Some quick bits

A quick update while we wait for the monthly numbers to be finalized.

| October 2023 |

Oct

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 118 | 183 | 284 | 376 | 480 |

| New Listings | 336 | 529 | 768 | 1019 | 998 |

| Active Listings | 2679 | 2708 | 2727 | 2765 | 2192 |

| Sales to New Listings | 35% | 35% | 37% | 37% | 48% |

| Sales YoY Change | +1% | -13% | -15% | -16% | -36% |

| New Lists YoY Change | +6% | +4% | +4% | +9% | +15% |

| Inventory YoY Change | +18% | +20% | +21% | +26% | +106% |

| Months of Inventory | 5.6 | ||||

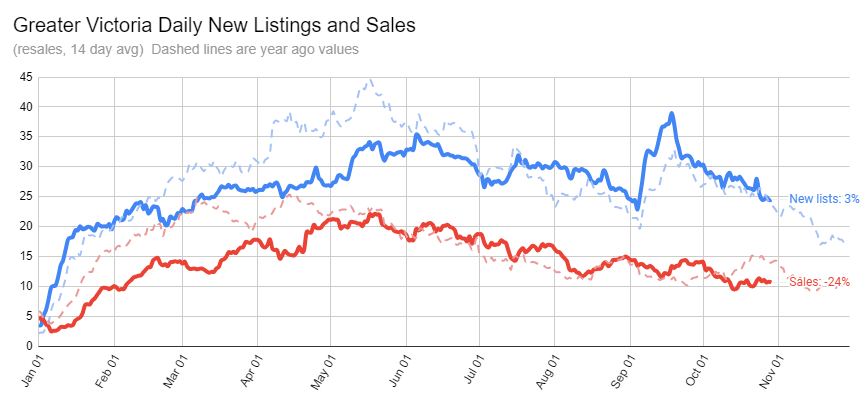

We were on track for new listings to come on roughly at the same rate as last year, and inventory growth was slowing down, likely to peak soon. However the short term rental restrictions came into effect and scared some additional listings out of the woodwork. If we look at new listings in short term rental buildings this month, we are up to 30, and there’s another day left (there were 3 just today). It’ll be interesting to see how many end up hitting the market given that the fall selling season is essentially done. Usually activity drops rapidly in November and December, so there’s not a lot of buyers to support additional listings. Sellers are also refusing to believe my estimate that the short term rental premium was 12% or more, and generally are listing at prices that reflected values before the provincial reforms. None of the listings have sold.

We should still be on track to hit close to 420 sales for the month. Over-ask sales have almost disappeared, down to just 4% of sales in the last 2 weeks.

Some readers have noted that banks can be more hesitant to finance small units that were commonly used for short term rentals. To check into this as well as renewal pressures people are facing in the current rate environment, I asked mortgage broker Mike Grace.

There’s been discussion that lenders don’t like to finance condos under 500sqft. Is this true? If investors are selling in buildings like the Janion, do you foresee any issues with buyers getting financing for 350sqft condos?

Mike: It’s true that financing condos under 450-500sq/ft is a bit more difficult, but it is entirely possible. RBC, Vancity, MCAP, RMG, BMO and Coastal Community will all finance in the Janion. There will be others as well, but most other lenders will balk at 450sqft in downtown Victoria.

How are people handling renewals at much higher rates?

Mike: For folks with larger mortgages, and enough equity, there seems to be a bit more focus on cashflow/payment management, so temporarily re-amortizing their loans to 30yrs is helping. For folks with smaller mortgages, getting the lowest possible interest rates by means of qualifying for insurable/insured transfers is a good way to go. These folks are accepting higher payments for the least possible interest expense.

Lump sum pre-payments are becoming more common as it makes more sense to pay down high interest debt as opposed to maintaining poorly performing stocks or even the super safe high yield GIC’s. I should mention a major shift recently that requalification for insured transfers can be done without a stress test applied! OSFI coming out of the woodwork to provide a bit of relief on this front.

Stay tuned for another update on Wednesday with the final October numbers.

Totally disagree. Primary residence buyers provide all the investment a health RE market needs.

New post: https://househuntvictoria.ca/2023/11/01/october-rates-and-regulations/

Meh I don’t think neighbourhoods will be seeing a whole lot of change , stuff will be slow to come on . I would be happy to see some brownstones

LMAO. Must be a coincidence that Ravi’s brother is a builder/small time developer. They will likely benefit from this the most.

I’ve only seen a couple. But enough to get the flavour.

I remember fondly Cook and Oliphant. This development was a travesty because it was going to block the views of Sooke Hills (which are nonexistent from Fairfield anyhow unless you are on high ground)

Heritage protection was a common approach by munis in California. I expect a lot more attempts not just to designate individual houses, but entire streets / neighbourhoods as heritage protected.

I guess this needed to happen, but there are going to be a lot of parking wars in the future in many neighbourhoods if on-site parking requirements are not part of the zoning.

Lots of older houses in Oak Bay on large lots. I don’t know the economics of tear-down/rebuild if you can build a six-plex on the lot? Going to be some very grumpy people not voting NDP next election.

Don’t quote me on this because I find the requirements pretty confusing, but as I understand it:

2 stories are ok with single egress, so 4plex on 2 stories no problem

3 stories with units that don’t have ground level entry you need the second egress and there’s limitations on what it needs to be. So third floor with external stair but then you still need the second way to get out of the unit on the third floor. Montreal is an exception, they have their own building code that allows the spiral staircases https://secondegress.ca/Montreal

That webpage has a very thorough description of the issue. The author wrote the building code change request but apparently it’s been pushed back https://secondegress.ca/

Does that apply even if everyone has their own exterior entrance?

Some other strategies you could employ as a buyer like buy on a street with newer homes. A newer built house in Oak Bay will not be torn down in our lifetime due to economics, but if you are buying next to a small fixer upper be prepared for a large structure next to you in the future.

Also, I would think this is going to be incredibly complicated to pull off on a bare land strata lot, if not impossible so a bare land strata subdivision with SFHs may or may not be some protection from density in the future.

Works for 3 story townhouses, but lack of single stair legalization continues to make 3 story multiplexes challenging. Consideration for national building code reform to allow single stair has been pushed back to 2030.

I think a big one is that there’s now a fast-track for OCP-compliant projects. Previously it made no real difference whether projects were compliant with the official community plan or not. They required years of rezoning and uncertain approvals either way, so developers just ignored the OCP and went for the max they thought they could get (for example, the 18 floor proposal at royal oak). Now there is incentive to submit OCP compliant projects. Make the engagement around the OCP actually meaningful, whereas before it was immediately ignored and overridden lot by lot.

Other things… These changes don’t apply to munis under 5000 people, and not outside the urban containment boundary. Highlands or Metchosin could be good areas if you want a reasonable expectation things won’t change.

So what’s left to cheer up the NIMBYs? Slow municipal permitting and interest rates staying high-ish? Asking for me.

Well that’s going to shake things up.

“The manual will set clear provincial expectations in terms of setbacks, height restrictions, parking and lot coverage.”

I’m curious what those setbacks will be. What is expected and looks good in Vancouver is totally different from Oak Bay. There is no minimum lot size for 3 units and you only need 3000+ sq/ft to do 4, so definitely 3+ storeys are coming.

I just skimmed the Bill, and the section respecting public hearings comes into force on the date of royal assent. There is a transitional provision that sets out:

So yes, it seems there will be no more public hearings for OCP compliant projects as soon as the Bill comes into force, unless first reading of the zoning bylaw was given before that date.

Gonna have to revamp the homes for living home page. Many of our headline asks have been done in October

Kind of facinating that not that long ago I spent multiple hours watching the public hearing for this small home (yes this required a public hearing) in the Oaklands area -> https://www.realtor.ca/real-estate/26211456/1346-kings-rd-victoria-oaklands

The opposition to it was fearce “I saw a deer on the property,” then the next person would be “it will ruin the character of the neighbourhood.” The stupidity just went on and on from one person to the next. The crazy part was some people lived 4-5 blocks away from the proposed rezoning/house.

Then all of a sudden a three story 6-plex is fair game, the opposition won’t have to worry about SFH infills anymore…just a three story 5,000 sq.f.t structure 🙂 Feels like the NIMBYS got what they deserved in the end.

I’m still waiting for clarification but I believe it takes effect immediately, not in 26 months. I.e no more public hearings for any OCP compliant projects as soon as the bill passes within days/weeks. Not sure the rules as to how quickly he can submit the project again, but it doesn’t have to wait for the required OCP updates

My buddy is an optimist much like yourself. I am a realist. View Royal has 26 months to make these changes then it still has to go through all the readings which they will drag out. It will be a while before he hands keys to tenants, imo, but it would he best for him and everyone in general if 30 rental units came to market sooner than later.

As for public hearings gone, finally. It’s like the introduction of the mute button to HHV! The stupidity I had to listen to at public hearings over the years probably made me stupider.

Your buddy with the OCP compliant rental project that was killed in View Royal is pretty stoked about it. Still waiting on some clarification from the province but it sounds like public hearings for those projects are gone as soon as the bill is passed.

More potential uses = more value. No doubt about that.

But broad upzoning means any development value gets diluted amongst thousands of lots. No single owner has excessive leverage when a builder can just go somewhere else.

I suspect impact will vary based on location. Places that are severely underbuilt and suitable for multiplexes (and little value in house) likely to increase more. Random lot in suburbia? Probably no huge impact.

But divergent trend in affordability of detached vs attached probably will accelerate as multifamily becomes more abundant and single family more scarce.

Let me know when something has occupancy that was built under these changes within a 1 km radius from you 🙂

Btw, any impact on market value of SFHs at all in the future given these changes?

These changes are really big. Beginning of the end for decades of lot by lot Guerilla warfare for housing

Max 21 to start with very little of site experience is about right . As soon as he gets some time under his built move on for more money . There’s no pay raises in construction . It’s 40/45 for experienced framers

In general I agree but I have seen some specific cases where CRA has gone nuts in detailed investigation of pretty minor tax evasion and cause the parties involved a degree of stress

https://www.canada.ca/en/revenue-agency/programs/about-canada-revenue-agency-cra/suspected-tax-cheating-in-canada-overview.html

Air bnb hosts use the exact scheme, buy furniture/house hold items for home use but claim it as air bnb related expense.

ok, sorry, so it’s just your friends then, that’s fine, thanks for clearing that up.

And PS yes, I think I understood your drywall scenario. When the guy sends the drywall to the subject reno site and then takes it to use on their personal home, that’s theft. And if he just invoices it but never sends it to the reno site and just uses it himself, it’s at least fraud. Both criminal.

I don’t think you understood my scenario. Contractor bids $100,000 to renovate your home (materials included). They send a load of drywall (that is not required) to subject renovation site to expense it against the 100k job, but they use it on their personal home.

I play by the rules, I am just explaining reality to you.

I’ve never personally given a rent increase to a single tenant of mine, but that’s not reality and I think caps on rent increases are counter productive even thought it is something I would never do.

Yeah, that’s criminal theft. Of course it’s a reality, but not one any of us should be proud of participating in. A country is a group project, and if everyone flouts the rules & is just in it for themselves, then it brings us all down a bit.

If everyone just does what you say, we all end up with less. So just checked, and Croatia is something like 50 out of 100 in terms of corruption. Why move here & then bring the rest of us down? I think it’s reprehensible. Things like this is why we end up having to put up signs that say “no spitting/peeing in the showers”.

PS I’m an immigrant myself, so I’m still allowed to say things like this.

That is likely coming to an end in 3 months.

Greystar Management (owners of the University Heights property) is being sued for colluding on rents.

Endless attacks on Victoria, the city just voted # 1 small city in the world by 500k conde naste readers. We are building close to a record 5,000 units per year. You should ask the developers of those 5,000 units how they got them approved.

https://www.theglobeandmail.com/canada/british-columbia/article-bc-set-to-table-housing-law-requiring-small-scale-and-multi-unit/

Off topic…My 18 year old son graduated Belmont last year and is now framing houses in west hills, they pay him $21 per hour with all the hours he wants…is that decent, I don’t know.

Also, do you guys think Langford is ever going to allow garden suites without rezoning?

I built a 20’x30′ building with a loft with a building permit…framed, rough plumbed to sewer, roofed, slab, sided…but they want me to rezone for two dwellings in order to occupy the space. My main house is up front, Its in my backyard on a 10,000 sq/ft lot in the heart of Langford by Belmont market/Glen Lake.

Thanks.

Just get a P. Eng to write a report that old infrasturcture (sewer, water, etc.,) can’t handle the density, or a bunch of other things. This will take years and years to play out. 2027 is my prediction for first permits and places like Oak Bay probably >2030.

Maybe, depends on how the legislation is worded. They are required to take into account 20 years of housing need.

No doubt some munis will explore every avenue to put sand in the gears.

Marko, the blog’s quintessential “everyman.”

Can’t municipalities such as Oak Bay and West Vancouver, after the requisite public hearing, simply rewrite their OCPs to (subtly) discourage increased density?

Due to “lack of staff” even after the $51 million muncipalities will ask for a 12 month extensions, which the province will grant. First permits will be issued sometime in 2027 or 2028.

Might not be a bad idea to pick up a teardown in Oak Bay….four units in South Oak Bay are going to fetch a lot of $ with downsizers.

Technical briefing for the changes. https://news.gov.bc.ca/files/Housing_Tech_Brief_Nov_01_2023.pdf

Looks good.

and Marko participates in all of them!

Uh oh. Marko’s “nonsense” detector is reading an 8/10. You’re in danger of getting muted, LOL.

In the case of my development property Colwood is trying to amend the OCP on a tranist route…..so it doesn’t really put an end to it 🙂

Developing… These are big changes. Lots of OCP compliant projects have been killed by regional councils here. This should put an end to that.

I haven’t sold anything in Croatia so why would I care? I had a CRA audit this year…..could care less if they audit again (other than wasting my time and increasing the bill with my accountant).

There are a million and one evasion schemes in Victoria that people do on a daily basis. You are a contractor and you invoice a load of drywall as an expense against a job but you take the drywall to finish off the reno on your personal house. 100 more examples. It is just reality.

How many developers/builders build a “princpial residence” every 2-3 years and pocket a million or two tax free and CRA does nothing?

Once again, who cares, you declare it and literally nothing happens. Even if you didn’t declare it reality is most countries don’t even have a property assessment and everything can be bought. If the 100k came into question and the CRA ordered an appraisal in Croatia or Tanzania in the vast majority of the world you can buy the appraiser for $50, assuming they have such a profession, and they come back at property is worth $95,000 CND. What is the CRA going to do, send a secrete service over to Tanzania to examine a property?

The CRA can’t (or doesn’t want to) cross-reference simply computer data in Canada let alone working with a country that is 10x more disorganized than Canada to try and achieve something. That is simply reality and either you accept it or not.

People make reference to the CRA like it is the SS and in reality they just want better wages in flex-Fridays like every other government branch.

So outside of 2012, this is the slowest October since 2011, crazy. Didn’t feel like 2013 was that busy from what I recall but looks like it had another 100 sales.

Not a good idea to use your real name and elude to potentially participating in a tax evasion scheme on a public internet forum. Unlike being criminally charged, the onus is on you to prove that you are innocent once the CRA sets their crosshairs on you.

You also have to declare your foreign assets every year if total cost amount was over CAD 100K. Page 2 of income tax return.

We’ve been trending down since 2020!

October 2010 – 467

2011 – 483

2012 – 373

2013 – 512

2014 – 602

2015 – 734

2016 – 735

2017 – 664

2018 – 598

2019 – 619

2020 – 990

2021 – 745

2022 – 480

2023 – 407

In general, would be a difficult to track due to nature of business in Croatia where a lot of property transactions include a substantial payment of cash euros (at the request of the buyer) for a variety of reasons which would take a long time to explain (a lot of people have physical $ on hand from tourism, etc.). I know a lot of my friends that have sold in Croatia are always bringing back $10k/cash at a time. The mentality there is also simply very different. For example, a Croatian would think if PTT is 2% and we’ve agreed on a million why don’t I give you $200,000 in cash and will save $4k in PTT. Majority of sales are private, no real estate agents, a lot of no mortgage required buyers, etc. I much prefer the Canadian system/way of thinking, but I’ve learned to adapt in Croatia when doing business; you have to approach is completely differently.

One thing I do like there thought for pre-sales is different tier pricing depending on how much you put down. You can get upwards of 10%-12% off purchase price on a pre-sale with 100% payment upfront (less bank/mortgage carrying costs for the developer).

Most hhvers probably didn’t experience 2008 in the states, they cannot fathom how a 400k place can go down to 90k. There are differences in the Canadian Market and vacancy rates are much lower in Victoria but I see a real possibility that those units in the Janion going down 50% in value.

Yes that is exactly what I think will happen lol. For example I think airbnb would have seen a significant downturn next summer that would have flushed out alot of the recent buyers anyways. But I guess May 2024 is better than October 2024.

Investors are very important to a well functioning real estate market. At the end of the real estate cycle they are the ones that take heavy losses and begin to sell their investments which brings prices down. The more heavily weighted the real estate market is towards investors, the larger the fall in prices and the longer the market takes to recover.

For the most part that’s what happen in the US market in 2008. The cities that had the most cranes building condos mostly for investors rather than for home occupation took the bigger hits in the market.

As all contributors to this blog are law-abiding Canadian citizens above reproach, I suppose it will be superfluous to observe that the capital gains tax one would pay on a Canadian property sale are identical to those due on a similar sale any of us might make in, say, Croatia.

Final October figures

Sales: 407 (down 15% VS last October)

New lists: 1100 (+10%)

Inventory: 2756 (+26%)

ok, just to note this, of course you know that a resident of Canada has to pay the capital gains taxes even on the condo in Zagreb. But I agree with you fully on the diversification. For me, it’s GIC’s, dividend funds, etc. and no tenant hassles.

This is why it is really important to diversify and why I’ve been buying property in Croatia ever since Trudeau came into power. No property tax, no spec tax, no capital gains tax, strata fees 80% cheaper. I just ran the numbers on a pre-sale condo I purchased in Victoria in early 2016 vs Zagreb in early 2016 and while appreciation has been similar. Approx 90% in Victoria vs 110% in Zagreb the after-tax return in Zagreb is insane as no tax(es) I would be pocketing the entire 110% uplift. Here the annual taxes + capital gains really add up.

Yes good idea!

I agree with VicRE that we’re in a more extreme environment. Which makes sensible changes like what you’re suggesting maybe even more important.

I think what’s really going to happen is that all the various changes to RE rules will more or less coincide with some kind of recession and reduction in number of investors in real estate, which is fine. Just hard to say later what was & what wasn’t successful if everything is happening all at once.

Reality is if u have 4 or 5 condos u probably bought them piecemeal as money and leverage came available with not a lot of thought to end game . With the small investor it’s pretty tough to guarantee anything , everyone luvs an investment until it goes flat and on to the next thing .

That would be sensible but too late now, government at all levels are looking for extreme measures to appease the public and buy votes. Right now airbnb and landlords with mulitple units are in the crosshairs. You already saw what happened with airbnb

There should be a “this is a secure rental” election that landlords make, that would do three things:

– 1. landlord would get better tax treatment (lower property taxes, more deductions on rental income)

– 2. in return, by declaring “this is a secure rental”, this means landlord gives up the “move in within two months”, and this changes to something longer, like six months or a year.

3. prospective tenants are made aware if the landlord has made this election, and can seek out these rentals.

Landlords who still need this “move in within two months” capability still have it, and they just don’t take that election. But they will be considered “hobby landlords”, not providing secure rentals, and may be subject to higher taxes.

An investor who owns multiple individually titled properties has outbid the same number of would-be owner-occupiers, who then have to rent. He is not adding to net rental supply. In addition the properties in question do not provide secure tenure.

Wondering why you think this? If someone is holding half a dozen condos as rentals, aren’t they providing a much-needed supply for the renters? I mean, someone holding half a dozen condos is not going to be looking to evict tenants under the “move in yourself” route, or anything like that. So isn’t that the kind of mom & pop long-term landlord we want to see? Why castigate this person as a “hoarder” or force them to buy a purpose-built revenue property when they’re already providing purpose rental properties?

I realize government at all levels has to do something to get the situation under control, but there’s also the concept that to a guy with a hammer, everything looks like a nail.

Oops how did I miss them!

Fascinating article about discovering the secret behind Roman concrete and why it self heals.

https://www.popularmechanics.com/science/archaeology/a42555277/why-ancient-roman-concrete-is-so-strong/?utm_source=google&utm_medium=cpc&utm_campaign=arb_ga_pop_md_pmx_ca_urlx_18645655673&gclid=Cj0KCQjwy4KqBhD0ARIsAEbCt6hmOq-_sV4oV_4JA1z-Cxsi4BDFYtSaCAkt7mvU2Oo2fzqK0dtjk1QaAmgCEALw_wcB

When tenants violate terms of their lease, such as not paying utilities or having adults not named on the lease occupying the premises, such as two of my imaginary tenants, they can be evicted with 2 months notice. According to my imaginary property managers.

I guess those property taxes I’ve been paying ($30,000 a year) are imaginary also. I wonder where all those monthly deposits coming into my banks are coming from. The tooth fairy? Some people are beyond ignorant.

Well Patriotz, I was

But I was talking about changes in the CG inclusion rate, not the election to take advantage of the soon to be discontinued $100K CG exemption. Two entirely different things.

https://www.taxtips.ca/filing/1994-capital-gains-election-package-t664.pdf

That’s good news for the tenant REaddict and for the rental market. That’s probably why I am seeing an increase in properties that are listed vacant. Once the tenant gives notice to leave, the owner decides enough is enough and puts the unit on the market.

So Frank, you’re hooped again. You can’t evict the tenant just because you want to sell. The new owner has to do it if they want to live in it or have a close family member move in.

https://youtu.be/8ckPatPBAk8?si=rWk8c-ETkrE17BLD

I’m not referring to a capital gains exemption. I’m referring to capital gains payable when an investment property is sold. As I hope you know, there is no “capital gains exemption” on RE sales of investment properties. There is an inclusion rate of 50%, which isn’t an ”exemption” . And yes, the 50% inclusion rate offsets the effect of inflation.

I’d suggest you rethink that, you are implying that the capital gain exemption is to account for inflation on investment properties? I think you need to go back to googling.

Walked past the pearl on the boardwalk and they did a fantastic job on it . The zinc shingles really nailed the look , much more so than ironworks .

Well no, the cola adjustments savings on the tax brackets don’t match for the capital gains tax paid on gains from inflation when selling an investment property . I’d suggest you run the numbers on that, and if you disagree, we can continue the discussion, where I can demonstrate that you’re wrong. . And it’s not even close. Not to mention corporate entities that are flat rates,

Whatever, you can’t evict people just because you want to sell a property. You’d have to move in or have a family member move in for six months first.

I agree with you VicREanalyst, it will discourage investors from buying additional rental properties. I suppose one could say it’s a form of rationing.

People will try to get around it. Just as foreign investors did using money mules or Smurfs.

I met a person a decade back, that told me he owned 95 condominiums in Vancouver. The most I’ve heard from someone in Victoria is 15. That was when the banks were giving out mortgages to anyone that could fog a mirror. I guess they won’t be happy if this happens.

My opinion is quite simple if you want to hold half a dozen condos as rentals, then you should be buying or building purpose built revenue properties with five or more suites. Otherwise you’re just hoarding homes that people could have bought to live in.

A $1.8 billion damages verdict against some US RE firms,. Many more lawsuits to come. While this goes to appeal, and ultimately to the Supreme Court, it will hopefully shake up the RE industry leading to more open competition and lower fees. If the verdict stands up on appeal, it may be the end of buyer’s commissions being paid by the seller in the USA. And the buyer’s agent will need to collect money from his buyer. To be clear, this is all US only, no effect on Canada.

This verdict just covers some RE companies in a few small states, and it could be tripled to $5.4 billion. Essentially the sellers objected to having to pay buyer’s commissions. And it seems like the verdict means the RE companies need to refund buyer’s commissions paid by the sellers for the last 7 years, and possibly triple that amount. That could wipe out these RE companies, .

https://www.cnn.com/2023/10/31/economy/national-association-of-realtors-commissions-high/index.html

Realtors found liable for $1.8 billion in damages in conspiracy to keep commissions high

“ Plaintiffs in the class action included sellers of more than 260,000 homes in Missouri, Kansas and Illinois between 2015 and 2022, who objected to the commissions they were obligated to pay buyers’ brokers. The verdict followed a two-week trial, and the damages award can be tripled under U.S. antitrust law to more than $5.3 billion.

Most of those pre-construction contracts in the Pearl occurred in 2019 when condo prices in Victoria were significantly lower than today.

Would also take away a primary appeal of acquiring additional investment properties. I would say on a net basis it would likely result in more homes used as primary residence and boost ownership rates.

Can’t blame people wanting to get top dollar for their investment! Now let the realtors work their magic!

You’re wrong Patriotz,

The 1994 capital gains exemption, for up to $100,000, is applied generally to capital property like cottages, rental properties, stocks, mutual funds, and similar capital assets. This election was typically filed with a taxpayer’s 1994 tax return, due April 30, 1995. A late-filed election was permitted for up to two years afterwards, with penalties payable accordingly.

Two new re-sales at the Pearl just hit the market in last 30 min. One is asking 180k more than pre-sale price and other 200k more than pre-sale price.

What municipality are they in? If they are in the COV they will get caught up in the 4 stays per year max so you could do two nights x 4 times but you are probably better off financially doing 90 days x 4 times (and if doing 90 days no need for a business licence).

Are you referring to the provincial legislation? If so then “principal residence plus one secondary suite or laneway home/garden suite on the property is allowed”

So in theory if you lived in a municipality or regional district that allowed STRs as a permitted use for your property type you could STR your principal residence (when you are away) plus another unit, but not multiple other units.

That is not what has happened when the CG inclusion rate has been changed in the past. The only valuation day was when CG taxation itself was introduced back in 1971.

If principal residences were made subject to CG taxes, you would very likely see a valuation day.

So a blip of sales in the short term, while in the long term making people less likely to part with investment properties. Sounds brilliant and therefore totally plausible.

You do realize that the actual tax brackets are adjusted every year to account for this very inflation right?

Yes that is the intent, to force the condos and SFH on the market in short order while still making it attractive for larger scale residential investment to occur. No one complains when someone buys up an 100 unit apartment building as an investment but people are up in arms when someone or persons buys up 100 individual condos as an investment.

I don’t even think you understand what Patrick just wrote down LMAO.

Yes please re-read my post, this is for investment properties or aka, the “commodification of housing”

A local BnB operator seems to think they’ll have to start operating as a 90-day plus rental business as a result of the new rules. I don’t think that’s the case because they’re primary residence is on the property. Questions for anyone in the know: Is there a maximum allowed “suites” a property can have? Are there any clear restrictions on what an income suite or garden suite is? Could a duplex for example be considering one half to be an income suite? And are there any exemptions for BnB operators who have been running a registered STR business (basically a hotel) for decades, before platforms like AirBnB existed?

Four or more units could also be an older fourplex. My point is that you don’t want investors to stop creating new rental housing such as condos or single family houses with suites. What you want to do is pry those older single family houses out and onto the market. The older homes that would be affordable for middle income families.

In my scenario, If Frank wants to be a landlord, then he can buy a new home with a legal basement suite and still get the exemption.

In the past what the government has done is set a valuation date where the rentals would be deemed as if they had sold. After that date any increase in value would be taxed from that deemed disposition date onwards. If Frank wants to keep his rentals then he would have to crystalize his investments as at that date which he can do by having them appraised.

I work with accounting firms to provide retrospective reports for CRA tax purposes. The most common one is when someone inherits a property or buys a new home and then rents their original home. They have changed the use of the property from home occupation to rental use and any increase from that date would be subject to capital gains.

Patrick, this applies to rental properties not your primary dwelling. If you bought the home you are living in for a million and it has gone to two million. It’s all yours tax free.

Patrick-You’re one of a very few people on this site who make sense, and usually agree with my perspective.

It would be unworkable if cap gains were taxed as full income.

If a $1m house rises to $2m via inflation, and someone sells it for $2m, they haven’t gained anything if they need to buy a replacement home for $2m. Taxing them with a $1m gain and $500k tax would be absurd in that case. They wouldn’t sell and the RE market would freeze.

So , to stay even, they at least need a tax break on the portion of the cap gain that is due to inflation. That’s one reason the cap gains inclusion rate isn’t 100%, as a rough estimate of inflation gains being non-taxed.

They might “discuss” it, but IMO it wouldn’t go much farther than that. Tax rates based on number of properties sounds arbitary and complicated. 0% on third or more, but multi-unit 4 or more is exempt? Doesn’t make sense.

.

You are right Frank. Some landlords will chose to evict their tenants before putting the property on the market. But the tenants will be entitled to compensation.

Those evictions would put pressure on rents to increase due to the low vacancy rate. But not all landlords would be evicting at the same time. There is also the issue that current market rates may have reached their maximum level so there may not be the ability for rents to increase much more than they are today.

In my opinion, it is necessary for the government to address the stock of older housing that is not being put up for sale. I think what will happen to tenants would be temporary and as more housing comes on to the market prices will decline which will help tenants to become home owners.

Lower house prices will also make it more economically feasible for developers to buy land in the city that they can assemble for rental housing.

A change in the Capital Gains exemption and the ending of deferring property taxes would incentivize Baby Boomers to downsize which will open up the middle income market.

Now Frank, aren’t you glad I don’t work for David Eby. I sure hope he doesn’t read this blog.

or maybe your imaginary tenants would still be imaginary tenants at the imaginary house with new imaginary landlords

That’s what the rumor is, read my post again, any building with 4 or more units would be exempt.

I heard it was something more like any sales after xx date would be subject to the new capital tax exemption, this way it will bring on supply quickly just in time for the election.

My imaginary tenants would still be real homeless street people.

Someone else posted the other day that they heard rumors the federal government might do something so I checked with some insider contacts back east today.

Imaginary properties with imaginary tenants…. On the off chance that it isn’t imaginary, if you divested then someone else would either buy it and live in it themselves or buy it and rent it out to tenants, zero impact on supply vs demand.

Don’t know what the right scale is, hhvers can decide for themselves how trustworthy my insider contacts are (where you at airbnb4me?) 🙂

Higher for longer is the slogan of the day. That may end up being bullshit, but the rhetoric suggests they will be cautious not to cut rates too soon.

If I divested my properties, some of my tenants would be homeless. Another very bad idea from a very bad government.

Vicanalyst , I suggested similar changes to the Capital Gains Tax on this blog months ago. It didn’t go over well with some of the posters.

If it does happen. Then it will be necessary for owners to determine the value of their investment properties as at a valuation date to be determined by the government. The government has done this several times in the past so there is precedent. 25% and 0% seems a bit harsh on investors. You don’t want to kill the sacred cow, just wound it.

I would alter it so that those investors that purchase new buildings would be exempt. In that way the government is targeting the used home market which would incentivize these owners to divest but not reduce the demand for investors in new construction. No sense in using a broad sword when you only need to use a scalpel.

Yeah that was funny. Never heard of a Realtor shortage. I doubt any will come through that program.

Leo and they want to fast track realtors to fill the shortage, Marko is being run off his feet and needs help

Hmm maybe the markets think Canada will blink first and cut interest rates for a faltering economy. Sad that interest rates really just normalize and Canadians can’t stick it

“In response to growing concern over Canada’s capacity to welcome more newcomers, the federal government says it will incorporate housing, health care and infrastructure planning with provinces and municipalities when setting the country’s annual immigration targets.” https://www.thestar.com/news/canada/canada-s-immigration-planning-will-now-take-into-account-housing-health-care-and-infrastructure-minister/article_b695c8d3-a474-59e2-9dd3-5681b63cbb36.html

Not that I see much to that effect in the plan. https://www.canada.ca/en/immigration-refugees-citizenship/campaigns/canada-future-immigration-system/plan.html

They did mention: “Candidates with experience in trades such as carpentry, plumbing and welding, would add more workers to Canada’s home building sector.”

And cracking down on fraudulent acceptance letters for international students.

Sounds like the plan to think about housing comes later.

Canadian peso down to 72 today.

Just had a chat with my own insider contacts on bay street. Seems like the capital gains exemption on investment properties is something that is being discussed in Ottawa, 25% on 2nd property and 0% on third or more is one of the proposals. Multi unit (over 4) buildings would be exempt.

Leo S, some lenders have appraisal guidelines that have unit size regulations. For example an accessory dwelling unit can not be less than 350 square feet as well as restrictions on some vacation rentals. These guidelines vary amongst lenders with some having no appraisal lending guidelines at all.

California passed a similar legislation requiring salary ranges in job ads. After that I remember seeing jobs advertised with a range of $75,000 – $225,000. Not very helpful in practice.

Wont’ matter for jobs that are bonus heavy as the bonus could be a big range, for example a posting that says 140k to 160k salary with a max bonus of up to 100% base salary still won’t tell you much.

Great to c the flat gdp . Maybe another 12/18 months of pain and then a slow climb out , should help to fix the housing market as investors flee

Pointless government intrusion into the private sector. Lots of employers and employees prefer pay amounts to stay private. Nothing wrong with that.

Funny how this is coming in now just as the labour market is tightening up. The quality of resumes our firm got in the last 2 months is drastically different from a year ago. Anyone else seeing the same thing?

I am curious is money will be clawed back from the ex-wife or the investors whom did get paid out.

ya doesn’t make sense, unless the strata in that particularly building needs to be notified prior to signs or locks being put on the property?

Which is 100% not how it works.

Martel investors resign selves to losing huge sums, talk about impact on their lives

https://www.timescolonist.com/business/martel-investors-resign-selves-to-losing-huge-sums-talk-about-impact-on-their-lives-7761216

Sounds like he is saying strata is notified prior to listings going live?

I like this.

B.C. job postings must include pay amounts starting this week

https://www.timescolonist.com/local-news/bc-job-postings-must-include-pay-amounts-starting-this-week-7761200

“For folks with smaller mortgages, getting the lowest possible interest rates by means of qualifying for insurable/insured transfers is a good way to go. These folks are accepting higher payments for the least possible interest expense.”

“I should mention a major shift recently that requalification for insured transfers can be done without a stress test applied! ”

Would it be possible for someone to explain what these mean? I’m familiar with insurable mortgages, but is there a way to access this when equity in a home has been built?

As a builder/developer I am definitively going wood as it is substantially cheaper. If buying for myself personally, concrete all the way.

Unfortunately in Canada even in concrete construction we don’t do concrete wall partitions. In Croatia the places I buy, even low-rise, concrete with 10 cm concrete walls in-between the units, extremely quiet. In the background of this video I made you can see what a really structure should look like -> https://www.youtube.com/watch?v=c-7W-Z4cpa0 not 2”x4” and OSB.

As for quakes….not sure I would be too worried about a modern concrete building. A 5.5 hit my place in Zagreb and cups didn’t even fall off the counter-top, zero cracks anywhere, and many older buildings in the neighbourhood were condemned and completely written off.

I’ve served on a lot of different strata councils and I have no idea what you are talking about?

See what happens with those condo listings; a couple of acquaintances of mine that sit on condo boards in buildings downtown: one got notices for 10 listings in for their building and the other 13 notices for their building this week.