Nov 13 Market Update

Weekly sales numbers courtesy of the VREB.

| November 2018 |

Nov

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 62 | 179 | 671 | ||

| New Listings | 123 | 313 | 843 | ||

| Active Listings | 2405 | 2377 | 1764 | ||

| Sales to New Listings | 50% | 57% | 80% | ||

| Sales Projection | — | 570 | |||

| Months of Inventory | 2.6 | ||||

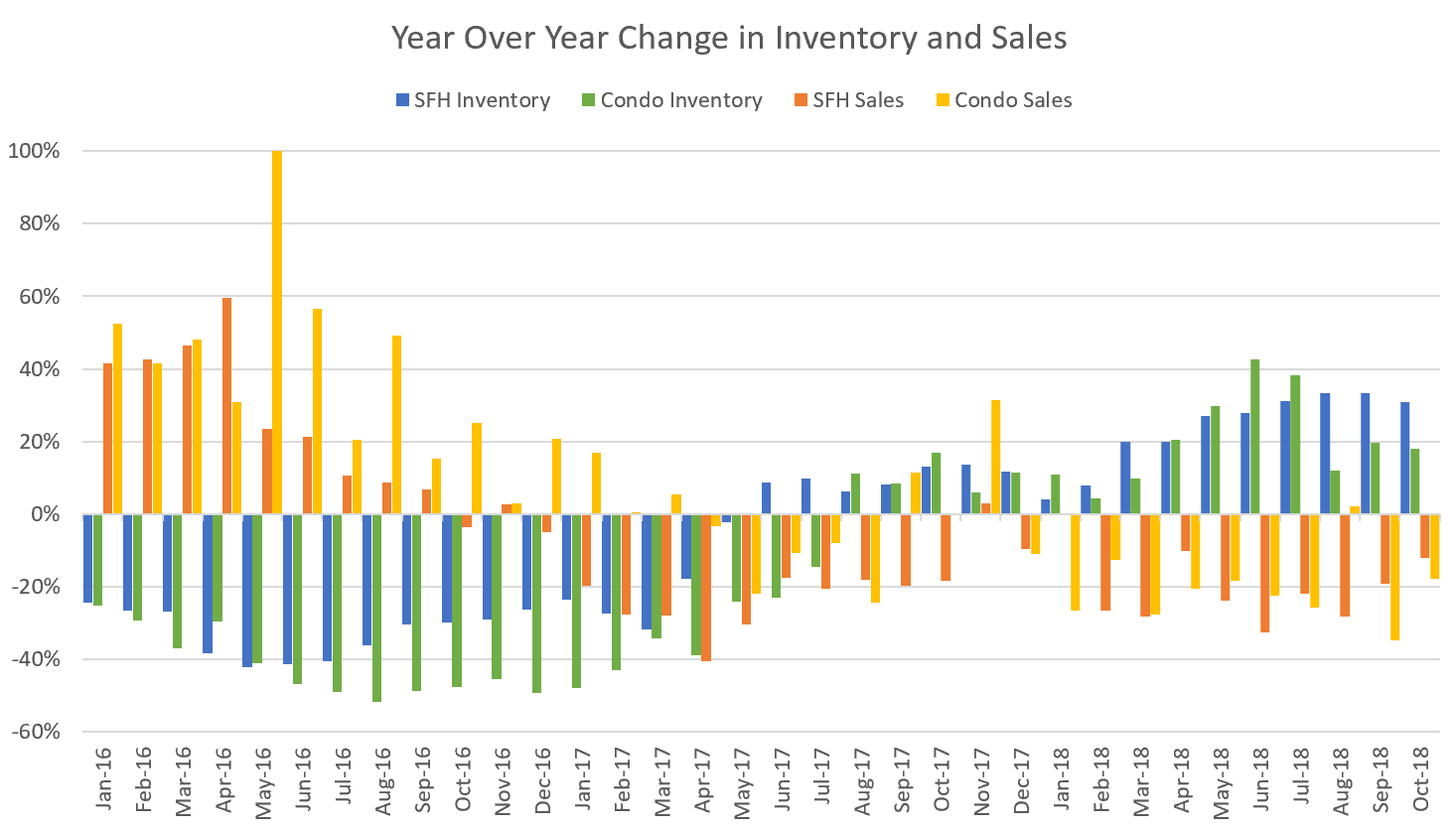

Estimating based on business days, we’re about 15% under the sales rate from this time last year, but I expect the final month’s numbers to come in at a greater decline especially for condos that are lagging and will be unfavourably compared to the pre-stress test sales bump last year (see below).

While the stress test definitely had an effect this year, it would be tough to say exactly how much and the most noticeable one was in pulling some sales forward last fall. Sales were declining by similar percentages every month in 2017, so the rate of slowdown hasn’t really changed. One reason for this is likely that the stress test for insured borrowers (down payment under 20%) already came into effect January 2017 so it took some buyers out of the market that year, but I suspect the larger market cycles and affordability pressures are the even more dominant factors driving the slowdown of the last 2 years. At a certain point as well, we will arrive at a sales level that won’t decline much more so our large year over year decreases will flatten out. We’re not quite there yet though and I expect sales to continue to slide for much of 2019.

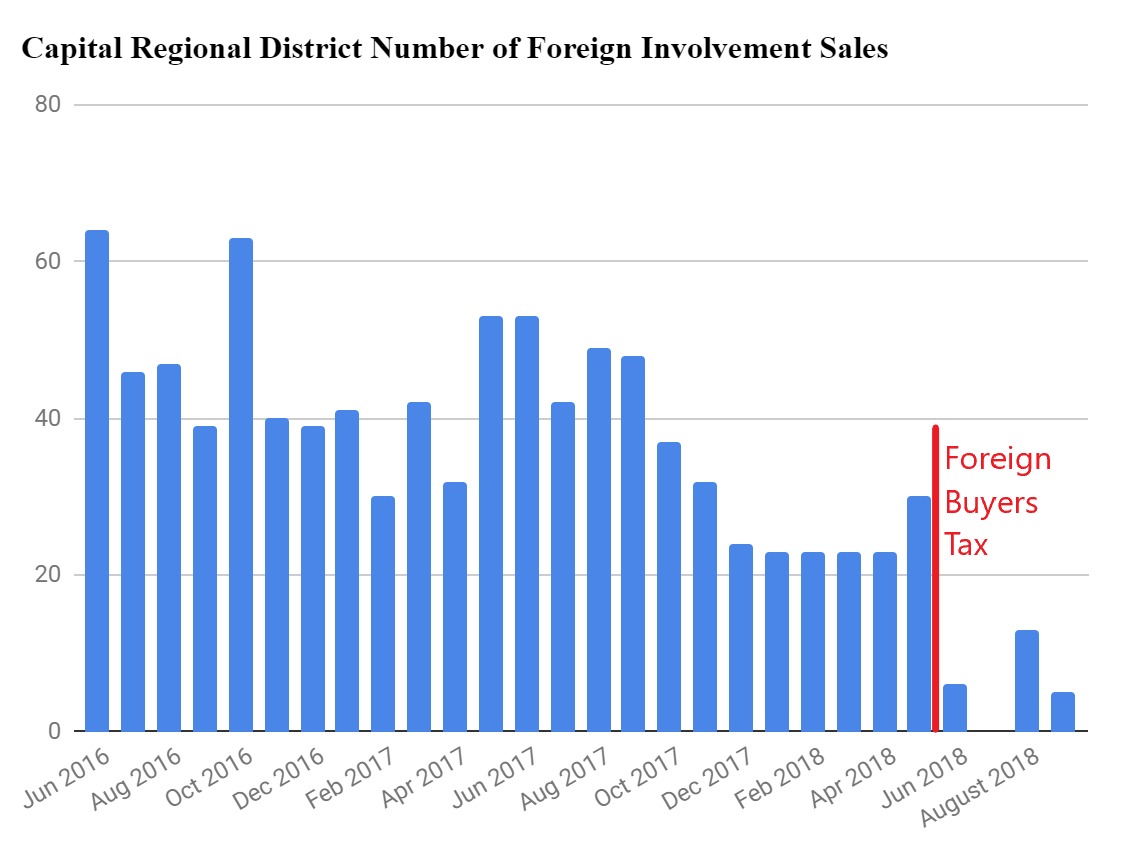

I’ll be watching single family sales especially closely this month because based on October data there were some signs that sales were recovering a bit from the lows of the summer. Given that the foreign buyers tax still seems to be doing it’s job and Vancouver sales are still cratering, a sales recovery would indicate that the effects of the stress test are starting to wear off for local buyers and they are coming back into the market. Although sales are dropping off sharply now for the winter, the seasonally adjusted data will provide us some information about the underlying trend.

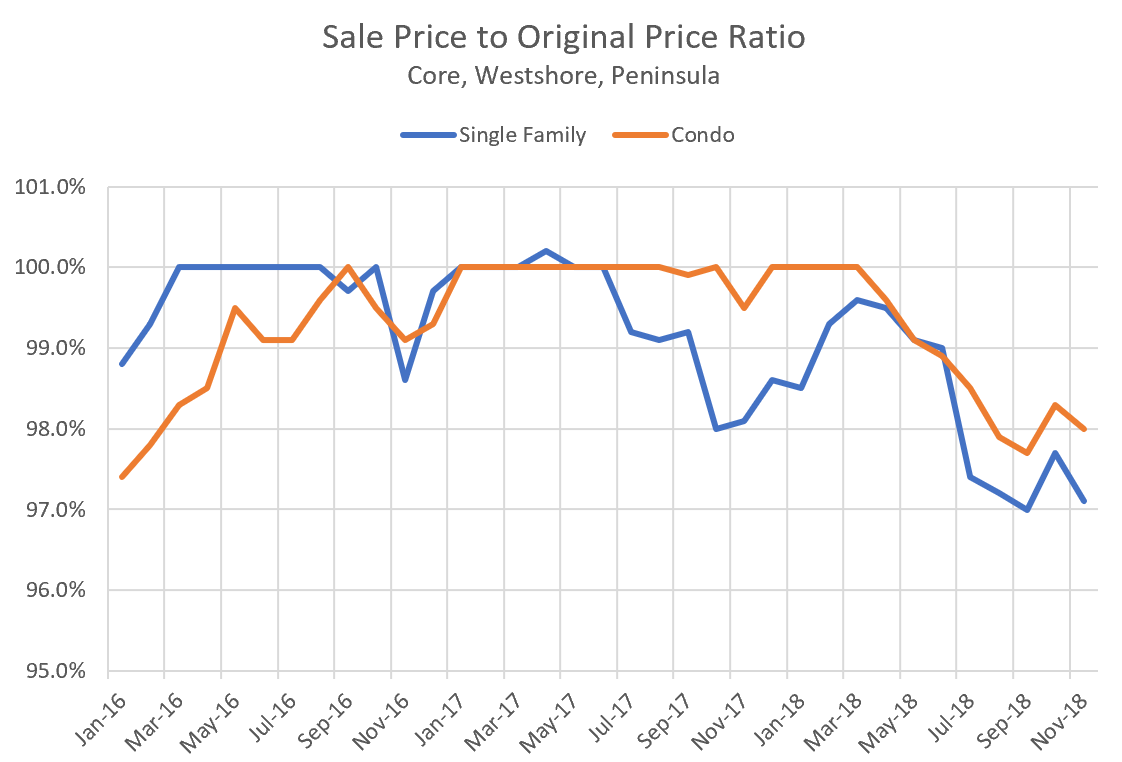

From early November data it seems that sellers are still having to make significant price concessions to move their properties but that hasn’t yet translated into lower median prices. As I’ve mentioned before, the sales price to original ask ratio bottoms out around 95%, at which point most sellers opt to cancel their listings and try again later rather than keep cutting prices.

255 government…omg! Just looked it up for the first time today. It looks like a mini version of the Bill Murray mansion in the movie Zombieland. Did anyone else notice the floor tile on the wall in the bedroom? Too much black => 85% of the problem.

The Popery we live in… And Assessment.

I can’t fully recall the exact number, but the assessment in 2012 was around $450,000

We purchased the property for $425,000

Our neighbour purchased their house 2010 for way more than $450K and they have the same type of house but smaller land size.

Now lets say, 2% inflation per year for 6 years: $469,234.34

Or lets do the market compounding on average at 7% for 6 years: $596,084.49 (Factor in that if this was the case we would be renting and getting no equity in any property, thus would be less percentage at this end.)

Now lets see what BCassessment says:

$588,000 Previous year value

$644,000 Assessed as of July 1st, 2017

So, has anyone seen a property on the market today, (SFH, 3 bed, 2 bath, 1 story, 1980s, 7000’ish Sq Ft land, near Royal Oak ), less than $650,000?

I’m sure after 6 years we could get somewhere close to assessment if not more in this market. But really, did we luck out. Nah.

If the market corrects, within the next 4 years, I think our property would be worth around 450K – 550K. Not that great of a return now is it.

So it’s all relative and hope you factor that in before you buy your home.

Just buy what you can afford, or rent and put your money in a diversify balance full market portfolio. And Stop Speculating!

*Side Note: In 2007 this property did sell for $425,000 before we got it in 2012 for the same. So 5 years earlier what was the assessment then???

Speaking of stock blogs… Does anyone have some tget would recommend?

Thank you in advance!

Not sure where this idea is coming from that somehow Hawk is cherry picking the data. Prices are way down in Gordon Head from the peak of 2017. Don’t take my word for it. Marko made a video that I saw a while back where if I remember correctly he talks about the prices not being what they were in 2017 in GH and homes either not selling or taking much longer to sell because they are being priced at 2017 value. I remember the shock on this blog at the time when a photo was thrown up of a home off of McKenzie near Uvic that sold for over a million. That was the reality for the area during that time. Most of those older homes that were selling for 900k to a million are now at most 850k. Look at that home on Tyndall Ave that they have been trying to sell for what seems like half a year or more for over 900k after a couple of price cuts. Would have easily sold for that price in 2017. The sellers can’t get over the fact that they can’t get what the assessed value is as many sellers are now finding out. Assessment in that area means little now. Sweethome the house at 4275 Baylis selling for 40K more than from 2016 doesn’t show prices have gone up. The large price spikes were in 2017 in GH so that is not a good example. Easy to see that since Gordon Head was ground zero for foreign buyers and speculation in 2017 and that since that time a foreign buyers tax has been implemented which has eliminated most of those buyers that the price would drop in this middle class area to what locals can afford again.

Totally, and driving much of it is/was a growing mountain of debt we now have to pay back. Wohoo!

😛

Who cares what someone paid 10 years ago. Totally irrelevant. All that matters is what is happening now and more below assessment sales are happening, which is what was Vancouver first indicator when things began to turn south.

Rates are starting to come off a 30 year bottom in emergency rates and the fear is everywhere in the global markets from real estate to stocks, emerging markets and especially bonds which drive everything. Making excuses for debt bubbles is a great way to go bankrupt.

Occasionally, in Victoria, you can make a killing in two years, if the market is red hot and you time it perfectly (very hard to do—just ask the Hawkster).

Better is to buy and hold, which is not very hard to do (assuming you can buy, of course).

I bet SFH appreciation in Victoria has been very good (and sometimes stellar) across any eight-year interval you choose between 1981 and today. (Maybe Leo can crunch those numbers for us: the best and worst eight-year intervals between 1981 and today.)

So, with both 4275 Bayliss and 4255 Parkside, the same house sold for around $800K in 2016 and around $40K more now. A small sample size of Gordon Head, but it is the same house, which is useful.

Also, the one on 4282 Parkside that sold for $141K over assessment directly backed Mt. Doug Park. For some people, that is a desirable feature, so it’s not really an average lot.

I would generally agree with you. You don’t make a lot of money or lose money on upgrades.

+1

Before upgrades – sold for $1,487,500 -> http://www.johnbodnar.com/property-details/375451

After upgrades – sold for $1,650,000 -> https://www.greatervictoriaproperties.com/property/397027/

I would generally agree with you. You don’t make a lot of money or lose money on upgrades. The exceptions are (1) You do the work yourself and do it reasonably well, (2) You have a particularly good eye for design and add value with the upgrade beyond what most people would do with a similar budget. I have seen people make money with both these strategies in a flat market. Both of these are working for the money tho. Not just the market handing you free money.

Not entirely, if the premise is the house might have gone in a bidding war a year ago, ie, the market has changed.

You can find bidding wars right now too, but I agree they have susbsided as compared to two years which was not normal.

It is the final outcome that is important. You could do better off slashing $200,000 than getting $50,000 over asking price. The starting point is only a bit important.

Despite recent experience, the norm in residential real estate is that you are unlikely to make money above expenses by buying and selling in two years unless you make significant upgrades.

I always tell my buyers that if they have to re-sell in the first 5 years to expect to take a substantial loss after PTT/commissions/legal fees/etc.

You really have to plan to stay in a place 8 to 10 years to avoid substantial odds of losing money.

@caveat emperor

The point of posting that one was to show the market shift. Take Van for instance, up until not that long ago, you could make a couple hundred thousand $$ flipping a high end house in a few months, with no renos.

My understanding is that you are more likely to lose money on upgrades than make money. This is obscured by rising markets, in which you make money anyway just on appreciation of the property.

Despite recent experience, the norm in residential real estate is that you are unlikely to make money above expenses by buying and selling in two years unless you make significant upgrades.

Not entirely, if the premise is the house might have gone in a bidding war a year ago, ie, the market has changed.

Having said that, I think everyone here already knows the market has changed. I’d be more interested in ones where sellers are taking losses, not lowering the price 100k for a reduced profit of only 250k – 500k.

Slashed are meaningless without context.

So they actually thought they’d get double what they paid in 9 years?

Were there renos involved?

congrats .. you have selected the few houses on the market with decent building values and renos … property that sits on a decent piece of land … stop selectively provide examples that fits your agenda..

can some one provide data of how many properties are sold above and below property assessment? i would like to see numbers

thanks

1908 Waterloo Rd in Mt. Tolmie just slashed again for a $300K total down to $1.29 million. Can’t keep up today

Purchased for $750,000 in later half of 2009. HPI Index show 53% gain since purchase.

Slashed are meaningless without context.

1908 Waterloo Rd in Mt. Tolmie just slashed again for a $300K total down to $1.29 million. Can’t keep up today . 😉

I just looked at 255 Government and leaving aside the decor it strikes me that someone threw a lot of money into the place. I think that it might be a hard sell.

Looks like Intorovert’s kitchen. I guess your assessment will be in the low end of $100K down with zero updating since the 70’s too.

One offs ? There’s about a dozen just in Golden Head/ Saanich East I listed. I can only imagine the rest of the city.

You need to take another LOA from the blog gwac, you’re sounding depressed again trying to defend a changing market you talk out of both sides of your mouth about.

Vancouver Detached Real Estate Sales Fall Over 32%, Price Declines Get Larger

https://betterdwelling.com/city/vancouver/vancouver-detached-real-estate-sales-fall-over-32-price-declines-get-larger/

“Flip” on Baylis Pl

Right next door I believe, to the Baylis house Introvert posted.

4275 Baylis Place

Sold July 2016 – 800k

Sold July 2018 – 840k

40 k difference in 2 years.

Once you deduct fees, not really making a profit on that one.

For someone who was bragging about their assessment going up $100K last year, it looks like it will be going down this year. Fake news my ass. 😉

826 Maltwood Terrace sold $87K under assessment for $1.08 million in Broadmead.

4937 Eagle View Lane in Cordova Bay sold $279K below assessment for $999K.

5172 Lochside Drive In Cordova Bay sold $55K below assessment for $865K.

@Sweet Home

Originally listed for 879k

$839k

@guest_51947

I was just going to say that one to watch is 4255 Parkside in Mt. Doug. It last sold in August 2016 for $805K. It was listed for around $850K, but now appears to be gone. Does anyone know if it sold?

The exterior isn’t bad – it’s traditional colors / style for that era of house. Now the interior – that makes a pimp-mobile look downright dowdy.

“You can’t look ’em up yourself?

$858K

$845K

$840K

”

So with these 3 recent sales in Gordon Head, how certain are we that last year these houses would have sold for $815k, $802K and 798K? If so then that would reflect the 5% increase the benchmark prices indicates.

I think there is a high probability that last year these home would have sold for more than what they sold for currently.

“Most people on here were calling for a flat market. So they all take the L.”

That is probably why most people on here have jobs and are not successful professional real estate investors with a long track record…..

Most people on here were calling for a flat market. So they all take the L.

Smart move to value a home based on assessment Hawk. Never go in/ Rarely actual drive by…As an average its fine. I think Leo said we are 10% above so far. That is a good idea of how things are.

One offs is total garbage whether over or under as a prediction to what is happening.

Hey this all seems to give your life meaning finding slashes and below assessments. So why stop.

This trend you speak of has been around the corner for years. Maybe it just not going to happen. Maybe time to accept that and deal with it.

‘Bury your head in the sand’?

The story was first recorded by the Roman writer Pliny the Elder, who suggested that ostriches hide their heads in bushes. Ostriches don’t hide, either in bushes or sand, although they do sometimes lie on the ground to make themselves inconspicuous. The ‘burying their head in the sand’ myth is likely to have originated from people observing them lowering their heads when feeding.

255 Government St. All those updates on the interior and they can’t pick a decent colour for the outside of the house.

Gwac, assessment is the base line measuring stick and first question any serious buyer asks.

With many sales the last year or two going 30% ir more over ask, to be selling under or even asking under in the hottest foreign buyer hood, it is massive news.

Keep your head in the sand all you want but a major trend shift is happening IMHO.

Accurate.

You can’t look ’em up yourself?

$858K

$845K

$840K

255 Government St is back on the market again! Their original ask which I think was way back in 2016 was $1,888,888. AFAIK this was on the market all the way through the 2 hottest years on record without selling. What an astounding failure. That’s a drop of $463,888 or 25%. Can someone confirm that it didn’t sell since 2016?

Marko Juras

The main reason for market slow down is the stress test. In vancouver east homes are being reduced by $100K each reduction. See this example: https://www.strawhomes.com/mls/2242-e-45th-avenue-vancouver-east-killarney-homes-r2310669/

“Damn that is expensive. Does that even fetch $850k in Victoria? 33.5′ lot.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

You're sure right about that Marko. That is an interesting example considering there are over 180 listings on the east side under $1.7 million, including a couple under $1 million.

@ Introvert

Hey Introvert, can you please list the sale prices please – thx!

So we know that this wacko market started in Van, moved out to the suburbs (Fraser Valley/Squamish) and then hopped the pond to Victoria and then ripped north up the island. And now it unwinds…

“The once red hot Fraser Valley condo market sees sales drop 50% and inventory rise 153% in October. The benchmark price has now declined for 4 consecutive months, that hasn’t happened since 2008.”

– Steve Saretsky

@Hawk

Thanks for posting, decent place, please keep posting this type of thing.

Gawc, those stats always seem misleading to me. So that stat is saying if I had bought a house say in gordon head in 2017 then I should be able to flip that same house for 5% more currently. Given the current market sentiment and sales environment compared to what it was in 2017, I have a hard time believing that to be true.

I guess there just aren’t many resales of the same property that was purchased one or two years ago for us to get an accurate comparison of what like for like properties have done.

With that said, hawk I think you will have to admit the “L” you have taken so far on your predictions for the last 3 years ;). That’s not to say you won’t be right going forward, but you are only as good as your track record.

KS

No according to the SFH core index we are up 5 or 6 %. Individual buys and sells possible down with sale expenses.

Higher end homes I think a person would have an issue.

Lol at the bickering between hawk and gawc!! Maybe the way to look at it is this, if someone bought a house say in 2017 and they were forced to sell now (No renos or anything), will they be selling at a loss?

Bank of canada’s new financial hub:

https://www.bankofcanada.ca/core-functions/financial-system/financial-system-hub/

Highly indebted new borrowers down 39%.

https://www.bankofcanada.ca/2018/11/staff-analytical-note-2018-35/

It’s a bit of both. Of course some borrowers went to private loans and are kicking the can down the road. But it isn’t accurate to say they all did. Many just didn’t buy. There’s a reason that sales are down so much, especially in Vancouver. You can’t say sales are at decade lows and yet the stress test didn’t reduce borrowers, merely pushing them into private lenders.

Hawk below or above individual assessment means SFA. Hey whatever turns your crank and makes the day worthwhile for ya go for it.

Keep making excuses for assessments gwac, these are decent houses in top neighborhood and all under a million which has been the toughest price range to buy in. Apparently the buyers have stopped buying or they would have sold over easy in that hood.

Well that’s all nice Intorovert, but the trend for below assessment is increasing by the hour on my PCS for Golden Head and Saanich East.

1749 Howroyd Ave just slashed again for $50K total to under assessment by 21K to $799K. This has never been seen here for a very very long time. Nice place too.

I sure hope Steve is just blowing smoke…people can’t be this foolish. Gawd help us otherwise…

Yeah Vancouver is another beast for sure. You have decade lows in sales and clearly dropping prices while we are at roughly lower third in sales and flatish prices.

Definitely the Vancouver weakness affects us here though. We are seeing it in reduced number of Vancouver buyers.

If not the stress test wearing off, another potential reason for a few more buyers coming out of the woodwork is increased inventory providing more choice.

The main reason for market slow down is the stress test. In vancouver east homes are being reduced by $100K each reduction. See this example: https://www.strawhomes.com/mls/2242-e-45th-avenue-vancouver-east-killarney-homes-r2310669/

Damn that is expensive. Does that even fetch $850k in Victoria? 33.5′ lot.

BTW

Individual assessments are garbage. Average Assessments are actually pretty good and can give a pretty accurate picture of what is going on.

What @guest_51899? Surely Hawk isn’t cherry picking his data, his lack of bias on this forum is beyond reproach.

“… the effects of the stress test are starting to wear off for local buyers and they are coming back into the market.”

This does not seem to be the case here in Vancouver. There are plenty of buyers who are still on the sidelines, not because they are waiting, but simply because they cant qualify.

In my opinion the stress test was introduced way too late in the game, when interest rates were already going up.

The main reason for market slow down is the stress test. In vancouver east homes are being reduced by $100K each reduction. See this example: https://www.strawhomes.com/mls/2242-e-45th-avenue-vancouver-east-killarney-homes-r2310669/

Contrary to what you hear on FHawk’s News, it’s not all doom and gloom in the lovely confines of Gordon Head; its actually more of a mixed bag.

4279 Baylis Pl

MLS# 401174

Sold for $112K above assessment in 10 days.

4282 Parkside Cres

MLS# 400973

Sold for $141K above assessment in 13 days.

4421 Bartholomew Pl

MLS# 400877

Sold for $35K above assessment in 8 days.

Toronto and Victoria are 2 different markets and have behaved very differently in price. Toronto has larger moves up and larger corrections.

Hey keep up the faith Hawk.

How insane was it for you buying your first condo at 50% off ? That was reality due to bloated markets with increasing costs plus inflation = correction/crash. The US proved it 10 years ago in dramatic fashion.

You need to let go of your denial and embrace it as a lifetime buying opp for your kids like I do. Hard to do when you’re stuck in the bubble tho and can’t see out.

My favourite thing about this listing is what looks like the original 1972 dishwasher!

Buying pool of high risk buyers that helped drive the market are drying up fast. The ones that are already in the market and being squeezed by inflation and increased loan costs will be enough to crater this thing.

Bank of Canada Finds Dramatic Fall in Highly Indebted Borrowers

https://www.bloomberg.com/news/articles/2018-11-14/bank-of-canada-finds-dramatic-fall-in-highly-indebted-borrowers?srnd=premium-canada

Local show me in non inflation adjusted these multiple 10% corrections.

If I remember correctly Leo graph show 2 inflation adjusted falls of 10 and 12 and zero (more than a few %) non inflation adjusted except for 1981

Bears need to suck it up and realize their beloved NDP government is probable going to keep this Victoria market from seeing any major fall. Plus 5%

All about Jobs and spending and the NDP is good and spending and hiring.

Hawk we must all have a fantasy. Glad to see you sticking to it regardless how insane it is.

Put on your Depends gwac, this has same ramifications as 81 with massive debt bomb that didn’t exist back then and similar rising rate effect with less increases needed.

As I’ve said before, Golden Head is ground zero and it’s now beginning to crack with foreign markets tanking.

That is false. We’ve had several corrections of more than 10% since, including one of almost exactly 10% around 08. That one IMO, was arrested by rates dropping lower so actual affordability improved markedly due to the combined effects of both. Probably some wage growth in there too. 1981 was notable only because of the scale of the downtrend, not because it was a downtrend.

Local

Victoria has to markets. Up and sideways… Trending down has not happened here since Hawks 1981. Victoria and the 1981 scenario are not the same as now,

4059 Ebony Pl just sold yesterday $88K BELOW assessment at $900K after 2 months on the market. Yes it needs a face lift and has a pool, but another one almost $100K below assessment in Arbutus /Golden Head ? The winds of change have arrived.

Markets trend up, or they trend down. Sideways for 3 to 7 years isn’t going to happen. A flat market indicates one that’s in a state of transition – you see it in peaks, and in troughs. It’s not a long term state of being.

hm it’s a reno flip with still room to go down. It’s been renovated but nothing significant. If they bought for $794,500, plus PTT plus carrying costs plus reno costs maybe they are in for just under $1 million is my guess.

Looks like some expensive renos were put in and $180K is a major expectation loss no matter what and will probably be another $180K to get the sale. Maybe more as below assessment sales pick up steam which has another $200K to go to the $1.25 assessment which is foreseeable. What it cost in 85 is just a curiosity number and not relevant to the market. It’s starting to crack IMHO.

1603 Hawthorne St. in Golden Head (nice place), just relisted and for sale below assessment at $788K. The trend is your friend, it doesn’t look flat and smells like some bad flatulence is leaking out of this market.

As long as the NDP keeps spending and there is job growth here. It is underpinning the housing market.

Sure – but if you have another look, you will see I am talking about the trend in the rate of growth, not what the rate of growth is.

If that’s an ouch, that’s more applicable to the buyer, not the seller. Last sold in April 2014 for $794,500. The house on Magdelin was last bought for $92k in ’85.

but like the energizer bunny it just keeps on going longer than anyone is expecting.

If the bunny makes it through the spring, I think we are pretty much set for 3-7 years of a flat market or maybe 2011-2014 scenario (down a point or two per year). IMO, the longer the market flatlines the lower the chances of a correction. We’ve pretty much flatlined for this year (SFH median 800k +/- since New Year) already give or take.

922 Lawndale Ave in Fairfield slashed twice, 2 weeks ago for $76K and yesterday for another $104K to $1. 49 million. Ouch !

4017 Magdelin St. in Golden Head sold for $715K only a mere $96K BELOW assessment. Not a reno job or tear down. The market is changing but stay in denial. I prefer a quiet crash with less screaming and terror. 😉

I do agree for the most part. Just looking at the increase in seasonally adjusted sales in single family and thinking about the potential cause. I’d say either:

a) It’s just noise, and not indicative of a sales recovery and will drop back down or

b) Buyers are returning to the market a bit.

If a, then we should see sales drop back down in coming months. If B, I am speculating on potential causes. Either some people had to acquire additional means after the stress test and succeeded, or some people decided to wait and see, and then decided to buy.

Doesn’t even necessarily have to be a positive signal. We know there’s a big increase in private lending in other centres. Could be that some buyers came back because they managed to find private lenders that allowed them to purchase, but at exorbitant rates…

Yeah it seems like they are just contributing that money to help fund construction, not paying for the whole thing. Construction costs for a mid rise is around $250-$300/sqft. Say modest 600sqft units makes at least $150,000 per unit in construction costs. That’s not including any land costs, overhead, planning, marketing, etc.

Are they assuming that the land will be contributed through other partners?

Victoria is apparently $65M for 588 units: https://www.timescolonist.com/news/local/province-to-help-build-588-affordable-homes-in-victoria-1.23496430

Projects in Victoria:

• $19 million for Pacifica Housing to build 130 units as part of the planned new fire hall on Johnson Street between Cook and Vancouver streets.

• $15.5 million for the Capital Region Housing Corporation to provide 155 homes by assembling parcels of land and redeveloping the Caledonia site on Gladstone Avenue near Victoria High School.

• $8.8 million for Pacific Housing to build an 88-unit development on the grounds of the former Burnside Elementary School.

• $15.7 million for the Victoria Cool Aid Society to provide homes for 157 families and seniors by redeveloping the Tally Ho hotel property at 3020 Douglas St.

• $5.8 million for the Gorge View Society to build 58 homes for families and seniors.

Yeah this is a bit of uncharted territory. Everyone keeps waiting for the other shoe to drop on this recovery, but like the energizer bunny it just keeps on going longer than anyone is expecting.

Mortgage growth is 3.4% per year. Seems OK to me, reflective of low sales numbers. “Too hot”, and you’d be saying it’s a sign of out-of-control-debt. “Too Cold” (below zero growth) and that would be also bad (deleveraging). Since you speak using colorful metaphors… maybe you could think of it as Goldilocks growth number…. “just right”

This is a mysterious detail to me as well. I hope they don’t mean municipalities. That would be quite ridiculous if they enforced that spec tax revenue needs to be returned to the municipality, and say View Royal can’t get money for affordable housing because they don’t have enough empty homes paying a spec tax.

Some details here https://www2.gov.bc.ca/gov/content/taxes/property-taxes/speculation-and-vacancy-tax/declaration

I guess the declarations will be mailed out in January and due March 31st. Very unclear to me what they will do with the surely hundreds of thousands of declarations that won’t be returned.

Gotta say the thought of the paperwork makes me shudder.

I don’t buy it.

The portion I bolded is IMO, presuming that the stress test was simply a market shock rather like the foreign buyer tax, or the stock market convulsing after Donald Trump drops the comb-over and gets a buzz cut. Market shocks do tend to recover, in the sense that the market resumes whatever trend it was on before.

The stress test is a completely different game. For sure there’s an element of “shock”, but the reality is a 20% cut in purchasing power is going to change the market, as is the interest rate hikes.

If I am used to being paid 100k in salary a year, and I spend accordingly and max out my credit cards – then you chop my salary to 80k and jack my rates – do the effects of that on my spending habits “wear off” eventually? Not a chance – I will have to make a significant change in those spending habits.

Are we seeing such a change in the mortgage market? Oh yes, are we ever. Mortgage growth in this country is rapidly sliding to a level slower than two geriatric turtles fighting in a barrel of cold molasses. And it’s not likely to make a sustained recovery until affordability in certain markets improve rather significantly.

The NDP plan to build 5000 affordable rental units for $500,000,000. That’s $100,000 per unit. In other words, they will build a 20 unit apartment building for $2 million. Land and building for $2 million is impossible.

https://www.cbc.ca/news/canada/british-columbia/bc-announces-4900-new-affordable-rental-homes-low-middle-income-households-1.4904044

You know the local real estate market is in trouble when the Saanich News starts reporting the changes.

https://www.saanichnews.com/opinion/peter-dolezal-canadas-real-estate-engine-signs-of-sputtering/

The companies are only doing so well as per the consumer keeps buying shit but they are now getting tapped out.

Apples suppliers are beginning to suffer therefore Apple falls because market knows they don’t want you to know sales are tanking. Apple is suddenly not doing very well and the tech boom is going to let off some major gas.

Apple, suppliers tumble as signs mount of weak iPhone demand

Apple Inc’ and major suppliers to the company’s iPhone fell Monday as investors fretted that one of the most important product lines in the technology sector was seeing weak demand.

https://business.financialpost.com/technology/personal-tech/apple-suppliers-tumble-as-signs-mount-of-weak-iphone-demand

It’s more that the market has been expecting a correction for so long that it just wants to happen. But then companies are making too much money and doing too well so they report and bounce back up again. Then Apple does really well but decides not to share iPhone numbers anymore and it drops a huge amount having a ripple effect… basically not as simple as “it’s a bull trap” or a “dead cat bounce”… or whatever….

It’s quiet here because everyone has moved to the stock market blogs. Hawk should post his Bull Trap graph on a few Stock Market blogs, it looks like the stock market is in the middle of a bull trap these days, DOW drops 600 points one day then the next day the buyers rush in to buy “on sale” and lift the DOW, then the next day it drops again. Then when everyone realizes it’s a bull trap, it might fall off a cliff.

The market is lulling the pumpers asleep while it begins to unwind 80’s style. What’s a $116K below assessment in ground zero right?

Real Canadian Mortgage Credit Growth Is Pointing To An Early 80s Style Meltdown

https://betterdwelling.com/real-canadian-mortgage-credit-growth-is-pointing-to-an-early-80s-style-meltdown/

I suspect that it is quiet because the market is really not doing anything.

Btw, the spec tax rates are all 0.5% for 2018, the rates I quoted were for 2019. So the biggest bill someone gets next March on a 600k condo is $3k and that includes foreigners. Likely $2.5m revenue from Greater Victoria for 2018. Whoopee.

On how the CMHC System turns the market upside down https://thestarphoenix.com/real-estate/mortgages/why-your-neighbours-kid-is-getting-a-better-mortgage-rate-than-you/wcm/38aa7d12-d5a9-43dc-a89f-c4ba2fe0f074

That said CMHC have cranked their insurance premiums over time so perhaps it’s not as unfair as it once was

Yes, it should raise about $5.5 million in Greater Victoria, about 4% of what the Property Transfer Tax raises.

The govt estimates that Greater Victoria has 3200 unit subject to spec tax. Of those, 2k are BC residents, 600 are ROC, 600 are foreigners (USA etc).

On a 600k condo….

BC residents pay (600-400) x 0.5% = $1,000 spec tax

ROC pay 600 x 0.5% = $3,000 spec tax

Foreigners 600k x 2%=$12k (though most NAFTA lawyer experts say the Americans will likely win the lawsuit saying the USA people should get the same treatment as ROC, if so the Americans pay $3k, not $12k.

So if everyone leaves it vacant and pays the tax, that is

– 2000 X 1000 = $2.0 million from BC residents,

– 600 X 3000= $1.8 million from ROC

– 600 x 12000= $7.2m from Foreigners (subject to refund via NAFTA lawsuit)

So that’s $11 m in all.

Maybe half will pay, that would be $5.5 m paid by Greater Victoria. I’d predict less than that, and they’ll scrap the tax within a few years. Many will avoid it simply by “renting” it cheap, furnished as-is to a friendly face for 6 months to take care of the place.

As a comparison, Greater Victoria property transfer tax is $150m yearly to the BC govt and that may well fall because of this type of meddling. So this $5.5m spec tax would be 4% of that PPT…

This is all unlikely to move any needles IMO, so I hope everyone here at least feels good about encouraging the foreigners (mostly Americans) to leave our tourist city of Victoria for almost no significant benefit.

Anyone know what the latest on the spec tax is? Are people going to get a bill for tens of thousands on their non-primary residences next March?

No crash in sight + nothing for homeowners to crow about = sleepy time.

The BC govt should send all the spec tax money collected in Greater Victoria to Langford and Victoria city, and not to the NIMBY cities (Oak Bay, Saanich) that haven’t helped so far with the housing crisis by building enough units for their population.

We have been told the spec tax was necessary to solve the housing crisis, and so I can (grudgingly) accept that. But I do object to the way it is being allocated by the Provincial Govt. If we want to maximize the help to the housing crisis, it should be sent to the cities that have been helping already by building housing.

Currently spec tax is planned to be returned to the cities where the tax was paid. That means NIMBY cities like Oak Bay (no housing units added 2011-2016) get spec tax collected from Oak Bay vacant homes sent back to them and can use it to help build a few housing units, while still being NIMBY cities ( compared to the YIMBY – Yes-in-my-backyard cities Victoria or Langford that build proportionally more housing units than expected by their population).

Instead, spec tax collected from Greater Victoria should be sent only to YIMBY cities (Langford, Victoria City), not NIMBY cities (Oak Bay, Saanich). That way we indirectly tax those cities for being NIMBY, and reward YIMBY cities (Langford and Victoria) for helping to solve the housing crisis. If/when a Oak Bay, Saanich do start creating housing units, they could start receiving money from the spec tax, not before! Don’t reward “talk”, reward “action”!

Saw this posted:

“The median sales price of Vancouver single-family houses in October dropped 13% year-over-year to C$1.88 million. From the peak of the crazy spike in the spring of 2016 to October 2018, the median price has plunged by over C$700,000 or 28%”

https://wolfstreet.com/2018/11/11/housing-downturn-in-vancouver-bc-canada-detached-single-family-condo-townhouse/

Eerie isn’t it.

test

edit: i think this is the quietest the blog has ever been. Is it in total moderation mode Leo?

A good read on how increasing density through rezoning is unlikely to improve affordability in Vancouver

https://biv.com/article/2017/12/city-vancouver-needs-treatment-its-overbuilding-ad