Mid-September: Cooling Down?

The day after the U.S. Federal Reserve chose not to raise interest rates, stock markets around the world are slumping due to concerns raised about the global economy. So far, these concerns seem to have had little effect on the Victoria real estate market. However, things may be changing …

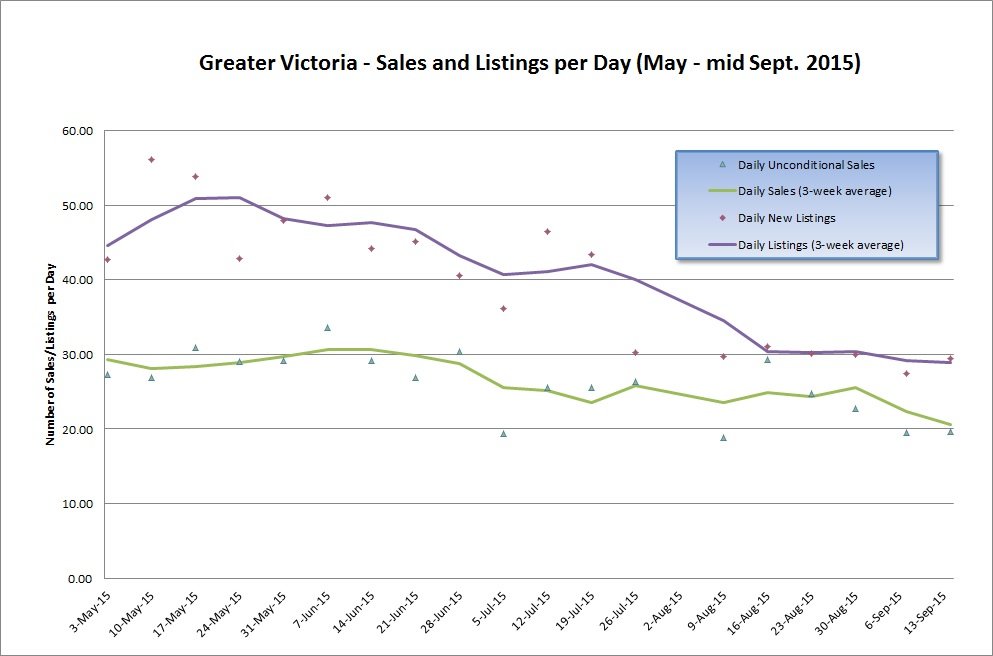

The volume of daily real estate sales (three-week average) was fairly consistent throughout July and August, but started sliding down after the third week of August. Over the past two weeks, sales have slowed down by about 20%. The volume of new listings (three-week average) has been tapering down since a high in early May, but has been fairly consistent for the past month at around 30 new listings per day. With the sales volume declining and the listings remaining constant, there are more options for potential buyers. Although far from a balanced market, we may be beginning to move away from the prolonged seller’s market that we’ve seen since early in the spring.

Yeh, didn’t think the first post had a personal attack directed at me, managed it with the second one though.

I don’t think it’s no liquidity… It’s the potential for lower liquidity. Isn’t super liquidity with little or no oversight the problem?

https://youtu.be/xRzAcDU6nqs

What no “yo mama” insults?

In humans the anus is the first part of the body to develop which means that all of us start out as assholes. You only have to worry if sunshine starts coming out of it.

JJ, you ought to consider a move to Langhole, where houses are more in your price range; where everyone thinks they’re good looking; and where one is actually most likely to see someone mowing the lawn in their birthday suit.

There should be a sign as one is driving into town: Beautiful Langford, where poor people own boats.

https://youtu.be/bJaz_S4deTM

You forgot good looking and likes to cut the lawn in the nude.

https://youtu.be/WlBiLNN1NhQ

“I’m not sure. My recollection, and I could be wrong, was that JJ decided not to purchase as he was waiting on a big inheritance? Maybe he was not serious about that. Not sure.”

Oh, yeah. I remember that. A few years ago he mentioned having a rich uncle in West Vancouver. I think he was joking about inheriting anything, though.

Current profile of JJ, as far as we know: bitter and renting in Oak Bay; kids go to Willows (or used to); doesn’t seem to have the money to buy or else wouldn’t be so bitter.

In my experience, people who are sitting on money and/or have a great financial plan aren’t super bitter.

When you’re first married sleeping double in a single bed is nice. Give it a couple of years and a king sized bed becomes too small and you start thinking of separate cities.

Totoro, you are not being singled out. What you’ve done by purchasing rental properties has been done for the last century. You are not unique, you have not found any hidden secrets of investing.

What is different this time is the interest rate, lax financing and government policies that have led to hundreds of thousands of people doing the same thing over the last decade or so. People who would never have bought investment properties or never would have thought to become landlords suddenly had the means to do so.

And that has created the situation we are in today. Massive hoarding of real estate.

Most economist will tell you that this can not continue. Economic forces will always force markets to return to equilibrium. Eventually every human being in this or any other city will sell. You can’t take the condo with you – although the commuting distance may be shorter with a penthouse. And when that happens it will not be just one property being sold by one owner but several properties by one owner.

In the past, when five owners fell on hard times and had to sell that meant 5 properties under duress being listed. Now 5 owners can mean 10, 15, 20 or more properties being listed.

I suppose your presence on this blogg illustrates your concern. You want to know when the tide is turning against real estate because you would like to maximize your investment. You don’t want to be one of the many that will be caught following the market down and have prices stagnate for a decade just when you want to retire. And I wouldn’t want you to be one of them – although there are times!

-That’s the same as a hundred thousand other investors too.

Who knows what in human psychology causes people en mass to wake up one morning and say “I don’t want to be a landlord anymore” That stuff happens in real estate as illustrated by sale volumes across most Canadian cities this year increasing by nearly the same percentage? What caused that to happen?

Most real estate blogs are set up by people in the industry as spring boards to selling. They are simply extensions of the the real estate section in the Times Colonist. Telling people what they want to hear because that’s what sells real estate. If you feel the need to have your ego stroked there are plenty of people willing to do that – for a price.

I believe that there are good deals to be made in real estate today. Unfortunately it isn’t what people are looking to buy. Most of today’s buyers are happy to buy the sizzle and forget about the steak. The deals today require you to be more than a passive investor.

https://youtu.be/yAMRXqQXemU

That article is a joke. The guy gets the kids only two weeks a month. I can imagine where the girlfriend will be in a year or two when those kids are much bigger….long gone.

BTW, it wasn’t a personal attack it was a suggestion with a hint of humour that you don’t seem to have any of.

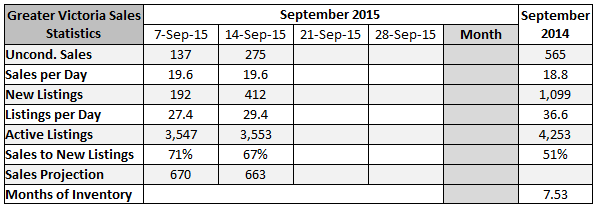

Lowest new listings for September in over 10 years.

On pace for the strongest sales year since 2007.

Thu Oct 1, 2015 7:35am:

Sep Sep

2015 2014

Net Unconditional Sales: 704 565

New Listings: 962 1,099

Active Listings: 3,478 4,253

Please Note

Left Column: stats for the entire month from this year

Right Column: stats for the entire month from last year

I just disagree. Higher land prices mean higher sell prices per square foot. Stopping higher density won’t result in lower land prices imo until you end up with a deserted and undesirable downtown core. What you will have is stalled development – like the Janion for the past 30 years perhaps and an inner core that will not be attractive to the market segment who would most like to live there. This is generally not those with families and enough money to buy a SFH or large downtown condo. The market seems to be younger single folks or those who want a second place to stay in for the winter. I think microlofts make a lot of sense in the downtown core.

The Janion is a hotel disguised as a condominium complex for individual investors to rent their space out by the day or week. It’s a gimmick not a market trend for home occupation.

But it’s a catch-22 when it comes to rising land prices. Smaller units means more units and that means the more developers are able to pay more for the land. Once they max out at that price level, the developers are back at city hall asking for smaller units again in order to make more profits.

If the city reduced the amount of units in the complex or increased the size or mix in the condominium complexes then developers, as a whole, could and would not pay higher prices for the land.

There is a difference between fact, opinion, bias and put downs.

LIving in smaller spaces generally does use fewer resources and costs less. That is a fact not an opinion. It is also an advantage that is real. There are disadvantages such as limited storage.

An opinion is that it sucks to live in a smaller space or it is better to live in a bigger space. MIght be true for you but not true for the next person. Valid to express but insisting only yours can be right is odd cause there can be more than one view on that as it falls within personal choice. It is not a right/wrong kind of thing on many issues and, imo, this is one of them.

Bias is prejudice that unfairly skews opinion. An example might be what you are, I think, alluding to which is when self-interest stops a fair analysis of the facts. I do often see unfair bias in the RE industry. For this reason I also generally approach realtor opinions with a bit of skepticism but I’m not going to judge until I’ve considered what someone has to say.

I see no evidence in anything that Marko has posted of significant bias. I do see facts such as he liked living in a smaller space and logic in some of the practical effects of living larger. You don’t like living in smaller spaces and your response to this is that Marko must be biased and wrong and saying what he is saying just because he makes his living selling real estate. I don’t even see the logical correlation there.

And then there are the personal attacks.

As for living in 800 square feet with a family. That too can be done and can be enjoyable if practically designed. We did it in Asia and it was fine due to the multi-purpose design of the space. There are families in Vancouver happily doing just this too: http://www.theglobeandmail.com/life/home-and-garden/real-estate/5-kids2-adults1000-sq-ft/article23875496/

I like to have a large garden and 1400 square feet still allows us to have lots of friends over so I prefer larger and not a condo myself. In addition, it allows us to retire early and stay put which is worth living a bit smaller.

No liquidity is a bad thing don’t you think ? If you can’t sell/buy then things must be not looking good for these corporations and our high yield lending market which companies rely on to operate.

Funny how justification for living in a closet is now “environmentally friendly”. Just because Marko shares the weekly stats then he gets a free pass on all his statements ? Having a bias when finances and incomes are involved do effect credibility wether you like it or not. I don’t see dozen’s of other agents on here backing him up. Maybe you and the dog and kids should try an 800 Sq Ft 2 bed condo with some bunk beds… just for the environment of course. 😉

It is difficult to hear someone’s views be denigrated because they are a realtor/landlord or whatever with no attention to content. I haven’t heard misstatements of fact from Marko. In fact, his information has been pretty reliable and is valuable to me as he does share inside information that I don’t have access to.

I don’t “make money off the backs of developers”, nor did I grow up in a condo, but I would agree that living in a smaller space makes sense for the environment and it can be done without a big quality of life sacrifice in my experience. Design is important.

We lived in a big house and didn’t really use one floor. Downsizing to 1400 square feet for a family and dog has worked out fine and allows us to stay where we are in retirement.

If you want a big house that is your choice. People who are at the age/stage/inclination for microlofts or any other housing can make their own choices. If you want to rent and invest and will only buy if prices drop a lot go for it. It is not like you are winning a battle here that lets you choose what is right for everyone.

That is an interesting chart and doesn’t demonstrate that increased interest rates always mean falling prices, or support the theory that increases in prices are only due to declines in rates. I’ve only seen the chart back to 1956 before.

The dramatic impact of the great depression and war on house prices between 1930-1945 shows that there has been a longer period of declining house prices than sevenish years. A family buying at peak in 1929, if they could have held on to the house during the depression, wouldn’t have seen full recovery of value until 1955 if I read the chart correctly.

However, a family buying in 1940 or after would have seen nothing but overall long-term appreciation between then and now. 75 years is a long time for a trend.

Having observed local governments and developers for many years, I agree that developers do try to exert some influence and there is an incentive to create tax revenues on the part of local government.

I can also say that elected officials make decisions by quorum based on research and advice received from staff in larger cities like Victoria, including city planners. They have rules they need to follow that mitigate the effects of lobbying.

A decision to permit microlofts, infill housing and secondary suites comes on consideration of factors such as invigorating the downtown core, increasing affordable housing and relieving low vacancy rates. There are reports and studies done before major decisions are made that set out the pros and cons and public support.

I’m quite unclear on the logic as to why microlofts would increase the price of detached housing.

It appears to me that increased density and demand influence the price per square foot of real estate, that this occurs first, and that this is what drives the market for smaller homes. And generally the buyer for a microloft is not the same as for a SFH. Nobody is forcing anyone to buy anything, renting is an alternative.

House prices are influenced by many factors but smaller size appears to be a response to affordability/availability issues and not a cause.

That sounds harsher than I mean it 😉

Let’s take Scotty as an example. You say not a tech company? Where the design and develop new products and fishing and boating TECHNOLOGIES. Where they hold multiple patents, operate an e-commerce network, and manufacture products using mass production equipment and TECHNOLOGY. But to you, you equate them to a “fishing company”…

This sounds like a good thing to me…

“The sales people and the traders are beholden to a compliance department that’s exceedingly cautious,” Mr. Marshall said. “The hesitation is to err on the side of conservatism, whereas prior to 2007 it would have been, ‘go for it.’”

So game and app dev, video and FX production, product design and manufacturing, IT servicesIn isn’t tech industry? In your world what is tech?

You didn’t grow up in a condo is not really good rational. It is like saying I grew up driving gasoline powered cars so I could never convert to a Tesla only to suffer from range anxiety.

“Low interest rates and lax lending policies of the past has led to where today’s young family must take on a lifetime of debt. While at the same time landlords boast of their financial success in amassing fortunes in rental properties.”

There are options to not taking on a lifetime of debt such as upgrading education/income, working hard and making common sense financial decision, or just simply buying less house.

I lived in a 600 Sq ft condo once, it sucked. You grew up in one, most of us I would bet didn’t. Since you make money off the backs of the developers I think your excuses are pretty transparent. When the market corrects and there’s blood on the streets then I’ll buy, until then renting and investing wins hands down.

The Janion is a great example as illustrated by Michael. Would we rather have 100+ people living at the Janion or another 100+ homes in Sooke or Happy Valley?

Cracks in the Canadian high yield bond market. Hmmm.

Goldman, Deutsche Bank halt trading in Canadian high-yield bonds

“Some of Wall Street’s biggest banks have stopped trading Canadian high-yield bonds with local investors after regulators made changes to the country’s licensing rules.”

“The moves have raised concern that bonds from the likes of Bombardier Inc., Air Canada and Quebecor Media Inc. may become more difficult for Canadian investors to trade, making it harder for companies to borrow in the United States’ $1.3-trillion (U.S.) junk-bond market. They come as global regulations implemented since the 2008 financial crisis squeeze banks’ profit margins and make them more selective about what businesses they operate in.”

http://www.theglobeandmail.com/globe-investor/wall-street-banks-abandon-canada-junk-market/article26572536/

“Telling us it’s just the norm to live in a fricking closet is joke.”

Because the norm should be a 2,600 sq/ft home with a double car garage, most preferably in Oak Bay so the kids can walk to Wiliows Elementary, and please throw in 37.5 hour work week and flex Fridays and 4 weeks vacation a year?

No one is telling you what the norm is, reality is determining the norm. As the population grows not everyone can live in the core without increasing density. If a closet doesn’t make you happy there is affordable single family housing in Sooke, or Crofton too.

I lived in a downtown 530 sq/ft condo for a year followed by a 780 sq/ft condo for two years. It was super cheap and awesome for the environment and I never felt like I was living in a closet, both condos were quite pleasant. Now I pretend to be environmentally friendly in my SFH because I take out recycling and I have the garage wired for a Tesla charger, for my future Model 3. We’ll just ignore the fact we spend 5x the hydro of the condos, we have a second car and drive three times as much from suburbia into town.

You don’t seem to grasp history. That was a period after WW2 with mass expansion,read up on it. They didn’t have HELOC’s, credit cards, maxed out record personal debt at 163%. Totally different times. Read the interest rate chart from 81, it tells the real story, not your fairy tale of million dollar averages in a few short years.

I checked the long term chart like you said and what I’m confused about is why housing prices skyrocketed the last time interest rates went from near zero (1946) to 20% (1981) ?

http://images.dailywealth.com/images/Adjusted%20Home%20Prices.png

Why have housing prices risen from the ashes of the early 80’s crash ? Consistently dropping interest rates, check the long term chart. From 20% to almost zero. Where else can rates go but up.

Jack is bang on with his social engineering theory. Developers control the game and use local government like puppets just like corporations influence the federal governments. Telling us it’s just the norm to live in a fricking closet is joke. Victoria isn’t London or Paris etc.

I do look forward to the inevitable correction because it will be much more than the last blip. The 163% record personal debt bomb is just waiting to be pricked as Harper wants to lead more sheep to the slaughter just as interest rates will be rising. Though I have a hard time believing today’s GDP numbers with oil , gas and mining supposedly leading the way, it points to inevitable higher Canadian mortgage rates.

The local tech industry could easily get bombed as well should another Nasdaq tech crash like 2000 happened. Investment would dry up over night. Great to see new industry for Vic but the bigger it gets the harder it will fall in a serious downturn in high risk lending in a high flying industry.

Where is your evidence of real estate hoarding?

I don’t see any presented and, quite frankly, I don’t believe it exists in Victoria.

People with real money invest in businesses and take advantage of capital gains exemptions spread through family members through family trusts or holding corporations with shares owned by children. Or they go market.

There is probably a slightly positive effect on the vacancy rate by those who do have one or more rental properties and very little to no impact on overall prices for SFHs. Residential prices are driven by the primary residence market ie. those wishing to buy a home to live in.

Show me the data and we can analyze the veracity of your assertions.

Guess it depends on your definition. By mine there has always been a permanent upturn trend over a period of sevenish or slightly more years. The long range rate of return is 5.4% in Canada, higher than inflation.

“Towers and towers of empty boxes that no one wants to live in. A colossal waste of wealth that puts a dagger into the heart of a city.”

OR we turn decades-empty eyesoars like the Janion into housing 50 newcomer techies that puts the vibe in our city… which btw completely sold out in a few days. Win-win-win, especially for the environment. Market gets what the market demands. When people moan over their 300′ size, I tell them to check out the 80 foot units of London, HK & Paris.

I’m not trying to sell the idea of tech’s impact on Victoria.

Likewise, when has there ever been a permanent upturn? The market goes up and down …

Except the real issue is rising land prices. I don’t assume that people want to have a suite either, or pay their rent for that matter. It is not a matter of wants but what the deal of the day is and how market forces respond.

If you are predicting a big bust in prices, people will be able to afford larger places, unless it is correlated with an increase in interest rates.

The only place I’ve been to with the empty building scenario was downtown Detroit. The local economy was pretty much destroyed prior to this happening. A very undesirable place.

I do agree condos usually lose value faster than houses in a downturn. But when has there ever been a permanent downturn in Victoria? Isn’t the answer never?

The market forces the developers are responding to is for less costly units so that they can sell more units. The city is accommodating that by allowing smaller and smaller units over the last two decades. That’s social engineering.

Don’t assume that people want to live in a 400 square foot condo by choice it is out of necessity driven by city councils without vision that are easily manipulated by the greed of developers.

We are building units that will have little value when market prices return to a balanced position. Towers and towers of empty boxes that no one wants to live in. A colossal waste of wealth that puts a dagger into the heart of a city.

What do you mean by social engineering? Are you saying that builders are acting on a devious plan to squeeze more people into smaller spaces rather than responding to market forces?

Any gloating over higher prices is most certainly a very recent phenomena on this board after seven years of the sky being about to fall.

I recall being much more concerned about finances when I didn’t have any to speak of.

As for the class thing, I’ve never found that it made much sense.

If you make $100,000 a year why are you upper middle class? If you are paying full taxes and have child support you probably are living on $50,000 a year net and if you have no other assets how is it a real measure?

Or if you are living on $40,000 a year generated from $1 000 000 in assets why are you lower middle class?

What you’re speaking about is social engineering. Creating smaller and smaller living units at the cost of higher prices for detached housing.

We should have been building houses for families and not condominiums for wannabee Donald Trumps gloating over higher and higher prices.

Another example of a bourgeoisie statement. That’s the problem when you accumulate things.

There is always the fear that someone can come along and take them away from you.

By yourself, you are not evil. But as a whole, this activity has led to massive hoarding of real estate by one sector of our economy.

Low interest rates and lax lending policies of the past has led to where today’s young family must take on a lifetime of debt. While at the same time landlords boast of their financial success in amassing fortunes in rental properties.

Now we live in a city of high housing costs and high rents. Costs that are strangling young families.

The solution is simple – and justifiable if we want a healthy functioning economy and city. We need controls on hoarding real estate.

I’m not evil…just an asshole.

I’m not sure. My recollection, and I could be wrong, was that JJ decided not to purchase as he was waiting on a big inheritance? Maybe he was not serious about that. Not sure.

Marko has worked hard.

Suites do make homes more affordable. I know, I was one of those new homeowners who didn’t have one and wished I did and didn’t have enough money to renovate right away. It is better for most new homeowners to buy something already suited if they want a suite because all the money goes into the first purchase and it is really hard to save $30,000 or more when you are first starting out as a homeowner to put a suite in.

Affordability and purchase price are simply not a straight-line equation due to the impact of financing on monthly carrying costs.

The original mandate of CMHC under the NHA in the 1940s was to assist veterans returning from war as there was a housing shortage and this was done through dramatically increasing housing stock and giving veterans preference as well as jobs in building them.

Insured loans, which I presume is the issue you are discussing (?), were introduced in 1954. I’m not sure what the difference in the mandate is that you are referring too? Is it the original one to address the wartime issues or the 1954 or 1970 amendments? They have expanded over time to create low income/social housing as well.

As far as housing prices go, they have been increasing faster than inflation for more than 50 years.

Secondary suites are a side effect of the impact of this on affordability, as well as increased density in desirable areas imo. Other side effects are smaller lots and new trends like micro lofts. Go to high value/density markets and you’ll find families living in condos rather than houses. Totally normal in Tokyo and becoming so in Vancouver in some areas.

Secondary suites may increase the price of a home, but they should: there is an increase in market value due to additional costs to construct. Secondary suites are not the cause of house prices rising faster than inflation imo. They may be a solution to extremely low vacancy and unaffordable rental housing in general.

House prices increasing faster than inflation is a trend I don’t see reversing within my lifetime in Victoria unless, perhaps, the big one hits.

Marko’s website indicates that he sold 332 properties last week. No wait, in his career, I assume! 332 x $20,000 = Ka-Ching!

I think JJ may be in the lower-middle class–which doesn’t feel so good–while a few others of us may be in the middle-middle class. And we all know that through hard work and determination, Marko is in the upper class! (I’m not being ironic, Marko: it does sound as though you have worked your ass off and are doing very well because of it.)

Sorry, Dasmo. Unless you’re renting, bitter and never able to own, you’re not in the middle class; you are a fat cow; and you may also be evil.

“Those who have rental properties are considered the fat cows in our society.” No they are the middle class… What you propose is no worse than what Harper is proposing. There is not a big tax break with owning a rental property. I know I own one. Income is added to mine, capital gains will be taxed.

Plus…. a young family gets to live in the heart of Fairfield where they certainly could not afford to buy even with your funny plans…. Shit I’m not evil, I’m subsidizing their lifestyle!

Suite’s don’t make houses less expensive. If you want to increase the level of home owners the government will have to target first time buyers at the expense of those buying as an investment.

It will be necessary to make housing not just affordable but cheaper to buy.

Let’s face facts. Those who have rental properties are considered the fat cows in our society. Not many taxpayers are going to shed a tear that specu-investors might have to pay higher interest rates from the secondary market or have to put down larger down payments. It isn’t the role of the Canadian taxpayer to make profiteers richer.

It’s time to shoo the pigs away from the CMHC trough and allow more Canadians to own a home.

https://youtu.be/EaAoXMbvVJk

Do you understand the meaning of the word “was”

That mandate is interesting. Notice that it talks about the well-being of the housing sector but not the well-being of citizens and if you provide “funding for housing at low cost” you will increase demand which ultimately reduces affordability.

By allowing 100% of rental income, they haven’t made the house more affordable (and a benefit to new buyers), they have made it possible to get into more debt and likely increase prices by increasing demand.

File this baby under Tectoria: http://www.timescolonist.com/business/silicon-valley-giant-buys-local-software-firm-mediacore-1.2072635

Gawd I love it when totoro methodically and intelligently pokes holes in nearly everything Just Jack claims to be true.

“CMHC’s original mandate was to assist Canadians in buying a home to live in. They have strayed from that ideal”

Um no, the actual mandate of the CMHC is set out in the National Housing Act and states it is to:

“promote housing affordability and choice, to facilitate access to, and competition and efficiency in the provision of, housing finance, to protect the availability of adequate funding for housing at low cost, and generally contribute to the well-being of the housing sector in the national economy.”

IMO the new rule changes fit exactly within the mandate of CMHC is. They will definitely benefit first time/new homeowners who need suite income to qualify.

JJ, just read your follow-up post on financing. I think you may misunderstand the CMHC rules that surround investment financing?

For an income property, only 50% to max 80% of the rents are counted. You need at least 20% down. Rates are generally higher.

It is only if there is a legal secondary suite in the primary residence, or a duplex, you are purchasing to live in that this would count for the 100% CMHC program. If it is an investment and you do not live in it does not apply. I think the program actually helps first time homeowners a lot. Not so much for investors.

http://www.theglobeandmail.com/globe-investor/personal-finance/mortgages/buying-a-rental-property-how-the-financing-game-has-changed/article6137071/

http://www.cmhc-schl.gc.ca/en/hoficlincl/moloin/hopr/hopr_007.cfm

This isn’t manipulating the market in a negative way. CMHC’s original mandate was to assist Canadians in buying a home to live in. They have strayed from that ideal and now the taxpayer is backing specu-investors.

The specu-investors have been milking someone else’s cow through the fence for so long that they have come to think of it as a right.

There is a secondary market of private financiers available for the specu-investor. Canadian taxpayers shouldn’t be backing their windfall profits.

Maybe it’s time to kill the fated cow?

https://youtu.be/51f9uEYGeKw

What data do you have to support the assertion that the buying up and “hoarding” of rental properties as causing a housing shortage in Victoria? It appears to me that a shortage in the core is due to geographic limitations. Most areas are built up and only increased density can create more housing. Go to Colwood/Langford and the same can’t be said.

Are you objecting to capitalism in general? If so, you have a lot of systemic change to argue for and some pretty terrible examples of how it the opposite plays out in real life.

You seem to have a very skewed idea as to how investments work. You tend to equate the ability to save and invest with greed.

For those of us without any inheritance I will say you need to work hard and save money to have anything to invest at all. Very hard to get started. There is no magical soaking up of anything. And then those of us without a pension also need to plan for that. I’m not complaining, just stating a fact.

Investments in general, be they houses or RRSPs, are not a result of greed but of hard choices and discipline imo. Instead of spending you save and invest. I’m glad we have this opportunity in our system.

You also seem to be under a severe misapprehension as to the rate of rental property ownership in Victoria. It is low because the ROI here is low because house prices are high. Basically, Victoria is a terrible place to invest for most landlords unless s/he is banking on appreciation – which hasn’t happened too much in the last seven years. .

And it is not like a bunch of homeowners with some equity in their homes are rushing off to buy second homes to rent out. They are not as far as I can see.

First of all, they’ll be cash flow negative, and second of all, to qualify for such a mortgage you’ll need a hefty down payment and will be paying a higher than residential rate with all the risks associated with rentals.

If you’ve been out looking at the house rental market in Victoria you’ll find that many of the SFHs are rented out by people who are away but plan to return. Others are generally people who kept their first house rather than selling when they moved on for various reasons. Very few own multiple SFHs because of the ROI. There are simply not an overabundance of landlords owning multiple homes with a view to profit here.

You’ll also find that there is a shortage of rental houses. Right now on CL 43 people have posted want ads for housing. The vacancy rate in Victoria is 1.2% so there is real shortage of rental homes.

If only we could convince those who have equity to borrow against their home, buy and hoard a rental home and rent it out at a loss so we can improve the vacancy rate and give families who cannot afford to buy more choices.

And what do you mean by 100% of rents being counted? I presume you are referring to the CMHC financing changes for legal secondary suites? This only applies to rental income from legal suites. The percentage of legal suites in Victoria is extremely low. Hardly anyone will be benefitting here, and no-one where suites are illegal such as OB.

http://www.canadianmortgagetrends.com/canadian_mortgage_trends/2015/07/cmhc-to-allow-100-of-suite-income.html

In order to increase affordable housing it likely makes the most sense for homeowners to be encouraged to legally suite their homes. Many studies point out that this is the most logical and cost-effective solution, including those done for the City of Victoria.

Or have you made potential house owners into renters by pricing them out of the market. You haven’t increased the supply of houses by building new homes. What you are doing is arbitrage similar to Martin Shkreli did with Daraprim.

What we have here is an unfair playing field where new home buyers are pitted against landlords that can use the rent to gain access to higher levels of financing than the prospective home owner.

A step may be to lower how much of the rent can be added to someones income to qualify for a loan for a non principle dwelling from 100 to 50 percent. Or adding GST to the purchase of non principle occupied homes. Or eliminate high ratio financing for secondary homes altogether. Why is our government making it possible for speculators and investors to compete with home owners by giving the specu-investor access to high ratio financing at preferential rates.

The government wants to increase the percentage of home owners in Canada. That can be done if the home owner is given an advantage over the specu-investor. Fewer specu-investors means more homes for owners to occupy.

So what defines tech to you?

Not that it matters… The economic impact is the same regardless of semantics….

I would suggest that every competetive business must apply “art, skill, cunning of hand”; and -λογία, -logia” or they won’t last long. Doesn’t make it tech except in your and viatec’s world.

Haven’t people like Totoro and myself helped the shortage of housing? We’ve essentially doubled the supply of homes to live… superheroes or white knights if you will, providing supply of affordable housing.

My mistake there Totoro.

What we need is some way of dissuading people from hoarding residential real estate. People like yourself, while not singularly considering what they have done, have en masse caused a shortage of housing for families to buy and that has raised prices. The low interest rate and the 100 percent allowance of rents has made it too easy for home owners to use their equity to soak up supply to the disadvantage of young couples starting out in life today. These investor/speculators are in direct competition with those wanting a home to live in and raise a family.

Our residential market should be for home owners not speculators and the government should be dissuading hoarding of shelter just as it would if people were hoarding food.

What untouched tax revenue in secondary homes? Rental income is subject to taxation at the highest marginal tax rate of the owner. Upon sale there is no capital gains tax exemption for rental property. Increasing the tax rate on capital gains would have the opposite effect: people would tend not sell rental properties, and assuming the rate would be increased on all capital gains it would have a chilling effect on business development as well.

In terms sectors within the tech industry, of the companies that responded to the survey, 37% said that Technology Software and Services was their dominant primary sector (i.e., the sector that generates the most revenue for their company). An additional 18% indicated it was also a key sector in which they operated, for a combined total of 55% of companies indicating this as a primary sector.

New Media and Internet Technology followed as the next most represented sector, with 23% claiming it as their dominant line of business, and an additional 4% also saying it is a key component of their operations (for a total of 27%).

His political aspirations aside, you can’t really argue with anything he is saying. You listen when Ichan speaks. The man moves the market with his tweets! But…HE is worth listening to not click bait headlines… Quote: “Its worse than before in 07 because there at least you had the banks as a safety net.” “I don’t you’ll have aN 08 in the sense that the banks will be threatened and the whole system will fall apart..”. Headline “IT’S WORSE THAN BEFORE IN 07″….

RE Movie production…

“art, skill, cunning of hand”; and -λογία, -logia) is the collection of techniques, skills, methods and processes used in the production of goods “…

From the horses mouth… No to being Trump’s Treasury Secretary but supporting him….http://finance.yahoo.com/news/billionaire-icahn-endorses-donald-trump-040100575.html;_ylt=AwrC1jHXgQtWFTUApQ6TmYlQ;_ylu=X3oDMTEyMmMyZ2tvBGNvbG8DYmYxBHBvcwM0BHZ0aWQDVklEMDZfMQRzZWMDc2M-

Harper’s ideas here are obvious bribery of votes yes but do you think people with secondary suites and second homes are the 1%? They are not… You are proposing cutting deep into the middle class…

So in your mind manipulating the market in a negative way is a brighter idea?

Let’s hope we don’t find out… Or maybe it would be entertaining if Trump got in…

Ironically, it would be better for the economy if Harper could stimulate more people to list their properties.

There is no profit in having a product that sells at $600,000 when you have no product to sell.

Perhaps increasing the capital gains tax on investment properties might stimulate some people thinking of listing their surplus properties. There is a lot of untouched potential tax revenue in secondary homes.

As per Ichan, he turned Trump down.

“As for being Trump’s Treasury Secretary, Icahn apparently said he would and then retracted that point. “He’s his own man,” Icahn says of Trump.”

http://finance.yahoo.com/news/read-icahn-policy-paper-sent-to-trump-and-others-151104201.html

Agreed David, as much as I wasn’t a fan of Flaherty, he made much more sense than Joe Owe who is in denial. At least he tried to rein in the bull and could see the edge of the cliff. Oliver has the horses blinders on with Harper on his back with the whip.

Ichan nailed it on his video. When the high yield debt holders try to sell and there is no one there to buy then then the credit crisis will be major on a global scale. Just a matter of when, not if.

It makes you wish Jim Flaherty were still around to talk some sense into his boss … I expect that Stephen Harper and Joe Oliver are working off the same script.

Let’s get everyone in the pool so there is no one left to buy. Real estate is Harper’s last hurrah as he rolled the dice on oil and lost. Now he let’s banks like CIBC break the law by allowing money laundering on a massive scale to prop up his political points with house prices in the big cities. If that was you or I bringing in the money from some other country we would be in jail. Sooner he is toasted from office the better.

Can’t resist – movie production is included in the methodology – OMG: Not many techies in this group:

https://en.wikipedia.org/wiki/Film_crew

And I bet they’ve counted their own revenues already.

Whether they are elected or not, you can’t trust the stats they give.

Home renovation tax credit ideas … 😉

https://youtu.be/okOVxfuSYPk

A good discussion of pros and cons from the Financial Post …

Stephen Harper wants to add another 700,000 homeowners in Canada. Is that what we really need?

Yes they did, they bought memberships…

According to the G&M article …

Maybe there is something to the current rumours about the BoC planning to drop interest rates again on October 21st. After all, getting more people into buying houses and/or renovating existing houses requires cheap and easy access to borrowed money.

They are a self proclaimed lobby group for themselves. The industry didn’t elect them.

Yes, they are a lobby group for the industry. And?

If they can’t make the 72% target, Harper does have a back up plan.

https://youtu.be/QM5AsuKTME0

How does Viatech make its money?

By pumping the tech sector for subscriptions and advertising.

From today’s Globe and Mail: Harper sets target of 700,000 new homeowners by 2020 http://www.theglobeandmail.com/news/politics/harper-seeks-to-put-home-ownership-in-reach-for-700000-more-canadians/article26582427/

Thanks – more easy cherry picking.

Here you go guys. Victoria tech sector in detail….

http://old.viatec.ca/sites/default/files/documents/victoria_technology_economic_impact_study_2014-viatec.pdf

I think it’s a good idea to be aware of changes in the stock market. I think the direction of the stock market over time does have an affect on consumer confidence and the housing market. The stock market seems to re-act in real time to current events like a stop watch while the housing market works at the pace of a calendar.

How much R&D do Shaw and Telus do in Victoria? Or are you counting cable installation…

Dasmo, it wasn’t cherry picking. It was way to easy to find those examples. It discredits the numbers provided by tectoria.

On Endorsing Trump: Trump had previously said he would want Icahn in his administration, suggesting the activist investor would take the lead in negotiating trade with China and Japan or would be a potential Treasury Secretary. After seeing Trump’s performance during the first Republican debate, Icahn tweeted that he would accept the offer.

Is Icahn now offering a full endorsement of Trump?

“I would say it’s an endorsement. I think at this moment in time, he’s the only candidate that speaks out about the country’s problems,” Icahn told Bloomberg on Tuesday. “I’m behind Trump.”

http://money.cnn.com/2015/09/29/news/carl-icahn-donald-trump/

From what I read Ichan turned down the Trump offer.

Well… that grabs your attention doesn’t and then BLAM it’s a Donald Trump ad!!! http://carlicahn.com/

I think he is promised a sweet position if DT get’s in and he is working on his political profile so he needs to now start appealing to the public.

(He does have good points though on the Junk bonds and high yield ETFs)

“art, skill, cunning of hand”; and -λογία, -logia) is the collection of techniques, skills, methods and processes used in the production of goods “…

Contech, Carmanah, First light Technologies, IVL Technologies, 3D Systems (part of Harman group) Procura, Shaw, Telus, Function Fox, Pereto Logic, StratPad, GenoLogics, etc etc…

Carl Ichan believes the world is heading into very dangerous territory and he should know, he owns billions in investments. Flip him off all you want but if you don’t understand what happened just 7 years ago to bail out the world financial system from collapse, then you will be setting yourself up for major wake up call. Free money comes with a price eventually.

As Jack posted, those who are over leveraged and think if the real estate markets tank they will just buy 4 more condos, they don’t get you won’t be lent a dime in a credit crisis, especially in a market that has just tanked.

http://www.forbes.com/sites/nathanvardi/2015/09/28/carl-icahn-warning-of-danger-ahead-in-financial-markets/

Scott’s was always known for making fishing lures, as well as firefighting equipment as well as paddleboards, sorry that’s not tech.

Ahhh the masters of cherry picking… Not every member of Viatec is a tech company… I’ll make it easier.

“art, skill, cunning of hand”; and -λογία, -logia) is the collection of techniques, skills, methods and processes used in the production of goods or services or in the accomplishment of objectives, such as scientific investigation.”

A manufacturer of planes is tech. Same with a plastic manufacturer that sells their products around the world. How about Meta Labs. Maker of the best selling tumblr skins. Or Abe Books the number one online book seller (I guess that’s why Amazon bought them) Or TC-Helicon, Daniels, Reliable systems, resonant light, Loud technologies, Starfish, The game studios, the app development firms, the IT service firms etc etc…

I always enjoy how every September the bears get extra excited that the world might end…again 😉 and that somehow the stock swoons might spill over into housing markets. Silly bears.

http://www.seasonalcharts.com/img/INDICES-FUT/DAX.GIF

The website looks like it stopped posting last fall. Just another victim of the tech industry ? 😉

I don’t see any of them being publicly traded companies. Since Mayor Helps had to go on a mission to San Francisco to help rustle up some venture capital then maybe the tech industry is peaking here ? No new money means tougher times when private companies and start ups need funding, especially with the Nasdaq showing major weakness.

Scott Plastics – Manufacturers of the Scotty line of Fishing, Firefighting and Outdoor Products

Viking Air is in the Viatec top 25 – they are an aircraft company.

Ditto what jack said after looking at viactec – 3rd company listed was Accent Inns. Not at all a list of companies producing tech.

http://www.viatec.ca/companies/accent-inns-hotel-zed

This can maybe help you JJ

http://www.viatec.ca/companies

If you concentrate on the money makers of Greater Victoria in house sales that would be Victoria City proper, Oak Bay and Saanich East.

This is the market with 280 current listings or about the same number as one condo tower in Toronto. Projected sales for this month are at 125 with a median exposure of 24 days-on-market. And at the same time only 152 new listings came to market.

Only 2.25 months of inventory on the shelves and the delivery truck isn’t bringing enough cans of houses, 1.2 new listings to every sale, to begin to fill the store room.

Our core market looks like a Target store with half empty shelves and two people fighting over the last jar of Marmite.

Sellers think they are under pricing when half the homes fly off the shelf in three weeks. Buyers are frustrated with the lack of selection and the high prices.

https://youtu.be/7D8sRGzeqag

I have no idea what constitutes a tech company anymore. It’s a phrase that has lost all meaning when it comes to describing what a company actually does anymore.

Sales for the month will come in significantly above 10 and 20 year averages. Inventory will be the lowest we’ve seen in a long time.

Mon, Sep 21, 2015 8:20am:

Sep Sep

2015 2014

Net Unconditional Sales: 608 565

New Listings: 846 1,099

Active Listings: 3,474 4,253

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

We don’t need retirees when we have millennials 😉 Check out the latest ad campaign by Bosa. No more grey hairs….

https://tectoria.wordpress.com/2014/09/11/1114/

You missed the important part, the summary says the condos are too expensive for the incomes and retirees aren’t flocking here as you forecast. Kind of like 2007/2008 all over again.

Interesting nuggets indeed…

“The group now projects that B.C.’s economy will lead all of the provinces both this year and next, with growth of 2.8 per cent in 2015 and 3.4 per cent in 2016, driven by solid gains in manufacturing and service industries.”

Who would have ever guessed? It’s like 1987 all over again.

I wonder if the Conference Board has even noticed lately that Vic & St Cath regions (Canada’s two retirement havens) are suddenly two of the hottest in the country? …and I’m not just referring to our climate 😉

Interesting nuggets from the Conference Board of Canada report on housing. Looks like Victoria is just a dream for many retirees as affordability here is only higher in Vancouver and Montreal. Don’t look to make any profit on that condo anytime soon.

From the Victoria section:

“Poor affordability continues to hamper demand for

apartment condominiums in Victoria. Principle and

interest payments on Victoria’s median unit consumed

16.9 per cent of average household income in 2014;

this is forecast to rise to 17.8 per cent in 2015. Only

Montréal and Vancouver have a higher proportion

among the eight cities covered in this report. This limits

interest from retirees, who would otherwise find the

area’s mild climate and picturesque surroundings magnetic.

Indeed, the relative growth of Victoria’s 55-plus

population has been the slowest among this report’s cities

in 8 of the past 10 years.”

http://www.genworth.ca/en/pdfs/Metro_Condo_Outlook_Winter_2015_EN.pdf

http://www.genworth.ca/en/pdfs/Metro_Condo_Outlook_Winter_2015_EN.pdf

Lag or does the outer core areas lead in a downturn!?

Michael, there may still be time for you to crystallize some of that equity into hard currency.

Getting bank financing to tap into that equity will become more difficult in a recession if lenders consider that you’re overexposed to the market by having too many leveraged properties.

Westshore lags Victoria which only makes sense. You can see both houses and condos didn’t bottom there until after Victoria. It looks to me like Westshore houses didn’t even bottom until early 2015.

http://i.cubeupload.com/5ZJMWH.png

There’s still time for you to get in on the ground floor Jack 😉

Here are the yearly median prices for condos in the Westshore.

Year Median

2008 $284,900

2009 $280,000

2010 $284,950

2011 $278,200

2012 $255,000

2013 $252,450

2014 $266,050

2015 $247,900

Looks like we’ve been bottoming out for the past seven years in the Westshore. If you bought a condo off a developer anytime in the last seven years the odds are that you will have to sell at a loss today.

Even a broken clock is right twice a day. If you keep saying the market has bottomed eventually you’ll be right one day.

Just not this day.

…Hence, the down part of the cycle.

http://i.cubeupload.com/0sPaPY.png

Person who bought for 700K off…pure genius 😉

Tell that to the guy on Bear Mountain who Jack posted the condo sale loss of $700K. Just like the Westshore development that I posted about last week who had to drop their prices from $385K to $335K just to attract buyers.

Benchmark for condos in the core were $278K, and five years ago were $287K. Your “lag” theory needs some serious adjusting.

Sometimes market competition isn’t so great: http://www.timescolonist.com/opinion/columnists/monique-keiran-b-c-car-insurance-not-so-bad-after-all-1.2069659

History has shown us that following what others have done has been a good strategy.

https://youtu.be/xMZlr5Gf9yY

re: condos (and houses)

For now the best way to see what’s ahead for Victoria is simply look to Big Sister.

For instance condo sales in Van are up 32% since last year and prices up 14% to $521,660, however condos only recently began jumping while houses there have been jumping for a few years. Condos seem to always lag in a new cycle and then play catch up.

And in Australia, after being fined 1.9 billion dollars, and a probe into money laundering has allowed

“HSBC cleared to hand over ‘suspicious reports’ to US investigator”

google the above as I can’t seem to be able to make the link work.

Interesting article from a couple of weeks back. Free money will be the death knell of this cycle, just a matter of time.

Easy Money Creates the Most Dangerous Bubbles

“In a new paper, economists Oscar Jorda, Moritz Schularick and Alan Taylor study housing and equity markets in 17 countries over the past 140 years. They find that the worst bubbles — those that inflict the most economic pain — tend to involve not just speculation, but a surge in easy lending and increasing leverage.”

“They find that economies easily weather episodes such as the dot-com bust, when speculation set up the stock prices of high-tech companies for a fall. It’s another matter entirely when a surge in easy credit encourages people to use borrowed money — also known as leverage — to buy assets. ”

http://www.bloombergview.com/articles/2015-08-31/what-s-the-most-dangerous-type-of-bubble-

I considered a variable but went with this instead. It’s a 2 year fixed and convenient to stay with my bank since I am away right now. Scotia’s Variable was not 1.85! Maybe after these two years I’ll finally go variable. The data says that variable has always been the way to go. Why why can I not make myself do it?

Why would you take such a high rate? Get a variable for 1.85. I just did it.

Having enough liquid assets to pay off your mortgage probably helps in getting the .8% discount too….

Just not super comfy with arbitrage. I do it a bit because I don’t pay off all my debt when I could. Borrowing a bunch more to invest. Not in me to do although it always looks like it was in hindsight. Then again in this market, I’m glad I’m not riding on borrowed funds. I operate like a poker bank roll. I build it slow and try to build it from itself….

And don’t forget to increase the global limit on your line of credit. Why wait until you retire to start using that equity. At 2.29% and some sleuthing you should be able to find equities that will provide a higher return.

Have you considered CrowdFunding?

http://ncfacanada.org/vancouver-event-sep-29-vanfunding-2015-crowdfunding-conference/

I’m just about to renew my mortgage for 2.29%. I couldn’t hold out for 1.99%. still might come this year but a bird in hand is worth two in the bush so I’ll take a 6.2% drop in my monthly payments upon renewal!

I think Norway was mentioned the other day:

Headline: Norway central bank lowers rates, eyes more cuts

“The central bank has been caught between the need to cool down a red-hot property market and the need to support the slowing economy.”

http://www.theglobeandmail.com/report-on-business/international-business/european-business/norway-central-bank-lowers-rates-eyes-more-cuts/article26513255/

There are some 480 strata titled condominiums for sale in the core districts this week. Ranging from a low of $109,000 for an 800 square foot 1970’s vintage one-bedroom along Hillside avenue to $5,250,000 for what is now a 15 year old condo building along Dallas road. The majority of condos being listed around $300,000 give or take 33%

The last 500 condos sold at an average price of $339,000, a median of $285,000 and a median sale to assessment ratio of 105.5%

The previous 500 sales sold at an average price of $333,500, a median of $285,250 and a ratio of 103.5%.

So it seems that the velocity of appreciation, so far this year, in condominiums is idling. Which is interesting considering that there is only 3 months of inventory and that characterizes the condominium market as a sellers or bullish. Historically markets that strongly favor sellers will tend to have rapidly increasing prices.

If you’re bullish on condominiums, this may be the time to buy. There seems to be considerable pressure on prices to rise.

However, there is no trend for rising prices established yet. I would think that if you were contemplating buying an investment condo you may want to time your purchase with a rising market since the condo market could idle along for quite a long time. As in most investments you want that investment payback period as short as possible.

Folks on Twitter were highlighting this CIBC mortgage offering yesterday: “International Student Mortgage. Now available with 35% down. No income required. Verification of down payment and full time student!”

Asking price was $799+GST so I am assuming that the negotiation ended up finishing off at $825,000 including GST. Either that or the buyer went for some serious upgrades.

Only way to know is to wait a couple of months and see the tax record (tax record sales always reported without GST).

… and the new owner will also be paying $41,250.00 GST.

3918 Orchard just sold for $825,000

We could enjoy some wonderful ghost cities, just like in China:

http://www.forbes.com/sites/kenrapoza/2015/07/20/what-will-become-of-chinas-ghost-cities/

Google “Canada and China signing deal to share ‘corruption’ assets”

That agreement was just signed on September 1, 2015

Thanks for the information!

Fascinating.

But why are we discouraging this kind of investment? Should BC not encourage the development of RE for offshore investors, but in such a way that it does not disrupt the local market. For example, why not develop some satellite communities to Vancouver and Victoria just for investors. They could be like those Chinese ghost towns, where condos, townhouses, and villas remain in pristine unoccupied condition, rising in value, year by year, in line with the rising cost of construction materials and labor, and thus providing the perfect defense against both the Chinese tax authorities and inflation.

We’ve spoken a bit about money laundering in BC. From what I’ve read, BC seems to be a very lucrative destination to launder cash because of our provincial government’s lax regulations regarding numbered offshore accounts and that lawyers are exempt from reporting suspicious transactions.

One of the ways of bringing cash into BC, that I’ve not heard the media discuss is foreign students. BC Schools and the government receive a lot of money through foreign students. Indeed some say the teacher’s strike was only ended when Beijing threatened the Premier of restricting the number of foreign students permitted to study in BC.

I suspect a lot of money is funneled through foreign students accounts in Canada. I have not found any restrictions on how much money may be wired into the student’s Canadian bank accounts for “education expenses”. Or how many luxury cars a student can export back to their home country or how many pre-construction condos or properties in general may be bought.

It is illegal to be a straw man purchaser when there is lender involved as that becomes mortgage fraud. But to the best of my knowledge fraud is not committed when it comes to cash transactions.

An article in an Australian newspaper reported that foreign students were being paid a 2 or 3 percent commission to buy pre-construction condominiums for investors in their home country. If this is factual, I would expect the same is happening in BC.

BC (Bring Cash) benefits from foreign money. Money that stimulates the economy by providing jobs, goods and services to everyone. The problem is that our market system for determining fair value may become distorted. Especially when estate agents, appraisers and the public rely on individual sales data that is tainted. Since money launderers are not concerned about paying too much but simply in having the cash placed in BC. For them, real estate is no longer about a fair price between buyer and seller but how much can be funneled out of the home country. Paying $3,000,000 for a 2.5 million property is of little consequence when the aim is to get 3 million out of the host country.

However, that taints our free market system as the $3,000,000 sale price becomes a benchmark referenced by estate agents, appraisers and the public. A benchmark that assists to sell properties, set lines of credit and property assessments for housing through out the community.

People are starting to clue in… “B.C. the new economic promised land” (the Globe)

Note that if the tenants have a fixed-length tenancy, such as the one-year leases common with whole houses, the buyer can’t end the tenancy early at all.

“655k compounded @ 8.5% for 5 years = 985k

…and yet we’ll still likely be less than half price of Van ”

One year of down 8.5% and your fantasy bubble is popped. It would have to go back up 16% in one of those years to make a million. Aint gonna happen…. plus Victoria is less than half the city Van is, thus the lower prices as it always has been and always will be.

Agree with CS, wait til after the election and a new government gets in, things will change bigtime. Toss in the bear stock market kicking in and people won’t feel so rich anymore after a 7 year run.

Yep, long story short. Give tenants 2 months notice and pay them one month’s rent. If you are buying make this a seller’s obligation. If you are selling make this a buyer’s obligation.

Lots of plain language guidance on this at the RTB’s site:

http://www2.gov.bc.ca/gov/content/housing-tenancy/residential-tenancies/ending-a-tenancy/landlord-notice/two-month-notice

That prediction seems to have been a bit premature! I’m not now expecting a crash before Christmas. But it could happen next year. if mortgage rates go to 5% plus. In fact with a significant rate rise, something like a 30% correction seems inevitable.

And here’s a comparison Info would surely approve: a 3000 square foot house designed by Frank Lloyd Wright for US$799,000, which even taking into account the exchange, looks like a deal compared with a million-dollar North Oak Bay bung.

Sure thing, but keep in mind that a million median core by 2020 only requires approximately the yearly pace we’re already at…

655k compounded @ 8.5% for 5 years = 985k

…and yet we’ll still likely be less than half price of Van 😉

Can anyone provide a clear explanation about the laws in BC governing what happens if you buy a single family home that is either rented out or has one or more suites – and you want to have all tenants move out so that the house can become your residence? What if the house requires renovations and will not be immediately occupied?

Maybe.

Refinancing costs money to do and may not be worth it for $35,000.

If you are talking about a HELOC, you are going to need to have a lot of your mortgage paid off first.

If you are at the median $645,000 your mortgage has to be less than $406,000 to be able to get a $10,000 HELOC. $382,000 left on the mortgage and you can take advantage of that $35,000.

If you are at $406,000 you’ve probably been paying the mortgage for seven years now given the flat state of the market. So you can now access a $10,000 HELOC. If you have had your home for a lot longer then you’ll have much more equity for a HELOC. Shorter and the $35,000 increase in price means no HELOC for you.

With almost $300,000 worth of equity I can see why someone would qualify for a $35,000 HELOC.

https://www.cibc.com/ca/mortgages/home-equity/calculator.html

– prediction from @Michael on July 4, 2015 at 5:46 pm

Care to revisit this prediction in a few years? 😉

Are you still predicting your average SFH price of $345K for this year?

CS said…

Victoria, 2015 nominal average SFH price = $345K plus or minus $70K, or back to 2003.

January 6, 2013 at 12:08 PM

Detached home sales in the core are on track to meet last years volume. However both the average and median prices are higher for this time last year. The average and median prices for homes in the core were $682,500 and $595,000 respectively. This month’s projection is for the average and median to be up around $711,000 (4%) and $645,000 (8.5%).

The projected median Sales to Assessment ratio increased from 103.5 to 109.75 or 6%

Year over year prices in the core districts are up between 4.0 to 8.5%. My guess is the HPI number for houses in the core would also be up at around 6%

Six percent or roughly $35,000 is nothing to sneeze about. Home owners can use that equity at low rates to buy a car, pay for home repairs, go on that much needed holiday,down payment on an investment condo or perhaps a destination wedding for a real estate agent?

Canadian confidence still low especially on real estate.

As I think I mentioned, the RE market will not dip nationally until after the election. By then Canada’s trade balance will have swung from an all-time monthly low of almost negative $4 billion in July 2015 to a positive number. That will be time for the C$ to strengthen, with an assist from a BoC rate increase, whether the US Fed raises or not.

Once it has been confirmed that interest rates can still move either way, sentiment on housing will turn negative. In the longer term, the US dollar looks vulnerable to a correction that may force the Fed to raise rates whatever the domestic consequences. Canada will then follow the US trend. A return to a five or six percent Fed rate will devastate in the US RE market and Canada’s market will likely follow.

I’ll save you the read….

”

Despite more than two decades of research to determine whether elevated EMF exposure, principally to magnetic fields, is related to an increased risk of childhood leukemia, there is still no definitive answer. Much progress has been made, however, with some lines of research leading to reasonably clear answers and others remaining unresolved. The best available evidence at this time leads to the following answers to specific questions about the link between EMF exposure and childhood leukemia:

Is there an association between power line configurations (wire codes) and childhood leukemia? No.

Is there an association between measured fields and childhood leukemia? Yes, but the association is weak, and it is not clear whether it represents a cause and-effect relationship.”

In other words…. Is it a health risk? Maybe.

The U. S. National Institute of Environmental Health Sciences (NIEHS) published a thorough science-based review of EMF in 2002: “EMF: Electric and Magnetic Fields Associated with the Use of Electric Power.“.

From your analysis (suggesting that there are fewer starter homes selling in the Western Communities, and that the median sales in the Victoria core have risen sharply), do you think that starter homes in the core have now been replaced by condos and townhouses?

Ok, thanks.

I agree about the WiFi. Seems low risk. Now a high voltage 30 ft WiFi tower buzzing over my head 24/7? No thanks 😉

@Iggy_12

Good points. Politicians could become pretty unpopular in a hurry if they try to directly confront and of the issues related to an overheated housing market.

That said, I believe that more could be done by politicians to better regulate the policies of Canada Mortgage and Housing Corporation (CHMC). I also believe that mortgage lending institutions Canada need tighter controls imposed through the Office of the Superintendent of Financial Institutions (OSFI).

Definitely. I normally have zero patience for the wifi hysteria crowd but I wouldn’t personally buy a house under high voltage transmission lines. That is several orders of magnitude different and not nearly as well studied

Yep, high voltage lines can certainly be an issue. Sensitivity to EMF tends to vary among individuals and occasional exposure is quite different than constant exposure. In order to keep exposure to 0.5 Milligauss (mG) or less, a 200 m distance is recommended from high voltage power lines (on metal towers).

Do you need to keep exposure < 0.5 Milligauss? It comes down to an individual choice and what you feel comfortable with for you and your family.

3926 Orchard Lane went for $785,000. The other sales no reported on MLS

Do your own research and make up your own mind if the risk is worth it.

The party line is:

” there are no known health risks that have been conclusively demonstrated to be caused by living near high-voltage power lines. But science is unable to prove a negative, including whether low-level EMFs are completely risk free. Most scientists believe that exposure to the low-level EMFs near power lines is safe, but some scientists continue research to look for possible health risks associated with these fields. If there are any risks such as cancer associated with living near power lines, then it is clear that those risks are small.”

What some scientists think…

http://emwatch.com/power-line-emf/

I’d say the power lines are hurting it for sure. Despite no solid evidence of ill effects, high voltage power lines are definitely going to hurt the property value significantly.

So if you’re ok with the eyesore and OK going with the evidence that they are safe to live under you can get a good deal in that property.

Hey Marko –

Can you tell me how much the 4 or 5 new houses under construction (one is complete) on Orchard Lane have sold for? 3918 and its neighbours, just off of Union in Maplewood. I believe 5 of the 6 have sold, or have accepted offers. Many thanks.

Has anyone been inside826 Palisade? Four bedrooms, $499K, Saanich cul-de-sac, yet it’s been on the market for a while. The first three photos on MLS are now of the neighbouring park, not the house itself. Perhaps the pool or power lines are keeping buyers away.

Mon, Sep 21, 2015 8:30am:

Sep Sep

2015 2014

Net Unconditional Sales: 432 565

New Listings: 635 1,099

Active Listings: 3,509 4,253

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

One reason why the federal leaders have no answers is because houses are not owned by some evil corporation that can be picked on. They are owned by regular people (voters). So you will never hear them say anything that can be construed as “Vote for me and I’ll make your house worth 30% less so that some kid just out of college can afford to buy it from you”

If 70% of Canadians are home owners, do you really think they will vote for something like restricting foreign ownership that will reduce the number of potential buyers when it comes time to sell?

House sales in the core districts seem to on par with last year’s volume for September.

In contrast, the Western Communities seems to be tracking towards a 44 percent increase in year over year house sales for September.

The activity in Langford and Colwood over the last 3 months has seen fewer starter house sales under $500,000. Most of the increase in sales activity is attributable to the middle income basement entry house in the $500,000 to $600,000 range.

The median price of the last 250 sales in Langford/Collwood is $485,000. Up from $465,000 for the same time period last year. During the same period prices in Victoria, Oak Bay and Saanich East are up from $615,000 to $688,000

That translates into more value for the money for those buying in Langford and Colwood than Victoria, Saanich East and Oak Bay. And that’s why more buyers are now choosing to live outside of the city core.

In my opinion real estate bubbles are more psychology than economics. When you have the party leaders debating a housing crisis on national TV this can have a dampening effect on sales.

Agreed David, I thought the article covered all sides of the debate and it’s the elephant in the room the candidates have no answer for as Canadians have never been at 165% levels of personal debt before.

As you said, the economy can’t expand forever and since Canada is entering a recession of some sort and things have to eventually cool down. Wether this is now an early sign of being tapped out or sales were pulled forward in the spring mania it will be interesting to watch over the next months.

I’m still firmly in the camp that it will be a global credit crisis event that triggers this crash/correction, just may take another year to play out from all the recent China/oil crash red flags like it did in 2007 to 2008. Things didn’t come undone all at once.

There’s always a slowdown in sales as we enter the fall. What surprised me was how strong sales were over the summer, which may have “pulled forward” sales from the fall. We’ll have a better idea over the next month.

That’s a fairly well balanced and insightful article that you linked to. Foreign ownership is a negligible issue in the Victoria real estate market. I think that candidates are reluctant to delve into the record personal debt levels in Canada as it is a political quagmire. There’s no easy solutions and it seems that the notion of an ever-expanding economy is a fallacy.

Real estate is a big part of that consumer debt, but a stagnant/recession economy with very low wage growth over the past ten years means that quite a few people have ended off living beyond their means – hence rising debt.

Could be the buyers shot all their bullets over summer and the inevitable slowdown is showing up. I heard some more Westshore developments had to drop their prices from $385,000 to $335,000 just to attract buyers.

Housing bubble risk has federal leaders at a loss

Is Canada ill-prepared for a possible housing price crash?

http://www.cbc.ca/news/politics/canada-election-2015-debate-housing-1.3234546