Homes for living and lots of them

You may have noticed that after more than 10 years of focusing only on housing analysis, I have been getting more into housing advocacy in the last year, being involved in the Saanich Housing Task Force and proposing some ideas about effective actions Victoria could take to help keep the city affordable as it grows. Documenting the deterioration of affordability is one thing, but in the end the situation we are in is largely of our own making and local government has a huge role in fixing it.

Thus I’m excited about the launch of a new community advocacy group, Homes for Living. It was born from the frustration of a young family trying to buy a home in Victoria. I got involved shortly after and hope to contribute significant time to helping them in the future and lobby local government to flip the script on housing. Check out the website and our list of initial proposals.

We have tons of ideas for projects that have been raised and what we need is volunteers to help do them. If you’re interested in working to make Victoria more affordable, the best thing you can do is join our Discord and introduce yourself.

If you’re only here for the stats, you’ll be glad to hear I have another outlet for the advocacy side. Stay tuned for a new post on Tuesday with an analysis of the month’s numbers.

Institutional investors have never invested in “ individually titled properties in Victoria, and in Canada generally,” if you’re referring to single family homes or single condos.

They invest in multi-family (apartments), seniors homes, and various business sectors. And overall institutional investment is way up, as detailed as detailed in this oct 2019 report.

https://www.torys.com/insights/publications/2019/10/key-trends-in-canadian-real-estate-investment

“ Key trends in Canadian real estate investment”

“Divestitures of non-core assets, rising institutional investment and multi-use, urban intensification investments are just some of the trends that are shaping Canada’s real estate sector. We anticipate that strong investment in the asset class is poised to continue, with investor confidence in a low-interest-rate environment likely to drive robust activity in the sector in the coming months.”

The rise of institutional investment is being felt across all sector types, including office, retail, multi-family and seniors housing, leading to continued downward pressure on capitalization rates.

May numbers: https://househuntvictoria.ca/2021/06/01/may-mixed-signals-in-the-market

Confirmed, we have been reducing Canadian exposure for years now in both residential and commercial.

Yes, Winnipeg property tax rates are about 1.2% of property value https://wowa.ca/taxes/winnipeg-property-tax

That’s more than double Victoria (0.5%). https://wowa.ca/taxes/victoria-property-tax

But not as bad as Moncton, 2.7% ouch! https://wowa.ca/taxes/moncton-property-tax

Of course these high rates are due to the low assessment values. But still, paying 2.7% tax per year means the property tax payment in Moncton is much more than mortgage interest payment for most people.

Patrick- The government mismanaging money? That’s their specialty.

I noticed this on a Middowne listing. Can this be accurate? Only 54% of Oak Bay is owner/occupied and 46% renters. Doesn’t seem right for that neighbourhood.

Owning a home is a great long term investment, for many reasons. But the federal government COVID-response spending and money printing, that was not restricted to people in need, has caused big problems, and fueled much of this recent house price rise.

The government economic response to COVID wasn’t properly targeted to the people in need. More COVID aid was given to the highest quintile income earners than the lowest quintile. Someone with $1m cash sitting in the bank didn’t need government handouts, yet they were eligible for CERB like everyone else. And the government lowered mortgage interest rates for them too, despite an almost zero delinquency rate on mortgages.

All this “free candy” works in the short-term, but the price is paid when the “sugar high” wears off.

https://www.bnnbloomberg.ca/trudeau-s-covid-19-spending-was-tilted-to-high-earning-canadians-1.1611069

“The top 20 per cent of income-earning families received an average of $6,728 from emergency COVID-19 assistance programs, according to data provided to Bloomberg by Statistics Canada. The lowest-earning households got $4,097 in aid, on average.”

I have news for you. Real investors understand that today individually titled properties in Victoria, and in Canada generally, are about the worst investment in fundamental terms that they’ve ever been. They are not the ones driving up prices. Who is? Owner-occupiers followed by amateur landlords. After that, you get a few shady types parking offshore money and the like. But institutional investors – nope.

Extremely poorly written.

Further to property taxes in Winnipeg. In the mid1990’s I looked at a “mansion” on Wellington Crescent, one of the premiere streets in Canada, it was selling for $400,000, the property taxes back then were $30,000 a year.

I think Vic&Van is claiming that the typical house in Winnipeg would pay $4K/year taxes, not the $1mil house.

Vic&Van- I don’t know where you are getting your information from but you are dead wrong. I have several friends that own houses in that area and their taxes are not $4000. More like $8000-12,000 and up. Please get more accurate information.

Thanks for joining Houses for Living Leo. It sounds like a great initiative!

A $1,000,000 home in Winnipeg is a mansion in Old Tuxedo, one of the top, it not the top established old money neighbourhoods. Tax would be about the same as here. It would not be a typical home in Victoria or there. $4,000 a year would be the more typical property tax bill.

But back to Victoria, I don’t think densification will make housing affordable – at least not in general. The city is just too desired as a place to buy in Canada. Monaco, Singapore, New York and Hong Kong are mainly all apartment living and yet they are far from affordable. But Indianapolis, Cincinnati, Phoenix and Edmonton are pretty low density and affordable due to less demand/growth and more land for SFH. Defeatist perhaps but realistic. That said, the Duncan/Cowichan Valley area is pleasant, spacious and relatively affordable. Putting more housing there could take some pressure off of Victoria.

I’m not that familiar with their voting records. One of the sub-projects we are hoping to do is track the voting records of council members to create a voting guide for the next municipal election.

I just went back and watched the entirety of council’s debate on that proposal. You’ve probably been following how councillors vote more closely than I have, so there’s a good chance that your classification of Plant and Haynes is more accurate.

I do remember Mayor Haynes, once during some council meeting, dismissing a particular NIMBY perspective by coldly stating something along the lines of “The fact remains that we’re in a housing crisis and so such concerns are basically invalid.”

When I heard that, I was like…hmm. So perhaps the mayor is inconsistent, as you say.

$1.25M

3343 Curley: Sold $1.115M

Also correction to my previous comment, it’s the lowest May on record for inventory, not sure why I said second lowest.

What did 3853 Graceland Dr go for? Did 3433 Curlew finally sell? Thank you!!

An example is the Raymond St development.

Land purchased in 2016.

59 units many affordable and close to transit and bike infrastructure near the uptown where they want to densify.

Mersereau, Ned, Zac, and Karen in favour everyone else against.

“If not here, then where?” – Rebecca Mersereau

No worries. There are a lot of people vying for your attention 🙂

Interesting. My sense is that Plant and Haynes are also on the pro-housing side.

Sorry didn’t see that. The way I see it we have Ned, Zac, Rebecca, and Karen as pro housing voices.

Susan, Judy, Nathalie, and Colin usually against.

Mayor is inconsistent.

So we barely have enough even to approve regular projects that are often still voted down and definitely not enough for bold action

I asked you this a few weeks ago and you didn’t respond: why does Saanich need to wait for a few more councillors to flip? As best as I can tell, the current council already has a sufficient pro-housing-affordability majority.

Not stagnant at all in Victoria. Last November I wrote an article saying it was surprising condo prices hadn’t moved upward much because market conditions indicated they should. Wrote about it a few more times after that to say that the market was taking off. Prices have climbed a lot in 2021 to catch up to single family. We’re probably almost caught up now, perhaps a bit more but we’ll see how the stress test change affects things

Over the long term, what appreciates is land. So condos won’t gain as much as single family over the decades timeframe. Also condo prices have historically stayed in a range linked to incomes + interest rates, while single family gets less and less affordable over time as the city densifies.

Well it’s a mix. Not many foreign investors due to the foreign buyers tax. So it’s a mix of about 4/5 people that want to buy to live in, and 1/5 investors based on current stats for investor ownership rates.

Investors aren’t as good as purpose built rentals, but at least someone will be living in those places, which brings up the vacancy rate and controls rent growth.

Doesn’t really make sense though. Let’s say we build 10,000 units and investors buy every last one of them. Then we have a huge rental vacancy rate and rents drop like a stone, which then motivates those investors to bail again.

Everything the city does or doesn’t do is against the wishes of many of its residents. Voting rates are atrociously low in municipal elections so it’s not like councils really represent the majority anyway. There was a drastic change in the last election bringing in Rebecca Mersereau, Ned Taylor, and Zac Devries. If one or two more of those kinds of councilors gets in it flips the vote on housing from against to for.

Someone should tell Langford they can’t grow because Oak Bay isn’t.

Not that I want the car-dependent Langford model, but clearly different munis are and have always gone in different directions on this.

I don’t believe a lack of building is the only problem – the fact that Victoria is a small and desirable place and the world is several orders of magnitude larger puts us in a problematic position. Right now, there is an equilibrium between price and demand in Victoria, supported by all the stakeholders acting on it – globalization, Canadian government financing programs, banks, demographics, CMHC all increased this equilibrium price of VI real estate dramatically over the last 20 years by exploding the buyer and financing pools and now, it just so happens that the equilibrium price outstrips the ability of most local income to afford those prices.

If lets say 10,000 units are built in Victoria tomorrow, and prices drop , units will be absorbed by local and foreign investors that are 1, 2, 5, 10% away from buying more units today, not locals who are 50% away. In order to re-enfranchise Canada’s working class, Canada needs restrictions on who can own property in Canada. There are hundreds of thousands maybe millions of investors, (even hedge funds and the CPP for goodness sake) in and outside of Canada that will absorb any construction in Victoria before enough can be built for prices to come down to a level affordable by local incomes.

And by restrictions, I don’t mean taxes – I mean legitimate discriminatory restrictions that reduce the buyer pool so that local supply balances better with local demand and ability to pay. It could be passports, a minimum number of years worth of taxes paid in Canada, whatever it needs to be to get the prices closer to incomes on which taxes are paid in Canada.

In my opinion, the primary purpose of Canadian residential real estate is to provide efficient proximity to work for labor and the primary purpose of any of these restrictions is to align labor incomes with housing prices. Contrary to what Adam Vaughn will tell you, you can have high housing prices or houses people can afford, you can’t have both.

Taxes that are paid to governments to enrich civil servants while pricing stays more or less the same are not solutions to this problem.

Mince-Meat: Here’s a few reasons people aren’t selling. No. 1- The daunting task of finding another suitable home makes residents reluctant to enter the market. No. 2- Investors don’t want to miss out future appreciation, it’s hard to earn what your house appreciates every year. No.3- Seniors are remaining in their homes longer after seeing what happened to residents in care homes during the pandemic. No.4- The demand is so high, homes sell within a week of being listed, not allowing inventory to build, probably caused by low interest rates. No.5- Overpopulation.

It is a great excuse, but that doesn’t take away from the fact that coordination is ultimately necessary to achieve your objectives and to do it in a way that has greater buy-in because it’s seen as fair.

Yeah, and Victoria is really expensive so if more people can’t afford it then I guess we won’t grow as fast.

Forget sprawl vs. density…some cities like Oak Bay and West Vancouver are opting out of growth.

Coming from the NIMBY perspective, I’m telling you that we can’t have Saanich earnestly trying to do stuff, against the wishes of many of its residents I might add, while Oak Bay can choose to preserve its wonderful 1960s-era low-density character in amber.

Supply is extremely inelastic in real estate. There is some evidence that investors cash out a greater rate after prices have risen, but owners generally don’t benefit from selling unless they are leaving for cheaper market. For new construction, the lag between demand rising and supply spooling up is often years due to the slow approval process for new projects.

Lowest May inventory since 1996 (start of data)

Marko, here is a public sector real estate job for you to just sit on your ass and get paid as you have alluded to before. Lol not sure what kind of real estate development BC Transit will be doing unless they are planning for rail or water solutions.

https://bctransitcareers.mua.hrdepartment.com/hr/ats/Posting/view/913/0

Market newbie here, but if this was about the psychology of markets (exuberance…bubbles…etc) wouldn’t we see a rush of homeowners attempting to sell to take advantage of historically high prices?

Any have any thoughts on why inventory remains so low? Leo, any idea on how the 1489 figure relates to a 10 year average?

Apologies if this was discussed before…

Will condos in desirable areas rise ? Seems like it’s been quite the stagnant market across the lower mainland and Victoria .

My perspective is that rents will be at where the market will bear, but the market will bear more of an increase if the minimum wages are increased.

Monday sales: 1013 (+133% from last May)

New lists: 1299 (+19%)

Inventory: 1489 (-41%)

I’m not convinced rising income pushes up rents.

Can’t compare that way. A $1M home in Winnipeg is a luxury home. You will pay the same here for a luxury home. It’s true that those in higher priced areas have an effectively lower tax rate which is oddly regressive.

Not everyone needs to densify. Many cities can sprawl to their heart’s content if that’s how they want to do growth. Not an option for us.

As for everyone needing to coordinate, I think that’s just an excuse never to do anything. Cities have always grown at different rates based on their decisions around housing and relative attractiveness.

Leo, any thoughts on the rise in minimum wage (33 percent in the last 4 years) contributing to rising rents which also attributes to rising home prices. I mean people are making 18-20 bucks an hour working at subway and Tim Hortons now after accounting for tips.

I am considering subdividing my property and creating a new vacant lot. Are there property transfer taxes or other fees that I should consider when I sell the new lot? Thx for any advice.

But all cities have to work at this simultaneously so that a) the negative effects of densification are spread out equitably across all cities, and b) so extraordinary demand isn’t induced in some cities and not others.

Back then boomers were walking 10 miles a day up hills in 6′ of snow both ways to and from work, hence housing were affordable.

“If I could turn back time”

Certainly not “always”. All of the above metros had decent neighbourhoods that were affordable to the working class not too long ago. Remember Archie Bunker? And he lived in NYC itself.

And that’s really lowering the bar to any kind of family-suitable space. A couple decades ago a single family house was affordable as well. I’ll have to run the numbers on median incomes but it would be close

This sounds strange and defeatist to me. Yes Victoria will always be one of the most expensive markets in the country to buy a single family home. What doesn’t follow is that the city can’t do anything to ensure people have an affordable place to live. There are massively impactful things they could do.

This is not true. Leo has a chart showing that 3 bedroom places 1200 SF or more were affordable on median family income in 2015. Today they are not. We aren’t going back that far. You also aren’t looking at incomes in some of these cities. Yes courtenay and Nanaimo and Kelowna have cheaper house prices but the median family incomes are lower as well. Calgary and Edmonton are more affordable no question but many of the jobs there are tied to oil which means if prices tank again you may be looking for work.

In comparing Victoria housing prices, people forget to factor the property taxes in other cities. A million dollar home in Victoria runs around $4500-5000 in taxes. In Winnipeg, houses in that price range pay around $10,000 in property taxes. You get more house but not much land, unless you go outside the city.

You are ignoring the unprecedented Canada-wide rise in prices over the past year. There has been a severe decline in affordability in previously reasonably priced markets. Victoria actually saw a relatively small % increase. And high housing prices threaten the country’s productive capacity:

Canada’s ballooning mortgage debts could put a dangerous dent in entrepreneurship

Here is another take on it. Victoria, Toronto and Vancouver are really unaffordable but have been so for a long time. Yet, much of the rest of the country is still reasonably affordable. Prices in Regina are about the same as they were 10 years ago. In Edmonton and Calgary you can get a condo for $100,000. I have a four bedroom SFH in a good, central part of Winnipeg for rental and the price has spiked to an outrageous $375,000 with rent at $1700! And weather aside, these cities have a lot of culture and facilities – as much as Victoria.

Most countries have unaffordable cities/areas that were always expensive and always will be. In the USA that’s San Francisco, LA and New York City. Most other places (e.g. Chicago/Arizona/Indiana) are not that bad. In France, it’s Paris and the Cote d’ Azur. People moving to and within these countries looking for affordable housing will simply have to relocate somewhere else.

Thanks for the response Leo. I’m sure you’re right and it won’t end until the market cools a bit. It sure is rough out there.

I think it’s unlikely that the system of multiple offers will change. The market will likely keep cooling to make them less common.

In the end it’s the sellers property so it’s hard to restrict them from selling it in a way that is most beneficial to them

Marko I appreciated your video on holding offers. As a buyer in the market right now I’m feeling very frustrated with this practice as often a bully offer comes in and they decide to no longer hold or as you said the deadline is not really the deadline. I find it all very unprofessional. Do you see us headed back to a market without this ridiculous system anytime soon?

The city of Victoria is blessed that it doesn’t have to pay for anything in its suburbs. Nothing for police, roads, water, sewer, etc.

Good idea.

Rental construction is back. Very dependent on gov’t money flowing, and the delays to getting it built (and the fact any economic rental built form requires a rezoning almost everywhere) are a big deterrent to getting costs down, and a big risk to aging buildings which are already zoned for rentals and will face re-development pressure.

It’s being changed right now because it’s not clear. What this is referring to is the fact that suburbs are a net money loser for cities. The discussion we had here last week. More taxpayers either enables the government to keep tax rates in check, or (more likely) allow the city to spend more on amenities that people want (parks, road maintenance, infrastructure upgrades, bike lanes, etc).

Probably true! But I’m an optimist for the time being.

Leo, good luck with your advocacy ventures but I think you will be very disappointed in the lack of logic and comprehension you will encounter. People do not want to hear reality.

My bets are on nothing changing and in yr 2035 SFH average in the core will be $2 million +/-.

As I’ve said before, at least once a month I am at a showing where my buyers’ friends, work colleague or acquaintance show up with another agent before or after our showing….yet let’s us blame the non-existent foreigners.

From Leo’s housesforliving.ca:

This is disingenuous.

Property taxes increase only because the city decides to raise them, independent of house prices.

We bought recently and our current accommodations are on the market now. The owner of the house has put the rent up 30% (over $1000/mo) versus what we are paying. I feel it’s outrageous given what it is. The monthly would finance a pretty fat mortgage. I dont know what family could justify paying the ask unless they are transient and looking to parking themselves only temporarily.

If you look at the total current PBR stock, I think you will find that most of it is still owned by the private sector. That’s what REIT’s invest in. Problem of course is that not much is being built these days. But a lot was built before the advent of condos and much is still around.

As far as government ownership properly speaking is concerned, that pretty much went out circa 1970. Policy since then has been for government to assist non-profit housing but it is owned by co-ops or societies, the latter primarily for assisted housing. False Creek South in Vancouver is an example of this new model.

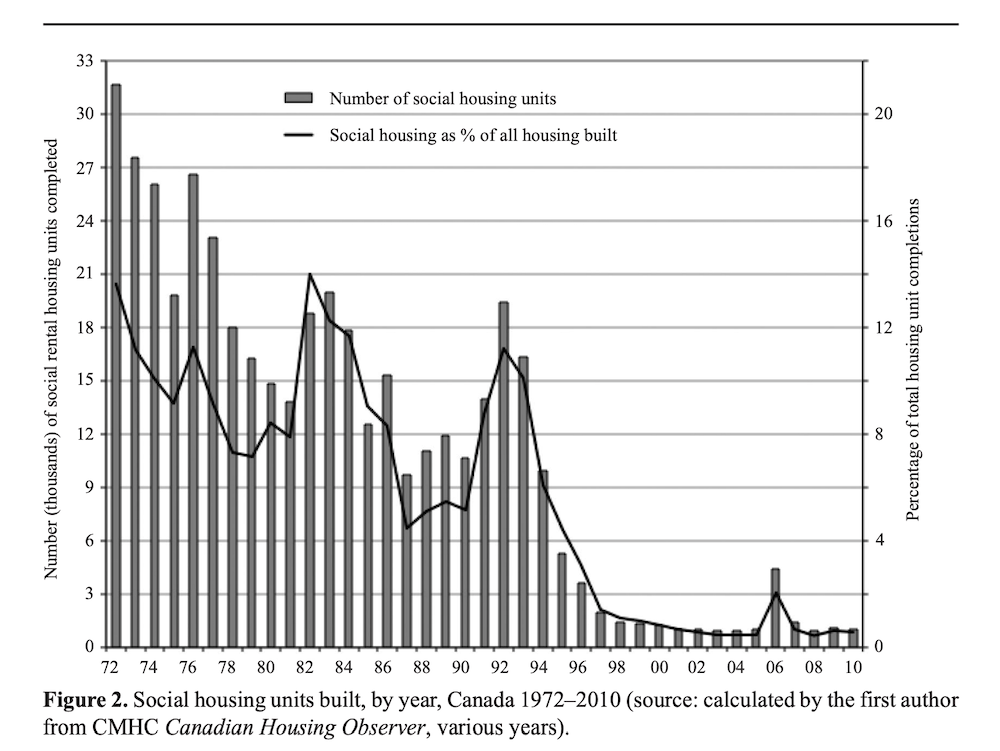

Not really. The investment in social housing really wound down in the late 90s and purpose built rentals before that, but there was such a boom in the 60s and 70s that we were able to skate by on that for a while.

Most definitely. One of the key actions we are proposing is building them. Right now we are building lots, but not where a lot of people want to live, and most aren’t family suitable. Just listen to stories of families in precarious rental situations. These aren’t poor people, just average families that are tied to a region because of schools but constantly in fear of their house being sold out from under them. It’s terrible.

That’s why I’m not in favour of cracking down on landlords like many are. Landlords aren’t evil, they’re simply filling a gap left by society.

I’m not. I’ve written at least 3 articles talking about how they’re a symptom of the problem, not the problem. That doesn’t change the fact that they both push up prices and provide less secure tenancy than PBRs. The way to fix that is to provide better housing for people.

Excellent post Totoro.

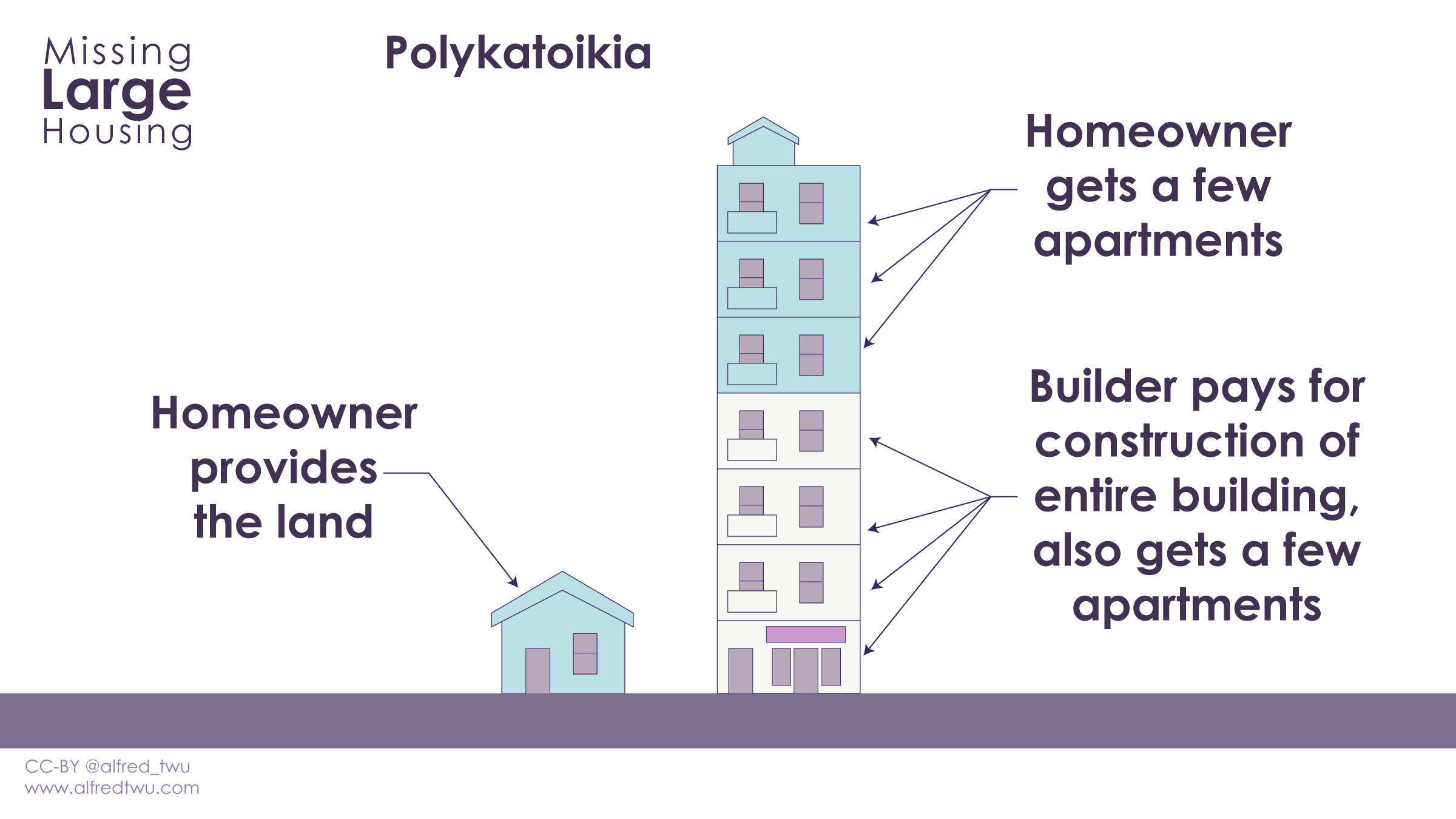

*** Missing Large has entered the chat ***

It is definitely a problem to have to vacate in a low vacancy environment, but this has been the case forever and renter protections have improved.

I think the real issue is that there is not enough affordable purpose-built rentals that will not be subject to the owner selling or moving in. This type of housing is generally government-owned, not private sector owned. The current situation is a failure of government to address affordable housing in a logical manner imo – or really pay much attention for decades as our housing crises developed.

Landlords who are renting out a suite in their home, or their secondary home, are not the sole solution to this problem, nor the cause of it. At this point, and until the numbers improve, these landlords provide at least some options for housing in an environment in which any additional rental housing that is safe is needed.

And, as far as regulating private landlords goes, they are regulated heavily through the RTB which favours tenants in most cases. Private landlords do need the freedom to sell their homes or move into them and they pay for this in the form of one month’s rent and they carry all the risks and expenses of ownership. If you tighten these restrictions further you are going to discourage even more people from providing rentals in a time when there are no other reasonable options.

So, imo, talking about foreign owners, dirty money, or greedy housing “investors”/landlords in a derogatory fashion clouds the main issue, which is that the fault lies with government policy and our tax dollars should be directed at affordable purpose-built rentals. In the meantime, private landlords should be encouraged to rent out their homes/suites and create new rental housing on their property imo. If we get to the point where we have enough purpose-built in the market tenants will not face such competition for homes.

I am. Doubt I’m alone. Now I’d rather invest in something that is not subject to such negative stereotyping.

I very much doubt any significant number of people are deterred from buying rentals by the social implications.

The perception of investors is born from the fact that many provide insecure housing. Some 15% of most recent moves by renters in BC was forced. Vast majority will be because private investors sold the property. That’s not a problem of perception, that’s a real problem

Seems logical if zoning permits, but there is significant stigmatization of private ownership of more than one home going on right now – even if the home is providing rental housing. I would expect that many people will not want to participate in this type of project unless this the social messaging changes.

The money is flowing right now. I don’t think it’s a problem of capital so much at the moment though it certainly has been in the past. CMHC is pouring in money through interest free loans. Pension funds are pouring money in as well.

Interesting suggestion here for seattle https://aluver.medium.com/the-great-seattle-housing-swap-acebbbbb7ddd

For new PBRs to blossom a large amount of capital will be required. Perhaps an ad could be placed in the financial papers?

“Venture Capitalists of Unexcelled Bovine Stupidity Sought for British Columbia Real Estate Investment

Complete unawareness of a provincial history of business-hating government an asset

Masochistic tendencies will be amply stimulated by a confiscatory tax regime

Intellectual engagement provided by untangling myriad overlapping and idiotic regulatory frameworks

Connoiseurs of lefty cant will enjoy routine engagement with notoriously biased tenant/landlord resolution boards

Those eager to throw away their money will be pleased with the efficiency of our rent controls, ensuring that there is no chance whatsoever of a just return on your investment”

Ks112- Re: coin-op washing machine. If you have a reasonable tenant, sure this is heavy handed, but you would not believe how some people take advantage of someone’ generosity by letting their friends and relatives do their laundry at your expense. Some people are just idiots.

They are building rentals, although the strict rent controls don’t help for sure. But for a family wanting to live in Saanich, hundreds of 1 bed PBRs in Langford don’t help. So those families are renting from investors. PBR townhouses / lowrises everywhere would help a lot. We used to build them, and in fact some of the best neighbourhoods in Victoria have low rise rentals. Never heard of anyone saying they ruined the city. Apparently now they will?

Clearly. PBRs have always required government support. But that money is flowing now. Rentals are being built, but only in some small areas, and again most of them are not suitable for families.

ending the ban on rental can only help the rental situation.

Definitely. Many housing providers spoke at the Vancouver hearing to allow 12 storey social housing. They are unanimous that the years of delay and uncertainty from rezoning is a massive impediment to them building anything. These were all non-profits that don’t have the deep pockets to withstand this kind of uncertainty.

Right. Especially when recently tightened BC govt rent controls limit rent increases to inflation, regardless of landlord costs, which could rise much higher than inflation if interest rates rise. What owner (or their banker) would want that risk?

They don’t build rentals because they can get a better return in much less time with lower risk building condos. They might speak less clearly publicly, but that’s the bottom line.

Maybe there’s simply more money for builders in build-for-sale (1-2 bdr) than build to rent (family 3 bdr) , and simplifying the zoning won’t change that,

It might be helpful to speak with builders, and get their input as to what would need to happen to make them build purpose built rentals. And not rely on what UBC professors think will happen with zoning changes, as they aren’t the ones deciding what to build. With so few rentals built since 1991, maybe the zoning isn’t the biggest reason the builders aren’t building family rentals. On the other hand, if was a big issue for them, maybe you’d have a quote from one of them on the site “if all properties were zoned for rental density, we would start building lots of rental 3-bdr family units.”

On the bright side, maybe more direct government participation is needed to make it happen. Perhaps providing funding, guarantees etc. Family rentals would seem something all levels of government should support.

Note that suites plus laneway houses were already allowed in many SFH zoned areas. That’s 3 dwellings. A duplex is just 2. This may have something to do with the duplex zoning not pushing up prices. And as noted below, there was general softness in the Vancouver market in 2018-19, particularly in lot value properties – which was noted in this forum at the time.

https://vancouversun.com/news/local-news/duplexes-in-single-family-neighbourhoods-a-success-after-first-year-city-says

@Patrick

That’s why the first action is to broadly upzone for rentals which should not significantly alter land values. Patrick Condon, a professor and significant opponent to broad upzoning for purchase (because of his concern about land value escalation) supports broad upzoning for rentals. That first fixes the problem of insecure rentals, and secondarily extracts renters from the private investor market, which reduces the appeal of private investors in the market and pushes down demand and prices.

As for broad upzoning for the purchase market, it’s unknown what it will do to house prices at this point because there’s little research on it. First of all the average house price is $1.2M so far this year. We’ve missed the boat on single family affordability I would argue. So what are our choices? Relegate ourselves to the fact that anyone that can’t afford $1.2 million is not welcome on 80% of our land? Does that solve anything? Or build more affordable houses for families to live in?

Right now the only choice for most families is a single family house. If we had abundant townhouses, it reduces pressure on single family demand. Many families may prefer to pay $800k for a townhouse rather than leverage to the max and spend $1.2M. That can reduce pressure on single family prices. None of that changes the fact that land prices will continue to escalate in Victoria over the long run.

As for the research support for the policies, I totally agree that it’s key. If we want to win against NIMBYs we need to be coming from an evidence based position. . We already link to some supporting research and will add more. I’m also talking to the economic department at UVic to get signoff for the proposed policies.

What are the early results of the broad upzoning that Vancouver did a few years ago? I can’t seem to find much info on that score.

Nice site and a great cause which I agree with. But there should be some rationale provided for the recommended actions, such as including success stories from other cities that have implemented these ideas.

And explanations as to why some of these same ideas failed in other cities.

Like this idea…

“ Upzone all single family areas within the urban containment boundary to allow multiplexes and townhouses by right.”

That could hurt more than help.

A 2019 Chicago study was done by an upzoning advocate , who studied an upzoning, and expected house prices to fall and construction level to rise. To his surprise, he found that upzoning had the opposite effect.

The upzoning…

1. Immediately worsened the problem by raising all single family home prices, due to the added option to upzone.

2. had no effect on construction, at least for the first 5 years that they measured,

https://www.forbes.com/sites/petesaunders1/2019/02/22/maybe-upzoning-doesnt-always-lead-to-lower-home-prices/?sh=79da87964dd3

“Freemark identifies two key mechanisms by which upzoning acts to increase prices. First, the fact that upzoning registered so quickly in higher prices is a signal that land prices respond rapidly to the ability to build more units, which translates into money in the pockets of incumbent landlords. Second, the large effect of reduced parking minimums on the value of vacant land means that the biggest impact of zoning liberalization is on land that is ripe for development anyway. As Freemark puts it bluntly: “[T]he short-term, local-level impacts of upzoning are higher property prices but no additional new housing construction.”“

I would never put a coin operated in my suite, i view the landlord-tenant relationship as one that is more mutually beneficial. If you give out the impression that you are trying to extract every dime out of the tenants, you are likely going to have more problems.

Assuming the washer uses 100L for a load, that’s 0.1 cubic metre. Saanich charges $1.742 / cubic metre which will cost the landlord 17 cents.

Still want to claim it’s about the water bill?

ks112- the cheap ass landlord that has to pay the water bill?

What kind of cheap ass landlord has coin operated laundry in their basement suite?? This gives good landlords a bad name.

https://www.realtor.ca/real-estate/23264179/1789-hartwood-pl-saanich-lambrick-park

YIMBYs unite!

Right on!…. very glad to see something like this get moving and get some traction! Hopefully there are enough people left in this town who care enough to keep the lights on.

Looks good Leo.