Jan 14 Market Update

Weekly sales numbers courtesy of the VREB.

| January 2019 |

Jan

2018

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 42 | 93 | 431 | ||

| New Listings | 92 | 274 | 772 | ||

| Active Listings | 1828 | 1884 | 1491 | ||

| Sales to New Listings | 46% | 34% | 56% | ||

| Sales Projection | — | ||||

| Months of Inventory | 3.5 | ||||

Well so much for more sales. Second week in we are down some 9% from last year’s already tepid sales pace while matching the pace of new listings. Last year we had a surge of condo sales mid month which I doubt we will reproduce this year. As usual, there are a third more properties on the market than a year ago.

This is the time of year when we start to get new listing piling on again (the big rush starts in February) and last week was a rare week that single family new listings were actually up over the same week last year. We are still waiting on a noticeable jump in new listings as a result of the spec tax so I will be keeping an eye on new listings volumes this year. The province says that speculation tax declaration letters will be going out mid-February, and I suspect that will make the whole thing a lot more real for a lot of owners that have only been peripherally paying attention.

As the price gains petered out in 2018, the headlines have had to be be more creative in order to remain positive. The Times Colonist wrote “Greater Victoria real estate market closed out the year with double digit increases” which caught my attention since I know that single family prices did a lot of nothing in 2018. Where are these double digit increases? Turns out the story is about the Royal LePage survey and the gain supposedly only applies to two story homes which apparently rocketed upwards by 13% while the median bungalow didn’t change in price. Pulling the price data for two storey homes I don’t see any significant increase, but it’s possible they have some combination of areas and definition of “two storey” that it shows up in their data. Either way it doesn’t reflect the reality of the market out there.

The amusing thing is that once the numbers are out, they must be justified. From the article: “Retirees who choose to buy a condominium are competing against first-time buyers, resulting in a lack of inventory. Retirees who are unable to find a condominium stay in their homes longer, resulting in a shortage of two-storey (homes). With a shortage of listings within these two housing types, prices in both property segments rose in 2018.” Isn’t it curious that neither first time buyers (looking for affordable single family) nor retirees (looking for single level living) were apparently interested in bungalows? And let’s not point out there were nearly 30% more two storey homes on the market at the end of 2018 than the year before.

As I said in an earlier post yesterday, I think the NDP did a brilliant job designing a SpecTax declaration system.

After thinking more about this new SpecTax declaration and reading the Government website, I realize the NDP are exceptionally brilliant!!!

Now that the Provincial Government is collecting and collating SpecTax information, Social Insurance Numbers, and B.C. Assessment Data and the Canada Revenue Agency is collecting Principal Residence ownership information and rental history, including basement suite details based on Social Insurance Numbers, I think the end result will include cross-referencing both sets of data based on SIN Numbers to identify tax evaders. Tax evaders include people lying about principal residences for the home owner grants, undeclared rental income, undeclared capital gains, SpecTax evasion, and probably other unreported details.

If both governments share data and collate and audit this will put an end to the rampant tax evasion that occurs from various real estate scams by ‘investors’ and speculators and landlords. And, it’s about bloody time!

Some more data on the level of connection between Vancouver and Victoria prices: https://househuntvictoria.ca/latest

East coast verses West coast living for under $400K.

https://www.realtor.ca/real-estate/20222817/2-bedroom-condo-202-505-cook-st-victoria-fairfield-east

https://www.realtor.ca/real-estate/19793914/3-0-bedroom-single-family-house-12-duncan-lane-hubbards-hubbards

Features of the $389K Houseboat include:

A. You get to park your car just 3 blocks away at Gorky Park beside the Russian Tea House on Belleville Street for just $400 per month. Either that or can go without a car and walk everywhere. Or you can ride a bike. But bikes aren’t allowed on the pier, so you’ll have to find a back alley nearby to hide it in.

B. Because you don’t really own anything except the wood and metal that makes up your dream home, you get to pay an expensive moorage fee once a month to park your vessel, to a hairy and unfriendly HAG (Harbour Authority Guy) that’ll kick the Bejesus out of you if you miss even one payment.

C. Because you will actually be living on the sea, you get to bob up and down like a top in the water, 24 hours a day, because, well, that’s what houseboats do on the water.

D. You get to take in the incredibly noisy engine sounds of countless other boats that will be streaming past your front door 24 hours a day. And you get to breathe in the cancer-causing diesel fuels from the harbour planes that land just feet away from your abode.

E. You get to wake up at 8 o’clock on Saturday and Sunday mornings, and be accosted by droves of tourists who come around looking to be entertained by you (“Look at that man over there Billy. I think he’s a real live skipper. He lives on that boat. Go ask him if we can go aboard for a tour”).

F. In 15 years time, when the ravages of the sea finally eat away at the hull of your boat until the sharks are circling underneath and there’s nothing left between you and death except a few barnacles, you get to think about (illegally) towing the remains of your junk out to the Gorge Waterway (at night) and “sinking her in the drink” when no-one is watching, thereby losing your entire $389K investment.

The form seems easy enough to fill out and submit.

The timing could be better, piggy backing dates for property taxes would have made sense. So this does feel rushed. However, I will agree with Dad on this one that data is required.

The Liberals not only turned a blind eye to the issues of housing, they encouraged investment from overseas. At a minimum the NDP is making a half step in the correct direction.

“Yes and no. There are real issues in the modern world regarding personal privacy.*

Agreed, but I’m not talking about personal information or transparency. I am talking about being able to access data to be able to better define and solve problems, to monitor whether a program or policy has the desired effect, etc.

@guest_54805

Isn’t income tax a temporary measure brought around to help pay for WWI or am I missing something?

Yes and no. There are real issues in the modern world regarding personal privacy. A certain amount of transparency is useful for good governance, but you should never willingly give away your privacy without very careful consideration.

And just one current example why this is worth caring about:

https://www.troyhunt.com/the-773-million-record-collection-1-data-reach/

(For clarity, I think the census is fine. StatsCan have been pretty good stewards of data so far, but their mandate is one step removed from policy.)

Edit: Make that two examples:

https://www.zdnet.com/article/oklahoma-gov-data-leak-exposes-millions-of-department-files-fbi-investigations/

The real objective is to funnel money to their cronies. Some IT firms and other consultants are going to make a lot of money…

“The real govt objective of this is data mining”

Good, complete data is necessary to make good public policy decisions. In the absence of data, bureaucrats have to guess and make assumptions.

Are you one of those people who complains about the census being an invasion of privacy?

@gwac

Meh. You can bash the NDP all you want, but at the end of the day, it was under the Liberals watch that ICBC got screwed over, hundreds of millions (likely billions) got laundered through Van real estate, the housing market became an absolute gong show (I’m hoping you don’t have children or grandchildren that get the luxury of trying to afford these bloated house prices). I could go on, but I’ll leave it be for now… The BC Liberals can go pound sand for all I care.

The American government could, in one fell swoop, resolve not only the unfunded pension liability crisis but also the ballooning costs of health care, by mandating lethal injections for all citizens who reach the age of 55.

Canada is a developed, constitutional, free market economy that engages in global trade. They can only go so far intervening in the market, and the only reason they’ve actually gotten this far in BC is due to the desperation of the situation and the economic threat a housing bubble poses. Whether or not that’s too little too late is up for debate; personally, I think it is.

So if a government could fix something, but that something is politically unconscionable, then I don’t think its contemplation presents a lot of practical value.

Hah! Requiring 1.6m people to fill out forms annually when 98% of them are not subject to this is hardly focused. Moreover, they could have made it a single line on the property tax form. “[x] this is my principle residence and not subject to spec tax”. And if you don’t check that off, then you fill out their forms if you want an exemption.

The real govt objective of this is data mining, to lead to new provincial tax revenue streams, direct from BC residents to provincial government (not involving feds or muni govs like BC income and BC school taxes do). Expect this housing tax “emergency” to last forever, with the net of affected home owners to widen, and the type of reasons to pay on this provincial stream to expand.

Either that, or the Libs beat the GreeNDP asap and throw this thing out.

They have complete power to fix the problem, which is why they are only willing to take baby steps. A precipitous fall in prices would be unpopular with the great majority of homeowners, thus the majority of voters, and would be fiscally disastrous with the economy as dependent on RE as Alberta is on oil and gas.

These are exactly the properties that are showing up as “empty” in the census. And IMHO they are the primary targets of the spec tax, not the very few properties that really are someone’s second residence. And I think those in the RE industry and in politics who oppose the tax are well aware of this.

@Barrister

No sorry, your assumption is incorrect. The population isn’t staying the same; young professionals are leaving Vancouver due to the cost of housing and family formation is down due to the cost of housing.

https://www.google.com/amp/s/www.cbc.ca/amp/1.4976682

Benjamin Tal, deputy chief economist with Canadian Imperial Bank of Commerce, thinks there’s no question household formation is being impacted by prices. –

https://business.financialpost.com/personal-finance/family-finance/millennial-money/rising-home-prices-are-keeping-canadians-from-starting-families-survey-says

Tomato: The question is not just local but rather provincial. Assuming the population of BC remains the same then all those people are spending their money that is earned in BC basically here and are also paying their taxes. Foreign owners

are an addition to the local economy in that they are spending foreign currency dollars not earned here. To some degree they are providing additional jobs in BC.

If your logic was correct we would be better off turning all the hotel rooms into condos and getting rid of the tourists.

If the housing market actually crashes (in my view possible but not probable) and we lose all those construction workers we might seriously regret also losing the foreign owners.

Did you forget that “hubris has to be wiped clean”

Only after the wisdom of Hawk is recognized will the market turn positive again.

A tale of 2 houses just on the market. MLS 404777 & 404778 are both located in the same area of Broadmead in Scottswood. Both are of similar age, size and condition. What makes each different? One is priced $67k below assessment and that’s the first line in the writeup. The other is priced $54k over assessment. Will be interesting to see if/when these sell and at what price.

Great post LF. +1

@Barrister

I did leave out the property tax because it gets paid regardless of ownership. The question is whether a full time occupant is more beneficial to the local community than a part time one.

Can’t really dispute that a FT resident is going to pay more tax provincially, federally, and locally as well as be a more active participant in the local economy, better for the fabric of the local community than a PT forienger that uses Victoria as a retirement destination.

Hey LF,

Totally. Nailed. It.

For those of you who are popcorn holders to the increasingly unfolding real estate spectacle here in British Columbia, just thought I’d throw out a novella of random thoughts. Most of them aren’t new, but newer readers might be interested…

The Blame Game

As the market continues to deteriorate, you will see this phase of the cycle start to become more obvious. People will begin angrily pointing fingers at everyone, and everything, for causing this mess. The reality is both Canada and other similar countries facing RE market dysfunction all have their scapegoats, and they’re all different. In fact, the only thing we all have in common is no one will point the finger at themselves, for getting caught up in mania. If you think people in BC are blaming the current government for what’s happening now, oh baby, just you wait…

_

This is a desirable market:

As you’re starting to see, that’s true until it isn’t. It’s not like the climate or scenery is any different from decades or centuries past. What made the market suddenly so “desirable” is the perception of guaranteed, fast, effortless, and large riches to anyone who was inclined to participate. Now that prospect is gone, and perhaps not mysteriously, so is the “desirability”.

_

We were “discovered”:

So what’s happening now? “undiscovery”?

_

The magnitude of the RE boom is due to a population boom:

No it wasn’t, no it isn’t, and no it won’t be. National population growth is actually very low, so low in fact, that governments are going all out to try to keep the growth level positive. It’s true that immigrants tend to favor larger metropolitan areas, but that’s nothing new. We’ve been accommodating large amounts of immigrants for decades, and some decades much more than others. Immigrants don’t typically arrive wealthy, and with the class of immigrants that the Federal Government is targeting, that doesn’t appear to be something that’s going to change. Also, the argument fundamentally begs the question – how can demand be collapsing when the population is up nearly 20% from the last downturn? Smaller amounts of regional movement, for instance from Vancouver to Victoria, are symptoms of the dynamics that have been occurring, not the cause. Expect those numbers to trend back to their normal levels as the market continues its descent.

_

Immigration is going to support these extraordinary prices:

It never has before, and it probably won’t this time either. There’s no question that some immigrants arrive wealthy, but proportionally there’s nowhere near enough of them to hold up a market at 10 to 35 times income in perpetuity. And no, just the raw demand won’t be enough either, especially with the rampant construction over the last several years and the pending oversupply. Most immigrants don’t bring over more cash than the lower end of 5 digits – and later they tend to make even less money than the general population does. QUIIP entrants undoubtedly had an impact, but that type of movement retreats as fast as it expands (that is also cyclical). Finally, immigration targets are always that – aspirational targets. If the economy is in recession, then that will make it harder to meet those targets, especially for regions in deeper recessions due to severely unaffordable housing.

_

The boom is going to resume soon/this is a mid-cycle deflation:

The credit cycle in Canada is in the early stages of rolling over; it’s not halfway through a boom. The extraordinary debt levels and collapsing sales volumes in the housing and automotive sectors tell it all. This is a market where the consumer is absolutely tapped out in an economy that has become egregiously imbalanced to real estate. Compounding this, is the reality that this slowdown is global, and Canadian consumers have never been so poorly prepared to withstand a recession. Look at the TSX – it’s gone nowhere in a decade, as the domestic population ignored stocks and decided to pump it into real estate. This correction has been a long time in the making and is drastically overdue. The only way this will be turning around quickly is if there is some radical intervention by central banks and policy makers, and I mean radical. I don’t believe that people are yet understanding the magnitude of the reversal of dollar volumes directed into RE nationally, and the simply staggering amount of capital gushing out of BC’s RE.

_

This is because of government policy:

No it isn’t. It’s to do with globally inflationary, and now deflationary, monetary policy, certain geopolitical dynamics, credit cycles maturing in emerging and developed countries, and payback for countries that borrowed their way out of the Great Financial Crisis. In British Columbia, media is rife with goofy stories blaming the original foreign buyer tax, the empty homes tax, the beefier foreign buyers tax and now, the speculation tax. But they’re largely window dressing policies; they’re nibbles around the edges of the problem which governments have very little power to “fix”. Campaigning on fixing housing affordability was always a fraud, no matter which party was arguing it. The NDP isn’t fixing anything for you. Neither are the Greens, the Liberals, the Rhinos, animal spirits or She-Ra. People blaming any of them IMO, have an axe to grind and if it wasn’t housing policy, they’d just as soon latch onto something else. Who or what will fix the housing market then? The solution to high housing prices has never been different – and that is, high housing prices.

_

It’s different this time:

In some respects, it has been. We’ve seen debt inflation before, but never to this scale. Central Bankers have reduced themselves to clueless, reactionary figureheads that instead of smoothing out economic cycles, they now seem more like serial asset bubble blowers – exacerbating the very cycles they try to mitigate. I’m not sure that’s a good thing in any case.

Stranger ti.es, I am pissed off about having to fill out one more government form and having to do it each year for no good reason. At least three of my neighbours brought this up as well (I did not raise the topic) and none of us own a second home in BC and all of us are here at least 11 months of the year.

I dont see a whole bunch of empty homes here in Victoria but there is a ton of AirB&Bs.

If you really want to open up more housing ban the AirBB’s

Jerry

<As Orwell identified, the left cares very little at all about the underpriveleged but expends the total of it’s energy in hatred for the affluent.

Which Orwell are you referring to? If you mean George, my understanding is he was quite the leftist in his own right as evidenced by this 1937 quote: "I have seen wonderful things and at last really believe in Socialism…". He even flirted with anarcho-syndicalism.

Am a touch confused….

Jesus Jerry can u thesaurus anymore of those words? I think you could have found a more complicated word for “little” to make that paragraph totally incomprehensible.

Dad ya I guess. PST is such a bad tax. HST is more efficient and collection is done by the Feds. The whole things was done so badly and lead to such anger. Mostly if I remember because of process of introduction. Ontario did a better job.

PST always felt like such an arbitrary tax where someone threw a dart to decide what should be taxed and what should not be.

That’s because Conrad is known to be deeply concerned about his posessions whereas I am known for my extravagant largesse.

It just occurred to me that Jerry’s writing is a lot like Conrad Black’s. Except Conrad Black knows the difference between it’s and its.

“HST should have been left by Christy.”

That would have virtually assured their defeat in 2013. Perhaps you didn’t live here at the time and you don’t remember how intense the backlash was here.

Dad that was not a proud liberal moment by Christy at the end. Sad display.

You are right hard to back policies out. Just look at the conservatives in Ontario, Not exactly going smooth and yep they seem to flow with wind….the liberals at time. HST should have been left by Christy. That was another stupid thing she did with the referendum Cost the province billons in money given back to the feds and future tax collection costs.

“Liberals just need to sit back and shut up and they will be back in power in quick order.”

You’re probably right. Realistically, where are the NDP going to pick up seats in the next election?

Just don’t delude yourself that it’s just going to go back to the good old free wheelin’, g-droppin’ Christy Clark days. You don’t like the spec tax, but the majority of British Columbians support the idea in principle, so if it goes away, it’s being replaced by something else in my opinion.

Much as the BC Liberals like to talk about “free enterprise”, they do not really seem to have a core orgnanizing ideology. Remember when Christy stole the NDP platform in a desperate bid to cling to power?

They are BC’s natural ruling party, no doubt, but the reason for that is that they are not ideologically rigid.

Trouble in the GreeNDP marriage….

https://vancouversun.com/opinion/columnists/vaughn-palmer-speculation-tax-letter-will-spray-1-6m-to-target-32000-mostly-locals

“The NDP can wear this,” he said in an interview Wednesday. “It’s not our tax. We hate this tax.”

However, the Greens did vote with the NDP to pass the tax. Weaver said that was only because the NDP considered it a matter of confidence, and the Greens forced the NDP to make key changes.

“People have no idea how much crap we got out of that speculation tax,” he said. “Now my job is to get the NDP to recognize it’s a stupid tax and get rid of it.”

The comments section of that article is near unanimous in condemnation of this opt-out approach, to call every homeowner a speculator and make them (and separately their spouse) prove that they aren’t. As we know opt-out billing isn’t legal for businesses.

Grant it is still substantially more taxes Period in BC…..Regardless of any refinery BS that may contribute to the wider discrepancy.

My post never said it was the only issue….Still would be the highest even if the refinery issue went away. Just would not be 40 or 50 cents.

Anytime the left is in power it becomes difficult to identify the apogee of iniquity in it’s policies but we have a clear winner here. When first introduced it was unclear whether the fatuity, the pandering to the sois-disant disadvantaged home-shoppers, the cynicism in naming the excrescence a “speculator” tax when not one true speculator can be identified, or the undertone of class warfare introduced into BC’s peaceful streets was the most contemptible. As Orwell identified, the left cares very little at all about the underpriveleged but expends the total of it’s energy in hatred for the affluent.

So what has the green-eyed monster given us now? The first instance of a policy which mandates that the citizenry reveal what they are doing with their assets. The CRA insists they are informed of your income but until now at least you are left alone to do what you wish with the surplus.

@guest_54864

Bleh – As someone who is still going through an adjustment on the heftier taxes in this province I’m loathe to start arguing on the other side of the tax debate, however in the case of gas, additional taxes are only a smaller part of the problem.

Let’s compare BC average ($1.38) to Alberta ($0.85) gas prices as of the end of the year.

Each include $0.10 to the Feds

Each have a carbon tax ($0.01 higher per ltr in BC)

Each pay GST

BC has its provincial sales tax ($0.08)

Victoria has a 5cent excise tax, 17cents in Vancouver

So ultimately there is about $0.13 additional in taxes in Victoria, much higher in Vancouver. But even so if we apply those taxes (let’s take Victoria’s excise tax) in Alberta it would raise the price there to only $0.98/ltr.

So why such a huge difference in final price? It’s not the taxes, it’s primarily the lack of refineries and supply/demand:

Sourced from:

https://nationalpost.com/news/canada/b-c-is-paying-some-of-the-most-obscenely-disproportionately-high-gas-prices-in-canadian-history

Introvert- notice I said “most” of these people don’t like the NDP. Your article you posted below makes my point. It is by Vaughn Palmer. You will see daily negative stories about these forms by liberal party supporters like him. He’s been trying to get this tax axed since it was announced. Also Andrew Weaver voted for the tax so it is extremely hypocritical for him to say the NDP own this. If he really felt it was so terrible he had the option of ending the coalition with the NDP

Not for amusement but complete disgust at what is transpiring. Hey I get it seems most want their government to provide for their stuff. Cause the rich will just keep paying the bill. Oh ya and the speculators too.

Keep shaking the money tree because its always going to be full..

People would be far more amused with your political rants if you took aim at the Rhinos.

One of their mandates:

“Adopting the British system of driving on the left; this was to be gradually phased in over five years with large trucks and tractors first, then buses, eventually including small cars, and bicycles and wheelchairs last.”

My last NDP post of the day

I hope you are all enjoying your more affordable life under the NDP,

Done wonders for homeless and drug use so far. So much better in Victoria and Vancouver…Barely see homelessness anymore.

They sure did use their 16 years in opposition to come up with great polices that are making everyone life better. Wow implementation of their policies. Flawless..

I love paying the highest gas prices in the country cause I know all those taxes are making people happy.

Finally nice to see all those new government jobs that are needed to manage all these tax increases. Warms my heart.

“any one bedroom @Metropolitan Era or Astoria grabs more than $3000/month. In the summer, it rented for about $6000/month… Why would any owner bother with long term tenants rather than placing them on AirBnb?

Also, a few managing companies approached my building asking for business either selling or managing airbnb listings.

rent itself is getting crazier those days….”

$3000 a month for a one bedroom @ Astoria? lol nice try bud: https://www.usedvictoria.com/classified-ad/1680–1br—568sqft—1Bedroom-1-Bath-Downtown-Victoria_32824933

Or there the Yello beside the metropolitan and also only 1 year old: https://www.realstar.ca/apartments/bc/victoria/yello-on-yates/availableunits.aspx?myOlePropertyId=579538&t=0.650228929163831&floorPlans=2295057

FWIW, I’m a GreeNDP supporter, and I think the way the government has chosen to implement this spec tax is pretty clumsy.

This government has done a lot of good things so far, but certain stuff just makes you scratch your head. The way it decided to eliminate MSP is another good example. It struck a task-force to determine the best way to axe it, then completely ignored its recommendations.

Sorry the Greens have their name on this when they supported the vote. Could have forced the NDP to end this.

What`s great with all NDP governments throughout history they usually start the stupidity quickly with stupid legislation and tax increase and more tax increases and than the infighting happens and than they get voted out quickly. Starting to see the pattern again.

Liberals just need to sit back and shut up and they will be back in power in quick order.

https://bc.ctvnews.ca/abbotsford-recall-campaign-aims-to-have-plecas-removed-from-office-1.4245815

Difficult to do but there is always a first time

Once again all the anger we are hearing regarding the spec tax forms in the media is coming from a small vocal minority who for the most part don’t like the NDP and blame them for the housing market slowdown. The same thing happened when the speculation tax came out and the media piled so many negative stories on it where you got the feeling that BC residents wanted the tax gone. Only problem is about three quarters of BC residents have always supported this tax . This tax backlash reminds me about all the anger we heard directed towards Lisa Helps on social media which made it seem like no one would ever vote for her. Once again it was a small vocal minority making all the noise. Every homeowner I have talked to the past day so far does not at all mind filling out this form.

This is nothing more than NDP saying they are doing something to their base. All BS same as trump`s antics. Stupid inefficient expensive to manage tax that will have no impact.

Got into a bit of a spat with Formafist on his latest video purporting to give the “real” numbers for the Victoria market to counter mainstream media spin. Too bad some of the numbers are wrong (condo) and it seems he is not interested in correcting them.

I think if you’re going to call out the media for inaccurate reporting you better hold yourself to a higher standard. Mistakes happen but to wave them away as just another opinion or to say that’s why he put quotes around the word “real” is disappointing.

https://www.youtube.com/watch?v=5aebr1ojr68&lc=UgxldB00AVQjl024cOt4AaABAg (scroll down)

For me the big issue with this tax is not the administration. It is that it was promoted as a speculation tax, but it catches other folks as well.

When it was announced people were upset about individuals, corporations and satellite families buying up homes and leaving them vacant with a view to profit.

The tax now labels BC residents and residents of other provinces who own ex. vacation homes they use regularly in the target areas, or a condo they use for work on a regular basis, as speculators, and penalizes them heavily.

Hopefully this NDP tax BS pisses off enough people in Nanaimo.

Not well thought out. Making everyone guilty not the smartest thing these socialist have done so far.

How many people had to be hired to manage this process.

Victoria’s advertised one-bed rental prices soar 15.8% year over year: report

According to the January 2019 monthly report by rental website PadMapper, the median advertised rent for a one-bed apartment in Victoria in December 2018 soared by 15.8 per cent year over year, to $1,390 a month.

Victoria also saw two-bedroom advertised rents rise well above inflation, up 5.3 per cent year over year to $1,590.

https://www.timescolonist.com/real-estate/victoria-s-advertised-one-bed-rental-prices-soar-15-8-year-over-year-report-1.23600501

If that’s what 2-bedroom suites are going for these days, our tenant will never leave

~~~~~~~

any one bedroom @Metropolitan Era or Astoria grabs more than $3000/month. In the summer, it rented for about $6000/month… Why would any owner bother with long term tenants rather than placing them on AirBnb?

Also, a few managing companies approached my building asking for business either selling or managing airbnb listings.

rent itself is getting crazier those days….

As a non resident owner you receive most/many of the services your property tax pays for. The big glaring exception is the portion of your tax that is provincial (ABOUT 20% in Victoria)

That’s not a great analogy. the reporting requirement is about as narrowly focused as could be. The (potential) tax is on homes in certain areas of the province. The only people that have to report is people that own homes in those areas. Maybe they could have come up with a better approach, but this isn’t some crazy scattershot reporting requirement.

Squabble and caterwaul people might; the NDP isn’t likely to back down on the Spec tax. But I would agree that it’s definitely kicking a wounded dog at this point. I’m sure there’s a growing segment of the home-selling population that is hoping, praying…that the speculators come back.

One day they will, but not today. Tomorrow doesn’t look good either.

I’ll cut through the bullshit here today with proof the rental market is beginning to decline. Dutton’s, the premier property manager in Victoria has updated many listings recently meaning they have decreased prices by $100+ on monthly rent.

I do not support any property management assholes so I won’t post a link to their site.

Burn, baby burn

Tomato: You left out the big payment which is property and school taxes for people that cannot access the two expensive services which is schools and health care. For a number of these people they also have large house maintenance bills, gardeners, memberships in golf clubs and marinas.

Time will tell but I cannot see it having a major impact on house prices, my guess is it might drop prices a percent or two at best. On the other hand I am not sure that it will withdraw that much cash from the economy.Personally I am not smart enough to really figure it out but a friend of mine who is an economist with the one of the big banks is fond of saying that most politicians simple dont understand the impact of the velocity of money. What concerns me is that decisions are being made without any concern to potential consequences.

Most people will line up on any issue here mostly on either their politics or their self interest.

Patrick, not be nitpicky, but your analogies keep implying that everyone has to fill out the forms but the form is only for homeowners. That would exclude many of your apathetic Millenials from having to do anything. Just FYI.

@Barrister

Although it may have the effect of removing some part time residents that get gas, shop for groceries and use the occasional restaurant in the local communities.

It will have a far greater impact on family formation, recruiting professionals, reversing brain drain which I think will have a larger net positive financial effect on those communities.

I think they could run into even bigger problems with their definition of satellite families.

The fact that everyone has to fill out forms was sort of predictable from the outset.

Does anyone know if the spec tax for satellite families only applies to people in the spec tax cities or does it apply to anyone who owns property in BC?

The legislation needs to contain a provision that allows anyone to fill within three months of getting the bill for taxes without penalty or at least a small $25 administrative fee.

I had an interesting discussion with an accountant that does a lot of the work for Americans here. He is of the opinion that the tax should be effective in bringing more houses on the market. At the same time he is concerned that the province will be shooting itself in the foot over the long run. His opinion is that these are people that spend a lot of money in the province every year and that is revenue that will be lost not only to the government but also to the economy. I doubt that it will be a really noticeable effect but there will be a few jobs lost when their spending is removed from the economy.

One thing that he pointed out is that while Victoria has the best weather in Canada for Americans there are all sorts of other alternatives south of our border.

Most Millenials don’t even vote, I expect they also won’t be happy about filing “I am not a speculator” forms each year, and getting a spec tax bill on owned property if they don’t.

A better analogy to this spec tax reporting would be, if the govt introduced a “capital asset” tax, to tax assets over $5m. And they made everyone in BC file a form (separate to taxes, and to a different place) every year by March 31 stating “I don’t have over $5m assets” and if you didn’t, you’d get assessed the tax based on you having $5m assets.

That’s what they are doing with the spec tax reporting, where according to the govt, 99% of BC won’t have to pay it, but every owner in the spec tax area has to waste time filing annually.

Unlike Patrick, I (generally) support the “GreeNDP”. However, I completely agree that the current government is at risk of shooting itself in the foot over this tax. In many other areas, I think Horgan and company are doing good work. This area, not so much.

Property prices and rental costs are coming down, regardless of the invasive tax forms the government will force us all to fill out. Beware the wrath of the elders. Filling online forms is not something the 75+ age bracket is really happy about.

Introvert Rents seem to be about the same as Ottawa which is another government town.

Here is a great example of a seller that has been and will continue to chase the market down.

4932 Cordova Bay Road.

Just listed at 1.49

Original list in spring 2018 1.79

Relist summer 2018 1.69

If they had of listed at 1.49 in spring 2018 they would have sold the place. They are going to leave it on the market at 1.49 for most of 2019. By the time they realize it is not going to sell for 1.49 and decide to drop the price again, the market will have moved downwards once again ahead of them, und so weiter, und so weiter.

Victoria’s advertised one-bed rental prices soar 15.8% year over year: report

According to the January 2019 monthly report by rental website PadMapper, the median advertised rent for a one-bed apartment in Victoria in December 2018 soared by 15.8 per cent year over year, to $1,390 a month.

Victoria also saw two-bedroom advertised rents rise well above inflation, up 5.3 per cent year over year to $1,590.

https://www.timescolonist.com/real-estate/victoria-s-advertised-one-bed-rental-prices-soar-15-8-year-over-year-report-1.23600501

If that’s what 2-bedroom suites are going for these days, our tenant will never leave 🙂

So why isn’t the spec tax declaration a single checkbox on the property tax bill?

[X] I declare this property is a principle residence and therefore not subject to spec tax

(If you aren’t checking this box, please complete a declaration form at gov.bc.ca/spectax)

Why subject all property owners, including principle residence owners, to a separate spec tax form, separate deadline (march 31), and separate payment mechanism ?

We have managed with a single BC/federal personal tax return, and a single property tax bill (municipal/provincial) So do we really need a third one? Isn’t this beaurocratic overkill?

The correct analogy would be to require everyone who owns a mine to declare what they are doing with it.

Yes, because that is a grant (a reduction in tax). This spec tax isn’t a grant, it is a tax that the govt says only applies to 1% of BC’ers.

As an analogy, imagine if I was extracting (mining) minerals from my backyard. I would likely have to pay some kind of minerals tax. OK. But the govt doesn’t make everyone in BC file an annual declaration that they are not mining in their backyards, and if they fail to file they will be taxed as miners.

Owner-occupiers have to apply for the homeowner’s grant, don’t they? You make a legal declaration that the house is your principal residence, and you don’t pay a tax penalty. Sounds rather like… you know.

As for people owning investment (i.e. taxable) properties – which includes 2nd residences – that’s a very small effort compared to the other obligations of being a landlord, or just an absentee owner.

totoro,

Thanks for the reply. Yes I agree with all that.

As an aside, to me this whole spec tax reporting requirement for EVERYONE is government over-meddling in people’s private lives. The average Joe/Jane couple living full-time in Victoria in a house they own are now going to need to file forms annually with the BC govt stating where they’re living and for how long in their house. This is something we don’t have to do now, and only about 5% of homes are going to be subject to the spec tax, so for the other 95% of us, its just govt meddling, and how are they going to use this extra information? As Trudeau Sr. said “the state has no business in the bedrooms of the nation”, and I would add that the state have no business to know every year for how many months the occupants are in those bedrooms.

Fact – the southernmost part of Victoria and Oak Bay is the driest and sunniest place on the Island. As you go north and west the amount of rain and cloud increases. The increase is fairly modest as you go up the east side of the peninsula to Sidney but much more pronounced as you go west to Langford, Colwood and Sooke. Going up in elevation (Bear Mountain) will also tend to increase precipitation

A bit more summertime fog than many parts of Victoria. However not that prevalent. Summertime fog gets more prevalent as you get closer to Sooke.

As an aside – temperatures vary dramatically in Victoria, especially in summer. Locations on or near the water can be 2, 5 and sometimes even 10 degrees cooler than locations inland. Hot summer day with southwest wind. 26 degrees at Uptown, 23 at Douglas and Pandora, 21 at the legislature, 18 on Dallas Road.

The term “make a home” is undefined in the law and I agree it creates ambiguity.

The only way I can see an arm’s length tenant with a lease disqualifying a landlord from the exemption because they did not “make a home” would be if the anti-avoidance provisions were engaged by section 77, ie. there was wrongdoing of some sort on the part of the landlord and an intent to evade taxation that ought to have properly been assessed.

An interpretation of the law that would require an arm’s length landlord to police daily occupancy under section 36(2)(a) is not, imo, going to stand up in court and not going to be one that the province takes. It is an invasion of privacy and a breach of the right to quiet enjoyment.

Yes, a person can have more than one home, but that doesn’t mean he does have two homes if he rents a second place but doesn’t live there much/at all.

You described (below) the law as requiring ” Just an intention to make it a home”, whereas the law states that an intention isn’t sufficient, and that it is “a place the tenant makes the tenant’s home”

It’s that point that the thor.ca article focuses on, whether the tenant did make it his home as the law says …. from the thor.ca article ….. “what steps an owner must take to determine whether the tenant has actually made the residence their home in a particular month.”

If the govt clarifies that the tenant has made it his home just from the lease and the intention to live there, regardless if he actually does live there, then that settles it. But they haven’t done that, and the wording of the law isn’t clear enough according to the article at thor.ca .

@Matthew that gave me a good laugh thanks. 🙂

I do not see any discrepancy between what I said and the Thorsteinssen commentary on the draft bill on section 36(2).

I would agree the law applying retroactively could be subject to challenge as could the broad anti-avoidance provisions in section 77 which go beyond what you would find in the income tax act.

In my opinion, yes for the purposes of the landlord’s exemption as long as you have a total of six months or more under lease to an arm’s length tenant.

Principal residence is defined in the Act. Make it your home is something different. You can have more than one home, but only one principal residence.

I would agree that it would be unfair to have a landlord have to make a declaration beyond that they have rented for six months or more to an arm’s length tenant. I doubt that the homeowner declaration will go further than this, and Thorsteinssons had not seen the form either last October but were raising concerns preemptively, but we will see.

If there is evidence of tax evasion ie. close personal relationship with named tenant and home was never actually occupied by the tenant but instead rented on Airbnb exclusively then the 36(2)(b) comes into play, along with section 77.

You’ll pay more to live there, since they have a separate Bear Mountain tax to maintain the golf course and tennis courts and other improvements. I think it’s like $600 a year.

For those wise in the ways of Victoria, from a renter up Island…………

We have driven around western Victoria a few times, I have heard Bear Mountain receives more rain and low cloud then downtown, myth or fact?

Also, we thought western Colwood was nice, but would the lower areas near Esquimalt Lagoon get a lot more fog due to the proximity to the Strait?

Thanks in advance.

Yes, this is a good point, and is partially discussed in this helpful article https://www.thor.ca/blog/2018/10/bcs-speculation-tax-bill-is-light-on-taxpayer-fairness/

What you are saying does not line up with what legal experts are saying. For example, https://www.thor.ca/blog/2018/10/bcs-speculation-tax-bill-is-light-on-taxpayer-fairness/

Look at what they say about landlords/tenants…. specifically this sentence in reference to Subsection 36(2) …. “The second condition, however, is that the residence must, for each month, be “a place the tenant makes the tenant’s home”, differs from what you are saying above. If you are an MLA who makes his home in Kelowna who rents a place in Victoria, but only stays in it for 5 months part-time, are you making it “your home” in each of those months?

You can read more about their analysis at that link, in the paragraph on Subsection 36(2)

The NDP did a brilliant job with the SpecTax implementation to force everyone, including both spouses in joint ownership, to file for an exemption.

This reporting method ensures compliance and it also ensures the Government has at least 7 years to catch and prosecute tax cheats who lied on their declarations.

Kudos to Horgan and the administrative law lawyers at AG.

I for one am pulling for the NDP in Nanaimo – I want the foreign buyer tax and the spec tax to stick around (and for other non housing issues as well). Apparently Nanaimo NDP got 46.5% of the vote in 2017 compared to Liberals who got 32.5% of the vote. Its a lot of ground to make up but Liberals do have the fact that its a bi election in there favor and any issues people take with NDP since election will sure to be heard. Personally I tweeted at Andrew Weaver and told them not to run a candidate. Green party got 19% of the vote last time and without them NDP would be sure to win by a good margin. Andrew tweeted me back and said that both the liberals and the NDP should bow out instead. I mean why would the liberals bow out – they could literally win and create a new election. I told him that and he never responded. Anyway it will be interesting to see how things play out – hopefully the $10 a day daycare promise (which is currently being trialed) will win some more votes for the NDP. That and the fact they are actually doin something about all the dirty money coming into the province – or at least thats the perception. Time will tell. Stats on Nanaimo 2017 vote here: https://www.cbc.ca/news/canada/british-columbia/british-columbia-2017-election-nanaimo-1.3911923

How do you figure they “have all the data they need”? Seems to me they don’t have the data they need at all to administer a system fairly.

No. For an arm’s length tenant there is no minimum period of actual occupation. Just an intention to make it a home (no requirement to be their primary home), and a right to occupy during the term which needs to be a month or more.

I don’t imagine too many people rent a place and then occupy it eight days a month on a continuous basis. The more common situation would be to own and occupy in this manner. This is now a big problem unless you are willing to have a roommate.

I imagine there are a number of provincial politicians who own a second home in Victoria who are affected by this tax now.

Actually that is a good question about a renter. For example while I might have bought a condo in Victoria because i have business that brings me here from time to time I decide that I dont want to pay the spec tax so i rent a condo instead. But my primary residence is in Vancouver and I only use the condo on weekends. It would appear the landlord is going to get stuck with the spec tax.

This this accurate?

Also, this is not really a speculation tax. It is a non-primary residence home tax. I’m not in favour of this tax for this reason, but here we are.

My point was that the actual administration of the system seems fairly well thought out and logical.

https://twitter.com/keithbaldrey/status/1085583044042354689

Seems very odd, and incorrect, given that section 36(2) of the legislation, which is the applicable law, states:

(2) …a residence that is part of a residential property is occupied by an arm’s length tenant for each month in a calendar year that

(a) the tenant is entitled, under a tenancy agreement, to occupy the residence, and

(b) the residence is a place the tenant makes the tenant’s home.

Landlords cannot control the days spent away, nor could this legislation impose this imo. What you can’t do potentially, imo, is write up a tenancy agreement with a friend as an intentional workaround (tax evasion) and then they never actually occupy the suite at all.

The legislation also distinguishes between arm’s length and non-arm’s length tenants (immediate family). Arm’s length tenants just need to make the place home – no set time spent at home – and have a right to occupy. Non-arm’s length need to spend more time there in a month than any other one place and have permission to occupy from the landlord – verbal will do.

https://twitter.com/MikeSmythNews/status/1085621848539258880

totoro:

It’s totally inefficient. They have all the data they need to only send out notices to people they suspect owe the tax. The extra upfront effort is minimal and it saves on operating costs. Definitely some edge cases that are difficult to catch, but if you can’t get that easily with a query you aren’t going to be able to catch people being dishonest.

As for operating costs, even if everyone responded online (doubtful, I still see people paying bills at the bank), it increases costs on that end (data storage costs, robustness of solution required etc) and regardless of response method they are going to need staff to answer questions. The more people they send stuff out to, the more people will need help. Any FAQ will be poorly written and most people won’t bother reading it, or if they do read it their reading comprehension will be lacking and they’ll still need help.

Basically my position is they chose the naive / brute force method of implementing this tax. It’s definitely rushed.

I’ll be curious to see how much implementing and running this tax costs vs what it brings in. Safe bet it costs more than expected and brings in less than expected. It’ll be in the black, but it won’t be the windfall the NDP were hoping for.

How about a bonafide landlord whose tenant rents for 12 months but only ends up physically living in it for 5 months. Legal analysis I’ve seen is that the landlord is liable for the spec tax. (And the exemptions list you post shows item 2 referring to that, and seems to confirm that the tenant must physically be there for 6 months) How can the landlord control how many months his tenant actually lives in the place?

The administration of the spec tax seems fine to me. You can just register online. And the requirement for co-owners to both make a declaration also seems sensible given that it might be the primary residence of one only.

The tax is a PITA if you have a primary and secondary residence and you don’t want to rent out either because you use both frequently for work or family purposes.

Might give rise to some house-sitting opportunities, but I’m not sure it is going to cause a lot of new rental units to come onto the market.

There are quite a few exemptions:

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/speculation-and-vacancy-tax/exemptions-speculation-and-vacancy-tax/individuals

If the NDP stays in, your wish that the spec tax becomes permanent would likely be granted. Moreover, the NDP will hear about the spec tax being “unfair” because it only affects part of BC, and will apply the socialist remedy to that, which will be to extend the spec tax to everywhere in the province. For example, expect that to extend to second-home “ski chalets” on Mount Cain. Hopefully your “makes long term sense” rational will still apply if/when the tax affects you.

Hi,

I am new to the forum but have been reading Leo’s post for a while and information shared has been very helpful. Thank you Leo.

I have a question if someone can please assist. We are trying to renovate a commercial space and has applied for building permit. Does anyone know how long it takes to get the permit in Victoria. It has already been 3 weeks for us and we have been getting no reply from city.

Really appreciate if someone could provide some directions.

Thanks

If it baffles you, perhaps you didn’t read the quote clearly. The quote from the article was “the majority of people impacted by this [spec] tax are hard-working British Columbians. On every front, this is a mess.”

Calling the “majority” (more than 50%) of multiple home owners hard working is reasonable. Moreover, the “hard working” wasn’t the point of the sentence, it was that this spec tax, supposedly targeted mostly at out-of-BC people, in fact is to be paid by BC residents.

There are plenty of hard-working middle class caught up in this spec tax nonsense. People’s lives get complicated, with kids from multiple marriages living in different cities, or taking care of their parents etc – all these are reasons that regular folks buy a second property. It is silly and naive for you to characterize the “majority” of this group as having done “little or no work” to acquire these properties.

And now mainstream economists are starting, ever so slowly, to state the obvious about Vancouver…

Vancouver becomes the weak link in Canada’s housing slowdown

“I’m not worried about Toronto, I’m worried more about Vancouver at this stage,’’ said Sebastien Lavoie, chief economist at Laurentian Bank Securities in Montreal. “The biggest worry I have for Vancouver really is the expectations that could turn a lot more downbeat because of the downward trend we are seeing now.’’

“Vancouver is in full-blown correction mode,’’ Royal Bank of Canada economist Robert Hogue said in a research note Tuesday. “Prices are poised to depreciate more — potentially a lot more considering the degree to which they are still unaffordable to average buyers.’’

https://www.bnnbloomberg.ca/vancouver-becomes-the-weak-link-in-canada-s-housing-slowdown-1.1199177

Really well done, Matthew. That was funny.

Regarding HELOCs and the people only paying interest but expecting to pay it off in 5 years…

Couldn’t it just be they plan on rolling it into their mortgage when they renew? 5 years is the most common mortgage term. They expect to have enough equity to cover the HELOC.

Whether that is in fact “paying it off” is another question, but it could be quite likely they expect their HELOC balance to be $0 in less than 5 years. Of course their net worth will be no better once the HELOC is “paid off”, but that wasn’t the question, it was whether they’d have HELOC debt.

OR people are just financially illiterate. We had a friend who needed to have compound interest explained and how their minimum payments would never get them out of debt. The person in question had huge debts in their 20s. A little bit of knowledge and some self restraint solved that problem.

WTF is with the having to apply for an exemption on the spec tax?! Surely they have all the data they need to know I don’t own multiple properties. Also… if more than one person is on the title each person has to apply?! Is the tax per person or per property? There can’t be a single form for all the titled owners of the property?

I’m glad I’m not in government anymore. I was so tired of fighting brainless solutions.

https://www.ratespy.com/a-major-bank-finally-drops-5-year-fixed-rates-01167890

Yesterday, on CFAX 1070, Adam Stirling discussed with councillor Geoff Young the possibility of Victoria’s implementing an empty homes tax:

http://bmradio-a.akamaihd.net/media/Cfax1070/1547577906_geoff_young__victoria_councillor.mp3

Such a progressive version of the left in this province. They will permit us all to fill out forms to justify our crime of property owning. You know they’d rather just drag you down to the basement and shoot you.

“It is absolutely astounding to me for an conceived tax that does not target legitimate speculators — the majority of people impacted by this tax are hard-working British Columbians. On every front, this is a mess.”

Calling multiple dwelling home owners “hard working” has always baffled me as a political ploy… I’m sure most people think that they work hard but property can be acquired through little to no work in this province especially 2nd properties that are not even being lived in. You don’t work hard for passive wealth like compounded investment income, rental income, inheritance etc. Which I’m sure fuels the purchasing ability of many who own 2nd homes. You’re average hard worker rents or owns 1 home. Is this line meant to stir up sympathy for land barons from the bulk of us who are not, or meant to help them feel less pompous for allowing property to sit empty during a housing crisis?

Mathew: Bravo.

That last point is interesting. I’m wondering if banks are holding to offset declining volumes and to collect higher risk premiums…

Fantastic write up Matthew I think you should be hired to more accurately describe most listings.

So far we have:

-Increasing Interest Rates (actually dropping to 1.92 5YR Bond. No response from banks)

-2% Qualifying rate above Post (sans Credit Unions)

-Increased Listings

-Increased MOI

-Foreign Buyers tax

-And this: 2nd Home SpecTax (Which requires EveryHomeowner to file or face the Tax)

https://vancouversun.com/news/politics/b-c-government-opens-exemption-process-for-speculation-tax

British Columbians with second homes who aren’t exempt will still get a credit intended to cover the tax on the assessed value up to $400,000, with the remaining value of the property then taxed at the full rate.

You’re a horrid salesman, and I love it! Hilarious.

Make sure to read that article that StrangerTimes linked to… spec tax implementation looks like a train wreck… Every year, every Victoria homeowner needs to file a form by March 1 saying they don’t have to pay spec tax, or they will have to pay it.

. (on the plus side, the GreeNDPs will lose a lot of votes by forcing everyone to register annually like this, and the Libs can promise to scrap the whole silly thing).

https://vancouversun.com/news/politics/b-c-government-opens-exemption-process-for-speculation-tax

“Just when you think a botched tax can’t get any worse, it does,” said Bond. “Now residents in communities like [Victoria,] Nanaimo, Kelowna and Abbotsford, to name a few, have to register to be exempt from this tax or they will get a bill in the mail for a tax they shouldn’t be paying.

“It is absolutely astounding to me for an conceived tax that does not target legitimate speculators — the majority of people impacted by this tax are hard-working British Columbians. On every front, this is a mess.”

Hilarious! Bravo!

I’ve decided to re-write a MORE accurate description for this VERY BASIC home for sale in Fairfield for a whopping $953,000:

https://www.realtor.ca/real-estate/20143589/3-bedroom-single-family-house-808-lawndale-ave-victoria-fairfield-east

My additions have been CAPITALIZED. Hope you like:

IF IT TOOK YOU 5 YEARS TO GRADUATE FROM HIGH SCHOOL, then opportunity knocks with this VERY COMMON one level rancher AS OPPOSED TO A TWO STOREY HOME in the OVERPRICED Fairfield East, Gonzales Beach neighbourhood. NO PRIVACY IN THIS UNCONCEALED, MEDIOCRE LOT with South West facing backyard for optimal sunshine IN A CITY THAT RAINS MORE OFTEN THAN NOT. TRY TO enjoy the partially covered outdoor patio WHICH WILL COME CRASHING DOWN ON YOUR FAMILY’S HEADS WHEN EVEN A SMALL EARTHQUAKE HITS for extra entertaining space, off the EXTREMELY DATED kitchen WITH A SECOND-HAND COILED STOVE AND A PINT SIZED DISHWASHER WHICH IS MISSING THE BOTTOM PLATE BECAUSE THE OWNER TOOK IT OFF TRYING TO FIND A MOUSE THAT MAY HAVE CRAWLED UNDERNEATH IT AND DIED. Inside you will find VERY OLD AND WARN fir floors THAT PROBABLY AT LEAST THREE PEOPLE DIED ON OVER THE 68 YEARS SINCE THIS HOUSE WAS BUILT IN 1951, a QUESTIONABLE gas fireplace THAT HOPEFULLY DOESN’T LEAK (BUYER BEWARE), french doors, three bedrooms WHICH ARE A GOOD SIZE IF YOU HAPPEN TO BE A FAMILY OF MIDGETS, two bathrooms, ONE WITH MOULD ALL AROUND THE SINK BASIN AND THE OTHER WITH A CONVENIENTLY PLACED WASHING MACHINE AND DRYER SO YOUR WIFE CAN DO THE LAUNDRY WHILE YOU ARE TRYING TO TAKE A CRAP and a separate dining room SO YOUR UNGRATEFUL RELATIVES CAN COME OVER ANYTIME THEY WANT AND EAT YOUR FOOD FOR FREE. Bonus rear lane access SO INTRUDERS CAN ENTER YOUR PROPERTY AT NIGHT FROM THE REAR WITHOUT YOU SEEING THEM with City Zoning R1-G allowing either a plus size garden suite or a legal suite WHICH WILL COST YOU TENS OF THOUSANDS OF DOLLARS TO BUILD AND LEAVE YOU WITH ABSOLUTELY NO YARD AT ALL. To be constructed with City approval WHICH COSTS THOUSANDS OF DOLLARS MORE IN APPLICATION FEES AND WHICH THE CITY MIGHT NOT APPROVE AT ALL. Ideal location AS COMPARED TO PLACES LIKE THE PALTRY UPLANDS with easy access to all major amenities LIKE NHL OR CFL GAMES IN VANCOUVER WHICH IS ONLY A TWO HOUR FERRY RIDE AWAY OR YOU CAN SPEND $500 TAKING A DANGEROUS FLIGHT ON A FLOAT PLANE WHICH CAUSES MORE POLLUTION THAN THE ALBERTA OIL SANDS NUMBER 1 UPGRADER PROJECT and within walking distance to Oak Bay Ave & Fairfield Plaza AND THE ROSS BAY CEMETERY IN CASE YOU DIE FROM A HEART ATTACK WHEN YOUR MORTGAGE COMPANY SENDS YOU YOUR FIRST MONTHLY PAYMENT STATEMENT. Bring your ideas to this VERY PECULIAR property, BECAUSE IT BADLY NEEDS IDEAS. Waiting for someone WHO IS RICH ENOUGH AND DUMB ENOUGH to call it home!

I know it’s an emergency measure, but I wouldn’t mind a permanent measure. Keeping investments in productive markets and keeping homes for housing makes long term sense to me. I’m curious what better system you have in mind.

Canadian Wealth To Fall From Highest In G7 To Among Lowest: Forecast

Canadians enjoy the highest level of wealth of any people among the G7 countries, but our “unsustainable” way of growing the economy means we’re burning through that wealth, and setting ourselves up for harder times ahead.

Canada’s business investment is increasingly concentrated in just two areas, housing and oil. “We’re putting a lot of eggs into a few economic baskets, and if those baskets go south we could find ourselves in trouble more quickly than we think,” said Robert Smith, an Ottawa-based associate with IISD and the lead author of the study.

Part of the reason why Canada’s wealth is stagnating is that Canadians are shifting ever more of their money to housing, which — other than providing shelter — is not a very productive part of the economy.

As wealth flows into houses, it fails to flow into financial markets, which helps explain why the Toronto Stock Exchange has seen among the worst returns of any major stock market in recent years.

This trend is “inflating house prices and leaving the rest of the economy reliant on foreign lenders for nearly three quarters of investment flows after 2012,” the report noted.

https://www.huffingtonpost.ca/2019/01/15/canadian-wealth-declining-iisd_a_23643252/

Patriotz:

Please re-read what I said: “The City of Victoria et al has jacked up sellers’ expectations”.

“Et al” is latin and it means “and others”.

It is a well known fact that the BC Assessment Authority works in conjunction with all BC municipalities when they come up with property tax assessments. It says so on their website. So you can rest assured that City of Victoria authorities had much to say about Victoria assessment figures.

By the way, what is your point? Do you have to be a homeowner to have an opinion on this forum?

In an average year, some 60% of new listings turn into sales. The rest are taken off the market or expire.

It does seem like the spec tax will be an administrative nightmare. I kind of hope they can eventually come up with a better system and phase it out.

Speaking of the Dominican republic, I thought this thread was somewhat interesting on VV.

https://vibrantvictoria.ca/forum/index.php?/topic/6685-retirement-options/?hl=%2Bretirement+%2Boptions

“Those folks who I know personally and went to school with here in this city and that have recently or are in process of retiring – I see their joyous FB posts increasingly it seems, trumpeting their last day on the job, lol – all have one thing in common: they all have had long careers in the public sector (RCMP, military, teaching etc.,) and thus have those pensions to look forward to. Even then I note with interest that few of them opt (or are financially able?) to retire in Victoria; those who do remain ‘local’ relocate up island typically north of Parksville. Others have retired as far away in this country as Newfoundland. ”

Wonder how many people actually choose to retire to other countries?

BC government opens exemption process for speculation tax

https://vancouversun.com/news/politics/b-c-government-opens-exemption-process-for-speculation-tax

This message is for all prairie people who have worked hard all their lives and are now considering retirement in a Canadian coastal area. Before you decide to give all your money to some greedy homeowner in Victoria, be sure to compare both east coast and west coast home prices. For example:

In Cole Harbour (just outside of Halifax) where Sidney Crosby is from, you could pick up this 1991 one acre 3309 square foot beauty for $365,000:

https://www.realtor.ca/real-estate/20038812/3-0-bedroom-single-family-house-9-pacific-avenue-cole-harbour-cole-harbour

Or you could get this 1935 one-story outhouse in James Bay for $990,000:

https://www.realtor.ca/real-estate/20226169/4-bedroom-single-family-house-48-menzies-st-victoria-james-bay

If you don’t have any money left over after purchasing the James Bay gem, there are several free soup kitchens in the area, one that serves up a mean tomato soup with only two-day-old rye bread.

With the $625,000 you could save by purchasing the (far superior) home in Nova Scotia, you could spend four months of the year (Nov, Dec, Jan & Feb) basking on the beach in the Dominican Republic (for example) where it was a balmy 28 degrees today. By the way, the high in Halifax today was minus 3. The high in Victoria was plus 7. Not much difference when you are talking a savings of $625K for a home.

” i dont get why realtors want to quote “coved ceilings” as a selling point .. maybe in the 60’s .. but now it just screams “old and mouldy””

Screams “there’s probably asbestos in that shit” to me. Still, I like coved ceilings.

Thanks.

Thanks on this too. I just wanna see what the long-term real annual appreciation percentage is using the most up-to-date numbers.

Many so-called intelligent buyers have also been predicting and eagerly awaiting a massive price crash for over a decade now, so it would seem they are in fact interested in a certain amount of BS!

hey leo… can you make a graph of monthly average new listing over the last 10 years vs the average sales … i notice that Peak new listing in the summer never really go beyond 1600.. this number remains relatively the same regardless of housing cycle .. noticed only the sales to active listing ratio fluctuates… wonder what the peak listing number will be this year … .will it go up due to fear of unable to sell .. or go down due to unwilling to sell at reduced price ?

besides the mystery of unrealistic high price .. i dont get why realtors want to quote “coved ceilings” as a selling point .. maybe in the 60’s .. but now it just screams “old and mouldy” … sorry if this offended anyone .. just want to let realtors and sellers know

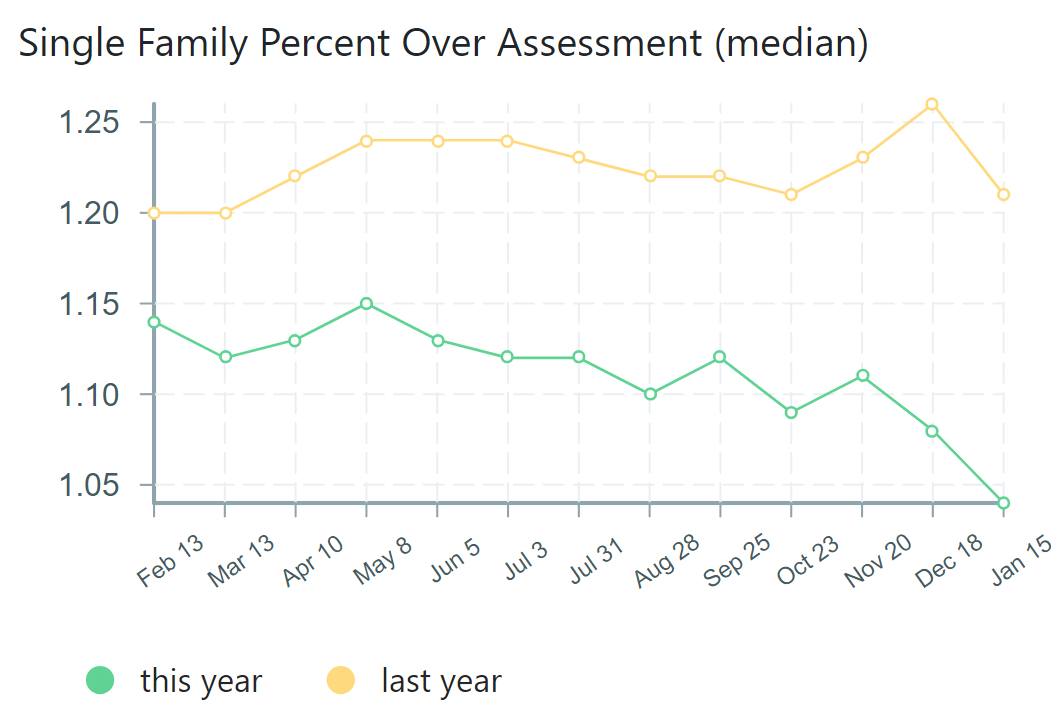

Will be interesting to see where the median Sales/Assessment ratio ends up after all the assessments are updated to the new values. Currently at 4% above assessment but expect it to keep dropping.

Have requested both from the developers of the commenting platform I’m using.

I’ll take another look now that the final 2018 numbers are in. I suspect it will be quite close to that level. Of course when recent points are at the high point of the cycle you will get an overall slightly higher level of appreciation, whereas at the low point of the cycle you get a bit less.

Yep expect a lot of it. Assessment this year on the house I sold last year is 20% higher than what I sold it for….

I used to see this all the time on eBay, and it’s laughably crude when you see this “trick” being done.

A merchant lists an item, for example a watch, at an absurdly overvalued price. Then they advertise it for 80 to 90% off that price for a limited time only, as though it’s some kind of once-in-a-lifetime desparado firesale.

Except, if you look for that same watch on other merchant’s storefronts/websites, their every day price is the same as that first merchant’s firesale price. In many cases, it’s even lower.

It’s not lying, but it’s pretty goofy. Talk about making hype from thin air. I think that’s what the Copperfield types call “illusion”.

Heh. You should see the Vancouver listings now. Absolutely full of exactly this…

Hopefully buyers aren’t too swayed by perceived savings….

You can buy my house for more than 1 million off of my fantasy price. Screaming deal!!

Assessments in BC are not done by individual municipalities, but by BC Assessment (hence the name). I suppose you’ve never been a homeowner, since the assessment and tax mailings take pains to explain this.

No one is buying because prices are so high even doctors and lawyers cannot afford to purchase anymore. Meanwhile, the City of Victoria et al has jacked up sellers’ expectations by issuing record high assessments on properties, and the main newspaper in town is telling everyone Victoria houses are being sold for record profits. Trouble is, intelligent buyers aren’t interested in the BS anymore.

I feel sorry for the realtors. Like emergency room medical staff, they have to try and talk the sellers down from their drug induced psychotic highs, and at the same time they have to try to bring the buyers back to life by administering defibrillator shock paddles.

“I’ve seen quite a few 100k reductions on listings recently.”

I’ve seen a few as well but I think it’s mostly still a symptom of not pricing the property correctly in the first place, there were many last summer/fall as well. I remember 6836 Jedora Pl. we viewed in 2017 and it sold for ~$670k then, was renovated completely and then relisted last summer at $899k. Unfortunately for the owners, by that time houses in that area weren’t selling over $800k anymore. A nicer house down the street listed at $849k then reduced down and eventually sold for $795k. After what looked like about a $100k renovation, I imagine the owners are going to be stuck with 6836 Jedora Pl. for a while (taken off the market at the moment).

What I think will become a really popular catch phrase this spring though is “Priced $100k below assessed value!”. I’m already seeing that in quite a few ads. I figure realtors have about a year or two to make good use of this line before the lag in assessed values catches up with what the market is actually doing. Hopefully buyers aren’t too swayed by perceived savings….

Here’s the Heloc survey – https://www.canada.ca/content/dam/fcac-acfc/documents/programs/research-surveys-studies-reports/home-equity-lines-credit-consumer-knowledge-behaviour.pdf

“HELOC holders” are about 35% of homeowners in this survey. 19% of those haven’t used the HELOC. So about 28% of homeowners are actual “HELOC borrowers”

Of these HELOC borrowers 9 percent pay interest only. (Another 18% percent mostly pay interest only). That is about 2.5% of homeowners. Of these 2.5%, 62% pay interest only and still expect to pay off in 5 years. These 1.6% of homeowners may be indulging in magical thinking or they may have real reasons to believe their financial situation will improve and they will be able to pay off the HELOC. Reasons could be expected career advancement, re-entry of spouse into the workforce, kids not needing daycare anymore, completion of paying off other debt, etc.

Definitely some indicators of financial stress though. 19% of HELOC borrowers using HELOCs for day to day expenses. Also 19% who borrowed more than originally intended. 25% of HELOC borrowers who would struggle if the payment rose by <100 per month.

For the average Canadian HELOC balance of $65K interest rates would need to rise 1.8% to cause a 100$ jump in monthly payments.

Since a few of you liked that picture I posted, I’ll post one more (promise, LeoS).

This is the view of Government St from the other (looking north) side of the bridge I referenced below. It’s taken from what would now be the corner of Government and Belleville, near the war monument. This shot was taken about 30 years later (1890’s), so considerably more development can be seen. The bridge had been replaced to accommodate the tramway, and the newly built St Andrew’s Presbyterian Church is visible in the background. Construction of the Parliament Buildings would have been either just completed, or on the verge of being so.

As you can see, still no Empress Hotel. In fact, you can see the inland mud flats where the land would eventually be filled in more than a decade later to accommodate the iconic structure.

You missed the part where every month they pay the interest and buy one 6/49.

Same dasmo, the icon is generated based on the email address and Dasmo has a spelling error on one of them.

Are there two Dasmos here?

@guest_54767

I can’t say. It was bulldozer bait in a desirable neighbourhood. But had some issues. I might have benefited from more time on the market but I didn’t have the luxury of time. I could have emptied more out of my RRSP and risk it but I already took some out and it was way too painful. AND there was to guarantee it would sell for more than what was on the table. As they say, a bird in hand is worth two in the bush. I’m pretty sure I could have sold for more the spring before though. The mania was peaking and lots of builders looking too.

Seems like a lot of magical thinking going on with HELOC holders.

“The survey found 62 per cent of those who paid only the interest expected to repay their HELOC in full within five years, a plan Toope called a “mathematical impossibility.”

https://www.cbc.ca/news/business/heloc-debt-fcac-1.4978987

I almost went to see this place. It’s 12 different unfinished projects and that’s the last thing I need, but it’s nice to see a decent sized SFH selling for something half-way affordable. No one’s buying small lot bulldozer bait for $800k anymore.

@Dasmo:

Just out of curiosity, say if you didn’t sell when you did and had to right sell now, can you give a best guess as to how much more or less you would have gotten for your place?

Hi Leo. Please put on your to-do list:

A. Add ability to cancel a comment during the editing period.

B. An editing period countdown timer would also be nice.

C. You updated the graph on the “Brief History of Prices” page, but can you please update the “real annual appreciation” figure just below? It still says 3.74%, and a while ago you mentioned that it is now 3.8-something %.

Thanks for maintaining a great site.

Let me tell you, it sucks being a motivated seller. I’m glad I acted swift with a not bad poker face. I fared much better than 1235 Park Terr at least…. Thanks again Leo and HHV for the heads up as to the winds of change….

This is why you can’t wait for a magic drop in the stats. It may not happen. Meanwhile if there is no mania, there will be motivated sellers out there.

Difficult to really answer that question because there is no way to query “number of price cuts” in the data currently. I would have to write a custom query.

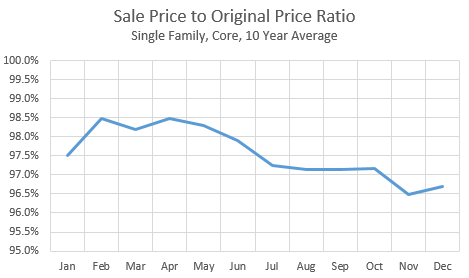

However this can be approximated by the sale price to original price ratio. There is a definite seasonal pattern here, and in the fall the properties that sell have dropped more from original ask than in the spring time.

I think I’ll try to be an unmotivated seller, when the time comes!

Government Street, looking south. 1860’s. Buildings on the left are where the Empress Hotel is today – you will note that they hadn’t done the land fill-in yet as the harbor extends further eastward than it does now (hence the bridge). You can see the old parliament buildings on the far right – referred to at the time as the “Birdcages”.

Out to lunch! Looking at the pics it looks like an expensive demo…. unless you love 1980’s DYI additions and decor….

*removed as Leo answered it earlier