his house value while trying to say markets will correct. They’re AKA hypocrites. Sad existence.

http://rebatereps.ca/wp-content/uploads/2012/10/2002-10-08-Housing-bubble-markets-flatten-a-bit-5301.jpg

That was a wonderful little essay, Jerry.

Ha ha.

Let me guess—helping Hawk check for price slashes?

Don’t take it so personal, Introvert they’re just foreclosure applications.

One owner was able to get financing and paid out the mortgage

Two were given the standard 6 month redemption period.

One property sold for 35% under assessed value.

And the rest I didn’t stay for as I had other things to do that morning.

No sense it throwing out personal attacks on the other bloggers unless you want to be treated in kind.

https://youtu.be/W8vXkR7WDEc

This could be true and if so is where I differ from the majority. If people are content to live in Prince Georges, Port Alberni’s or Sarnia’s of the world then that’s odd to me. Location does matter a whole lot to me, which is why I kept moving until I finally found it. I couldn’t imagine wasting my life away in a place like Prince George. Life is short, why not aim for the best place you can? There’s a reason Victoria is expensive and likely will continue to be, but w/ a bit of tenacity, I think anyone can make it work here if they try. Good things in life don’t come easy, if they did then hard work wouldn’t matter.

Focusing on positives wherever you are is good advice – but I’m betting that’s harder to do in most places compared to Victoria, esp. when inundated w/ pollution every day in the Prince George ex. It’s pretty hard to be negative when you live in what I think is the best place in Canada. However, as we see almost every day on here – a certain minority of people (constantly looking for single digit bankruptcy stat’s for ex.)- are just wired that way, and they’d be like that wherever they were.

Haha. Well written. I was listening to the melodious sound of rumblers in the distance this morning as well. Having lived in the interior (-50C as a kid is fun, but only once), I will take rumblers and liquid sun any day of the week…

New evidence this morning that we can all easily ignore the imperfections in our own terroir.

Thirty or so years ago I used to visit Prince George regularly. That first yellow inhalation as you left the airplane for the terminal was like a red hot poker sliding down the trachea. Blinded, staggering into the building seeing visions from Wilfred Owen (gas boys! gas! an ecstasy of fumbling….) the first question one would ask the residents was “how can you bear it?” To which the reply was always “bear what?”

Sitting in the sun in Oak Bay this morning at Ottavio and every five (five!) minutes the window panes would rattle, the coffee cups would dance across the galvanised table, and small dogs would cower between their owner’s legs. Three hundred thousand of us bearing the brunt because some Tom Cruise wannabe feels the need for speed. We asked the server “how can you bear it?” To which the reply was “bear what?”

Anyone actually smoke crack these days.

I saw it on Colwood councillor Gordie Logan’s Twitter feed: https://twitter.com/GordieLogan

Not sure where he got it from.

Looks like John Dollar/Just Jack and Hawk both set up Google Calendar reminders to check public foreclosure and bankruptcy filings. These are a coupla guys who are really going places!

It needn’t, but I suspect it tends to have that effect.

Sure. I wasn’t arguing that everyone who moves from the prairies to Victoria would be happier.

You could be one of those people (the majority, perhaps) for whom location doesn’t really matter a whole heck of a lot.

Faced with either changing myself or changing my city, I figured changing cities was easier 🙂

Or not even then as that’s widely available in Langford.

That Simpsons picture made my day.

Found an interesting blog if anyone is interested in real estate law https://bcrealestatelaw.com/

Nice find, some good topics covered there.

Found an interesting blog if anyone is interested in real estate law https://bcrealestatelaw.com/

As for the weather, I don’t think it makes a huge difference to me. Can’t say I was ever miserable in the interior in the snow. It just… is. Certainly below about -25 it gets a little grim.

If your mood is overly determined by the weather I doubt that is the root cause.

In the last 10 days or so:

14% of SFH sold over ask vs 29% of condos.

And places are selling at the same rate that they are being listed as. So 100% sales/list which isn’t overly unusual in December given the low rate of new listings. However combined with the higher rates of expiring places inventory is definitely dropping fairly quickly.

I haven’t been downtown since August. Zero reason to be down there unless you smoke crack.

Disagree. It is sound advice. If you live, you are going to live somewhere. That somewhere is ALWAYS going to have some negatives. You can choose to focus on those or you can choose to focus on the positives. Focusing on the positives of where you live needn’t blind you to the possibility of moving somewhere better.

Lots of happiness research out there. Moving generally doesn’t make people happier. Living in a better climate doesn’t make people happier (on average). Key determinants of happiness are basic things like relationships and social networks, health, wealth (to a point), your temperament, success, achievement and recognition, not living in a conflict zone or oppressive regime.

Introvert that’s awesome… where’d it come from? Has anyone been able to find the judgemental map of Victoria? This reminds me of that but I can’t find it…

Oh my JD. I count 7 foreclosures hearings plus 2 new ones today as well as 5 new bankruptcies. Thanks for the heads up. Looks like the bubble is leaking.

Haha

Hawk, did you see the number of foreclosure applications for tomorrow!

Local fool your tree post made me laugh!

This house is so great … that we can’t show you any interior photos:

https://www.rew.ca/properties/379104/1660-san-juan-avenue-saanich-bc?search_type=property_browse&search_id=gordon-head-saanich-bc

It gets so cold in Ottawa, that some days the Liberals stand around with their hands in their own pockets 🙂

Frozen tundra are great to visit and play in…. We have one three hours away if you like.

Bingo,

Actually 1 Bate Rd was part of 95 acres of 1 Westoby Rd before it was sub-divided (to 45 acres and 50 acres), may be in the late 70s. At the time, there were no Bate Rd, access to this (45 acres) property was an easement through 1 Westoby (50 acres). Likely the same owner owned both properties for a while after the division (note the road to 1 Westoby also has easement from CRD).

This property (1 Bate Rd) was sold to current owner in 2008. Then 1 Westoby was sold in 2016 for $705K, 50 acres beautiful land with lake access, but no house. The easement on 1 Westoby for its neighbour may not be part of the deal. https://www.luxurybchomes.com/properties/lot-1-westoby-rd-365039#

ha. Most places in this country have buses to get children to school. Victoria is ridiculous in this respect. They also use their garage as a garage, so no scraping windshields. Frozen pipes is what exactly? I don’t know anyone that might have had to deal with this mythical problem?

Normally, a landlord should be informed of these additional roommates and add them into the lease, so they have the same right and responsibilities. It is a bad idea that they are not on your paper, as you may not be able to deal directly with them legally.

This happened to us when we were helping friends with their house (they moved outside BC). One person signed the lease first and said she would get roommates after moving in. We asked her to inform us the roommates names and contact info before taking them, and to add them into the lease paper, as advised by LandlordBC. She did for the first two. But half year later she signed a sublet with a new person to lease out the master bedroom (her own room) without telling us, when she was away.

One evening we decided to have a walk in that neighbourhood, and saw a truck in front of the rental house and people were moving out. It turned out that new sublet girl had a violent boyfriend who had been in and out jail. He was not part of the sublet, but stayed in with the girl full time. Other tenants were so scared of him that they decided to move out one month before the lease end, without telling us the issue.

We went to LandlordBC for advice again, they said since we were not involved with the sublet, we can’t contact the sublet person directly at all, and since we don’t live there, we can’t call police either, even as landlords. Only thing we can do is to go after the person who signed the lease, as she had to pay the rent, she had to make sure the sublet moved out by end of the lease, and she had to call police if there was an issue, and she had to pay for damage if there was any.

So we did inform the lease holder about the rules and told her that she should have informed us about the sublet before hand. So she was the one responsible and to avoid the duty wouldn’t do any good for her future.

Luckily for us, she did contact the sublet. The bad boyfriend was out of town on lease end day, the sublet moved out by 9pm (not 1pm as on the lease). There were no damage other than some broken (tenants’) furniture.

Again, join LandlordBC is a very good idea.

Yes, these ‘glass half full’ discussions of Canadian weather are fun, but the sober realities of life (dealing with getting kids to school, infirm parents to the hospital) – together with scraping windshields and frozen pipes do bring us back to reality.

There’s nothing like a snowy landscape in the sun for playing with your family!

But both Ottawa and Calgary (two cities where I spent several years each) also have at least as many bad winter days. Calgary and its bitter wind-blasted days (in the fall, winter, or spring – often just frozen dirt visible, with no friendly, fluffy snow to go with it) when no one was outside by choice. Ottawa and its rain-turned-to-slush-turned-to-frozen-chunky-hardpan days as its temperatures vaccilate from +7 and raining to -18 and no longer precipitating. More of each of those than the fun in the snow days, unfortunately.

In Victoria, November rain is the worst of it (phew – glad it’s December), and then it usually sucks a bit in January again, and then suddenly it’s spring!

Question: does anyone know the rights of roommates under the current Landlord Tenant legislation?

For example; if I sign a rental agreement with one person to rent my house, then after he moves in he takes in two room mates. What rights do the roommates have? What if my tenant moves out, do the roommates have any right to stay in my house?

Assume I, as landlord, have no written agreement with the roommates

Any other comments about roommates are appreciated.

Sort of.

For some people, geography matters a great deal in terms of one’s happiness. I am an example of this. I hated Calgary (spent my first 24 years there) and was determined to move to Victoria, a place I had visited often. If I were still in Calgary, it’s safe to say I’d be fairly miserable.

There are many people (perhaps even most) who are the opposite; these are people for whom place matters very little, seemingly as long as they’re near friends and family, and have a good job.

I will never understand these people.

Also, the suggestion to “make the best of wherever you live” subtly reinforces the idea that changing where you live is exceedingly difficult, if not impossible.

I’m here to tell you that in many cases it is doable. My partner and I moved to Victoria with no jobs lined up and no job prospects, after both turning down full-time job offers in Calgary.

@Hawk

” When the next market tank/recession hits the population will decrease as it always does as they flood outward for cheaper locales and the landlords suddenly start begging for tenants.”

I like your optimism Hawk.

Sometimes though, I think the chances of my children ever being able to afford a house here has slipped out of sight. I now hear them saying they are going to bring their family up in a less expensive city. I hope they stay but I will not be surprised the day they pull the plug. It’s too bad that a professional couple (lawyer and computer engineer) still don’t feel like they can afford to stay. Victoria will be a city of absent wealthy owners and the retired. What a sad thought.

I am sure some will say the profits will be fantastic and real estate will go up, up, up but that only benefits the investors and the greedy.

” Yesterday I had the misfortune of coming back into the city at rush hour with the car. Is it getting worse the traffic? I do not remember it being this bad.”

I’ve been saying for the last year but got slagged with multiples of: “you don’t know traffic like Vancouver, Toronto, blah blah etc… it’s a very congested city with few options to increase flow.

Deb,

I use that same route behind Hillside Mall most of the time but forget it after 3 as it backs up all the way from Cook to Shelbourne heading out of town and can take longer than ever.

Some people love Victoria like a guy I was just talking to but he only comes to visit once a year. Then I have relatives who were here month or so back were disgusted with downtown druggies and homeless that weren’t there last visit 10 years ago. Nanaimo was even more disgusting they said and very unsafe feeling.

Paradise always comes with a dark side but there’s a tilting point where it scares people off, especially retirees. When the next market tank/recession hits the population will decrease as it always does as they flood outward for cheaper locales and the landlords suddenly start begging for tenants.

@bitterbeer, try these (http://www.victoria.ca/EN/main/residents/garbage-recycling/hypodermicneedle.html):

AVI Mobile Harm Reduction Unit

Wednesday – Friday 12-4pm

250.896.2849

SOLID

7 days a week (small fee charged for pickup)

857 Caledonia Street

250-298-9497

BC HAZMAT

Serving the Greater Victoria area (fee based)

250-656-3382 or click here for more info.

freedom_2008

Interesting. Thanks for the info.

I wonder if it never had a proper easement. I’ve heard of landlocked lots before. One I know of you’d have to trespass to get to. The jurisdiction it’s in has rights to build an access road, but they said they never would since there is 0 reason to take on that cost for a single lot (cost of building then maintaining said road). It makes the lot nearly worthless (other than neighbours that may want a larger lot).

How did they even get a building permit if access wasn’t certain?

Bate rd would probably would make a good office for park management/maintenance (plenty of garage space).

thank swch25. Unfortunately, they only go as far as Blanshard. They told me to pick them up myself and put them in a plastic box until I could dispose of them in a needle box in a public bathroom.

Metro Montreal is over 4 million(bigger than Seattle, so would be the 15th largest Metro in the US). Metro Toronto is only 5.5, which would place it 10th in Metro’s in the States.

@ Bitterbear: these guys clean up the stairs in front of my office before we get in (usually).

Downtown Victoria Business Association Clean Team

Needle pickup for areas within the DVBA boundaries

Monday – Friday 8:30 – 5pm

250-386-2238

Also, we installed black lights in the back parking lot for at night. They cant see their veins to shoot up under certain lights so they dont congregate anymore.

Barrister

You may be joking, but I’ve definitely been on the receiving end of people thinking we are just a short drive from Vancouver. Wouldn’t surprise me if at least one employee there isn’t familiar with the fact Victoria is on an island with no bridge/road to the mainland.

Had a tourist get angry when I said, “There isn’t a bridge back to the mainland and if you think you didn’t come on a plane or ferry you are mistaken.” I was working in retail downtown at the time. I had heard similar stories before and didn’t believe it (or thought the person must be joking). Judging by how angry this guy was I can tell he wasn’t playing with me (red faced, spittle etc). Similar to the response when you tell them, “No, you don’t get US money as change.” People would get livid.

Had a call centre person from Ikea insist I should just drive to Ikea to pick up missing parts. IIRC they even quoted how close it was in km (or they knew it was really close). I don’t think I was very polite explaining how that was an absurd suggestion. They ended up sending the parts, but the slowest possible method. Original order took a week, missing parts took an extra month.

Just checked with the listing agent, it seems to be a very special case that the access road (Bate Rd) has been removed (by CRD?), and the new owner has to negotiate a easement with city/CRD/neighbour to access the property. There are other rules as well. The best would be CRD buys it.

You haven’t lived till you have experienced spring on the Prairies. I still get wistful thinking of the dog turds melting out of the snow drifts in March or April 🙂

Seriously though – I LOVED the winter activities when I lived in Alberta. Skating outdoors, tobogganing, and XC skiing 5 minutes from my home rather than 3 hours drive. But I also remember the bitterly cold times, the brown dreary fall, and the spring that sometimes waited till May to arrive.

Make the best of wherever you live and don’t count on a change in geography to improve your life. If you are a miserable grump in Tofield, chances are you will be a miserable grump in Victoria, or any other location where you haul your sorry ass.

Leo S

I suspect there’s a reason no one has done that yet. I’d hazard most people don’t want to take on an immediate reno (or it doesn’t show up on their mls due to 1 bed), but with how much market exposure that place has had (during a super hot market) I suspect a few intrepid renovators have taken a gander and said, “Nope.”

Does anyone know who you call for used needle pick up in Victoria? My parking lot is a mess.

For people who love winter outdoor activities, it is very true that we don’t have enough snow and ice in Victoria. But I do notice lots cars with Alberta plate here in winter, probably much more (in %) than cars with BC plate in Calgary and other Alberta cities. 🙂

We also can do biking, hiking, running, canoeing and kayaking year around here. For me, it is easier to do them in rain than in snow and on ice. So get out and enjoy what we have, and you can always take trips to up island to get snow and ice if you like.

Luke:

You are right where there is a will there is a way. I am assuming that you are referring to being able to afford Victoria after you inherit. Make sure you dont get written out of the will in the meantime.

I have to agree with you Anna. I lived in Calgary for 13 years and summer and winter there is lots to do as long as you get out there and dress for it. The mountains are so close for year long fun. The only time it gets miserable is the period of change between equipment needed. Ski’s, snow shoes, ice axe or hiking boots, kayak, trail runners.

I have lots of friends who live there and visit us here. They often say they love the early spring but they also look over to the Olympic mountains and say it’s too bad they are so far away.

I also biked to work every month of the year while we lived there, the bike paths are fantastic.

I guess this is true if you want to go to Esquimalt from OB (but who would? Ha ha just kidding). Watch out for the bridge delays upcoming on JSB as well – we are finally getting our Chinese steel installed! Question is… will the new bridge work? I’ve been thinking they should wait to tear down the old one until they’re sure it’s working ok.

As an OB resident, I’ve figured out many ways to avoid going through downtown… One of my Fav’s is using North Dairy Rd from Shelbourne which for no apparent reason turns into Finlayson – the biggest problem w/ this route though is getting stuck on Landsdowne coming from OB (which changes into Hillside) before getting to Shelbourne (if travelling in afternoon). Once on North Dairy/Finlayson… If going north then right on Cook which might turn into Cloverdale, Quadra, or Maplewood (depending on where you’re going). An alternate route could be Cedar Hill X Rd, this is often free flowing but only works if travelling well north of downtown.

Want to go to James Bay from OB? Just take the scenic route along the water… You’ll start on Beach Dr – then turn onto King George Terrace which mysteriously becomes Crescent Rd… then suddenly it morphs into Hollywood Cres. before finally changing into Dallas Rd! Gotta love the chameleon roads in this town! I think we can blame the British for that one?

True Anna there are plus sides to getting ultra cold in the winter… I noted the happy skaters on the Panama flats when it froze over here last winter. However, there are also downsides, it depends on your preference I guess but winters can get awfully long in other parts of Canada. Now… out to enjoy the sunshine – I’m so glad the wettest Nov. ever is over!

I wonder how many people on here who talk about how horrible the weather is elsewhere are from Victoria originally?

I go to visit family in one of the frozen landscape places in Canada and the ski hill is bustling, the toboggan runs are filled with laughing families, the frozen lakes and ponds are filled with skaters with a nice bonfire off to the side, the snowshoeing through the woods is beautiful and the snowmobiling is fun. You haven’t lived until you’ve heli-skied.

Most people who here where I live express that they wish they lived here. Not once has anyone expressed sympathy….

That’s an odd anecdote LF, all I hear constantly is the exact opposite – Most everyone in this cold inhospitable country would love to live here if only they could, and also those I know internationally. However, many either can’t find a way how, or don’t have the gumption to pack up and come here, or their ties keep them where they are. We are, after all, the California of Canada. Our biggest problems are… lack of housing and cost of housing. But I say to doubters, where there’s a will there’s a way…

But don’t just listen to me, the Population growth Stat’s prove it: We’ve outpaced National growth rates over the last five ‘between census’ years (2011-2016)… Our regional growth rate was 6.7%, while the National rate was 5%. My bet is that since 2016 it’s likely accelerating even more so far. My prediction: They will keep coming… and you can see by looking at this link, they will definitely keep coming to the cheaper area’s of the CRD (Langford had the highest growth rate of 20.9%)

http://vancouverisland.ctvnews.ca/census-population-of-metropolitan-area-of-victoria-outpaced-national-growth-rate-1.3278184

Also, had to laugh yesterday when Hawk’s attempt at downplaying condo sales was proven wrong – even during this slower than normal time of year for RE sales! Good one Leo. When I look at what’s avail. out there it’s so apparent there’s nothing much to buy – condo’s or SFH – but that’s also partly a symptom that’s normal for this time of year. Spring will be more telling as to what direction things head inventory and price wise. We will just have to wait until then.

During the winter, that’d probably be more than “a fair number”. Last person from Calgary I talked to about the weather, I realized that quite literally, it’s often colder there during the winter than the north pole.

I’d like to experience it for the novelty. Not for months on end.

It worked!

That’s a good one.

All I know is a fair number of Calgarians I talk to wistfully sigh when they hear where I live.

I bike back and forth into the city. Yesterday I had the misfortune of coming back into the city at rush hour with the car. Is it getting worse the traffic? I do not remember it being this bad.

Barrister on your point. DT is the issue. The rest of the so called core still has the same feel. Really no reason to come DT except for work. UpTown/ Langford and Hillside have everything you could need to buy.

Problem with Oakbay is going through DT to get to things.

According to my neighbour who owns a bed and breakfast, a lot of their guests are saying that it is not as nice to visit anymore. The most common complaints focus on the downtown being dirty, with aggressive homeless everywhere and the number of high rises are quickly changing the feel of the city.

She has taken to suggesting that people shop and eat in Oak Bay. The owner of a second bed and breakfast totally agrees with her. It does seem to be a bit concerning.

I read Lisa Helps campaign to get people to bicycle or take public transit downtown because of the shortage of parking and I have taken it to heart. In my case I have decided not to go downtown and shop at all this year. I am not sure that was really her intent but I feel that I am being part of the solution.

lol well ok then. Come on, we’re at least a little bit cool…

In a global sense everything in Canada other than Toronto is a backwater.

Relatives paid $145/square foot for a resale condo up island last year. Nice building in good condition, definitely at least on the better side of “basic”. Prices have gone up since then but units are still selling well below replacement value.

“Backwater”

I do wonder where that term originated in the context of this region. A quick perusal online will show you’re far from the first person to use it. It seems to be employed where Vancouver is compared against a back drop of “global” cities – significant hubs of trade, finance, or culture, to which Vancouver is generally none. Vancouver is a relatively small city with a small economy and population. Don’t see other cities of similar size getting that term, though.

For Victoria specifically, most times I’ve heard actual people talk about it is, “a nice place to visit but wouldn’t want to live here”. Kind of standard sentiment for a geographically isolated, largely tourist town, I’d think.

CHMC just thinks we are a suburb of Vancouver and maybe we are. Someone at CHMC read about the cost of the blue bridge and they are assuming that it will link us to the mainland.

Could be. I requested access to the full report. Link in the summary report is not functional

I knew I could get a rise out of someone with that comment 🙂

So if we shaved off 30,000 people from Halifax (population 403,390), would it then be a “vacation backwater” like Victoria (367,770)?

That Victoria isn’t included in many studies like this one isn’t because we’re not a major centre; it’s because we’re physically too close to Vancouver and CMHC wanted a nice, even geographic spread among examined cities.

“Development cost” might include marketing and management fees etc.