November Numbers Wrap Up

Let’s complete the look into the monthly numbers for November.

Sales

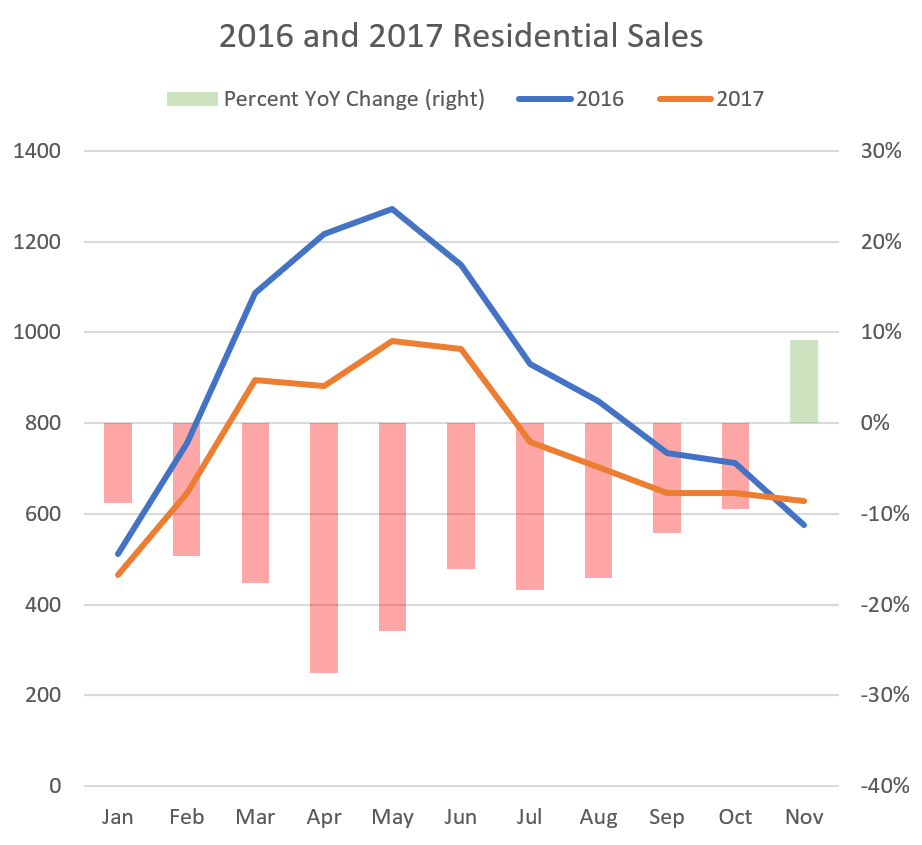

On the sales front, as already discussed, November broke the long standing trend of lower year over year sales that we’ve seen in 2017.

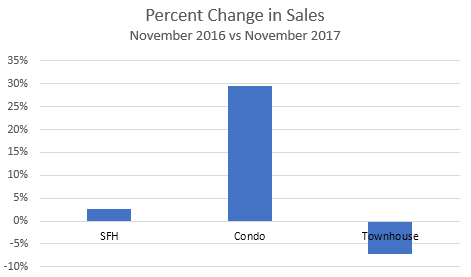

In October we only saw SFH sales decline while condos held the line, but this month it’s quite a big change, with single family flat year over year and condos up 30%.

Sales didn’t actually increase from October, they just didn’t decrease, which is very unusual for this time of year. Usually October to November is one of the biggest sales drops of the year, so you know when that pattern is defied that something is up.

The decline last year was a bit larger than normal, but the majority of the discrepancy definitely comes from the lack of decline this year. It’s another clue that the stress test will be a doozy when it arrives in January. If this many people are scared enough of it to move their home buying plans up, we’re going to see the hangover in a couple months.

Prices

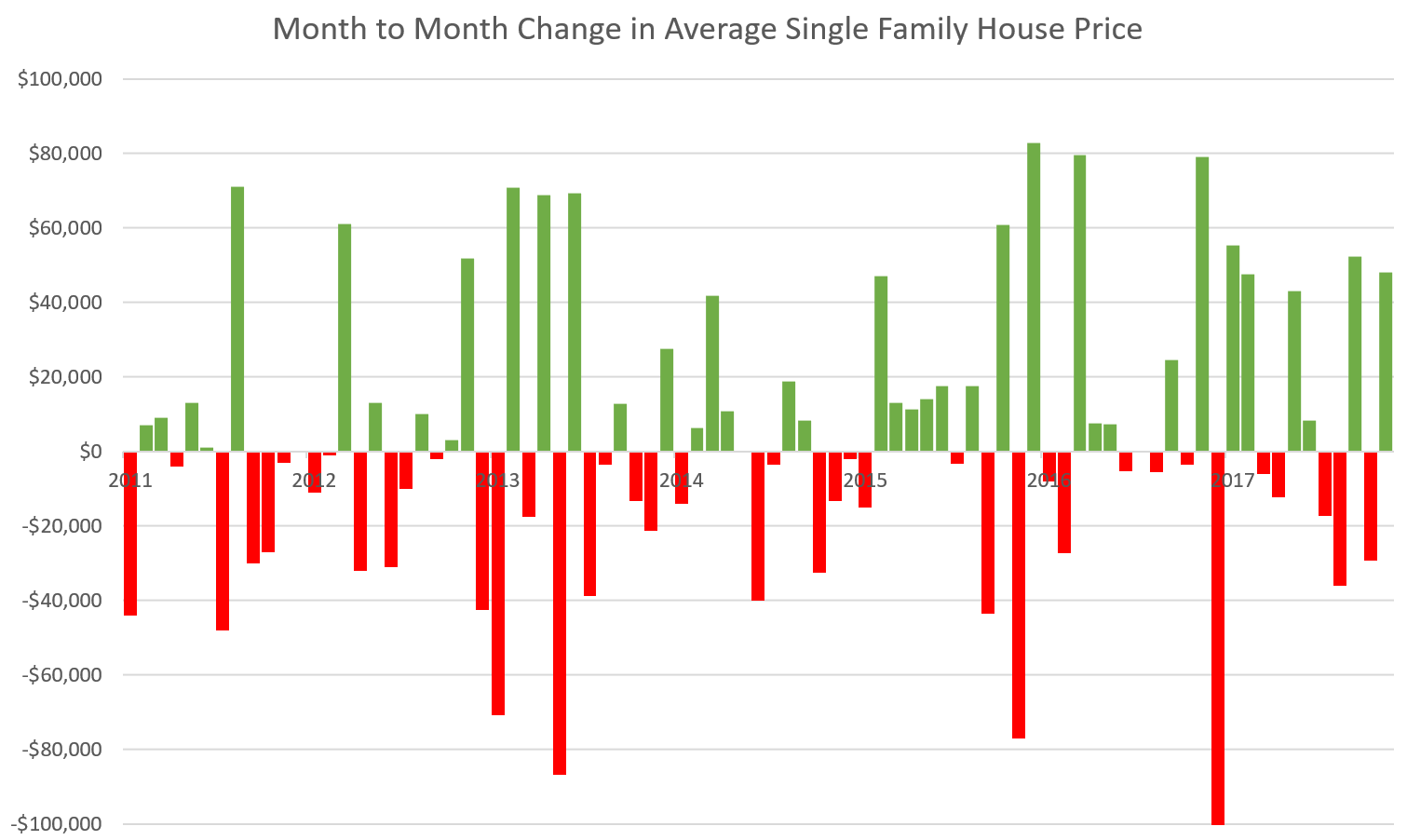

The headline number here was that the average price for single family homes was over $900,000. While true, it’s a figure that is 100% meaningless. The average price routinely swings wildly, sometimes by over $100,000 from month to month, and this month it swung up because of a $12M sale in Central Saanich. That’s it. An article talking about how condo averages are down 2.5% from October is actively misleading.

The short story is that single family house medians have only seen marginal increases since February after they jumped to $750,000 while condos and townhouses have appreciated a bit more since then.

The sales mix is pretty consistent still, no great shift towards or away from condos this year.

Market Conditions

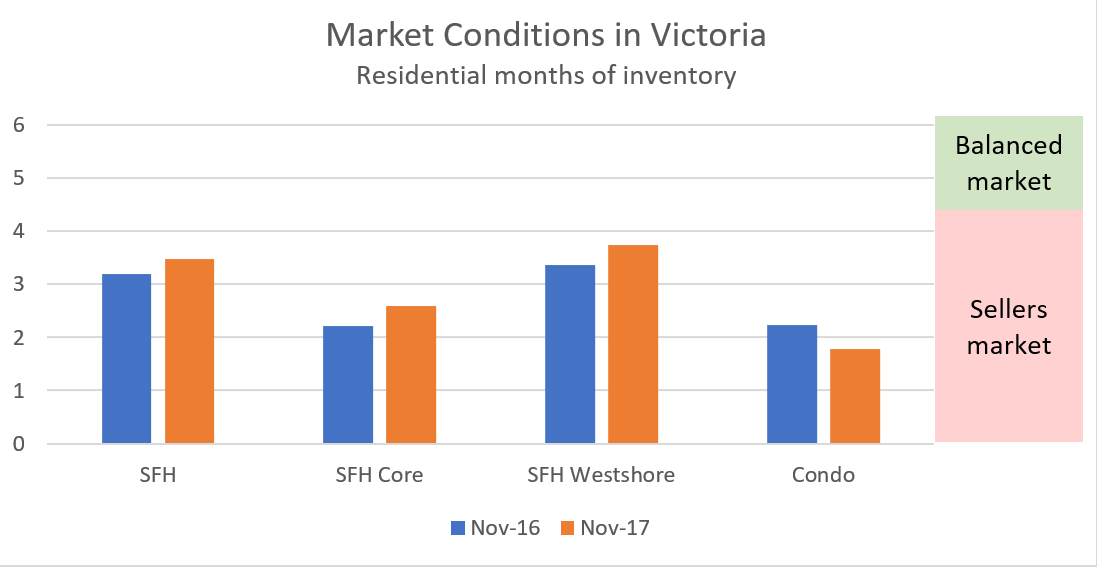

In the overall market, we still have strong sellers conditions.

How does that break down? Well unlike a few months ago when some areas were starting to cool down significantly in some areas, everything is back to solidly in sellers market territory, and quite similar to the conditions last year.

New post: https://househuntvictoria.ca/2017/12/05/cmhc-dedicated-rental-buildings-barely-viable/

I stand corrected . My mobile is different from my desktop for some reason. I see about 10 but nowhere near 20. Most still went for under asking price.

Lack of supply causing “price increases across BC”

“A cycle…is eight to 10 years, and…Finally, it’s hit the proverbial fan.” The decreased supply is…causing price hikes right across the province.

“Prices have definitely gone up,” said Wim Vander, “They’re up about five per cent…this year.” He advises anyone who has their heart set…to get out and buy one well before the holiday. “There is going to be a rush, we know that,” Vander said. “Don’t leave it too much longer…because then there’s going to be a mad panic.”

http://bc.ctvnews.ca/shortage-of-christmas-trees-causing-price-increases-across-b-c-1.3707100

I cannot explain that discrepancy other than perhaps your PCS is misconfigured.

Hawk you must be missing some areas. I don’t follow the entire core but still seeing frequent 2 bed 2 bath sales. Here’s a few recent ones:

Dec 4: #101-1101 Hilda St ($313K)

Dec 3: #207-2527 Quadra St ($321K)

Dec 2: #204-1188 Yates St ($330K)

LeoS, my PCS is set for 2 bed 2 bath – $250K to $500K over 700 sqft. Only 2 sales in the core since 24th.

Leo S:

I have not been following the case but generally one first needs to get leave to appeal to the SCC in matters such as this. Most cases are denied leave and usually the denial comes down within a year or less.

I dunno. If you finished the absurdly large garage it could be big enough. Then get permission to add a carport or just park outside.

Eventually this will happen for sure. But it could be a few more years. First TREB will appeal their decision. That will take some amount of time before their appeal is thrown out (Barrister can you weigh in?). Then someone in BC will have to stick their neck out and either publish sales data or take the real estate boards to court to allow them to.

I come down to Victoria about once or twice a month. Usually get into town around 9:30 am …the dilemma is when to leave….2 pm doesn’t give me much time there but leaving at 3:30 or even 3 pm makes for a very long drive home. I can wait until about 6 pm but in the winter I prefer to do the Malahat with some light.

Sunday has become the best day although that isn’t always convenient.

I remember the days when you didn’t have to give time of day much thought when driving anywhere in Victoria.

freedom_2008

Sounds about normal for that time. Starts ramping up before 3pm I think.. I don’t bother trying to get out to Langford past 2pm now. If I have business to do out there I try to go in the morning when it’s clear sailing.

Wilkinson gets pretty bad that time of day too (starts ramping up before 3pm and is pretty horrid by 3:30pm). I assume that’s mainly people heading out to Colwood/Langford and picking kids up from school etc. Definitely no good. That new interchange can’t come quick enough.

I see 20. Are you looking in a certain region?

Status is one of ‘Pending’, ‘Sold’

Listing Sub-Class is ‘Condo Apartment’

Price List is 0 to 500000

Bedrooms is 2

Baths Total is 2

Date Pending is 2017/11/26 to 2017/12/05

Hopefully yes. Already have seen a lot more of these fail. Places still selling, but after 4 weeks rather than in the first weekend.

You’re probably correct. However it is very difficult to make a rational argument against “it has worked out well so far”. The dumbest most financially reckless investor buying almost any property in 2014 has done great. This won’t change untill there is a signficant decline that causes a lot of pain and changes the sentiment that RE always goes up.

Your thinking makes more business sense. But the land is in View Royal “Sensitive Terrestrial Ecosystems DP Area”. So sub-division would be extremely difficult by the book, regardless donation or not. Others here said the current owner had it for sale since 2015. So if feasible, they would have done it already, and get more money that way. Hopefully CRD could buy it for the park.

On another subject, we went hiking today in CRD newly built Sooke Hill trail, very nice trail with a suspension bridge. On our way back to town, the traffic at McKenzie and Hwy 1 on the opposite direction was backed up all the way to Carey Rd. It was only 3:30pm …

“I confess I don’t quite understand why Asians like Richmond. To my eye, Richmond is very drab.”

well if you were going to go live in a foreign country, wouldn’t you want to live n a place where you can easily get along in your native language?

More Canadian mortgage fraud. Tip of the iceberg after Home Capital cover up. Stick a fork in this pig. It’s done.

Laurentian Bank audit uncovers $89M worth of mortgages with ‘misrepresentations’

More loans may be included

While the price tag of the loans Laurentian’s audit of itself has already found is $89 million, more problematic loans could yet be uncovered, Laurentian warned. That’s because the bank said it conducted a “limited sample file audit” of $1.1 billion more worth of loans originated in its branch network, and found similar instances of documentation issues.

http://www.cbc.ca/1.4433982

I confess I don’t quite understand why Asians like Richmond. To my eye, Richmond is very drab.

But I completely understand the Westside and West Vancouver.

I haven’t observed many “ghost houses” in Gordon Head; however, I have observed numerous entire-home rentals south of the Feltham/Edgelow line.

“I view Asians as smart investors and prudent managers of money, by and large. So if Asians disproportionately live in Gordon Head, that’s a positive.”

Funny how someone can view 20% of buyers in your hood leaving their places empty is a good thing for community etc after all the destruction in Vancouver. Some are very very slow learners when they live in a greed bubble though. No wonder the price slashes in Vancouver are at 80% of listings.

Only 5 days into the month and the slashes still run deep.

https://www.myrealtycheck.ca/

I like your thinking. I am seeing more of this kind of thing happen lately. I think several of the parks in the Highlands grew substantially from exactly this kind of scenario.

At the end of the day, who needs a huge lot if you are next to a major park?

Luke

Thanks Luke.

Now I’m certain my wife showed it to me. My immediate reaction was, “One bedroom?!” Seems it’s a carriage house waiting for a house.

caveat emptor

Cool idea. I don’t see that ever happening, but I’d support it. Bit more inventory, more parkland.. win, win.

I love Thetis lake / Francis King. It’s pretty cool taking out-of-towners there. We’re lucky to have such an awesome park so close to town.

freedom_2008: I think you have the right idea. I actually think there is an opportunity here for someone to buy the place and perhaps strike a deal with CRD and View Royal where the majority of the property gets donated right away (to add to Thetis Lake Park) in return for being able to make a couple of “small” 1-2 acre lots adjacent to the existing house/garage. If you pulled this off you’d end up making a massive charitable donation, have a lot to sell off to pay expenses, and wind up with a building lot for yourself in a beautiful spot and feel good about protecting most of the land which is frankly best suited for parkland.

This property has been listed for quite a while

This was listed in late 2015 when I was looking for a place…. I think, back then it was $899k but going off memory so that might not be correct. I don’t think it sold as there is no sales history on BC Assessment. However, Leo could tell you more perhaps. Certainly an unusual property, it probably isn’t on city water and does it even have hydro??

I’m wondering – if the decision against TREB by the courts there has any effect, or is going to have any effect here in BC? Are we going to be able to see more data here like they already do in NS on sites like viewpoint.ca?? That would be welcome and I think reform is badly needed in the Realtor industry. Also, Realtors should be paid much less, now that house prices have risen – more like 1.5%. The current commission structure is too rich. Data around sale prices, multiple offers (where one should know what the others are offering and not have it kept secret), previous sales/lists, re-lists (these are endless on the ‘dreg’s’ around here), etc – all of this needs to be made public!

josh

I forget who brought it up, but I agree this all stems from lack of education in basic finances. What did you learn in CaPP (career and personal planning, affectionately called CraPP by students)? Precious all I’ll bet. Maybe one reference to compound interest by a disinterested teacher. I don’t think most parents discuss finance with their kids either.

I’ve know people that treated credit as a pile of money they could spend, rather than a hole you’ll have to dig yourself out of. “Oooh, I just got a new credit card, now I can spend 5K more!” With your other card maxed? SMH.

I had someone suggest I get a new trailer because, “it’s only $200 a month!” $200/month on 20K+ of debt at 6%+?! So spend a decade paying off a trailer and pay >5K in interest… the mind boggles.

Barrister

Same as any panels. You can use their output locally to offset costs or supply the grid and get paid. In my building the water heater is electric, there’s shared laundry and common areas have heat and lighting.

Bingo

That’s a great analogy and I think it’s entirely how a lot people think. It reflects utter obliviousness to the nature of debt and we know the situation our nation is in also reflects that. I’ve overheard 4 lengthy bus / ferry and camping conversations that entirely support this thinking as well. These people actually said things like “well real estate is safe, it’s always going to go up” and “money’s cheap, you can always borrow more. the bank will love you for it.”. They really do think that once they own they can just cheat their way into Scrooge McDuck levels of wealth.

“Why any ethnic group picks a certain area over another is often a head scratcher for me”

There is a Feng Shui aspect to Richmond which is favorable.

Any Feng Shui experts able to elicit why good energy flow in Gordon Head?

freedom_2008

Maybe you could have afforded it a year ago or whenever it was last listed.

Leo, is this a relist or resale? I swear it was listed least last spring if not earlier.

edit: or maybe I’m confused. Maybe there was a similar place on an acreage that was similar.

Why any ethnic group picks a certain area over another is often a head scratcher for me. For ex., I know Asian’s like Richmond b/c it’s closest to the airport, and also there is the domino effect of just more settling where they already have a community. Richmond, however, will not fare well in an earthquake or if the ocean level rises. Asian’s picking Gordon Head, where some of the area’s up there are quite nice (north part near the ocean), is not all that perplexing when in Metro Van they seek out the Westside or West Van.

It’s really odd to me in this day and age in most western countries we haven’t come further yet w/ ethnic integration when I think we should have by now, though we are slowly getting there. There’s still a lot of division between ethnic groups. It’s now getting worse in other western countries, at least Canada has improved on this over them. It’s another example of odd human behaviour. Making ourselves so different when we’re really all the same.

If I have an extra $1M, I would buy the place, live in the house and reserve the land, will it to the CRD to add to the Park when I am gone. Very tempting.

It sold for asking price which was $920k. I was looking at that one thinking of a potential downsize as it’s in my fav. ‘hood where there is virtually nothing to buy in, but it needed sooo much work! Great location though.

Another interesting sale recently is 52 Maquinna. Another new place like 863 Richmond where they started a bit high but settled at $1.7m. Don’t forget to add GST to those prices!

https://censusmapper.ca/maps/870#12/48.4582/-123.3401

VIA this link note the density of ‘haunted houses’ i.e. empty homes, is highest in Gordon Head or Downtown/Vic West. In Downtown/Vic West it’s mostly empty condo’s. As for Gordon Head – Freedom_2008 informed me it is empty suites, and I had to agree I don’t see a lot of empty 70’s boxes up there (maybe the suites are rented some of the time to students but still classed as empty). Note the empty suites/homes concentration is highest closest to UVic (corner of Gordon Head Rd & Mckenzie). This data set can be a bit misleading if ‘suites’ is classed as a home, because it’s difficult to ascertain what is causing more of a concentration of empty homes in a given area. For ex, we see area’s where it’s mostly condo’s w/ more empty homes. Also, area’s that are mostly vacation homes, like the Gulf Islands, have lots of haunted houses. But in places like OB that supposedly don’t allow suites, yet still there is a ton of them there? How can the data be all that accurate then?

Interestingly, the visible minority data does show the highest proportion of this in our region in Gordon Head – but I think we all knew that already and I’m not sure how that correlates to suites not being rented perm.? Visible Minority or not, I think this would happen in that area anyway as it’s mostly about the students.

Visible Minority data: https://censusmapper.ca/maps/926#11/48.4836/-123.3778

You did notice all the decorations, trees, Santa, Nativity scene’s, and nice lights around town right? You have to step out and get groceries sometime don’t you, or do you get them delivered? I think typically over the holiday season, and winter for that matter, RE dies down, no?

once and future

THIS. Plenty of legit reasons to hold a house, even a residential one in a company. If I were, for example, buy a property with a family member or friend I’d do it through a company (rental investment, vacation property, whatever). Nothing nefarious there. As an individual I wouldn’t bother with the overhead for a single property.

It’s something totally worth discussing with your accountant over a beer (i.e. the pros and cons of holding RE in a company).

I view Asians as smart investors and prudent managers of money, by and large. So if Asians disproportionately live in Gordon Head, that’s a positive.

It’s not a coincidence that Asians didn’t settle on the Gorge (home of Hawk’s dingy basement suite) as their preferred location.

Local Fool

Interesting story. Rings true from my own annecdotes. Stuff in Westhills is definitely going over 800K (know someone who just bought). Lots are a bit bigger than the stuff out Happy Valley, and it’s closer to town (lol) and most have income suites. Take a drive through there some time. It’s surreal. Plenty of new cars and toys like in the GC’s story.

Wife and I were talking about it and how it seems crazy. Lots of families out there (some with modest belongings) but it seems to lean towards plenty of toys and displays of wealth (new trucks, trailers, luxury cars, boats). Do those people actually make enough to support their lifestyles? My guess is no and those neighbourhoods attract the type of person that measures affordibility on whether they can keep up with the monthly payments. I’ve seen similar in the interior, but the houses are half the price. People in Victoria aren’t making twice the income.

As for people buying houses as “investments” that are cashflow negative. That just seems the norm here. People generally don’t like to put mental effort into decisions.. it’s the whole lizard brain thing. From the people I know that have “investement” properties (but shouldn’t) or are planning on it (but shouldn’t) here’s how the logic goes:

-I want to retire at some point, I need money to do so

-Stocks and bonds are scary, a house is a tangible thing plus HGTV taught me I can make money off a rental house

-I’ll buy another house, have renter pay down mortgage, OK if I have to put some in too, “It’s like a forced savings plan.” (yes I have heard those words) I’m putting money in I’ll get back when I sell to retire

At no point does any sort of spreadsheet or back of the napkin arithmetic work into it. It’s simply, “Can I afford the monthly payments?” If yes, buy. Just like the lizard, “Will this fit in my mouth?” If yes, eat.

It might even work out for some people buying now if they can hold on to the property long enough. Rate of return isn’t a term they are even familiar with.

The people I know with good investments (my age) seem quite nervous about RE. Of course I guess it’s not surprising it’s either or. Hard to afford both in Victoria unless you are quite wealthy.

Never mind Hawk, didn’t see your link.

There have been a lot of cuts lately on SFHs. Lots of sales after a 2-3% cut though. Perhaps indicative of what we’ll see next year? prices softening 2-5% from 2017 highs within a general framework of low inventory. Hopefully this kills the “we will accept offers Monday at 5 PM” seller crowd.

I haven’t heard of this so specifically – is there a data source that indicates empty homes by area and related ownership stats? There may be, but I don’t recall.

Still only 3 sales in last 10 days of 2 bed 2 bath condos under $500K . I think the banks have clamped down early on the first time buyers. Sellers will have to start hacking bigtime in the new year with all the new condo completions hitting the market in spring/summer.

The problem is, that apparently definitive statement also works in reverse. Kind of tough to say whether the matter is exaggerated or conversely, understated – and in knowing either, what of it.

Having said that, I don’t buy the argument that would suggest that we have no way of knowing anything about what’s going on in China, so why bother. Yes, some of the PROC’s stats are likely there to fit a narrative, though there are other proxy measures that can be used to broadly assess certain aspects of their economy (forex reserves could be one).

Where China goes, we tend to follow. The BOC has previously identified economic dynamics within China as one of the larger external economic risk factors Canada faces. A lot of that risk lately, comes from a fairly mature credit cycle over there. Even their leadership has flagged it as a serious issue.

Is there a consumer debt problem in China? Is there a land speculation problem there? Are Chinese monies coming into other countries and impacting those markets? I do get it – it’s kind of a catch 22. Should a buyer here, look to dynamics there as a factor in making a purchasing decision? In most cases…not really. And that isn’t really the point, either.

Is a significant disruption in credit activity in China going to affect us in Canada? Most definitely. My throwing it up there was just intended as awareness, not necessarily having future market dynamics predicted with nicety.

I don’t think China is too complex when BC has the highest concentration the past 7 years of funnelling billions illegally into our province to launder and scam through the casinos and real estate. We will be the first to feel the effects like a tsunami.

Funny how the mouthiest homeowner on here is the one who lives in the highest concentration of ghost houses in Victoria, owned by foreigners from the most highly suspect country in the world for money laundering and fraudulent documentation.

Imagine 20% of your Golden Head hood having to go up for sale or being foreclosed on all at once. That will be a very sweet event to watch as the walls cave in. 😉

https://censusmapper.ca/maps/870#12/48.4505/-123.3590

where to install solar panels

https://xkcd.com/1924/

No, Hawk definitely has China all figured out. Just like he has real estate timing all figured out.

Anyone know what 20 Moss Street sold for?

Beautiful location. It is a wonderful bike ride out to the end of that road. A possible issue with that place. It is zoned to build one residence. The “Garage Mahal” that they built counts as that one residence. So to build a normal home you would have to (a) tear down the garage or modify it, (b) plead with View Royal for a variance.

Dasmo probably knows more. That is his neck of the woods.

The article spins it the other way but when was the last time the majority of the country (and these aren’t even just prospective buyers) knew about something as dry as rule changes from a banking regulator? http://www.remonline.com/canadians-dont-know-not-worried-mortgage-changes-survey-finds/

@Bizznitch – Interesting article (assuming the Mortgage Brokers Association aren’t slanting things too heavily). I’ve wondered for a long time what the ratio of approved mortgage to accessed mortgage is.

More mortgage news. Keeps getting better and better.

https://www.theglobeandmail.com/real-estate/tougher-mortgage-rules-could-affect-up-to-50000-potential-home-buyers-a-year-report/article37190155/

@LeoS

I noticed that listing earlier and the thought struck me that if I was younger and looking for a place to build it might be an interesting property. Wonder if there are future severance possibilities. If anyone looks at it let us know what you think.

Likely true. That’s why I often don’t know what if anything to make about news about China regarding capital controls or outflows. Too complex to determine how it might affect us, if at all.

Anyone gone out to see this place? https://www.realtor.ca/Residential/Single-Family/18363575/1-Bate-Rd-Victoria-British-Columbia-V9B6J7#v=d

Steve Saretsky’s latest on SFH and the stress test:

“The Vancouver detached market continues to soften in November. Sales increased on a year over year basis but remain well below the ten year average. Buyers are getting more house for their dollar and a weak sales to actives ratio favours the buyer in negotiations.”

http://vancitycondoguide.com/vancouver-real-estate-detached-market-report-november-2017/

“90% of Vancouver Real Estate Buyers Dodged the Last Stress Test But Won’t This Time Around”

https://www.youtube.com/watch?v=DKESoXTHLKI

Local Fool and Hawk,

Don’t be misled by the Reuter report. It is just a single case and means nothing. You don’t know how difficult it is to get a mortgage from a bank these days in China.

Because of the strict price control measures like over 30% downpayment required for first home buyers and no mortgage for the second property, a lot of poor people have already lost their rights to own a home. But at the other side, in cities like Shanghai, Beijing, Nanjing rich people lined up to pay millions in cash for a condo at the “government guided price” which is 20% lower than the market price. It’s just a winner-take-all game.

By the way, China is too complex to observe from outside. Simply exaggerate the impact of China will only lead you to the wrong way.

http://info.51.ca/news/china/2017-11/598039.html

The link is in Chinese, but photos can tell everything.

Yeah I always wondered why all those 60s apartments with pools didn’t put in a solar hot water system. I guess they don’t want to invest anything in a building that likely only has 10 years of useful life before major renos.

$1.7M

More rental inventory available soon:

Brand new 60 unit rental building in Langford

Railside House starting at $1250

Ready March 2018

Anyone know what 863 Richmond sold for? It was a new 3300 sqft house on a 7,000 sqft lot. Pricey @ 1.85!

I’m going out on a limb here but I would add governments to the list of real estate agents, valuation companies and banks themselves are party to the scam.

Clueless is the clowns that have no idea what a housing bubble is and keep touting “value” just because its cheaper than some other fools shack.

The Chinese are defrauding the global system and will be a major catalyst when the house of cards soon collapses.

Fake documents are used everywhere and Eby’s report will stun many how bad BC is loaded to the hilt with houses financed by imaginary assets.

China Mortgage Fraud Frenzy

Gravity-defying property prices in China have spawned widespread home-loan fraud as buyers fear missing out on what seems like a sure bet. Real estate agents, valuation companies and banks themselves are party to the scam.

https://www.reuters.com/investigates/special-report/china-risk-mortgages/?utm_source=Twitter&utm_medium=Social

That’s just part of the boom/bust cycle. Right now it’s likely only a trickle of people leaving the city for jobs in other provinces, but that trend will rise. That our vacancy rate increased at all is amazing given what some consider to be a strong market. But remember what happened before the last price increase. The vacancy rate dropped and then house prices increased.

Greater Victoria isn’t any different than any other boom/bust city in the world.

The new condo market is still red-hot judging by the new place at 986 Heywood, beside Beacon Hill Park.

The foundation is not even finished and it’s sold out (maybe the last unit hasn’t closed yet).

And the prices… don’t ask, you probably can’t afford one. I’ve heard the units went for over $1000 per square foot.

I agree with your assessment, Entomologist.

Josh:

I am sure that I am missing something but how would buying these panels make any money for the landlord?

Just going to chime in on the solar comments. The potential of some places just in James Bay blows my mind. If you take a look around on google maps in orthogonal view, it’s nutty how much unused roof space there is. There’s huge covered car parking stalls where you don’t need to worry about the code for roof penetrations and even if it causes leaks, who cares. I’ve thought about running an awareness campaign to get some low rise owners to look into it. The economics of having tenants pay for their own heat is painful though. There’s virtually no incentive to replace shitty windows or install solar. But perhaps there’s an owner out there that cares about these things that would do it if they knew how cheap it is these days.

@john Drake:

Actually, I feel sympathy for the 70 trying to find a lady on plenty of fish.The vast majority of women who are single are too sensible to want to be involved with guys around 70. They dont want to be trapped with someone that they will feel that they have to nurse much sooner rather than later.

The fact that a lot of men keep looking for women that are too young for them and out of their league does not help any either. I know two guys in Victoria that are now being taken to the cleaners by their

common law younger women. God knows what they were thinking. More often than not, men are idiots .

Ento: Not saying that I disagree with you, but I suspect that the vast majority of first time buyers have already lowered their sights to the low end of the condo market. It is difficult to asses the impact on the market in Victoria since so much of the market is governed by outside money. I doubt if the two million plus market will even feel the change but it will be interesting to see what if any effect it will have on the lower end of the spectrum.

Leo:

I really want to thank you for all the hard work that goes into assembling the stats, charts and graphs. It really is appreciated.

I’m personally very skeptical of any big changes to the market in January. Perhaps a 2011- style slow decline?

If people’s buying power changes significantly, then sure, first time buyers will be affected. They will turn their sights to lower-priced properties. So competition for condos, already quite heated, will heat up more. This could prompt more move-up buying, and slower sales. Sellers not interested in dropping their prices may cancel their listings. More motivated ones could reduce prices, causing a slight decline. There could be some good deals to be had.

But if prices did decline a few percentage points, why would that prompt a stampede for the exits? People renewing 5-year mortgages now would have locked in in late 2012 or early 2013 – the lowest price point and highest affordability time in years, when prices were at least 40% cheaper than today. The idea that people are suddenly underwater in early 2018 after a 2-5% YoY price drop, for instance, doesn’t really make sense. Who cares? They will only have to act upon renewal time, and if they’re renewing for another 5 years, interest rates are still low and they should have boatloads of equity in the form of cap. gains. As we saw in 2010-2013, things don’t change that quickly here usually based solely on pricing. Are people who bought more recently, in 2015 or so, who have seen 20% gains since then and are happily paying their mortgage – are they going to suddenly want to sell if the market flatlines or dips a bit? It doesn’t seem likely to me.

Another period of stagnation, like in 2010, when people suddenly decided that prices had risen too quickly – that I can see happening. We did see a few % points of decline annually back then, until everyone woke up in 2013 and found the city suddenly affordable.

And a larger economic or political shock – war, major political upheaval, terrorism, big natural disaster – yes, those could cause fear and bigger moves, but that’s always been the case.

There still seems to be enough of a pool of people waiting in the wings, still hoping to buy and annoyed that they didn’t jump in a couple of years ago, to buffer any big changes from happening. It’s the new reality of the information market – where everyone knows too much and at the same time no one knows anything.

swch25

Coast Capital is not exempt, or if it is, it won’t be for long. They recently applied to be regulated under the federal Bank Act. And I doubt CU’s could pick up the slack even if they wanted to. They just don’t have enough cash to loan out.

For anyone interested, here’s an interesting article about the escalating and widespread mortgage fraud occurring in China. To an extent, there are some parallels between there, and some of the activity occurring in southern British Columbia.

“A Reuters examination, including a review of court records… shows that across China, unqualified borrowers use fake documents to secure mortgages, while loans deceptively obtained for other purposes are funnelled into property. These frauds are often committed with the consent and encouragement of other parties to the transactions, including lending brokers, property agents, valuation companies and the banks themselves.

Hu Weigang, a senior partner at Guangdong Shen Dadi Law Firm, would like to see the law enforced on the mainland as it is in Hong Kong, where creating a bogus document can lead to jail. But, he acknowledges, the scale of this cheating makes it virtually impossible.

While property prices in China continue to rise, mortgage fraud remains largely a hidden danger, much as subprime loans in the United States remained mostly out of sight ahead of the 2008 global financial crisis. The fear is that in a property correction, fraudulent mortgages would unravel, accelerating a collapse of housing prices in the world’s second biggest economy.

The motive for widespread mortgage fraud is simple: fear of missing out.

Millions of homeowners are enjoying the sensation of ever-expanding wealth. The average value of residential housing in China more than tripled between 2000 and 2015 as a huge property market emerged from the early decades of economic reforms. So far, China’s new home-owning class has yet to experience a sustained downturn in housing values.”

https://www.reuters.com/investigates/special-report/china-risk-mortgages/

@Barrister agree. but aren’t credit unions exempt? Everyone i know who has a mortgage has it though Coast Capital or Vancity. Why wouldn’t people just go there?

@john Drake:

Thank you for your response to my question. I talked to a young couple the other day who were moving to Kitchener, they actually found jobs that paid about the same but their rent was going to be almost half although their plan was to actually be able to afford a house. It made me wonder.

Yes, Net-zero would have been a much more useful investigation. Producing net-gain solar on most summer days, when Victoria is +20 or so while folks in the SW US are cranking their air conditioners, so that BCHydro can sell power back to the grid, remains a useful proposition. Assuming that solar can be stored during our long rainy spells, like the month that just ended, is clearly much more of a stretch. No one will be buying more than a small handful of Powerwalls (most homes owned by conservation-minded people will do with 1 or 2), so they should have just ended the line of inquiry there.

If there is anything to the theory that sales are being driven by the mortgage changes then we should see a banner December followed by a dead man walking of January and February. It should be interesting to see if reality follows theory.

I agree Leo S, a silly article. Why not net-zero?

Odd article. There’s no need to be self-sufficient, hydro is the best storage around. Of course no one in their right mind would go off grid here using only solar panels, and without making massive changes to their energy consumption. Not sure why PICS wasted time on this.

Just to clarify. I believe many “shell” companies can be set up to appear to be rentals. That is why I am focusing on corporations with rentals. Without severe corporate scrutiny, it is very hard to tell the difference between a “shell” and many reasonable situations.

For a corporation to own a home, and have someone related to the company live in it (or really anyone), market rent has to be charged or CRA considers it to be a taxable benefit. If the corporation is not reporting a taxable situation to the CRA, that is a completely different issue.

I guess I am curious as to what you think a shell corporation actually looks like on paper? Maybe I am not seeing something obvious, that would be easy to enforce?

OK. I guess you are purely going off zoning? No commercial, no farm, no anything but residential. That might work.

Now, please define who escapes this ban on corporate ownership of residential zoned property? I think you might find it a lot harder to enforce than you think.

How about UVic and CRHC? OK, now we have to allow institutional. Not too hard. What about a person who has incorporated a small business to rent out 3 homes? Do we keep a registry of some kind? What about a small business that rents out one home? What if the renter is the owner of the company? I that a shell?

What if Amazon decides to relocate to Langford and buys up 100 houses to rent to their employees? Of course it would have to be market rent, but does that get disqualified?

FYI (CBC news from two days ago):

Solar self-sufficiency possible, but not feasible in coastal B.C., researchers find

http://www.cbc.ca/news/canada/british-columbia/solar-self-sufficiency-not-feasible-1.4427770

There was some talk about the upper end of the SFH market over $1.1M not being affected by the stress test.

I don’t buy it. Yes at a certain level I’m sure the buyers are not income constrained, but I don’t think $1.1M is that level. Probably more like over $2M is where you start to get buyers that really don’t care about what the bank will lend them.

The over $1.1M market is just a bit slower than what it was last year. 7 months of inventory in November, which seems like a lot, but 2 years ago it was 12, the year before 19, and the year before: 50.

I said residential real estate. Not commercial or agricultural.

As for rental, that would be fine. But the houses they are looking at are not rentals.

Crazy. Solar tracking usually drives up the cost substantially. But bigger installations have better returns for sure.

If we didn’t have all the trees in the backyard I’d definitely be doing solar on the roof.

This is a cool story. Paging Leo!

Metchosin resident shines light on benefits of going solar

https://www.cheknews.ca/metchosin-resident-shines-light-on-benefits-of-going-solar-394039/

Our market hasn’t been juiced, either. Interest rates are the same here as in Winnipeg. The difference is that Winnipeg is a shithole—and prices reflect that.

It’s precisely what someone who’s bullish on Victoria real estate would do.

Clueless is the guy in the Gorge basement suite, who sold thinking we’d tank, but instead we went up 40%. Oopsy, hey?

All solid predictions.

Barrister if you are part of that very small percentage that are able to live and work in the downtown area then life has likely gotten better for you.

However, for the majority of people that need to use a car to take their kids to events or buy groceries or have to commute the quality of life living in Victoria has diminished.

I see the hidden costs of vacation rentals on families and the younger generation. In order to afford the rents in this city they have to rent out rooms to others. Last week I saw a home where they rented a bed in a walk in closet to someone to make the rent. No heat on in the house and only the glow of a TV for lighting to keep costs down. For some this city isn’t the California of Canada it’s the Calcutta.

As for retiring here. A lot of people come here to escape the weather in other parts of Canada. However, if they don’t have family here it can be a lonely and expensive town to live in. I was speaking with a retiree from Alberta yesterday and he puts money into jars to budget dinners and beers despite that he owns a $400,000 condominium and has a similar amount in the stock market. And as ironic as it may sound he wants to buy another condo as an investment because in his mind this is the only way he will be able to live in Victoria.

So I asked him why he doesn’t sell and rent a new condo for $2,000 a month and not have to worry about money as he was 70. And he looked at me and said that he expects to live to 100 and will need that money. Then he turned back to his laptop to see if he had gotten any messages from his profile on Plenty of Fish in the Sea.

There are many legitimate reasons for a company to own land. Any business that owns its own office, farmers that own their own farmland, companies that maintain rental properties. If you ban corporate ownership of real estate, the provincial economy will implode.

So, we won’t do that. Next step, how do we define a “shell” company? How do you know that the house down the street owned by a company isn’t something completely innocent? Easy to rant about, very very hard to pin down legally what you mean by “shell” company.

Quotes from Steve Saretsky… and you know what happens in Van, eventually happens in the Vic market…

“Over 1500 houses for sale in Vancouver. Detached inventory at it’s highest levels of any November in the past decade.”

“Vancouver Detached prices are slowly coming down. Like watching a cruise ship pull a U Turn.”

@Bearkilla:

You forgot to predict that Barrister will learn to yodel.

It’s almost time for a new years prediction here. Just finished putting up the christmas decorations here so I’m all set for some predictions:

1) Hawk will continue sad posting. Sad.

2) Bears will be wrong again for yet another year. Not only wrong but once again prices will climb EVEN MORE above what they can afford.

3) Many bears are going to leave town as rents rise even more.

Put me in the screen cap.

@john Drake:

I am curious, leaving aside prices, do you think Victoria is more or less desirable as a place to retire than it was five years ago? And why?

The upper income market for houses in the core ($1,250,000 +/0 $100,000) has slowed significantly over the last 90 days and that has shifted the median price to a lower level in November of $810,000 down from October’s $867,500. However, the more important mode has not changed significantly which has remained solidly at $860,000 for the entire year.

Despite low months of inventory and new listings coming to the market just enough to match sales, the average days to sell a house in the core has been increasing from a low of 16 days to almost a month now. Which I had predicted would happen in the beginning of this year.

Possibly we could see the homes listed in the $1,250,000 range reduce their asking prices and that would ease up pressure on the middle income house market that is around $860,000 and lead to moderate price declines. The market for houses in the core is still considered stable but that could easily slip into a stable to decreasing market in the new year.

Active listings still remain low by historical standards but November had 410 active house listings and that beat 11 out of 12 months for all of last year. What that means to a prospective purchaser is that you are still going to be put through the grinder on a sale but not to the extent of those that bought last year or in the spring of this year – they got shafted.

When the crash happens no smart investor will want to catch the falling knife. They will let the buy-the-dip crowd get sucked in then watch them dump quickly as they see it’s worse than they thought.

Debt levels in 81 were 100%. Now they are 167% on the dollar. That’s a ton of debt flushing out to go thru like Nortel from $100 down. Garth even said back up the truck at $60. It’s a 3 year or more process this time around, The Big Short style plus.

If NAFTA goes down the retail businesses will be crushed according to reports out today. Consumer spending will seize up like no other time. Credit lending will do the same.

You think you’ll buy a house in Oak Bay at half price when your own house is worth less than you paid in late 2000’s? Talk about totally clueless.

Introvert:

Ask ten people get twelve opinions. personally, I would never have bought into the Victoria market as things stand today. But that is just a personal opinion. I suspect that if there was a major crash that the recovery would be very slow. Out of the eight people I know from Toronto that came out here with the thought of retiring in Victoria all of them had a negative impression of the city. That could very well be coincidental. Just saying that it is better than Saskatoon is not an argument in the making.

I am not going to repeat what my friends said because many would disagree and besides I dont want to be a punching bag on this blog again.

That’s the “buy the dip” phenomenon; a similar dynamic is currently happening in the US stock market. When investors are thinking, “quick, buy the dip – it’s on sale for a limited time only,” the market hasn’t really turned, IMO. When it turns, it turns. That’s it – it must run its course.

But it depends on the time scale your talking about. Housing corrections can take years to unfold, crashes can move faster, but they recover even slower. The US housing market is a good example of this.

Having said that, I think it’s fair to say that Victoria would have a better, faster recovery than somewhere like Winnipeg. But then again, Winnipeg’s market hasn’t been juiced – they wouldn’t have far to fall anyways.

When the psychology of real estate mania finally breaks, RE simply won’t be looked at as a way to make money any more – quite the opposite. The idea that prices quickly drop, investors rush in and prevent long term pain despite high levels of household debt, IMO, is not likely.

Now on a longer time scale, this run up, or something like it will of course happen again. Prices will get very high, people will think that it’s different this time, RE will be the rage, and we repeat again. After all, it really is just a market – much as us locals like to think how special we are.

Corrections or crashes are possible.

But if we have a correction (or even a crash), I think it wouldn’t be long before prices rose dramatically again. After all, a price correction in Victoria doesn’t mean that everyone suddenly thinks we’re Saskatoon.

In such an event, I think those with deep pockets would go on a buying spree. The wealthy think Victoria’s current all-time high prices are a relative “deal”; what do you think they’ll think if prices drop?

What do savvy investors always say? When the market is tanking and everyone is panic-selling, that’s when it’s best to double down and buy as much as you can while there’s a discount.

If we ever have a crash, maybe that would be a good time for me to buy an investment property in Oak Bay for half-price. Do you think prices in Oak Bay would rebound pretty quickly? That would be my bet.

If it is a rental property then you will be subject to capital gains, regardless, but if you sell the shares of the shell company then you dont have to pay land transfer tax which on a million or two million dollar property can be a fair chunk of change. Technically the land is still owned by the same company.

Drug lords, politicians and some shady foreign buyers love this type of structure.

John Drake:

Your black SUVs are not the mob but Donald Trump. Go ahead, throw those firecrackers at him; that will show him.

I can’t tell you the reason for that except the owner doesn’t want anyone to know who they are. Witness protection? Gang leader? Drug lord? Most likely you don’t want to live beside them when the black SUV’s show up in the early hours of the morning.

But the reason that the house and business are sold together is to reduce taxes. By inflating the value of the house the seller pays less tax on the business portion. It’s all in the art of the deal. And I suspect this is common in the high end property sales. I’ve seen it occur in some deals in Victoria where a doctor has sold his business and house to another doctor. It’s a loop hole that CRA doesn’t have the person power to check on and if done in a reasonable manner almost impossible to prove.

After all how many times have we heard the erroneous statement that a house is worth what someone is willing to pay for it. So if a person has a 4 million dollar home in Rockland they can sell the house and business for 10 million and show the sale of the house at six million and the business at 4 million. That’s another 2 million capital gains free to the seller.

“An Uptown 2br/2ba condo is currently advertised for rent for $2150. “Garden” suites in GH renting for $1800. Victoria has officially entered the outer edge of Vancouver’s wacko-sphere.”

What’s wacko is the wackos stupid enough to pay it. Many apartments are $1600 to $1700. If you want to pay some owners bloated mortgage then you deserve to be fleeced.

Interest rates are a risk. Historically it has been better to go with a variable rate in Canada despite this risk. In our case when we went with a 10-year fixed rate, which did not work out in our favour. If you want to adjust for a potential increase you can input a rate slightly higher than what you are offered to evaluate ROI. You also have to consider what weight, if any, you will assign to principal pay down.

For us, the bottom line is that a RE investment needed to be cash flow positive to manage all the risks when we were first starting out. I would still buy a property here today if I felt it had potential and would be something that our children could live in and buy from us in the future, but the numbers certainly do not work for cash flow so you’d better have savings or a extra available income if you choose to do this.

When looking at what will happen in future I look at what has happened in the past and what factors are currently influencing the market. I also make sure I do a detailed financial forecast accounting for all variables based on my best guess and just make the best decision I can. So far so good and far better than analysis paralysis would have resulted in.

@ Totoro – how do you account for interest rate risk using that model? In Canada you can’t really depend on interest rate stability like you can in the US and with interest rates are on their way up, that model could lead one to make some pretty bad mistakes?

An Uptown 2br/2ba condo is currently advertised for rent for $2150. “Garden” suites in GH renting for $1800. Victoria has officially entered the outer edge of Vancouver’s wacko-sphere.

Funny how Intorovert is ramping up the slag posts like Trump in panic mode on his crapper. Imagine owning a home being up all that fantasy cash and losing sleep over an opposite opinion. Sad.

In real news the Malahat LNG joke is now officially dead as I predicted from day one which Mike guaranteed was in the bag.

When has the local media ever done unbiased real estate stories? Never. Advertising dollars own them.

Oh, yeah. I forgot you’re one of them now. Sorry to slag you there, pal!

Leo, you’re both a realtor and the closest thing we’ve got to a “housing researcher” in this town.

I may have lost the ability to claim higher ground on this one. Would be nice if the news went to housing researchers, but it seems we don’t have any that focus on the Victoria market.

Well, CHEK’s “experts” were realtors, so what did we expect?

For some balance, CHEK ought to seek out “experts” from the opposing camp.

“Now we go to Tess van Straaten, who is live tonight in a basement suite in the Gorge. Tess, tell us what blogger Hawk expects to happen.”

I will predict this to be nonsense. Prices may not decline a huge amount, but the market will definitely cool off. You can’t pull sales forward without a corresponding dip after.

What legitimate reason is there for a shell company to hold residential real estate? Just ban it all.

I would define house hoarding only to include people who are buying properties and leaving them empty the majority of the time. No matter how many properties you own, if you rent them out full time that is fine by me.

Barrister, my comment was more global. Didn’t necessarily mean you specifically. Whether you think 5% or 75% is realistic, I’d wager you’re in pretty lonesome company.

If people thought prices could really go down, you wouldn’t see people behaving the way they are.

Average home price in Victoria surpasses $900,000 for first time

https://www.cheknews.ca/average-home-price-victoria-surpasses-900000-first-time-393536/

New mortgage rules not expected to cool Victoria’s hot housing market : say experts

https://www.cheknews.ca/new-mortgage-rules-not-expected-to-cool-victorias-hot-housing-market-393875/

Local Fool:

I dont feel that 20% is an extreme correction rather a quite possible one. An actual collapse would bring us back to 2014 prices which were pretty well in line with local incomes. And, yes we might be looking at a 50% correction. I am not predicting it but it is well in the realm of the possible.

That you can’t accurately assess the types of articles I post isn’t surprising; we know accurate assessments are challenging for you.

Thanks, totoro.

Anecdote alert.

A friend of mine and I were at the Sooke arena a week or so ago and were discussing among other things, the housing market. As we were talking, I could see a fellow to our left taking interest in our conversation. He eventually interjected with, “Ya, it’s crazy”. At first I was kind of annoyed with the unsolicited interruption, but what he said next made me interested in hearing more.

Turns out, he’s a general contractor that builds homes in the Westshore area including Sooke. He said new builds on small lots with 2000 square foot homes are now starting to go for north of 800k. I don’t watch either area, so I was shocked at the valuations he was quoting.

He said he’d never seen anything like it. I asked him, “do you have a sense who’s buying these homes?” I expected him to say, “investors”, or other folks of similar ilk.

“Nope”, he said, “It’s generally local families”. He added that within the last year in particular, these folks are often sporting brand new cars, trucks, and frequently, that truck is towing a boat behind it. He shook his head and said with an air of trepidation, “Don’t know when all this is gonna end, but man. Crazy.” While he of course wouldn’t know for sure where their “money” was coming from, he knew about the explosive growth of HELOCs.

The sense of apprehension from him was palpable, and actually said he hoped he still would have work at the end of this. As many know, construction work is generally feast or famine, with the degree of the latter typically commensurate with the extent of the former. He said he was saving everything he could in preparation for that eventuality – something I think many others can’t really imagine anymore. I admired his prudence. Seemed like a really good guy.

In a sense, it made me hope the madness will never end, because people like him are going to get creamed. People with families – who just want to make a living and have a place to live. It’s not just speculators that’ll get it in a mean reversion. Everyone gets hurt, possibly even you and I.

West Shore construction workers building homes they can’t afford to live in

The housing market on the South Island is so tight, construction workers say they’re often unable to afford housing despite being in the business of building it. It’s an example of cruel irony in a housing market that has reached crisis levels in British Columbia. Workers trying to keep pace with a construction boom on the South Island say they’re struggling to find homes of their own.

Stories of carpenters living in cars, tents and even crawl spaces are becoming tragically common in places like Sooke, where a vacancy rate of 1.3 per cent has been vastly eclipsed by a population growth rate of 13.7 per cent.

“It’s a bit depressing, being able to build the walls but not getting the roof,” said Andrew Tyrell, a trades worker in Sooke. “My partner and my three kids, we were all living in about 200 square feet for the last two years, because that’s what we could afford and that’s what we could find,” said Tyrell. “It was a camper on a friend’s property, and that’s the best we could get.”

One Sooke contractor told CTV News one of his part-time workers often sleeps in a utility shed at a construction site.

http://vancouverisland.ctvnews.ca/west-shore-construction-workers-building-homes-they-can-t-afford-to-live-in-1.3704214

A 20% reduction is actually a fairly small drop given the escalation in prices. That would take us back to what – somewhere in 2015? And those values were already very high.

It’s really sobering how so many highly intelligent folks are painting 10, 15, 20% drops as a somewhat extreme scenario. They mean it, too. Almost like anything more is unconscionable. Impossible. That kind of thing just doesn’t happen in Canada.

Whatever happens, I think it’s fair to say that things may well unfold in a manner that many of these people don’t expect. Our housing valuations are hyped up on speculation, mania, excessive credit and the deceptively indomitable belief that our real estate can never really meaningfully drop in price.

Recent buyers betting on continued, aggressive gains better hope that “it’s different this time”.

Like magic.

@Andy:

I am wondering how much it will impact the first time buyer market in particular.

This is interesting — a property just listed for sale had this in it’s first line. So I guess realtors are pushing this agenda as well.

“Qualify under existing mortgage rules until December 31st, 2017! ”

I am so curious to see what the numbers will be in the first few months of 2018, especially for SFH.

I use the spreadsheet linked here adjusted for local conditions slightly: https://www.biggerpockets.com/forums/88/topics/25519-free-property-analysis-worksheet

Personally i would wait to see what steps the NDP take in dealing with foreign buyers. If they implement a large annual property tax on foreign owned property or any similar effective measure than there could be a serious drop in property values throughout the province. Considering that we dont know the effect of the new mortgage rules waiting to see what measures the province is going to pass would be prudent. Houses have almost doubled in Victoria over the last few years, and not to sound like Hawk, a 20% correction is not out of the question.

Introvert:

I doubt if any of the houses are actually cash flow negative if you are not carrying a mortgage on it. It is just that they dont provide a great rate of return on your capital. Basically you are relying on the house increasing in value every year to provide you with your profit. Had you bought four years ago and sold today you would have done brilliantly.

I suspect your real question might be how much mortgage can the house carry before it becomes a negative cash flow. Estimating taxes and insurance is relatively easy but maintenance costs, if it is an older house, can be a bit more problematic. A leaky roof or collapsed perimeter drains can really take a bit out of the rental income. Its like Dirty Harry said “Do you feel lucky punk, well do you?”

I think the point about negative cash flow was based about the assumption that you are only putting down about 20%. With an all cash purchase, based on reasonable maintenance costs, your return on capital seems to be somewhere between 2 and 3 percent if all goes well.

“I try to share stuff that’s interesting, whether it supports my opinions or not.”

Well that’s a switch from all your pumper internet articles and being a twerp. Go to confession or something? 😉

totoro, do you have a nifty spreadsheet or online calculator for determining whether a real estate investment is cash flow negative/positive? If not, could you possibly walk us through how you determine it? I know I would find it enlightening.

http://www.timescolonist.com/business/incoming-mortgage-stress-tests-see-buyers-rush-to-make-deals-1.23111016

Numbers are high due to upcoming stress test. Will not expect to see it next month.

Still cash flow negative unfortunately.

Clearly banking on appreciation, which will likely work out in the long term.

Just do this for no active management and higher return. No need to be so complicated: http://canadiancouchpotato.com/model-portfolios-2/

Leo, for simplicity’s sake, I hope you don’t make a habit of copying comments from one post to another. Clean breaks are preferable.

My two cents.

Unlike you, Hawk, I don’t just post things that support my predetermined narrative.

I try to share stuff that’s interesting, whether it supports my opinions or not.

Freedom said: “Over $40K/yr is not too bad for $891K price.”

You would still have a monthly loss in excess of $500, even if you received rental income of $3,800 per month, which is unlikely for that house.

Once and Future: I totally agree with you about the “house hoarding” comment you made. I have yet to really get a good definition of house hoarding from anybody. it just seems to be a pejorative that people throw out.

Looking forward to someone telling me exactly what the term means.

Note the rent would be close to $46K (I left out 6K for taxes and insurance, etc). I wouldn’t buy any in current market. But this house was bought by a local investor who is also renting out a room in his own house. So hopefully he has calculated the return and know what he is doing. Maybe he doesn’t like to spend time to manage in the stock market, and he couldn’t find any GIC with more than 3% return?

3350 Uplands Rd sold July 2017 for $3.2mm and now for rent for $5500 a month. Property taxes for 2016 were $13k a year.

Routinely was an overstatement. What I meant was that the average routinely swings wildly, sometimes over $100,000. Corrected in the article.

I agree it is better than a SFH without a suite, but it is a negative return unless the home appreciates and even then you have to count the profit after capital gains are paid. You are cash flow negative each month after expenses and taxes with 20% down. 100% down and you are earning less than just investing the cash in the market and you have to manage a property.

“The headline number here was that the average price for single family homes was over $900,000. While true, it’s a figure that is 100% meaningless. The average price routinely swings by over $100,000 from month to month, and this month it swung up because of a $12M sale in Central Saanich. That’s it. An article talking about how condo averages are down 2.5% from October is actively misleading.”

LeoS, Can you show us where the average has swung $100K in a month in the last 6 months ? The largest I can see is $50K range this past month and in August. Also any idea what would the average have been without the $12 million sale?

True for most cases. But for SFH with suites, the return may still be okay. Take 1613 Pear St mentioned in the last post, there are 5 bedrooms, 3 in upstairs suite, 2 in downstairs. The rent is $2350 for upstairs, it could be another $1450 for downstairs. Over $40K/yr is not too bad for $891K price.

More condo’s taking a major hit.

21 Dallas Rd , #516 at Shoal Pt on slash #2 for a $450K whacking down to $1.79 million.

1400 Lynburne Pl , #321 at Bear Mountain on the golf course slashed $50K to $399K.

Over half an acre tear down with prime ocean view in Maplewood slashed $50K to $899K. Developers can’t make a buck it seems.

Can you make a profit when buying a rental property?

Several recent comments here by people trying to determine the feasibility of being a profitable landlord.

This excellent app allows you to enter the basic mortgage numbers, taxes, rents, etc to determine profit/loss, principal, interest, amortization, etc

https://canadianmortgageapp.com

The short answer is NO, it’s basically impossible to make a rental profit on a SFH in Greater Victoria. And that raises an interesting question: In previous decades Revenue Canada disallowed any annual loss where there was not a ‘reasonable expectation’ of profit from a rental property.

Re Andrew Weaver. He has been a landlord for many years (since 1986). He said in a recent speech: “In my personal case, I viewed it as a way to give back. We, for years and years, have given below-market rent in a house or two houses because we could give someone a leg-up.” … “I mean, some members here would think it kind of odd if I said that we rented a four-bedroom house for a $1,000 a month. That is what we did here, because it covered our costs, it gave people a break, and it allowed us to protect ourselves for the future and our children in this escalating real estate market.”

You can read his full speech at: http://www.andrewweavermla.ca/2017/11/02/bill-16-tenancy-statutes-amendment-act/

Barrister, I don’t think we can jump to conclusions without a hell of a lot more information. Owning more than one property is not a sin, and he may either be housing other family members or renting them out. The city needs rental units and someone has to own them.

“House Hoarding” is not just owning a second property.

Thanks so much Leo for all your detailed work.

So whose buying all these sudden surge in rentals at low prices ? After reading the money laundering news makes you go hmmm.

“Eby added that allegations of transnational money laundering linked to casinos go deeper than that: “I have reason to believe that these matters might be linked to other areas of B.C.’s economy.”

Eby also said that he believes B.C.’s property ownership system — in which true owners of property can hide behind opaque legal mechanisms — could be attracting foreign criminals and corrupt officials seeking to hide wealth in the province. Eby said Finance Minister Carole James is working on reforms to pull back legal veils that cover true ownership of property and corporations.”

Intorovert has come over to the bear side. Amazing. 😉

The BC money laundering scandal is about to blow wide open. Liberals shut down the enforcement department while the foreign criminals then went wild. No wonder BC real estate went insane flushing billions through BC.

‘More to come’ on money laundering allegations, B.C. attorney general says

“One of the members of the public service said, ‘Get ready. I think we are going to blow your mind.’ While I cannot share all of the details, I can advise you that the briefing outlined for me allegations of serious, large-scale, transnational laundering of the proceeds of crime in British Columbia casinos,” Eby said. “And I was advised that the particular style of money laundering in B.C. related to B.C. casinos is being called, quote, ‘the Vancouver model’ in at least one international intelligence community.”

“Eby pointed specifically to a decision by the B.C. Liberal government to cancel funding of a police unit that tackled illegal gambling, after the unit identified concerns with organized crime influence in B.C. casinos and proposed changes “to improve the ability of the existing policing team in identifying and prosecuting offenders.”

“There were countless red flags from regulators,” in recent years, Eby said. “And it is important to note that this same period was a period of exceptional growth in the province’s gaming revenues.”

http://theprovince.com/news/local-news/more-to-come-on-money-laundering-allegations-b-c-attorney-general-says/wcm/690df985-2915-44cf-b01d-89dd3e9bc889

‘More to come’ on money laundering allegations, B.C. attorney general says

Excerpts related to real estate:

Eby pointed to a 2016 study by Transparency International that showed real estate buyers in B.C. are using shell companies, trusts and nominee buyers to hide their beneficial interest in property.

In examining Vancouver’s 100 most valuable homes, the report found that 46 per cent — amounting to more than $1 billion in assets — have opaque ownership. Of the 100 properties, 29 are held through shell companies, at least 11 are owned through nominees (listed as students or housewives on land titles), and at least six are disclosed as being held in trust for anonymous beneficiaries, the report said.

Eby said B.C.’s landownership system could be connected to Metro Vancouver’s skyrocketing home prices. Top economists have “made inescapable arguments that taxable incomes reported to Revenue Canada have no connection to real estate values in Metro Vancouver until you get out to the distant suburbs of Vancouver,” Eby said.

http://vancouversun.com/news/local-news/more-to-come-on-money-laundering-allegations-b-c-attorney-general-says

That is the problem. I shook my head at everyone that thought Weaver some some kind of anti-establishment vote. Their platform was virtually identical to the NDP.

Only two sales of 2 bed 2 bath condo sales under $500K in the last 7 days. Coincides with the $52K drop in average price the last 2 months and the mostly under ask sales. They must be backing off for the coming lower prices as new condos flood the market next year.

Bitcoin going to the futures market where the pros can short the shit out of it and scare the bejeezuz out of all the new world order types.

Trump impeachment coming down the pipe with Flynn about to blow up the whole pack of traitors. Kushner is next then Donny boy and sons. That’s going to really increase the market volatility bigtime. Hold on your asses, things are going to get rough. 😉

The price to rental income only seems to make sense if you really expect house prices to continue a major climb.

@Barrister I agree.

With young families priced out of the market and forced to rent at a premium, I can’t help but hope that some type of speculation tax is introduced. Will market conditions come January dampen the speculative activity? If this many houses are being rented out the vacancy rate will surely increase. I think Freedom pointed out it already has slightly. The number of approved projects and under construction rental buildings in greater victoria is a very long list.

I don’t think it’s entirely not possible. I’m sure there are still some opportunities out there on the cheaper end. However in general cap rates are way lower than what would be called investable elsewhere. People are banking on appreciation.

You’re right. I went down a wrong path on the last article by minimizing the effect. It is interesting though. In the graph I posted, we had about a 120 sales drop from October to November in 2016, 2015, 2014, and 2013, so one might think 120 sales got pulled forward by the new rules. But then I just looked further back, and in 2012 we only had a drop of 6 sales. In 2011 we had a drop of 1, and in 2010 we had an increase of 12. So it is not a hard and fast rule that sales decrease in November.

I did a quick, and inaccurate, look at investment return on a house here. Assuming you paid a million dollars for the house and are able to rent it out for 2,500 (total 30k a year) and assuming that between taxes, house insurance and incidental maintenance you expenses are 10,000 a year you end up roughly with 20k return or about 2%. This does not compare well with blue chip dividend bearing stocks especially after their tax treatment.

The short answer is that people are assuming that their profits will come through the appreciation of the house. I guess that it all depends on were one sees the market going in the future. My problem is that I cant totally discount the fact that Victoria might be in a serious bubble.

Comments below copied from previous post (https://househuntvictoria.ca/2017/12/01/november-the-market-picks-up-or-did-it/) so the discussion doesn’t get lost.

I guess Andrew Weaver is a house hoarder by some peoples definition. Where one stands on an issue often depends on where one sits to eat.

Agreed, and it’s too bad that that simple observation doesn’t occur to so many people. Hail Mary indeed…

Incoming mortgage stress tests see buyers rush to make deals: VREB

Canada’s incoming mortgage stress test for uninsured buyers likely led to the higher number of sales finalized in November — the largest number for that month in 21 years, said [Ara Balabanian,] president of the Victoria Real Estate Board.

Sales numbers and comments from real estate agents last month showed that “some buyers have indeed accelerated their purchasing plans to avoid the stress test,” he said.

November’s 671 sales also beat October’s total of 664 sales. “The fact that we’ve had an unusual month does not necessarily mean that this is the start of a new trend. It is however, a good example of how outside forces can impact a housing market,” Balabanian said.

He anticipates that more government changes will be coming up in 2018 and is hoping that different levels of government co-ordinate their efforts to avoid a negative effect on the market.

http://www.timescolonist.com/business/incoming-mortgage-stress-tests-see-buyers-rush-to-make-deals-1.23111016

I did a quick look at the VREB sales statistics and it struck me that there seems to be a real divergence between condos and SFH. I might be reading the stats wrong, so I would ask someone here to take a closer look.

The inventory of active SFH seems to be greater this Nov than last. Total sales were up by 5% but units listed was up by 14%.

I assume he rents there?

Interesting. Not that there is anything wrong with investment properties but you have to wonder if it will reduce his motivation to do anything about property values

It’s intriguing to notice that several people who post here have noticed that it’s not possible to make money with a SFH as a rental. I guess that explains the number of people you hear proudly announcing that they bought a rental home as an “investment”.

A SFH rental is not an investment, it is a leveraged Hail Mary that home prices continue to increase faster than the rate of inflation.

It’s also possible that if a $900,000 property can be rented for only $2300 it is not actually worth $900,000 as a yield-bearing investment, it is worth $500,000. That observation brings us closer to the truth. And perhaps prophecy.

Not really how people work. Unless that retiree has no family or friends in Winnipeg they are staying there.

Anyway 90% of people who have spend their lives in Winnipeg can’t afford Victoria and haven’t been able to for 15 years.

http://thebreaker.news/news/mla-disclosures-2017/

Why does David Eby only have a home in Victoria when he lives and represents Vancouver – Point Grey?

https://www.scribd.com/document/365992701/EBY-2017

Looks like Weaver bought 2 investment properties in the past year

https://www.scribd.com/document/365992662/Weaver-2017

https://www.bcassessment.ca/Property/Info/QTAwMDBIUEgzUw==

https://www.bcassessment.ca/Property/Info/QTAwMDBITkYxMA==

I have to say I’m loving bcassesment to poke around neighborhoods and see lot sizes and details on homes.

LF, I agree. I would be the first to defend personal privacy, but several thousand TREB realtors already have access to this information. It is not like the cat isn’t out of the bag already. I would certainly support anonymizing the info as much as reasonably possible, without rendering it useless.

However, TREB’s arguments are so blatantly self-serving that it is embarrassing to watch.

Can anyone comment on the how this compares to the situation in BC?

Mortgage brokers are emailing all their clients about the upcoming stress test, basically saying buy now before you lose your buying power, so I think it’s had a huge effect.

I watch the monthly numbers for single family homes both in Vic and up island and the trend has been consistently downwards in both places, until in Oct when it spiked up, up island, which exactly coincides with the OFSI announcement and in Nov it spiked up in Vic. Do I think it’s related? Very likely yes.

An avalanche of retirees fearing a credit crunch coupled with anxiety of being priced out of their dream retirement destination. Rent out for many years in advance. Old people are highly risk averse, paying a hefty price when you can afford it is favorable to having to retire in Winnipeg.

The price to rental income only seems to make sense if you really expect house prices to continue a major climb.