July: Market remains resilient, but price growth stalled

July ended with sales a respectable 17% above last July’s total, while new listings were about the same and inventory was up 12%. That was a substantial improvement from mid-month when sales were running about even with the year ago levels, and roughly in line with June’s figures relative to a year ago (+15%).

Those sales are not high given we are coming off a 20 year low, but it’s a decent showing considering how much more expensive credit is now than 12 months ago.

200 condos were reported sold last month, which is actually around the midpoint of the historical range and better than detached sales which came in near the bottom. No indication that there were an abnormal number of new condo sales reported so this looks like an accurate count. (Note that last month I pointed out the unusual number of new condo sales being reported, but not all of those ended up being counted in the final figures that were released by the board which are reflected in the charts below).

Given that rates and the mortgage stress test are 1.5% higher than a year ago and prices are unchanged at best, you might think sales would be lower than they are. But the month ended with solid activity and sales steady. There’s many ways that could be explained away: perhaps buyers with rate holds jumped in in advance of higher rates, or sellers wanted to make deals to go on vacation. However over time I put less and less stock on rationalizations for the numbers and prefer to deal with the data as it stands. And whatever the reason, those sales occurred despite markedly deteriorated affordability.

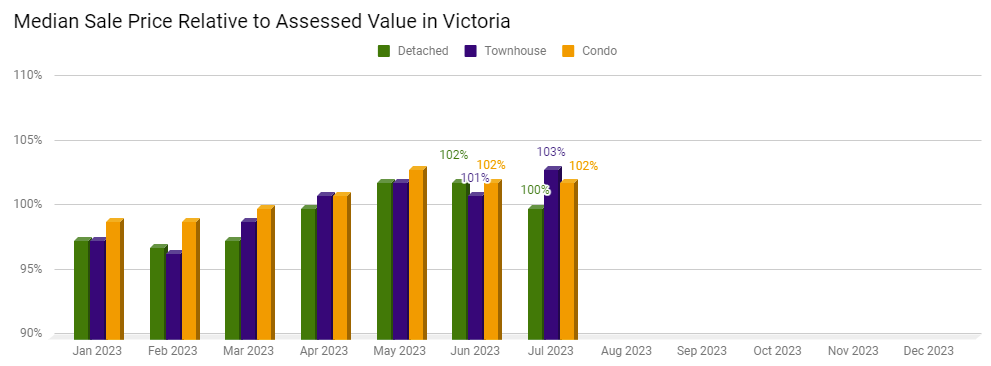

The rate of over-ask sales declined in July, but that’s fairly normal after the spring market. Expect more subdued activity on that front for the rest of the year.

Though incomes are rising at a reasonable rate, that’s not nearly enough to counter the impact of rising rates. Affordability has been deteriorating in recent months due to the partial price recovery and rising rates after remaining fairly stable for the preceding year.

That’s going to drag on market conditions, and we can see it starting to happen. Months of inventory has been creeping up again (indicating cooling) after being on a downward (heating) trend since late last year.

It’s not a major move, and it wouldn’t take a lot of sales to reverse it, but it’s consistent with the pattern in the sales to new list ratio, which has also started dropping (cooling) again.

On the housing activity gauge, we remain in sellers market territory, but we’ve pulled back from substantially hotter conditions in the spring.

Normally this level of inventory are associated with rising prices, but the shift in market conditions has stalled out price gains for the time being. The only property type where median prices are still on an upward trend are townhouses, but as always there are fewer sales there so the data is noisier.

The same picture is evident in sales to assessed value ratios. The median detached house sold for exactly assessed value, which means no change in value since July 2022. That’s a dip from June, while there was no change in condos at 2% above assessed value, and townhouses rose slightly to sell for a median of 3% over assessment. Some outlets got very excited about the high average house price of $1.37M in July, but that number as always is nearly meaningless and jumps around drastically from month to month. Prices in reality have not changed much in 3 months.

Breaking that down by price ranges, there’s isn’t a huge variability for houses under $1.5 million. The higher end seems to be holding up better. That could be that luxury buyers are less rate sensitive, but it could also be that BC assessment is less accurate in their assessments of those more unique properties.

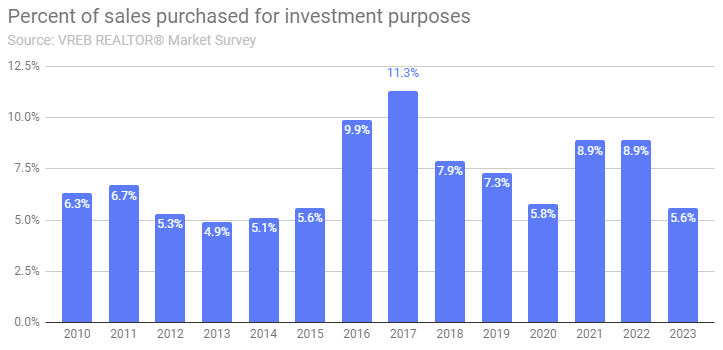

Investors meanwhile have been largely sidelined by higher rates. Despite very strong rents growth, it’s tough to make the numbers work when you’re borrowing at 5-6% not only on the investment property but also the primary home.

Overall I’m sticking with the forecast I made to start the year which is for the second half to be weaker than the first. No doubt the price bump we saw in the spring was stronger than most expected and the Canadian market (and by extension Victoria) surprised to the upside as it has many times in the past. But stubbornly higher rates will drag the market for years as they filter through, and the unemployment rate is likely to only rise from here. Set against still tight inventory, I don’t expect prices to make any big moves, but end the year more or less where they started (which was a few percent below where they are now). For buyers and sellers, that relative stability is a welcome change from the frantic years we experienced since the pandemic.

New post: https://househuntvictoria.ca/2023/08/08/whats-going-on-with-airbnb/

Even if you have to rent out your current house and move into the new build for awhile.

I still think you are better off building it out to turn key, way bigger audience. Banks won’t touch a lot.

The opposite happens Max. If you’re building a spec house and it hasn’t sold then you’ll sell off some of the lots you purchased for future builds. You need the cash!

Builders finance their spec homes too. They are paying high interest rates on the debt and trying to get extended credit from their suppliers until the house sells.

You don’t want to be a landscaper in this type of slowing market. You won’t see any money. The trades that get shafted are those that do the finishing work. Electricians that have to come back and put the outlet plates and light fixtures in, landscapers, finishing carpenters, etc.

I don’t think we are in that type of market. There are lots of people loaded with cash that can put down big down payments. Lots of people that have made buckets of money buying and selling properties over the years. I haven’t seen any house listed or sold for less than what it was last purchased.

You are far better off building the lot out than trying to sell it vacant right now…but you better hurry up.

Frank, land values are still high. Lots of building lots for sale and not many selling each month. You are going to have to wait before land prices come down.

The last economic downturn, entire new subdivision went bankrupt. A few houses built, some only half finished and the rest vacant lots with incomplete services.

Vacant land is costly to service to the lot line. Money is expensive and those bank charges every month eat up most of the profit. There is a credit crunch coming. The government is going to have to bail out developers if they want new housing built.

Or they can stay out of the market and let the vacant land developments be bought out at two-bits to 50 cents on the dollar.

The market is going to take care of itself. I am not in favor of governments interfering in the natural order of cycles. Someone has to reach out and hit the reset button.

Whatever- I have both, I don’t buy new homes, tend to stick to well maintained houses from the 50’s and 60’s. Rebuilding homes every 40 years will only make the housing crisis worse. Canada already has a huge inventory of houses that need to be torn down. In some neighborhoods, the houses built 70-100 years ago were literally shacks.

I hate to beat a dead horse, but the only solution is to decrease demand, yesterday.

I heard a rumour that they found some affordable land to build a pile of homes on. It’s next to the unicorn ranch.

Pretty sharp downturn in construction jobs in the past few months.

Well Frank, built in economic obsolescence is a good thing. 30,40 or 50 years from now the house will be torn down and a new one built creating more construction jobs.

As for the quality of homes built today. You can drop that quality further with economy flooring, cabinets, fixtures, etc. to bring the costs down. Above ground basement entry homes on slab foundation with about a thousand square of main living area and a 3/4 unfinished basement. Build half a dozen of these in a row and you can bring down the construction costs for first time house buyers.

You can have it either good or fast.

-Pick one. You can’t have both.

Frank is getting near the point actually, which is that building a cheaper structure is not going to help affordability today when land prices alone are so high. What we need is more units on less land per unit.

I remember AHOP myself, it got a lot of criticism at the time, and predictions that it was slum building, but it turned out pretty well. But remember in the 1970’s Surrey was way out there and far less developed than today. You could still build an affordable SFH.

What’s the sense in building a crap home? It will only have to be torn down and rebuilt in 30-40 years. Planned obsolescence is okay for appliances, they’re cheaper to replace than repair. It’s not okay for a home. I’ve said it before, I’ll say it again, what they are building today is substandard compared to 60+ years ago. I’m watching a friend’s new cottage being built nearby- stick framing, OSB sheeting and 1/2” drywall you can put your fist through. That’s today’s standard, it’s crap.

Listen to the Minister and reflected on past solutions that were made during previous boom markets. One such initiative was near identical standard house plans that would be approved quickly. The houses were economy construction basement entry homes with a single carport. The basement was left unfinished to reduce costs and the sites were not landscaped. The construction had to come under a pre-set amount to qualify for the government project. Most of these homes that I encountered had been built in Surrey under an AHOP program. They were cheap homes that could be built quickly in about three months.

The homes were crap, but they were still a home.

Bit of both I think. People opposed to housing will continue having endless arguments for how we shouldn’t build more. Zero point in engaging there because they simply don’t want it and no reasoning will convince someone to accept a townhouse nearby. It’s more about the government realizing what they need to do and spotting a bad argument when it’s made. I think we’re there, with Eby not being afraid to call out the NIMBY academics like Andy Yan for doubting that we need more homes.

From our discussions with Eby and Kahlon I have no doubt they get the problem and want to fix it. Remains to be seen if they have the political courage and competence to actually do it though.

Remains the case that a good chunk of the voting base doesn’t think it’s a problem at all, and certainly doesn’t want it fixed. Liberals have been getting negatively polarized against zoning reform for example.

Could you go a little easier on the strawman arguments?

https://www.cbc.ca/news/canada/british-columbia/single-family-zoning-split-1.6800265

It isn’t simply a matter of creating more supply. It is also a matter of how one goes about creating competition for all builders and developers and not one or two large corporations.

Sure the government could re-zone a section of land to provide 5,000 new homes but if that is then sold to one developer that creates a monopoly on land prices.

Otherwise we might have the government getting into the land development business and creating serviced building lots to be sold off in small blocks to different builders via a lottery.

There are examples of this in small communities where the municipality has developed an area for industrial use to promote new businesses to locate in their towns.

I agree, but it would appear that the arguments are simply endless. Right after this one we will roll into a brand new argument and the recent changes to strata property act and this airbnb non-sense will be forgotten.

There appears to be zero self-reflection along the lines of “hmmm we made all these changes and literally nothing happened, maybe we should think about supply.”

I guess most missed the segment on CBC nightly news that put an Airbnb owner on one side with 3 Toronto residents who couldn’t find an apartment for rent on the other . One woman went to an apartment that advertised 5 units for rent. She had $24,000 to advance pay the rent. When she got there, an Airbnber had offered substantially more for all 5 units. This is where

the problem lies, primarily in the rental market. It takes little investment for an individual to rent any number of apartments. To purchase a house or condo is out of most people’s reach as an investment. Put simply, anyone and their dog can sign a lease, put up the security deposit and 2 months rent and bang! you’re in business.

As for the person who rented out a few rooms in the house they were living, that is totally different than permanently renting your entire house on a short term basis. Same with Marko renting his primary residence while on vacation, that is what airbnb was intended for. However, outbidding renters looking for a place to live so one can earn extra money with little skin in the game, is causing a shortage and inflating prices of apartments.

Also, purchasing a house or condo solely for the purpose of turning it into a hotel room, is contributing to the housing crisis.

In some communities, like cottage country, it might actually provide a service for vacationers.

Many factors went into creating the housing crisis, including the COVID-19 pandemic and builders’ inability to secure the building supplies needed to build more structures. However, it’s difficult to deny the role Airbnb — and, to a lesser extent, its smaller competitors — played.

There’s nothing inherently wrong with short-term rentals. The problem is that local governments have a tough time reining in the number of short-term rentals operating in their cities. The overwhelming number of Airbnbs makes it difficult to provide enough housing for permanent area residents

We know that property owners, referred to as “hosts” by Airbnb, can make far more money renting their property to out-of-towners on a short-term basis than they would collect in monthly rent from a traditional renter. Airbnb hosts snapping up property as soon as it hits the market diminishes the housing supply available to everyday families. Renters have been hit especially hard as rental costs have soared.

Because the proliferation of short-term rentals is a new problem, it’s yet to be determined how local governments will balance the needs of the community with the rights of the investors. It may be that they will set a strict limit on the number of Airbnbs allowed in their cities. They may also impose a high enough tax on short-term rental operations to discourage hosts from settling in their city.

As municipalities work to find a solution to address the issue, local renters continue to struggle to find an affordable place to call home.

It will return units to the long term market by solving the enforcement problem. It makes a difference in the same way that building those units new makes a difference. When we’re talking about a shortage of tens or hundreds of thousands of homes, a few thousand potentially returned units provincewide is certainly not going to solve the major problem, but it helps a bit and reduces one more argument to supply side intervention (“it’s useless to build more because it’ll all go on Airbnb”)

It doesn’t. Taxes are automatically applied and remitted to the province and muni on short-term rentals.

Provincial Sales Tax: 8% of the listing price including any cleaning fees and guest fees for reservations of 26 nights or fewer in the Province of British Columbia. For detailed information, please visit the British Columbia Sales Tax website.

Provincial Sales Tax: 7% of the applicable service fees. For detailed information, please visit the British Columbia Sales Tax website.

Municipal and Regional District Tax: 2–3% of the listing price including any cleaning fees and guest fees for reservations of 26 nights or fewer in the Province of British Columbia. For detailed information, please visit the British Columbia Sales Tax website.

You’ve had plenty of articles/ideas on adding regulations. I just don’t think adding more (like your bnb government licenses idea) will make a difference.

“You ban airbnb my unit sits vacant while I am away”

“Well, yes”, your neighbors would say, “as it should”.

Smart politics to ban them to a large extent. After all it is mostly rich people ( or so is the perception) that own them and often own a number of them.

There are some 115 building lots for sale in the Greater Victoria area, yet only five sold last month.

There’s the problem.

Lot prices have to come down before we will experience any surge in new construction. Until this is addressed we will see F.A. done to increase the number of new homes built.

During 2020 small lots in Langford were selling at around $279,000. Today they are asking $369,000. And the cost of a new 1,800 square foot completed home on one of these small lots is around $900,000. Very little can be done to lessen building costs such as material and labor. Those lot prices have to come down to make new home prices less expensive.

How much do they have to come down? That’s hard to say as land doesn’t depreciate, but it is effected by market conditions. There is no bottom to land prices as vacant land has no rental value. Unlike houses that can be rented If completed home prices fall too low then investors will step in to buy the completed homes for their rental cash flow. There is no rental market for vacant land.

Way too simplistic. Yes in an ideal world we have an abundance of both long term and short term accommodation. We don’t live in that world, and in the meantime prioritizing long term (need) over short term (want) makes sense. By all means when we are swimming in homes we can nuke those regulations.

More regulations?

The solution to the housing crisis is LESS government regulation, not more. This would encourage a building boom, which is what we need.

Month to date activity:

Sales: 104 (up 25% vs same day last year)

New lists: 231 (down 2%)

Inventory: 2398 (up 11%)

New post tonight (coincidentally about Airbnb)

Could it be that pretend to do something would keep them in office for that pension?

Because, it would be political suicide if they are actually doing something for the greater good of society that would upset the NIMBYs, and their myopic social engineering supporters.

There’s a dead simple way to do this that completely solves the enforcement issue without compromising host privacy

After the fire in Montreal, that is what Quebec is going to. Should solve the problem of enforcement, and this is what BC should do as well. Any option where the cities are in charge of enforcement and have to chase hosts won’t work well.

I don’t know but they need progress, so I don’t think telling the public they got data sharing from the platforms does a whole lot… They would much rather go on TV and tell the public that they put xx units back to the long-term rental pool/housing inventory come election time.

Most won’t, some will, just like they are now.

It’s the optics that government is doing something that is the point. I have no idea why but Airbnb seems to be all of sudden in the forefront now.

Just view royal alone votes down that many proposed units every month.

It is literally nothing.

Not sure I agree, the market is not nuts and people still aren’t backing out of 200k over ask accepted offers.

What makes you think they will back out of 200k over ask offers in a hot market?

I can’t imagine that the province is going to pull the rug out from transient zoned condos like the Janion. This zoning is legal and the units this would be grandfathered at worst, but my guess is that the zoning and right to rent short term remains.

I’d expect that the legislation will be aimed at data collection and mandatory requirements for licensing at the platform level – ie. Airbnb and VRBO must display this info and owners have to complete a statutory declaration about use of the licensing conforming to license requirements. It will then be easier for municipalities to set up and enforce licensing requirements which may include that the unit has to be your primary residence with a yearly cap on number of days it can be rented.

I guess we will find out soon.

It’s a few hundred units in the City of Victoria. Not nothing, but not massive.

I see this differently. A huge part of the justification for fixing the real problem comes from fixing the minor things that people think are major things and then having it not work.

You and I know the real problem, but the general public doesn’t. Ever read /r/canadahousing? It’s 90% people claiming AirBnB or foreign buyers or investors or financialization are causing the housing crisis. It’s intuitively attractive. People are pissed at the housing market, and the obvious culprit is your landlord who is an asshole and charging you crazy rent. Zoning is complicated and arcane and the defenders of it make attractive points (we’re sticking it to the developers building overpriced housing, we’re protecting the community, we’re ensuring the place looks nice, etc).

Supply side reforms only get political support when you address the demand side at the same time, even if it’s just lip service. That’s not a criticism of anyone, I spent hundreds of hours over 10 years thinking about the housing market and didn’t write a word about the supply side as a cause for high prices. Granted I’m 50% dumber than the average but it’s a weird issue where once you get it it’s blindingly obvious, but before that it’s very difficult to see.

Yes. Though less obvious when the market isn’t nuts.

Same issue it solves in the new build market. Emotional buyers making bad decisions during high-stress transactions and regretting them.

Debatable whether it’s a big enough issue to justify the intervention. Similar to the new built market. How many people back out of condo presales using the cooling off period?

My point is there is a lot of reference to airbnb listings but a lot of those listings are such situations if airbnb was completely banned it would result only into a small fraction being converted into long term rentals, or sold.

If there are 2,000 airbnb listings a small % of those are going to be sold or long term rented.

Aka the impact of cracking down on airbnb will be minimal while we draw attention from things that would actually move the needle.

No one cares about the important shit like why are ocp complaint rezonings being vote down or why does it take 1 year to get a garden suite permit in saanich to build a garden suite for aging parents, when it should take one week.

It was suppose to cool off insane bidding wars “driving up prices.”

Do you believe the legislation improved consumer protection? What issue did it solve? You still can’t inspect the house during those three days of cooling off.

You would be ok if that is your principal residence.

Who knows, government will do whatever they feel gives them the best shot at pleasing the public come fall and housing is at the forefront this time around.

Hard to actually measure this. When we get the new vacancy tax data we will see how many units previously exempt due to rental restrictions are now either paying the vacancy tax or have dropped off (due to being sold or rented). It’ll be a few hundred province-wide, maybe up to the low 4 figures.

Pretty much. Always was going to be a nothingburger for prices but to be fair I don’t think anyone ever said it was designed to lower prices. It was always a consumer protection measure, not price control.

Well this explains why there are so many outdated assessments still. System pulls in the data from 18 months ago, and a lot of agents don’t bother to update them to the current value.

As usual, my sales/assessment charts only use listings with current assessments

Lots of short term rentals are not tourist related. Life gets complicated, people move to a new city etc., and require a rental on short notice and for a short period of time. This is nothing new, and short term rentals have always been available. They provide needed accommodation for Canadians. The government shouldn’t mess with them by “amending the definition of short term rental to anything less than 90 days from 30 days.”

Ohhh yea and the cooling off period came into effect January 3rd, 2023. Starting to lose track of all the non-sense legislation introduced in the last 7 or 8 years.

What’s happened since the cooling off period went in? Affordability deteriorated what 10 to 15%? (Leo?).

Wouldn’t that require an amendment the tenancy act as that would elimate renting to someone month to month. You would need to start every tenancy with a three month lease?

What’s next a one year min on all rentals? When I was a respiratory therapy student bouncing around hospitals on the lower mainland and Victoria I didn’t need places for 8 or 12 months.

Just like everything completely overestimated. Did we already forget the ban on rental restrictions in stratas just half a year ago? Wasn’t the suppose to add thousands of units to market for rent? Has it?

In my building there are 10 +/- units up on airbnb year around, 80% including mine are principal residence. When I go on vacation I lower the price and rent it and the remainder of the year I have it on airbnb for some insane price that if it comes to fruition I sleep at friends or in my office. It’s happened before.

You ban airbnb my unit sits vacant while I am away. My scenario is just one of many different scenarios that would result in no units being converted to long term rental units. Would some unit be put up for long term rent? Yes, and in my estimation less than just approving one apartment tower downtown.

People suffering heart attack up-Island are getting substandard care, doctors say

https://www.timescolonist.com/local-news/people-suffering-heart-attack-up-island-are-getting-substandard-care-doctors-say-7378023

a large number of people are saying that actually. It is being hammered home by city planners and politicians. It is a do nothing response to distract from the failure to address the true cause and more importantly the real solution and who’s responsibility it is to execute

I dont think anybody is saying that banning a large number of AirBnB’s will solv the housing problem but it will add a lot of additional units to the market for housing.

Well, I was trying to explain to Frank how we can be in need of affordable housing at yet be able to use airbnbs for travel.

For us the main difficulty with affording a home is getting in the door. Given the constraints imposed by lenders (39/44% debt service and stress test) we’ll still be saving quite a bit on the other side of a home purchase. As a consequence of simple and frugal living. The difficulty is the high barrier to entry.

Running a Bnb was a path to affordable housing for my family. We rented 3 rooms in our house which carried us through the downturn post 2008. Without it We might well have become homeless. Blaming bnb operations for the incredible shortage of housing units is absolutely laughable. The housing crisis began the moment governments stopped building social housing yet they are the ones pointing fingers outward. So let’s ban Bnb altogether and that won’t even move the needle on the problem and may actually prevent people from affording a mortgage with the price of a house these days. They will be coming for your home office, your workshop, your crawl space and your tool shed next.

Whatever the motivation the crosshairs are on air bnbs come fall. For anyone that owns one the transient zoned condos and thought about selling, this could be the last crack at getting a premium over the other condos.

Also heard some talk about amending the definition of short term rental to anything less than 90 days from 30 days.

Lmao, if you could you would have already. 100k a year in passive revenue doing that Lol go have another drink.

Frank, I honestly don’t understand what you’re saying here.

Several things can be true at once.

Given the housing shortage those units should be returned to market in greater Victoria or at least be better regulated.

That segment is however a minor perturbation that will not make a long term impact.

Like Uber as an alternative to taxis, Airbnb can be a reasonable (and often much more affordable) alternative to hotels. Especially in other parts of the world that aren’t so screwed up on housing.

All this discussion of airbnbs has inspired me. Since people who are having a hard time finding an affordable house to buy support airbnbs when traveling, I guess it’s okay for me to renoevict my long term tenants in Ladysmith, and throw a hundred grand at it. I could put a tenant/ supervisor in the basement suite and airbnb the main floor for $300-400 a night. 3 bedrooms, 2 bath, large raised deck with great ocean views, heck, maybe $500 a night. A hundred grand a year revenue, stress free knowing my property manager lives downstairs, what a great idea (for me).

Because politicians love to use myopic unqualify social engineering public to get in power for that golden pension. Instead of leaving the planing to the trained and experience professionals.

Don’t want to hire qualify/experienced “50 year old white guys”. Titanic CEO Stockton Rush

First it was the dirty Chinese money that drove up our housing price, then it was the foreigners, then it was boomers that refused to downsize, then it was rich investors that leave their houses empty, and now it is airbnbs.

When are we going to stop blaming on others for the demise and focus on the where the problem actually is?

High housing costs are due to the lack of supplies, because we voted in politicians and councils that restrict development to save the “green space/environment”, and added a mountain of red tapes.

Limiting it to a owners principle residence is the likely route for the NDP. Politically a good move and it will bring some additional units on the market.

Most measures are political theater. The bc ndp is closely watching the federal liberals digging their own grave due to housing so they are going to do what they can to appease public opinion. Airbnb is a pretty easy target, limiting its use to only if the owner is also occupying the residence province wide. They can then say that they have put xx housing units back into the long-term rental pool during election time.

What does cash rich mean? Are u still going to be cash rich after housing payments if you buy?

Another do-nothing idea to help housing, the equivalent of “burning the furniture” (tourist accommodations) for heat, for a one-off insignificant addition to the housing supply.

I would be more inclined to Airbnb a suite but wouldn’t rent it long term

Getting rid of hundreds of AirBnb.s in BC might not be the overall solution but it would add more units to the housing stock while reducing the number of investors that you have to compete with for a condo.

Certainly for whatever people move into those units it will make a real difference.

@Frank i think many commenters on here have above average household incomes. Probably bc it’s a housing blog that tends to attract investors. There is a lot of pain out there right now – even tho some are feeling it less and some not at all.

@Kristan our neighbors have roughly the same size house as ours but they don’t rent out any of it. Seems crazy to me but perhaps that’s because I didn’t have a lot of money growing up so I just see it as cash on the table. Either way we are here on a vacation that is out of reach for most and they are there enjoying all their empty space (we have 2 suites rented out to long term tenants and someone else renting our main residence while we travel). As you say Kristan – each has their own priorities. I saw a house one street over from ours that rents for over $500 a night on Airbnb. Makes me feel like living in the backyard – I tried to float the idea of moving into a tailler in the backyard (seasonally) to my husband but he doesn’t think it’s worth it (even for $500 a night and even if it’s a very nice trailer).

For us vacationing is not the right word. Let me elaborate a bit so you get the right picture.

My sister happens to be visiting WA with her husband (who’s doing field work while here, so this is a work trip for him) and their two little girls. They live in rural Maine and so we don’t get to see them often. We’re renting a house with them for a few days through Airbnb. About half of the rental is a work expense for him, so the total cost is half the lodging split between the two of us. But even if we were paying it all, that total cost is comparable to Motel 6 for both families and < half of a decent hotel.

We’ve also used Airbnb when visiting Ucluelet (half the cost of hotel) or when I take my family with me on work trips (at worst comparable to hotel and much more suitable for family AND a work related expense).

Reality is that for people in our situation (younger and above average income) that we’re cash rich but housing poor. About 40-50% of take home pay goes into the “saving for a house” bucket, the expenses are very simple (how many times have you had oatmeal for lunch?) so that a trip like this one, even though it’s optimized to save $$, is a drop in the bucket.

Also a big fan of Airbnb. It is great for family travel. I rarely stay in hotels and we travel frequently. I think we would stay home more if hotels were the only option. Still, the changes are coming in BC – and it seems like Quebec too.

People (including me) like the self-service and low-cost aspects of airBnb’s.

There should also be more “tiny hotels” aka “Capsules” offering bare bones place to sleep at low cost https://www.cntraveler.com/galleries/2014-09-09/cozy-or-claustrophobic-the-smallest-hotel-rooms-in-the-world

They range from “capsules” to “low frills hotel room”

Here’s an extreme example …

Next msg

Food is too expensive, rents and housing are too expensive, yet everyone seems to be vacationing in AirBnBs???????

Salting the earth where the planning offices stand still seems to me to be the best way forward..

Dee, let me echo everything you said about traveling in Airbnbs with kids. I’m fact we’re in one now visiting family in the states. 🙂

My take is that, in Victoria, the problems with Airbnb are mostly an indirect consequence of the heavy restrictions on development and building. If we had anything approaching reasonable supply then Airbnb wouldn’t be a problem.

Multi-pronged multiple things creates multiple bureaucracy. Probably making things worse. Don’t hold your breath.

The NDP appear to be taking a multi pronged approach including tackling zoning issues. Devil will be in the details come fall.

Either way, fixing things from the the supply side will take time – freeing up homes via rental restrictions or air BNB has an immediate impact and will help some in the short term. I also think the feds should drastically reduce immigration. Point is, the Province can do multiple things at once.

The primary reason we choose Airbnb over a hotel is because they are far more workable with kids. In a hotel room there are two beds in one room – or pay double the rate for two adjoining rooms (assuming that’s a possibility). In our Airbnb there are separate bedrooms so the kids can share a bedroom and the adults have a bedroom. In a hotel there generally aren’t cooking facilities. In our Airbnb we can make dinner at home and eat at a table and have that semblance of continuity and connection – no matter where we are. All of our Airbnb have been much larger than any of the hotels we have stayed allowing us some space which helps avoid conflict (especially on longer trips). They are also cheaper than hotels. Bottom line is hotels were mostly designed for business travellers and adult leisure travellers. Some hotels have taken steps in retrospect to make their spaces more family friendly but the general room design never seems to out longer term stays with children first.

That being said I do agree that there should be more regulation.

Great, let’s burn another year or two banning AirBnbs without addressing real housing issues. Guess what will happen to rents and prices? Nothing. Only tangible outcome will be a hotel stay in Vancouver will be $1,000 a night.

The government is actually really smart. They get people all excited about things they will do, poorly, that even if done well do shit all to buy themselves more time. What has all the legislation that has been passed in the last 7-8 years done? Instead of talking about why are municipalities voting down OCP compliant re-zoning applications we are talking about AirBnb.

We are at all time record unaffordability and after AirBnbs are banned or regulated more or whatever, guess where we will be at most likely. Record unaffordability.

“LMAO, if this were true then you and your “boyz” sounds like some real winners.”

Says the wannabe finance bro lol

I run high end high quality airbnbs in areas that have 100% occupancy in hotels but somehow I’m a villain and whiners that think they could afford my properties want to rent them. I’m sorry to be harsh but that’s the reality of it all. If I put my STRs up for rent (which I have in the past) for market rent I’d be criticized endlessly by whiny losers that think they should be able to rent my place for whatever their budget is

Yes, I had some great stays this summer in Airbnb’s in Europe. Also use them for short stays in Vancouver. Cheaper and better than hotels. Hopefully the government won’t mess too much with them other than regulations.

Not necessarily opposed to regulation that requires business licences, appropriate taxation on business, etc, just thinking it is a bit tricky as many cities don’t seem to have enough hotel space in the summers. Perhaps the balance will be found eventually.

Extraordinary claims require extraordinary evidence.

AirBnB is a subsidy to the tourist industry since the properties do not pay commercial property tax rates and license fees, and often evade income taxes. Properties are also not subject to the same regulation as hotels, etc.

What you get for this is some more low paying jobs in tourism – which can’t fill job vacancies as it is – and competition for housing stock that’s in short supply. I don’t think that’s a good deal.

Yes it does. You may google it. I’m sure the real estate agent on this blog can confirm this as they should have taken a webinar on this topic.

If the Air bnb regulations reduced the number of short term rentals (which I presume would be the intent) I wonder about the secondary impact on tourism. I have used air bnb to make travel more affordable, especially in summer months when hotel space is limited, non existent, or price prohibitive.

Does that protection actually exist in this day and age?

Personal Information Protection Act (Private Sector)

Under PIPA, individuals have the right to access their own personal information. The law also states the rules by which organizations can collect, use and disclose personal information from customers, clients and/or employees.

Couldn’t AirBnBs be monitored through the utilities? An owner of several units would have their name on several hydro accounts, or is that included in condo fees? I’ve never owned a condo.

Re. regulating Airbnb, I don’t think it is as hard as you think provided there is political will.

The way to make it cheaper to enforce is to have mandatory data-sharing re. payments in the same manner that employers have to report employee income, mandatory visible licensing in units and online with the online monitoring responsibility being with Airbnb, statutory declarations by operators re. health and safety as part of licensing, and automatic taxation imposed and remitted at the platform level. The province has the power to require all of these things.

It is clear the NDP are making this a priority. Leaving it up to municipalities is both unfair and unworkable.

You can read the UBCM recommendations here and my bet is that they are implemented.

Given our vacancy rate, I think the majority of voters will be in favour of this.

https://www.ubcm.ca/sites/default/files/2021-11/Policy%20Areas_Housing_Priorities%20for%20Short-Term%20Rentals%20Report_2021-10.pdf

LMAO, if this were true then you and your “boyz” sounds like some real winners.

Re: Airbnb’s and effective legislation. I am

Im Europe and am now in my 5th Airbnb in my 5th country. There is very little or no regulation here. I am skeptical that they will be able to effectively regulate it in BC. I think Eby called it a “wicked problem” which I think means it’s very difficult to solve. Anyway that’s assuming that the problem with Airbnb is that they convert long term housing to short term housing – and assuming that the solutions offered would end up converting airbnb to long term housing. Also aren’t there new builds in Victoria that have a certain number of units set aside just for Airbnb? Aren’t there a lot of people who are quite entrepreneurial who make their living doubt Airbnb (and could t make the same with long term rental)? I’m not saying it’s morally right (or wrong) but I have read politicians referencing these things when talking about the difficulties in making rules around it. In addition to paying for on the ground enforcement (bylaw officers) i sure hope they have a healthy budget for their legal team to defend the lawsuits that will inevitably come up. Perhaps I’m being too negative. It just seems like a very difficult pool to wade into.

Took the words out of my mouth. Heh.

Thanks Alexandra for the suggestion about Thetis heights! We’ll take a look.

Thank-you for the mute function, Leo.

A tidy anecdote on Garth today revealing what can happen when snowflakes bat their eyelashes and step into the ring with contract law. It’s worth passing on to anyone you know who is stretching their resources to try and complete a purchase.

“Everyone and their dog will now buy anything the second rates are cut since everyone is now a macro economic expert LMAO. The favorable base effect for inflation is also over now.”

You normally post some of the dumbest shit I’ve ever read but this is actually on point so congratulations frequent contributor

Yeah to bad the NDP are about as useful as BC Ferries so we’ll see if they can string a sentence together to end AirBnBs, I’m not the least bit worried and will continue to avoid renting long term as it’s been nothing but a problem in the past

Also had a good laugh with the guys on the tailgate with beers on Friday about this blog again. The BS shared here is incredible but you guys keep hoping for that crash in your moms basement while we’re out wakeboarding on Shawnigan this weekend

For nearly a decade, new condos have been regarded as sound investments in Toronto but rising interest rates coupled with the flattening of average sales prices since March mean some investors are facing an increased financial burden — even struggling to close on projects nearing completion.

Those who invested in preconstruction condos in particular are in increasingly challenging positions. In some cases, they’re unable to finance the closing of a property due to lower than expected appraisals and interest rates that are significantly higher than when they bought the units.

“Preconstruction condos for the most part that were purchased in 2019 through 2020, after commissions, after fees, those individuals are not making any profits on this side. They’re probably actually taking the loss,” said Jordon Scrinko, CEO of Precondo, a firm that handles mainly preconstruction projects. He says it’s been a busy few months for his firm.

But not busy in a good way.

“It’s putting out a lot of fires, calming a lot of people down, trying to find out-of-the-box solutions,” said Scrinko, who adds the firm has been getting lots of calls from other people’s clients looking for help as they approach a project’s completion.

I think that the Airbnb free for all party is over. The NDP government has put a lot of time and effort into the housing platform and has already announced they are looking at new regulations. My guess is that there is going to be a move towards proactive and effective enforcement of licensing at the platform level – which only makes economic and public policy sense.

Doesn’t mean there will be zero Airbnbs, but there probably will end up being zero unlicensed Airbnbs and those that are licensed will have to pay the vacant homes tax unless they rent long-term for at least six months of the year. That is a big penalty at .5% of the assessed value of the home and that, along with all the licensing fees and very effective enforcement with high penalties, is going to kill the economics for those who might think of doing whole house short-term rentals.

It was occurring because inflation wasn’t impacted, no longer the case now. Everyone and their dog will now buy anything the second rates are cut since everyone is now a macro economic expert LMAO. The favorable base effect for inflation is also over now.

P.S. insider contacts tells me Ravi is about to kill airbnb condos in BC come fall, so if you own one, now is a good time to unload.

Why? So police don’t do any enforcement as part of regional force instead of not conducting enforcement within their municipal structure.

That’s the way it’s supposed to work. However, we have governments and central banks that think differently. Every time the market finds a price unacceptable to governments, a huge intervention (money printing) occurs.

+1

I’m not in the market, but have friends/family members who are. “Absolutely depressing” and “keeps getting worse” is (unfortunately) a good summary, and it would be nice for some relief.

This is truly one of the nicer areas in Langford IMO, especially once you are back a few blocks from the highway. Fantastic access to walking and biking trails (not to mention lake swimming) Reasonable bike commute to downtown if you have to go that way (Phelps Connector trail). Traffic on Millstream a bit of a pain but you can literally walk to foodstores that are right there.

The issue they are going to have is that inflation and the job market are really only minor (but the most visible factors) when it comes to the rate. One of the main factors that people like to ignore the more debt there is out in the market, the higher the rates need to be to sell it (this might be news to the folks that believe in borrowing their way to wealth). I actually had someone say to me the other day: “rates can’t go up because people have too much debt”, they couldn’t grasp the concept that more debt people were carrying, is the reason the rates need to be higher in order to keep it marketable for debt bond buyers to take it on. So, this is also true for the budget will balance itself world, to keep the loser cheques going out to those that believe their neighbours and fellow citizens should subsidize them, the government is borrowing massive amounts of money. To support that, it needs to sell bonds, to make those bonds competitive, rates still need to go up. They have put themselves in the position to even keep the rate where it is, it will require QE and I think everyone has finally figured out what that does for inflation. Not to mention, the fiscal capacity to undertake QE again in Canada has been more than expended. So, if rates don’t go up again in September, they will just need to go up again at another BoC meeting before Christmas and probably for more points then instead of what the September rate increase would have been.

Keep in mind: there’s one more inflation report coming before the rate decision.

Lousy jobs report has reduced chances of a BOC hike in September. Swaps market odds of a rate hike fall from 34% to 27% after the jobs report. Implying an 73% chance of “no change” in rates in September. Odds of any hikes this year also fell to 45%, making the base case to be that the BOC is done.

One reason for the rising unemployment is that the labour force grew 2.8% YOY, adding 590,000 workers. Canada needs to add that many jobs just to keep the unemployment rate steady.

https://www.theglobeandmail.com/investing/markets/inside-the-market/article-instant-reaction-how-economist-and-market-views-on-future-boc-rate/

Might be one more reason that Oak Bay properties cost more. Also why over the last decade Esquimalt has seriously increased in desirability.

How did Duncan avoid it’s place on the “top five” list? I sense intrigue and machinations.

Victoria’s unemployment rate remains one of lowest in country

https://www.timescolonist.com/business/victorias-unemployment-rate-remains-one-of-lowest-in-country-7370732

https://www.timescolonist.com/local-news/above-average-crime-severity-number-shows-need-for-regional-force-say-victoria-police-7372197

Pretty much prepare to self insure. Like florida is going, I expect most anything in the fire interface zone will be uninsurable in the future.

Extreme weather risk changing Canada’s insurance industry, raising costs

https://vancouversun.com/news/national/extreme-weather-risk-changing-canadas-insurance-industry-raising-costs

After moving to the westshore a few years ago, we realized how much more we love it here – such a good spot to live and raise a family, parrticularly Royal Bay. Langford/Colwood has everything we need, we never bother going into downtown victoria. when we do we can’t wait to leave anyway.

It’s housing market has caught up to most places within the city, but i think the upside is huge including the growth plans along the ocean front.

Kristan….I don’t want to try to change your mind knowing you have your hearts set on a certain area. But if you haven’t already, google homes for sale in Thetis Heights area of Langford. This is a very nice location for children to live in. School nearby, buses, walk to all types of shopping and eateries, nature trails, Thetis Lake Park etc. Also, from there, if it is not rush hour, you will be able to reach town at least just as quickly as you would from many parts of the peninsula.

Right now there are at least three lovely, fairly modern homes for sale well within your price range (between $850K and $1.1 M ) and sitting on large, quiet ,private landscaped lots.

Maybe get the kids in the car and drive out to some of these places, park and walk the entire area. You have to walk an area to truly get the feel of it.

Just a thought.

The suite is a legal suite also. There is also downstairs space for the main house in addition to the main suite, the backyard is also flat absent of weird trees. And one can say stretch and say they live in Oak Bay….

Allenby is in the sweet spot for buyers. A good size main floor, renovated, and a bedroom suite. That’s the type of property prospective purchasers are clubbing each other over to buy.

The only draw backs are only two-bedrooms on the main floor and a dining room addition that added to the original square footage of the main floor. It would have been better to have built a third bedroom rather than a dining room.

Hi Alexandra, thanks! We’re looking for detached with 3+ bed 2+ bath (we have three young boys), ideally 1700-1800+ square feet and a bit of a yard. Doesn’t have to be a lot but usable. Our upper bound without a suite is 1.125m and 1.275-1.35 with a suite (depending on one vs two bedroom). Although the wife would prefer not to have a suite if it can be avoided. (We’re pushing 40 and it would be nice to finally have a space just for us; but if need be, we’ll be flexible!) We’re not interested in Victoria proper; too expensive. We’re looking up the peninsula where we can get more value but not as busy as the Westshore, and where we’ve been renting anyway. Problem is that’s a small market. Positive side is it’s easy to keep tabs on everything that comes up at least.. all this being said conditions are so bad (and getting even worse!) that all of our hopes may have to get tossed. We’ll see.

1936 Allenby St? That is more like Oakbay/Henderson/Sannich boarder between Foul Bay and Richmond, with upgrades and a legal suite on a 6000sqft lot with a flat backyard. But ya, I was expecting $1.2 to $1.25 sale price.

Hello Kristan, I can’t remember your price range, size of home etc. you are interested in….could you remind me again? Thanks.

From: https://financialpost.com/news/economy/canada-sheds-jobs-july

Hopefully, the numbers stay strong enough for one more good interest rate bump in September before the recession kicks into gear.

Hey Adam, just to update on those potential distressed sales, two of those five have sold since then. One at its 2022 asking price and the other at an enormous gain for the sellers. The other ones are holding steady.

Thing is, inventory is so bloody low that people can demand 2022 prices even when interest rates have jumped to 6%.

Absolutely depressing to me. With things being historically bad for first time buyers like us it would be nice for it to not keep getting worse.

In general, a housing recession will impact first time home owners more than luxury home owners. However, when a luxury property goes upside down in their mortgage and the owners have to sell, it’s like a Boeing 747 hitting a mountain rather than a bunch of smaller planes. Lenders face a larger potential loss on luxury homes as the demand for them goes into a flat spin.

If you google the news media for the Seattle and San Francisco markets there are some interesting thoughts on why their prices for luxury homes are in decline in those locations. The articles lack substance and rely too heavily on Zillow. But that’s the sign of the times which is only going to get worse with chap gpt. GIGO

My guess Barrister is that many of those homes were bought some years ago, or even decades, when they were much cheaper. Their occupants don’t “need” the money, so they sit much longer. Forced with dropping the price some $250k, or waiting and locking in their massive gains over the last years to fund retirement, most would rather wait a bit longer. It’s in the <$1.5M younger crowd that we are going to be seeing distressed sales/price drops. Kristan was pointing out some that they thought might be examples of this last week.

The 2 to 4 mil range of houses seems to be really slow but on the other hand there does not seem to be a lot of price reductions. It is like there is no urgency to sell and people are waiting for a real top dollar offer. A lot of these listings seem to be seriously overpriced to me but obviously I am out of touch.

Crazy thing is I have people phoning me along the lines of “we are pre-approved at 5.79% for X amount and would like to buy a home.”

I am guessing August will be very slow, but then just today some crazy over ask sales. Bungalow in Saanich listed for $1,150,000 and sold for $1,343,000 and a number of other 100k over asks.

Market is defining all logic imo.

VicRE: So exactly what do you think is happening and how concerned should I be?

https://youtu.be/5FEW5mh7iAI

Now that the 5 year bond yield seems to hav found a home at 4%, it’s just a matter of weeks before the slow victoria folks realizes what’s happening. Happy long weekend:)

In the 70s and 80s, there were two distinct inflation episodes that led to double-digit price increases in Canada. One from 1971 to 1976 and another from 1977 to 1983. In both cases, food and energy price shocks were the trigger.

So taking money out of peoples pockets helps everything?

How?

Didn’t say that. What I did say is that tax cuts were partly responsible for starting the inflationary spiral .

And yes the tax revenues didn’t go down, because of the hot economy of the 60’s. The point is that tax cuts put more money in the pockets of consumers which is inflationary.

https://en.wikipedia.org/wiki/Revenue_Act_of_1964

“Tax cuts are inflationary as they increase spending power of households. Tax cuts in the US, together with Vietnam War and social program spending, were responsible for starting the inflationary spiral of the late 60’s, 70’s, and early 80’s.”

So we just kill the young people with moon shot taxes?

I have been apartment hunting for months. My son and his girl want a place to call home. The rentals in Langford are very nice, brand new, applicants are thoroughly screened. 1 bedroom, 1 parking slot is $2200. Belmont market is by far the best, they have a flagship Thrifty foods down below. They don’t even need a kitchen, its far more cost effective to just go down stairs to eat, dispose of your trash, grab a sandwich for lunch tomorrow.

The common areas are really cool in these new builds and the units are very nice. At $1100 per month each its the best way in these times.

Own nothing and be happy.

On another topic: Come 2024, many low/medium income individuals/families will be able to claim the BC Renter’s Refundable Tax Credit for rent paid in 2023. I wonder how this will impact the “mom & pop” basement rentals who may not have been declaring rental income from their “in-law” suite. Renter’s may be asked to provide information to support their eligibility by providing the name of person they are paying rent to or showing proof of rental. I would think there are also many renter’s who are renting a room or sharing a condo/house with the owner.

A lot has changed in Calgary and Edmonton they are much more liberal and don’t share the same views as the smaller communities

Yes, it wasn’t that long ago that huge net migration out of Alberta was front-page news in the Calgary Herald.

There has always been a separatist movement in Alberta that would like to separate from Canada and join the excited states of America. I might suggest a new name for Alberta then as Puerto Rico North because the Americans will drain that wannabee state dry of oil and natural gas.

To an American the most right wing Albertan conservative is still a liberal.

On Craigslist this morning there were 316 rentals available within a six kilometer radius of the downtown core. That’s still low.

One-bedroom suites are still very expensive at an average of $1,895 per month with a range of $1,780 to $2,340 per month. Unlike one-bedroom suites, there is a larger price variation in two-bedroom suites ($1,940 to $3,460) that average $2,680 per month.

A two-bedroom in an older condominium in Quadra Village is around $2,200 per month (+/- 5%) or about $2.50 per square foot of livable area. A one-bedroom in the same area is around $1,775 per month or $2.60 per square foot.

My opinion is that one-bedrooms relative to two-bedrooms are very expensive on a price per bedroom basis.

Alberta is a “have” province, thanks to the petroleum industry, and must be pissed about the equalization payments it contributes to the have not provinces every year. I think there is a strong political push to separate from Canada. I don’t blame them given the B.S. they have to put up with from Ottawa.

Did that haunted house reno ever sell in gordon head?

All booms never last.

“The boom and bust cycle describes alternating phases of economic growth and decline typically found in modern capitalist economies. First anticipated by Karl Marx in the 19th century, the boom bust cycle is driven just as much by investor and consumer psychology as it is by market and economic fundamentals.”

-Cambridge Dictionary

Estimates are as high as 60% of migrants eventually return to their place of origin. As one person said to me that moved to Victoria and was returning to Calgary after living here a half dozen years. “Victoria is nothing like the brochure they sell you”

People leaving for Calgary is nothing new the boom there never lasts

Interesting article Introvert. We will have to see if more 20 to 34 year olds are leaving Victoria than moving here. They’re not worried as much about cold winters as retirees. Besides Canadian winters build character. You’re not a true Canadian until you’ve experienced 30 below weather.

Rental rates don’t appear to have come down, so we are likely not experiencing a great number of 20 to 34 year olds leaving – yet. But if we do then we could have a rising vacancy rate.

Crazy B.C. housing prices help fuel 230% surge in Calgary condo presales

https://vancouversun.com/business/real-estate/bc-buyers-fuel-calgary-condo-presales-surge

Receiver to apply to have mortgage broker held in contempt

https://www.timescolonist.com/business/receiver-to-apply-to-have-mortgage-broker-held-in-contempt-7361119

Prices in Canada are up 82% since 2015 . Frank said “almost doubled” “across the country”. That’s close enough that he isn’t “making things up” as you allege.

teranet Canada index 170 (2015) to 310 (2023) = +82%

Next msg

Re. “Tax cuts” in late 60s-early 80s.

US overall tax revenues didn’t fall during the period mentioned (late 60’s to early 80s), as measured by % of GDP. Stayed remarkably stable, and if anything went up.

https://fred.stlouisfed.org/series/FYFRGDA188S

Immigrant- House prices in the Prairies are lower because land prices are lower. We have millions of acres of farmland to pave over.

Why you just keep making things up Frank. House price across the Prairies including your hometown Winnipeg are not event increased by 50% since 2015.

Inflation is caused by too much money chasing too little goods and services. That excess spending power may be from households, business, government or any combination of these.

In the current inflationary environment there is no correlation between levels of taxation and inflation rates between countries. I don’t think you’ll see it for “red tape” either, however you define it.

Tax cuts are inflationary as they increase spending power of households. Tax cuts in the US, together with Vietnam War and social program spending, were responsible for starting the inflationary spiral of the late 60’s, 70’s, and early 80’s.

You can take out a heloc and buy things 🙂 couple hundred k of instant liquidity.

“Since 2015, house prices across the country have almost doubled. Under current conditions, there is no way of reversing it.”

Since 2003 my house has quad rippled…but what does that mean ?

Nothing.

Since 2015, house prices across the country have almost doubled. Under current conditions, there is no way of reversing it.

“Is the inflation rate fraudulent?”

No, however the government is fraudulent driving prices so high through taxation and red tape. Do you actually like who is leading this country?

They are building out what they have started and can’t get out of.

Is the inflation rate fraudulent?

“According to the vacancy rate they should be 99% rented. Is the vacancy rate fraudulent?”

Yes, it is.

Another thought: Wouldn’t an empty condo be subject to the spec tax if it remains unsold or not rented? While an empty “apartment “ is not subject to the tax.

REAddict, less than 5 seconds on google and……..

“Market equilibrium is a market state where the supply in the market is equal to the demand in the market. The equilibrium price is the price of a good or service when the supply of it is equal to the demand for it in the market. If a market is at equilibrium, the price will not change unless an external factor changes the supply or demand, which results in a disruption of the equilibrium.”

According to the vacancy rate they should be 99% rented. Is the vacancy rate fraudulent?

Whatever, there are many more would-be-buyers out there than the number who are no longer buyers because they have now bought! For every actual sale think about those not successful who bid and weren’t the lucky one, who can’t qualify or can’t buy because they can’t sell, or can’t sell because they can’t buy. During the crazy early spring of 2021 I was just amazed at the number of offers on offer night, say 14 and the 13 kept on and did or didn’t buy depending on their luck or financial prowess or stupidity. There was no end to the stream that would be there to compete against you on the next one. Some have given up but not all. I don’t believe demand is in any way met because not everyone turn’s into an actual successful buyer. It’s been a tough slog for many since 2019! And prices in most instances just can’t go higher for those buyers already straining at their max because of house prices and over the last year interest rates. Even those that already have homes are truly trapped in their homes no matter how much they want to buy and perhaps move to a new home.

“Probably a better return on investment to rent at $3200 a month (ridiculous). Laughing all the way to the bank.”

Yeah but most of them are vacant, and I’m not talking the Danbrooke one…all of them. They have a video game arcade , pool tables, gym, very nice common area, really nice units. But I’m sure the “investors” would have rather of sold them as opposed to renting them because investors want their money now, not 20 years from now.

Probably a better return on investment to rent at $3200 a month (ridiculous). Laughing all the way to the bank.

All the rental units in the westshore started out as condos for sale, then rent to own, now they are just rentals at $3200 per month.

“That is not “investing”, it is leveraged speculation upon the future value of a gyproc box in the sky.”

They bought it as a pre-build condo off the plans years ago, now those years have passed, the unit is complete, and now they are f#cked.

Vancouver July sales up 29% YOY, Fraser valley up 37.8%. Where are the sellers going and where are the buyers coming from? Not what one would expect with rising interest rates.

Our market has more in common with the Fraser Valley than it ever will with Vancouver

SURREY, BC – After five months of successive increases, real estate sales in the Fraser Valley dropped in response to a combination of continued rising interest rates and the summer sales cycle.

The Fraser Valley Real Estate Board processed 1,368 sales in July on its Multiple Listing Service® (MLS®), a decrease of 29.3 per cent below June, but still 37.8 per cent above July 2022.

July new listings, at 2,855, were also down by 16.6 per cent compared to last month but 19.7 per cent higher than July 2022 levels, and virtually on par with the ten-year average. Active listings continued to climb, increasing by 4.3 per cent over June, bringing the total inventory available for sale in the region to 6,199

Apartments: At $555,500, the Benchmark price for an FVREB apartment/condo increased 0.6 per cent compared to June 2023 and increased 0.8 per cent compared to July 2022.

Compared to Victoria….

August 1, 2023 A total of 595 properties sold in the Victoria Real Estate Board region this July, 16.7 per cent more than the 510 properties sold in July 2022 and a 15.6 per cent decrease from June 2023.

Sales of condominiums were up 16.3 per cent from July 2022 with 200 units sold. Sales of single family homes increased 15.4 per cent from July 2022 with 293 sold.

The MLS® HPI benchmark value for a condominium in the Victoria Core area in July 2022 was $600,000, while the benchmark value for the same condominium in July 2023 decreased by 3.7 per cent to $578,000, which is up from the June value of $573,800.

Umm…really. Easier just to read the bank reports. Now if we only had reporters that would cover this. Oh well, there is always chap gpt.

Vancouver July home sales up 29% from last year.

Lenders have their pre-approved mortgages and they can break them down by market as a way to measure prospective buyers (that are serious). It usually gets released in the quarterly reporting. However, that doesn’t account for the cash buyers and people that make offers without having financing pre-arranged. But it might still work as a pretty good measure reflecting that segment of consumers.

Warren I would tweak your assessment a bit. And I would say any investor buying today.

In the past buying an investment condo had some brilliant returns that could not be matched in any other investment with a similar risk.

Home owners will do almost anything to save their house. Including making very bad decisions that just kick the problem down the street to be dealt with another day. Lenders are betting on this. Lenders know that a home owner will hold onto their property even if the mortgage is slightly higher than the market value of the home.

For the most part, investors don’t do that. If the cash on cash return is lower than other similar investments such as a REIT and there is no evidence to indicate prices will be increasing in the reasonable future. It may be more beneficial to sell, park the money in a better investment and if the market returns then go back into the housing market.

Some things that an investor should be concerned about are:

-the security of the capital invested

-the security of the income stream

Every investor will have a different return on equity. We do have the almost perfect comparable to measure their return against another investment. And that’s a REIT.

Is your return on equity equivalent to a REIT? Better? Worse?

Patrick, it would be better to track mortgage applications. But still a ton of factors would be missing.

You can google “How to derive a demand curve” It’s an intense exercise with multiple factors to consider. Just solving for four factors is difficult. Imagine having a dozen factors to solve. At any time one of those factors can change and the results would be different.

Best left up to bank economists with lots of minions to do the research.

You might be familiar with the KISS principle which is Keep it Simple Stupid. Can not tell you the number of buyers at each price point, but can tell you if supply and demand are being met.

At this time, the months of inventory, new listing to sales ratio, and days on market all indicate a strong market in favor of sellers which typically indicates rising prices. But – that’s not happening. Price are flat. That’s troublesome as sales activity is at a 20 year low!

Anything can happen at low sales activity, that would have the potential to knock the wheels off this cart. If investors sentiment were to change and they became net sellers – there goes the market. If the 20 to 34 age group packs their bags and head off to Alberta there goes the low vacancy rate. And some landlords won’t be making their mortgage payments. If business insolvencies increase then the unemployment rate will increase. You can’t make the rent in Victoria on unemployment insurance.

Too many factors.

I misinterpreted your question. Just pulled up my mtg online:

In early 2021:

Principal: 2k

Interest: 1k

Now:

Principal: 1k

Interest: 4k

That doesn’t make sense. You should be still paying down principal if your variable payment has gone up.

Castles for sale is still a semi-regular googling for me. The upkeep, heating and regulations around renovation and just how to maintain them are all a nightmare, but I still like looking.

Anyone who has purchased a single-unit condo rental and believes themselves to be an “investor” has been misled, usually by an impeccably coiffed Audi-lessee who is the graduate of a School of Creative Realting. There is no chance that such a unit was ever or ever will be cash flow positive once the opportunity cost of the downpayment/equity, the interest costs, the insurance, maintenance, and strata fees are soberly considered.

That is not “investing”, it is leveraged speculation upon the future value of a gyproc box in the sky.

If rising interest rates are responsible for bringing a moment of clarity to these “investors” it is one of the rare positives of the currrent financial climate.

With sellers, we get to know the number of prospective sellers (by looking at listings). For buyers, we don’t get that or any decent measure of prospective buyers. This could be (and likely is) easily tracked by realtor surveys of the number of buyer clients they have.

Anyone here have info as to whether RE agents are seeing more buyer clients these days?

On the topic of insurance (sorry). I posted a while back about TD sending over a ‘specialist’ to said rental. They came back with a rebuild cost substantially higher as well as a list of deficiencies they want fixed. Some are legit, some are silly. Cost increased by $1200/yr.

I’ve asked for a copy of the full report, but so far radio silence.

While I agree, I actually think it’ll be the mortgage renewals on primary residences that is more important. I suspect there is a decent chunk of the population (without investment property) that will have no choice but to severely reign in spending as their mortgage renews. I’m hearing more and more stories of folks (with good jobs) renewing and lamenting that all discretionary spending is gone. I’m also hearing some stories on the commercial mortgage side.

I suspect the market will be a decent chunk lower next summer (when I would sell), but I don’t see the BoC dropping rates until the last possible minute. Given what we’ve just witnessed with low rates, I suspect they’ll be gun-shy and be very resistant to lowering.

I’m still a housing long-term bull, but I’m awfully tempted to unload some debt ASAP.

The simplest way to estimate if demand is meeting supply is prices. If prices are stable then demand is meeting supply. If demand is greater than supply then prices would be rising.

Since prices have been stable over the last six months that would be a good indicator that at today’s current interest rates demand is being met.

That’s not likely the answer that you were wanting. What you’re probably want is how a demand curve is derived. We mere mortals don’t have the necessary micro and macro information to do that type of analysis.

Sidekick, your decision to hold or to sell the investment property is key to what may happen to the future market.

With one-year left on the term, you’re faced with a decision if the tenant gives notice to vacate.

Unlike a year ago, you now have a choice to sell and re-invest in safe and secure investment such as GICs that will give a 5 percent rate of return or re-rent the property in the hope of obtaining a rent that will give you a higher rate of return than 5 percent to compensate for the additional risk of holding real estate with rising costs such as insurance, maintenance fees, and property taxes.

The decision that hundreds if not thousands of investors, such as yourself, do collectively is the key to the price stability of the future marketplace.

From > 1k to > -2k

probably would require realtors to disclose how many different buyer clients they have.

What is your debt pay down a month?

What is the best estimate of “ PROSPECTIVE purchasers that are actively looking to buy”?

It seems that most other housing metrics are tracked closely. For example, mortgage delinquency rates changing from .12% to .14% is a big deal on hhv.

But there doesn’t seem to be any kind of estimates on how many serious buyers there are out there. And yes, it is difficult to define that, but if we measure it the same way, over time we could discover if more or less prospective buyers are in the market.

For example, maybe there are double the number of serious buyers looking for homes than there was five years ago. If true, that would be an interesting housing metric that might help explain price and sales movements.

Is there any metric that tracks buyers?

ya, I don’t think fixed has gone up higher than that.

Common misunderstanding among the public that the total inventory of housing forms the marketplace. The marketplace is much smaller.

At this time less than 1 percent of the total stock of housing is listed for sale. That’s the supply. While demand only consists of PROSPECTIVE purchasers that are actively looking to buy. Not everyone that is living in the community are potential buyers.

There are a lot more houses and condos than 20 years ago, but that will not have an effect on prices. Replace the word homes for another asset such as cars and it should become self-evident.

Is this true Leo? My variable is up way more than that. Like 1.X% to 6.X%.

Which brings me to re-state that I feel like this is a “dead market walking”. The fact the economy hasn’t tanked yet is (IMHO) solely due to fixed-payment mortgages being the majority of variables. I’d be a seller right now if I didn’t have a year-long lease. My rental has gone from cash-positive to significantly cash-negative, so I’ll either have to bump up the rent (by 1.5k to break even) or unload it.

This place sold quickly. So…

If you take out the >$1.5M sales then are the sale price to assessed values below 100%?

Also more people here than 20 years ago, so I think what you’re really looking for are per capita sales.

I am wondering if using a twenty year comparison range is actually appropriate considering the vast growth in inventory especially in condos. Put another way, if there are twice as many condos today as there was twenty years ago (not the actual stat but there are a lot more condo units today) than you would expect sales and listing to be about double.

Does the graph look very different if we are using a five or ten year average?