Out of town buyers remain active in Victoria

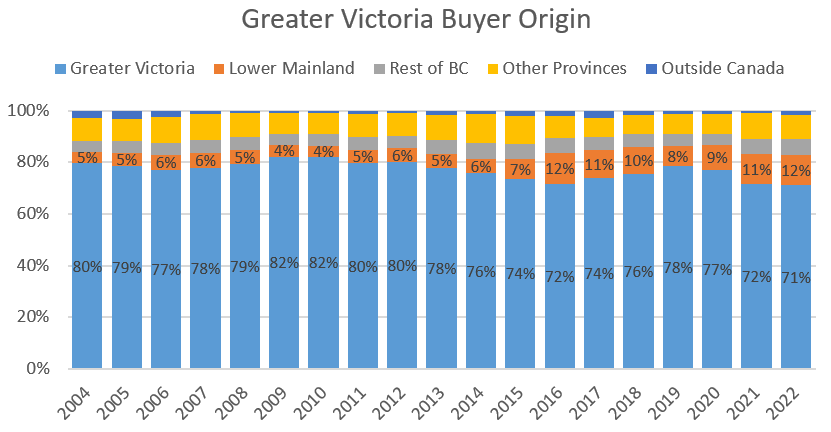

The full year of buyer origin data is out and it shows that while out of town buyers pulled back a bit during the weak second half of the year, 2022 marked a new high for out of town buyer participation in the market.

As a reminder, this measure is collected by the VREB and input by agents in response to the question of “Where is the buyer currently residing?”. The answer to that question is open to interpretation but it’s the best data we have on where buyers are actually coming from and how that has changed over time.

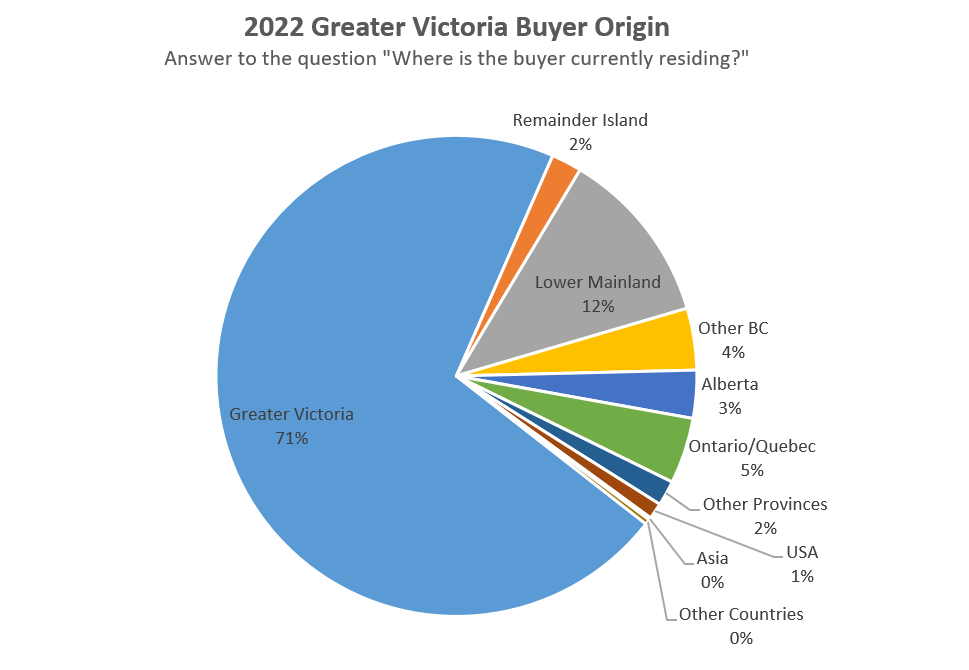

Last year, 71% of buyers moved from the Greater Victoria area, while the rest came from out of town, with the Lower Mainland remaining by far the largest source of buyers.

On an annual basis, that marked the highest proportion of out of town buyers since 2004 when the data starts. The shift from nearly 80% of buyers being local to now near 70% came mostly from an expansion of buyers from the lower mainland which started in 2015/16.

We did see some slight pullback in the rate of out of town buying activity after the market cooled. Comparing the latter half of 2022 to the same period in 2021, purchases by locals decreased 35% while purchases by out of towners decreased 47%. But that merely brought out of town buying activity from an extreme high (31% of sales) to a still elevated level (27%). With a much slower market going into 2023, this will be a key measure to watch, as out of town buyers (along with first timers and investment buyers) have a disproportionate effect on market conditions.

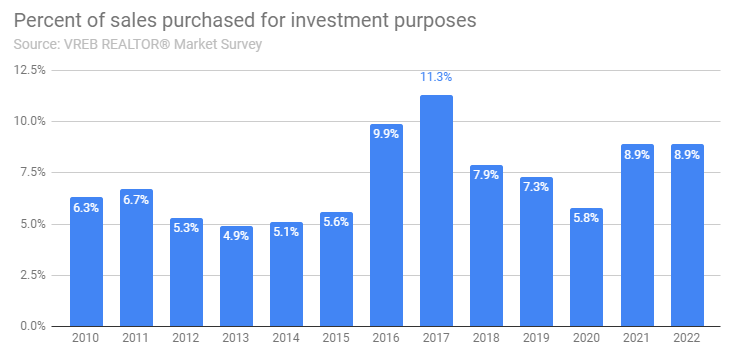

In other annual data, the survey figures for 2022 are also out, and the proportion of investment buyers stayed constant from 2021, at about 9% of buyers. The annual figures there also hide a shift in the market, with investment buyers dropping from 10% in the first half of the year to 7% in the second. However that remains above the ~5% we saw in slower years.

Also the weekly numbers.

| January 2023 |

Jan

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 26 | 474 | |||

| New Listings | 190 | 692 | |||

| Active Listings | 1617 | 744 | |||

| Sales to New Listings | 14% | 68% | |||

| Sales YoY Change | -51% | ||||

| Months of Inventory | 1.6 | ||||

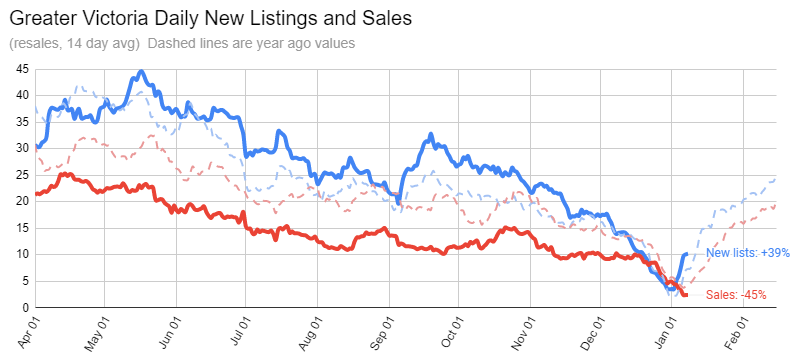

There’s little point in reading too much into the first week of the new year where sales are typically extremely slow. On the face of it it’s a good start to new listings which are up substantially over this time last year while sales are down by half. However once we look at the chart, we can see that this is a time when new lists and sales both ramp up very steeply, and a delay of just a couple days can drastically change the year over year figures. We’ll have to wait until near the end of the month to get a good read on how on how durable the change in activity is.

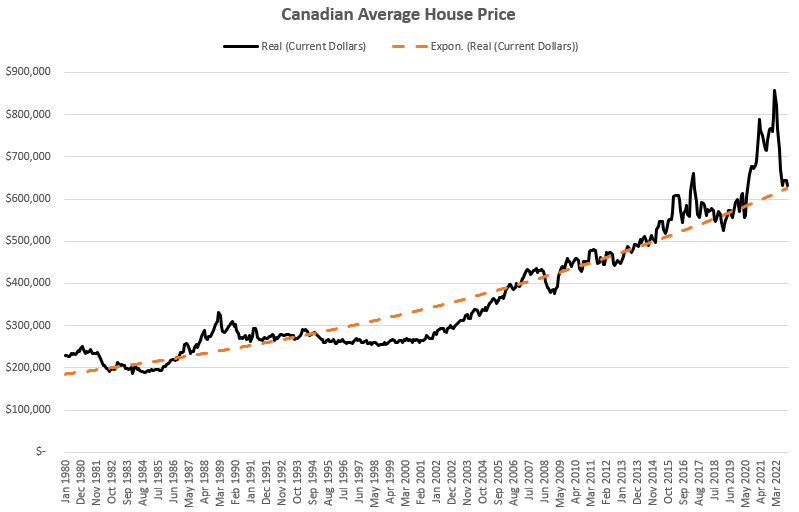

Meanwhile on a national basis it’s interesting to note that prices have returned to the long run trend (of about 2.9% annual growth after inflation) after the sharp correction in 2022.

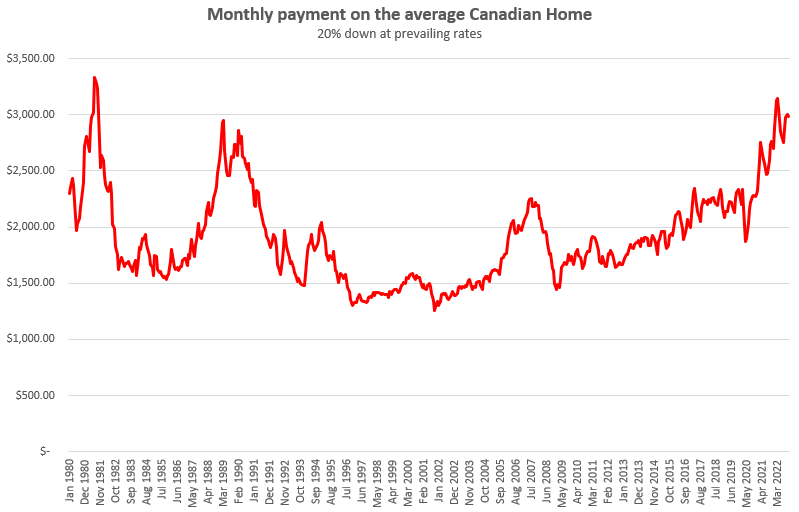

However that trend was established during a period when rates were nearly continuously dropping, so there’s little reason to believe it will continue. In fact when we turn the average home price into a mortgage payment, we are at near record high levels, similar to those in the early 80s and 90s. Both those times were followed by years of flat or declining prices nationally.

I joined the ranks of “relisted a lower price” this week when our property didn’t sell last fall. We’ve officially had 12 times as many showings in the first 3 days as last time. And four offers, compared to none. We accepted one.

Ontario starting to pay for treatment at private clinics. Primarily for non- life threatening ailments. It’s only a matter of time when we have access to a private medical system. I don’t blame the system we currently have in place. I blame the failings of our system on chronic abusers who repeatedly do harm to themselves.

Lots of accepted offers out there. The paces of sales will start to increase quite a bit going forward.

The interesting part is inventory….not really seeing much quality coming to market whatsoever. Lots of re-lists, unattractive rental properties, etc.

+1

If the government was serious about speeding up permitting, they would have eliminated red tape, purchased padlocks and announced layoffs in the permitting departments.

Often with a price drop though so fresh at that price level.

Conflicting signals out there. People in Seattle and Vancouver saying market starting out very active, and a few agents here have said the same but sales figures very slow.

I guess, but it is stale inventory versus fresh?

Depends on how you compare.

Jan 16th, 2023: 379 new lists

Jan 17th, 2022: 273 new lists

By calendar day = (379/15)/(273/16) = 48% higher

If we go by business day, it’s 39% higher.

But if we actually compare resale new listings for January 1st to 15th in both years in metro Victoria (which is the criteria I use for the weekly sales/new lists charts), it’s only 23% higher this year

However none of these account for relists. Not really sure it matters a lot though, if someone is relisting it’s still inventory for sale.

Thank you Patrick, and it is nice to be back in Victoria.

Empire state building took 20 months start to finishing. Fast forward 100 years a few townhomes on Foul Bay take 10 years. That is how we are progressing on housing.

Well well, those over educated liberal art graduates have to do something don’t they?

Is it really 48%? I haven’t analyzed the numbers but this year we have a ton of re-lists in January (properties that did not sell last year). In January 2022 we would have less re-lists as everything was selling so no reason to re-list. I would think the 48% is heavily inflated due to re-listing, but not 100% sure. Leo, any thoughts?

“Premier David Eby announced today the creation of a “one-stop-shop” approach to improving provincial permitting with the intention of speeding up the construction of homes to generate much-needed affordable housing supply sooner than later”

Let’s get real, this is a complete joke with an expense of 200 new employees sitting around thinking up new processes on how to make things more complicated.

Do you know what would speed up construction of homes?

Eliminating owner builder exam.

Do you know what would improve affordability of new homes?

Eliminating owner builder exam.

Do you know how much evidence is out there that the owner builder exam has had any impact on quality of owner builder home in the last seven years?

Zero.

So why not scrap something 100% useless that would improve speed of construction and lower costs? Well what would the government do with the employees, managers, etc., that oversee the owner-builder exam?

This government is 100% talk, including Eby. Like they literally do nothing tangible, well other than the strata property act amendment which will just make those condos less affordable to purchase now.

As time goes on I am more and more pessimistic and believe we are totally screwed on housing. If I wasn’t in the market and had the means I would seriously consider getting in in the next 18 months on this dip as I don’t think the future is going to be good in terms of affordability. For every person swinging a hammer in Langford on a construction site will have 14 government employees overseeing and 500,000/year immigrants piling in. The way the immigration works they will let in 400,000 educated ones, 99,998 unskilled refugees, and 2 people that can swing a hammer. Then we will wonder why housing is unaffordable.

I am not sure how CREA did this price decline calculation. If it is based on the benchmark crap instead of median values, it is not very reliable for Victoria – especially with VREB’s screw up with the benchmark data. I would rather place my trust in Leo’s data. We are probably in the -15% range based on median data.

@Introvert

Well, would you look at that, just outside of the top 10 least desirable places in Canada to live.

https://www.cbc.ca/news/business/crea-housing-december-2022-1.6715177

Good to see the listings up and weak sales be great to see it keep going The faster we tank the economy the better

Wow, that’s an actual job title.

I’m not so pessimistic, but provincial approval timelines are not that significant for most housing. Some big projects in the LM might benefit. Also I would much prefer them to set concrete targets like we will do the turnaround in 1 month instead of just staffing up and not having a specific target.

Hahah, all that matters is that I am right ;). Gona be meeting with some international insider contacts this week. If I hear anything that I think maybe of interest to this forum I’ll drop a few tidbits.

In the academic sector this is how we get associate vice presidents of inclusive excellence..

New BC permitting strategy

“The Permitting Strategy for Housing is supported by an initial investment of 42 new full-time positions.

Once those positions are filled, the team can be increased to 203 positions.”

Ha ha, great, so in reality permits will take twice as long and will be burning a few tens of million in salaries as well.

We are so screwed on housing long term it isn’t even funny.

Until mortgage renewal. Cash flow positive at 1.6% will likely change at 6% .

But having rental income helps when qualifying as well. A suite will be considered when buying a home and can compensate for a lower salary. Another reason income alone doesn’t tell the whole story for affordability.

It is not an even playing field.

https://www.theglobeandmail.com/real-estate/vancouver/article-interest-in-vancouver-condo-ignited-after-rental-and-age-restrictions/

Insider contacts or good guess? 🙂

Looks like a small positive but nothing that will move the needle.

https://news.gov.bc.ca/releases/2023WLRS0003-000033

Hey Patrick,

Thanks! Same here..

Month to date numbers.

Sales: 74 (down 47% VS same time last year)

New lists: 379 (up 48%)

Inventory: 1670 (up 135%)

Slow start. Some of that is likely stalemate from higher assessments confusing sellers as to market value

New post tonight.

BC saw a record growth in population in latest quarter (Q3) measured by statCan

That’s +48,942 BC population in 3 months, an incredible population growth of 0.9% in 3 months!. (This despite a small loss of 5k to Alberta)

This was all from immigration (mainly to Vancouver), and some was one-time catch up/processing. But given the surge in immigration numbers expected in 2023 onward, big immigration numbers and BC population growth numbers are expected to be the new normal.

https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2019036-eng.htm

Permitting related probably.

Leo’s two charts are interesting. I would think lots (possibly most) of those mortgage free homeowners are not in the top 30% (i.e. ≥ 125K/yr) household income groups. So the wealth tied to their homes are from the past or gifting.

I do think your age has something to do with it, but I agree with you 100%. 🙂

I think that has more to do with age than anything else. Older homeowners are less likely to have a mortgage (although more likely than they used to be), and Victoria is one of Canada’s oldest metros. Of course as previously noted homeowners may be bringing that mortgage free status from somewhere else.

Note how far down Calgary is, even though it’s one of Canada’s most affordable big cities. Reason? One of the youngest populations among Canada’s big cities.

Why do you say that? So far everything seems to be for immediate effect, not delayed.

It might be my age but I dont consider todays mortgage rates in the least bit high. Money has been far too cheap for far too long.

Are they though? This city is full of wealth, but we just see the complainers online whining about why they can’t afford a SFH as a FTHB. I think what those with their entry level government jobs don’t realize is there’s a lot of money in Victoria and their starter salary is someone else’s vacation budget.

Or, some that have cash positive rental properties and have others paying their mortgages regardless of the interest rates…

Please see above patriotz lol

Any of the proposals will be set to take affect after a spring election or at some unknown point in a new mandate.

Leo’s last two graphs are astounding.

43% in Victoria

Income is only one gauge.

You also have a significant number buying with cash, with significant down payments from homes they’ve sold in higher priced markets, downsizers in the same market, those buying with money they’ve inherited, and those with substantial family help.

34% of homeowners don’t even have a mortgage.

Any guesses for the BC government housing announcement tomorrow?

Unclear to me why they don’t break it down more finely. Maybe in the PUMFS

wonder how it looks at 280k.

Definitely going to skew higher than average. Younger people and people with less income aren’t going to be diving deep into reading about the housing market.

The distribution looks odd due to the unequal groups, but apparently 10% over $200k

Leo should do a poll

Thanks for the discussion.

Well Patrick, I thought that I could have been mistaken and taken what you wrote out of context.

So, I went back and looked at your post….

“Greater Victoria median age actually got a little younger from census 2016 (age 45) to 2021 (44.8)”

The I looked back at mine to find “domino theory” that you placed in quotes. Placing something in quotes means that I actually wrote that.

as opposed to what I actually wrote…

“Losing that age group may also have a domino effect.”

No theory. Just an opinion of what may happen in the future. It doesn’t rise to the level of a theory. It may happen or it may not. Just simply expressing a possibility after considering why some retirees chose to move to Victoria in order to be close to their grand children.

Read my post. About the difference, I said “ Call it flat”. That’s the same thing as “immaterial”

You’re the one with a “domino theory” telling us that Victoria is aging.

Another ref point is reddit member (where 65%-80% are young people between age 20 to 45) counts now:

Reddit Victoria: over 100K members, with total CRD population 415,481 (StatsCan 2021)

Reddit Nanaimo: 18,508 members, with total Regional District of Nanaimototal population 170,367

Victoria seems to have more (or at least not less) young people % wise than Nanaimo, from numbers above.

Maybe most young people in Nanaimo are too busy with their houses to join reddit? 😉

Well Patrick, it depends on what you consider a material difference. Is the difference between 45 and 44.8 years material? The numbers are rounded to the nearest one tenth up and down. I would therefore call the difference between 45 and 44.8 immaterial.

Is it really a small club if every other HHV contributor is at 280k?

I don’t think it would have a material effect on median age. There are factors both ways skewing median age a little.

There were about 1,600 Covid deaths in BC prior to the May 2021 census. Those would be average age 80. That would tend to reduce median age.

Sadly, many more young people in BC than that (6,000+) died from opioids during the 5 years between the census. They are young in their 20’s. That would tend to increase median age. https://news.gov.bc.ca/releases/2022PSSG0056-001250

In any event, Victoria population is close to 400,000, and Victoria’s 8% share of those excess mortality numbers is too small to move the needle much.

Sure. But how about from the point of combining housing price with work/job/pay opportunities, rather than just housing price alone?

One downside to younger people moving to Victoria, presumably couples, is that 50% will eventually separate and require 2 places to live instead of one. My renters are currently the result of marriage breakups.

Patrick, I wonder if some of the younger age in Victoria might be linked to earlier deaths from Covid. Don’t have the stats but but somewhere I read that average age was reduced by a year or something. Actually if anyone knows it would nice to find out.

Greater Victoria median age actually got a little younger from census 2016 (age 45) to 2021 (44.8). Call it flat. Significant as a rebuttal to the common hhv poster narrative that vic is aging fast. Such as the data-free “domino theory” of aging released here today.

But let’s look at the difference between Nanaimo and Victoria. The median price for a detached home in Nanaimo is $752,500 calculated from 182 sales over the last 90 days. The median price in Victoria’s core districts is $1,120,000 calculated from 203 sales over the last 90 days.

But what is a little bit more interesting is the price difference between condos in the two cities. In Nanaimo the median price of a condo is $384,000. In Victoria it’s $525,000. That makes it easier for those in their 20’s and 30’s to buy their first home and to eventually upgrade to a detached home.

Quite a bit of difference to consider when making a choice between Victoria and Nanaimo.

Actually that CTV article says:

“Over the past seven years, the age of people moving to Vancouver Island, and where they’re coming from, has changed, says VIEA. Between 2014 and 2020, the percentage of people who were moving to the island who were aged 50 or older declined from 59 per cent of all migrants to 35 per cent.”

Sounds like “younger generation move-in” is more than just in Nanaimo, and CRD has 2.44 times of incoming people as Nanaimo for that period.

Well that’s good for Nanaimo, Patrick. But we should be looking at current net migration to Victoria. The lower cost of housing in Nanaimo would be more appealing to the younger generation. It works both ways. Those that leave Vancouver for lower prices would be the same reason why people leave Victoria for lower prices in other cities too.

Check out the VI CTV news article I posted before yours. It contradicts what you’ve apparently “seen on this blog”, and talks about increasing numbers of young people coming to the island.

Young people buying here will, over time, put more strain on the housing market. A 35 year-old buying here might own for 50 years. A 65-year old might own for 20 years. As it stands, the main source of available SFH is people “leaving” from natural causes.

If y’all can see past the pitchfork and cloven hooves, Garth has an interesting bit about the OSFI today.

I think Leo S graph illustrates, on a basic level, that as long as the net migration to Victoria is positive the demand for housing increases and leads to higher prices for homes, rentals and new construction. But there isn’t sufficient detail to determine as to who constitutes that demand. How many were single people, retirees or family households of 3 or 4? Or how many became renters or purchasers?

From what I have seen recently seen on this blog, In 2022, Victoria is now losing the age group that are typically made of renters and first time buyers. The 20 to 30 group that are typically single or newly coupled up. That doesn’t bode well for the rental or condominium markets as this age group are typically the largest consumers.

Losing that age group may also have a domino effect. One of the reasons why retirees chose to leave their friends in other cities is to be near their grand children in Victoria. While Victoria is a pretty city and generally warm all year round; I personally don’t believe that is enough of a reason to leave someone’s life long friends and family to move here. But if retirees have grand children here that is a strong reason to migrate. If the retirees children and grand children are moving away for better jobs and less expensive housing, then there will be less of a reason for retirees to move here.

Nice to see that “ Young people make up growing number of newcomers to Vancouver Island”. And “ Earlier this month, the City of Nanaimo said its 25 to 44-year-old demographic was beginning to outpace its 65-plus cohort…”

I used to talk about “well-heeled boomers” coming. From the recent millennial’s $$$salary posts on HHV, it looks like we should expect more well-heeled millennials coming here too

https://vancouverisland.ctvnews.ca/young-people-make-up-growing-number-of-newcomers-to-vancouver-island-report-1.5866073

“Between 2014 and 2021, more than 89,000 people moved to Vancouver Island, according to the Vancouver Island Economic Alliance (VIEA), with more than half of those people coming from elsewhere in B.C.

More than half of all migrants who came to Vancouver Island between 2014 and 2021 moved to the capital region, according to VIEA, with approximately 45,800 people settling there”

Vancouver net inflows to Victoria

Why does ‘missing middle’ housing make people so angry?

https://www.timescolonist.com/local-news/why-does-missing-middle-housing-make-people-so-angry-6379651

I would like to know what percentage of the general population own a rental property. Let’s include the parameter for over 10 years. Lots of people have ventured into the real estate investment game but bail after a bad experience and incur a loss.

Talk is cheap, but interest rates aren’t any more. Enjoy.

All investments are speculative, that’s why you buy quality. Higher the quality, the less the risk.

Only if cash-flow negative without including the mortgage principal payment.

Silly assessment that appears to restate “wisdom”.

An investor is someone who invests with a view to profit. Speculation simply means buying with a view to profit but with a chance of profit or loss.

Most fortunes are made with leveraged investments and some degree of speculation and risk.

Being able to carry losses through to successful returns is a requirement in an appreciation market like ours – or almost any business endeavor.

The past is the best predictor of the future. If you own a cash flow negative rental property in Victoria that you bought recently and can hold it you have a very good chance of exceeding a GIC or other secure investment. In addition, those losses are tax deductible against other income which reduces your interim risk.

The biggest thing before you make any investment is to do your research and do a spreadsheet with projections which assesses risk and returns.

If you are buying a cash flow negative property in an area which does not experience much appreciation or negative appreciation then the math won’t work long-term. There are many areas of the US where you can get great cash on cash return, but not appreciation. Good for short term, not great for long-term.

It all comes down to math, not blanket statements.

You’re also paying off equity, and will own the property free and clear in 25 years. That’s another route to success.

“Rents are holding and it’s only a matter of time before values climb again for the little guy investor”

If you are in a sustained cash-flow negative situation and your only hope of success turns on a rise in the value of the property you are not an investor, you are a leveraged speculator.

I agree, unless the landlord did helocs on the prior properties to buy new properties in 21/22 on variable I don’t see how anyone who bought pre covid can be in big trouble.

Ha ha, no. If you bought Feb/March 2022 with a variable mortgage yes but that has to be less than 1% of landlords. A lot of landlords are complaining but it doesn’t tell the complete story. For example, with the strata insurance skyrocketing and other inflation strata fee increases have outpaced rent increases. This sounds unfavourable for landlords, right? Until you look at the actual numbers.

One of my condos in Vic West

Strata fees in the last 9 years $150 to $250 = 67% increase

Rent in the last 9 years $1100 to $1,750 = 59% increase

How exactly am I getting hammered? Strata fees went up $100 and rent went up $650.

Principal has gone done every single month since purchase, I think I’ll survive the inflation.

Well I don’t think you will have too much to worry about as long as homeowners (owner-occupiers and investors) are in the majority. Barring a change in that, I doubt you’ll lose even the partial capital gains inclusion, and the deductibility of net rental losses against your other income. So put away the Kleenex.

LMAO, don’t be sour because westshore didn’t make the shortlist. Btw, u sure you don’t have any kids?

I think that’s correct. But when that happens and some payout ultimately arrives, you’ll be told it’s an undeserved windfall, you’re part of the problem, and a whole cohort of society will be trying to figure out how to take it from you!

The question I have is: how fast will be the recovery in house prices? Based on a past article Leo posted, if I recall correctly, Victoria’s recoveries are consistently slow. Is that correct, Leo? And if so, the second question I would ask is: isn’t there reason to expect 2024 to be different given high demand from out of town buyers, many of whom won’t be encumbered as much by interest rates especially as they fall?

“Waiting decades for a crash that never came must also be a ‘dear school’ ” – Patrick said.

Anyone who bought more than a couple of years ago is still well ahead on the purchase price and shouldn’t be doing too badly on current expenses. As for those who bought more recently, “Experience keeps a dear school, but fools will learn in no other”, as Ben Franklin said.

True, but you don’t go into an investment expecting it not to go down sometimes. We can still pick our number and sell then, whenever that times comes.

We really need a symbol for sarcasm. Most small landlords are just totally being hammered by inflation and government regulations.

280K is a sic income. That’s about what my partner and I combine to as well. There should be a club. But it would be a small one. Your wife should check out the medium income in BC by household. It’s probably about 100K. Globally a fraction of that. No room for anything but humility and gratitude for this.

Frank, I spend $7000 on a fence and $14000 on a repair, interest rates are up, and values are down. Def agree not easy times providing housing as a landlord. But you know what. Brighter days are around the corner. Rents are holding and it’s only a matter of time before values climb again for the little guy investor, if I can state the obvious.

You don’t. That’s why lot prices take a beating during RE downturns. Remember – endogenous pricing.

I notice that the listing is 34 days old. Let us know when it sells and for how much. Well according to the listing it has $1/year property taxes LOL.

Kristan,

Not necessarily, the FTB could be getting gifts from parents and not have high incomes. If I recall correctly, you were telling us that was a big factor for FTB. So it is relevant (and not merely “by definition”) that the FTB incomes are in fact, as measured by statCan, much higher than average. I was surprised to learn that FTB have 2X the income of renters for example. And 20% higher income than existing homeowners.

That sounds promising, and there’ll be a big HHV cheer here when that happens.

Hey Patrick,

Well what you’re describing is a selection effect no? FTBs have to be able to afford to buy in a time of low affordability, which almost by definition means they skew wealthier. Yes, definitely; my aside was just that said wealthy millennial population is non-representative, and not a good basis for extrapolating future housing trends. Maybe rich people are enough to support (or worsen) historically bad affordability for SFDs; I hope not! But I guess we’ll find out soon enough.

PS On our end once UVic finally wraps up collective bargaining (salaries are still stuck at mid-2021 levels and tenure bump is coming this year) we should finally be able to jump into the fray.. here’s to hoping inventory builds. There’s not too much out there right now, but thanks to you all I know that’s usually the case for this time of year.

By the way millenialhomebuyerx2, we rent up in central saanich, out in the countryside, and have found it an absolutely lovely place to raise our three boys.

QT,

We;come back, and nice to see you posting again.

I suspect that the housing market in Victoria will remain pretty strong overall. Not as sure about the condo market.

Millennial here, our combined income is actually 280K as well… Was just discussing this with my wife today. She seems to believe 280K is not that high for our cohort, while I tend to agree with you that is. I guess it is all a matter of perspective (I grew up poor, she grew up pretty well off!).

From The Martlet (UVic newspaper): https://martlet.ca/uvic-students-are-dumpster-diving-to-save-money-and-reduce-food-waste/

The median income of FTB (the relevant cohort) is much higher than the overall median household income . FTB income is about double the income of renters.

For example, according to statcan, In Vancouver, median for a two income household FTB is about $140k in 2023. Of course a $1.4 m sunnymead home is well above average so we would expect the income cohort buying it to be higher than that. Probably $200k household income.

https://www150.statcan.gc.ca/n1/daily-quotidien/220412/dq220412a-eng.htm

I agree that some are near international airports, but the places that I saw were 2-4 hours from paved roads, and at least 9-10 hours from an airport.

That Sunny Mead home sure looks great for a young family of four with young kids. Everyone loves putting their toddlers and infants into the ensuite soaker tub with all their toys each night right? I don’t even have kids and that jumped out at me with a 3 piece in the main and a 4 piece off the primary.

SMH.

What a VicREanalyst!

By the way, I wouldn’t count on 280k millennial household income to prop up housing. That’s top 1-2% territory, multiple standard deviations from median and average income for the region. But all of this underscores the point about bad affordability.

Have a nice weekend all!

If the cheapest lot in Langford is $600K then how the heck would you turn a profit if new built it under $900K?

4307 sqft vacant land: https://www.realtor.ca/real-estate/25129953/lot-25-2158-millstream-rd-langford-bear-mountain

Barf emoji.

I’ve never witnessed someone’s ego grow so much over so little and yet, here we are…

The poster said west of Blanchard, not east as you’ve said.

I have nothing against any of those neighborhoods. It was the poster that said they were hoping to buy elsewhere and they didn’t like the school where they were. And sunny mead was on their list.

millenialhomeownerx2 – East of Blanchard, just South of Mckenzie in a central neighbourhood? If that’s in Maplewood, you are in a good neighbourhood. Nothing wrong with that place and 2400 sq feet is not tiny. I know a number of doctors and lawyers who live there and you have a good golf course and lots of great parks nearby. In many ways superior to Sunnymead – maybe.

Slow day at the office today ;). I am glad your keeping tabs on me though

< VicREanalyst

January 11, 2023 12:59 pm

You should get a commission on how often you post.

12 posts today. Nice work. Are you the pot or kettle?

“It just sucks to know you are doing well in life financially, but not be able to get into the house or neighborhood you want.”

“I refuse to pay more interest than principal”

====

I don’t see how your statement is correct that you are “not able to get into the house or neighbourhood you want”. Because later it sounds like you would be able to, but that would require paying “more interest than principal.” That seems a self-imposed rule keeping you out of the neighbourhood that you want for you and your kids.

That’s fair enough, but you should be upfront about that, and not tell people that it sucks because you’re unable to buy.

My advice, buy the “Sunnymead”house now. A young child, and one more on the way, these are the years to be settled down into a nice family neighborhood like Sunnymead. Not where you are now, where you don’t like the school, and you can’t even put a name to your neighborhood.

You know what they do have? An airport that offers direct flights to major cities around the world.

Yup, that’s why i am the VicREanalyst 😉

Kudos to you Marko (especially considering that your business is buying /selling houses)!

I could be completely out to lunch, but my hunch is that the current real estate situation is setting up for an up swing. Because, millennials household are earning $280K a year, minimum wage is increasing, everyone are getting a raise, unemployment is ultra low, influx of immigrant from overseas, economists are predicting a small or flat interest hike, and it also look like the stock market has found it bottom.

PS. I just got back from a 3 month trip overseas. And, my assessment by world standard, Victoria is ultra cheap compare to many places that visited. Some places land price costs more than 20 times Victoria price that have absolutely no service (lack of health care, sanitation, schools, security, electricity, roads, jobs, and rampage corruptions).

And if a 1980’s house in Sunnymead is not an upgrade then current situation is pretty darn OK

Thanks for all the responses…I was expecting a lot of negativity but pleasantly surprised. Also I am a she, but I do have a better half who is a he…so doesn’t really matter.

We have toyed with the idea of paying down the mortgage aggressively, as I mentioned we did increase our payments by 15% and brought our amort down to 13 years. However, during a potential recession we would prefer to have cash on hand rather than lock it up.

I refuse to pay more interest than principal … outdated thinking maybe but we didn’t overstretch ourselves for this reason. When we bought interest rates were very low, we got 2 year fixed for 2.19 in 2017, and I rationalized that having a 4-5 bedroom house in a worst case scenario we could host homestays to supplement the mortgage if we needed.

Yes with soon to be 2 young kids an upgrade for us would be a cul de sac or dead end street, with a floorplan that separates bedrooms from living. Also a garage would be nice, or even a carport.

This is based on us living in a 50s bungalow, it’s 2400 sq feet finished but we really only use the main floor, even though the basement we fully redid. We don’t live in oaklands etc, we live south of mckenzie but west of blanshard I don’t think our neighborhood has a name, it’s not the gorge, it’s a nice little pocket…so although we are decently happy with the neighborhood, the school catchment is not what we would want. Our ideal areas would be outskirts of GH, broadmead, sunny mead, cordova bay, more rural saanich, central saanich.

In the end I know we are very fortunate to be in the position we are financially– but this is not due to sheer luck only. We left friends and family in vancouver to be able to afford a SFH, didn’t over leverage and have balanced investments in our TFSAs and RRSPs. We also have demanding jobs that require education and trianing. It just sucks to know you are doing well in life financially, but not be able to get into the house or neighborhood you want. Again, first world problems…but this is a housing blog.

One more edit: I fully agree with marko’s comment below. We are getting near the point of simply accepting we stay here. I also think grass is always greener and a larger property = more maintenance , and with 2 littles we don’t have much time. We have it good, just did not plan for this to be our long term / forever home when we bought and renovated.

Big picture I don’t see an issue with this, is it not better for the environment, etc?. Maybe people will be stuck in their current home long enough for the kids to move out and then it will be a perfect size again and they won’t have blown all that cash on transaction fees upgrading/downgrading 🙂

In Croatia both sets of my grandparents one house entire life. Even my parents, bought the one house in the Oaklands area 27 years ago and they will defintively live there until they pass or have to go into a home. They could have easily upgraded many times but moving just seems annoying and not sure if upgrading real estate really creates any additional happiness. I would say the majority of my upgrading clients do it out of life just being too boring/simple. When you have plenty of food/water and a steady job you need to keep busy with other things in life like pets, upgrading homes, etc.

I suggest you do that actually. Poster said they lived bought a dump for 660k in a super central neighborhood that he thinks is worth $1.2 now, which I think implies oaklands, maplewood or fernwood, not sure why you don’t think Sunnymead is not an upgrade if that was the case.

VicReAnalyst, You should re-read Millennial’s post. I think you missed a lot of what the poster was saying. And, unlike your comment, I have no reason not to believe what the poster wrote.

And as for the listing you showed. if you are living in a good neighborhood of Victoria, then a 1980’s house in Sunnymead is not an upgrade.

What are you talking about? he is buying and selling at the same time in the same market, if he is upgrading then a down market will generally work in his favor. They are also not carrying large debt, assuming what he posted is true their current mortgage is 2x their income….

Millenialhomeownerx2, you are caught between a rock and a hard place. And so are a lot of people your age today. You did what most on this blog said to do. Bought the least expensive home in a neighborhood that was gentrifying. Then you fixed and repaired and built equity. You did what every home improvement show said to do. How could you not as this was working for so may people to move up the property ladder. The more debt you took on the more your wealth increased. Now we are in a different market where carrying a large debt and high leveraging a property is crushing.

You don’t want to leave the city or down size, so all you can do is aggressively pay down the mortgage. On the flip side, you are better off than most as you have good incomes and that gives you an option. Pay down the mortgage and when the market turns again then you should be able to take advantage sooner than most others in the next real estate up cycle.

Is this considered an upgrade? https://www.realtor.ca/real-estate/25176511/1186-dewland-pl-saanich-sunnymead

Excluding new home construction.

When an investors sells one of their homes, that doesn’t mean there is one less home owner. The home ownership rate goes up by one if it is bought for home occupation. And if it is bought by a renter then the number of renters goes down by one too. If the property is bought by another investor then nothing has changed. The number of home owners and renters stay the same. The market isn’t just home owners and renters. The market is home owners, renters and investors. Investors playing a very important part in the market place.

Investors are typically seen as having a stabilizing effect on market prices. As prices rise investors sell to home owners and that increase in supply would normally cause prices to plateau. When home prices are low, then investors would begin to purchase properties and that would cause a market in decline to bottom out causing a price floor.

At least that is the way it is suppose to work. The lower interest rates in the past and the ability for people to access large sums from their home’s equity and other sources permitted more people to become investors. And those investors were able to sell to high risk investors that were purchasing for price appreciation rather than a positive cash flow. That allowed prices to continued to rise while the number of home owners and renters changed marginally.

My suspicion is that today we have people that have invested in properties that a generation before would have never bought a second, third or more property as it would have been too risky and they didn’t have access to large sums of cash and lines of credit. That herd of high risk investors that bought on appreciation rather than a positive cash flow has to be culled before the market place can bottom out or stabilize. Which means that it isn’t possible to determine how far prices may decline as most potential investors will have been burned by a real estate correction and not be in a financial position to take advantage of lower prices. There may not be many potential investors left to step in and start purchasing even when the rents begin to provide a positive cash flow and reasonable rate of return. It may take a decade before investors can recover from their losses or develop trust in real estate again as investors become more risk adverse.

prices need to come down so much more. did a quick calculation using ratehub to see what prices we could look at for moving up the property ladder. We bought our home in 2017 for 660K (it was a total dump), super central location, yet very quiet and private backyard. We put the absolute min down payment and started with a 700K mortgage as we took out a bit more to do renos, we now owe 550K on the mortgage. We have spent 300K on renovations everything from the roof to the drain tiles and water line, and cosmetic upgrades too of course. Assuming we could sell our house for 1.2 in todays market that only leaves us with approx 600 K down after realtor fees. Which means we could only buy a house worth 1.3 to keep our monthly payments similar, but our mortgage would go up 150K. There is absolute crap for 1.3 nothing that would be considered an upgrade…and by upgrade, we are mostly wanting a more established neighborhood, slightly larger lot, house with good bones that has been well taken care of….does not need to be new/modern.

The only way it will make sense for us is to buy something worth 1.7 that has a good suite we can rent out for 2500+/mo. But then we are sharing with someone. Or maybe I am underpricing our current house.

For reference we make 280K in household income. But have one child in preschool and another on the way. No other debts. Based on after tax income we pay 32% of our income towards our mortgage (we do accelerated bi-weekly and also recently increased the payments by 15% to ensure we are still paying down the same amount of principal despite higher rates). I’d prefer to keep it that was as no way I want my life to be governed by massive mortgage debt payments

It’s crazy to me!! Based on this I expect local first time buyers and property ladder climbers to remain on the sidelines for the foreseeable future. I bet the market will slow drastically until rates begin to come down or prices fall more …unless we get a lot more out of town buyers with deep pockets or high incomes.

From: https://www.ctvnews.ca/business/home-prices-in-q4-down-year-over-year-first-decline-since-end-of-2008-report-1.6229449

Agreed, apartment units are more secure from an eviction point of view. I think the amount of notice (time) for mom-n-pop landlords to evict to move in should be increased to something like 6 months, to discourage this practice.

Frank, renters most definitely outnumber landlords. ( I never said homeowners).

Patrick, the owner of a fifty floor rental building would have a hard time convincing the LTB that they wanted the whole building for their family use.

Any landlord can sell any owned property, and the new owner can kick out the tenants to live there.

Fair point. I should have used the term dwellings. I think the point I’m making (“rentals are good”) is the same.

Thanks for the discussion, time will tell just like how I said how Victoria folks were slow to housing market changes in spring 2022 and how used car prices had peaked in summer 2022. I also called rent peak in Oct/Nov, can’t wait to see some more data on that!

Correct and I think the causality is actually working the other way. For example:

https://www.theglobeandmail.com/drive/mobility/article-how-low-can-they-go-used-car-prices-are-falling-but-dont-expect-a/

May sound like a nit pick, but a property is not the same thing as a dwelling. A property has its own title. Home ownership stats are for ownership (or not) of dwellings by households.

Security of tenure. The pension fund can’t kick you out to move in, nor likely will the billionaire, but the mom-n-pop landlord can, or someone they sell the unit to.

Teslas are 1.3m of the 298 million cars on the road in the USA. That’s 1 out of 229 cars (0.4%) on the road.

I wouldn’t get carried away with the impact that a price reduction of new teslas will have on the entire used car market.

The home ownership percentage (currently 66.7%) is the best metric to track. That means 33.3% of properties are owned by landlords (in the broadest sense). Home ownership rate fell a little (from 67.8% in 2016), but has been relatively stable. That means one less homeowner out of 100 homes, and one more renter. Hardly a cause for alarm.

It doesn’t matter how many properties one landlord owns. For example, if you look at 100 units in an apartment. Why would it matter if they were owned by a pension fund, one billionaire, or 100 different mom-n-pop landlords?

Rentals are the main source of affordable housing for poor people. And people in transition (newcomers, students etc). If we want more low-income affordable housing, we should look to having more rentals. And we should be happy that the home ownership rate fell a little, as it points to less gentrification.

Thing was RE is that there are tweaks and additions you can do to generate additional cashflow you can’t really do with stocks/bonds. plus there are tax savings with write offs etc. on the income. But obviously being a landlord is not passive income and there is work involved.

Over night every single used tesla purchased in the last 2 years currently for sale is likely underwater. Given the popularity of Teslas, this will have an impact on the other cars as well.

Me too. That’s also why I find it more intuitive to have a dividend focus in retirement more so than ‘total return/sell gains’. I believe there are various studies that show this focus on dividends is misguided, but if you don’t have a pension, there’s nothing like cash in your jeans every month.

But if focusing primarily on positive cashflow, doesn’t that equation run into a sort of brick wall in places like Victoria, vs. say Moncton, vs. say forgetting about RE and just buying a good dividend ETF which gives you nice yield and still potential upside? I mean, I realize the equation gets easier with price declines (how much easier is another question if financing costs go up). But even so.

When their largest market introduces large price-based incentives. There was quite a lot of speculation they would do this to get in on the fed rebates. Plus they have 2 large factories ramping and raw materials have dropped quite a bit from their highs. Prices are still higher that early 2021.

I don’t think this particular cycle is normal businesses. How often do manufacturers of popular vehicals drop their prices on new vehicles by 20%?

Look at how many used teslas are for sale on auto trader. This is going to hurt

Normal business. They made bank on the way up now they take some losses. These price drops are good for the industry, the previous price hikes were just getting into completely unreasonable territory. Crazy that people were paying nearly $100k for a Model Y. New prices are a partial step back to reality, very similar to housing.

To the extent that there are landlords with multiple properties, renters DO outnumber landlords. I do support the view that there must be a limit for rental properties owned by a landlord. .

LMAO, dealerships with used tesla inventories are in a world of hurt now!

What are people’s opinions of what will happen to Royal Bay and other large developments in the Westshore if there’s a continued softening in real estate this year? Talking to builder friends, they say building costs per foot haven’t really moderated since the start of the pandemic. I keep getting emails from Gablecraft about new deals, and the realtors there (that wouldn’t give me the time of day a year ago) are suddenly really pushy trying to lock in a deal.

Gablecraft has advantages through volume and cheap land but you have to imagine their margins have changed considerably in the past few years. If prices for their new SFHs drop to the 800s, there has to be a point where they simply stop building until conditions become favorable again. Certainly a risk for someone buying there right now, that you live in an unfinished construction zone for potentially many years (dockside green anyone?).

Other areas of the CRD too.. if building costs are what they are and not moderating, but the rest of the market is, then suddenly there is a huge discrepancy between new builds and their surrounding homes. This has to eventually impact the construction business in a big way. A friend of mine offered on a new home in Maplewood recently, albeit a little under ask, and the offer was rejected on the basis that the “developer would be accepting an offer below their cost”. Those are some tight margins… and the prices are already starting to seem way out of wack for the surrounding area.

I am cashflow guy, paper gains don’t really appeal to me. I rather be consistently cashflow positive 20k a year than be cashflow negative and have higher more volatile paper gain/losses.

Barrister- Renters do not outnumber homeowners. I’m not even going to comment on the rich evil landlords causing the HOUSING CRISIS, that’s ludicrous.

BC’s $500M plan to buy rental buildings sounds good at first glance but the more I think about it the more problematic it is.

It doesn’t add any new rentals, so while some tenants will benefit from likely getting more stabilized rent, that’s just a lottery.

It doesn’t target priority areas. If a non-profit buys a market rental, what are they going to do, evict the tenants to make room for people that need shelter rate housing? Likely not. So many people that have no real need for affordable housing will get it while people that really do need won’t.

If a building is end of life and up for redevelopment (max risk for displacement for residents) then putting it into the non-profit space doesn’t solve any of those problems. Great if the non-profits buy it and redevelop it into a lot more units of social housing while supporting existing tenants, but I suspect what will happen instead is that government will be terrified of the headlines (“Building purchased to prevent evictions is being demolished!”) and just overpay to keep the places limping along that really should be replaced.

The $500M would be a lot better spent adding new deeply affordable units rather than buying existing ones, or at least buying those end of life buildings with the specific aim of redeveloping them into higher density social housing.

Frank, we dont own rental properties in Canada, cannot imagine why? You are missing my point, the politicians dont care about your reality, what is more important is that renters greatly outnumber evil rich landlords that are causing the HOUSING CRISIS, It is a matter of votes.

You can buy a better property and operate it efficiently, but the best ROI in RE in Victoria is not on rent, it is on appreciation on leveraged capital.

Of course, if you rent out a suite in your home this is different as you are getting some assistance with current expenses without too much additional capital invested.

Someone buying today with a mortgage and renting out is almost certain to be operating in a cash flow negative position unless they have a huge down payment – which also reduces the ROI because you have more invested. And then there is a risk of a further downturn on leveraged capital that magnifies losses if you have to sell.

The only time this shifts is if you hold for a long period of time. Long enough to have rents rise while your mortgage amount declines and your payment stays around the same. Even then, the ROI on the capital invested based on rents is poor and, while a well maintained rental may be not too much work, it is not a passive investment.

Given the current outlook on appreciation in Victoria and mortgage rates, owning rental property might not be as attractive as, say, a GIC, unless you are really in it for the long haul and willing to stick with losses until the next bump up in prices.

People who can qualify still may buy rental properties with a view to future appreciation, but not as many, and certainly not as many will buy with a HELOC.

Rent prices are dictated by the market. Only thing I can do to maximize my return is buying the right property and operate it efficiently.

As B.C. homeowner grant approaches $1B, critics call for its end

https://www.vancouverisawesome.com/highlights/as-bc-homeowner-grant-approaches-1b-critics-call-for-its-end-6360174

Barrister- Just curious if you own a rental property. This year I spent $14,000 on a downstairs bathroom and $13,000 on a new roof. Add in property taxes and insurance, it’s going to be a huge loss this year on one of my properties. This idea that landlords are racking in tons of money is not reality.

Patriotz, fascinating article, thanks for sharing!

How I learned to stop worrying and welcome a housing crash

Eby is on record as being opposed to this. Just discourages new rental housing. When it was last in effect in BC (70’s) it was a major factor in the shift out of PBR and into condos.

I suspect that we have a reasonable chance of seeing Bold Action on the housing front before the next early election where rents are tied to the unit. This would be a very popular move since there a lot more renters than there are landlords.

This will the advantage of allowing BC Housing to pick up a lot of building at a cheaper price as some landlords decide to get out. It will also convince a lot of owners of individual condos to put them on the market cheap. Landlords have neem gouging the poor renters and it is time for BOLD ACTION>

It is a good discussion. It’s risk reward calculation. You need margin of error from rents. But you can’t ignore market recovery. Historically, the Vic market recovers quite gradually, but it’s harder to predict in context of a policy induced correction that is quite reversable. The Vic market may return fairly briskly once buyers are confident a turnaround is underway.

Oh, so the Canadian MBS CAD$ market you previously said doesn’t exist, you now say “ Canada MBS market is $100 billion”.

At least you learned something today.

I’ll stick with ex-BOC Chief Poloz’ optimism that MBS could also be used successfully in Canada for significant long-term funding if regulations were changed.

Thanks for the discussion.

US MBS market is $11 trillion, and $300 billion is traded every single day. Canada MBS market is $100 billion, or 1% of US MBS market . Anybody can buy Canadian MBS doesn’t mean everybody will buy. Only Canadians would buy the Canadian MBS. Very little demand from outside Canada.

Nonsense. Plenty of MBS already in Canada (since 1987) and in CAD.

Poloz (2019 BOC chief) idea as described in his paper is to expand it for longer term MBS. Primarily by making investor friendly changes to banking and mortgage regulations, such as removing the “no-break-fee other than 3 months interest” after five years.

https://financialpost.com/moneywise-pro/mortgage-backed-securities-are-the-little-noticed-cog-keeping-canadas-housing-market-running/wcm/5786f402-d675-42ee-b55f-b410b0109eca/amp/

MBS issued by Canadian banks won’t work as we don’t have a pool of international buyers for those. The MBS market exists only for USD denominated securities.

Yes, and OSFI should help FTB, by simply eliminating the stress test entirely for people signing up for 10 year terms (currently 5.99%).

No, the Canadian system isn’t setup for US-style long term mortgages (at reasonable rates, like 6.4% as seen in USA now), from a funding or regulation perspective. Note that in my post I specified “enabling USA-style long term mortgages”, which is not the Canadian-style version of just lending someone money for 30 years at a huge interest rate.

Poloz (prior BOC chief) went in great detail to describe the considerable steps needed to properly enable USA-style long term mortgages in Canada. These are extensive and involve creating a MBS market in Canada, and changing regulations (e.g. eliminating no penalty after 5 years ). Essentially the entire Canadian system is setup to efficiently fund 5 year mortgages, and it would need to be setup like the USA, to fund 30 year mortgages.

You can read Poloz paper on the topic, explaining all those points here https://www.bis.org/review/r190507b.htm

There is no restriction on banks offering long term mortgages. Royal Bank offers 25 year terms. The problem is that borrowers were not willing to pay the rates that would make lending long term attractive to the banks. In any case, a 10 year term removes most interest rate risk, and that’s widely available at a small premium to shorter term.

https://www.rbcroyalbank.com/mortgages/mortgage-rates.html?utm_dc=ga_PMX_17595042897____c_x_&gclid=EAIaIQobChMI8-fN58zC_AIVHf3jBx1tbQlGEAAYASABEgIXA_D_BwE#posted-rates

OSFI should instead make it better for first-time buyers. The big problem is the risk of mortgages payments rising with interest rates AFTER the initial loan is granted . All borrowers (not just highly indebted) can get hurt by rising rates.

OSFI should focus on solutions to that. Namely enabling “USA-style” longer terms for fixed rate mortgages, as proposed by then BOC chief Poloz in 2019 . Then if you afford it at time of purchase, you know your payment won’t rise during the entire term.

This solution would mean you sign up for a 30 year rate (currently 6.3% in USA)., where the rate never changes (though you can optionally refinance to lower rates)

https://rates.ca/resources/are-us-style-long-term-mortgages-coming-to-canada

“ Are US-Style Long-Term Mortgages Coming to Canada?

Longer [fixed rate] mortgages, up to 30 years, have been available in the U.S for decades. Now [May 2019] Poloz says Canada should consider the same.”

Sounds like things will be even harder for prospective first time buyers..

Implementing such measures for folks buying a second, third, &c property sounds great. Artificially increasing the barrier to entry though?

The problem is that some BC sawmills lose money at that price. This article (below) was written in nov 2022 when prices were $433. Today, prices are lower than that ($402), so worse for the sawmills.

https://www.bloomberg.com/news/articles/2022-11-03/housing-market-gloom-threatens-to-put-sawmills-on-chopping-block

Housing Market Gloom Puts Sawmills at Risk of Shut Downs

Price is so low B.C. producers are losing money: RBC analyst

“ “We are below the bottom, so B.C. producers are losing money,” Quinn said in an email. “I suspect we will get a number of sawmill closures over the next year.

– Canadian producers West Fraser Timber Co. and Canfor Corp. already announced reductions in output at B.C. sawmills this year. “

Like I figured, nothing burger, since this is soooo closing the barn door after the cows have escaped and mice and rats have moved in.

OSFI considering further restrictions to reduce the number of highly indebted borrowers

Loan-to-income (LTI) and debt-to-income (DTI) restrictions – i.e., measures that restrict mortgage debt or total indebtedness as a multiple, or percentage, of borrower income.

Debt service coverage restrictions – i.e., measures that restrict ongoing debt service (principal, interest and other related expenses) obligations as a percentage of borrower income.

Interest rate affordability stress tests – i.e., a minimum interest rate that is applied in debt service coverage calculations to test a borrower’s ability to afford higher debt payments in the event of negative financial shocks.

https://www.osfi-bsif.gc.ca/Eng/fi-if/rg-ro/gdn-ort/gl-ld/Pages/b20-cd.aspx

More pessimism from a bank. Scotiabank: “Canadian Housing Entering Bear Market Territory”. Note:

https://twitter.com/SBarlow_ROB/status/1613518313757315073?s=20&t=3vcLVRP2EoZNaXa8Ylyb_Q

That would be surprising considering lumber is still north of $400usd/1000boardfeet.

Hearing reports (on BNN) that sawmills around North America are stopping production due to low demand. I guess builders are cutting back due to the uncertainty of future prices. That’s not going to help the housing shortage.

No the accuracy of the predictions is not the point at all. The point is that a bank would effectively say, “Buyers are likely to lose money, and risk of losses will increase for lenders like us, in the year going forward.”

Some people won’t be able to afford their mortgage on renewal over the coming years if rates stay this high. This will be unlikely to show up on a credit report accurately imo because delinquency affects credit scores and many homeowners have options. Homeowners will refinance, rent rooms, get side hustles or sell. If unemployment rates rise some of these options become harder and delinquency may rise.

This university based economist’s basic data-free presentation is that “many” people can’t afford their mortgages , but that isn’t supported by mortgage data, which shows at/near record LOW arrears of mortgages. There are 5 million mortgages, and a record low of 7,000 are delinquent. (0.14%). Even lower in BC 0.10%.

Let me fix that headline to something supported by data, such as “Good news!… a record low 1 out of 1,000 BC mortgages are delinquent”

We got a heat pump installed into a 1950s bungalow just under 1100 square feet. It replace a natural gas furnace so it already had ducting in the crawl space, so we used a system that used the ducting. It works amazingly well. No problem keeping the house at 20 even when it was -8 last month. Our insulation is ok, but not great. It’s old and not superthick insulation, but the energy assessment guy said it was pretty good for the time. Usually in December/Jan/Feb our Natural Gas bill was about 140 or 150 a month. Its 30 in the summer with only hot water. Hydro was about 45 a month (90 every other month). Last Hydro Bill was 150. Seems like the heat pump is cheaper than natural gas was. Pretty happy with the decision, and A/C in the summer is an amazing bonus 🙂

The optics of the prediction would only matter if experts could make predictions with any sort of accuracy, but it has been shown over and over again that they can’t.

We have installed 2 heat pumps in 2 different houses over the past 10 years (1954,1961). We installed the high efficiency diaken units (a 2 tonne and a 3 tonne). Both houses had/have ducting though so we used air exchangers. We have been very happy with both. The second house we replaced an old oil furnace. Our hydro bills are about the same, but we don’t buy any oil.

From: https://www.ctvnews.ca/canada/canada-s-real-estate-market-still-really-overvalued-warns-economist-1.6226491

Well, yah, everyone really knew that when it was happening.

Yes, that’s a good point. At least the author at TD kept the numbers small, a clever career move. If someone at TD predicted something big ( -35%), and it didn’t happen, he’d be the laughingstock of the bank, and would likely be looking for a new job.

Patrick- When they move to Alberta they usually buy a pickup truck, ATVs, skis, guns, and a cowboy hat and boots.

Good point, everyone.

I was more thinking that folks who own don’t want their home’s value to drop in half, but I didn’t think it through.

What’s significant is not the precision of the numbers themselves but that a bank would make a prediction so at odds with its own commercial interests. I’ve never seen a bank predict a double digit decline in a major market – and this is on top of declines already registered in 2022. Almost always when industry players predict a decline they try to make it as small as credibly possible.

YW (from TD) 😉 🙂 🙂

Found an interesting link here- https://cba.ca/mortgages-in-arrears

It looks like less than 0.5% of buyers in any province are behind on their payments. Going to take while for those waiting for forced sales and markets to crash.

Millenial, re your heat pump question, I have a 1956 built home that was added on to in 1979. It’s just about 1075 square feet total. It has a mini-split heat pump with one head in the dining room which is combined with the living room and that is the addition. It may have better insulation than the rest of the house, but I don’t really think so. The rest of the house has electric baseboard heaters. I think the heat pump helps a lot with heating and cooling costs in terms of the whole house. It just isn’t quite a big enough system to do the whole house, and I cannot add another head apparently. I asked when I had it serviced this summer. I find it cools and heats to a nice temperature, although I do admit to cranking it when I’m not actually in the living/dining room to get that spillover effect. I just need to turn on a baseboard heater when I am in my bedroom, and the bathroom has one of those wall heaters which I use when in there. It runs me about $120 a month for all electricity including the heating and cooling. A friend at work with a similar home is putting in a system and was similarly on oil heat so was blown away by my monthly costs as she fills up her oil tank 2-3 times a year at over $1,000 a time with no cooling. Since you have ductwork it will probably effectively heat and cool the whole house and I would go for it if you plan to stay.

Thank you for some complete random guesses 🙂

“TD’s prediction for Canadian housing in 2023” (somehow it missed NFL).

Source: https://twitter.com/67Dodge/status/1613117094928809984

Where did you move to Animal Spirit? When did you move and what are you finding about your new home and new location that has made your life better? It would be interesting to hear about your new adventure and perhaps others would become motivated to move in the same direction. Maybe even me!

You should get a commission on how often you post.

“half price is only desirable if you don’t own a house”

Wrong. Moved to another location in BC with prices around 2/3 of that in Victoria. Cleaned out the mortgage, have funds left over from the purchase of a new house and aren’t looking back. Best move we have ever made.

I wonder if the sellers are going to move to Alberta, buy a half-priced house and a no-tax snow shovel?

Explains why people from Vancouver who own are selling and moving here.

Sold for 660k.

2020 yr build on Bear Mountain sells March 2021 for $1,740,000 at a time 5 year fixed rates were 1.5%ish. Re-sells this morning at $1,900,000 at a time when 5 year fixed rates are 5%ish. For a lot of product we aren’t even back down to early/mid 2021 prices despite much higher interest rates. Quite the market resilience imo.

That “Victoria is still affordable” $699k 4 bdr Gordon head townhouse 50-4061 larchwood that I talked about dec 24 isn’t listed any more. https://househuntvictoria.ca/2022/12/19/dec-19-market-update-new-listings-pull-back/#comment-96766

Did it sell? Do I get a commission? 🙂

Moncton houses are half of Ottawa prices. Does that make it a no-brainer for Ottawans to move to Moncton? Or should they “want to think that one over”?

Want to think that one over? I keep hearing on this forum that Victoria is desirable for existing Vancouver homeowners because – well you know.

Half-price is only desirable if don’t yet own a house.

Barrister, it isn’t a “chart on taxes”, it is a chart of income taxes. The chart specifies that they are “income” taxes, by calling it the best province to “earn” that money. You’re referring to consumption taxes, which would be the the best province to “spend” money. The chart and Freedom’s post are correct.

Perhaps your post was made before your first cup of coffee.

in general you will always be better off fixing insulation first if there’s major deficiencies, but your pre-assessment should give you a sense of whether there are low hanging fruit.

That’s correct, sorry should have indicated.

Barrister & James Soper,

That chart is just one angle to view some of the differences among provinces. Note that social benefits are also very different among provinces, in addition to PST and other local taxes. But you all already knew it of course to not be misled.

Every time they say “according to experts”, I mentally replace that with “according to my insider contacts”

It’s not that misleading. All taxes in BC, Alberta and Ontario are together the least taxed provinces (although Alberta would be least for most people) and Quebec the most taxed.

Ridiculous, starting with the headline. Everyone on this forum knows that regulation of the housing market is largely responsible for excessive prices, not falling prices. They have picked out the new foreign ownership ban, which as we’ve discussed is largely moot, as “heavy-handed regulation of the market at the hands of Canadian prime minister Justin Trudeau.”

Over-taxed housing market? What tax? Do they even know about the principal residence exemption?

Anyone with any sense knows that it’s the increased interest rates that are bursting the bubble.

Freedom: Your chart on taxes seems to leave out the major cost of both provincial sales taxes and gasoline taxes as well as things like Land transfer tax. The chart while interesting is seriously misleading but I am sure that was not your intent.

By that token, it would be best to live in a completely tax free environment, with private roads, sewage, health care, education, firefighting and police.

FYI:

Some perspective from across the water. From that remove the judgement is that Canada prices should fall around 30% this year.

https://www.telegraph.co.uk/property/house-prices/trudeaus-high-taxes-have-tanked-canadas-housing-market-britain/

Except for the houses are half price part. 🙂

That would be an easier to sell to a Winnipeg crowd, than to us Victorians.

Why not move to Alberta? Houses are half price, gas is half price, and no provincial sales tax. It’s a no brainer.

If you look at the age, it seems young people (age 20s) are the ones moving to Alberta. Likely going for oil jobs. That seems to be a popular option with the recent immigrants to the Fraser valley.

Alberta may be playing catch-up. For the 2016-2021 years when they’ve lost people. Seems to be most closely related to the price of oil.

That last graph for monthly payment on average home is also adjusted for inflation, yeah?

Thanks Leo for always finding such interesting datasets to present.

Has anyone installed a heat pump in a 50s bungalow? Looking to ditch our oil furnace but concerned about the performance of the heat pump in a home with questionable insulation. Currently working through the Greener Homes Grant/Energy Audit process.

Any recommended installers or other words of wisdom?

Sorry the graph is tough to read – but you can click on it to zoom in. Cheers.

If history repeats then this is unlikely to be a 1 quarter blip, especially given the amount. I pulled the numbers since 1970 and every time we see any outflow its followed with multiple quarter declines closely linked. The last time this amount went out (around 5K – late 90s) we had sustained long term outflows. Not saying that will happen this time but something to consider. And as Patrick mentioned, the last time we had sustained outflows we had price declines. Here is the chart i just made from the StatsCan data:

But historically net migration from BC to Alberta has taken place when BC had higher unemployment. Now we see net migration to Alberta when BC has lower unemployment (4.2% versus 5.8%). Could be that this time it’s about affordability not jobs.

It’s still early days, either a blip or the start of a trend.

The Q3 stats for inter-provincial migration showed a flood into Alberta from every province – 19,000 total. Also a 32,000 international migration net gain for Alberta in 3 months.

BC lost the most people in a quarter in a decade (-5,000). That consisted of 10,000 bc ers moving to Alberta and 5,000 Albertans moving to BC. Historically, a sustained trend of outflow from BC has led to lower (more affordable) house prices in BC.

https://www.todocanada.ca/alberta-sees-high-interprovincial-migration-population-growth/

@freedom_2008, I swear a saw a comment here a couple of blogs ago about a mass exodus of Albertans from BC last year? Maybe Leo can remind me. If I remember correctly there was net migration from BC even for out of province-ers?

Very good report. I am surprised to see the small % from AB, even less than from ON/QC. Maybe all those cars with AB license plates here are mostly students and snowbirds (some of them may have already bought here years ago)?

Great article with the usual very well laid out facts. Thanks for the very interesting read.