Higher rates, but what’s the impact?

As expected the Bank of Canada raised rates again last week, now hitting the steepest calendar year of rate hikes since the 1930s. But are all these hikes still having an impact on housing purchases? Perhaps not as much as some might think.

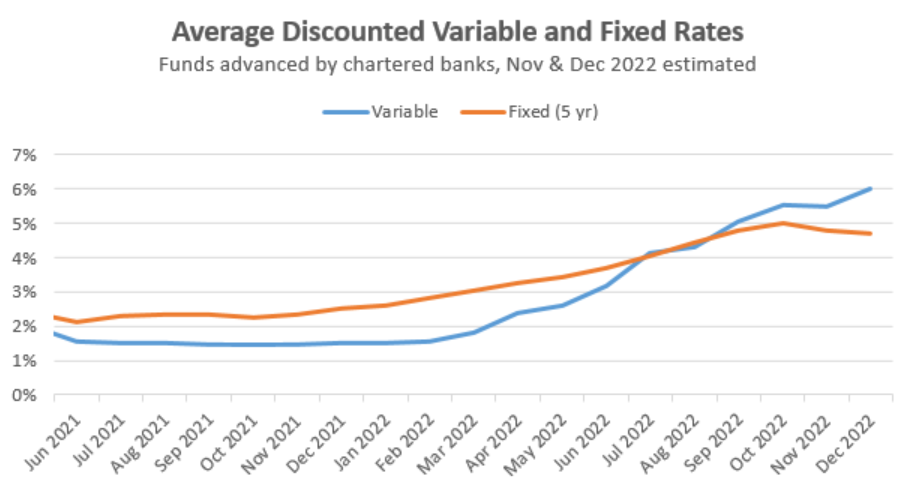

Up until the September rate hike, every Bank of Canada raise had an outsized effect. Those hikes bumped not only the cheapest rates available to buyers, but it also raised the bar for the mortgage stress test at the same time. However that’s quite different now as fixed rates have stalled out and even pulled back slightly while variable rates continue to increase. Do further rate hikes really matter if buyers can simply ignore them and switch to the cheaper product?

That’s in fact what they are doing, with only 29% of mortgage volume going to variable rates in October, down from a peak of 55%. I would expect it to be well under 20% now with the premium for variable even larger. The banks are going to be extremely busy with borrowers jumping ship to cheaper fixed rates. In October we still had 34% of outstanding mortgages in variables which remained at the recent peak, but expect this to drop going forward.

We also know that everyone with a low variable rate has been triggered at this point, but given the continued low to normal rate of new listings in the market, that apparently hasn’t caused enough pressure on sellers to list at a higher than usual rate. As more stories come out from different lenders, it seems that most are doing their best to keep payment hikes for borrowers as small as possible, opting instead to extend amortizations or only increase payments as little as possible to keep the interest covered.

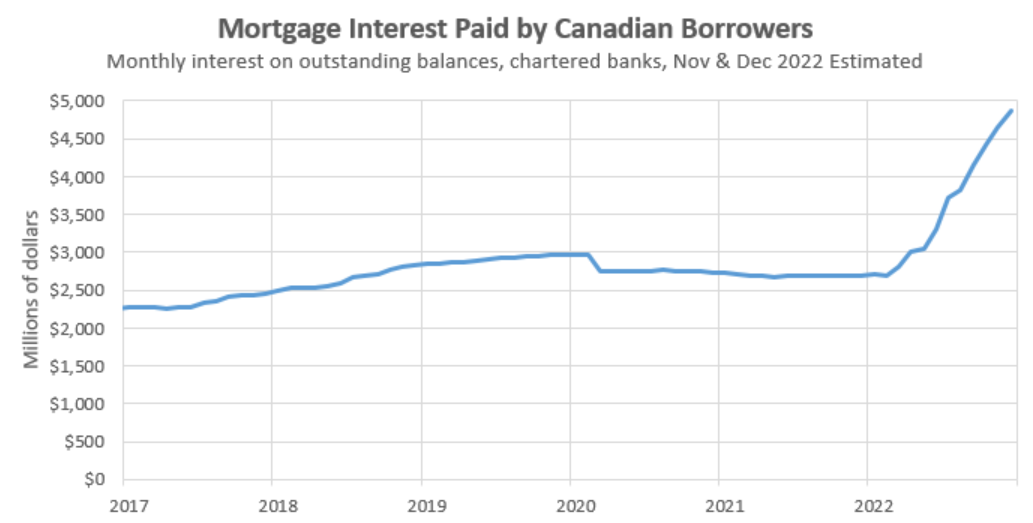

That’s good for owners and will help them hang on to their properties, but it doesn’t change anything about the rapid rise in interest costs which still need to be paid sometime. Monthly interest costs for outstanding mortgages have nearly doubled since the start of the year, from $2.7B a month in January to $4.9B now. Every renewal into a much higher fixed rate (about 2% of mortgages renew every month) and every jump out of variables locks in those higher rates for years.

So while the immediate increases may not force too many additional buyers out of the market, the impact of those higher rates will be felt for years as those funds are diverted from the rest of the economy (the purpose of rate hikes after all), and a reduction in buying and selling activity from upgraders that are feeling the burden of their existing loans. But beyond housing, the purpose of those hikes are to reduce demand and cool off the economy. So far price declines have come despite a continued extremely strong employment market, but the central bank may not be done hiking until that changes.

Also here are the weekly numbers courtesy of the VREB.

| December 2022 |

Dec

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 47 | 138 | 438 | ||

| New Listings | 87 | 204 | 399 | ||

| Active Listings | 2035 | 1975 | 652 | ||

| Sales to New Listings | 54% | 68% | 110% | ||

| Sales YoY Change | -24% | -21% | |||

| Months of Inventory | 1.5 | ||||

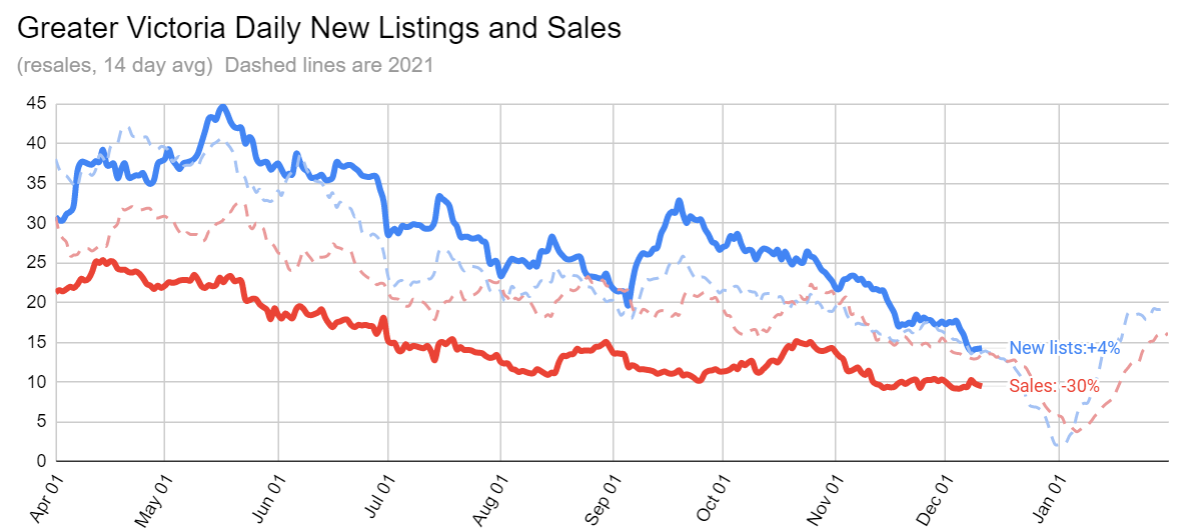

Sales are holding up OK so far in December, down only about a fifth from the year ago pace while new lists are coming in at the same rate as last December. Some additional condo sales may come from investors taking advantage of arbitrage opportunities with the lifting of rental restrictions. I’ll take a closer look at that at the end of the month to see if it’s noticeable, and then do another deep dive in a few months to see if the price differences have equalized.

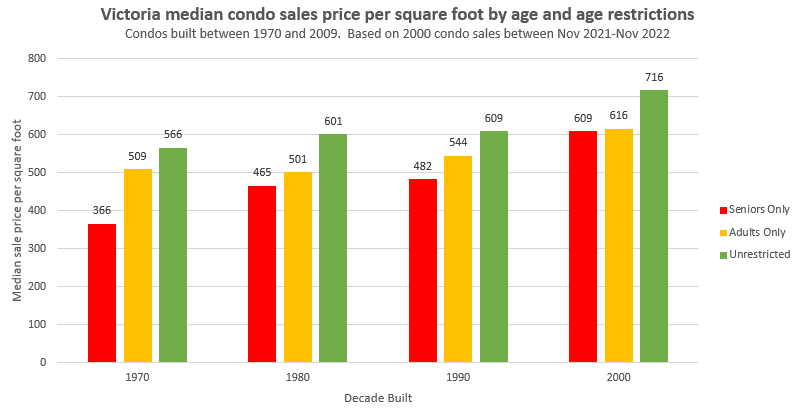

Of course rental restrictions are not the only ones that were lifted by the provincial government. They also banned adults only (18+) condos while still allowing seniors only (55+) rules to remain in place. That has led to some strata councils wondering whether they could switch from an 18+ to a 55+ age restriction to keep those meddling kids out of the building. That’s a possibility of course but if you’re in a strata considering that move you should note that it will cost you in terms of unit value. Comparing condo values by year built, we can see that seniors only condos are by far the lowest per square foot of space, lower even than adults only buildings. That vote may keep the building quiet, but it’s probably the most expensive bylaw the strata council will ever pass.

(next thread)

New post: https://househuntvictoria.ca/2022/12/19/dec-19-market-update-new-listings-pull-back/

Hey Patrick,

Yes, apples-to-apples comparisons are important. But you have to do more than compare inner-city condos in Victoria with say Amsterdam. While some families don’t mind small spaces there, the physicists with families I know tend to be on the lookout for slightly (but not much) smaller versions than here, in the realm of 3 bed 2 bath 140 m^2. With that in mind there are two discrepancies that have come out in those conversations. (1) There are row house options available in continental cities for that range that don’t match up well against townhouses here. Hence missing middle. (2) Prices for them generally fall off faster away from the city center than here in Canada. Even in those more expensive countries. Marko has commented on this as well with Croatia. That leaves more flexibility for those willing to commute a little extra.

As for wages, you’re looking at raw numbers, how wages in one country compare to those in another. But what I had in mind was to track housing costs relative to income. And, in particular, indexed value, where you compensate for the fact that different housing stocks in different countries are worth different amounts on starting date X.

What a storm.. high likelihood of a third consecutive white Christmas up here on the peninsula!

I don’t see anything remarkable in comparing USA vs Canada incomes over the last 20 years. The numbers are all USD, and the differences seen are likely F/X related.

https://countryeconomy.com/countries/compare/canada/usa?sc=XEAA

Next msg

It doesn’t work like that. The buying cohort isn’t just “buy to occupy”. It’s also buy as a landlord to rent. So low home ownership means fewer “buy to occupy”, but more “buy to rent out”.

Hard to predict what if any effect that has on prices. If Canada’s home ownership rate (67%) fell to germanys (50%), your theory would predict that canadas house price/income (7.5) would rise to Germany’s level (9). I don’t see that.

Your friend in Holland might be buying a much smaller home than you. As Marko has told us, in Croatia. a family with kids could live happily in a 600 sq foot apartment. That same option is available to you in Victoria. So next time you’re talking to the guy in Holland, compare what size/type homes you’re talking about.

It is important to note that numbeo standardizes for home size. So with numbeo we are comparing 1,000 sq feet with 1,000 square feet.

I could buy a 500 sq. ft. home in Vancouver cheaper than a 1,000 sq foot home in Victoria. But that doesn’t make Vancouver cheaper than Victoria. So I think it’s important to standardize for home size. This seems obvious to me, but there are HHVers here that think that people love the tiny homes in other places and so we should compare a 1,000 sq feet in Canada with 500 sq feet in Holland.

Australia and New Zealand have similar price/income to Canada.

UK is a meaningful comparison, and it’s price/income is 27% more expensive than Canada.

The point being, other than USA, Canada doesn’t have signifcantly higher price/income than any of your hand picked list of countries.

It’s only meaningful to make comparisons to countries with similar density, housing stock, ownership rate, and property tenure to Canada. That’s obviously the US, and also Australia and New Zealand, but the others don’t match in various respects. Germany for example has a low ownership rate compared to Canada which means the buying cohort is more upper income, but the price/income comparison remains for everyone.

Hey Patrick,

Well you are absolutely correct that as an American it is a particularly jarring adjustment. But the things I have in mind (curious what your thoughts are on them) are the growth in indexed value as a function of time, and in comparison with the growth of disposable income. As I understood it with respect to both of those metrics Canada has been an outlier over the past 25 years.

The other thing I have in mind is anecdote, conversations comparing notes with colleagues in many of the places you say ((Holland, UK, France, Israel, etc).

If Canada prices with a price/income of 7.53 is “insane” and an “outlier/exception”, what about all these countries with much higher price/income?

For example…

Germany 9 (price/income from numbeo)

Italy 10

UK 10

Austria 10

Japan 13

Israel 14

Croatia 14

South Korea 23.

China 29

Philippines 30

Hong Kong 45

As you’ve stated, you’re measuring the “insanity” of Canadian house prices as an American. But America has the lowest house prices of any country of 109 countries In the world (ok, except for Saudi Arabia and South Africa). This is numbeo data, crowd sourced and current to 2022. Price/rent data.

And Canada is 16th cheapest out of 109 countries.

So you ask us Canadians if we “realize how insane the house market is here?”. It seems you would need to qualify that with “compared to USA”. And this also means your claim that Canadians think they are “the exception” isn’t valid, because lots of countries have higher price/income than Canada. Or perhaps you dispute this numbeo data?

https://www.numbeo.com/property-investment/rankings_by_country.jsp?title=2021

Gauging how investors will respond in the new year, in my opinion, is not possible to determine at this time. The vacancy rate is low and rents are high. While there was a significant run up in prices and rents during Covid with prices coming down from the peak, rents seem to have not come down.

At this time, I don’t see that changing in the immediate future unless unemployment increases and people choose to leave Victoria for less expensive areas. High rents and the high costs of living on an island should have an impact on migration to Victoria. Victoria is a pretty city – but it’s on an island.

Investors are the wild card yet to be played, because if the rents start to decline and the vacancy rate begins to rise then I believe more investors will opt to sell.

So my opinion is that home prices while important to someone looking to purchase is not the straw that has the potential to break the market It’s the rental market. If that rental market declines then more investors will bring existing homes onto the market. And that could be a large pool of existing homes coming onto the market. More homes than say new construction coming on to the market.

So how big is the investor market? Every second home in Victoria seems to have a suite. What happens when some of those suites stay empty for a month or two and then the owner has to either lease them at a lower rent and subsidize the property with their income or put them on the market?

How the investor reacts is, in my opinion, the more important issue facing the real estate market. Not people looking for a home to live in.

I disagree. Financing is definitely worse since the bank of Mom & Dad has closed up shop.

Yeah I still think affordability is important and will return for at least attached housing. Not so sure about detached houses, they may not recover affordability as much as in the past. For attached even with sticky prices that would be another 15% price drop unless we drop back to ultra low rates.

https://househuntvictoria.ca/2022/10/17/what-would-it-take-to-get-affordability-back/

Yup, big increase in unemployment throws that out the window. All fun and good to hang on to a negative cash flowing investment property when you have a job and are confident that the market will turn around soon like it has in the past.

Enjoy the snow all!

When it comes to price declines since March, is that the right metric to understand the market the rest of the year? Affordability, which more closely tracks what people need in order to buy, has basically flatlined. From my seat, as a prospective buyer in the new year, the market is almost unchanged from March when it comes to financing and reach. I.e. affordability has been the metric that has most accurately measured our position. There have been changes of course, welcome ones that Leo documented before, like the blowing off of froth, no more bidding wars, and less risk when it comes to interest rates. But if prices had not declined, the market would be even worse compared to then. And, let’s not forget that affordability is near historical lows.

FWIW, as a non-Canadian, I think y’all don’t realize how insane the housing market is here (meaning the entire country, not merely greater Victoria) when viewed from outside Canada. Run-ups during COVID compare with those elsewhere in the developed world, but the baseline is an outlier. I’m not counting on it personally, but some regression toward the mean seems more reasonable than “we’re the exception.”

Determining supply is as simple as looking on the VREB data system. Determining demand is more difficult because any data is imperfect and not available to most. If you had the information from all of the lenders on mortgage applications that would be a place to start, but it would only be partial data on those requiring a mortgage. Otherwise you are left with looking at the sale prices achieved relative to supply and assuming the market is at equilibrium.

Real estate is unlike other products and services where a company has future orders that can be tracked to determine demand. That type of data for real estate is difficult to determine and is mostly educated guestimates based on past performance of the market with a lot of assumptions. It’s imperfect data that can fluctuate from lender to lender and the public’s perception of the future.

There may be significant immigrants that have the means to buy a home but choose not to. They would not be considered part of the demand for housing either as they are not participating in the game. They are watching the game on their TV and have no effect on the outcome of the game. That’s why demand is not made up of all people but a small subset of the public that are actively looking to buy. If you are not actively looking to buy, but have the means then you are not part of demand either.

When someone says that they would never buy a home at the current prices they have no effect on the market as they are not participants in the game. Relative to the total inventory of homes and home owners, the size of the real estate market is made up of active sellers and prospective buyers is very small, perhaps one to three percent of all the inventory of homes in Canada at any time. What happens at that small margin determines prices for property assessments and lending purposes for all of the housing in Canada.

Canada is a very stable country and that makes the real estate market work very well. Black swan events are therefore extremely unlikely to occur in Canada. It is extremely unlikely that a significant number of home owners that are content to watch the real estate market would ever enter into the game to sell their homes or that a significant number of people in Canada would all of a sudden become prospective purchasers. A reason why governments concentrates on having more homes built than on stimulating the non-participants to sell in the hope that if they can increase the supply of new housing on the market then prices will decline. But if the government is stimulating both demand with low interest rates and programs to increase the supply of new homes at the same time then you are just going to get higher prices.

But imagine what would happen if 2 or 3 percent of the total mortgage holders in Canada went into default. That additional 2 or 3 percent would swamp the market place with active listings doubling or tripling. while demand remains unchanged. This is highly unlikely to occur in Canada. In other less stable countries it is more likely to happen.

Home occupiers are stable, they tend to not be impulsive. Investors are different. How they react to declining property values can effect the marketplace. My guess is that they are no longer buying as they have been in the past. But they are not selling in significant numbers either. What they do or do not do in the spring will be a determining factor on what will happen to market prices as they move or not move from being non participants to active sellers. That re-sell market of investors is a lot larger than the new construction market.

TORONTO, Dec 19 (Reuters) – Canadian home prices fell in November from the previous month and at a faster pace than in October, while year-over-year price gains continued to slow, Teranet–National Bank National Composite House Price data showed on Monday.

The index, which tracks repeat sales of single-family homes in major Canadian markets, dropped 1.3% on the month, led by declines in Vancouver, Montreal and the metropolitan area of Ottawa-Gatineau. It was down 0.8% in October.

From its peak in May, the index has now fallen 9%, with Hamilton down 16.9% and Toronto, Canada’s most populous city, falling 12.9%.

Prices are still higher than a year ago, up 2% from November 2021, but gains slowed for a seventh consecutive month and were the slowest since November 2019.

The Teranet index tracks closings, so it typically lags realtor sales data by three to five months.

Reasons that the rates are stabilizing are that there’s a incoming recession being forecasted. Normally that doesn’t lead to a stabilization in prices.

My thoughts yes. The price declines we’ve had are unprecedented with such low months of inventory and inventory. Pure rate shock. Unless we keep seeing rates escalate in 2023 I don’t think that continues.

Review of the previous year’s forecasts and new forecasts coming up probably next week or the week after

Month to date numbers:

Sales: 223 (down 27% VS same week last year)

New listings: 292 (down 12%)

Inventory: 1869 (up 127%)

First time we’ve seen new lists drop below the year ago level since May. New post tonight.

From: https://www.cbc.ca/news/canada/toronto/ontario-homebuyers-struggle-close-1.6685427

An Uber driver who also manages properties signed to buy a near 2 million dollar property? Geez.

Leaves my question outstanding which is approximately how many do have the means to buy? Many that come through the Quebec program have substantial assets. It is obviously not all of them and also not zero. Demand also needs to be projected a few years down the line.

If you are saying that they will not be able to afford to either rent or buy what are we talking about in terms of demand on our very limited social housing?

Refugees or immigrants, the statement regarding demand remains the same. They have to have the means to buy to make them prospective purchasers.

Whatever: I think you might be confusing refugees with immigrants. The question becomes how many immigrants are coming to Canada who have substabcial capital resources that allow them to buy a home?

How are you defining demand?

As the interest rate increases fewer people qualify to buy a home. That restricts demand and house prices decline. During the previous few years the interest rate fell and more people could buy a home which increased demand. This brought more potential home buyers into the market earlier and drove home prices higher.

The government could dump 5000 refugees into Victoria tomorrow but unless they had the ability to buy they would not change home prices. Most might not even be able to pay rent in Victoria either. They would just be living on the streets. I doubt that is a policy the federal government wants to achieve or make the news.

You can keep on building million and two million dollar homes that doesn’t mean that refugees can buy them or rent them. They just are not counted in demand. Demand is not made up of people that wish for a home but don’t have the means. They have to have to be prospective purchasers.

At this time prospective purchasers are meeting supply and home prices seem to be stable.

It’s provincial policies that are limiting supply. There’s no inherent reason why housing stock can’t keep up with current levels of immigration.

I don’t think that federal immigration policies are intended to create excess demand for housing. You might also note that no province wants lower immigration, except Quebec.

Agree and federal policies seem aimed to ensure demand outpaces supply so house prices and rents keep going up.

This is true as well, unfortunately.

Prices may be going down, but the higher interest rates mean first time buyers will have higher mortgage payments unless they put down a substantially larger payment. At this point, lower prices are not making it easier for first time buyers to purchase a home. The price of these initial starter homes, be it a condo or a small house, still have to come down over the next year to offset the interest rate increases.

If you already own a home then lower prices have a negligible effect on your buying decision. Your home may have come down in price but so has the one you want to buy.

But perhaps the bank of Mom and Dad may be coming to an end as the parent’s home equity has lessened while the down payment their kids require has increased.

I would be watching the low end market for condos and starter homes. It’s difficult to find a condo in Greater Victoria for under $400,000 today. However, I expect that price floor to drift down, as well as the price for old and small starter houses, over the next year.

As for renters, they are going to be screwed over for at least another year or maybe more until starter homes come down to match the increase in the interest rate. Unless there is a change in the migration pattern to Victoria and perhaps a spike in the unemployment rate. Those that survive will be able to buy a home. Those that don’t will move to places like Moose Jaw.

It’s because owners outnumber renters among voters by more than two to one. Democracy in action. If the majority of voters really wanted lower house prices, politicians would care, big time.

Real estate prices going down is negative for existing owners and investors but positive for people who don’t yet own homes or rent. I think its important to recognize that there is a large section of the population for which the increased cost of housing has been a disaster. Unfortunately most politicians only seem to care about existing owners since they usually own homes and/or investment properties themselves so I won’t be surprised by policies to “fix” things.

Here’s a funny “honest government ad” from Australia that kind of sums it up (warning lots of swearing in video).

https://www.youtube.com/watch?v=gqFPhsO-2W0

The real question is were will the RE market be this time next year after the rate increases finally start to bite.

I absolutely dont have an answer to that other than it is a cause for concern. Not much help in that observation.

Down 15% after a 50% runup? Seems like blowing off some froth.

With the market down 15 points or so seems already pretty crashy to me

An interesting data point on delinquencies, from the CMHC data. The highest delinquency rate for Ontario was 0.7% on your chart. Saskatchewan routinely has higher delinquency rates than that (e.g. 2019 = 0.75%, and is currently 0.57%. Sask. is a “delinquency” outlier for Canada.

And Saskatchewan of course hasn’t seen a crash. I’m in agreement with many here in that we would need a recession/unemployment to crash prices.

I think it would take a prolonged recession before defaults would have an impact on market value. In other words defaults will not likely be the cause of a crash but the results of a weaker economy.

And I don’t expect prices to crash but to moderate lower over time.

You don’t need a lot of defaults to have a crash though. Note the chart below is arrears, which are going to be smaller than defaults, since not all the former result in the latter. Arrears were at an all time low just before the chart by the way.

Good news from latest data (CMHC released dec. 5, 2022) on mortgage delinquencies in Canada. Many new all-time record lows hit (q3, 2022), including for Canada (0.14%), BC (0.10%), Ontario (0.07%), Vancouver (0.08%), Toronto (0.06%) and Victoria (0.06%)

For Victoria, that’s 1/1,667 mortgages delinquent. Note that this isn’t “defaulting”, it’s just delinquent 3 months or more. That would be about 50 mortgages in Greater Victoria. Most won’t advance to default, they’ll either pay up or sell. As an indication how remarkably low this 0.06% Victoria delinquency rate is….in 2014, the Victoria delinquency rate was 6X higher (0.39%)

So it’s no surprise that the best click-bait headline the financial post could come up with is “Mortgage defaults starting to hit the market: broker”. Of course mortgage defaults have always been present. And if you watch the interview, they ask the broker “have you seen any defaults?” and she says “no, but I’ve heard there are some in the GTA”.

It’s good that we have actual data that measures this from the CMHC:

– https://www.cmhc-schl.gc.ca/en/professionals/housing-markets-data-and-research/housing-data/data-tables/mortgage-and-debt/mortgage-delinquency-rate-canada-provinces-cmas

It isn’t impossible that mortgage defaults are starting to hit the market. I would think it is improbable, at this early stage, as most lenders can work with the mortgagee to extend the amortization period or add the missed payments onto the mortgage. It can take months or even a year before the lender obtains a Conduct of Sale.

If the mortgagee has exhausted, the aforementioned, they may no longer have an option not to put their home on the market and wait till the market recovers as the lender wants their money. The mortgagee may do this voluntarily or the lender may petition the court for conduct of sale. It is better for the home owner to list voluntarily as the legal costs and mortgage penalties, and lender fees are expensive once lawyers are involved.

At this time, according to VREB, only one property in Greater Victoria is under a court order. That’s not significant. What no one knows is how many properties that are in default are voluntarily listed. I suspect it is very small as the market is still favorable to home owners that have to sell, unless they have re-financed to the hilt.

And a prospective purchaser is not likely to get a significant discount from market value on a court ordered sale at this time either as the market has only rolled back to 2021 prices. Prices would have to roll back to 2019 and earlier before the number of defaults begin to have a significance in the market place. And that would require a lot more inventory on the market than we have today.

Impossible. People will just not sell until the market recovers.

RBC market update

https://thoughtleadership.rbc.com/canadas-housing-market-stays-quiet-as-end-of-year-nears/

Special notes for BC and Ontario.

Mortgage defaults starting to hit the market: broker

https://financialpost.com/real-estate/mortgages/mortgage-defaults-housing-market-broker

It will be interesting to see the sales figures after Christmas although I suspect it will be a good selling season. The interest rate hikes are only starting to take effect on the outside margins.

We have not seen any real job losses yet and only a very small percentage of people have had their mortgages go up at this point. While inflation has affected seniors on a fixed income most will still splurge for Christmas.

My guess is that we are a year away from seeing the impact of the rate hikes.

No wonder Walmart at Hillside was half empty (people wise) yesterday morning. 😉

Noticed same while doing Christmas shopping. Example at Robinson’s Outdoor I waited in a long line at the till to pay for my wife’s present. I’d guesstimate 50% of the line were ringing in >$500 and maybe 25% > $1000 – an amount that is quite easy to reach when purchasing a few items of name-brand outdoor clothing.

It depends on the class of people. Rich people are doing well and having a good time; the (shrinking) middle-class is doing ok; the poors are not going out on the town.

I see the project at 240 Island Highway in View Royal has the foundation in but seems to have come to a grinding halt. I assume that is one of the projects Marko mentioned that is “in trouble”.

Isn’t Red Robin a budget place? Could be why it’s packed?

At Red Robin with the kids tonight. Place is packed and looks a bit understaffed for the numbers here. Doesn’t look like anyone is shy to spend on meals out and with xmas around the corner to boot. Wife was out last night with friends at another venue and same observations. Maybe it’s just that payday was yesterday or folks are in town for the holidays eager to celebrate. Whatever it is there doesn’t ‘seem’ to be a hesitancy on discretionary spending in this town.

Thank you for your response Marko. It’s going to be an interesting few years.

Thankyou, especially Marko, I found it interesting.

Not completing projects won’t help the supply shortage. I wonder where all these “affordable” units are going to magically appear? Investment dries up when rates go up, and supply dries up also. Funny how that works.

There will be a ton of projects not moving forward, but no big news there (unless they pre-sold and need to return deposits before construction starts which I can’t really think of right now). Interest rates have gone up (remember developers need to finance these projects over three years, 3yrs x 6% is a lot of $$$), real estate market is shaky, constructions costs are still very high with a tight labor market. Obviously a ton of projects will get put on the back burner.

When I say “in trouble” I am referring to those that have already started construction and maybe their financing has been pulled under them or similar. I can’t refer to specific projects due to nature of my job but if you do some research on Reddit or Vibrant Victoria you can draw your own conclusions. When a building is partially built and there hasn’t been anyone on site for months that isn’t a good sign in this environment. This is not going to be widespread in my opinion but a number will not make it to completion and deposits will need to be returned to buyers. Might actually benefit some buyers if they are underwater.

Can you elaborate Marko on the ones that are “in trouble”, or not moving forward?

Cool, good to know.

https://www.theglobeandmail.com/canada/british-columbia/article-vancouver-area-developer-cancels-pre-sale-condo-contracts-months/

https://www.cbc.ca/news/canada/british-columbia/buyers-sue-vancouver-developer-who-cancelled-pre-sale-deals-1.646182

https://ottawa.ctvnews.ca/orleans-home-buyers-have-contracts-for-new-builds-cancelled-by-ashcroft-homes-1.5035059

Should be getting some fun stories again anytime soon…

If you want to take a look at some great predictions, you should look at what the Fed was forecasting interest rates to be at now in December last year.

That’s not how pre-sale contracts work. They have a clause by when the developer needs to start construction and an outside end-date (if not finished by this date buyer gets deposit back). Developer can’t enter into pre-sales and then sit on the project for years on end until they feel it is a good time to start.

Undoubtedly a number of projects will fail for sure. There are already a few that are in trouble in Victoria but in BC the pre-sale deposits are protected in the event the developer cannot deliver on his or her obligations.

Nothing to do with losing your deposit as a result of failing to complete a pre-sale, or any other sale for that matter.

More with multi-phase developments where say phase 1 has started construction would be completed on schedule or completed faster, however, phases 2 and 3 have yet to turn any shovels but may have had some pre-sales,but not significantly pre-sold, so, the following phases that are becoming less economically viable are slowed or idled.

https://www.google.com/url?sa=t&source=web&rct=j&url=https://www.reco.on.ca/wp-content/uploads/Consumer-Deposit-Insurance-FAQ.pdf&ved=2ahUKEwju2_ajt_77AhW9IDQIHfOjAuMQFnoECE4QAQ&usg=AOvVaw29WV4-xS-V9Pa-Iyssnpw8

As far as developers go most exceeded 90% sold before this downturn. Only a handle of pre-sale buildings have substantial inventory, one of them being the Mod (concrete building on Cook Street where Plutos use to be). I think they are approx. 50-60% sold.

The interesting thing is the one large pre-sale that did launch recently https://abstractdevelopments.com/developments/central-block/

is selling well. They’ve sold quite a few units at over $1,000 per square foot, not including GST. That’s really solid for a wood-frame on Tillicum.

Things are completely different then 10 years ago. Back then pre-sales went for a discount compared to tangible market, now often they go for a premium compared to tangible market. This trend started in Vancouver 7-8 years ago and made it to Victoria more recently. You really need to evaluate each project to see if the value is there or not.

I represent a lot of pre-sale buyers and yes in theory things aren’t looking good; however, the way things unfolded in reality the situation isn’t that bad. The thing is there were not many pre-sales launched January 2022-May2022 when things went nuts. It takes years and years to re-zone something and launch pre-sales so it was impossible for developers to react that quickly to peak prices.

Here is a real life example(s) of the pre-sale buyer situation.

804 – 834 Johnson St (12 yr old building, next to shelter) sold yesterday for $435,000. 484 sq.ft. unit with no parking spot.

My clients purchased a pre-sale at Nest (the new concrete building going up at corner of Cook Street and Yates) November 2021 for $434,900+GST (but you get a bit of the GST back under 450k). 480 sq.ft., but a much larger balcony 2x size, 2024 build (when finished), better location, better finishing, etc. When you look at yesterday’s sale at the 834 Johnson this Nest unit would be 470-480kish if it was finished today; therefore, they aren’t even under water.

If you bought into projects marketed earlier you are still way above water. For example, a lot of stuff you see under construction such as the Pearl the early pre-sale buyers have seen a big uplift, even with the market correction. They had one bedrooms at the Pearl with parking around 450k. Those would be north of 550k now.

I would say given how things unfolded most pre-sale buyers aren’t under water and the ones that are certainly are not anywhere near underwater 15 to 25% (the deposit amount).

As far as qualifying, I don’t see it being a huge issue. If you are putting down 20% three years in advance you typically aren’t at the fringe in terms of qualifying. You also have plenty of time to prepare.

Some crazy stories on Reddit Personal Finance from Ontario pre-sale purchases, but that isn’t the average I am seeing.

What are you talking about?

Deposits have been 15% to 25% the last last few years. I would say the most common I’ve seen is 20%. fyi, 20% of 500k is 100k, not $10 or $20k.

What are you talking about? Developers have to finance these projects, they will make every effort to complete ASAP. They could care less what interest rates are for buyers. As the deposits are 15 to 25% very buyers few will walk. Even if the buyer does walk at minimum the developer collects the deposit and re-sells. Finally, how would delaying things help? What if interest rates are higher in 12 months from now? Which is a very plausible scenario. What if we go into a recession and pre-sale buyers starting losing their jobs?

A pre-sale contract is not an option to buy, it’s an obligation. If the developer loses more than the deposit they can sue you for the balance.

Pre-sale buyers actually have two problems – the rise in interest rates requiring a greater qualifying income, and the fall in market price requiring a bigger down payment to meet the pre-sale price. Fail to meet either and it’s default time.

https://www.theglobeandmail.com/news/british-columbia/reluctant-condo-buyers-sued-for-backing-out-of-village-purchases/article567310/

It will be interesting if some no longer qualify for the mortgage amount when possession comes due especially if they originally qualified at around 2%. I imagine some would have purchased deposit insurance, but many just might look at walking away if their deposit is only $10k or $20k when they signed the contract. However, developers have ways to put off possession dates, I imagine you might just see a slow down on some bigger developments to stretch out another year or so before completion to help offset any problems.

I am curious as to what is happening with people who bought presale condos?

That was pretty much completely based on the 1980s. I wouldn’t rely on that. That being said, we’re almost a year into this.

Where can i get good time series on the Courtenay market?

I see from here: https://www.ojohome.ca/market-trends/courtenay-bc/

that the Courtenay condo market has been obliterated but it’s good to have longer historical context – i.e are we now at pre-pandemic levels?

thank you!

Mild recession or deep recession does not matter for interest rates in the current cycle. Fed and BoC are now focused on 2% inflation. Core inflation and PCE data have much higher predictive ability for future headline inflation, and these are at 5% or higher. In the past cycles, when these crossed 5%, it took three years or longer to get them back to 2%. We are at the start of the new regime for interest rates. The last 40-year period from early 80s was an aberration for interest rates – like a free lunch for speculators. From 2009, it was free dinners with QE, Operation Twist, etc. No more free lunches or dinners.

Actually, there are a few of them on that sunshine list making close to or over $250K thus the 54% MTR rate 😉

That’s scary …… the high income earner must be a government municipal worker.

Where did you get that number (hopefully not from your tax accountant 😉 )? Remember the plural of anecdote is not data.

Income tax on GIC interests is the same as on any other regular (say salary) income, the rate is level based and should be at your MTR.

e.g. If you have total, say $50K income, your average tax rate in BC (one of the lowest provinces for that level in the country) for 2022 is about 15% (would be 16.72% in AB), and your MTR is ~23% (i.e. you would pay ~$230 on $1000 extra interest income), no where near 54% at all.

But if your MTR with all income combined is at 54% (~250K or more income), of course the CRA will tax you at 54% for any extra income, be it from GIC interest, net rent income or salary. But you are a high earner now, good for you.

US long term mortgage rates falling big today. Now 6.13%. That’s down 0.14 from yesterday and down from the 7.37% peak in October.

– this despite the rise in short term rates, as the 10 year bond yield is falling too.

Its to bad that in BC, the government takes 54% in tax on GIC’s interest gains.

We are lucky not to have a mortgage to worry about. But it feels good to see those GIC rates reaching over 5% finally after 15 (or 20?) years!

Agreed – I wouldn’t bet on rates ever dropping that low again but you never know. The wildcard is whether we end up in a recession (My guess is that we will) and if so how deep (I have no idea). The Fed is guessing at where rates need to go, have indicated they don’t care if they over-tighten, and that they would rather over-tighten than under-tighten. That doesn’t bode well for a unicorn ending to this tightening cycle known as a “soft landing.”

Did I say “mark my words”? or anything to that effect?

These aren’t predictions, they’re just thoughts.

I don’t think I’ve ever participated in Leo’s predict the avg/interest rate game, nor do I ever come back and say “see, told you so” or talk about “insider contacts” or what have you. I also didn’t think they’d continue raising rates past September. I’m a random internet poster, no one gives a shit what I have to say, except Patrick.

edit: I actually do remember now pointing on something I had said in late February/ early March 2020 about their being a pandemic coming, to point out that it should have been obvious by then that it was coming.

Prediction track record alert! Remember when you said in June that the likelihood of school starting in September was “zero” because teachers were without a contract?

From: https://www.cbc.ca/news/business/crea-housing-number-november-1.6686776

From: https://financialpost.com/real-estate/mortgages/osfi-mortgage-stress-unchanged

Good, at least they didn’t cave to the industry pressure. The stress test is more important now then was when it was first implemented.

I don’t think the feds having to raising rates by 1700% should have the inflation characterized as transitory either.

I post this just so that people can get some sense of other life options are out there.

(I do not mean to promote any particular company …I just don;t know how better to share this info.)

https://www.royallepage.ca/en/property/new-brunswick/moncton/664-mclaughlin-dr/18928609/?utm_source=allclassifieds.ca

The example is a four bedroom house in Moncton NB and is for sale at $189,000.00 which boggles my mind. (No snide comments from anyone please about my mind and how that works…or doesn’t 🙂

Dad: You are right about rates being raised and then lowered as part of the cycle. My guess (notice it is just a guess) is that rates will see a few more bumps up during 2023 and then will be lowered down to somewhere about where they are at the moment. I dont imagine that we will see the uber low rates of the last few previous years. But my guess is as good as everyone else and I am old enough not to make predictions.

I spoke to my insider contacts and they answered all our questions.

Q: Is Inflation dead?

A: Like Westley in the Princess Bride it is only mostly dead.

Q: Will the Fed/BOC overshoot and cause a recession?

A: They always do.

Q: So there is a recession coming?

A: A mild one. Barely a sniffle.

Q: Will interest rates fall?

A: Yes, but don’t hold your breath for 5 year 1.99%.

You are welcome.

I don’t think anyone would characterize over a decade of high inflation as transitory.

Lol, ever? Most tightening cycles end in recession and rates are cut to address the spectre of deflation. It seems reasonable to expect this pattern to continue.

lol. Inflation was transitory in the 80s too, just took 20% rates to get there.

It would be great if we’re done with inflation. It would be like getting stopped for speeding, and the cop lets you off with a warning.

I am not sure why anyone really expects interest rates to drop soon or ever for that matter. They are back to historically low normal rates and I suspect are likely to stay there. The last few years were insanely low and I doubt we are going back to them.

The chart you posted is not seasonally adjusted. The same data that is seasonally adjusted shows no declines or deflation. Encouraging signs of lower inflation for sure, but too early to blow the “all-clear”.

Seasonally adjusted raw data: https://www.bls.gov/news.release/cpi.nr0.htm

Same data charted: https://tradingeconomics.com/united-states/inflation-rate-mom

No deflation, but 5 months of disinflation is a positive trend. The official story from the Bank of Canada is that it takes 6 to 8 quarters for rate hikes to have their full effect on inflation.

Maybe team transitory will be proved correct in the long run.

Strictly speaking there have been monthly declines, but they are not statistically significant. Not what I would call deflation.

I haven’t seen that anywhere. 2 months previous were both .4%.

Maybe that’s because the owners would rather leave them empty. No such thing at can’t rent, just won’t rent.

https://househuntvictoria.ca/2022/12/12/higher-rates-but-whats-the-impact/#comment-96527

It actually isn’t a huge problem and hasn’t been since June. Prior to that, the average MoM US CPI increases were close to 1%/ month or 12% annualized. Since then, the US has had 3 months with negative changes to CPI (Deflation) and the average over the last 5 months has been about 0.1% or about 1% annualized.

Prices aren’t coming down however. So while prices going up isn’t really a problem, everything is super expensive and I wouldn’t expect that to change unless we either accelerate production of various things we need (houses, hospitals, food, energy, etc) or reduce immigration to 100-200k/ year and lower the rate of demand increases for Energy, Housing, Food, healthcare, and everything else included in the CPI basket in Canada.

Inflation still a huge problem that’s not going away anytime soon Imo they will stay the course for a while yet the economy would have to really go in the toilet for them to start cutting

They’ll start cutting by summer.

The removal of the limitation on number of rentals does seem to be a point of contention in 55 plus communities. According to the Condominium Home Owners Association, the vacancy rate in 55 plus buildings is not low at all. Removal of the number of rentals in 55 plus buildings will not have an effect on vacancy rates but it will have an effect on the enjoyment of the seniors living in the complex.

I am in favor of 55 plus communities to retain both their age and rental restrictions. Rental limitations are necessary to maintain the appeal, safety, and maintenance of the complex. Sure, 55 plus communities are exclusive of others. But seniors have earned it. The gated communities such as Arbutus Ridge provide safety and security for the residents. They provide as close to a crime free neighborhood as you can get.

Leave the frigging seniors alone!

“In a marvel of efficiency, the BC government introduced into the legislature and made into law, the Building and Strata Statutes Amendment Act, SBC 2022, c 41 (the “BSSAA”) last week. In addition, it seems the government ignored CHOA’s concerns, which were sent by letter on November 21, 2022. Most of the concerns involved the ban on rental restrictions and its disproportionate impact on smaller, self-managed communities and the lack of evidence that rental restrictions resulted in a decrease of affordable housing. With barely any time for debate and the public to react, the government amended the Strata Property Act”

-source CHOA

The Fed is sticking to 2% inflation target. What matters now is not how high they will go (5.0 – 5.25%), but how long they will stay there. It looks like no rate cuts in 2023. BoC may stop 50 bps short of Fed and reach 4.5 – 4.75% and pause there for a year.

US Fed just raised rates by another half point, suspect that we may have to follow.

That would be too obvious caveat. Easily spotted by CRA and easily disallowed.

Here is a question for you then. If you had to walk out of your home today and rent it fully furnished, linen, cups, saucers, etc. How much rent do you want?

That makes it more difficult for CRA to determine what the fair rent would be – doesn’t it.

I highly doubt that. Otherwise you could exempt yourself from the tax just by asking above market rates

I didn’t think the vacant home tax as drafted provides exemptions for trying but failing to find a tenant. (Beyond an initial grandfathering that I think has expired or was set to expire, I didn’t think the tax even cared if the strata restricted rentals)

What two million really buys

https://www.cnn.com/travel/article/italy-castle-sale/index.html

No there won’t be according to new legislation.

In a 55+ community, it’s likely that you’ll only be allowed to rent out your home to a fellow 55+ renter, which could make it harder to find occupants. Additionally, there might be a limit on how many homes in a community can offer rent at a single time. While each community is different, many adhere to strict guidelines, meaning that renting may not be a plausible option.

I haven’t found an answer to the question that if you live part of the year in a 55+ community and are advertising for a tenant, through a property management company, but to no avail will you be exempt from the vacant home tax? A potential loop hole in the legislation that would make 55+ communities, used as a secondary home, more appealing.

100% agreed, but the discussion centered around whether 55+ will now be more desirable that other age restrictions are no more and I don’t think it will make a big difference.

I’d think one reason being that you live in a concrete & steel building where noise transference is less of an issue. Probably at least some of those stratas in wood-frame buildings that were 18+ are now seriously considering going to 55+ for valid reasons.

I’m in the demographic Barrister talks about, and it wouldn’t bother me at all to move into some nice concrete & steel condo, without worrying too much about an age restriction – it might actually be preferable to have some “life” in the place…

Marko: You are probably right since I am pretty sure you have a better feel for the market than I do.

Developers aren’t stupid; therefore, they don’t build 55+ buildings. Secondly, how exactly is one suppose to rezoning for a condo building in Oak Bay? Finally, if there was by some miracle a new condo built on Beach Drive I am pretty sure a rich 70 yr old with adequate funds would not pass on an ocean view unit just because there is no 55+ restriction.

As I said in my no restriction condo the majority of occupants are 55+. My neighbors are an older couple must be late 70s early 80s. There is also a 2 yr old on the floor. The small dog owned by a 70 yr old single woman way more annoying than the toddler when I am waiting for elevator.

Sure there’s a market, the question is whether the developers will make more money building 55+, i.e. that they well sell for more. If not, they don’t get built.

Or that they thought it was best to borrow to their maximum capacity when interest rates were at a record low and rates only had one way to go.

Old people also sometimes have a lot more money than a young couple sp perhaps there is actually a market for some elegant new built, 55 plus condos her in Victoria or better still Oak Bay

So rates stabilizing, broader affects lasting for years, sales relatively solid. Does it seem 2023 is looking towards a stabilization in prices in SFH then? And, what kind of price recovery in 2024? It seems to be pointing towards more or less flat prices next year with a very long slow recovery in keeping with historical norms. No repeat of the big jumps of 2017 and 2020/21 for quite some time. It will be interesting to reconsider the price forecasts made by participants of HH last year.

Sellers not motivated enough at the moment. Seems like there is a solid floor at 400k weather it be a newer one bed in Langford, or a crappy 1970s build in town, or a nicer studio with parking, etc.

Find anything interesting to buy?

Yup, last week took me by surprise in terms of sales. I thought everyone, both buyers and sellers, would call it a day and just wait until the New Year.

Really looking forward to this! I think there is a small uptick in previously restricted condo sales, but can’t tell for sure if it actually is a small uptick or just me noticing these sales a bit more.

Why you surprised? This is the norm.

Personal experience. COV wanted our lawyer to put together some bond assignment agreement paperwork. That was done, then city staffer that wanted this agreement left the COV. New staff don’t have it, don’t know what it is, 8 months later still trying to get my $2,000 boulevard grass deposit back. Sometimes I get once sentence email replies after 2 months. Literally all that has to be done is someone has to inspect the grass and release the $2,000.

As I keep repeating on loop. Politics might change (or they might not, look at Langford) but the bureaucracy always stays and gets worse. There just aren’t many examples in history where bureaucracy becomes easier to navigate.

Then we complain about why housing is so unaffordable.

I live in a 2019 year built building (no restrictions) that is full of 55+ owners/tenants. Everyone is overlooking that 55+ buildings are usually 70s, 80s, 90s and typically not that nice. To the best of my knowledge there is only one 55+ building built post 2000, a 2008 year built on Viewmont. Other than Viewmont everything is 25-50 years old.

Old people want nice stuff too, I don’t think there will be a line-up of buyers waiting to secure 1970s 55+ unit despite the 55+ age restriction being a scarce commodity.

Government action is required to give condos the ability to age discriminate at all, so arguably removing some of that ability to discriminate is less government interference not more.

Or are you more objecting to the Human Rights Code which is what would make age discrimination illegal if there wasn’t a special carve-out?

LeoS, have you tried comparing prices in a few building that are geographically and structurally similar to confirm that the stats are accurate. I just dont know where most of the 55 plus buildings are actually located.

It appears that non age restricted complexes sell for more than restricted. Maybe a $75,000 difference. But that isn’t that big of a price to pay for the benefits one would receive living in a complex with people of a similar age. And that difference may change over the next year depending on supply and demand for senior complexes. It’s not unfathomable that senior complexes could be worth more than non senior in year or so from now.

The property rights of a condo owner are subject to and limited by various strata rules adopted by the members. This is something agreed to and expected by all owners. There are likely a number of existing rules that the government could outlaw, that would affect property values as shown in Leo’s chart. But that would also be simply meddling in agreements between consenting parties, with no clear benefit to society.

I suppose if you have a winter condo in a 55 plus building you could employ a property management company to find a short term tenant that is over 55 and meets the condominium’s strata bylaw occupancy regulations. I don’t know how successful that property management company might be in finding such a tenant. As the owner of the condominium, you still have to abide by the strata’s bylaws. If you don’t then you can be fined by the strata council. But at least you tried.

There are boutique markets which are subsets of the much larger market place. Examples are Live/work condominiums and complexes that are zoned for vacation rentals. As long as the demand for these boutique condominiums is greater than the supply they will trade at higher prices relative to non boutique complexes.

There are age restricted town house developments in Central Saanich and manufactured home parks on strata lots in Sidney that receive a premium over other non age restricted developments. These complexes were constructed specifically for seniors and are not well suited for families having only two-bedrooms with little yard space and/or a higher density of units per acre.

Another example is no step ranchers. Seniors plan for old age and prefer no step ranchers over two-storey homes. I suppose you would call it the broken hip syndrome. Before the construction boom occurred there were more seniors retiring to Victoria and these one-storey homes were rising quickly in price. A 1500 square foot rancher was selling for more than a 2,000 square foot two-storey. The livable area was secondary to the ease of mobility.

Today, I don’t think the demand is large as the market has shifted more to families than to retirees in Greater Victoria. But it doesn’t have to be large as long as the demand for senior housing is greater than supply. If the demand is found to be large enough then developers will begin to develop senior communities once again.

What the legislation has done, by removing the age restrictions for non senior complexes where people desired to live in an adult building, is shift that demand onto the boutique market for senior complexes.

What we don’t know is if there will be enough senior complexes retained to accommodate the increased demand? But we will find out in the next year or so.

Depends on how you look at it. The age restrictions are only possible because they are authorized by the Strata Property Act. They are a limitation on the property rights of the condo owner, after all.

Quite a few of the initial 55+ buildings changed their 55+ to 40+,45+ &50+. Realizing that these people wouldn’t have children, it would open it up to “early retirees” as well as a larger sector of prospective purchasers on re-sale. Some of those buildings perhaps will up the min. age to 55+ again.

The majority of people who bought into the buildings down sized from their large family homes and they came from all over. The larger suites accommodated most of their existing furniture, thus the unit felt more home like to them. This was their final home. Some were fortunate and they lived in their comfortable, quiet, safe and familiar “retirement community” for 20-35 years before they passed away or needed to go into a home. When that time came, their family were then forced to sell. Now, they will have the option to rent out the condo if they wish to another retired couple who can’t or don’t wish to purchase. So the unit can be kept in the family if it is their wish or one of the heirs can buy the rest out to either live in or rent out. A few more options anyway at usually a very difficult time.

Thanks Leo for the informative post as always!

This seems like government meddling. Let them keep their age restrictions.

I get the theory but I very much doubt it will happen. Both adults only and seniors only condos were cheaper than unrestricted condos before. Seniors only condos may gain a couple buyers from seniors that were previously in an adults only building that is now too loud for them, but not many.

The fundamental reality remains that 55+ buildings exclude about 55% of the potential buyers out there and that depresses prices.

The townhouses are on Rainbow st. Saanich council voted to send it to public hearing last night. But why it took 3 years to get to that point I have no idea. Developer said they didn’t delay it on their end.

Saanich is quite possibly the worst in the region for process delays. Also outside of Oak Bay the only municipality not even hitting their own very conservative housing targets.

@Leo S are you talking about the townhome/condo complex that got voted down by NIMBYs on the north-west corner of Tillicum and Highway 1? After 3 years and multiple hearings/designs it got voted down due to parking requirements and now the land has been sold again to another developer who will – wait for it – spend 3 years trying to get a design approved. I’m not sure what’s been proposed. However, Victoria gets called out for their inane and plodding approval process whereas I feel Saanich is just as bad!

The adverse impact on market value of the 55 and older condominium complexes is not carved in stone.

Those that purposely bought into adult orientated complexes (18 and older) now only have the option to purchase in 55 and older complexes. If the demand for adult orientated (55 and older) complexes increases without an increase in supply then market prices for the 55 and older complexes would rise.

There are advantages to living in an adult orientated complexes and communities.

I understand that you generally mean greater Victoria but these charts by other people are all over the map. Since there is a really big variant between condo prices in the core as opposed to the West shore does geographical difference account for a lot of the pricing differences? I actually have no idea were most of the plus 55 units are located although the one across from the Empress is super pricey.

Are there a lot in the inner core?

Today in crazymaking time wasting.

242 condos on Doral Forest park were approved at public hearing in July 2021. It took Saanich 17 months to draft a couple legal agreements and covenants to be ready for final reading yesterday. During the time the applicant couldn’t do anything on site, not even tear down the 3 decrepit houses.

Dec 2019 some townhouses on 3 lots on Rainbow St were submitted to Saanich. 3 years later it went to third reading and was voted to proceed to public hearing. No substantial changes to the design in 3 years but hundreds of hours of taxpayer time went into… something?

I sympathize with their personal situation, but why is a couple that age carrying an apparently substantial mortgage balance?

Greater Victoria in this case. Sorry I usually put it in but in general Victoria means Greater Victoria and I use “City of Victoria” to refer to the actual city.

When it comes to real estate stats, unless it breaks down to municipal level, I normally assume it is per metro area so Victoria means great Victoria . But CoV probably has more condos than other municipalities in great Victoria area.

https://www.ctvnews.ca/business/canadians-with-fixed-rate-mortgages-terrified-in-face-of-higher-interest-rates-upon-renewal-1.6191490

More and more starting to feel the rate impacts now and causing changes to their housing arrangements.

Is your condo chart (adult, senior, unrestricted) for City of Victoria or for greater Victoria. (I really wish that this sort of chart or stats would clearly indicate which geographical area it is referring to. For some reason people just label it Victoria and it really makes a difference whether it includes greater Victoria or just the city center.