The (not so) remarkable increase in condo sales

May condo sales increased to 379 from 293 in April. That’s an increase of some 30% and seems pretty significant. Is it a shift to condos as prices of detached houses move out of reach of local buyers? Is it a lack of inventory forcing people into alternatives? Is it a wave of retirees downsizing into condos? A run on AirBnB investments?

Or nothing. It’s always good to take a step back and make sure we’re not getting all excited about that much noise. One way to take a look is whether the breakdown between single family, condos, and townhouse is out of normal ranges (I’m leaving out manufactured homes).

The percentage of single family home sales bounces around between 55-65% and May was nothing at all unusual from that perspective. While it was a relatively big shift from April, those things periodically happen. But let’s look at the raw numbers instead.

Aside from the staggering increase in sales this year, it does seem a bit unusual that detached sales have dropped off this early in the year. May and June is when we normally see the largest number of detached sales and a more gradual dropoff after that. Looking back further, we see the pattern stays constant.

The only other year that doesn’t fall this pattern is 2010, when the market last topped out. Now I wouldn’t jump to any conclusions based on this one month, but something to keep an eye on. I’d say the most likely explanation is a lack of inventory pushing down sales because there just isn’t enough out there to buy. What do you think?

Triple A

Thanks for the info.

I realize a new post is up however a last post here with respect to deposits in our banks.

While I’m not a Joe Oliver fan, he poses some interesting thoughts and questions in the link below. I won’t copy/paste so those interested can read the article without a preview or my opinions on the subject

http://www.financialpost.com/m/wp/blog.html?b=business.financialpost.com/fp-comment/joe-oliver-how-the-budgets-bank-bail-in-changes-could-cost-canadian-depositors

Currently the reporting on buyer origin is voluntary and some 5% of buyers do not disclose this. However I’m not sure how the government is going to improve this. Seems like once someone is here there is little point in trying to track buying.

Also new post: https://househuntvictoria.ca/2016/06/13/june-13-market-update/

The first early signs of an itsy bitsy slowdown.

Triple A Rated:

I’m confused by that article you posted on bail ins. Are you saying that my money isn’t even safe just sitting in savings account until I pull out after the big fail?

HSBC would be the last place I’d put my money when things go south. They are the biggest money laundering chutes of all, not to mention all the Asian money that will be pulling out fast in a financial crisis.

https://www.rt.com/uk/332135-hsbc-cartels-money-laundering/

Curious Cat – we looked into it, were told either SFH or duplex, decided we didn’t really like the duplex idea. Then the sewage treatment plant reared its head about the same time that it was decided to buy out my husbands business partner. So now we’re in rebuild the business mode. Guessing the rebuild is 3 years out.

Just a little history for those that are not aware regarding Banks in Canada

Back in the days of the Bank of B C (now HSBC) there existed a regulation F.I.R.A. that prevented foreign ownership of a Canadian bank to 5% or less.

With the National Energy Policy implementation, the Western Economies tanked and there were at least 3 banks facing bankruptcy. (Bank of BC, Northland Bank and Canadian Commercial Bank in 1985)

The CDIC was unlikely to be able to bail out the depositors. (after all they are really an insurance policy with limitations)

Legislation was passed in a 1/2 hour Parliamentary process that overturned the FIRA ruling allowing the Hong Kong and Shanghai Banking Corporation to take over the Bank of BC (basically a bail-out) and that changed the unique canadian banking hegemony.

So what does this lesson suggest?

1) Is the CDIC capable of bail-outs of depositors?

2) Rules change when the SHTF.

Just Janice, I remember you posting a few months back about subdividing, tearing down, rebuilding, etc. Whatever happened with that? Did you ever get a quote from a GC?

@ Triple A – just move everything from one of the big 6 banks to HSBC or another, smaller bank. They are unaffected by this legislation as they aren’t “domestic systematically important banks”. For now anyways.

The fear play is usually targeted at buyers, eg., from Pragmatic Marketing:

“In a B2C market we connect with the buyer’s pain, fear, and guilt.”

http://launchclinic.com/2012/03/the-difference-between-b2b-and-b2c-buyers.html

It’s possible to target it at sellers, but a brochure about foreign buyers, if it’s effective, should “excite” someone into selling their home for big $. If they were scared, they’d stay put, because their home is their “safe place.”

One theory about why Tony is using Mandarin on the flip side is because it’s cheaper to print 1 postcard for both buyers & sellers.

In fact, the Mandarin doesn’t say the same thing as the English side – it’s a list of 4 points not related to the English side.

He might be handing out the same postcards to Chinese buyers (who don’t speak English) as part of his marketing package for each house.

Triple A rated,

I am not sure how zero hedge took this statement to mean depositors:

“This would allow authorities to convert eligible long-term debt of a failing systemically important bank into common shares to recapitalize the bank and allow it to remain open and operating.”

I don’t know if there is anything specifically written about fear based marketing only working on buyers.

I know that when the market is in favor of buyers then sellers are afraid that they won’t get a better offer or even that they will get an offer at all. In a buyers market if you can get a seller to buy a home before they sell theirs then they are more motivated to sell and accept a lower price for their home.

Now I have not seen the brochure but I wonder why the Mandarin? That’s what the people I spoke with didn’t like about the brochure they felt they were being manipulated by fear that their neighborhood would be changed.

Instead of Mandarin, he could have had a picture of a sewer plant if he was trying to get listings of homes along Dallas Road.

BMO reduced 5 year fixed to 2.49% today. This comes on the heels of serious talk of delaying fed increases. I think the odds of stimulus packages are higher than the thought that rates will go up if I had to choose between the two.

Further to previous discussion, the Liberals also have extended Bailing out Canadian Banks to Deposited savings in the form of “Bail-Ins.” I was shocked to read this part below.

This part may have been previously posted so forgive me if it has.

“…Canada has just become the latest country to treat depositors as the bank creditors they are, and as such, they too will be impaired, or “bailed-in” the next time a Canadian bank needs to be rescued…”

http://www.zerohedge.com/news/2016-03-22/its-official-canadian-bank-depositors-are-now-risk-bail-ins

@ Vicbot:

I don’t know. I would presume that brochures like the one Darren Day and others circulate also target buyers as well as sellers. In the former, the message is more implicit rather than overt. A prospective buyer sees that and may think something like, “Oh look, realtors are telling sellers that out of town buyers are interested and, will pay more”. As it was said below, the fear of a well heeled out of town buyer coming in and out bidding you can be a psychological imperative to hurry up and buy, and in the process prime you to pay more to be competitive.

One more note: for fear-based marketing to work, it’s supposed to be targeted at buyers, not sellers.

A brochure to a seller isn’t supposed to elicit fear, it’s supposed to elicit trust that the realtor will sell “for top dollar”. As Tony says in his own words, homeowners aren’t selling “for less” to “non foreign” buyers he talks to

Living on top of a sewage treatment plant

http://www.vicnews.com/news/374762951.html

This is a good read as many probably don’t already know that it’s there. And they live and eat on top of it everyday!

I agree with you Hawk,

We may think that the foreigners have buckets of cash because of all the cash deals.

But back in Guangdong some bank or mobster might have a claim on that money. The difference is that one of them collects on their debts in the middle of the night. And our police are not capable to deal with the different culture of secrecy and gangs.

https://youtu.be/9cWnubJ9CEw

Sales is also about “following the money.”

The most successful salespeople I’ve known have followed that mantra and they’ve literally made millions. They “don’t waste time” on things that don’t make money.

Tony himself said in the news, “I have not had a single homeowner that has said they’re willing to take less money for a house just because it was a non-Asian or non foreigner.”

So what that statement implies is that he’s dealing with foreign buyers and he’s dealt with homeowners that are “willing to take” more from foreign buyers.

His own words. (he’s the one that keeps bringing specific buyer origins into it)

If he’s trying to “scare” people – it’s obviously not working to his benefit – it’s creating a backlash of people expressing concerns about rising house prices.

The brochures that you are reading are directed at you not at foreign purchasers. They are meant to illicit an emotion to get you to sell. I’ve not see the brochure, but I’ve been told that some of the brochure is written in Mandarin. Why would they do that if they know the readers speak English?

To illicit an emotion that it is better to sell now for buckets of cash than find yourself in a suburb of another Richmond. Marketing is all about tapping into a persons fear and greed.

Falsifying isn’t the right word. How about less than forthright.

JustJack, I didn’t say anyone is falsifying data – anyone can easily have a Victoria address but just not live here most of the year (or rent here for a few months before buying). We just don’t know. Personally I saw a lot of it in Vancouver.

Bank of Canada is probably getting data from the banks, not real estate boards, because the data the boards collect is voluntary, and as FinTrac has found, not following money laundering prevention standards.

However – it’s a minor point compared with the obvious way realtors are selling Victoria homes to “investors and foreign buyers” – in their own words.

When all those supposedly filthy rich foreigners with bucket loads of “margined” cash get their calls from their unfriendly banker to pony up back in China, the BC real estate sell off could be swift and ugly.

Most of that cash is not from their own pockets, it’s borrowed from over there against their businesses or investments. Afterall, it’s other people’s money that makes all the world markets go around and around.

‘Smoldering Bonfire’ Shows Where Kyle Bass May Be Right on China

“Kyle Bass, the U.S. investor known for betting against subprime mortgages, is among famous money managers who expect turmoil in a Chinese banking industry struggling with bad loans. It’s in the least-known corners of the financial system that their predictions could start to come true.”

“It’s a smoldering bonfire,” said Keith Pogson, a senior partner for Asia-Pacific financial services at Ernst & Young LLP. “If the wind changes and inflames it rapidly it could burst into flames quite easily.”

http://www.bloomberg.com/news/articles/2016-06-13/-smoldering-bonfire-shows-where-kyle-bass-may-be-right-on-china

Just Janice, the biggest disappointment about Victoria is the beaches.

Maybe after they put the new sewer in Clover Point they should just truck in white sand and make an artificial beach over the entire plant. Bring your towels and lotion down to the white sand beach. Roller blade paths, volley ball nets and water slides. The city might be able to make a buck out of this.

There are placards all over the neighbourhood – with many houses sporting large signs with respect to Clover Point. I agree, it might be a hard sell under the current uncertainty with regards to the Sewage Treatment Plant. Perhaps councillor Plant or Mayor Atwell will be willing to take the property off their hands seeing as they are so confident about its safety, aesthetics, etc.

I don’t see a high risk of foreclosure, but there is moderate risk of needing to sell in order to liquidate an estate or fund long term care. Many of the owners in the neighbourhood are of advanced age.

Mon Jun 13 2016:

Jun Jun

2016 2015

Net Unconditional Sales: 460 910

New Listings: 570 1,346

Active Listings: 2,362 4,003

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Vicbot, do you think more or less people are now saying they are from Victoria when they are not?

Because, the assumption is, when you are comparing two different time periods, that while some may want to falsify (what ever the point of doing so would be) where they are from that would have been the same as six months ago or a year ago.

And I have to wonder where the Bank of Canada is getting its data? Probably from the real estate boards that you don’t trust.

For me it was different. I was from another city and it was only after living here a decade did I consider myself from Victoria. When people asked me where I was from, I always said my home town. But that could also be that if you are from a major city saying you’re from Victoria is a step down in your career path.

And that’s the same for others that I have worked with over the years. Far better to say that you’re from L.A. than Huntington Beach or Tarzana.

Yes when saying Vancouver, I mean Greater Vancouver.

Tony’s postcards say, “Investors & Foreign Buyers Want Your Property!” So is he following the money trail like all salespeople do, or generating fear? He’s probably being honest, going where the money is, like Darren Day is, and other Victoria realtors, including the ones I meet at open houses.

Bank of Canada isn’t trying to generate fear when it says, “The typical factors that drive housing markets – such as job growth and immigration – don’t explain the current frenzy in these two cities … foreign demand does contribute to price increases that are driving the rise in household indebtedness.”

Another issue is that VREB says around 70% are local and 30% are out of town, but the plain fact is that you can call yourself a “Resident” even if you’re in Victoria 1 month a year, or maybe 6 months a year for school.

Added to that, when foreign buyers influence Vancouver prices, that causes Vancouverites to leave for smaller towns, which creates a ripple effect to Victoria – they have more money to pay higher prices.

The realtors are just following the money – simple. Unfortunately then Vancouver prices are the result.

Just Janice, do the neighbors still have the anti sewer banner across the front of their home?

That can be a real deal breaker. Until the sewage issue is settled it would be tough to sell the property. The home could be well worth the 1.9 million but no one is going to make an offer. And the vendors would be unlikely to lower the price.

The property is therefore stuck in limbo. The vendors would have a 1.9 million dollar property that they can’t sell. Cross your fingers that no one around you goes into foreclosure and is forced to sell.

Vicbot, I assume when you say Vancouver that this also includes other cities from the Lower Mainland coming to Victoria. Since some of the out of town buyers are from places like Burnaby and Surrey

In contrast to what Darren Day said, I find that the out 0f town buyers are purchasing in all areas and all income groups.

Yes there have been some very costly purchases made by some out of town buyers but these are outliers and have negligible effect on the mainstream market. Most of this craziness is being generated by people who identified themselves as coming from Victoria or the surrounding areas such as Sidney. Very few first time house buyers, most are middle income households buying more real estate and are scared of buyers from Vancouver and China buying up all of our real estate.

Because it doesn’t matter if it isn’t true that the market is driven by out of town buyers. All you have to do is convince the locals that it is. Just simply saying to a local prospective buyer that someone from Vancouver is coming to look at the same condo will make the local offer 5% over asking price.

“Are we losing control over our province as our politicians have to always ponder the reaction of the Chinese government. The teachers strike was ended immediately as soon as Beijing snapped the rolled up newspaper across the noses of our politicians saying that their government would recall their students.

Does BC now stand for Beijing China?”

Great questions Jack. I believe it does. How many junkets does Clark do to Asia with real estate developer buddies ? Like twice a year it seems. She has no choice but to dance to their demands as she has no other cards to play and has zero credibility to stand on her own and take a stance on what all the world can see. In other words a coward, afraid of the commies.

The market does seem to have gotten a bit nutty as of late. Neighbours a few doors down from us have (1314 Dallas Rd) just listed at $1.89M and they will be directly across the street from a sewage treatment plant if it goes forward at Clover Point. (Note – there’s a petition against it, and I would encourage anyone and everyone to sign). I have to admit, if they get $1.89M – I’d be sorely tempted to sell as we’d have to be near there in value.

The accelerated pace of value increases is very worrisome – getting a toe hold in such an environment becomes near impossible, and there are trickle effects to the rental market and labour market.

freedom_2008, just to clarify

Tony said about half. He did not say 50%

About half could be 50% but it could also be 40% or 60% too.

And then there is who Tony is marketing his skill set to. He travels between Vancouver and Victoria and is involved in the Chinese communities of both cities. So his “about half” may or may not represent the industry as a whole.

Yes Tony was sending a clear message that he’s willing to use the term “resident.” But we understand that “resident” doesn’t mean “citizen” or “permanent resident,” both of which have different tax & foreign status designations.

Let’s face it, many Victoria realtors are fully aware that the situation in Vancouver is having ripple effects to Victoria.

Victoria realtors are even stating very clearly in their most recent postcards that “investors”, “foreign buyers”, and “out of town buyers” are willing to pay more than the local market.

eg., Darren Day’s postcard: “Many of our out of town buyers are accustomed to higher Real Estate Values; therefore may pay more for your home than the local market is willing to pay … The Offshore Network. Vancouver, China, Calgary, Toronto, USA, and Abroad.”

Yes out-of-towners have affected Victoria in the past, but now the situation is a lot more extreme in Vancouver than ever before. As Vancouver’s mayor said, if teachers or doctors or nurses can’t afford to live there, who’s going to provide services? As Trudeau said, they’re not going to want to commute for several hours each day. Most people don’t want this to happen to Victoria.

VREB cannot track the detailed data of buyer residency because it’s all voluntary and “resident” isn’t defined (in my neighbourhood in Van, some houses were only occupied 2 months of the year. The slippers on the front steps were a giveaway)

Another point. The “All Cash Offer”.

Again a topic that was touched on at our meeting.

An all cash offer does not mean that the buyer will not be getting a mortgage on the property. It just means there was no subject to financing clause in the contract to purchase.

If you are putting down a fat down payment you might not have a subject to financing clause. If you are only putting down 10 or 20 percent and not using a subject to financing clause you’re just plain stupid.

It may be misleading but it is debatable if the statement is or is not correct.

Personally, I think Tony was absolutely clear in what he said.

Another point that he briefly touched on was what I have been calling blind auctions. However he was very careful not to call this activity an auction. I can’t remember the exact term but it was along the lines of Delayed Offers. Because it is questionable if a real estate agent or salesman may conduct an auction unless they possess the credentials of being a licensed auctioneer? And most certainly there would be a conflict of interest in being both salesman and auctioneer.

But delayed offers? Is that or is that not an auction?

The agents that I have spoken with feel that those conducting these “delayed offers” are opening themselves up to a potential law suit by the purchaser or by the seller.

JJ,

All I was saying is that Tony Joe’s statement that his sales “None were foreign purchases” is incorrect and misleading. Anyone who is not a Canadian citizen or Canadian permanent resident is a foreigner, regardless why he/she is here.

Also, 50% from out of town is significant.

I think we can all agree with you that a Canadian resident is not the same as a Canadian citizen. I would also think that the foreign student program is a significant source of speculation in housing and provides a steady flow of large money transfers into the province.

If you want to tackle the speculation housing market and large transfers of money that stay in the province long after the students return home then you have to look at BC’s foreign student program too.

There is little doubt in my mind that the present government has capitalized on the foreign student program as being a significant source of revenue for the province. But is that what education has now become? Are our universities and colleges providing education or have they know become a conduit for cash to move from one country to another?

Are we losing control over our province as our politicians have to always ponder the reaction of the Chinese government. The teachers strike was ended immediately as soon as Beijing snapped the rolled up newspaper across the noses of our politicians saying that their government would recall their students.

Does BC now stand for Beijing China?

Actually, the term “Canadian resident” does not necessarily mean Canadian citizen or PR. Per CRA definition, people with visiting/working/study visa/permit and stay in Canada for over 183 days are Canadian residents per tax purpose. I know people who works in Tony Joe’s team, and I am sure they have sold houses to these type of Canadian residents. If the buyers are here on visiting visa or study/work permit, they are really foreign buyers.

When a Paris think tank believes you might crash, you know you’re in trouble. Too bad it’s too late.

Canada Should Tighten Rules to Mitigate Housing Risks, OECD Says

“Canada should consider further housing-market restrictions to avoid a crash, the Organisation for Economic Cooperation and Development said, adding another voice to the recent chorus of those warning rapid price gains may be unsustainable.

The country has the highest ratio of residential investment to gross domestic product among the 34 OECD nations, and household debt equal to 168 percent of disposable income is also near the top of the group, the Paris-based group said in its annual review of the Canada’s economy published Monday.”

http://www.bloomberg.com/news/articles/2016-06-13/canada-should-tighten-rules-to-mitigate-housing-risks-oecd-says

StepbyStep, that’s the tough part with this whole situation – we want to uphold the law, but people are intentionally flouting the intention of our laws, and taking advantage of loopholes (eg., Quebec’s investor program – as TripleArated said, causes thousands of “business immigrants” to move to BC & Ontario, then they don’t actually provide the jobs or tax benefits promised)

So how do we get Quebec to stop this investor program, which brings them the federal transfer payments? (The Visual Capitalist showed since 1986 the federal investor program brought in 45,000 people & the Quebec program 65,000, which is now allowing 1300 per year)

Maybe we should restrict “out of towner” ownership of property like PEI does – the only province in Canada (so far) that has rules …

http://business.financialpost.com/personal-finance/mortgages-real-estate/prince-edward-island-the-one-place-in-canada-where-foreign-property-buyers-must-check-in

“P.E.I. has long worried about the impact of absentee landowners. But unlike the rest of the country, which is so consumed with the issue of foreign ownership that even Canada’s top housing agency has gotten involved, P.E.I. identified those people and enacted laws to prevent them from taking over ages ago.”

“If you want a parcel of land over those five-acre or 165-foot shoreline limits, you have to make an application to the Island Regulator and Appeals Commission, which makes a recommendation to the provincial cabinet, which ultimately rules on exceptions.”

For Victoria, it’s nice that VREB has tried to track people’s local or out-of-town residency – but we’ve been burned so many times by lack of oversight from BC real estate boards (eg., New Coast Realty, shadow flipping, recent threats to at least one Vancouver homeowner, etc) that it’s hard to trust it. People have only had to report their status voluntarily, and they can claim they’re local if they’re a “resident” of Victoria or Vancouver, even if they don’t live here full time.

My friend just told me her realtor sold a house in GH for 369k over ask. It had 10 all cash unconditional offers, and the winning bidder was not asian. I asked if it was a local buyer and she said she forgot to ask. And he also told her another realtor sold a house for 420k over. I have no way to verify this or if its exaggeration, I’m just spreading gossip to an audience I know will find it interesting. One other thing, he also said he sold a apartment building to someone local and then someone from Van wanted to buy it and bought it off that local guy and made $300k.

From personal experience and reading the Personal Finance forum on rfd, its not a credit score thing. (Both mine and my husband are 800+). Some banks are more aggressive with their loc rates. http://forums.redflagdeals.com/please-share-your-unsecured-line-credit-interest-rates-lenders-1834473/

Perhaps because you don’t use it, that is why your rate is so low, as they are trying to entice you? Last time I asked about my unsecured loc, over a year ago, the banker said it was because I didn’t have any investments with them. I have a mortgage and BMO world elite mastercard and chequing account with them, but they don’t like that my RESP and RRSP are with other financial institutions. At the time I still had a balance on the LOC so I had no leverage. My mortgage is up in less than a year so I will definitely be considering both the loc and the mortgage rate when I choose whether to stay or go.

84 condominiums have sold in the core so far this month. About 68% of them were purchased by persons indicating their residence as Victoria. The median price is $350,350

In comparison 103 stand alone houses have been purchased with about 68% indicating Victoria as their residence. The median price is $750,000

And how is this different from one year ago?

In that same time period 74 condos had sold with 66% indicating Victoria as their home town. The median price was $297,500

And 117 houses had sold and 83% indicated Victoria as their residence. The median price paid was $639,000

Note: This is a small sample and is subject to sample variability. And that means don’t think of the numbers as being carved in stone. Pay more attention to the direction and strength of the increase or decrease.

@triplearated You said:

“There should also be a mandate that requires 5 year live in, which since they are registered would be fairly easy to implement.”

I would never support a restriction on movement in Canada for anyone who is legally here. That, IMO, would be a human rights issue.

Vicbot has a good point.

Residents would likely mean recent additions through the foreign investor program. Currently we allow 45,000 annually most of which comes through Quebec’s back door which is 4x what US allows.

This is a function of our country too large to control regional issues. The BOC is in the same light on this one. Where one province that year in year old receives have-not payments, but allows foreign investors to ‘leave’ the province is astounding.

In my opinion, the overall number should be reduced by half (minimum), and should be allocated to all have not provinces equally. There should also be a mandate that requires 5 year live in, which since they are registered would be fairly easy to implement.

This ‘program’ has been abused, has never served its true purpose, and has no net benefit to Canadian citizens.

I’m curious to know if there are any updated numbers for percentage of buyers from Vancouver/other provinces/other countries etc. ?

I use my LOC as my chequing account and run a negative balance. Zero transaction fees and free cheques with the added advantage of having a full service brick and mortar bank.

Also interesting that Tony said “residents” not “citizens” – which may be consistent with the postcard.

Guess Tony’s marketing effort to mainland China isn’t going as planned. I still find his efforts to sell us out as something we should be thrilled with is a disgrace. The majority I bet don’t want to be another Vancouver.

Forgot to include the headlines in Tony’s postcards:

“Investors & Foreign Buyers Want Your Property!”

“Victoria’s Innovators Marketing to Mainland China”

Sorry, I was wrong. It’s 4.7% on the unsecured. I got confused by the offers they send me for temporarily lower rates.

Could get a secured LOC at a lower rate but not worth the hassle given I don’t use it.

JJ, thanks for the numbers – very interesting.

If Tony’s not selling to foreign buyers for “top dollar”, then can he re-issue his postcards? (I’ve included a quote from his postcards at bottom).

Also I’m surprised that Tony is still trivializing the seriousness of these housing issues with the “race card” – it’s offensive to people seeking intelligent discussion about the effect foreign investors have had, who are absentee owners, not paying taxes, and shadow flipping (and leaving whole neighbourhoods in Vancouver empty).

Is Tony disputing the facts pointed out by Bank of Canada, National Bank, Globe & Mail, South China Morning Post, The Economist, Mayor Gregor Robertson, Professor David Ley, Professor Josh Gordon, Australian/NZ banks, & many other researchers?

from Globe & Mail, a Chinese Canadian researcher: “Andy Yan, an urban planning researcher and adjunct professor at UBC, never expected to be accused of racism when he crunched the numbers on foreign ownership and house prices on Vancouver’s west side. ”

Many of my Chinese Canadian friends are also very concerned about Vancouver real estate, and are insulted when people say it’s racism. The only people denying housing affordability issues are the ones receiving big $ from the real estate industry (Christy Clark, Mike de Jong, & Tsur Somerville, who’s studies are funded & students employed by the industry)

From G&M: “Foreign ownership contributing factor in rising housing prices: BoC”

http://www.theglobeandmail.com/news/british-columbia/foreign-ownership-contributing-factor-in-rising-housing-prices-boc/article30387587/

So can Tony change his postcards now? They say: “With direct connections to the Lower Mainland, across Canada and in China, our Buyers see excellent value in your neighbourhood. These buyers have flexible timelines and are able to pay top dollar for your home.”

“70% were reductions and 30% were increases to the price.”

I don’t really get the increases in price. Does an owner list a house at a particular price and then, when interest in the property seems high, raise the price expecting to get more? That strikes me as weird in a market where people are already paying far over asking for the most desirable properties anyway. 2021 Carnarvon was recently pulled off the market after only a couple of days and then relisted at $80,000 higher. In these cases do the owners think that their real estate agents have screwed up on the asking price and demand that the price be increased?

Thanks Just Jack. Good summary

Check that you’re not mixing up a secured line of credit from you’re home equity plan with an unsecured line of credit from the bank.

If you own a house, it wouldn’t make sense to have an unsecured line of credit as it’s more expensive.

I think our unsecured LOC with TD is in 3% range as well. Never use it, it’s just an emergency fund replacement.

Here are some numbers for the month so far.

142 new home listings versus 116 sales in the core. That’s 1.22 new listings for every house that sold.

Generally a new listings to sales ratio between 1.5:1 and 2.5:1 is a balanced market between buyers and sellers with stable home prices. A ratio of less than 1.5:1 indicates a market that favors sellers. And if the ratio falls below 1:1 then you have irrational exuberance with prospective purchasers making foolish over bids on properties.

A ratio of 1.2:1 indicates we are still in a market that favors sellers. But the ratio has improved in the direction of being balanced when the ratio has dipped under 1:1

We have also had considerable price changes for houses in the core. 70% were reductions and 30% were increases to the price.

Another 13 listings were cancelled. To me, this is interesting that people would cancel in such a hot market. But after speaking with Tony Joe, the former president of the real estate board, he believes this is to do with the high expectations of vendors. As the owners tend to believe that their home is better than the one that just sold. The vendor doesn’t get the high price they feel they deserve and they cancel the listing.

And for those that think the exceptional over asking bids are of significance. They have also been declining.

They are down to 34% for more than 5% over asking

16% for more than 10% over asking

8% for more than 15%

3% for more than 20%

And the median price for a house in the core is unchanged from the previous months at $751,000

And for those that are afraid of the “Yellow Peril”. Speaking with Tony Joe, the former president of the real estate board and a Chinese Canadian, about half of his sales this year went to buyers that were not from Victoria. And those that were not from Victoria about half of them were Chinese. But all of these Chinese were Canadian residents. None were foreign purchases.

And that matches very well with what I have been saying for the last several months. In fact I found very little difference in what Tony and I have been saying so far this year.

Thank you for bringing this to my attention db. I will re-post with the revised interest rates.

If those that over bought, hold their homes for a long enough time then market values will rise over time so that the value of their homes will be higher than the original purchase price in real terms.

If you over pay by a $100,000 today, then you will make a $100,000 less in real dollars when it comes time to re-sell. And for 25 years you have been paying a higher mortgage payment on that extra debt. Then there are other hidden costs to do with liquidity of the asset and lost opportunities to invest that hundred thousand in other investments.

A house can be an investment or used as a hedge against inflation in the long term. However, over paying for any asset is not a good strategy to accumulate wealth.

Eventually the marketplace will shift from being an extreme sellers market back to a balanced market between buyers and sellers. And those that over paid will have lost more equity than than those that did not over pay.

Most of us will not own the same home for 25 years. And that home will be re-financed and the mortgage increased many times over the ownership of the property. For some, the home has become a debt instrument with a low interest rate. Instead of paying 19.5% on a credit card or 6.7% on an unsecured line of credit they are paying 2.5% on a mortgage.

The benefits of home ownership get quickly stripped away when you over pay and over spend.

CuriousCat

In 30 plus years, I have never had a line of credit higher than prime plus 1-1/2% (which was introduced after the 2008 crash).

It may have to do with credit ratings after-all (so I will apologize). But then I don’t carry mortgages on my properties either. So maybe that explains why I don’t see eye to eye with the doomsters here.

“…The proposed plan outlined in the federal budget released on Tuesday would allow authorities to convert eligible long-term debt of a failing lender into common shares in order to recapitalize the bank, allowing it to remain operating.”

Yes, this is share dilution and would obviously reduce dividends thus institutional investors would bail long before this. Increased scrutiny over mortgages to questionable prospective clients lead to a healthier system than now. Hardly even news.

db – it may be a slight exaggeration, but my unsecured LOC with BMO was 6.95% the last time I used it, Aug 2015. Back then, prime was 2.7% (same as today), therefore my very shitty rate is prime +4.25%. Hence, why I do not use it.

I have never had any success in getting BMO to lower it.

I always sign up for 30 year amortization and pay well above what’s required. It’s only prudent. If I needed to I could reduce my payment to the 30 year one. You know what they do say about ASSumptions.

And I just double checked – my secured line of credit is prime plus 1/2%

So I find exaggerations tend to dilute the message

My CIBC unsecured line of credit is prime plus 1%

So I question it when I hear 9% given that is only 3.7%

When people post false DATA I don’t tend to believe them

“Hawk,

Since you’re all about worst case scenario… You don’t think big banks woukd get bailed out? ”

Triple,

Do you not read the many posts on here how Justin just changed the rules for banks so their own shareholders will be the ones to bail them out because the taxpayers already did that once in 2008 ?

If you’re going to keep pumping before you’ve even picked up the keys from the bank, at least educate yourself.

If the banks are saying they are cutting back lending for mortgages, do you need another reason to think otherwise that the banks know the peak has passed and their risk level is over maxed ? Bank no lend, you no buy. How much more simple is that ?

db, I don’t understand what point you’re trying to make.

If I should write a post on the cost of unsecured lines of credit from various banks, I will let you know.

However, since the intent of the post was to show that the interest rate for a home equity line of credit is lower than an unsecured line of credit or the interest rate charge on credit card, the intent of the post does not change.

PS BMO unsecured line of credit is 6.7% Other banks may be higher or lower.

I agree with Leo.

Pay less interest, pay down up to 10%+ annually.

Hawk,

Since you’re all about worst case scenario… You don’t think big banks woukd get bailed out? Voters own houses, Government at every level will protect their market share at any cost.

Inflation run rampant? Savings will be utterly worthless, hard fixed assets prevail.

Markets have been a mess since the printing press went into overdrive after Tech meltdown, and 9/11.

Those taps are ready to open right back up if required.

Please tell me you were encouraging people to actually buy homes in 2002 and 2010, because you can’t have it both ways.

Not necessarily. A longer amortization reduces your risk because you can lower your payment if you need to. Smart thing to get a longer amort and then just pay it on a faster schedule

Does anyone have thoughts on how a correction would affect the rental market? I see Hawk mentioned a weak rental market a few years ago. Is there a strong tie-in with sales? For example, in Vancouver, a lot of rental stock has been taken off the market because it is being bought and sold, and a lot of people think that, in a downturn, with fewer sales, there would be more stock and lower rental prices. Is there enough stock currently off the market in Victoria for this to be a factor? Is there any other reason why sales are likely to impact rents in Victoria?

Just Jack…

Please elaborate… I didn’t understand anything you said here…

I do understand the fact that people are willing to pay/can pay the interest on a larger mortgage due to the fact that rates are LOW… but when is an unsecured credit line higher than prime plus 1% ? (9% seems like an exaggeration to me).

Once you present a false data point, the rest is questionable…

Total amount this year for us is $781. I wonder why our coverage differs so much, since — if I recall correctly — we have similar homes. Weird.

One wouldn’t think so, but dealing with home insurance is akin to dealing with Telus and Shaw: phone them, complain a bit, possibly threaten to change providers — then miraculously they find a way to lower the price.

Perhaps it takes even less than that. A few years ago, we called just to ask a few questions and add some coverage and by the end of the phone conversation the rep had lowered the overall cost considerably (even though we added coverage).

This seems rather defeatist, which is unexpected coming from you, Leo.

Vicbot,

Good points. Mike has a tendency to BS his charts leaving out the reality of true major losses of those down periods. People taking out 30 and 35 year mortgages just shows us this is 2007/2008 all over again and if the Canadian bond market freezes up, look out below bigtime.

No wonder RBC short levels increased 32% in the past 2 weeks and TD even higher. The fixed income market is on shaky ground and the US bond lenders will not like it, no wonder S&P just down graded RBC to negative.

For me, the Fuzzy Thinking graph represents dollar figures, but the misleading part is that it looks like a stock chart where every single homeowner’s wealth grew substantially, and it’s not really true. It misses the more complicated underbelly:

(a) large amount of money people still owe on their mortgages, HELOCs

(b) large amount of savings people lost during major recessions (and divorces)

(c) large amount spent on taxes, maintenance, upgrades

(d) inflation

(e) forced sales due to job transfers out of town, during the dips

etc.

Most people just need a home to live in. Some might have extra cash for investing in rental property. But the generation that gained the most was the 50s/post-war generation, because housing was most affordable compared to income, and they got in before globalization. I don’t really see that same wealth effect happening with the next generation.

With those 70 odd price slashings and median price for the month heading down it makes sense that the greater fool pool is decreasing. That Shelbourne place should have sold for 200K over based on all the other dumps going for the same in lesser hoods the last few months. This was a prime flipper on a good part of Shelbourne for guys like Mike who think it’s the New Paradigm.

From the BOC:

“Apart from housing, the bank is highlighting concerns about liquidity in the bond market which could result in a market freeze. ”

Mike’s cereal box chart looks like 1981 and 1994 where it took over 10 years to recoop all that pain and massive losses, divorce and bankruptcies. This will be far worse as 5 year rates start moving up for years to come.

For those New Paradigm idiots who think “it’s different this time”. Welcome to Denial Island.

http://2.bp.blogspot.com/-ZWsQNhB12M4/Tf161ZP8iFI/AAAAAAAAAu4/iEFXxNao1KU/s1600/800px-Stages_of_a_bubble.png

http://i.imgur.com/l3MclIA.png

Shocking stats on Garth’s site. Mortgage lenders are going to get oh so screwed. No wonder Garth has changed his opinion last month from a slow melt to a hard landing, took him long enough to see the light.

“Here’s one you should fret about: almost 60% of all new uninsured mortgages (taken on houses selling for more than $1 million) have 30 or 35-year amortizations. It means buyers are stretching themselves to the max to get into the market. They may have borrowed, begged or earned the down payment, but the monthly’s a strain. By extending the am, they lower the payment while ensuring they’re screwed over for more interest.

Finally, our biggest bank (RBC) carries the biggest share (54%) of these uninsured mortgages – the volume of which has grown like a weed as prices rise and after CHMC cut off insurance on any purchase over seven figures.”

http://www.greaterfool.ca/

One of the largest quakes in California (in terms of damage to infrastructure, homes, and lives lost) was in 1989, affecting the San Fran Bay area. They re-built within 10 years:

http://www.sfgate.com/news/article/AFTER-THE-FALL-The-earthquake-shattered-the-Bay-2902450.php

With Victoria being in the Cascadia Subduction Zone, with multiple fault lines – going south until Oregon and a bit of northern California – the entire length might not be affected. Maybe 10 years is a good estimate for rebuilding both homes & infrastructure.

Is it 906 Pemberton Rd (open house daily until the auction day):

https://www.youtube.com/watch?v=NBW9tdQOv88

@bearkilla the article is about private insurers that havent paid

If those that over bought, hold their homes for a long enough time then market values will rise over time so that the value of their homes will be higher than the original purchase price in real terms.

If you over pay by a $100,000 today, then you will make a $100,000 less in real dollars when it comes time to re-sell. And for 25 years you have been paying a higher mortgage payment on that extra debt. Then there are other hidden costs to do with liquidity of the asset and lost opportunities to invest that hundred thousand in other investments.

A house can be an investment or used as a hedge against inflation in the long term. However, over paying for any asset is not a good strategy to accumulate wealth.

Eventually the marketplace will shift from being an extreme sellers market back to a balanced market between buyers and sellers. And those that over paid will have lost more equity than than those that did not over pay.

Most of us will not own the same home for 25 years. And that home will be re-financed and the mortgage increased many times over the ownership of the property. For some, the home has become a debt instrument with a low interest rate. Instead of paying 19% on a credit card or 9% on an unsecured line of credit they are paying 2.5% on a mortgage.

The benefits of home ownership get quickly stripped away when you over pay and over spend.

Leo, New Zealand has the equivalent of ICBC for earthquake insurance. So of course they haven’t paid.

@ JJ: “And in my opinion a lot of the buyers in the last several months are going to get burned on the re-sale of their homes.”

I’m inclined to agree if they hope to turn around and sell at a huge profit in the next few years, but I wonder how many people are really buying houses right now thinking that they’ll do that. Everyone I know who has bought a house in Victoria lately plans to stay in it for the long term. Anything can happen that might prevent that, of course, but I think that these really high prices have made people reconsider the traditional property ladder and instead try to get into something that they can stay in. (I’m talking about SFHs here, I guess. Condos are usually going to be a different story.)

Try 906 pemberton jj

Time to break out those Simpson ties and bolt the house down

Leo S and Just Jack,

Earthquake risk according to the Institute for Catastrophic Loss Reduction Map could be mistaken for Median Sales to Assessment.

It’s intriguing that so many people find (generally) 100 year old houses built upon clay appealing. That earlier post about rattling pipes and groaning houses made my hair stand up.

Excellent posts on Insurance. Very thought provoking. Can anyone shed some light on the Insurance providers with the most robust Underwriters?

Does anyone know the address of the property that is to be sold by auction in Rockland?

Just for fun I wanted to make a guesstimate of what it would sell for.

3 houses on Emily Carr sold this week. Carol wood one at 500 bucks a square foot. That street is busy.

Check this out. In Christchurch, 4 years after the earthquake, only 57% of earthquake claims have been settled. http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11402718

And that’s a teensy tiny city of not even 400,000 people. Now imagine 10 million people affected.

I revise my estimate to 20 years before you see a payout from your policy.

I figure I’ll just disappear then. Good luck getting your house rebuilt in less than a decade when the entire west coast is destroyed.

Take off and mail the keys back to the bank.

You guys understand that if you don’t buy earthquake insurance and your house is a write off you’ll be out not only replacement cost but also demolition cost. You couldn’t build a small garage for 70k today. I believe my deductible is 5% as well which would mean 50k if replacement cost us what they estimated. If my house was fubarred after an earthquake I’d gladly pay 50k vs losing everything.

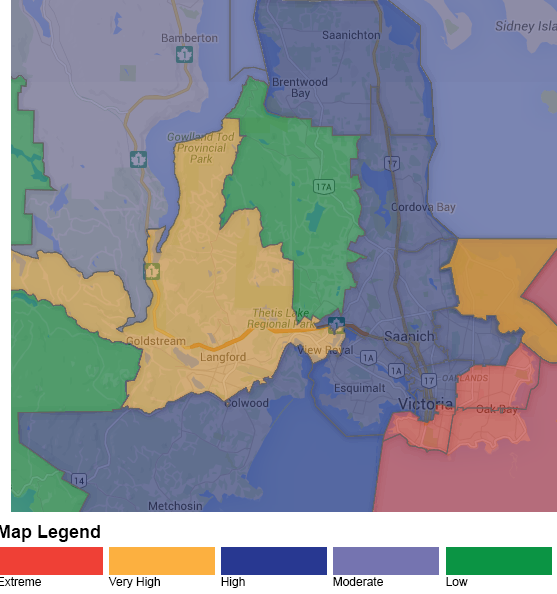

For those that are interested in what areas, relative to the property’s assessed values, are the most over sold here is a short list.

For example in Victoria the median sales to assessment ratio for the last two months was 131.5%

Sooke urban areas 110%

Langford/Colwood 113%

Esquimalt 119%

Saanich West 123%

Saanich East 131%

Victoria 131.5%

Oak Bay 134%

As you can see the price appreciation has not been uniform across all areas. And it seems that the price appreciation has been mostly centered in the demand by middle income households.

Two reasons why I don’t think this market is sustainable. And in my opinion a lot of the buyers in the last several months are going to get burned on the re-sale of their homes.

Earthquake risk according to the Institute for Catastrophic Loss Reduction

Thanks. I fixed your formatting. If you put 4 of ~ in front of your text and after it it will preserve the spaces.

Same, but they switched insurance companies this year and it seems to have gone up significantly.

Same policy was 860 last year, this year they want $990.

$742,000 total value, earthquake coverage with 5% deductible is $497.

Thinking whether to renew it this year. Might raise the deductible… I’m very skeptical it will be worth anything if the big one hits.

Averse.

I’m with TD Meloche Monnex. My premiums go up every year (thanks, climate change), but what I’m paying seems to be competitive, from what I can gather.

TD MM offers discounts to university graduates, so be sure to mention that should you contact them.

The same sort of geography/price phenomenon occurs in cities with limitless land. For example, the “core” neighbourhoods in Calgary (e.g., Rosedale, Sunnyside, Crescent Heights) all enjoy a huge price premium over the outer, newer neighbourhoods (even though Calgary’s public transportation system is excellent and efficiently moves workers into downtown).

This is why price parity won’t come to Greater Victoria if we miraculously build a state-of-the-art light rail system (which we won’t): the core neighbourhoods will still be more desirable than the far-flung ones. Would it make life better for West Shore residents? Certainly. But it wouldn’t alter the appeal of Oak Bay, Gordon Head, or Fairfield (to name a few).

Introvert, that seems like a good deal. Can you share who the underwriter is? (I’m with CNS/Island Savings)

We have earthquake insurance ($570k limit; 5% deductible; $321 premium). So far, nothing has ever persuaded me not to carry this coverage.

@curiouscat Thanks for sharing. I wonder how useful earthquake insurance really is. I don’t think people understand the deductible part. I read the policy b/c we came from out of province so it was new to us. I also felt that I would be paying out so much money due to the deductible that I might as well skip insurance.

Prices getting slashed where a couple weeks ago it was a privelege to live on Shelbourne and Bay for $200K over. Who woulda thought ? Weeding out the suckers one by one. Thanks for posting Curious Cat.

Last time I looked Mike this is a huge province and island and not everyone wants to live by your flop house. Better get out the for sale sign ASAP or you might end up being one of those price slashers. 😉

Hmmm, reviewing my insurance policy. I pay $515 and my deductible is $41,400 for the main house, $4,140 for “additional buildings”, and $33,120 for “Personal Property”. That’s crazy! I didn’t realize there was a deductible for personal property!

I would have to shell out $78,660 and apparently I’m limited to 125% of the Dwelling Building which would be $517,500.

Man I sure hope we never have a damaging earthquake. I don’t mind paying the $43/mth extra for the insurance, but almost $80k deductible is ridiculous. The year before the deductible was simply stated as 10% and there was no limit to the Guaranteed Replacement Cost.

Here are some houses in the core that have dropped their prices, sorted by Days on Market. Being on a busy street seems to be a common theme. (I apologize for the funky chart – i put spaces in the comment boxes but it seems to eliminate those….)

@davidl not everyone has a mortgage. But I agree with your point and maybe mortgage lenders do require earthquake insurance?

6.6M forecast for BC by 2038. Soon enough we’ll pass Quebec as the 2nd most populated province.

We should probably move Ottawa’s Parliament Hill to Victoria as an MP perk.

And there’s no supply problem, we’re going to start dumping sand in Cadboro Bay, like they do in Abu Dhabi, to build houses on 🙂

Mike,

Didn’t say you were making it up, I said your theory is wrong. Population in Saanich and Oak Bay have declined the last 5 years while prices rose due to lower interest rates and lax lending policies by firms like yours.

If rates go up 1 to 2 percent I think your office will be much slower as many won’t qualify and prices will drop. You’re banking on that not ever happening and population increase only.

Just like only a few years ago it was a renters market, with free rents all over the place and slow sales. People obviously left Victoria as in past market peaks. Demand is the problem, driven by emotion, not supply.

I also buy earthquake insurance. When I bought my house in 2002, the extra premium was $80, now it’s about $500. Mind you, from an insurance perspective – there have been a few significant earthquakes over the past few years.

Frankly, I’m surprised that mortgage lenders don’t require earthquake insurance (particularly on the West coast). The odds are much higher that we’ll experience a damaging earthquake in the next 50 years than experience a fire – as demonstrated by the much higher insurance premium that is charged.

Does anyone know what 2990 Rutland sold for?

@Hawk.

I’m not too concerned about making up stories on geographic constraints to put bread on the table.

Population of Greater Victoria has increased 83% since 1986. That’s not just a ‘good story’.

Fact check here: http://www.bcstats.gov.bc.ca/StatisticsBySubject/Demography/PopulationEstimates.aspx

I don’t disagree about foreign influence. But combine the beginnings of this showing up in Victoria, with our strong population growth and limited geographical area and you have today’s market as the result.

My only hope is that Victoria’s market stays based on the fundamental principle of people using their houses to live in.

@mooselessness Thanks for bringing up the earthquake insurance topic. We declined it this year for the first time but I’m still pondering this. Our physical house is worth $70k on an optimistic day (more like $50k IMO). It sits on a large property that is valuable. The earthquake insurance part was about $600 plus another nearly $400 for fire, water, etc. (earthquake has a $60k deductible). I did talk this through with the agent who said it costs a lot to get rid of the rubble and then rebuilding would be expensive because the price of labour, lumber, etc would sky rocket. That logic does make sense to me and we would tend to move away and leave the lot behind for several years (we would have to clear it for safety reasons), returning when we retire. I’m generally risk adverse with high liability insurance on cars & house, but our physical house is so basic and poorly built and I anticipate that the next purchaser will tear it down (or push it over!). I’m hoping others will share their viewpoints on this.

I buy earthquake insurance too there moose. My policy is in the same ballpark as yours there. I know people say it’s not worth it and that insurance companies would go under etc etc etc but those are people who don’t know how to read and do research into the situation.

The supply side theory seems to be all bullshit. Housing starts in Vancouver are at 25 year highs.

The “very southern tip of a big rock” claim didn’t stop the market from tanking 50% in the early 80’s or in the early 90’s. It’s an economic mania driven by cheap credit and foreign money pushing on the locals. All manias and economic drivers end eventually and some extremely nasty like the next one will.

Good story if your in the lending bizz and need sales to put bread on the table., but not the reality.

The housing problem isn’t supply, it’s unsustainable foreign demand

“Consider the claim that it’s “all about supply.” This claim suggests that we are not building enough new housing to meet the demand from a growing population. But is there any evidence of that? No. In fact, the ratio of population to housing units in Greater Vancouver has been falling for the past 20 years or so. Even the UDI said in a late 2015 report that housing starts were in the “healthy range” given population growth, and had been for several years. And housing starts have surged recently, to their highest point in over 25 years, even while net migration (international and domestic) into Vancouver has declined somewhat in recent years.”

http://www.theglobeandmail.com/report-on-business/rob-commentary/housing-costs-are-rising-but-its-not-a-supply-issue/article30380106/

@gwac

I had a bit of a slow-down last week and a half of May, but it’s picked right up again starting in the first week in June. End of April, early May was nuts.

Market seems like a bit of a short-squeeze right now. Considering our geography, (at the very southern tip of a big rock) supply could be one of the biggest issues facing our marketplace for the foreseeable future.

To clarify, I believe Foxington Place is technically in Gordon Head. Gordon Head ends at Finnerty Road, beyond which is Cadboro Bay.

What makes things a little confusing is that VREB seems to have subcategories (like Arbutus and Queenswood) for some neighbourhoods.

Mike, glad to hear that the original buyers got the house. Hope realtors here are able to maintain above-board, fair market practices because, as we’ve seen in Vancouver, the same sort of bribery & under-the-table wheeling-and-dealing just hurts the locals trying to follow the rules, to the point where they cannot afford to live there.

mooselessness, I also pay for earthquake insurance with a 60k deductible for a house rebuild. Having grown up in Victoria, I’ve experienced a huge variety of sizes, shapes, & sounds of tremors, especially 70s to 80s (frequency of the larger ones went down after that – don’t know why). Cannot forget sounds of earth/house/pipes booming/creaking/shaking so I’m willing to pay for extra.

Mike

Has this month shaping up?

Had a client tell me a really interesting story the other night. They had a conditional deal on a property in Saanich, and during the conditional period, some HAM came in and offered to bribe the selling realtor (who was double-ending the current deal), to make the current conditional offer ‘go away’.

Thankfully the listing realtor had some scruples, (and a bit more skin in the game by having double-ended the deal) and said no. As a long time home-owner in Victoria, I have to say this situation actually saddens me. It’s my sincere hope that Victoria doesn’t morph into a mini-Vancouver, but hearing this I’m not so sure we’re going to be immune.

Although there are some wealthy people here in Vic, the majority of us are working middle class. People need to remember that the value of their home is only what it is worth for them or other people to live in it.

The discussion on Saanich East neighbourhoods is very helpful and illuminating.

Triple, where did you end up buying and why?

With regards to Queenswood and Ten Mile Point, you do see some listings in the low $1,000,000+ range on large half acre lots with houses that usually need updating. They don’t seem to last long, however.

Once you get to $2,000,000 it looks like you can get some reasonable deals (even for waterfront) that don’t require bidding over the asking price. My sense is that the very high end hasn’t moved that much from previous peak prices. For instance, I see that there are two listings in Ten Mile Point for $2.5 million that advertise a reduced price; one is a 90’s, largish, house on half an acre of rocky waterfront and the other is a big house (on Tudor Ave.) on a huge, almost two acre lot.

I don’t think those prices are out of line. They certainly seem to be better value than the standard Gordon Head tract home box or an old Oak Bay, moldy, cottage.

Insurance renewal time. HHV had some differences of opinion on earthquake insurance earlier in the year.

We’re in a 2004 wood frame home on bedrock in a grey (low risk) area on the Earthquake Hazard Map.

We pay $533/year to have the insurance pay for earthquake damages past the first $41,000. (The house is worth about $800K).

I think we’re risk averse enough that we’re going to renew this rider, but I’m curious what others do.

Is this the first time a Victoria home has gone up for public auction?

http://www.timescolonist.com/business/public-auction-a-new-twist-in-greater-victoria-s-hot-real-estate-market-1.2275300

Related to detached home dropoff: it’s also happening around the same time that Scotiabank curtailed lending in Vancouver’s “overheated” housing market, and National Bank called on the gov’t to do something. Wonder if something’s happening with mortgage approvals?

The banks and BoC are now all saying it’s a demand problem, not supply, especially in the bigger cities (and as people leave those cities for cheaper houses, there are ripple effects to smaller ones) – and possibly locals are giving up until things get a little less heated?

http://www.theglobeandmail.com/report-on-business/rob-commentary/housing-costs-are-rising-but-its-not-a-supply-issue/article30380106/

“The Bank of Nova Scotia has gone to the exceptional step of curtailing its mortgage lending in Vancouver (and Toronto) because it recognizes the market surge is not mostly based on local fundamentals, such as supply constraints, but rather on large flows of volatile international capital (and the bubble mentality it has generated). The Bank of Canada now seems to be intimating a similar view.”

As per value, Brentwood comes behind Broadmead. There are obviously commute factors but it’s nothing compared to the Westshore ever growing issues. I can’t imagine how bad the traffic there will get once construction starts, and I can well appreciate the planning process. But that’s another matter.

Back to topic, I would have considered Cordova Bay over Broadmead based on numbers only. Sq ft finish, unfinish, lot; all black and white. The emotional connection to the area, personal choice. Theres a reason that someone chose a PT Cruiser or a Dodge Viper, neither of which I find appealing. Different strokes for different folks.

Triple

Brentwood or Broadmead?

Between Gordon Head road and Finnerty its mostly older blue collar homes from the day situated around Arbutus school. The homes themselves are nothing to speak of and generally assess at $500k to $600k. The exception to this area is Manhatten Place where the homes are later, executive style and hold a premium.

Cadboro Bay seems to be commanding $200k-$300 k or more over the Arbutus area. The homes are not much different. The exception is Queenswood which is another matter altogether where I believe doctors, lawyers and those with higher incomes reside. This area commands $3M+ and acreage. In Cadboro Bay there is a community feel in the village there, and you’re walking distance to the water.

There were a couple of homes on Tudor that were remarkably good value that were on the market for weeks earlier this year. The drawback is that you’re not walking anywhere, if that matters.

With respect to value Brentwood has consistently provided the best value in town this year with both size of home, size of lot, and age of property. We did not buy there, as we found a home with even higher value but we seriously considered it.

I agree with the last comment but the Arbitus area is just as close to UVic as Gordon Head so should go overlay a definite premium. The quality of houses, trees’ waterfront, proximity to Cadboro Bay village, lot sizes screams for Arbitus/Queenswood to go higher than GH. In fairness, some areas such as Broadmead which for years seemed undervalued relative to Oak Bay are catching up in this market. I see this within neighbourhoods too. Usually, the lower price junk moves quickly over asking while the higher priced but actually cheaper larger houses/lots just sit and sit.

@ Ash RE: Foxington: I totally agree that Queenswood/Arbutus should be going for a premium over GH. It seems like many people are in a frenzy over certain neighbourhoods (GH, Fairfield, OB) and that those neighbourhoods have gone up in price out of all proportion to other locations in the city. It’ll be interesting to see if there’s a leveling out to historic price differences between neighbourhoods in the event of a real estate price drop in Victoria.

I’ve always been surprised by how valued GH is but I think it’s gotten to the point where it’s totally insane. Is it really that people are desperate for proximity to the university? (A friend recently reported that his realtor told him not to bother looking at houses within a few km radius of UVic because the competition is too fierce.)