May Market Update

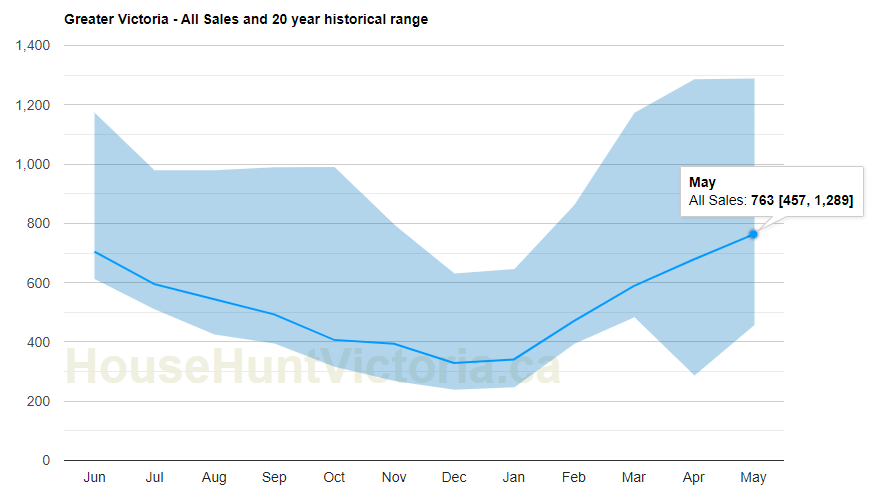

The final May numbers are in, and if you just look at the year over year change in sales rate, absolutely nothing happened. The 763 final sales for the month were in fact 2% below last year’s total. That figure is far from the best (1289 in May 2016), but also far from the worst (457 in 2020). We remain a little on the sluggish side of normal, with this year coming in 6% below the 20 year average of 816 May sales.

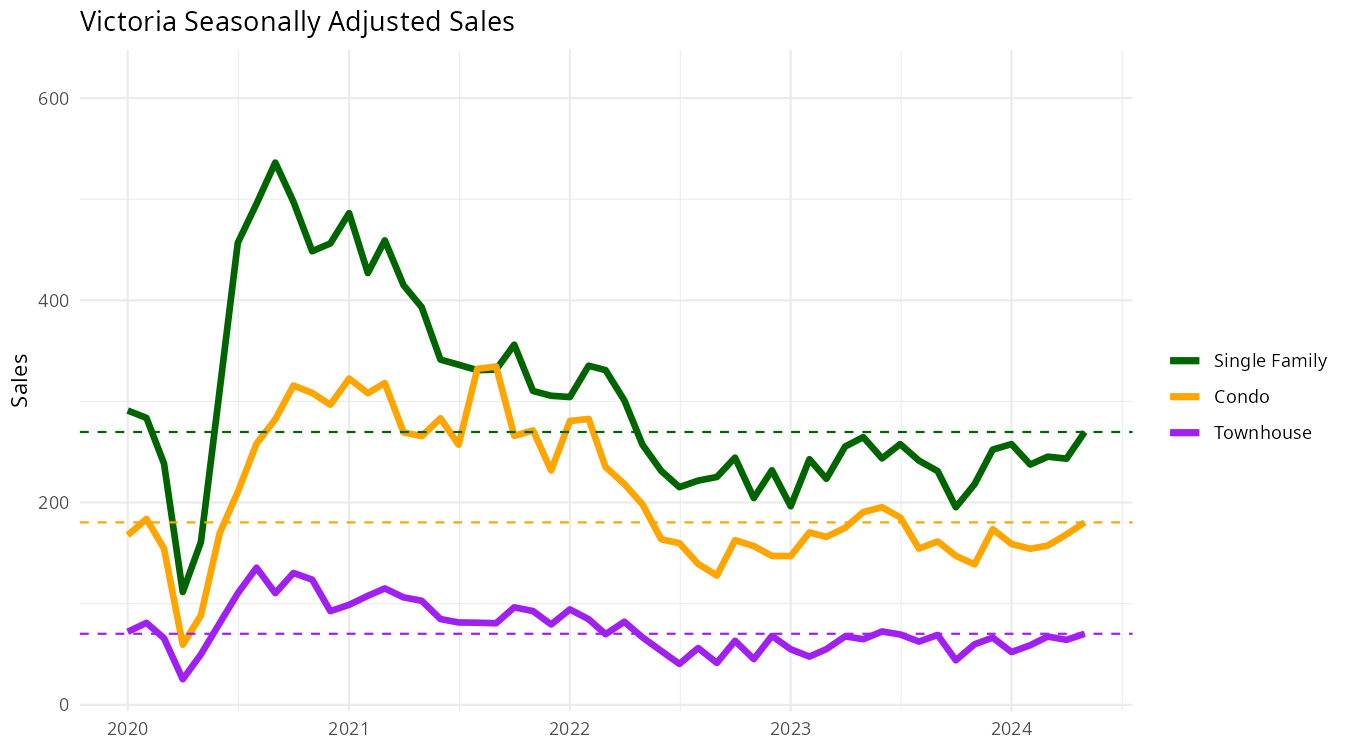

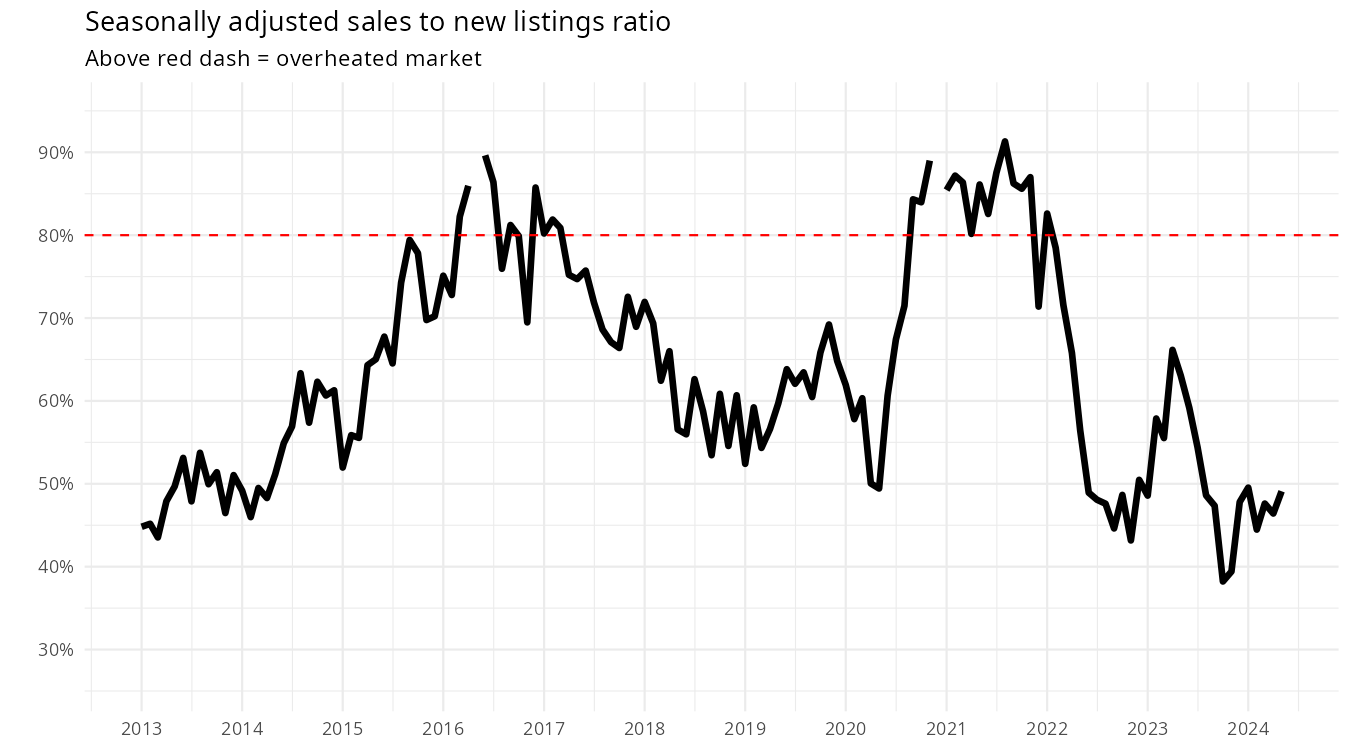

But when you seasonally adjust those sales and break it down by property type, there is a little bit of an increase in May, with both condos and detached properties experiencing an uptick from the April pace. One month is not a trend, but sales are looking a bit better than most of the past two years.

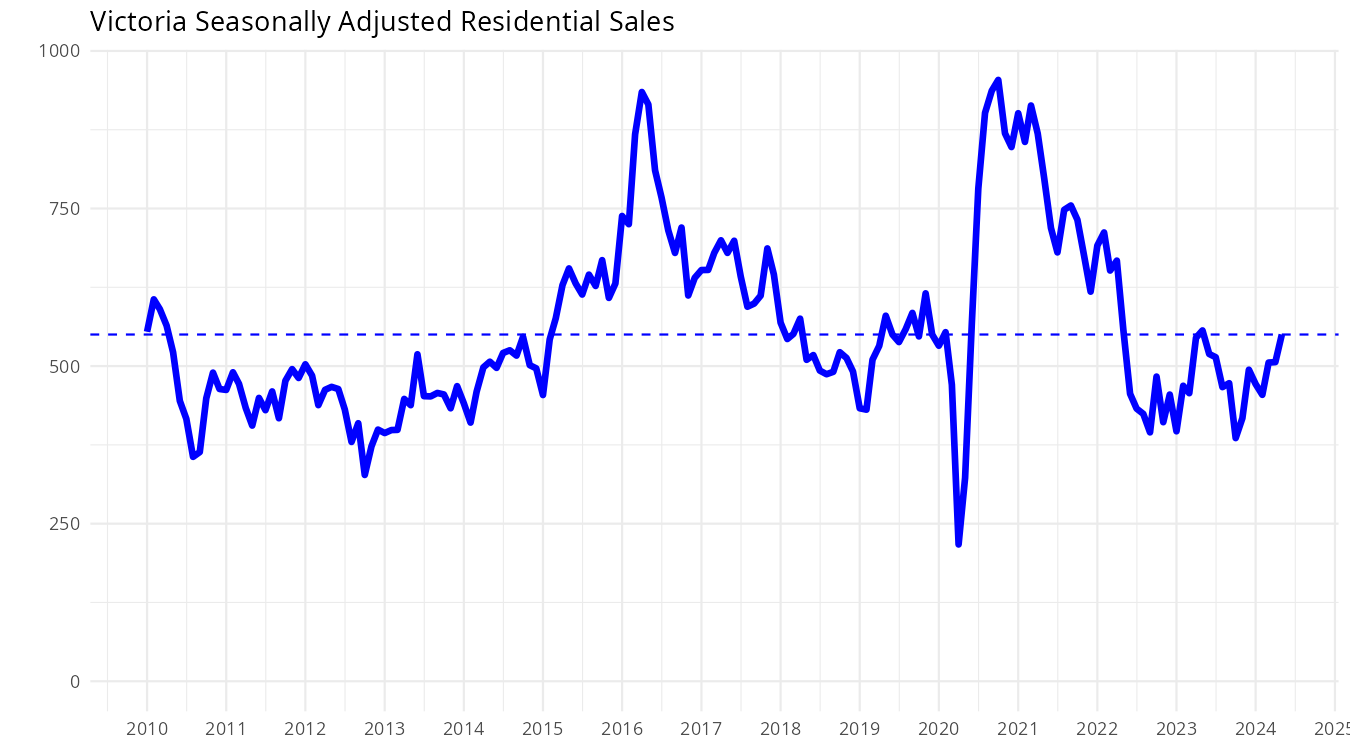

To put this into perspective with less turbulent times, it’s similar to the sales rate pre-pandemic, and about 15% higher than the slow buyers market of 2011-2014.

Those are small moves, but worth watching how it goes as the spring buying market winds down. The last two years we saw relatively weak fall markets with falling prices. Whether that happens again this year depends largely on the trajectory for new listings and rates.

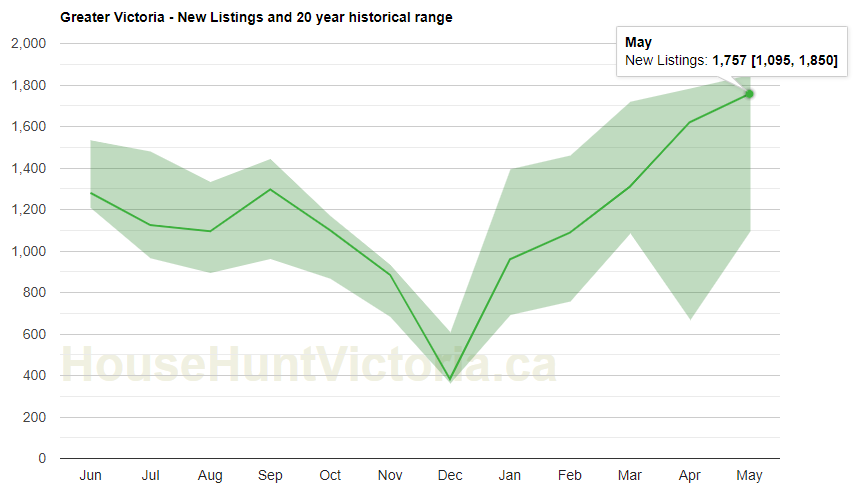

As has been the case for a couple months, the more interesting story is in new listings, where despite the month ending slower than it began, we are getting closer to the top end of the historical range. This May’s 1757 new listings were 17% above the 20 year average which doesn’t sound like much, but it’s actually enough to make it the second highest number of new listings in the last 20 years. Only the 1850 new listings of May of 2008 when the world was teetering at the edge of financial crisis were higher.

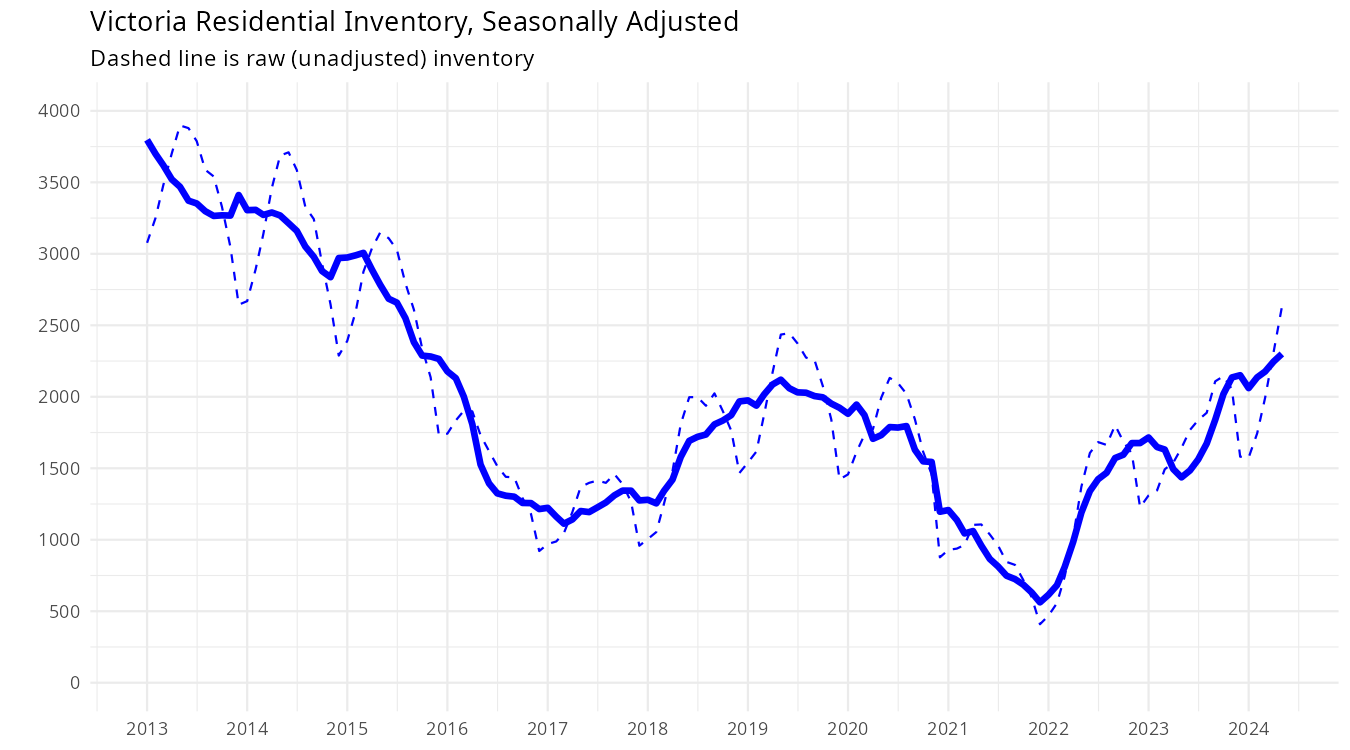

That strong new listings rate is continuing to push up inventory. We’re 52% higher today than a year ago, but that puts us just 1.5% above the 20 year average level for this time of year.

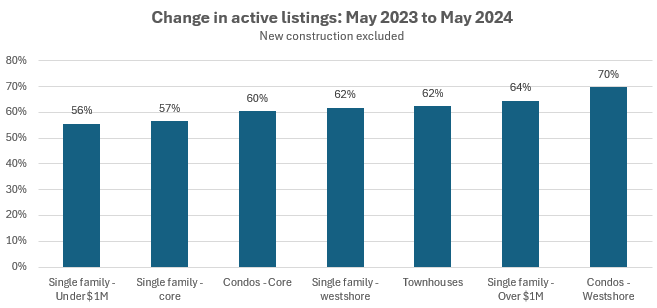

I’ve written a few times about where those new listings are piling up, and there isn’t a super strong pattern. It’s broad based across property types and regions. Yes the westshore has seen more of an increase while entry-level houses have seen the least, but the differences are not massive.

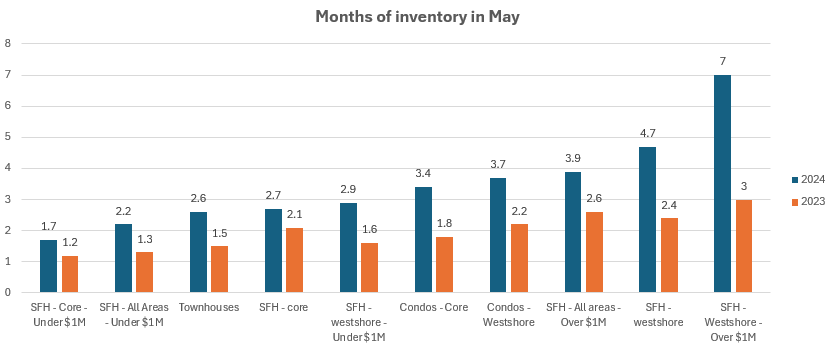

However that’s only half the story and sales are the other half. That’s when the differences in product types and region become more apparent. While the market is weaker across the board from a year ago, there are large differences between the hottest and coldest parts of the market. If you’re looking at houses under a million in the core: good luck, that market remains extremely tight with only 1.7 months of inventory. If you’ve got over a million to spend in the westshore, you’re in the drivers seat with 7 months of inventory signaling a real buyers market. Eventually these kinds of gradients will even out as homes in different segments serve as partial substitutes for each other. As the differential in market conditions pushes prices further apart, buyers leak between regions and will even it out. For the time being though, where you’re looking will dictate the experience you have.

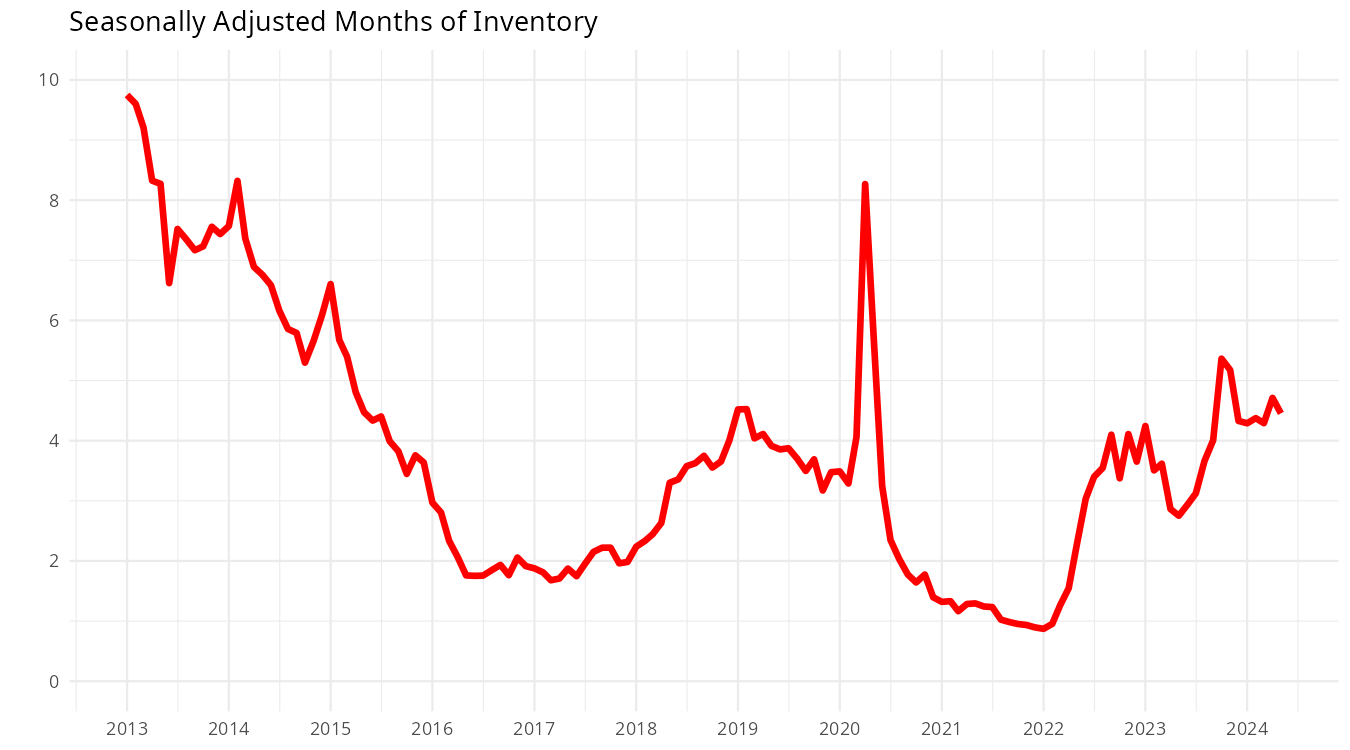

With such a big gradient, the overall months of inventory levels may not mean a whole lot, but that actually tightened up a bit on a seasonally adjusted basis. This is within the margin of noise, but essentially little changed from April. For the whole market, we are still way below where we were 11 or 12 years ago. If you’ve only been following the market for a couple years it may seem very slow with properties lingering on the market, but it can get a lot slower.

As before, months of inventory is pointing to an overall mild sellers market, while the sales to new listings ratio points to a buyers market. Overall, call it roughly balanced. I know I said I’d come up with a new market gauge this month to reflect both measures, but I ran out of time. I’ll post the revised one in a future article.

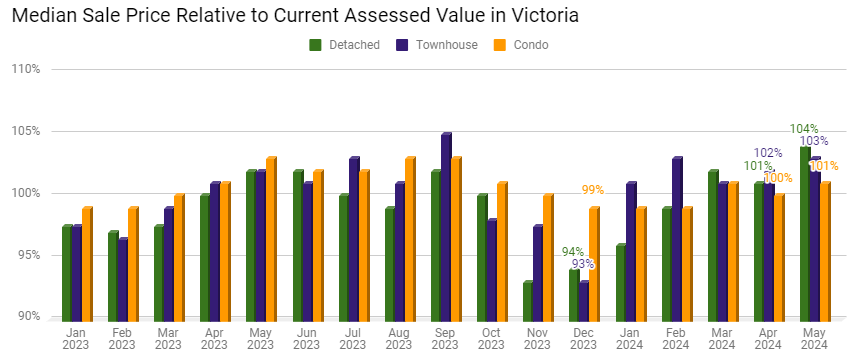

The roughly balanced market is also reflected in prices, though prices have crept up a little this spring as they often do.

That’s also reflected in the sales to assessed value ratios, where especially detached increased from the previous couple months. That’s likely because sales are skewing towards the stronger core while the weaker westshore (whether the average place is going under assessment) does not have many sales.

The Bank of Canada is announcing their rate decision on Wednesday, and with economic data showing Canada petering on the edge of recession, the expectation is for them to cut rates. While that’s likely to happen, I’m not convinced it will change much in the market. Rates remain the crucial lever that is limiting buyer activity due to poor affordability, but the reality is that rates will go down because the economy is floundering. It’s tough to pay a mortgage at high rates, but it’s much tougher if you don’t have a job. My bet is that a couple minor cuts in rates will be roughly cancelled out by the drag from a slowing economy, and my long-standing view is that the central bank will be very cautious when cutting. I don’t expect more than a couple quarter point cuts this year while everyone assessed the impact.

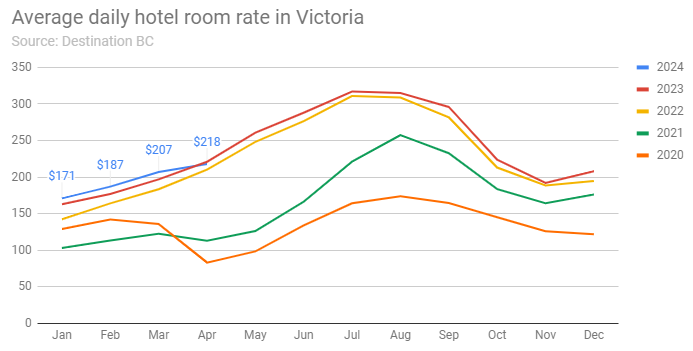

As for my ongoing look at hotel rates in response to AirBnB restrictions, we don’t yet have data for May but so far no sign of abnormal increases. In fact the average room rate in Victoria in April was down from the year before.

We’re still waiting for updated AirBnB data (that last InsideAirBnB snapshot is from May 1st for Victoria) to see how well the new provincial restrictions have worked, but looking at a booking map for some options in the summer, it’s very sparse. It seems like most hosts are not running the risk of continuing to run short term rentals, at least not advertised publicly on the major sites. From the destination BC arrivals data it also doesn’t appear that arrivals are down, but peak tourist season hasn’t started yet. Will be interesting to see how it shakes out, and if the predictions for either sky-high hotel rates or decreased tourism come to pass.

The distinction between a PBR and a group of individually strata titled condos is the security of tenancy. The condominiums can still be sold and the tenant evicted on a one by one basis.

In the recent past there have been Investor groups that have bought multiple strata townhomes and condos whilst under construction to use as rentals. Units that can be sold separately. Unlike PBRs that will always be used as rentals.

New post: https://househuntvictoria.ca/2024/06/10/will-dropping-rates-revive-housing/

And the big rental banner didn’t stay up too long, so they seemed to have rented them. Smart move IMO

There is the newly completed building on Shelbourne by Kang and Gill where they sold approx half the building and kept half as a rental and as a result it is stratified even thought have is rental.

There are also some PBRs that are stratified. Not super common but happened quite a bit in Ontario. That’s where the bad headlines of “90% of new condos are owned by investors” came from when it was actually stratified purpose built rentals being built.

I’m not quite sure the reason behind it, but may be that if the owner builds a rental but only commits to 10 years, they can easily sell off the units individually later.

I’ve seen lots of apartments to condo conversations (and stratifications) without going down to the studs. Just a few examples, 3800 Quadra was an appartment building converted to condos (I’ve sold four units in the building an other than newer kitchens and flooring it is original apartment building). 2515 Dowler is another example, etc.

Stratas are created when the Title is registered in the Land Title and Survey Authority. Besides Heritage Conversions the only building that I can remember that was converted to strata was the Mosaic on Fort street. However this building began as an office building. Both Heritage and the Mosaic were stripped down to stud walls and upgraded to BC Building codes.

I have a faint memory that the building has to be certified as new construction and having never been occupied. A new building is one where more that 50 percent of the building has been renovated. That’s down to the studs, new wiring, new plumbing.

I recall during one economic downturn, a developer wanted to change the condominium complex he had just built to an apartment building but retain the units as strata titled so that he would save on property taxes and then sell them when the market got better. That failed.

In the past and I’m pretty sure it’s the same now . Legally strata’s are created at the framing stage and not before or after for whatever reason . So to convert an apartment block , u would have to take it down to the studs and bring it up to code . Maybe someone has done one recently that can chime in

I thought developers sold the apartment building to a REIT or some other entity and they would not be dependent on CMHC financing. If there is a multi year covenant, they pay a penalty and move on. In Montreal, builders were supposed to provide a specific number of affordable units. They didn’t and just paid a fine. Big money people do what they want.

Add municipalities can add a 20, 30, 50 year rental covenant to the re-zoning which most developers will accept right now as they want to build a rental anyway.

Well, then I guess that’s that. It will just be the haves and the have not’s moving forward. If I were tenant I would be more happy knowing renting to own is a lot better than pissing your money away each and every month.

Except that

I think that was their plan all along. It doesn’t take much to convert an apartment into a condo…Just change the name from apartment to condo. Or some rent to own scheme.

After a couple years of putting up with dead beat renters, and “keys for cash “ scenarios, the owners will convert the apartments to condos and get responsible owners.

No one.

I think they may have to do some thinking about how to provide a better path for condo financing other than presales if more of the rental market shifts to PBR and investors become less interested in financing them. One way would be to just relax the standards for CMHC financing and say that anything with 50% rentals qualifies so you can have split buildings.

Who is going to leave a rent controlled apartment at a below market rent to move into a newer apartment they can’t afford?

For those watching Craigslist, a ton of new purpose built apartments have just been listed.

There are now 666 rental listings on craigslist for units within an 8.7 kilometer radius. That’s about a hundred more than typical and they are new and they are expensive.

The question is if there will be enough of them coming on line in the next several months to increase the vacancy rates in the older apartment, condo, and basement suite rental market?

Over the last couple of years, quite a few of the older apartment buildings have undergone substantial renovations to compete with the condo market and now they are going to have more competition from the new apartment complexes.

What will happen to basement suites is not so easy to understand.

I agree there would be less construction activity, but I don’t know if this is the best lever to use big picture. CMHC financing is tied to the bond yield so as interest rates start to drop even if some strata become viable (that currently are not) developers will go the way of CMHC financing as CMHC financing costs will also decrease.

Right, but how many of those projects would be even viable as strata? It’s just a fact that the new construction market sucks. Some are switching to rentals because of increased profit, but many are switching to rentals because otherwise they don’t have a project that pencils at all.

I don’t know what that split is, but I don’t think it’s up for debate that if CMHC pulled back on rental financing we would have a lot less construction activity.

I disagree, lots of developers are pivoting on the exact same piece of land and switching to purpose-built rentals instead of a pre-sale strata and government levers are influencing this. Government is making it more attractive to build purpose-built rental (CHMC financing, No GST, etc.) and less attractive to build strata (tenancy laws decrease investor interest for example, etc.). In my personal situation I don’t even have an option, Colwood forced a rental covenant on my building as part of the rezoning.

I do think purpose built rentals are very important in the marketplace; however, in my opinion government should be applying policy to increase construction across the board, like I don’t know cutting bureaucracy bullshit instead of making one type a bit more attractive to build versus another type.

I hope in 10 years people aren’t complaining on Reddit how there is nothing to buy or is too expensive as everything built in the last 10 years is rental 🙂

I do think we need a ton more purpose built rental but if people think Starlight Investments renting 100,000s of units for the next 30 years to them is going to make their life better, good luck. On an individual basis I am still pro ownership and paying something off over 30 years.

I don’t think they’re being pulled, the ownership market just sucks and presales are a tough slog so those projects are being shelved. If CMHC wasn’t singlehandedly financing most of the construction I don’t think those builders would be switching to condos and townhouses, we’d just be building a lot less.

While the article definitely has a self-serving interest no denying that purpose built rental housing starts are being pulled from SFH/Strata. It would be nice if we could simply have more of everything.

SFH Housing starts

Warrantied and Owner Builder

2003 – 11,498 & 3,507

2013 – 6,536 & 2,067

2023 – 5,728 & 692

2024 – So far on pace for all time record lows on both SFH warrantied and owner-builder front.

Goes to what I’ve been saying on HHV for the last year, if I wanted a SFH and I could afford one I would buy sooner than later. Will be plenty of 500 sq.ft. apartment rental options going forward, SFHs to purchase not so much.

Not great but not the worst.

As I noted the majors decided to close down the metro Vancouver refineries because they found it more profitable to refine in Edmonton and ship product. Why would they or anyone else want to reopen them in the first place, given their investment in refining capacity in Edmonton, and the expanded capacity of Transmountain?

Visiting the Okanagan and came across this wonderful piece of “journalism”: https://www.castanet.net/news/Think-Local/491433/Rentals-are-popping-up-all-over-Kelowna-leaving-little-property-to-purchase

That realtor is a saint – really sticking his neck out for prospective homeowners.

The fruit trees and some of the grape vines have leaves on them (some are clearly dead) but there is almost no fruit to be seen. Estimate is 90% crop loss this year due to the extended cold snap. Never happened in my lifetime before. Thank you climate change.

One cut is not enough imo. I think once we see three more then we might see a decent uptick in sales.

It has only been 5 days, lets see what happens!

The obstacles and consulting with all the “stakeholders” would probably take 10 years just to get the paperwork to build.

So instead we continue to consume like crazy, we buy products from countries with few regulations and then pat ourselves on the back for doing our part for the environment 🙂

Last June wasn’t that bad in terms of sales thought?

After the BoC cut, realtors are like: HURRY, buy your house now, The prices are going to da moon.

Reality be like: Sales are down from 2023, which was one of the worst years, inventory is up 50% from last year, new lists are up by 20%……

Zero chance of a new refinery. No demand since we have apparently stopped using oil and gas; investors have been scared away; way too many obstacles to success.

seems like the only new manufacturing ventures announced today are government backed. “Liberals announce $10B gift to companies destroying the planet”. Can’t see it. (Unless it was in Quebec)

Dockside was a polluted site, that may have been the reason for the delay.

Right. Forgot about that.

We used to have our own “Refinery Row” stretching from North Burnaby to Ioco. The big flare at Ioco was a landmark driving into Port Moody.

Now only one left, now owned by Parkland, originally Chevron I think. The majors decided to refine in Edmonton and ship the finished product through Transmountain.BC also gets some refined product form the Anacortes refineries which are served by Transmountain on the crude side.

Bosa only bought Dockside recently and then built three towers after a decade of nothing so I wouldn’t say Bosa has sat for so long; rather the development (under different ownership) sat idle for a decade.

Surprised they have sat so long without doing anything while others went ahead with big projects over the years.

Another large thread on Reddit people complaining about rents going up -> https://www.reddit.com/r/VictoriaBC/comments/1dbgkpp/victorias_onebedroom_apartments_now_average_2168/

Weird, all the airbnb units didn’t flood the market and lower rents?

Actually four decent sized refineries and a host of other petrochemical facilities in Edmonton and immediate area. https://www.canadianfuels.ca/our-industry/fuel-production/. Most of it between Edmonton and Fort Saskatchewan and a few facilities further out

BC on the other hand could badly use some extra refining capacity as we are prone to swings in fuel prices based on transportation bottlenecks and happenings at Washington state refineries.

Developers have switched to building rentals so not much to pre-sell. Some of the largest developments ever in Victoria starting construction now (Chard @ Mazda dealership and Starlight @ Harris Green) are 100% rentals.

The pre-sales left are smaller projects like the Abstract is building on Shelbourne.

The next two towers at Dockside are on hold and given the soft condo market, but strong rents wouldn’t surprise me if Bosa switch those to rentals as well.

Many people wonder why we don’t do more oil refining in Canada. As I understand the problem, crude breaks down into many products so if you want gas or diesel you get all sorts of other by products. To be successful in the refining business you need markets for all these by products. Huston Texas has a huge plastics industry that is co-located to their oil refining capacity. Throw in economy of scale and it is very hard to compete with the producers there. I believe there is a small refinery in Edmonton and a producer of polyethylene near by. Not sure what other plastics they produce there or what they do with the other by-products. It is easy to build a pipeline to carry crude. It is not easy to build a pipeline for each by product hence the need for a local plastic industry and the associated market for the plastic you produce.

Things seem reasonably stable , how is the condo market doing. For that matter how are presales doing?

Month to date activity

Sales: 174 (8% decrease over this time last year)

New lists: 458 (up 18%)

Inventory: 3387 (up 52%)

Even daffodil pickers can be very easily replaced by AI and robotics . Unless your position requires critical thinking and dealing with humans on a day to day basis, it is very likely your position could become a redundancy.

No one. You would be far better off dropping a couple hundred grand on equipment and keeping up with the times.

Combines can harvest 1000’s of acres of land via GPS, I believe a driver still has to be in the cab. Gigantic mining trucks are driverless. Who needs humans?

If they can automate the vast network of the industrial oil sands in northern Alberta via AI , they most certainly can automate all three levels (municipal, provincial, federal) of the government via AI . What we need to do is refine our own crude into gasoline rather then sending it down to the states, then buying it back at value added prices in USD.

https://youtube.com/shorts/TxMA74GvP_Y?si=7gORb8Nv-Qc4FUhK

Automation. AI. People aren’t needed anymore, too unreliable.

Then why are all the camps empty?

I’ve heard that Alberta is producing record amounts of oil. The U.S. is the world’s largest producer.

Well, they have pretty much shut down oil and gas. Forestry is a thing of the past along with commercial fishing. Whats left other than real estate? Government workers? Is that what’s going to drive our economy moving forward?

Well, you started off changing this:

“if we are in an economy that is shutting down real estate” (my statement)

to this

“Why? You think everyone’s job depends on RE? Guess what, they don’t.” (Your statement)

Further to that, do you think I was suggesting that absolutely no first time buyers bought even at the peek of the 80’s crisis? I’m sure some did – I’m also sure it wasn’t a long line up.

I think the whole narrative is a lot of this: https://en.wikipedia.org/wiki/Straw_man

It’s a beautiful sunny day and I’m going to go enjoy it. I hope you do too.

My uncle was a closet heroin user. You would never know it. He was a home owner and worked for the navy. He overdosed back in 1994. They found him with the needle still in his arm.

What I said was “10+% unemployment in BC in the 1980’s and there were still first time buyers. Just at lower prices.”

Lower prices than when? Well than when unemployment was lower before the bust, of course. Perhaps you didn’t notice that I was replying to someone who claimed that first time buyers would be shut out after a bust due to high unemployment.

In 2016 Fort McMurry was hit hard by the drop in oil prices and by a fire. There home prices have continued to fall while other cities have had massive increases in home prices. Fort McMurry homes that were selling at $700,000 then are now in the $450,000 range.

Fort McMurry is an example of what economists call “Dutch Disease” in that the community is almost entirely dependent on a single resource. Similar to China where a large percentage of its GDP is from real estate.

World economist warn that while Canada has a diverse economy, the percentage of GDP that the real estate industry adds to the economy is extremely high which puts Canada at a greater risk of a recession than other countries.

It’s important for all levels of government to push the narrative for more houses, more houses, more houses as it may likely be the only thing keeping Canada out of a recession.

From my memory , 81 hit the fan seemed every second house was for sale and people losing their jobs on tv . Having said that by expo 86 things had already been much sunnier. The 90s was worst decade of nothingness

Is there anyone left that remembers owning properties during the early 1980’s? I’ve interviewed a few baby boomers that had rental properties back then and for them it wasn’t so much the interest rate as it was their suites going vacant. People were leaving BC for jobs in Alberta and Ontario. And as the suites went vacant they took longer and longer to lease up and at lower rates.

But….. because of the high interest rate at 18 to 20 percent they couldn’t rent the suites at a lower price and make the mortgage payments.

They were caught between a rock and a hard place. Eventually they negotiated a quick sale or let the bank foreclose. This devastated their credit rating with some declaring bankruptcy. Their credit was screwed for the next decade.

Your recent comment was about the “lower prices” of “the 1980s.”. Which seems an inaccurate way to describe a decade (1980s) where prices more than doubled (2.7X) , and rose the most % of any of the last 4 decades. But yes, I agree with you that there was a price bust in the early 80’s.

Patriotz: “10+% unemployment in BC in the 1980’s and there were still first time buyers. Just at lower prices.”

I would like to know what percentage of home owners are addicts, and what percentage of renters/homeless are addicts. You would not be able to determine how many unemployed people are addicts, they don’t show up in the data.

These people must know going in that there is no coming back, that’s a given, everyone knows opioids will destroy you.

Seeing lots of sold signs , and that’s a good sign

dont forget where interest rates were in the 80s

48 unit apartment = 48 potential drug addicts. Good luck.

It was the over leveraged in the 80’s. It was the people that relied on real estate for a living that took a bath. Most didn’t though since we had a very robust natural resource sector. Forestry, mining, commercial fishing, oil and gas, etc…Even at 20% interest rates the majority made it out. Expo 86 helped too.

Short term absolutely no it doesn’t make any sense; however, in my opinion housing crisis will just get worse and worse and it will put upward pressure on rents. Interest rates will also likely come down.

Not much point in being a landlord these days for lots of people. Get all the stigma, tax hits, interest rate hikes, and work with negative cash flow and no appreciation near term. Good thing that the federal government is putting 1.5 billion into coops – maybe it will create 3000 new units?

I would not take on a non-conforming converted 1912 house. Way too much O&M.

There are about 25 multi-family properties currently for sale just in the Victoria Core. It seems like a lot of landlords are looking to get out of the business.

One can buy a nice five-plex character conversion in Fairfield for $1.8 million that’s about $350,000 a door.

Or you can buy a 48 unit apartment building along Esquimalt road for $11,500,000 or about $240,000 a door.

Heck of a lot cheaper than buying condos. But very, very few of them are selling!!!

Where have all the investors gone???? It does seem that more of them are following the Frank and Gambler plan as a lot more want to sell than want to buy.

And who exactly said it was? I have always referred to the early 80’s bust, in which prices declined 35% nominal and 50% real from peak. That’s a big deal. Particularly for the previous owners of the foreclosed house that I bought.

I doubt if there are any Bears left in Victoria. They have more than likely moved up island or to Alberta by now.

What I expect to happen is that we are going to have a rental market adjustment as the vacancy rate and bad debts increase. People like Frank and the Gambler will no longer want the problems and will sell adding to the growing inventory of housing.

One can think of the real estate market as a pendulum where it was once advantageous to be a landlord and now that pendulum has swung to the point that landlords want to get out of the business. It’s time for a new generation to take over the reigns as prices come back down to where it is again advantageous to be a landlord.

One can now buy a 1980’s two-bedroom condominium starting at around $400,0000. Two people using their RRSP contribution combined of $125,000, would have mortgage and strata fees of $2,200 per month which is close to what the condo would rent. if more Frank and Gamblers added to the inventory that would weaken prices and bring rents down too.

As I have said before, the key to the market is getting more of the old stock of properties onto the market. Only about 2 percent of these pre-owned properties are for sale at any time. If that went up to 5 percent most of the housing problems would go away.

Dad: I should have clarified that none of my mortgages are at the start of a 30 year term so I’m past the earlier phases of higher interest. Like I mentioned I’m sure some will face this but even in your scenario it’s an extra $650 a month and with savings, lump sum payment options and wage gains over the past five years I don’t see how people won’t make it work. Sorry bears, even 2026 doesn’t look hopeful for your crash.

Frank: I’m also looking at getting out of renting but can’t do it all at once with the capital gains hits

And re: elevators. I have friends with one and it’s also glass like that picture so you can clearly see if someone is stuck. They also never take it together as a rule, but they’ve said as long as you do the maintenance you’re supposed to they’ve never had a problem. Funny they sometimes just use it to move groceries and they take the stairs.

typically the cooperating commission is 50%

Renting to tenants is becoming a nightmare. After 35 years of few minor issues, things are now not worth the grief. Renters simply can’t afford the skyrocketing rent, utilities, etc.. As landlords like myself opt out, I doubt there are many investors that want to take our place as the entry level costs are too high and it doesn’t make financial sense. My properties are basically paid for (I maintain as smallish mortgage) and escalating maintenance, property taxes, and insurance costs are exceeding even the ridiculous rents people attempt to pay. Housing is completely f**ked thanks to excessive immigration.

It’s disturbing how much of our GDP is dependent on housing.

We keep flogging the housing horse to get another mile or two out of her.

Speaking with a property manager today. Rents are up, but so are the bad debts as tenants are having problems making the rent payments on time.

I am not remotely an expert on elevators but a couple of anecdotal encounters indicate there might be a couple of issues you wouldn’t immediately think of. I gather that even a private elevator must be inspected annually with an associated expense and maintenance. A bigger issue might be power. A friend went to install a car hoist and was informed that they fell under the elevator category so would require a 100% duty cycle for the load calculation. Along with a small welder and he needed 200 amp service for his hobby garage. Seems silly to me but if it required a service upgrade it would be another expense. My in-laws had a stairlift installed and none of these issues applied.

I’ll ask the question again.

As a seller, I can negotiate my agent’s commission.

Understood.

But as the seller, I also need to compensate the buyers agent.

How much is that?

Is it a % of the seller’s commission? Or is it something else? Is there a “standard” such as 3% of first $100k + 1.5% of the balance type implied fee?

My cousin’s daughter lives on the 8th floor of a condo building in Calgary. The elevator is going to be out of serve for months and she recently had a hip replacement. Luckily she a renter, I wonder what the assessment for repairs is going to be.

Good point. Hopefully they have some plan B built in to the elevator that gets someone out of a stuck elevator in their home. Given that the typical customer is an elderly person with mobility problems, often living alone, I would hope that they’ve got a solution for that. Like a panic button (or cellphone) with battery backup.

That IS a nice elevator! I have recently looked into this as my in-laws have an upside down house (kitchen, living room, their bedroom is all upstairs) and they both have serious mobility issues (bad knees/hips) that makes their house dangerous IMO. They admit that the stairs are a problem, but even when we suggested a stairlift, my FIL is resisting. He doesn’t like how that “looks”. He is refusing to acknowledge the reality of the situation (mid-70s and needs a hip or knee replacement) and they continue to suffer and gamble with their lives. I thought maybe the cost was the real issue, but then learned he just spent over $30k restoring a old vehicle to gift to their golden child. (Not my husband, and to be fair, my BIL would never have asked for it either.) My jaw literally dropped when I heard that because that would have paid for a fancy elevator like this in their home and then boom, problem solved.

12% unemployment means 12% of the people wanting to work that are actively looking for work. If you’re not looking for work but unemployed, you’re not counted in the 12% unemployed. So there are a lot less than 88% employed.

I am not aligned with any political party (and don’t a new government will actually do much) but nice summary in 3 minutes -> https://youtu.be/ZE1ha0L7160?si=TS-0lYYFPgladigP&t=54

I actually wouldn’t be surprised if bureaucracy is a higher input cost than labour in housing.

Vancouver house prices did well in the 1980’s. Much better than the 1990s and any decade following in % terms for example

Vancouver detached house prices more than doubled in the 1980s (+177 %). (From $90k Jan 1, 1980, to $250k Dec 31, 1989)

That’s a bigger rise than they did in the 1990’s (+56%). ($250k to $390k)

Same story for condos (tripled in 1980s (+200%) from $50 to $150k. And up only 27% in 1990s.

In percentage terms, the 177% rise in Vancouver SFH prices in the 1980s is the HIGHEST rise of the last 4 decades, beating 1990s (+56%),2010’s (+150%) , and 2010s (+74%).

So in terms of nominal prices , the full decade of the 1980s was no “bust” in Vancouver. It was more like the “Booming 1980’s – with the hugely successful Expo 86 (22 million visitors) in the middle of it” https://www.bcbusiness.ca/industries/general/the-booming-80s/

Attached chart shows Vancouver prices (dark blue = detached houses)

Want to read my post again? In the worst BC economy since the Great Depression, there were still first time buyers. That’s a fact. 12% unemployment means 88% employment.

And, you’ll note my comment was “if we are in an economy that is shutting down real estate” not the other way around.

If the economy is in the toilet, they are not buying houses. Noted the unemployment rate is currently over 6%. Those people are not buying houses.

Why? You think everyone’s job depends on RE? Guess what, they don’t.

10+% unemployment in BC in the 1980’s and there were still first time buyers. Just at lower prices.

What I’ve advocated is close to this, i.e. banning any tying of sellers and buyers agents commissions. The way things currently work the listing contract between the buyer and listing agent influences commission options between buyer and buyer’s agent and thus is a restriction on competition.

It should work like the stock market, where the commissions paid by buyer and seller have nothing to do with each other.

Gambler, “Oh sorry, the implied bear narrative is that my mortgage renewals will cost more than my current mortgage payments and I’ll be forced to sell because I can’t afford them anymore. Layered on that is many will experience the exact same scenario and be forced to sell and by extension making it a race to the bottom to sell and there will be discount prices everywhere…” I agree with where you are going here. The other point often missed is, imo, if we are in a an economy that is shutting down real estate – short of a few wealthy holdouts here on HHV – who is buying these properties in a crisis downturn? The first time buyers that are waiting for a crash will be switching back to kraft dinner. Buyers will have to have cash in the bank which your average millennial bear does not, imo.

Wonder how much of a selling point an elevator is these days? Is it a good alternative to a single story house for the elderly? Are there many of them out there? Imagine there are concerns about maintenance. If it breaks down are you left stuck for days.

Maybe it is time to consider banning the practice of paying commissions to the buyers agent. In effect, it has produced a monopolistic system where for all practical purposes the vendor is forced to pay a commission essentially set by the Real Estate industry. Let buyers negotiate whatever fee structure they want with their agent.

Negotiating a fee with your agent is a bit illusionary when half the commission is virtually preset since it is paid to the buyers agent. And before someone argues that this is how capitalism works it clearly is not. The government controls and bans all sort of monopolistic practices that result in de facto price fixing which this clearly does.

Politically this would bring a howl from the whole real estate industry. So its not going to happen.

And no mystery about who farted in the elevator.

Good idea. The problem of “ guaranteed no one will ever go for it.” could be solved by…

‘An alternative would be someone to offer same deal as above, except $6k flat fee, payable only when the house sells. Yes, if the seller agent get “fired”, the agent gets nothing. But that’s only if more than 16% of deals end up with no sale. Somebody firing an agent like that is likely going to pay more for a new agent, so they may think twice. At any rate, many RE agents have little or no clients, so something is sure better than nothing.

And the buyer agent should offer a similar deal. Flat fee $5,000 if you end up buying, paid by the BUYER, otherwise after a certain period of time (eg. 6 months) the agent bills the BUYER $40/hour for the time spent with the buyer. .if the buyer ends up buying, any amounts paid would be deducted from the $5,000.

With that system setup, the seller pays $6k flat fee seller commission, and $1 to the buyer agent, so total $6,001 commission paid by seller. The buyer agent gets paid by his buyers, who pay $5,000 under the deal described above,

And this is flat fee, regardless of home price. If a buyer agent refused to show the $1 commission homes to his clients, his clients could use a broker that did accept the $1 commission, in return for being paid by the buyer.

ECB cut interest rates today , funny how central banks move at the same time . A good read if curious where rates are headed

“Yes you missed “you still need to offer a cooperating commission”, which is what the buyer’s realtor gets.”

okay… i am in suspense. so how much is that?

is it a percentage of the Marko special “$5k upfront, full service” deal?

or something different? is this also negotiated?

It only takes a lawyer to buy or sell real estate. Realtor’s are a rip off. The only thing they have going for them is the mls portal.

Yes you missed “you still need to offer a cooperating commission”, which is what the buyer’s realtor gets.

Of course you don’t have to offer anything to get a buyer who doesn’t have an agent.

You can get some really nice looking elevators these days…

https://www.stiltzliftscanada.com/residential-elevator/

Marko

i get the “My offer stands on HHV ($5k upfront, full service, and seller pays expenses which are $500 to $2,000 depending on degree of media/size of home…”

is that it? how does the buyer’s realtor get compensated? am i missing something?

What is the cap on duration for this arrangement if no sale? 6mths, 1 year or indefinite?

Well if that were ever going to happen then it’s in 2026, not now. So bears will be waiting for awhile…

Yeah, this mindset is how many people end up staying in debt forever. (And then many of these same folks blame the government for ruining their lives and making them poor.)

I ran the numbers and I paid down 12.7% on my principal over my 5 year term that comes due in August.

Not sure I understand this. If you had a $500,000 mortgage amortized over 30 years with an initial 5 year-fixed term @ 2%, your monthly payment would be ~$1,850 and the outstanding balance at the end of the term would be ~$436,000. Renewing into another 5 year-fixed term @4.5% would bump your payment up to $2,400…unless I’m calculating this wrong or missing something, I don’t see how your payment goes down? Or do you mean the new monthly payment is less than it otherwise would have been (i.e., had the initial term also been 4.5%)?

Listing portion, you still need to offer a cooperating commission but heck if I am getting paid 5k upfront you can set that coop to $1

Yes, but if you are a seller makes more sense the more expensive the property is.

Maximum 7k on a sale for the listing realtor? Who wouldn’t take that? Like I said I’m loyal to my realtor but this is a hell of a deal. Is this for any property type?

Oh sorry, the implied bear narrative is that my mortgage renewals will cost more than my current mortgage payments and I’ll be forced to sell because I can’t afford them anymore. Layered on that is many will experience the exact same scenario and be forced to sell and by extension making it a race to the bottom to sell and there will be discount prices everywhere. While this is possible it’s unlikely. Like I said I did the math at a conservative rate for renewals (4.5%) and they’re all at least a few hundred dollars less due to paying down so much principle with low rates. I’m sure some will face this that are on variable and have been paying only interest, but I doubt it’s going to set a new floor on SFH. Just my opinion too of course.

You fall into 2% of people with common sense and you have experience with mere postings, 98% would not. My offer stands on HHV ($5k upfront, full service, and seller pays expenses which are $500 to $2,000 depending on degree of media/size of home), but guaranteed no one will ever go for it.

I only took one probability class at UVIC but even with a 50% chance of a sale in a tough market, for example, this type of setup would come out ahead of a traditional listing fee setup on any property over $1 million.

I am really curious how the market will evovle in the US with advertising of the coop being banned this summer. Huge media coverage for a few weeks and now not hearing anything about it.

I would agree to list on this basis NP.

Let me put it this way if someone phoned me and said “Hey Marko, I have a $5 million dollar home in the Uplands I’ll give you $5k up-front at signing of listing contrat (for traditional full service listing} and I’ll pay for the photos/video/floorplan/etc., and you can lockbox the house” I would agree to that arrangement 100%.

Reality is no one is ever going to e-transfer my brokerage $5k+expenses upfront without a successful sale.

Their thought process is agent isn’t going to do his or her job if they don’t have a commission to chase, I need a big international brokerage to market my home, etc.

Fundamentally problem is the seller doesn’t want a limited scope.

How were they going to buy it from under you if you are not selling?

Hence limit scope

Thing is some of those that update their instagram reels multiple times a day are very successful so it is a strategy that works well.

I am not sure re up island, looking at a sample size of listings listed today with the VIREB the coops are a mixed bag.

3.5% First 10K, 1.5% on remaining balance ****not sure if this agent made a typo re first 10k?*****

3.5% first $100,000/1.25% balance

3% $100k & 1.5% on remainder

3% 1st 100k 1.5% on Bal

3% 100K/1.5% bal

3.5 100/1.5 Bal

$4500 ****yes, you can offer an absolute amount if you want***

The two most common appear to be 3.5%100k+1.5%balance and 3.0%100k+1.5%balance (multiple those x2 for the gross and nither add up to 7%100k+3.5%balance).

That doesn’t sound like much of a friend at those rates. My experience has been more along the lines of what Marko described as I’ve dealt with the same realtor for multiple transactions and have had everything from $1000 back to zero commission taken. I think they know I’d never fire them (mostly due to the competency and guidance over the years) but also just because they’ve become loyal to me the same way I’ve become loyal to them. I’d rather have that than any luxury agent that updates their instagram reels more than communicating with their clients.

Oh yeah and thanks for the comments on the renewals comments. I’ve also wondered how the bears thought they’d swoop in and buy my properties out from under me and good to see others grounded in reality feel the same.

Nothing says BFF like $50,000 commission.

Email around. It’s highly probable that you can do better than that.

I understand, it’s crazy. Would gladly use your services if you were up island.

But in your absence, I’m looking for what Realtors consider to be ‘normal’ or ‘average’ commission these days.

These HHV stories of “friends” that keep popping up are absolutely mind boggling to me 🙂

I sold a $2.235 million dollar house last week for a friend I graduated from Vic High with for $5k (listing portion) and I am really happy with that [difference from my comments below is 99.9% certain he would never fire me as common sense business owner – understands it comes down to asking price].

We are about to list up island. Our friend is a realtor and they are quoting 7% (first $100k) then 3.5% on the balance for their commission. Is that high? I thought 6%/3% was fairly standard.

The market takes down the price. In my opinion, it doesn’t make a difference who the agent is if some sort of minimum level competency is met. Right now, you have higher end properties that are on their very third experienced (1000+ career sales) agent and property still hasn’t sold.

This one I assume? First listed for a million+ over assessment. “Luxury” realtor took the ask down by a million and a half.

https://sothebysrealty.ca/en/property/british-columbia/region-greater-victoria/oak-bay-real-estate/1405575/3550-beach-drive/

https://www.bcassessment.ca//Property/Info/QTAwMDBIUThSNA==

I did a listing presentation on a $4 million dollar property two weeks ago and the six comparables I had all sold for >500k less than original (not to be confused with current) asking price.

I get that it is pretty hard to value higher end properties, but it’s a bit mind boggling that someone lists for almost double market value.

Not going to get 5%+ on a GIC over that term, plus it’s taxable. Using TFSA if contribution room available solves the latter but not the former.

I won’t negotiate on higher end properties, odds of getting fired extremely high right now so you have to build that into your business decision.

A property sold last week in the Uplands for $2,700,000. It was first listed June 2023 for $4,980,000. The first agent got a couple of price drops then that agent was replaced then the next agent got a number of price drops, etc., until it eventually sold. Do you think the first agent was the problem or maybe it was just the asking price?

The problem is 98% of consumers have no common sense (and it doesn’t improve with high networth for some reason) and I work under the umbrella of a very small no-thrills locally owned brokerage. If I list a $4,000,000 property and it doesn’t sell in six months the odds are the seller fits the 98% mold and will be talking to a friend, family or acquaintance who will say “I’ve never heard of this Fair Realty brokerage, no wonder your property hasn’t sold, you need to list with Bob from XYZ luxury brokerage so they can fly in foreign banned buyers to buy your property.” Reality is Bob from XYZ luxury brokerage is using the same photo/video person as I am uploading it to the same MLS system, but people believe the smoke…I like to call it fog.

I eventually get the can and I am out expenses and then they re-list with Bob from XYZ brokerage from $3,500,000 and lower the price with him or her down to $3,000,000 and eventually sell for $2,700,000.

If sellers were down with giving me a $5,000 non-refundable “retainer” I would discount higher end properties, but let’s be real that will never happen.

People also talk a lot about saving money on real estate fees but when it comes to luxury sellers always go with agents associated with “luxury real estate.” That is why I am asking Barrister who he used to purchase, I am curious. I am betting it wasn’t Suzy’s locally owned 50% cash back to buyers brokerage.

Why not just keep all that extra money in a GIC and then do one big payment at renewal when your term is over?

Primary through TD. I am guessing banks are going to want to capture business from those people that want to play the BOC game going forward; therefore, they will increase discounts on variable to be competitive for this business.

I renewed almost exactly a year ago from a variable to a 3 year fixed at 5.14%. Since then I have increased my payments and done a lumpsum so that when I renew in July 2026, I only have 3 more years to go (down from 4 years). Between years 5-10 of owning this house I had my eye on “upgrading”, eyeing bigger houses, nicer areas, imagining what it would be like to have an ensuite, a bigger eat in kitchen, a flat lot, etc. But that was when it felt like I would be paying a mortgage forever. Now that the end is in sight (5 years!) I’ve since switched my mindset and accepted that this house will be a great retirement house, location and size-wise (the only caveat would be the stairs) and we’ve instead focused on making upgrades that will preserve it’s lifespan rather than “will this appeal to a future buyer?” There’s a sense of freedom in that.

Marko- Is that a fixed variable or open variable? The open variable was quite high. What term is the fixed variable?

you named some below, no open houses, do your own pics, no extra marketing, not be present for any showings. Essentially have the agent upload the write up and pics you have provided to the MLS then act as a mailbox for showings and offers. Sounds like you should get her to call Marko and negotiate something between his flat listing and full service.

VicRE: Can you clarify decrease the scope of the agent? At this point, I have told my neighbors daughter who is staying in the house since dad is moving into a nursing home to just have the agent do a single open house for agents and not bother with open houses, forget about fancy advertising packages of any any type other than MLS listing, have the house professionally cleaned and get rid of clutter but what sells the house will be price. Between deferred taxes and lines of credit and other debts getting the maximum out of the house is really important balanced against a limited time to sell. Any other suggestions would be helpful. All valuables have mostly been removed so showing through a lockbox without the listing agent present is fine with her. She also has a valid power of attorney and has contacted a RE law firm here. But at some point sooner rather than later she does have to return to Toronto.

This is for rental or primary?

Decrease the scope of the agent and discounts will follow.

Thank you Marko for your helpful insight. I was more curious as to the present state of affairs. But as always I do find you comments extremely helpful. In any event, we are not putting our home up quite yet and I was asking for my neighbor who is selling after his wife passed away.

But thanks for the cheerful and happy advise anyways.

I think you have plenty of experience with real estate agent discounts, you’ve boasted a number of times when you bought you negotiated seven crates of wine. Perhaps you can share the name of the agent you used that was so amendable to such?

On a different note, when one is selling ones house what sort of discount can be arranged for your real estate agent. I assume you dont want to reduce the commission of the buyers agent and create a disincentive there.

As to your agent is the commission a lower percentage or a flat fee. I am assuming that the discount is larger on a 4mil house than a one million house. The amount of work on each is not very different.

I assume that the “top sellers” are not interested in discounting so I imagine the hungry young ones might be.

Does anyone have any insight or any experiences with this?

Personally my mortgage is coming up in for renewal in August. I am going to go with variable (6% or 5.75% depending on what happens in July) product that includes some cash back, and zero fees to convert to fixed. I wouldn’t worry about gouging you can just pay three months interest and go elsewhere, I would think the bank you are with would be very competitive to tie you down into a 5 year fixed and most banks you can convert painlessly over the phone.

and then I’ll just see how things play out with BOC decisions/bond yield.

Same bank offered me 6.47% on a one year fixed so the variable seems like a no brianer. It would appear some banks are starting to be aggressive/push the variable product again.

From the BOC statement, it’s clear that they are expecting more rate cuts to follow this one. These two statements below make that point.

https://www.bankofcanada.ca/2024/06/opening-statement-2024-06-05/

“ But total consumer price index (CPI) inflation has declined consistently over the course of this year, and indicators of underlying inflation increasingly point to a sustained easing.

If inflation continues to ease, and our confidence that inflation is headed sustainably to the 2% target continues to increase, it is reasonable to expect further cuts to our policy interest rate. But we are taking our interest rate decisions one meeting at a time.”

In March, I went from a 1.89% to a one year 6.49% fixed at RBC. The Homeline plan I have is essentially a line of credit secured by my property. They advised me that I can renew without penalty in 6 months, and that’s what I’ll do while rates come down. So in 3 months I’ll take out another one year mortgage that I’ll renew after 6 months. Not sure if this is available at all banks. The line of credit is only 25% of the value of the property. The open variable rate they offered was quite high, so I went this route. Long term fixed variable was lower, but you’re locked in.

In light of the rate decrease today, what are everyone’s thoughts on the best mortgage products right now? Selfishly assessing for my own circumstances, I’m curious whether a 3yr/5yr fixed is the right move or whether variable makes sense if we’re beginning the downward trajectory.

I’ve also heard of people converting their existing variable terms to fixed midway through, but that seems dicey given that you have to stay with your current lender and they can basically gouge you.

Introvert! Haha. Love the blog and the long format.

Leo busted out approx. 12 tweets today, including one in which he quotes from a 1926 Supreme Court document.

Sadly, he shared nothing with us on HHV. How long before he pulls the plug on this blog and its 27 readers to devote 100% of his housing nerd energy on X.com where he has almost 3,000 followers?

There are 108 downtown condos and 417 rentals of all types within an 8 kil0meter radius of downtown for rent on Craigslist.

The average downtown one-bedroom condo rent is now $2,140 per month ($1,700 to $2,900). Two bedrooms average $2,872 ($2,550 to $5,500)

Lowest priced bachelor in the Janion at $1,550 per month

A three-bedroom within 8 kilometers of downtown averaged a ($2,550 to $4,500)

Really surprised with the range in rents. In general, the higher the rent the longer they have been listed on craigslist. Lately I have been finding Craigslist more expensive than property management companies..

Thanks, still think they should be holding interest rates, but I will take advantage of the drop. The return of inventory and selection paid off.

Thanks

At a medium pace, unless inflation takes off again. Hopefully they are not repeating the Jimmy Carter and Trudeau senior era inflation right mistakes.

Thanks, it was an extended process, but the right place, in the right location, and at the right price or close enough (less would have always been better).

It has an 8′ ceiling height loft with very easy to traverse stairs with 7″ risers and 12″ treads that doubles the size of the space. The oversized (530 sq/ft) two bay garage in the main house will always be mine. I will never surrender that space. Under the 18’x18′ existing deck is another 325 sq/ft of added space to the lower suite of the main house.

I don’t know, maybe we will go for the lower suite in the main house.

So you and your wife plan to spend your retirement years in a 40m2 garden suite? I suppose that is fine if you plan to live majority of the year somewhere else. But if its full time, isnt that space a little small?

This is what they really want. Its very important to have an architect involved. This is the plot plan…

It only cost me $600 for three sets of plans.

This is why I have do another 5 year fixed In late November 2025…

I would be mortgage free right now. But in late 2020 the 5 year fixed rates were at 1.86%. I refinanced 80k and built a garden suite in my back yard. It was free money. I couldn’t refuse. So here I am looking at another 5 year fixed in late November 2025.

Not yet and there is a difference between actually working versus being on payroll.

Interest rate cut just announced. 25 basis points.

in 2008/09 people were waiting for the south Oak Bay SFHs for 600K 🙂

People will be renewing pandemic era ultra-low fixed rate mortgages over the next couple years. Even if 5 year fixed rates come down to the 3 to 4 per cent range over the next couple years (seems plausible), that’s a jump if you were previously at 2 per cent. On the other hand, after 5 years of wage increases, seems like most people will manage fine.

I never bought the bear narrative of rampant foreclosures, enabling the bears to swoop in and buy five of houses or whatever it is they think they are going to do.

Nope, but they can be on the payroll to manage the rental properties going instead going forward 😉

I have friends that live across the CRD and they’re all pretty nice people, but what I will say is that people living in the core are more likely to go out of their way to criticize the West Shore and I see less of of that shade being thrown the other direction. Just an observation.

In other news with the rate cut, albeit a small one, is anyone questioning the narrative that seems to be everywhere about rate shock on mortgage renewals? I feel like the people pushing that boogeyman narrative online fail to take into account the current low rates and the principle being paid down. I’ve run a conservative estimate on renewals coming up and they’re going down in payment amounts.

Tell me you are first or second-gen immigrant from Asia/SE Asia without telling me. It is a very big accomplishment to do this.

Elaborate. I don’t want a hopped up F-150.

Max , now is the time to borrow against your property and leverage up .

Amusingly, Victoria gets the same annual rainfall as Oakland. Just a wildly different distribution.

http://www.worldclimate.com/climate/us/california/oakland

—

And congratulations Umm on the accepted offer! Wonderful news!

damn straight it is. Get that shit behind you as soon as possible.

I was happy to hear about the cut. My next and final renewal comes up November 2025.

So does your dad still work for you, or no?

Whoever said this needs to learn to pay more attention to what they are reading.. and also lighten up.

I took it that barrister wasn’t speaking literally, just making the point that Leo’s “build, build, build” advocacy may be frequently aligned with the same interests as developers. So what. I don’t think Leo would disagree with that.

And introvert was just confirming that Leo isn’t a paid lobbyist by saying he’s a volunteer for the ”good guys” at homes for families.Which is all true.

For me it’s retiring my parents early.

Buying back your time early in life is an achievement in my books.

I wouldn’t know!

In actuality, I think Leo’s housing arguments are pretty sound. It’s just that we have different preferences for Victoria’s future. Leo wants to jam-pack as many people into the region as fast as possible, and I don’t.

Money to buy a fancy new bike -> great

Time to go for a ride with the bike you already own -> priceless.

Bobby K kind of nailed it. There’s tons of nice stuff on the Westshore – stores, schools, access to the outdoors. But they are on average more car dependent areas and that changes the feel of the neighbourhoods.

Of the newer hoods I agree Royal Bay is great. Close to the water, shopping being developed right there, great access to walking trails.

Which, if accessed, would show that the random thought I generated is a fact. I don’t dispute that the climate is warming, and that the heat waves we experience are likely to get hotter over time.

Neither Barrister nor Introvert actually believe Leo is a lobbyist for developers. It’s just a shortcut to discredit his views without having to engage with the substance of his arguments.

I get my climate predictions from the Farmer’s Almanac, it’s always wrong.

1) Senior executives tilt older than junior employees, so at root this is just another version of “kids these days”

2) I’d bet good money that senior executives in the 1920’s were disappointed with lazy workers advocating for five day work weeks

Most people don’t get the value/joy they think they will from expensive depreciable assets.

We all have access to past climate data AND future climate projections based on science. All at your fingertips. Now that is progress from the days when people could get away with saying stuff based on their random thought generator.

Here in good old Gordon Head, we have one 19-year-old Toyota and are a few months away from having a paid-for house.

The way I look at it: there is a time for toys, and it’s not when you owe $500K to the bank.

The [CRD’s] past – defined as 1980 to 2010 in the report – typically saw 12 days a year where the daily high topped 25 C. The number of annual days exceeding 25 C is expected to triple by the 2050s.

https://www.vicnews.com/local-news/greater-victoria-projected-to-face-worse-heat-waves-more-extreme-rain-7333874

Sure, but part of what you’re buying into in a place like Oak Bay is showing that you’re really not into cars. Goes for any walkable neighbourhood in larger cities. Whereas those in cheaper areas have more of a need to boost their egos with their wheels.

@Deryk Houston

No, I don’t take the possibility of world war 3 into consideration when investing in real estate. If WW3 does break out I expect real estate, world wide, would take a big hit depending on where the actual fighting was occurring. A war in Europe would be vastly different than one in North America. for housing prices in Europe vs North America.

However I think the likelihood of an actual large scale world war is low. Countries like to talk a big game but a world war would crush certain economies which few world leaders actually want. China will likely take over Taiwan eventually but would the rest of the world actually do anything about it? No, they wouldn’t. Hence why USA and Europe are building huge chip manufacturing plants elsewhere, to reduce the reliance on Taiwan for semiconductors. Russia can’t even beat Ukraine. Russia’s cyber attacks are stronger than their military.

Heat waves and cold snaps have always been regular events here.

+1, based on my observations of constantly being in different areas showing properties, the average cost of a car is often higher on a street in Kettle Creek in relation to a street in Oak Bay. Drive through Kettle Creek sometime; loaded F150s, Teslas, SUVs, etc.

you can find the opposite on bear mountain folks up at jacks…..

New immigrants who know nothing about the school quality care about the school rankings from some institution. Immigrants are going to buy up the housing price if they choose the location for school quality.

Talk about stereotypes.

What I can say as an Oak Bay resident is that I really appreciate access to the Oak Bay dump. Now that is a perk.

My neighbours are nice. None of them are ostentatious- they drive small modest older cars and do their own yard work like we do. If they sold their houses they would have their home equity, but I don’t think they are “millionaires” otherwise. In both of the homes across the street the adult children/grandchildren are living with their parents. I’m sure there are opposite examples to be found, and the same in many areas, but not what I’ve experienced.

I like Oak Bay because it is charming, quiet, safe, walkable, has little traffic, enough shops, is far enough but not too far from downtown, and has lots of parks and waterfront. Fairfield is similar. Oak Bay has leaned hard into stopping development historically so we’ll see what happens next.

Northern Canada was 3 degrees warmer in 2023 than the 1991-2000 average. Quite possible the VI average temps will rise 3.5 degrees by 2050. And you are looking a heat waves and cold snaps as regular events. Already here. Average doesn’t help you when it is 40 degrees or more and you have no AC or -20 and you have electric baseboards and poor insulation.

https://www.bcclimatechangeadaptation.ca/library/vancouver-island-adaptation-strategies-plan/

Possibly, but aren’t we looking at a degree or two increase in average temperature over a period of many decades? I doubt most people would even notice that.

Whatever , with todays cut and the boc saying more on the way , I too was thinking when are the banks are going to start to pump. They have been quite the last couple of years , but who knows maybe the fall market might be busier than expected. The realtors in this weekends opens will be pumping the rate cut

Why do people want to see their home prices rise?

Because those that have the most toys when they die – wins!

Quite right, but I would say that if you want anything out of your house beside a place to live, you are an investor.

Cool marine air is going to be valued by people more and more as summers, on average, get hotter.

Now let’s see how the lenders respond to the interest rate cut? The rate cut will lower someone applying for a loan payment by about $15 a month per one hundred thousand.

Lol, does anybody actually pay attention to these Fraser Institute rankings anymore?

With Oak Bay, you are buying history and name recognition that adds another 15 percent to a lot’s value over one in Saanich East.

Myself, I prefer Cadboro Bay, Rockland, Arbutus, and Ten Mile Point over Oak Bay as you get more value for the money.

If you are buying in Oak Bay, you are buying for prestige and you will find yourself surrounded by others that place a value on impressing others with wealth.

I’m not a big fan either, and you get the best of both worlds by moving inland a little bit imo. Big difference in summer temps between the University of Victoria and Gonzales Point, for example, but not much difference in annual precipitation.

Umm really , congrats now u can ride the interest rates down

Congrats!

Bobby, lots of folks are hobbled with debt that are being slammed , the most vulnerable get hit the hardest when we raise rates to beat down inflation. Yes imo real estate prices will more than likely go up as interest rates come down , but then real estate has always just gone up .

Hey, that’s great to hear. Congrats! How is the world lookin’ so far from the other side of the owner fence?

Because it is part of your net worth and most people would like to see it go up and not down….

It is… Just got an AO a few days ago….

We will most likely now see other countries move on interest rates in the next month or two . Sunnier days ahead for everyone , now what to do with mortgage hmmmm

Yes I was 1 month late on my call for the .25% cut…..

Thurston, as I’ve mentioned before I can’t understand why most people would like house prices to rise other than investors. I hope for people possibly like yourself who are just hanging on with variable mortgages are able to get some relief but any future rate cuts are going to rely on US economic weakness and rate cuts. The rate cuts may come but will be due to continuing weakness in the economy which will lead to weakness in the housing market.

I agree with Marco, royal bay is about as nice as your going to get given the cost of land these days, it appears that most lots are in the 3000 to 4000 sq foot range for single family homes which is part of the reason why prices for most homes are lower then the cost of just the lot in the core. If I had to live in the west shore and worked from home royal bay would be high on my list.

Colwood and Langford are like Langley vs Vancouver West Side and West Van. Not many people choose to live in Langley and beyond other than for affordability. Traffic is already very bad at times during the day and is going to continue to get steadily worse in the west shore, similarly to Langley. That sense of calmness in most of Fairfield and Oak Bay is the opposite of the frantic energy of living in a car oriented suburbs such as Langley and the west shore, just look at the letter introvert posted on horrible sooke and west shore traffic issues to get a taste of the future.

I can’t comment on schools other then to say I have heard first hand that violence and other problems like drugs are more prevalent in the west shore vs core schools like Oak Bay and Mt Doug, which should be a concern when parents are choosing where to reside.

Nice to see the rate cut . We know what the future looks like going forward , it’s time to juice the market

A complaint from Sooke leads off today’s letters to the editor:

https://www.timescolonist.com/opinion/letters-june-5-do-something-about-congested-sooke-road-limit-tax-increases-dead-zone-for-cellular-8985688

Barrister, ask VicRe, but take his call with a grain of salt. He bet on the bank staying put today.

BofC drops a quarter point. Not a real surprise. The real question is one or two rate cuts before year end?

Anyone knows why Mount Douglas High School’s ranking is only 4.9/10 now?

I don’t think anyone “wins” a war.

Andrew Coyne of the G&M has put the case that WWIII has already started. The major powers are well aware of what a direct confrontation between them would bring, so they wage the fight on smaller fronts. Which is not wholly different from the old Cold War days (e.g. Vietnam War) but more diffuse.

I think that the West has the resources to win this Cold War for the same reason it won the last one – the other side is fundamentally weak and is making the same mistakes (e.g. Russian empire building). But it will require strength of will.

I would expect massive debt spending on another wasteful war. That could increase rates which would devastate our economy and housing market. On the other hand, Canada would be viewed as a safe haven (hopefully) and money could flow in from foreign countries. That could have the reverse effect. There’s only one way to find out.

I’ve been following the comments on House Hunt Victoria for years because I like to keep a pulse on what is happening in real estate in Victoria and area. Certainly lots of topics covered and I value it very much.

One thing I don’t see talked about very much is the state of the world and how close we could be to WW3. (within 2 – 5 years )

I hope that I am wrong of course, but what I would like to know is what happens to real estate if we cascade into war.

I’m not really looking for a discussion on whether war will break out or not.

What I am looking for is what people think will happen to real estate, world wide, if it does and is anyone taking that into consideration when they invest in real estate.

For what it is worth even if you think schools are better in The Core now compared to Westshore I doubt that will be the case twenty years from now. Younger teachers can’t afford to live in The Core with how expensive housing is.

For 1.1 – 1.2 million I could buy an excellent 4+ bedroom home built in the last 15 years that I could have kids and live in for the next 30 years. By then who knows what will happen to prices by then.

I hate rain, and there’s a big difference, almost double the rain in Langford (45 inches.year) than Victoria or Oak Bay (24 inches).

This is because of the protective Olympic Rain Shadow

The difference also means more sun and less dreary days. All documented here https://www.olympicrainshadow.com/olympicrainshadowmap.html

Annual rainfall by city … Langford 45 inches, Victoria 24 in. https://www.reddit.com/r/VictoriaBC/comments/hbl0re/how_rainy_is_victoria_compared_with_other_cities/

I spend half my summer in 35 c + weather where you can’t go out mid-day so I personally really like the cool marine air as a contrast.

and Oak Bay doesn’t work for me either for other reasons but you can’t deny it isn’t very nice. At the end of the day the market sets the price and South Oak Bay is very expensive for good reasons, imo.

Marko – ask VicRE. They have made the call. For shame if they made the wrong call.

Lol

I graduated from Vic High and I believe at that time Vic High was ranked 256 out of 264 high schools in BC. I think only 56% of my glass graduated, we had a daycare on site, and all in all I really enjoyed my time at Vic High and two of my best friends are still from Vic High days and very successful (one owns a business with over 400 employees).

You could skip class and smoke or you could apply yourself a bit, the teachers were totally fine. We had kids scoring 100% on the provincial exams in math/english/etc…(I wasn’t one of them).

I’m not a Royal Bay person so maybe my opinion doesn’t count here, but South Oak Bay would not be on my list if money was no object. I like daytime highs to be in the mid 20s during summer. Might sound dumb, but the cool marine air would be a dealbreaker for me. Different strokes and all that.

Neighbours to the left of me are both school teachers and parents. Neighbours to the right of me are both RCMP officers and parents. They are both really good neighbours to have. Are they bad parents for choosing to live in the westshore?

How many hours until the BOC decision?

I like how there is no middle ground in any discussion/opinion anymore 🙂

I am a huge fan of Royal Bay, I’ve had 15+ clients buy pre-sales in Royal Bay. This video on YT I posted more than 7.5 years ago from Royal Bay, there was barely anything there -> https://www.youtube.com/watch?v=66bbwfW6Td0

Also bought a few lots off Gable Craft and built/sold SFHs in Royal Bay. I think it is great for families and especially for those that don’t have to commute into town everyday. For a few years Royal Bay was cheaper than Westhills and I thought that was a an amazing value given the proximity to the ocean, etc. I remember one of my clients bought a home on a 8,000 sq/ft lot (they had some big lots in the first phase) for something like $519,900+GST.

All in all, no need for core people to s*** on Westshore as there are some really nice areas, modern schools, amenities, etc.

As far as the Royal Bay people, while I really like it for what it is, common, if you’ve spent any time in South Oak Bay riding a bike or taking your dog for walk up to Anderson Hill Park you have to be real, if funds/affordability weren’t an issue 95/100 people would pick South Oak Bay over Royal Bay/Westshore.

That being said there is nothing wrong with not having a budget (or just not wanting to spend) of $2.5 – $3 mill for a new home in Oak Bay and buying something in Royal Bay for $1.2 million.

and if I can throw in my stereotype, if I am being tailgated by a Dodge Ram I am willing to put a lot of money on the line that the location is somewhere on the Westshore, not Oak Bay 🙂

(I have zero desire to live in Oak Bay even thought I could easily afford to, but it is very nice and I have to agree with VicREanalyst in that many people would probably move into the core if affordability wasn’t an issue)

IMO, the only legitimate concern that many West Shore schools face is overcrowding.

If I had kids, I think I would have seriously considered home schooling. I’ve always been self employed so I could have set my own hours. They would have been involved in community center sports and enrolled in music lessons. I would have stressed the basics and let their interests guide what subjects they would focus on. Each child deserves a curriculum that is suited to their strengths. I’m not confident that our education system is doing a proper job in teaching what is most important. Instead, they seem to be preaching an agenda.

Kinda went downhill when Nando’s closed

I dont see anything wrong with the Westshore and it offers a good selection of housing, jobs and shopping.

Honestly this class warfare is revolting. There are many schools in the Westshore ahead of ones in the core in terms of quality. There are lots of good teachers and classmates and it’s ignorant to suggest otherwise. I literally don’t know anyone in Royal Bay who wants to move to Oak Bay or any of the other bays because we like it here. And I paid more for my house than my friends in Oak Bay and my house is nicer. Whatever, there’s barely any difference between the places and it’s desperate white privilege trying to maintain old Victoria snobbery. I get VicREanalyst carrying on cause it’s a troll persona but the rest of you should be thankful for the stolen Indigenous land you have and stop trying to attach your petty snobbery to parts you don’t live in. Going to go back to ignoring this site.

100%

I don’t think 50 is in the cards.

And one more sleep till a 50 point cut interest rates

April stop arguing with the other side , we still need you in oak bay

Do you have listings in those areas?

Whatever Karen, send them to vic high.

School quality is not about the buildings, it is about the teachers, classmates, and their parents.

I am not the one you need to convince, you need to convince the majority of your fellow westshorers with dreams of moving to oak bay, cadbro bay, cordova bay, broadmead etc.

I’m sure Glen Lion Norfolk on Beach drive wouldn’t take April with her middle class income and all.

So you can rub shoulders with elites like April. Who wouldn’t want to do that?

This is a really dumb comment.

A lot of people work in the westshore and never have (want) to leave, because everything is here.

Why would we go to town? Beacon hill park? Butterfly world?

We used to go down town to catch a movie, But now we have the best cineplex imax in town.

Lmao, cope at its finest.