January: Anecdotes and data tell different stories

It was an interesting if confusing month in the world of real estate. The twittersphere was dominated by positive anecdotes in multiple markets, with stories of multiple offers and an increase in buyer and mortgage activity, but the data (at least in Victoria) remains just as sluggish as before. Total sales of 278 were down 41% from last January, while we had 16% more new listings and inventory was up 133% from a year ago. As far as January goes, that’s one of the slowest on record, matched only by the 277 sales in 1995, and above the record low of 247 in January 2009. In 2009 it turned out to be the bottom of the brief price correction and start of a bull run, but unlike today, rates had just been dropped to the floor by central banks.

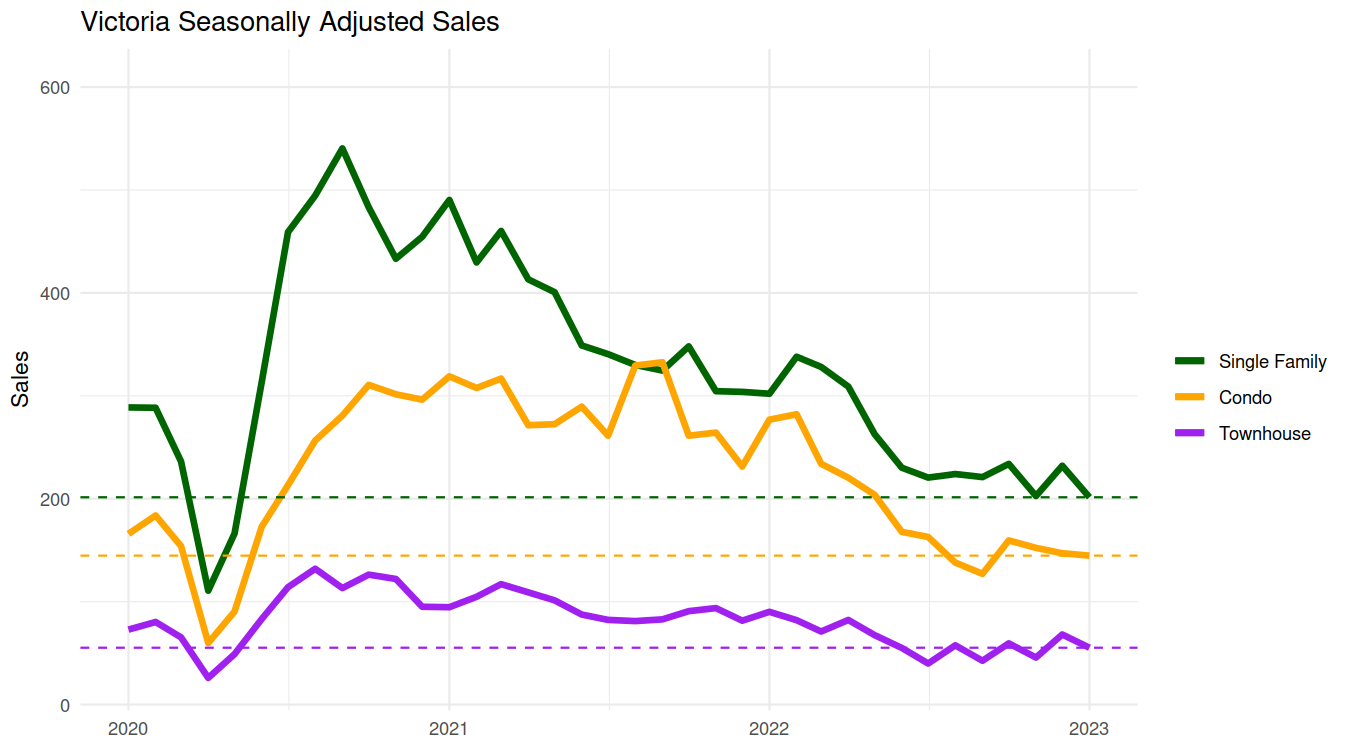

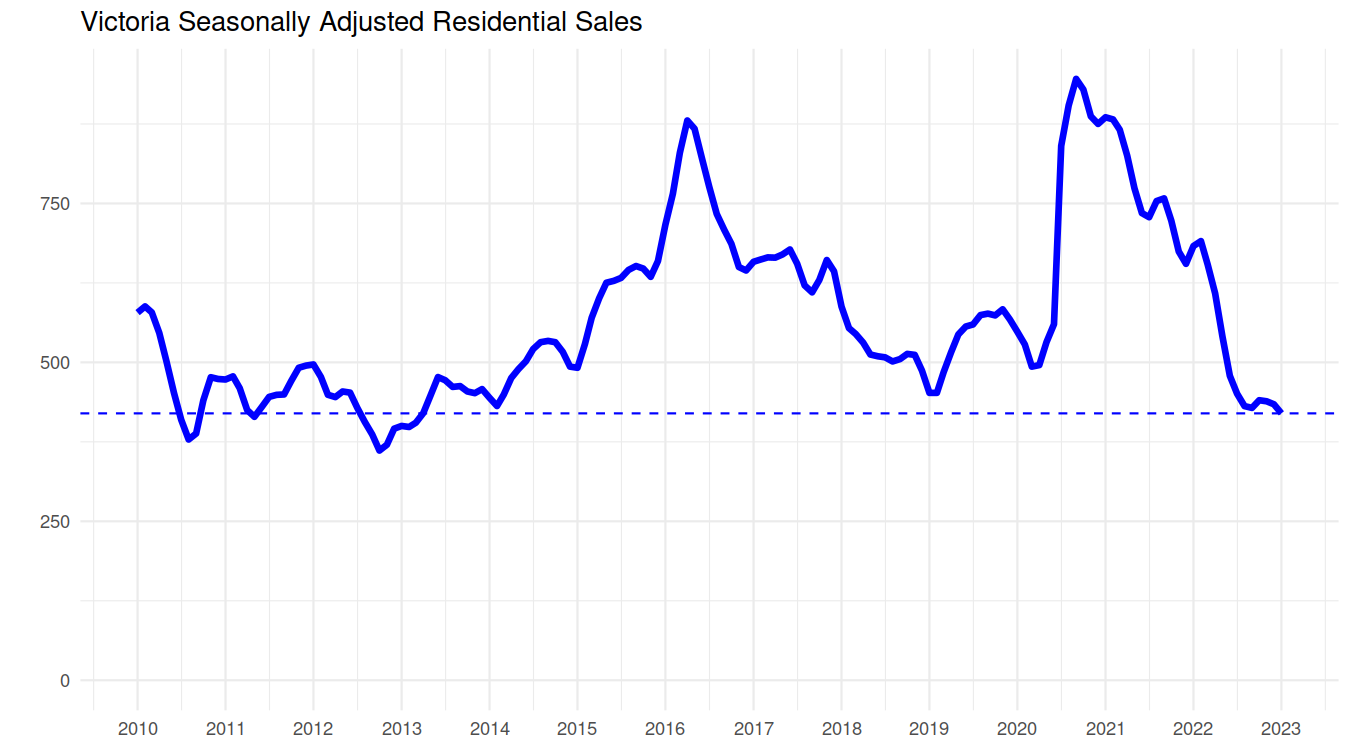

More interesting than year over year data is the current trend though, and sales have remained at the low but stable level that we’ve been at since the middle of last year, with little change in any category from December.

That’s also evident when we combine all residential sales. We’re at sales levels we last saw in the buyers market a decade ago.

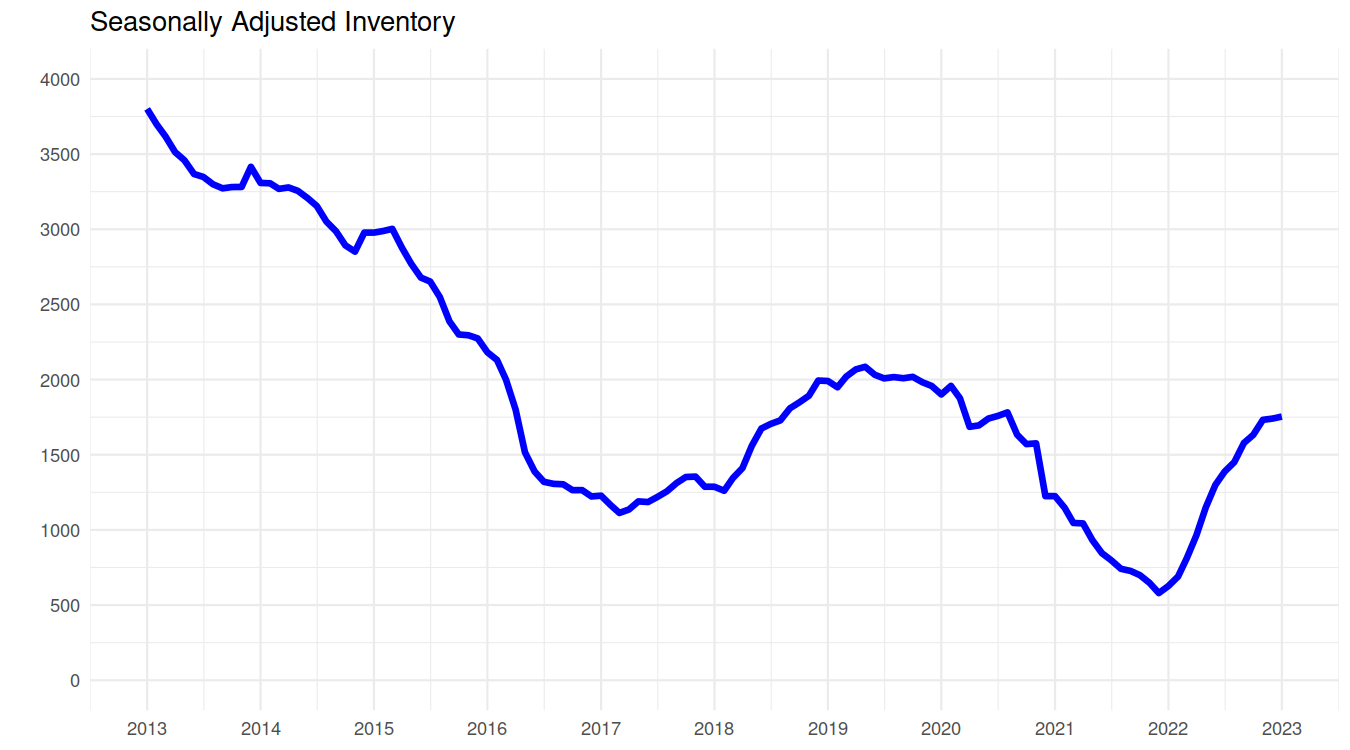

Meanwhile inventory continues to increase on a seasonally adjusted basis, but only very slowly. That’s quite different from early last year when it was shooting up, and we remain at about half of the level of the last true buyers market.

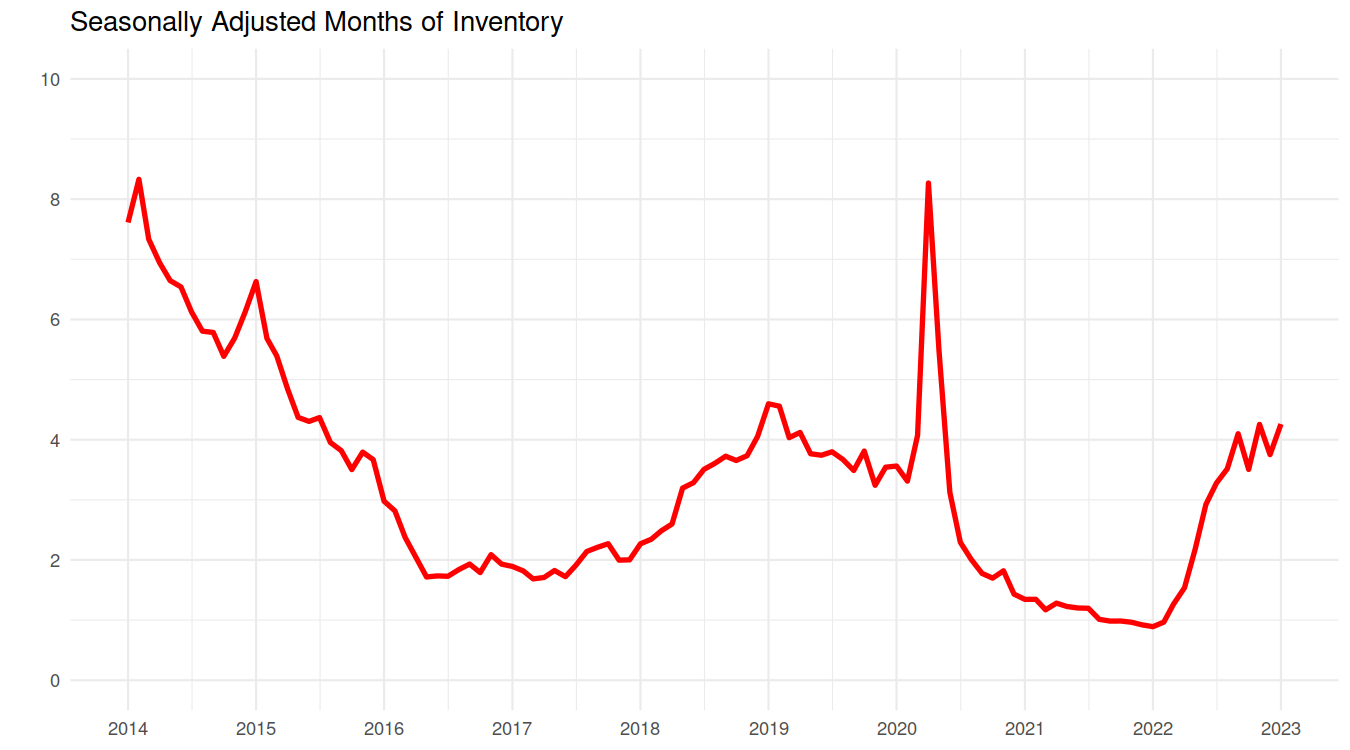

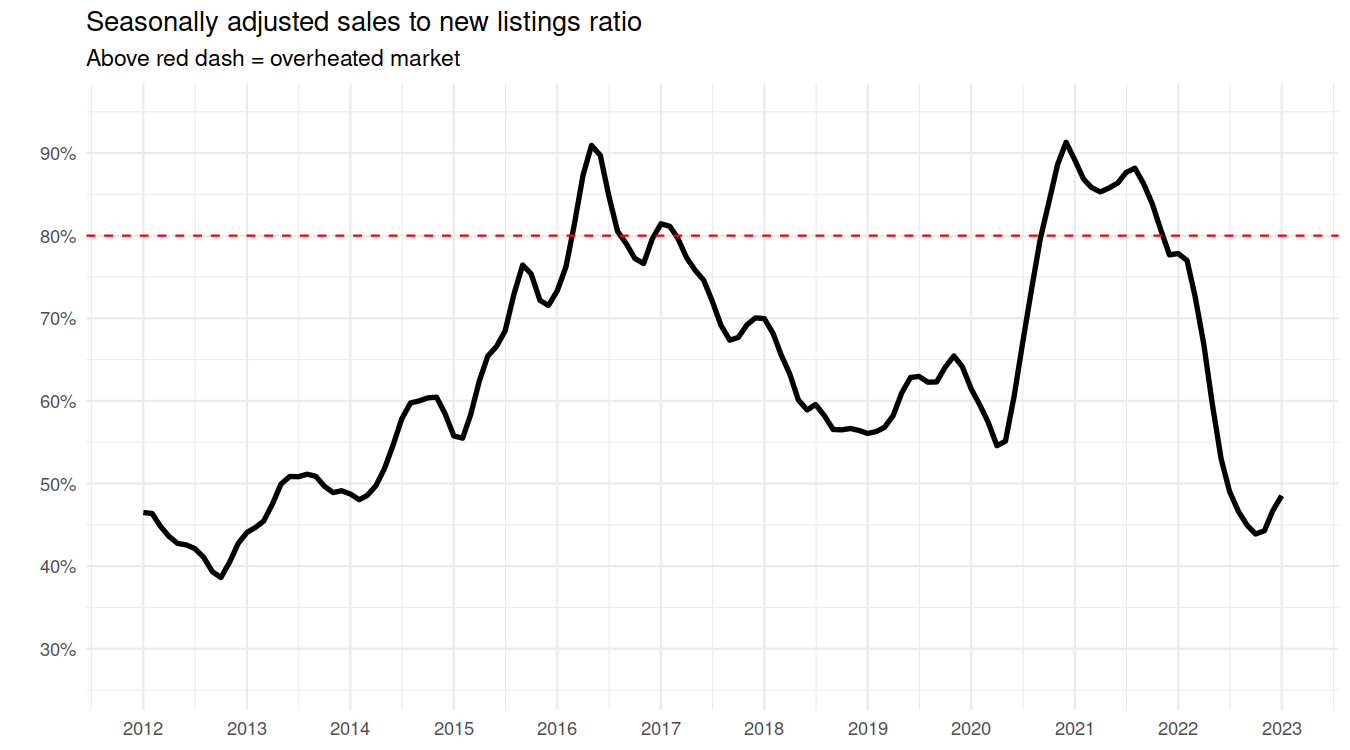

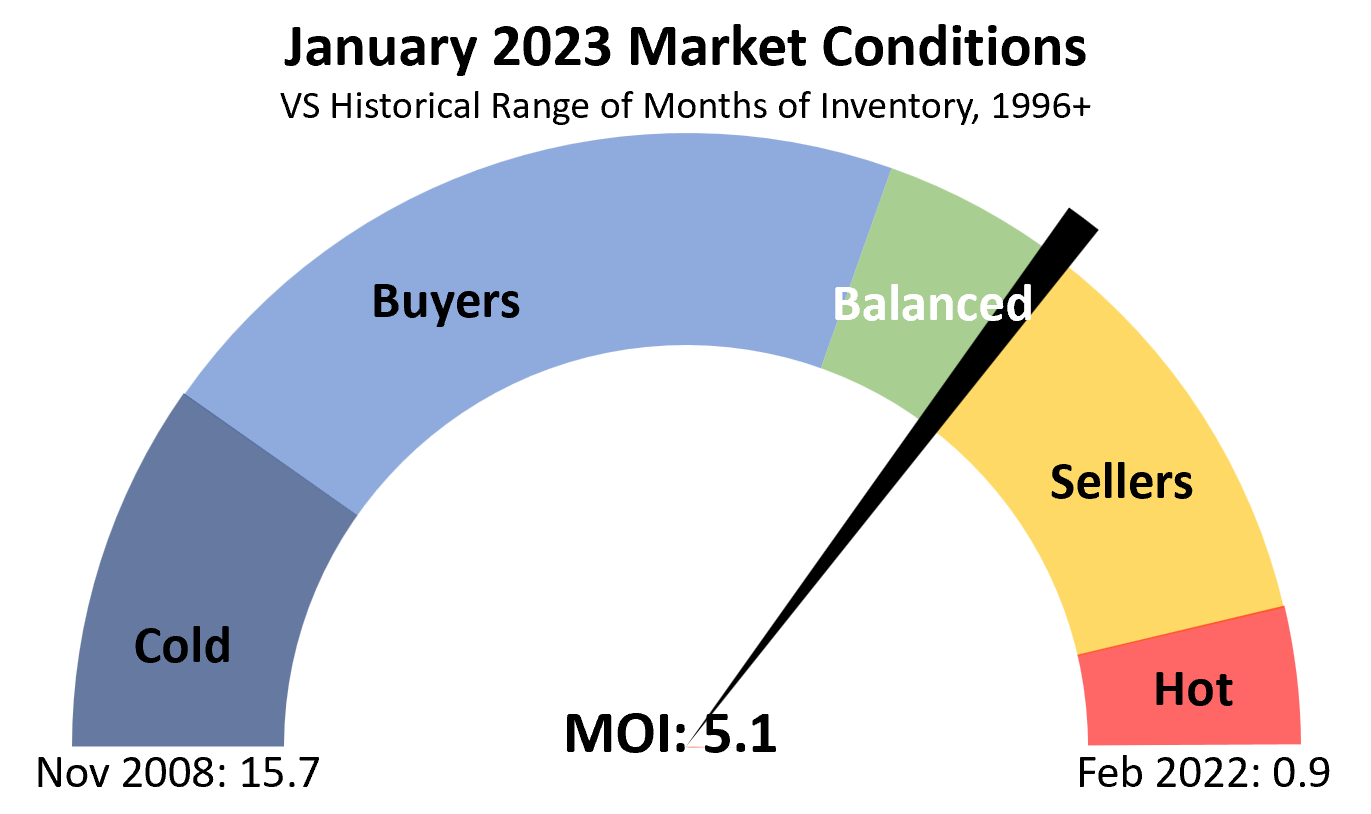

Market condition indicators were mixed, with the sales to new list ratio strengthening a bit in recent months while months of inventory was back up. Again though, while months of inventory is higher now than it was 6 months ago, the rate of increase is substantially less than at the start of 2022.

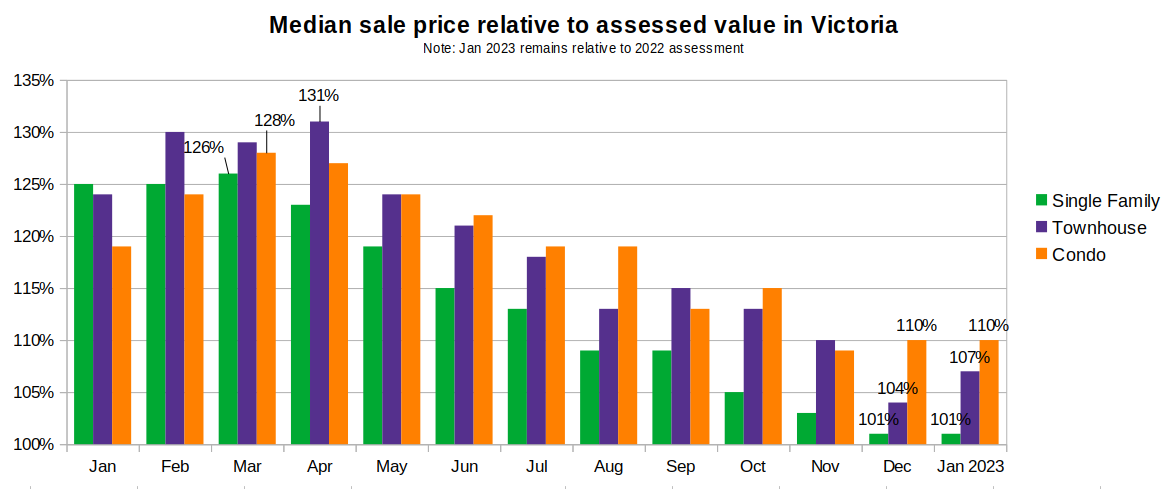

Sale prices were essentially unchanged in January. Though we have switched over to the new assessment roll, most sales in January were still from old listings, and rather than looking up the new assessed values for all those sales, we’ll do one more month compared to last year’s assessments. Median sales price to assessed value shows no change in prices for detached and condos which came in at 1% over and 10% over their 2022 assessments respectively. Townhouses bounced a bit from December’s low value, but that measure is naturally more volatile than the others due to low sales, so I wouldn’t read into it.

Median prices were largely unchanged, with only townhouses recording a big drop, but again that’s noise from low sales.

Shocks VS Regular Market Conditions

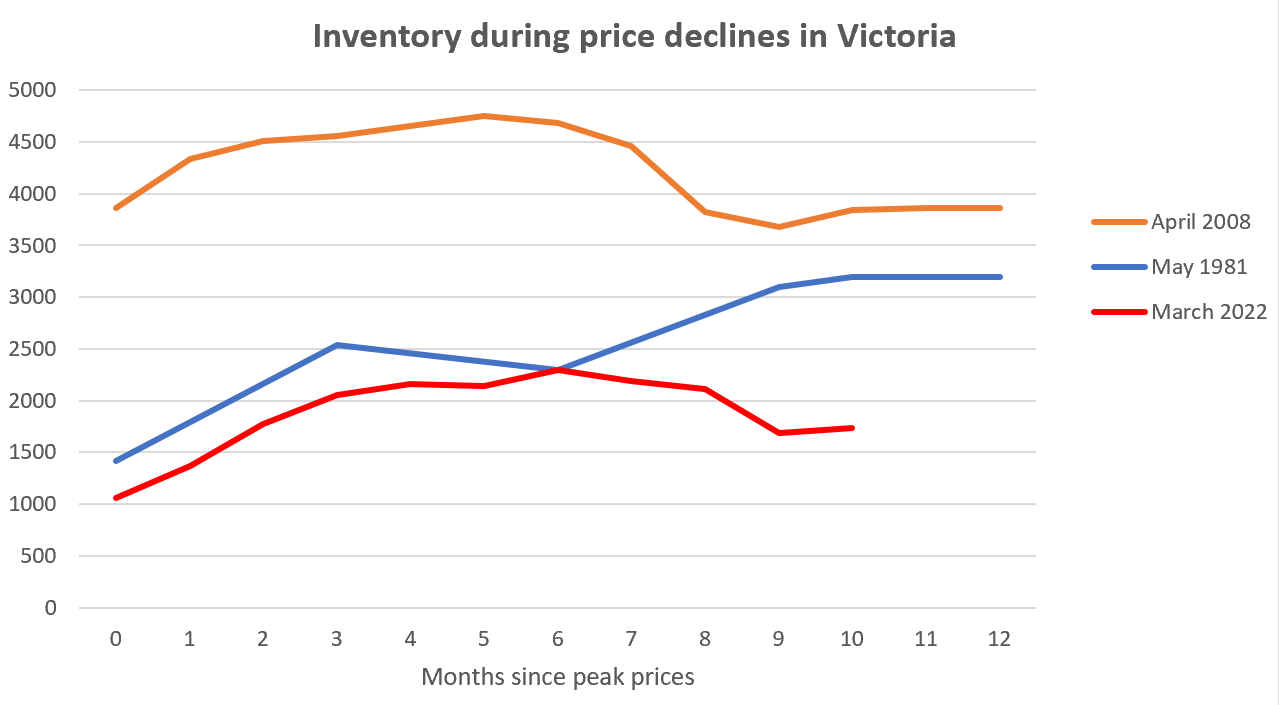

Last year was an incredibly anomalous year for real estate in Victoria. Despite an average of only 4 months of inventory, prices dropped rapidly after rates started rising in the spring. The overall market gave up some 15-20% from peak depending on how you are measuring, which erased about 12-18 months of the preceding rapid gains. That happened despite inventory remaining quite low. If we compare today’s inventory to that available in previous price corrections in 2008 and 1981, we can see how odd the last year really was (note only some months in 1981 have data).

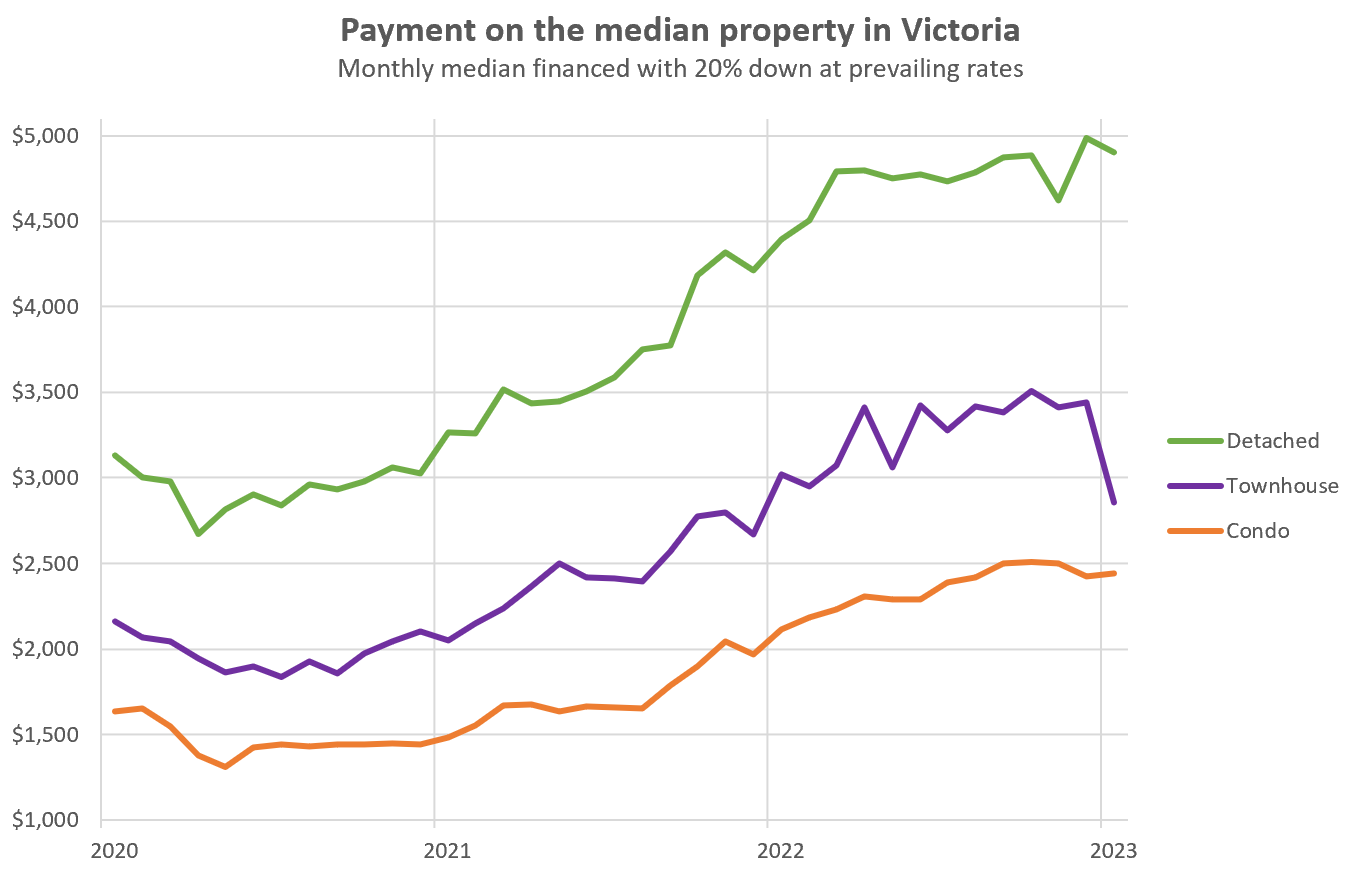

Nevertheless the shock of rates rising in 2022 did quickly overwhelm buyers and forced sellers to cut prices to compensate. It’s been pretty remarkable how payments have stayed roughly constant while prices were pushed down to compensate for higher financing costs.

However if we are to believe the Bank of Canada, rapid rate hikes are behind us. Some bank economists have gone even further by forecasting that rates will be cut substantially starting as soon as this year though I very much doubt this will happen. Central banks faced a serious hit to their credibility by acting too slowly to counter rising inflation, and they will want to be sure that monster is good and dead before they relax monetary conditions again. With today’s hawkish signals from the US fed it’s also not certain that we’re at the precise top of the rate cycle quite yet. However last year the shock was that we saw rates rise by 4%, and I think we can be pretty confident that that shock won’t be repeated with another big increase. Of course the big upcoming risk is a sharp rise in unemployment which again could sideswipe our fragile market, but it’s still unknown if or when that will arrive.

Absent a new major shock, I think we have to return to market conditions as a guide for where prices are likely to go, and those are pointing to a midway point between the excited anecdotes and the poor sales data. I paused the market guage in 2022 because it wasn’t accurately reflecting the state of the market, but with residential months of inventory at 5.1, we are at the warm end of balanced market conditions. In normal times, balanced market conditions lead to roughly flat prices, not rapid drops.

In addition, as detached prices hover around the psychological barrier of a million dollars, more properties are available for just below, dropping minimum down payments from $200,000 to $75,000 and allowing more buyers to compete. That’s not to say the mortgage isn’t still a huge challenge for buyers, but the lower barrier to entry undeniably adds stickiness to prices.

To be clear I’m not calling the bottom for prices just yet. The reality is affordability has barely improved and history tells us that periods of poor affordability are followed by corrections or price stagnation over years. Market conditions may well continue to deteriorate slowly, or rates will keep increasing, or the economy will finally take the dive that the central banks are trying to engineer. But I think it’s also unrealistic to project the big price declines that we’ve seen into the future. At some point the acute shock is digested, and the reality of market conditions becomes dominant again. Perhaps that time is now.

What do you think? Are we in for a period of stabilization or will we see prices slide a lot more in the coming months? Has the shock passed or will it continue reverberating through the market in 2023?

.

New post: https://househuntvictoria.ca/2023/02/06/all-bunched-up/

I didn’t think there was, but rush4life’s comment was a good clue for where to find this info over time. Will post in tonight’s article

In other words, they are calling a bottom. Well they would say that wouldn’t they?

The US Fed is targeting the hikes to bring down inflation that, despite recent signs of slowing, is still running near its highest level since the early 1980s.

“We can now say I think for the first time that the disinflationary process has started,” Fed Chairman Jerome Powell said, while also noting that it would be “very premature to declare victory or to think we really got this.”

Looks like Bond traders today are disagreeing with the rate pause.

Although prices are down from January 2022 to January 2023 what isn’t shown in those numbers is if today’s middle income buyers are getting less or more of a house in terms of its physical aspects such as age, and house size than they did a year ago.

They could be paying less for a house today and getting less house too? Or they could be paying less for a house today but getting more house than they did a year ago?

Things that make you go hmmmm.

From: https://bc.ctvnews.ca/gloomy-economic-outlook-elevated-mortgages-drag-down-2023-b-c-housing-market-bcrea-1.6261718

This is old news, perhaps, but I wonder if it might be the start of a way forward to reduce all those endless permits. https://www.cbc.ca/news/canada/british-columbia/david-eby-bc-housing-developer-permit-approvals-1.6715643

That is essentially what I meant. 🙂

Well that’s surprising, but I have to assume the stats are lagging somehow.

What I think is causing all of the volatility is the FIRE industry’s systemic optimism; if the FedRes & BoC could be taken at their word without all the wishful-thinking interpretations, the slowing of the economy could be induced with less jerky looking graphs.

Not sure I agree with this. You never have certainty on what you can afford it unless you buy it in cash (or have the cash collateral somewhere) because you can have income loss at anytime so having a 10 year rate secured doesn’t help if you have no income. Those that bought with rates under 2% most likely had been stress tested anyways.

It’s really about being realistic and balancing your income prospects (volatility, safety and trajectory) along with your spending. For example, in the current environment an average doctor would be able to take on much more risk when it comes to borrowing and spending compared to a average lawyer, engineer or accountant.

Yes, but that’s pretty much tautological. The issue is if you’re borrowing to buy you don’t have certainty that you’ll be able to afford it going forward. Just ask someone who took on a floating rate mortgage at under 2%.

I do agree that taking out a 10 year term makes risk going forward minimal.

From the VREB current stats posted Feb 1 2023 – The Victoria Real Estate Board represents 1,594 local Realtors. The one from Feb 1 2022 says: The Victoria Real Estate Board represents 1,525 local Realtors.

In general, I agree that buying a family home is not gambling if you can afford it.

Making a decision “not” to buy because one thinks that the market will go down is something I wouldn’t do.

Hey Leo, in your “Median Price” graph above it looks as though Sept 2021 = Jan 2023, but the peak is off the scale. Would you please let me know what level & date that graph’s peak was so that i can see numbers that better represent Victoria?

Leo do you have stats of how many realtors there are in Victoria? be interesting to see the change over the past year.

Our home insurance premium went up by 114% in one year. The previous backing company went out of business or stopped offering services.

Month to date activity:

Sales: 57 (-47% same period last year)

New lists: 161 (down 12%)

Inventory: 1747 (Up 120%)

new post tonight

Borrowing to buy a house as an investment vehicle is always a gamble.

Rotating back into the market to buy a home to live in long-term is, well, buying a home.

Remarkably stable for us in 10 years.

It would not surprise me if Oxford economics is about right at a 25% drop from peak. I also suspect that it will take another year for this to play out. Is anyone seeing a big bump up in house insurance rates.

It would be gambling not to buy in that scenario if you intend to live where you bought until atleast the end of the mortgage term.

Good advice. I don’t consider buying a family home to be gambling, if you can afford it, and have a fixed rate mortgage for at least 5 year term (preferably 10 year term).

Speaking of 10-year terms, rates are falling BMO 5.78% ! https://www.ratehub.ca/best-mortgage-rates/10-year/fixed

Interesting points made by the Oxford Economics …. it’s a crazy, un predictable time ahead.

On the one hand I want to say that it does not make sense that the housing market could possibly drop all that much because of all the people being brought into Canada …but another part of me thinks anything is possible because back in the early eighties it seemed impossible for real estate to drop considering how many building foundations were being put in place. (It all turned on a dime in one day and all those foundations in the ground just sat there.)

It’s not a time for gambling.

From: https://financialpost.com/executive/executive-summary/canada-home-prices-will-still-fall-economists

Excellent example of the entitlement mentality of the small RE investor. Fair means developers keep their side of the contract and you keep yours. Nothing more, nothing less.

since Whateveriwanttocallmyself took over from Leo?

Consider ourselves lucky. Just Jack’s comments are IMO some of the best content on this thread. You might disagree with his opinions or it might offend some, but his methodology is bang on. Thank you for posting Just Jack and the thoughts shared by you so freely would surely cost hundreds of dollars per hour in marketplace. I always look forward to your take. Be Well and have a great week everyone.

This is “Jack’s” 5th or 6th alias. If historical patterns hold he will eventually get called for too much BS, disappear for a while then resurface with a new alias.

I wonder if people actually understand the possible pitfalls of buying preconstruction? Perhaps a ILA certificate should be mandatory before these contracts are valid.

Would these buyers complain if the same models sell more in a regular/hot market?

Unfortunately there is no fairness, only the market price wrt pre-construction.

from: https://canadatoday.news/ca/they-paid-the-highest-dollar-for-pre-construction-homes-at-the-height-of-the-market-now-their-builders-are-selling-the-same-models-for-far-less-257572/

There’s no taking over. I don’t always keep up with all the comments though and tend to focus most of my advocacy comments on twitter instead of here to keep my comments here more data focused.

Marko, is that the same listing you had at the encore you were talking about couple months ago where they took it off the market to rent it out instead?

Anyone else lost their joy in our lively comments section since Whateveriwanttocallmyself took over from Leo? Any chance we could get him back?

Except the mobile home park itself needs a permit, or more to the point zoning.

Aren’t even existing parks disappearing because more money can be gotten out of the land from other uses?

That’s it Frank. And when you find a job in the tar sands, you hook it up and go.

Your basically talking about mobile home parks. All you do is pull it onto the lot, hook up the utilities, and your set. No permits required.

I think we could solve the rental problem very fast and very cheap.

All that is necessary is to provide temporary housing until demand for contemporary housing can be built.

Take large acreage parcels, put in underground services, pave it and have hook ups for recreational vehicles. Take about three months to have a rental pad ready so that people can move their own recreational vehicle on to the site. Give them a five year lease on the pad then they have to vacate the pad.

Probably get 15 to 20 temporary units per acre. Once demand for housing has been met through contemporary construction then these parcels can be re-purposed for a different use.

Whatever, from what I have read CMHC doesn’t have any part in the process any longer. They used to provide market appraisals. Housing is solely the purview of the Canadian Forces Housing Agency, CFHA. Lots of good information here: https://www.canada.ca/en/department-national-defence/corporate/reports-publications/audit-evaluation/eval-military-housing.html#Shelter

REaddict, go back and look at my posts please. I acknowledge that the military are most likely paying less than what a similar floor area is renting in the community. It depends on how CMHC determines economic rent which differs considerably from what is currently available. It depends on how long they have been living on the base. It depends on the quality of housing, etc. etc.

The base housing was originally for short term postings of under three years. It has morphed into long term housing. There are people that have lived on base for 15 years and are paying well below what that same space would rent for in the local community today.

Whatever, that’s simply not true that military housing is at market rates. My daughter and her husband are going into a 3- bedroom duplex where her husband was just posted, on Feb 15 for $900 a month. It’s not here but you can go on the website and see what housing there is anywhere there is military housing in Canada and what the rent is if you’re interested. I know a family in a four-bedroom house in Edmonton paying $750.

That’s great news! Congrats.

Congrats, that Tracksell house looks like a nice one, I almost put in an offer on it myself. Glad it worked out for you!

It finally happened! An accepted offer!

Arrow, I think you are on the right track.

Naden base could be relocated to Sooke and the lands returned to the First Nations so that they could re-develop the land as rentals as they are doing along Craigflower. That would alleviate traffic congestions and promote more development outside of the core.

That could provide rental housing over the next few decades for thousands.

I expect people working from home are going to make some nice big offices for themselves. Your home is your castle, why not.

Well you have the example in Vancouver of the former Jericho army base now being developed as a joint venture between the feds and a couple (I think) of the local FN’s. That’s in an area not covered by any treaty. Don’t know how the Douglas treaties would tilt things for Esquimalt, but it wouldn’t be to the detriment of the feds.

Before anyone brings up that development at the end of the Burrard Bridge, that’s on a reserve.

I believe that DND does dispose of surplus lands from time to time but there is a formula laid out on how it is done. There would be many claims ahead of just selling it off to a private developer. In this case, I am pretty sure First Nations would get first dibs as part of a land claims settlement.

anyone know the sale price on 4037 Holland ave?

At this point in time BC government workers do still have to reside in BC. I believe it is possible in special circumstances to get permission to work out of province. Don’t think you get permission to do out of country. I suppose you might get found out eventually if you did that under the table.

From: https://financialpost.com/news/economy/higher-interest-rates-until-2024-cibc

I am glad that you disagree with me as I am here to learn; I wouldn’t have been offended had you wrote, “It isn’t as simple as you.”

And I suppose that the idea of the military selling off under-utilized land is as far fetched as imagining no wars.

I am glad that you disagree with me as I am here to learn; I wouldn’t have been offended had you wrote, “It isn’t as simple as you.”

And I suppose that the idea of the military selling off under-utilized land is as far fetched as imagining no wars.

Frank that will never happen. Ask the indigenous people on how well that worked out for them.

If no one went into the military, there would be no wars. And countries would have tons of money to fix all their problems. I have no idea why anyone would go into the military.

Arrow, the wait list is long at what CMHC charges for renting these little homes. As I said before the rents paid are suppose to be at what is available in the local community. Most of the housing on the base is in poor condition so I suspect the rents being paid are less than in the local community as the quality in private residences is higher. I have been in them they’re bad.

Build new housing and the rents will be more expensive and the wait list will shrink. Which is one way to solve the problem of housing the military – at least on paper.

If the housing is affordable on a military wage then it will be occupied. Although for most people, in the military, it is preferable not to live on base. School catchment areas for example. Another issue is deployment which effects single personnel. That can be six months at a time which would increase vacancies in any proposed apartment style buildings.

So I am going to disagree with you, it isn’t a simple as you make it out to be that more is more. The vacancy rate for new rentals on DND land could be higher than the surrounding neighborhood. Build too many of the wrong type, and size of home and the base could end up with unoccupied homes at a great cost to taxpayers.

And defiantly relieve pressure for on-base housing:

“…around 700 military members are on waitlists for housing. Even members who have secured housing through the military say more is needed. …Jordan Desroches, who lives on the base with her three kids, says space is limited.”We took a downgrade in size to move here, to be in one of the houses…”Because of [how long] the wait is, we’d probably still be on a waitlist,” she said.”

https://vancouverisland.ctvnews.ca/cfb-esquimalt-land-could-be-used-for-more-housing-eby-tells-trudeau-1.6259010

Not maybe. If the housing is built someone will live in it. More is more.

Is it that much of a worry for those retirees that bought monstrosities? Or is it a problem for their heirs?

Wouldn’t we all like those kinds of real estate problems.

CFB housing is administered through CMHC. The military no longer get subsidized rental housing as they now have pay market rent for their base housing. Any new housing built on DND lands will not be available to the public to rent.

That being said, the reality will likely be that the housing will be less costly to rent on site than offsite depending on how CMHC determines economic rent. As was illustrated in the recent CMHC vacancy stats they do tend to under estimate current economic rents. So that may draw military families back to the married quarters and single sailors to newly built apartments which may relieve pressure for offsite rental housing. Maybe.

Working from home will definitely have it’s pros and cons.

I’ve worked at home all my life as an artist, and when my wife retired it changed everything for me. It took quite some time to get used to a new routine and now a grandson also throws changes our way.

Nothing stays the same!

Anyway. Change is happening and I’m sure people will work it out and in ways we can’t even imagine yet.

My daughter works from home. She see her son several times a day. She is not stressed. It will be interesting to see how that changes the next generation.

That’s good news for all the retired couples that bought new 4 bdrn monstrosities in the Thompson-Okanagan; I always wondered who they’d sell to.

https://corridorbusiness.com/survey-millennial-home-buyers-want-larger-homes/

April 2022: Survey: Millennial and GenX home buyers want larger homes

As the home building industry celebrates New Homes Month in April, new research shows that new buyers have an increased desire for bigger homes and more outdoor amenities which are driving new home designs.

Home builders reported a rise in the average size of a new home to 2,524 square feet, and the percentage of new homes with four or more bedrooms and three or more full bathrooms to 46% and 34%, respectively.

“Home buyer preferences have continued to reverse trends in new home designs, and builders are working to respond to new interests in the wake of COVID-19,” said Melissa Schooley, Eastern Iowa president of Great Western Bank and 2022 president of The Greater Iowa City Area Home Builders Association.

The recent study, “What Home Buyers Really Want,” conducted by the National Association of Home Builders (NAHB), is based on a survey of recent and prospective home buyers across the country. The survey revealed that more than a third of millennials (36%) and Gen Xers (34%) say their housing preferences have changed because of the pandemic.In addition to a desire for more space and more bedrooms, millennials and Gen Xers are also looking for homes with modern or contemporary exteriors that are designed for multiple generations. Other changes include an interest in exercise rooms and home offices, as well as designated bike lanes in their communities.

“New homes offer flexible spaces and modern designs to accommodate the changing needs of home buyers so they can enjoy more time at home comfortably,” Ms. Schooley said.

For certain things, sure. And yes, all the upsides of people working from home that you’ve cited are there as well. But I think there are a couple of questions: one, is the work all really getting done with the same degree of energy and output, and two, what else is lost by having everyone work from home?

If you can have very objective deliverables, then there should be no reason why working from home doesn’t yield the same results in productivity – on paper, anyways – I’m just somewhat doubtful, probably based on my own experience trying to work from home and being distracted 10X over and spending a lot more quality time with my wife and my cat, but the work still “getting done”. I’m sure some studies have been done, but not all of this is really quantifiable.

I think a bigger issue is that the work-from-home concept is going to lose productivity-related factors in work environments that rely on a lot of interaction. We all saw enough of zoom meetings to last a lifetime I’m sure. I can only tell you that in my own work environment (pre-retirement), the ability to just knock on someone’s door for a quick 5 minute interaction, or the quick discussion just walking down the hallway or whatever, these things all added up to a certain undeniable synergy that I’m convinced had a direct impact on the overall energy of the place and productivity for the result to our clients. And that’s before we think of the other things that are lost, like hands-on training the next generation. A fast-paced collegiate office environment takes on its own energy that makes the day go faster and the result better. Hard to quantify, and probably a lot of people never had that kind of experience, but it’s just what I’m thinking based on my own experience. But maybe my experience was not the norm.

And that’s the part of working in the office that I actually do miss – being part of a group of people working well together on a fast-paced transaction with lots of interaction to achieve the optimal result. Don’t get me wrong, being retired is still a way better ‘job’ of course!

Agreed. The rapid transition to remote work in the 2020’s has been a huge benefit, and yes, “more happiness.”

It changes the type of housing that many people are looking for. In the “old days” (pre-covid) I used to see posts here from househunters looking for small spaces downtown. They said they were out most of the time at work etc., and didn’t need much space. I recall a discussion about selling a big home in Rocklands, and the HH consensus from the millennials was that no one wants these big square foot homes.

I think now, with many households spending much more time at home, including need for two home offices, bigger homes are in demand again. Especially among millennials and GenX!

—====

My opinion is that there is a distinction between home ownership and investor ownership. Home owners being more likely to hold on to property during an economic down turn than investors.

From Leo S graph it appears that there is has been considerable investors’ play in the condominium market that has a potential to come onto the market rapidly. This large shadow inventory has a potential to de-stabiles the condominium market.

The impact on the rental market would be less direct as it may follow various scenarios such as but not limited to:.

-The existing tenant could purchase the property from the investor thereby increasing the home ownership rate.

-Two single renters could combine their households to purchase a condominium and thereby increase the vacancy rate.

“More Provincial Government employees being able to work from home”….. Good to see this happen!!!

People will have more time with family.

Less expensive housing opportunities and car costs.

Less pollution because there will be less cars commuting.

More happiness all round.

Many people will not like this idea but it doesn’t matter because it is happening all around the world.

Businesses that don’t want to change will be at huge financial disadvantages. (Large office costs in rent etc.)

The one serious consideration to plan for or manage carefully would be that people living in the cities could have cheaper competition from anywhere, anywhere in the world.

Think about it. A person in Victoria has a good paying government job. They now work from home. They decide to live in a beautiful, inexpensive part of the world on a tropical beach. No one would likely even know where they were working from.

And why would anyone care if the work was being done anyway?

They sell their home or rent it out while making good wages while they live in tropical paradise.

I could see this happening and governments should be taking steps to plan for big changes.

Two news stories today give hope for freeing up more accommodation in Victoria:

More Provincial Government employees being able to work from home,

https://www.timescolonist.com/local-news/provincial-government-embraces-work-from-home-for-more-of-its-employees-6486078

and a shove by Eby to increase housing density on the grounds of CFB Esquimalt,

https://www.cheknews.ca/cfb-esquimalt-housing-proposal-building-steam-1139253/

Condo ownership by investor type

Ok, who lifted my royal bay post and put it on the FB group “Vancouver Island Housing Market”!?

–have fun navigating home insurance.

Like a house conversion? Sure, quite a few of those around Fernwood and Fairfield. Just never seen one involving an 1100 square foot house on a 1400 square foot lot.

I don’t see any potential for it here. If not for the heritage designation, the house would be a tear down.

Feels like a definite spurt of activity in the lower-priced sfh area with four pending today. All priced under 850K, two going over ask by 51K and 52K and one under by almost 35k (smallest), and the other almost 27K under after 52 DOM. While at just a bit higher price point things seem to be languishing. The market is fickle. 890 Lampson a 4 bedroom home with basement at $869,900, granted a small lot, but not a bad looking house with lots of character expired.

Dad, you’ve never seen a heritage home conversion?

Oswego is heritage designated…have fun navigating city hall.

Well Gosig, just thinking about that property a bit more. It might not be that bad if you lifted, updated and could get approval to strata title as two units. It could be doable.

There are lots of funky houses in James Bay.

We have had concrete since the Romans. But some houses in James Bay have brick foundations or wood posts on concrete piers. Walk around the house in your socks and see if there is unevenness to the floors and then look around the foundation for cracks. Look to see if the siding is in contact with the ground. Cracks are not always bad unless there is another crack in an opposing corner.

If you have to pour a new foundation then the house can be lifted or if there is a crawl space it can be dug out and under pinned. If you’re going to that then make it a basement suite. There are some homes on small lots along that street that have basement suites which would then increase the floor area from 1,000 to 1,575 square feet. But now you’re talking really big bucks in renovations for a property that might fetch 1.2 million, when completed, if the market remains stable.

You better love James Bay because you may be there for a long time.

So this assumes they lied on their mortgage application because they had to get stress tested?

Or a 800k for a POS house on a 1500 sqft lo next to a drive way to an apartment building and backing into another one. LOL neither scenario is ideal.

Wouldn’t sink too much money into oswego seems anything before 1960 gets pretty funky more trouble than it’s worth

Which is going to be a small subset of buyers from that period. Most vulnerable are those who took out variable mortgages and stretched to buy in the 21-22 bubble. I can see some forced selling on the horizon for those people. Absent economic hard times/rising unemployment, I doubt it will be that significant though.

This is what I keep saying over and over again. The spring 2021 0.99% HSBC mortgages are the ones that might face some issues on refinance come spring 2026.

If you are renewing into another fixed term this spring, then you would be going from about 3.5% over the previous five years to 4.5-5%. The vast majority should have no problem handling that after five years of wage gains.

550 sq ft minus the hallway down the side. Isn’t that small even for a townhouse?

Right so a $3 million dollar 4,900 sq/ft corner. Makes sense given a 5,800 sq/ft corner just sold in Fernwood for $770,000.

RE: 119 Oswego

I have zero experience with 19th Century houses – would they typically have a poured concrete foundation, or something else?

I am not really seeing it….still stuck at 24 SFHs under $1 million in the core, Oswego being one of them.

Looking at the google maps, there are two more properties and you would have the entire corner.

Oswego is an alternative to buying a newer 2015 to 2022 condominium in that neighborhood which is going to cost about $850,000 to $900,000 for a two-bedroom.

This is a property that lays between a rock and a hard place as it isn’t appealing to investors, first time buyers or middle income households. It’s target market is limited to empty nesters/professional couple with a large down payment desiring a house to remodel. For most prospective buyers this isn’t going to be appealing. But all you need is one.

James Bay is an eclectic neighborhood with some alternative lifestyle people that would fall in love with this house and spend a bucket load of cash fixing it up.

Yup it’s a fugly, but a prospective purchaser is paying for living space in James Bay and at a price of $800,000 that’s not that bad. I envision the exterior painted a Salmon color.

Re: 119 Oswego. If I was in the market I would definitely consider this place. And plan to fix it up. And live in it. Tons of character. Needs some sweat equity. The buyers sweat equity. Not contacted out. Personally I get a lot of satisfaction out of restoration work.

It could be a great home. Maybe not a great investment – which sadly seems to be the sole focus of this forum.

I love james bay. Partly due to the eclectic mix of housing. Some truly wacky lots and homes. I am in a 110 year old duplex.

I would pick this over a townhouse. No strata fees which can be substantial.

It’s a dutch builder.

How does that sound like a reasonable explanation? The lot size is 1,430 sq/ft.

Just looked “119 Oswego” on BC assessment, felt very strange that the new assessment decreased the land value but increased the old house value (+14.5%)??

That sounds like a reasonable explanation.

~$1.1m seems about right to me.

Asking people to self assess their personal finances based on a poorly worded question about something they probably don’t really understand is a good way to generate clickbait headlines.

Agree with Patrick. 35% of mortgage holders being at risk of forced selling seems absurdly high.

Looks like land assembly possibility.

I am not saying it will get there, I am just saying if that’s where I guess the bottom will be if the market tanks. So the peak that house would have got would have been $1.08M in March 2022?

Please tell me that $800K for the 500 sq ft wreck at 119 Oswego isn’t considered a good deal warranting a bidding war.

Listed Tuesday: https://www.realtor.ca/real-estate/25239235/119-oswego-st-victoria-james-bay

Long way to go to get back $700k on that house. That would be about a 35% peak to trough decline.

If its a good deal then there will always be multiple offers….

https://www.vicnews.com/news/victoria-real-estate-hit-by-multiple-offer-madness-even-as-home-sales-fall-off-a-cliff-say-buyers/

Is that media hype or pent up demand?

I’d say maybe it bottoms at 700k given current rates and wages, <20% down and mortgage of ~4.5% will be ~$3k+ a month.

Nice tries, but the questions are linked from the article. And they didn’t ask them if they were renewing, just what type of mortgage they had.

https://static1.squarespace.com/static/5a17333eb0786935ac112523/t/63dab986ca356913d1d52ac4/1675278727005/Yahoo+Interest+Rates+Impact+DTs+F+2+2+23.pdf

And the question they asked them

Q. “Let’s say the Bank of Canada increases its prime lending rate to 4.50%. How long do you think you can ride it out before you are forced to sell or vacate your home for another arrangement?”

—==

Now, while you’re telling us how much sense this survey makes to you, please explain if the question makes any sense at all to you by referring to the bank of Canada “prime rate” rising to 4.5%? Not the policy rate, the “prime rate” (which is set by the commercial (big5 etc) banks, and was already 6.7% at most big5 banks when they asked the question ) Don’t you think they could have got that term right, considering it was the headline question?

As I expect you know, the BOC doesn’t have a “prime rate”, as the prime rate is a term describing the rate commercial banks charge their best customers.

So yah, if we ignore the misuse of the term “prime”, it sure makes sense that “ 35% of those with a fixed rate mortgage say they will be FORCED to sell or vacate their home for another arrangement after 10.4 months” , even though likely less than 20% would be renewing during that period . ((Sarcasm))

yahoo is just making a poor summary of the actual results, which make more sense. For example

https://static1.squarespace.com/static/5a17333eb0786935ac112523/t/63dbc57ab461821b25759683/1675347323419/v2Yahoo+Interst+Rate+Impact+Factum+F+2+2+23.pdf

Well, can’t see the actual full data breakdowns or how the questions were presented and in that way almost every survey reported in media is absurd, however, if the 35% of fixed rate facing 10.4 months is representative of those renewing in a higher rate environment from the fixed cohort, it’s much less absurd.

… from that same yahoo article

“ 35% of those with a fixed rate mortgage say they will be forced to sell or vacate their home for another arrangement after 10.4 months”

Absurd numbers like that make the survey results look unreliable to me.

From: https://ca.finance.yahoo.com/news/45-with-variable-mortgages-say-they-would-have-to-sell-in-under-9-months-yahoomaru-poll-110037392.html

I guess that gets that year done to feel the impact of of the interest rate increases.

Who needs to pay ghostwriters to do their listing descriptions for them when there’s Chatgpt to the rescue? At least I think that’s what is happening here: “Welcome to a modern timepiece that offers a unique blend of classic charm and contemporary amenities. Tastefully renovated featuring 4 bedrooms, 3 bathrooms, and a private fenced SouthWest facing backyard. You will find that this home offers beautiful natural sunlight throughout …” It’s a house I believe, not a watch!

Elections are coming up in less than 2 years, inflation will magically disappear well before then. As for money supply, the banks do have to follow rules set by the government on their lending practices. No one wants to kill the goose that laid the golden egg.

As I see it, the only way inflation will fall (below 4%), is if wage inflation stops. I can’t see that in this current full-employment economy.

So this means we will see ongoing interest rate increases until demand is reduced, and we get a recession/unemployment rises to stop the wage inflation.

So far, corporate earnings are fine (stocks up), unemployment is ultra-low, so why wouldn’t wage inflation continue? And there’s no way cpi falls to 2-3% with >3% wage inflation.

Most likely scenario is more inflation, interest rate increases, until we get this recession. I don’t see a case for a “soft-landing”.

I assume it’s a spec home?

Fwiw, it’s the entry level model that could be had circa 2019 for ~$650k.

Not finished yet. Pre-sale buyer bailing? Or is this the developer?

What they really profited from was the decline in interest rates from the time that they bought. It made the debt they took on for the initial purchase less expensive to carry.

Those were the days.

Hit my trigger rate yipeee! Good thing I picked up 3 more clients doing multi year development projects. I thought business would tank but if anything it’s ramping up. I just cant seem to make sense of this crazy world. I guess I didn’t need to take that second job and sell my vehicle. lol

How about you hold that thought, and we can resume it after you’ve purchased your house 🙂

Lol, remember when I was bearish on Royal Bay and said it’s going under $1M and some of these slow Victoria folks disagreed, LMAO…..

https://www.realtor.ca/real-estate/24527308/3356-ryder-hesjedal-way-colwood-royal-bay

Wow, it’s probably just because I got use to seeing very few listings the last couple of years, but the last 2 days have had a lot SFD rolling in on the portal. Let’s see what happens on the sales side now that selection appears to be increasing.

Not really profiting if the folks who got the tax free gains just upgraded to a new better more expensive house in the same market. This would have happened in a flat market too. The ones taking on HELOCs to buy more homes are taking on risk so that is fair IMO.

The folks who gets around the tax rules to profit would be another story.

A condominium in Sidney just sold for $469,000. It’s in a 1980 built 25 unit four storey condominium complex. Nothing special about that except the complex is on ONE ACRE. That’s ridiculous. There is enough space at the rear to construct another multi-family complex.

We have so many of these older complexes that are under utilizing the land.

What’s the steel-manned take from those folks regarding homeowners profiting enormously (and tax free!) from real estate growth? (Generally left unsaid while focusing on the evil small developers.)

Right. Every withdrawal from a HELOC adds new money as if it was printed. And every pay down of bank debt removes money.

If you’re referring to a homeowner selling, moving, and buying in a new city just to get mortgage payments down…

Given the transaction/moving costs involved, I wouldn’t expect to see much of that. I could see that if they lose their job.

Let’s see what they said last year in January:

“Persistent supply constraints are feeding through to a broader range of goods prices and, combined with higher food and energy prices, are expected to keep CPI inflation close to 5% in the first half of 2022. As supply shortages diminish, inflation is expected to decline reasonably quickly to about 3% by the end of this year and then gradually ease towards the target over the projection period. Near-term inflation expectations have moved up, but longer-run expectations remain anchored on the 2% target. ”

Haven’t even got close to 5% yet.

Just a point about the money supply. The government isn’t the major cause of the increase in the money supply. The lending institutions are the dominant source of new money in Canada. Over 90 percent of new money is created through mortgage lending not from the government printing money new money.

JT isn’t sitting behind a gestetner in the basement of Parliament printing bills.

LMAO, so you think a property manager carrying out repairs for you will be more cost effective than someone shopping around themselves??

I thought you were a China immigration guru, I guess you are an economic one now too?

You are also lucky Frank wrt the property manager. We used one (recommended by our house insurer then) when we bought a SDF here in 2004 before we moved back from the east. It was fine until they requested (and we agreed) that under $300 small work/repairs could be done without pre-approval from us. Then all sorts of small bills (fireplace cleaning, pest control, …) started to show up. We even received a couple bills for the “work” done one month after the house was vacant for us to move back in. We sent the bills back to the property management company and never receive a reply back.

Factor in the insane cost of living and wages not keeping up – something is going to break, and soon. I know several people who have either rented out single rooms in their home in order to keep up with variable mortgage payments, or thrown in the towel and moved to cheaper markets. These are the young people who keep the business cogwheel moving in Victoria. I may be wrong, but this seems to me it’s the beginning of an exodus.

I’ve said it before and I’ll say it again.

Our house is 50 years old and was slapped together from a cookie cutter design by a greedy developer. It’s lovely and we are so grateful to have it.

reading the “greedy developer” stuff on the last thread.

My house and neighbourhood were built by greedy developers in the 1910s. Does that matter one pin to me now? Would we have been better off if there had been no greedy developers back then?

Having a good property manager actually saves you money, I’ve found, because they have tradespeople who work for them at reasonable rates, in return they get a steady stream of work. If tenants do not pay their rent, good luck finding another place to live, my manager screens tenants thoroughly. I’ve been doing this since 1989, I wouldn’t dream of not using a property manager. I’m fully confident that in the next ten years property will be up 50-100%. This is just a blip. Governments keep printing money, it’s all they know.

As do up cycles.

I think that I’ll wait until a place that meets my tight criteria pops up, and leave the second guessing to the professionals..

I just don’t get why everyone thinks having a rental is so easy. Yes if you have good clean low maintenance tenants that pays rent on time then it is largely fine (those aren’t that easy to come by) but the longer you are in the landlord game the more likely you are going to run into headaches. Yes you can have a property management company run the place for you but that costs money and when things needs to get fixed you are going to want to be involved in the decisions.

Having no rent for 6 months at $1500 a month rent wipes out 18 months of incremental rent received at $2000. And that is assuming no major damage is done to the place, which is quite possible if the relationship has gotten to the point where eviction is on the table. Too many armchair landlords on the internet amongst other experts….

” if I should wait a bit more before buying & moving”

Real estate down cycles tend to linger on for years (5 – 10 years) so I would wait for a larger selection (fall?) of houses before buying. Of course, if you feel you must buy now for a specific reason other than FOMO, go ahead and buy a house that suits you. If you live there long enough, down cycles do not matter much.

“I don’t know where all the sellers who rush to the exits are going to live.”

They go somewhere just like other years: heaven, nursing homes, condos, out of town/province, back to renting, etc. Every year only 5 – 7% of the houses are sold and bought. It is an equation of how many potential buyers are there relative to the number of listings at each price point.

And assuming that the rent covers their expenses. If not, they are essentially speculators who have bought on expectation of rising prices.

I dont think our economy has seen the effects of the rates on GDP, output, consumption just yet. The mortgage debt being the largest of retail debt felt the pain first and that’s where the price shock seen in RE has come from. However, the labour market has remained fairly strong IMO due to mass retirement of the boomers starting in and around pandemic. As gen X and Y take their positions we’ve seen “worker shortages”. When businesses truly start to digest the higher borrowing costs met with decreased consumer demand they’re going to get squeezed from both supply and demand sides. Then we’re going to see the marginal propensity for saving go way up as people’s outlooks for the future of their earnings becomes bleaker and bleaker. I think its been propped up in the short run by the millenials as they finally start to have families and buy goods, but there’s less millenials than there are ageing boomers so there’s going to be some businesses that are just going to disappear and with them the productivity. economic recession when labour market corrects, followed by flat and declining prices especially in condo and townhouse market projected out over two years. That’s my bet.

Have you been through the eviction process before? I have and it took 6 months and you can guess how much rent I got during that time. This is why I only consider renting up and downstairs separately now to diversify away from that risk.

As for tenants paying their rent on time.

As a landlord, how brutal would you be on tenants if they can not make the rent on time?

If you can evict them, then the odds are that you can find a new tenant quickly and raise the rent substantially.

When I say sellers I mean people who actually have a reason to sell. e.g. downsizers, multiple property owners looking to cash out, overleveraged, etc.

Assuming they have good tenants that pays the rent on time lol.

I almost agree but I think If you see something you really like that checks all the boxes and can afford it then it’s always a good time to buy.

I don’t know where all the sellers who rush to the exits are going to live. Even investors aren’t worried if the price drops, rents won’t be coming down any time soon. Real estate is not the stock market. Like I’ve said before, all my friends are complaining about how much their portfolios are down, not the value of their homes.

“In the long run we are all dead. Economists set themselves too easy, too useless a task if, in tempestuous seasons, they can only tell us that when the storm is long past the ocean is flat again.”

-John Maynard Keynes

Right now sellers are excited about their new assessments (even though we know conditions are much different now than mid 2022). Will be interesting the psychological effect next year when assessments go back down a bit. When people feel richer on paper they aren’t in a rush to sell but when paper gains start dwindling all of sudden there is a race to the exit. I think next year will be when inventory really starts to build.

There’s no rush to buy at this moment…let the spring inventory pile on (hopefully) and see. If there is something you like and can afford then go for it…but don’t buy something you don’t love for the sake of buying out of fear the market will run away again.

I’ve been doing a lot of reading to figure out if I should wait a bit more before buying & moving, but have no way of telling if it is the Optimists or the Bears who are correct…maybe I should just head Kris Kristofferson’s old line:

“But I won’t spend tomorrow regretting the past for the chances that I didn’t take.

‘Cause I’ll never know ’til it’s over if I’m right or I’m wrong [loving you],

But I’d rather be sorry for something I’ve done than for something that I didn’t do.”

Hell, even Lord Garth is singing that same song now:

been calling this before, rate duration is the key.

I’m calling the boring in house prices.

Noise just like the drop in December. Will be interesting to see how multifamily behaves in coming years though. Affordability will weigh heavy unless we see a rapid drop in rates and supply is constrained mostly by policy unlike detached.

I’m of the feeling we will give up another 10 points this year as the economy continues to weaken I still wouldn’t consider 10 points to be a train wreck though It’s still going to take time to get inflation back down to 2 percent imo

Condo median increased 20k in January.

Greater Victoria real estate market limps into 2023

https://www.timescolonist.com/business/greater-victoria-real-estate-market-limps-into-2023-6474050

‘Monumental’ change: New system hikes pay for B.C. family physicians in effort to ease health-care crisis

https://www.timescolonist.com/local-news/monumental-change-new-system-hikes-pay-for-bc-family-physicians-in-effort-to-ease-health-care-crisis-6474087

Interesting stats as always. I am not sure that the economy has absorbed the interest rates hikes yet and I suspect there are a couple more quarter point hikes in the future. The condo market is a bit suspect.