Will dropping rates revive housing?

The Bank of Canada dropped rates by 0.25 percentage points for the first time in four years last week. It didn’t take long for people to predict that this was the end of our housing slump and prices would soon be heading upwards again.

In some ways it’s a logical expectation. Dropping rates set the market on fire in 2020, why wouldn’t they do the same today? It’s certainly possible, but I’m doubtful that we will see much change in the market from last weeks cut or the one or two that are likely to follow later this year.

The obvious reason that the current cut is unlikely to change much is simply that 0.25% is a very small change. If you’re one of the unlucky ones that have been on a variable mortgage through this inflation fight, a 0.25% drop in your rate will cut payments by about 2.2%, or $15/month less per $100k of debt. Enough for a discount burger, but you’re probably not going to change your house buying plans over it.

The second reason is that variable rates have been essentially irrelevant since fall 2022, when they rose above fixed rates and everyone fell out of love with the variables. Does it matter to the market that variables are down by a quarter point when fixed rates are still more than a full percentage point lower? There’s no doubt that rate cuts do improve affordability, but I don’t expect it to really make a difference until variable rates are close to or under fixed rates, or the bond market drops from the range it’s been stuck at for the last two years.

As of the most recent available data from March of this year, only 12% of new mortgage debt was going into variable mortgages. If you’re already voluntarily paying a big premium to go that route you probably have a very good reason to do so and a small cut will not make any difference.

I’ve long been of the opinion that central banks will be very cautious when it comes to cutting rates. They were raked over the coals for acting too slowly post-pandemic. A miscalculation on how much stimulus the economy needed caused inflation to run wild for a couple years and I doubt they’ll be keen to repeat that mistake. That was reinforced by Tiff Macklem in an interview last week. When asked if the central bank’s credibility had been damaged, he admitted that “we’ve taken a bit of a hit, and we need to rebuild that trust”. In addition, they are cautious about the durability of those inflation reductions, saying they “don’t want to jeopardize the hard won progress that has been made”. I expect we’ll get another cut or two this year, but I don’t think it will be enough to really move the market until next year, and only if we avoid recession.

And that’s really the crux of the issue. Rates are being cut because the economy is slowing down, and if they are cut further it means the economy is continuing to slow. While interest rates are a crucial factor in affordability, employment is an even more important factor. It’s hard to pay a mortgage at a high rate, but it’s nearly impossible without a job. Now if BC and Victoria manage to buck the national trend and maintain a strong economy while rates drop, that would be a real tailwind for the housing market. However while Victoria historically has a lower unemployment rate than most cities, it does tend to move with the rest of the country and has been on an upward trend. Since January of last year it has risen from 3.1% to 4.7% in May. As a point of reference, that’s still lower than during our last buyer’s market when the unemployment rate averaged around 6% in Victoria between 2010 and 2013. In the long price stagnation of the 90s, unemployment rates were around 8-9%.

Long story short, my bet is that the tailwinds from a few cautious cuts will be cancelled out by the headwinds of a slowing economy. I think we’ll need to see the overnight rate drop below 4% before it starts to be felt in terms of increased market activity.

Also the weekly numbers

| June 2024 |

June

2023

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 174 | 705 | |||

| New Listings | 458 | 1297 | |||

| Active Listings | 3387 | 2342 | |||

| Sales to New Listings | 38% | 54% | |||

| Sales YoY Change | -8% | +15% | |||

| New Lists YoY Change | +18% | -6% | |||

| Inventory YoY Change | +52% | +14% | |||

| Months of Inventory | 3.3 | ||||

Sales are lagging a little to start the month, while new lists continue to be healthy. Last June’s sales were up a little from the previous year and the buyer’s market of a decade ago, so there’s a bit of room for sales on the downside. Sales per day aren’t far off from the year ago rate, but there are two fewer business days this June than last. Thus the month-end comparisons for June will look worse than what it really is.

New lists continue to be healthy though the eye popping increases from earlier in the spring appear to be behind us.

It’s still enough to keep inventory building slowly, and the market overall to be cooler than last summer even if that gap has narrowed. This is the time when bond yields started going on an upwards tear last year and slowing the market, so expect these to converge further into the summer and fall.

New post: https://househuntvictoria.ca/2024/06/17/schrodingers-investors/

Worth remembering that demographia is all about detached properties. Sorry to say but that’s an increasingly meaningless measure in any large city. </quote/

Condos are little better than TO here: https://www.nbc.ca/content/dam/bnc/taux-analyses/analyse-eco/logement/housing-affordability.pdf

Let's not forget that the condo trap is what's driving families out of Victoria. People don't want to raise kids in a crammed 800-900 SF condo. Once you account for the reduced SF of condos, and the added strata fees (most of which doesn't go to home maintenance of your own home), the supposed "affordability" of condos largely evaporates.

Worth remembering that demographia is all about detached properties. Sorry to say but that’s an increasingly meaningless measure in any large city. Urban containment boundary or not, you just can’t physically fit everyone into a detached house.

Although it will be a surprise to exactly no one, Victoria has cracked the top 10 international rankings of “impossibly unaffordable” housing, ahead of Toronto, in a new report.

Victoria is apparently too small to list on the main list and is reported as a Vancouver sub-market, but with a median multiple of 9.8 in 2023, we are officially in the top 10. Great job city of Victoria.

Not only did we surpass Toronto, but also Greater London (UK), NYC and Miami.

It is worth pointing out that the report’s authors identify one key feature as underlying the extremely affordable land values in all of these cities: “urban containment” — i.e. a focus on preventing sprawl and forcing high density zoning.

See the report here: http://www.demographia.com/dhi.pdf

I knew you wouldn’t Max. Just don’t assume that would mean you’ll pay less taxes.

I don’t have a problem with that.

Frank, I don’t think much risk of a four plex. The site is built out to the max with rock hillside otherwise. Not the norm to see blasting in Saanich to build out more on a property. Not the most usable lots.

They municipality still would Max. But now BC Assessment won’t care about what you built, since only the land would be taxed. It wouldn’t matter if you had a 2,000 square feet home or a 4,000 square feet home. The taxes would be the same.

90 percent of BC Assessment employees would be laid off.

Most improvements to my house required a municipal inspection. BC assessment shortly followed with cameras in hand taking pictures of the said improvements.

It’s not a spec or vacancy tax. If you and your neighbor have an identical lot in value, then you both pay the same taxes.

You are now free to build and improve as much as your heart desires without being penalized by having to pay more property taxes for improving your home. You can start on Vault 31 tomorrow.

Land owners that are holding properties for future development but makes no economic sense to move forward at this time, given their full intention is to build this property out at a later date when it makes economic sense to move forward with the build. Should not be charged spec tax or land vacancy tax.

A Georgist* proposal is being promoted by urbanists and pro-development advocates as a solution to the housing affordability crisis is to tax the land only and not the improvements to it.

The idea is to tax landowners annually based on the value of their land and reduce or eliminate taxes on any developments made to it, such as apartments, office buildings, retails stores, etc. The principle is: tax what you take out of the natural world, now what you make. Those on the political left like it as a progressive tax, while free-market conservative and libertarians like how efficient and pro-development it is.

It makes it more expensive for investors to buy up and sit on undeveloped or underdeveloped land in the city, just waiting for it to appreciate while actively hurting the neighborhood.

*Henry George an American and political economist that published “Progress and Poverty” in 1879

some are, some aren’t. Know of some >$500k downpayments on non luxury homes without sale of primary residence or HELOC.

That’s because last year sales really dropped off starting in June, if sales doesn’t go up year over year going forward then it would be very troublesome.

Are stagnate house sales and increasing inventory a result of families trapped in their homes?

As families that had bought homes with historically lower interest rates are unable to move up the property ladder due to post pandemic higher prices and higher interest rates?

Looks like sales have stopped going down year over year and might be starting to go up

Nothing very dramatic in the way of changes this month. It seems to be a stable market for the moment to me.

Month to date activity:

Sales: 340 (no change vs same time last year)

New lists: 863 (up 24%)

Inventory: 3416 (up 49%)

Falstaff is in a subdivision that in earlier times when it was built would have been a starter neighborhood with small detached homes on small lots. Today the style and size of the improvements makes it middle income housing. Only the year built and original 1980 condition puts the price in the starter home range.

I wouldn’t call it a dump. They sell for about the same price per square foot as a half duplex closer in to the downtown core. You get a better house but in a slightly less desirable neighborhood than a half duplex closer in to town. For Falstaff you could budget $100 per square foot for a substantial renovation and still have a house that is within a reasonable price after the renovation.

So I would say Falstaff is well priced and provides good value in terms of the improvements for the money.

I think it is wiser to go for improvements over location in this case. More home for your money.

I think the buyer did well. And they will have a home in a neighborhood that will do them well for a decade to come. I give the buyer a B+ on their purchase.

In other words, a dump. Assessed for $772K. Also it’s a strata.

I know some people have access to this:

What happened to 38 Falstaff in View Royal? hard to believe it sold for $725K

Thank you.

May have the first court approved sale coming up this Wednesday on a one-bedroom condo in Victoria. It has been a couple of years since this has happened. Will see what the bids come in at?

Readdict- Maybe your neighbor will sell and someone will tear it down and put up a 4 plex. Then you’ll have 4 times the problems. But you’ll be doing your part all in the name of increasing density and creating affordable housing.

My friend looked at suites in Vic West. I think that it is a better area in many ways than right downtown.

Max the power is still on and the landlord said in their name. He’s stuck with the water bill since they last paid and that’s in his name. Yes, I thought CERB also. The guy was a personal trainer. Covid wasn’t good for business. Who knows. I don’t know what I hope for, that he sells or I continue on a revolving door of rental turnover next door. These people were probably 4 years there but before it was frequent turnover. Had the police at my door maybe 5 years ago about the downstairs tenant in that home. Asking very specific questions about his movements (vehicle there or not) as he was a suspect in a murder inquiry. I’m one of only four resident owners in this short block of seven homes. One is owner occupied up but suite rented down so really 50/50 and as there’s up and down turnover it never seems to end. On the other side of me the home was bought two years ago by a woman from Alberta for $1.25 million for her daughter while she’s at UVic. 3 bedroom up, two bedroom separate suite down. The suite seems to changeover multiple times a year. Upstairs she has two roommates. She must break even?

A surge of new listings would be good for Victoria as increased selection would allow more renters to become home owners.

Here is an excerpt about the Toronto Market from Better Dwelling. Take it all with a grain of salt as most media is now sensationalist click bait. The media is a strong influencer of public opinion.

“A generational low for buyers might have panicked a few sellers, who showed up in full force. New listings climbed 21.1% from last year to 18,612 in May. That pushed the sales to new listings ratio (SNLR) to just 37% in May, marking the worst demand balance for May going back to… well, ever. The board’s data only goes back to 1996, and demand has never been so weak relative to inventory in that period.

The SNLR is considered a fundamental indicator for the industry, helping to determine market balance. At just 37%, this is what’s referred to as a buyers’ market, where they expect home prices to fall.

The region has also seen homes take significantly longer to sell, leading to a glut of inventory. Active listings, those remaining at the end of the month, surged 83.3% from last year to 21,760 homes for sale in May.”

If you don’t pay your hydro bill they can shut off your smart meter remotely with the stroke of a key. That’s probably why they bailed. The landlord now has to pay that bill in full in order to have the smart meter turned back on remotely with the stroke of a key.

That story of bad renters is going to get more and more commonplace. Drug houses seem to be rented to what appear to be nice, “normal “ people when in fact they are far from normal. I recently experienced a drug house two doors down from me. Same story, garbage in the yard (no concept of using a trash bin), dozens of different people and vehicles coming and going. Eventually ended with a double shooting last weekend and now the place is empty. I wonder what property they have found to infest now. It seems that half our adult population is addicted to these dangerous drugs. I don’t know why we are wasting our tax dollars on trying to help these brain dead people.

Sounds like an ineligible CERB recipient.

REAddict there is no easy solution for a landlord. Charge market rent and that comes at the cost of higher vacancy and bad debt with an increase in tenant turn over.

Don’t pay them, then see what happens. We are trapped in servitude.

The perfect slave is a slave who doesn’t think he is a slave at all.

The house next to me (rental) has been abandoned for a month. I finally saw and spoke to the owner yesterday. The police came on May 24 to do a wellness check on the renters and when they didn’t get any one at home came to speak to me. I’d just returned from a trip to Ontario two days before and hadn’t seen anyone since my return and I asked my son who had stayed at my house and he hadn’t seen a soul. Before I left (mid-May) there was suddenly a bunch of garbage thrown in the side yard. I think they left mid-month.

The owner said he’d spoken to the woman early in the first days of June because they hadn’t paid rent but were often a day or two late. The family rented the whole house. Upstairs three bedroom for couple and twin boys and downstairs suite an older daughter and her boyfriend lived in. $3,500 a month according to the owner.

She eventually said to him they wouldn’t be renting from him anymore and told a tale of woe of owing $23,000 to the government, thousands to BC Hydro and on and on. They left most of their possessions. Trampoline and kayaks and patio furniture in the yard, furniture inside the house and exercise equipment which apparently she said the owner could sell.

He is getting a dumpster because aside from what’s inside the house they left all kinds of crap all over the yard and property. It’s a mess. Very strange situation and he still says she was a nice lady. I always thought her partner was a nut!

He may sell he says after cleaning and painting but says his kids don’t want him to. He has to go through the RTB process. The woman has ghosted him since that call. Strange times!

Sounds like they got this exactly backwards, taxing things they could use more of like income and consumption while letting their valuable asset (land in beautiful locations) be owned tax free

Don’t kid yourself. Croatia has lots of taxes- income tax , sky high VAT (25%), health, social and other taxes adding up to 38% of GDP, putting them near the top (12th highest of 188 countries) in the world.

Canada is lower than that (34th place, 32% of GDP). USA lower still (57th place, 27% of GDP).

France has the “honour” of highest taxes in the world (46% of GDP).

https://en.wikipedia.org/wiki/List_of_sovereign_states_by_tax_revenue_to_GDP_ratio

List of 188 countries, from highest taxed to lowest …

note: the top 30 highest taxed countries are all in Europe (except for the socialist paradise of Cuba)

Marko has convinced me that we have too many damn taxes here.

I wonder how much Russian money is buried in Croatian condos? If they added property taxes, they would also get invaded.

You pay “Literally zero” taxes in Croatia? Nonsense, there is a VAT tax of 25% in Croatia, which is close to the highest VAT tax in the world (Hungary’s VAT is highest at 27%)

If you’re paying any utility bills, house expenses or using any local consumption or services in Croatia, 25% of that is added tax. Your “rich German and his friends” example that visit their villa in Croatia don’t pay property tax, but they pay 25% VAT on most of what they spend while there. Tourism is biggest industry in Croatia, and a major source of tax revenue, so it’s a smart idea to let the Germans buy villas so they can come, spend money and pay VAT tax.

If Canada raised the GST from 5% to 25% we could close to eliminate federal personal income taxes.

Huh. Well I’m baffled how anyone there is tolerating it. As you say makes no sense and you actually know the country.

But I think that’s a super compelling argument right there. Much more convincing if it applies to you rather than some random foreigners

Of course I think most things in BC are dumb as they aren’t supported by the numbers, imo.

Why spec tax in Croatia?

i. BC never had 36% foreign buyers (and Croatia can’t tackle this problem with foreign buyer tax due to being in EU)

ii. We have property tax in Canada so even if you leave a property vacant you are still paying annual tax even without the spec tax (no such thing in Croatia)

iii/ We have capital gains in Canada (no such thing in Croatia if you keep a property longer than 24 months)

iv/ Croatia is 3.9 million people and there are 595,280 vacant condos in the country while the real estate situation is dire. For example, rental stats came out May 15th, 2024 and YOY rents in Zagreb increased 22.38%.

BC is 5.1 million did we even have 50,000 vacant homes before the spec tax?

I was thinking the other day, I have a few properties in Croatia and I pay zero taxes in Croatia. Literally zero. Who exactly is paying for the power grid to be maintained to my places? Sewer? Water? Roads? It is coming out of taxes local workers pay which isn’t really fair.

This is a real life example, rich German comes to Croatia and buys a one million euro villa on the Dalmatian coast. Over the course of 20 years uses this villa (and all the infrastuctural in that coast town), invites friends to use this villa (aren’t spending money in hotels), pays zero property tax, zero vacancy tax, and sells it for 2 million euros after 20 years and there are no capital gains (in Croatia).

If Croatia had annual property tax I wouldn’t be arguing for spec tax as I think that would deter a lot of foreigners in itself. It would also bring some of the 53,000 vacant condos in Zagreb (unlike the coast, mostly owned by Croatians) to rental or re-sale market.

Yes, I would, but I have to be realistic. Spec tax isn’t coming to Croatia in my lifetime (just like the housing crisis won’t be solved in Canada in my lifetime) that is why I’ve invested in properties over there (also a very safe country, excellent private health care in that I can see any specialist within 24 hrs, great food, and if obviously if you’ve been there one of the top countries in the world in terms of natural beauty).

I am moreso fascinated on why presented with a similar societal problem opinions on potential solutions can vary so much. Even people that aren’t well off in Croatia have an attitude of “well, if they have the money to buy a condo and let it sit vacant it is their money to do as they wish,” and my “homes are for living” and other Canadian/western counter arguments don’t sit well with them 🙂

There are some explanations I’ve come up with such as people in Croatia aren’t familiar with investing in things like the stock market so everyone piles their savings into real estate, etc., but fascinating none the less. If a Croatian family has a business on the Dalmatian coast (hotel, renting sailboats, etc.) the #1 thing they do when they save enough is buy a condo in Zagreb (the capital) and for the most part leave it vacant or kids use it while attending university. it is like a national past-time to buy a condo in Zagreb, if you can afford it. Unfortunately the problem is it causes those that can’t afford it to leave the country.

Giving local buyers an advantage even if that advantage is largely symbolic can pretty much summarize the current provincial government’s approach to housing. It’s not surprising they gave the housing ministry to the smoothest talking politician* they have.

I’m kind of confused why you’re making these arguments though. I got the impression you thought most of what BC has been doing including vacant home tax was dumb. And wouldn’t you be hit with any kind of vacant home tax?

Don’t think of 53,000 condos as vacant. Think of them as 53,000 bank accounts

The large amounts paid for real estate make it an attractive option for laundering proceeds of crime.

There are typically three stages to most of these methods including:

1) Placement: introducing the proceeds from criminal activity into a legitimate financial system. This can happen through the purchase or sale of real estate.

2) Layering: transferring proceeds from criminal activity into another form, using multiple financial transactions (i.e. layers) to create a complex audit trail of the source or ownership of the funds. These financial transactions can include buying and selling real estate.

3) Integration: the blending of the proceeds from criminal activity back into the economy through refinancing or remortgaging property or reinvesting the money after the sale of property.

That’s not to say that all the proceeds from condos are from crime. There may be legitimate reasons why you may want to hide assets outside of your country, especially if you live in a country that has an authoritarian form of government. it’s a lot more comfortable than cramming diamonds up your butt if you have to leave your home country quickly.

Sure, but price for buyer still went from $1.7 million to $2.0 million. Seller could have lost 500k for all it is worth.

To loop back around my point is whether something sold $200,000 over asking price or 20% below original asking price is meaningless without context. I would say the sale at $2,435,000+GST for a 1,700 sq/ft non-waterfront, non-view home is exceptionally strong irrelevant of whether that is 5, 10, or 25% off original asking price. Just my two cents.

Sorry Marko, I stand corrected (although you knew this all along), 2664 Windsor sold in 2017 and it looks like it was subdivided. the rate of retun from 2020 to 2024 looks like about 4% annually (before land transfer tax, real estate fees to sell and possibly GST on the purtchase), so the sellers annual return may have been 0-2% annually.

Its debatable whether the builder will have made much money on the 2 homes behind 2664 Windsor.

I guess if i’m going to post I should be more careful and look at the site more than once a day, my apologies.

Well their home ownership rate in Croatia is already near the highest in the world, at 90%. Sounds like they’ve run out of people to sell to, so why not let people buy second homes without spec tax?

https://finance.yahoo.com/news/25-countries-highest-home-ownership-153539930.html#

Case in point:

Metro Vancouver’s Chief Administrative Officer Jerry Dobrovolny was paid a base salary of $451,949 in 2023. He also received $222,578 in what Metro calls taxable benefits, plus just over $37,000 in expenses. Metro’s top man collected a grand total of $711,668.

https://globalnews.ca/news/10569090/metro-vancouvers-top-bureaucrat-700k/

There is an insane disconnect and I think people are leaving the country when there is no hope that they will ever be able to buy a 1-bedroom condo. However, pretty much everyone disagrees with me. Below is a classic counter arguement I receive when I tie insane real estate prices and young people leaving the country together. I think it stems from high ownership rates and distrust of the government (you raise money with property tax and they’ll just find new ways to waste the revenue).

Damn, that is good! I appreciate it.

There are a ton of arguments anti-spec tax I will have to fend off tomorrow. Very odd ones I’ve never seen come up in discussion in Canada. For example, there are 53,000 vacant condos in Zagreb (data from national power provided – units using near zero hydro), but at the same time there is a huge traffic problem in Zagreb so one of the arguments is if we open those 53,000 units via spec tax the city will be even more congestion and quality of life will decrease. Like what do you even say to that 🙂

I don’t give a shit what race you are. As long as you keep the piece and be of good behaviour, pull your weight and pay your taxes.

You still haven’t answered my question; can you explain to me how a 2019 built home sold in 2017 for $1.9 million.

Maybe you don’t understand what I am trying to convey so let me help you. You can’t sell a house that doesn’t exist; therefore, you need to use some common sense as to what actually sold in 2017 for $1.9 million (aka it wasn’t the 2019 non-existent build).

Like there’s no connection between these factors and an economy based on selling RE to foreigners? Plenty of people in BC would think otherwise.

Sorry Marko, the address were mixed up . It was 2264 Windsor that recently sold for 2MM, it sold in Nov 2020 for 1.7MM, not in 2021 as you stated. It was initally sold for just over 1.9MM back in 2017. So the 7 year total return was 5% or under 1% per year.

2266 Windsor lot was bought for 971K (BC assessment value) in 2020 and then a 2768 sq foot home was build and finally sold in April 2024 for 2.075MM

2268 Windsor lot was also bought for 971K in 2020 and and 2759 sq foot home was built, it was finished and listed several times at 2.35MM and it was finally taken off the market.

Sounds like Canada.

If high RE prices was the issue, they could move 40 km outside the city where house prices are half.

That article is from Croatia, and it states the same reason that all the other articles from Croatia I’ve seen say. Namely the reason people leave is “ primarily injustice, the immorality of political elites, legal uncertainty, nepotism, and corruption.”. Too bad, it’s a beautiful country, with great people, but these problems are serious enough that people leave.

Surely the disconnect between RE prices and local incomes must be a factor in people leaving Croatia. This is from a country of about 3.9 million.

https://total-croatia-news.com/real-estate/more-croats-emigrated/

I don’t think it’s an entirely invalid argument they are making. The construction sector isn’t static. If there’s lots of work and everyone’s busy then that brings up wages and incentivizes more people to join the industry and expand the workforce.

So you can take two approaches to it. Either tax the empty condos and make more homes available more quickly for locals or you don’t and wait for the market to catch up with demand. As long as the supply side isn’t unduly constrained by other regulations that should happen. Demand from foreign vacationers is not infinite. The risk here is that the more empty and foreign owned properties there are, the more vulnerable the country is to epic housing crashes. Small changes in the willingness of foreigners to hold that property like during a global recession and suddenly the market is flooded and prices crash, decimating the construction industry and putting a ton of locals underwater as well.

As for the argument, I would make it in two ways: one is a fairness angle, is it fair that local Croatians can’t afford a house or are forced into overcrowding while thousands of rich foreigners are leaving their homes empty and not contributing much to the economy after the house is built? And secondly, a spec tax doesn’t have to be punishing or force foreigners to sell their condos or kill the construction industry. Say you charge foreigners an extra $1000 / year tax. Not enough for anyone to sell their condo most likely, but it:

How hard to crack down on empty homes also depends on how diversified the economy of Croatia is. In BC I feel we have enough of a diverse economy that we are not reliant on foreigners buying up condos and keeping them empty. But Croatia may be more dependent on the tourism economy and not want to dissuade it.

Well, that would suck to be them. The small individual builder would have to send the keys back to the bank who would be in first position on the property(s). And would more likely have to go bk. The banks feel no pain, They will just wait until it sells for fair market value.

Its only when the house is not complete without an occupancy permit that the bank will feel some pain. This is why they release the funds on progress. your final draw is at occupancy.

The majority of households in BC receive the HOG.

I think MP’s would be last people to be worried about OAS reform, given what an MP pension pays. Plus with all their directorships and what have you, they probably get it all clawed back as things are.

Not disagreeing with you Whatever. The small individual builders are already feeling the pain, I would think – particularly if they are sitting on a spec house or two with debt.

Just not sure it’s better to sell raw land, assuming it fits your budget and where you’re at in life.

Absolutely.

But also, the voting bloc of wealthy seniors is quite small compared to the vast majority of others in society who don’t benefit from, and are likely paying for handouts to the rich.

As a result, I have a hard time believing that there is broad support in this society for handouts to the wealthy.

I would argue that the main reason OAS reform has failed to make it into the political discussion year after year, is because wealthy older adults make up a large caucus of our elected officials.

Which means the people who run our government are direct beneficiaries of these policy failures and they are constantly hobnobbing with others in the same cohort who benefit from these policies.

I think we all know that moneyed interests often have ways other than voting to influence the political discussion in their favour.

Volume builders build in phases. If they are not getting the price they want…They stop building.

It’s always hard to tell because condo inventory is so fluid. Investors deciding to exit, owners upgrading to bigger places and household size fluctuations changing condo demand all influences the inventory side even without new condos coming online. And more PBR means less demand from renters for condos.

That said it’s a big difference from 2008/10 when all the new apartment pipeline was condos. May already be visible because if you look at Toronto which didn’t switch to PBR to the same extent as here, the condo market is a lot weaker there. So all things equal I think it will strengthen condo outcomes here.

Tomorrow I am going on a Croatian podcast show arguing for spec tax in Croatia (the vast majority of Croatians rich/poor young/old are against spec tax let alone regular property tax). Current situation is 100,000s of thousands of vacant condos/homes, last year 36% of buyers in Croatia were foreign and the vast majority of these foriegners leave their properties vacant as there is no property tax and there is no spec (vacancy tax).

One of the arguments people keep making on various platforms is when a foreigner buys it helps the construction industry

“Croatia needs growth and job creation. Construction is an industry and is only now in a growing phase, the last thing Croatia’s economy needs is to slow it by introducing a spec tax.”

What is a good way to word a counter argument for the above? (context is there is a labour shortage in Croatia as well, there is no unemployeed trades people [that want to work]).

Whatever your opinion on Saretsky, this guy consistently identifies some of the most insane housing policy steps imaginable.

Development fees for high density housing are skyrocketing in cities in BC and Ontario: https://www.youtube.com/watch?v=-H5DFXeSCP8.

In Toronto fees have gone up nearly 50% over 2 years! Now that’s just insane.

There just isn’t any way we see lower prices from dense housing as long as cities, and their higher level government enablers at the provincial and federal level, continue to tack on more and more front-loaded fees and taxes that are passed on to new home buyers.

These actions are how you keep the existing low density single family home supply cheaper per square foot than new density forever, and force more and more of the lowest income people in our growing population to live in tiny homes or a dozen people to a unit.

Westerly, in a softening market builders will look to reducing their exposure or improved their cash reserves to a downturn by selling off land rather than building on the lot. If they can sell for more than they bought then so much the better. The same with one-time or serial investors that bought a lot and now find that the costs to build are too high to make a profit on the end product. That’s the roll of investors in the marketplace. They buy when they perceive prices are low and sell when they perceive prices have peaked. By doing so they create a price ceiling and a price floor which brings stability to a marketplace and we are far less likely to have crashes.

Investors do seem to work in unison with each other. That’s the “magic” of real estate of how hundreds if not thousands of individual investors seem to come to a similar conclusion at the same time. For example, the condo listings in Toronto in May. That’s because they are getting similar cues from the marketplace. You spoke of a wise gentleman that gave you advice about real estate. I’ll give you another one that was given to me. Watch the number of real estate signs in your neighborhood. If they are increasing in number and are up for longer then prices are going to come down. What I like about this observation is that it is a visual cue that many people don’t consciously realize they are picking up on but psychologically it affects their decision making process.

We also pick up other cues from the media and talk around the water cooler. Or even blogs like this.

FYI, Of the four lots for sale in Oak Bay, all four were previously purchased during Covid. They possibly illustrate a change in the market place with the sellers less confident in the future than they were when they bought the lots during Covid.

If everything is switching to rental purpose built what are your thoughts on how that might impact condo prices in 5, 10, 15 years?

Wouldn’t be surprised if the fall is weaker like it was last year and the year before. But are we on the verge of a big drop? I doubt it

I deal with seismic hardware all day long. The foundation is heavily reinforced with steel grids tied to the upper top plate of the structure. A continuous hold down system from the roof to the foundation is put under tension creating a unit . Hurricane clips are then installed to every member of the truss system. Shear walls are applied to both the interior and exterior walls of the structure to prevent lateral racking.

They are built like a brick shit house.

Thanks Max, but a friend of mine is starting to look at condos and some people are telling her that she should wait until the fall or later as they believe that prices look like they are about to fall. I have no idea although I have heard that prices are about to fall generally for the last ten years.

The moon plays a vital role when it comes to both residential and commercial real estate, Especially living on an island. It controls our tides and with climate change and rising sea levels it’s something to consider when buying ocean front properties.

On the earthquake topic, I still think about this 2015 piece in the New Yorker:

The Really Big One

https://www.newyorker.com/magazine/2015/07/20/the-really-big-one

South Island could be in most quake-prone part of the Pacific coast: study

https://www.timescolonist.com/local-news/south-island-could-be-in-most-quake-prone-part-of-the-pacific-coast-study-9087971

Hm, it’s not on Google Maps.

I have a cousin that frets about this stuff while he is 30 pounds overweight, smokes and eats at McDonalds twice a week

At the end of the day we are all going to die sooner or later last thing I am going to worry about is a nuclear attack or being swept away by a Tsunami in my waterfront mansion.

Or I don’t know I could eat a common sense diet and keep my cholesterol in check, exercise every day, etc.

Switch the two addresses, but you’ll still be confused – see my comment before this one.

Can you please explain to me how a 2019 built home sold back in 2017 for $1.9? Thanks in advance.

Whatever, “What I would expect to see happen is those builders that bought land during covid will be trying to sell the land. They paid too much for the land and with higher building costs it’s unlikely that they will be able to build and make a profit at today’s home prices.

Better to sell the land and recoup what you can than continue to hold it.”

Years ago I was giving an old East Indian man a ride home from a sawmill we both worked at (I thought he was old at the time, probably 50…) Nice guy that had some valuable words of wisdom that I haven’t forgotten. I was 20, nowhere near thinking about real estate but somehow got on the topic. In that 10-15 minute drive we got talking RE. Firstly he said, ‘you don’t make money owning one house. You have to live somewhere today and tomorrow.” Secondly (if I’m crediting the right person), he said “the best time to buy real estate is when interest rates are high and RE value is low.” And thirdly, perhaps the most important advice he provided regarding buying real estate was … well, I’ll save that for another time.

We have held land throughout Covid. Although we didn’t over pay at the time we bought (or at least its gone up since), I look at our investments year-by-year. The decision to hold land is not different than the decision to buy today. Land is not selling and if we sell today we will probably get (perhaps) 20% less than if we had sold a couple years ago (Marko or Leo may have a better estimate.)

I totally agree that builders that bought / built in the last couple years will be trying to recoup losses – or at least get what they can out of the project. But (not that you did), be careful not to mix developers in there who are well heeled. Land is a tough sell atm. As land drops in value while interest rates go up, there are developers around that will quite happily pay less for your land. I read a recent raw land appraisal that concluded, “the highest and best use is to hold the property in the interim while the market stabilizes”. This is what builders / developers that are not over-leveraged are likely to do.

Wandering back to housing (and away from the moon), does anyone have a feel as to what is happening with the condo market? In particular with condos in the downtown core. Thanks for an insights.

BC Assessment says last sale for 2266 Windsor was Mar 26, 2021 at $971,250. However that’s apparently with the old structure since they say the house was built in 2022.

I find the conversation hard to follow, there’s a bit too much “house next to”, perhaps there’s some confusion there.

Just got one last year, a Co-op! much better than the Fields they used to have. You take care now, ya hear.

Marco tell the truth now the home next to 2264 Windsor Rd, 2266 Windsor Rd sold in Nov 2020 for 1.7 not 2021 which was a very different market. It also sold originally for just over 1.9MM back in 2017, so about 100K gain in 7 years.

The moon is also hollow. If an asteroid impact from the asteroid belt is big enough, the moon will ring like a bell. The entrance is on the dark side of the moon.

https://podcasts.apple.com/in/podcast/moon-conspiracies-hollow-moon-secret-bases-artificial/id1332383970?i=1000465245244

Are you speaking of the hollow earth theory in Antarctica?

https://storied.illinois.edu/land-of-wondrous-cold/#!

Admiral Richard E. Byrd.

https://search.library.wisc.edu/catalog/999934745502121

☮

By 2060 we will have cities under the ocean where there is lots of room to expand.

In 2060 everyone will be riding ev skate boards with an umbrella.

I think you’re missing the joke about the Tsunami thing…. You can’t really fret about things that are not in your control and can’t do much about…. Tsunamis, nuclear war, homelessness, drug addicts over dosing and climate change. Well, if we’re off the first strike list, I guess we will just need to be happy the flash, shine and fallout from Whitby Island and Bremerton.

Lmao, have you been to the navy base? Our ships are useless in a real war.

It’s not happening in Victoria, but Toronto had its highest number of condos listed last Month. 8,000 condos listed -that’s a record.

During the pandemic people bought homes and then financed and rented their condos, now with the rising maintenance costs of condo ownership many are choosing to list their investment condo.

Economist call this the donut effect as the inner downtown core has a higher vacancy rate and higher months of inventory than properties outside of the downtown area.

One problem with condos is that there isn’t much in the way of variety to distinguish one condo from the next one. One is simply buying square footage. Unless you have a view condo, the only thing you have to compete on – is price.

That might mean that those that bought during covid might not only be loosing on the rent, but may lose their covid market gains too. For the typical downtown condo that could be a loss of between $75,000 to $100,000. A drop of $100,000 would be $600 less a month in expenses for the next buyer which might make the condo break even on it’s rent.

So what do you think? Are we going to have a wave of condo listings coming to Victoria?

True – Vic west seems to be on a good trajectory and it’s come a long way since my friends lived a couple houses over from the Dayglo Abortions

Maybe at the height of the cold war when the USSR had ten times the warheads deployed as now. If Russia has 1700 actively deployed warheads it’s hard to imagine that there aren’t at least 1700 locations in NATO of greater military, strategic, industrial etc. importance than our little backwater-by-the-sea and puny navy.

Just a guess but I am going to surmise that you are not actually privy to the Russian’s strategic launch targets and scenarios.

A fleet headquarters and a centre government. It’s not wasting one, it’s several and automatic if they fire off. Look on the bright side, it solves the homeless, addiction problems, housing shortages and fixes climate change.

I live in Vic West and it just gets better and better with each completed development, imo. Plus the COV spent millions re-doing the park/approach around the bridge on the Vic West side. Once Dockside + Roundhouse are finished in 30 to 50 years it is going to be pretty awesome, I’ll be dead by then or in a nursing home but it will be nice.

Just look at the public amentiy/stairs/insane kids playpark inbetween the two new bosa towers when your are in Vic West next time.

At the end of the day even with the 15-20% “off” 1179 Monterey sold for $2,435,000+GST for a 1,700 sq.ft. 3 bed 2 bath house, I would say that is a pretty solid number for a small house.

Another piece of context. The 2019 build right next door to 2266 Windsor sold yesterday for $2,000,000 on the dot. It was purchased in 2021 for $1,700,000 so it went up 300k without any improvements over 3 years.

I personally prefer to look at the final sale price versus whether it sold 200k over asking or 15-20% off. Sometimes the 200k over ask is a better value than the 15-20% off.

Can’t imagine anyone wasting a warhead on Victoria

https://www.ctvnews.ca/business/mortgage-delinquency-rates-in-ontario-exceed-1b-should-we-be-concerned-1.6927100

Looks like Ontario is moving ahead of the curve nationally.

And the Russian subs are just a couple hundred miles off shore. Gone in 60 seconds.

Don’t worry, Victoria is a first strike target in a nuclear war if you want to play value against probability games.

Surely construction workers are paid more than minimum wage anyway. I thought they were in short supply.

Many oak bay houses locate in the tsunami zone, who would pay millions to buy a home to be washed away with high probability?

The builders got caught with astronomical increase in the price of materials during covid. Since then some materials have come down but the minimum wage has also gone up.

That has put some new construction on hold as home prices have to increase to cover these higher costs or the builder goes broke.

I doubt if we are going to see much in the way of new construction until condo and house prices go up by 20 percent.

What I would expect to see happen is those builders that bought land during covid will be trying to sell the land. They paid too much for the land and with higher building costs it’s unlikely that they will be able to build and make a profit at today’s home prices.

Better to sell the land and recoup what you can than continue to hold it.

Not for the entire country though. They stopped collecting this data for rural areas. A timeseries that goes back to the 50s and now it’s terminated because we can’t be bothered to spend a couple bucks on data collection.

Thought that I would take a look at Oak Bay as there are some bloggers that have made some posts.

The big surprise was that there are 96 homes for sale in Oak Bay and another 20 or so strata homes. That is a lot for Oak Bay. Historically there is usually only half that amount for sale at any time.

Oak Bay doesn’t have a large inventory of homes with only around 8,200 single family and stratas. That’s about 1.5% of the total properties for sale.

The median or typical property in Oak Bay sells for around $1,750,000 of which 1.3 million is lot value. That’s a 1945 built house of some 2,500 finished square feet on an 8,000 square feet lot. 75% of the value of a typical Oak Bay home is in the land value.

That land to building ratio is a tricky one. 75% usually indicates a neighborhood that is in transition with the older homes being replaced with modern contemporary designed housing.

I don’t think this is entirely accurate. I just looked on CMHC, and under construction inventory and completions still exist for CMAs.

For SFH, the time to completion depends on who is building the home. The “pros” building SFH for sale build them up to twice as fast as homes built by the owner or built for the owner by a contractor.

This is partly due to less customization required by the building homes for sale builders, and so they become more efficient “cranking them out”. Many of the examples on HHV of permit delays are just small builders overwhelmed by the paperwork to get permits. The bigger builders have people dedicated to this, and so it all happens faster because they do it right the first time.

If we want to build lots of homes, we should focus on big builders and big projects delivering hundreds of homes at a time.

Here is US data on time to complete a home depending on builder. (See pic)

For example, a big US builder like Lennar builds a 3,000 square foot house in 5 months. https://www.nitinguptadfw.com/lennar-homes-buyer-faq-incentives#:~:

Nothing to see here.

Interestingly enough, the US has the same problem, with time to completion skyrocketing around the same time.

Canada’s approach is just to not bother collecting this data anymore, they stopped collecting completions and under construction inventory data after 2022. Can’t say there’s a problem if we just don’t look!

i see new builds in south oak bay at 1179 Monterey and 2266 windsor rd finally sold after more than a year on the market at 15-20% off or 400K down from the original asking price.

As soon as Gold River gets a grocery store again!

I feel their pain. Yesterday there was another car on my Fairfield street at the same time as me. It was a close thing – I nearly panicked.

I tend to agree with Introvert that packing more people into the region doesn’t automatically make things better and has the potential to make things worse. In 2060 maybe we’ll be approximately double today’s population if trends continue.

However some things are better than 2004 (twenty years ago):

– We have an arena

– We stopped dumping raw sewage into the Strait

– Rifflandia

– microbreweries

– better bike infrastructure

– Great Trail

– swimming docks in the Gorge

– floating homeless community in the Gorge cleaned up

Not going to argue that these counterbalance all the increased busyness and increased social problems, but it’s something.

That has always made sense for estate planning and personal planning if you had the capital to do so re. the primary residence exemption. Most people can only afford so much house.

Yes, thank you. And “the 50% tax on the $750K with the increased tax inclusion of 17% is $67,750,” – this is the increased tax over and and above what it was at a 50% inclusion.

Introvert – stop going to Costco – your quality of life will jump immediately

That should be estates with capital gains over $250K, not just assets over $250K. Following sentence is correct. Otherwise informative, thanks.

Wonder if it is going to make sense to buy more principle residence then you actually need going forward for estate planning.

A couple thoughts on the capital gains discussion:

The 1 year cited on death is called “the Executor’s year”. It provides the Executor with a year to get the estate affairs in order prior to wind up (protects the heirs). There is no “one year” with respect to capital gains. When someone passes away, all of their assets are treated as though they sold them a minute before dying and are valued as at the date of death (unless it transfers to a spouse wherein the spouse takes the assets on as though they were the original purchaser – at the original purchase price.) After that all gain in value of assets and income arising from investments is taxable when sold. There is an exception regarding real estate: if a child of the heir lives in the home it may be treated as the PR of that person, conditions apply. While in practice people ignore any increase in value of a P/R over the first year (it is not usual for there to be much difference, 2020-2022, aside), it is not legislatively correct.

The increase in capital gains inclusion rate is going to affect estates, at least those with assets over $250,000 – not counting principle residences. When dad passes and has a property over and above his primary home with a gain in excess of $250k he will now pay tax on 67% on the excess. If the assets transfer to the spouse (and his estate does not pay the tax), they transfer at the original cost. When mom eventually passes she is now treated as though she sold the property just before death – and has a cost base of the original purchase, be that it may have been in 1950. It all adds on top of any other income, and has the likely effect of paying tax at a higher marginal rate. This is where families often realize they cannot hold that family cottage going forward as they cannot pay the tax themselves without selling something.

People can sometimes avoid this situation by transferring property to their adult children before death, but as mentioned the tax is due for the year of transfer – money that the retired often does not have and that the kids do not want to or cannot afford to pay.

Sorry, this is wordy: As an example of the effect of marginal tax rates and the affect of the change (is that correct?), I was once involved with an estate whereby the divorced (or widowed) dad passed away at 65. He had invested well in RRSPs, had something like $750K or a million at death. His estate paid tax as though he had sold and deregistered the entire RRSP when he died. With no spouse to pass it to, the estate (through his date of death return) paid: zero tax on the first $10,000, 15% tax on the next $20,000, $35% on the next $40,000 and 50% on the rest of the RRSP (this is a while ago, I don’t the recall the actual year, specific tax rates, income inclusion rates, and may have missed one marginal bracket). All the lower marginal rates aside, he paid close to 50% of the million in tax.

He didn’t have real property outside of his home. If he had taxable gains on real property (let’s call it $1 million) the estate would have also paid 50% tax on 50% of the gain on the first $250K of the property and 50% tax on 67% of the gain on the balance of $750K. 50% tax on the $750K with the increased tax inclusion of 17% is $67,750. He is not the 1% in today’s world.

As an aside, assume he’s held it for decades – his nominal gain is $1Million (that he pays tax on), his real inflation adjusted gain is zero or close to it.

E&OE

I bet Introvert thinks that Gold River is the bee’s knees, and is planning her move as we speak. Personally I’m more than happy with throwing out anyone who didn’t make it to Victoria by 2004.

I bet Leo thinks Sooke is “better now than it was 20 years ago and in 20 years from now it’ll be even better.”

‘Unreal traffic’: Ongoing congestion in Sooke sparks petition

https://www.timescolonist.com/local-news/unreal-traffic-ongoing-congestion-in-sooke-sparks-petition-9082738

What is happening with the condo market these days? Has the AirBnB restrictions made any impact?

Perhaps, but they are not going to affect a lot of people substantially either way. Also what’s been obscured is that the effect of pushing the estate into a higher marginal rate, which has always been around, is more significant than the change in capital gains inclusion rate. And both of these can be reduced by realizing capital gains over multiple years before death.

They simply don’t care. There is a huge disconnect between what the government presents in the media and how things actually work.

The COV MMI was huge news, right? Everyone including Barrister panicking about their streets being lined with six-plexes.

Well…..show me one project where there is a shovel in the ground under MMI? It isn’t for the lack of trying, I personally know multiple builders/developers trying to put a shovel in the ground but requirements/process by COV staff is just mind boggling insane. You really have to experience it firsthand. One of the developers updates me on the comments from city staff on his MMI project and it is lunacy and then when has a solution to address their concern it takes weeks for staff to answer while the houses that need to be torn down to start the project are sitting vacant.

The city staff also don’t grasp the massive problems and delays they create with their non-sense. This is one out of 10s of examples. This developer has two houses backing onto each other on a corner. He is trying to build 10 rental townhomes (do we need three bedroom rental options in the core, or not?) under MMI on the two lots, but he can’t get HPO warranty sorted until the two lots are amalgamated which can’t happen until city staff approve everything. The chain impact on all of things such as this, financing, BC Land Title paperwork, etc., etc. is enormous.

You almost need a Phd to be a builder/developer these days and the cashflow ability to carry things for years.

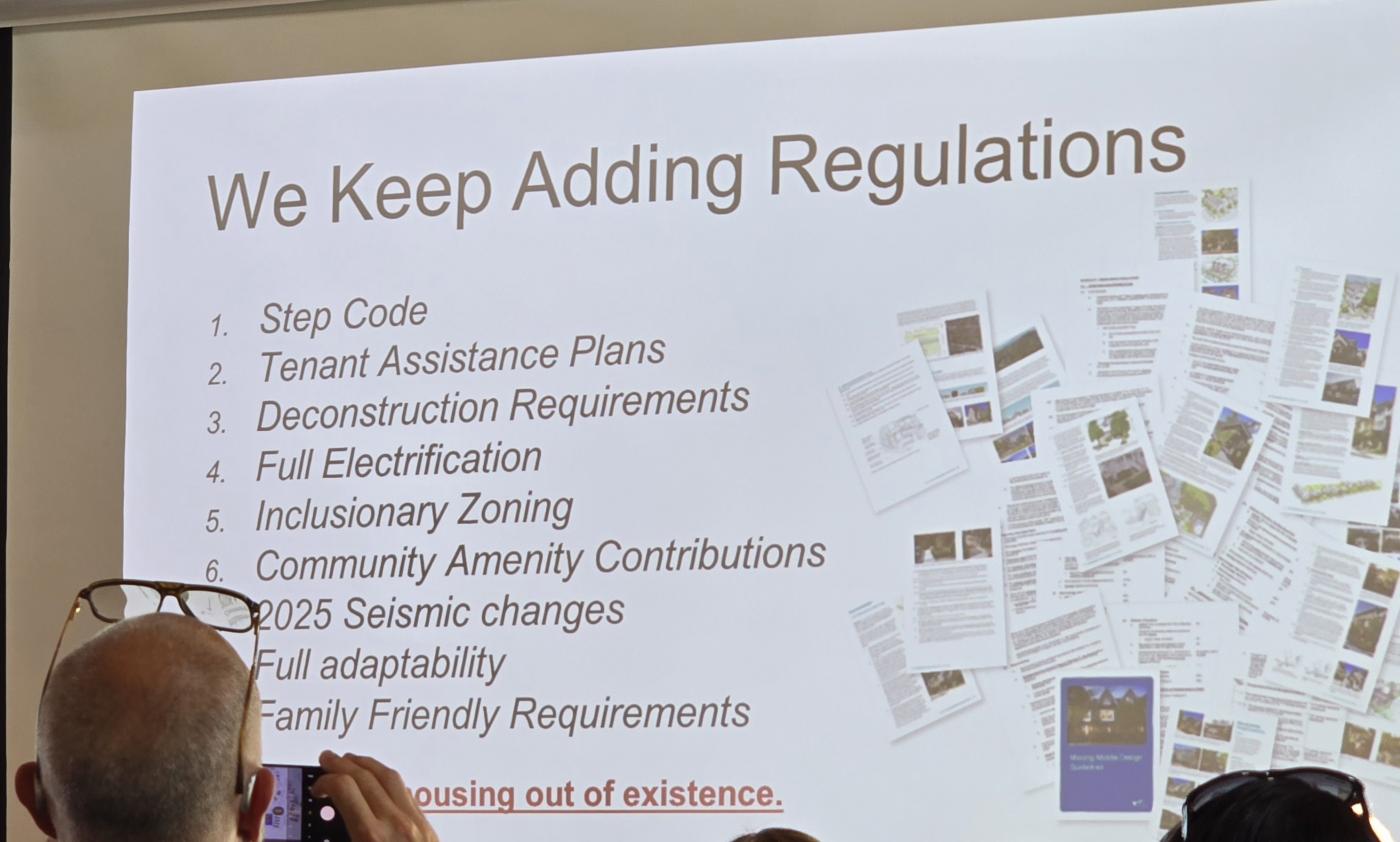

Went to an event today where missing middle was a topic of discussion and a well known developer noted the numbers simply don’t pencil especially for fourplexes on the basis of land cost. Also, noted that while the COV touts 12 units on a corner lot when you apply all the offsets/rules/regulations realistically what you can build is a fourplex, not 12 units.

He also had some other great bureaucracy tidbits like the COV charging $60,000 to “rent the boulevard” during construction on one of their projects.

I really don’t think there is any hope of ever climbing out of this housing crisis.

Last night, a deer climbed three concrete stairs to eat my petunias in a container on the porch. Never seen that in the 15 years I’ve lived in GH.

Another thing that’s way worse today than 20 years ago: deer.

Other than probate fees (which is not really technically a tax), no. The beneficiary gets the estate tax free. The capital gains changes are going to bite a lot of millennials way more than the boomers. I think the government is being very disingenuous about this in billing it as fairness for the generations.

I may have been misinformed on the capital gains part, not sure. Is the distribution of estate dollars income for the heirs that they would have to pay tax on?

I agree. I think you are correct.

But if they sell it once probate clears (and don’t hold it for more than a year) I don’t understand the capital gains advantage of selling before you die when it comes to princpial residence.

If the estate holds the property in question for more than a year capital gains kicks in.

Does the estate have to pay capital gains on a principal residence? Just curious to what the advantage of selling before you die and dipursing the funds to kids is. Probate is approximately 1.4%, etc., but didn’t know there were capital gains implications (on a principal residence) for estate.

There’s no capital gains tax on your primary residence when you die anyway. It is however subject to probate fees like the rest of the estate.

Re capital gains, yes, I realize that, should have been more clear. Was thinking of people who sell their primary residence before they die, pay no capital gains tax and distribute much of of the sale dollars to family.

You become liable for capital gains at any time you cease to be the owner of an asset. Sell it, give it away, or die.

Of course that’s exactly why Harper and the BoC were able to turn the market around. Don’t discount the fact that the Harper government did intervene in 2008 by buying mortgages from the banks to keep lending going. And we all know about the BoC dropping rates, as did all central banks. That was enough to stop the price decline and get prices rising again in Canada.

https://www.ctvnews.ca/canada-s-banks-received-114b-bailout-study-asserts-1.803031

I agree with the comments against income testing for the OAS. Given the huge (unprecedented) concentration of wealth in homes and savings vehicles for boomers (and others, and the kids they help), I’ve long thought income testing is a very out dated way of determining eligibility for programs. Similar to Totoro’s example, some of the wealthiest retired people I know get benefits over others with greater annual incomes but far less wealth or savings at their disposal. This is one of my pet peeves, primarily because I’m a big supporter of the ‘welfare state’ and collecting taxes to help those less fortunate. When the money instead goes to those more fortunate, it means less for those who really need it. And, not sure if taxing capital gains on the estates will capture things as those with wealth who are lucky enough to time things (i.e. not die suddenly) often gift away their wealth to relatives before they die. Further, to Anonymous’ point of a concerning trend of the people who pay the most taxes not being able to access social programs at all – this is also tied to income vs wealth question. If you’ve never used any social benefits, have no family inheritance coming your way, have saved hard for years and are counting on OAS as part of your retirement income, it would be more than a drag to be told that you won’t get it, or it will be clawed back. Having said all that, I agree that the reality of the future funding has to be dealt with, I just hate the income test as I think it is a relic of the past. Possible, instead to go to a wealth test? A sworn statement of wealth at the time of application? Harsh penalties for liars as a deterrent to fudging?

Uh. Harper tried and failed to push financial deregulation. It was our federal regulations which were responsible for Canada faring much better than the US and Europe in 2008.

https://thetyee.ca/Views/2008/10/08/HarperEcon/

https://www.nber.org/system/files/working_papers/w17312/w17312.pdf

The US RE market, and banking system more generally, was a house of cards based on inflated prices and denial of lending risk. Once the chain reaction started it could not be stopped.

Contrast with Canada, where prices in Vancouver and Toronto started falling rapidly in 2008, but the Harper government and the BoC together were able to turn the decline around. Canada was the only country which saw rising house prices and household debt during the ensuing recession.

That said central banks are not going to resort to major interest rate cuts to save the RE market this time around. They have to contain inflation or lose all credibility. What you may see, and indeed have already seen, is kicking the can by allowing homeowners to reschedule mortgage debt.

https://www.cheknews.ca/petitioner-seeks-effective-solutions-to-traffic-gridlock-in-sooke-1209206/?amp

So happy that pandemic offer I made out in Sooke was outbid by $127k.

Can someone let me know how the markup/markdown works for editing? Thanks

“If it’s market priced the City can’t design affordability. It can decide how many dwellings it wants to get built, though.”

I agree that the City can’t design affordability, but they can look to lower regulations and speed up approvals, rather adding additional requirements. I just can’t see how mandating climate approved materials or electric car chargers is going to mean cheaper housing. Greater Victoria is already the 3rd most expensive real estate market and the answers to this survey are going to guarantee no improvement in affordability.

If it’s market priced the City can’t design affordability. It can decide how many dwellings it wants to get built, though.

Well for SFH homeowners, there’s this one that’s “better”

Has your Victoria house gone up to 4X the price you paid 20 years ago?

Answer: YES.

2003: $328k average SFH

2023: $1,288k average SFH

That’s up close to $1 million tax free, like winning the lottery… what a country!!!

And it softens the blow of other “not better” things on your list like “longer waits at BC Ferries” 🙂

https://www.vreb.org/media/attachments/view/doc/2023_historic_summary_of_single_family_detached_sales_by_year/pdf/2023_historic_summary_of_single_family_detached_sales_by_year.pdf

The City of Victoria has a new survey for the OCP. https://engage.victoria.ca/ocp/surveys/ocp-survey-draft-211 It seems extremely biased and there is no place for entering meaningful comments. You get to rate how important various City-Selected factors (climate friendly building materials, electric car chargers, trees, diversity etc), but no option to choose those factors that young and hopeful families want (more affordable SFH or at least cheaper townhouses) As mentioned previously, there is a big upcoming challenge with the current demographics and if we don’t actually provide those things that women that have 2+ children want, then they might move to more family friendly places like Alberta or choose to have just 1 or 0 kids if all they can afford is a condo.

That’s a problem for a lot of income tested benefits – the imputed income from an owner-occupied home is not taken into account. If you wanted to fix this, perhaps you could allow renters to deduct their rent from their income when determining benefit eligibility. On the flip side, you could stop giving homeowners grants and property tax deferral regardless of need. But good luck with that.

Canada has no estate tax per se but it has deemed capital gains upon death and any RRSP/RRIF balance becomes taxable as income. Exceptions for both if they go to a surviving spouse.

You have probably heard a lot about capital gains if you’ve been following the inclusion rate controversy for $250K+ annual gains.

For some people in Victoria life has indeed gotten a lot better in the last 20 years. Twenty or so years ago there wasn’t much choice in homes in Victoria. But with the Westshore opening up there are some absolutely drop dead gorgeous properties. Once you get home, all of those issues that Introvert stated just disappear.

https://vimeo.com/953211824

Just ten years ago, this home sold for $880,000.

OAS benefits are income tested for incomes higher than $86,912. Maybe that income threshold will drop, not sure, but a senior can continue to work and collect benefits and many do because they have to and some of them earn more than this. Those without home equity, for example, could be over this threshold while a retired couple with a paid off house of 2 million dollars have much lower income but get full OAS. Not sure how lowering the income threshold is fair.

I personally know two people who are over 65, still working full time above this threshold, and are doing so because they cannot comfortably retire due to not owning a home.

one correction of the % to the total # of units- should be 10% not 40% for new construction. For existing properties, it now requires 40% of units.. new requirement will likely kill many retrofits projects across town as min 40% units wont even make their project pencil anymore. Older buildings get hit bad as less exit for anyone wants to buy or retrofit them….

We don’t have the reserve currency status like the Americans. If we try to borrow too much, the interest rates will rise to a much higher level.

The Americans thought they had this power too, but they were powerless to stop the RE prices from falling 40-50% between 2007 and 2010.

‘ https://househuntvictoria.ca/2024/06/10/will-dropping-rates-revive-housing/#comment-116530

@Leo

MLI had huge loophole and used to be called “a la carte” for the developers: https://twitter.com/UnitalCapital/status/1724622758943064288.(this is summary of how it used to works) there are three criteria that developers could choose from…. Most developers hit Step 4(only) to get 100 points and choose not to pick affordable piece as it lowers their NOI for their project. This loophole allowed developers take advantage of the MLI program without providing affordable piece… My personal take is that the intend use of MLI funds must align with providing some” affordable” piece before someone start criticize CMHC’s ( if not already). However, there are still loopholes in the system… for example, CMHC is still using $1666 as 30% of median total household income before tax as a target for Victoria. (2019 data set). Savvy developers may choose to use smaller unit size and better unit mix ratio to maximize NOI- meeting the requirements of 40% of the total affordable units. Have to pay very close attention to see what the developers had been proposing and adjusting their unit mix ratio after this policy change to fully understand their math behind their decision making process

Introvert: I feel the same way. I support density because of how crazy it’s gotten, but I don’t feel Greater Victoria has gotten better as our population doubled over the past few decades. Your list is pretty spot on. Whenever you try to have a rational argument about it, someone brings up the coffee shop/restaurant discussion, and that’s about it in the pro column. You didn’t even mention how much thicker road traffic is, and how much harder it is to escape up island for a summer weekend.

In regards to other posts about OAS. I’m not sure how this goes down. The conservative government tried increase the age for OAS, but it was going to be delayed so it didn’t really impact the boomer generation (which the size of that generation is putting the pressure on the costs of that program). It kind of defeated the point.

I’m not sure how well it would go down, so lower it on people after they’ve retired. There could be a fair number of situations where people were counting on that income in retirement, included it in their retirement budget, then don’t get it, it causes problems (like people who carried mortgages into retirement). The ship might of sailed on that one.

There’s also the concerning trend of the people who pay the most taxes not being able to access social programs at all. Lack of health care, the suggestion to drastically lower OAS threshold, no dental care, no pharmacare etc… I think if you’re paying a lot of tax, you’re ok with a fair percentage of it going to help other people, but when it’s most or all of it, and you get nothing to show for it…. the biggest part of the tax paying base, might start questioning why are they paying these monstrous amounts of taxes.

Given that the boomer generation will aging over the next few decades, maybe you can gain revenue through taxing estates (like remove the principal residence exemption for an estate kind of thing) or overall estate tax. Might upset the heirs whose parents have a lot.

Is any one of the following better now than 20 years ago:

• Housing affordability

• Income-to-price ratio

• Homelessness

• Wait times at the ER

• People who have a family doctor

• Number of walk-in clinics

• Wait times at walk-in clinics

• Wait times at BC Ferries

• Traffic volume and congestion

• Parking

• General noise

• Privacy

• Busy-ness at the mall or any store

• Wait times to book a campsite

• Urban tree canopy

Literally all these things are objectively worse today than 20 years ago, but, sure, Victoria is better now!

It’s hard to have a rational conversation with someone who’s drunk the pro-growth, pro-density utopian Kool-Aid as much as Leo has. 15+ things off the top of my head are worse today than 20 years ago, but one indie coffee shop opens in a mixed-use building within walking distance of Leo’s house and he’s all in on the plan to cram as many people into this town as fast as possible and he’s absolutely certain that in doing so we will improve everyone’s quality of life, because everyone’s quality of life in Victoria has improved so much over the past 20 years! Victoria is just getting better and better and better!!!

I wonder what Musk has planned for the $56 billion he wants to steal from his company. Maybe he’ll get his husbandry sharpened.

And the best, and most equitable, way to do that is to make housing more affordable.

NGO’s aren’t government. As for crown corporations, there are a lot fewer of them today than decades ago.

Had a chinwag with the mortgage fellow yesterday and they are seeing an uptick in mortgage enquires, so hopefully this will translate into more demand . Not sure if there is any mortgage peeps on here seeing the same

Nice to start the day with a Shakespeare quote.

I’ve bookmarked that quote to rebut posters who claim that HHV comment section has gone to hell.

I haven’t seen many Shakespeare-caliber quotes on Leo’s twitter feed. Gotta come to HHV for that 🙂

Barrister- You and I know that will never happen. It’s a hungry beast.

Might also be time to seriously reduce the size of government. Government and various NGO and crown corps seem to have grown a lot faster the economy.

Because “it dulls the edge of husbandry.” (Shakespeare) One’s life is no longer completely one’s own, but is instead partially owned by another.

Yes, both of these are good ideas and could be done now.

Overall, the best way out of the growing deficits and debt is to grow the economy. Electing pro-business governments in BC and Canada would be a good start.

Many retired people have mortgages and are still helping their kids. The home owners grant and OAS helps keep them afloat. Mortgaging their home is cheaper than credit card debt. If the government relies on perpetual debt, why can’t we?

Same reason we have a home owner grant on our taxes that costs the Province about a billion per year.

Older wealthier people are very reliable voters

Why can’t we pile on more debt? The U.S. hit one trillion of debt in around 1980. That’s where we are now. So in 40 years why can’t we reach $30 trillion like our neighbors. Don’t be so pessimistic.

In followup to that, I should be clear that OAS absolutely will need to be cut. The OAS projections in the latest budget for the next 30 years are frightening.

OAS is currently paying the maximum payout to high income seniors: households earning up to $173k, which is close to double the median household income.

Most retired, high income people in this country don’t have a mortgage, and don’t have dependents to pay for, so why do they need a big government handout?

Next government needs to significantly reduce OAS by reducing the threshold for the clawback and better supporting the GIS (for low income seniors) instead.

Even with needed cuts to spending like these, expect to see major pressure from all future Canadian federal governments to keep population growth high for the coming decades to deal with our aging population.

Even the conservatives say they are going to match population growth to housing construction.

Unfortunately for you introvert I think we’re going to see a lot more people coming into this country for a long time.

And unfortunately for people trying to by a home: we’re likely looking at a long term supply shortage no matter how much we try build.

Not a single thing better, you say?

I guess you missed Paul Kershaw’s latest articles in the Globe and Mail on why the federal government has been pushing for sky high population growth.

The reality is that we are progressively seeing a decline in the number of workers to dependents from a high of 7-to-1 a generation ago, down to 3-to-1 in the near future. They want more warm bodies to pay taxes.

Without population growth we can expect to see big cuts to government spending—with OAS and health care being on the chopping block, among others—or much higher taxes.

Likely we need all 3 factors to come into play to right the fiscal ship.

We can’t keep piling on the debt: federal debt interest alone already costs as much as health care in the latest budget.

I had made a long post a few weeks ago talking about not expecting housing prices to rise or fall rapidly but stay the same and become devalued because of inflation linked below this paragraph. I would like to add a bit about the power of belief.

https://househuntvictoria.ca/2024/05/13/towards-a-better-measure-of-market-balance/#comment-115494

There is a scene in Game of Thrones where two characters are talking about power and one of them asks the other a riddle “Three great men sit in a room, a king, a priest and the rich man. Between them stands a common sellsword. Each great man bids the sellsword kill the other two. Who lives? Who dies?”

The answer is power resides where men believes it resides. Everything from marriage, to governments, to the floating exchange rate for currencies relies on this fact.

Canada is caught between to beliefs about housing right now. One is that housing is over valued. Housing should be 3-4 times the median income not whatever the hell it is now. The other is that housing is an investment that will grow. Most of us here hold both these beliefs even though in practice if not theory they contradict each other.

A big reason holding prices high is the belief that our population is going to continue to grow rapidly due to immigration at the rate it has post pandemic. This has changed. With the permanent residency cap still at 0.5 million per year and temporarily visas being cut those already here cannot get PRs and many who now want to come, cannot. There will be a lag until this is noticeable by average people. My rough guess is around 2-3 years.