Feb 19 Market Update

Weekly sales courtesy of the VREB:

| February 2019 |

Feb

2018

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 56 | 152 | 259 | 545 | |

| New Listings | 91 | 308 | 454 | 837 | |

| Active Listings | 2001 | 2063 | 2059 | 1537 | |

| Sales to New Listings | 62% | 49% | 57% | 65% | |

| Sales Projection | — | 535 | 492 | ||

| Months of Inventory | 2.8 | ||||

Sales took a hit last week for obvious reasons and are currently running about 17% behind last year’s pace. However this should be a temporary blip because while buyers were kept from showings and sellers were kept from listing for a few days, that has all cleared up by now. If those buyers were serious about buying, they will be making last week’s deals this week. If they weren’t, then they were never a factor anyway. I’ll take a more detailed look at the impact of the weather on sales a little later this week. The drop in new listings was pretty dramatic but again that should bounce back this week.

Prices are a bit of a mixed bag so far. Both condo and single family medians were low in January and I would expect them both to rebound somewhat just from mean reversion. That has so far only happened on the single family side but there haven’t been that many sales so expect some more movement there. Both prices should come in lower than the year ago value for February.

As has been the case for a while, the weakening in the single family market significantly outpaces the condo market, with January months of inventory more than doubling for single family homes.

With rate hikes seemingly on hold, the stress test will remain a more constant barrier this year rather than continually ratcheting up like we saw last year. This could allow some more buyers through, but I suspect this will be countered by increasingly negative coverage of market conditions as the weakness in Vancouver becomes more widespread. I expect continued inventory build and market weakening this year with the only obvious wildcard being regulatory waffling ahead of the federal election. Credit is such a big driver of the real estate market that any moves to restrict or loosen it tends to have a substantial effect.

del *

Speculation tax is aimed at satellite families, not just empty homes, and hopefully it will have an effect.

https://www.burnabynow.com/b-c-real-estate-audits-reveal-widespread-tax-evasion-1.23643194

Thanks to Local fool for the inspiration for this post: https://househuntvictoria.ca/2019/02/21/the-left-and-right-hands-of-government/

I’m not priced out or bitter. I would expect a video promoting Victoria to talk about what makes it unique. There’s plenty that does make it unique and I like it very much. The video, however, is a manifestation of classic Victoria pretentiousness. At least it’s not unrepresentative.

Then it depends on whether the household has one earner or two. One earner alone with no obligation I would say at least 90k, but that’s no good with a spouse, mortgage, car payment and 2 young kids. But, two at 90k has potential to be quite decent.

I say “potential” as so much of that comes down to the cost of accommodation and the price of child care. A lot of the people I know are within 140 to 200k but in knowing them I’ve observed that that doesn’t really translate into how much disposable income they have.

One of my best friends is at about 180k HH but by the time he and his wife paid the bills and all his sports escapades for his kids…there’s not much left. It’s crazy, but he does have two new Toyotas in his driveway.

Right now, the ugly reality is if you bought a home here in the last two years without family support and have two young kids, 200k a year doesn’t go as far as you might think. I honestly don’t know how a family of four making 40k a year do it in this environment and given the income stats in the city vis-à-vis the current shelter prices, that’s a social problem we all pay for one way or another. It certainly goes a long way to explain the appalling levels of consumer debt we’ve racked up.

Is there something wrong with promoting and loving Victoria? Is that where we are now? Wow, the priced-out bitterness is gettin’ strong.

Was going through some old posts and found this:

https://vimeo.com/121326803

Victoria: The only place where coffee, sunrises, local food, craft beer, flowers, and good conversation happen. And over produced pretentious af beat poet videos apparently.

Sorry, that was to read “San Fran isn’t that unaffordable”.

https://thetyee.ca/Analysis/2019/02/21/Tweet-Reminder-Rich-People-Homes-Geller/

KS112 Alternatively, just marry rich, you might not have a happy marriage but you are guaranteed a great divorce.

Oh local fool I thought we were talking individual incomes…

Oh local fool I thought we were talking individuals…

Looks like Victoria has the highest median household income of any Canadian city that doesn’t experience winter eight months of the year:

https://en.wikipedia.org/wiki/List_of_Median_household_income_of_cities_in_Canada

This is a hoot. Looks like it may (or may not) have snowed in Los Angeles:

https://www.nbcnews.com/news/weather/bit-snow-los-angeles-suddenly-it-s-snowmaggedon-n974306

With DB. Without it, you might need an additional 10-20% or more, depending on what your employer offers and if you have any health issues that consume cash. I am also talking about HH income, not individuals.

Is the 125k or 150k a public sector or private sector salary? Big difference given the defined benefit pension in the public sector.

125+ No kids

150+ With kids

One of the highest median incomes in the country, which is part of the reason for the prices. It’s also a comparatively volatile market, as coastal ones tend to be.

A cousin bought a building lot on the beach outside Tofino for $20K in 1974. Inflation adjusted for today that lot should cost $100 K. Interest rates are quite a bit lower today so perhaps similar affordability would be $200K.

Since it is all just cycles and it is NOT different this time when can I get my Tofino waterfront lot for $200 K? It is my right dammit.

Since I am a generous guy I’d even be willing to pay $300K.

Speaking of making lots of money, what does one consider a good salary for Victoria?

You’d fit in well with all the people there though.

San Fran isn’t that affordable to a lot of people there though. There’s a lot of people making a lot of money.

The thing about the 200k salary that i didn’t really consider is that you also get stock options. Still would rather my life though than the money.

Now you’re getting it! 🙂

Barrister,

At the end of 2013 that king george house would have probably sold for 750k – 800k without the reno, so maybe a million after the reno.

In hindsight the only thing I could have done was to borrow some money from parents for a bigger down payment, buy that house, get roommates/tenants and then take out a heloc to do the reno eventually. I would probably be able to get rid of the roomates now as I got a significant pay bump in 2017.

Introvert: actually summers in southern Cal are okay if you are right on the coast. Go inland a couple of miles and it turns into a very different story.

This is true.

Don’t worry, as Local Fool explains, it’s all about cycles. San Fran will be affordable to the masses soon! It’s not different there, either.

It does sound nice. Southern California winters also appeal to me: highs around 20°C and lows around 10°C—perfect in my books! Summers are too hot, though. Same for Australia.

KS 112: did not look at the other one so I cannot compare. As to prices my brain is back at the end of 2013 when I bought. My house is old but totally renovated and at $212 a square foot on a 26,000 square foot lot seemed reasonable. Prices now seem out of line for me so I am a bad judge of it.

80 hours a week for an IT job? interesting, didn’t know IT jobs were that intense. I thought it was only Legal and Finance jobs that gets up to 80 hours. Might as well get a slack $80k IT job for the public sector here and run a side consulting business while your at work.

It was 200k in San Fran. Also involved moving there, and working their hours.

I’d already had one kid, and 80 hour work weeks don’t make good parents.

Also, at 80 hours a week, you’re making about the same hourly while paying a boatload more for housing.

Also, you’d love Australia, you’d never complain about it being too cold.

Well making 150k in san fran is like making 70k here. Neither gets you very far…

Thanks for posting. That is alarming, hopefully the govt can stop it

Do I recall correctly that you once turned down a $150K job in California?

Barrister, i guess you went through the house post Reno? If so, how were the furnishings? It sits on a large but mostly unusable lot, which I don’t personally mind but could be a deal breaker for lots of others.

There was another one I saw in that neighborhood for the same price but its not listed anymore so not sure if someone bought it, it was on Quixote Lane. Did you by any chance look at that one too Barrister?

KS112: I went through that house and it has a nice view but I was underwhelmed by it otherwise. But take a walk through and judge for yourself. To me it is not worth a thousand a square foot. I am also not a fan of house interiors that have the feel of a condo but different strokes for different folks. But if memory serves me right this house has been on and off the market for a while.

As a citizen that would make much more money there as a programmer, it is great news.

Highend homes always get hurt in a softening market. I think you will need to find a few more dollars though. Good luck….You have the right idea though upgrade in a soft market.

gawc, $1.2m (or roughly ~500k ish delta between the current house and the new one) is the max I can afford currently without taking a huge hit on lifestyle…. So my hope is that the upper end comes down a lot more than the lower end. I also don’t want to sell the current one and wait for the upper to come down in case something weird happens.

Ya went through the photos once again. Nice finishes it seems. Could be new doors to the deck, fireplace work and a new deck so ya it adds up, so 150 to 200k may be real low. 1.2 is real low. 1.6 to 1.75 is my guess. I could be real happy there. 🙂

What`s your guess on renovations?

looks like the deck and other possible structural work. They started off at $1.85m in the fall, no way they will accept $1.2M in the current market. Power lines are annoying but, it is what it is.

Ya unless something major done or moved around. Looks like the typical kitchen/bathroom and floor redo. Nice place. Since they are below assessment already. me thinks they may accept something under if it stays on the market.

edit

I went through the pictures again. Really would have to see the before. Looks real nice. The value is the land… 150 to 200k interior is my best guess.

@ gawc,

You think its only $150k in Renos? Previous posts on this house has suggested that it was complete tear down

Stephen Poloz, from Intro’s article:

God help us. How frothy did you think it was, then?

Would have thought that at the point where annual housing prices in BC went up more than the entire annual provincial GDP, you might think the issue was a bit more serious than…oopsie, people are a tad gaga for houses.

More on Roundup in our forests….

http://www.andrewweavermla.ca/2018/11/07/time-stopping-spraying-glyphosate-bc-forests/

Every year in B.C., 16,000 hectares of forests are sprayed with an herbicide known as glyphosate. It’s sprayed over forests that have recently been logged and replanted to kill broadleaf plant species that might inhibit the growth of lodgepole pine seedlings. The result is reduced plant diversity, leading to monocropped forests that are vulnerable to more frequent and destructive wildfires and beetle infestations.

The World Health Organization has warned that glyphosate is likely carcinogenic. It also has genotoxic, cytotoxic and endocrine-disrupting properties. For decades, researchers have been reporting reduced numbers of rodents, moose, insects and birds in forests that have been sprayed.

Seeing a number of flips show up in the listings today. Here’s one that caught my eye: 1050 Thistlewood Dr MLS 405851. I saw this house several years ago (2015?) and it needed a huge reno. Purchased and fully reno’d and then sold on 7-26-2016 for $1,070,000. It’s listed today at $1,399,000. I’m not sure this current owner has done anything to the house as what I remember from the 2016 listing was a huge makeover from when I’d seen it previously. Wait – listing says new gas FPs and new appliances which stove is gas so perhaps they brought in gas? How much can that cost? I see the electric baseboards are still there so didn’t update to a gas furnace.

It’s a nice neighborhood, a bit odd on the layout of the house and a truly lousy backyard. Will be interesting to watch.

Poloz Says Bank of Canada Rate Hike Path ‘Highly Uncertain’

https://www.bloomberg.com/news/articles/2019-02-21/bank-of-canada-s-poloz-says-rate-hike-path-highly-uncertain

Well at least they got a house, which they can payoff completely in 25 years, using falling fiat currency. Unlike many shutout of home ownership by B20 (according to CMHC).

Or the people rushing to get in before the advent of B20. Almost as though they thought they were “beating” something, when really, they’re just imperiling themselves.

https://www.bcassessment.ca/Property/Info/QTAwMDBIUUE2QQ==

Sold 2016 for 1m. Maybe 150k in renos….

10% below assessment

@ ks112

#56665

Why wait, place a low-ball offer and see if they will accept?

This article details the continuous stream of similar economists crash predictions for the Australian house market since the 1960’s (when Sydney prices were $15k per house). None of them happened,

https://investorsprime.com.au/12-spectacular-failed-australian-property-bubble-predictions-by-academics-and-so-called-property-experts-by-konrad-bobilak/

There’s a reason economics has, for 170 years, been referred to as the “dismal science.” https://en.m.wikipedia.org/wiki/The_dismal_science

I just want the $1.8M house to drop to $1.2M so I can upgrade. Does that make me a bear?

https://www.realtor.ca/real-estate/20311675/3-bedroom-single-family-house-46-king-george-terr-victoria-gonzales

Been watching this one for awhile, its back on the market again.

What I have learn on here is people have one big issue paying 50k more for something if they have the mindset it will be cheaper, Boy if prices are rising they can sure justify paying a 100 or 200k more than a couple years ago in a rising market.

The biggest one is if the market rose 300k and they pay only 200k more because prices fell 100k after rising 300k than they think they beat the market.

Buy in 1982 vs 1981, yes save 17%. (126k vs 105k)

Buy in 2009 vs 2008, same price (<1% difference) (583k vs 580k)

People who waited for a drop in 2013 passed up average $598k home and are still waiting, as average in 2018 is $908k – up 50%.

https://www.vreb.org/media/attachments/view/doc/ye782018/pdf/Annual%20Summary%20of%20Single%20Family%20Sales%20from%201978

Great news that renters in Victoria, BC, can soon afford to buy a place in Australia!

Anyways we can argue this but unfortunately we don’t now the future until its the past. Some will have made the right decisions some will not. Back to playing the penny stocks…

So true, and this shows the homeowner wisdom of a big mortgage – borrowing fiat currency to be paid back up to 25 years later when it has “fallen in value over time”. None of these benefits accrue before you buy, and you typically just pay more.

Think that one has been posted too.

Anybody waiting in 1981, or 2008 who waited for a year got a much lower price.

Anyone who has waited in Vancouver for the last 6 months has got a lower price.

Anyone waiting here over the last 6 months likely has as well.

Can’t we do both? I work super hard and always have. Younger generations have lots to complain about as wage growth is in the toilet, price of education keeps rising dramatically, the “gig economy” is actually the elimination of worker’s rights, and the ratio of average wage to housing prices has gone completely insane…. for some reason we’re just suppose to shut up and take this all while the government spends most 3/4s of it’s money on the wealthy older generations who could buy a home being a cashier in their 20s while I can’t buy a home with no kids, no car, and both me and my wife working full-time as professionals. We can complain all we want because frankly, it’s bullshit.

Show me a chart that doesn’t demonstrate fiat currency falling in value over time, or interest rate trends over the last 35 years.

Your great grandparents might have bought a house for 800 bucks and a candy bar for a ha’penny. So? Does that mean you can’t afford it now that it’s $1.25?

Your income, whatever it is, would be unimaginable to them, even though you may actually be relatively similar in terms of purchasing power. Just because a mortgage is larger in nominal terms, it’s not meaningful until we see what the holder is actually using to pay it off and how much of it they have relative to that debt.

Indeed, that’s also been the case for nearly a century. Not really a new dynamic.

LF: Victoria is a small city with a medium sized economic basis and but also an active retirement industry. It is what distinguishes it from Ottawa when it comes to house prices.

Great chart show me the chart that shows waiting has gotten a smaller mortgage or paid less for a property.

Actually, it’s not new at all. And we don’t need to constrain it to 30 years, we can go back even further. From the sounds of it you may not have seen this chart that our mutual friend made for us, so here it is again. 🙂

Market dynamics wow that’s a new one…Waiting for market dynamics how has that worked out the past 30 years in Victoria. Only thing time has gotten people is a larger mortgage.

If the test is “something being unaffordable” then sure. Most people can’t afford A. Lange & Sohne’s Grand Complication timepiece, but I don’t think that’s saying much.

But if the test is “virtually everything being unaffordable”, then the last 40 years of housing data we have demonstrates pretty conclusively that “average” accommodation will indeed become more affordable to the “average” family after unaffordability peaks. We’ve done this many times, and we’ll do it many more. The fact that people continue to argue perpetual unaffordability in contradiction to the data is interesting to say the least. And quit picking on the core, the issue extends far beyond there.

Victoria is not a major city and probably never will be. It is a relatively small city with a small economy and is not a major hub of anything.

Correct – it’s not magic; it’s established market dynamics. Unless of course…it’s different this time™.

Core is not downtown only. Most expensive place in the core is Oakbay.

32% of people have no clue the difference between an RRSP and TFSA. So its not surprising to me that people think prices in cities cores will get affordable again.

Never know. Commuting could become a big thing again w/ self driving cars. I used to live in downtown Toronto 15 years ago, and places weren’t expensive. Montreal the same. Reason being that people preferred not to live downtown. If there were a subway that took you past the commute from langford to downtown, there would be way more people who would live out there.

Just because something is unaffordable does not mean it is going to become affordable for the average person/family. The core at one time in major cities was affordable for the average family. It is not magically going to be affordable again by waiting. Chances are it will continue to become even less affordable as population/demand continues to grow,

Q post is a good one…..Especially looking at just outside the core.

Our economy does seem to be weakening and rates do not seem to be going any higher, demand is not disappearing. Victoria is a resilient little market. 2019 may turn out to be a good time to buy…

I wouldn’t say they’re too bad in relative terms. Westshore is now and suddenly very expensive, but still more or less underpinned by the local economy IMO. If a nasty correction happens I would think that this area wouldn’t see quite the level of retrenchment as places like Fairfield or Oak Bay.

Don’t jump on me because I am neither a bull or a bear, but I do wonder if about a quarter of all buyers are from out of town (most with deep pockets) and if a significant numbers of the sellers downsize and remain in Victoria then whether the bar of affordability is simply moved up the income spectrum.

One of my neighbours suggested that if one applies the affordability metric to the West Shore and ignores the inner core then prices are not all that far off. Not sure if I agree with this but I found it an interesting thought.

I knew that was it. All along folks were thinking that the economy had become too reliant on housing, debt levels were growing too large and too fast, and as a result housing was becoming disconnected from the economy that supports it.

Personally, I thought it sobering that as we speak, tens of billions of dollars of equity are being sucked out of the Canadian housing market faster than Charlie Sheen can snort a line of coke. If only folks were more actualized, they’d jump in and lever to the hilt, regardless of those little irrelevancies.

Lo, the light now shines thus: ’twas all a petty display of victimhood wrought by those myopic, idle little folks who cannot see past their own sense of indignant victimhood. I’d pull myself up if I had bootstraps, alas and because of you I am too poor to afford boots.

No matter, I’m off to the Vefra building to pick up my cheque – society (you, the taxpayer) owes me at least that much.

😛

Or both.

Correctly observing that a house is less affordable now does not preclude working hard. Working hard is necessary but often not sufficient in order to buy a house these days.

Put another way, working hard does not mean you must turn your brain off to the reality of the affordability picture.

QT well said.

@ QT

It sounds like an ultimatum.

Add:

The moral to most of my RE posts to the bears is to stop bitching and whining of how hard you are done by, and stop placing the blame on your parents, elderly, foreigners, immigrants, criminals, or anything that happened to be the flavor of the week. Pickup your bootstraps, put your face to the grind stone and work hard, because you will get closer and quicker to your goal/s than stand by the side and wait/time for the miracle/market crash.

I’m not clear with what you wrote, but does this has anything to do with my bet that Victoria RE will not drop more than 10% in 2 years base on historical trend, when many people as well as you (if I recall correctly) called for a drop of 10% or greater? Or, perhaps it is the guilt of making fun of someone poor English brought all of this up?

I’m sorry if I accused of anyone of prejudice over my poor grasp of English. However, I don’t think it was me that accused anyone on this merit. I don’t believe that I put on a persona as you call it. It is all me and I never once claimed that I’m a recent immigrant, however I’m a first generation immigrant (I even offered to meet over the bet so that people can get to see me as who I really am). I have poor English spelling and grammar that take many edits to get something somewhat comprehensible thanks to the new forum 15 minutes edit time.

And, yes my family owned a house in the core for 36 years and my mom lived in the core since 1980. I now live in Langford because the price for SFH is right, and because of the great outdoor actives as well as the amenities that are available out here.

The moral to many of my posts is that there are much more to offer outside of the core as many people are lead to believe that it isn’t so or from fear of the unknown, and the bonus is that housing outside of the core is still somewhat affordable.

All of you who are so emphatic that people never change should be closely observing the life history of QT. He first arrived on the forum as a recently arrived Asian immigrant with a fragile grasp of English. When someone (I forget who) called him out on his ineptly constructed false persona he responded with accusations of prejudice.

Yet now we find he has lived in the core with his family for the last 36 years.

See? People CAN change.

Why wouldn’t it be called the bull anet Patrick? I don’t know what the results will be.

Vancouver is only down 3.3% since peak….. are you sure your interpreting the results right?

Great idea and impressive methodology. That will be much superior to Teranet. It’ll be a feel good index – you guys can call it “Bear”-anet 🙂

Some one just post 10 random recent (last month) sold prices (5 SFH and 5 condos) in the core and have people on here decide for themselves if those would have sold for more in 2017.

Dude, even the BC Govt is saying that even Condos are down double that.

Too true. I admit I’ve perpetually thought housing was too expensive throughout time where ever I was. Coming here and learning what makes RE tick and why it’s the way it is has re-adjusted my expectations. I’ve gone from being horrified at half-million dollar homes to being delighted by them.

House hunt is going just fine gwac. The price slashes and flat market makes for the best view I’ve had in 3 years.

Yes, but the reason I think their housing downturn will be worse is that they have “Vegemite”, whereas we just have maple syrup.

God’s righteous act of vengeance upon an utter abomination.

what happen to the y/y growth in 2016 and 2017 .. hhhmmmm…

Teranet Jan 31,2019 house index for Victoria unchanged. Still near all-time high (-0.5% from Sep 2018 peak). Based on closings., 3 month rolling average.

Vancouver down -0.27% for January and down 3.3% from peak (July 2018)

https://housepriceindex.ca/2019/02/january2019/

lets do comparisons

Canada: natural resources , housing boom, Chinese investors, sky high debt, low income to affordability ratios, lots of land, harsh climates, City name Sidney and Victoria, beavers and bears

Australia : natural resources , housing boom, Chinese investors, sky high debt, low income to affordability ratios, lots of land, harsh climates, City name Sydney and Victoria, kangaroos and koalas

I bet it will be worse in Australia than here, certainly nationally. But what’s funny, the commentary from analysts, economists, academics, developers, politicians and the RBA was the same as you hear in Canada now.

Despite almost comical levels of consumer debt and a fantasy-priced RE market, there was no bubble. No issues. No systemic risk, no issues with loan quality. Strong lending practices, strong employment, pent up demand and oodles of millennials to take on the supportive torch of ever escalating prices. Then the RBA inquiry happened, and then they changed their tune and were required to revamp some of their policies (mainly the curtailment of interest only mortgages).

When the massive scale of overpricing started to bite, guess what? They said no worries!

I remember reading this stuff last year; I posted quite a bit of it here. First they forecasted muted growth, then perhaps a small downward revision in prices, then possibly 5 to 10%, then 10 to 15%, then possibly as much as 25%, a few lunatics said 50% or more… and so on and so forth. Some of you might have noticed that these people are doing the same as sellers do in a downturn – their commentary chases the market down, always one step or more, behind it.

And where are we right now here in BC? I suspect we’re somewhere between the “no worries” and “muted growth” paradigms. This once again demonstrates that the commentary these people provide is no substitute for learning history and watching data objectively.

Thanks for posting CS.

As pesticides go Roundup is actually one of the more benign ones. I won’t put it on my backyard veggie garden though. Even some of the so called “organic” pesticides are fairly nasty.

Very few countries have actually totally banned Roundup but it is fair to say the pressure is on. Sri Lanka which did have a nationwide ban, recently rescinded it.

Ah, yes, we’ll all be dead from global warming in 12 years unless we rebuild the world from scratch and drive Teslas instead of Toyotas.

Actually, a greater “win” environmentally, would be to do without a car altogether, which would mean living within walking, or biking, or scootering distance of where you work. And it would be better to live in a condo, than a house. Better actually to live in a barrel: even more energy efficient. And of course no more Hawaiin holidays, conference travel or road trips to visit grandma in Saskatchewan.

The thing is, reorganizing the world on such a basis and ensuring everyone plays their part is virtually impossible without either a Bolshevik style-tyranny or a market mechanism that guides consumers to follow a resource-efficient life-style. And appalling though the current Liberal Government in Ottawa is in virtually all other respects, they have it dead right (well almost) on the carbon tax.

With the tax folks, can have as many Teslas as they want, just as long as they pay the carbon tax on the embodied carbon-based energy in the manufacture of the vehicle and the generation and transmission of the electricity consumed. Then all the government need do is keep jacking up the tax until carbon emissions, come down to where they are tolerable.

There would, of course, have to be a countervailing duty on goods imported from countries without a carbon tax, which would both protect our industries and encourage every country to adopt a carbon tax, a detail our government seems to have overlooked.

We may also need taxes on black carbon and sulfate emissions, which have climate forcings comparable to carbon dioxide.

News.com.au:

‘Let the bloodbath begin’: House prices in Sydney and Melbourne ‘could halve’ in worst crash since 1890s

House prices could fall by more than 40 per cent in the “worst crash since the 1890s depression”, a new report warns. We’re now in stage two of the “bloodbath”.

Only in Australia?

Roundup is so nasty it’s slowly being banned around the globe….

@ Dasmo

#56623

It has even been found in some organic food crops.

If you purchase organic foods or beverages, you should theoretically be safe from glyphosate exposure, as this chemical is not allowed in organic farming. But new analysis revealed glyphosate has now infiltrated many organic crops.

As for how the organic became contaminated, it’s likely that the glyphosate drifted over onto the organic crops from conventional crops nearby.

It’s also possible that the contamination is the result of glyphosate that’s left in the soil after a conventional farm converted to organic; the chemical may remain in the soil for more than 20 years.

Your best bet for minimizing health risks from herbicide and pesticide exposure is to avoid them in the first place by eating organic as much as possible.

EVs are a net win environmentally, even factoring in lithium mining and everything else.

https://www.youtube.com/watch?v=6RhtiPefVzM

The world will always require oil for certain products and applications. Needing to burn gasoline in an internal combustion engine to get us to the mall isn’t one of them.

Yup, and ever since Italian consumers learned that the wheat they were importing from Canada contained Roundup Canada’s wheat exports to Italy have slowed to a trickle.

https://ipolitics.ca/2018/04/03/pasta-spats-canadian-wheat-exports-to-italy-slump/

Dasmo, you’re a beaut 🙂

We eat almost entirely organic. You keep on spraying your veggie garden with roundup. It’s perfectly safe!

Oil completely underpins virtually every aspect of our modern way of life. Without it, we’d be in the early 19th century at best. Go ahead and get an EV, but if someone really cares, then they ought to walk the walk. But it’d be extremely painful. Oil is absolutely amazing, notwithstanding the obvious need to develop new materials and sustainable energy sources.

144 Products Made From Petroleum And 4 That May Shock You

https://www.innovativewealth.com/inflation-monitor/what-products-made-from-petroleum-outside-of-gasoline/

Hate to mention this. But Roundup is in most of your foods. Especially breads. It’s used to hasten wheat to dry out quicker before it naturally would. Most non-organic wheat in North America is now contaminated with glyphosate, the active ingredient in Roundup and similar herbicides.

https://nowtoronto.com/news/canadian-wheat-tainted/

and

https://www.cbc.ca/news/canada/saskatchewan/health-canada-herbicide-glyphosate-roundup-1.4975945

Pre-harvest treatment of crops with glyphosate helps farmers to harvest their crops more efficiently and at less cost

I didn’t know they were spraying roundup in the forests! Maybe f*ckg with nature’s balance is to blame for all the fires in more ways than one. If you think this is a good thing you gotta stop spraying Roundup on your veggie garden….

When will that be? And, when will you outfit your family clothing and furniture with natural bamboo, hemp, and cotton?

While you at it, please replace the EV wheels with wooden wheels, don’t drive on environmental harmful pavement. Please save the environment by living off grid, and grow your own food instead of purchasing produce that are grown and delivered by fossil fuels.

I know. And I don’t feel good about it. So I’m gonna continue to oppose expansion of fossil fuel infrastructure. Also, as soon as it makes financial and practical sense, we will be replacing our family’s one vehicle with an EV.

That would be great.

Did you hear that the proposed Fraser Surrey Docks coal shipping terminal project was recently cancelled? That was a big win.

Yes, I recently read about the B.C. government’s heavy use of Roundup in our forests. Chemicals like this are nasty (see below) and we should think twice about such practices.

https://www.cnn.com/2019/02/14/health/us-glyphosate-cancer-study-scli-intl/index.html

year 1723, canada was free .. damn .. should of bought it then

Specially in a declining or balanced market. All assets go up in an ascend market, and from what I have seen in the past here locally, house tend to lose value or don’t ascend as rapidly as land in a balanced market.

NDP have the track record of what you said in the past, and they are not known at creating jobs or keeping the economy going. IMHO, the majority of the people with student loans would prefer to have a job in their field of studied instead of a couple of thousands handout.

I can go back a little farther than that.

My best friend parents purchased their house in Shaughnessy in 1969 for $33,000 and his grandparents though that his dad was crazy. They had to relocate to Victoria for work so his dad sold the Shaughnessy house for $35,000 in 1971 to buy a small rancher on a 5 acre lot in Metchosin for $39,000.

My parents friends thought that we were crazy in 1983 to pay $97,000 for a house in the core, while houses in Colwood at that time can be had for less than $60,000 and Sooke/Shirley less than $20,000, and the 14 units low rise apartment on Carlton Terrace that we had to vacate from (renoviction) was sold for $295,000.

Family friends also thought that we were crazy that my dad gave my sister 25% down on a house that they purchased for $176,000 in 1987 (it is now the Pat Bay Hwy/McKenzie overpass). And, if I remember correctly, at that time 60 acre farm with 2 houses in the “sticks” were going for $66,000 and may have sat on the market for at least 6 months before it was purchased by a developer (that farm is now call Sunnymead.

A history lesson for the bears. You can wish for a market crash all you like so you can get into a SFH in the core for $500K is highly unlikely now or in the near future.

Also, just as a public announcement. If you’re between the ages of 23 and 52, you only got one set of MMR vaccinations (unless you didn’t get any). Which means only an 89% chance that you’re covered if you decide to go over to Vancouver. Top ups are free. Call your doctor.

And yet you’re still financially supporting the oil sands by driving every day.

Maybe BC should close North America’s largest coal port as well. Along with discontinuing spraying Round up after every forest fire to get rid of Aspen.

Climate change and costs…

The B.C. Forests Ministry’s firefighting costs were $551M over budget last year. Extra emergency program costs associated with floods and wildfires added $308M. That’s a combined overrun of $859M.

$859M is higher than the combined operating budgets of these 8 ministries:

Environment

Energy

Labour

Agriculture

Indigenous Relations and Reconciliation

Jobs, Trade and Technology

Mental Health and Addictions

Tourism, Arts and Culture

Source: today’s TC. Strangely, there is no web version of the article.

Past results don’t guarantee future returns.

what would be a better long term value for investors?

700k in a town that does relies on growth of vancouver or 1.4k home that drives growth in nearby town

That’s taking into account that they can actually sell the house. How many sales have their been in Vancouver this year?

https://www.zolo.ca/vancouver-real-estate/trends

^ this can’t be right. It says there have been 214 sales in the last 28 days, which would be less than Victoria.

edit:

Found this: https://www.rebgv.org/market-watch/monthly-market-report/january-2019.html

1,103 in January. Townhomes going for $800k.

That’s comparing with Victoria’s 329 properties sold.

So less than 4 times more sold, with over 6 and half times more people.

Shiny new bridge 🙂

Vancouver had the olympic to boost image .. what did victoria had since then?

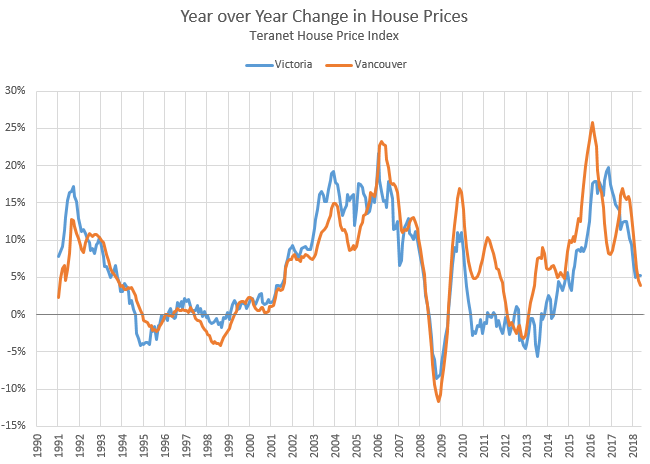

Since 2010, it appears correlation has weakened compared to before. That is, if you add it up, there is a lot more total white area between orange and blue from 2010 to now (9 years) than there is from 1990-2010 (20 years).

The weakened correlation during the past 9 years signals to me that Vancouver’s % price drops may not come to pass in Victoria, just as Vancouver’s % price gains didn’t either.

I am in agreement. Last time I was in Vancouver a $699k Shelbourne townhome is $1.75 million on a 6 lane street in Vancouver. The Vancouver place could easily drop to $1.4 million and not have much of an impact here.

I agree, depending on the market segment. And that’s generally a good thing. Violent changes in shelter costs aren’t anyone’s friend in the long run.

Just as I once held the vain hope that Vancouver’s influence would propel Victoria median prices to $1.5M, so too will others nurture the vain hope that Vancouver’s influence will clobber Victoria median prices down to $500K.

Looking at Leo’s graph, it seems that YOY change in house prices were highly correlated until about 2010.

Since 2010, it appears correlation has weakened compared to before. That is, if you add it up, there is a lot more total white area between orange and blue from 2010 to now (9 years) than there is from 1990-2010 (20 years).

The weakened correlation during the past 9 years signals to me that Vancouver’s % price drops may not come to pass in Victoria, just as Vancouver’s % price gains didn’t either.

I can accept your reasoning but, I don’t think we need to delve into hypotheticals.

Specifically, I would be inclined to see to what extent, if any, our markets are correlated. If the markets are in fact quite correlated, and we accept the notion that “the whole Vancouver saga of the past 10 years is a complete anomaly” (I do) then your own post would seem to suggest what kind of upcoming trends the VicRE market may expect.

Incidentally, LeoS recently did a post on our market’s correlation with VanRE.

Forever is a long time, but your recounting of the last 30 years of stories of people saying “$[insert figure] is crazy” is powerful.

The whole Vancouver saga of the past 10 years is a complete anomaly. So it’s not surprising to me that atypical gains are being followed by atypical losses, now that governments foreign and domestic are cracking down in various ways.

The only question is, to what extent did Vancouver’s anomalous price gains contribute to Victoria’s price gains during the same period?

If the answer is that it contributed to a very large extent, then Victoria’s recent gains may be more fragile than past ones. However, if the answer is that it did not contribute to a very large extent, then Victoria’s recent gains may prove to be just as durable as all the prior gains you listed in your 30-year timeline.

@ gawc,

Not sure what other infrastructure projects soaking up the work resulting from a housing crash has to do with housing tax revenue?

The NDP also had been vague on what affordable housing actually means. Would be nice if they pegged it at a certain multiple of median household income or something like that

That perception has gone on for a long time.

Early 90s my parents buy a quarter section (160 acres) for $75,000

In the late 90s considering a condo for the kids: “Over a $100k for a little condo? That’s crazy!”

Early 2000s brother buys a house: “$280,000 for a run down rancher, that’s crazy”

Mid 2000s sister buys a house: “$380,000 for a house in gordon head? That’s crazy”

Mid 2010s we buy: “$550,000 for a house in gordon head? That’s crazy”

Good to be aware that shock of house prices is not a new thing per se. Even far before that people were shocked at house prices. On the other hand that doesn’t mean it will continue forever. Some vancouver sellers are getting shocked the other way when trying to sell right now. Better to look at other metrics to determine if you should be shocked at house prices or not.

A crash has major impacts on more than just housing tax revenue, It will impact the whole economy so I think they care about a crash.

@ Leo S

I think the NDP are indifferent to a crash as long as the other infrastructure projects soaks up the work so the overall affect on the economy is minimized. If that happens then really the only “bag holders” are the ones that bought since 2016. Obviously they can’t openly say or hint that.

Hang on! Don’t you mean better and better? I though you wanted affordability to improve

Clearly! Still the more expensive one is brand new, the cheaper one is 100 years olde.

Recently chatting with a couple who are friends of ours. They were saying that around ten years ago their stance on buying a house was “$500K for house? That’s just crazy. No friggin’ way we’re paying that. We’ll just wait till prices drop a bit.”

Fast forward to today. Now they have two kids and they recently bought a place in the core. Suffice it to say, they paid a lot more.

I am a bit surprised the NDP has called an end to BCs housing market correction. Maybe they plan to impose restrictions on the amount people can lower their asking price by. Or, the data looks so bad that they realize it makes.no difference what the say or do anyway, the market is bust.

They definitely don’t want a crash. However it’s unfair to say they aren’t doing stuff on both ends. Spec tax, who knows what the effect will be but foreign buyers tax and the new beneficial owenership registry whenever that comes are serious efforts to remove the cash injections that have been distorting the markets. Investigations into money laundering and (if we’re lucky) a public inquiry into what happened is another message that it’s not anything goes anymore.

Yes we did. In fact there was a very significant degree of affordability improvement due to lower prices but even more so, through falling rates.

In fact, in the last cycle we never got there!

Many prospective buyers were waiting and waiting on that inevitable ~25% correction (SweetHome likened it to “falling asleep at the wheel”) and then all of a sudden the market heated up and prices ended up rising 40%.

Never.

Personally very disappointed the budget did not include expanded daycare subsidy. Quebec showed us that this type of program gets women back in the workforce and ends up making, not costing, in the long run.

https://www.citylab.com/equity/2018/12/affordable-daycare-subsidized-child-care-working-mom-quebec/579193/

@LF you are starting to see clearly now. “Affordable housing” has nothing to do with bringing the market down so you can buy a SFH at 2009 prices. It’s about spending crap loads of money to build and buy subsidized rentals. The government doesn’t want a crash. They want to create even more RE activity. They threw you a bone in the form of a revenge tax but you watch. Signs of real pain and the stress test is gone, 30 year amortization is back etc.

Out of the country at the moment but oh! how grand to see the much anticipated NDP pixie dust scattered in my absence….

We began with poof! ferry operating costs will not increase, poof! daycare is cheaper! and now poof! certain types of debt do not incur any interest!

This is the NDP’s doing and behold it is marvelous in our eyes.

There will be naysayers. Someone here at the breakfast table says it looks more like a cynical ploy to buy votes from unproductive people and funding it by extracting cash from your grandchildren’s future earnings.

She also mentioned that in a location where an embarrasingly-large portion of the populace needs dope to get them through the day, budgeting should perhaps be done outside the province.

It is a flaw of human nature that we can believe in two incompatible ideas at the same time. In this case, it is the govt believing that we will create affordable housing, while the govt maintains revenues from housing sales. Many homeowners are like this too, wishing for “affordable housing” for the new buyers, but not expecting that their house will fall in value if that happens.

If typical home prices fall 25%, with the expected drop in economy, rising deficit and unemployment, it will be hard to imagine the NDP having a proud announcement “well we are so happy to tell you that there is now affordable housing, prices down 25% thanks to our hard work.”

Rant time!

I had a look at some of the budget commentary of what BC is expecting in the coming year for RE. It was a beautiful exposé in why I dislike politics.

Who are these people that actually premise a budget on stable or rising RE sector revenues, while at the same time continue to champion affordability and the need for lower home prices? These are diametrically opposed objectives, given that a sustainable and competitive economy is going to require housing prices in some markets to be far, far lower than they are at the moment.

And that’s what’s currently underway. The data in BC is getting worse and worse with each passing month and it’s spreading geographically in exactly the same way that the run up spread. This takes a lot of time – it’s taken nearly 3 years just to get it to the point where it’s gotten obvious to everyone. But by the time that happens, that’s not the beginning of the end, that’s the end of the beginning. Now, we move on to asset repricing to a level that buyers are willing to meet sellers at. And that sure as heck isn’t here, and we don’t get there in a mere few weeks.

Are the analysts in their Cabinet unable to fog a mirror? Are they confounded by toilet paper rolls or mystified by Pez toys? Because it seems to me that anyone who has the ability to pay a modicum of attention can quite plainly see what’s been happening and why. BC real estate isn’t in the closing stages of its correction, for goodness sake.

If you want more affordable housing, you’re going to have less revenue coming in from the housing sector, not the same or more. This isn’t a difficult proposition to understand. Ergo and IMO, you can expect that this particular government is going to end up continuously revising its revenue forecasts down, down, and down from here.

I am left to wonder if Phil Soper was the team lead in their forecasting department.

This isn’t an NDP or Liberal issue, because they both do this double speak; a half distorted and wilfully oblivious bout of poppycock for the mass consumption and comfort of the ignorant. It’s really sobering to see forecasts which appear to ignore or distort reality to a degree that Kellyann Conway couldn’t pull off if she was tripping out on magic mushrooms. Ah, my tax dollars at work. Love it!

Oh and here’s a picture for y’all. You know, old time’s sake.

Pending contracts.

When a contract falls through it is subtracted in the month when it falls through so that the sale is not double counted. So if a sale goes pending this month it will be counted this month, but if it falls through in March, then it will be subtracted from March’s total.

Yeah I should have thought about that a little bit more before throwing that in. I do expect some sales to be pushed forward into this week, but the market is slowing so will likely not exceed year ago sales even with that bump. Sales increase latter half of Feb but not enough to make 520.

Last year in the last 8 days of Feb we had 233 sales. If we had the same we would end up at 492, so I’ll update it to that.

$1.4M. 12 DOM

Half a million dollars cheaper does wonders for selling.

119 Moss seemed to sell quite quickly, especially in comparison to near neighbour 111 Moss that has been languishing for many months.

Anyone care to post the final price and DOM.

Started writing an eBook on the Victoria real estate market. Hard to capture the whole picture in a blog format… going to see whether the important things I learned in the last 10 years can be captured in one place.

anyone know what 8607 Emard Terr sold for?

My listing. $1,437,500+gst so just north of $1.5 million.

KS yep here it is.

https://www.point2homes.com/CA/Real-Estate-Listings/BC/Port-Alice.html

Impressive budget. Status quo.

No new measures to hit housing. No tax increases.

No new giveaways to middle class, instead targeted to the poor who need it the most (e.g. child care benefit maxes out at 25k family income, and slides down to $0 at $97k family income. )

And a shoutout from the govt to the importance of the golden goose … “the government’s forecasted surplus is predicated on a number of factors, including property transfer taxes remaining stable…” https://www.cbc.ca/news/canada/british-columbia/bc-budget-day-2019-victoria-1.5023978 (Q. If the govt is projecting transfer taxes to remain stable, how interested are they to seeing falling housing prices?)

Let’s hope that fed budget is stand-pat like this one. So we get to see the market determine the price of housing. Should be interesting,

anyone know what 8607 Emard Terr sold for?

@ Gawc, do you have something in Josh’s price range you want to sell him?

Always a pleasure Josh. I am a firm believer people should not be reliant on the government and should pay for their own shit. How`s the house hunt going.

Didn’t think you were capable of mental re-assessment when it came to the NDP.

https://business.financialpost.com/diane-francis/money-laundering-by-foreigners-is-whats-really-destroying-housing-affordability-in-Canada

Governments need for revenue will stop them from a full ban…

Lastly government rules and regulations and fees are a big part of the cost problem.

I’m a little disappointed that the exemption price for first time homebuyers was not increased from the current 500k for property transfer tax… the rest of the budget is ok. But come on, the average home price for the province is 700k. Throw us a bone.

(From the previous thread:)

Not if what’s making you miserable is Moose Jaw.

Speaking from my personal experience, geography can greatly affect general happiness. I’m a happier person for living in a place I love.

Place seems to matter a whole lot more for some than it does for others.

Looks like no new housing items in the budget. Makes sense, still need to see how it all shakes out.

Is the NDP moving to the center…Not the tax and spend budget I was expecting.

I don’t generally post Zerohedge articles, but this one was too funny to pass up. As some of you know, China is currently the epicenter of the global housing slowdown.

With so much dependence on ever rising RE prices to the Chinese Economy, the latest strategy to deal with falling RE prices there is to…ban them. Ban what, you say? What I mean is, the government making it illegal for developers trying to move product, to engage in lower pricing that may “disrupt market order”.

Got to love Communists.

https://www.zerohedge.com/news/2019-02-19/big-trouble-china-housing-government-bans-malicious-price-cuts

Apologies if this has been asked many times and I just missed it (or asked previously and forgot in a grey hair moment :-)). Are sales pending contracts or when the property is sold? If it’s pending, how are numbers adjusted when a contract falls through? Thx

Ok, reading Leo’s post again he had factored in the pent up demand from the snow days to show up this week and next.

So if there are 259 sales so far and there is 9 days left then I would expect the sales projection to be around 400? I dunno, unless historically there is typically a large spike during the last week of Feb?

Business days are what matters. We have this week plus Monday to Thursday of next week. Also, as you head into spring sales ramp up due to seasonality.

520 is a bit rich because the month ends on a Thursday. I am projecting 480 sales for the month.

@ Leo S

Just wondering how you came up with the sales projection of 520 for this month when looking at your table the weekly sales seem to be around 100. So if there are 259 sales so far and there is 9 days left then I would expect the sales projection to be around 400? I dunno, unless historically there is typically a large spike during the last week of Feb?