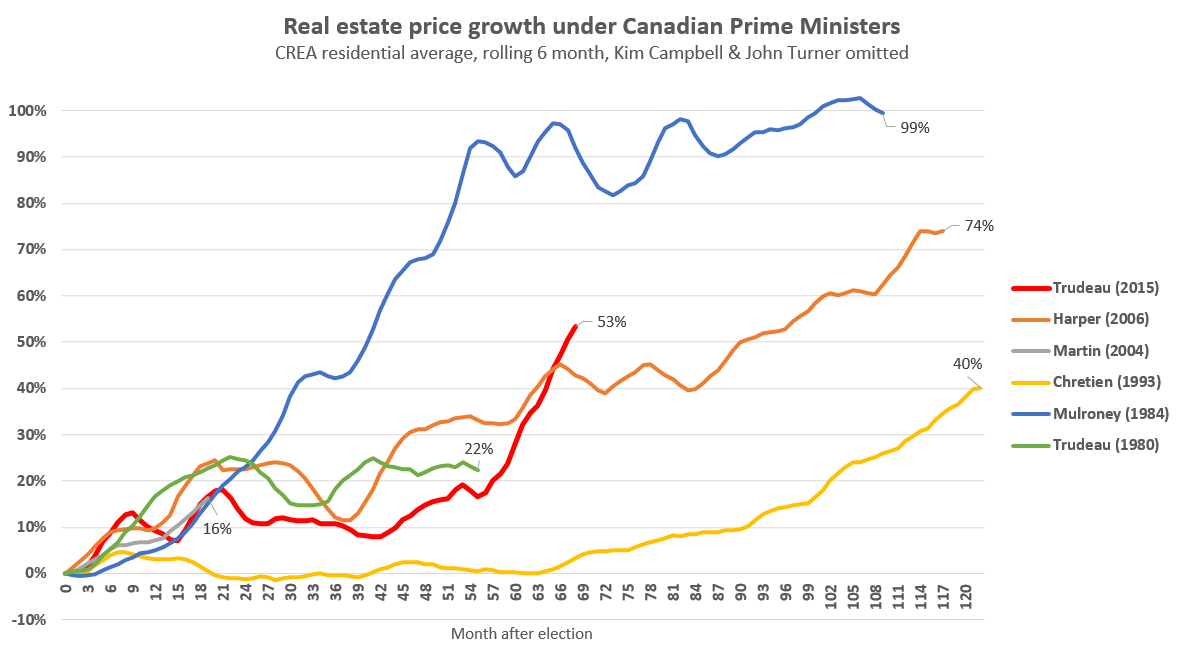

Ranking our prime ministers on housing

There’s an election coming up and one of the top priorities for Canadians is housing affordability. What have house prices done under our national leaders?

Of course this comparison is just for fun. Prime ministers don’t have that much control over house prices, and any initiatives they put in place often take years to really influence the market. But there you have it. Mulroney was the king of house price growth, and Trudeau was lagging Harper until the pandemic hit.

Anything surprising stick out to you?

As for the housing platforms of our leading parties, so far they have all left a lot to be desired. Both the NDP and the CPC have rolled out a mix of lacklustre initiatives with downright terrible ideas. Lots of negative media out there on the slow start to the campaign from the Liberals so far, but I suspect they are taking notes and will boost measures on housing when they release their full platform. Housing is shaping up to be the most important issue of the election, and I think we’ll see some one-upmanship from all sides before election day. Once all three platforms are released I’ll write a comparison here.

Note: no market update this week as I’m on vacation, but suffice it to say it hasn’t cooled one bit this month. New lists have clawed their way back to the 2019 levels last week which is promising, but sales remain 20% above what we saw then, and inventory remains at record lows (and dropping).

Kenny- One interesting tidbit I’ve heard concerning surveys is that people lie through their teeth, giving the answer they think people want to hear. Humans are innately selfish but want to be perceived as caring and giving. It’s B.S.

Nothing stopping you from selling your home lower than the market price to help out the next generation, but advocating for higher tax is a penalty on the middle class who already pay for the bulk of the government revenue.

..

Thoughts on housing platforms: https://househuntvictoria.ca/2021/08/26/election-housing-policy-the-bad-the-ineffective-and-the-missing/

That’s not how it works. Domestic student places are government funded. Foreign student places are not. Universities can only take domestic students up to the number of places they have funding for. That limitation does not apply to foreign students.

My own opinion is that we have too many people going to university as it is. Not necessarily the right people though, I would rather have fewer people with lower tuition and better student aid for those who need it. Like when I went to university.

My wife and I are having a baby at the end of the year so need a bigger place – but considering moving to AB next year so don’t want to commit to a purchase.

“No one wants to see the value of their work property decline and they might be looking closely at the different parties’ platforms regarding the housing crisis”

‘

‘

Actually I recall seeing a survey in the last few months that said a significant percentage of Vancouver home owners would welcome falling home prices to help the next generation be able to afford to continue to live in the city.

https://www.google.com/amp/s/www.cbc.ca/amp/1.4798828

I completely agree and would welcome a large correction; not that many people actually downsize and pull money out of their houses so falling prices wouldn’t effect most long term home owners.

I think it’s inevitable and only fair that people pay capital gain taxes on their PR and rental property gains are fully taxed as income, homes shouldn’t be treated as speculative vehicles or investments if we are to have a healthy community. And yes I own a home and it’s worth more then 2x the average and I am more then happy to pay my fair share.

“For some strange reason Canadians do not take full advantage of the opportunity to get a better education, and universities have vacancies for foreign students.”

This seems misinformed considering:

“In 2016, more than half (54.0%) of Canadians aged 25 to 64 had either college or university qualifications, up from 48.3% in 2006. Canada continues to rank first among the Organisation for Economic Co-operation and Development (OECD) countries in the proportion of college and university graduates.”

Source:

https://www150.statcan.gc.ca/n1/daily-quotidien/171129/dq171129a-eng.htm

Maybe they live in a small town and have a large family, and there isn’t a big house available for rent. Or they are a very rich American, starting a business here and want to buy a big beautiful mansion in the Uplands, and none are available for rent.

They’re living here legally, working, paying taxes, just like you, and are going to occupy a home regardless of if they rent or buy. Why are you bugged about them owning a home to live in?

The number thrown around is 65-67% of Canadians are home owners. Does that include every man, woman and child in the country? Is it calculated from people of a certain age group (over 18)?. Does anyone know? I can’t see including school children or seniors living in care homes in the stat. Can someone explain, I’m trying to determine the actual number of home owners who are all eligible voters and what percentage of the eligible voters they represent. I don’t think housing affordability is of major concern since most home owners have a large percentage of their net worth sitting in their home. No one wants to see the value of their property decline and they might be looking closely at the different parties’ platforms regarding the housing crisis. The party that has the most aggressive policy to make housing more affordable might find themselves losing a lot of votes.

I don’t think we appreciate the access to education Canadians enjoy compared to other countries. U.S. tuitions are astronomical, limiting access to the wealthy. Competition is fierce in China and only the top students get the privilege of higher learning. For some strange reason Canadians do not take full advantage of the opportunity to get a better education, and universities have vacancies for foreign students. The parents of these students have the means to purchase a house for their children ensuring them a stable place to live, and it’s a pretty good investment. Maybe our government should look at filling our universities with Canadians, instead of foreigners, but that would mean that Canadians would have to get off their ass and apply themselves. That might be asking too much from a populace wanting everything handed to them. I’m fully aware that foreign students pay higher tuitions that the universities enjoy.

Why does someone who has not been granted the right to live in Canada long term need to buy a residence in the first place?

Why are you looking to rent? Just released data from Teranet shows that it’s never been a better time (since 2007) to buy (vs rent) in Victoria.

For many prospective buyers, an important part of the “affordabiiity” equation is the cost of “rent vs buy”.

Teranet has just released updated affordabiiity data to June 2021 for Victoria. An interesting finding is the chart on page 11 for Victoria https://www.nbc.ca/content/dam/bnc/en/rates-and-analysis/economic-analysis/housing-affordability.pdf

Note: This data is from Teranet up to June 30, 2021. Teranet is a little laggy (3 month rolling average), and so curent prices might be a little higher now, but rents are also “laggy” and up since June 30, so that’s likely a wash,.

For the first time in their 15 year data series (since 2007) , in 2020-21 in Victoria it has become cheaper to buy vs rent, and is about equal averaged over the last year. At least measured by mortgage cost vs rent on a 2 bedroom median condo in Victoria. Of course there are more variables at play than these two. I’m not looking to discuss all the other costs/benefits (taxes+maintenance vs equity+appreciation), because that’s not my point (if you are interested in the other costs, you can see a detailed look at “buy vs rent” here https://www.ratehub.ca/blog/rent-vs-buy-canada/

But the “mortgage payment” vs rent is a big comparison for many people, and the fact that these are now equal in Victoria is important for a number of reasons.

– investors are more likely to buy when they can be closer to cash flow positive. Investor buyers can afford and support these high house prices.

– 79% of mortgage payments are equity (at 2% over 25 years), meaning that only 21% of mortgage payments are “money down the drain” vs 100% of rent payments.

I think this flipping of the “buy vs rent” numbers in favour of buying is a big factor in the buying boom, bringing in many new investors and renters as “new buyers”, and could remain that way for years to come.

For renters in Victoria , the question shouldn’t be “can I afford to buy”, it should be “can I afford to rent”?

Do you seriously believe that “mansion student buyers” are a relevant factor in the housing crisis seen across Canada?

Lots of homes are bought for young people by their parents. Most of them are Canadian students and Canadian parents.

So I’m not sure what the ”horror” comes from when we make it a “foreigner” and a very expensive house. What is about the key words “foreigner” or “mansion” that makes it unacceptable to you? But are you OK with an “Albertan” buying a median price condo for his kid in Victoria? They are both just one household, and the condo is more affordable for the average Victoria buyer.

If you’re genuinely concerned about supply of affordable housing, why aren’t you more concerned about the albertan buying a median condo for his kid, and realize the single “UBC kid buys a mansion” story you linked to (now a few years old by the way) is irrelevant.

Do you mean those “mansion student buyers” like stated in the article below. I did quite a few tax returns for international student over past few years, none of them, including grad students, made enough money to cover their living+tuitions, never mind enough buying condos/houses. The house buying money of theirs come from elsewhere for sure.

https://vancouversun.com/opinion/columnists/douglas-todd-vancouver-still-suffering-fallout-from-students-buying-mansions

That’s correct.

But there are lots of foreigners living in Canada legally, that are not yet permanent residents (immigrants).

These would include students, foreign workers and refugees (prior to claim being accepted).Many of them

are on an (eventual) path to citizenship, just like a Canadian might be on a H1 visa in USA.

They live and work and pay tax here year-round on valid visas. I don’t see why this group should be prevented from buying RE via a 2 year moratorium or subject to a 20% buyers tax throughout Canada. If they don’t buy, they’ll rent and still occupy a home that a Canadian citizen could live in, so the housing market isn’t better off.

Stats Canada reports that most foreigners buy condos, not SFH. We are not running out of land for condos. And it also reports as Leo has, that they are a small percentage of homes sold.

See heated discussion on reddit wrt it:

https://www.reddit.com/r/VictoriaBC/comments/pbd87w/rental_bidding_wars_coming_to_a_town_near_you/

First of all Canadian RE markets have historically been largely out of sync. For example during the Toronto bust of the late 80’s-early 90’s, RE prices in BC went up. They’ve really only been in sync since 2000, and even then Alberta – which gets a lot of immigrants – has been an outlier.

You also have to look at where the causality lies. We know that immigration tends to be lower during recessions. Housing downturns tend to happen during recessions. Which is the cause and which is the effect?

mover- My point exactly, thousands of Canadians own foreign property, however, I think many are considering liquidating and moving to “warmer” parts of Canada. Health insurance is the big drawback once you reach your 70’s and covid has thrown a wrench into the mix. Drought and water shortages that in turn cause power shortages, are making life in paradise more tenuous. Not to mention escalating crime. I believe that is contributing to price escalations across our country.

“How many Canadians bought property in Arizona in the 2008 downturn? I couldn’t believe how many people I knew bought then, many of them sold when Trump got into office and covid has motivated even more to sell.”

A picture is worth a thousand words -if you got a chance to chat with your Saskatchewan friends, you will be shocked how many Canadians own properties in Arizona.

https://www.cbc.ca/news/canada/saskatchewan/riderville-pride-tour-arizona-march-1.3389300

I wonder if you overlayed immigration levels of each Prime Minister’s term, if the correlation would identically match % of price increases.

My wife and i have been looking for a bigger rental (bad timing i know with students back). We have reached out to several in the past month with no responses (or relistings with higher prices). We finally found one yesterday that had a good price (condo for 2500 – 3 bedroom). My wife sent me the application which I am filling out now and here is the price section:

Blind Bidding wars all around i guess.

Immigrant is just another term for permanent resident.

When a person gets his/her immigration permit/paper (to stay in Canada), he/she becomes a permanent resident, it does matter how long or not at all he/she has been in Canada.

How long before a new immigrant (technically a foreigner) can become a permanent resident? Again, I’m totally ignorant when it comes to immigration. Please inform me.

Only Canadian citizens and permanent residents can legally contribute to Canadian federal parties. No other person or entity.

Good point Patrick. How many Canadians own property in foreign countries? I’ve heard Quebecers own 500,000 properties in Florida alone. How many Canadians bought property in Arizona in the 2008 downturn? I couldn’t believe how many people I knew bought then, many of them sold when Trump got into office and covid has motivated even more to sell. I believe a few participants on this site own property in Europe. Most Canadians are immigrants from foreign countries and still have family ties there. A lot of them inherit family properties, I know several people who own property in their homeland. If we want to stem the sale of our country to foreigners, we have to stem the flow of new immigrants.

patriotz-I wasn’t talking about foreign governments, I was talking about foreign individuals. I’m incredibly stupid when it comes to politics, but is it legal for a foreigner living in Canada to make a contribution to a political party? Please inform me, thanks.

I fixed the toilet today. Only 1,399,999 more homes to go!

Any country that has signed a treaty with Canada that prohibits taxing their citizens differently than Canadians on RE purchases, would want their citizens treated fairly. Such as USMCA and many other treaties with countries and Canada.

For example, If the USA was implementing a 20% tax on Canadians buying housing in the USA, and a 1% yearly tax to Canadians, I would expect the Canadian government to file a claim under the USMCA (formerly NAFTA). Because that Is prohibited.

If Trudeau ban foreigners from buying in Canada like New Zealand (4.8 million population, greater land area than the UK), and implement everything else that the Libs are promising, plus keeping the interest rate as it. Then, it would drive housing price to the moon like New Zealand is experiencing, because like Canada their interest rate is ultra low.

What foreign government wants their citizens to buy housing in Canada?

Dad- What I should have said was- too much foreign influence in the government.

The foreign buyers tax is always the best red herring to play to the xenophobes in the electorate. 90% of sales are all local and it’s our domestic idiots that borrow way too much money to compete against each other drives up the prices (people just hate looking in the mirror and assigning blame to themselves). Any housing policy that provides additional liquidity through tax breaks and other incentives (handouts to get people into the market) will only lead to higher prices! But hey, people only vote for that tell them it’s not you, it those foreigners and those investors (that don’t really make up a significant part of the market compared to the individual domestic scale) that are driving prices and it’s definitely not you getting hundreds of thousands from your mom and dad and borrowing everything you can to bid against the mirror of yourself doing the exact same thing. Just keep telling yourself that the kid living in a $6 mil West Van house driving a Ferrari is what’s preventing you from owning a home and you’re not just a petty and jealous person.

“That’ll never fly, too many foreigners in government.”

Do you mean too many non-white people?

Only a big price drop will restore housing affordability. No federal party will acknowledge this

Told ya.

“That’ll never fly, too many foreigners in government.”

Care to explain how a foreigner, who can’t even vote in elections, made it into government?

NDP want to impose a 20% foreign buyers tax. Jagmeet must have a stockpile of houses for his friends and relatives.

Liberals also proposing to ban foreign purchases of homes for 2 years. That’ll never fly, too many foreigners in government.

From BNN- liberals’ campaign promise to end blind bidding on housing. Good time for an online, open bidding platform. First one to offer it wins.

Preserve or repair doesn’t add to housing supply. That sounds like another government giveaway to subsidize people’s renos, increasing home value, which we don’t need. They should just announce how many new homes they are going to build. They had a $350 billion deficit last year, and a $100+ billion one coming, so I don’t see how the government is in a position to offer giveaways to new and existing homeowners.

Decent summary of housing platforms

https://nickfalvo.ca/ten-things-to-know-about-the-federal-conservatives-housing-platform/

https://nickfalvo.ca/ten-things-to-know-about-the-federal-ndps-housing-platform/

And given we have the TFSA I’m not sure how much difference it will make. By 30 someone will have some $75,000 in room there, so that’s a decent down payment tax free right there. So now we’re targeting people with maxed TFSAs and a relatively high appetite for risk that they are investing their down payment for higher returns (and getting hit with substantial tax). a minor subsidy for higher income folks mostly.

I’ll be writing a full analysis of all the platforms once they’re released, but overall 1-3 are just adding demand so won’t help anything. 4 sounds good but no details on how they will override the municipalities’ objections to new housing. 5 is interesting, would like to see how they will implement this. 6 was already announced although they say there is more to it

This is a resurrection of the Registered Home Ownership Savings Plan, created under PET. I had one. It was a lot more effective in a high interest rate / lower house price environment. Still not a bad thing to encourage saving.

Decades you say! I’m unaware of any BC housing forum prior to 2005. Note also that a collapse did in fact start in 2008 but the market was rescued by intervention from the Harper government and BoC. That rescue effort is ongoing, as can be seen by falling interest rates and government programs that actually support higher prices. Will it work indefinitely? I don’t know.

Aha, knew they were delaying their plans so they could one-up everyone.

Liberals housing plan:

Now the question is, will people believe them?

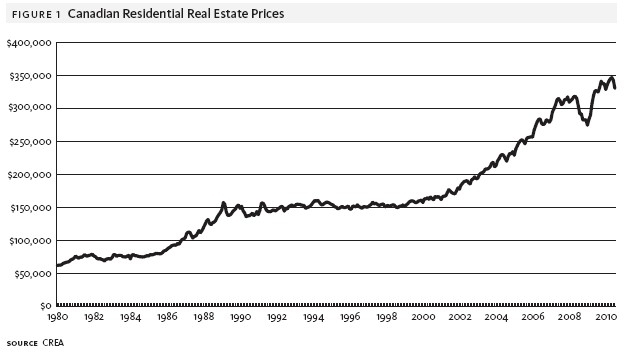

Heard on BNN- Bank of Montreal total mortgages $130 billion, up from $105 billion last year, an increase of 24%. That might help explain the run up in house prices. Canada’s average mortgage $300,000, almost 5 million mortgages in the country. BMO financing approximately 400,00 customers. How long can we sustain a 24% increase in mortgages driving prices higher. If interest rates remain historically low, the future looks bleak for affordability.

Yes.

Sadly, there are people here on this board that have been posting for decades on various BC housing forums about the BC housing bubble that they were sure started in 2001. And they’ve waited since then for the imminent collapse that never came. No big deal, and I expect the huge sustained rise in house prices was a surprise to everyone. The lucky ones bought and held.

Sing it out

“A 2018 C.D. Howe Institute study compared the cost of construction per square foot of new homes to the eventual sale price in the “eight most restrictive cities” — Vancouver, Abbotsford, B.C., Victoria, Kelowna, B.C., Regina, Calgary, Toronto and Ottawa-Gatineau.The authors found that barriers to development accounted for between 23 per cent and 50 per cent of the total cost of new homes. This means that, on average, Canadians in those cities were paying an extra $230,000 per new home over construction costs, once accounting for developer profits and excluding the cost of land. In Vancouver, it was $640,000…..

……But acknowledging that municipalities should be held at least partially accountable for limiting housing supply is a start, and highlights why the best federal housing plan is no plan at all.”

Luckily, if you habitually vote NDP or “Green” you can ignore all that. After all, look at the source…..

https://nationalpost.com/opinion/carson-jerema-housing-in-canada-is-expensive-and-the-federal-government-keeps-making-it-worse?utm_source=Sailthru&utm_medium=email&utm_campaign=NP%20Platformed%20newsletter%202021-08-23&utm_term=NP_Comments

There weren’t any ‘wait and see’ types back then. Remember that BC had experienced a huge bust less than a decade before that didn’t really bottom out until the mid-1980’s. Housing was far more affordable than at the peak of the early 1980’s. Why would anyone expect another bust so soon and with such better affordability?

The bubble debate that you hear today just didn’t exist then, and I find it amusing that people would try to project it back to that time. When prices were affordable people didn’t debate, they just bought.

From: https://financialpost.com/commodities/lumber-prices-collapse-forces-sawmill-production-curb/wcm/b85241f6-791a-4072-98ae-6d369bc7cd90/amp/

Lol, this why government at all levels need to get out of the way of house construction. Developers will over build if they could as fast as they could to get the price of the moment. Then just let the market correct itself.

Woohoo!! dr Bonnie Henry announces BC COVID vaccine cards and mandatory vaccination required to enter almost anything public like a restaurant (patio or outdoor), gym, concert etc.

Effective sep 13 must have one dose

October 14 must have both doses (>7 days post 2nd dose)

Tomorrow they talk about schools.

Well done government and Public health!

Perhaps we should thank the environmentalist for the tiny house movement, that lead to more condo and apartment building instead of single family house as shown in the attached chart.

https://tinyurl.com/3yaht3dw — Canada Mortgage and Housing Corporation, housing starts, under construction and completions.

Employment rate was horrible in the 90s (manufacture loss), and lowered interest rates were the only tool that the government had at that time. Thus export were up due to lowered Canadian dollar.

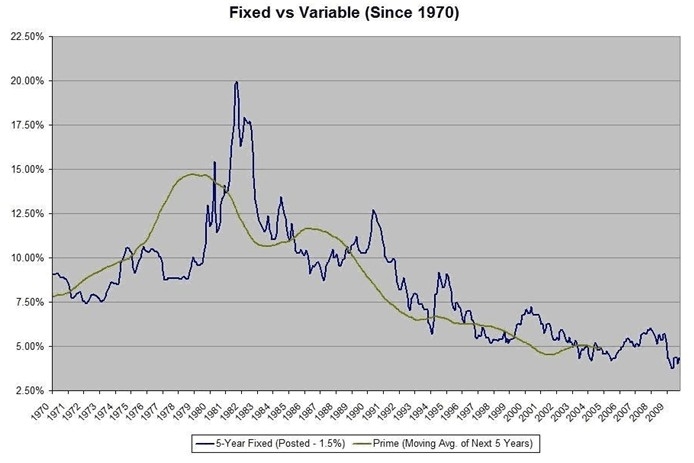

That’s quite a decade for interest rates. From 10-12% in 1990 to 5-6% in 2000, that has to be the biggest relative drop in the past half-century. Risk-tolerant buyers and investors were rewarded, while more careful ‘wait and see’ types got screwed. (Are they waiting still? Hopefully not, or that could lead to a lifetime of bitterness. )

Who gets the credit for that? I guess Chretien was in power through most of that time and John Crow and Gordon Thiessen were Governors of the Bank of Canada . I was too young to recall much from then, though I know our currency was quite weak for most of that period, with US/Can $ exchange rate at around 1.5 by the late 1990s/early 2000s (US trips were bloody expensive back then).

It must have been very tempting for Americans to come and buy up prime Victoria real estate then. (Kind of like when Canadians were (briefly) scooping up Florida and Arizona properties for ultra-discount rates in 2010, post-US crash).

Politics aside, a large percentage of the population are millennials and they are entering the housing market age, and we are adding an additional 150,000 millennial immigrants per year to the slow housing development, plus the ultra low interest rate is here to stay till at least the second half of 2022.

So don’t expect the housing price to stabilised at anytime soon, and perhaps for the foreseeable future till mortgage rates hit at least 4-6%.

This boomer is telling you that we had it easy.

Thanks for another great graph Leo.

All about the starting point of course. Mulroney took office around a market bottom in both BC/Alberta (major bust) and Ontario (less major). That flat line in the first five years of Chretien was mainly due to the slow recovery of GTA after the late 80’s/early 90’s bust.

I agree that both the NDP and CPC platforms to date have been a mishmash of contradictory measures, some of which would actually make housing more expensive.

Nice post.

For house prices, It brings back some bad memories of the 90s. Tail end of Mulroney and then we got Chretien and the Bloc. Canada house Prices (nominal) were flat for ten years (89-99), and fell in real terms. And mortgage interest averaged 8% during the decade. This is the decade Canadian boomers were young homeowners, and we are told by millennials here that first time buyer boomers had it easy!

mortgage interest averaged 8% during the decade.