November: The market picks up, or did it?

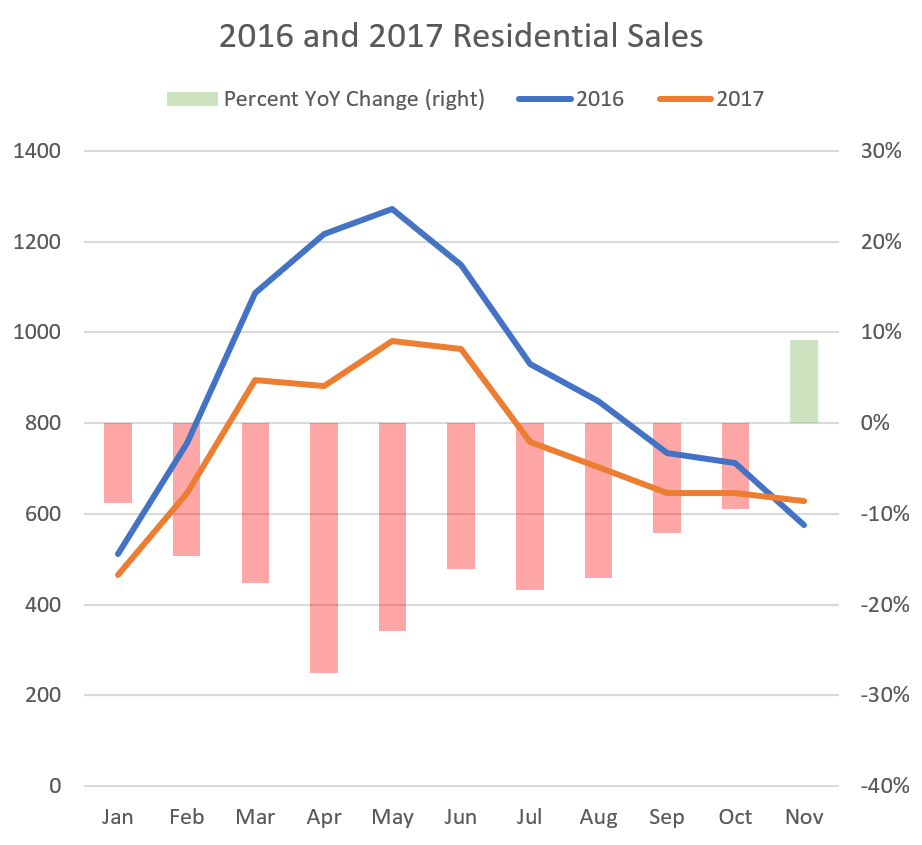

The theme this month has been an increasing number of sales relative to last year after several months of the opposite. Looking at the last few months of daily sales rates, it seems that sales equalized in October and then outpaced last year starting mid November.

Of course we know that these numbers are a bit suspect. They are based on when a sale was reported, not when it occurred, so 5-10% of the sales counted in a given week actually occurred before that week (sometimes way before). However even backing out those errant sales, sales are slightly up in November, breaking a long standing trend. Looking at the monthly numbers, we can see how dramatic the swing has been.

My previous theory was that the looming stress test is pulling buyers forward. But I wonder how much the general buying public really knows about that. The obvious second explanation is that the stress test for insured mortgages went into effect Oct 16th last year. After a rule change that restricts demand we would expect to see a dip in sales that overshoots and then stabilizes at the new level. October 16th is pretty much exactly the date that 2017 sales started outpacing 2016 sales, if you look at the first chart above. You can also see above how steep the dropoff was in sales Oct to Nov 2016. There is always a seasonal decline this time of year, but last year’s was steeper than most. So it seems more likely that the market is more or less stable, but compared to the dip last year it seems to be picking up. Expect the VREB press release to emphasize these year over year gains.

Separating out condos vs single family, and can see there was a more or less equal hit last year on those two, while this year sales stayed steady.

The dip last year is a clue in a smaller scale as to what we will see come January. More on the month’s numbers coming later.

New post with some more November numbers. https://househuntvictoria.ca/2017/12/02/november-numbers-wrap-up/

I copied some comments to the new post so the interesting discussion about sales data, rental yields, and the political disclosure doesn’t get lost.

I guess Andrew Weaver is a house hoarder by some peoples definition. Where one stands on an issue often depends on where one sits to eat.

Agreed, and it’s too bad that that simple observation doesn’t occur to so many people. Hail Mary indeed…

Incoming mortgage stress tests see buyers rush to make deals: VREB

Canada’s incoming mortgage stress test for uninsured buyers likely led to the higher number of sales finalized in November — the largest number for that month in 21 years, said [Ara Balabanian,] president of the Victoria Real Estate Board.

Sales numbers and comments from real estate agents last month showed that “some buyers have indeed accelerated their purchasing plans to avoid the stress test,” he said.

November’s 671 sales also beat October’s total of 664 sales. “The fact that we’ve had an unusual month does not necessarily mean that this is the start of a new trend. It is however, a good example of how outside forces can impact a housing market,” Balabanian said.

He anticipates that more government changes will be coming up in 2018 and is hoping that different levels of government co-ordinate their efforts to avoid a negative effect on the market.

http://www.timescolonist.com/business/incoming-mortgage-stress-tests-see-buyers-rush-to-make-deals-1.23111016

I did a quick look at the VREB sales statistics and it struck me that there seems to be a real divergence between condos and SFH. I might be reading the stats wrong, so I would ask someone here to take a closer look.

The inventory of active SFH seems to be greater this Nov than last. Total sales were up by 5% but units listed was up by 14%.

I assume he rents there?

Interesting. Not that there is anything wrong with investment properties but you have to wonder if it will reduce his motivation to do anything about property values

It’s intriguing to notice that several people who post here have noticed that it’s not possible to make money with a SFH as a rental. I guess that explains the number of people you hear proudly announcing that they bought a rental home as an “investment”.

A SFH rental is not an investment, it is a leveraged Hail Mary that home prices continue to increase faster than the rate of inflation.

It’s also possible that if a $900,000 property can be rented for only $2300 it is not actually worth $900,000 as a yield-bearing investment, it is worth $500,000. That observation brings us closer to the truth. And perhaps prophecy.

Not really how people work. Unless that retiree has no family or friends in Winnipeg they are staying there.

Anyway 90% of people who have spend their lives in Winnipeg can’t afford Victoria and haven’t been able to for 15 years.

http://thebreaker.news/news/mla-disclosures-2017/

Why does David Eby only have a home in Victoria when he lives and represents Vancouver – Point Grey?

https://www.scribd.com/document/365992701/EBY-2017

Looks like Weaver bought 2 investment properties in the past year

https://www.scribd.com/document/365992662/Weaver-2017

https://www.bcassessment.ca/Property/Info/QTAwMDBIUEgzUw==

https://www.bcassessment.ca/Property/Info/QTAwMDBITkYxMA==

I have to say I’m loving bcassesment to poke around neighborhoods and see lot sizes and details on homes.

LF, I agree. I would be the first to defend personal privacy, but several thousand TREB realtors already have access to this information. It is not like the cat isn’t out of the bag already. I would certainly support anonymizing the info as much as reasonably possible, without rendering it useless.

However, TREB’s arguments are so blatantly self-serving that it is embarrassing to watch.

Can anyone comment on the how this compares to the situation in BC?

Mortgage brokers are emailing all their clients about the upcoming stress test, basically saying buy now before you lose your buying power, so I think it’s had a huge effect.

I watch the monthly numbers for single family homes both in Vic and up island and the trend has been consistently downwards in both places, until in Oct when it spiked up, up island, which exactly coincides with the OFSI announcement and in Nov it spiked up in Vic. Do I think it’s related? Very likely yes.

An avalanche of retirees fearing a credit crunch coupled with anxiety of being priced out of their dream retirement destination. Rent out for many years in advance. Old people are highly risk averse, paying a hefty price when you can afford it is favorable to having to retire in Winnipeg.

The price to rental income only seems to make sense if you really expect house prices to continue a major climb.

487 Superior is also an active listing for $929,000.

Or when bitcoin crashes for real, or Trump is impeached, or N. Korea launches a rocket in the direction of Washington DC, or maybe just an old fashioned stock market crash.

None of which is going to happen. Keep the dream alive bears.

Other rentals managed by rental professionals, like 3910 Ansell and 4070 Copperridge Lane, are definitely not local buyers. You can call to find out who and why. I have friends in Calgary who bought a house here in 2015 for themselves, but they have to stay in Calgary for work (school teacher, hard to transfer to here) . So the house has been rented out until they move back in a couple of years.

“Maybe after the baby boo stops retiring and has mostly died out?”

Or when bitcoin crashes for real, or Trump is impeached, or N. Korea launches a rocket in the direction of Washington DC, or maybe just an old fashioned stock market crash.

Dipping a bit more (just a quick Google search of Ads phone numbers), at least three of them probably belong to investors:

209 Ontario and 487 Superior St belong to a person with a Saskatchewan phone number. Actually he has 3 victoria rentals posted with two of them fully furnished (airbnb converting to long term rental? ) https://www.usedvictoria.com/p/ktbhold

1613 Pear St belongs to a local investor who also renting out a bedroom in his own home: http://www.usedvictoria.com/p/Jbellows. The return is not bad for Pear St, as $2350 is only for 1200 sqft upstairs suite, not for the whole house

@Introvert The only trend I’ve noticed is that a lot of them say ‘recently renovated.’ I’d have to do more digging to see if they were reno’d before or after the sale.

@Just saying I agree. Are people assuming that values will continue rising therefore an $800k investment property is a smart idea? Or are these houses being used to park large sums of money? I really wonder.

“Does anyone find this info useful/interesting?”

I do – I also noticed that with even 20% down they don’t cover the costs to own. Maybe foreign buyers? Anyone else have any ideas?

If a house is being sold and immediately rented out, but the rent doesn’t appear to cover the carrying costs, it’s possible the buyer is hoping to sell the property in a few years to acquire capital gains. But in the intervening time, they have expensive carrying costs. It may be preferable for a buyer to have at least some of those costs mitigated, if the market cannot bear a rent that would cover all of it.

If they carry the title for 2 years and rent it for say, 3k/month they would be able to pull in about 72k, of which the after tax amount could go towards carrying costs. If they properly declare, of course.

If gains are extraordinarily aggressive and if you’re planning on selling again in a year or less (hardcore speculator), it’s likely easier to eat the carrying costs and leave it untenanted.

There are other more benign explanations for this behaviour (they plan on living in it later) but in either of the speculative scenarios, it’s a rather dangerous game that at least some of them are going to lose.

These places being bought and rented don’t appear to be able to support the payments and maintenance so why is this happening?

Off-topic, but interesting…

Scroll down and click on any MLA to see their 2017 annual conflict of interest disclosure summary (which lists things like what they own, what they’re invested in, whether they have a mortgage, etc.):

http://thebreaker.news/news/mla-disclosures-2017/

Yes.

It is a bit strange. Can you see any patterns of location, or other?

Condo averages down another $12K. That’s down $52K in last 2 months. Not surprising with the mostly below asking price sales and multiples of price slashes. Looks like the condo blimp has sprung a leak.

4070 Copperridge Lane sold Aug 2017 for $811k and now for rent for $2750.

Does anyone find this info useful/interesting? I can’t believe how many houses are being purchased and rented out.

5500 is pretty cheap but that house doesn’t have enough bedrooms. The neighborhood is a little trashy too I’m surprised about the pricing.

209 Ontario sold Aug 2017 for $700k and now up for rent for $2500.

3910 Ansell sold April 2017 for $880,800 and now for rent for $3000.

487 Superior St sold May 2017 for $855k and now for rent for $3000.

1613 Pear St sold Aug 2017 for $891k and now up for rent for $2350.

Note: These are just ads posted today.

402 Latoria sold June 2017 $835k and listed available for rent Nov 1 for $2300.

How many houses are being sold for the buyer to actually live in here?

For sure. Moonlight Lane is a super quiet little cul-de-sac with a great name. I’ve taken the pedestrian shortcut through there many a time.

All I can think of is that someone bought it in order to retire here in three or four years from now. You dont want to leave it empty for that long. A bad tenant could seriously trash a house like that.

Intro

Taking into account taxes that is a very low return

https://www.youtube.com/watch?v=5BfmyjNAEU0

Nice house

Who would rent a place like this?

“Toronto real estate board loses their appeal.”

Statements like that irk me because they’re such a large red herring it borders on out-and-out deception. They ‘believe’ it ‘strongly’ to the extent that it serves their actual interest here, which is to inhibit buyers from accessing data that would enable them to make an informed decision. If buyers had that data, they may be less inclined to act foolishly when buying a home, which would be a detriment to the realtor. Just stinks to high heaven. TREB don’t give two hoots and a hollar about your info otherwise.

Besides, it’s not about about “personal financial information”. What you paid for a house or got paid is so subject to external variables that the sales value is almost meaningless. No one knows what you make, how much debt you have, how much you sold your previous place for, how big or small your trust fund is, how many bankruptcies you have, what your Visa number is etc.

I hope that decision has national implications; informed consumers are a good thing IMO.

4409 Moonlight Lane sold Aug 2017 for $2.4mm now up for rent for $5500 a month.

Toronto real estate board loses their appeal. They have 60 days to appeal to supreme court, otherwise sales data can be published publicly in Toronto. I suspect they will try to appeal to drag this out even longer.

http://www.cbc.ca/news/business/treb-court-ruling-1.4428262

Parents helping their children, to what lengths? Delay their own retirement?

New census data on working seniors shows that in 2015, 53.5 per cent of men and almost 39 per cent of women who were 65 worked at some point in the year. Almost 30 per cent of senior men at age 70 said they worked in 2015, as did 17.1 per cent of women. Note the number probably includes people doing odd jobs like writing a to be published book or babysitting/petsitting or managing rentals or paper delivery or election polling station work.

Percentage of seniors (aged 65+) working (full or part time regular jobs) in Canada is about 20% in 2015, which is almost double that of 1995 (10.1%).

CS:

You are right about not yet. Maybe after the baby boo stops retiring and has mostly died out?

“A million dollars does not exactly buy you a luxury home in Oak Bay…”

Not yet.

Josh:

I only partially agree with you. I think you are correct about the changes having an impact on properties up to about 2 million but these days the luxury market seems to start at around 2 million and up. It would be interesting if we had actual statistics but I suspect that most purchases of over two million are for cash and the majority are out of town buyers. I dont believe that you will see any significant reduction of demand at the luxury market level.

A million dollars does not exactly buy you a luxury home in Oak Bay or for that matter Fairfield or James Bay these days. I am still trying to get my head around that fact.

“Parents should be allowed to use RRSP to assist children with home purchase: CREA”

The industry is scared shitless and desperate to keep the bloated pig alive as long as possible. Next thing you should be able to cash in your company pension plans to help out the poor kids who need to quit buying so the market will correct instead of being sitting duck for the crash.

Trump and his crew going down hard today is not going to help world markets going forward. Prepare for major volatility.

Josh, I agree with you, it’s not a reasonable assumption. (But one I’ve heard several times over)

“But I wonder how much the general buying public really knows about that. ”

If they don’t they should fire their agent and mortgage broker ASAP. Pretty obvious sales are up because of the race to beat the stress test. It’s been plastered all over the media.

Bull, that’s not how corrections work. Luxury will fall the hardest since so much of their value is speculative.

This is going to be a landmark case. If the TREB loses, we will see sales data published here soon as well: http://www.cbc.ca/news/business/treb-court-ruling-secret-mls-1.4382200

Good thing for everyone.

I can’t imagine that’s a policy that’d be implemented. That’s up there with the Aussie rules allowing FTB’s to raid their superannuation to buy a home, and it’s the opposite direction to which our leadership appears to be moving. CREA must be rather desperate to find new sources of funding to keep this going. I guess it’s not surprising, but still. Yikes.

Second the other posters who’d like to see a condo/SFH breakdown. At the moment the activity in Vancouver is being reported as almost entirely driven by condos.

Leo S. You were wondering how much the general public knows about the the looming stress test, and in our case we know quite a bit. We sold last May, and are still looking to purchase. We know our purchasing power will go down but we expect (hoping) the prices will as well. That being said, as soon as we find a suitable place, we will buy it. (Still need a place to live) We won’t panic buy, because homes are so expensive we need the right one. We ask realtors at open houses what they think will happen with prices when the stress test starts. The response has been similar, homes under $1,100,000 will go down (though nobody knows how much) and homes over that price of a $1,100,000 will not be affected. Not sure why the upper end that’s been slow anyway would keep value? Thoughts?

Parents should be allowed to use RRSP to assist children with home purchase: CREA

http://www.cp24.com/news/parents-should-be-allowed-to-use-rrsp-to-assist-children-with-home-purchase-crea-1.3702544

The equivalent for us would be Hawk, who has said “looks like the bubble is about to burst” almost daily for a period of years.

I also would love to see the breakdown between houses and condos. I suspect a lot of people house hunting would have been told about the mortgage changes by their real estate agent. Buy now because by January you wont be able to borrow enough to buy want you want.

I’d be very curious to see the split between SFH and Condo sales.