The Evil Investors

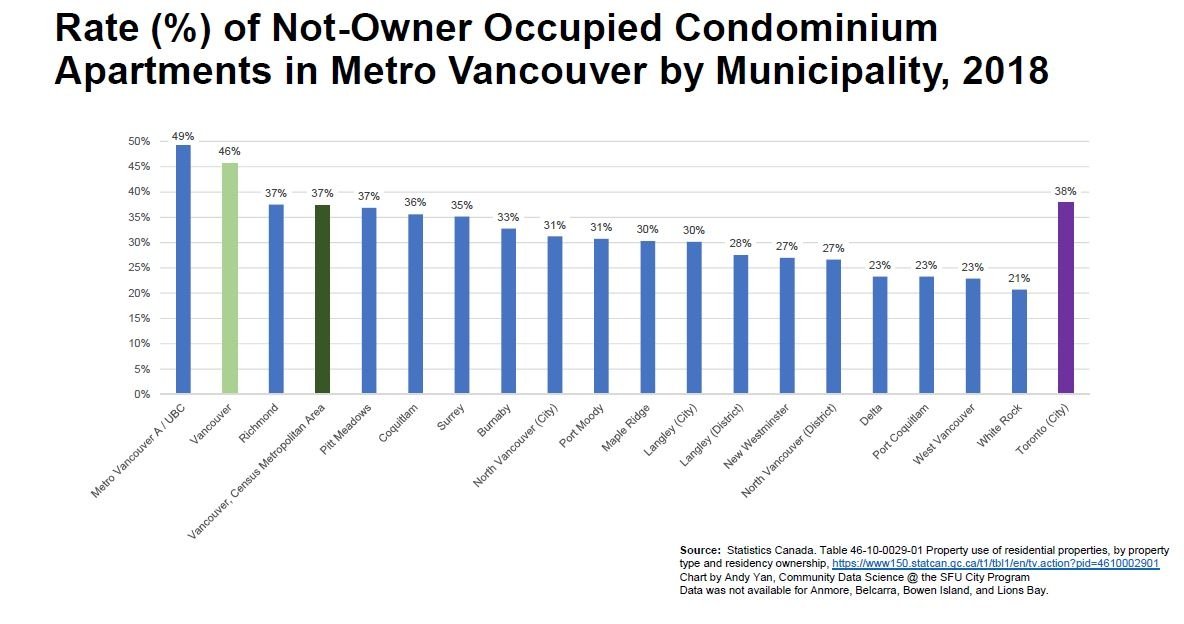

There’s a study out by SFU’s City Program that has been getting some media coverage lately. In it, Andy Yan examined the latest statistics from StatsCan’s Canadian Housing Statistics Program which has been digging deeper into who owns what real estate and why. In Vancouver proper, Andy found that nearly half of condos are not occupied by their owners, or in other words: they are investor-owned. Those properties aren’t necessarily rented out (they could be empty some or all of the time), but the vast majority of them will be rentals.

This is the first year of data collection but Andy compares the current statistics to his earlier work to conclude that “things became progressively worse, and we knew [about it] 10 years ago.”

However here is where I have a problem, because I don’t see investor owned condos as necessarily a bad thing. The vast majority of these condos are rented out, and if you are saying that investor owned condos are a bad thing, then you are saying that renting is inherently inferior to owning. According to Yan, it “really goes into the question of what’s the priority in demand that our housing system needs to meet — investments versus, say, someone who’s trying to set their roots in the city“. The implication is that renters are some kind of second class citizens that can’t put down roots in a community which I find bizarre.

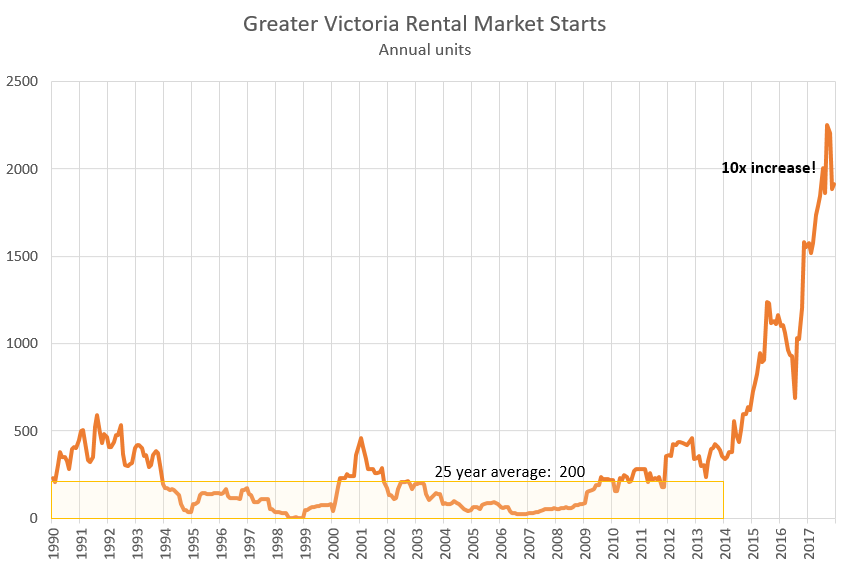

Why do investors buy condos? Because there is demand for them in the rental market. Yes, there are certainly also speculators that buy in order to flip, but that is a temporary phenomenon of the upward part in the real estate cycle that is effectively damped down when prices fall (as they are in Vancouver). Isn’t it a good thing that rentals are being created in the private market? Last I checked rental vacancy was still near 1%, rents were rising quickly, and before 2015 we were building near-as-makes-no-difference zero dedicated rental stock for several decades in this city. Only recently has rental construction taken off.

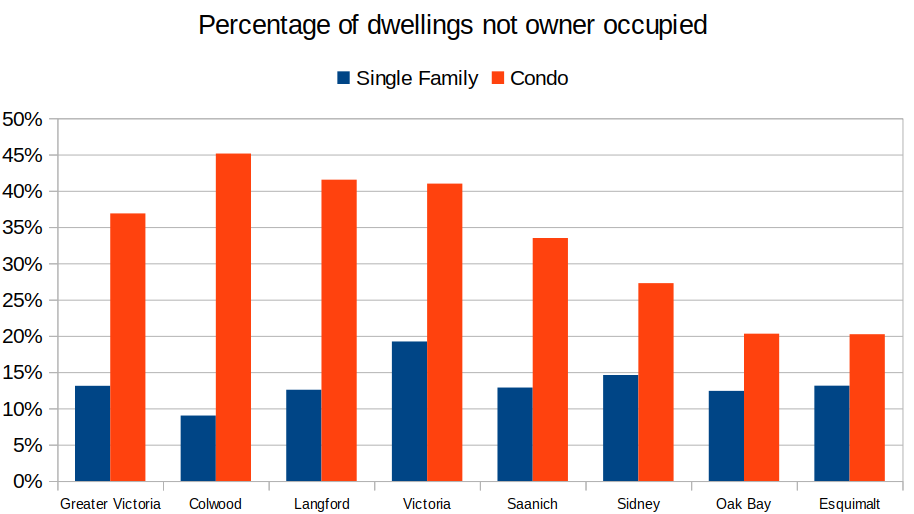

So what does the picture look like for non-owner occupied properties in Greater Victoria? As might be expected, the municipalities with the most condos best serving the commuter markets have the highest percentage of investor owned condos.

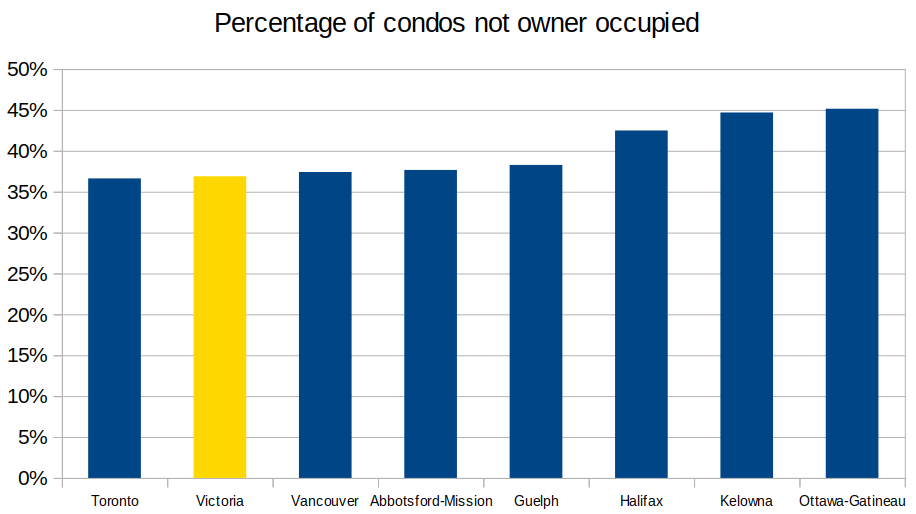

There is no evidence in this data of speculative activity driving higher rates of investor holdings of condos. Comparing cities across Canada, high priced and high-appreciation cities actually have some of the lower rates of non-owner occupied condos. Granted I would like to see data for cities like Calgary that have had stagnant real estate markets for a long time but it doesn’t look like there’s a smoking gun here.

No doubt we have a big problem with poor affordability in Victoria and it’s off the charts in Vancouver, but blaming investors buying condos is barking up the wrong tree. As long as those condos are not left empty or turned into hotels (both specifically targeted with the spec tax and short term rental restrictions), then those condos are providing rental accomodation for people that need a place to rent. And condos are exactly where we want investor dollars to go, as unlike single family houses they don’t have an effective upper limit to how many can be built.

The better solution for stable long term rentals is absolutely purpose built rentals and I’m glad those are starting to come online in a big way. However we shouldn’t demonize investors for creating rentals to bridge a gap in the market.

I think governments like investor-owned rentals because such owners have to pay regular income tax on rents they collect and can’t incorporate. Taxation on a rental property is brutal compared to say stocks, which get capital gains treatment and you can defer taxation for years.

I agree with you Barrister about that style of home. It is very cold, boring and will eventually look dated. I much prefer a classic sophisticated look with timeless design design that has staying power.

My wife and I went through that house when it was open last week and I was wondering about the price as well. I have to be up front and say that style of house is really not my cup of tea but I am aware that others love it. I do think that it is a good quality build on a nice quite street. It has a nice pool but I am not sure if that is actually a positive for a lot of people. The season is pretty short here and they can be a lot of bother and expense.

One of the nicer features is a very large and pleasant rooftop patio. But the fact that there is no elevator to reach it sort of makes it impractical for parties if you and your friends are older. An elevator might sound like a real unnecessary luxury but considering the price of the house and that it is not waterfront it is a bit of a drawback.

Because i find that style of house totally uninspiring and rather cold and boring I dont want to say that it is overpriced. We will see what the market thinks.

Monday numbers: https://househuntvictoria.ca/2019/06/24/june-24-market-update

“All it takes is one buyer that really wants the place”

That’s a great way of putting it. That house is hard on the eyes. But that’s the point, eye of the beholder.

Curiosity might ask if there’s actually a real bag that you’re given that says “Bag Holder” on the side.

If you look at the first chart on that page though, you can see why the summary (now removed) said what it did though.

Look at the last cooling period (2010 -> 2013). Prices did not start dropping until months of inventory hit about 7. Right now we are at a 12 month average of 3.73 which is still in the hot market range. Hence the system deciding that prices should keep rising.

I believe the main reason is the shock of the stress test which the market is still adjusting to, and the fact that during the super hot market from a couple years ago sale prices were above market due to the mania so now our year over year comparisons look down when values are likely more like flat (or slightly up still).

Sorry no it’s my lack of updates to that page. That page is automatically generated based on the data, however it uses 12 month average data, so it tends to be quite lagging (hence the warning at the top of it but I should have modified that code long ago).

Then what it does is use the historical rate of price appreciation at similar MOI levels in the past to come up with the projection. That worked alright on the way up, but has been quite far off in the last year or two.

I’ve removed the automatically generated summary for now because it is so misleading. What I’m going to do once I find some time is to fix it and then write a new article about how it does by backtesting against previous price history in Victoria.

Barrister: ok, so I’m not actually missing anything. Wow. VREB is something else.

Koalas: You are missing the fundamental nature of snake oil salesmen.

Feel like I’m not understanding something. Just had a look at the VREB generated market report you have listed Leo. It says:

“As of May 2019 the market in Greater Victoria is pretty hot. This means that the market strongly favours sellers and prices are expected to rise quickly.

There are currently 3.2 months of inventory which is low for this time of year.

In the last year, prices for median single family homes have risen by $6,500 (1%) to $775,000 while prices for median condos have risen by $26,300 (7%) to $428,950.

If current market conditions prevail, you should expect the median single family home price to increase at a rate of about $100,000 (13%) annually.”

That last bit, predicting 13% annual price raises. Where does that idea come from? It is followed by a bunch of charts that seem to be mostly saying that sales are down, prices are a tiny bit down, MOI is up and sales to inventory is down. Clearly the conclusion is that house prices are likely to rise 13%/year? What am I missing?

I wouldn’t put too much stock into a list price. Let’s see what it sells for.

$2M+ listings up 65%, sales down 30% from 2017. Does not seem like a recovery to me. But there is a lot more individual variation on high end houses. All it takes is one buyer that really wants the place.

I think 1454/1456 Begbie is possibly a similar concept as a co-op building, say 2455 Beach Dr. or 895 Academy Close, that there is no individual ownership/title and all units owners together form a joint ownership. Normally there are detailed rules about common property and sharing, rental/pets, … etc. But individual owners couldn’t borrow traditional mortgage as there is no title for the unit.

While the co-op buildings have been here for a long time, co-op units in a SFH (like Begbie house) is probably a recent thing, house sharing/co-housing in high cost market, I guess?

Is the high end market recovering? Was out for a stroll and see that 1535 Despard Avenue is back on the market for 500k more than it was bought for in 2017.

https://www.rew.ca/properties/412252/1535-despard-avenue-victoria-bc

It does look like a pretty amazing home but I remember it being on the market for a while before it was sold back in 2017 for less than asking.

Lol @ Marko real life vs text book. It’s actually real life vs real life. Are you discounting someone’s experience because they worked on a transaction from an office/boardroom instead of putting on a steel toed boots on and making sure all the nails are hammered in correctly?

Sure it’s a warning sign that the market is in trouble, like other forms of “partner” ownership.

They’re not essentially sold off, which is the problem. Each owner has a fractional interest in the whole property. They may contract to use various parts of it, but all the liabilities associated with the property fall on both owners. For example, if one owner get a reno and doesn’t pay, the lien goes on the whole property. There is only one title.

Well if no one has anything to post, I’ll post a joke.

No English dictionary has been able to adequately explain the difference between these two words:

“Complete” or “Finished”.

In a recent linguistic competition held in London and attended by, supposedly, the best in the world, Samdar Balgobin, a Guyanese man, was the clear winner with a standing ovation which lasted over 5 minutes.

The final question was: ‘How do you explain the difference between COMPLETE and FINISHED in a way that is easy to understand? Some people say there is no difference between COMPLETE and FINISHED.’

Here is his astute answer: “When you marry the right woman, you are COMPLETE.

When you marry the wrong woman, you are FINISHED.

And when the right one catches you with the wrong one, you are COMPLETELY FINISHED!”

He won a trip around the world and a case of 25 year old Scotch!

There is a house for sale on Beggie street where they are offering a one third interest in a house with exclusive use of a suite. Is anyone familiar with this type of partial ownership sale? Is this a new trend where basement suites or garden suites going to be essentially sold off by the owners? Who decides what common expenses or repairs are undertaken?

How are disputes handled?

Are the parts of a house worth more than the whole?

@guest_61097

What service are they providing & what are the costs involved?

Yes, or the pyramids at Giza. Built 4,500 years ago, and going strong! If Pharaoh Khufu financed it with a 100 year amort, he’d be free and clear for the last 4,400 years.

Most investments that businesses make last for a much shorter time than condos and end up essentially worthless, yet obviously they are worth buying. That’s because the present value of the net income they produce over their lifespan exceeds the purchase price. That’s the basis of all investing.

Net income for a condo is of course rental value minus all expenses, including depreciation.

I’m with Marko’s approach on this, to be conservative, self-financing and use your own capital where possible.

Many RE developers go broke through excess leverage. Like the dangerous idea that he “should be building 6 houses using financing”.

The best advice is captured by this quote from a famous American financier. “More money has been lost reaching for yield than at the point of a gun.” – Raymond DeVoe Jr.

There is really no “right or wrong” on investment or life styles and choices, to each his/her own. So there is probably no need to “preach” 😉 unless being complained or requested.

Totally. Look at all those obsolete buildings in Europe. What were they thinking.

On the topic of leverage to create greater returns vs paying off debt.

You can either sleep well or eat well. Choose one. You can’t be wrong.

My point was that it is not worthwhile to design a building to last more than 50 years as it will be obsolete by then regardless.

It’s like the Ikea cabinet debate. Quality is not that important when they only need to last 10 years.

@Barrister#61234

#handsup

@Marko Juras

In each business case (property development, systems, equipment acquisitions) I apply a wide array of financial tools, theory, sensitivity/risk analysis, sustainability, balanced scorecard, etc.. When assessing my business needs finance is often a key measure, however I will invest in initiatives or projects that may not have a financial return but are tied to some other strategic objective. I am not saying anyone can accurately predict the market, however it is important to understand financial implications and the degree of variability in investment returns that an investor is willing to withstand.

There is a fair difference between how small residential developers with less than 5 employees operate and companies like Starlight and Brookfield Residential. Not to say one is better then the other, it is just a different scale, with different resource requirements, and different financial expectations. Although then there are companies like Abstract (house of cards) and that is another story…

Not exactly, you also said:

I think the fact is that Marko and his father know their business. Not having to use leverage, and congrats to Marko’s dad for reaching this stage, is a sign of success and independence in my books.

If Marko’s dad can afford to do what he does without financing he has no need to go big, or do anything anyone else says he should do. Plus he is saving the financing charges by using his capital, which may make sense on a short term investment like this where the costs of commercial borrowing are at a higher rate and the payoff period is short, and you’d like to access the capital for the next build in a relatively short period of time.

At the end of the day pre-sales happen to mitigate risk. The bank doesn’t like the risk, the developer doesn’t like the risk, no one likes risk. If there was no risk and the market was guaranteed to appreciate 3% per year no one would pre-sell.

This notion that developers would wait, on average, until completion to sell if there was no financing involved is non-sense in my opinion. If the market completely sucks (i.e. Era by Concert @ 728 Yates) the developer might shut down the sales center for a period but everyone will try to pre-sell if they can.

I can’t recall a 50+ unit development in Victoria that hasn’t pre-sold.

If you were the CFO of a large organization and did not consider the cost of capital, cost of debt and did not do any financial analysis in a business case you would probably be fired pretty fast.

Once again….theory vs real life.

I did my masters at UBC and took business courses where we wrote exams calculating the IRR internal rate of return and all the crap. However, very little real life application because you have to make a ton of assumptions. It is good to understands concepts of leverage (i.e., I personally prefer to invest versus pay down my mortgage) but trying to applying textbook theory while ignoring real life is amusing.

Actually what the articles were stating is that the maintenance costs became cost prohibitive. Not an issue of land use.

Will all the little guys making a couple of million a year here put up their hands.

That sounds about right. For comparison, the design life of detached houses is 50 years.

The lifespan can be extended indefinitely with good maintenance and renovation, but the structure will become increasingly sub-optimal use of the land.

There are lots of ‘50s era houses around that are solid, but are too small relative to the land value. For most, it is just a matter of time before being bulldozed.

Jesus Christ, I never said anything about it’s better being a big guy vs being small guys or vice versa. All I did was explain why pre sales and financing are vital to the profitability of a large development for a developer.

You can be perfectly happy making half a million to couple million a year being a “small guy”. Just like how you can be perfectly happy driving around on weekends and evenings showing houses as a realtor or putting on your tool belt everyday working in trades. Being a “big guy” or having a “prestigious” job isn’t for everyone and that’s perfectly fine, there is no right or wrong.

Re: Victoria Golf Course.

I’m not a member but I have friends who are. It was built in 1893 and is the oldest golf course in Canada still on its original grounds. It’s initiation fee if I’m not mistaken is North of $50k, with a 5 year waitlist. Uplands Golf Club is a little less but I’ve heard it’s 7 year waitlist.

While you and I, and 99% of the population will probably not play it this year, it’s a fiscally sustainable venture. Gorge Vale is suffering, and was really struggling for members. It’s the first to go in my opinion even if it is a more enjoyable and challenging course to play. If we get into crippling water restrictions we’ll see who is still standing…

Victoria doesn’t need more SFH’s. It needs increased density. In 30 years I’d expect to see a lot of Fairfield to look more like James Bay. More multiplex’s of various sizes. More condo’s. Fairfield Thrifty’s plaza and surrounding area is probably incredible value based on the land and future re-purposing.

Totoro: Stop being sensible, it is confusing people.

I was reading an interesting article which stated that the anticipated lifespan of a highrise concrete building is anywhere from 50 to 75 years (no the building does not collapse but the maintenance and remediation costs soar to the point of being unmanageable). If there is any truth to this assertion one has to wonder how sound an investment these condos are considering that land makes up such a small portion of their value. Human nature being what it is most people dont consider the depreciation value of the structure when buying. Just a passing thought with my first cup of coffee.

That reminds me the story of “fisherman and businessman” 😉 :

A businessman was at the pier of a small coastal Mexican village when a small boat with just one fisherman docked. Inside the small boat were several large yellowfin tuna. The businessman complimented the Mexican on the quality of his fish and asked how long it took to catch them. The Mexican replied only a little while.

The businessman then asked why he didn’t stay out longer and catch more fish? The Mexican said he had enough to support his family’s immediate needs. The businessman then asked, but what do you do with the rest of your time? The Mexican fisherman said, “I sleep late, fish a little, play with my children, take a siesta with my wife, Maria, stroll into the village each evening where I sip wine and play guitar with my amigos; I have a full and busy life, señor.”

The businessman scoffed, “I am a Harvard MBA and I could help you. You should spend more time fishing and with the proceeds buy a bigger boat. With the proceeds from the bigger boat you could buy several boats; eventually you would have a fleet of fishing boats. Instead of selling your catch to a middleman, you would sell directly to the processor and eventually open your own cannery. You would control the product, processing and distribution. You would need to leave this small coastal fishing village and move to Mexico City, then LA and eventually New York City where you would run your expanding enterprise.”

The Mexican fisherman asked, “But señor, how long will this all take?” To which the businessman replied, “15-20 years.” “But what then, señor?” The businessman laughed and said, “That’s the best part! When the time is right you would announce an IPO and sell your company stock to the public and become very rich. You would make millions.” “Millions, señor? Then what?” The businessman said, “Then you would retire. Move to a small coastal fishing village where you would sleep late, fish a little, play with your kids, take a siesta with your wife, stroll to the village in the evenings where you could sip wine and play your guitar with your amigos.”

The fisherman looked up, waved both hands outward like a game show host displaying a stage full of prizes and said, “you mean, like this?”

So much better not to be the “big guys” imo. Corporations take on a life of their own. Real freedom in operating without all that and with financial independence.

Leverage is good when you are building to financial security. When you have enough I don’t see the point personally. Better uses for your energy.

In case anyone’s interested, was checking out the May SFH inventory and it’s nearly doubled since 2017.

SFH Active Listings for May:

2019 – 1058

2018 – 803

2017 – 593*

2016 – 628

2015 – 1208

2014 – 1484

2013 – 1533

@guest_61220

” common small business mindset”

Easy for someone to say who doesn’t own a business

“The negative consequences for the general standard of living and quality of life of largely uncontrolled immigration to the US is now evident in a number of states, particularly California and Florida.”

And what are those negative consequences, particularly in California and Florida?

@guest_61220

Do you mean like all those smart financial experts at Lehman Brothers that overleveraged themselves on RE debt before the housing market collapsed in the US?

I agree using debt has it place, however if you are investing shortly before retirement or have other reasons to be risk averse, there can be good reasons to not leverage your investments.

The other asinine thing is taking market observations from the last 150 years – the most anomalous period of human history – and elevating them to the level of natural law.

Yes

If you were the CFO of a large organization and did not consider the cost of capital, cost of debt and did not do any financial analysis in a business case you would probably be fired pretty fast. The cost of debt is really low right now, when you can get a 25 year fixed term loan from a major bank for 3.2% on a big rental project it makes no sense to fund it with cash when you consider the after tax cost of the interest. There is a reason these big companies have a few CFA’s or CA’s on staff and aren’t just funding projects with cash. It is always fascinating when you see individuals rush to pay down low interest debt when capital can be earning a higher rate somewhere else. But that’s it is a common small business mindset for people who are not finance professionals.

Lol landlord, marko’s dad can do whatever he wants and I am sure he’s quite successful at it but he’s not doing $100m plus projects.

Anyways back to that redfarn house, I remember looking at a similar house on a similar sized lot couple streets over on Chaucer in around 2013 before ultimately buying something in Gordon head. And back then the house on Chaucer went for I think $770. From what I remember this redfarn house has better renos. I wonder if the assessed values accounted for the renos.

@ Intro

I would say, rather, that you comment seems suspiciously like a “troublesome” view about Canadians, who as you have indicated, you’d be glad to be rid of in your own neighborhood of Gordon Head.

@ Patriotz

Mainly correct, although the central Asian republics are well above the replacement rate, as is Israel/Palestine, and more significantly, Pakistan, a large country with a mean fertility rate of 3.55.

And remember, Africa is a big place, the second largest continent, where, in most countries, the fertility rate is two or three times the replacement rate, and where population is expected to double within 30 years.

Further, there are countries with stable but very large populations where a large proportion of the population would migrate to the Western world if they could. That is perfectly understandable, but it indicates that the relatively small (by population) European majority nations could be radically transformed by immigration, if migration were ever to become unregulated, as many in the US seem to want. The negative consequences for the general standard of living and quality of life of largely uncontrolled immigration to the US is now evident in a number of states, particularly California and Florida.

The good news, in Canada, is that most if not all first nations have a positive fertility rate. Good for them.

Also another advantage to not having to rely on financing is that you can act more quickly.

Let’s say you are putting a deal together for those 6 properties with financing. While you are busy doing “risk mitigation and quantification, financial modeling of different deal structures” to try and get the bank to finance you. In swoops Marko’s dad and buys the most lucrative of those 6, by making an offer with no conditions. Now your deal falls through, because your “business case” was dependant on the profit of that lucrative property.

Okay. Assessed at $986K, asking $975K. Sold in less than two days, $80K over asking, with no condition.

We were looking for something interesting to do, and the open house and its asking price caught my eye last night. Not bad a buy for the house and the location, even has a nice suite (shhh …. 😉 )

Sold $1,055,000

Does anyone know the story of 1605 Redfern St (located just a few steps from Oak Bay Ave Red Barn store)?

https://www.nytimes.com/real-estate/can/bc/victoria/homes-for-sale/1605-redfern-st/2712-59114480

It was listed maybe 2 days ago and suppose to have a open house this afternoon. But there was no one there when we passed by, and the list was removed from mls. Possibly sold? Sold price? Just curious. Thanks.

@guest_61122

No, I was not responding to your original argument that financing is good for development and that pre-sales can help with that.

I was responding to some of the statements you made in subsequent posts like: “no one will buy one property in an all cash deal when they can buy 6 properties with the same amount of cash but use financing”.

Going back to 1950 (which predates modern birth control of course) dramatically obscures current population growth rates. Africa and parts of the Middle East are really the only parts of the world with rates significantly above replacement today, and many Asian countries (most obviously China and Japan) have rates well below replacement.

Former Landlord, what part of “risk mitigation and quantification, financial modeling of different deal structures” did you miss from my previous post. The whole point of my post was to show why developers need pre-sales to get construction financing, and why construction financing is key to a developer’s profitability.

In your example, what if interest rates decreased and prices keep going up, my god you would have made out 10x more if you invested in three projects with financing. So that’s where the analysis comes in to play and why large projects needs to supported by business cases with detailed analysis and sensitivity testing before they come to the investment committee for approval to proceed.

Marko’s dad buiding SFH houses in langford is not the same as Quadreal building the Oakridge development (FYI, Ellisdon their contractor is flying workers in from Saskatchewan for 10 day shifts and putting them in hotels, it is cheaper that way compared to hiring local trades)

On another note, whats the worry in Victoria anyways, I thought prices would never go down here, so with the assumed 25% margin buffer you are guaranteed to make money!

@ Leo

“I would prefer not to get too far down the immigration discussion please. Tends to go off the rails.”

I understand your concern, especially when Introvert asserts what is quite untrue that I have expressed “troublesome” views about immigrants — a false claim for which he has yet to offer an apology.

However, it is the case, that you cannot realistically discuss housing economics without taking into consideration demographics, and you cannot consider demographics without considering immigration rates, as well as birth rates and death rates.

Moreover, I don`t think it makes for a very useful discussion to eliminate all reference to a matter of housing-related policy that is at issue in the forthcoming Federal election, of concern not only to to the party of Maxime Bernier, a former Industry minister and Minister of External Affairs. but to supporters of both the liberal and Conservative parties, which advocate quite different immigration target rates.

@guest_61122

You are implying that the way the “big guys” do it, is the only sensible way of doing things. Using leverage will expand your potential for profits but also add significant risk. In a downturn you could lose everything as many “big guys” experienced in the 80s.

If I used $30M of my own money and $70M of the banks money, then interest rates go up, housing prices go down and let’s say I am able to sell the project for 80% of my initial investment. After paying the bank back the principal I only have $10M and most of that will probably have gone towards the high interest rates I had not anticipated. Now consider I only invest in a smaller project with my $30 and then I lose the same 20%. I still have $24M left and I am still able to retire comfortablely.

lol Marko not trying to give you a lesson, just telling you how things work at sophisticated large scale developers that’s all 😉

However, may I suggest you or your father expand your location preference to outside Victoria? I am sure you will find some attractive pre-sales / building lots. You won’t because you are not familiar with those areas and is too much work right? Well that is the difference between you and the big guys.

This seems suspiciously like “a view about immigrants” which you claim not to hold.

You got it, boss. The above will be my coda on the matter.

I would prefer not to get too far down the immigration discussion please. Tends to go off the rails.

Thanks for your Investing In Real Estate 101 explanation. Unfortunately, yet again there is theory and there is reality of how things actually work. I’ve bought a lot of pre-sales since 2009 so I know a bit about leverage and there is more to investing in real estate than a textbook.

Real life problem….there have been no attractive pre-sales for years so how do I leverage when it makes zero sense to buy in what I invest in? Same situation for my father. We found a great deal on two building lots that can’t be replicated. Not going to suggest he buy more building lots for 50k more just so he can finance and improve his “return profile.”

@ Introvert:

This is where you drift off into political imbecility. When the entire population of Gordon Head consists in just Introvert, and the rest of country has been likewise depopulated (despite Introvert’s theoretical love of mass immigration), how much clout would Canada have in the world then?

Lack of population has been a problem for Canada from the outset, for the reason that most people would rather live in a temperate climate than in a country that is 60% permafrost, the rest being comprised of swamps, forests and fields of grain. Now the problem of inadequate population has been exacerbated by social pressures, housing costs and technological developments that have made the Canadian population reproductively dysfunctional.

What do you think the transcontinental rail project was about? It was to bring more settlers to the North West before the Americans grabbed it.

What clout do you think a Canadian population of the present size or less would have versus a US of 800 million as is projected for the end of the present century?

We are already seeing Canada being treated for the insignificant power that it is. Duterte of the Philippines (population 104 million) threatening to dump garbage on Willows Beach, China (population 1,400 million) holding Canadian citizens hostage over our insistence on adhering to our extradition treaty obligation with the US.

No, we need people. And we need an efficient, ecologically sustainable economy. That means we need more houses and we need to provide them economically, or we will see the fertility of the population further diminished.

Yes, we could probably replace every single native-born Canadian with an immigrant. But who’s for that? Speak up Introvert, if that’s what you believe. If not cut out the silly PC admonitions.

No one cares about the lack of thermal bridging, but people do care about strata fees. I’m not aware of this happening currently but lenders do take into account heat when calculating GDS. If they get on board with energy efficiency people could even qualify for more in a passive build.

In fact, CMHC advises that Heat costs should take into account actual heating costs so the groundwork is already there. “Heat Costs: Mortgage professionals are expected to ask the prospective borrower what the monthly heating costs are for the subject property and use the actual heat cost records, if provided by the prospective borrower. Where no history is readily available, the heat costs used must be a reasonable estimate taking into consideration factors such as property size, location and/or type of heating system. Such estimates are to be based on a sound rationale, providing an accurate estimate that is reflective of the characteristics of the property being purchased.”

Unlike an F150 and a Prius there should be no downside. In fact from a status perspective, the passive house gets you more social points amongst Victoria residents.

No Marko, I am saying you are better off using that money for other projects or uses that yields a higher return than what the financing costs will be. If you are a competent developer/business then your cost of equity (cash) will always be much higher than the cost of debt. Do you want to tie up $100M for two years to make $25M or do you want to tie up $30M for two years and make $13M, and use that other $70M for something else, because now your break even is only $12M and that developer can make the $12M using the $70M remaining in his bank on something with a lower risk profile than that aforementioned project. So in this scenario while the developer still made $25M with his $100M, but he did so at a lower risk profile.

That is how things work on a bigger scale, except obviously there are a lot of risk management/quantification and financial modeling to optimize the amount of financing, the type of project undertaken and the structure of the transactions. That is something not typically available to unsophisticated developers. If your father is confident in his ability as a single family home developer then he should be building 6 houses using financing, or using those funds for something else that will yield a higher return then what the cost of financing would be.

It is the exact same principle as real estate investing through the use of leverage, no one will buy one property in an all cash deal when they can buy 6 properties with the same amount of cash but use financing. Although a prudent strategy in that scenario would be to buy 3 properties with financing and use the remaining funds to diversify into a different asset class so you don’t have all your eggs in one basket.

Once consumer awareness increases, these places will sell for a small premium as well.

Highly doubt it. People buy houses cause the deck has stairs off it into the yard for their dog Boo. I’ve never heard anyone ask about truss heel height and other energy efficiency building methods.

How many people buy the Prius C becuase it is super efficient? All I see is F150s.

Seems like an easy thing to mitigate as well by providing low cost financing for the additional capital cost and city development bonuses to offset construction uplift.

Once consumer awareness increases, these places will sell for a small premium as well.

@ Intro:

Soooo?

Is that the expression of “views about immigrants.” No. Obviously not. And it’s a relevant question, in a country where:

the fertility rate is barely equal to two-thirds of the replacement rate,

where there is a large immigrant influx (a planned rate equal to 1% of total population per year).

Perhaps you are numerically challenged. But to anyone even barely numerate it amounts, over a generation or two, to a policy of population replacement.

That’s not a comment on immigrants — I am one — its a comment on demographics. And if you are not prepared to think about demographics, you might as well drop out of the conversation about housing economics. Or is that out of bounds on this blog?

Step code houses (at least beyond step 2/3) will cost more to build, but less to operate. Those costs should drop as products become available here and the municipalities get with the program.

I think step 1 is just a blower door test value of 3 or less.

You once wrote:

“Do Canadians want to be replaced by people from elsewhere…”

https://househuntvictoria.ca/2017/09/06/regulation/

Why does whether Canada’s population grows via immigration or via Canadians having more kids matter so much to you?

Why would anyone want more people to live in their neighbourhood?

The current density in Gordon Head is fine. If anything, I’d support a density decrease.

ks112….what you are telling me is that if I have $100 million and one project on the go I am somehow better to finance and keep $70 million in cash sitting in a savings account?

I know multiple developments that were built with cash (multiple partners) and no bank financing; however, they all pre-sold. No one is in their right mind would take a 100 to 200-unit building to completion and then sell. There is always downside risk and plenty of examples….Falls, Bayview One, etc., etc.

Right now my father is building two houses with no financing. I don’t understand how him financing the houses and leveraging would increase his absolute profit, not some theoretically return profile. I guess in a theoretically world he would build 6 houses with financing, but that isn’t how reality works.

Marko, why would a developer ever self fund a development project without debt financing? It is with the leverage from the debt financing where they make most of their money from.

Do you think say the Jawls or any other developer will put up 100% of the construction costs for a project? Having worked on one of those transactions (commercial, not residential), they will go as far as taking out a second mortgage from another entity that is setup solely to save on tax.

Why would anyone put $100 million down to finance a whole project to make say 25% margin (purely assumption no idea what residential margins are) when they can go get a loan with an LTC for say 70%. Then you only put down $30M plus interest cost of say 9% to be conservative assuming you also took on mezzanine financing. So over the course of construction you will incur $14M of interest but at the end of the day, your return profile is ~43% [($25M-$12M)/$30M] not counting any tax efficiencies from the interest expense.

The point is, developers need financing to make the deal work and the banks need pre-sales to provide financing at reasonable rates. If the banks will provide financing without pre-sales at reasonable rates then I will guarantee you there will be some high risk taking developers who will hold until completion to sell.

That has nothing to do with step code though.

The way municipalities operate in real life is no one will know wtf is going on with the step code and they will simply ask for multiple energy reports, consultants and engineering certificates further adding to costs.

Just hired this company for two houses in Colwood -> http://enertech.solutions/ Is it really going to make for a better house? Nope.

I kid you not that there is more than 50k worth of complete BS on a 699k product, but common-sense items like require an electric car plug (super cheap during rough in) in each garage is not required.

Does anyone know what’s wrong with this house?

Court foreclosure……went in court for $807,501 this morning.

@ Intro:

“But, yeah, our economies require growth (in many ways). ”

Does it?

In what way?

I think it would be good if our economy contracted in many areas: commuter travel for example. But that would require an end to NIMBYish opposition to densification in places like Gordon head.

@ Intro

“So I think it’s incredibly naive to think that increasing the population of Oak Bay and Greater Victoria and B.C. and Canada and North America and the world is going to be a net good.”

Who talked about a “net good”?

No one.

I mentioned only the issue of survival, by which I meant Canada as an independent, sovereign state, which requires at the very least preventing a population implosion because without population you don’t survive.

@ Introvert:

“CS, I think your views on immigrants (which you’ve shared with us before) … are troublesome.”

My views on immigrants? What you talking about?

I expressed no view about immigrants, here or previously.

Your false allegation I find “troublesome”.

Agreed on the 20% requirement though. As usual, Helps gets it.

“Mayor Lisa Helps, however, urged councillors not to increase the requirement to 20 per cent, arguing it would result in fewer project applications and thus fewer affordable units.

Helps noted that Victoria is already seeing a boom in construction of rental housing.”

https://www.timescolonist.com/news/local/make-20-of-units-affordable-in-larger-condo-projects-victoria-councillors-say-1.23857034

That has nothing to do with step code though.

Almost certain this is fear mongering

Doubt it. Trying to put in a DP/BP application to Colwood for a cheap SFH home and already at over 40 pages. When I built my personal house in 2014 it was literally 2 pages (building permit + HPO letter).

Things are getting out of control quickly.

CS, I think your views on immigrants (which you’ve shared with us before) and on population-as-a-defense-measure are troublesome.

Globally, fish stocks, mammals, birds, amphibians, plant species, forests (and on and on) are in massive decline. And that is with the present worldwide human population.

So I think it’s incredibly naive to think that increasing the population of Oak Bay and Greater Victoria and B.C. and Canada and North America and the world is going to be a net good.

But, yeah, our economies require growth (in many ways). But infinite growth on a finite planet is impossible, and the longer we attempt it the worse off we will be.

Almost certain this is fear mongering.

“Another approach is to simply look at the overall cost of building passive low-energy affordable housing projects to see if they are affordable relative to other projects. This type of information is available from a number of projects in Pennsylvania, for example. In October 2014, the state added 10 points (out of 130) for targeting Passive House performance to their affordable housing project proposal evaluation criteria. Subsequently, of the 85 multi-family affordable housing project proposals submitted in February 2015, 32 were aiming for Passive House. Out of 39 projects awarded funding, 7 were planned Passive House projects, involving a total of 422 units. The average cost of the 32 Passive House project proposals was $169/ft2, which compares quite favourably to the 53 non-Passive Houses that had an average cost of $165/ft2”

https://eppdscrmssa01.blob.core.windows.net/cmhcprodcontainer/sf/project/archive/research/rr_passive_approaches_to_low_energy_affordable_housing_projects.pdf

In general you would expect a small increase in costs but that will be reduced as expertise increases and with innovative methods like mass timber. We definitely need more public case studies on this though.

Victoria has the ideal climate for passive house. Not hot, not cold, so heating and cooling days are minimized. In a cold climate it is definitely much more expensive to built passive houses.

I went to a presentation yesterday put on by a reputable local developer and he thinks the new step code will add approximately $100 per square foot in a concrete tower.

He also noted that banks won’t touch projects in the COV with the new “20% of large developments be affordable rental housing”

Between the two he thinks going forward market will have to support $1,000 sq/ft to offset step code and to offset the 20% affordable rental housing (80% of the market units will have to offset the 20% affordable units).

I can see house prices affecting the fertility rate, not sure how much of a link there is with the subsequent stuff. It could be true, but the question strikes me as academic and difficult to prove. You could just say, housing prices that are a glaring mismatch with an economy are bad for a society.

I don’t think immigration adequately explains the housing prices in certain regions. Regardless, my guess is peak immigration is probably here, or near it. Like I’ve said before, I believe we are heading into a housing led recession and in regions like BC, that’s not going to promote a net positive for inflows.

We’ve seen it before, and we’ll see it yet again.

@LF

“Building will always catch up to population needs, always has, always will. Imbalances naturally occur between supply and demand, and that’s what drives the ascents and downturns in RE.”

Correct. But with our current land-use regulation, the price of land where people want to be continually escalates. So what we are seeing now is escalating house prices depressing the fertility rate, leading to higher immigration to compensate, resulting in further escalation in house prices, with no end to this self-destructive cycle until we change the rules on land use.

As for why having more people is a good thing, for the same reason now as during the days of John A. MacDonald: to keep control of the territory. in a world where the population of Nigeria, one of over 50 African states, is headed for three quarters of a billion, a Canada of 35 million or so and falling ain’t gonna have much clout in the world.

Fact: population is not growing, it is shrinking. That’s why the Liberals want to up the immigration rate to 350,000 a year: it’s to make up for the losses.

High house prices must certainly depress the fertility rate, but unless you really hate Canadians, why would you want higher prices when the fertility rate, even now, is barely two-thirds of the replacement rate?

What we need is some of those African stick houses. You could accommodate a coupla thousand of those down at Beacon Hill Park, then we’d might see a spike in the birth rate.

Meantime, instead of taxing the poor dying Canadian population for futile birth control programs in Africa, we should be flooding Africa with glossy Homes and Gardens magazines. Get the Africans hooked on granite and multiple bathroom homes and their fertility rate will crash.

Anyhow, more people are, not is.

You’re right, but I’m taking a more global view this morning.

Isn’t it asinine to think that population can grow forever?

I think we have more than enough cities with enough people in them to come up with great ideas.

Of course. But just because we can doesn’t mean we should.

Marko, developers do pre-sales in large because the banks need it in order to give them construction financing. If they can get the financing without pre-sales then there will be some risk takers that will hold the price risk and sell upon completion.

I’ve seen lots of developers that don’t need financing pre-sell. What is a good example of a large development in Victoria where the developer waited until completion to sell? Banks don’t like the risk and neither do developers. The point is there is always downside risk.

“Why is more people good?”

More densely populated areas show to have higher productivity per person. The theory is that more ideas are shared between people and companies (as there is more opportunity for employees to move between companies). This why we see a worldwide trend of urbanisation. As we have more people we should have more opportunity to come up with great ideas, like on how to solve climate change. Canada has tonnes of room to support a much higher population.

“The crises won’t end until the population stops increasing. Building can’t keep up with population growth—and in the long run, we shouldn’t try.”

I wasn’t being serious, but you are.

Victoria’s population grew by what – 6.5% between 2011 and 2016? Not sure why we shouldn’t be accommodating modest growth. If your asinine fantasy of zero population growth came true, where would the demand come from to drive house prices higher?

Supply may lag demand over the short run because of the time it takes to design, finance, get municipal approvals, and construct new supply. Over the longer run, it seems to be able to keep pace.

“Two of the reasons I like our high prices: 1) they send the signal to people that Victoria is full, which it is; and 2) they discourage people from having more than two children.”

Well no, but it does send a signal to builders to build more dwelling units.

Why is more people good?

This is totally false on its face. Sounds more like a projection of, “I’m socially anxious and misanthropic, but now that I’m here, please keep my world as small as possible or disaster will strike.”

Perpetual housing crisis due to simple population growth is essentially impossible. Building will always catch up to population needs, always has, always will. Imbalances naturally occur between supply and demand, and that’s what drives the ascents and downturns in RE.

@guest_61112

I agree Victoria is pretty densely populated, so you wouldn’t want cram too many more people in there. However Oak Bay only has a population density of 1700 ppl per sq km compared to 4,400 in Victoria. Plenty of room for more people there. I think a good start would be to convert Victoria Golf Club to SFH and condos. This might also incentivize others in the area to move out of their giant estates since they are no longer so close to a golf course. Doubling the population density in Oak Bay gives us room for an extra 20,000 ppl close to downtown.

Marko, developers do pre-sales in large because the banks need it in order to give them construction financing. If they can get the financing without pre-sales then there will be some risk takers that will hold the price risk and sell upon completion.

If you think about how long it takes to build a condo (I am talking shovels in the ground as that is where they start to incur significant costs) compared to the duration of the typical boom bust cycle then many developers would find it to be a prudent choice to hold the price risk until completion.

No, more people would move to the region and we’d have a housing crisis again.

The crises won’t end until the population stops increasing. Building can’t keep up with population growth—and in the long run, we shouldn’t try.

Two of the reasons I like our high prices: 1) they send the signal to people that Victoria is full, which it is; and 2) they discourage people from having more than two children.

That ten-fold increase in rental housing construction reminds me of what happened in the 80’s when Federal Government tax incentives created a boom in rental housing construction. That boom was followed by a crash.

Agreed. And it’s not rocket science. Provide very low cost loans for building rentals and have cities give them preferential approvals and construction explodes just like what is happening now. Hopefully this time after catching up construction will continue at a lower level rather than this odd multi-decade boom-bust.

Koala, I was responding not to your assertion that in Canada there are “poor tenant rights”, not the remainder. There are not poor tenant rights in Canada, in fact one of the issues for landlords is that rights favour tenants to the extent that it people don’t want to become landlords and have to deal with res ten issues.

I would strongly disagree that we should create greater tenant rights as a way of creating stable rental housing here, that is not going to work given the rental returns and other issues for owners which place an unfair burden on them. I think the only way to do it is to incentivize the creation of stable purpose-built rental housing, likely through more co-ops or rent geared to income units run by non-profits.

I agree that in Germany the policies are tailored to create a neutral housing market where owning is not incentivized like it is in Canada.

Note in BC, the maximum rent increase allowed each year used to be the annual inflation rate plus 2% . But BC government has capped it to the annual rate of inflation starting this year.

Also there should be more long-term renters in rental apartments/townhouses, as the longer you stay the less rent you pay comparing to market rental price. We just need more purpose-built rental units.

Those are two different things. The article tries to connect the drop in rented units to vacant home tax but that doesn’t make sense. Very likely due to drop in prices and some speculative landlords selling.

As for the 117 units converted to rentals, the other impact will be those selling their empty units and adding to resale inventory. The article says that is a zero sum game “He said he knows of a number of people who, to avoid the EHT, have sold their condos and instead are now renting. That means that there is no real change in how many units are occupied” but that is not true. If someone owns a condo that they only occupy occasionally they are “occupying” 1 condo, 100% of the time. If they sell then they release one unit, but only occupy a unit when they are actually in town (say 20% of the year). That is a net gain of 80% of a unit.

Totoro:

Most of the points you make are in the article I linked. Glad to see you read it. My central claim is not that renting in Canada is less advantageous due to poor tenancy protection, but that policies over the years have benefitted homeownership more than renting. In turn, that leads to the dynamic you identified, that there is greater incentive here to sell houses which can lead to tenant eviction for instance.

That being said, I think an argument could be made that, to rectify the lack of balance in incentives offered to homeowners vs. renters in Canada, tenant protections that actually exceed those in Germany for instance could be a way to achieve greater balance.

As the article stated: “In general, Germany strives to pursue a “neutral housing policy” that doesn’t favour homeownership over renting.” Witness the current new policy in Berlin ( 5 year rent freeze) to address rising rents that are a consequence of rising home prices in turn due to gentrification. Can you imagine the uproar here if Helps were to try to pass a similar policy?

My contention is that Canada has an asymmetric housing policy that favours homeownership over renting. In turn, that engenders a culture elevating home ownership over renting. And that is a shame because, for many people, renting could very well be a much better way forward.

Vancouver Empty Homes Tax is in year 3. After the first year, the supply of rented homes unexpectedly fell according to CMHC. Even the city govt is only claiming 117 homes rented out possibly because of the spec tax.

https://www.theglobeandmail.com/canada/british-columbia/article-vancouver-councillors-support-empty-homes-tax-despite-dubious-results/

“The proportion of Vancouver homes rented out fell to 24.5 per cent in 2018, compared to almost 26 per cent in 2017, said Canada Mortgage and Housing Corp. analyst Eric Bond. Vancouver’s precedent-setting empty-homes tax resulted in only 117 homes being converted to rented from vacant in the second year of its operation, according to a staff report. ”

@freedom_2008

Re: Talk about population growth

Africa’s astounding population growth relative to Canada’s negative population growth (excluding immigration) is surely due at least in part a difference in house construction method and hence cost.

CMHC publishes vacancy rates in October which would be first year of spec tax. I bet they will be up (mostly due to other factors but small impact from spec tax)

If you are comparing the situation here to Germany where there are many more lifelong renters, it is not tenant rights that is making the difference. Imo, Canada has stronger tenant rights than Germany overall, there is just greater incentive to sell a property in a shorter window of time here so it is more likely you’ll be required to move for this reason if you are in a privately owned rental.

What made a real difference is that Germany incentivized private citizens with capital to become long-term landlords. Any profit from the sale of a residential investment unit is tax-free provided the property has been held for at least ten years.

Also, there are just way more purpose-built rentals. During the war in Germany many homes were destroyed. Post-war few could afford to own or build and Germany incentivized the construction of rental housing as fast as possible by providing a combination of direct subsidies and generous tax exemptions to public, non-profit and private builder owners.

In addition, today in Germany it is hard to get a loan, typically banks require 40% down payments and many Germans are debt averse and there is no stigma against renting.

Talk about population increase, see this picture (from CBC news):

In Vancouver they have vacancy rates that haven’t changed and house sales at decades-lows. Are you holding out the possibility that many people are currently selling their homes because of the spec tax?

FYI: Pacific FC building $5M field house in Langford, largest in B.C.

https://www.timescolonist.com/sports/pacific-fc-building-5m-field-house-in-langford-largest-in-b-c-1.23862879

I don’t know anything different than you on the spec tax numbers, but I do have a hunch that the numbers of people that have declared as owing spec tax are far lower than expected, based on something the govt said in May 2019. Because…

When the spec tax was launched, the govt announced their expected numbers that will be subject to it. Namely 32k people. 20k from BC (63%), 6k from ROC (18.5%), and 6K(18.5%) from foreigners. Jan 2019->https://vancouversun.com/news/politics/rob-shaw-b-c-government-offers-leniency-as-speculation-tax-deadline-passes

So, in the recent announcement in May, that would be the perfect opportunity to announce what the totals were (if they were high), instead the only numbers they gave out was that only 20% of the total is from BC (not 63%). https://bc.ctvnews.ca/99-of-b-c-property-owners-exempt-from-controversial-taxes-ministry-1.4427363 “To date, foreign owners, satellite families and Canadians living outside of B.C. make up more than 80 per cent of those paying the tax,” the finance ministry said.”

So, a huge drop in the mix, from 63% BC expected, to 20% BC. That means

– their projections were way off of % of BC vs non-BC

– If only 20% are from BC, now there are expected to be about 40% from ROC and 40% foreigners/satellite families. I think that points to more “vacation properties” than “evil speculators” because why would we have so few speculators in BC, and so many in ROC? And “satellite families” are at worst “mum and pop” type small time speculators, because they only have so many kids at university in BC. That uni kid would have rented anyway, occupying a home.

– As for the total numbers, we will have to wait and see. To me, the big drop in BC % combined with silence from the govt on any numbers in the PR points to low numbers, but that’s just a hunch, and anything possible with the final numbers. There are still 3% that haven’t declared and that’s a wild card too.

That’s more than 50 years ago. There have been similar ones more recently (e.g. in Nigeria and Kazakhstan) but I don’t think building new national capitals is really relevant.

There have been new small cities built in Canada and the US, such as Kanata in Ontario, but aside from new resource towns, they have all been on the fringes of existing metros. Basically if there’s an economic rationale for a small city to exist somewhere there already would be one. The government is not going to spend huge amounts of money building new cities and hoping people come.

“Also do you see millenials like Hansel that do not want to own a car or commute working in Langford.

Do they even sell advocado toast in Langford?”

As a millennial, I would be happy to work in Langford. If I did, it would be much easier to move to the warmer, less windy and more affordable Cowichan Valley. And then I wouldn’t have to choose between avocado toast and owning a single-family dwelling.

Better yet, maybe instead of moving offices out to Langford or spending a bajillion dollars building new small cities, we could just stop arbitrarily requiring workers to sit in a cubicle for 8 hours per day if they don’t need to be there to do their work. Let em work from home. All the empty office space could be converted into condos. Housing crisis solved.

freedom – I believe I am the one you are referring to who is looking for a TH in Fernwood or Oakland. Thank you so much for thinking of me! Sadly, the home you linked is a little too far north for me. In addition, it is larger than I need and I can afford a higher price tag so I can have a more central location. Still, appreciate the thought!

I wrote about this before but here it is again. I was so struck when I was in Germany how the attitude re. renting is so different than here in Canada. As far as I can tell, a number of policy decisions have made renting less attractive here in Canada compared to Germany. In turn, that has led to greater number of home owners which, of course, gives them greater political leverage thereby protecting (or increasing) the benefits of home owners. The capital gains primary residence tax exemption being a good example.

I used to rent, than owned and now am renting again. Were it not for the constant insecurity or renting (poor tenant rights), I think I would strongly consider being a renter for life. Like Franz, an Essen nightclub owner I met, who had rented his home for over 20 years. I expect he still lives there. He had renovated his house and really thought of it as his life-long abode. Have never met anyone in Canada who has that relationship with their rental accommodation.

Anyhow, here is an interesting article that sheds some light on the differences in perspective re. renting in Germany vs. Canada. Note that the German lady, at the end of the article, decides to rent again in Germany after claiming that renting in Canada is horrible.

https://globalnews.ca/news/5366848/renting-for-life-canada-germany/

Also do you see millenials like @Hansel that do not want to own a car or commute working in Langford.

Do they even sell advocado toast in Langford?

@Bingo

I didn’t say all people, maybe I should have said some people. I was in a situation where the company I worked at needed to move due to growth. We were downtown and still under 20 people at the time. The owner wanted to move the company to the Westshore, because he lived North of the Malahat (and office space was cheaper) and a good portion of the employees lived in the Westshore. Quite a few of the employees that lived downtown threatened to quit if we moved out of downtown (I guess they didn’t want to give up the perk of walking to work). I don’t know if they would have followed through with that threat, but some of them were key employees so we stayed downtown.

From my understanding in Sweden there was no regulation on maximum amortization. As house prices started rising, banks offered higher and higher amortization periods to compete for business, by offering potential buyers lower monthly payments. Only recently has the government stepped in as house prices were getting out of control and put a cap of 105 years on it ( by then the average amortization was 140 years).

In the Netherlands up to recently you could get mortgages that were interest only and there was no requirement to pay it off. This was mainly motivated by mortgage interest payments being tax deductible, so buyers are incentivized to keep mortgages as high as possible. Banks also structured investment mortgages around that so that your principal would go into investments and not go towards paying down the mortgage, so you would keep your maximum income deductible of the interest.

The government is no slowly reducing the portion of the interest that is tax deductible and no longer allowing new mortgages that are interest only.

Former Landlord:

Really? I think you’re projecting and have nothing to back that up. I worked at a company in Langford (medium size by both employees and revenue) and most of the employees lived “in town” (Core, peninsula etc.. basically anywhere other than westhore). Commute back when I did it was fine (maybe 15 minutes from Saanich to Langford).

I’ve done it recently and the highway portion was still fine once you get beyond the construction (adds 5-10 minutes if you leave at the wrong time). Langford itself is a lot busier than a decade ago.

For the person who posted here and wanted to buy a TH in Fernwood and Oaklands areas, this one might be interesting:

https://www.realtor.ca/real-estate/20831830/3-bedroom-condo-1527-north-dairy-rd-victoria-oaklands

Totally agree.

Maybe you know something that I don’t but so far we don’t know how many people are paying the spec tax or how many will end up selling or renting because of it. I do agree the impact will be small though and they may just declare mission accomplished and let it fizzle out in a year or two.

I think one of the main reason people want to own so badly is because of the very high appreciation rate of real estate we’ve had here.

See comment #61002 from Jono about how people in Halifax without the crazy price appreciation aren’t so RE obsessed

Totally agree. Huge respect for Andy, but I don’t get his thinking here.

I’m surprised city council hasn’t proposed restoring the area to its natural state.

Milton Keynes is one example. A key step in its development was taking planning authority away from local government.

Brasilia

Theoretically, it does change supply, by raising prices.

“Does anyone know what’s wrong with this house?”

It’s the paint: beige throughout, ugh.

Quite a few I imagine. And I imagine that a drop in rental demand may cause some private landlords to give up and sell.

I’d be interested in seeing ownership rate compared to wealth inequality. I’m not so sure that low ownership rate means high inequality but haven’t looked into it.

I haven’t looked into it but i would love to know what the reasoning was behind extending amortization so far.

To me it seems counterproductive. It briefly improves affordability but doesn’t change anything about supply so in the end all it does is drive price up by increasing demand. Seems to me you could just as well leave amorts lower and end up at the same equilibrium but your guess is as good as mine

Not sure what you mean here. Buildings that restrict rentals are more likely rented in Victoria? I don’t follow

What I am trying to say is do these %s reflect having no rental bylaw condos removed from the sample size? If you have a neighbourhood that only has no rental condos the % of non-owner occupied will be 0%

Caveat, not to beat a broken drum, the other alternative is to develop more small cities.

What are some examples of these cities that have been developed in the last 50 years? That are not in China.

$1,101,000

How dumb do you have to be not to recognize that there is downsize risk to a pre-sale purchase?

It’s like grade 8 common sense. If the developer/bank was confident that prices would appreciate during construction, they would just sell everything on completion. Obviously, they are never that confident, so they sell pre-sales to mitigate risk.

I personally think pre-sales are a great way to get into real estate if they are selling below market value in relation to completed re-sale units at the time of entering into the contract; however, like with any investment there is risk.

Splendid. I see we’ve reached the point at which personal finance blogs are feeling the need to offer tips on

How To Financially Prepare For The Climate Crisis

https://www.moneyaftergraduation.com/how-to-financially-prepare-for-the-climate-crisis/

Any idea what the house on Glendenning went for?

“https://www.realtor.ca/real-estate/20474233/3-bedroom-single-family-house-3545-salsbury-way-victoria-maplewood?”

Super cute style of house. Inside needs minimal investment to make it livable. Location is mediocre. Not sure about the lot but would be easy to spice up that deck out back. This is something I would do if it was in a location I’m interested in – fix flooring before moving in.

Nothing is hard to sell. It might be hard to get the same price as a house with a suite, though.

Thank you Arrgh, I suppose anything without a suite is hard to sell these days.

This is the view you would see if you looked east towards where the Empress Hotel is now. The ground the Empress sits on today was all a body of water then.

1899.

Today, few people realize just how much fill they’re walking on, on Belleville St. This picture provides some perspective. 1903/04.

Inner Harbour under construction, 1903. James Bay Bridge visible immediately behind the emerging wall’s foundation.

ks112

Does anyone know what’s wrong with this house?

I went to see it for an open house. I hated the lot – no backyard and a very exposed (no privacy) front yard closer to busy Tatersall drive than you expect (no house as a barrier). Maybe a fence could help. Feels strangely lorded over by the houses next door. Not really suite-able. I didn’t even go inside. But privacy/quiet were high on my list.

Surprised nonetheless at how low it has gone.

Arrgh

Ks112…Do you know many muppets lost their lives for that colour carpet! What have we become?

I’m hearing listing agents advise 10% under assess if you want to get some attention.

Can anyone validate this?

Does anyone know what’s wrong with this house?

https://www.realtor.ca/real-estate/20474233/3-bedroom-single-family-house-3545-salsbury-way-victoria-maplewood?

Canada’s Fixed-Variable Mortgage Spread Dives to Multi-Decade Low

https://www.ratespy.com/canadas-fixed-variable-mortgage-spread-dives-to-multi-decade-low-06209794

There’s nothing in the article to suggest that they are asking for any sympathy. If you just like spotting and making fun of people who’ve lost money, that’s your problem.

Brutal!

Not all pre-sale condo buyers were greedy. Some may have been terrified they’d never be able to buy again if they didn’t stretch and buy a pre-sale “while they still could”.

I agree it seems foolish, but then again most people don’t follow the RE market as much as people on HHV or similar. They just want a home. During peak mania it can really feel like there’s no end in sight to the price escalation – in fact, an end to it might seem almost impossible.

I’ll also wager that if enough of those buyers go belly-up, a lot of people will care. Possibly even you. The US housing bust affected a great many people – they didn’t even have to have any involvement in RE.

Having said all that, yes, there are certain segments of the buying cohort that I am decidedly less sympathetic with…

YIMBYs outnumber NIMBYs in Vancouver, housing survey suggests

https://biv.com/article/2019/06/yimbys-outnumber-nimbys-vancouver-housing-survey-suggests

Well it can’t increase forever. And I don’t want to see the results of our attempting it.

Hi Leo – I take no issue with your thesis. Condos are akin to apartments. They are not for me; to each their own. Buy them, rent them, live in them, just don’t leave them vacant in a City like Victoria where the rental stock is paper thin.

I think Andy’s research is invaluable. He was one of the first to report on the foreign ownership issue in Metro Vancouver. He and Sam Cooper did the Province a service uncovering the money laundering and impact on RE there.

No sympathy at all for the greedy person who thought they could buy and flip a presale contract and pocket tax-free profit. He or she now can’t flip it and if they do, they take a loss. World’s smallest violin playing. Laughter accompanying. No one cares and you get what you deserve.

VB

Yes, good idea.

Patrick: Langford is really just a suburb of Victoria. The idea is to take somewhere the size of Mill Bay or Cowhichian Bay and develop it into a small city of about 150,00. The government seeds the development by doing things like building a regionional hospital and a major nursing school there. Moving BC Ferries head office to Mill Bay where there actually is a ferry landing and providng major tax incentives for developers to build high quality housing and facilities to entice retiring boomers to pick the location over Victoria.

If you dont want people commuting to downtown Victoria move the some of the jobs out and create desirable and more affordable communities for them to live in.

By the way the Swiss have been creating new smaller communities in addition to the existing ones for a while. Because of architectural controls designed to please tourism some of these places look a lot older than they actually are.

My only point is tht there are three alternatives not the two that everyone mentions: higher density in the core, suburban sprawl, and, the third, new smaller communities.

I guess the fourth factor would be to stabilize the population which of coarse would cause the rich developers to go into cardiac arrest.

Langford is not able to compete with Victoria for (certain) businesses. To attract the largest pool of employees a business has to located downtown. Most people living downtown would refuse to commute to the Westshore for work. However people living in the Westshore expect to have to commute.

I like how Leo takes issue with the assumption that renting is inherently inferior to owning, while Alton Black suggests that an impossible-to-pay-off 100-year mortgage is “still better than renting.”

Isn’t this happening in Langford?

Isn’t that just the way Switzerland has developed organically? Most of these towns and cities have been there since the middle ages and some since Roman times. One thing that helps support a lot of small centres is there decentralized government, and also the fact that they have 26 cantons (states) for a population of 8.5 million. All but the smallest cantons at least contain one centre of 30-100 thousand people.

I included that possibility – see bolded text

“If speculator landlords sell there will be other investor-landlords buying to maintain that 38% rentals, if not then home ownership % would rise which would be OK.”

If that’s going to happen (investors pulling out), let the market make it happen, instead of some govt attempt at engineering it. The govt first attempt at targeting “speculators” (spec tax) missed most speculators completely, leaving vacancy rates unchanged.

Caveat, not to beat a broken drum, the other alternative is to develop more small cities.

The Swiss have done this successful on terrain that is more challenging than Vancouver Island.

With this argument are you assuming that demand does not change if the investor-landlord pulls out of the market, and that the renter population is not interested in buying regardless of where prices are at? In other words, if prices fall enough, how many renters would become owners? Production costs are tied to rising land costs which is driven by overall demand no? Is this the basis of Mr. Yan’s position? I might have to agree with the thinking that this reduces wealth concentration. Overall I think it is better if more people own instead of rent, although I have no problem with RE investing/landlording if that is your gig.

I don’t like the idea of longer amortizations than 30 years. Paying off a house completely before retirement is a great plan to deal with falling income in retirement.

I do like the idea championed by BOC Poloz, to have longer term mortgages available (perhaps as long as 25 years term like in USA). That would provide certainty of payments and protect against inflation spiking mortgage payments in the future. Millennials should get on board with this, and groups like stress gen should tell the govt that they want this (instead of DOA ideas to lower house prices).

/=====

“Bank of Canada’s Poloz: There are ‘good reasons’ to encourage mortgage terms longer than 5 years” https://globalnews.ca/news/5245517/bank-of-canada-poloz-mortgage-backed-securities-longer-terms/

Some not-owner-occupied condos are parents bought for children.

Homes include condos and townhouses. So SFHs becoming unaffordable is not the same as “homes” becoming unaffordable.