Market Breakdown: Where’s the activity?

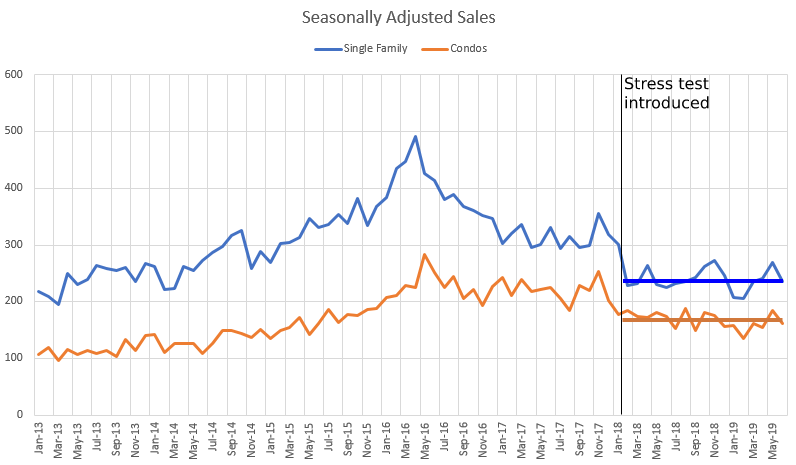

We know that sales are slow out there, with June coming in at just above last year’s total and near multi-year lows. But what’s selling?

Now that the spring market is winding down, we can look at the last 4 months of sales and see how they compared to a year ago. Single family sales from March to June came in 4% above last year’s total, while condo sales dropped 5% over the same period.

Overall sales are roughly flat, and have been since the stress test kicked in.

Because prices are roughly flat year over year, we can compare the spring market and see where the activity has been concentrated.

From that we can see that although overall sales are roughly flat, the luxury market continues to weaken (hence we are starting to see losses on resale in the higher end) while the mid market is more active this year than last. The good news if you’re shopping in that crucial mid range is that new listings have also increased to essentially cancel out the increased sales.

Interestingly enough, the Westshore is the region responsible for most of the changes in sales this year. While the core is very stable with condo and single family sales nearly identical to last year, condo sales in the Westshore dropped precipitously while all the gain in single family sales was concentrated in that region.

What conclusions should you draw from that? Honestly, probably not that many. The high end market and condos continue to weaken while the rest of the market is in roughly the same shape as this time last year with a bit more selection available for buyers. Shifts of sales between regions and price ranges are like the little waves on top of the ocean swell. They will toss a piece of bark up and down, but they are ever shifting and none of the waves will get too far away from the surface of the swell before being pulled back down. So too are individual market segments connected to each other, and all of them ride the wave of fundamentals and the larger market cycle.

If you’ll allow me to torture the metaphor further: When interpreting market conditions, be the kayak that rides the swell, not the piece of bark.

Monday numbers: https://househuntvictoria.ca/2019/07/15/july-15-market-update/

QTs reference was to the “majority of millennials on this board”, not all millennials.

I think it would be interesting if Leo did a survey of people on the board to see where they’re looking.

I made a post awhile back asking if anyone was looking Westshore, and I recall one reply saying yes, and the rest were looking core only. I’m sure you’ve read posts saying “I won’t commute”. “Langford is for warehousing people” etc.

As we all wait for the Monday numbers so that we can read the tea leaves.

Westshore is of course thick with millennials, and that is exactly who is buying there.

Generation Grumpy Old Man

No.

🙂

The economy does not matter for the majority of the millennials on this board, because the concern is centered around personal lifestyle and the core. Hence, empty Westshore homes are uninhabitable or any place outside of Victoria core and Vancouver West/West Side is nothing more than envy taxes that aimed to punish “wealthy” homeowners and to appeased the vociferous crowd.

Gag me with a spoon.

Speaking of unicorns, does anyone really believe that the economy of Langford depends on letting houses sit empty?

The tech unicorn will appear any day now and spread wealth and riches through the land.

Sigh.

Leo, you tend to not mention the Spec Tax in your market analysis very often. I view it as the single greatest destructor of the BC RE market right now. I believe the market to be in holding pattern until the next election. I cannot post an amended version of your ‘Seasonally Adjusted Sales’ graph ..but your Stress Test Intro line needs to be adjusted back to Oct 2017 (to reflect the announcement date, which is more significant). You will then notice the uptick in activity as people rush to beat the implementation. The more significant line will then be the Envy Tax, which was announced in Feb 2018. The market crush can then be seen in direct correlation to the actual influences.

Yes, but since the total number of spec tax homes declared is about 1% of total housing stock, and that includes Airbnb, at least we know that Airbnb (use more than 6 months) is also a small factor <1%, at least according to what has been declared.

And if they proceed to actually build they should not have to pay again.

The tax working as expected, all for the paltry cost of $12,500/ vacant year

According to the article the owner says they applied for the permit in 2017, not 2015. Why then? Well maybe they thought it was a way to beat the tax, which was to go into effect for the year 2017. Now read what the bylaw actually says:

.2A vacancy tax is not payable under this by-law for a parcel of residential property if the residential property was unoccupied for more than six months during the vacancy reference period in order to do one or more of the following:

(a)redevelop or safely carry out major renovations to the property:

i.for which permits have been issued by the City, and

ii.which, in the opinion of the Chief Building Official, are being carried out diligently and without unnecessary delay, or;

(b)carry out either redevelopment or initial development of residential property that is unimproved with any dwelling units, or the rehabilitation and conservation of heritage property:

Note: the tax is not payable if the property was unoccupied in order to redevelop and for which permits have been issued. The owner bought the property and left it empty for two years before any application to redevelop. IF they had applied for the permit in 2015, that would be different.

In Vancouver or Victoria? Only way you can manage that is by asking a rent which is way above market, which is the same thing as deliberately leaving it empty.

Or rather not empty but AirBnB, which is what I think is actually happening in most such cases.

Well of course, and that is stated in my posts. No one disputes that. The satellite families have one or more owner who doesn’t live in Canada 6 months so isn’t subject to Canadian income tax. Their kids, spouse, parents or other close family members live in the house The owner pays taxes elsewhere (eg USA) and also pay property taxes (and PST/GST on Canadian expenses).

This isn’t rare, as I pointed out in an earlier post there are more satellite families then BC residents paying spec tax. Life gets complicated for lots of people, you shouldn’t assume that there are “evil” intent behind these satellite family situations, and delight at throwing huge taxes at them.

Maybe you’ll move to USA and buy a condo for your elderly mother to live in Victoria. Then you’ll be a satellite family too!

No, and those aren’t the facts of this case.

Read the article. The home was last occupied in 1997. The current owners bought in 2015, applied and waited for approvals/building permit and have obtained them and torn the house down and have (2019) started construction on an $8m home, which will boost BC economy with jobs and taxes.

So, based on the facts as presented in the article., I don’t think they should have to pay Vancouver empty homes tax (or spec tax for that matter).

There has to be some common sense to these taxes. For example, there will be legit landlords who only manage to have a tenant 5 months in a particular year, do you want the letter of the law applied to them so they too pay spec/vacanacy tax? And at a 4X higher rate if the legit landlord happens to be a foreigner? If you do this, you will end up with less homes for rental, not more.

Wonder if the spec tax will apply or if it will be waived due to the fact that they now have a building permit

Well how about various high tech industries. The kind that have trouble getting people to work for them in Vancouver and Victoria, because the housing is so expensive.

Are you seriously suggesting that someone should be able to get out of the vacancy or spec tax by allowing a property to become derelict?

What’s absurd is the idea that there should be a payoff for such openly antisocial behaviour. Many jurisdictions issue hefty fines for this sort of thing.

Anyone who lives in Canada over 6 months a year is considered a resident for income taxes. In addition, the satellite family status is not based on whether those living here are citizens, permanent residents, or otherwise. It has to do, as has been clearly pointed out, with whether the majority of their income comes from outside Canada.

I’m in favor of taxing speculators, ie) people who buy and sell homes within a short period of time (5 years) to make a buck. ALL speculators, not just the foreign ones.

Taxing satellite families is typically taxing people with homes that are fully occupied 12 months of the year, just because they’re foreigners (with no obligation to pay income taxes in Canada). That isn’t anything close to an empty homes tax or a “spec properties” tax..

An amazing statistic, from the BC govt spec tax report. There are more “satellite families” (occupied homes, not vacant) paying spec tax than BC residents (with vacant homes) paying spec tax.

https://vancouversun.com/news/local-news/early-speculation-tax-figures-show-foreign-owners-hardest-hit

“• 27 per cent (3,241 people) were satellite families, defined by B.C. as a household in which 50 per cent or more of the income comes from outside Canada.

• 20 per cent (2,410 people) were B.C. residents, who own more than one property that is vacant more than six months of the year.”

But of course the most amazing stats from the govt report are the low numbers of vacant/spec homes found, pointing to only 1% of homes in Victoria – a tiny factor in the housing crisis.

Taxes have to be proportional to the amount to have any effect.

Kinda like speeding tickets in Norway which are based on your income and more effectively deter dangerous driving for high income drivers

Please note that that $249K 1% tax for year of 2017 is Vancouver empty property tax, Not recent provincial spec tax for 2018.

“The City’s Empty Homes Tax is separate from the provincial government’s Speculation and Vacancy Tax. If you have an enquiry about the Province’s tax, please refer to the Province’s website or call 1-833-554-2323”

Added: Patrick, I saw your earlier post blaming it to the spec tax, thus my post above. But you changed your post since, and now it seems like you dislike all the taxes wrt empty/vacant/spec properties.

$249k tax is absurd for a derelict house valued at $10k (land worth $25m). Especially when the new homeowner is developing the property for someone to live in, which is what the city of Vancouver wants. Simply a wealth/envy tax.

Yeah I was curious about that part. Why didn’t the exemption get approved? I suspect there was more to it like perhaps the building permit was applied to more as a stalling tactic rather than actual construction.

LeoS:In fairness he seems to have applied for a building permit before the vacancy tax even came into effect. A eight million dollar house also represents a lot of jobs being paid by foreign currency. His property tax bill, including the extra school tax is going through the ceiling on this one. We might not like the foreign ownership but is this a better way of getting foreign exchange than selling barrels of oil instead.My point is that if we dont want to export houses than we have to consider what will make up the difference in our balance of trade. We import one hell of a lot of stuff and we have to pay for it somehow.

To be fair it’s only been vacant for 20 years. Seems a little hasty to slap a vacancy tax on.

https://vancouversun.com/news/local-news/belmont-property-has-been-vacant-for-years-but-owner-is-suing-over-vacancy-tax

FYI :

The secret to lower housing prices? It’s all in the zoning

https://www.theglobeandmail.com/opinion/editorials/article-the-secret-to-lower-housing-prices-its-all-in-the-zoning/

It’s ostensibly an average for the whole country, which is just as useless as any other average over all of Canada when looking at real estate. They don’t cite data sources so they can’t be taken seriously anyway.

https://www.numbeo.com/property-investment/indicators_explained.jsp

4 and 5% isn’t a range, as discussed it’s two different things, (4% rental yield in apt in city center, 5% in outside city center apt). Seeing one yield at 3.2% for a house just tells you it’s a below average rental yield, probably because it’s a house not an apt. fwiw, I don’t expect that the numbeo data is that accurate, likely useful for comparisons though.

Yeah, that only misses the mark by 20-36%. Kind of like selling an $800k-1M house for $640k.

Regarding rental yield, here’s a chart of rental yield by country. https://www.numbeo.com/property-investment/rankings_by_country.jsp (use the link and then set it to “gross yield city center, which is a median 1000 sq ft apt. in city center)

Highest rental yield in the world is listed as USA. (10%) Canada is middle of the pack at # 55 of 93 countries @ 4%. Yield for Canada outside city center is 5%. I wouldn’t read too much in to these, as it’s not always apples to apples, but it’s an interesting chart nonetheless., and their 4-5% for Canada isn’t far off from the broadmead example 3.2%.;

In recent travels in USA, I’ve noticed rents to be much higher in general related to prices (compared to Canada), implying a higher yield in USA vs Canada. The 10% quoted yield for USA still seems high though.

I take it you’re not someone who paid double digit interest rates for well over a decade. You have a choice to get a mortgage without break fees, etc. at rates that are still near record lows.

Look on the bright side, after expenses you’re not going to have much income to pay taxes on.

without running the numbers in detail, unless you are hoping for some sweet capital appreciation, those are some terrible cap rates for every single one of those properties… especially the Cottontree Ln sale for 1.2 million. 20% down minimum as its not a principle residence is $240,000. Thats $800.00 per month just in opportunity cost (4%).

Even if they paid cash for the house, the rental income ROI, without any expenses (maintenance, property taxes etc.) is only 3.2% and that doesn’t include any income taxes either. yikes

I was wondering about that Salsbury Way property – the owners were chasing down the market for awhile now. There are a few in Broadmead with similar sales points & now on the rental market.

4465 Cottontree Lane sold for $1.2 million and looking for $3200/mo.

https://www.usedvictoria.com/classified-ad/4-Bedroom-House-in-Broadmead_33624662

4493 Emily Carr sold for $863k and looking for $3600/mo.

https://www.usedvictoria.com/classified-ad/single-family-house_33482236

I believe the Emily Carr is wishful thinking for that rental rate given the house is dated and not terribly large. The Cottontree Ln. is the better rental value in the area.

3545 Salsbury Way which just sold for $807k , now being listed as an executive rental for $3500/month. https://victoria.craigslist.org/apa/d/victoria-full-executive-house-with/6929222956.html

4033 Cedar Hill Rd sold for $811k, looking for $3400/month. https://victoria.craigslist.org/apa/d/victoria-beautifully-renovated-4/6927363475.html

@Leo S It would be an interesting article to look at cap rates in our current market.

Listings are starting to increase on my portal. Anyone else noticing something similar? Over the last 2 years it’s gone from <200 to 335 at the moment which is an all time high.

I know it's been posted but could someone direct me to the historical sales and listings by month graph.

In some ways I think that KSS is right. Leo’s data is on properties sold. I’ve noticed a definite decline in asking/selling compared to last year for some places. Could it be that owners who tried to sell last year at $1.5 are now having to lower their expectations to $1.2 if they want to sell their property?

KSS: Interesting thought but Leo was saying that prices have not changed much in the last year. Be interesting to know what percentage of this price range is local buyers.

My understanding is that all 10 year mortgages have low break fees (three months interest) after the first five years by law. That’s one of the reasons the banks don’t love them. Effectively it amounts to a five year mortgage with the option for the consumer to continue if the interest rate is in their favour or break if it is not in their favour.

Banks are not your friend, that is for sure.

I haven’t paid any fees on the mortgage but definitely breaking the mortgage is expensive. Calculating that right now since our variable rate is no longer competitive.

But I find most mortgages have more than enough prepayment options. Usually you can double payments plus pay down 20% of the original amount every year. With the large mortgages around here that should be way more than enough for most people

I’d be quite happy with a 10 year mortgage and low break fee. As a first time buyer I’m really appalled at the various types of fees and their amounts relating to mortgages. Breaking fees, fees to pay extra onto your debt, fees to skip a pymt, fees fees fees. fees in the thousands of dollars when I only make a few thousand a month. Just seems like an industry that price fixes and rakes people over the coals.

Barrister, this maybe because the $1.2M homes sold this year were priced at $1.5M last year?

LeoS: You do a brilliant job not just organizing the numbers but also providing charts that provide a real insight into the market.

I find it interesting that sales in the 1.2 range are actually up this year, any thoughts as to why?

You need a more persuasive argument for me than someone’s been saying it here on HH. Or even worse, that some economist has said it.

This is precisely why govt support is needed to make longer fixed rate term mortgages happen. Luckily BOC Governor Poloz is on side with this. Govt can help (through legislation and policy) by:

Inflation should rightly be feared by anyone with a short term mortgage in Canada. USA has 30 year rates of less than 4.0%. If Poloz can do this, and make long term fixed-rate mortgages widespread in Canada, it would do more good for BC first time buyers than all the BC govt programs to smoke out the foreigners and bogeymen from their BC homes.

As has been pointed out many times here, construction is proceeding at a record pace.

As has been pointed out both here and by economists, such programs simply boost prices.

Lenders can offer 25 year fixed rate if they want. The reason they don’t is that people are not willing (or able) to pay the rates the lenders would need to make it worthwhile. The risk is higher for the lender so the rates are higher.

Excellent write up as usual.

Leo have you thought about making a Facebook group and posting this info there, it would reach a bigger audience and people need to see and hear what you’re writing.