Feb 19 Market Update

Weekly sales numbers courtesy of the VREB.

| Feb 2018 |

Feb

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 72 | 185 | 312 | 675 | |

| New Listings | 104 | 311 | 519 | 880 | |

| Active Listings | 1434 | 1487 | 1519 | 1537 | |

| Sales to New Listings | 69% | 59% | 60% | 77% | |

| Sales Projection | — | 473 | 506 | ||

| Months of Inventory | 2.3 | ||||

Sales down 25% so far this month compared to a year ago which is a pretty significant drop. If we hit the current projection of 506 sales for February, that would be a bit below the level of 2015 but still substantially above what we would expect in a truly slow February (around 400 sales).

Thing is, this mediocre market performance is probably the best we’re going to get. The stress test is in effect but there might still be a couple pre-approvals left (gotta be scraping the bottom of the barrel there). Tomorrow we get the second hammer dropped in the form of the budget and the expected policy announcements to address our little housing situation.

No one really knows exactly what’s coming, but a pretty safe bet is lots of money for affordable housing (that will be piled on top of our existing condo supply pipeline) and some meaty actions to address money laundering and regulatory loopholes that have allowed money to pour into Vancouver’s real estate market (and when it pours in Vancouver, it always splashes us too).

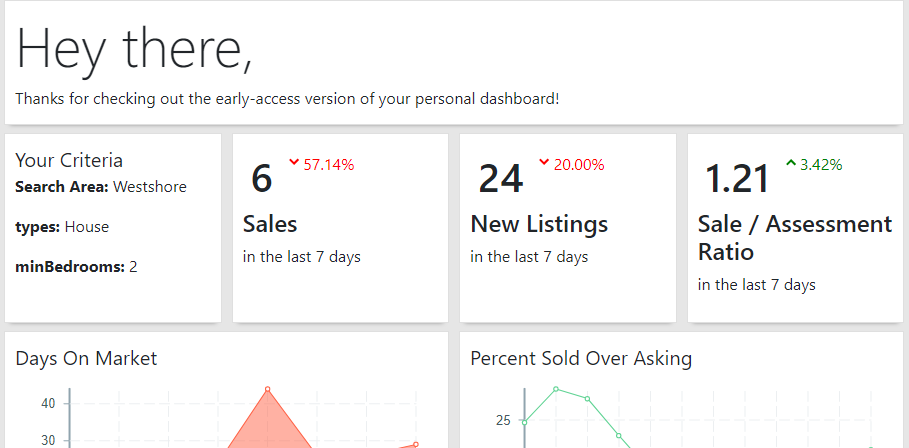

By the way, here’s something I’ve been working on. A custom dashboard that ties into the live market data to get a handle on what’s going on in a market segment. Just trying to hunt down some nagging data integrity bugs before you can try it out…

What would be useful to see on there?

New post with links to plan and highlights here:

https://househuntvictoria.ca/latest

Closing comments here to gather on the new post.

New tax on businesses to pay for MSP ouch

1b in childcare

new database to make sure presale condo owners pay tax

20% foreign buyers tax including Victoria

As I guessed last week this we the safest political play.

spec tax on non taxpaying absentee landlords .5% than 2% next year.

20% foreign buyers tax including Victoria

Property transfer tax increased over 3m as I guessed to 5%

Watch the budget speech live here:

http://www.cbc.ca/news/canada/british-columbia/b-c-finance-minister-carole-james-set-to-deliver-2018-budget-1.4543544

LeoM

That interactive chart is pretty impressive comparing it even over the past 10 years or 5 years is crazy.

It is also very interesting to see average US and Britain prices have not come back from their 2007 high’s. It is also interesting to see just how little Canada fell in 2009 compared to the US.

I know we used to have a poster on the fridge at work from another HHV member showing the monthly / quarterly declines of the US housing market during the 2008/9 collapse.

While you’re waiting for Horgan’s announcements you might be interested in revisiting this Economist link from last year.

The Economist Magazine website has a great interactive graph showing how insane Canada and New Zealand real estate prices were one year ago, and prices are even higher now in some areas.

Tap the five tabs above the chart to view different perspectives.

https://www.economist.com/blogs/graphicdetail/2017/03/daily-chart-6

There seems to be very little SFH inventory in James Bay, Oak Bay, Fairfield and Rockland. If you eliminate the 2 million plus properties the number really shrinks.

Over assessments do they have recent upgrades?

numbers hack, you really are a hack. Don’t like to let facts penetrate the bubble, eh?

https://thetyee.ca/News/2017/04/13/Clark-Debt-Free-BC/

Is it just me or do house prices seem to have gone up drastically since the new bc assessment is out? I know houses were selling for lets say 15-20% over assessed but now that 2017 assessment is out and the BC assessments have come up 15-20% throughout Victoria and surrounding areas it seems like the people are using the same formula to price their homes.

Assessment price X 15-20%.

Some of the prices I have seen come up on my filters the past few weeks seem ridiculous. I’m going to have to mark them off and follow to see what happens.

Lived there for 11 years cumulatively. It’s not bad as far as cities with real winter go :).

Can one be a spring chicken and have the onset male pattern baldness?

I don’t think anyone actually fits that description unless it’s an exaggeration by a factor of ~4.

+1

Maybe he’ll be leader of the NDP some day.

Not a bad idea. Defining high end is problematic though. A dump in Vancouver costs a high end price for the rest of the province and bear in mind that the NDP’s base is in the Lower Mainland. Will they want a tax that hits their supporters hardest?

So true. A significant number of paid crossing guard positions at many local schools are unfilled because they just can’t find people that want a few hours of work per day. You’d think some of the bottle-picking, coupon clipping seniors that Number 6 is always going on about might be interested in a few hours of work with low physical demands.

As an example our school has found some generous community /corporate donors to top up the crossing guards wages to near $20/hr. Still no dice.

There are plenty of places like that in desirable parts of Oak Bay as well, a smattering on Ten Mile Point and other areas of the Saanich waterfront. If you go into the average neighbourhoods of Greater Victoria my guess is very few seasonally empty vacation homes.

I personally don’t love it that some of our nicest areas are barely inhabited. And I do think there is a trickle down effect making the general market more expensive. This would be tough to deal with though (even if people agreed vacation homes were a problem). How do you stop a rich Albertan from buying a nice place in Greater Victoria and living in it part time or barely at all? Do we even want to stop it?

“He will commit to “clamping down” on fraud and money laundering (why do we need a policy statement about doing something that should already be happening?)”

Because apparently the previous government hid information from the public and allowed it to continue and become much worse than anyone knows?

We’ve got the Attorney General basically accusing the former Premier of knowingly allowing criminal activity to flourish because it would benefit her politically. That is rather amazing, and if true, a national embarrassment. It would seem as though a great many BC residents didn’t care either, so long as they got a cut of the profit.

Oh sure, if you asked them “do you support criminals?” of course they’d say no. But they’ll gleefully welcome foreign money into their neighbourhood, with no apparent concern for where it came from. They only care that it increases their property value.

If Hogan was smart he would announce an annual property tax on all foreign owners of real estate and then continue by stating that all the housing starts will be paid from this tax or that all daycare will be paid from this tax. I read that there are about 25,000 foreign owned properties in B.C. With an average tax of 10,000 per year this would produce 250 million a year every year which would go a long way to paying for subsidized housing.

Horgan will probably talk tough but do nothing to upset the ~70% of British Columbians who own their home.

Of the 30% who are renters, at least half are lifelong renters with no aspirations to own. So why risk alienating home owner voters after his razor thin margin of voter support by pandering to the 15% who want to buy in Oak Bay while earning $50k per year.

My guess is a restriction or tax on foreigners (non-voters) purchasing real estate and a big empty promise of new subsidized housing, part of his 114,000 new rental units— over the next 10 years, so nothing immediate.

I hope Horgan surprises me with effective measures.

Luke:

Yes, you are a spring chicken but I am not sure that Josh has even been hatched (no offence meant, I am making fun of myself).

Is it just me?

The more I hear Eby speak, the more I am impressed. You don’t have to agree with his ideas, but he layouts out his thoughts/arguments logically so it is easy to follow his train of thinking. Horgan is a tad bombastic and “don’t touch me” haha, that gets me laughing everytime. He reminds me of the class bully, so much harder to give him any credence to anything he has to say!

Sorry Luke:

Just got my first cup of coffee, was confusing you with Josh. Now I feel really old since I had been a homeowner for a few years by 1978.

By the way Josh I have a number of friends who live in Ottawa and it is a great place to live. Wonderful choice for a young person if you do end up there.

It’s all just speculation until we hear what they do… only a few hours to go…

Dun dun dun.

https://m.youtube.com/watch?v=cphNpqKpKc4

Oh. I see. We’re all just spring chickens to him 😉

I think he may have meant Josh

Barrister I think you’re a little confused. I’m already a home owner. Turning 40 this year not sure if my generation is really the one that is screwed. I think those under 35 and esp under 30 got the screws more. I just seem to have scrapped past the worst of things just by being born in 1978.

I was saying earlier home owners are still house hunters if we’re ever thinking of moving to a different house one day. That’s why I keep my eye on the market and this blog. In fact, one could argue some of those renting may never be house hunters in the core again, unless prices drop significantly.

That’s interesting sweethome. I hope so, would love to see what Vic looks like with more inventory. However, even at double current levels it’s slim pickings. Maybe best to just be happy where we are. There are probably lots of people thinking that. But, I’ll always be keeping an eye on things.

After listening to Eby’s interview yesterday I hope they will announce the closure of the bare trust loophole and all the numbered corporations owning residential land. I think once they change this process so we can finally determine how much of all the residential land is owned by who and from where it will make an impact. The issue is even when they change this it will take a while for them to process the details and get all that information.

Eby makes it clear as well that he thinks its more about the questionable money coming in to real estate vs just foreign buyers. Track the money. I think as well if they track this money fully they would uncover lots of illegal activity and speculation.

Overall I think the entire thing is really controlled by central banks and if it is true that we are moving towards a change and we are going into a rising rates period this will have the most impact on the markets. (IMO)

Free money is a huge thing of what has brought us here and allowed it to continue. When I bought my condo in 2007 I could not qualify for close to what I could have a year ago. A drop of 3% to allow super low rates has made for very cheap money.

https://www.bloomberg.com/graphics/fomc-dot-plot/

I think the changes will not happen over night in the real estate market even though I would like them to. I think it will be a grind of various forces to move the market in BC.

I think Horgan will make a feel good story out of increased subsidized housing and he will commit to “clamping down” on fraud and money laundering (why do we need a policy statement about doing something that should already be happening?), but I doubt he will commit to anything else ie we need more data about speculation etc. I expect overall he will talk a good story knowing full well that his “changes” will have little impact on the market. He will wait to blame someone else for taking the punch bowl.

Well you cant tax the poor since they dont have any money and you cant tax the rich very much since they have already arranged their affairs mostly to avoid paying tax in Canada so the middle class, or what is left of it it, is going to get it in the ear again.

I do feel sorry for young people like Josh who are pulling the wagon. At least when I was pulling the wagon there were a lot less people riding in it.

AirBnB in general is way more expensive than it used to be. I used to use it years ago and places were dirt cheap… like $50 CAD downtown city cheap. Places are also dirt cheap when people first list them because I think as mentioned here they don’t really do the math.

I now find myself comparing AirBnB and hotels and sometimes hotels are cheaper. Over time they have added taxes, added cleaning costs (some are insane, $75 a night rental + $50 cleaning) and now they have added local taxes.

I think all of this is important to change AirBnB on a level playing field with hotels but I do think AirBnB in your spare bedroom should be considered differently than renting a full condo. I have met lots of people over the years of using it.

Some take assisted living rentals, end up renting multiple and then turn around and AirBnB them out. Just imaging BC residents catch wind of that, their subsidized rental units actually being flipped into AirBnB’s.

I have also met mothers who have kids and are staying at home and do the cleaning as part of a supplemental income. This is generally in a extra room or suite.

I have used places in other cities where the owners just rent a bunch of units in the core of the city and in close proximity, these units are rented out pretty much full time so I would assume they have a cleaning staff that just visits them.

It blows me away that I will look a few months in advance in a city and only 2-5% of listings remain. This tells me that people are listing them way under what you would pay for a hotel. It also blows me away that people pay $300 a night for a tree fort in the middle of no where or some super basic cabin to get off the grid in the hills of California.

“Places being relisted over and over. Old tired listings not selling and not reducing price enough to sell. Buyers spooked or pulled forward by B20. Most sellers or their realtors have not yet gotten the memo.”

Good points Charlie. Once a few crack then the walls come down. Their agents will tell them to drop the price or good luck.

Remember 47% of mortgages are up for refinancing this year. Those with HELOC’s maxed could put a strain on any new deals in a downward market.

I would not be surprised if the go after land transfer tax on the high end over x you pay double and use that money to help housing. That would be a good tax.

Quick predictions:

1/ expect more onerous conditions for foreign buyers

Foreign buyer tax BC wide is my big prediction.

Never used AirB@B.

Awesome service, I used it a lot when I travel and I 100% use Uber in cities it is available in.

I just think operating an AirBnB and Uber is a crap business from the owner operator standpoint.

That is why I think if you add more regulation and a bit of cost (licencing) to AirBnB it could have a decent drop-off like in San Fran. A lot of people will just cease to operate and some will put the unit back into the long term rental pool and the occasional few will sell.

Quick predictions:

1/ expect more onerous conditions for foreign buyers

– though they are less than X% of the demand

– they can’t vote in the next election

2/ expect lots of money for social housing

– better buy your BC Bonds now, we are going to run a deficit kiddos for the next decade! We are still paying for the fast ferries.

3/ expect nothing to quell local speculators

– Weaver owns 3-4 homes in his disclosure

So you want affordability, easy kill demand, increase the supply. Readers can make their own decision if the above holds true.

Me either

I just went on it once to see what was available. Shocked how much in Victoria. Cleaning charge can be real expensive.

Cleaning/managing the key can be a good business if you live in the building and have a few clients.

Good point Marko, especially since the cleaning is not always at a regular schedule. I wonder if it is more efficient if you have twenty or thirty units?

gwac:

Thanks good to know. Never used AirB@B.

cost of cleaning the unit is an extra charge on airbnb that is set by the owner.

It isn’t so much about the cost of cleaning as it is organizing it. A lot of my clients that have AirBnBs have had a such tough time with finding cleaning services that they just do it themselves. It is pretty tough to find someone for an hour every few days with no parking downtown, etc.

cost of cleaning the unit is an extra charge on airbnb that is set by the owner on each rental.

We have a house on our street like that. Owners hardly ever come anymore (couple weeks a year). Main floor sits empty 90-95% of the time. At least the basement is occupied by a long term (10 years plus) tenant.

The end of fixed term leases will encourage more individuals to keep their homes empty.

A few days ago I walked into an incredibly cluttered/dirty condo….showed horribly. I talk to the listing agent and turns out the sellers were planning on selling it vacant once the fixed term lease came up but since the government changes the laws in December they can’t get the tenants out (legally) anymore and are forced to sell with the tenants in place.

I am pro changes the government made but defintively some unintended consequences.

Marko:

There is also the cost of cleaning the unit.

Appreciate the warning Hawk. Will keep an eye out for stalkers. As for the Victoria housing market…

I think we will continue to see low sales for the spring. Seems like new listing prices are higher than ever and at times totally delusional. Places being relisted over and over. Old tired listings not selling and not reducing price enough to sell. Buyers spooked or pulled forward by B20. Most sellers or their realtors have not yet gotten the memo.

This would be if there’s a specific property I know I’d be very interested in if it was ever on the market. Could also be used to keep an eye on your neighbourhood and be the nosy neighbour poking out from behind their curtain.

The analogy is useless. There isn’t a vehicular affordability crisis or massive shortage of rental cars.

Interesting how San Francisco squashed AirBNB with some tough rules and poof, instant big rentals increase while AirBNB listings plummeted.

I never understood the business of running an AirBnB in Victoria; therefore, I expect to see the same trend in Victoria. If you can rent a 1 bedroom unit at the Era for $1,500 per month ($50 per day 365 days a year) just makes zero sense to do Airbnb at some $100-$120 per night when you factor in fees, vacancy during winter, work involved, investment of furnishing the unit, etc.

I find people that do run AirBnBs put little value on their on time.

I have a GT3 in my garage. Over the last 18 months I have driven it 4300 km. Shall I expect a policy which forces me to put it onto Uber or pay a penalty? The analogy is direct.

If you need any help putting on some kms let me know 🙂

Interesting how San Francisco squashed AirBNB with some tough rules and poof, instant big rentals increase while AirBNB listings plummeted.

https://www.sfchronicle.com/business/article/SF-short-term-rentals-transformed-as-Airbnb-12617798.php

“London’s Property Crash Has Begun”

Be careful Charlie, the fact 4 out of the top 5 bubble cities are beginning to tank as well, you might be stalked for having an “ultimate goal” to take this whole town down. 😉

Luke:

No Idea what is going to be in the budget but I am pretty sure that it will involve your taxes going up and making it even harder for you to buy a house. You get to pull the wagon while even more people get to ride in it. I dont envy your generation.

Horgan’s day is upon us.

Will he take tough actions to make a difference, or will he wimp-out with tough sounding words?

We’ll know in a few hours.

I guess you haven’t been paying attention to what is happening in Vancouver. Turns out that many people in fact feel that no, you can’t do anything you want with your house including using it like an occasional plaything or a store of money in a community that has an acute housing need.

Coming soon to a Canadian city near you.

“London’s Property Crash Has Begun”

“4. And then there’s perhaps the most overlooked factor affecting the market: after years and years of being squeezed relentlessly, the indigenous London middle class, as it is in the wider UK, is largely skint.”

“Over the coming months you will read and hear plenty of commentary from interested parties talking up the prospects for London’s property market. All of it will be bull.”

“Whisper it: 2018 will be the year smug Londoners finally stopped boring on about basement and loft conversions at smart dinner parties.”

http://www.zerohedge.com/news/2018-02-19/londons-property-crash-has-begun

Not sure how to feel about properties standing empty for part of the year?

I would say that unless you want to revitalise the term “kulak” and reach for your revolver, the way to feel about it is: “that is someone’s property and he can do with it whatever he likes”.

Green-eyed socialists grandstanding to the great unwashed notwithstanding, any other notion is the end of civilisation.

I have a GT3 in my garage. Over the last 18 months I have driven it 4300 km. Shall I expect a policy which forces me to put it onto Uber or pay a penalty? The analogy is direct.

12m for a church in Vancouver. Times are crazy

http://vancouversun.com/business/commercial-real-estate/kitsilano-anglican-church-put-up-for-sale-for-almost-12-million

“If we don’t do better financially, at least we’ll know our economy is not built on a foundation of total garbage, and I think that’s critically important,” Eby said.

Hah! Love it.

Just another great job to keep the economy going! That garbage can mover probably clears $80k with benefits.

I’m not sure how to feel about that. On the one hand it’s an empty house that could be used for people to actually live in, on the other hand it’s waterfront and always gonna be expensive. Maybe not a huge loss if it’s essentially a vacation home. Depends on how many non-waterfront houses there are like that I guess.

Neat. Would be interested to see it.

You should be able to see that in regular matrix accounts, but yes not over multiple years. Problem is that amounts to sales history and I believe I wouldn’t be able to publish that, even for verified “clients”.

Interesting. This wouldn’t be difficult, but I’m not getting the use case here. Anyway drop me a line if you want to chat sometime.

But you do it with such style!

Global fool, huh. Much too ostentatious for my vaguely atavistic mind. I’m just a nothing who likes to tell people their financial recklessness will send them to purgatory…

QE’s done a great job at it, too. Debt? How could it be, if it costs less than inflation and houses go up 30% per year, year after year?

Arguably rational, certifiably insane.

Sweet Home:

If prices are driven down so will the house you are in. Sometimes you are better off doing an addition or a reno on were you are if you like the neighbourhood.

@ Local Fool,

Finally someone agrees with me. You can now be promoted to Global Fool,

Thanks for the support!

I love it! You sir, just made my evening. 😀 😀

Housing is going to increase in value until all the repercussions of the money printing are realized. M1, M2,M3 money supply has gone bizzzzerk since 2008. 400% It is not going back…. if you think it is ok, why? Why? Why? No it is not going back! Grab a hold of something solid and hang on. Hawk will win by buying puts on the Pot Socks. The reason Canada has gone into so much debt with their HELOC’s is because they are smart. I wish I could have done that.

Once I donot think we will see that on the island. Main land everything is open. Cheaper housing is needed for the average worker or there will not be an average worker there.

@Luke: “Maybe someone bought a home too large for their needs and given the extreme lack of inventory that was the only choice? To me, Victoria seems a very difficult market to move in at the moment. And, there is a lack of smaller SFH’s.”

I totally agree. We bought in 2016 (unfortunately after the majority of the run-up in prices). The house we bought was not ideal for us because the selection was so poor then. Although our house has increased in value, so has everything else. It looks like we’re stuck staying where we are because the selection is still bad, and we would lose those darned taxes and transaction fees.

Inventory is low in the areas and price range I would be interested in, which would be east of the Pat Bay and no farther north than Cordova Bay. I did a realtor.ca search for freehold properties today and there are only 28 houses in that area between $800-950K.

Also, that price range used to get one into a bit of the low-end luxury market, but no more. My face dropped when I saw how little you now get for that price. I guess another month or two will tell if there are more listings that might drive down prices.

Yeah, a blanket rezoning seems like the most brutal thing you could do to old neighbourhoods. You destroy places people have lived in and shaped for years so that people who don’t live there are happy.

The Provincial govt over-ruling the Municipal govts would be just like the Federal govt trying to ram this pipeline down BC’s throat. Local controls are there for a reason.

Why don’t we just rip down Government House, Craigdarroch Castle, and other places that take up too much room? We could build housing towers there. (Yes, that is sarcasm.)

We choose to preserve old buildings, we choose to preserve nature in parks, but somehow preserving neighbourhoods is a bad thing?

I am not saying we shouldn’t change some neighbourhoods, just that it shouldn’t be done in a rush.

How would blanket rezoning work with titles like uplands with a Min x amount of land?

If the propose and do a blanket rezoning (which is much needed) it would drive up land values so in the short term it will make it worse. But we can’t always think short term….

RE: Tomorrows budget: does anyone know what happens to property values when the zoning is switched from Single Family to Multi Family? If we do what California is proposing we could solve the problem quite easily. We all just need to live in smaller places. I am not sure that that will collapse the housing market but it could solve the problem.

Definitely – it is a shame to see empty houses with the current rental situation. Do we have statistics on how many actual long term vacant houses there are? There are always a few empty houses as things wait to be sold, renovated, moved into. Then there are people owning vacation condos or houses that seasonally occupy them. We have a house on our street like that. Owners hardly ever come anymore (couple weeks a year). Main floor sits empty 90-95% of the time. At least the basement is occupied by a long term (10 years plus) tenant.

There are lots of homes out on the water here in North Saanich which are empty 99% of the year. I look around and can think of a few that are owned by people in Alberta and California. I think they “might” come out a week or so in the summer and that is it. One I know, an amazing house, the kids prefer to go to Arizona compared to here when vacationing form Calgary it has sat here vacant for years.

The best people to know would be the companies which service these homes. They seem to have someone check in the odd time but I do find it interesting how many homes just sit around and have been for a long time on the water.

Apparently, Hawk grabbed the wrong bottle this morning and downed some caffeine pills.

This is mind blowing stuff: From Ottawa politician to law enforcement about why they won’t stop the money laundering. “Too many people making too much money”.

There ya go, the establishment is milking this cow from within. Hopefully tomorrow Horgan and Eby can start to clean up this mess, kill the golden goose ,screw the specs and start to bring prices back down to reality.

https://twitter.com/steeletalk/status/965723313224933376

Wow nice work Leo! Can’t wait to see the finished product!

Barrister, if you actually followed the posts, the child is not myself. He has a sick obsession which is now bordering on harassment. Do you not read my posts with links etc ? I make no reference to him.

He finally posts a link of something after days of harassing posts just to make himself appear legit. AKA a troll.

Maybe he’s hiding some shady real estate deals he’s worried about coming out in the mess @scoopercooper has uncovered?

https://globalnews.ca/news/4034217/no-quick-fix-bcs-attorney-general-says-money-laundering-in-real-estate-casinos-will-take-years-solve/

Hopefully they can solve this

Does anyone know what 545 Crossandra Crescent went for? Seemed like it was only on the market for a few days.

RE: Hawk and GWAC

What I find a bit worrisome is when there is barely a single thought and that is only when you combine both of them. Give it a rest children.

Suckered in ? LOL You’re whacked. Must be all those Alex Jones conspiracy theories of the right wing tin foilers you watch. Yep, I have a master plan dude, I’m gonna take this whole town down, better look out.

Definitely – it is a shame to see empty houses with the current rental situation. Do we have statistics on how many actual long term vacant houses there are? There are always a few empty houses as things wait to be sold, renovated, moved into. Then there are people owning vacation condos or houses that seasonally occupy them. We have a house on our street like that. Owners hardly ever come anymore (couple weeks a year). Main floor sits empty 90-95% of the time. At least the basement is occupied by a long term (10 years plus) tenant.

I don’t think your average (domestic) specuvestor can afford to buy a house and let it sit vacant long term. Quite the opposite. The folks I know who own second investment houses MUST have tenants or the investment thesis falls apart.

Not getting suckered in Hawk. Enjoy your week.

Troublesome ? Ultimate goal ? Because I post the latest news of rising interest rates or price slash ? Get off your sicko obsession loser. Give him the boot LeoS. This is getting f’n ridiculous and degrades the blog.

Hawk not obsessed with you just the way you present information on here on what your ultimate goal is. Very big difference.

Almost new digs at 1479 Lang St on slash #2 for a $200K slash to $1.19 million.

“Amazing Leo.

Thanks again for the great work. I will behave with Hawk for a week or so. He can keep living the 1981 dream and I will refrain from reminding him how wrong he has been for so long.”

Exactly what I was talking about LeoS. He has to mention me in every post. A very sick obsession for a grown man. Maybe if he got banned for a few weeks this crap would stop, along with Introvert.

They should consider renting it out.

If anyone is interested, here is Vancouver’s Amazon HQ2 proposal.

In it, they tout how little Vancouver tech workers earn compared to other cities.

http://www.vancouvereconomic.com/amazonhq2/

What’s the take here? Pre-emptive action to avoid an empty homes tax? Or just the more mundane consideration of making a house look occupied to avoid being a target of B and E/burglary?

They should consider hiring some neighbourhood kids to occasionally play in the yard and leave toys strewn around.

@Deb did my link not work? I used tinyurl to shorten it. It seemed to work fine for me when I view it.

Interesting that TREB sounds like they are saying there seeing a slowdown and that rates for borrowers last year was around 2-2.9% vs what they expect for this year around 3-3.9% .

https://www.bnn.ca/toronto-home-sales-poised-to-fall-in-2018-amid-regulatory-changes-real-estate-board-1.982572

Is there a website like this one for Toronto? I have noticed various twitter accounts etc but it would be interesting to see what is happening over there as well. I know I had friends looking last year, both couples have good jobs and both ended up getting beaten out in biding wars time after time they decided to hold off for a while.

Right!? I’d be ok buying if we returned to 2014 prices and I was convinced the market wasn’t going to continue falling off a cliff. In 2014 a 2 bed townhome right beside me was listed for $450k and sold for $425k. Late 2017 a unit in the same complex listed for a million. It’s since fallen $100k. Absolutely pathetic. I think it might even be the exact same unit.

@Leif

Hi here is a link that works: https://www.bloomberg.com/news/articles/2018-02-16/canadians-can-t-stop-using-their-homes-as-piggy-banks

More on HELOC’s from Bloomberg.

Titled: “Canadians Can’t Stop Using Their Homes as Piggy Banks”

https://tinyurl.com/ya9jw52a

Here’s an interesting twist. Two empty homes on my block have hired someone to put out empty garbage cans and take them back in again.

https://www.bloomberg.com/news/articles/2018-02-16/canadians-can-t-stop-using-their-homes-as-piggy-banks

Heloc balances jump 7% over the past year.

Josh:

A lot of what you describe is offered by Zillow in the US. I spent a little time looking at condo prices in Victoria and I was totally shocked by the prices that were being asked. Lots of them were at 800 per square foot. That is almost four times what I paid for my house only four years ago. This sounds rather insane.

Amazing Leo.

Thanks again for the great work. I will behave with Hawk for a week or so. He can keep living the 1981 dream and I will refrain from reminding him how wrong he has been for so long.

+1 for dashboard! A programmer coworker of mine made an app that scraped realtor.ca and grouped everything together by address. If someone removed a posting and relisted with a different, it would just track that as a price change. It was just designed to share notes with his wife but it ended up being super useful for other things. I think I still have a copy of it somewhere.

I’d like to see stats on properties I’ve specifically favourited. Say I’ve been keeping an eye out for years and have favourited properties along the way (I have). It’s super annoying that they just vanish. I’d like to see price increases, price drops and sale price. I’d also like to be able to watch a property without there being an existing listing – just enter the address and it notifies if it’s posted. I realize some of that is difficult or impossible but that’s my wish list :D. Do let me know if there’s something you want to offload.

Thank you Leo, the new dashboard will help me, being a true house hunter. Looks like the waiting game may have been worth the stress, fingers crossed anyway.

Some more info to ponder the implications when rising rates don’t stop for decades. It’s 1981 all over again. 😉

Bonds are entering a rising rates cycle for the first time since the 1940s, which could be ‘worrisome’

“Bid farewell to the bond market bull run, because the markets are entering a phase not seen in 72 years: A rising rates cycle.

“The 36-year falling rates cycle, in our opinion, is over,” Louise Yamada, managing director of Louise Yamada Technical Research Advisors, told CNBC’s “Futures Now” on Thursday.

Interest rate cycles are long, typically stretching 22 to 37 years. This new rate cycle could last at least two decades, introducing a whole new class of investors to rising rates.

A move up to 3 percent looks likely as soon as this quarter, says Yamada, especially as expectations rise that the Federal Reserve will be aggressive about containing inflation.”

https://www.cnbc.com/2018/02/16/bonds-are-entering-a-rising-rates-cycle-for-the-first-time-since-the-1940s.html

“Might it be time for a one-post-per-day limit? I’m getting repetitive strain injury from scrolling past the towering column of dross.”

One post ? It would make it a pretty boring place in a hurry. I just scan past the ones I don’t want to read tho an ignore button would be most welcome.

If the pumpers could learn to control their impulsive anger, not be juvenile and attack the few bears almost everytime they post some news with new stats, or sharing a personal experience then the “dross” wouldn’t happen in the first place.

The dashboard looks great. Hate to be repetitive but what is the split between SFH and condos.

I really like this dashboard idea as well. Would be really interesting to see all this info broken down into specific areas.

The thing is, home owner or not – we are all true house hunters all the time – even the ones forever renting. Do you think that just because someone is currently a home owner they are never ever thinking of down/up/side-sizing? Maybe someone bought a home too large for their needs and given the extreme lack of inventory that was the only choice? To me, Victoria seems a very difficult market to move in at the moment. And, there is a lack of smaller SFH’s.

Well it’s true that you can always just scroll past and I often do. But if one or two poster’s in particular get too numerous, negative or annoying then ignoring them would be a great feature. But, we already talked about this long ago and I thought we came to the conclusion it would be too arduous for Leo.

I like this idea – but maybe make it three post’s per day. This might be better than having an ‘ignore’ feature. That way the thread doesn’t get completely saturated from just one or two people’s points of view – or – a couple posters having a senseless argument which personally I don’t find useful or entertaining at all. And – we can make our posts as long as we like 😉

Interesting HELOC chart, when you see the sudden spike it has to send chills down the banker’s spines.

:large

:large

Interesting price action in Toronto too in hot hoods. Since prices haven’t budged in over 6 months here is this a taste of what’s to come when listings start to really pop ?

“This house located in the “high demand” Chaplin Estates area of Toronto was bought for $2.14M back in June 2017 after several failed listings in the $2.5M+ range. Sold again in February 2018 for $1.8M for a $314k++ loss. Price discovery at its finest. #tore”

https://twitter.com/ExtraGuac4Me/status/964463069005938688

Great idea Leo. Will really help the true house hunters out there.

The numbers continue to not look good for the bulls, the flood gates should open after tomorrow.

Good listen from Kathy Tomlinson on her investigative report on how the Chinese are money laundering and playing bank lender then putting liens against the house and other shady shit. They need to nail this down in the budget tomorrow with a simple outright foreign buyer ban. No respect for our laws and only help keep the bubble afloat and kill neighborhoods.

https://twitter.com/Hutchyman/status/965643061958094848

Cool dashboard. Nice work, Leo.

The dashboard is a great idea! Looks really good.

Any idea on split for detached and condo sales for the week or month so far?

The dashboard looks great!