Feb 13 Market Update

Weekly sales numbers courtesy of the VREB.

| Feb 2018 |

Feb

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 72 | 185 | 675 | ||

| New Listings | 104 | 311 | 880 | ||

| Active Listings | 1434 | 1487 | 1537 | ||

| Sales to New Listings | 69% | 59% | 77% | ||

| Sales Projection | — | ||||

| Months of Inventory | 2.3 | ||||

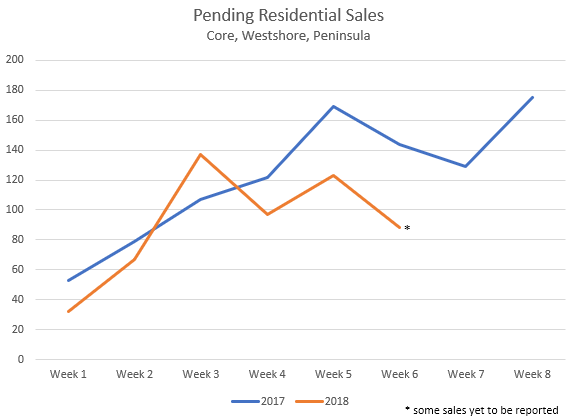

There’s no two ways about it, this week sucked for sales. There were only 113 reported sales which puts us at 30% below this time last year. Yes, sales are lumpy and they can swing quite significantly from week to week so it is still possible this is a temporary lull. However so far the sales gap to last year seems to increasing over time. What’s the standard real estate excuse? Probably the nice weather that’s been keeping people on the beaches.

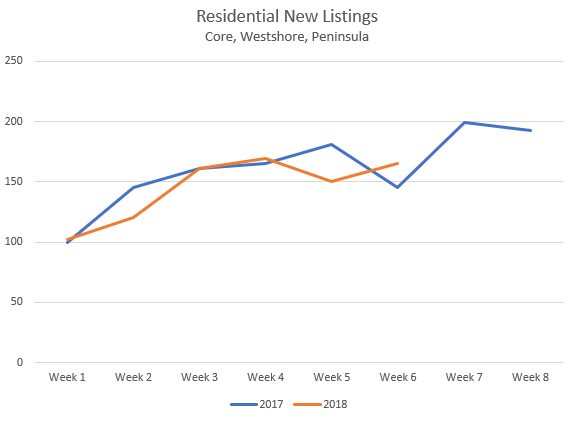

You are going to hear about inventory constraining sales, and it is true, but the same was true last year. There are about the same numbers of both condos and single family properties available on the market now as a year ago, and yet sales just aren’t keeping up. Through price appreciation and credit contraction, clearly there aren’t enough people able to pay the going prices. One would expect that shift in demand to lead to increasing inventory soon. So far new listings are more or less matching what we saw last year. I hope that when market conditions loosen it will bring more sellers out of the woodwork that have been driven away by the fear of getting stuck in bidding wars when they acquire their next house. Those move-up buyers won’t help the supply demand imbalance, but it will help improve selection.

Good Morning Children:

On a totally unrelated topic, we went garage saleing yesterday and picked up a handful of useful items.

Spent all of 13.50. I was curious what they would have cost me new so I looked them up online (looking for the cheapest sales prices of coarse). Was rather shocked to discouver that it would have been $485 before taxes. A few of the items were brand new and obviously never used. For example there were two high end German cooking knifes that had barely been used and certainly had at least another thirty years of life in them. This was a pretty typical day for bargains for us.

What surprises me is that the crowd at these sales seems to all be over fifty. I am surprised not to see young people starting out in life not showing up more. I can understand that they are not interested in getting a deer head but you would think that a full set of top of the line Henkel knifes for under 15 dollars might make the hunt worthwhile. If nothing else it is a great way to upgrade what you have at next to no cost.

For us it is a matter of a treasure hunt that gets us out and about (and away from the gardening) but knowing knowing how hard some young people work for their money you would think more would take advantage of saving possibly a few thousand dollars over a couple of years.

No comments on my Scottish heritage please.

@ Average Commenter.

Thanks, good insight. It was dumb as a way to make housing more affordable (pushed up prices) and apparently dumb even for an individual. And as it turns out dumb as a way to buy votes!

Good discussion on speculators.. Here are my thoughts. https://househuntvictoria.ca/latest

I still have a hard time believing the NDP will do anything to target local speculators. Just doesn’t make sense politically.

The BC Gov’t HOME partnership plan was never as good as it sounded.

Using it to increase your downpayment so you only needed to put down 2.5% and your CMHC charge would increase from 4% to 4.5%. So the HOME Partnership never helped me buy anything I wasn’t going to buy already.

Also, using the HOME partnership the bc government charges a flat $600 fee. And my conveyancer added a $275 fee for registering the 2nd mortgage.

So for me I bought a house in Colwood last summer for around 500k. My mortgage rate was 2.4% for a 5 yr fixed. BC Home kicked in 26k.

Interest savings of $3200/5 yrs(0% vs 2.4%). Less $875 in fees, total savings of about $2325. Overall it was worth it for me. But in the grand scheme of things it really didn’t change a whole lot. Add in the fact that it was one more thing that needed approval, one more thing to apply for, one more set of things to sign for, and then one more moving part on closing day.

BC HOME partnership is a dumb program. I was one of the first to take advantage of the program. After telling several friends of mine who also bought last year about the process most of them decided it wasn’t worth the hassle.

Stockholm at #2 is cracking as well with sales down 51%. No worries Gwac, Victoria has zero connection to the outside world. We’re our own race if you listen to you pumpers. 😉

The end of 2017 was horrible for Swedish property developers

[STOCKHOLM] Home sales and housing starts by Swedish property developers tumbled at the end of 2017 amid the biggest drop in prices since 2008.

After years of booming prices, fueled by a shortage of housing and low interest rates, Swedish home prices dropped 7.8 per cent in the three months through December after an increase in construction pushed supply too high at a time when households started becoming more pessimistic about the outlook for the market. High-end apartments in Stockholm have been particularly hard hit.

http://www.businesstimes.com.sg/real-estate/the-end-of-2017-was-horrible-for-swedish-property-developers

Hawk please show me the 8 year crashes in Victoria. I am waiting.

Waiting for a 1981 crash has been a brilliant move. Timing at its finest

OMG Gwac, “can’t happen here” when the scenario is identical to 81 but worse with the debt bomb is more than naive. Living in serious denial is a recipe for disaster. Victoria is connected to a global crisis more than ever from tech to real estate bubbles world wide. Just keep clicking your ruby slippers.

Toronto is #1 and is already cracking. Vancouver at #4 is right behind with detached house sales tanking. Vic will tag team in tandem.

The cities on the verge of a housing bubble

Eight cities worldwide are at high risk of having real estate bubbles that could deflate — and none of them are in the U.S.

https://www.marketwatch.com/story/the-cities-on-the-verge-of-a-housing-bubble-san-francisco-isnt-one-of-them-2018-02-14

My favourite part about all of this is that Hawk, a boomer, is envious of me, a millennial, for my real estate gains.

WTF is wrong with this picture?

Omg hawk we have 1 major crash in Victoria 37 years ago. Time to move on from that.

Show me these 8’year crashes in Victoria.

Gwac ,

WTF are you talking about ? Outliers that “rarely happen” actually occur every 8 to 10 years and we are at that point now and a dangerous global market place more than ever.

You bought your first place off the back of someone who lost 50% but it won’t happen to you? It happened in 81 and in 07 US house bubble as well. Trudeau will not save you like Harper did. They have zero cash for anymore stimulus today. Forget about when the SHTF.

Getting ones finances in order means selling over valued assets like houses that will be the most effected by higher interest rates and inflation and illiquid in a panic market and credit crisis. Stocks can be sold with a click.

Funny I was talking to my buddy today reminiscing on 81 crash and how we got 10% wage hikes that year and 5% the following 3 years. Go ask your boss tomorrow if he can give you the same. I guarantee he’ll laugh in your face.

Andy totally agree but those that were able to hold on are up big time in demand areas. Less demand cities may still be down.

Hawk you are always looking for the outliers that happen rarely and if wrong in timing or actually happening are very damaging to be wrong.

Right now is a time to get ones finances in order.

Gwac

You’re likely right on this, but I have my doubts as well. I have friends in the states who lost their homes back around 08, and they were hard working people. They’re back on their feet now, but these families lost their homes and it was devastating for them.

I think the thing to remember is be cautious, and have a back up plan in case things go sideways. For some, that might be having a rental suite on their property, just in case.

HOME partnership plan was a waste of time but I’m surprised more didn’t take advantage. If you’re going to buy and qualify, it makes sense to take advantage of it.

Intorovert exposed. 😉

https://youtu.be/E5Hrvza9FkM

Homeowners in negative equity and who can’t pay their mortgage/HELOC won’t be fine Gwac. They will be poor and/or bankrupt. The millineals and GenXers are clueless to both.

Hawk

Only time will tell. Whatever happens most home owners will remain home owners. In the long run those home owners will be just fine.

Home Ownership is just that simple.

It’s why, when Hawk says we’re shitting bricks right now, we have to just laugh.

Infrequent Poster

I completely agree.

i mean, the ice cream was pretty damn funny.

Once,

You must be new and seem to be looking at it ass backwards. Every time I post the pumpers squirm with anger and have to resort to juvenile taunts. Grown men with families who are in denial and can’t handle the fact the bubble is about to burst from a decade of easiest credit in history. Pretty sad if you ask me.

Gwac, 10% in 2 years? When it starts it will be that in first few months. Another pumper who fraudulently tries to play the fence.

I’ll be keeping a close eye on affordability measures. Those have signalled all the past buying opportunities

One thing the so called pumpers have going for them is they do not treat their houses as a stock and buy and sell and buy and sell. Where will prices be in 10/15/20

Years? Up is a pretty good possibility. How many more people in this country in 10 years 4m? What impact does that have on the major cities and the demand side. Short term. I could see prices going down 10% in the next couple years. That will be a buying opportunity for those looking.

Hawk, in case you hadn’t noticed, your shortage in the sense of humour department makes them enjoy looking for new ways to get a rise out of you. It does seem to work every time.

Yep this definitely supports prices. We will not see a large drop in Victoria without weakening of the economy. Of course those two things could happen simultaneously.

“Agreed boss, yet interesting that prices went up 900% from ’65-’81 while credit was being tightened (mtg rates tripled)”

What percent did house prices go up between 1965 and 1985?

How about interest rates between 1965 and 1978?

I don’t think most homeowners are too worried.

The goddamn global financial crisis was only able to knock local prices down 5-10% (then a few years of flat).

Historically, prices in Victoria have been very sticky on the way down, and very slippery on the way up.

Agreed boss, yet interesting that prices went up 900% from ’65-’81 while credit was being tightened (mtg rates tripled), combined with a falling immigration rate (little cash from outside).

http://www.statcan.gc.ca/pub/91-620-x/2014001/c-g/figure51-eng.gif

As far as incomes, weekly wage rates are starting to accelerate:

ICYMI, a year ago the pumpers were counting license plates lined up around the block on a daily basis. This year ? Crickets. Look out below. Credit tightening in motion.

Home sales drop to lowest monthly level in three years as new mortgage rules douse demand

http://business.financialpost.com/real-estate/update-1-canada-home-sales-drop-in-january-as-new-rules-take-effect-crea

“In other news, I noticed the former Premier has been hired to speak to a room full of real estate agents later this month. They want to give her their money for some reason. How nice for her.”

Christy is going to start preaching her BS to the salesmen that whatever Horgan is doing is “illegal”. That corrupt bimbo needs to disappear forever after the way she’s raped this province.

When the pumpers are now obsessed imagining how another poster looks in real life, you know they’re shitting bricks on the bomb that’s about to drop on their pumper party.

Game is over bulls, Asians are gone, first time buyers disappearing by the day as the word gets out there is no more easy money to made like their buddies temporary paper profits blown on new trucks and trips, and now the specs who drove this bubble to insane prices cash out to the bagholders for the next decade or more. It’s gonna get ugggggly.

The City of Burnaby has posted a video explaining their opposition to the Kinder Morgan pipeline. I hadn’t realized that the National Energy Board (NEB) has just allowed them to route a new pipeline through several parks and ignore local zoning.

https://www.burnaby.ca/About-Burnaby/News-and-Media/Newsroom/City-s-Opposition-to-Kinder-Morgan-Pipeline-Route-Highlighted-in-Video-Released-Today_s2_p6371.html

Personally, I think pipelines are safer than trucks, but shipping it through the Burrard inlet and past Victoria is just insane. Over-ruling local municipalities also comes across as pretty draconian. Has Trudeau just accepted that he lost the west coast to the NDP and doesn’t care any more?

Richard that is exactly how I pictured him.

“BC down payment loans boosted home prices 0.6 per cent”

Ah yes, another government real estate scheme that lowered the standards to lend money to people who otherwise would have been rejected. And it artificially boosted demand and increased prices you say? How odd. I could have sworn it was all about first time buyers. And yet they are in more debt than ever.

In other news, I noticed the former Premier has been hired to speak to a room full of real estate agents later this month. They want to give her their money for some reason. How nice for her.

Agreed Gwac !

I think Hawk has found an alternative to his graph and graphically more persuasive !

OK Expat you got me there! Why didn’t I think of CMHC ! But then again I forgot about CRA as well ! However if you stacked them up against any Insurance Co. or the Mob respectively I’m sure they would prove to be woefully non competitive and inefficient !

That Hawk photo is the best posting on here from anyone apart from Leo. Well done.

Introvert:

You are misleading us again; that is a picture of Hawk taken ten years ago.

BC down payment loans boosted home prices 0.6 per cent

http://www.vancourier.com/real-estate/bc-down-payment-loans-boosted-home-prices-0-6-per-cent-1.23174070

Loan program for 1st-time homebuyers has had few takers, little impact on market: report

1,400 have applied in 9 months, far fewer than projected.

When the program was launched in January 2017, the provincial government estimated 42,000 homebuyers would take advantage of it over three years.

http://www.cbc.ca/news/canada/british-columbia/first-time-homebuyer-loans-b-c-1.4534426

“Governments can never do anything productively and profitably.

Name one government program/department that belies this.”

I’m gonna go with the Canadian Mortgage & Housing Corporation. They were crowing like little red roosters about their profits while they kept producing new rule changes that benefited existing land owners and pushed prices higher. All in the name of affordability for first time buyers!

ROFL

So sorry 3Richard Haysom for an idea that will cause your rental properties to drop in value, but that’s the whole point.

And yes, many developers do like the idea of owning rental property, as was the norm until about 1985. And, yes again, that could include pension plans such as the Ontario Teachers Pension corporation. And yes one more time, if the government owns the land then their investment is secure and will keep up to inflation.

The only losers with this idea are investors and speculators, primarily those who created this problem.

@Leo M

” Somehow create incentive for delelopers to become profitable landlords.”

Developers are not in the business of being landlords. They make money building and selling. The last thing they want is to tie up their assets and become landlords. If you are talking pension funds that would be a different matter.

“if the three levels of government create a joint land corporation………”

Why on earth do you want the government to get into the RE business ? Governments can never do anything productively and profitably.

Name one government program/department that belies this.

Lots of talk on here about immigration levels increasing to Canada – in this article we can see that many of them favour the large Metro areas – where ‘local’ residents are moving to surrounding areas – like Victoria.

“Victoria is finally shedding its reputation as a destination for “the newlywed and nearly dead,” said Mayor Lisa Helps, and has seen an explosion in the number of residents in the 25-40 age range.

She said, although high-cost housing and low vacancy are major challenges in Victoria as well, it’s not a surprise that people are moving there from the mainland, and she listed a number of factors drawing new residents, from a booming economy to a vibrant tourism sector.

“It’s very exciting and we welcome our neighbours from Vancouver,” she said.”

And here we can see that Hawk likes ice cream… 😉

http://vancouversun.com/news/local-news/metro-vancouver-population-sees-record-losses-in-latest-census-report

The best way to remove speculators and investors from the RE market will involve two steps:

1. Somehow eliminate the incentive by eliminating the fundamentals that cause rapid property value escalation, and

2. Somehow create incentive for delelopers to become profitable landlords.

Step 2 might indirectly cause step 1, rapid property value escalation, to be less of an issue, although other measure will still be required to keep foreigners and speculators out of RE.

The cost of land in major urban centres make rental units unprofitable for developers/landlords. Affordable housing rentals won’t happen if developers are buying land, so let the government buy the land instead.

For example, if the three levels of government create a joint land corporation, they could buy land, re-zone it to higher density, then the Government Land Corporation could lease the land to a private developer/landlord for 40 years, under a strict lease whereby the developer must build X units of specific size, then rent them at rental rates that give the developer a fair profit during the first 25 years while the building is mortgaged, then the developer gets higher profit for the last 15 years of the lease after the building mortgage is paid off. After 40 years the apartment building and any other improvements become government land corporation property, to be re-leased for renovation, or demolition and rebuilding.

This could be a win-win situation for everyone; government and developers, more affordable housing, more rental units that won’t be owned by speculators, they don’t become Airbnb units, they could decrease homelessness, and it could rapidly reduce speculation in the RE market.

The only way the NDP election promise of140,000 new affordable rental units will materialize is if the government owns the land. I know this idea is a Dave Barrett ideology thing, but something like this might work.

Pretty sure that is my wife’s hand.

“That is undoubtedly a female hand! It is beautifully gracefull, the epitome of feminine elegance! Hawk has commendable taste!”

Thanks Richard. It will be the most elegant bubble popping ever. Divorce court will be jammed to the rafters. 😉

“Never has more persuasive evidence been presented on this blog.

I’m calling my realtor right now. It’s time to sell.”

AKA The Honey Trap Bubble. Better call fast, more condos listed in last 3 days than in ages. 😉

Barrister, it is an interesting idea. I don’t know the politics behind such things, but there may be different levels of acceptance for increasing a one-time tax (property transfer) vs an ongoing tax (local yearly property taxes).

I think you would get a lot of municipal support if you gave the extra yearly property taxes to the city rather than to the province. In a way, that is who is providing most of the (local) services to this increase in population.

It would be an alternative to banning foreign purchase like New Zealand. However, I think their ban leaves alone people who purchased property in the past, where your idea would make it difficult for them to continue to hold the property.

As a general rule, I think taxes should be implemented with lots of warning and not punish people who did things in good faith in the past. This may be seen as changing the rules mid-game. Then again, it is better than some of the alternatives that have been proposed!

@Gwac

“How do you know that is a women? Never presume!! ”

That is undoubtedly a female hand! It is beautifully gracefull, the epitome of feminine elegance !

Hawk has commendable taste!

I tend to use “guys” to refer to any group that includes men and women, similar to the French word “ils.”

Home sales in Canada dip to lowest level in 3 years: CREA

Canadian home sales fell 14.5 per cent between December and January, marking the lowest sales level in three years as the housing market was hit last month by a double whammy of tighter mortgage rules and lending rate hikes.

About 85 per cent of all markets had fewer listings. The Greater Toronto Area led the decline, with large percentage drops also in British Columbia’s Lower Mainland, Vancouver Island and the Okanagan region, as well as parts of Ontario.

https://www.peninsulanewsreview.com/business/home-sales-in-canada-dip-to-lowest-level-in-3-years-crea/

Sorry Josh, as Barrister pointed out this is not the definition of “speculation.”

As I said before, your suggestion of a short term flipper tax on second properties would be better at catching speculators. It would leave alone those people who are holding long term rentals or holding a recreational property for family enjoyment.

As far as real estate speculation goes, there doesn’t seem to be a commonly accepted definition. Some people point to intent, which should catch those buying and fixing and selling a primary residence after two years imo, which our current system does not address. Some to timeline only ie. “flippers”. Which is odd given that they are taking on risk and paying capital gains taxes. Some to a second property no matter what the intent or timeline, so to any activity that increases demand like out of province buyers, some to foreign owners only…

We already have capital gains taxes. The best way to curtail big gains is to apply them to all properties over a certain amount of the gain. This would curtail windfalls and dampen enthusiasm and somewhat even out the positions of those who bought ten years ago and those trying to buy now imo.

Not my argument really. Based on a bunch of reports, stats and economic analysis and there are some studies pointing out potential negatives too. Canada is planning on expanding the immigration target to 450k/year – not reducing it. They state this level of immigration won’t cancel out the impact of an aging population and low birth rate.

In terms of economic impacts, the Morton Beiser’s Strangers at the Gate study looked at the arrival of the Vietnamese boat people who began to arrive in Canada in 1979 to much controversy. The total number of refugees was 60,000, the largest single group of refugees to ever arrive in Canada. Beiser first studied the boat people upon their arrival, finding that few spoke English or French, that most were farmers with few skills useful in Canada, and that they had arrived with no assets with which to establish themselves. Beiser then followed the progress of the boat people to see what effect they would have on Canada.

Within ten years of arrival the boat people had an unemployment rate 2.3% lower than the Canadian average. One in five had started a business, 99% had successfully applied to become Canadian citizens, and they were considerably less likely than average to receive some form of social assistance.

This is great.

It took me a while to realize why wealthy Chinese investors would want mortgages. Because of the capital controls, they may only be able to get a certain amount of their wealth out of China each year, so 35% down and no questions asked worked pretty well for them. Nice that they now are linking it to income declared with CRA!

Intro

How do you know that is a women? Never presume!! 🙂

Guys, the woman with the pin is about to prick the … housing bubble!

Never has more persuasive evidence been presented on this blog.

I’m calling my realtor right now. It’s time to sell.

“Aha, this is the change at CIBC I heard about a while back. Killing the mortgages without foreign income verification. It all piles up.”

Exactly LeoS. Turn out the lights, the party is over bulls. Slashes on several very nice Oak Bay places the last couple of days, one on the waterfront and no Vancouver millionaire wants it either.

“drastic” is indeed what is needed and now in motion. I guess when you find out piles of them have properties they can’t verify over in Asia then it’s time to pull the plug. Watch the rest of the banks follow suit.

“Foreign buyers just got one of the most aggressive hurdles when buying Canadian real estate. The Canadian Imperial Bank of Commerce (CIBC) quietly notified its mortgage advisors the “Foreign Income Program” has ended. The program was replaced on February 1, 2018, with a new program designed to ensure compliance with B-20 guidelines from OSFI. This change will have a drastic impact on those that use foreign income to qualify for a mortgage, from one of Canada’s largest banks.”

Listening to question period leads one to question democracy.

For those reading this right now, Question Period is on now at the B.C. legislature.

Watch live: https://www.leg.bc.ca/documents-data/broadcasts-and-webcasts

It’s nicer here! Winters around Waterloo are tolerable but still crap compared to here. But realistically it’s because my wife is just starting her career. Ottawa is a real possibility in the next 2-5 years.

Josh:

We can argue definitions and you can turn most investments in speculation if you broaden the definition. But, traditionally, speculation is based on investing with a view to seling at a higher price and not investing based on ongoing profits from income.

put more simply is people who buy houses with a eye to flipping them for a higher price. Often these properties have a negative cash flow but the investor is exclusively looking at his ability to flip the house for large gains. The rental income is a small bonus but not the focus of profit.

Presenting: the Elon Musk Goal Watcher:

https://www.bloomberg.com/features/elon-musk-goals/

Josh:

My God, we agree on something. We desperately need to build new cities. Cities between the size of 200k and 400k are by far the most efficient and generally provide the highest quality of life. The Swiss figured this out years ago when they started developing cluster communities. We dont need to be brilliant but it would be nice if we at least were smart enough to imitate success.

I am not sure that basing immigration numbers on companies needs for cheap labour is really the way to go. I really dont care that foreign companies like Whole Foods, Tim Hortons, Amazon and

McDonalds might have to start paying people a descent wage and have their profit margins cut.

Josh:

For the life of me I cant understand why you dont move to somewhere like Kitchener/ Waterloo. You have the advantage of being able to work from home. It is a great family community with reasonable house prices. Two great technology Universities are there. A much more vibrant cultural life there than here. Winters are still fairly mild and far from the extremes of Alberta.

Realistically my estimate is that house prices in Victoria might decrease 10% or 15% at best until the boomers really start dying out.

You’re using these properties exclusively for income. That’s the definition of a speculative use of housing stock.

It is a bit though isn’t it? Kind of like having a hobby of trading stocks with real money. It’s “mixed speculative”.

The speculative tax I mentioned wouldn’t affect either of these examples. I still don’t see how it would unjustly limit opportunities. It removes the opportunity for exuberant short term RE gains, but that’s exactly what it’s supposed to do.

It’s a combination of things that just means buying here would be an extraordinary bad choice. There’s a fist full of houses I could get in the GVA but they’re awful dank tiny little things in a crap area that I wouldn’t enjoy living in. I’m not going to pay mansion prices for something so undesirable in a market that’s so far departed from fundamentals. As for debt required, I’ve done the spreadsheet and know what I can afford and consider that my max. It’s not what the broker tells me I can afford.

The limit is picked each year based on what we need, which is dictated by economic targets and what businesses need to fill positions. Record low unemployment sounds look a good problem, but not if you’re a major employer. Immigrants are a source of solutions, not problems. Cramming everyone into the same cities is a big problem, that rural Canadians are exacerbating as well. So lets build some new cities already damn it!

Barrister

AI/other technologies does not and should not change employment levels it changes the types of jobs and skills required. A more educated/skilled work force will be needed.

GDP needs to grow to pay for programs only way to make that happen is to take people from other countries. Our liberal governments recognized that decades ago.

Totoro:

Actually, at an unprecedented rate, technology has been reducing the demand for labour. This factor might be less visible in BC but it has gored the manufacturing heartland of Ontario. It is particularly apparent in Ontario’s auto manufacturing sector were robots and technology is seriously reducing the numbers of people in manufacturing. I suspect that we are on the verge of seeing an explosion in self driving vehicles. The most conservative estimate are that at least ten per cent of truck drivers will lose their jobs.

Your argument is that we need immigration to replace an aging workforce. I am not convinced that your argument is correct but even if it is correct the number to replace is somewhere between 50 and a hundred thousand not three hundred thousand. Our population between the ages of twenty and sixty five has been growing not decreasing for the last few decades.

Intro

Be awhile for that. Drug prices are out of control and need one central buying group to buy and fund the program with an aging population.

We also need a universal dental care program.

Immigration done right is a good thing. Being land locked (not Europe issues) allows us to make sure we get the right skills/education/non skill, non educated balance.

Country was built on immigration and to keep our social programs/ increasing GDP must continue.

Canada could just as easily take steps to encourage birth rate increase to above replacement level, instead of replacing the population through immigration. Recent changes to parental leave structure are a start. It’s not just a foregone conclusion that people here don’t have a lot of kids, it’s a result of societal/economic factors which can be changed.

Immigration is the only way to keep the expensive government handouts going. Bring in the young to pay for the retired who are living longer and costing the government more. Next program will be a nationalized prescription drug program.

You could stop immigration, but Canada has an aging population and sub-replacement birth rate. The majority of immigrants are younger adults of working age. There would soon be a shortage of workers to provide services to the boomers which would increase in severity over time. I suppose you could just bring in temporary foreign workers like japan or uae do, but with no hope of immigration I’m not sure how it would work out. Or where they would live.

Having strong enforcement on rental income is a fairness issue. It reduces roi in some cases – which is one of the many interconnected factors behind investment in real estate. Probably not a strong one but the empty home tax is likely far less effective imo.

$55-million expansion project for Nanaimo Airport terminal

Construction will start next month on the first phase of a 20-year expansion at Nanaimo Airport, where passenger numbers have been setting records in recent years.

In 2017, numbers topped 358,000 — a 110 per cent increase in six years, Hooper said. “We’ve been hitting records every year for six years.”

WestJet and Air Canada currently serve Nanaimo. Passengers can fly non-stop to Vancouver, Calgary and Toronto.

http://www.timescolonist.com/business/55-million-expansion-project-for-nanaimo-airport-terminal-1.23174665

Everyone seems to always be focusing on the supply side. The obvious easy solution is to stop bringing in 300,000 immigrants year. Basically, the immigration level means that we need to build a new city the size of Victoria each and every year. Or squeeze that number into existing cities which is what we have been doing. (No I am not talking about forcing immigrants into a new city.). I know that I am not being politically correct but that would make housing more affordable than any other single measure.

Soon the bay boomers would start to die out and people like Josh would have a fighting chance of getting the house that they want.

The common fallacy that newer is always better.

Freaky.

If sales are slow next week the VREB can blame this bitter bitter winter weather (it’s always the weather). Parts of the city were below zero this morning. Oh the humanity.

Yes to the first. The second I’d support on its own merits but I’m not sure how it helps housing prices.

Not sure why we would want to support owning a huge single family home worth 3 million that is sold with a million dollar exempt gain, but call someone who has a one million dollar house, no pension and a 600k condo they rent out and pay capital gains tax on when they sell and income tax on rents a speculator. Seems to me if we want to create less incentive in the market and increase density and rental stock and tax revenues we should be capping the exemption for primary residences and cracking down on rental income reporting.

Is it that you can’t afford a SFH in Victoria or is it that you are not comfortable with the debt that would be required?

Fundamentals matter. House prices are not like bitcoin.

Prices can only go up by a large amount further if either incomes go up, credit is loosened, or cash from outside floods in. The latter two are being tightened as we speak

Once and Future:

I agree that ill thought out taxes can often have severe unintended consequences. But I do believe that at least we can begin to address the problem of foreign ownership through a stiff regime of taxing residential real estate owned by non Canadians ( I include landed immigrants in the Canadian category but not people here on temporary permits such as students).

Such a tax has a number of obvious advantages:

1) It will discourage foreign ownership much more than a one time tax.

2) More importantly it will encourage foreign owners to sell out their residential real estate back to Canadians.

3) Of equal importance, it would provide a ongoing benefit to every BC resident to having foreign ownership and not just windfall benefits primarily to developers.

4) It would be relatively easy to administrate since it could piggy back onto the municipal tax bill system. (municipal tax bill of 10k then slap an addition foreign ownership bill of another 10k or some other multiple).

5) The tax can easily be modified and tailored for various municipalities (for example foreign ownership in some areas like Whistler might be more desired than lets say Victoria; I am not saying that is true but rather this type of tax has easy flexibility to address the needs of BC).

6) The tax could be implemented at lower multiply of the property tax and then gradually increased as needed to see the consequences to the market.

7) The government can pass this type of tax without any political objections (a few developers and real estate agents might be pissed but so what) but not a single voter would be hurt or out of pocket.

I read an estimate that about 25,000 residential units are owned by foreigners in BC. (no idea if this is true). If this number is correct and we tax each unit an average of 10k each and every year we would raise 250 million in taxes. This would pay for the whole subsidized building program without taxing BC residents a penny.

I know I have proposed this before but I would like to get some feedback from the people online here. Maybe this is such an obviously stupid idea that nobody has bothered to comment. But if you think it is a bad idea write and tell me why.

Not sure if this was posted. Weaver asking about questionable immigration, tax and real estate schemes.

http://www.andrewweavermla.ca/2018/02/14/government-clamp-questionable-real-estate-tax-immigration-schemes/

Been watching this guys home inspection videos. Scary home new homes are built. Zero pride.

Guy is from the main land.

https://www.youtube.com/channel/UC_oQ6vAc_Mku_G5li4eUjAA/about?disable_polymer=1

One way to affordable housing could be allowing more not more restrictions. Like allowing tiny homes, or yurts. Or allowing these buildings that are being moved to the US for their affordable housing to be relocated here for our affordable housing. Or allowing prefabricated garden suites to be erected without having to take the HPO exam or allowing greater density where it makes sense in a regional way.

The most obvious way IS to address supply. But even that isn’t easy since more building makes building more expensive in the short term.

Aha, this is the change at CIBC I heard about a while back. Killing the mortgages without foreign income verification. It all piles up.

https://betterdwelling.com/cibc-kills-foreign-income-program-makes-buying-canadian-real-estate-harder/

Josh, it is just like any investment. It can be for the fundamentals (like 3Richard’s long term rental income) or it can be an irrational expectation of endless asset price increase (someone acting on Introvert’s dreams). Speculation in any market tends to be destabilizing and the source of bubbles (see bitcoin). I don’t think ordinary people should want speculators to distort their retirement investments in the stock market either, because the party will end at some point. Hmmm, I am starting to sound like Hawk.

I agree that some part of the solution is demand-based, but it has to be very carefully handled. On the other hand, just focusing on supply seems pretty self serving for the development and real estate industries.

Dasmo, I tend to agree. I am open to being convinced that there is some clever new tax we could apply, but my experience with new taxes “written in anger” is that the collateral damage to innocent people is usually too high.

False.

Recreational property isn’t speculative.

“Investment” property isn’t either (see below). Note, amateur landlords can be good for the rental market.

Transition buying before selling.

Limiting freedom and opportunity is not the solution to affordability. It will only limit freedom and opportunity.

There is no question this is brutal and that speculation in RE is not good for our social Fabric. But I do question driving towards more punitive government intervention when it’s government intervention that got us here in the first place.

@josh

“All non-primary residences are speculative.” True or false, and why.

FALSE I am self employed. I bought revenue property (houses) to hold and rent out using the rents to pay off the mortgage, taxes, insurance and maintenance. My objective was 25/30 years later when the mortgage was paid off the rents would be my pension. I never anticipated the values of the homes to go up as much as they did. The big rise in value occurred between 2002-2006 after I had owned them 10 years.

Plumwine

Damn skippy Saskatoon is too shitty, a year is more than enough time to figure that out. 5 years is the north end of how long we’d wait. I don’t have to have a SFH but considering I can afford a SFH in every city except Vancouver / Victoria / Toronto, it’s not an unreasonable desire. Your fascination with my life choices is odd.

I’d like to know people’s opinions on the following. “All non-primary residences are speculative.” True or false, and why.

Josh @ 2:26pm Feb 14th…

Great post.

Thanks all for the discussion as always. Looking forward to budget day.

Totoro

I can usually get 2-3 servings out of a large chicken/veg curry and rice dish. Same with double large portion chicken burritos which nets 2+ meals. Same with a large chilli dish and a large salad which nets me 2+ meals. I could go on…

Now, if you’re eating peanut butter and jam sandwiches, then yes, home made is cheaper. I enjoy home made food and it’s generally made with healthier ingredients, but if done well, eating out can be quite economical.

FWIW, here are my thoughts on housing a family and not waiting to have that ‘perfect’ SFH. Modern large SFH are not necessarily the best for raising kids. All that space causes a family to grow apart as you are never forced to be together. We have 3 amazing kids and they actually like spending time with each other and us. I’m not kidding when I say people actually marvel at how well we all get along with each other. I really do think a part of that is because we have not had the ‘luxury’ of >300 sq/ft per person.

Do we have any stats as to how many SFH in Victoria are not owner occupied? Frankly I dont have any idea. We are talking about speculators but I am trying to figure out if there actually that many properties owned by speculators. Are we talking one in ten or one in a hundred?

Hmm. 3Richard, that part wasn’t in my thoughts, but it is an idea worth debating. I was thinking just to delay the added flipper tax for a year. However, if we are serious about supply, having a capital gains holiday would probably have an effect, as you say.

However, capital gains is a federal tax and I highly doubt the FedLibs (or CRA) have much interest in that. It may also be perceived as rewarding the speculators who jumped in and drove the market up in the first place. So, on the whole, interesting but I would be surprised if anything like that happened.

Great new article on Andy Yans work to expose real estate fraud in Vancouver

http://www.macleans.ca/economy/realestateeconomy/andy-yan-the-analyst-who-exposed-vancouvers-real-estate-disaster/

Josh, put down your homebrew and take a deep breath.

Saskatoon is too shitty, Alberta isn’t good enough for you. Vancouver + Victoria aren’t fair in your opinion. After 5 years(?), you are still waiting for the market to crash/correct to fit your ideology.

I hope your spouse shares the same vision as you do, iirc, you stated you want to start a family in SFH. This gov’t may not live up to your expectations, the RE may not be fair to you in the future. But the clock won’t stop ticking, rethink your priority once in a while isn’t a bad thing.

Victoria maybe expensive, enjoy your valentines evening in the most romantic city in Canada.

“Will be a good time to buy more.”

Too bad you won’t qualify. Self employed salesmen are lowest on the totem pole after a market crash.

That’s funny Mike. 1 in 5 can’t qualify now so when rates go up another one point it will be 2 or 3 out of 5 who can’t cut it. Two more points and you’re SOL trying to flog your shack anything close to todays lottery win price. A market cleansing is coming not some insane greed filled pablum babble.

After your load the boat gaurantee on GE at $30 and its now at $15 you’d be the last clown to believe for a second.

ICYMI Mike there is a debt bomb that didn’t exist in the 70’s to early 80’s. But some like you are slow to grasp the realities of how derivatives and bond markets function. Sad. Sell now or get smoked.

@Onca and future on

“If it were me, I would put in a grace period so that current owners could take advantage of no extra tax if they sold in the next year.”

Absolutely great idea especially for investment properties. If the government reduced the Capital Gains Tax formula from 50% to 25% for a one year grace period I think that would produce a whole slew of new listings helping to moderate the supply problem and lower prices.

Although, it looks like Vic did closer to a quintuple in the first inflation, so there you have it. And no, I’m not trying to be a dick by posting these. I’m actually trying to warn people that this next decade may not be very friendly to the unprepared. If you think the below is unsettling, take a look back at food, lumber, metals, fuel……

You can count on Trudeau/Trump being as inflationary as Trudeau Sr./Nixon.

(just never count on all the horgan/weaver types around here having much of a clue what’s going on 🙂 I’m becoming like Jack, always gotta get a final dig in)

Best guess is Edmonton quadruples over the next decade, using the first ‘great inflation’ as a guide.

https://www.cnbc.com/2018/02/14/inflation-rise-toward-key-level-rekindles-stagflation-fear-from-the-1970s.html

Possibly more as, like you mentioned, it’s been so stagnant since ’07.

This, and my personal familiarity with Regina, both confirm that Saskatchewan is a shithole of monumental proportion.

You’ve obviously have had a stroke. Want to try re-writing this so it makes sense.

What are you eating that is cheaper than making lunch at home?

Also, IMO, the most profitable ‘speculation’ happens with primarary residences. The capital gains tax provides a windfall on high end homes.

Marko

Although sometimes it is cheaper to eat out than to make it yourself; really depends on what you’re buying and how many meals you can get out of it.

The difference between these perspectives is weather you think the problem is supply or demand based. I’m on team demand based. It’s not punishment to force speculators to pull money invested in real estate out and put it back into the stock market. The gains over time will do just fine and the result is a huge improvement in affordability, which everyone benefits from.

Exactly. The more I think about it the more it makes sense. It would just take the exuberance out of the market.

Did you even read the post? Rhetorical question. Screw people treating homes like stocks and pricing out 85% of working people.

True story: I lived in Saskatoon for a year and absolutely loathed it. It wasn’t just the weather. It was insanely expensive, incredibly boring, full of crime and super racist. I wouldn’t raise a family in Saskatoon if someone gave me a house there. Calgary isn’t too bad but I’d never consider it when Ottawa and Montreal exist.

Where do I start with this… If you think homes should be traded like stocks with zero regulation, then you’re saying working people shouldn’t be able to afford property. Cheap overseas goods… are taxed… and regulated. Canada is one of a small cohort of countries that allow foreign ownership, has a network of businesses that make it super simple, and have such a lack of transparency for the whole process. If you don’t think that’s a problem, then you’re wilfully ignorant, benefiting from the collective corruption or likely both. It’s not anti-globalist to want the government to intervene when so many working people can’t afford basic amenities. It’s what the current government was voted in on, so I’m not alone.

Josh, that is an interesting idea: Just have a flipper tax on non-primary residences with, say a two or three year timer. Bankruptcy and death will still need to be addressed, but the basic idea would not be an issue for most “compassionate” cases. If you have an investment in a non-primary property and get relocated, just keep renting it out.

If it were me, I would put in a grace period so that current owners could take advantage of no extra tax if they sold in the next year. That would achieve more product on the market and make sure everyone holding non-flippable property was given a chance to make a rational decision to stay in.

For those advocating affordability, Edmonton should prove a nice case study. Prices peaked in 2007 and have yet to return!. There you have it – houses for housing, not a source of investment. Is that a good thing? (I honestly don’t know).

Or maybe ask an Edmontonian. Or maybe invest there; seems high value, at least for western Canada.

http://www.edmontonrealestatemarket.ca/siteFiles/Image/SFD%20average%20sale%20price%20March%202012.jpg

plumwine, I agree that I see too much of this attitude at the moment. There is certainly an affordability problem, but the attitude of many in BC is turning to punishment instead of actually trying to solve the housing imbalance. The problem with punishing people you don’t like is that it casts a much wider net than you ever expect.

Wow, Vancouver will see 20-25 more highrise towers in just one section of the city over the next 20 years:

City approves ambitious plan for Northeast False Creek

http://vancouversun.com/news/local-news/city-approves-ambitious-plan-for-northeast-false-creek

Sometimes things change and they don’t ever go back.

Like this, for example:

Similarly, I think the nature of real estate in desirable cities like Toronto, Vancouver, and Victoria has permanently changed over the last decade (or more), and these places are going to remain unaffordable going forward.

Don’t misunderstand me: prices can and will decline. But, in my view, the core areas of cities like ours won’t ever return to the days of broad-based affordability.

Maybe. Won’t bring them much revenue. They’ll need it if they are hoping to get to 10/day daycare and build a bunch more subsidized housing. Wonder where the money is going to come from.

250 to 540 sqft with median of 444

Yup.

We’re totally fine with buying $6 T-shirts courtesy of Asian child labour, but when out-of-town wealth threatens the upper middle class’s ability to afford a house in the core then suddenly globalization is out of control!

Yup, more tax! 15%, 30%, why not 100% tax? It only took ~5 years to double the value @ core. Taxes sure will solve the problem. Screw the people have thing that I want to own.

Edmonton is a great city, so is Calgary. Perfect for young families. -30C is nothing once you lived there for a year. Driving is 100x easier than it used to be (traction control, fwd, winter tires, defogger that works!)

Globalization is a 2 way street. We enjoy cheap goods from oversea for decades, their 1% now enjoy our cheap real estates in prime location.

Marko:

In your experience how large is the average studio condo in downtown?

Marko

How much more is parking in that building?

Yeah, how can we ever forget, you’re perfect. Give it a rest FFS. When real estate tanks will you still be perfect?

Will be a good time to buy more.

“I am always shocked at home many people working 9 to 5 pm middle class jobs buying lunch every day. When I was at VIHA I was living at home, used car, pre-pay cellphone, I would make my own lunch, pretty much whatever it took to get ahead in terms of getting into real estate and further my education. The education part turned out to be a complete waste of time and $40,000 but real estate paid off.”

Yeah, how can we ever forget, you’re perfect. Give it a rest FFS. When real estate tanks will you still be perfect?

What’s everyone’s big news prediction for next weeks budget?

My guess is the NDP will play it safe and introduce the foreign buyer tax province wide so it looks like they are doing something substantial, but it really isn’t.

It has already been done and it didn’t tank the Vancouver market.

275 to 350k for a 1br 500sq and 400 to 500 for a 2 br 800sq has a subsidy and is actually cheaper?

Relative to market yes it is. Studios without parking downtown are going for around 300kish.

Marko

275 to 350k for a 1br 500sq and 400 to 500 for a 2 br 800sq has a subsidy and is actually cheaper?

Seems expensive

I don’t want non-speculators to get screwed, but a comprehensive anti-speculator tax in my mind wouldn’t require loopholes. The worst of speculation happens with non-primary residences. I think that would encapsulate the situation nicely without screwing over freshly divorced military folk and such. Maybe just one loophole for anti-speculative tax exception in the case what would otherwise be bankruptcy, which couldn’t be used for non-residents.

I really don’t think that has anything to do with ‘instant gratification’ and everything to do with it just being a bad deal. The amount that it’s subsidized by is something that can be saved just by jumping on more eager sellers’ listings. The only people paying current market prices are speculators anyways. There’s so many things that would have to fall into place to make Vivid a good deal and none of them are in place.

Agreed. Projects like the Vivid are a complete waste of subsidy money. So the first owners get it slightly cheaper but all press presents it as a good investment that you merely have to live in for 2 years to cash in on.

I am also not in support of Vivid style subsidy but slow sales at Vivid do point out the concept of instant gratification in our society. Even if you cut out the investor, drop the prices a bit, people still don’t want to go for it.

Since Vivid launched I’ve had clients enter into worse re-sale deals as they simply don’t want to wait for the 2.5 year build out. Seems as soon as people get a half decent job they want a car, a dog, vacations, and real estate to be affordable and for them to move in as of last week into their dream condo/house.

I am always shocked at home many people working 9 to 5 pm middle class jobs buying lunch every day. When I was at VIHA I was living at home, used car, pre-pay cellphone, I would make my own lunch, pretty much whatever it took to get ahead in terms of getting into real estate and further my education. The education part turned out to be a complete waste of time and $40,000 but real estate paid off.

“At the same time do nothing about local speculation (haven’t heard peep about that speculator tax recently).”

Was mentioned in the throne speech, I quoted it. The majority who bought housing during the hot periods did it to make the big bucks. Those days are gone. Once the sheep figure it out the market will tank. By the looks of last week’s numbers it may have started already.

Weaver has leverage, massive leverage. Horgan and him would both be crucified if nothing substantial is implemented.

Lots of decent condo inventory hitting the market thus far today.

Canada’s housing market saw prices rise on a national basis in January, but the growth was almost entirely due to strength in Vancouver and Victoria.

The Teranet-National Bank National Composite House Price Index, which measures sale prices in 11 major markets, rose 0.3 per cent in January over December.

Teranet said the price bounce was not widespread, however, with only four markets climbing in January. Prices were buoyed largely by a 1.2-per-cent increase in the Vancouver region — which came on the heels of a 1.3-per-cent increase in December – and a 1-per-cent price increase in Victoria.

Article here: https://www.theglobeandmail.com/real-estate/the-market/home-prices-rise-on-gains-in-vancouver-victoria/article37975024/

Josh:

I dont disagree about the idea about your proposed tax on “flipping” but I would add that there there should be a clause where a homeowner can apply for an exemption based on unexpected circumstances or for compassionate reasons that required the sale of the house. I am thinking of situations such as job transfers to another part of the country (not uncommon with the military) or

the death of a spouse or the need for someone to enter a nursing home. Divorce is a difficult issue as well and, regretably, rather common these days. I am aware that creating loop holes has certain risks of abuse. I worry about someone having to bear extra tax when their spouse has a stroke and has to enter a nursing home and the primary reason to sell the house is to afford good care for that spouse.

It happens in Victoria more often than one might think.

While I agree it’s nice to live here, this is a super pompous statement that doesn’t excuse maniacal west coast prices. We knew the speculative party was going to be crashed. No sense crying about it. You do NOT have an intrinsic ‘right’ to 15% returns on real estate. See what I did there?

I’m not holding my breath for effective changes but I’m hoping they tighten the clamps as hard as they can. I want to see at least a 30% tax on buying and selling within 1 year without renovation, and at least 15% buying/selling within 2 years. I’d support an outright ban on non-resident ownership too.

Some of the loopholes will be closed to increase revenue in fact.

Whoops, missed that. I read a summary that didn’t include that mention. Thanks.

Hey cool, index investing just got dead simple. Buy VGRO and forget about it.

http://canadiancouchpotato.com/2018/02/05/vanguards-one-fund-solution/

Gack Horgan should just just tell him to shut up and go play with his blocks.

I think he probably has.

“NDP can talk a good game but reality is Housing is too big a part of our economy to tinker to much with the golden goose.”

Correct. They have already adopted the moar supply rhetoric of the previous government. They will tinker at the margins on the demand side. Too much revenue at stake to do much at all.

Bman

Those 2 promises probably got him elected.

Glad they are gone also but he may pay for breaking them.

Any policy changes made may bring in some tax dollars but will have little longterm impact on house prices and availability. There are no easy answers to BC housing issues. NDP can talk a good game but reality is Housing is too big a part of our economy to tinker too much with the golden goose.

Any spending on housing will just increase house costs because of limited available construction workers and land.

“At the same time do nothing about local speculation (haven’t heard peep about that speculator tax recently).”

This is right in the throne speech:

Safe, decent housing is a right that is under threat by speculators, domestic and foreign…Budget 2018 will put forward new measures to address the effect of speculation on real estate prices.

Why would government mention domestic speculation in the throne speech, if they aren’t prepared to target it?

“No 400 dollars

no 10 dollar day care

All smoke and mirrors.”

Gwac, I am quite pleased with government’s willingness to back off on terrible policy commitments made in the heat of a campaign (the $400 renters rebate), and to take time on expensive ones.

Refreshing given the previous government’s bullheadedness on LNG, and their incompetent handling of the foreign buyer file. Now that was all smoke and mirrors.

I have to agree with Gwac.

Weaver talks a great game on housing/real estate issues, and I believe he genuinely wants to see big changes implemented; however, housing isn’t among his top three priorities, and he certainly wouldn’t take down the NDP government over anything related to it.

540 Victoria Ave in South OB popped up as a sale today – but what caught my eye about this $1 million sale – $20k over ask – was the sq. footage of the house! Only 1242 sq ft. Only 2 beds/1 bath. Very odd kitchen w/ no dishwasher. Good luck trying to open the basement door w/ the stove in the way! Maybe you don’t need to access the 6’5″ basement (not all that useful anyway), at least not while the stove is fired up. No privacy in the backyard w/ window’s peering right at your deck.

But hey, it’s in South OB so I guess all that doesn’t matter? These people didn’t bother to wait until next week when the Gov’t is supposed to save buyers…

This 1938 house shows there once was a simpler time…when people lived w/ much less… but that time also had simpler prices…

Weaver ain’t going anywhere Hawk. Liberal are not going to take him in and Green cannot afford another election just yet. So the bitching Weaver does is all smoke and mirrors. Horgan should just just tell him to shut up and go play with his blocks.

@LF, that’s only saying they will start to enforce the law. Hardly anything really….

I actually think that has more potential to affect the mainland RE market long term than a spec tax…call me crazy. Speculation is more a symptom/amplifier.

Agreed. Projects like the Vivid are a complete waste of subsidy money. So the first owners get it slightly cheaper but all press presents it as a good investment that you merely have to live in for 2 years to cash in on.

Affordable housing should concentrate on affordable rentals.

Also his recent comment about how we don’t want to keep out immigrants. As if it has anything to do with immigration.

However the throne speech is what I was expecting them to do. Crack down on fraud, loopholes, and money laundering which is politically safe and they can slam the Liberals while they do it. At the same time do nothing about local speculation (haven’t heard peep about that speculator tax recently).

Then spend big on affordable housing. One key area that I’m glad they’re tackling is housing for universities. We need to build a ton of new residences. That would solve a lot of the rental problems.

Rook, governments have a way of fucking up good intentions. I’m confident whatever they do it will kill the market. Once you take away the part about making easy money with no rules, then speculators/money launderers leave to find other avenues to profit from. The real estate game is over like bitcoin. Fun while it lasted then the crying begins.

Hawk, be prepared to be underwhelmed by Horgan on foreign capital.

“Housing is a critical component of many people’s equity and their retirement prospects, and we want to make sure we don’t adversely affect the marketplace.” – John Horgan

Weak in my view to see their own role in government is to stray away from legit, honourable, right-thing-to-do policy in case it might decrease boomers retirement prospects. What about the rest of the population who didn’t make windfall gains on price appreciation (from speculation) in the last 5 years?

Good points Andy. The global money goes most where there are no rules which is here. The easiest money laundering/tax evasion machine in the world. Local speculators have piled on. Time to make drastic changes.

Lore

I call B.S. We are living in a time where half of a street can be foreign owned and empty. I don’t believe it’s happened to this extent any time in our history. If we sat back and did nothing, we’d be left with nothing. When things get out of control, sometimes you have to intervene. In a normal market, without a lot of foreign capital, you could probably just let it run it’s course. But not in this market. Something needs to be done.

We have more of a right to live in a place, than does any foreign parked capital. Houses are for living, not for playing the stock market.

BC needs to pull out Alberta’s housing playbook from the 70’s. If anyone can recall 1970’s Alberta, there was a critical shortage of housing, and 0% rental vacancy. That also was a time of higher and rising interest rates.

In that environment Alberta Housing Corp was formed. This was a government department to encourage the building of rental units and tens of thousands of them.

Essentially the government provided very attractive subsidized interest rates to build apt. buildings. The deal was to qualify for these attractive rates, 10% of the units had to be earmarked for low income earners and the rents on these units would be restricted for 15 years. The subsidized interest rates would last for 15 years as well. After 15 years all restrictions on the building would come off as did the subsidized interest rates.

Pretty well all these buildings were converted to condominiums after the 15 years and in many cases existing tenants were given first opportunity to buy their or another unit in the building.

Obviously some of these criteria could be changed to suit todays circumstances but a program similar to this would go a long way to improving the housing market crisis plaguing BC today.

Gwac, unless Horgan wants to lose Weaver for good he will do something big. People voted in Horgan for this very reason. He knows it. The industry is out of control as the speech said. Its time to shut down this corrupt casino.

@ Lore: I think you’re right – Central bank policy is going to affect this market more than anything.

@Gwac: Agree with you as well. ~ $50 billion in total revenue for BC government. 1.5 to 2.0 billion of that from the property transfer tax. 2.2 -2.6 billion from property tax. How much more from the PST on construction related spending? How much more from corporate and personal income tax from people employed in construction and real esate.

Killing this RE racket will kill billions in revenue.

http://bcbudget.gov.bc.ca/2017/bfp/2017_Budget_and_Fiscal_Plan.pdf

@Hawk – I don’t think we can count on the NDP to make our wish come true. I think the only person in government that can help us is Trump.

Yep, They are doing nothing. They will direct more money to building subsidized housing. Which is a drop in the bucket and does nothing for affordability in general. It only benefits those that build it and the select few that can rent it.

And this is the closest thing to something :

“create an absentee speculators’ tax”

Which is nothing but creating a new department of highly paid executives. You need to be “absent” and a “speculator”. What does that even mean? If one visits the country once a year they are not then taxed? is it even a punishing tax?

This is far from banning non residential ownership….

I’m not promoting more government intervention here, simply calling out the BS….

In speech

No 400 dollars

no 10 dollar day care

All smoke and mirrors.

They already hurt one industry

They cannot afford to kill housing. Way too much revenue. You will see the PR machine at work though about how much their new rules will help.

gwac – John has already said they want to crack down on speculation and also they need some sort of taxes to offset all the promises they have made (10$ a day daycare, no MSP premiums, no tolls) – they need to bring in taxes for these things – I wouldn’t be surprised to see something a bit more substantial for housing. 1 week until we know for sure.

Hawk

Prepared to be underwhelmed…Not in the NDP interest to send the housing market into a tailspin.

“Speculation from locals and foreign”

Prepare for a nasty tax speccies.

From the throne speech:

“Government’s first step must be to address demand and stabilize B.C.’s out-of-control real estate and rental market” – will include legislation to crack down on tax evasion, tax fraud and money laundering as it relates to real estate”

It’ll be a real step forward for this blog if everybody agrees to simply HALT any talk about annoying things like markets, creditworthiness, DEBT, responsible public policy, or any of those other TRIVIALITIES, because this is Left Country, where you just think positive, ignore the negative, and hand out stuff, because dammit, you’re ENTITLED, right?

So, Horgan Claus is declaring that he will PERSONALLY (on his own dime) build a house for EVERYBODY. He’ll take care of it all — even cut the lawn, fold laundry, clean windows, pull hair out of the tub drain, and other odd jobs. You wonderful, generous man. I tried to find out where to sign up, but there doesn’t seem to be a list yet (although I’m sure it’s coming), so I just emailed my specs for a sweet dream home at a choice South Island location, and look forward to the keys at your very earliest convenience. Oh, and we’ll also need you to throw up additional houses for Grandma, cousins Curly and Moe, and another for that 420-friendly uncle who bilked ICBC by faking a disability…

Yet again, ideology and shallow, short term interests trump good research and responsible governance. Why, oh why do semi-intelligent policy groups never learn from the past consequences of government interference in markets? (“Nobody can tell us, because we’re smarter, we’re better, and darn it, we’re SAVING THE PLANET, ‘n stuff…”)

It’s lame, hugely expensive, perverse, and unnecessary…

Prices will continue to rise in all markets as long as debt is easy. Prices will always be higher where it’s nice to live. Measures to make residences “affordable” drive prices higher, like subsidized tuition. You do not help a market by throwing up thousands of shoeboxes on the premise that anybody should be able to live wherever they want: you just lay groundwork for future social ills. All the talk about “Chinese capital” is proving marginal and incidental to the much more influential theme of central bank policy. The best thing that responsible government can do is get out of the way and let prices correct themselves. (You do NOT have an intrinsic ‘right’ to live anyplace you want!)

It is brutal getting into town right now. I’ll go to my building site and be heading back around 11 and all routes in are choked due to construction. The latest is the bus lane on Douglas.

Here’s how many Chinese investors are interested in Canadian property in 2018

We expect Chinese buying in [2018] to be on par with levels of 2017, unless something significant happens to change the investment environment,” writes Juwai.com CEO Carrie Law, in a statement.

According to a recently conducted survey by Juwai.com, Canada is the third most popular investment location for Chinese travellers in 2018. Fourteen per cent of Chinese investors chose Canada as their top pick, behind the US (26 per cent) and Australia (19 per cent.)

Toronto was the number one city of interest to Chinese investors, followed by Montreal, Vancouver, Ottawa and Calgary.

http://news.buzzbuzzhome.com/2018/02/heres-many-chinese-investors-interested-canadian-property-2018.html

Number 6:

That is why most people rely on their professional real estate agent to advise and guide them.Personally, I have always totally relied on the real estates agents directions when buying a house (we need a universal symbol for sarcasm since at least one person on here is too dim to get it).

Perhaps so that the buyer thinks he is getting a better deal by getting the seller to drop their price by $20,000 instead of $10,000?

You put a sign on a pile of shirts at a store saying 30% OFF. 30 percent off what? The sign is just to get attention and you can do that by raising the price. After all it got your attention.

I think most people don’t know what they are doing, they just follow the crowd and hope others know more than they do.

I’ve noticed quite a few listings have had upwards price changes recently which seems counterintuitive to current market conditions. Any thoughts on why a realtor would do this?

What was happening was the agent under listed the property by hundreds of thousands to get 20 people bidding on the property in a week. This was the deferred offer or blind auction marketing scheme. Most people just paid fair market value for the property. Some got caught up in the marketing scheme and over bought, but they are going to pay for their irrational exuberance when it comes time for them to sell.

Just had one yesterday where the buyer purchased a property for 1.6 million several years back and the property values have increased by 30 percent but the best he can get today is 1.7M. Yes they made a profit of a hundred grand but if they had not been caught up in the hype they would have made three times that amount.

Let’s see if we can figure what will happen next when the Spring market starts mid March?

Historically, the Spring market is the most active season when most prospective purchasers attention is on buying real estate. It is also a time when you will find the most new listings coming to market.

Will prospective purchasers step up and pay these high prices or will inventory increase at the same rate as the last two years as new listings start to pile onto the market?

At this time I’m leaning to the latter and we’ll have months of inventory and days-on-market reach well into the balance zone between buyer and sellers. That translates into more choices for buyers for pre-owned properties.

As most large development projects build price appreciation over the course of construction into their projects, there may be some projects put on hold as they’re not economically viable at market prices that are not appreciating. And since construction plays one or if not the most important contribution to the Greater Victoria economy we may have both increasing unemployment and vacancy rate.

Could the government pull a rabbit out of the hat? Sure, over the years they have added to the cost of building homes with taxes and regulations. They could reverse those decisions and lower the cost to build a home in BC. That’s not the best idea though, as it would make the home completed last week more expensive than to build a home that would be completed six month from now and so on and so on. That adds uncertainty for developers as they face greater competition and less profit as the projects nears the end.

The government has a narrow fence to walk. It would like prices to moderate lower but not to disrupt the construction industry which is keeping us from a recession. It would take the wisdom of Solomon to solve this puzzle but the NDP and Greens don’t have one of those. As it would take a strong capitalistic move and that’s just not in their party’s philosophy. They will just be content to fiddle while Rome burns.

True, and expect pretty much nothing to happen for at least another week as people wait to hear what’s in the budget for housing… Just one more week to go!

With practically nothing to buy – many buyers are likely taking a ‘wait and see’ approach – the spring will be telling about what direction the market takes this year…

It seems to me the opposite is happening now compared to what was happening in late 2015/ early 2016. When the market was rapidly appreciating back then – many home owners who were selling hadn’t caught up their mentality with prices the market was suddenly willing to pay! Hence we had so many ‘over askings’. For ex., you’d have a house listed in the core for $800k – and suddenly it would go in a frenzied bidding war, often for over $1m. Now, the same house is priced at $1.2m, but probably may only fetch $1.1m., and now perhaps only one or two buyers, if any.

So, for what extreme limited inventory I now see in the core – places are going on the market often for sky high prices as owner’s mentality gets inflated over what the market is really willing to pay. And of course, they just sit as sensible buyers wait…

One thing that would be really nice to see this spring is if we finally got more inventory.

It is really hard to tell what is going on when inventory is this low.