May 21 Market Update

Weekly numbers courtesy of the VREB.

| May 2019 |

May

2018

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 121 | 306 | 498 | 755 | |

| New Listings | 298 | 671 | 1010 | 1504 | |

| Active Listings | 2798 | 2881 | 2924 | 2394 | |

| Sales to New Listings | 41% | 46% | 49% | 50% | |

| Sales Projection | — | 820 | 825 | ||

| Months of Inventory | 3.2 | ||||

Another week and we are still on track for that same 5-10% increase in sales from last May. Single family medians and averages are both down from April, and will definitely end up lower than last year (same for Teranet). Condos are a mixed bag, with the median up year over year, and the average down. Call it roughly flat.

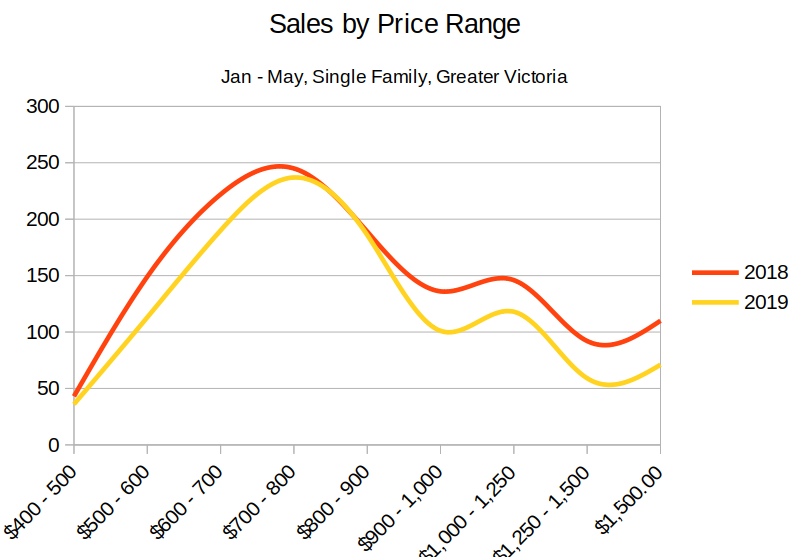

Last year I looked at where the weakness in the market was by price range, and 12 months later the picture is much the same. Comparing this year to last, every price range is taking longer to sell (on average 3 weeks instead of 2 this time last year), but some are doing worse than others. Like last year, the middle of the market (~$700k-$1M) is selling the quickest, with the low end and high end having slowed the most compared to last year.

Actual sales paint the same picture. You can see that in the $700-$900k price range, sales this year are near identical to last year, while the high and low ends of the market is where the drops have been. So don’t believe the press releases that the slowdown is only for luxury properties, but if you’re focused on that middle price range you can see why it hasn’t been impacted as much by the slowdown. Properties are selling more slowly, but approximately at the same rate.

In the end, all segments of the market are connected by what you can imagine are elastic bands. If the high end drops, it pulls down the middle since higher end properties are now relatively better value and some buyers will move up. Same with regions or property types. While we may see temporarily disproportionate strength or weakness in one area or type of property, those areas pull on the others and the market adjusts. There is no such thing as one segment escaping from those around it.

The topic of suites and whether they affect the exemption from paying capital gains tax on your principal residence has come up again, and there is good info in the comments on the last post. I am going to try to get clarity on this issue from local accounting firms over the next few weeks. Failing that, I will look into asking the CRA for a tax interpretation on the issue. We’ve covered this extensively here over the years, and I am still vexed by the apparent contradiction between how seemingly clear the rules are that indicate (to me, neither an accountant nor a tax lawyer) that capital gains would be due on a rental suite, and the paucity of cases of people actually paying it, as well as the advice of some local accountants that say it isn’t a problem. As always, consult your own professional for advice, but perhaps we can dig down to the deeper truth this time around.

Let’s not bandy terms. When I give charitably it is re-distribution. When our otiose overlords take money from me for you, that is extortion. If you take that money which wasn’t yours you are diminished.

New post: https://househuntvictoria.ca/2019/05/26/the-affordability-distribution

“No matter how earnest the belief in the magical powers of the loony left, there is no magic pixy dust that makes daycare free, ferries that run at less than cost, and health care that operates with no premiums. Here in the real world, someone has to pay.”

It’s called re-distribution Jerry. If someone is SOOOOOOO rich that they don’t need anyone they can just go and buy an island and live all alone. Oh wait, that would suck, right? So even the super wealthy need others, if for no other reason than to have someone to notice their wealth. We all need each other.

As for daycare, it’s fair for money to be re=distributed to pay for part of these fees. Imagine if people stopped having kids. Entire industries would collapse, think Huggies and Pampers alone, what would that do to those publicly traded stocks?

Redistribution is fair and makes sense.

So you’ll be thrilled if the govt policies make house prices fall “10s of thousands” by the time you buy a house next winter. Supporting that is the easy part for you. The hard part will be continuing to support that if, after you buy, the same govt policies make the house that you buy next winter continue to fall by “100s of thousands of $”. So that, a few years after you buy, you are underwater by a hundred thousand or more. Are you still happy to support that plan?

I’ll send you the bill Jerry 🙂

Yes, YOU are paying less because your children and grand-children will be presented with the bill. No matter how earnest the belief in the magical powers of the loony left, there is no magic pixy dust that makes daycare free, ferries that run at less than cost, and health care that operates with no premiums. Here in the real world, someone has to pay.

Not rich here but I’m paying less under the NDP. Primarily due to the break on daycare.

Viola…thanks!

@guest_60062 Can’t speak for the others but the Farm was recently granted a license and seems to have a pretty decent menu.

https://originalfarm.com/

Patrick I am happy to pay a few cents more at the pump (I bike and my wife takes transit so we don’t fill up very often) in order to save a couple hundred a month on daycare costs and what will hopefully be 10s of thousands on a house next winter. Don’t need a tax cut to reduce expenses.

Hey Deb, Patrick, Introvert, where do you guys get your weed from?

https://www.ratespy.com/5-year-fixed-mortgage-rates-now-lowest-since-2017-05259528

I was responding to Introvert who’s comment was “Music to my ears” I guess cacophony was my stab at humour…. My English is just fine but thank you anyway!

From the Oxford English Dictionary:

Cacophony: “A mixture of loud and unpleasant sounds”

I was responding to Introvert who’s comment was “Music to my ears” I guess cacophony was my stab at humour…. My English is just fine but thank you anyway!

From the Oxford English Dictionary:

Carcophony: “a mixture of loud unpleasant sounds”

Rich people owning West Van houses should see a *reduction^ on their property taxes next year, due to

1. Fall in assess property values (% fall more than average % house price fall)

2. School tax assessment over $3m falling drastically, often to $0.

For example, if house price for a $4m assessed West Van home fall by 25% to $3m, and average house prices are only down 10%, property taxes (funding muni and some prov) will fall about 15% for these West Van homes.

And in the above example the school tax extra assessment would entirely disappear since it only applies over $3m.

If we accept the view of many here that the BC Govt housing measures are responsible for this, then it follows that…Those lucky rich West Van owners may be some of the only BCers to experience a tax cut under the NDP!

I think Deb’s use of the word “cacophony” was perfect to describe the mixture of opinions that we see on the topic of future direction of interest rates.

Went to one open house today and it was really lonely. The agent started out rather aggressive and almost immediately suggested that there was an offer coming in so I turned to my wife and said that maybe we should not bother looking since the agent seems to think it is already sold. The agent then slammed his engines into reverse thrust and it was at least amusing (if somewhat cruel) to watch him back peddle. The house was a major rebuild but the quality of the work in my mind leaves a lot to be desired. We both think that it is seriously overpriced so it will be interesting to see if it sells and for what price.

Deb, you might want to look up the meaning of the word cacophony before using it again.

We attended 3 open houses today.

Have been staying up to speed and using a PCS site. Also using Realtor.ca

Seeing far more “For Sale” signs and heard lots of “realtor speak” today.

Sellers, I must say, are becoming more motivated. Realtors are more aggressive with their “this one won’t last….consider making your best offer soon”. Get real.

I must say that I have not seen these many price drops in many years in this City.

The government regulations are working far better than I had anticipated – any one who suggests that the foreign money has dried up lacks credibility.

I came across this interview of the BC housing minister who openly shares the PC governments goal and take on the results of the housing plan [30 points]:

https://www.youtube.com/watch?v=gk8ZcWkAVFk

Very informative. The mainland [greater Vancouver] is hit hard. But no credible voice would suggest that there is no affordability impact here. Frankly, given the run up, I think this will continue to decompress over the next 2 years [I had clung to 18 months as of October 2018, but I think this will take longer] – the Regulations are here to stay at least over the 2 years it will take Cullen J. to complete his inquiry. Would love for the sessions to be televised. I firmly believe this money-laundering in BC RE started with Glen Clark (NDP) and the Casinogate mess – remember that? Then Christy Clark accelerated this mess. Not a chance of the BC measures or Federal B20 [see what Siddal and Poloz said this week] being relaxed for at least 2 years.

@guest_59953

Or is it just a cacophony:

https://business.financialpost.com/news/economy/bank-of-canada-could-resume-hikes-if-data-proves-slowdown-temporary-governor?utm_campaign=magnet&utm_source=article_page&utm_medium=related_articles

Music to my ears…

https://business.financialpost.com/news/economy/poll-bank-of-canada-done-raising-rates-40-chance-of-cut-by-end-2020

Seems like it costs $17.99 and up unless you’re a member, but the Sunday brunch buffet is $12.99.

I’ve never set foot in a casino. That’s how much fun I am.

https://elementscasinovictoria.com/specialty-buffets/

Speaking of Warren, anyone checked out the one at the casino for $9.99? Any good?

I love the buffet, especially if it has prime rib!

The crash is always next month, next fall, next spring, next year…

Yeah, get a load of all the significant declines since 1960! Buyer beware!

Yep. And like almost all of them, their predictions trail the market. By the time they really say something is wrong, it’s usually far too late.

For most of them, those “deep pockets” depend on how much they can sell their previous house for.

In other words, prices go up except when they go down, and prices are high because they’ve gone up. Thank you for your insight.

« Another question for HHV: Given the current conditions of the Victoria market which seems to be mostly about question marks, how accurate would the services of an appraiser be? Am possibly looking at buying where the price would be set by an appraiser…”

I’ve heard of situations where people are divorcing and one wants to buy the other out but they can agree on a price/appraiser so they list the house and try to get an offer or two to see what the market value is. A lot of hassle but perhaps the most accurate.

You and the seller could each hire your own appraiser and take the average. Or split the cost and agree on one appraiser.

We tried to do a private sale once. Lady told her she was thinking of selling for 399 and she was open to private sale. We offered her that, then her family told her it seemed too low and to ask for more. We didn’t want to offer more so no deal. She was right but I’m happy we didn’t get it since where we are now is way better anyway and got it for 399. Anyway, point is I would say don’t get attached to that particular outcome and be ready to walk away. Have a max price in mind and stick with it.

I’m on a PCS and many of the houses that were sitting have sold. Seems to me the market has picked up and if there’s going to be a serious correction won’t be until later this year or next year (or not anytime soon).

Patriotz: You might be right about were the market is headed but your guess is as good as mine and my guesses are usually off the mark.

Just to be contrary, I am really starting to wonder if “affordability” linking house prices in Victoria to incomes is really an accurate tool in relation to Victoria.What it leaves out is the fact that about 20% of houses are bought by out of town retirees many of which have deep pockets. In some ways it could be argued that we are ” Tale of Two Cities” (which if I recall correctly is a story about a hooker that worked the Windsor -Detroit area). As one neighbor pointed out house prices in the West Shore and Esquimalt are really not out of line with local incomes.

Last I looked more than 20% of purchasers are from out of town. But my guess is that well over half of buyers in Oak Bay are older retirees from out of town. The problem with the stats occurs when you have a significant percentage of purchasers with low pension incomes but the ability to write a check for well over a million in cash.

House prices are out of line with local incomes but is that surprising when one has a significant percentage of buyers whose incomes are totally detached from their ability to buy? People keep waving this magic metric of house prices being linked to income but I am not sure how valid a measure that is as long as the boomers keep retiring faster than they are dying out. Absolutely agree that it is only one factor amongst many.

Anyway it is a cloudy damp day out and my wife wants breakfast out.

For the last 40 years buying Victoria RE has mostly involved paying “historically high prices”. Because prices have mostly been making new highs or hanging out within a few percent of recent highs.

That’s what you get with the combination of inflation plus appreciation.

By this definition it would be impossible to be contrarian as there are always people buying. Bought the SP500 on March 9 2009? Just one of the sheep!

Koalas: I assume you are thinking about buying a family owned property since the price is being set by an appraiser. At the end of the day it seems to me that you think the is good or not is all that matters. Appraisals are often all over the place in my opinion. Certainly at best they can provide you with a snap shot of range of prices.

No. As far as markets go, the “herd” is those who are actually buying and selling. Those not in the market don’t count. And those buying are still paying historically high prices, on the expectation that prices will not see any significant decline and interest rates will not go up. If you buy now you are agreeing with them.

Don’t confuse the prognostications of bloggers or analysts with facts on the ground. We are in about the same place as the US in 2006, not the US in 2010.

Another question for HHV: Given the current conditions of the Victoria market which seems to be mostly about question marks, how accurate would the services of an appraiser be? Am possibly looking at buying where the price would be set by an appraiser…

Yeah it’s a bit more of an issue for those that bought their house for 250 and now sell for $1M. Can’t imagine we will repeat that trick again,

Totally agree about insurance deductible. Insurance is there to protect against catastrophic losses, that’s it. So max the deductible. Our insurance is also about $1100 for a less valuable house but with earthquake. Not quite confident enough to drop the earthquake insurance yet.

Yes, in my experience, having just switched insurers, suites are just one of a long list of issues that will tack on a bit extra to your policy. How many suites? How many fireplaces or wood heaters? How many decks or patios? How many businesses being run from the home? Age of the electrical system? Etc.

Going huge on the deductibles helps. My theory there is if I have an insurance claim under $10,000 I rather deal with it myself than have an adjuster involved. Huge deductibles, no earthquake (house built on rock), and I am at $1,1xx/year on a home with a construction replacement value over one million.

I’ve done the same thing with ICBC for last 15 years. All my deductibles are >$1,000 and no collision or comprehensive once car value drops under 25k. If you commit to over a lifetime, assuming you are a decent driver, far offsets the one time your car gets jacked or you drive it into a tree….and your premiums won’t change either unless you get ticket(s) for driving into a tree.

I think a study done in Saanich a few years ago estimated 9,000 suites and they only had 98 permits on file for suite.

I’ve discussed this before but if you are paranoid about CGs and suites just build a super small suite. Brand new 500 sq/ft suite will probably fetch $1,200/month but you’ll be lucky to get $1,800/month for 1,000 sq/ft. If your house is 3,000 sq/ft that 500 sq/ft is only 1/6th. The year you sell it if you are looking a huge CG bill by some chance just take time off work 🙂

I also wonder how revenue Canada would determine the size of a suite given 90% or more are not on file with the municipalities.

That all being said I doubt we will see huge CGs bills going forward as appreciate will likely be very low in the next 2 to 10 years.

Koalas,

I know that you are only interested in core areas. But be aware in certain neighbourhood, say Broadmead, no rental suite of any type is allowed by a special development covenant put in place long time ago, even the city can’t change it. Neighbours there are always watching and for sure will rat a suite out if they see one.

Thank you HHV community for your answers re. illegal suites. Seems what my realtor is saying is pretty much confirmed. He also mentioned that the ‘illegality’ is often due to zoning.

why’s that Barrister?

I concur.

There is no line item in my policy indicating the extra cost associated with my suite, but perhaps the cost is baked into my policy.

My insurer, TD Meloche Monnex, is aware of my suite and my policy even covers “additional living expenses including rental income.”

However, my coverage also says “vandalism or malicious acts coverages are not covered for damage caused by a tenant of the insured.”

I just bought (as a bear I am not completely happy with it but family circumstances and financial ability made it doable and I do think rates will remain low for a very long time). Anyway, this is about illegal suites. Our suite is not legal although a good candidate with 7’6″ ceiling, separate entrance etc. The bank did not even flinch and offered about 50,000 mortgage per $1000/month rental income – they had an appraiser do the rental estimate though (but did not need to appraise the whole house?!) which came in pretty low I think – but we don’t yet know as closing is a month away. RBC by the way and perhaps a big down payment made them pretty easy to deal with.

My realtor said about 80% illegal in Victoria and complaints driven – and I trusted him – he was awesome and spent more energy trying to make sure we were aware of the downsides of any houses we saw rather than encouraging us to buy.

@rush4life

But wait, what about Buffet – “be bold when others are fearful and fearful when others are bold”? If you really want to be ‘contra-the-herd’, is now not the time to buy??

Such horseshit. No one knows anything. Markets go up or down, but mostly up in stable countries. Buy when it’s right for you and think long term. That’s it.

I doubt it. This one is likely priced in already as virtually nobody is paying CG tax on small secondary suites in principal residence.

Yes, in my experience, having just switched insurers, suites are just one of a long list of issues that will tack on a bit extra to your policy. How many suites? How many fireplaces or wood heaters? How many decks or patios? How many businesses being run from the home? Age of the electrical system? Etc.

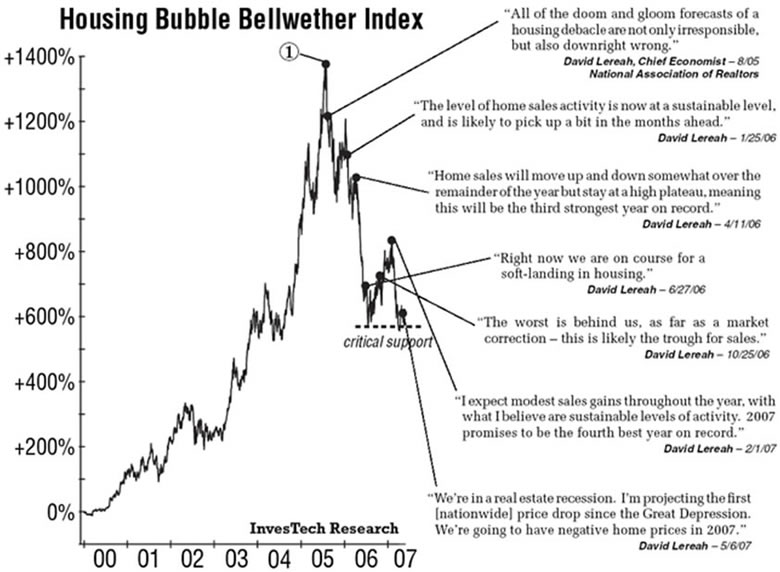

Lereah was nothing more than a rah-rah mouthpiece for the realtor’s trade group. Most people in the US were aware of what was going on. Unfortunately there were factors that were in play (robosigning, mortgage fraud, etc) that helped propel the market downwards. The price decline started in many areas in mid-2005 and not the 2006 that has been touted often. Of course the articles out from local real estate boards and NAR kept painting a rosy picture of just how wonderful a time it was to go all-in on real estate.

The real estate crash was in many ways a slow-moving train wreck from which many areas of the U.S. have not or just barely recovered.

The legal/illegal only refers to their status with the municipality. Insurance company doesn’t care as long as you told them it exists. Of course barring something like blatant negligence on your part when putting in the suite which caused the claim which they might be interested in.

Costs extra but not a lot. Depends on the insurer.

As suite, legal or illegal, is so common in Victoria and Vancouver, insurance company normally have no issue with it. But you have to tell them that there is a suite, and the extra extra cost is not much more (under $50 or $100 per year).

The only thing is that if the house is gone due to fire/…, insurance company may not pay to rebuilt the suite unless it is a legal one.

LeoS What is the situation with house insurance and illegal suites? Roughly how much extra is house insurance?

Your agent is correct unless you’re talking oak bay there is little risk from the municipality. Not zero, but low.

The bigger issue is financing. If you are relying on the suite to make mortgage payments you probably won’t be approved for financing (lenders have drastically cut back on how much they will take into account rental income). Even if you did get approved it is somewhat risky if you are truly depending on suite income and it is empty for any reason (damage to suite for example).

I am not an expertise, and maybe someone here is, but I think that you have to make sure that your house insurance company is aware that you have an illegal suite. I would concerned about there being an undisclosed material risk that might void your policy.

Does anyone know what the situation is when insuring a principle residence that has an illegal suite? Any idea how much more it costs to insure a house with a suite in it?

A few points by way of response:

• an illegal suite does not in any way void a legal tenancy agreement

• Saanich’s enforcement of illegal suites is almost entirely complaint-driven (and I haven’t personally heard of anyone complaining and getting busted, although I imagine it happens occasionally)

• when we bought, our lender, Coast Capital, was fully aware of the illegal suite and factored in the suite income when it was doing its mortgage calculations

My sense is that, in Saanich, the risk is very low but not zero.

Prices had already been falling, in some markets for a year, when Lereah said this. Lereah knew it, and this fact is what he was actually afraid of, not what the academics et al were saying. But most people in the US were unaware of it.

Like all other tax breaks to homeowners, this would make housing more expensive. And it would increase the wealth gap between owners and renters.

Koalas: Another thing to consider in assessing risk is whether an existing illegal suite could be made legal without too much work, e.g., is the ceiling height adequate, does it have a separate entrance or could one easily be added? etc.

@Koalas

Your real estate is correct, my experience with the city of vic & sannich is it’s largely ignored and this city would be big trouble if they all get shut down.

A couple things I’ve seen is bylaw gets involved due to complaints so you

A – try to legalize the suite

B- pull the stove out change the stove plug to a dryer plug, get it RE inspected, change it back after

C- ignore bylaw and hope for the best, we have actually seen a bylaw infraction added to the title of the property, saying work was done without permits and suite was unauthorized, funny thing is the suite was still fully tenanted

Like barrister said you could always contact a real estate lawyer, we use Sitka law for all our stuff, they are great ( you already know what a lawyer will say though)

From a financing point of view we have yet to have an issue with them funding a property that has an unauthorized suite or suites.

Also on a refi or getting a second mortgage etc, some banks will not take your rental income into account unless you have been claiming it and it shows up on your T1

Koalas: 90% sounds like a reasonable estimate. Some municipalities take a hard line on illegal suites (Surrey), while others mostly turn a blind eye (Victoria, Saanich). I have no idea what happens if some busy-body complains to Victoria or Saanich but I doubt either municipality is keen on doing anything when the purpose-built vacancy rate is near zero. Making people homeless over parking skirmishes would be insanely bad public policy.

Anyway, probably not a bad idea to seek legal advice as barrister says. Also probably no harm in contacting the municipality you are looking in to find out what their policy is on unauthorized suites (if there is a complaint hot line, that’s a really bad fucking sign) and legal secondary suites. I suspect if you’re buying in Vic or Saanich, the risk is really low.

Koalas: I really suggest that you speak with an experience local real estate lawyer on the issue of illegal suites BEFORE you sign any offer to purchase. Like the bank, your real estate agent is not your friend. Can people here recommend a couple of great real estate lawyers?

question to HHV: what is the deal with non legal suites? My real estate agent estimates that 90% of suites are illegal. He seems to think that this is largely ignored by the city unless a neighbour lodges a complaint in which case it can be quite tricky, and expensive, for the owner. How much of a gamble is it to buy a house with an non-legal suite and rely on it to make mortgage payments?

Viola, not really sure what I’m thinking but am always up for a drink!

every should buy now .. bulls are all in .. do it .. buy buy buy .. don’t wait .. buy buy buy

Dammit I missed the bottom again! thanks RBC, I thought we were friends…. Oh wait… someone once told me the bank is not my friend…Oh well ….back to skipping rocks at the pond.

I like those quotes, Patrick. They make me feel as though the finance industry is worried and they are trying to will something into happening. Trying to make people buy in a market when people are reluctant to do so (and rightly so). Its reminiscent of this quote I saw on YVRpulse today

“The steady improvement in [home] sales will support price appreciation…[despite] all the wild projections by academics, Wall Street analysts, and others in the media.”

David Lereah, NAR Chief Economist, January 2007

We all know what happened the very next year in 2008. I’m not saying that we are going to see anything like the 2008 crash in the states – not even close. But taking advice from a bank (or most realtors for that matter) who have too much skin in the game seems like a bad idea.

Good new is we will be able to confirm whether they are right or wrong over the next few months. Either bottom is in or we see more declines this year. Time will tell.

Just thought if a great metaphor to describe the current and near future Vancouver real estate market.

Hindenburg.

I thought this was worth re-posting. It’s from a discussion we had two years ago on this same topic:

https://househuntvictoria.ca/2017/04/24/taxation-without-representation/

My property tax is down $30 a month, thanks to my 2% lower 2019 assessment.

I’m very pleased!

May 15, 2019 … RBC declares “April’s good news: the bottom has been reached for Canada’s housing market” http://www.rbc.com/economics/economic-reports/pdf/canadian-housing/housespecial-may19.pdf

Taxes actually down by a whopping $5 this year despite a 5% tax increase from Saanich. Assessed value barely changed compared to avg 6% increase.

I find the letter to the Standing Committee on Finance to give very compelling reasons in favour of the stress test. For example, this part:

“House prices tend to track growth of disposable income in the long term. Over the past 20 years, average Canadian house prices have increased by 3.8% per year while national income (GDP) has increased in real terms by 1.9% per annum. Gross household debt has increased from $539 billion in 1998 (106% of disposable income) to $2.2 trillion, or 178% of disposable income in the fourth quarter of 2018. Said otherwise, household debt has increased over 20 years from 58% to 99% of GDP and mortgage debt from 37% to 65%.

Our appetite for housing, both as shelter and as an investment, has been filled by borrowing — a liquidity boom akin to the historical cases I mentioned earlier.

Debt is a claim on future income. Borrowers monetize future income to buy houses today. Since that future income must therefore be dedicated to repaying debt, it can’t be used for consumption — buying goods. And that means that the consumption on which our future economic prosperity rests (58% of our GDP) is already spent. Our future spending is sustained only if we borrow more, such as by using our homes as bank accounts through home equity lines of credit.

As policy makers, we have a choice. We can continue to fuel this liquidity or we can gently let the pressure leak out. The stress test was designed to do exactly that.”

https://www.cmhc-schl.gc.ca/en/media-newsroom/cmhc-statement-letter-standing-committee-finance-fina

Pretty sure it does.

https://business.financialpost.com/real-estate/cmhc-head-forcefully-defends-mortgage-stress-test-as-calls-grow-to-loosen-rules?video_autoplay=true

“The stress test requires would-be borrowers to show they would still be able to make payments if faced with higher interest rates or less income. It first applied to insured mortgages or those with down payments of less than 20 per cent of the purchase price with a variable rate and a term of less than five years.. In Oct. 2016, Federal Finance Minister Bill Morneau extended it to five-year mortgages.“

—-===—-

Does this mean that the stress test doesn’t apply to 10 year term (uninsured) mortgages? (As it shouldn’t IMO). If so, a 10 yr fixed (at great rates like 3.49%, uninsured) would be a great plan to avoid the stress test and buy a family home for the long term. It beats passing the stress test @ 5%.

And that is rare in government

Evan is only stating the obvious

Another good quote from Evan:

“we must avoid policies that serve only to enrich the people who have already made tax-free gains on real estate”

Connected to our discussion on people making tax-free gains on income properties or….?

He also confirms my thoughts that the first time home buyer incentive was designed to have basically zero impact

“And that program has been scaled to have a near insignificant impact on prices as well as to avoid stimulating borrowing.”

“Apparently, Mortgage Professionals Canada is content to see home builders, real estate agents and mortgage brokers receive short term benefits while Canadians bear the long-term costs.”

Savage.

Marko…next summer.

Well Evan become CEO in 2014 so I don’t think you can blame him for any of the loose credit and stimulative policies CMHC used to push

James: At least they did not lose too much money on it (mostly inflation loss). Vancouver was long overdue for a correction but I am not seeing much in the way of prices drops in Victoria.

Beautiful day out there today, after gardening all morning we managed to take a great walk this afternoon. I am barbecuing this evening so all in all a great day.

Me too, but at the same time, his organization has had a significant role in enabling this problem to metastasize in the economy.

What happens Marko when $4 million houses become $2 million houses?

I still can’t afford $2 million so makes no difference to me. When I can buy a new 3,000 sq/ft home with a suite in the Oaklands area for $850,000-$900,000 let me know.

710 GREENWOOD ROAD, West Vancouver

Bought 2012 $1,950,000

Just sold for $2,153,000

46% below 2017 assessed of $4,002,000

30% below 2018 assessed of $3,077,000

What happens Marko when $4 million houses become $2 million houses?

https://www.cmhc-schl.gc.ca/en/media-newsroom/cmhc-statement-letter-standing-committee-finance-fina

“In closing, therefore, I would ask you to see past those who insist that everything will unfold benignly, as we all nonetheless hope. As a former US Senator once said, ”A billion here, a billion there; sooner or later it adds up to real money.” And then we have a problem — and one we could have avoided.

Impressed with Evan Siddell’s bluntness and resolve on this one.

“Critics of the stress test ignore the fact that high house prices are the overwhelming reason why home ownership is out of reach.”

“My job is to advise you against this reckless myopia and protect our economy from potentially tragic consequences,” he said, asking the committee to “look past the plain self-interest” of the Canadian Home Builders Association, the Mortgage Professionals Association of Canada and the Ontario Real Estate Association.”

https://business.financialpost.com/real-estate/cmhc-head-forcefully-defends-mortgage-stress-test-as-calls-grow-to-loosen-rules?video_autoplay=true

Province has no intention to relax housing policies anytime soon

B.C. Finance Minister Carole James insists the market is seeing a moderation, not a crash, and she has no intention of taking the foot off the pedal anytime soon.

“I think the majority of British Columbians would tell you that we have a ways to go yet for housing to be affordable,” said James, adding she’s encouraged with the direction of the real estate market.

It aligns with a report from the International Monetary Fund this week, which said it would be ‘ill-advised’ for Canada to ease up on policies designed to gradually slow the housing market.

“We’re seeing a moderation in prices and an increase in vacancy rates,” James told CBC. “The tools we put into place plan seem to be having a positive impact and it’s something we’re monitoring month-to-month.”

She makes no apologies for those who have used the housing market as a stock market, pointing to speculators who bought to make a quick buck rather than a home to live in.

“For the majority of families who’ve entered into the market in the last few years, they’re looking for long-term homes — they’re not looking to get in to speculate on the price going up and then sell two years later,” James added.

https://www.cbc.ca/news/canada/british-columbia/province-not-yet-prepared-to-ease-policies-as-housing-market-sputters-1.5144280

So true—the tax on rental income isn’t burdensome.

As someone who’s always reported suite income and hasn’t deducted CCA, I’ll let everyone know what happens to me at deemed disposition. But you’ll have to be veeery patient, as that event is still a few years out 🙂

“but the ones who did have one usually didnt claim the income, I cant remember anyone ever getting dinged for it”

I have seen taxpayers dinged for it and it is fairly punitive. They will go back at least 3 years, more if they can prove negligence, apply tax on the gross rental income and then charge a penalty for not disclosing income on the gross amount. CRA will allow expenses but they don’t make it easy and they won’t always reverse penalties on the gross figure because the tax legislation says they can apply penalties to missed income and gross rent is missed income. CRA is asking about rental income more and more because they have so much more data now. They have a list of taxpayers’ addresses and they can see different people with different last names filing per address. Say 4 adults at one address and some of the people change year to year, they send out a questionnaire asking about rental income. It’s pretty hard to lie on paper to CRA and if they have asked the question you are on their radar and they likely already have an idea of the answer.

Funny thing is after expenses most taxpayers don’t pay much tax on the rental income so I’m not sure why people try to avoid it. Maybe to avoid future capital gains issues?

Thanks @Numbers and @Leo S for your insights.

“Changing the use to personal a couple years before selling to avoid the taxable capital gain could be seen as fraud or tax avoidance by CRA.”

Thanks. That’s what I thought – if the intent is to avoid the tax then it could be problematic. But, if the intent is just to actually use it personally, then will depend on the accountant’s advice at the time based on how the CRA approaches these things in the next few years (as might be likely to change).

I can imagine a situation where years go by and the suite was rented at some point in the past, maybe in the beginning, but then never again. Maybe it was only rented the first 5 years, then used as part of primary residence for the next 20. Not sure the cra could even go back 20-25 years.

I read the political parties are seeking feedback from the public on how to address housing affordability. I think all the parties should change it so that the cra can’t apply cg to mortgage helpers. We need to encourage more people to rent out their suites/create suites. I’ve heard from a few people that are too afraid of the tax implications and the cra to even consider renting out a suite.

“What about it moving in the opposite direction, time wise? For example, buy a house with a suite when younger and you need the extra money from the mortgage helper. Rent it out for the first 5 years, then decide you no longer need to rent it out. So, just keep it there and start using it as part of PR. Maybe you remove the doors separating it. 5 years goes by, then you sell.

It would depend on your intent. Technically if you purchases it with a suite because you need a mortgage helper, you are buying it to earn income just like if you got a second job. And it when you stop using it to earn income it would be a change of use (business to personal). At which time you should stop and consider filing a 45(3) election to defer reporting the capital gain until the house is sold. There are consequences to filing a 45(3) so don’t do it without getting advise.

If you planned on living it in for longer and only rented it for 5 years some accountants would be willing to argue that it was temporary and ancillary so would claim the entire exemption. The trouble is, that though the law is fairly clear, CRA application of the law isn’t and people’s scenarios are jumbled. The fact that they are asking more questions in black and white make me believe that their application of the law could change in the near future and we will have a better idea of this in 2 or 3 years.

Changing the use to personal a couple years before selling to avoid the taxable capital gain could be seen as fraud or tax avoidance by CRA.

April Data now out.

Victoria added another 450 units under construction, and completed 250 leaving us with a grand total of 6235 units under construction.

In that case it’s the deemed disposition at the 5 year point when it goes back to personal use, and you would calculate capital gains as of the market value of the property at the time it is converted back to PR.*

*as always, because I can get in trouble if I don’t put it here: not advice, consult a professional.

” If you buy a house with a suite in it, immediately start renting it out and do so until you sell you’ll have a hard time arguing for full principal residence exemption. But if you buy a house, use the whole house for personal use, then your kids move out so you move your mother in and make some structural changes to give her some privacy. She dies two years later so you figure you might as well make some rental income on the suite and the sell some years later you are going to have a very good filing position on claiming the exemption.”

What about it moving in the opposite direction, time wise? For example, buy a house with a suite when younger and you need the extra money from the mortgage helper. Rent it out for the first 5 years, then decide you no longer need to rent it out. So, just keep it there and start using it as part of PR. Maybe you remove the doors separating it. 5 years goes by, then you sell. I ask because I’ve heard of people intending to avoid cg by taking over the entire house for a few years prior to selling. I’m not advocating that, obviously – it seems a little fishy to me.

For people have suite, be careful when claiming rental expenses. If your 500sqft suite is 1/5 of the your 2500sqft house, then don’t claim 50% of your mortgage interest as rental expense, claim 20%, to match up with future capital gain percentage portion. Utilities expenses are different and could be claimed by usage/person.

Your memory is true, but not likely useful anymore moving forward. As mentioned by multiple people (CPA or not) repeated on this site, that CRA new rule of claiming PR sale starting 2017 (for PR sale since 2016) is the game changer.

That’s likely true. But is it worth engaging in clearly illegal behaviour to save a few bucks? Most bike thieves don’t get dinged for that either, but they are still scum.

Just my 2 cents, in working with investment clients over 20 years, I cant remember many who actually claimed the income from a basement suite in their principal residence, now I dealt with more affluent clients so most of them didnt want or need a suite in the pr but the ones who did have one usually didnt claim the income, I cant remember anyone ever getting dinged for it

Nothing brings the CPAs out of the woodwork like some juicy tax talk! Thanks everyone for your contributions.

If any of you or the firms you work for would like to go on record with their explanation of this issue or sit down for a brief interview about it please drop me a line Leo.spalteholz@gmail.com

Troll and love this site but rarely post. I’m a CPA who has worked in accounting for 23 years and I just had to add my perspective. I think I have a different take than most accountants. When CRA started asking taxpayers about the sale of their principal residences yearly on tax returns I saw that as laying the ground work and gathering information for a change in how they apply the legislation. They have been lax in the past about applying the tax law because it was costly and not common for people to have suites. It is very common now and there is a lot of tax $ available for CRA on applying these laws. I think accountants do a disservice to their clients if they tell them that there will be nothing to worry about. There are clear and muddy cases. If you buy a house with a suite in it, immediately start renting it out and do so until you sell you’ll have a hard time arguing for full principal residence exemption. But if you buy a house, use the whole house for personal use, then your kids move out so you move your mother in and make some structural changes to give her some privacy. She dies two years later so you figure you might as well make some rental income on the suite and the sell some years later you are going to have a very good filing position on claiming the exemption. CRA will go after the obvious cases where they can see long term rental income with large gains whether or not CCA was claimed. Just my opinion and don’t get me started on the tax and GST liability of using your personal residence for AirBNB…. Don’t do it! and if you feel the need to, ask your accountant to go over the worst case scenario because I’ve read into some of them and they can be ugly.

It is possible to do all those things (additional entry door, second kitchen, move walls) without creating a suite. If you like to cook and install a second kitchen, then that would not be a change of use.

Sometime later you might decide to rent out part of your house, ancillary to it being your primary residence. Conveniently, no structural changes are needed to do so.

Would a judge accept that? Maybe, maybe not.

Great post as always Leo !

As for the Principle Rez and capital gains exemption, our accountant has also advised us we have nothing to worry about with running a suite/air bnb out of our prince Rez, the suite is about 35% of our residence.

He is a cpa and owns his firm with about 25 employees and is not some back yard hack.

As for an update on rental prices from us, we had 3 tenants give notice over the last month

3 Bed top floor unit in a renovated character house in oakbay/Fairfield RE rented for 2500/month plus utilities within two weeks

( took longer then expected and had a lot of student inquiries)

2 Bed/Den in the same building (basement suite) rented for 2100/month plus utilities in 4 days ( could have raised rent we had 5 solid couples apply )

1 Bed top floor unit in renovated character house in Fernwood rented for 1595/month plus utilities. We listed it Monday night and had 4 showings booked tues with 2 of the 4 showings applying, we are signing the lease for this tomorrow evening at 5pm, but are still doing 4 showings tomorrow ( we have been burned in the past, so we keep doing showings until the lease is signed and deposit paid )

I’m seeing consistent drops in Comox Valley. So many properties are blatantly overpriced. The only ones selling fast have been modernised / renovated and are in good locations.

@ Patrick

It followed a ways after Vic. It’s started to contract, prices not so much yet.

The_Underwriter, what do you mean by “you”?

I never performed any renovation on my PR (the renovation had been performed by the previous owner of the property). So does that mean CRA doesn’t consider me to have performed a renovation?

Could you please clarify this?

Yes, expressly so:

In addition to the property transfer tax, if you are a foreign national, foreign corporation or taxable trustee, you must pay the additional property transfer tax (i.e. FBT)…

A foreign corporation is a corporation that is one of the following:

Not incorporated in Canada, or

Is incorporated in Canada but is controlled directly or indirectly by one or more foreign entities (see section 256 of the Income Tax Act (Canada) for further details), unless the shares of the corporation are listed on a Canadian stock exchange.

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax/additional-property-transfer-tax

Comox Valley RE on fire. Who knew?

@ Leo S

I’ll add to this – How are sales for SFH’s in general?

@ Ford Prefect

Yea, the CV went from one of the best deals on the island a few years back to one the most expensive outside of Vic I believe, but still has the high crime rates. Qualicum’s a better deal these days.

Thanks, useful insight. So to confirm do you agree that

a) capital gains tax is due on the portion of a PR that was converted to a suite for the specific purpose of earning rental income AND

b) in practice enforcement is difficult for the CRA and therefore has been historically lax?

If so it would seem to be a matter of risk tolerance whether to proactively declare the suite when selling your PR, and I guess many accountants have decided that it is acceptable not to? Still seems a little odd to me but I am not versed in the legal requirements of a CPA as to their advice.

Also matches up with some of the cases that show when people have been dinged for suites, it’s because they are under audit and if you’re going to audit someone you may as well collect on everything you can.

Well the tax benefit in that case is owning an income-producing asset that is exempt from capital gains.

Comox Valley:

A brief update, based on data gleaned from 24 real estate sales of $500k or more during the approximate period Nov. 2018 to end of March 2019.

Most properties sold very slightly below list price.

Compared to assessments sales were, on average, 13% higher than July 1, 2018 assessment and 29% higher than the July 1, 2017 assessment.

Sales for these single family dwellings were down 17% in April, but as shown above prices are continuing to rise quite rapidly.

@Koalas

I believe we are talking about three distinct possibilities (please let me know if there are more): 1. an existing duplex; 2. something that could be changed into a duplex; 3. a really big house that is shared. I will address each in turn.

1.

For an existing duplex I don’t see there being too many risks. There are issues that could come up that would be annoying/potentially costly. For example, what if one person backs out at the last minute? What if one is slightly different than the other, how is the value of each determined? But, such risks could be addressed in a well thought out legal agreement and with the assistance of professionals. And, if it works, it could work very well and be beneficial to everyone.

2.

This is obviously more work, potentially a lot more work. It could end up being a lot more expensive than 1. And, imagine if, at the end of the day, it couldn’t be legally separated into 2 places? Then what? It would definitely have to be the right place that has homes around it that have been divided and have a layout that lends itself intuitively to such a change.

My instinct would be to try the path of least effort first (i.e.1), and then re-asses. If you’re thinking about this we should meet for a drink to discuss.

Sorry to flog this dead horse………

Let’s say I sell my principal residence now:

Over the last 10 years I have rented out some of my basement some of the time and also used it for our family for significant chunks of time.

I fill out this: https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/5000-s3/5000-s3-18e.pdf and check Box 1 of line 179 and then I fill out page 1 of this form: https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2091ind/t2091ind-18e.pdf.

I would have absolutely no problem making this declaration based on what I know now. That said I would DEFINITELY press my accountant hard on this issue and make absolutely sure that he considers this the right way to report considering the specific facts of my situation.

Leo, you’re absolutely correct that there are other conditions. In practice, the CRA has full access to information on whether or not you have claimed CCA but has limited information over whether or not you have performed a renovation, when the renovation was performed, and whether your intent with that renovation was to earn income. The deduction of CCA shows that you are aware you are operating a business and have elected to benefit from the associated tax advantages. As a result, this is typically the triggering event for a loss of the PRE.

Why this is the focus of the CRA: If you were to claim both CCA and the PRE you would be double dipping on your taxes, which would be unfair. This is effectively depreciating an asset and then not paying capital gains on your realization (from a reduced cost base). On the other hand, when you perform structural changes you do not realize any tax benefit (unless you claim CCA).

The whole ‘deemed disposition’ thing seems like a nightmare for CRA to police for most home-based suites. So you rent out the basement suite for 2 or 3 years, then the renters leave (deemed disposition, from business to PR). You use the basement for storage and for your model trains and exercise equipment for a couple of years, then your niece moves to town and you let her stay in the suite while she’s at Camosun, for cheap rent (deemed disposition, from PR to business) . After she finishes college, your 17 year-old son moves into the suite; he gets free rent while at UVic (deemed disposition, from business to PR). Eventually, the son moves out and you become an empty nester. You do a bit of Air B&B (deemed disposition, from PR to business) and then find it’s too much hassle (deemed disposition, business to PR). Eventually, your Mother-in-Law moves in. Does she get free rent? Only if she’s very sweet. All of this over a 5-10 year period.

Sure, this is entirely fictional, but should be fully legal, assuming the rental income is claimed all along, and probably isn’t too far off some people’s situations. Does CRA want photos every step of the way? “Can you prove those are YOUR model trains?” No wonder they say keep the PR exemption for ancillary use.

Leo: How are sales doing in the over 2.5 million catagory?

Viola, Just out of curiosity, if you were to look into sharing a house with someone, how do you see it could work? Looking for a duplex and splitting the title in 2, renovating a large house to make it into 2 units? Or are you thinking something like actual roommates?

Besides suite size, why accountants in town only talk about CCA, but not the other full PRE requirement?

I guess no-CCA is a clear requirement for PRE, it is also under accountants’ control (to report or not). But no accountant could ask their clients not to put a kitchen in the rental suite. So they avoid talking about kitchen addition/change and hope that CRA will ignore it, too. 🙂

I would think that only cases when one has been reporting rental income but still qualify for full PRE, other than full house 4-year rental rule, is having roommates and boarders sharing the house.

@ Transformer

Unlikely the downturn is over; look at what’s happening in Van – Vic trends behind Van.

Sorry if I missed it in previous comments… Why do you think there’s a pick up in sales? Does it mean that the downturn could be soon over?

Marko Juras

How do you select the right long term applicant?

@guest_59981

Why does the CRA say that you must satisfy three conditions (suite is ancilliary, no structural changes, and no CCA) if only the CCA matters?

See here, section 2.59: https://www.canada.ca/en/revenue-agency/services/tax/technical-information/income-tax/income-tax-folios-index/series-1-individuals/folio-3-family-unit-issues/income-tax-folio-s1-f3-c2-principal-residence.html#N10B54

The debate is only about the second requirement (no structural changes). Nearly no one claims CCA, and almost all suites are small/anciliary in relation to the PR so those two requirements are easy to meet.

However I’ve never seen a suite that was not created via structural changes to the house.

Note that the CRA specifically interprets structural changes as “Generally speaking, such changes must be of a more permanent nature, such as the installation of a separate entry or kitchen, or an addition or reconfiguration of space by adding, moving or removing walls.” From: https://taxinterpretations.com/node/452886

In other words, the exact set of things that everyone does when putting in a suite.

Thanks, The_Underwriter.

Yet another CPA confirming what many other CPAs have independently confirmed, which is that you won’t owe CGs (i.e. lose the PRE) unless you do something foolish like claim CCA, which every accountant worth his/her salt won’t let their clients do.

All these concerns about whether the suite is 25% or 50% of the home and whether the structure of the home was changed don’t appear to matter a great deal to CRA, except in extraordinary circumstances.

Introvert – Yes I’m a CPA . The CRA will typically look at the deduction of CCA as an indication that the principal use of the property has changed. The generation of income from the property will usually be considered ancillary to the main use of the property (principal residence) if you do not deduct CCA. This is a common mistake that people make when doing their taxes – they try to minimize their current year income tax through the deduction of CCA at the cost of the (typically) more significant principal residence deduction in the future. Personally, I would never claim CCA on my primary residence.

Current plan is to continue to pay off the mortgage ASAP. When it’s paid off, we’ll probably take back the suite (deemed disposition!) and save up to do some stuff:

• a few renos

• maybe solar panels on the roof

• perhaps get a Tesla, if the company is still around

The nice thing is, saving doesn’t take long when you don’t have any payments.

James, good thing you missed it.

Yes, my accountant is a CPA.

Nuts, just missed it. I was looking forward to lunch.

Pretty close but due to how the system works it’s impossible to tell for sure. Wasn’t a lot of inventory growth last week so could be not until next week. The numbers that the board releases every monday cannot be reproduced independently in the system. Best you can do is wait for next week’s numbers and interpolate.

Well Leo – it’s May 22. How did the inventory prediction go?

Unfortunately I am not aware of any public statistics on this. Would be interesting to see if purchases through numbered companies increased after foreign buyers tax as well.

Former Landlord: How you handled it made sense.

When my wife and purchase a home we want a place with a suite. The way I look at it is every $500 in rent I receive pays 100K of my mtg (roughly). So if i find a place with a nice two bdrm that i can rent for $1500 then effectively I have my tenant paying 300K of my mortgage. In the scenario that I paid 700K for my place and put 100K down then we are both making equal payments to my mortgage. Now of course there are some extra costs to having a tenant (increased water, hydro, etc). but at that amount it doesn’t make sense to buy a condo for 400K if you would prefer to have a yard and a home that will likely increase in value more over time.

For a real example take a look at MLS 410406 just dropped down to 799K – has two self contained suites – you get 1250 for each one and that pays for 500K of the mtg. Not a bad deal if you can find some good tenants.

Barrister: this was my interpretation of the change of use rules from the CRA (at the time). My understanding was that by changing the use of 60% I had to treat it as selling the whole property at FMV. I may have been mistaken and may have only need to do this for the 60% portion. In the end I used it to transfer all the property for tax purposes to my spouse whom is lower income since we were now getting a much larger profit from the property. Also when we eventually sold the property I didn’t get any of those capital gains, they were all on my spouse’s name. So in the long run it worked out for us.

I dont disagree with your view on suites but I would add that if you are not renting the suite out it is prudent to actually being able to show that you have being using it as part of your personal residence. My neighbour has an unrented basement suite but he intentionally installed his wood working shop into it. He has video of himself “massacring? perfectly good pieces of wood in his efforts to produce either a chair or a side table (not sure myself what it was supposed to be). The point is that the space is clearly being used for personal use.

Many of us have checked with our accountant, and some here don’t seem to like/agree with the professional advice that we have received.

lol…….have to love bears. At the end of the day according to their calculations I am paying the tenant to live in my house.

My parents have collected substantially more in rent than what they paid for their home in the last 25 yrs and they literally haven’t had one bad tenant in those 25 yrs. You go 10% less than market and when you aren’t desperate to rent you can wait for the right applicant.

As I’ve said before I can’t imagine owning a house with a suite. Whether I rent it or not is another story, but I don’t think I would ever buy or build a SFH without one.

I think it is super important to recognize there is the potential for CGs but not something worth losing sleep over.

Introvert: Just out of curiosity is your accountant actually a CPA? I am only asking because the term accountant seems to couver a range of people with varying levels of training and accreditation. Not in your case, but I have had people call a bookkeeper their accountant.

Has anyone actually consulted a tax lawyer on this issue and what advise did you receive?

Former Landlord: I am not following why the capital gains tax would be triggered on your 40% rental since there was no change in use or ownership? But I am not a tax lawyer. I would assume that there was a notional change in use with a new cost base for the 60% you used as a principle residence.

Many of us have checked with our accountant, and some here don’t seem to like/agree with the professional advice that we have received.

I cannot believe the tortured discussion on change of use rules going on here. Let me point out the obvious to those that are being willfully blind.

If you are renting out a basement apartment then that is the actual use and that is all that is relevant. The change in use rules come into play if you converted a basement into a suite but have not rented it yet,

If you buy a house with a self contained suite then you will have to prove that you are actually using the suit as a personal residence in order to claim the PR deduction which is actually what was relevant in the court case that was bandied about.

The problem arises from the CRS trying to create an undefined exception for minor use.

Human nature being what it is people are now cramming a transport truck into a garden shed.

Check with your accountant or lawyer for advise since this is not intended as advise but just opinion.

In terms of numbered companies being used, if an American purchases a house in Victoria by using a BC numbered company does the foreign buyer tax still apply? In law a corporate entity is treated as a person and its domicile is were it is incorporated. Put simply I suspect it is treated as a BC “person”. I dont believe the tax is applied or has any mention of beneficial owners or at least not yet.

Sorry, one of those early morning thoughts while sipping on my first cup of coffee.

“However, you are not considered to have changed its use if all of the following conditions apply:

• you do not make any structural changes to the property to make it more suitable for rental or business purposes”

That’s right, a previous owner made the structural changes. That’s when the change of use happened. The suite was already a business property when you bought the house.

I had a mortgage helper in our previous home and wrote my expenses off against the rental income at 40% using the room count rule (suite had 2 bedrooms, we had 3 bedrooms). We then moved out to our new home and kept the original house and rented out both units. My understanding was that this would fall under the change in use and this triggered capital gains on the 40% of my home that was used for the rental.

I could see a case where you only wrote off direct expenses related to the rental portion that you could get away with saying it is part of the principal residence. But in my case where I was writing off 40% of my mortgage interest against the rental income, I think it would have been a hard case to make.

Consult an accountant, however, what you seem to be talking about is a change in use of part of your property from income producing to principal residence which results in a deemed disposition (i.e. it’s as if you sold the property at that point and immediately re-bought it). Hence you calculate whatever capital gains are owing at that point in time based on the fair market value of the property.

That is explained here section 2.54 and 2.57 (partial change in use): https://www.canada.ca/en/revenue-agency/services/tax/technical-information/income-tax/income-tax-folios-index/series-1-individuals/folio-3-family-unit-issues/income-tax-folio-s1-f3-c2-principal-residence.html#N10B54

Note what they say: “The above-mentioned deemed disposition rule applies where the partial change in use of the property is substantial and of a more permanent nature, that is, where there is a structural change. Examples where this occurs are … the conversion of a portion of a house into a self-contained domestic establishment for earning rental income (a duplex, triplex, etc.)”

Yeah, a limitation of the export feature that it lumps all properties over $1.5M together. I’ll ask for that to be changed.

Sheer said he would tweak the B-20 rule to allow switching lenders at renewal without the stress test. Which would make sense and would add zero demand to the equation. I suspect that’s not what the real estate lobby was looking for though.

I suspect more first time buyers without equity that are being hit by the stress test more acutely.

They can be, but the correct course of action for anyone concerned about their suite is still to take their accountant’s advice. I just want to push those accountants a little further to see if they can explain their advice logically.

Question regarding the PRE.

What if the following year one went from renting 50% of one’s home (business rental) to 0% (no rentals)

(Assuming of course no structural changes to the home were made and CCA was not used)

Would the CRA average out the past 2 years … 50% and 0% meaning it will come out to 25%. I know some say 10% is what they mean but without guidance 25% would probably pass muster.

Or maybe just go rent free for two years, to be able to claim the full CRE without any fear of future liability?

Perhaps they don’t realize that Vancouver is 100 km away.

I’ve been fishing. Sellers have been quite stubborn (and so have I). You’d think someone would be willing to take a 1.9% hit after being on the market for close to 2 months.

Did you even read the article you cited? It explains:

Yup, I agree!

House prices must fall, particularly in areas like Vancouver, Victoria, Toronto, Hamilton, Calgary, Edmonton……: that is the aim of regulators and even the IMF sees that as the aim because an orderly deflation helps our economy.

https://www.bnnbloomberg.ca/imf-praises-canadian-banks-resilience-after-stress-tests-1.1262098

The banks are solid – even under a recession, the banks are solid. So, let the housing market fall. We will survive. This is what the BOC wants too. This is what your NDP Provincial Government wants as well. Because, this is what the voters want. Let’s get some high profile money-laundering prosecutions underway and civil seizures and sales.

It is happening right here, right now. Love being a renter today.

Great job, Leo. But, would love to see the same analysis for 1.5M to $2M to $3M. That is where the pain is and rightfully so.

On the principal residence issue [re: rental suite] – I can answer that: If only part of a home is used as a principal residence (for example, where there is a secondary suite in the basement that is rented out), only the part occupied by the owner would qualify for the principal residence exemption. Here is a layman’s explanation:

https://www.moneysense.ca/spend/real-estate/income-properties/principal-residence-exemption-rental/

Or, more detail and citation:

https://www.ey.com/ca/en/services/tax/managing-your-personal-taxes-the-principal-residence-exemption

Check Dominion Tax Cases as well – if you want a case directly on point, let me know and I will post a link to it.

“I actually would consider the idea of sharing a house. I too am clean and always pay my bills on time.However, I am a meat eater, so that could be a deal breaker. Maybe we could do something like buy something big and then divide it up in 2 units, like duplexes or something. But then you would have to be ok with me bbq outside sometimes…

0 ”

If it was properly divided I could say nothing about your meat eating habits. Where I live now we share walls and I am sure my neighbors regularly eat all kinds of things. I’m not against it per se, I once watched my partner eat bugs in a cave in Asia, and we’re still together 🙂

Another article on rental fraud:

https://www.vancourier.com/real-estate/opinion-housing-shortage-is-feeding-rental-fraud-1.23828740?fbclid=IwAR1jvVIqOW6qTHHMiWEFVGeEP95x_Mpgat_7gqAfYkCOje5-ZsOw6Pttry0

duran duran, housing is still more affordable, even in nice areas. It is actually possible to find SFH for 600-700 000 in Old Ottawa South, Centretown, Sandy Hill, Hintonburg and New Edinburg. Nice areas all. I’ve even seen some pretty decent houses in Centre Town selling for $600 000 that have a suite. Much more doable than here. And if you are open to duplexes or townhouses than the options expand much more.

I also echo missing the NAG. Some great artist-run-centres around especially in Hull.

Still the whole civil servant vibe and the cold winters are a turn off for me as well.

I think there is a good chance we will get clarity on the rental suite issue and capital gains over the next few years.

I agree with introvert on the common understanding of accountants currently. I also allow that they COULD all be mostly wrong.

In the next few years we may well see:

– clearer guidance from the CRA

– a change in the common understanding of this issue

– lots of people levied CG tax on sale of homes with suites

– a continuation of nearly nobody levied CG tax due to renting basement suites.

For my own situation I am reasonably confident that I meet the CRA’s definition. I have not made any structural changes and considering both time and space the rental use of our property has been small – 25% of the floor area about half of the time since we owned the house. In addition our basement suite connects logically with the rest of our house.

I have pressed my accountant on this issue several times and he maintains the opinion that I will not be liable capital gains.

I used to live in Ottawa too and still have connections there that I visit every couple of years. My favourite was Gatineau Park, for mtn biking and xc skiing. But it isn’t all that cheap, at least the nice neighbourhoods. While Ottawa has miles of boring suburbs all around it, the character-laden old brick hoods of the Glebe, Elgin, Westboro etc. are still $800k-1M+ for a family home. Ok, your commute from Blair Rd or Merivale to downtown will be quicker than living in Sooke, say, but if you’re out in the NCR sticks you might as well live in Calgary.

“You could move to Calgary and have steak for breakfast lunch and dinner. Skating on the Rideau canal with a hot beef sandwich and a beer for lunch is great.”

I think I’ll stick with my Buddha bowls on the beach 🙂

“+1. Left rat race in Ottawa 2008, never went back. Missed National Art Gallery a bit, but don’t miss the ice rain at all.”

Miss the NAG so much! And the blues scene. And the canal. But much prefer it here.

The_Underwriter, do you have particular expertise in this area?

Capital gains tax on your primary residence should only be due if you have deducted Capital Cost Allowance (CCA) from the income that the property has produced. If you do not claim CCA then you will not be subject to capital gains tax when you sell your primary residence.

Introvert you’re making some pretty grand assumptions that your accountant and yourself are operating above board. Accountants can be wrong, and willfully wrong as well to try to save you some bucks and ensure repeat business. Assuming that others are breaking the rules doesn’t mean you’re going to be off the hook when CRA assesses your suite and cap gains declaration (or lack of) upon sale.

Totally different system than the beneficial ownership registry which is what we are talking about. I’ve said before the spec tax is an administrative nightmare.

I report my suite income because it’s unambiguously the law, and I enjoy sleeping well at night.

As for it being a red flag as to my eligibility to claim full PRE, we’ll have to wait and see.

@ Leo S

Why do you think the low end is slowing faster/ dropping more than the mid market segment?

For those hoping for a softening of the B20 rules.

IMF warns against easing Canada’s housing rules: https://ca.finance.yahoo.com/news/imf-warns-against-easing-canadas-housing-rules-161756790.html

Let’s hope election politics don’t end a good policy meant to stop over borrowing by people that cannot afford it.

Again, “If you’ve historically been reporting rental income on your return from the same property, this could raise a red flag as to your eligibility to claim the full PRE.”

If this is still not clear to you Introvert, I don’t know what else can be 😉

What could go wrong?

And yet, the rule as written lacks specificity and careful wording and, as such, leaves itself open to interpretation.

And Victoria accountants have been interpreting it differently than you and some others might, but we don’t know if accountants are doing anything wrong because there have been no widespread consequences that would suggest that.

I contend that it’s possible the two are linked. It’s possible CRA hasn’t made pursuing CGs on suites a priority because most people with suites don’t owe CGs at disposition, just like the accountants have said.

+1. Left rat race in Ottawa 2008, never went back. Missed National Art Gallery a bit, but don’t miss the ice rain at all.

DOH I’ll file that under never seeing the footer of this site (or very many websites). Thanks!

This is where you want to think about intent. What is the intent of this piece of tax code? Is it to discourage people from making structural changes themselves but leaving it ok to have others do it? Does it make sense that one person who put in their suite themselves is on the hook for capital gains while another that bought a house with an identical suite is not? Clearly not. That would be a massive loophole.

The issue of whether the CRA is making pursuing suites a priority (clearly not) is separate from whether you should be paying CG on them or not.

The new reporting requirements also fundamentally change the game, just like the spec tax does. Before, if you had a suite or an empty home, you flew under the radar but very importantly you never made any statements about them. Now it is different. You must fill out the form and attest that it is your principal residence just like you have to attest that the home is not empty. If that turns out to be false then you are in a very different situation than if nothing was ever filed.

Viola: You could move to Calgary and have steak for breakfast lunch and dinner. Skating on the Rideau canal with a hot beef sandwich and a beer for lunch is great.

My accountant goes with 50% or less (an admittedly liberal interpretation), and I’m guessing most other accountants in Victoria do too (because, as you said, many people, including accountants, have a personal financial interest in interpreting the rule this way). However, and this is the crucial part, that (liberal) interpretation hasn’t resulted in mass audits or notices of reassessment, to the best of our knowledge.

Quoting CRA’s second bullet point:

However, you are not considered to have changed its use if all of the following conditions apply:

• you do not make any structural changes to the property to make it more suitable for rental or business purposes

“You,” as in the person filing taxes. I personally didn’t make any structural changes. Factual statement.

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-127-capital-gains/principal-residence-other-real-estate/changes-use/changing-part-your-principal-residence-a-rental-business-property.html

These court cases as seeming precedent are lovely, except that we’re still faced with the fact that, to date, the general population of Victoria has not been dinged with CGs when it comes to suites.

This recent reporting requirement does seem like it could be a game-changer. But I guess we’ll have to wait and see.

Check the footer at the bottom of the page.

Hey Leo – would you consider adding the built-in Calendar widget to this site? Your post reminded me of something from last year and searching was sort of hit or miss for me. I know approximately when the blog posts were so a calendar would make it easier to go back and review.

barrister- looking forward to what comes back.

@ introvert- I’m only trying to help. I believe many accountants are being willfully ignorant of the most obvious way to interpret that guidance because no one has been caught yet and no one wants to be the first person to change interpretation for their clients because it will cost their clients money and potentially the accountant current and future clients as well.

Rule 1 is likely much less than 50%. Probably anymore than one bedroom. (I.e 10%, maybe less)

Rule 2 Covers ANY change. I.e having folks living in a small part of your house is probably ok but put in a plug for a second stove and you could be offside.

Barrister also pointed out- if you bought a house with a suite, you actually bought a principal residence and a rental property. When you sell the rental property, tax on the gain is due.

Also, the court case about the guy who built the suite but never rented it hinges on the space not being regularly inhabited, so that’s important as well. If you bought a house and never rented or regularly inhabited the suite, it’s still a rental property.

There don’t appear to be any signs that the market is about to break to the upside, and it’s more likely to be flat-ish for years. You could keep putting in lowball offers and you may get a bite

While there is recent change/new (2017?) about PR selling reporting to CRA. From Jamie Golombek (NP Tax Columnist) :