Disclosure Disclosure Disclosure

If you’re not in the real estate industry, you may have missed what’s been happening in response to some substantial rule changes that will be taking effect this Friday.

What’s happening? In short, the Real Estate Council (formerly an industry group, now run by the province to govern the real estate industry) is changing how you can work with a REALTOR® and increasing transparency on commissions. These changes were announced last fall and after some delays will take effect this Friday, June 15th.

Why might you care about this? Many of the changes are procedural changes on the agent side and you can safely let the industry wail and gnash their teeth about it. However there are a few that will be visible to you if you’re buying or selling and could drive some small change in how properties are bought and sold. Here are the major changes:

1. No more dual agency

As of Friday there will effectively be no way for a realtor to represent both the buyer and the seller in the same transaction. The key word there is represent, since there will still be cases where only one realtor is involved and either the buyer or seller remains unrepresented (more on this later). There is a tiny loophole for completely remote communities that may not have enough realtors, but in Victoria you will not see any more dual agency deals. This means that if you are working with a realtor and want to buy one of their listings, you will likely be punted off to one of their colleagues who will write up an offer and represent you in the purchase.

This change has huge implications for how realtors do business and may very well mean the end of large real estate teams who will find it increasingly difficult to connect their buyers and sellers together. This is why there has been intense opposition from the industry to this change at every level but from a consumer’s standpoint you likely won’t be impacted.

2. Changes to disclosure of your relationship with a realtor

Now that there is no more dual agency, there are only two ways you can work with a realtor:

- As a client, where the realtor owes you a fiduciary duty and must act in your best interests, protect your confidentiality, and disclose all relevant information.

- As an unrepresented party, where the realtor can help you with a transaction and provide factual information about the property but cannot give you advice on price or strategy, or protect any confidential information you tell them.

If you have dealt with a realtor in the past 25 years, you’ve likely seen the Working with a Realtor form that explained these different relationships (unrepresented party used to be called a customer relationship). Well throw those away because now there’s a new form with the super friendly name: Disclosure of Representation in Trading Services. Anytime you start working with a realtor you will be asked to review and acknowledge one of those as soon as possible.

In practical terms, if you are working with a realtor to buy or sell a property, you will almost always have a client relationship with them. If you want to make an offer on a property directly to the seller’s realtor, they may help you draw up an offer as an unrepresented party. Note that in this case the seller’s realtor only represents the seller and you will also have to sign the Disclosure of Risks to Unrepresented Parties form.

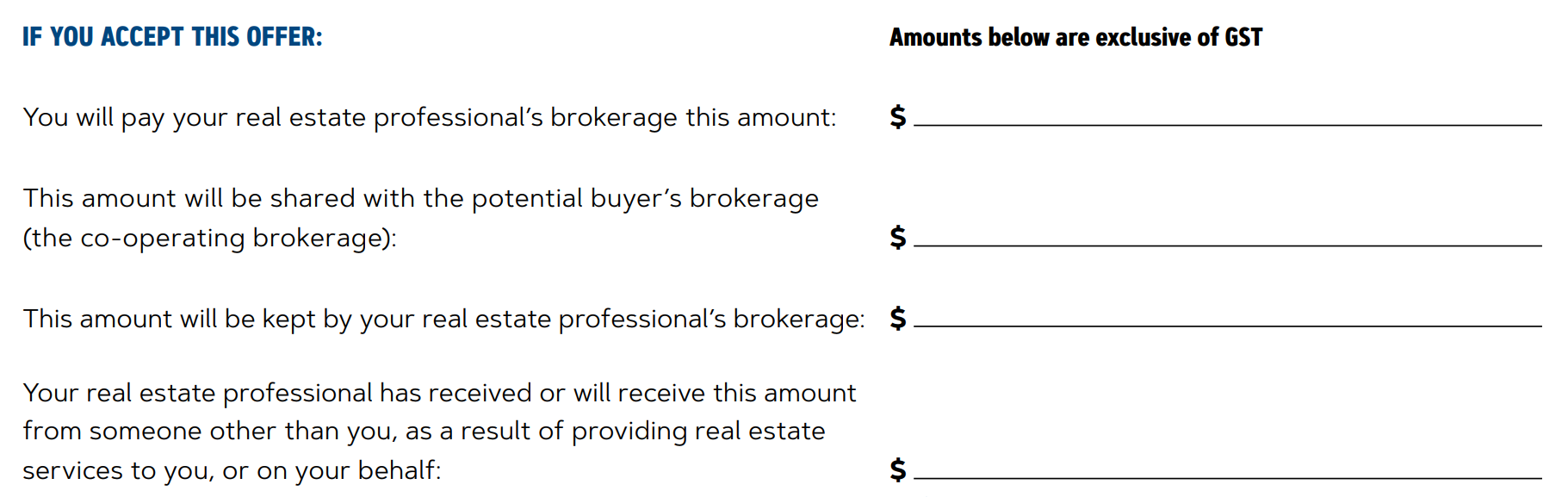

3. Changes to disclosure of compensation

If you sell your house with a realtor you agree to the commission as part of the listing contract. There you would see a field with the commission due on sale, such as the very common “6% on first $100k, 3% on remainder”. Then the topic of commissions wouldn’t really come up until you complete the sale and have to pay the commission to your realtor’s brokerage.

Now this is changing, and as a seller the commission you will be paying will be front and center every single time you receive an offer. Your realtor is now required to fill out the new form: Disclosure to Sellers of Expected Renumeration before presenting the offer itself. The key part there is that your realtor needs to spell out, in dollar amounts, exactly how much commission you will be paying if you accept this offer, as well as how much goes to the buyer realtor’s brokerage (if any) and any other compensation they expect to receive.

In addition, in the listing contract the realtor will have to specify how much commission their brokerage expects on sale, as well as how much would be given to the buyer’s brokerage, and if there is none (buyer unrepresented) how much commission is expected.

My Take

The killing of limited dual agency is a no brainer in my view. The idea that one agent can effectively and simultaneously act both in the best interest of the buyer and the seller when those interests are diametrically opposed was never defensible. I also think that the distinction between a client and an unrepresented party is much clearer than before. Yes this change will cause problems for many agents (especially the busier ones) and will make some deals awkward, but it will improve the integrity and honesty of the industry.

I’m somewhat conflicted about the new flurry of forms. On the one hand it’s great that the Real Estate Council is now on the side of the consumer rather than the industry and I’m glad they are looking into how to strengthen consumer protections in real estate transactions. On the other hand, I feel that some of these forms are still longer and more complicated than they need to be, especially for those looking to make offers as unrepresented parties. Yes there are real risks and you should definitely consult a lawyer if you are entering any contracts, but the multiple required forms seem a little over the top and may be used to pressure unrepresented buyers into working with a realtor instead.

That said, the new disclosure forms concerning compensation may give unrepresented buyers an edge. When the seller’s realtor has to fill out $0 as the amount going to the buyer’s brokerage, and the entire commission going to them, it may cause some sellers to think twice or negotiate a reduced commission with their realtor to make a deal happen.

Overall I’m fairly impressed with the council’s communication around the changes. It seems they are putting a lot more effort in describing the process in plain language that both consumers and licensees can fairly easily understand. If you are interested, they have good overview videos about the changes to realtor relationships and remuneration disclosure on the new council Knowlege Base site.

What are your thoughts? Do you think these changes will improve anything in the industry or is it just paper shuffling?

-Who looks at open houses on Fathers day, etc., (a) people looking to buy a house

(b) funny old retired folks who otherwise spend all week working in the garden, wandering the beaches minus the weekend mob and who take gentle walks through the LG’s gardens. (c) noisy neighbors.

Hubby and I were chuckling at all the open houses yesterday we went by. Who would want to go look at houses on 1) Father’s Day 2) Car-free YYJ (was awesome FYI) and 3) a beautiful, sunny day.

Gwac, you seem really bent out of shape lately. No joke. If you feel that bears are wasting their lives, then shouldn’t you be glad you aren’t one? If you love the sunshine, I’d just go enjoy it. 🙂

20 minute bike ride

a beautiful sunny day

Hold on why be happy in paradise. House prices are crashing somewhere in the world so Victoria is next. Day 140365 is my guess for the crash. Plus 10 to 15%.

True story when I moved here I wanted to move to bear mountain. Houses reminded me of home. About to put an offer in. I really did 0 investigation. I was at Oak Bay arena. Started chatting to a stranger told me to stay on this side of the highway, Gave me a list of reasons including traffic. That stranger has saved me a ton of time in traffic. Still love Bear Mountain though.

Another beautiful day out there and here we are all waiting for the Monday numbers.

Underachiever,

I was wondering if I was the only one lame enough to pick that up. It’s actually been roughly 12,000 days since prices fell 30%+, give or take a bit. 😛

I didn’t know real estate data went back to 719 BCE.

Same with bashing the place you live.

Went to three open houses today and we were the only people there for all three. I guess the nice weather has moved people down to the beach.

Happy Father’s Day to all you dads !

Kissing the ground because of no crash yet is pretty scary stuff. Should be the last thing on your mind on such a beautiful day out.

Hope the Toronto guy isn’t stuck in the Malahat /TCH gridlock due to another daily nasty accident that’s shutdown the northbound all day. It’s only going to get worse. If I was thinking of moving here, I’d do some serious homework.

Then again gwac probably wrote that letter. 😉

I was wondering who the little weirdo was who was tailgating me. 😉

And he needs to have TWO in the garage to ensure that at least one will start and the day’s posing will not be impeded by riding on top of a flatbed.

Ask me how I know.

On the way home from Beacon Hill Park this morning, I encountered a Ferrari 599 GTO/GTB driving in front of me on Henderson Road.

Just looked up the MSRP on that machine: $320,000 USD ($410,000 CAD). Damn.

Day One Million of no price crash in Victoria. Enjoy this sunny summer Sunday, everyone!

I don’t have a dog in this fight, but doesn’t your chart actually match their claim? The drop in CAD/CNY from 2014 to 2016 looks a lot like it matches the insane rise of Vancouver house prices.

5+ years ago TD came out with their collateral charge mortgages that make it difficult to switch lenders on renewal. I imagine they found that to be quite profitable. Now stress test doubles down on that for some of the most stretched borrowers. A way for the banks to increase their profits in times of low rates

Thing is, the stress test gives the bank huge leverage in this situation on renewal. Lots of people that are highly leveraged are going to have no choice but to pay whatever uncompetitive rates the bank offers.

A good letter. What a beautiful day yesterday and start to a long stretch of great weather. Happy Father’s Day.

“You can access up to 65% of your home’s value on a HELOC. Most people who bought in recently with 20% down or less likely don’t qualify for a HELOC in the first place. Prices would have to fall a lot before those with more than 35% equity would be impacted. ”

While its true you can only access 65% as a LOC if you combine it with a mortgage you can still go up to 80% provided the LOC doesn’t exceed the 65% (at least thats how it was a couple years back). When I worked at Scotiabank we would set up the charge on the home so once the client was below 80% in mortgage value they could set up other secured debt such as a LOC or a credit card secured against their home. Unfortunately a lot of people get caught up in debt and we would seeing them using their mortgage payments as access to more debt. Every time a mortgage payment was made it would reduce the principal and open up room under the “STEP” (Scotia Total Equity Plan) and they would come and increase their LOC right away and use their available equity like a credit card they just made a payment on. It was extremely common to see someone with 50% mtg value and 30% LOC.

My thoughts are that if prices came down 10% even, the banks would start looking at borrowers more closely – particularly ones who had purchased or refinanced during the peak. They can’t have you borrowing more than combined 80% so if your house goes from 1million to 900K then your combined “flexible” borrowing secured to your house goes from 800K to 720K. My assumption is they would look to see when the valuation was done and if it was during a peak year they may reduce the access to borrowing until you have an appraisal done. That is just a guess though – the banks definitely wouldn’t be wanting to take on additional risk especially in a rising interest rate environment.

A letter from this morning’s Times Colonist:

You can access up to 65% of your home’s value on a HELOC. Most people who bought in recently with 20% down or less likely don’t qualify for a HELOC in the first place. Prices would have to fall a lot before those with more than 35% equity would be impacted. A rise in interest rates will likely have a greater impact on those with larger HELOCs than a decline.

You’re welcome Victoria Born. It’s pretty obvious the pumpers are having a hard time accepting that the game is over and nowhere for this market to go but down.

Business cycle is over extended as NAFTA/ Trump will just push it over the cliff heading into fall.

Bubbles always pop but this one took longer than expected due to BC liberal government incompetence. Thankfully the NDP got in the nick of time. Don’t see Krog’s seat going liberal. Look at the mess they left us.

Unfortunately, the national data on housing is looking worse and worse almost by the day now. If that “market bashing” causes only a single person to at least stop and think before making a foolish financial decision, then it’s worth it.

If someone’s sole buying criteria is, “I won’t buy until they’re XX% off”, that’s not being a bear, that’s being a fool.

That’s not how the affordability cycle in Victoria, or anywhere else I’m aware of, works.

Never mind all that though. Gorgeous day today, had a great picnic near Centennial Park in Central Saanich. So many bouncy castles there today…why can’t we be kids again. 🙂

“Not one person saw Harper secretly bailing out the banks with $113 Billion of taxpayers money on crap mortgages that should have been called in and keeping it secret til 2013. Manipulated markets always crash the worst the next time around.”

If you’re such an astute investor, perhaps you should have known that QE & stimulus would have resulted in higher asset prices. Stop using excuses to justify your failed bearish stance. Just accept that no one, including you, can predict RE or stock markets with a high degree of accuracy.

Can someone enlighten me as to what it would mean if we had a downturn with HELOC debt sky high? If banks stop believing the asset you’re borrowing against is worth what you say it is, how does that play out? When and how do they re-evaluate those loans? It seems like it could be a snag in the sweater that unravels the whole thing, but I don’t think people are borrowing so hard that they would be bankrupt with a 15% correction. They would have to have bought in the last few years, borrowing their maximum to be at risk, right?

Seriously bashing the market daily, does it not get tiring and pointless. Even if this Market goes down it will be maybe 10 or 15%. Back to 2016. Guess what all you bears will do sfa waiting for the 50%. Never ending cycle. Enjoy. Also enjoy the higher rates that negate any fall. Just pointless.

Thanks for the posts, Hawk. I am in agreement with your assessment and had come to the same conclusion independently. The data supports the conclusion and I am seeing little to nothing to suggest otherwise. The peak was mid-2016 and Leo S’s graph in the last installment or two shows that nicely. The risks [higher mortgage interest rates, stress tests, speculation tax, foreign buys tax, Trump’s populist tariffs, NAFTA on life-support, a tax-hungry federal government, etc.] clearly are overcoming RE sentiment – a house of cards is tumbling.

On a separate note: visit http://www.roadbc.ca and consider signing the petition to stop the NDP from taking away your legal rights. It is a slippery slope – you only get one chance at saving the system.

Leonard Krog in Nanaimo will run for Mayor and will win – he will give up his MLA seat resulting in a by-election. If the Liberals win the seat – we are staring at an election.

Not one person saw Harper secretly bailing out the banks with $113 Billion of taxpayers money on crap mortgages that should have been called in and keeping it secret til 2013. Manipulated markets always crash the worst the next time around.

Uh oh. Icebergs ahead.

The foundation of Canada’s financial system has a few cracks

Kevin Carmichael: We might not see the next crisis coming — the odds are high that someone is asleep at the switch simply because we have so many switches

“Household debt still is so high that we’d be in trouble if something bad happened, such as a global trade war that crippled demand and sunk commodity prices. And real estate prices in some places are still so extreme that we could be the cause of our own downturn; house-poor consumers could stop shopping, or a sharp drop in home values might leave households with debts that exceed the value of their assets.”

http://business.financialpost.com/news/economy/the-foundation-of-canadas-financial-system-has-a-few-cracks

Most bears didn’t buy in 2009 either. The majority thought more declines were coming. Once it started going back up a prominent view was that it was a dead cat bounce

Leo is right about ones own emotions. Real life example: Christine Hughes, AGF Canadian Bal fund manager. Her fund lost virtually nothing in 08, but by the end of 2010 was one of the worst performing mutual funds over a 5 year period(she never bought back into the market, thinking things were going to get worse even when stocks were historically cheap). If a professional money manager has a hard time doing it….

Also picking the bottom of any market is like catching a falling knife, you’ll get cut.

No not proven, because that is the buying behaviour of the general population, not the RE bear who is waiting for a dip to buy. The general population believes that the higher prices are, the better it is to buy.

Millennial here, was still in Uni in 2008 so I was definitely not paying attention to what happens to the investing climate during a recession (or dip if you prefer). I’m wondering how accurate this statement is? Anyone care to share their experience? Are there specific area’s of investment where banks are more likely to look favourably on applicants with liquidity during down times?

Living in the land of make believe must be nice.

https://www.xe.com/currencycharts/?from=CAD&to=CNY&view=5Y

The Big Short Canadian Style.

Canada Has a Subprime Problem

https://betterdwelling.com/canada-has-a-subprime-real-estate-problem-you-just-dont-know-it/

Agreed oops. Most have no idea how bad the bankers turn into Scrooge McEvil in a real bear market. This generation hasnt seen one yet. 2008 was a blip. Your equity doesn’t get you an investment property with nothing down Cash is king in a bear market.

The other thing that most people underestimate is their own emotions. 2009 was a great time to buy both houses and stocks. But it sure didn’t feel like it. Felt like the world was going to end.

It’s very easy to talk about how you are going to buy the dips. Much harder to go through with it. Proven by how few people actually buy at the bottom.

Sounds like a good idea to me. Home owners grant is dumb. PST is a cancer that needs to be eliminated or consolidated into the HST but voters killed that very sensible idea with their shortsightedness.

Very very limited research on this. I will publish a literature review of sorts on this topic at some point.

@ Barrister

“I get the impression that the flood of Vancouver money has been converted to a steady stream of money; greatly reduced but still coming.”

Strong price appreciation up Island suggests that there’s a stream, if not a flood, of money out of Victoria, too.

Forgot to mention in the article that when a seller lists a property, the listing contract must now specifically mention how much commission will be paid if a buyer is unrepresented. This makes it more likely that a seller will insist on a lower commission if there is no representation on the buyer side and makes it less likely for a realtor double ending a deal to collect double the commission.

Not outside the realm of possibilities. If the trade war escalates CAD will likely be depressed relative to USD. And 15% I would guess perhaps slightly above my best guess but not by a lot.

You’re likely double my age, but I bet we have a similar net worth. Who’s the dummy?

As much as I think Hawk is rude, he might be right.

Check out 4016 Gordon Head Road and 4105 Cortez Pl…listings under $800k? Not even sure that is to encourage bidding wars…

As a very liquid American I’m crossing my fingers that the USD soon buys 1.5 CAD and that Victoria real estate corrects 15%+.

Pipe dream?

I’m not sure who would ever argue that originations drop to zero. In the deadest of dead markets, there’s still activity unless you’re a realtor in Pripyat.

So your comparison is on the extreme end (going to zero) but also not really apples to apples. I wasn’t speaking nationally. My criteria is “falling off a cliff” (say 30% or more within 18 months) and in a more local fashion. I don’t think the market nationally will implode. I do think that certain regions may be facing that elevated risk, though.

Say the market here goes south more strongly than anyone expects. If that happens, folks are going to have a much harder time getting mortgages – the old adage “to borrow money you first have to prove you don’t need the money” will more strongly assert itself. Buying a second property in that environment using funds borrowed from the bank because you believe it’s going to pay off…well, your lender has to be of a similar mindset or you’re walking out empty handed.

The US experience suggests otherwise. Mortgage origination fell during the financial crisis but it did not go to zero. In fact it fell roughly by half.

So in the thick of the financial crisis people were still getting mortgages. For new purchases the banks will still loan if there is a crisis but surely more conservatively. Strong credits will get loans and be able to buy at low prices. Weak credits won’t. The rich get richer.

Caveat

The task force was looking at ways to find $. Two big items. Kill the grant and have a vat instead of pst. Vat would be on more things and raise more $. Nothing about using grant to lower pst. This is the NDP.

It doesn’t much difference what I say to myself, but the reality is that retort reflects a lack of understanding on how house prices are actually established. Part of that thinking is, “I’m going to buy in when others are fearful, therefore I am the smart money, I’ll make a bundle etc”.

The problem is, is unless you’re using your own capital, it doesn’t work. By in large, house prices are not set by how much a buyer is willing to pay, as much as they are a reflection of how much lenders are willing to lend. You’re not going to get a loan on a devalued, and devaluing asset, using a devalued and devaluing, collateral. This isn’t abstract theory on my part; this is inherent to what happens every single time in the pullback phase of the cycle in any western RE market anywhere.

Eliminating the homeowners grant and using the proceeds to reduce the PST would make so much sense. Therefore it is not going to happen.

Taxing incomes and then rebating it to pay property taxes is just stupid. Other than wasting money the main thing it accomplishes is letting local governments tax more as they know that the provincial government is splitting the bill.

A 30% drop in total sales dollars translates to a pretty hefty drop in provincial revenues.

On a positive note, the house at 2820 Somass sold for 1.8 million, at asking, which is still a very good price for that property. I get the impression that the flood of Vancouver money has been converted to a steady stream of money; greatly reduced but still coming.

Last time Canadian dollar dropped, prices in Vancouver went up as all the international buyers from China got more buying power.

This Cliff I have heard about for 10 years where exactly is it located. Seems to be hiding or a figment of someone imagination. These people probable believe the earth is flat and that’s where this elusive cliff is.

Introvert: You just keep telling yourself that.

Local Fool is right, unless you actually have the money in the bank, Introvert. Helocs will become persona non grata where real estate is concerned … if values are crashing/correcting.

You would be shocked at the change in the banks attitude regarding mortgage lending when property values are dropping hard. Something about shrinking collateral. lol.

You also have to keep in mind that helocs are shrinking with the value of homes in a correcting environment. A lot of those highly leveraged heloc accounts will be discovering that this year.

Everytime the NDP gets a “recommendation” gwac thinks it’s fact. Chill out there gwac and don’t get another hemorrhoid. The bike lanes need you. 😉

“James was not available for comment Thursday, but her ministry issued a background statement saying the return of the HST is not under consideration and neither is changing homeowner grants, the discount on property taxes for those who live in their home.”

The rules change for realtors might entice a few real estate lawyers to get their realtor licence so they can collect their 50% buyer’s commission to stop the seller’s realtor from double ending the commission.

Looks are deceiving. The thrill is gone.

Mortgage rules starting to hurt housing affordability: BC Real Estate Associaton

“It may not seem like it in Metro Vancouver, but the housing market across British Columbia is cooling down considerably, according to the latest numbers from the B.C. Real Estate Association.

Unit sales in May were down 38 per cent compared to the same month a year ago; the average price of $739,783 was down 1.7 per cent, and sales dollar volume fell 30 per cent.”

https://globalnews.ca/news/4276211/mortgage-rules-hurt-housing-affordability-bc-real-estate-associaton/

I never called it a dump, just boring as hell except for the waterfront places. Narcissists are always right tho. 😉

The young and dumb show their true colors. SMH You’ll be lucky to get a free pen.

Just out

NDP task force recommending elimination of the homeowners grant and a new VAT to eliminate the pst. The no fun taxing NDP are looking for more revenue. Good times in BC. Although the report does mention the difficulty of doing this.

You just keep telling yourself that.

If the market goes off a cliff, you’re not going to walk into a bank and get a mortgage to buy investment properties.

First off, you’re always wrong.

But if they do, I can tell you that I won’t sell. I’m not that dumb. In fact, I’m more likely to double-down and buy an investment property in Gordon Head, depending on how much, if any, is remaining on my mortgage.

It’s not like, after a crash, Gordon Head will lose all the intrinsic features that have made it desirable up to now.

I’m glad you think GH is a “top hood.” Depending on your mood or argumentative goal, you sometimes say it’s a dump.

Not good sign when the agents are saying things are heading down.

CREA cuts home sales forecast after May sales hit seven-year low

Realtors now see 11% drop this year

“This year’s new stress-test became even more restrictive in May, since the interest rate used to qualify mortgage applications rose early in the month,” said Gregory Klump, CREA’s chief economist, in a statement Friday. “Movements in the stress test interest rate are beyond the control of policy makers. Further increases in the rate could weigh on home sales activity at a time when Canadian economic growth is facing headwinds from U.S. trade policy frictions.”

http://business.financialpost.com/real-estate/crea-cuts-home-sales-forecast-may-sales-down-16-2-compared-with-year-ago

The claim is made by some that a good realtor can get you more money selling than a sale by owner and that this extra money more than pays for commission.

Personally I tend to agree with Marko and think this is unlikely.

However I am curious. Has any attempt been made to test this? In principle one could look at agent sales vs private sales and look at different ratios – sale price to listing price, sale price to assessed value etc. and see if there was a difference.

Somehow one would have to remove the private sales that are not arm’s length transactions.

Good plan Barrister. Wouldn’t want to be Intorotroll. What’s his life going to be like as prices start to cascade over the cliff? It will be very sad event to watch, but then again he won’t be here anymore so we can check the crime pages for any ominous signs.

More Golden Head slashes today. Buyers strike by the looks of it when one of the top hoods has the most slashes the past month or two.

NAFTA blowing up will have some serious ramifications for Canadian small businesses the core of the job increases the past many years.

‘Shaken to their cores’: Small firms in Canada pivot away from U.S. amid imploding NAFTA talks, tariffs

Small companies are rethinking their heavy dependence on the U.S. as trade disruptions escalate

http://business.financialpost.com/news/economy/shaken-to-their-cores-small-firms-in-canada-pivot-away-from-us-amid-imploding-nafta-talks-tariffs

All my secret predictions that I never tell anyone have also been uncannily accurate.

Any prediction I have put on the record – not so much.

@guest_44948 See even that is a bit misleading. Agents representing the seller continue to be free to collect both ends of the commission, as long as the buyer they are working with is not represented and they appropriately disclose this to the buyer and the commission structure to seller.

This is called “double ending” and will continue to happen.

You stated that “his predictions over the last few years have been accurate to an uncanny degree.”

Well, we’ll never be able to verify that, will we?

Also, do you make a point of tracking his longitudinal predictive accuracy, or do you just go by feel?

Introvert:

Actually it is next to nothing to take at my word since I am not actually repeating what his thoughts are on the matter. That the Canadian dollar has dropped against the US dollar is a matter of record and not opinion. That Canadians purchasing power has been reduced by this fact is most arguable true.

Hawk has a very defective crystal ball but perhaps some of his points might (and I mean might) have some merit.

Obviously, since we are considering selling the house soon, it is not in my self interest to see the market decline right now. But a very gradual decline in prices would not actually shock me at the moment.

The CREA [which routinely touts the RE market] has changed its tune and projects an 11% drop in sales in 2018. This is prompted by the dismal May sales. National average home price fell 6.4%. But if you exclude Vancouver and Toronto, the drop is only 2% – so, the price drops in Vancouver and Toronto are have a disproportionate impact on the national average [translation: priced there are dropping faster than the national average]. They say the “Spring” home buying season was a dud – we all know that from looking at the “immune” Victoria market. Perhaps Hawk’s fork found its mark. CREA places emphasis on falling BC and Ontario sales. RE markets don’t crash on a dime – they slow, then drop and then the drop accelerates. Just as one can’t reverse course of a steam-ship on a dime – it slows, turns slowly, get’s gets direction and then starts and accelerates. The coffee is in front of you, you have to decide when to wake up and smell it. Here is what is reported about CREA’s analysis:

OTTAWA — The Canadian Real Estate Association is lowering its national home sales forecast for this year due to weaker sales in B.C. and Ontario.

The industry association which represents about 100,000 real estate agents across Canada said Friday it now expects home sales this year to fall 11 per cent compared with a year ago to 459,900 units this year. The prediction compared with a forecast for a 7.1 per cent decline the association released in March.

“The decrease almost entirely reflects weaker sales in B.C. and Ontario amid heightened housing market uncertainty, provincial policy measures, high home prices, ongoing supply shortages and this year’s new mortgage stress test,” the association said in a statement.

The updated forecast came as CREA reported actual home sales in May hit a seven-year low as they fell 16.2 per cent compared with a year ago.

The national average price for homes sold in May was just over $496,000, down 6.4 per cent from a year ago. Excluding the Greater Toronto and Greater Vancouver areas, the average price was just over $391,100, down two per cent.

This drop in sales activity capped off a lacklustre spring homebuying season, as March, April and May are typically the most active months in any given year. National home sales activity in March and April were down 22.7 per cent and 13.9 per cent, respectively, according to CREA numbers.

Combined sales for the three-month period fell to a nine-year low, CREA said Friday.

Factors weighing on home sales include new government measures introduced in British Columbia and Ontario, such as a foreign buyers tax, as well as interest rate hikes by the Bank of Canada.

That’s what the agent/seller is betting on… Cash back on closing is a pretty common way to sell expensive things. Used to be a huge way to sell mortgages before the regulators cracked down.

Can still get them though: https://www.ratehub.ca/cash-back-mortgages

Does this really influence a buyer’s decision?

Because this way you get $10,000 cash that you didn’t have before and it makes you feel rich so that you can go and buy a jetski to go with the house.

Patriotz is correct in that this also means the market value of the house is Price – $10,000 and this must be disclosed to the lender.

Well, that is quite a lot to take at your word.

We can also reverse it. Many people seemed to believe a doubling over five years was simply unthinkable and today think a 40% drop over the next five is a natural progression (regression).

Three years of daily incorrectly predicting a price crash mean that we ought to continue.

It sounds like it may complicate the situation where an agent has a buyer and the agent wants to show one of his own listings.

I probably should stop talking to my friend who is the chief economist with one of the big banks. Worst thing about him is that his predictions over the last few years have been accurate to an uncanny degree. He has a nasty way of pointing out the obvious that we all prefer to ignore. On a minor point, the fact that the Canadian dollar has lost a quarter of its value over the last few years means that Canadians simply have less purchasing power when it comes to imported goods. if the average working Canadian feels poorer it is because he is poorer. On the positive side it has kept our export jobs alive but it has come with a price.

I will admit that I only half understand his explanations particularly when he starts talking in mathematical terms. The point that struck me is that people seem to believe that house prices nearly doubling over five years is a natural progression while the thought of a 40% drop over the next five is simply unthinkable.

I am starting to suspect that maybe I should stop making fun of Hawk.

It looks like everything is being looked over with a fine tooth comb in real estate. My son just received a notice of assessment to return his first time home buyers grant. He is a student and we purchased the condo 2 years ago in his name so that he and his sister can attend university and not pay 600plus each in rent.

The matter was quickly cleared up with various receipts that proved that he lived in the condo from the date of purchase. I’m wondering how many other people with similar circumstances received this type of assessment.

Of course it matters when you buy, i.e. how much you pay. I once bought a house that had been foreclosed after a price crash. It mattered to the previous owners when they bought, big time.

If he’s actually talking about somebody downsizing, yes this does make sense as you are selling and buying at the same time.

This is an artificial inflation of the selling price and must be disclosed to the mortgage lender, otherwise it’s mortgage fraud.

Interesting… this popped up today on my facebook feed, sponsored ad of a house for sale by a realtor. I don’t remember seeing this type of thing before…

“$10,000 Cash Buyers Incentive Upon Closing!”

At first I wasn’t sure if they were saying there’s a $10,000 incentive for the buyer, or a $10,000 incentive for an all cash buyer. Turns out the seller is offering a $10,000 cash back incentive to the buyer at closing. Question for the realtors out there, why not simply drop the asking price by 10k?

Ugh. Doing the mandatory re-education course right now on the new rules. You are so right. I like the intent behind the changes, but everyone is going to get formed to death.

“Is it time to worry that the boom in global megacity housing prices could turn into a bust with a potential contagion across the global economy?”

. By the end of May, home prices in Sidney had fallen 4.7% year-over-year. In Toronto, the average price of a single family home had fallen 13% since the market’s peak in April of last year. Meanwhile, in February, London saw its first annual decrease in prices in more than eight years, which accelerated in March and April. And in the first quarter of this year, Manhattan saw the median price-per-square foot fall 18% year-over-year.

https://latest.13d.com/boom-global-megacities-bust-contagion-economy-real-estate-30d0951e21bc

@ Introvert”

“Can an economic system predicated on growth continue indefinitely on a finite planet?”

No, but it may be continue for longer than many expect. The super-optimists such as the crackpot physicist, Michio Kaku, say that we will become a “A Type 1 civilization that … has harnessed all of its planetary power. It controls earthquakes, the weather, volcanoes, and it has cities on the ocean (Saanich Inlet, anyhow). Anything planetary, it controls.

Then. having exhausted the power of the planet, we will go to “A Type 2 civilization, which is stellar. We will get our energy directly from the sun. … We will use the power of the sun to energize huge machines.

Eventually, a Type 2 civilization “exhausts the power of its star, and goes to a Type 3, galactic civilization … harnessing the power of billions of stars within a galaxy….

So according to Kaku, our current status is that of a Type 0 civilization, which means lots of scope still for capital gains there in Gordon Head.

True story: as a kid, I heard the term “euthanasia” on TV, and I thought they meant “youth in Asia.”

Seriously, though, world population is a problem. Some other recurring thoughts I have: Why does Victoria need more people? Why does Canada need more people? Can an economic system predicated on growth continue indefinitely on a finite planet?

The changes to realtor rules is good news. The best advocate when you’re a buyer is a good real estate lawyer, like Mullen DeMeo. An honest, knowledgeable realtor, like Marko, is great to have on your side, but if you’re buying without a realtor then rely on a good lawyer before you sign anything.

Negotiations only really become effective when you have the flexibility to make creative compromises and employ different strategies. That isn’t really the case in a real estate transaction. There are very few levers that a realtor can pull here to negotiate, and in fact a realtor cannot negotiate past the parameters set by their buyer or seller, so they are even more hamstrung. This isn’t like negotiating NAFTA where everything is on the table.

That is the typical argument, but think about what this implies. Let’s say market value is $950k, what you are arguing is that an experienced realtor can get $50k over market value. Given that most buyers are represented by realtors as well, that means the buyer’s realtor must be incompetent in order to let their client pay $50k over market value.

I do think that the personal networks used to be much more valuable for realtors than they are today. When there was no realtor.ca the only way you could get exposure for the house is to have a large network to promote it to, and pay for ads in the newspaper. Now, what 95% of home buyers will use the internet to search for properties? All you need to obtain market value for your property is sufficient exposure. At a certain point adding more exposure does not increase likelyhood to obtain market value.

This. Timing the market is hard. If you just want a good place to live, then buy what you want (make sure you won’t want to move in 3-5 years due to something annoying), make sure you can make your payments comfortably, and relax and live life. Dont worry about the month to month. Peaks and valleys will happen. If you cant withstand them, then rent.

I agree that capitalism is destroying the planet. The only solution is euthanasia. You first comrade.

@ Grant

Re: Realtor/no realtor

The people that I know that got the best deals on real estate all did private deals (no MLS) with no realtors. Some were first time buyers, some had bought multiple properties. I think it just depends on what you’re most comfortable with; for some that’s buying with a realtor, and for others, buying without a realtor is not an issue. However, those private sales all happened in the city they’d lived in for awhile.

@Gwac

Check out Ross Kay re: house prices. Not a bad listen, according to him, he’s saying:

Actual selling prices are down over 100k in Toronto and 20-35% off peak 2016 prices in Van. Anyone who is working their way up the property ladder, don’t buy now, wait. Anyone over 55* who is buying to make a lifestyle change and will be in the same house for the next 20 years, then it doesn’t matter when you buy.

*note: I imagine if you’re under 55 but planning to stay in the same place for the next 20 years, same advice would apply.

https://www.howestreet.com/2018/06/04/house-prices-in-toronto-fall-for-fifth-consecutive-month/

Markets don’t crash overnight, they slow down first as buyers wake up that rising rates are for real and the local economies peak out on all fronts. The agents and related industries are taking the first predictable hits.

Commercial Leading Indicator Points to Slower Activity on the Horizon

“The first quarter of 2018 marked the first time since 2008 that all three components of the CLI posted declines. ”

” Employment growth in BC has stalled over the past six months as the BC economy appears to be operating near full capacity. Key commercial real estate sectors are also seeing employment weakening with the CLI office employment measure falling by

about 6,800 jobs, with losses concentrated in the finance, insurance and real estate sectors, while manufacturing payrolls contracted by 1,000 jobs.”

http://www.bcrea.bc.ca/docs/economics-forecasts-and-presentations/clireport_.pdf

If the buyer is simply paying a % of the sale price directly what changes really? The buyer’s agent is still incented to work against the interest of the buyer, which is to get a lower price. Now if the buyer’s agent was paid a commission based on how much he could negotiate the price down, that would be a real change.

As for myself my latest purchase was though a cash back buyer’s agent. I decided what I wanted to buy and then got him to make the offer.

Everyone gets fixated on the commission, but often don’t realize that when you’re looking at the trees you’ll miss the forest. Is it better to maximize your sale price at $1Million and pay $30 some odd thousand in commission, or sell at $950K and have little to no commission?

This is why commissions are so high…people believe this crap.

Real life example to show how things go both ways. I get called to do a full service listing presentation a few months ago. I honestly kept coming up with a figure of 950k. I wasn’t trying to lowball the seller it was simply my honest opinion. The seller kept insisting it was worth more. Seller says okay screw it I’ll just do a mere posting and ends up selling it for $1,020,000.

Houses in most of Victoria (easier in places like Happy Valley) are too subjective to evaluate but take a look at mere posting condo sales and similar units in the building selling at the same time via full service. Guess what, they all sell at market value give or take. If you have a 10th floor condo listed for full service at $499,900 and an identical 11th floor condo listed at $499,900 mere posting which one do you think will sell first? Somehow the full service agent will convenience the buyer’s agent who will then convenience the buyer that the view from the 10th is better? Let’s use some logic here.

On average it is difficult to make up the commission via higher sale price unless you believe that higher commission leads to sales above market value.

Hmmm…

https://twitter.com/WoodfordCHNL/status/1007362422997331968

2) You’ll be lacking in experience of what to do in those instances when something unique happens with the deal. It could be all sorts of things. A good realtor with a decade (or preferably much more) of experience is likely going to have seen all the different scenarios and permutations of a deal and know what the best course of action is in most scenarios.

I think transaction volume is way more important than years of experience. You have realtors that do more volume in one year than those in 10 years.

After 600 transaction I am still often guessing what the best course of action is. Like a request for a financing extension…..sometimes just a complete guess whether to grant or not. Also a lot of the time the sellers don’t listen to the best course of action.

Perhaps buying land on Titan might be a decent speculative play. I can see it now, “I just bought a gorgeous piece of ethanefront property!”

http://cronodon.com/images/Titan1.jpg

1) You better be an exceptionally good negotiator. Most aren’t, and even for those that are good negotiators, when it’s your money at play, or your house, it’s difficult to stay balanced and calm when negotiations turn intense. You best also be very personable because often times getting a good deal is more than just throwing an offer across the fence.. it takes discussion and good interpersonal skills.

Having done hundreds of mere postings and full service I honestly can’t say that I negotiate better than the average mere posting seller. Sometimes they actually do a better job. Let me give you a good example.

Back in 2011 or 2012 I mere posted a home in Cobble Hill at $439,900. 30+ days on market with zero showings. Sellers finally get a showing and that party makes an offer of $430,000. If I was helping my clients negotiate via full service I would have said take $430,000 and run for the hills as this is probably the only offer you will ever get. They counter at $435,000 and it is accepted….go figure.

Honestly, there is almost no discussion in justifying value in residential real estate negotiations when you are dealing with top agents. There is so much subjectivity involved that it is usually a complete waste of time. Sometimes both parties use the SAME comparable to justify their position (one party thinks it is inferior and the other one superior). Basically you go back and forth and either it comes together or it doesn’t.

I justified offers in 2010/2011 then I gave up the practice when I saw it was a complete waste of time. When 2015 rolled around I gave it another try on a brand new home in Fairfield. There were a lot of deficiencies I picked up on. I knew where the builder bought most of fixtures, etc., so I put together an email along the lines of “my clients are offering x amount, there was some cost saving done in that your shower assembly is from Costco, etc.” and the reply I received was essentially “the builder was insulted after reading your email and won’t be replying going forward.” Totally screwed my buyers over and they ended up buying something else less desirable.

Any thoughts on separating out the buyers and sellers commission so that each party pays there own realtor.

This would be awesome; however, it will be difficult to change the system.

She makes a good point.

Just a thought from a buyers point of view. I would not sign anything without having met the realtor in person. It might work better for your prospective clients to ask them to sign any agreements when you meet them at the property they are interested in. I am sure if they feel comfortable with you (and you with them) they would be happy to complete your document.

So I am going try to make some random individual comfortable with me before I ask them to sign a form that says be very UNCOMFORTABLE with this situation?

You are correct. This is the recommended approach. Warn clients that they will need to review a form before being able to see the property, and bring it to the showing.

Multi-page form….and the signing will take place on the hood of the car?

Sophisticated unrepresented buyers will figure it out quickly; they will sign a form, saved it their desktop, and just email it to realtors who ask for it.

Unsophisticated unrepresented buyers will be weeded out which is what you want.

Calgary no, Toronto and Edmonton are World Cup hosts, so yes.

Canadian real estate market. Not exactly crashing in this realm.

https://www.theglobeandmail.com/real-estate/canada-house-price-data-centre/article29697029/

How exactly do you find a good realtor? Someone who will point out the faults of a place and stop you from buying a bad place? Who could negotiate a good price?

I would say the value of a realtor depends on the type of market you are in. In a hot sellers market, having a realtor to sell your place(vs Mere posting) has less value(anyone could have posted there property and paid the buyers commission in 2016 and got a good price for there place). That being said right now I believe there is great value in having a realtor when your are buying a place. With so little inventory having someone know when things come on the market and other little details would be valuable.

Any thoughts on separating out the buyers and sellers commission so that each party pays there own realtor. I believe this would add more transparency and more of a free market as you could pay for what you wanted in a Realtor. Right now there is very little choice(save for Leo and Marko and a few others) for choices in how you want things done.

We’ve got about 5 billion years and then our Sun will start it’s helium burning phase, turn into a red giant, its outer layers will consume Mercury and Venus and reach Earth. The oceans will boil off and life on earth will cease to exist. Ok, let’s have a beverage!

I’ll step up to bat for realtors – or rather, the good and experienced realtors, of which there are many. (And there are also many that are not very good – so do your homework.) For me whether to get a realtor is similar to the question of whether you need a lawyer or not – as the saying goes “A person who is their own lawyer has a fool for a client”.

Yes, you can educate yourself on the current RE market conditions where you are looking to buy/sell, you can understand the macro economics at play, you can be very well versed in all the legalese and ins-and-outs associated with a real estate transaction, but if you don’t have a realtor:

1) You better be an exceptionally good negotiator. Most aren’t, and even for those that are good negotiators, when it’s your money at play, or your house, it’s difficult to stay balanced and calm when negotiations turn intense. You best also be very personable because often times getting a good deal is more than just throwing an offer across the fence.. it takes discussion and good interpersonal skills.

2) You’ll be lacking in experience of what to do in those instances when something unique happens with the deal. It could be all sorts of things. A good realtor with a decade (or preferably much more) of experience is likely going to have seen all the different scenarios and permutations of a deal and know what the best course of action is in most scenarios.

3) Even if you think you’re up to speed on the market, since you’re not a realtor you aren’t seeing what’s happening real time, you aren’t conversing with other realtors to get their opinion on what’s currently going on, Right. Now. Less knowledge is not in your favour.

Everyone gets fixated on the commission, but often don’t realize that when you’re looking at the trees you’ll miss the forest. Is it better to maximize your sale price at $1Million and pay $30 some odd thousand in commission, or sell at $950K and have little to no commission?

For selling: What’s the appropriate price to list at? Well, you may see final sale prices in the neighborhood, do some $/sqft calculations etc., but what other offers are being put on those other houses? You won’t have visibility. Do you know how to handle a multiple offers? How do you get more exposure than just an MLS listing or open house? Do you have mailing lists to other realtors? Do you have the time to handle the transaction details? Are you OK with the fact that if you make mistakes it could be very costly? If you’ve cut down on the buying agent’s commission, are you ok with how many agents may ignore your listing all together? You want as many potential buyers as possible, not fewer.

For buying: If it’s a hot market, are you prepared to write a subject free offer? Do you know to adjust your offers accordingly? Or even simple things like having a network of trusted professionals/contractors. Who is going to be your lawyer for signing of documents? Oh, you need to redo the roof? Who is a good roofing contractor? Oh you want to refinish the floor, who is going to do a good job and charge you a fair price?

I’ve bought and sold 3 times now and I try to stay on top of market dynamics – I’d like to think I’m pretty well educated and prepared on real estate and there’s not a chance I’d represent myself.

A crash? For that we’d need to see declines of 25% or more. A crash will only be visible in our rear view mirror, a year or more down the road. Absent some major shock, I don’t see a crash happening, but that doesn’t mean prices can’t cool significantly.

The rules changes are welcome. The conflict of interest is palpable and would never have been permitted in the practice of law in any common law jurisdiction. The fiduciary conflict still exists under the new rules for Realtors – even the buyer’s “representative” has a pecuniary interest in getting the buyer to pay the highest possible price because his or her RE commission will be higher. It is a broken system that is replete with self-dealings and conflicts of interest. The solution – look at the property, get an inspection, get your financing and draw up your own contract, have a lawyer [do an LTO search and get a survey if available] review it and present the offer to the seller’s realtor.

Just out: Canadian mortgage borrowing drops to lowest since 2014. The new policy changes and rules are working, along with rising interest rates, to cool the demand side. We need more construction to increase supply – the gross part is the density will rise.

The RE market is not crashing [it is not a leading indicator, it is a lagging indicator], it is correcting and adjusting. Will it crash, yes – eventually, but that could be long after we are gone. I can say with absolute certainty that between now and the end of time, the RE market in Victoria will crash. “Timing” is the weak link in all of this. Play the hand you are dealt.

No, but the lower mainland and surrounding region and the greater golden horseshoe might as well be. A sizable minority of the entire country live in one of these two regions and if their markets go kaput, that ‘s enough of the population to effect mortgage credit availability in the entire country – especially given the scale and speed of those markets’ debt-fueled ascent.

Because that’s not normally how a RE market works. If prices rose and fell rapidly with each cycle shift, it would never get the kind of years-long up/down momentum it does. Prices tend to overshoot, and then over-correct, for a reason. For now, people need to be looking at the sales volume trends, as they lead price declines by several months.

Hey I wasn’t trying to criticize Vancouver just making the point that softness in Vancouver does not equal a Canadian crash.

If you included the area immediately around Lugano wouldn’t the pop. be double or triple that?

Depends I think. In Switzerland or Northern Italy the transportation is so good that there is little downside to living in a smaller center. Lugano – 2 hours to Zurich, 2 hours to Milan on excellent trains. What’s not to like? Moving to a smaller centre in Canada like PG or Fort Mac is a different story. Still has its charms but you sacrifice the opportunity for any big city stuff.

Left a town of 60,000 a few years ago because it was just too small. The sweet spot seems to be at least 100,000+ or extremely close proximity to a larger city. Here are a few of the items that just bugged us:

FedEx / CanadaPost / UPS treated this city as being in the boonies so you pay for overnight delivery but in reality it takes a minimum of 3 days. Ordering online doesn’t help because everything got stuck in Calgary before (it seemed) a mule could be hitched up and the packages brought down on wagon.

Everybody knows your business and I do mean E-V-E-R-Y-B-O-D-Y.

Recreation centres offered a hodgepodge of limited activities at prices 2-3 times what you pay in larger areas.

Major illness or disease – most smaller areas are not able to offer proper treatment so be prepared to travel. For the city we were in, it meant going to Calgary and as noted that is a 3 hour one-way trip.

That’s just the start of the list that had us rethinking our decision to settle down in a small city and move to something larger. There are always trade-offs.

is Calgary Canada? is Toronto? Edmonton?

Saw this on CNBC:

https://www.cnbc.com/2018/06/13/gmos-grantham-capitalists-need-to-wake-up-to-climate-change-reality.html

Thanks for the information, Leo.

Re: “Anytime you start working with a realtor you will be asked to review and acknowledge one of those as soon as possible.”

What if they are already working, informally, with a realtor, who is acting as a buyer’s agent? Is any past understanding between realtor and client now nullified?

Also, what would the buyer’s obligation to the realtor normally be under the new arrangement? Half of 6% and 3%, or what?

Patriotz:

I dont disagree with her at all. Mind you we are looking at moving to a town of 65 thousand. Personally I believe that the quality of life usually decreases once cities get larger than 250,000.

I am sure that there are drawbacks to moving to a small town of 65k but I just cannot think of any at the moment.

Where are the Vancouver declines???? The 3 plus million homes are not the typical homes sold. The benchmark has not budged.

I think many if not most in Vancouver would agree, and there’s been plenty written about young people leaving. Remember she’s speaking about the merits of starting a family now.

Caveat:

Vancouver is not Canada? My God, we finally have sold the whole city to foreign buyers.

Our neighbours daughter is doing her articles in Vancouver and using her new expertise in legalese she summed up her experience succinctly as “It is a shitty place to live and you have to be insane to think about raising a family there”. Mind you, obviously, millions disagree.

The buying window has past. The repeat sales index just came out and Victoria led the country at 1.79% for May.

“Ten of the 11 markets covered by the index saw price increases last month. Vancouver and Victoria led the charge…”

http://news.buzzbuzzhome.com/2018/06/canadian-housing-price-index-rise-condo-prices-shoot-upwards.html

Did anyone from the cave take advantage of the mid-cycle fear? Even if to add some more REITs back in early Spring?

I had never liked dual-agency until I sold my last home in Alberta. The listing agent was also the buyer’s agent and is a common practice in that city. In my case, I think my agent reduced / offered part of his commission to get the sale done as we (seller & buyer) were about $5k apart in negotiations when suddenly – done deal and we got what we were looking for. The agent was great and explained throughout the process that he had brought the client and he did offer to send them to another agent. Sometimes you have to trust the gut and mine said – it would work out. The property was a bit unique for the neighborhood and so to get top dollar was worth the risk of this type of transaction.

I put the dual-agency in the YMMV category. As with any big transaction, go in with eyes wide open and do your homework.

Vancouver’s current price declines are significant, but its gains were more so.

When a $4M house now only goes for $3.2M, it’s a shocking $800K decline but regular people still can’t afford to buy it. However, regular people who lucked out and bought 20 or 30 years ago can still cash out and pocket $3.2M.

Victoria’s market isn’t so much crashing as cooling. And prices haven’t gone down an inch, despite a lackluster spring.

I agree with Leo’s response.

Our realtor would point out lots of deficiencies in properties we looked at (many of them were obvious even to know-nothings like us), and we would all joke after the showing about how dreadful a place was.

I also remember our realtor talking us out of buying a particular property we were strongly considering mostly because we were letting the disappointment of losing out on a better place cloud our judgment.

You are correct. This is the recommended approach. Warn clients that they will need to review a form before being able to see the property, and bring it to the showing.

Of course if the goal is to deter unrepresented buyers, it’s better to send the form first.

No crash

Toronto is actually/stabilized and showing sign of a small upturn in the second half. Vancouver prices do not seem to be coming down.

http://vancouversun.com/news/local-news/greater-vancouver-home-sales-slow-in-may-2018-as-real-estate-listings-increase

http://business.financialpost.com/real-estate/toronto-home-prices-inch-higher-owners-stay-on-sidelines-amid-worst-sales-slump-in-almost-10-years

Yes.

Vancouver is not “Canada”

Just a thought from a buyers point of view. I would not sign anything without having met the realtor in person. It might work better for your prospective clients to ask them to sign any agreements when you meet them at the property they are interested in. I am sure if they feel comfortable with you (and you with them) they would be happy to complete your document.

Leo:

I tend to agree with your summary as to the value of an agent. It is generally good advice. I think you have summed up the criterion really well.

For me it is more a matter of it being a fun project. I will be the first to admit that we are not in a typical position since we already own the second home and there is no real pressure to sell. Being retired time is not at a premium and I doubt that the negotiations involved can be any more challenging than trying to strike a matrimonial settlement when one party has an anti-social borderline personality disorder and the other party is a raging psychopath. Not having a pressing need to sell also changes the equation. I am also considering severing two 6000 sq foot lots off the back of the property both of which would have independent road access. This would still leave the main house sitting on a 1600 square foot lot. I have not looked into it but I am guessing that a 6000 square foot lot in Rockland is worth upwards of about 700K. I would put covenants on the lots as to height restrictions to ensure that the main houses ocean views were not blocked.

If it turns out not to be fun or just inconvenient then one can always get an agent.

Turned down for Funding. Victoria is asking its residents in a referendum whether they support borrowing 70m for the Crystal Pool. I would support it. The city needs facilities for its residents especially as it grows.

I also think the NDP turning down funding is wrong. But we have the no fun NDP who has one priority so not surprising.

Take away the bottom of the food chain and the inevitable happens.

Canada’s Riskiest Real Estate Buyers Are Disappearing After Mortgage Stress Tests

https://betterdwelling.com/canadas-riskiest-real-estate-buyers-are-disappearing-after-mortgage-stress-tests/

Good news on the debt front. Still too high but hopefully Canadians have gotten the message.

https://www.theglobeandmail.com/business/economy/article-canadas-household-debt-burden-falls-to-two-year-low/

“I have no idea.”

Well there’s no uncertainty about your clear lack of intelligence why the Golden Head slashes are leading the pack. ICYMI it’s the 7th hike since 2015 and 2 more this year and 3 or more next year will push the Canadian 5 year rate up another 1.25% or more.

Add that on to the stress test to well over 6.5% and do the math on the average $600K mortgage and the buyers will be shut out by thousands more than they already are going back to February.

Most people on Victoria incomes cannot afford another $1000 month upon refinancing or purchasing.

More and more mortgages being denied by big banks

“A lot of these people should be bankable,” Noble told The Canadian Press. “But they’re not.”

https://www.mortgagebrokernews.ca/news/alternative-lending/more-and-more-mortgages-being-denied-by-big-banks-237393.aspx

Good advice Leo.

My view is potential money saved may be lost and more in the eventually selling price.

Like to see fees go down…Only a matter of time before the UBER/AIRbnb of real-estate is figured out hopefully forcing fees down.

Taxis once thought their permits were a gold mine. Not so much anymore.

You mean a mere posting? As for the advantage of using an agent, I see it as the same advantage as any other advisor. You can do the research and invest your money yourself, or you can pay an advisor. You can do the research and buy/sell yourself or use an agent. Which is better depends I would say on two things:

It’s not quite so simple. Yes from an economic perspective the incentives are misaligned. However fact is successful agents become so through referrals from previous clients. So while being a little unethical may get a few early deals through faster, it will not lead to long term success.

Actually, I am seriously thinking about using Marko if we decide to sell this house. Once you have access to the MLS, I really dont see the advantage of having an agent.

On a serious note, and I am not being sarcastic here, exactly what type of advice are people actually expecting to get from their real estate agent? Certainly you are not relying on them to tell you about the quality of the product. Nor are they likely to tell you about any deficiencies in a neighborhood (like that the fire hall is a block away hidden by a small hill).

My experience in Victoria is that even when you ask for something simple from an agent such as a comprehensive list of comparables that what you get is a selectively edited list.

In terms of advice as to both the market and in depth advice I was fortunate to know a real estate lawyer here who provided great insight into the different areas of Victoria and what to look out for when buying here.

The simple economic reality is that your real estate agent is not on your side and his economic interest is not aligned with yours and that is true whether you are buying or selling. The agent has no interest in you either paying or receiving the best price. The agent is simply interested in closing a sale as fast as possible, with the least amount of effort and time on their part, because that maximizes their profit. There is nothing evil here as long as people recognize that the real estate agent is not your friend and is on their own side and not yours. So you are on your own and you better do your due diligence.

On a side note, Grant was pretty smart to be asking advice on a site like this one. A lot of different opinions but also some real insight into Victoria.

Imagine if you are a Luxury Realtor right now… especially the guy driving the flashy cars on youtube.

I’ll get you $2MM for your house, it will cost you $63K for me to take a few pics and upload them to a bunch of websites/social media and write a 1 paragraph blurp. I’ll guide you through a less than 10 page legal document and act as a secretary to field questions from the 10 interested parties in your property. If you buy/sell a few more properties with me, I might even invite you to my Christmas party!

I think I’d call Marko first… haha

Leo…Top 10 Post. This affects most people buying or selling RE. Here is the commissions paid by house value/and as % of sales price up to $3MM. Realtors take 3.1 to 3.4% of the value. Not bad.

Sale $ Com % Sales

$800,000 $27,000 3.38%

$900,000 $30,000 3.33%

$1,000,000 $33,000 3.30%

$1,100,000 $36,000 3.27%

$1,200,000 $39,000 3.25%

$1,300,000 $42,000 3.23%

$1,400,000 $45,000 3.21%

$1,500,000 $48,000 3.20%

$1,600,000 $51,000 3.19%

$1,700,000 $54,000 3.18%

$1,800,000 $57,000 3.17%

$1,900,000 $60,000 3.16%

$2,000,000 $63,000 3.15%

$2,100,000 $66,000 3.14%

$2,200,000 $69,000 3.14%

$2,300,000 $72,000 3.13%

$2,400,000 $75,000 3.13%

$2,500,000 $78,000 3.12%

$2,600,000 $81,000 3.12%

$2,700,000 $84,000 3.11%

$2,800,000 $87,000 3.11%

$2,900,000 $90,000 3.10%

$3,000,000 $93,000 3.10%

The Vancouver SFH market is in free-fall.

MyRealtyCheck.ca

For almost 2 years each month would show about a 3 to 1 price drop to increase. Now that ratio is closer to 5 drops for each price increase. Last month was the first month the total amount of price change reached over 200M in decreases, looks like we are getting there this month as well. It was usually about 150M in drops per month over the past year.

Data from ZOLO, SFH market only, May14-June 11 YoY

City-Sold listings

Van -65%

W. Van -77%

White Rock -91%

N. Van -68%

Richmond -73%

Burnaby -82%

There has not been any market recovery this spring. The 37K Liberal government handout has worked its way through the market. I have asked this before…is there anyone on this blog that does not think the Canadian housing market is currently experiencing a crash?

Think the changes are good, particularly noting the compensation up front – people don’t math well a lot of the time. I don’t know why you’d have to fill in the form as an unrepresented merely to view a property Marko – waste of time for a buyer too and using it to discourage dealing with unrepresented parties seems like a personal choice rather than a requirement? The forms seem like the sort of thing you’d need to do for an offer from an unrepresented party.

First off, once again I tip my hat to you Leo. You have taken on HHV with such depth and integrity that you have made this place a real gem. Not only are you a real estate Advisorer (R) you’re also a journalist! To bad this stuff is goes over most people’s heads….

I might also just classify this as administrative inflation. I have bought twice without an estate agent representing me without issue. Both times they made is very clear they are not on my side. That said I do have a lawyer….

Over the past forty years, I’ve witnessed more and more paperwork at every level. The listing, the purchase, the sale and the follow up through the lawyers office. It was much simpler in the past. Today, I see more and more power being taken out of the hands of the purchaser. More fear because of the added complexity when in fact it is quite a simple process. At the same time, I see more and more things being dropped, with more mistakes being made at every step.

There comes a point that people become frozen because it is unnecessarily complex.

There has been an explosion of short term vacation rentals in the core of Zagreb, Croatia. The reason being is the delta between short term and long term monthly income is huge, for the timing being before the market become saturated. Most people are using booking.com and AirBnb. I’ve been bringing up the issue of it impacting the long term rental market inventory and interestingly enough people view it completely different.

Most of the conversations are along the lines of……..”Yea, but the increase in tourism is helping the economy and as a result you have developers building new residential neighbourhoods just outside of the core for families, etc.”

No strata restrictions in Croatia to short term; however, municipal licencing has been required since day one.

Super interesting how there are two totally different perspective to the same phenomena.

On a side note I am travelling through different countries in Europe right now and damn real estate is crazy expensive everywhere. I am in Malta for a few days and a half decent condo is around $600 to 800 CND a foot and Malta isn’t even in my top 10 places I’ve travelled too. Really poor roads, the coast line of the island isn’t that nice (relatively speaking). I went to the “Blue Lagoon” everyone talks about on Malta and literally there are 5 nicer bays on the one small island I am from in Dalmatia, Croatia. I would rather take the coast (and the crappy weather that comes with it) in BC over Malta.

I’ve chatted up a few locals and wages are a lot lower than I thought they would be given GDP. Income to real estate ratios are a lot more out of whack here for sure.

For the most part REALTORS are against these changes but I think they are great. In my personal business it will save a ton of time in various ways.

One of the time killers for me over the years has been unrepresented buyers. A lot of them don’t show up to appointments, many aren’t qualified, most don’t do basic due diligence (they will book a showing for a condo that doesn’t allow pets but they own pets), etc.

Now when an unrepresented buyer emails to book a showing I’ll email back the Disclosure of Risks to Unrepresented Parties form with a note of “please review and sign and we can proceed to booking a showing.” Guaranteed I won’t hear back from 95% of such buyers.

The 5% I do hear back from the expectations of how things work if they decide to make an offer after the showing are set.