Mar 11 Market Update: Sales cycles

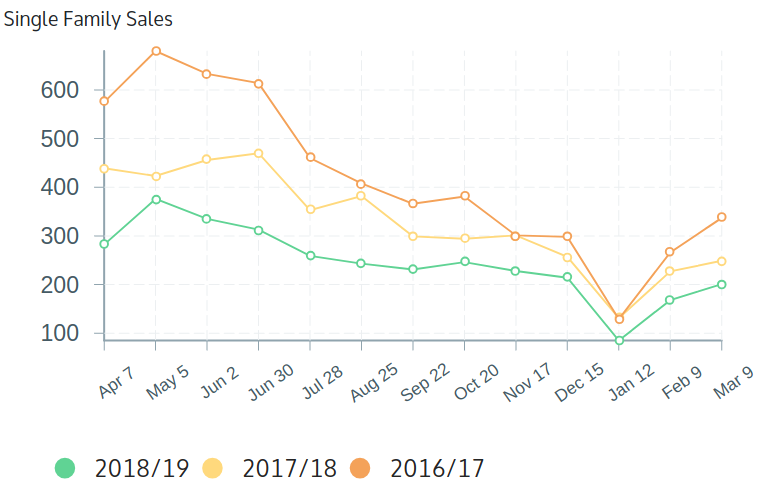

Weekly sales courtesy of the VREB:

| March 2019 |

Mar

2018

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 176 | 688 | |||

| New Listings | 390 | 1188 | |||

| Active Listings | 2204 | 1766 | |||

| Sales to New Listings | 45% | 58% | |||

| Sales Projection | 598 | ||||

| Months of Inventory | 2.6 | ||||

Sales so far this month are down about 18% from the pace of last year (down 13% as measured by weekday sales). Last year there was an obvious external reason for the slowdown: the federal stress test which sidelined many borrowers. This year nothing major is different and yet sales are still decreasing year over year.

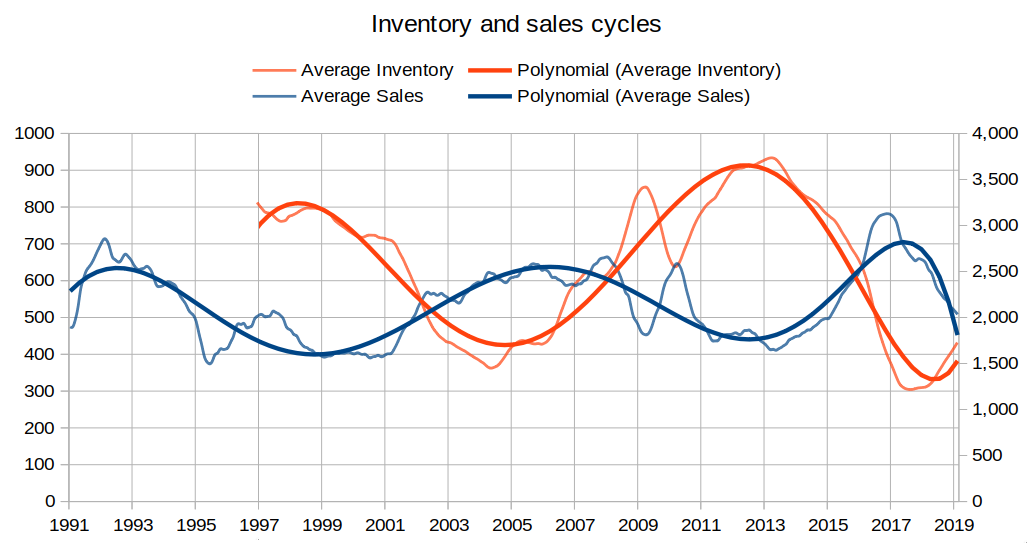

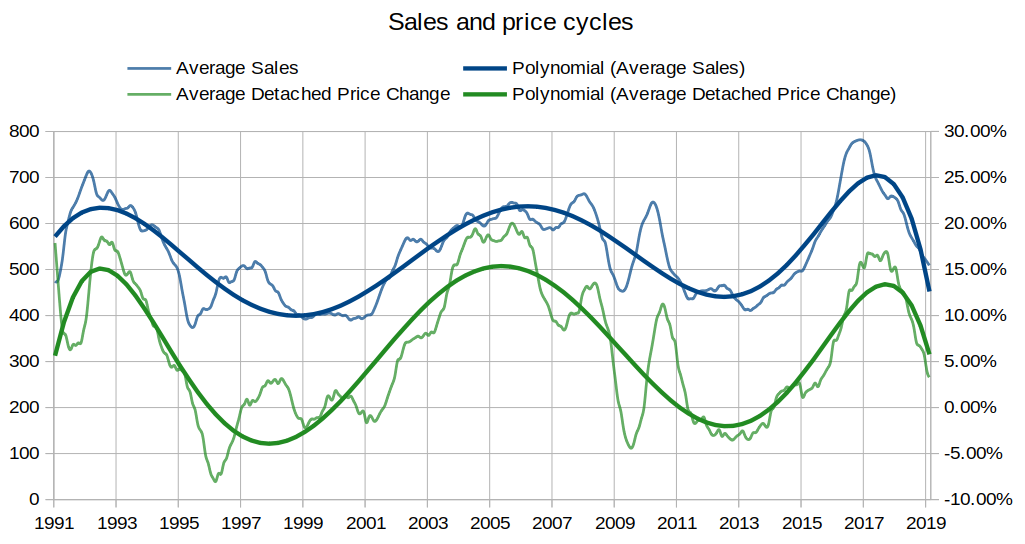

Why is it happening? Because real estate moves in cycles and we’re about 2 years into the down cycle. Why does real estate move in cycles? The strongest reason I’ve seen is affordability. When properties get too expensive for local buyers, sales slow down for several years until affordability improves. This is a pattern we’ve seen happen 3 times since the mid 70s, and today we find ourselves at another peak of that cycle where affordability is very poor and so sales have been slowing down.

Connected to the same cycle are prices. When sales decrease, inventory increases, months of inventory increases, and prices drop (or increase more slowly as the case may be).

Regulator actions can influence this cycle by compressing it or slowing it down. I believe the runup in the 2000s was extended because regulators at the time were making credit easier to access, with insured mortgages going from 25 to 40 years in length over that period and other regulations being relaxed. The last runup seems to be getting a bit compressed because regulators are taking the opposite approach and tightening up access to credit. But the underlying cycle stays the same. Even the great financial crisis was only enough to give it a wobble before it carried on its way.

What we don’t know yet is where the bottom will end up. Sales will likely stay in the same range as earlier cycles, but price movements are (as always) an unknown. Will we get a gentle slide with prices dropping 3-5% for a couple years like the last two corrections? Or will it be more dramatic as we saw in the early 80s? Will the solid job and income gains we have been seeing recently be enough to restore affordability? Right now the slowdown still looks relatively orderly so I don’t expect anything too exciting, but one thing I’ve learned over the 10 years I’ve been analyzing the market is that something always surprises.

Short-term rental (“airbnb”) type homes are a “target” of the spec tax, not some kind of exemption,. And how about the lost value (we are told about here) of not being able to have the CRA audit all of these foreign owners in Whistler?

Washington has little rental activity from Apri/May to November. While MTB started up again there most are day trip. Whistler is a year round destination place. So easier to rent out. I assume that is why it is not so lucrative to own in Washington.

New (guest) post: https://househuntvictoria.ca/2019/03/13/optimizing-your-mortgage-renewal-in-the-post-b-20-era

Patrick I assume that chalets in Whistler get rented out all ski season and there are subsequent municipal taxes paid on those rentals, licencing etc. They’re more like hotels than homes. I think the spec tax should be applied to them as well if they’re sitting empty all year but I assume they’re not and this is why ski chalets were excluded from the spec tax.

Speaking of ski chalets I was at Mount Washington this weekend and it seems as if every other chalet has a for sale sign on it. I wonder what the fees and taxes are to run one as a rental, seems pretty lucrative given what they charge per night, but maybe not?

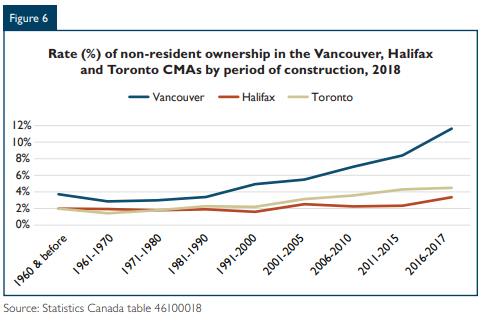

We hear lots of people pointing out high foreigner ownership rate in Richmond, but it is 11%, and Whistler is 20%.

Whistler also has a lower vacancy rate (0.5%) than Richmond (0.7%) or Vancouver (0.8%)

So can the “I’m OK with that” crowd explain to me why Whistler is immume to the spec tax and foreign buyers tax? What about BCers that want affordable housing to live and work in Whistler? How come foreigners get to leave their chalets empty without having to pay spec tax? Can’t we just wreck the economy of Whistler and add these taxes ASAP?

Also, Richmond now, according to stats can, has the same foreign ownership rate (11%) as Vancouver, so hopefully people will stop complaining about foreigners in Richmond. The foreigners are in Whistler.

https://www150.statcan.gc.ca/n1/en/daily-quotidien/190312/dq190312a-eng.pdf?st=vYGNuAMp

cadborosaurus

This map shows some of the launch options:

https://www.langford.ca/assets/Maps/Things~To~Do/ParksandTrails.pdf

I don’t find lakes that are mostly surrounded by houses to be that attractive. The accessible lake options in Victoria are a little weak compared to what is available up island. That said any lake will do in a pinch in the hot days of summer. Just need to keep your mouth closed and shower afterward 🙂

I like Matheson Lake and the back end of Thetis Lake and Elk Lake. The first beach in Thetis Lake park should be officially renamed Dog-crap Beach.

Maybe Dasmo had the right idea with his semi-private lake

Swimming Lakes

So there’s a few lakes in Langford that look big from satellite view but when I drive around the areas there’s not many access points. What are these lakes like does anyone live near them or swim in them? I assume there’d have to be public access points but are there beaches or just trails between houses? Is there much parking? Have a kayak would want somewhere to park then walk the kayak to the lake. Langford Lake / Glen Lake / Florence Lake.

From my very few visits to these lakes over the years they also seemed quite murky. Are they treated at all now? I recall seeing news articles in the summer about closed lakes due to algae etc. Kind of a turn off, even for a cadborosaurus.

If we’re doing anecdotal, I have to agree with this statement. Traffic has increased significantly northbound on the Pat Bay. Would be interesting to know more detailed information on job location.

A bunch of traffic does break left at Mackenzie without a doubt.

We aren’t the center of the universe so Tdot towers we do not have but the commercial/industrial density downtown is greater than anywhere else in the region.

Well, two big news items on foreign ownership of BC RE.

Statscan reports that B.C.’s non-resident-owned property worth more than resident-owned and over 11% of Vancouver condos have a non-resident owner.

Sources:

https://www.theglobeandmail.com/canada/british-columbia/article-non-resident-owned-property-in-bc-worth-more-than-resident-owned/

https://www.cbc.ca/news/canada/british-columbia/over-11-of-vancouver-condos-have-a-non-resident-owner-says-new-cmhc-report-1.5053083

Dasmo: The traffic is from the west shore inbound but what is the spread and concentration; a lot of it seems headed up the peninsula. Since you have pointed out the obvious might I also point out that unlike Toronto we dont have forty and fifty floor office building in a tight knit cluster.

Teranet for February…. gloomiest February since 2009, and Victoria led the pack down…

“Indexes lost ground in nine of the 11 metropolitan markets of the composite index: Victoria (−2.0%), Hamilton (−1.4%), Quebec City (−1.2%), Calgary (−0.8%), Vancouver (−0.7%), Ottawa-Gatineau (−0.7%), Winnipeg (−0.4%), Toronto (−0.2%) and Edmonton (−0.1%). The only indexes up from the month before were those for Montreal (0.4%) and Halifax (0.3%).”

https://www.nbc.ca/content/dam/bnc/en/rates-and-analysis/economic-analysis/economic-news-teranet.pdf

Things look a little brighter when comparing to peak values .

Victoria (feb 2019) down -2.5% from peak (sep 2018)

Vancouver (feb 2019) down -3.9% from peak (July 2018)

I think the direction of traffic in the morning tell us where the most jobs are….

Does anyone know if there is an actual map outlining where the jobs in Victoria are actually located preferably with a breakdown as to the type of jobs. Everybody seems to be assuming that all the jobs are downtown and while that may be true I just dont see the large office towers that back that assumption.

Every time I go by the BC Ferries head office I really wonder why they are located in downtown Victoria. I dont see a single ferry in the inner harbour. They could just as easily be located in the Westshore or better yet in Mill Bay.

Demographia is an oil backed “think-tank”. It’s amazing how effective it is getting it’s marketing into the media for free. LA here we come!

Demographia’s dream is actually to just lift most land use restrictions and allow maximum sprawl. Hard to argue that won’t improve affordability but it’s not the European transit utopia you’re thinking. More like the Texas model

It looks like the supply of new SFH starts in Greater Victoria is worsening, and the demand for them is still high.

The current 2019 building rate in Greater Victoria is for only 426 single family homes per year (1). This compares to a rate of 3k multi-family units.

So that means only 12% of new housing units started in 2019 are detached SFH. Yet this 2019 survey of young urban Canadian families show that 83% want a detached SFH, and about 56% of families end up buying a SFH (2) . Seems like a huge mismatch, people want SFH, we are building condos.

(2) http://www.newgeography.com/content/006189-canadian-families-denied-preferred-detached-houses-forced-condos-survey

(1) https://www.timescolonist.com/real-estate/hectic-building-pace-continues-in-greater-victoria-but-signs-of-slowdown-emerging-1.23660508 “Through the first two months of this year, builders in Greater Victoria started 71 single-family homes, down from 105 during the same period last year. By contrast, 501 multi-family units have been started year-to-date, compared to 306 units in 2018.”

Ya. Like build the tram and then upzone the large amounts of vacant land all along it. Just like I’ve been saying. But, the spec tax makes the subjects happy.

Housing affordability across the globe:

Most affordable and unaffordable cities

http://demographia.com/dhi.pdf

The way out of an affordability crisis

Politicians and planners have to stop believing in fairy tales consisting of thinking that smart zoning can

allocate housing fairly between the wealthy, middle class and poor households. The only solution (except for

the homeless) are solutions driven by market forces. A new school teacher finding a new job in a city is not

helped when entering a lottery is the only way to access a house she/he could potentially afford. An

alternative will be registering on a waiting list where she/he will stay for many years before obtaining a

“below market” housing unit. The characteristic of markets is that there is constant flow in and out of the

housing stock, allowing new entrants to find accommodation within at most a month of looking for the best

choice offered by the housing market. The market solution also allows any household searching for a house

to select the best trade-off between location, floor area and density that would best optimize its welfare.

The solution to unaffordable housing does not consist in inventing clever regulatory gimmicks or in designing

massive subsidies to be paid by the taxpayer or by a few wealthy households. The answer will always consist

of increasing the supply of land and floor space and removing any land and floor regulatory straight jacket.

The tradeoff between housing standards, like housing sizes, densities, lot sizes, and location are always better

left to the decision of the consumer, and not the whim of the regulator.

But increasing the supply of land requires having a financial mechanism to finance the infrastructure and

transport systems that will make the new area of land developed accessible to the city labor market. A city

cannot expand without disposing of a financial instrument to finance new infrastructure as the need arises for

an urban extension. This instrument should be able to finance infrastructure including road, storm drainage,

and sewers as well as urban transport network that would ensure that the new residents will be within a

commuting travel time of less than one hour from the city labor market.

Then we aren’t importing our speciality food! Perfect! And if the apocalypse comes we can grow food to survive on. Win Win.

At points over 20% of sales in Richmond and Langley were to foreigners. It’s not like most of the country was having an issue with this, only the places where they were laundering billions of dollars a year.

Maybe they should lobby to have people with second homes taxed too, oh wait we’re doing that.

“Maybe not Soy farming…. But….

https://10acres.ca/farm/“

Haha! The big joke about 10 acre farm is that it only produces a small fraction of the food that’s served in the restaurant. Most of the food comes from regular suppliers, just like any other restaurant. It’s just a marketing ploy and a tax write off.

Their problem isn’t the small 3% of homes that are bought by foreigners. Their problem is being outbid on the 97% of homes bought by fellow Canadians. The would-be buyers should stop blaming foreigners, and instead lobby their govt for measures to encourage more house construction, which would make houses more affordable.

https://www.cheknews.ca/artificial-grass-over-real-growing-in-popularity-and-not-just-in-langford-landscaper-says-542620/

What’s next plastic trees. Saving a buck just pave the whole place and get it over with. Maybe fill in Langford lake too and build more homes while you are at it.

James the main rd. Is it sannich rd I think. Up and back down I guess.

Apparently unaware of the irony when many Canadians are unable to buy even in their own country.

Huh? It didn’t hail in Gordon Head. But I agree that I’m at fault.

touche…

but at what cost – the whole point of protected farm land was suppose to be self sufficient and allows less import – specialty farms that sells at higher prices defeats the purpose – none of the stuff i get from local suppliers can compete in pricing

.. but nonetheless – you got a point , SOME SMALL FAMILY FARMS can make a profit

“We shouldn’t stop the foreigners owning our property unless we are prepared for foreigners to respond by preventing Canadians from owning their property.”

Too late Patrick – this scenario already occurs in many places in the world, philippines, thailand, australia, china, hong kong, switzerland and i’m sure many more all have regulations (and some outright bans) on foreigners owning property/housing. You know why? They are looking out for their citizens trying to make sure they can afford a home in the places they live, work and PAY TAXES. The NDP is looking out for its voting tax payers for obvious reasons. As for the spec tax I also believe that a big reason for its implementation is to find people frauding our tax system and i’m fine with that too.

Champlain Heights in south east Vancouver was acquired by the City in 1930’s due to property tax default. Nobody was even willing to pay the back taxes to acquire the property.

The City still owns the property, all the housing on it is leasehold.

LF, Conspicuously absent from your “summary” of RE events in Vancouver early 1900’s was a repeat of your original (remarkable) claim of $700k as the “the nominal price for many [Vancouver] standard lots at the 1912 peak, when referring to house prices then and now.

I hope that means that now noone, including you, still believes that claim to be true. Part of being a hobby historian is getting things right, and correcting misstatements, so they won’t be repeated by others. Typical Vancouver house prices 1900-1915 were in $2k- $10k range, as shown in the articles posted here. Perhaps a record sales for a large prime corner business lot in downtown Vancouver might have fetched that at the peak, but certainly not for standard residential lots.

Maybe not Soy farming…. But….

https://10acres.ca/farm/

Which lasted barely over a decade.

No one is stopping people from owning property.

They just have to pay for it, like in Hawaii.

Let me know if you find any political party in Canada that agrees with that lose-lose idea.

Canadians invest and own much more foreign property than foreigners own of Canadian property. Canadians (as represented by their gov’t) are happy with this, as it helps Canada be one of the wealthiest countries in the world. Shutting out foreign investment would result in reduced investment in and out of Canada – and be a negative for the economy, including jobs.

https://www150.statcan.gc.ca/n1/daily-quotidien/181129/dq181129b-eng.htm

agree 100% .. unfortunately reality works differently – farming is just not profitable for small family business .. nor was it efficient… one day all farming will be automated…

Richmond – BC , is a good example how protected farm land was used .. – giant mansions on farm land , with no farming – still legal… only recently , laws were drafted to ban giant mansion in richmond.. we even have that here – seen a few of them up north sanich

Introvert, you jinxed it and made it hail today.

Edit: Hah! I’m the third person to come here and blame intro for the hail.

Patrick you left out a whole list of other joys like polio and pneumonia and other joyous

diseases. On the other hand they did not have to struggle with the post traumatic shock of having an internet interruption.

What are you doing to get around it?

Any idea if you can just go up Swan and back down Pendene?

I don’t know. I am still a little gun shy when shopping for tulip bulbs.

https://en.wikipedia.org/wiki/Tulip_mania

bet you majority of Canadians are fine with not owning foreign properties

It is hailing out. It is 64F under blue skies in Malibu.

I blame you for the current massive hail storm that we’re experiencing.

Just more non-specific demonizination of foreigners (non-residents) owning Canadian real estate. In this case, it’s regardless of whether they rent the place out or not.

Foreigners own Canadian property (houses, stocks etc) . And Canadians own foreign property. We shouldn’t stop the foreigners owning our property unless we are prepared for foreigners to respond by preventing Canadians from owning their property. I happen to think that it’s very beneficial for Canada, for lots of reasons.

That’s temporary AFAIK, and a sensible upgrade…

Local to each his own. This site is great but the problem is it gives people too many reason to not buy. Been that way for 10 years. 2019 is not 1981 and certainly not the 1910`s but hey those that like living in the past go for it.

My biggest problem is the future and the closure of the brett trustle. Life sucks 🙂

Thoughts on the new non-residency ownership report from CMHC?

So amongst newer condos, about 12% are non-resident owned in Vancouver.

Would these attract spec tax if most of the income is being earned abroad?

Report: https://eppdscrmssa01.blob.core.windows.net/cmhcprodcontainer/sf/project/cmhc/pubsandreports/housing-market-insight/2019/housing-market-insight-canada-68469-2019-m03-en.pdf?sv=2017-07-29&ss=b&srt=sco&sp=r&se=2019-05-09T06:10:51Z&st=2018-03-11T22:10:51Z&spr=https,http&sig=0Ketq0sPGtnokWOe66BpqguDljVgBRH9wLOCg8HfE3w%3D

I bet hundreds of locals missed a great opportunity to buy in Victoria on account of some random former member of parliament who thinks he’s smart enough to know what the real estate market is going to do.

Great posts today. An important reminder of what our families faced in the early 1900s (WWI, Spanish flu, eight recessions/panics (1900-1924) and then the Great depression https://en.m.wikipedia.org/wiki/List_of_recessions_in_the_United_States).

Puts things in perspective.

Gwac, we’ll just have to hope and have faith that HHV readers won’t miss an opportunity on account of some random guy posting 102 year old articles. 😛

“We learn from history that we do not learn from history.” ― Georg Hegel

You can miss opportunities by focusing too much on the past.

Good definition. There is some actual “smart money”, a much, much smaller amount than those who think they are the smart money.

HAM in 1917. Wow!

There was not total censorship of the outbreaks but the severity particularly in the military camps and transports was definitely edited. Unlike most flu epidemics the victums were mostly the able bodied in their 20’s to 40’s and not the very old or very young. There are a few good books on the topic of recent vintage available at the library. Certainly towards the end of 1918 the outbreak was so severe that total censorship was impossible since cities had to deal with the problem.

Nope. You must have seen how telephone numbers then were three digits!

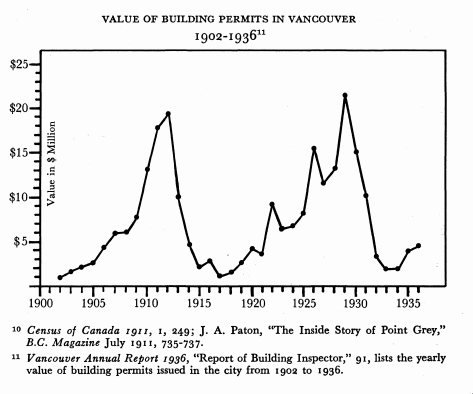

I bet there’s some juicy articles from the early 1930’s. I have no direct data but Leo’s construction graph makes me suspect it was once again, game over for RE.

Given where I think we’re at today, I’d be most interested in the “reassuring” ones (no land, immigration, Asian buyers) that would have inevitably been seen in media as everything went south, and then the later stories accounting for what would have been probably terrible pessimism.

Surprising how they were talking about Asian buyers affecting the market over 100 years ago. We can learn a lot about what we see today, by learning about the past. They were us, and we are them.

I scour the old newspapers all the time in doing research. I hadn’t noticed the above so decided to take a stroll through a random October 1918 Times Colonist paper and found several articles on the flu from how other cities are dealing with cases, which cities are under quarantine (Lethbridge in this one), how many new cases, etc. In all cases I saw, the reporting just said either “flu” or “influenza” and didn’t have the “Spanish” moniker. I’m sure that there was quite a bit of under reporting but that’s not surprising. It isn’t that hard to see that there was an epidemic at that time and it was being reported on.

Quite a bit of old reporting was maintained at the local level. Fires were quite devastating as they would sweep through a locality’s tinder dry storage room. Modern technology allows us to easily report & manage the data in a manner that allows for more accurate reporting and long term storage of that data.

The Spanish Flu is a near and dear topic as I’ve found ancestors who were seemingly healthy and young who succumbed to the disease at that time.

PS: Found an ad for 40 acres on the waterfront in Cordova Bay. Dearly wish I knew how much that was going for. I guess I can’t call that number in the paper anymore 🙂

The added factor in this era was also the outbreak of the Spanish flu. You will not find articles on it in 1918 due to military censorship. (Interestingly it was named the “Spainish Flu” because it was reported in the Spanish newspapers since Spain was neutral during the war.). There was about 40,000 to 50,000 deaths although once again because of censorship the numbers are hard to determine and some estimate that the actual death toll was closer to 75.000.

I have comments to make about the weather forecast but I am not going to make them, given past results.

A summary for those that don’t feel like reading all that.

• During the run-up in RE from 1910 to 1913, “rents and values on the Coast were notoriously higher than those in Eastern Canada”

• Victoria, along with Vancouver, then apparently suffered among the largest downturns in terms of price retrenchment in recorded history,

• Landlords had struggled to find tenants and were practically “begging” for them – rents had fallen below the national average,

• By 1917, market watchers were starting to notice all the classic signs of recovery: population beginning to rise faster, easier to find tenants, rents rising, but actual home prices still were not yet rising (like in a correction, price changes are among the last of changes to be seen when a market changes direction),

• Industry insiders were also commenting on the increase in out of town buyers, with wealthy Asian buyers getting notable mention,

• Confident projections from the local RE industry, and,

• Warnings to those who might not buy in or choose to sell their properties, that they will miss out on the coming recovery.

[Oddities/Errors may be present in the text due to the conversion process]

The Daily Colonist, Victoria BC, Sunday September 30, 1917.

Victoria Real Estate Takes Upward Trend: More Legitimate Residential Purchases in Last Two Months Than in Preceding Three Years — Prices Now Below What Conditions Warrant — Population on Increase

Victoria has passed the extreme in the depression of real estate values. According to real estate experts who have been in touch with market movements for the last decade or score of years, the lowest point was in the first seven months of this year. Since summer there have been unmistakable evidences of a gradual and persistent tightening of values with a strong upward tendency.

While experts assert that the odds are against a recurrence, while the war lasts, of the boom market of 1910 to 1913, they are confident that the underlying market conditions are working for a substantial increment in values through an increasing demand for property. In normal times the big industrial boom in Eastern Canada and the United states during 1915 and 1916 would have been reflected in the course of a year or so in a strong rising real estate market in the West. But under war conditions, with heavy taxation and the attraction of surplus credit to war loans this real estate market is practically bereft of the wherewithal for price inflation. These conditions, however, do not preclude realty values returning to normal from an unwarranted depression as has existed in Victoria since the outbreak of war. Ultimately realty values are based on rents. And the rentals and values of business property are reflected directly from the rentals and values of residential properties.

Before the war, rents and values on the Coast were notoriously higher than those in Eastern Canada. Since 1914 the situation has been reversed, as shown by statistics published by the Department of Labor at Ottawa. During the last year rents in Eastern Canada have been steadily moving upwards. The Ottawa department takes as its rental standard the monthly cross yield of a six-roomed house with sanitary conveniences in an average class district. Official figures are that a year ago the highest rentals in the busy industrial centres of Eastern Canada, the first to be stimulated, ran up to $20. in Victoria the average was $14, in Vancouver, $12. The average for the whole of Canada was slightly over $16. Both of the chief cities on the Coast were considerably below the average.

In the Winter months the high rentals in the East jumped first to $20-$22 and then to $22. Victoria and Vancouver rentals remained at $14 and $12 respectively. The average for the whole of Canada rose to $16.33, then $16.41 and in April to $16.64. In August last the highest in Eastern Canada Jumped to $35 and the Canadian average went up nearly $1 to $17.462. The upward movement then began to be reflected in the extreme West. The Vancouver figures jumped from $13 to $14. Victoria remained unchanged, however. Figures for September have not yet been issued, but indications are that they will show that Victoria rentals have been appreciably affected. Renting agencies in the city report that during the last six weeks business has been more brisk than since the beginning of the war.

Since Summer one of the largest realty firms on Fort Street has been compelled to increase its renting staff from one to four persons and supply a motor car and motor cycle. These four persons are kept busy only on rent business. Other renting firms report their business similarly affected. The member of one firm yesterday from actual book figures on an average well-located house, showed that a property that went begging for a tenant a year ago was last Spring rented for $30 a month. In the Summer the demands from an increasing number of potential tenants sent the price to $36 a month. A couple of weeks ago the price went to $40, with any number of potential tenants for It. The conditions underlying this specific instance are becoming common to practically all classes of residential properties. This increased demand for dwellings is in common with the increased demand for apartments. A year ago there were many vacant apartments in the city.

During the early part of the year the better class of apartments gradually filled up. Since Summer apartments have almost been at a premium, and now the condition is being reflected in the upward tendency of apartment rentals. Following closely the strong upward tendency in the rental market comes the stimulation of the selling market. Mr. James Forman, considered the best posted man on real estate in Victoria, asserted positively and most emphatically last week that there have been more houses purchased in Victoria during the last two months than during the three previous years. As yet there has been no striking increase in the selling prices of houses, but there is nothing more certain in the real estate market than that property prices will sorely move upward closely after rents. During the last couple of months most of the residential property has been picked up at the lowest of prices, but as soon as these weak holdings are eliminated from the selling market, prices as a whole must move upwards. There have been indications during the last couple of weeks that holders of property have regained confidence and are unwilling to sacrifice. Buyers will thus be forced to pay higher prices as the snaps disappear.

The positive condition in the residential property market will be shortly reflected in vacant property as the number of available houses decreases. And with the appreciation in vacant property will come a sudden burst of strength in business property rentals and values. That the limit is fast approaching in standard vacant houses is indicated in the trend of building permits at the City Hall. Despite the abnormally high cost of labor and building material, building returns “have taken such a spurt during the last three or four months that city officials predicted yesterday that the total for 1917 would exceed that of 1916, despite the fact that many of the permits last year were he connection with the inauguration of shipbuilding and other war work.

As population between census years is largely based on school attendance, the probabilities are that during the middle part of this year there has been an actual and appreciable increase in the number of persona living here. The large numbers of men in the shipyards furnish only part of the clue to the increase. To complete it one would have to discover the number of persons who this year have moved their residence here from all parts of Vancouver Island, British Columbia and the Northwest. Besides these persons, according to real estate men, there have been considerable numbers of wealthy persons who have moved to Victoria from the Orient. Where they all come from may be difficult to discover, but that they are coming and settling here is proved by figures at the City Hall and more directly by the returns in the offices of Victoria real estate men.

The result of this influx and the general betterment of realty conditions throughout Western Canada and strengthened confidence in the outcome of the war, have had their first effect on residential property here. The leaven is just now beginning to work into down town property. From whatever angle the question is approached it is apparent that the low point in the chart of Victoria realty values has been passed and that the market has assumed no uncertain trend upwards.

Victorians who are pessimistic about Victoria real estate just now may find that through their lack of a justifiable and reasonable optimism they may be casting away profits in the near future by sacrificing property now or by falling to get in before a healthy and normal bull market gets under way.

NDP is introducing legislation that will restrict anyone from even “asking” to take land out of the ALR. Good is my view.

Farmland needs to be protected. People knew what that bought.

It seems to be a pretentious umbrella term for people who work in finance or have the privilege of readjusting their investments on a weekly basis. Being the first to panic their way into or out of a market isn’t something I would consider smart. Especially because it’s usually the case that over time they’re no better than those that didn’t panic.

Really good post, Leo! And looking forward to a post analyzing if there’s ever been a bad time to buy. It would be hard to evaluate if compared against renting over time.

Real estate has been a boom and bust industry for a long time

Okay, then stay tuned. I do have a Daily Colonist (Times Colonist) article chronicling and opining on the RE recovery in ’17. To be clear, that’s the “other” ’17, haha.

Multi tasking atm, so it’ll be up in a little while when work permits. The article will need to run through a JPG to TXT conversion and will probably butcher it in the process. Funny, they seemed to blame the downturn on the war, high taxes and diversion of credit to war funds, yet, were predicting a return to normal values despite the fact that war would continue raging. Almost reminded me of today’s arguments about the stress test.

I don’t have data right now (and maybe never will) on whether ’17 was really a recovery or not, but it’s very possible it was, given the scale of the crash and the onset of the roaring 20’s.

“At some point I might go look and see if there’s anything from the Times Colonist about the downturn here”

I remember back a few years ago someone shared some really interesting details of the Victoria boom and bust. A lot of Fairfield developed in the run up to the 1914 bust. Around 1912 places were selling for insane (for then) prices. Prices then fell quite a bit and didn’t fully recover for decades (this is all from my vague memory).

I’d be interested to learn more.

The 700k made me look. That detail isn’t so important. The insane price gains with an eventual crash was your point and that is interesting. This particular time line would be interesting to get more detail on as it relates to Realestate. There was certainly a lot of activity then. Basically Leo needs to do throwback Thursday and do an HHV post as if it’s 1914.

No worries and no reason to keep cutting yourself off at the knees.

It’s pretty neat that a few people took some interest in that piece – didn’t think anyone would really care. At some point I might go look and see if there’s anything from the Times Colonist about the downturn here as it occurred, but with no ability to keyword search that might be a while and I’d be liable to give up. I have seen from the Times Colonist’s 1912 publications after April that there’s plenty of local talk of Bruce Ismay and his unceremonious escape from the Titanic. 😛

Oh sorry LF. Like I said I ain’t so smart….

A Critical Growth Cycle for Vancouver, 1900- 1914 by Norbert Mac Donald.

“In 1905 typical housing lots sold for $100 – $200.

A modest bungalow on a 33 foot lot sold for under $1,000 but the majority of

houses fell in the $1,500 – $2,500 range. A very few on large lots in prime

residential areas sold for over $3,500.00”.

Hey Dasmo. You didn’t need to google it – that’s the secondary source I directed you to in the post below. That also wasn’t the source of the original number you were asking about either. If I locate it I’ll certainly put it up here because now I’m curious if there’s any additional info around it. The only other thing I remember about it is it juxtaposed that price against the common hourly wage at the time which was apparently under 50 cents. Like I said it is in HHV here somewhere.

That run up was pretty interesting though. The railroads had recently been put in, Hudson’s Bay company was expanding like crazy, people from all over the British Isles were pouring in, and money from Europe drove prices up to huge heights. No dramatic interest rate changes then either. Just collapsed under its own weight…

I’m not as smart as you LF and my English ain’t as good as Mrs Introvert but my Googling makes up for my deficiencies….

Excerpt from

A Critical Growth Cycle

for Vancouver, 1900 -1914

NORBERT MAGDONALD

“With the real estate dealers 1909 has been a banner year in Vancouver. Three years ago it was prophesied that the real estate business had reached its apex and must decline; today prices have doubled and trebled and real estate brokers have probably made more money in 1909 than even in the early days of the great real estate movement about 3 years ago. Five years ago lots might have been purchased within the city limits for $50 each; now it would be difficult to secure a single lot anywhere in Vancouver for less than $6oo.

With appropriate changes in prices the comment made about 1909 could be repeated for 1904, 1907, or 1912.

Among the numerous examples of profitable real estate transactions was the small 26 foot lot on Pender Street that was purchased from the G.P.R. in 1887 for $480. The original owner held it for 3 months and sold for $600. By March 1888 it sold again, for $1,500. It did not change hands again until 1904 when it sold for $4,000, and just two years later it sold once more, this time for $6,ooo.18 Similarly a 52 foot lot on Hastings Street owned by ex-Mayor C. S. Douglas, was sold in 1904 to the real estate firm of Martin and Robinson for $26,000. They held it for four years and sold in 1908 to N. Morin for $90,000 and he in turn sold it just one year later for $ 175,ooo.19

Even the U.S. Consul in Vancouver felt the impact of surging real estate prices. Anxious to get a raise in pay he pointed out to his superiors in Washington, D.C. that the new landlord had increased the rent from $30 to $45 per month. He also sadly announced that the house he could have bought for $3,800 in 1897 had sold for $6,000 in 1905 and that the present owner had declined an offer of $ 10,000 for it in 1906.20

The boom in real estate peaked in 1912, and for those who held out for still higher prices it was a painful experience to see their paper profits suddenly evaporate. While evidence abounds of the dramatic profits between 1887 an d 1889 and from 1904 to 1912, it is not surprising that few people were willing to divulge the extent of their losses after 1912. Then as now no one liked to admit that he had failed to exploit a “sure thing” — or even worse that he had lost heavily. Yet we do have some examples of the downslide. One owner of an expensive corner lot on Robson and Granville who had refused an offer of $250,000 in 1910, sold for $122,500 in 1916, while another disillusioned investor sold his Gran-ville-Helmcken lot for $40,000 in 1917 having rejected an offer of $125,000 in 1912.”

Looks like Van had an insane run up for 23 years before crashing. With Bears saying “the peak is in, the crash is here” and being horribly wrong for eight years, and then one year being right. Could this be that time?

Or will we go another 4 years?

Stay tuned for another Year of HHV!

I wrote about the house price index a couple years ago, making mostly the same point as in that comment. Beyond just being shaky with a few sales, the HPI will happily calculate an index value for a region with zero sales of a given type. I imagine it does this by using sales of similar properties in other regions and extrapolating based on the historical price differentials from those regions to the ones where sales occurred.

I’m not really opposed to the MLS HPI per se. The fact they use benchmark homes is also not really a problem. It makes the index a little more understandable when you say “the benchmark home costs $800k” rather than the Teranet where no one has any clue what an index level of 207.5 is supposed to mean.

I think they should do a better job of defining their benchmark for each region (say it has 4 bedrooms, 2 baths, good condition, 6000sqft lot, etc) which would help people visualize what they’re getting for that benchmark value.

The MLS HPI is no panacea for price measurement. The biggest problem with the benchmark price is unlike the Teranet index, it does not really measure price changes for the entire set of single family or condo properties. It only measures the benchmark home price, so if prices decline in the high end the benchmark could be entirely unaffected and give the impression that nothing is happening (until that price pressure migrates down).

I like medians because they are simple to understand, and despite the noise in monthly medians, I’ve never felt that the MLS HPI gave me any insight I didn’t already have from looking at prices. But it’s also no big conspiracy, both can be used. Given the choice of an index I’ll take the Teranet every day though.

Wow, it would make a great story if any of the lots were passed down through a few generations of a family.

Potential Topic: RE as an investment for retirement for people who do not have a defined benefit retirement plan. (e.g. don’t work in the public sector)

From Warren Buffett: interesting read.

https://www.biggerpockets.com/blog/2014/03/10/real-estate-investment-advice-warren-buffett/

@Leo

Making money in RE is no guarantee, but empirical evidence shows owning vs renting has provided better economics over the long term. The YoY price changes in your nice graphs show this rather clearly.

The key question for HHs is when to step in. Many posters over the years have provided a rather simple reply – “when you are ready”. That obviously will have different meanings for different people.

Bears want prices to go down to have an “entry” point, which seems more elusive by the day due to macro events and policies that are well above my pay grade. But 2 things have served our family well in making decisions from a financial standpoint:

1/ the trend is your friend in terms of prices

2/ use an affordability calculator to see what you can afford, perform sensitivity analysis if your income DECREASES 50% and INCREASES 25%. Take an average of the 2, and buy when you are ready in price bracket.

It is not a silver bullet, it has served us well. You can adjust 2/ to whatever your own circumstances may be.

Just saw an interesting comment in Greaterfool blog (by “realtor magic” that I am curious to get some opinions on with HPI – which i never understood. Leo what you think about this:

It is beyond ridiculous that the results of the Victoria board’s “benchmark” home price index are allowed to be published. Yet each month the media publishes this misleading housing market information.

And realtors on this site quickly rush to defend the “benchmark” index any time somebody posts valid price information that disagrees with its cooked up results that have nothing to do with reality.

Absolutely nothing about its methodology suggests that its results are anywhere near valid. On top of that, realtors are the ones in charge of using it to calculate its results. How does any of that bring about honest and valid results? It doesn’t.

Victoria board admits that their “benchmark” home price index uses (fake or imaginary) “notional” homes:

“At the heart of the (realtor benchmark price index) HPI is the concept of the “benchmark” home, a notional (imaginary or fake) home…”

“The benchmark home does not represent any actual house…” – Victoria’s R/E board, Feb. 3, 2014

A single sale in the month of February and a total of 6 sales in the last 3 months isn’t nearly enough sales to be able to accurately gauge how much Oak Bay condo prices have increased or decreased over the last 12 months. But that’s exactly the kind of thing the Victoria R/E board claims to be able to do with its “benchmark” index.

So with only 6 sales over the last 3 months, the local board claims that Oak Bay condo prices have increased 16% year-over-year. And realtors on this site will undoubtedly claim that this result is 100% accurate and valid.

Year-over-year price comparisons are more accurate with more sales. 6 sales in 3 months isn’t enough to produce an accurate result.

On the other hand, if we consider that 39 Saanich East single family homes sold in February 2019 and 61 over the past 2 months, we can use those 61 sales to get a general idea of the year-over-year price change of Saanich East SFHs.

Saanich East SFHs

Average price increase/decrease

Year-over-year:

Feb. 2019: prices down – 21%

Jan. 2019: prices down – 14%

(Source: Victoria’s R/E board)

Realtors will try to discredit this valuable price information by (incorrectly) claiming that the stress test caused a “radical change in the sales mix”. However this claim is easily proven wrong.

The stress test came into effect on January 1, 2018. This means that all of the sales used to find February’s – 21% price decline and January’s – 14% yoy price decline were from after the stress test was implemented. Most sales in January 2018 would have been affected by the stress test and February 2018 would have had a higher percentage of sales affected by the stress test.

So comparing 61 (stress test) sales in January and February 2019 to the (stress test ) sales in January and February 2018 gives us a decent idea of what SFH prices have done over the past year in Saanich East.

And Saanich East’s year-over-year SFH price decline isn’t -2%. Obviously any results from the Victoria board’s “benchmark” price index can be dismissed. Comparing home sales to a fake house can’t produce real price change results.

It have come to conclude that if it exists at all it is very rare.

I’m much more inclined to believe there is smarter if not incredibly smart money.

An investor that calculates cap rates and buys something that cash flows is smarter money than one who buys because real estate always goes up. This is independent of the result even if both end up making or losing the same amount.

An investor that buys or doesn’t buy after due diligence and calculating the risk is smarter money than someone who buys or doesn’t buy based on overconfidence. This applies on the bull and bear side equally.

Is there a secretive set of people that know something that the rest of us don’t and use that knowledge to stay one step ahead? In general no. There are people with the means and the determination to make bets that would be too risky for most people and sometimes those bets pay off big.

“As Leo demonstrated (and acted on) there was a substantial improvement in affordability in the middle of that period. Most people didn’t notice it at the time though as there was very little decline in prices.”

When we actually got serious and started looking at mortgage payments and what we could afford back in 2015ish (we were renting a two bed suite for something like $1200 a month which was about market rent) I think that’s when we clued in that affordability really wasn’t that bad because we could buy a place that was way better than what we were renting and pay less monthly on the mortgage than we were paying in rent. Since rents have risen, the payments seem pretty cheap now.

In our case, I think it was more dumb luck than smart money though. We both had steady jobs, and were at a point in our relationship where it made sense to buy.

You’re may be remembering an article about prices for business property in center of Vancouver. Vancouver Residential Houses and Lots were under $10k. At least, this is what this UBC article says…

https://ojs.library.ubc.ca/index.php/bcstudies/article/download/769/811/

Page 32 … Majority of [Vancouver] Houses fell in the $1,500 to $2,500 range. 1905 A very few large lots in prime residential areas for $3,500

Page 32 … [Vancouver] Typical housing Lots in the $100-200 range 1905

Page 34 ….Business prices in center of Vancouver: Granville/Helmcken was $125K at the peak (1912) but fell to $40k (1916).

House prices rose from 1905 to 1912, but not from $2k to $700k

… or you could have a free lot in WhiteRock (2012, right at the peak!)…. http://pricetags.ca/2014/05/14/magazine-promotion-in-1912-white-rock-lots/

The term “smart money” was intended as a concept depicting people or agencies who successfully use market metrics to make beneficial financial decisions. And like I said, people do it all the time. I wasn’t referring to any person on here or actually anyone in particular.

The primary source was from an archival publication called, “The History of Point Grey”. I remember the number distinctly because I had the same “no way” reaction when I read it a few years ago. That’s about 15 million dollars in today’s money, which when you look at valuations at their peak in 2016…doesn’t seem so far fetched. What I don’t recall is what the zoning was, and I don’t know if the lot sizes were different then.

HHV poster “Michael” had posted similar material at one point when he was talking about inflation cycles over the last century so I’m certain it’s on here, but after several minutes of trying I haven’t pulled it through search.

Areas in downtown were going for huge prices as well. One academic account (BC Studies No 17, 1973 ) made reference to an “owner of an expensive corner lot on Robson and Granville who had refused an offer of $250,000 in 1910, [later] sold for $122,500 in 1916”.

The 250k was two years before the peak, and as we know, the last bit of the peak tends to be the meatiest.

Someone who followed the blog since the beginning and thought THEY were the smart money could still be waiting for a time to buy that better than early 2007 when it all began.

As Leo demonstrated (and acted on) there was a substantial improvement in affordability in the middle of that period. Most people didn’t notice it at the time though as there was very little decline in prices.

Huh? Where do you get 700k for a typical lot in Van circa 1912?

From the last post:

This is primarily a function of a few cities in Canada in the last 20 years.

I am fairly confident that we have a couple years coming up where no one will complain about being “left out completely”

Take another mulligan on that one.

Smart Money,

Money that makes you more money!

If nominal price was the sole measure (and presuming we discount affordability), then there wouldn’t really be a “bad” time presuming a hold of at least 10 years. But accounting for that, the “worst” time to buy looked at first glance to be 1980-1981. You’d probably have to go back to the 1930’s to find something comparable but a few decades earlier (in Vancouver, anyways) was the mother of all of them.

Southwestern BC had among the fastest growing economies in the world from 1896 to 1912, as the forestry industry moved west into the pristine Cascadia region. Populations exploded as did real estate speculation, and capital inflows gushed into the same regions here as they were recently.

Vancouver’s run ended with a catastrophic real estate crash in 1913, which dwarfed 1981 by a huge margin. Even the valuations (in real terms) of Vancouver today are much smaller than they were at the peak then, unbelievable as that sounds. When the bubble popped, Vancouver slid into a depression and soon after got sucked into WW1.

So had you spent 700k on a lot in Vancouver in 1912 (yes, this was the nominal price for many standard lots at the peak), then today you would have perhaps doubled or even quadrupled that number in nominal terms. I guess then if you bought a 4 million dollar bungalow today, in 110 years you might be just as lucky.

What do you guys think about “smart money”?

I wonder if it really exists. I’ve noticed bears often claim to know what the “smart money” is doing at different times. Has anyone else noticed that?

Good idea actually for an article actually thanks. Has there ever been a bad time to buy Victoria real estate given last couple downturns have been very mild? Will dig into it.

Yes, I saw that, along with the discussion about how that is a type of price cycle. I think that there are a lot people also interested in nominal house prices (and not just the derivative of them). Then you could comment if you see them as a cycle as well. Nominal prices would fit nicely on your chart, starting near 200k at bottom left going up to 900k at the top right.

I could show a graph of Apple share price changes that would show them to be cyclical, but that would miss the point of the phenomenal 500X price rise that is shown in a simple nominal price chart.

Anyway, thanks for the great post, and maybe in an future post you’ll include nominal prices.

Cynic,

Read what I said. It was that I know many people that made a million or more from Victoria real estate. That’s different than knowing the majority of millionaires. If you don’t think that there are even many people that have made a million on RE in Victoria, go ahead and believe that.

See last chart above. That is nominal house price change. I also pointed out it is decidedly positively biased and declines have been small the last two cycles.

Patrick,

So you know the majority of millionaires in Victoria? And can vouch for how they all became millionaires? Thats awesome.

Also, thank you random internet dude for vouching for your own argument. Totally makes it stronger and more compelling.

Cynic,

Good point. Since it isn’t material to my argument, I hereby revise the statement to “ created many of the millionaires in Victoria. I know many such people, so can vouch for that.

Having said that, remember that Andrew Carnegie, one of the richest people ever, said many years ago that “90% of millionaires became so through investing in Real estate.”

https://www.azquotes.com/quote/856550

“created most of the many millionaires…”

Now there is a darn fine analytical, evidence-based, and wholesomely researched statement if I have even read one.

And some people are not aware that market cycles havent existed for some things – like nominal house prices. These are notably absent from most charts presented, presumably because they aren’t “mysterious” and don’t cycle, but just boringly rise over time. Too bad, because it’s riding the nominal house price graph that’s likely created most of the many millionaires in Victoria.

Sure, otherwise it wouldn’t be interesting to watch. I’ve said that many times. However, I’ve always gotten the impression that most of the general public are not even aware that market cycles exist.

For many people, RE prices are just some abstraction that varies month to month without rhyme or reason, other than it always goes up. The reality is RE prices don’t come out of nowhere, and understanding at least the principle of cyclicality and credit can be enlightening and in some cases even useful. Smart money does it all the time…

I think this particular cycle has extended that for a lot of people.

Yes, and on the big cycles there will be wobbles that are important at the time. Most importantly a 10-15 year cycle is too long for most people to really take advantage of. Buying timeframes are generally 6 to 18 months, not 5 or 10 years.

There will always be mysterious aspects to markets, because humans are involved.

Some realtors are blaming it it mostly on decrease in foreign money entering Vancouver.

‘A reality check’: Housing prices continue to drop in Vancouver

https://web.archive.org/web/20190306014640/https://www.theglobeandmail.com/real-estate/vancouver/article-a-reality-check-housing-prices-continue-to-drop-in-vancouver/

Okay, let’s bring this up at the end of month 🙂 I would like to be called out if sales are not within 5% of last year.

Another thing to consider Marko is that for weekly sales the reporting method that VREB uses is really bad. A few presales being reported that sold months ago throws the whole thing off. So guessing how many total sales will be reported is basically a fools game to start with. Looking at pending dates is better.

By the way here was last year sales:

Week of:

Feb 25: 143

Mar 4: 145

Mar 11: 157

Mar 18: 140

Mar 25: 156

Notice no big escalation. Maybe this time we will get the escalation? Who knows.

And this year:

Feb 24: 126

Mar 3: 108 (some 10% more to come as they are reported)

I dont see that there is enough inventory out there for prices to really start sliding. It is still too early in the spring market to see where it is going. My feeling is that we will see price drops in the luxury end of the market with prices close to flat in the rest of the market. My opinion ,might change depending on what I have for breakfast so your guess is at least as good as mine.

Perhaps. Sales go up and down week to week so this is no science. Last month we had some wildly diverging weeks, with the first week being up 4% from last year, then down down down for the rest of the month. Sometimes it goes the other way. I’d say down 5 to 20% is a reasonable guess for the month.

But here’s the thing:

Last March 12th, we had 235 sales. I have a little tool that automatically looks at the numbers and spits out the sales rate and difference to last year.

So that’s 11 days of sales at 21.36 sales/day

Now we have 176 sales for 10 days or 17.6 sales a day, hence the 18% drop.

Most sales happen on week days, so we could do that (I should update my tool):

Last year: 33.57 sales/weekday

This year: 29.3 sales/weekday.

13% drop in sales (this is probably a better measure than the days of month but as the month goes on the difference gets less and less)

So will we end up down 5% for the whole month? Could be but only if the pace of sales increases.

Wasn’t February a wonky month without the acceleration factor? How has that been in previous years? For sure, March will be an interesting month to follow.

We will finish the month within 5% of last year.

131 x 3 at minimum + 171 = 569 + acceleration factor we will finish around 650 for the month, not 18% down.

Great update – always enjoy the simple, easy to understand principles that help unmask the “mystery” of the housing market.