Budget Impacts on Housing

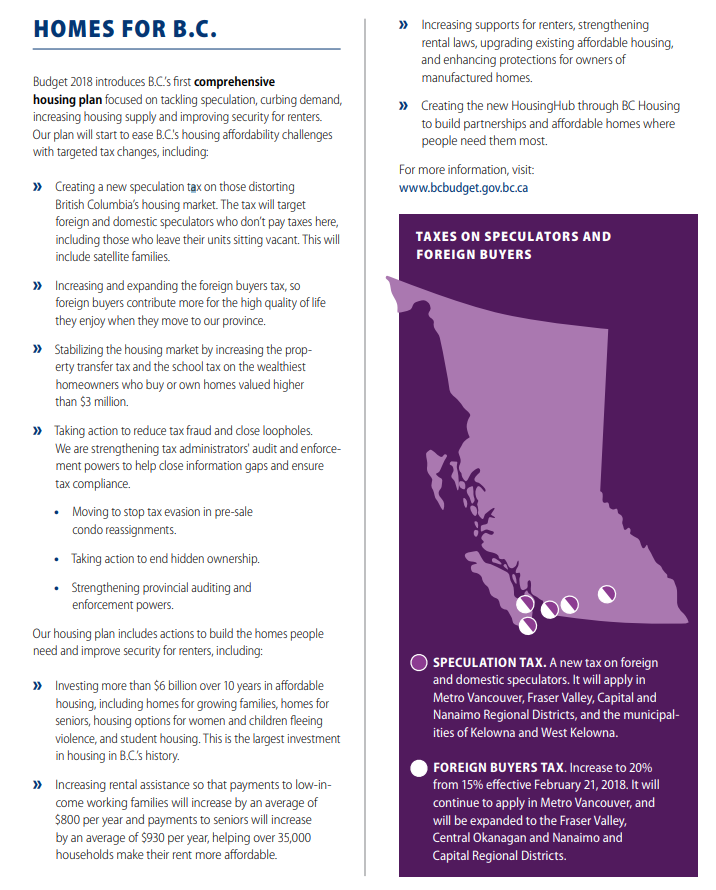

The new budget was released today and as expected, it focused majorly on addressing demand and adding supply in the housing market. A closer look coming later today, but here is the summary of their housing actions from the highlights document

Click to expand or read the highlights here. The full housing plan is here with main actions:

Thoughts?

@Introvert

The census has a specific date. When the information is actually taken makes no difference to the date applied. During the last census the applied date was May 10, 2016. So the people living in a residence on that date is the data that was collected. Also one of the questions was about temporary residents, renters, visitors etc so this information was also included.

Some more of my thoughts on how this could affect Victoria

https://househuntvictoria.ca/latest

@ Numbers Hack: “Taxation revenue is forecast to average 7.6 per cent annually due to new policy measures and economic growth.”

…And that IMO is the scary part. Almost everybody seems to be willfully, stubbornly turning a blind eye to the terrible underlying market conditions. A storm is coming, and the sheep are out drinking Kool-Aid.

Enjoy your perverse sense of entitlement while you can, Free Stuff Army, because the whole ball of wax is about to go up in smoke, and you WON’T like the consequences. (Mock me now; quote me later.)

Analysis from the Canadian Manufacturer’s association

http://bc.cme-mec.ca/british-columbia/advocacy/analysis-of-2018-bc-provincial-budget.html

Summary of budget from CU Economics

https://www.central1.com/sites/default/files/uploads/files/analysis_report/report_file/BC%20BUDGET%202018%20flash.pdf

Taxation revenue is forecast to average 7.6 per cent annually due to new policy measures and economic growth.

Marko what is the tax on trucks. It is different than my post for the price levels?

If you buy a 80k car you pay the 10%, but if you buy a F350 Lariat for 80k you don’t pay the luxury tax (you pay the 7%) because it is used for “industry.” You’ll find a lot of F350 cruising around on the Westshore..hopefully not making a stereotype there 🙂

Marko what is the tax on trucks. It is different than my post for the price levels?

Today’s housing policy platform has caught the attention of the Wall Street Journal…

https://www.wsj.com/articles/british-columbia-cracks-down-on-foreign-housing-speculators-1519173162

It does. It just doesn’t apply to 1 tons as these are often used in industry i.e. logging etc.

But you don’t need a F350 Lariat Edition for industry……the $80,000 1 tons I see haul boats, RVs, and cruise around. A cab and chassis F350 for industry is below the luxury tax anyway.

30k in provincial taxes on 150k car .

Got this right?

As a luxury car owner I don’t have issues with this tax (as long as they eventually include pick ups, that is my only beef). At least with a luxury tax you have the option of not buying the car and few luxury cars are built in Canada so you aren’t hurting the economy much.

I think we do – given that they are hindering so many of the aspects of the housing market that weren’t about housing – what do others think? Is it enough of a hinderance?

Even if our housing market actually returns to being just about housing, what does this mean for prices? Inventory? How much of an impact will it have on Victoria’s housing market? Since our best core market is so small I think it will hold up well. It’s probably not being driven by all the FB factors as much as Van.

My prediction is this budget will have more of an impact on Vancouver than here, given Van is more heavily foreign influenced. Even so, are the FB so rich they will just shrug this off? The price to pay for paradise? Or is it finally enough to chase them away and return BC to Canadians?

Some other questions come to mind…

1) Given the ‘hidden’ nature of shell companies, etc, that were buying property – up until now we never really knew how many FB there were in Vancouver or elsewhere. It was more than we thought it was, that’s for sure. The FBT up to now was not effective b/c there were ways around it. Will we now know this info. since it will be exposed? We will get new statistics? Essentially, since it appears they are creating a registry of ownership – will we now also be able to determine how many of the total current owners ‘% wise’ are foreign? Can we use this info. to – eventually – get property back into the hands of Canadians? Will this info be publicly accessible here given Canada’s strict privacy laws?

2) Will ALL the loopholes be closed? Really? – Or, will the foreign buyers somehow find new loopholes? This is what they do and they are relentless at it elsewhere (like in Hong Kong where they doubled the FBT to 30% and still have a problem w/ FB finding loopholes).

3) How will it all be enforced and will everything/everyone be captured? i.e the money laundering, the casino connections, the fentanyl connections, etc. The task seems onerous.

4) I do find it curious they did not cover all of South BC w/ the FBT. Did they have info. that FB weren’t present in considerable numbers outside of the area’s they are now covering? For ex. will FB be pushed to Comox Valley now? I don’t see it happening though given the lack of established communities for them there.

5) On Astronaut/Satellite families – where the prime breadwinner earns large amounts elsewhere (China) and sends it home to families living in mansions in the best parts of Vancouver who pay little tax here yet enjoy the most benefits, best ‘hoods – and price out locals. How will they ensure this Speculation tax that will be applied to them in a way that actually works? I wonder what they consider the amount of income tax paid here to be reasonable? (in order for them to be able avoid this).

We have much to discuss and see how it all plays out in the coming weeks/months. And I have many questions about how this will all play out. Interesting times ahead for sure!

This article shows things from the South China Post’s perspective – the news just hit them there!

http://www.scmp.com/news/world/united-states-canada/article/2134046/vancouvers-hot-property-market-gets-tougher-wealthy

Lots of rental properties in Gordon Head south of Feltham. The area is ideal for rentals: it’s walkable to UVic, Gordon Head Rec Centre, and all amenities.

Depending on when the census questionnaire was administered, many of these houses could have been temporarily vacant or transitioning between tenants.

I highly doubt that many of them sit empty for any significant stretch; it isn’t North Saanich waterfront.

Leo something we can shoot for. 🙂

Expensive to live and drive for rich foreigners as of today.

I will stick with my Bike and 15 year old car. 🙂

Hey in Denmark that would be $225,000 in taxes on a $150,000 car.

Car tax is what

7% to 55K

8% 55 to 56

9% 56 to 57

10% 57 to 124,999

15% 125k to 149,999

20% over 150k

30k in provincial taxes on 150k car .

Got this right?

@ Marko

It does. It just doesn’t apply to 1 tons as these are often used in industry i.e. logging etc.

Yes price to income and price to rent are the only useful measures in that article. The headline graph is actually completely useless because it just sets 1980 as 100 which would have been at different points in the real estate cycle in each country.

That Economist graph link is wonderful.

If you click on the tab farthest to the right which shows the “price-rent” ratio you can see that there is no shortage of subsidised housing in Victoria or Vancouver. Any SFH bought as an “investment property” is subsidised directly by the owner.

Barnum thought there was one born every minute but he would be astonished that you can have an entire swath of society eager to acquire a self-inflicted financial wound.

Leo that is from a tax decrease for his friends. There are times to cut taxes and it’s not when you are running a huge deficit all ready. Trump economics are not sound economics.

Paying 20% extra in a rising market means nothing to wealthy foreigners, but paying 20% extra in a stagnant or falling market will be a deal breaker. Wealthy or not, foreigners will walk away from RE purchases in a potentially declining market.

When I first got off my parents account and got a letter from MSP demanding money I thought it was a scam

Hard tidbit to find in the reading (one short sentence) , but the BC Home Partnership will be ‘wound down’ or cancelled to fund HousingHub.

Speculators tax is getting a lot of attention, but I’d personally rather see more focus spent on scouring land titles registered mortgage records for known money launderers and amending proceeds of crime legislation to allow seizure of these funds on disposition of the property.

The criminal element needs to be removed from the market yesterday.

Would have been nice to see a property tax credit for landlords offering long term rental housing as well.

That must be why Trump is exploding the deficit. Damn socialist republicans

Once

They cannot kill housing the revenue is required to

Pay for programs. There are some heavy taxes on

Foreigners/ Canadians buying expensive homes 3m plus. 3 taxes 20%, increased land transfer and 2%. There is a tickle down impact from a local having his house bought. I see less transaction, lower prices and lower tax revenue. Not sure that is exactly what they or the economy wants but who knows. There will be an impact not just on expensive homes but right down the line. That 2% is huge, totally agree

Hawk, don’t get me wrong. I am shedding no tears for people with $3m homes.

Gwac, that is a good question. Leaving out Cowichan but including Nanaimo seems like it needs some explanation.

The 20% foreign buyers tax is easy to understand and good for headlines, but I think the 2% spec tax is going to grind on absentee owners much harder than people might expect. I am very curious to see how it unfolds, too. I guess by starting at 0.5% it gives the NDP a chance to dial it back if the market tanks this year.

Hawk let’s bring that to the average of 1m. That is 20k plus school funding . Will have an impact on demand. I guess that is the plan so let’s see how it unfolds. Kind of interested to see if this causes the golden goose to die along with the revenue needed for the programs spends. Let the fun begin.

Once

Maybe some houses for sale cheap. That is an expensive tax. Not sure I get the rationale of someone paying that tax in Victoria but nor in shanigan or Lake Cowichan.

I’m sure the guy with a $3 million empty house in the Uplands blows $60K on a weekend on the Riviera 5 times a year. Let’s not get all sympatathic for the filthy rich. Jeezuz.

Probably all offshore and doesn’t pay a penny in Canadian tax.

Gwac, it looks that way. The income tax offset to the spec tax only looks like it will be applicable if you file taxes as a BC resident. However, they still have not said what the other exemptions might be.

Along with that spec tax for 60k, it looks like they are increasing the local school tax portion of the yearly property taxes for properties over 3m. Not sure by how much, though.

I predict a lot of waterfront to come on the market over the next year or so. I am not sure if that will have a big impact on middle-income people, though. I guess it does raise revenue from people who don’t contribute a whole lot to the local economy.

Hawk, I think the map you linked to shows more like 8% to 10% over the whole of “Golden Head”. It is only as high as 17% in one area south of Feltham. I would be really curious to see their methodology and what is actually included in their definition of “haunted house”. Even 10% is too high, though, if it means not resident or not-rented.

Marko people will find away around it

Question

Someone from Alberta who owns a 3m home in uplands and uses it in the summer will pay 60k in extra tax next year. Have I got that right.

Anyone else having posting issue. Just hangs

Marko to get around the 125k tax. . All cars are now 124,900 but you have to lease or finance at a

Higher interet rate than normal to pay for the discount. Guarantee you will see things like this.

I can see why politics are so difficult. This 125k+ tax set of a bunch emails from the local Tesla Club…

BC NDP increased tax on Tesla vehicles with no exception for EVs.

This is just disgusting.

We have to mobilize and act on this. It will hurt EV sales in BC

And by Tesla sales what they mean is highly optioned Teslas (autopilot, premium interiors, etc).

When I replied with the fact that could can buy a Tesla with the largest battery/longest range for $122,000 the reply I got was

Yup, we need to stop taxing success and start taxing petrochemical waste & pollution.

Damn, everyone has their own spin on things.

I will be curious to see what their “beneficial ownership registry” ends up looking like. It looks like it will also hit share ownership for small businesses. It is certainly the case that businesses don’t disclose their ownership changes to the govt unless directly asked, which is fairly rare.

Not sure how I feel about this. I am a big believer in privacy, particularly in the age of internet stalking. However, it seems like it has become to open to too much abuse. I am not surprised that things are tightening up.

From the article:

Yeah, well, in the BC Liberals’ quest to make life sweeter for corporations, it triggered some unintended consequences.

http://theprovince.com/news/bc-politics/mike-smyth-b-c-businesses-blindsided-by-new-taxes-in-ndp-budget

Worth a read.

Once ,

I’m sure there’s thousands more here with the same mentality setting themselves up for a whole lotta hurt.

Those poor developers dont like the new rules. Tough shit.

https://twitter.com/scoopercooper/status/966096334833897472?ref_src=twcamp%5Ecopy%7Ctwsrc%5Eandroid%7Ctwgr%5Ecopy%7Ctwcon%5E7090%7Ctwterm%5E0

Marko to get around the 125k tax. . All cars are now 124,900 but you have to lease or finance at a

Higher interet rate than normal to pay for the discount. Guarantee you will see things like this. 🙂

Hawk, that is a hilarious quote from VV. I would love to sue people when my investments don’t go up 15% a year!

That makes sense. Certainly holding your business assets in a company is good practice. Making sure the business is rental rather than property transactions is sound planning, so you can shift any future sales to capital gains. As I said, I think they will have sensible exemptions to the spec tax for people in your situation anyway.

If this isn’t a head exploding. Imagine this guy’s place going down 15%. There would be mass Hari Kari in the streets. 😉

“I wonder if BC homeowners can sue for cutting the increase in the value of our houses? I was planning on another 15% increase this year which is another 450k tax free. Curious if anyone else feels the same way?”

Some guy over there want everyone to pay 15k with any home value over 1.5m. Sell if they cannot afford the 15k. Thats half of Oak bay and people who have been there forever.

I am curious how it will hit people like Marko.

I have my rental properties in a holding company so pretty much have to rent properties for X amount of time for tax benefits unless the market is completely nuts then you forgo the tax benefits.

If I flip a condo for a $200k profit (business income) I am looking at $27k in tax (11%+2.5%) and my $ is stuck in my company. If I rent for an reasonable amount of time (capital gains) and then I flip for $200k then I only pay $19k tax and I have $100k in credits (i.e. I can pull 100k out of my company which is huge from a tax planning perspective).

Basically I already have to long term rent.

No heads exploding.

https://vibrantvictoria.ca/forum/index.php?/topic/5820-bc-home-vacancy-tax-and-foreign-buyer-tax/page-24#entry426427

Local Fool, the first year is a warning shot. In 2019 it goes up to 2%. On a $400,000 condo in the CRD that means $8,000 a year in extra tax. Unless you are a high earner paying a lot of income taxes to offset it, owning a few extra properties could start hurting pretty quick.

In a way, it is pretty much what Barrister was hoping for (but smaller).

I am curious how it will hit people like Marko. It does sound like there are exemptions for long-term rentals, so it may not be as scary as it looks on the surface for landlords.

Well, I haven’t read every detail, but here are a few thoughts so far:

MPS: Until lately, I hadn’t known that BC was the only province to have fees. I previously leaned more toward a “user pay” type system (within affordability) but what they have proposed seems ok. Personally I wouldn’t mind my taxes going up the same amount that I paid in MSP fees, but that is because I know the medical system needs the support and I am lucky to be able to afford it. If big business are going to pick up the tab, that doesn’t hurt me personally.

Ferries: I know it will be unpopular, but I think fees should go up (except for the small islands). For essentials, no one needs to leave Vancouver Island and keeping fees low distorts the real cost of travel. Plus, I want less people coming to the island from Vancouver! Just like ICBC, some day there will be a reckoning for BC ferries. Let’s make sure we don’t underfund it just to buy votes.

Spec Tax: I am glad it looks like they are exempting primary residences. That was my main worry. For the other stuff, I am wondering if someone like Dasmo, who is building a house, will have some kind of exemption. It seems unfair to punish people building a personal home. It can’t be your primary residence until it is done. Sadly, there is still no real detail on what the exemptions will be. I find that hugely frustrating, like they haven’t really thought it through, yet.

On the whole, the budget is decent. They have tried to do a lot of stuff and may have gotten a lot of it right. I hope the spending doesn’t make us regret it later, but I can’t argue with most of the reasoning.

“A few heads exploding at Vibrant Victoria over the tax changes.”

Hope the property kings don’t make a mess of their new digs. Not sure if insurance is covered under “New Rules”. 😉

Caveat, which forum is it on VV? Not really familiar with the site…

“Wasn’t it about 20% of sales in Gordon Head last winter that were foreign buyers?

Jacob, the census says 15 to 17% of ghost houses in Golden Head.

https://censusmapper.ca/maps/870#12/48.4505/-123.3590

A few heads exploding at Vibrant Victoria over the tax changes.

Quel dommage 🙂

The local UVic political guy on the news said it was the most progressive budget seen in 30 or 40 years. That’s impressive as this guy always calls it like it is.

Good points LF. With all the other head winds working against this market moving higher and more chance of lower, the new rules will be sending a strong message to the foreigners that it won’t be an easy road and they will scrutinize your identity/income sources which many of them don’t like in the least.

I think we’ll also see there was more FB going on in this town than we ever thought.

@Leif > @Jacob

Please, Teagsy.

I’m actually a bit surprised that the NDP went as far as they did here. A few things are common sense (bare trusts, tax evasion schemes, farmland for farmland), but the others are more aggressive than I would have thought.

I’m fenced about the very low spec tax. 0.5% is nothing, but it’s important to understand that policy against everything else:

…Aggressive capital controls in China

…Sharply slowing global property markets

…Rising interest rates

…Stress testing

…Increased PTT over 3 million

…Expanded and increased FBT

…Slowing mortgage originations

…Enormous consumer debt levels (primarily mortgage related debt)

…Major legal and structural changes to frameworks abused by launderers and speculators

You start to wonder if a spec tax is almost superfluous at that point. Would you buy 3 million dollar bungalows now, expecting a windfall in 3 years time? How about a condo? Do people really think it’s just going to keep climbing because “nothing else has worked thus far”?

Our market has already been slowing, without all these policy changes. And a spec tax is more polarizing – NDP would be painting a target on their foreheads if things really went south. Conversely, who would seriously support money laundering, fraud, and selling out to foreign and domestic speculators? They walked a line today, and not a bad one IMO.

Speculation always takes time to develop to the point where caution is thrown to the wind. That sentiment can reverse with shocking speed. What we’re seeing from our leadership and other institutions does not bode well for folks who think the sky’s the limit, it’s different here™ and different this time™.

It never was, and from the looks of things, that may start becoming rather apparent.

Thanks Leif, just checked it out. For anyone else who’s interested, here’s the links:

http://www.rdn.bc.ca/electoral-areas

https://www.crd.bc.ca/about/about-the-region

I still have concerns about the rest of the island, especially the Comox Valley, which has already skyrocketed, now getting hit with increased foreign buyers as well. I watched that play out in Van when the fb tax came in and it hasn’t been pretty.

I really think the fb tax should have been applied to all of lower BC.

It ends and the malahat. CVRD. Cowichan regional district runs from there to lady smith to Lake Cowichan. This should have been included.

https://en.m.wikipedia.org/wiki/Cowichan_Valley_Regional_District

If you are going to do this. Protect and tax the farm land up there also.

Andy7 it says Capitol and Nanaimo regional district. If you google it that covers all of the Peninsula and Victoria area towards Duncan (not including duncan) and Gulf Islands. Also from just after Ladysmith to past Qualicum but not Port Alberni.

It is easiest to google a map and look. I would post it but my image links never render a image 🙁

Nice to see some good steps taken in this new budget.

I am concerned about the Foreign Buyer tax… I would have liked to have seen it applied to the lower half of BC.

On the island, is it only Victoria and Nanaimo that’s getting the foreign buyer tax?

I worry that what happened in Van, might happen on the island. You put the tax one place, and it drives people into the more affordable areas, rendering them unaffordable. It looks like there are towns up island that have gone up more % wise (not $ wise) than Vic that aren’t included in this FB tax.

@Jacob

I thought it was 1 in 10 for Saanich. I’m not sure specifically for Gordon Head. There is a chart on this site somewhere.

“If two people make $45K a year total they paid $150 a month”

I think the cutoff was even lower when we were there, something like $30K if I remember correctly. I don’t know how we tell a young family with a kid that earns $600-800 a week they’re too wealthy and need to contribute more. But that’s exactly what we did for many many years.

Wasn’t it about 20% of sales in Gordon Head last winter that were foreign buyers?

I’m not sure how to add a image tag

Here is the page on speculation:

https://imgur.com/a/1lyZG

Overall not a bad budget.

On it’s own it won’t do a lot to lower housing prices IMO, but clamping down on some of the fraud and speculation will be useful.

I think the payroll tax on business is a mistake. If eliminating MSP was a priority better to pay for it with a broader based tax.

I hope “review the homeowner’s grant” ends up being eliminate the homeowner’s grant. It is a stupid program. I can defend the government taking my money and using it for useful ends. I can’t defend the government taking money only to give it back to me. It also doesn’t reduce inequality. Get rid of that expenditure and you could cut the PST by 1-2 points.

That’s BC government in a nutshell. When was the last time BC actually voted out a Premier that they voted in? Dave Barrett in 1975. Look at the Premiers of this province. They’re as criminal as they come.

I’m with Hawk on the MSP premiums. Why BC has the ‘privilege’ of being the only province in the country asking for this monthly pound of flesh was never explained to me.

Business venturing into business often has that result too.

James said the government will eliminate MSP premiums in January 2020, to be replaced by a new payroll health tax on businesses that hits corporations with a payroll of $1.5 million and greater with a full 1.95 per cent, but levies no charges on smaller businesses with payroll of fewer than $500,000.

That is good news for small business’

Corporations already pay this for their employees so now I guess they have to pick up the tab for all of BC. I would be curious to see what kind of increase it is for them paying another 2% vs paying for MSP for their employees. Seems like a lot of extra tax.

Do we?

What a relief to see they are finally taking steps to address some of the profound issues that were ignored in the Liberal era.

Unbelievably, I’m in agreement with Hawk that the speculation tax isn’t enough, but at least it’s something!

Now we will finally get to see what a housing market just for… you know… housing …looks like!

Going after foreign buyers in the way they have is fantastic news!

Go New Greenocrats Go! Hurray!

“I have no idea why they eliminated MSP premiums. Many employers already pay a contribution and low income was already exempt. Now people with plenty of money for premiums get a benefit for no particular reason I can see?”

Many employers don’t pay it. You also have your numbers wrong. If two people make $45K a year total they paid $150 a month up until Jan 18.. That’s not “plenty of money” and is a bit of cash every month with only one income.

I have no idea why they eliminated MSP premiums. Many employers already pay a contribution and low income was already exempt. Now people with plenty of money for premiums get a benefit for no particular reason I can see? Medical costs are increasing for the province and imposing a payroll tax seems less fair than income testing.

Seems like a good plan to me.

About time.

Great.

It will be interesting to see how this works but with the exemptions it seems likely that the taxes raised will not exceed the costs to implement and enforce.

“1990 on wards BC NDP you can look that up. That was huge disaster that the NDP do not even want to talk about. RCMP and other delightful issues.”

It’s the only thing the BC Liberals can talk about to make the case for why they should be the government, which says more about them than the NDP.

The MOST important thing to me is the return of the free bus pass for the disabled. No doesnt apply me at all but the anger and disgust that I felt towards the Liberals over that was huge.

That Michelle Stillwell of all people supported

Clark and her meanness was appalling.

NDP fast ferries fiasco: $450M

Debt run up in just 4 years of BC Liberals under Christy Clark: $10.85B

Solid fiscal management!

http://www.cbc.ca/news/canada/british-columbia/b-c-fast-ferries-sold-to-uae-buyer-1.852093

https://thetyee.ca/News/2017/04/13/Clark-Debt-Free-BC/

Bob Rae was Ontario

1990 on wards BC NDP you can look that up. That was huge disaster that the NDP do not even want to talk about. RCMP and other delightful issues.

Liberals at the end needed to be shook up. They lost their way.

My philosophy is simple. If you can take care of yourself please do. If there is something that makes that impossible than society should be there to sort you out. That is not Liberal or NDP.

Luxury tax starts at 125k. But I agree, should apply to all non commercial vehicles.

It is actually $57,000 but looks like they left $57,000 – $125,000 as is (3%) and just bumped it up between 125k-150k and than even more >150k.

Even though Tesla club of Victoria is already complaining about this I think it is fair. If you can buy a loaded Tesla you can pay the taxes.

I still think the 57-125k luxury tax bracket needs to include pick-up trucks not registered as commercial.

The last 16 years in B.C. haven’t been pretty.

From what I’ve looked up about fast ferries, it looked like a very good idea that then suffered from poor execution. Government venturing into business often has results like that. I don’t see anything in these announcements that indicates they’re making that same mistake.

Josh

I hope you get a house.

I have lived through the biggest NDP disaster of all time. Bob Rae so I am a bit jaded with NDP governments it all sounds good on paper but reality is not as pretty.

Yes we’ll just let ICBC and crown corps pay for all the Liberal so called balanced budgets with the last 15 years but now Joe average will have to pay $400 more a year car insurance. I’m sure more dirty laundry will come out due to severe government mismanagement and robbing from the till.

I don’t see mention of that in the 30 point plan and there’s no indication in that article of what timeframe they’re talking about. Carole James said it was balanced in her speech. 4 cents on the dollar doesn’t seem unreasonable to me but I do long for a return to $0.

And conservatives like to complain about taxes weather they pay them or not. Even if receiving the benefits of them.

Thank you sir.

Exposing the hidden ownership of numbered companies and offshore trusts etc will be huge. The money launderers and rich boy industry insiders are in for a rude awakening. Nowhere to hide now.

We so called right wingers just do not expect everyone to pay for our stuff. I know that is a weird foreign concept for most on here and on the island. You all got what you wanted so enjoy and lets see if there is the golden NDP rainbow at the end or just more taxes and debt as it goes south. 🙂

If you had been paying better attention over the years, Soper, you’d have noticed that Hawk and I are generally left wing—or at least generally anti-BC Liberals.

http://bcbudget.gov.bc.ca/2018/bfp/2018_Budget_and_Fiscal_Plan.pdf

Pg 79 of pdf (pg. 72 of budget document). Can’t copy and paste unfortunately.

I think most will be pleased that at least something is being done, especially when compared to the near criminal-level of negligence by the former government.

With the recent revelations of BC’s Wild West underworld + the AG’s response, the Gotham comparisons brought to mind are sadly hilarious.

Holy shit.

That explains the frostiness out there today.

I just buy a reservation if I really need to be on a certain sailing.

Yup.

Luxury tax starts at 125k. But I agree, should apply to all non commercial vehicles.

Josh

Bottom paragraph

http://vancouversun.com/news/politics/live-b-c-budget-has-big-investments-and-big-tax-hikes

The province’s total debt is set to jump by $4.1-billion, the largest single-year jump since 2012/13.

British Columbia debt is expected to rise to $69.4 billion in 2018/19, though James said its indictors by revenue and GDP remain affordable. Almost four cents of every dollar of government revenue goes toward debt repayment.

I know socialists like others to pay for things and and think there is not cost but there is.

The 4.1b is assuming everything goes good. With the ndp it never does

“The budget is balanced. Quit vomiting lies.”

It’s par for the course Josh. Right wingers can’t help themselves when joe average gets a break.

Last I looked Christy and gang dumped us $21 billion in the hole.

The budget is balanced. Quit vomiting lies.

Would love more details on the speculator tax.

Intro

That all equals longer waits. Better get some more boats. Good thing but has consequences for peak times that are already a disaster in the summer. More sailing are needed.

This is great news:

5.2 billion in new taxes and more debt. It is an NDP budget that’s for sure. Only real concern is that 2% business tax, rest is consumption and foreign tax so you have a choice.

150k for cars maybe should have added boats also.

More spending = more jobs= more people looking for homes=homes not going down anytime soon because of this budget. Luxery market may suffer.

Over all….great!

new tax on luxury cars

I would have ZERO issues with this tax if it applied to pick-up trucks, but it doesn’t which is complete BS. Buy a F350 Lariat for 80k to cruise around in; no luxury tax.

Curious that they don’t indicate what the degree of spec tax will be. They may be waiting to see what happens between now and the fall?

Thanks for posting, Leo. Sure a lot of dogpiling going on to wrestle down the RE market.

FB tax good, offshore/hidden ownership good, spec tax a joke. Should have been 10% minimum.

Some good stuff here not sure it will have an impact on the average home.

They targeted well.

Both CVRD regions are excluded it seems from the 20% Not sure I agree should have hit the whole island.

new tax on luxury cars

new tax on business to pay for MSP