July Sales – Mixed Signals

It’s too soon to see what effect the recent drop in the prime lending rate may have on housing sales – but it’s fair to say that July 2015 has been an interesting month. Some segments of the market are “up” while others are “down” …

The Single Family Home (SFH) price for Greater Victoria in July hit a record high of $663,791 – breaking all previous records. When accounting for inflation, the average SFH price in July was actually $23,990 less than in 2010, when the average (annual) SFH price was $629,925 (or $687,781 in 2015 dollars). The SFH median has dropped to $545,000 – less than last month and July 2014, and is now at the lowest level since December 2014. The average for condos is down to $308,561, a 3.3% decrease from July last year. The median of $268,00 is marginally up (1.5%) from last year – but has been steadily decreasing (by a total of 9.1%) since February 2015. The townhouse average is up to $420,710, a 3.8% increase from June. The townhouse median is also up – to $405,000, a 5.7% increase from June and the highest level since December 2014. The full VREB news release and statistics are available here.

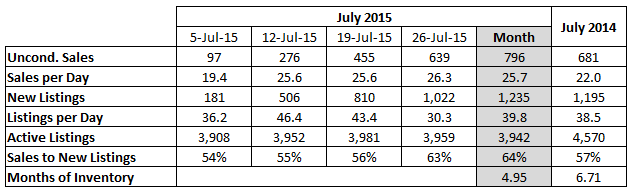

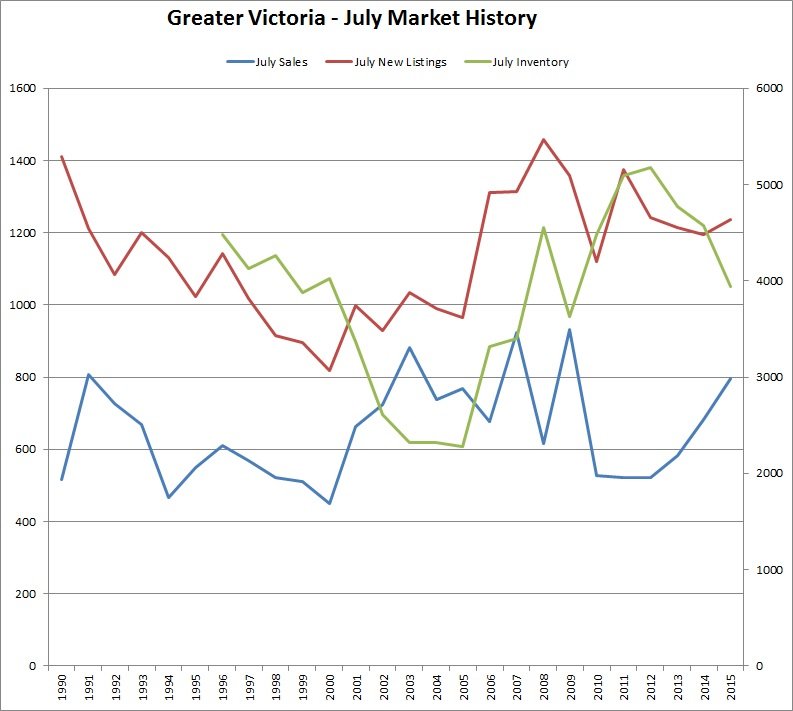

The rate of new listings for July is close to the average over the past ten years, but ironically the active listings are at the lowest count since 2008. Sales are up substantially, at the highest rate since 2009. It’s a market of contradictions!

The rate of new listings for July is close to the average over the past ten years, but ironically the active listings are at the lowest count since 2008. Sales are up substantially, at the highest rate since 2009. It’s a market of contradictions!

[Sorry about the delay in posting the July Sales … At 4 PM on Monday, my water heater “died” and I was busy replacing it on Tuesday. The joys of home ownership!]

The Stadacona complex definitely had upkeep issues but their STRATA split during the remediation so commercial and residential are each managed separately now. As a long-time commercial tenant the only problem we still have to deal with on a regular basis is parking.

The building still has very poor road access and parking. While management has taken care of abuse issues it remains a challenging location for vendors who rely on foot traffic and access. They have vacancies which have been open over 2 years now.

Again, that’s why there are 5 for sale and no buyers. They are 70’s apartments not condos with age restrictions and no renters. There’s a reason they are cheap cause they’re crap and eventually cost the owners $75K each.

Buying a home on top of several restaurants is probably never the wisest idea. For starters, you might spend a fortune eating there 😉

As far as age, older construction is in many ways superior to modern construction. The least problematic I’ve owned over my lifetime are certainly the 60s 70s homes.

And I still think for a 25 year-old millennial with a secure enough job (university, gov…), saving $300 per month by owning that condo seems wise. That $300 per month invested at historical returns will be over $50,000 by the time they turn 35. Even if they decide to stay and continue only contributing the $300 per month, they will end up with over $350,000 by age 55, which is entirely from the savings of owning over renting. Of course by that time they will be saving far more than $300 per month over renting, as rents keep increasing and their mortgage is history. They now also own a home outright in addition to the $350,000.

It also makes you think if buying into a condo complex with ground floor commercial is that wise of a decision? Ground floor retail commercial rents are pretty harsh on retailers. Vacant retail units can have a long lease up time and no occupier of this space wants to see their monthly costs rise and kill their chance of a profit. The strata council will find a lot of resistance to any strata fee increases by the commercial owners. You can have a couple of home owners refuse to pay the increase and manage. But having the entire ground floor stop – that’s going to hurt the profit and loss statements for the complex.

That’s something for a prospective purchaser to think about. Take a look of the mix of retailers on the ground floor.

In today’s market it seems that condo complexes that have rent and age restrictions sell for a lower price than similar complexes without these restrictions.

That hasn’t always been the case. At one time those age restrictions were put in place to keep the price of condos up. Having renters and younger people in the complex was seen as having a negative impact on value. What changed is Victoria. We have grown out of being a retirement community and we have too many condos. Every time Mayor Lisa approves another condo tower, prices for condos built ten years before decrease a little bit more.

That makes the condos with restrictions more riskier purchases than others without same. A 25 year old buyer in that complex may have to re-locate or loses their job and may not be allowed to sell their home because the mortgage is in excess of the net sale price. They also don’t have the option of renting the condo until prices improve. The property goes into foreclosure and sells at a deep discount leaving the home owner with a debt still to be paid but no home to live in. The bank is paid in full by the mortgage insurance company.

That’s a risk a purchaser takes. And to compensate for that higher risk they bid lower for this condo. The wider the difference between condos with and without restrictions is an indication of risk in the market.

As risk increases – prices decrease.

Exactly Leo. In this day and age young people change jobs every couple of years and getting tied down to some ancient 1970 condo which is really an apartment with poor sound proofing is not how to start out life. The days of permanent jobs for life are long gone. Mobility is the work force theme these days.

Blaming the Stadacona problems on the commercial owners sounds pretty lame. Bottom line is it happened in a 70’s building when stated it doesn’t and cost all residents huge money. I seem to recall the 100K number being talked about as final figures as it was not your typical leaker just in the exterior walls.

I worked with someone who owned a 70’s townhouse in Saanich who got the $75,000 bill when their place was discovered to be a leaker about 6 years ago. They had done what they thought were all the proper maintenance and checks. 70’s buildings are just as susceptible as 80’s or 90’s.

Stadacona’s problems were primarily the commercial owners underneath, no enforcement of by-laws, and complete lack of building maintenance over the years.

In other words, much like many older buildings.

the first thing you want to do as a young person is live cheap and build wealth.

The first thing you want to do as a young person is maintain your flexibility. Hmm, save a couple hundred a month or earn thousands more by having the freedom to move at a moment’s notice for a better job.

It isn’t just an envelope failure that arose from complexes built after the building code change in the 1980’s and introduction of new construction products like some types of radiant ceiling heat. Any building may need a special assessment for re-pointing the exterior brick work or replacement of windows, indoor pools and other items. These should be normal maintenance issues but were deferred by the councils and became bigger problems later on.

The Depreciation Reports are suppose to address this issue and allow the strata council to build up a reserve for replacement so that they’re less likely to get a shock payment payment sometime in the future.

Any building can be assessed a special assessment including complexes that have been remediated against abnormal water penetration in the past. The report is to assist the strata council in taking action to minimize the risk by building up an adequate reserve for replacements. As a prospective purchaser you’ll have to read the report, understand it, and ask questions to the strata council.

A good first question is to ask the strata council if there are any special assessment levied or contemplated to be levied in the future? Another tip may be to look at the monthly strata fees relative to other similar complexes. If the fees seem low – then you need to investigate some more.

Personally, I think the term Depreciation Report is a bit misleading because what the report really is is a reserve fund study. You can look up in a table the life expectancy for an elevator with normal maintenance. You can call the elevator company to get an estimate to replace the elevator. The tricky part is to determine the financial part of building up a reserve to replace the elevator but without raising the strata fees so much that the home owners lose market value.

Stadacona’s problems were primarily the commercial owners underneath, no enforcement of by-laws, and complete lack of building maintenance over the years.

Folly ? Seriously, you need to get your misleading facts straight. Stadacona Centre condo/apartments were built in the mid 70’s and just went through a 2 year remediation like no other I have seen. Every place was completely stripped to the studs and owners lost bigtime. I believe the final bill was in the $75,000 range but may have been higher. Sounds like you’re one of the agents flogging these apartments.

What would this site be without someone to show the bears their folly? 😉 80s & 90s buildings are the leakers, a millennial can live there much cheaper than renting same, and the first thing you want to do as a young person is live cheap and build wealth.

The last thing you want to do as a young person starting out not certain of where you want to build your career is to hang a boat anchor in the form of an old condo around your neck.

Market rent for the suite is zero. Bylaws do not allow for the suite to be rented. Age restriction is minimum of 25 years.

A hypothetical condition has to be reasonably attainable. Since the bylaws specifically prevent renting of the suite it would unreasonable to assume an economic rent.

5 units for sale in the same small building is not a good sign. Smells like a 1970 potential leaker, just what every millennial needs to start off their life with.

For a millennial starting out it’s much cheaper to own than rent in Victoria. The only stipulation is you must be able to do grade 3 math.

http://www.realtor.ca/Residential/Single-Family/15950096/120-1680-Poplar-Ave-Victoria-British-Columbia-V8P4K7

All-in (interest, maintenance, taxes, insurance…) you would save nearly $300 per month owning it over renting it. Assumes $900 rent, however would likely rent for more in that location.

Nice to read a common sense article advising the young to not be dumb.

Are millennials better off renting? Why young Canadians may want to put off home ownership

http://business.financialpost.com/personal-finance/mortgages-real-estate/are-millennials-better-off-renting-why-young-canadians-may-want-to-put-off-home-ownership

“A wise man makes his own decisions, an ignorant man follows the public opinion.”

Looks like the bears missed out again. Old chinese proverb says careful picking bottoms because you only get stinky finger. That is the only thing many bears will be left with after this sales season.

15 percent of the houses that sold in the core last month sold above their most recent asking price. But were they intentionally under priced to start a bidding war or inexperienced real estate agents?

The three that sold the most over asking were around 14 percent greater than asking price and located Tillicum, Gordon Head and Ten Mile Point. Two were in need of renovations and were vacant at the time of the sale which might suggest a duress sale. And that makes sense to under list to get as much attention as possible.

The other was waterfront won by an out of town buyer paying 32 percent over assessed value. I don’t think price was an issue in this case. The buyer wasn’t going to let fair market value get in the way of purchasing this property.

So I would two of them were intentionally under priced and one was the Bluebird of happiness knocking on the window

https://youtu.be/ALuzmbs9S3o?list=PLwxRx5yJATDrxbXqmnuaPeSeeAJobwlwN

Agreed! 😉

Is the market heating up or strengthening? I guess whether you ask a bear or captain obvious, you get very different answers. That’s what makes markets and discussion boards like this enjoyable.

Saying a market is strong because of a lack of selection is like shopping in a Siberian grocery store with two cans of baked beans on the shelf. Prices are going up would then be a sign of a strong Russian economy.

How demand and supply interact determines price. Most of us then infer that if prices are going up then demand is strong. Something you hear a lot from people justifying the market.

Increasing prices then become the proof that everybody wants to live here or that we are the best place in Canada to live or the baby boomers want to retire here.

But if our meager month over month price increases are more of reflection of an extreme lack of supply does that make our market strong?

As an example look at Calgary’s stats for July, they had a substantial drop in sales activity but there month over month median price increase was much larger than ours. Yet I doubt most of us would say that Calgary’s economy is strong.

I opine that our markets across Canada are going through a readjustment phase and that’s why we are seeing more WTF data.

Yep. Except for the prices being up 5% and the multiple offer scenarios which I think are reality right now.

A wonderfully fluffy advertorial, that TC article …

No, I wouldn’t. If rising prices are an indication of demand (or “popularity”), I would suggest that some people who were considering condos have purchased townhouses instead. There’s no way to know this for sure, but the selling prices for condos has been sliding while townhouses have been going up. I expect that the prevailing low interest rates are helping as well.

As for SFH, the “record” average and dropping median (lowest level since January 2015) is suggesting how different segments of the housing market are selling. For the average to rise, more expensive (higher-end) homes must be selling. For the median to drop, there must be an increase in the sales volume of less expensive (lower-end) homes. More lower-end SFH’s selling is a good thing for the market, as the “property ladder” needs to be propped up at the lower end of the market in order to sustain the top end. Who knows, maybe some buyers who were considering a townhouse have opted for a starter home?

The really weird thing in this market is increasing sales volume but decreasing volume. We last saw this pattern during July in 2000 through 2002 when the market was heating up. Does this mean that the market is heating up again? I don’t think so, as the average monthly mortgage payment (20% down, 25-year amortization) for a newly purchased SFH in 2001 was about $1930 (in 2015 dollars) while now it’s about $2700.

http://www.timescolonist.com/business/greater-victoria-house-prices-up-5-as-real-estate-sales-stay-strong-1.2020943

I’m curious then, by your analysis would you say houses are suddenly becoming very unpopular, and townhouses popular?

http://i.cubeupload.com/hlp9gX.png

I think if you stick with HPIs and something like a teranet (both showing 6%’ish for houses) you will have a much better view of what’s actually happening. If you’re going to use medians, at least use a several month average. By the way, the HPI for townhouses is showing 2.9% y-o-y and flat m-o-m.

Benchmarks (such as Teranet) indicate a trend, but provide no analysis. The analysis shows that SFH’s and condos are going in opposite directions and that the SFH mean and median are telling very different stories. Apparently townhouses are getting more popular.

The VREB media release will always be good news, regardless of how the market is performing. That said, the VREB statistics provide a wealth of data.

Best to use benchmarks (or teranet) for accuracy. That’s what the media release. We’re only up 6 to 7% in the core. Vancouver core is up 16.2% and their sales are up 30% over last July!