Affordability (Part 1)

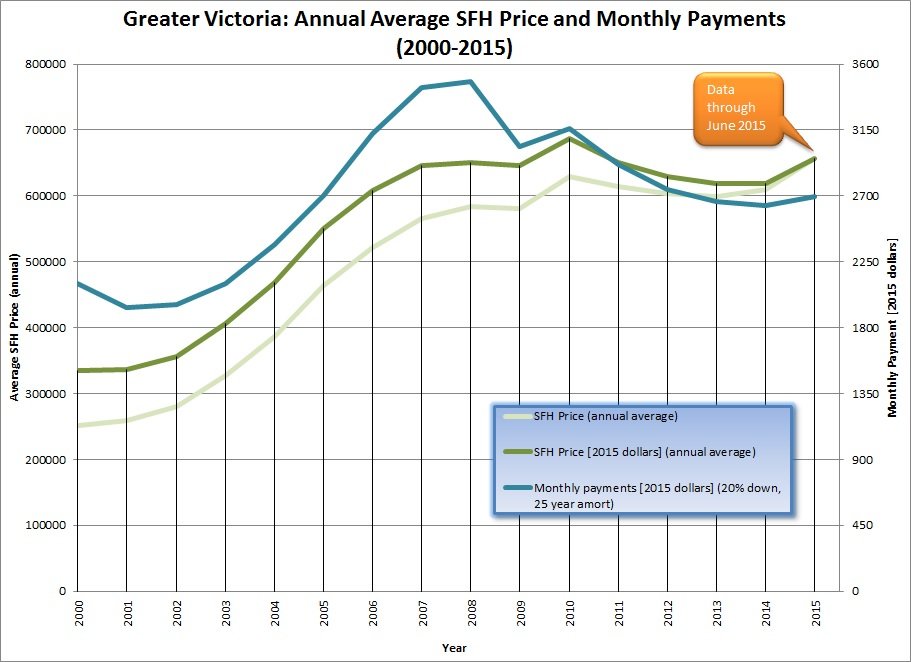

There are many ways of defining affordability, but in a practical sense – most people who have a mortgage are limited by how much money they can afford spend each month. From that point of view, I thought that it would be interesting to analyze Victoria housing prices and the corresponding expected monthly payment for an average-priced house.

A previous poll showed that HHV readers equally prefer a fixed versus variable rate mortgage. The 2015 Spring Mortgage Report from CAAMP shows that 72% of Canadians prefer at fixed-rate mortgage. With this in mind, I updated the detailed data set compiled by Leo (HHV’s previous administrator) to determine for Greater Victoria between the years of 2000 and 2015:

- Single Family Home Price (annual average)

- Single Family Home Price [2015 dollars] (annual average)

- Monthly payments [2015 dollars] (20% down-payment, 25-year amortization)

The monthly payments are calculated based on the prevailing average 5-year fixed mortgage rate published through Statistics Canada (CANSIM v122497).

In terms of the monthly payment required a purchase in 2008 was the most expensive year to buy. Since then, the least expensive year to buy was 2014. However, in the past six months prices have been surging up and even with astonishingly low rates, the corresponding monthly payment has increased from $2631.89 (2014) to $2693.95 (June 2015). That $62/month increase may not seem like much, but after 25 years it adds up to $18,600.

In terms of the monthly payment required a purchase in 2008 was the most expensive year to buy. Since then, the least expensive year to buy was 2014. However, in the past six months prices have been surging up and even with astonishingly low rates, the corresponding monthly payment has increased from $2631.89 (2014) to $2693.95 (June 2015). That $62/month increase may not seem like much, but after 25 years it adds up to $18,600.

[By the time you read this post, I’ll be away on a cruise to Alaska for a week – so this will be the only blog topic until I return. If anyone is interested in writing a future blog post, please let me know via the contact page.]

[…] rates introduced in response to the Great Recession may have changed the narrative. As shown in my Affordability (Part 1) blog post, the monthly payment required to buy an average SFH in Victoria peaked in 2008. Does this […]

It’s not just the Boomers… There are many of us Gen-X’ers who bought condos between pre -2008, who have seen some nice price increases (200-400%). Many of my cohorts don’t think that a “trade-up” to an 800K 1100sf townhouse is a good move, can’t afford 1.4 million for a shack, don’t want to commute 2-3 hours a day from Maple Ridge and find the Sunshine Coast “a little too quiet”.

We’re the ones eyeballing the 600K houses in Victoria. With a 25-50% downpayment, and maybe even a suite to make a little money on until mom needs to be moved closer, BC Ferry rates don’t even seem so bad 😉

Thanks DavidL…. Seems pretty high once you add taxes, all the appliances, window coverings and a fireplace (if you wanted one)

Thread drift alert:

Could someone recommend a Victoria law firm which has experience of handling a real estate transaction where the vendor is a non-resident Canadian? There are some tax issues which are straight forward but someone with familiarity would be preferred.

Internet creep—that made me laugh so hard!

924 Snowdrop Ave (MLS: 353347) is listed on 2015/08/14 as a pending sale for $639,000 – $30,000 less than asking price.

Here ya go: http://www.fmreb.com/sites/5098200ae7e1b41bc50042de/content_entry50bf9565e7e1b41bc501133d/55d23d8b5918ad74850000c2/files/July_2015.pdf?1439841788

For year over year SFH’s, the number of sales are down 41% and new listings are down 35% for July 2015 in Fort McMurray. The median and average are about the same as July 2014 – but the incredibly low volume may be skewing these results.

Can you find me Alberta and Fort Mac?

Edmonton up 3.19% y-o-y (all-residential median).

http://www.ereb.com/News&Events/LatestMarketStatistics.html

Calgary up 2.35% y-o-y

http://www.creb.com/Buyer_Resources/Housing_Statistics/

They were posted the same day as Victoria numbers (Aug 4th?).

Can I get a price on 924 Snowdrop ave?

Internet creep! Yep, mother in law is retired and volunteers for the greens.

July – a month that does not seem to exist for the Alberta real estate board. It’s the middle of August and still no stats for July in Alberta.

-How bad can it really be?

I see that Leo S has a nice Elizabeth May lawn sign up and mine, they tell me, is on its way.

Mon, Aug 17, 2015 8:00am:

Aug Aug

2015 2014

Net Unconditional Sales: 375 609

New Listings: 484 904

Active Listings: 3,753 4,316

Please Note

Left Column: stats for the entire month from this year

Right Column: stats for the entire month from last year

His chances of getting elected just went down. At 70% ownership there is a majority that don’t want this “bubble” to burst. Harper knows what bribes to put on the table…. I’ll probably vote liberal as a protest/pro legalization vote…

As per Garth Turner’s column today, his mention of Tom Mulcair’s opinion on the real estate scene was most interesting :

“There could be a bubble created there, and we could be in for a terrible surprise.”

““Right now there is a serious danger. I think that (in) some cities the prices are too high,”

Positive to hear from the potential new Prime Minister of Canada. At least he’s honest and that has my vote.

http://www.bnn.ca/News/2015/8/14/NDP-leader-Mulcair-sees-serious-danger-in-Canadas-housing-market.aspx

Thinking of moving up the property ladder? And can’t decide if it is better to buy first then sell the family home or sell then buy?

It really depends on if it you’re in a sellers or buyers market. The market for houses in the core districts is heavily in favor of sellers. If you are seller in this market it would be better to buy the home first and sell yours later. The odds of being stuck with two homes and paying for bridge financing for two properties is then low. Or worse – you end up owning two properties and becoming a reluctant landlord.

In contrast, if you’re in a market that favors buyers such as acreage in the Western Communities then you should sell your acreage first then buy a home.

This might also be an example where your interest may not be the same as some sales persons. it is easier on the sales person to have a “motivated” seller. Selling your home first certainly motivates you to buy the next home quickly.

I suppose if you looked at the number of brokers per capita relative to the price to income ratio of each city that might be reflective of soft fraud?

The mortgage fraud story continues. Tell me that Vancouver and Victoria could be immune to this fraud, you’d have to be naive to think this is just Toronto related. As Jack mentioned, we won’t know the true number until the market corrects. Have to think with all these private lenders doubling their mortgage numbers that there are many who got turned down from conventional sources.

http://www.theglobeandmail.com/report-on-business/equitable-group-combing-through-mortgage-loans-for-possible-fraud-link/article25968903/

“white flight”? I thought you were pounding the Asian drums Michael ? What’a next ? French Canadian flight?

“Probably” just some Vancouver people who bought two years ago and didn’t like it. Assuming they bought in 99 is pretty lame assumptions for an agent make. I would expect more professionalism from my agent than making up hypothetical stories to pad the sales hype.

I wouldn’t get excited til hundreds of Vancouver buyers are buying $600,000 houses. That would mean a true exodus,not a few wealthy buying a summer home.

Or everywhere could be overpriced.

+1 …and I think the trend has only just begun… millions of big-city boomers starting to retire, some “white flight” to our predominately white core, our cheapened currency, accelerating economy, and more foreign money discovering what Vic has to offer.

Now long-time Vic residents can follow their dream to retire to Nanaimo and sock away a hundred thousand 😉

Out of town buyers will tend to spend 2 to 3 percent over that of a local buyer on a standard home. Mostly because standard homes are reasonably priced from the start by the sales persons. Where out of town buyers lose big time is when they buy acreage or waterfront. They just haven’t a clue about local values.

I’m glad they’re spending their money here as it allows one more Victorian to retire to Qualicum Beach and put a million dollars in their bank account up there.

A lot of sales being reported with “buyer city,” as Vancouver; a lot more than I’ve seen in previous years. In last hour 1.1 mill and 2.0 mill properties in Gordon Head both to Vancouver buyers.

Probably a few of these buyers are those that purchased in Vancouver in 1999 for $600,000 – cashing out for 2 to 3 million and retiring here with a million in the bank.

Several of the Chartered Banks consider the problem of soft fraud so wide spread in the industry that they have stopped buying mortgages from brokers. It seems to be a “crime” without a victim. Except it causes home prices to increase because of increased competition.

We will not know the extent of the soft fraud problem until there is a market correction. But my guess is that the problem is be bigger than that of the USA.. If a Canadian bank says it is willing to turn business away because of questionable broker’s applications – how bad is it? Really bad.

No, we are not overpriced compared with Manaus Brazil at 25:1 (Numbeo.com link you provided).

LOL.

What is the home ownership rate in Manaus Brazil? And if, say, only one Manaus family in ten can afford to own a house, what is the relevance of average price to income ratio? Virtually none.

And how would folks in Victoria cope (home ownership rate of ca 65%) with a price to income ration of 25? It would mean $500K down and a mortgage of $2 million at 3.75%, or monthly payments of $6250 per month, or around 100% of average family after tax income.

So Victoria could be overpriced at a far lower price to income ratio than in the places with which it might be compared — and that would include many places in the US, depending on ownership rates and the specifications of the average home.

We are not over priced.

Victoria Ranks #72 in the Americas in terms of price to income ratio

http://www.numbeo.com/property-investment/region_rankings.jsp?title=2015-mid®ion=019

You could technically move to Havana if you trust the medical care there.

the problem with affordability indices is that they cannot take into account the future, which means that, whatever the measure used, what looks affordable today may not be affordable tomorrow. Or conversely, what looks barely affordable today may look cheap tomorrow, although under present circumstances such an outcome is difficult to envisage.

BTW, keep the YouTube’s coming Jack.

https://www.youtube.com/watch?v=dQEIYjS1ePY

Interesting interview on BNN on mortgage fraud and how the private lenders are increasing with limited verification of income. When prices correct those who chose these low end lenders could wind up in a tough spot, especially when listings eventually begin to increase.

http://www.bnn.ca/Video/player.aspx?vid=677745

Anyone else getting the impression that Just Jack likes YouTube?

That’s what people said about Regan. He was just a B list movie star out there for attention too.

An economic indicator that we have neglected to discuss is expired listings.

Properties that have been exposed to the market and may have had several price reductions before the owner pulls their home off the market. It’s kind of a different way of looking at the price a vendor puts on their property

In general, the ratio of expired listings to active listings is the lowest when prices are increasing. The rate dropped from 8 percent in January down to 3.5% in April and May.

Month-Expired-Active

Jan 40 493

Feb 28 567

Mar 29 626

Apr 25 706

May 25 715

Jun 42 691

Jul 41 659

Medians

Month-List Price-Sale Price

Jan $615,000 $542,500

Feb $652,500 $597,500

Mar $677,000 $625,000

Apr $649,000 $631,200

May $649,000 $620,250

Jun $649,000 $629,900

Jul $659,000 $611,000

That ratio seems to be increasing once more as the last two months of June and July were both around 6%

December 2014 we ended the year with 86 sold houses in the core at a median Sales to Assessment ratio of 104%. Last month our median Sales to Assessment Ratio was 111%. If you want to make a 10 percent year over year increase by December then the spread between the two years will have to increase another 3 or 4 percent over the next few months. Although I see the rate of prices decreasing it’s very possible to achieve a 10 percent year over year appreciation by Christmas. But like I said our prices were drifting downwards in the back of half of 2014.

The median price of a house in the core last December was $561,250, A 10 percent year over year increase would put us at $617,500. Which is just a smidge above last months median at $611,000 when we had 202 house sales.

Put it another way all we have to do to make a 10 percent yoy in December is not to have prices decline for houses in the core districts.

I differ with you and I think Greece, China, low oil and the parties of Prince John, Tweedle dee and Tweedle dum have and will have an effect on the market.

https://youtu.be/8DCneMP6YRM

I’m more surprised that prices haven’t increased a lot more given the short supply.

When you plot the frequency of sales by price range, the mode hasn’t changed much for houses in the core over the last five years. The difference this year from last year has been an increase in the number of sales in the $600,000 to $800,000 range with a slight decrease in the range of what would be first time house buyers.

This decrease in sales of first time house buyers is reversed as an increase in condo sales in that same price range. That’s a significant change in buyers preferences. But what does that mean?

A similar increase has happened in Langford and Colwood in the $500,000 to $600,000 range for houses.

This is likely skewing both the averages and medians leading to a slight over estimation of price increases.

Another problem is that at this time last year our prices were softening. That makes any year over year calculation of price increases larger in absolute terms.

Oak Bay is different too. You can see the effect of out of town buyers in this market because Oak Bay is the only graph with three pronounced modes. One at around $625,000 (that’s the locals) another smaller one at $1,250,000 ( lots of Vancouver and Alberta buyers) and the last at $1,500,000 ( Probably just buyers who got lost getting off the ferry).

Oak Bay doesn’t have a significant impact on our market because including or excluding it from any calculation doesn’t significantly effect the outcomes.

JJ – there are about 7000 bankruptcies filed each year in BC. The vast majority of them (75%) are not homeowners and they didn’t have their home foreclosed first and then become renters.

There are approximately 4,659,272 people in BC and about 68% are over 19 – 3,168,305. This means that 1750/3168305 were homeowners who declared bankruptcy – you are talking about something that affects half a percent of the population and of those we know from the stats can report it is usually misuse of personal credit plus a life event such as divorce, job loss or illness precipitating the bankruptcy – not mortgage debt.

Even if we limit the number to households owning homes alone we are talking about 7/10 households. For simplicity sake if you take 70% of the adult population as say they fall in the living in an owned rather than rented home category this is 2,217,845 people – .079% would be affected.

In bankruptcy proceedings, which you will likely end up in far before a foreclosure is completed, if you have no equity the trustee and the mortgage company are in the drivers seat.

The mortgage company/bank will most likely want you to continue to make payments – you have to decide if it’s worth continuing to pay for a house that is worth less than what you owe for it. You cannot sell with negative equity, so a bankruptcy or proposal allows you to surrender the property back to the mortgage holder and include the loss the mortgage holder takes into the bankruptcy or proposal.

If you have significant equity in your house above your exemption limit, you’re probably not filing a bankruptcy. Essentially you’d just be paying a trustee to do something you could do yourself – sell the house. Almost everyone that has equity and is in financial trouble would consider the following options:

-sell the property first and using the proceeds to pay down debt without having to file bankruptcy,

-consider re-mortgaging,

-borrow the equity value from a family member to pay the trustee to keep your house, or

– file a consumer proposal.

Studies of bankruptcy filers in Canada present the same basic portrait. Compared to the general population, they are more likely to work in lower-paying less-skilled jobs, have a weaker history of steady employment, be divorced and own virtually no assets; in short, they are living paycheque to paycheque and not former homeowners.

http://www.statcan.gc.ca/pub/11-008-x/2011001/article/11431-eng.htm

Also, there is a very big difference between corporate and personal bankruptcy. Donald Trump has never filed for personal bankruptcy – businesses he has been associated with have filed for corporate bankruptcy four times:1991,1992, 2004, and in 2009 .

Just an observation of mine about the Teranet numbers. It’s very complex to do a paired sales comparison. Teranet implies a paired count of over 600 from all areas and all property types in July. Yet there were only 730 residential sales recorded in the these areas.

Can there really be that many paired sales? The answer is yes. The information is taken from various sources including BC Assessment that provides the last 3 cash transactions on a property. A property that sold this week and previously sold 15 years ago would be a paired sales comparison. The problem is with recent re-sales of the same property in the last year or two that probably have had some renovations before being flipped. Good data is extremely limited and made up of wildly different properties in scattered locations. Then there is the problem with older data. Between the dates of the transactions a new mall like Uptown could have been built or a new highway out to Langford constructed. That will have an impact on market prices in the immediate neighborhoods but none in the outlying areas.

That makes the reliability of the data for the last 12 months and data that is older than 10 years questionable. So you end up having to do a lot of moving averages and smoothing of the curve. And there is always the assumption that all property types in all neighborhoods appreciate at the same rate.

Because of all the massaging of the numbers it would be impossible for anyone else to re-create the Teranet numbers. If the numbers can not be independently verified by another person then Teranet’s numbers wouldn’t be primary evidence of what is happening in the market. They do provide an independent cross check and should be used in conjunction with other sources such as the HPI. But not simply by itself as the error in the data may be significant. Overtime the Teranet numbers would show a direction in the general market for all types of properties. But it would be incorrect to assume that your specific property increased in value by that reported by Teranet.

It would be an improper use of the Teranet numbers to factor that number with the price and when you bought your house to determine a current market value.

True, non-core won’t see near the gains as core.

I think you should stick with Vic for retirement…

Air pollution:

Victoria 10 very low

Hangzhou 76 high

Qingdao 78 high

Price to Income:

Victoria 5

Hangzhou 18

Qingdao 28

Yes to a 10% increase in the core between March 2015 and March 2016 imo. I don’t know about 2016 having its own 10% gain – too hard to predict that far ahead for me. I also don’t know about areas other than the core being up 10% – seems unlikely but JJ will have a better take on that.

Real Estate and Gold have been the traditional hedges against inflation.

Maybe buying properties using straw buyers in some of China’s retirement cities.

https://youtu.be/NmNUOjP8_lE

July Teranet are out.

We are now accelerating faster than Van on a monthly basis. Surprising since July was a scary month around here… Greece, China, Mulcair’s poll numbers 😉

Vic 1.73%

Van 1.57%

For annual gains, we may be headed in the direction of double digit increases. Does anyone think a 10% yearly increase in 2016 is in the realm of possibilities?

What happens is that people first lose their home to foreclosure, then the bank or mortgage insurer comes after them for the balance, penalties and fines. That’s why most people in bankruptcy are renters.

Donald Trump filed for bankruptcy – twice.

https://youtu.be/jz8iyhjJdw4

In my opinion one should be able to make mortgage payments while maxing out TSFA and RRSPs.

If people stuck to that the housing market would collapse for sure.

Even if there was no rise in income what family cannot live on $4,300 a month net income after mortgage costs?

The kind that buys a 1.4 million dollar house.

Devaluation and currency wars.

Any suggestions as to what I could buy that performs well with inflation? 😉

“You certainly have a lot of wind in your sails.”

Too bad this isn’t a UK-based forum. Your statement would then not only be more accurate but also more humorous.

Unfortunately now whenever I see the word “Totoro” I will see Lord Flasheart.

https://www.youtube.com/watch?v=QC3sURgYxng&spfreload=10….

Start at 1:35 if you are pressed for time.

final comment

China is like the Saudi’s in terms of oil production. They have a market share and now they are defending it. The consequences are unknown, but it can’t be good for the world economy in the race to the bottom.

Toronto/Vancouver RE

If the Yuan goes down 10%; that would make it 10% more expensive for them to buy RE in Canada. Not a small amount when you are talking a $2MM home in Vancouver. It will weed out some buyers; how many is the million dollar question.

This is no surprise!

The Chinese Yuan is pretty much appreciated 3% to the USD over the last months. The USD has appreciated 20% against G7 currencies in the 12 months; so essentially their currency is up 23%, making their exports more expensive in USD terms by 23% and therefore a 9% decrease in their exports last months.

Can’t blame the Chinese when the entire world is printing money like crazy. Like a famous economist once said, who cares how much you owe, when you print the money (e.g. US Fed and EU Central Bank) haha.

Now China devalues by 4% and everyone is up in arms. Like said many times before, the problems we have right now is of our own undertaking. We need innovation and a smarter workforce and a government that foster that, but no, we are too busy with our NIMBY problems.

China is going to devalue their currency which will make it more expensive for them to buy elsewhere in the world.

There’s no time limit on this. Markets expand and contract at their own pace.

That China devalued its currency today shows that their economy is feeling the pinch of a world wide decrease in demand for their products. Which means lower demand from them for our natural resources to make those products that are more expensive because of our lower dollar.

Why would a home owner accept that they will never be out of debt. Mortgage terms are generally 25 years. Sometimes renting is better than owning but mortgages do get paid down.

And you are correct that financial mismanagement of credit is behind many bankruptcies, usually precipitated by a life event. It is; however, the use of unsecured credit which causes the vast majority of problems – not secured debt such as a mortgage. And I’m not guessing, I looked up the stats.

And who actually files for bankruptcy? It is not generally people who make $180,000 a year and buy a 1.4 million dollar homes.

The average annual household income of an individual who filed for bankruptcy is about $25,000. Bankrupt individuals tend to be unemployed, so have little to no income, and are typically renters.

Unlike the debt load of the average Canadian household, the debt of a large percentage of bankrupt individuals does not include mortgage debt, but is instead composed of unsecured bank loans and credit card debt.

“Household Insolvency in Canada Bank of Canada Review • WINTER 2011–2012”

“The real fun comes when the market contracts and renters leave and then it’s a game of investment dominoes.”

Going to happen any day now.

I believe you can extend that to 30 years on a refinance and really save yourself a bundle. Perhaps buy that investment condo that everyone seems to have these days. Or put in a basement suite and add 100 percent of the rent to your gross income.

The most important thing in real estate investing is leverage, leverage, leverage. The more you borrow the higher the return on equity.

The real fun comes when the market contracts and renters leave and then it’s a game of investment dominoes. If you are married or in a common law relationship those debts of your partner may be seen as yours too.

Be smart make sure you and your partner practice safe investing. Remember to always use your own lawyer and never share lawyers even among friends. You never know where that lawyer has been.

https://youtu.be/FqSZLVkUUTk

Why do people put themselves under pressure to make payments? Perhaps buying a little too much house?

In my opinion one should be able to make mortgage payments while maxing out TSFA and RRSPs. Our first condo was 505 sq/ft in order to allow for investments and to save down payments for subsequent investment properties and eventually our house.

There is also no way we would sell all our investment properties so we could buy $800,000 more house than what we currently have.

Finances are common sense, not rocket science. If you make $180,000/year don’t max out every penny on your house. Buy half the real estate you can afford. If you live in Vancouver buy a townhome or condo instead of a house? Invest the rest whether and you’ll be laughing in 10 years.

Unfortunately this seems to be a difficult concept to grasp.

Are we factoring in principal repayment when it comes time to refinance? Even if interest rates go up you can refinance at the same amortization with a much lower principal if you aren’t particularly financially disciplined.

For example, you take out a $500,000 mortgage at 2.1% on a 25 year amort.

After 5 years your principal is $420,000 and at that point you can refinance again at a 25 year amort. at 3.7% interest rate without your monthly payment changing.

Try Sooke

And If a generation of home buyers accept that they will never be out of debt during their entire lifetimes what will that do to the real estate market? Owning real estate and renting then become synonymous. Owning a house without equity is just renting without benefits. The difference being if you buy then you’re guaranteed a place to live until rising costs and interest rate renewals force you to move to a rental. And then your credit is shot. My advice – not yours. Is for people to seek out professional help with a bankruptcy attorney before its too late and not to just hope things will work themselves out. Or in otherwords – plan ahead. The numbers are so large these days that it doesn’t take long before you can’t pull yourself back from failure.

I’m sure all of this pressure to make the payments isn’t going to help the marriage along either. Nor is the added stress good for anyone’s health. As you said divorce and illness are seen in a lot of foreclosures. But my better guess – not yours, is that money problems was the precipitating factor.

I have no idea how many people have mortgages in Victoria. Would 50,000 be too high or too low for a city our size? Imagine how many new listings just one-half of one percent would add to our inventory of homes for sale. Enough to turn our market from a sellers to a buyers market. A 0.38 may be low but a 0.68 would be devastation.

https://youtu.be/-ysH4zPyQp0

Yep. Lots 🙂

If only I could find a fifth property that had numbers that work from an investment perspective. I have given up on it for now.

Hate to be the fear monger again, but realities are China’s devaluation of the yuan has upset the world commodity prices once again to levels not seen in ages. What is Canada’s economy based on ? Commodities and real estate mania/OCD. Something has to give soon.

http://business.financialpost.com/news/mining/chinas-surprise-currency-devaluation-sends-commodities-plunging-another-sign-of-economic-weakness

“The drop in commodities underscores the fact that investors have deep-seated concerns about China’s shrinking growth, and the government’s ability to stem the slowdown. China is the world’s primary driver of commodity demand, and its recent equity market meltdown and disappointing economic data have been rattling commodity markets for weeks.”

“Unsubstantiated fear-mongering again.”

I guess if I was up to my eyeballs with five houses and a mountain of debt that could bury you when the next financial crisis hits, I would be a growly old dog too if someone spoke the realities of life. 😉

https://youtu.be/-ysH4zPyQp0

You certainly have a lot of wind in your sails.

I see. So you are stating that these particular buyers are incurring ever-increasing credit card debt so they won’t be able to afford to pay a higher amount upon renewal because they are choosing to constantly buy more than their $5300 remaining income will support? I feel sorry for them.

And so their solution is to buy a condo after refinancing upon renewal? This means that given that this is an investment they will need to have at least 20% to put down and will need to have the additional income to qualify for the next mortgage. This now raises their income requirement to somewhere north of $300,000 a year not counting the rental income from the condo.

Problems with credit don’t mean that the average professional couple, or the vast majority of professional couples who had to go through the mortgage qualification process are unable to plan and pay for their mortgage, including for increases on renewal.

It means those that have spending problems may need take responsibility for their poor money management skills when they overspend and it catches up with them. If planning for bankruptcy is how two professionals do this that is up to them, but it is unnecessary and will impact their retirement and long-term financial position drastically.

Also, you are aware that the delinquency rate on Canadian mortgages is considered to be very low? Data from last year indicate a 0.38 per cent default rate on Canadian mortgages. http://www.huffingtonpost.ca/2013/02/27/cmhc-foreclosures-rule-change_n_2776256.html This means more that 99.62% of home owners somehow manage to pay their mortgages.

Financial mismanagement – primarily through the use of unsecured debt (credit cards/lines of credit) – is a problem that can be resolved but requires individuals to take responsibility for their actions. Planning ahead to resolve mortgage rate increases through a declaration of bankruptcy rather than behavioural changes is a very, very poor choice and I have no sympathy for someone who takes this approach as a way of permitting themselves to spend more than they can pay for through the use of unsecured debt.

And I would suggest you are just wrong in your assumptions and theories. You are not talking about the average professional couple buying a 1.4 million dollar home. You are talking about a rarity for married couples in this income bracket. If they had just divorced and rates went up and prices went down below equity amounts then you might have some grounds for a doom and gloom scenario.

Foreclosure, like bankruptcy, is generally either caused by, or dramatically increased by, a life altering event. The most common of these include marital separation or divorce, job loss and personal illness.

Mortgage are secured debt and rate increases are not part of the common causes of bankruptcy. Rate increases can be managed – these life events can not always be managed easily and I do have sympathy for those brought to bankruptcy by them.

Such as? I used a real fact pattern based on real calculations using a mortgage qualifier, CMHC stats and research. If you could do the same to set out the rationale for preparing for bankruptcy if you buy a 1.4 million dollar home in TO or Vancouver then we’d have some real discussion based on math instead of ungrounded speculation.

The more likely scenario is that there life requirements and expectations have increased along with their credit card bills and they find it more difficult to live on their salaries. City taxes, utility, food, etc have been increasing much faster than the rate of inflation. And the couple at renewal time extends their mortgage out to 30 years to lower their monthly payment. Some may even consider buying a condo as investment now that their payments are lower. Or desperately reach out to a second or third mortgage at 9 or 12 percent interest to save the home.

They dodge the bullet this renewal time but another one is coming up. Eventually they just decide that they can’t live like this anymore with every dollar seeming going to pay the bank.

Most new home owners don’t go into foreclosure in the first 3 or 5 years. Most have owned their properties for a least 10 years before the bills catch up to them. They are so far into debt that they don’t even try to save the home.

I don’t know if it is fear mongering to say to someone to prepare themselves for the worst. Wouldn’t have been better to prepare yourself and your finances before this happened.

Heck I like John Wayne movies too. The bravado of charging up the hill and damn the consequences. But sometimes it’s better to know when to run away.

https://youtu.be/Q-a7KPmOnok

Lots of assumptions on your part.

Unsubstantiated fear-mongering again.

In order to qualify for a mortgage of 1.12 million dollars, assuming 20% down on the 1.4, you will need a household income of approximately $180,000 with no other debt. Each of you needs to be earning about $90,000 per year – net $5,800 a month each assuming no additional deductions or RRSP contributions.

The mortgage is $5,000 a month at 3% interest. They have $6,600 a month to live on aside from the mortgage payment. This goes on for five years and upon renewal rates are 7% and the mortgage amount remaining is $970,000.

All of a sudden the payment rises to $7,300 a month assuming 20 years remaining on the term.

Assuming their wages have kept up with inflation they are netting about $1000 extra a month five years later so their remaining funds after paying the mortgage are $5,300 a month. Even if there was no rise in income what family cannot live on $4,300 a month net income after mortgage costs? It is more than the median family in Victoria has currently (median household income is $84,000) after paying rent or mortgage costs now!

Where is the hardship requiring a declaration of bankruptcy?

Oh, and in your alternate scenario you are qualifying only one of the two for the mortgage so that means that one person needs to be making $180,000 a year on their own. I still see no emergency bankruptcy looming.

Where you really get into problems are when there is a divorce or disability in a market that is falling. You’ll be in trouble whether rates rise or not depending on the equity in the home.

This isn’t the USA, the sub prime or 2006.

This is Vancouver and Toronto today where a professional couple facing a lifetime of debt just for wanting and believing they can have the middle income life that their parents had.

It’s unrealistic to believe that you will be able to pay off a 1.4 million dollar debt in the next 25 years with increasing interest rates. So don’t pay it off and just consider buying a house as paying rent but with a secure contract for 3, 5 or 10 years.

Plan ahead and both of you won’t have to go down in flames. One of you will take the hit, but not both.

I suppose from a home owner’s perspective this could be frightening to some.

A complete game changer for the real estate industry as home ownership is treated the same as leased cars. What sells real estate is stability and security that you’re building something for the future. Then along comes a generation that doesn’t have that belief and considers real estate a throw away commodity when it becomes too expensive to hold. Debt becomes something you just do to live for the moment.

” I’m sorry but anyone who thinks Trump will be the Republican nominee is extremely naive.”

No need to apologize. Just put us down as extremely naive in thinking Americans would like their jobs back from China, their immigration laws respected and a simplification of the tax code that would put H & R Block out of business.

Oh, and how much do you wanna bet?

Yes, I will bet. I’m sorry but anyone who thinks Trump will be the Republican nominee is extremely naive. Recall the 2012 election when, roughly at this point, everyone but Romney took turns leading in the polls, including complete hacks like Herman Cain.

What is possible, however, is that Trump will eventually decide to run as an independent candidate, à la Ross Perot in 1992.

So you are telling professional couples to plan for bankruptcy in 3, 5 or 10 years because of a potential increase in mortgage payments despite the fact that they qualified for the mortgage in the first place? This is not the US.

The sub-prime market did not take hold in Canada to the extent that it did in the U.S where the vast majority of mortgages were originated by third parties and then packaged and sold to investors who often did not understand the associated risk. Most mortgages in Canada, on the other hand, are originated and retained by institutions whose goal is to maintain a long-term relationship with the borrower. https://en.wikipedia.org/wiki/Subprime_lending

Estimates place sub-prime lending it at less than 5% of the Canadian market at its peak in 2006 vs. 24% of the US market. http://www.cmhc-schl.gc.ca/en/corp/nero/jufa/jufa_018.cfm

If someone bought in Vancouver or TO with a subprime mortgage in 2006 they are doing fantastically well now. Made bank in appreciation and have already renewed their mortgage at a lower rate.

And how do you expect a professional couple to rebound from bankruptcy and its associated seven-year effects on credit rating? And what exactly are the ways to “bullet proof” yourself from creditors?

The real hardship will come if the couple divorces or one of them becomes disabled without insurance.

Some sort of long-term creditor proofing plan that hinges on bankruptcy is a foolish waste of time – the professional couple would be better off spending a fraction of the time and effort to develop a financial plan which has a contingency for a potential rate increase upon term renewal. Like cutting back on lattes and leased cars.

My take on it is if a mortgage increase is going to bankrupt you, you are not going to qualify for the mortgage in the first place and you have other financial issues you should be addressing.

“.can’t see Trump ending up with the Republican nomination.”

Who do you think it’ll be? Carly? See her rating was up sharply following the Fox-News debate: from 1% to 3%.

But sure Trump my not be the next president. My point, though, was that such a thing could happen with devastating consequences for RE prices.

Trump promises tariffs on manufactured goods from Asia and Latin America and an end to uncontrolled immigration. That means a manufacturing boom in American, sharply increased wages and inflation and, inevitably, a rise in interest rates, perhaps by 5 or 10 percent. That’s when the price of a clapped out shack in Oak Bay would nosedive.

And one could come up with many other scenarios with similar consequences for RE, which means that those who just bought are living on the edge of a volcano. They may be fine. Or they may not be.

There are many ways for a professional couple to bullet proof themselves from creditors. If you’re buying such a tremendously expensive home with high ratio financing then you should also be planning in the event that you may not be able to meet your financial obligations at mortgage renewal time.

You’re not buying a forever house – you’re buying a house for 3, 5 or 10 years until the mortgage renews at a higher rate.

This is the new reality in cities like Vancouver and Toronto. Plan accordingly and you won’t develop an emotional attachment to brick and mortar. And you’ll feel better knowing that there is a way out that won’t completely devastate both of your lives.

I read the article with the same reaction. Ridiculous writing with not enough facts to have any reasonable hope of a logical analysis.

And two professionals aren’t supposed to have a mortgage? Since when? Because being a doctor means you have $800,000 cash?

Then went on to read that they were spending $2000 a month on a leased second vehicle. There is a red flag indicator for who not to take financial advice from.

“Our townhouse was a money pit,” Kathy Fiala says. “We had a mortgage — as two professionals, we weren’t supposed to have one, but we did — plus taxes, maintenance fees, plus anything that got broken down.”

http://business.financialpost.com/personal-finance/mortgages-real-estate/why-you-should-rent-that-condo-even-if-you-can-afford-to-buy-it

lol, what? Am I reading this right? Kathy feels because she is a doctor she isn’t suppose to have a mortgage? Further re-enforces my opinion of how dumb these rent vs own articles are most of the time.

In my opinion it comes down to you have financial savvy/common sense/foresight or you don’t, irrelevant of whether you are renting or buying.

Unfortunately the average person has a level of financial savvy/common sense/foresight that is ridiculously bad. 98% of people are paying 21k+ to sell their average Victoria home in a hot market that is. The same flock is also probably paying a 2% MER to someone to manage the little money they have after they pay real estate commission. It is all pretty sad as financial savvy/common sense isn’t rocket science at all. It is called Google, Redflagdeal forums, etc., but the average person is probably browsing horse forums trying to figure out what type of hay to feed their hobby horse and then complaining at the price of housing in Victoria.

The polls and how people actually vote come decision day can be two different things….can’t see Trump ending up with the Republican nomination.

Wanna make a bet? Trump now at 31% among registered Republicans versus his closest rival Jeb Bush at 11% (the loser).

The only way he’ll be stopped now is with a bullet. Quite possible as Hillary looks more and more like a cornered rat and needs some drastic action to avoid indictment on a charge of treason.

The US HPI began falling as the Fed funds rate peaked in 2006 and is still falling and is a lot lower than in 2004.

But a 425 pt rate rise could occur overnight in which case the HPI would crater overnight.

30%? Dream on. You would need massive easy credit expansion like in 2000’s. Not going to see American banks go down that road again anytime soon. They are still paying for the last crash.

“…what would such a rate rise do to a housing market “

If it’s like the last time the Fed raised rates 425 basis points starting in 2004, then it looks like US home prices will rise another 30% in the next couple years.

http://cdn.theatlantic.com/static/mt/assets/business/assets_c/2009/12/fed%20funds%20v%20home%20prices%20bubble-thumb-570×368-19082.png

There will be no President Trump. I guarantee it.

Everything looks great except that, because of low interest rates, folks are taking on huge debts in relation to income. That’s not a problem so long as rates remain low, but what is the probability that they will remain low indefinitely? In the States, rates went from 1 to 6% in 18 successive increases in 2005/2006, apparently on a whim of the Chairman of the US Federal Reserve. A recurrence of such bizarre Central Bank behavior may be unlikely, but what is the risk that war, financial system instability, or political revolution (President Trump, for instance) will cause a rate rise of at least a couple of percent, and what would such a rate rise do to a housing market where something like 28% of buyers are opting for a variable rate mortgage now available at less than 2%?

Jeez, I thought everyone made money on real estate ? 😉 Why are all the million dollar shacks on Bear Mountain asking an average of $300K to $400K over assessment ? Is there gold buried on those skimpy lots where you can easily toss your neighbor a roll of toilet paper when he’s in a jam ? I think there is wee bit of insanity going on out there.

Is it time to buy that retirement condo in Langford?

There are 72 pre-owned condos listed for sale in Langford City. With 18 sold in the last month.

Ranging from a low of $164,000 for a Bear Mountain hide away that your spouse will never know about to a high of $340,000 or the equivalent of what Donald Trump will spend on hair spray over the next 18 months. Langford is becoming Canada’s newest retirement community faster than a walker on an icy road. People from all over the world and Oak Bay are now discovering Langford.

So leave those bidding wars behind and come to Langford where nothing sells for over list.

Worried about appreciation? You will be relieved to know that you’re guaranteed to sell for less. So forget about losing sleep on whether it was a good choice or not to buy.

Like Herman Lapinsky who bought a new condo in Reflections back in 2007 for $319,900 or about the same price as a new luxury condo in downtown Victoria, and has just recently sold it for $219,000. He’s taking his winnings and getting the first letter of his named tattooed to his forehead.

Remember, you can’t take it with you – and in Langford we’ll make sure that there will be a lot less left behind.

Mon, Aug 10, 2015 8:00am:

Aug Aug

2015 2014

Net Unconditional Sales: 170 609

New Listings: 267 904

Active Listings: 3,852 4,316

Please Note

Left Column: stats for the entire month from this year

Right Column: stats for the entire month from last year

This information comes from the latest ‘Monthly Comparative Activity By Property Type’ Report

Look here for updated figures each Monday morning.

You’re riding one of these.

https://youtu.be/EtSPFXj_eZM

Regarding affordability, it’s still cheaper to own than rent in many cases (as per my example) and we have one of the better affordability indexes.

But I think the comparison that really matters is…

Vancouver average price $1.4 million

Toronto $1 million

San Jose, London, HongKong… $gazillions

The reason being a large portion of boomers (millionaires) will leave their metropolises to retire to the best mid-sized cities. In their eyes, we are incredibly affordable.

Just to clarify what I’m meaning is new house listings coming to market and not recently built houses.

Where are you likely to find better selection and lower pressure to buy a house in the core today?

That would be the Esquimalt / Vic West and View Royal area. This area has the most selection of houses for sale with 4.2 months of inventory with new listings coming to the market at a ratio of 1.4 new houses to every sale.

Surprisingly though, Victoria City proper has recently improved with the months of inventory increasing to 3.1 and new houses coming to market at the rate of 1.4 to every 1 sale. Victoria has now become slightly better than Langford / Colwood which has similar months of inventory but listings being added more slowly at at rate of 1.1 to every sale. That makes buying less stressful in Victoria today than it was just a few months ago.

Saanich East is no slouch when it comes to adding inventory at the rate of 1.5 new houses to every sale and I would expect to see the months of inventory grow from its current 2.4

All of these markets favor sellers. Some are just a little bit better than others when it comes to selection and not having to look over your shoulder at someone waving a check book in the air.

Looks like more people are waking up to the grade 3 math.

——————————————————————-

Why you should rent that condo — even if you can afford to buy it

“In a searing hot real estate market, long-term renting is starting to look like the more prudent option, challenging the traditional view that signing a monthly cheque to a landlord is akin to using hundred dollar bills as fire starters.

The Fialas, in fact, found it was the opposite.

“Our townhouse was a money pit,” Kathy Fiala says. “We had a mortgage — as two professionals, we weren’t supposed to have one, but we did — plus taxes, maintenance fees, plus anything that got broken down.”

http://business.financialpost.com/personal-finance/mortgages-real-estate/why-you-should-rent-that-condo-even-if-you-can-afford-to-buy-it

Cruise to Alaska in only a week? Didn’t know you could get up there and back so fast.