Rents launching upwards in Victoria

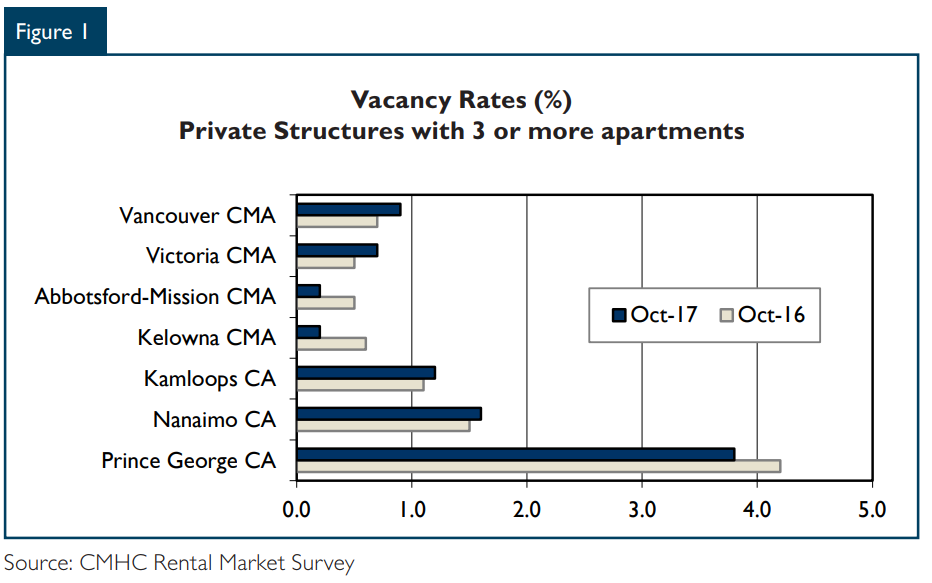

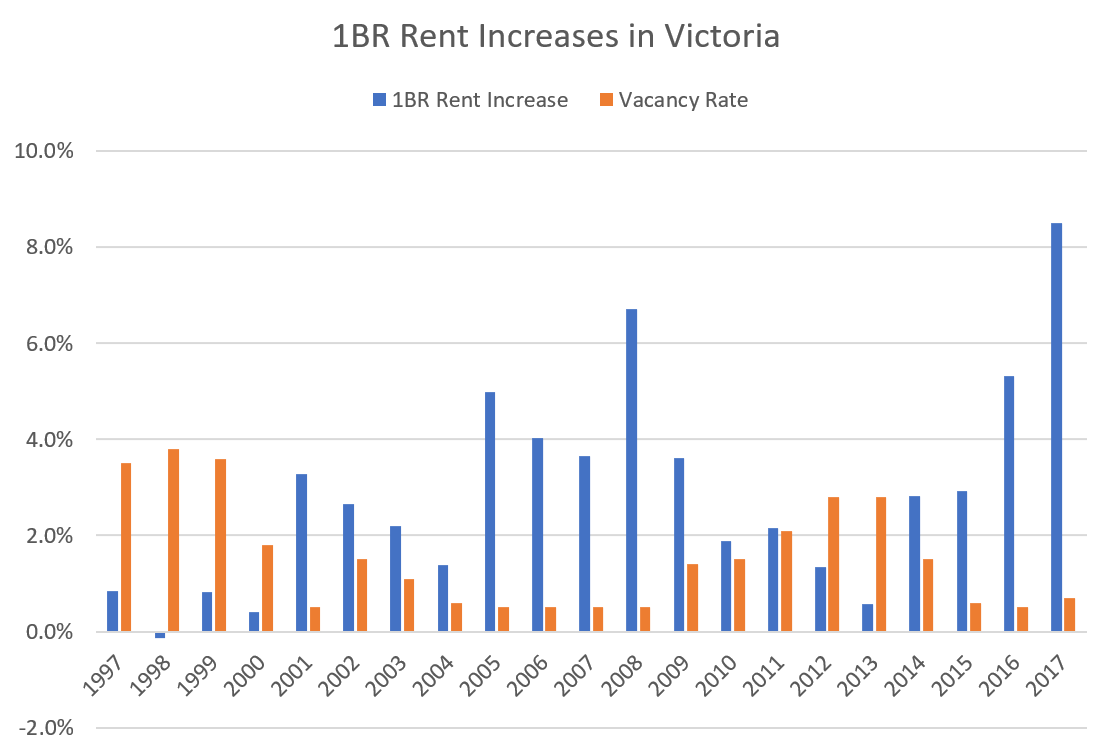

The CMHC has released their 2017 Rental Market Report for BC and Victoria. As expected, rents have been rising quickly in Victoria. After years of low vacancy rates, simple supply and demand dictates rents will rise, and rise quickly. Despite a small easing from last year, Victoria’s vacancy rate at 0.7% is still extremely tight.

Sure enough, rents increased by the largest percentage on record since 1989, a huge 8.9% increase in the last year.

The only good news on the horizon are the 1842 rental apartments that will be hitting the market in the next year or so. They won’t be cheap, but at least supply will increase.

Rents, unlike house prices, are not subject to distortion from the cost of credit or speculative mania so they represent a much better measure of the level of demand in a region than what we spend most of our time talking about here. There’s a reason that a 1 bed costs $3400/month in San Francisco. Therefore there is no doubt that demand is up in Victoria, even if the comparison to those other tech hubs are more than fanciful.

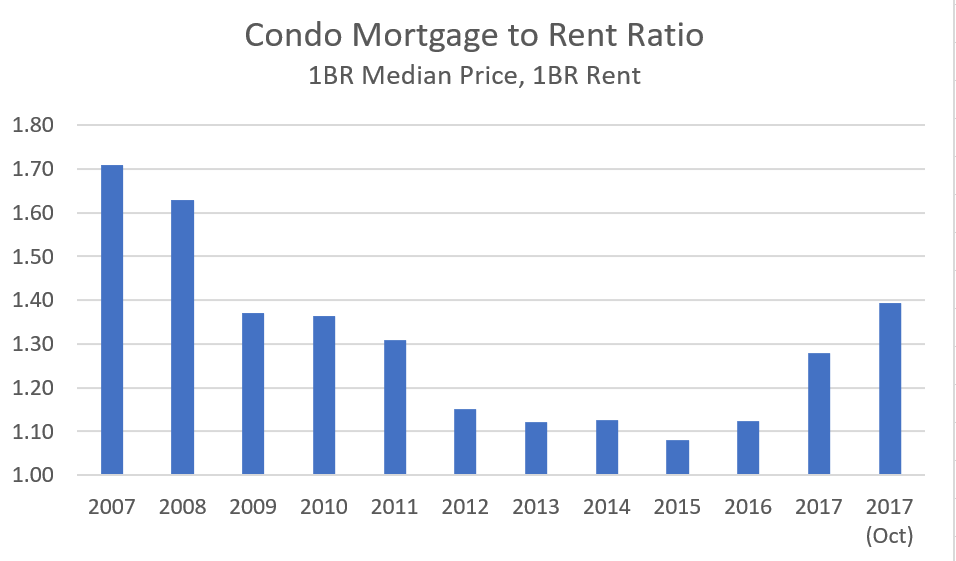

It makes sense to compare house prices to rents to get a sense of how far out of whack the apartments you rent from the bank are from the ones you rent from a landlord. Problem is the price/rent ratio that most analysts use is fundamentally flawed in that it doesn’t take into account the cost of credit. Comparing the cost of the mortgage to the cost of rent is much closer to how real people make decisions as to whether they will buy or not. Here is that ratio.

So recent condo price increases have pushed up the ratio of a typical condo payment to rent, but things were quite a bit worse back in 2007. Condo prices likely have some more room to run if interest rates stay low. However the stress test will impose effective higher rates at purchase so that could also put the brakes on things come January.

New post: https://househuntvictoria.ca/2017/12/01/november-the-market-picks-up-or-did-it

It seems like a lot of housing/rental prices correlates to unemployment. Today’s news is good:

November’s strong showing comes on the heels of a decent October, when the economy gained 35,000 jobs. Karl Schamotta, strategist at Cambridge Global Payments, said in a note to clients after the numbers came out that “this is the largest two-month gain in full-time employment since the early eighties (at least).”

http://www.cbc.ca/news/business/canada-jobs-economy-1.4427948

Lawrence Solomon, the most consistently provably wrong columnist I know of.

Opinion is right. Solomon cites minimal facts, or facts out of context and basically runs through a Gish gallop of anti-cycling memes. Meanwhile scientists are actually quantifying the issues he identifies and finding out that cycling is generally a positive – for instance – https://www.sciencedirect.com/science/article/pii/S0091743516000402

When you are ignorant on a subject – and most of us are by necessity relatively ignorant on a wide range of topics – the best bet is to believe the consensus of experts rather than some random reporter from the National Post.

For instance I have not personally researched the safety and efficacy of vaccines. I could search on the internet for opinions telling me that vaccines are a dangerous scourge, or I could listen to the overwhelming consensus of public health experts telling me that they are safe and efficacious.

A proper city core shouldn’t have cars at all. That article sounds like he wants highways and parking lots as a city core…. no thanks!

I was watching the late Christopher Hitchens take someone’s dearly held dogma, slice it, dice it and serve it with a dash of vitriol.

Have a look at the link. No matter how dearly one holds to one’s received opinions there is always someone as equally convinced on the other side of the spectrum.

http://business.financialpost.com/opinion/lawrence-solomon-ban-the-bike-how-cities-made-a-huge-mistake-in-promoting-cycling

Bill 16 seems to have a big loophole when a rental unit is subleased. For example, I’m a landlord, I sign a rental agreement with my son and then he immediately subleases the rental unit to a 3rd party and the sublease has a vacate clause. The 3rd party must vacate on the date in the sublease contract. I then have my son sublease it again to anyone for 15% higher rent.

The other loophole is I simply licence a tenant for a specified time, just like a hotel.

Just saw this on BBC. Interesting that Scotland just puts an end of the fixed-term rental.

http://www.bbc.com/news/uk-scotland-42179428

Meanwhile the guy on Richmond Rd got hosed for over $100K in 6 months. Not everyone is a winner.

Hawk I posted this one, we were considering the home but even less of an offer. The issue is they let it sit for a long time and apparently the owner picked up multiple properties so maybe they were reducing their exposure.

Honestly I dont see why they didnt pay a landscaper to fix it up and pay for staging. The place looked in distress as no one had been there in almost a year.

None of these things do anything for the current vacancy rate.

They will for the future, but that has nothing to do with the point I was making.

851 Sayward Road: $2,250K slash to $1,998K.

It last sold Nov 1, 2016$1,030K and has undergone extensive reno.

I don’t get the new changes to the tenancy act. A fixed tenancy agreement could totally be in the interest of both parties, if it meant that they wouldn’t be kicked out ahead of time due to use by the landlord. If they wanted to get around th rent control loophole, they could have just added a clause saying that if the tenant signed another agreement with the landlord the rent had to be equal to what was specified in the previous agreement. As it is it seems like they totally leave it up to the tenant, which is just kind of inconvenient.

The easiest way for a landlord is to join LandlordBC, to get the professional advice, and to avoid troubles and save money.

See their posting on the matter: https://www.landlordbc.ca/update-bill-16-legislation-restrict-use-fixed-term-tenancies-vacate-clause/

Note that I am not related with nor working for them, but was a member for a few years when helping friends’ rental.

@Caveat

Here is how I see it working: a landlord can enter into a tenancy agreement with a tenant on a fixed term. Once the agreement is signed, the landlord can immediately issue a 2 month notice to end tenancy with an effective date that coincides with the end of the fixed term, or try and get the tenant to agree to end the tenancy on that date pursuant to s. 44(1)(c)

Where the landlord would likely run afoul of s. 5, is if the landlord tried to include a mutual agreement to end tenancy as a condition or term of the tenancy agreement. That is, if the landlord tried to include a term that said something like “the landlord and tenant mutually agree the tenancy ends on XX date.” That would be tantamount to including a vacate clause in an agreement, so likely would count as contracting out. It could also be unconscionable. The mutual agreement would need to be a separate agreement signed after the tenancy agreement was in effect.

As for unscrupulous landlords using the mutual agreement as a way to get around rent control, the rent control provisions will now be tied to the unit, so that would only work if the landlord shuffled the tenant to another unit.

“4601 Cordova Bay Rd , Lot 2 slashed $60K to $1.88 million.

4601 Cordova Bay Rd , Lot 1 slashed $60K to $1.88 million.”

Correction, those are $1.18 million.

83 Saghalie Rd , #1904 in the Songhees slashed $44K to $799K.

2322 Beach Dr on slash #2 for a $95K loss @ $1.3 million.

4601 Cordova Bay Rd , Lot 2 slashed $60K to $1.88 million.

4601 Cordova Bay Rd , Lot 1 slashed $60K to $1.88 million. Guess the developers think it’s a gouge.

Vancouver developers fear ‘alarming’ land prices hinder profit

Vancouver developer and architect Michael Geller warns that land has been selling at such high prices that some condo developers – and new condo buyers – fear they won’t be able to profit on the final product.

When all soft costs, such as design and landscaping, city fees, community amenity contributions, legal fees, marketing and commissions are piled on, Geller said a developer would need to sell new condos at well above $1,400 per square just to achieve bank financing, let alone a profit.

There are now 30,000 strata units under construction and a total of 120,000 in various stages of the pipeline across Metro Vancouver, according to industry estimates.

Yet prices for residential land – much of which already has a building on it – continue to soar.

The question is whether the land costs that developers are willing to pay will match what future condo buyers are capable of buying.

Some buyers of newly completed condos are already re-selling their units for less than they paid at pre-sale during construction, Geller said, citing a new concrete tower in Burnaby’s Metrotown area as an example.

“The effects of speculation have caused significant consequences for housing in Vancouver, and has hindered many of our attempts to build affordable rental housing as the high cost of land make projects unviable,” said Gil Kelley, Vancouver’s general manager, planning, urban design and sustainability.

http://www.westerninvestor.com/news/british-columbia/vancouver-developers-fear-alarming-land-prices-hinder-profit-1.23109055

If any developers want to buy my 26,000 sq. ft. lot in Rockland let me know.

Literally speaking, no, it’s not low interest rates. Increases of that magnitude are a sign of speculative activity.

However, low rates provide a platform for enticing more market entrants, boosting demand beyond normal levels and creating a fertile environment for speculation to flourish. Speccers don’t care about rates as much as they do their ability to make money over and above the opportunity cost.

LF – thanks for the pointer. Since explicit reference is made in the legislation to “the landlord and tenant agree in writing to end the tenancy” and no limitation is placed on the timing of when that agreement is reached it seems like that is probably a legitimate way to set up a tenancy for a term. If an unscrupulous landlord used the “mutual agreement” to not actually end the tenancy but rather to extort a higher rent that would likely fall afoul of Section 5 – this Act cannot be avoided. so perhaps all is as it should be.

https://victoria.citified.ca/rentals/the-enclave-langford-peatt/

Combined that’s 215 new rental units available this Jan/Feb.

https://victoria.citified.ca/news/134-units-of-purpose-built-rentals-coming-soon-to-downtown-victorias-squeezed-housing-market-v-1488/

If any developers out there want to buy my 6900 sqft lot Fairfield house with an easy to demolish tiny house on it for $950,000 just let me know…

Meanwhile the guy on Richmond Rd got hosed for over $100K in 6 months. Not everyone is a winner.

Renting your basement to strangers can be very risky. Never know who they really are.

Billionaire got Canadian citizenship after renting a Montreal basement

https://www.thestar.com/news/paradise-papers/2017/11/30/billionaire-got-canadian-citizenship-after-renting-a-montreal-basement.html

Since there hasn’t been much in terms of actual apartments coming available (aside from the Hudson Walk, I can’t think of anything?) .

I believe the Enclave in Langford is almost complete. It’s a rental building.

2734 Roseberry Ave sold June 2017 for $670k. Reno’d and now up for rent for $2975. Is this an investment or speculation?

The number of recently sold houses that are listed for rent is shocking. What happens when the demand eases and these houses won’t rent for so much $$?

And this “norm” cannot even remotely adequately be explained by low interest rates.

yup, not a bad return at all in 26 months

》 There’s also 377 Sparton; sold in July 2015 for $685k. No work appears to have been done and it just sold for $1.015 M.

Yep, nutso or not, another example confirming my point: 40% (to 50%) increase over past 30 month is not special case, but the norm in our SFH market.

There’s also 377 Sparton; sold in July 2015 for $685k. No work appears to have been done and it just sold for $1.015 M.

Is “NeverEverLand’ers” the updated form of address for a RE bull?

Bears should have one too…nominations?

Having a hard time accepting reality is tough for NeverEverLand’ers stuck in their bubble world of always-right-no-matter=what arrogance.

Credit availability decreasing huge in last 6 months and continuing into 2018 with rising rates and 2% stress tests. Same stuff happened before US crash.

“The insolvency business is cyclical, and the last five-year peak was in 2009,” said Terrio. “We’re now into the eighth year of a 5-year cycle because of people’s equity in their homes and low interest rates.”

“I think 2018 is going to be a scary year,” said Douglas Hoyes, an insolvency trustee in Toronto.”

http://business.financialpost.com/real-estate/crunch-looms-as-house-correction-puts-some-canadians-under-water

Thanks, Mr Always-Wrong.

“The buildings were sold by HOOPP Realty, part of the Healthcare of Ontario Pension Plan”

The pension plan obviously knew when to sell at a clear market top to an insurance company who needs to prop up their share price and can hedge their portfolio.

No sales in last 6 days of 2 bed 2 bath condos under $500K. Most of last dozen sales went under ask. Smells like the condo bubble popping.

Isn’t Fortress doing the financing at one of the new condo projects ?

https://fortressrealdevelopments.com/projects/victoria-medical/

“Rents, unlike house prices, are not subject to distortion from the cost of credit or speculative mania so they represent a much better measure of the level of demand in a region than what we spend most of our time talking about here. ”

Total crap. It’s a better measure of the level of demand compared to supply maybe? When you have a ton of houses that are vacant according to the census (various parts of Gordon head are over 10%), while at the same time a bunch have been sold to foreigners (almost 20% of sales in January in Saanich were to foreigners), it could easily mean people getting kicked out of their rentals, and having less places to rent, certainly less affordable ones. You could easily have less demand than last year, but so long as the number of rentals available have dropped more than demand, prices would tend to increase. Based on the vacancy rate increasing, wouldn’t that actually mean it’s more likely that demand has dropped? Since there hasn’t been much in terms of actual apartments coming available (aside from the Hudson Walk, I can’t think of anything?) .

65 Sims Ave – raising it up $20k

Caveat,

For option 3, sections 5(1),(2) & 44 (1)(c) of the RTA may be instructive.

http://www.bclaws.ca/civix/document/id/complete/statreg/02078_01#section5

Rental question.

Fixed term leases with move out clauses are dead and no tears shed.

Let’s say I want to rent out my basement suite from now until the end of May and after that we need the space so that in-laws and other relatives can come stay with us over the summer. Let’s further assume I find a renter who wants a place for that period of time.

I can’t sign a fixed term lease with move out clause.

My options are:

1) Sign a month to month agreement and just count on the tenants moving out when we agreed.

2) Sign a month to month agreement and then two months before move out date serve them notice ending tenancy for landlords use of property – https://www2.gov.bc.ca/gov/content/housing-tenancy/residential-tenancies/ending-a-tenancy/landlord-notice/two-month-notice. This requires me to give them a month of free rent as compensation which is not ideal.

3) At the same time as tenant and I sign rental agreement we could sign a mutual agreement to end tenancy dated to the end of our agreed term (end of May) – https://www2.gov.bc.ca/assets/gov/housing-and-tenancy/residential-tenancies/forms/rtb8.pdf.

Is option #3 legal?

I don’t see anything indicating it isn’t legal. But I could see this being abused by unscrupulous landlords who don’t actually want to end the tenancy but who still want to have the tenants over a barrel at the end of the term.

Just noticed on Assessment that 945 Runnymead Pl sold for $1.3m in Oct. 2016. So, with the current list price of $1.438k they’re trying to make a profit of around $8k a month after costs. Looks like it’s in a good location w/ adequate sized lot of almost 10,000 sq ft as well as extensive landscaping.

Quite true Introvert re. location of dumps like Hampshire, location was about the only thing going for it, the backyard was tiny and east facing. Also, we are still only around 1/3 Vancouver westside prices in OB.

Next week when Vancouver council votes on their ten year plan could be very telling for Van prices esp. if they ban ‘non resident’ owners (though Province would have to approve that and Province has said they weren’t going there). Wednesday we will see what happens there.

You know what sales like these are reminiscent of? Vancouver.

Horrible, tiny, run-down, stinky places that sell for exorbitant prices only due to land value (location).

I went to the open house at. 2319 Dalhousie which was right on the corner of busy Cadboro Bay Rd. I think they overpaid. It was very loud inside from traffic noise due to single pane windows. Reno wasn’t impressive – all they did was paint the kitchen cabinets. Old furnace. Wet damp basement. Lots of wood rot. Drainage issues. Crappy parking. It goes on and on. Hopefully they’re happy with that. I bet the sellers are celebrating!

Another shocker is recent sale of 943 Hampshire for $1.2m. Awful! The tiny suite was hokey pockey with no heat. no way you could insure this place. Hodge podge Reno upstairs half old half crappy 90s new. Most ridiculous plumbing contraptions I’d ever seen in basement, and yes folks- sump pump!!! Don’t forget the prominent ‘old house’ stink! Small lot. More happy sellers.

A rare quality listing popped up today though. Looks good in the pictures anyway. 945 Runnymead for $1.438k.

My point about 2319 Dalhousie (bought $760K in 2015+major reno$$$K, sold $1.21M now, note it has even dropped list price once before sold): it is not a special case to be surprised at all, as over 40% gain over past 30 months is the norm in our SFH housing market, especially in desirable hoods.

High-profile office properties sell for $131.5M

Michael Miller, senior vice-president in the Victoria office of Colliers International, was part of the listing team. He said “it’s certainly the largest sale ever in our office” and believes it could be the largest office transaction in Victoria’s history.

…

“Victoria is really on everyone’s radar screen, not just locally, but regionally, nationally and to some lesser degree internationally,” Miller said. “I think Victoria has come of age.”

Relatively speaking, Victoria is still a bargain on the world stage, he said.

http://www.timescolonist.com/business/high-profile-office-properties-sell-for-131-5m-1.23108596

If one can pay off the mortgage, owning in Victoria has historically been an excellent financial decision.

If one is taking on significant debt beyond the mortgage (e.g., line of credit, HELOC), then one is not likely to pay off the mortgage, in which case owning offers few advantages.

Thanks for reposting LeoM. I posted at the end of the last thread and I think the seriousness was missed. As suspected the HELOC’s are just covering the coming pain.

Back to the syndicated mortgages I posted on months back no one wanted to talk about looks like it’s about to open a massive can of scam. We’re no better than the US in The Big Short and will soon come home to roost.

How many got scammed in BC ?

Special Report: Canada regulator ignored warnings on risky mortgage investments

“Compliance officers at the Financial Services Commission of Ontario (FSCO) had evidence that syndicated mortgages were being marketed and sold in ways that broke the law, putting the savings of thousands of Canadian mom-and-pop investors in danger. (Graphic: Hot property – tmsnrt.rs/2AGYA8n)

Brokers affiliated with Fortress, the compliance officers had found, were telling clients they could put their investments in retirement savings accounts administered by a trust company not licensed to do business in Ontario, according to three people with direct knowledge of the matter and internal FSCO documents reviewed by Reuters. The activity, the team determined, was a breach of provincial law – by brokers for recommending Olympia Trust Co, and by Olympia for operating without an Ontario license.

The compliance officers sent their findings to FSCO investigators and later recommended that Olympia be ordered to stop operating in Canada’s most populous province, according to the sources and documents.

FSCO’s investigators did nothing. Their boss, Executive Director for Licensing and Market Conduct Anatol Monid, decided in May 2015 that there was not enough evidence to proceed, the documents show.

That decision was part of a larger, more troubling pattern: From 2011 to 2015, Reuters has found, senior FSCO investigators rejected or ignored compliance officers’ multiple recommendations that the agency investigate or take action to rein in the marketing and sales of Fortress syndicated mortgages.

Since then, growing investor outcry about the products has focused public and government attention on FSCO’s lax regulation of the market. In the past decade, more than 20,000 retail investors have put as much as C$1.5 billion (US$1.17 billion) into syndicated mortgages, mostly in Ontario, according to regulatory sources. Roughly 90 percent of those investments, the sources said, have ended in a loss or are at risk of doing so, and Fortress projects make up more than half of the investments.

The documents seen by Reuters, supported by interviews with 10 sources familiar with FSCO’s activities, show that the agency didn’t merely miss the problem; its senior investigators ignored or downplayed clear warnings from within their own ranks that retail investors were being sucked into a market to which they were ill-suited.

As yield-hungry savers were pouring their money into the investments to profit from Ontario’s red-hot real estate market, FSCO compliance staff opened at least 17 Fortress-related investigations, according to the sources and internal FSCO documents.

In at least 10 of those cases, FSCO staff found possible breaches of Ontario law that they felt warranted action. The breaches included misleading marketing, selling products unsuited to clients’ risk tolerance, and failure to disclose the risks and costs of the investments, among other infractions. And in all but one case, FSCO’s investigators either overruled or ignored the recommendations.

Why the FSCO investigation team repeatedly declined to pursue recommended investigations isn’t clear. Current and former FSCO staff said the investigators, most of them former police officers, lacked the required skills and knowledge and were discouraged by senior regulators from pursuing complex cases.”

https://www.reuters.com/article/us-canada-mortgages-regulator-specialrep/special-report-canada-regulator-ignored-warnings-on-risky-mortgage-investments-idUSKBN1DU1YP

http://fingfx.thomsonreuters.com/gfx/rngs/CANADA-MORTGAGES-REGULATION/010051YB4E2/index.html

Yep. And it’s a horrible way to live. To think that some people will be facing this strangulation over the next few decades defies imagination. All for a house. It’s just a house, folks. Owning has many advantages, but not if it’s your debt prison. I’m not sure anything is worth that…

What happens if you walk away from your mortgage?

https://www.bnn.ca/video/what-happens-if-you-walk-away-from-your-mortgage~1272809

Looks like thousands of homeowners are just barely avoiding bankruptcy.

A few interesting points in this interview; for example: bankruptcies are down only because people have used their line of credit to cover huge debt loads.

I do think that Victoria was pretty good value back in 2012/2013/2014. Obviously that is true looking back, but looking at things like the price/rent above, and the affordability for SFH, it was back down to levels where historically the market would pick up again.

Right, missed that from the quick glance at the description. Still, nutso.

Sure, so do lots of us if we sell today, comparing to our houses’ value in 2015.

Good point Freedom. Maybe they only made $8k-$10k a month 🙂

Note this house seems to have some major reno done since 2015. See my post below.

Nothing better explains a house going from $760k to $1.21M in 2.5 years like low interest rates!

I’m sure the buyers were pleased with the low rate they got on a five-year fixed term on their $1.1M mortgage.

Re 2319 Dalhousie: Looks like there are some work, especially the new basement and the new kitchen, have been done there (see pictures in 2015 sale and recent sale in the links below).

With cost of major reno and the full agent commission they need to pay, the gain is good, but not as big as you think.

2015: http://www.victorialistings.com/property-details/347122

2017: http://uplist.ca/h/JulieRust-2319-Dalhousie-St

Strawman argument. I don’t think there’s anyone, having regard to the facts, that would conclude no money is coming into Victoria. That’s quantifiably false and paints the debate in a simplistic manner. The actual argument is more nuanced and debatable, which is how much money, how much effect, and how permanent. I suspect the people in the low rates camp know there’s always been money coming in, but feel that the low rates provide a better explanation for many of the market dynamics that we’re seeing.

Invalid – I’m sure it doesn’t. I’m a bit of an inv…ah crap. Got me. 😛

I don’t think invalid means what you think it does.

I read your comment to a friend of mine and he laughed for about a minute straight. Very funny!

There are only two possibilities I can see, which I know isn’t saying much. Anyways.

Speculation. That includes “Vancouver refugees”. Just because they’re flush with bubble cash it doesn’t mean they’d want to blow it all – unless you are a complete invalid, you’d only overpay that dramatically if you think, “it doesn’t matter, it will be worth more tomorrow”. Meanwhile the locals think: Infinite Chinese cash to Van —->Infinite refugees to Victoria —-> Chinese “discover” Victoria——> Victoria is the next Van = prices that go up forever. Pay a price – any price, to get in. 15k per month gain? Check…sigh.

The second possibility is that Victoria was dramatically undervalued. Of course, that gets more nebulous because you’re trying to compare an ethereal “intrinsic” value with market value. But there are some proxy measures you can use to determine whether prices are getting ahead of the economy’s ability to support them – one of them is the measurement LeoS laid out in this update. Of course that only refers to condos, I don’t know what the ratios are for SFH’s. But I would suspect they’d tell us that story.

Personally, I don’t think it’s even a question that speculative activity sitting atop low rates is the primary culprit though some may disagree. But if it is, expecting a speculative price to hold up in perpetuity would be like expecting Bitcoin to be the next New Paradigm™.

As an aside, the curious dynamic of poor old Bitcoin is that it was designed to be used as an alternative currency and instead, it’s being exploited as a means to generate it. As an aside of an aside, anyone see a similarity in graphs depicting Bitcoin’s ascent, and Vancouver RE?

@Leo S It’s unreal. I guess everyone that missed out on real estate is jumping on the bitcoin bandwagon.

My opinion – Rental increases are the result of very low vacancy caused by so many houses being sold and re-rented for ridiculous prices to pay for massive mortgages. Case in point:

1. 2953 Charlotte Dr sold Sep 2017 for $595k and listed for rent Nov 28 for $1800 (main house)

2. 544 Delora Dr sold July 2017 for $770k and listed for rent Nov 28 for $2100

3. 2667 Crystalview Dr sold Oct 2017 for $800k and listed for rent Nov 26 for $2200 (main house).

And that’s just browsing 3 days of ads on one site friends.

Barrister, there is no money flowing into Victoria. The only explanation for sales like this is low interest rates. That’s the conclusion (almost) everyone has drawn, so it must be true.

@Rover – thanks. And wow, 60% increase in 2.5 years.

Or in other words, it appreciated $15,000 every single month from April 2015 to now.

Who here makes $15,000 per month? Ridiculous.

Edit: That’s $15,000 tax free

And 2319 Dalhousie previously sold June 2015 for $760k.

Thanks for all the great info on this site Leo! I really enjoy and appreciate reading everyone’s feedback.

A million dollars does not seem to buy very much anymore. Makes me wonder were all the money is coming from these days.

@Ask Why $1.21M

What was the sell price for 2319 Dalhousie?

Except at the end of all this bitcoin investors won’t be able to enjoy some nice flowers

You are right Barrister, buying in 2014 would be better than renting, but only if they have enough savings for a down payment. Renters all have different reasons to be renters, and some of them just don’t have the means to get a mortgage or no money for a down payment. Tell a person who lives from one pay check to another to buy Apple stock? What a kindness.

(From the previous thread:)

Halifax may have good investment potential, but I wouldn’t want to live there:

Source: https://www.weatherstats.ca/

Interesting comments from a short seller of Royal Bank and CIBC. Of his survey of 140 mortgage brokers across the country, 75% of them say credit availability has “decreased significantly the past 6 months”. Another big step down is expected with the OSFI stress rules.

Also the banks accounting rules are changing in the new year as they are pricing projected loan losses to a more than generous level. When you’re priced to perfection the hits could be huge when things turn in the housing market.

https://www.bnn.ca/short-seller-takes-aim-at-rbc-cibc-1.928053

Most average 2 bed apartments are still in the $1600 to $1700 range they were a year ago. It’s the new condo landlords or reno’d basement suite the new property kings need to jack them up higher to pay their mortgage costs. I would be surprised if many aren’t negotiating them down from $1900 for a closet. That’s a total rip.

Now bitcoin is a true parallel to tulips….

you really don’t want to be the last to go all in on bitcoin. But congrats to anyone who has made a killing on it

I see a lot of lights out at the Janion these days at prime times. Maybe 2 or 3 are on. I bet many wannabe AirNB kings are feeling the winter blues as the tourist season dies. How can you plan to have life down there when no one is there? But those poor families who bought one to pay the monthly bills…. so sad.

bitcoin is pure casino gambling. There is nothing at the end of the coin. You are paying for nothing.

The governments will eventually shut this down since it bypasses all of Fintrac/Fincen reporting. If they do start the reporting the thing will nosedive.

Bitcoin could easily go higher, much higher. Only a tiny fraction of people are invested in Bitcoin. What’s stopping it from another tenfold increase?

^Not a prediction

Indeed. It’s in free fall right now, last I checked it’s down from $11370 to ~$9300 last few hours (~18%). My bet is it rises back to ~10k level, but prints something similar to a gravestone doji today.

https://www.cryptocoinsnews.com/bitcoin-price-flash-crashes-10075-market-goes-berserk/

“This sell order caused the bitcoin price careen down to $10,075, representing a decline of $1,324 — or 12 percent of bitcoin’s total value — in just four minutes.”

http://vancouverisland.ctvnews.ca/average-rent-in-greater-victoria-sees-biggest-increase-in-26-years-report-1.3697977

172 comments so far on Reddit about this article… I don’t normally post Reddit threads here but this is related to the topic… appears there’s lots of frustrated renters out there…

https://www.reddit.com/r/VictoriaBC/comments/7g7y5e/average_rent_in_greater_victoria_sees_biggest/?sort=new

I believe there are so many places being rented out on Air B&B that the new restrictive rules will release quite allot of rentals onto the market. That and the new rental construction could stabilise or bring the rental costs down very quickly. People are relying on rent to cover their mortgages/costs and they may be willing to take less in rent rather than have their places empty.

I would be very interested to see the difference in vacancy rates between periods when students are in town and when go home in the summer. The restrictions in renting places out for vacationers in the summer months could mean that landlords will consider longer leases for permanent residents. I guess this would make it harder for students to rent. Bring on the new student accommodation on campus.

The bitcoin bubble is interesting to watch. This is really where Hawk’s chart applies. Instead of scaring people off, all the articles about how it’s a bubble served to attract retail investors to the currency. Now it’s above $11,000, up 10x since april.

http://www.cbc.ca/news/business/bitcoin-surge-1.4424509

Josh:

Had you bought a condo in 2014 would you have been better or worse off financially? I have not done the numbers but I suspect that you might have.

If you and a friend bought a 600k house in the Uplands together in 2014 and both lived in it you would have made about 600k each. On the other hand if you bought Apple stock when it first hit the market you would be living in Malibu. I really wish my wife was not using my crystal ball for a paperweight.

Actually, there is a strong argument to be made that you are ahead by renting rather than buying a condo.

“Comparing the cost of the mortgage to the cost of rent is much closer to how real people make decisions as to whether they will buy or not.”

Amen. That’s how I’m making my decision, but evidently a lot of people aren’t, otherwise sales wouldn’t be so high right now. I’m just glad I got into the rental market in 2014. The landlords have been raising rent the maximum legal amount for the last 3 years but I’m still paying roughly 3/4 what people in Langford are paying and I’m in James Bay.