The left and right hands of government

They say that once a group gets large enough, communication starts to break down. The human brain and our communication modes are just not equipped to remain aware of what everyone is up to once you’re working with more than about 7 people. So it’s no surprise that an organization the size of the provincial government isn’t always rowing in the same direction.

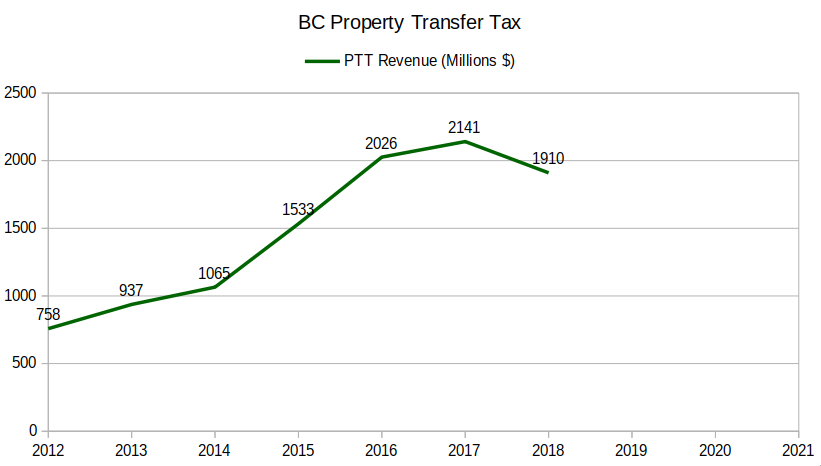

This week the government dropped the budget and on the face of it, there isn’t really anything new as far as housing is concerned. They are waiting to see how the measures announced last year (spec tax, increased property transfer tax, and affordable housing construction) play out, which is likely a sound strategy. After all, sales are declining around the province and prices are starting to slide as well. With a vessel as slow moving and valuable as this one, you really don’t want to get too impatient at the controls. Revenue from the property transfer tax has been growing faster than any other tax revenue source, ballooning by 150% in the last 6 years and bringing in nearly two billion in revenue.

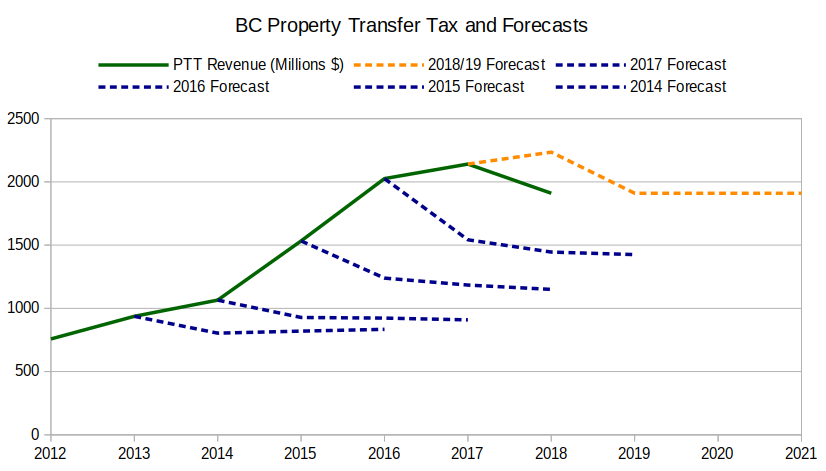

The amusing part though are the projections that every government has made for property transfer tax revenue which have turned out to be spectacularly bad.

While the Liberals cheered the appreciating housing market, looked the other way at large capital inflows into the lower mainland, and attempted to put hundreds of millions into programs to boost buying, the beancounters in the government were becoming increasingly pessimistic about the market, and predicted a larger and larger decline in transfer tax revenues every year even as income kept increasing.

Then the NDP were elected partially based on their promises to clamp down hard on the out of control housing market with an impressive sounding 30 point plan. Again the forecasters weren’t having any of it though, this time predicting an increase in PTT revenues for 2018/19 to a record $2.2 billion. Needless to say the market was having none of that with the actual extrapolated income for the full fiscal year missing the mark by a whopping $325 million.

Now the government’s budget forecasters are predicting a classic soft landing with PTT revenue unchanged for the next 3 years. That means they might:

- think the job is done (mission accomplished, housing is affordable now!),

- believe their own policies will be completely ineffective and won’t slow the market further,

- think foreign buyers and increased PTT rates for high end properties will fill the gap, or

- not be thinking at all.

I bet we won’t maintain current PTT revenue levels and because that income source is so large it will threaten the projected surpluses which are only a couple hundred million. They are predicting no increase in foreign buyer tax revenue (flat at $190M) so the only way that PTT can remain the same is if sales don’t decrease (they’re decreasing), new construction doesn’t decrease (currently at peak and likely to decrease), and prices don’t drop (some markets decreasing, others flat).

Does not compute.

The problem with the incomes discussion is that BC Gov pays poorly. Municipal, CRD, federal, crown corps, Universities, health authorities and larger private sector corps all pay significantly better than BC public service. ( That’s why there are so many vacancies at any one time.) So there’s your outlier.

Sales looking worse and worse as the month goes on. 4 days left which gave us 92 sales last year but we’ll see. https://househuntvictoria.ca/2019/02/25/feb-25-market-update/

So I guess that makes me in the top 50% (income male) for Victoria. :/

Making my wife in the Top 40% (income female) for Victoria.

And we have no debt. And own a home outright in GVA.

Leif,

The numbers I talk about are from personal experience and can be observed on websites and recruitment ads of various public agencies. I am talking about salaries for my interpretation of what consistutes as a professional income. I had created a sample list of those jobs in my prior post, feel free to reconcile.

If your wife is an experienced CPA who works for 70k a year then she should get a new job. A senior financial analyst for example at the CRD pays roughly 90k a year and it is a unionized position. Similar positions at VIHA, BC ferries and BC transit will start in the 80’s. Bcimc is an outlier which dependent on experience could be excess of 150k all in.

@guest_56713 Do you use statistics for your numbers or just pull them out of your general coffee talks?

For Victoria.

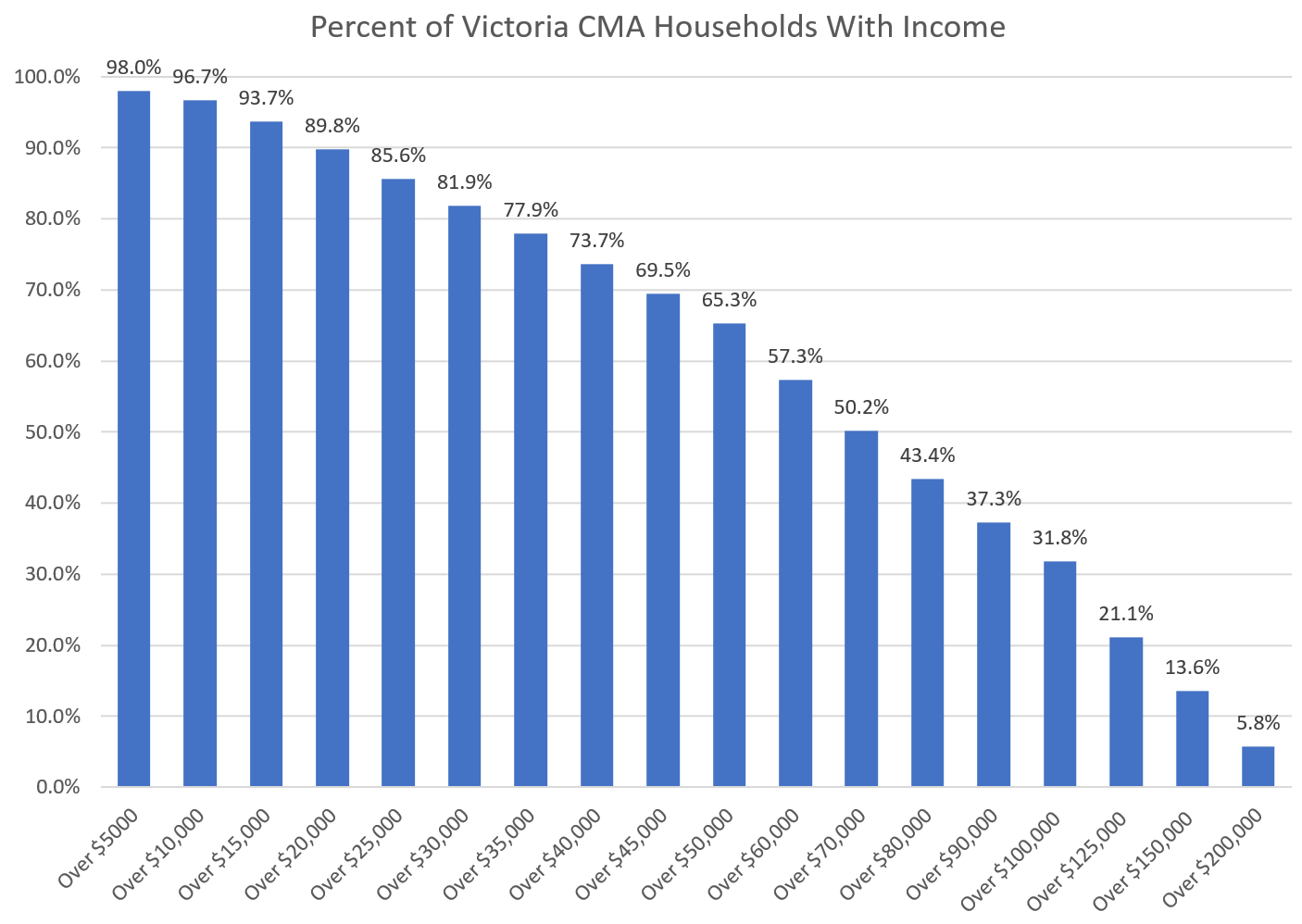

“Individual income needed to be in the top 20%: $62,940”

Top 1% in Victoria for household income is around $220k.

$160k for a household implies both workers are in the top 10% of income earners in Canada.

My wife would make over $100k easily in Toronto with her CPA without issue and in Victoria good luck. The government and union jobs here were in the 70k range with wage adjustments.

Your stats are not relative to real numbers.

I would have to agree with ks112 income ranges, based on my circle of friends and all of them are in our early to mid 30’s and also the majority of our tenants as we are in the upper end on the rental market.

One thing that blows my mind is the new cars and payments that go along with it !

BC government officially bans ‘mega mansions’ on farmland

On Saturday, the provincial government announced that new legislation restricting so-called ‘mega mansions’ on farmland is now fully in effect, with an aim to better preserve BC’s fertile soils for farming and ranching uses.

Bill 52 was introduced last November, and it restricts new homes on ALR to a total floor area of less than 5,400 sq. ft. However, special consideration for larger homes will be provided if there is direct proof a larger home would support a farming business.

“I’m very happy to see this law come into full force and effect. This new law will encourage farming and better protect farmland by banning mega-mansions, stopping the illegal dumping of waste on farmland and reinstating the one-zone system,” said BC Minister of Agriculture Lana Popham in a statement.

https://dailyhive.com/vancouver/bc-agricultural-land-reserve-mega-mansions-ban-farmland-february-2019

Current construction costs in Victoria are ranging from $200 to $300 in Victoria and for high rise residential in the $350 to $650 sq/ft range depending on the type of structure, number of units and finish. Unfortunately the high cost of land and the construction of a low rise concrete structure buildings has pushed selling prices to $1100 sq/ft. Building a raft slab in a seismic zone is not cheap and the new building code is only going to increase the cost of construction. Compound that with the labour issues moving forward and the cost of construction is only going to get exponentially worse.

In regards to the cost of family income… A nice home is in Langford is in the $720k range and a household income of around $110k would reflect a typical trades person wage and their partner in an administrative role. Since these individuals have no student debt they would be able to save up for a down payment in a reasonable period of time, however their lifestyle would have some cash flow constraints. Home ownership is feasible, but the consumption of local goods and services will be impacted by the higher cost of housing on the island.

@guest_56713

I think the down payment is a barrier for many. If a person is buying an 800k house they need to have 40k saved for the down payment alone (plus closing costs). Take into consideration that the professionals you referred to are likely quite educated, they are delayed in when they are looking to buy because they are students until the mid twenties (at least, or for many late twenties), then further delayed because the first few years in the workforce are spent paying back student loans. Doctors now regularly graduate with 300k in student debt, lawyers with 100k (based on conversations with people in those professions). So, by the time they can really start saving for the down payment they are in their 30s (mid or early – if they’re lucky). Student debt had pushed the whole deal back by 10 years (average amortization of student loan repayment). Of course if someone comes from a family with money it’s a different story.

That being said, anyone who honestly believes there will be a major reduction in prices in Victoria (>=10%) is essentially holding their breath for a communist revolution. House prices are (largely?) a reflection of a society’s values, and in this capitalist society we value individualism and – money. So yeah, the increasing divide and ever edging away of what was once taken for granted (owning a sfh in the city where one lives) is not a problem, from a capitalist perspective. That’s just my 2c.

And so, i think people need to adjust their expectations. Having lived in Asia Im quite surprised at the number of people that think they need soooo much space. So people that are holding out because they want their first house to be their forever home – maybe not the best plan. Though there are exceptions of course.

del

Jamal,

The point you brought up is valid

Wolfe this is a pointless debate, the range of 80k-100k implies an average/median of 90k.

Regardless, a dual income of $160hh income in you example will have no problem buying a home. If I remember correctly back when I made ~80k a year my take home pay was around 4200 a month after all deductions (including DB pension) and would increase by couple hundred in in Q4 once the CPP and EI max contributions are met. So at 160k a year then the take home pay would be at least $8400 a month. If one can’t afford a home in Victoria on $8400 a month then they have some bad habits to get rid of.

how many dual income professional lives in Victoria ? – a big chunk of the population is locked up in retirement – a big chunk of the residence is students – ,there are lots of health care professionals .. but if you look at VIhA public accountability page – there are roughly only 4500 names above 75 k – but that is around 20% of VIHA employees – majority of those employees are already rooted here for decades – can’t imaging a whole lot of new employees ready to buy

https://en.wikipedia.org/wiki/Island_Health

https://www.islandhealth.ca/sites/default/files/2018-10/employee-remuneration-expenses.pdf

Not every $55,000 job translates into a $90,000 job 10 years down the road. I will believe that you would have reached $90,000 had you walked the walk. Pay distribution follows a bell curve and it’s relatively easy to get a median-pay job but it’s obviously more difficult as one advances due to increased competition for fewer higher-pay jobs. Lots of people don’t advance, pursue other interests, etc.

@Ks112. Not quite. Your estimate of ‘professional income’ has widened; initially it was $90,000 which I think is on the high side but now you are saying $80,000-$100,000. I suggested that $160,000 is achievable for most dual-professional income households ($80,000 per person). The professionals who make $90,000 or $100,000 however I think are seniors with lots of experience who are on the high side of their fields and the proportion of them relative to everyone else is smaller such that the blanket statement – and I paraphrase – ‘a professional couple with two incomes earns $180,000 and should easily be able to afford a house in Victoria’ is not really reflective of what’s out there.

@ Wolfe,

So what you are saying is that the 80k-100k per year range is in the senior/executive sub-section of professionals?

I would have to disagree, I started off at a government related entity (think BCIMC, BC Ferries, ICBC, BC Transit, BC Hydro) in a Finance Capacity at the analyst level right after university close to 10 years ago. My starting salary at the time was $55k a year. After 3 years i progressed to senior analyst and my pay was close to $80k a year, had I stayed in that position with just normal annual increases within the pay band I would have reached $90k a year in 10 years and that was just at the senior analyst level and not manager. The exact same progression is available had I worked in the IT department

Again I am just referring to what I view as a Professional Income. Not the median or average income.

In today’s Globe and Mail:

Morneau faces pressure to help first-time homebuyers in March budget

https://outline.com/Dtyy4h

Agreed Wolf

@Ks112. I’d say you’re referring to the senior/executive sub-section of professionals and that would not be reflective of the median. I think a dual-professional income household can buy a house in Victoria but I don’t think they’re as well off as you think. My experience suggests that most dual-professional income households are in the sub-$160,000 range rather than near $180,000.

FWIW, I’m from a dual-professional income household and both of us are at a senior level such that we know private information on median earnings in our fields.

Wolfe, I don’t have the time to show you every salary I referenced. But any public sector agency posts folks who make more than 75k a year, those are online usually in the statement of financial information section (not to be confused with financial statement) go have a look and you will see all those jobs I referenced.

If you are a working professional (4 year degree with additional professional designations) with 10 or more years of experience in a particular field and make less than $90k a year I don’t know what to tell you. I do not characterize a unionized glorified data entry clerk as a Professional. I would saye a Professional income in the ranges of $80k-$100k a year in Victoria, Executive income would be $125k and above.

I don’t see a Victoria Detached house as unaffordable to a working Victoria couple with each earning $53k or more. ($105k combined income)

You can pass stress test, with 20% down and ….

– Buy a $600k house with $105k household income.

– Or buy a $800k house with $135k household income.

– Or buy a $1m house with $165k household income.

Deryk (forum member) has pointed out several examples of $600k homes for sale in Victoria.

Using govt of Canada calculator, with 20% down, you need $105k gross household income to qualify and purchase your $600k single family home

That’s two people with $52.5k each in income. Is that too high a hurdle for people here?

Try it… input buying a $600k house with 20% down and a $480k mortgage with $105k gross household income and here’s the result ….

“You will likely be approved for a mortgage amount of $480,000.00 since your GDS ratio (31.39 %) does not exceed 32.00 % and your TDS ratio (36.53 %) does not exceed 40.00 %.“

Mortgage payment is $2,400 per month. ($1,400 interest and $1,000 principle repayment per month in year 1. More principle repayment in higher years so that over 25 years average of your $2,400 mortgage payment is $800 interest and $1,600 principal)

https://itools-ioutils.fcac-acfc.gc.ca/MQ-HQ/MQCalc-EAPHCalc-eng.aspx

If a $600k house isn’t good enough for you, scale up those numbers and use the same calculator to qualify for a $800k house with 20% down and a $640k mortgage with $135k in family income. Or $1m house with $165k family income.

What level would that be? Most people who aren’t in a supervisory role max out at a 27, which, even with a temporary market adjustment, pays a max of 84000.

My partner is a professional and makes 80k. He just started this gov job in 2017, so eventually he will be up to 90.

The income bracket for my profession, which isn’t a profession in the traditional sense, is 70-90k.

We were very fortunate to be on the right side of the most recent run up, having bought in 2012. Even with our 2 professional incomes we’d be hard pressed to build a downpayment on our own, particularly when we had student debt.

Hansel’s story makes sense to me.

I think you’re conflating “professional” with “executive” and at any rate, there aren’t enough of those folks to support the current market valuations.

Pretty easy to see what professionals are getting paid if you look at the 2016 census, and most of ’em aren’t getting 90k. Let me know if you’d like me to give you the Statscan link.

@Ks112. Opinions based on conjecture and anecdotal evidence don’t seem to carry much weight around here. Care to provide numbers to support your claim?

https://househuntvictoria.ca/2017/10/17/stress-test/

https://househuntvictoria.ca/2017/07/27/how-you-gonna-pay-for-that/

Wolf: The problem may rest with the definition of “professional income”. There has been a growing trend to label more and more things as as profession. The fact of the matter is that simply stating that you have two professional incomes is rather meaningless in and of itself in an era where ever increasing number of jobs are being labelled as a profession.

One ends up in a meaningless debate at that point.

Basically, they are stating that their two income employment does not pay enough to buy a house in this city. Actually, their type of employment might not earn enough to not be able to buy a house in a number of cities in Canada for all we know. So I am not sure what the point is here.

haha well I don’t know what to tell you.. we’re both professionals (I’m literally in BC’s PEA union). We don’t make 180k a year household and obviously could buy a house if we did. We’ll get there eventually 🙂 Just frustrating to be on the wrong side of the recent run up. We’ll just need to keep on banking cash as hard as we can.

@ wolf,

A typical professional salary is absolutely $90k+ a year in Victoria. Pharmacist, professional engineer, manager and above in municipal government, director level and above in provincial government, manager level and above at crown corps and health authorities, manager and above in commercial banking etc… then u have the Nurses with over time, Cops and firemen etc

2050 RUSSET WAY WEST VANCOUVER V7V 3B4

2012, assessment 1.5 mill.

https://www.youtube.com/watch?v=qyC5UdekINE

Was asking $2,180,000. But we know it went for $2,025,000.

https://webcache.googleusercontent.com/search?q=cache:eidyG_yeTBcJ:https://www.jacksonyoung.ca/property-search/detail/179/R2312884/2050-russet-way-west-vancouver-bc-v7v-3b4/+&cd=12&hl=en&ct=clnk&gl=ca&client=firefox-b-d

B.C. real estate audits reveal widespread tax evasion

https://biv.com/article/2019/02/bc-real-estate-audits-reveal-widespread-tax-evasion

@Ks112. A typical professional income in Victoria is not $90,000+/year. If you looked around you’d realize you’re over by a ball-park 20%. The upper end is more difficult to find and if you do it’s even more difficult to find and secure two. Stay down to earth and realize that the vast majority (90%) out there are not pulling in more than $180,000 year.

Dropping home values in the $1-1.2 million range are evidence of this in my opinion.

That’ll be interesting when they go to file their T776. If I were the CRA analyst looking at that, that’d be a red flag indicating possible tax evasion.

If a deluge of folks in BC suddenly start filing their forms reporting $12.00 a year in rental income, that’d get even more attention.

Besides, having a home engenders real operating costs. If a tenant isn’t paying it, someone else is. What possible motive would a landlord have to have their property used/damaged, all the inconveniences associated with renting it out, and to do it for nothing. A total non-starter, IMO.

How are you not able to afford a house with two professional incomes? A professional income in Victoria is 90k+ a year, so how can u not afford a house with a hh income of 180k+ a year??

No can do.

My apology for being a bit late on the reply as I was too busy renovating the house on my spare time.

I agree that you must not turn off your brain, but you have to be smarter than the guy next to you.

I’m sorry if this doesn’t apply to you. The educated professionals in this board can easily out think and out bid the majority of the new immigrants that are slaving (at more than one jobs) away as baristas, sandwich artists, nails artists, gas jockeys, cashiers, servers, house keepers, bed makers, room boys, janitors, taxi drivers, etc…, if they stop wallowing in negativity. The only leg up the poor immigrants have over the local educated bears is their work ethic, and these immigrants are capitalizing on the fact that they are free to work as much as they want, and they are saving so much energy from the lack of bellyaching, hence they have more time to make money and buy houses.

My sincere apology to Marko Juras as I will use him as an example of an outstanding board member/Canadian citizen who came to Canada as an immigrant. Perhaps, it make sense to take a page from his play book. Marko recognized that not all education/professions lead to a lucrative career hence he went into RE after his university education.

At some point, one have to admit defeat if one unwilling/can’t compete against one peers, then it’s time to pack up one belonging and setup shop elsewhere.

You’ve got to know when to hold ’em .

Know when to fold ’em.

Know when to walk away.

And know when to run.

I was in LA this last smoky June, and my cousin told me that his employer Cisco was looking for network security admins/architects @ 40 hours regular work week with pay OT (1 senior $160K, 2 intermediate $140K positions start, with stock options of $40-60K. And $200K after 3 years at the job). The money sounds great if one don’t mind the insane commute and traffics, and the fast pace American lifestyle.

There is a possibility that the spec tax revenue will decrease over the years as this tax was designed to discourage second home ownership, foreign investments. And, many may rent out that spare home out for $1 to avoid the tax.

I’m curious as to the house size, detach or attached garage, rancher or 2-3 levels, finished or unfinished basement, how many bathrooms, and the quality of the kitchen/bathrooms finish?

I am still surprised what people will pay for new builds in Oak Bay

“I think there’s a very small chance of one decade of nominal price declines and a smaller probability of more than one decade of price stagnation in real terms.”

It seems to me this is beyond the realm of theoretical assessment since it depends on choices yet to be made by Government and by government agencies: choices that will determine the future inflation/deflation rate, currency devaluation/revaluation, budget deficits, immigration rate, etc.

If in the unlikely event we had a government committed to an Austrian school economic policy, we could see prolonged house price deflation, especially if a sound money policy were combined with reduced immigration.

However, if the Trudeau liberals were to rule for the next dozen or so years, it seems possible that we could see Victoria house prices quadruple again, as they did in the last 16 or so years.

For those concerned to optimize their investments. there must therefore be a choice between betting all on some particular vision of the future, which maximizes the potential for either loss or gain, or spreading the risk thereby reducing both up- and down-side potential.

Sorry if that sounds platitudinous.

Speculation tax is aimed at satellite families, not just empty homes, and hopefully it will have an effect.

https://www.burnabynow.com/b-c-real-estate-audits-reveal-widespread-tax-evasion-1.23643194

(accidentally posted in the old post, so reposting)

Decades of declines in real house prices are IMO not something to be feared by homeowners.

Unlikely to happen of course. But if does happen, the mortgage has still got easier to pay off each year due to inflation. And of course the house is fully paid off in 25 years.

For example, The $1m house they bought is, 25 years later, fully paid off and worth $2m. The perennial renter next door points out that with inflation the house should be $2.5m. The owner thinks to himself “I own a $2m house and have no mortgage, what does the renter have?” So, in this example, who’d you rather be? … the owner or the perennial renter?

LOL!! That explains it.

Million dollar loss in West Vancouver.

70s box, super steep driveway, backing onto the Trans Canada Highway for $2 million and change. Still makes Victoria look like a bargain.

I don’t think price makes any difference at all to the length of the correction. I certainly never saw any examples of this in other jurisdictions around the world. In a sense, it’s almost the reverse. What makes the difference is how much real support there is in the economy for a given price level and the less support there is, the faster the decline within a given period tends to be.

The 2009 downturn in Newfoundland took nearly 3 years for sellers to begin to lower their prices, and that was only by about 50 grand. Surprising? No, because the spread between buyers’ ability to pay and sellers, wasn’t that large.

Now contrast that with Vancouver west side, where in many cases formerly 2 million dollar homes shot up to 6-8 million on orgy of speculation and capital inflow that Vancouver hasn’t been seen in over one hundred years. And guess what’s happening there?

Already, and in about half the time it took for my NF example, these homes have lost millions in value. In fact, they are firmly in crash territory and going deeper into it by the month. At the moment they are down 30 to 35%, and this implosion radius is moving out from there just the same as the explosion did.

I doubt Vancouver will see a much longer period of declines than Victoria, and I can’t see a scenario where it takes 10 years – perhaps 5 as you suggested but even that would be really protracted. The difference will be in the rate and degree in which the prices drop, and that’s exactly what we’re seeing over there now. Victoria never got as extreme as Vancouver did and so while our market will likely fare better, the economic spillover from there will probably sting pretty hard anyways.

Central bank meddling could affect timing of course, but we’ll only be able to spot those effects if and when they make such a choice.

Million dollar loss in West Vancouver.

https://www.bcassessment.ca/Property/Info/QTAwMDAyOTVBQg==

I was talking about entire metro markets, not enclaves of rich people.

Yea eventually SFHs in Oak Bay will be for the 1%ers and the core SFHs will be for the 5%ers. The others will have to make due with the expanding Westshore/Sooke/Malahat & Area or condos in the core.

In the priciest markets I think there’s a very small chance of one decade of nominal price declines and a smaller probability of more than one decade of price stagnation in real terms. I don’t believe Victoria is overpriced enough for that though.

Even in Vancouver I expect price declines to stop after 5 years.

I was talking about entire metro markets, not enclaves of rich people.

More likely is the sfh home becomes out of reach for the average family and only the top incoming earners will be able to afford a sfh close to major cities.

Three new home sales in Oak Bay in the last week ranging from $1.75 to $2.1 million.

I too prescribe to the theory of more absolute top earners over the long haul, but fixed inventory.

And demand is how many people can pay (i.e. borrow) how much money.

Patroitz that’s just wishful thinking. More likely is the sfh home becomes out of reach for the average family and only the top incoming earners will be able to afford a sfh close to major cities. Remember as population grow so does the number of top earners. Available Land is not increasing it is decreasing as groups try to protect land. Housing is about demand and supply. Very simple.

Does anyone know if this legal question on the spec tax possibly applying to some house purchasers has been resolved? It was raised by a leading BC law firm in May 2018. The question is whether purchasers of homes could be liable for old unpaid, undisclosed spec tax bills on the property. The article says it’s also unresolved for the separate Vancouver vacancy tax.

https://www.thor.ca/blog/2018/05/bcs-unclear-speculation-tax-is-creating-legal-concerns-for-unintended-targets/

“BC has refused to identify whether the [spec] tax will apply personally to a seller who might have used the home in a manner that triggers the tax, or alternatively whether it will run with the property, like property tax, and possibly become a liability inherited by the buyer.”

Given that we’ve had a decades long increase in real house prices without matching increases in incomes, I wouldn’t dismiss a decades long decline in real house prices with or without immigration.

“But the discussion was getting purely into immigration as it relates to right vs left wing which usually leads to fighting rather than discussion.”

That’s true. But I thought we were being very polite! And it’s a now part of the pre-election debate, with the Liberals shooting for 350,000 immigrants a year versus the PPC demanding a reduction to 250,000. The difference of 100,000 is alone sufficient to account for approximately one quarter of new construction.

And if we were like Japan we could have free houses, which migh do something for the fertility rate:

https://www.dailymail.co.uk/news/article-6421791/Japan-GIVING-AWAY-abandoned-homes-superstitious-buyers-dont-want-unlucky-house.html

Analyzing Poloz’s Latest Rate Clues

https://www.ratespy.com/analyzing-boc-governor-polozs-latest-rate-hints-02228370

It certainly is. Immigration is the reason we are not in for a Japan style scenario of decades long real estate declines. But the discussion was getting purely into immigration as it relates to right vs left wing which usually leads to fighting rather than discussion.

“Let’s move on from the pure politics about immigration please. Offtopic.”

Well it’s your blog Leo, but immigration is surely a factor affecting both the local and national housing markets.

Province collected $180M from foreign buyers tax in 2018. So their estimate of $190M is pretty accurate given they will have a few more months of tax in the expanded regions this year.

You do have a point here. Looking at the projections:

They think $87M this year, and let’s say average property value of $1,000,000 at .5% this year so they are expecting it to apply to 17,400 properties this year.

Next year they think $185M. Hard to know what the split will be between foreign owners and Canadians but previous estimates have been mostly Canadian residents so running through some scenarios:

At 10% foreign owners: 28,461 properties paying

At 25% foreign owners: 21,142 properties

At 50% foreign owners: 14,800 properties

So if we got to the target income numbers, unless we have more than about 35% foreign ownership of vacant houses (and those owners actually pay), the numbers of vacant houses wouldn’t actually go down.

I suspect the actual income will fall far short. Perhaps $80-$100M steady state. Which is a good thing.

Let’s move on from the pure politics about immigration please. Offtopic.

I sort of miss Hawk. But we have not always been kind.

“Right wing parties and beliefs don’t become more and more popular for no reason.”

If we are to take the left to be the party of the poor and weak, and the right to be the party of the rich and strong, nationalistic opposition to mass immigration is not an issue of the right but of the left.

Specifically, mass immigration lowers wages, raises the cost of housing, and raises taxes due to increased demand for infrastructure, all consequences bad for the poor and weak, i.e., the left, and good for the rich and strong, i.e., the right.

The term right wing is attached by globalists to opponents of mass immigration to paint them as goose-stepping, Nazi, skinhead scum. But in fact, National Socialism was a mix of leftist domestic policy and genocidal imperialism. Globalism is a mix of rightist domestic policy and genocidal imperialism, the latter requiring the death of the sovereign democratic nation state and, hence, the extinction of of every nation as a racial and cultural entity. Nationalistic opposition to mass immigration is thus a policy of the left not the right.

The Trudeau government is of the globalist right, having declared the Canadian nation to be defunct:

https://vancouversun.com/news/staff-blogs/the-dangers-of-trudeaus-postnational-canada

@ local fool

It’s too bad that hawk left. Lol I managed to uncover in about a week (which Introvert agreed to) that in order to buy $550k house, he/she needed dual income, parental support for downpayment and basement tenants. If true then the alleged home has appreciated 200k-250k over that past 10 years.

Regarding the vast networth he/she constantly brags about, I had break the news that it needs to be divided by 2. And who can forget about those pretty winter in Victoria pictures that all of a sudden stopped coming in February, lol too funny!

“China, Japan, and the Koreas which together have about 1.5 billion people have next to no immigration and are heading for population declines (Japan already).”

Correct. I was referring mainly, though not explicitly to the Anglo countries you mention: Britain, the US, Canada, Australia, and NZ.

“Only Canada, the US, Australia and New Zealand have large scale immigration, i.e. anywhere near 1%.”

Between 2004 and 2017 the foreign-born population in the UK nearly doubled from 5.3 million to around 9.4 million. You may not call that large scale, but most would, especially Brits in London, Birmingham, Leicester, Luton and many other urban centers where the English have become a minority in their own home town.

That’s not true. China, Japan, and the Koreas which together have about 1.5 billion people have next to no immigration and are heading for population declines (Japan already).

Russia, the biggest country in Europe, has had a declining population for decades. Germany, the second biggest, has gained about 3 million more people since 1991. Other European countries are similar. The UK has been growing a bit faster but that’s due to EU migration from Eastern Europe.

Only Canada, the US, Australia and New Zealand have large scale immigration, i.e. anywhere near 1%.

Thanks for the info. So in years 2 and 3 the govt projects the same spec tax revenue each year ($185m), which is above what they projected ($170m) back in October. And people here defended the spec tax by pointing out the govts real motive was “changing behavior”.

My spec tax predictions are:

1. The govt will announce an extension to March 31 deadline due to low compliance.

2. that the revenues they ultimately get from the spec tax will be a small fraction of what they are predicting.

3. Increases in “genuine” year-round long term rentals from people renting out their homes year-round to avoid spec tax will be negligible. Most rentals will be useless 6 month rentals merely to avoid spec tax.

4. Much of the initially announced “revenue” will be people getting erroneously billed due to the opt-out billing, and will eventually get refunded after much confusion and media coverage.

5. The NAFTA challenges will succeed and they’ll eventually have to refund 75% of the spec tax paid by Americans, so that Americans pay what ROC pays (0.5%). They will also have to refund 100% of foreign buyer tax paid by Americans, as that too is a glaring violation of NAFTA. https://business.financialpost.com/opinion/barry-appleton-b-c-just-violated-nafta-with-its-foreign-property-tax-and-we-could-all-pay-for-it

6. Spec tax will get scrapped within 3 years. Replaced by higher general taxes for all BCers to pay.

https://househuntvictoria.ca/2019/01/03/bye-bye-investors-and-high-ratio-mortgages/#comment-54312

PS Leo or anyone who might know – where is Hawk??

1,417 audits is nothing compared to the staggering volume of flipping activity that Vancouver saw from 2015 to 2017. The tax man is just getting started and the design of this speculation tax is going to transform the invisible into completely low hanging fruit. Imagine getting a 100k surprise bill – and that excludes penalties you might have. This is where we’re going to see how “equity” isn’t going to save anyone, and indeed it never has.

This whole debacle is going to get rather ugly, but my goodness this all just needs to end for the good of everyone.

“That is presumably the intention of the present Government of Canada, or at least it is consistent with government policies that make household formation very expensive. But I doubt it is the wish of most people in what remains, at least in theory, a democratic country. Certainly it seems not to be the wish of the first nations or of the Quebecois.”

Very true but I think this is more about the world governments plans vs just Canada. It’s happening in pretty much every western nation. I’m sure to put it to a vote it would show some interesting statistics. Right wing parties and beliefs don’t become more and more popular for no reason.

@guest_56716

I hope they start to tackle this, I’m sure lots will fake the questionnaire.

Totally agree. I hope the NDP has a second term… They have made a lot of good I think from the Liberals debacles.

I hope they don’t go too far down the climate change path anc I just hope they don’t continue to raise taxes on income.

Just saw this on the Vancouver subreddit – link here – https://biv.com/article/2019/02/bc-real-estate-audits-reveal-widespread-tax-evasion?fbclid=IwAR0D4CdY-1Oxsq1iy0oeOMd33tzVrraZIYivEmjNnPp3KWsjY_4W-9_gMgU

Here are some highlights of the article:

“Complex audits are bound to follow the submission of speculation tax declaration forms, policy and tax experts suggest.

B.C. real estate audits lucrative for the taxman

In 2015 the CRA augmented its compliance program for B.C. and Ontario real estate audits. Last month the agency issued a report claiming it had collected $140.7 million from 1,417 real estate audits in B.C. alone, from April, 2018, to December, 2018. That’s $99,294 per audit, well above the three-year average of $45,182 per B.C. audit, and miles ahead of Ontario’s average of $17,241 per audit.

Tax collectors are getting more efficient, it appears, as 1,470 B.C. real estate audits from April 2015 to March 2016 generated only $18.5 million in evaded taxes.

In B.C., $173.4 million of the $310.4 million recovered in taxes – from 6,861 audits since April 2015 – is income tax related (lifestyle audits of owners of expensive homes and capital gains assessments on home sales). The other portion relates to unreported GST on sales and house flipping. Ontario’s 31,749 real estate audits since April 2015 brought in $547.4 million. Overall, the CRA also applied $70.9 million in penalties for knowingly making false statements

The government said it does expect the speculation tax auditing process to help identify overseas tax evasion and thus the ministry is expected to flag audit leads for the CRA.”

I know we had talked about this here and there over the past few months but it seems like the NDP is really gonna crack down on this. Its ironic that the liberals made tons of money allowing illegal money to run rampant through the province and now the NDP are gonna make some good coin shutting it down.

And to finish, the top comment on the subreddit – “This is so awesome, and so many people are going to get absolutely nailed. Oh, you say your property is rented on the vacancy tax declaration, but the CRA doesn’t have a rental income submission for that address for you. Care to explain? I can’t wait for all the cheaters and liars to start crying about how unfair it is that they have to pay that mean old government.”

I know a lot of NDP haters around but I really hope they see a second term.

It would likely be fine with everyone in the countries concerned if it meant that their population was falling. It would mean a surplus of housing for one thing, and thus much lower housing costs. But most of the sub-2 fertility countries have rapidly increasing populations due to mass immigration. Moreover, their fertility rates are being raised as a consequence of the higher fertility of the immigrant populations. In Britain for example, 27% of live births are to foreign-born women, a number that will likely exceed 50% within a generation.

Yes, but in the meantime, if we have a sub-2 fertility rate while sucking in 350,000 people a year from plus-2 fertility rate countries, we replace ourselves rather quickly with people from elsewhere.

That is presumably the intention of the present Government of Canada, or at least it is consistent with government policies that make household formation very expensive. But I doubt it is the wish of most people in what remains, at least in theory, a democratic country. Certainly it seems not to be the wish of the first nations or of the Quebecois.

That graph is not construction costs. It’s the “construction cost gap”, i.e. the difference between what it costs to build a house and what it sells for. The article correctly describes this, but the URL is incorrect.

My house cost close to $300/sqft to build not including land. But it’s not really the standard affair.

ooops .. srry miss read article …ignore my last comment – here is a post for marko

http://markojuras.com/2017/07/2017-update-what-does-it-cost-per-square-to-build-a-home-in-victoria-b-c/

https://globalnews.ca/news/4208533/vancouver-detached-home-building-costs/

who knew .. every day i find something new .. always thought Victoria will cost more due to isolation and lack of trades people

think that is a lot higher … back in 2011 when my parents build their place in vancouver, it was already $140/sqf ..and they are kinda in contracting business…labour and material has gone way up since then

Looks like no updates done to the property. Could the original owner of this house be selling it after 58 years? Walking past this place many times over the years, I did notice the vintage 60s Mustang kept in the garage. Could that car have been in that garage all that time?

I agree gwac, 2019 may be the year to buy. So might 2020, 2021, 2022, 2023….

Whats the $/sqft to build a house these days assuming medium/high quality furnishings? $200?

gwac: materials have also become really expensive.

Trades are only going to get more expensive, 1 in 45 kids from high school are going into the construction trades and it is increasingly difficult to recruit quality talent. Individuals with high critical thinking and problem solving skills with the potential for leadership in the trades is going to be an even bigger problem.

2019 may be the year to buy. Especially if you are handy and can put in some sweat equity. Trades are still expensive.

@ Introvert,

As discussed before I am also watching gordon head closely due to my own interests.

Right now this one of felthem is listed at $759:

https://www.realtor.ca/real-estate/20356200/3-bedroom-single-family-house-1845-feltham-rd-victoria-gordon-head

I believe this one was also listed at $759 before it was taken off, not sure if it sold:

https://www.zolo.ca/victoria-real-estate/1824-feltham-road

If these start selling below $700 then I may reevaluate my plan of waiting to upgrade before selling…..

I feel like this is germane to the conversation on population, automation, and jobs:

I like how, perhaps, “Keynes made the mistake of thinking that human wants are finite.”

https://thepolymathproject.com/keynes-workweek/

It is interesting to observe two contradictory narratives in the media on this topic.

On the one hand:

“Robots are stealing all our jobs. There will be no work for us in the future. Economy will crater.”

On the other hand:

“Not enough babies! The economy will crater. Who is going to fill all the jobs?”

Only three OECD countries have >2 fertility rates. Israel, Turkey and Mexico. No country in Europe has >2 fertility rate. France comes the closest at a hair below 2.

I don’t see slightly below replacement fertility rates as alarming. Most of the world is overpopulated and a gradual decline in population is fine by me. 9 Billion won’t make the world a better place than 2 billion.

That said I think really low fertility rates can be a problem as they will produce a pace of change that will cause social dislocation.

Most of the western world is already there. Japan is far far past that. China being the biggest country and having a 1.62 is a huge part of it.

https://data.worldbank.org/indicator/SP.DYN.TFRT.IN

Just checked, world fertility rate is only half a point over replacement level at this point.

One of the lowest sale prices in Gordon Head that I’ve seen in a while:

2308 Hazelton Pl

MLS#: 405042

Asking: $799,000

Sold: $755,000 ($48K below assessment)

DOM: 27

Mind you, this property needs a ton of updates, so not sure how great a deal the buyer got, but still.

Excellent news on the bike lanes..

https://www.timescolonist.com/news/local/victoria-gives-green-light-to-fast-track-bike-network-1.23642139

The knuckle-draggers aren’t going to like it, but this is a smart move on the part of Victoria council: complete the entire bike network before the next municipal election, so that it can’t be stopped halfway through by a different mayor and council.

Dragging Victoria—kicking and screaming, usually—into the twenty-first century is what this elected group is all about. Kudos, I say.

The latest revelations in the legislature scandal. It’s starting to read like a Seinfeld script:

In his latest report, Plecas alleges that James organized an earthquake preparedness conference in Washington state in August 2017 which amounted to no more than a $1,024 whale-watching trip for eight people and $1,073 worth of tickets to a Seattle Mariners baseball game.

The official-sounding agenda for the Washington trip was misleading, Plecas alleges. He says a whale-watching trip was listed as “Tsunami Watch: Guided tours of Haro Strait and Juan de Fuca Strait with explanations of aquatic life and seismic activity”, and a baseball game at Safeco Field was described as “Safe passages: Large-Scale Evacuations.” Lenz and James’s spouses were also on the trip.

https://www.timescolonist.com/news/local/legislature-officers-work-trips-served-as-holidays-speaker-says-committee-oks-probe-1.23642098

Yes but two of those listings were for the same property. One was a boat and the third was a money pit or development property.

We need sub-2 fertility rates in every country, tbh. Too many people on earth.

It’s interesting that Russia, with a fertility rate of 1,75 (versus a replacement rate of 2.1), has opted to provide families with real estate tax breaks, mortgage subsidies, cash grants to pay down mortgages, and free land, whereas in Canada, where the fertility rate is even further below the replacement rate than in Russia, the Province focuses on taxing home ownership, while the BoC frets over its inability to raise interest rates for fear of bursting the property bubble that its own negative real-interest-rate policies created.

Good point.

Maybe not, Leo.

According to this article, “government has socked away a $500-million forecast allowance, a $750-million contingency fund and $375 million in supplementary estimates to help cover future expenses.”

https://vancouversun.com/news/local-news/live-b-c-budget-2019-government-offers-only-modest-new-spending

House $500K max. Wow! Never got any results last year.

😛

https://www.realtor.ca/map#ZoomLevel=12&LatitudeMax=48.5096909&LongitudeMax=-123.2041110&LatitudeMin=48.3470320&LongitudeMin=-123.5271778&CurrentPage=1&PropertyTypeGroupID=1&PropertySearchTypeId=1&TransactionTypeId=2&PriceMin=0&PriceMax=500000&BedRange=0-0&BathRange=0-0&BuildingTypeId=1&Center=48.42842650139837%2C-123.36564440000001

In Greater Vancouver scores of 1 and 2 bedroom condo are under this price.

In Greater Victoria 1, 2 and 3 bedroom condos and a handful of SFH

Most other communities in the province – a decent SFH

The NDP was too greedy in not increasing the PTT exemption for first time buyers. 500k? What could you possibly buy in this province for 500k.

This is the only meaningful mechanism the province has to assist FTB without inccuring record debt levels.

By the way u can see budget stuff here. https://www.bcbudget.gov.bc.ca/2019/pdf/2019_budget_and_fiscal_plan.pdf

It’s sort of ironic they are expecting the same inflows over the next three years. One would think if the spec tax reached it’s intended consequence (putting homes back on the market) then it should be shrinking each year….

Patrick according to the budget last year they were expecting 87m for spec tax (which is due this July) and for this year’s budget and the next two years they are expecting 185m. I should specify that this is for the spec and vacancy tax combined. Cheers.

LeoS” 5) knowing that what they are saying is both impossible and untrue but lying in order to tell everyone what they want to hear.

LeoS,

Great post. Did the govt project spec tax revenues?

@ Barrister

Marry rich is a way to go, but what’s the point of being rich if you can’t do whatever you want. I suppose you can marry rich with the goal of divorcing for her but that’s a low life move.

But I would definitely want to marry someone that makes atleast 75% what I make just so if it does end up in divorce I don’t completely get screwed. But that in itself is hard in this town….

This article is…what I “meant” to say in my rant. Tsk tsk. Do you believe me? 😛

Ya, I find their forecasts strain credibility and the more this correction unfolds, the more you’ll look back at what they’ve been saying all this time and think…what on earth were they thinking? I’m guessing a combination of scenario 3 and 4, but who knows.

All they know is they have a very angry and concerned public regarding housing, but paradoxically that same public (or more precisely about 70% of them) will be even more angry when the reality of the medicine required to “fix it” starts to effect them personally. Whatever government is in power during a major housing bust is screwed, IMO.