The real story on assessments

BC Assessment has released their previews of assessments for the year, and the media has jumped on them to make breathless proclamations like “Greater Victoria home assessments to fall up to 10%” and “Metro Vancouver single-family home values plunge“.

As an aside, this is why I don’t put that much stock into theories that the media is paid off by the real estate industry or that they only publish favourable stories to keep their industry advertisers happy. The currency is clicks and readers, and readers are attracted by both positive and negative stories. These two headlines certainly do a good job attracting attention, and both manage to be misleading while still being technically correct.

First the Vancouver story which says that single family home values plunge. It’s absolutely true that the single family home market was in dire straits in Vancouver in the summer. June sales were at 20 year lows and prices dropping at a rate of some 10%/year (and more in the luxury space). However there has been substantial recovery since then, with a strong strengthening trend and sales back to average levels while inventory dropped steeply. Of course it could be a dead cat bounce but with market indicators looking up quite strongly, saying that “home values plunge” does not seem to capture the situation anymore. The biggest effect of the decreased assessments in Vancouver will likely be on seller confidence which will certainly take a hit when they get a letter saying they’ve lost a couple hundred thousand in equity. As little as individual assessments actually mean about the market value of your home, there is something about that bold number on a piece of paper that has a powerful anchoring effect.

Low let’s look at the Victoria headline which again is technically correct, but certainly gives the incorrect impression that prices are falling quickly in Victoria. What BC Assessment actually said is that assessments will vary between -10% and +5% while condos are between -5% and +5%. We don’t know exactly how BC assessment defines those ranges (what percentage of properties fall into those ranges?) so we can’t determine an average, but it seems pretty clear that condos will be roughly flat, and single family perhaps slightly down (say -2.5%). That would roughly match prices where detached medians are down about 2.5% from mid 2018 to 2019 while condos are up about 2%. But the headline “Assessments broadly unchanged in Victoria” does not get an article to the top of the most popular list.

Another way to look at this is by area. Since assessments are as of July 1, we can take the sales from June and July, and get the median sales price relative to last year’s assessed value as a pretty good guage as to where prices went in that year. Actual assessments are of course a bit more complicated than just looking at sales price, but this should give us a pretty good estimate of where regional assessments will land.

Median Sale Price Over/Under Assessment

| Region | Single Family | Condo |

|---|---|---|

| Core | 0.5% | 4.1% |

| Westshore | 4.6% | 4.5% |

| Peninsula | 1.2% | 0.9% |

| Oak Bay | -8% | -- |

| Saanich West | 4.8% | -- |

| Saanich East | -1.1% | |

| Victoria | 1.4% | 4.4% |

Now we can see a clearer picture emerge that mirrors what we’ve been observing all year.

- Single family was somewhat weaker than condos

- High end is weaker than low end. This can be seen in the poor performance in Oak Bay where there is no low end market, the stronger performance in the westshore, and even between regions like Saanich East which has higher property values (and assessments are predicted to drop slightly) and Saanich West which has more lower priced homes (and assessments likely rising nearly 5%).

Remember that your assessment going up or down does not mean your taxes will go up or down. Taxes are set by the municipal government dividing their budget into the total home values in the region. So if everyone drops 10% or increases 10% your taxes will simply increase by this year’s budget increase from the city. Only if your property increases more than your municipal average will your taxes go up more than most, and vice versa.

need help. Am in the process of buying a home. I vaguely recollect that there was an issue with the speculation tax (i think?) that could make the buyer liable for the seller’s tax if it had not been paid. Is my memory failing me again? I am trying to line up a lawyer to go over the papers with me before removing conditions but would appreciate if anyone on this blog knows anything about this issue.

Thank you so much in advance and wish me good luck!

Monday numbers https://househuntvictoria.ca/2019/12/16/the-average-renter-is-a-long-way-from-home-ownership/

Oak Bay 2011 census – 18015

Oak Bay 2016 census – 18094

Since when does staying approximately the same equal “dwindling”?

That article on housing keeps referring to the need for occupied “bedrooms” in Oak Bay. Is this word “occupied bedroom” some new type of housing “code word”, instead of referring to homes? For example, it says “It should be noted that these are occupied bedrooms and does not address that Oak Bay’s proliferation of empty bedrooms.” For example, could someone decode that statement for me? How and why is the government supposed to “address” a declared “proliferation of empty bedrooms”? Is there something the people living in the homes with “empty bedrooms” can do, short of moving out? Convert them to music or exercise rooms? Or is this code for “let’s tax their empty bedroom and smoke them out of their homes”?

I just realized that DNS records weren’t properly updated by the site host after the server upgrade… so site has likely been inaccessible for most last week. Should be fixed once the DNS propagates

Housing policy proceeds one death at a time.

Study shows Oak Bay’s dwindling population is rapidly aging

https://www.vicnews.com/news/study-shows-oak-bays-dwindling-population-is-rapidly-aging/

Real estate developer in Vancouver getting creative

Corporate cash was banned from B.C. elections. Developer’s employees started donating

https://vancouversun.com/news/local-news/corporate-cash-was-banned-from-b-c-elections-developers-employees-started-donating

A lot hinges on how Britain does outside of the EU. If things go poorly, it will help the movements in Scotland and Northern Ireland.

It’ll also be interesting to see how (Southern) Ireland does. Ireland (97%) already surpasses England (94%) for % of English language speakers, and (when U.K. Brexits) second place (in Europe) is way back – Malta (62%). https://languageknowledge.eu/languages/english

EIRL anyone ? https://www.ishares.com/us/products/239662/ishares-msci-ireland-capped-etf

Also for the first time ever, parties advocating union with the Irish Republic won a majority of seats in Northern Ireland. But Sinn Fein MP’s will not be taking their seats as usual.

The labour party is modifying part of its platform so that they only intend to nationalize model trains instead of Britain’s railroads.

Yeah Labour shot themselves in the foot with that one. If they would’ve run a business as (almost) usual and no Brexit candidate I bet they would have won.

The the next year is going to be fascinating to watch. Scotland secession?

Yes, and it looks like Corbyn – the Labour leader who called Karl Marx a “great economist”- is resigning!

What mistake?

Only mistakes I ever make are engaging with you in the first place.

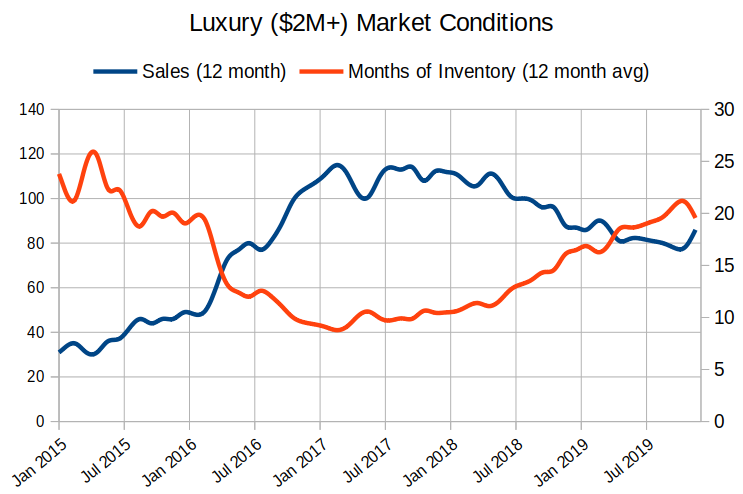

Small uptick in $2M+ sales in November, with 10 sold.

Condos didn’t even see that much of a decline to start with and are back in sellers market territory over there. MLS prices haven’t increased but with current market conditions they likely will be, at least a bit. Nowhere near 2016 market conditions though.

Strong Conservative majority. Brexit is a go.

Thx Leo.

I don’t know if anyone listens to the Vancouver Real Estate podcast, but in the most recent episode, they were discussing surging condo sales/prices in the last few weeks. In one case, there was a >$100,000 over-ask sale on a 1-bed condo. Bull trap or a market recovery?

Looks it might be possible that the Conservatives might have won a ,majority government in the British elections.

$695,000

Original list $829k

… says the “time traveler” who likes to tell us he goes back in time to fix his mistakes and make those “insane” decisions to buy.

I am also curious about what 65 Oswego sold for!

Sounded insane.

Just like the price of bitcoin hitting nearly 20 grand.

Listings per capita would be listings/population.

(2259/380000) = 5.945 listings per 1000 people

(11000/2550000) = 4.314 listings per 1000 people

but the math works out.

(5.945 – 4.314) / 4.314 = 37.8%

You should have bought Apple shares instead. Up 20X last 10 years.

We’ll see what happens but low inventory with average sales and low new listings does show some stability returning.

But I don’t pay too much attention to Vancouver so I could be misreading it. It certainly doesn’t seem like the connection should be over there

the cost of my apples doubled in price in 8 years – does that sound bullish?

Vancouver home prices are up 100% in the last 10 years. Did anything during that epic run strike you as bullish?

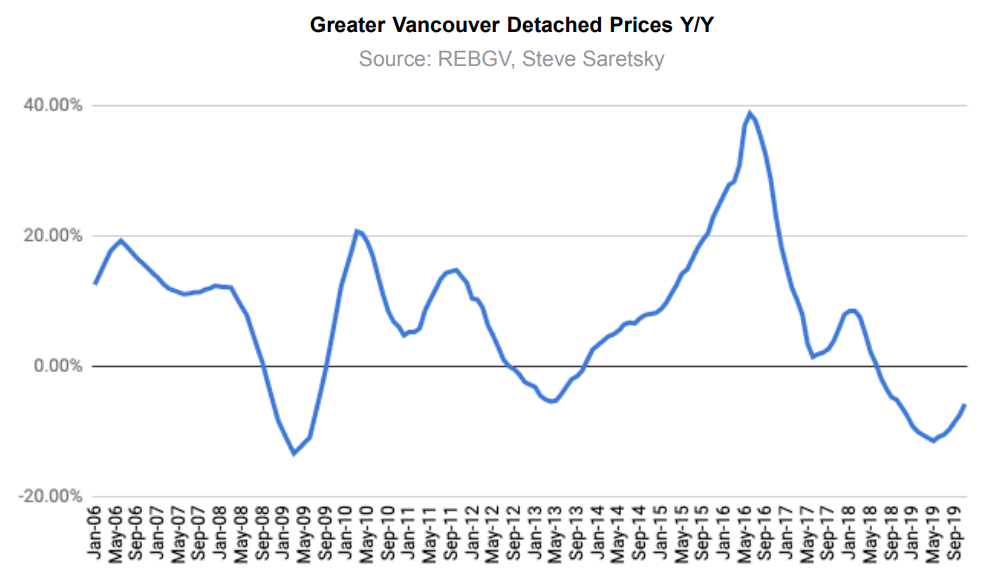

Vancouver detached home prices yoy:

avg price $2,094,987 $2,534,107 – 17%

Somehow with the slowest year of sales in over a decade they’ve managed to have the lowest number of detached listings in a decade and a half…

Something is up there, and it’s doesn’t strike me as bullish.

Condo inventory on the other hand isn’t going to be going down, they’re building at an ridiculous pace.

edit: avg days on market is up in all categories over the year before. Condos it’s up by 30%. That doesn’t strike me as bullish in the least…

Armed with new data, B.C. set for crackdown on tax evasion in Vancouver property market

As I’ve said, I think this is the real reason why the RE industry has been so opposed to the spec tax. Not Granny’s cottage.

Yes, especially Vancouver inventory trend. Looking bullish.

Many consider our housing inventory to be low in Victoria.

But Victoria has 37% more listings than Vancouver (per capita).

Vancouver 2.55m people/ 11000 listings = 231 people per listing

Victoria 380k people/2259 listings= 168 people per listing

231/168 = 37% more listings ( per capita) in Victoria than Vancouver

Could someone tell me how much 65 Oswego sold for? Assessed at $653k. Original asking was something like $830k and they very gradually dropped it to $699k. Thanks!

For sure. But if you look at inventory and sales numbers and recent trend it is looking like at least stable prices if not growing unless things worsen again (certainly possible). https://stevesaretsky.com/wp-content/uploads/2019/12/SaretskyReportNovember2019.pdf?mc_cid=94b92f557f&mc_eid=e0c1157b8d

I thought the authority on resales was the Teranet index. 2017 was an active year, with strong increases y/y all through the spring.

According to their resale metrics, the index is most definitely up now (Oct 2019 index value 211) since, say, winter 2017 (Feb index value ~177). Up somewhat less compared to late 2017 (Dec. 2017 value 197), but still up a few %.

Whether on not those are based on renos or what is anyone’s guess; same holds true for the market as a whole at any time, right? Prices at the high end of the range (say, for any given 2300-2700 ft^2 house on a quiet street in a desirable neighborhood) tend to be in better shape, better kept than those at the low end. If owners did a short-term flip with no changes, then you expect the value of the improvements to be slightly lower due to depreciation. The shiny new house in 2016 is slightly less shiny in 2019. Land value might increase slightly, which makes it a wash, or a slight increase or decline, depending on the specifics.

“I don’t put that much stock into theories that the media is paid off by the real estate industry or that they only publish favourable stories to keep their industry advertisers happy”

The perception of media being pro-real estate industry is about who media has repeatedly gone to for market analysis and predictions: leading local real estate professionals. The media may as well have been printing regular stories about the state of hen-house security, using only foxes’ opinions.

Yeah, the media want to print sensational stories using credentialed sources. Has the problem been that there aren’t enough credentialed objective real estate sources for them to go to? I’m sure the media have just wanted to write up and print the stories quickly. “Oh we have ongoing relationships with foxes who are hen-house secruity professionals. Let’s repeatedly go to them for ‘objective’ reporting”.

A clear example: Back in 2005, US chief economist of National Association of Realtors, David Lereah, repeatedly publicly mocked concerns about a US housing bubble, calling any bubble believers ‘Chicken Littles.’ I get that he and all in his job are basically paid to be cheerleaders, and would be crucified by their industry if they didn’t put things in the best light possible. But that’s not objectivity, that’s not truthful, that has no place in reporting without a counterbalance. The media should be ashamed of pretending such real estate sources are anything close to objective reporting. How many people lost their homes because of they trusted the industry assurances from that everything was just fine?

Whether its media laziness, lack of credentialed objective/constrasting voices, advertising dollars, or a combination of all these, the result has been the same. Over the years a lot of people have become jaded to the sensational newspaper real estate cheerleading. Only in the last couple of years have papers like The Vancouver Sun started weighing in with contrasting academic opinions. Finally. But it has come far too late, and I’m sure they have already lost many readers over it.

For Vancouver that graph doesn’t mean prices are going up, just that they’re less down year over year. Last September was a when it really started to drop, so it kind of makes sense that it’s less of a year over year drop.

I’m not disputing BC Assessment’s numbers at all. They are of course the authority and know exactly what is being sent out. I am just poking at the misleading headlines. The reality is that assessments in Victoria are roughly flat. But if you read “Greater Victoria home assessments to fall up to 10%” you get the impression that prices and assessments are falling substantially. The headline isn’t incorrect (some assessments will certainly drop 10%), but someone not reading carefully will get the wrong impression. Perhaps I’m being a bit pedantic here.

Yes I should do that although I don’t agree that it would show that the majority of 2017 resales are down (after fees yes, but not in price). Haven’t had the time to make any substantial use of the direct access, so currently deciding whether to drop it as it is a relatively expensive licensing fee.

Good breakdown LeoS. As usual your analysis is thorough. However… I think your analysis hides the fundamentals behind the drop in assessed values.

If B.C. Assessment says prices declined by 10% then they mean that prices dropped 10% compared to last year’s assessed value.

The only way to prove or disprove the B.C. Assessment numbers and see the true extent of the decline is to compare actual re-sales of actual houses/condos from 2016 to 2019 to establish a trend. There have been dozens of re-sales recently of houses/condos which were purchased from 2016 to the present. Since 2017 the only places which have re-sold for more than purchase price have been places with substantial renovations to kitchens and bathrooms; otherwise they re-sold for a substantial financial loss. If you did an SQL search of your realtor database then created a graph or table on just the re-sales, I think the results would surprise most readers of this blog.