November: Detached prices dip under a million

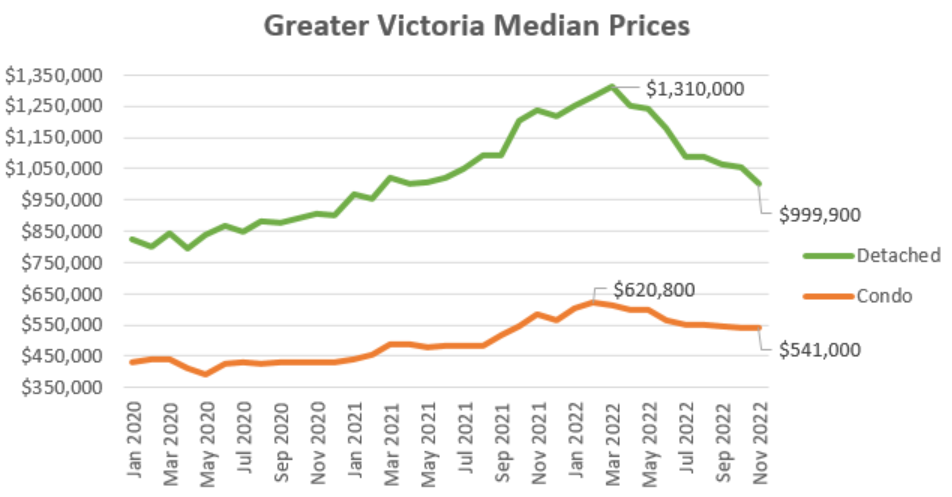

A million dollars is an arbitrary number and prices crossing that mark has no more significance than if they had crossed any other number. However I couldn’t help noticing that in the November data the median price of a detached house came in with only 6 figures, which we haven’t seen since February of 2021. At $990,900 we were just barely below the million mark, but it’s a significant pullback from where we were 8 months ago when the median price peaked at $1.31M. Medians are noisy though especially in the winter, so don’t be surprised if we’re back above a million in a couple more months to come.

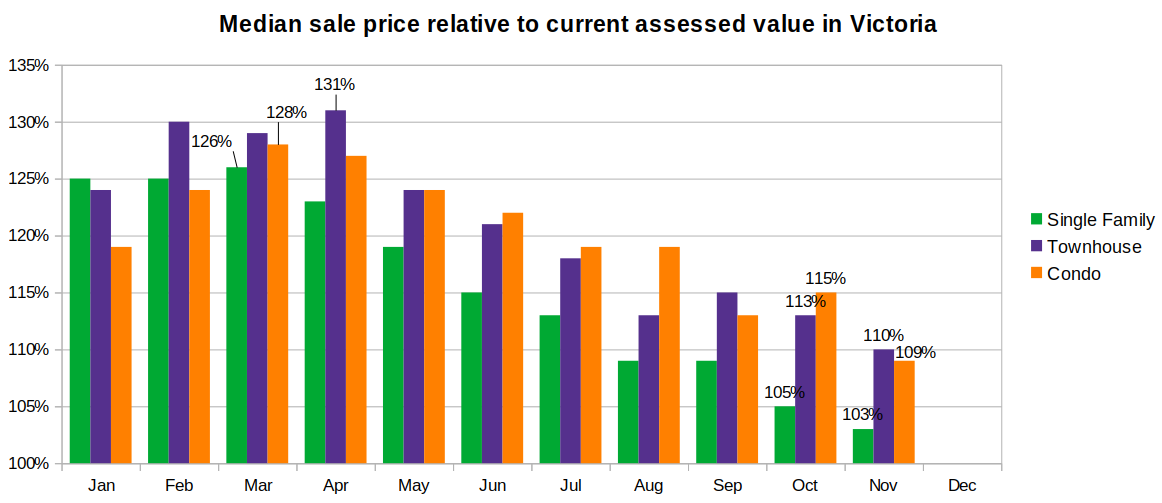

November’s figure puts prices back 21 months or a drop of 24%. Have prices actually dropped that far or is part of this due to noise? A bit of both. While it’s not out of the range of possibility, according to my preferred measure of median sales price to assessed value, detached prices have dropped 18% from March to October, while condos are down 15% and townhouses have dropped 16% (though this number is the least certain with only a few dozen townhouse sales most months). Worth noting is that all of those figures are still above the valuation from July 2021. When the new assessments are released in January (reflecting July 2022 valuations), most sellers are going to have to adjust to listing substantially below assessment to make the sale.

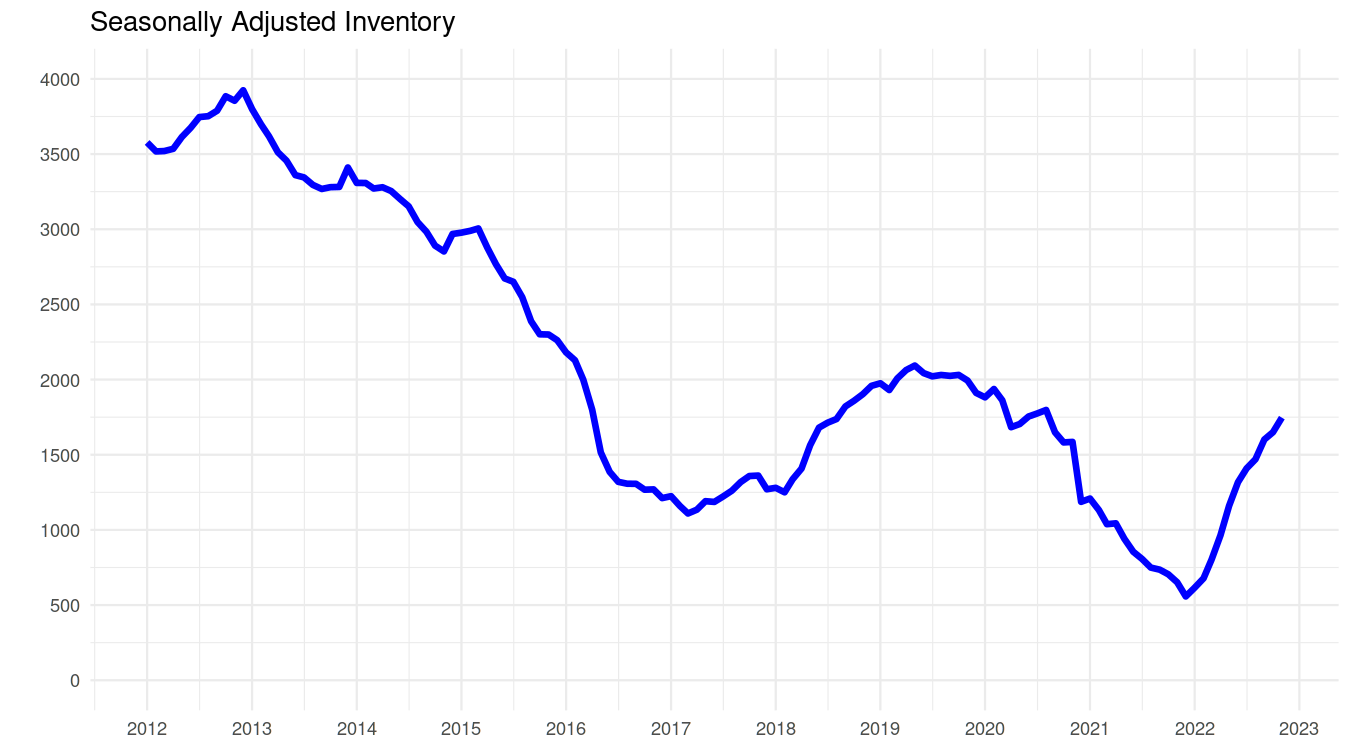

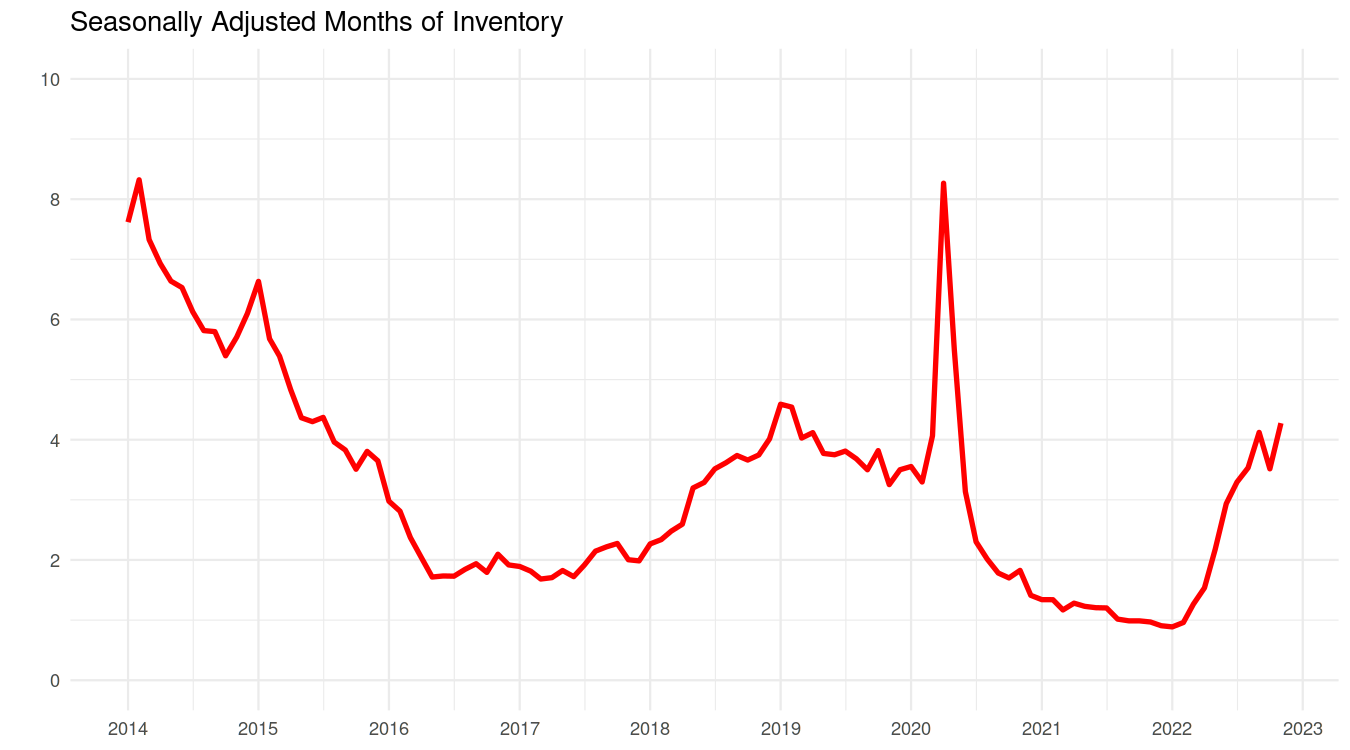

We know that inventory has risen sharply (residential inventory going from just 597 last November to 1603), but we’re still at only about half the levels of our last traditional buyers market (2010-2014).

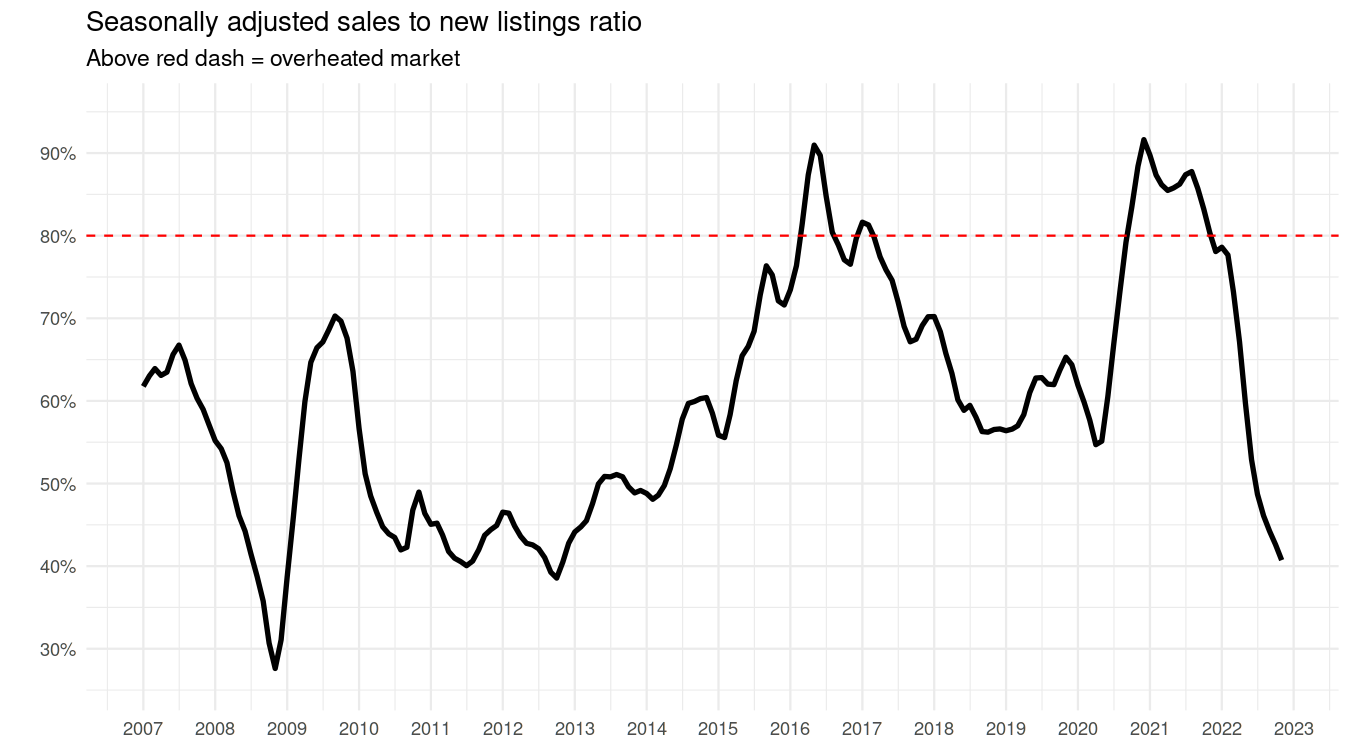

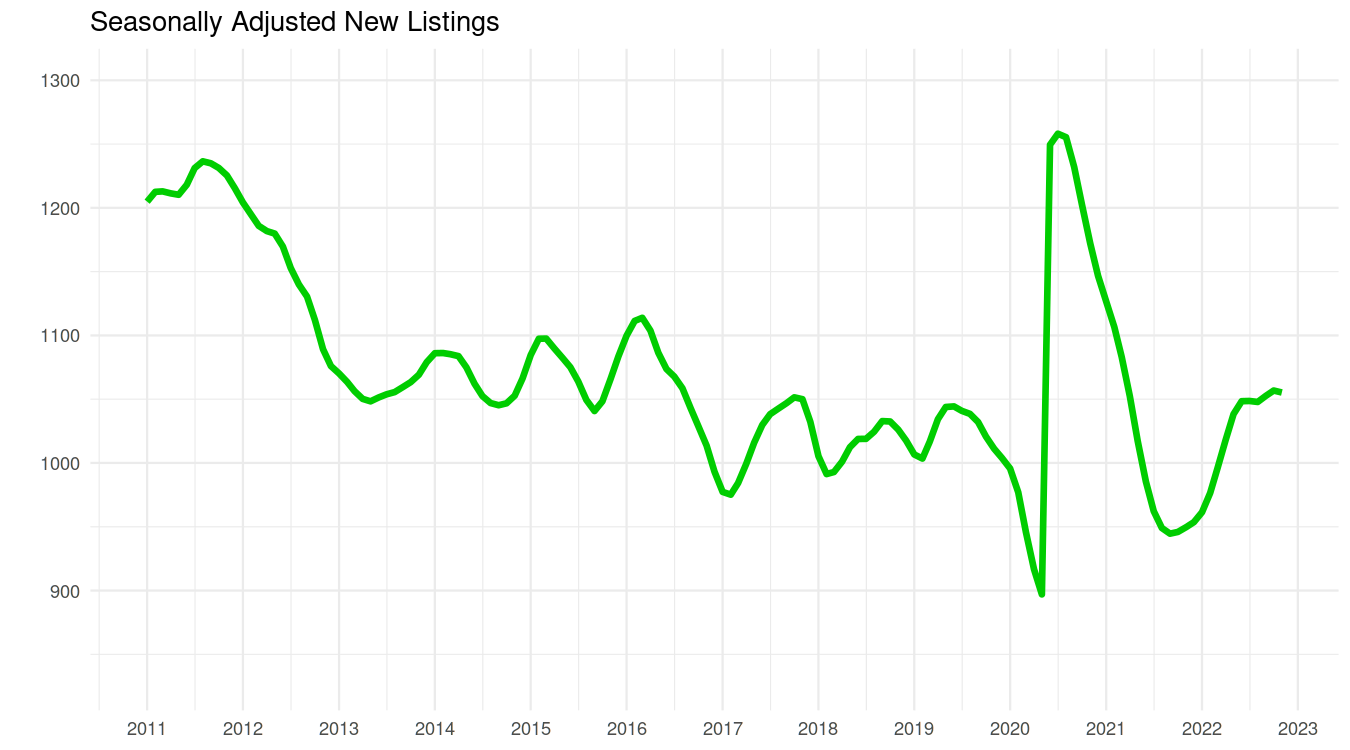

So why have prices continued to slide despite relatively low inventory? So far simply because sales have dropped so rapidly that a key measure of market balance – the sales to new listings ratio – is deep in buyers market territory.

And unlike a decade ago when this measure was relatively stable (and price declines were very gradual), it has dropped extremely rapidly since the start of the year. The pattern is more similar to the tail end of 2008 in the depths of the financial crisis when prices were declining at a similar pace. There’s differences between then and now though. In 2008 the central banks crashed interest rates to bring back affordability which there is no sign of this time around. On the other hand back then we had more inventory on the market and a spike in unemployment, while today selection remains low and employment at all time highs.

On the other measure of market balance, months of Inventory remains relatively low though it did reverse October’s surprise drop. Because of low inventory, this measure remains very sensitive to even small upticks in sales activity.

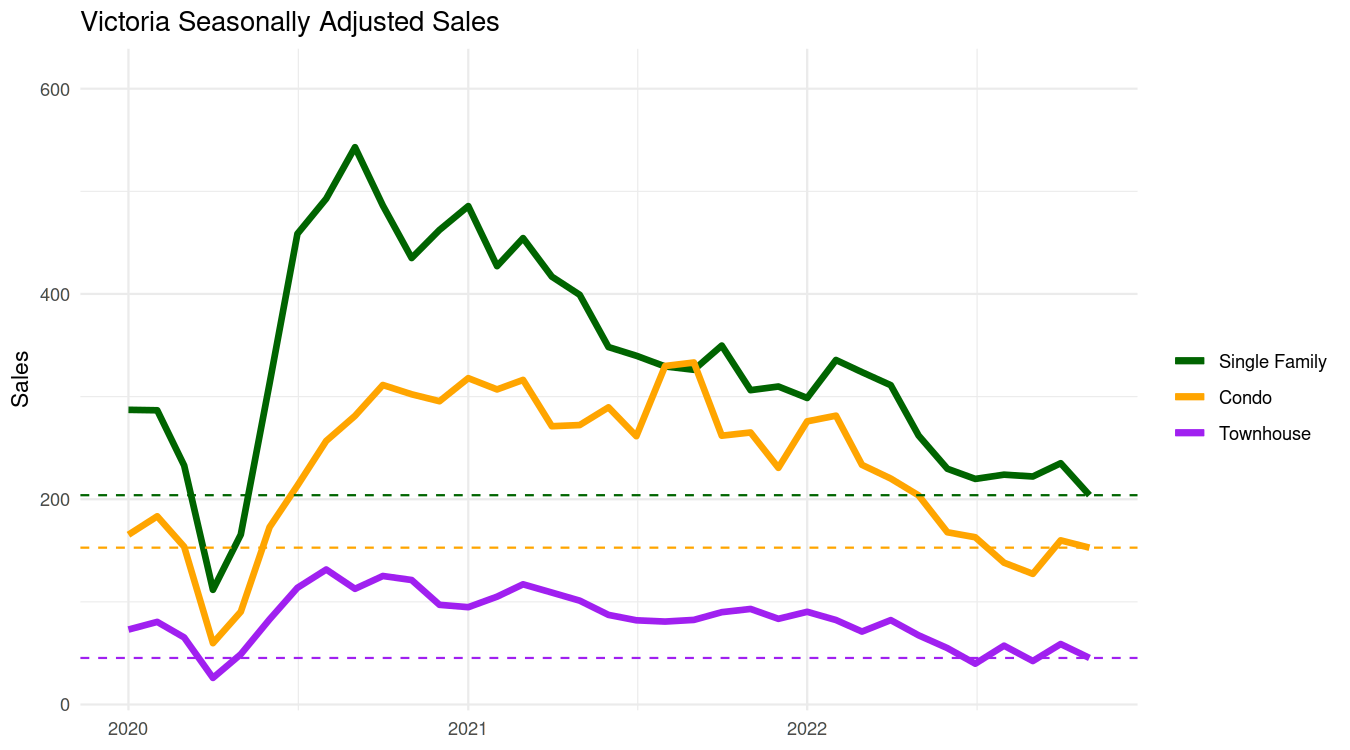

Sales meanwhile were mixed for the month with detached the weakest and condos falling back slightly from the October bump.

New listings meanwhile – a key signal of seller distress – show no signs of that. Though they have recovered from the severe drought a year ago, we’re only back to roughly pre-pandemic levels. That’s unlike in the early 80s when investors and owners were forced to sell in large numbers.

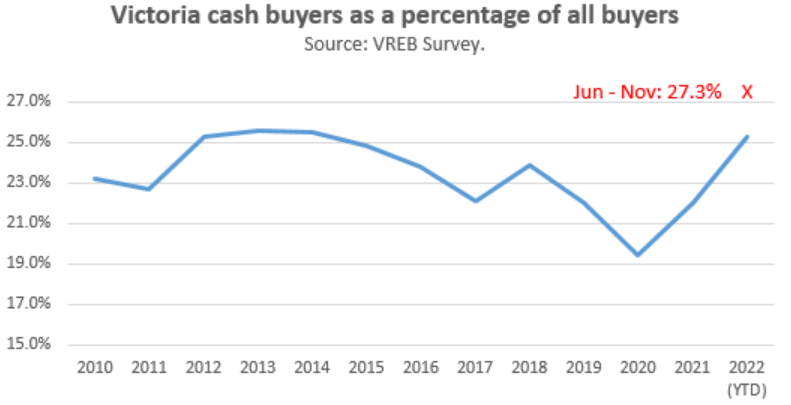

Interest rates will be rising again on Wednesday by at least a quarter point. That won’t affect affordability much, but it’s another hit to an already moribund market. And while regular buyers are suffering from the poor affordability, cash buyers are, well, cashing in. Though their absolute numbers have not really increased, their share of all purchases has rebounded especially in the last 6 months as other buyers stayed away. Another reason why the high end market has held up the best.

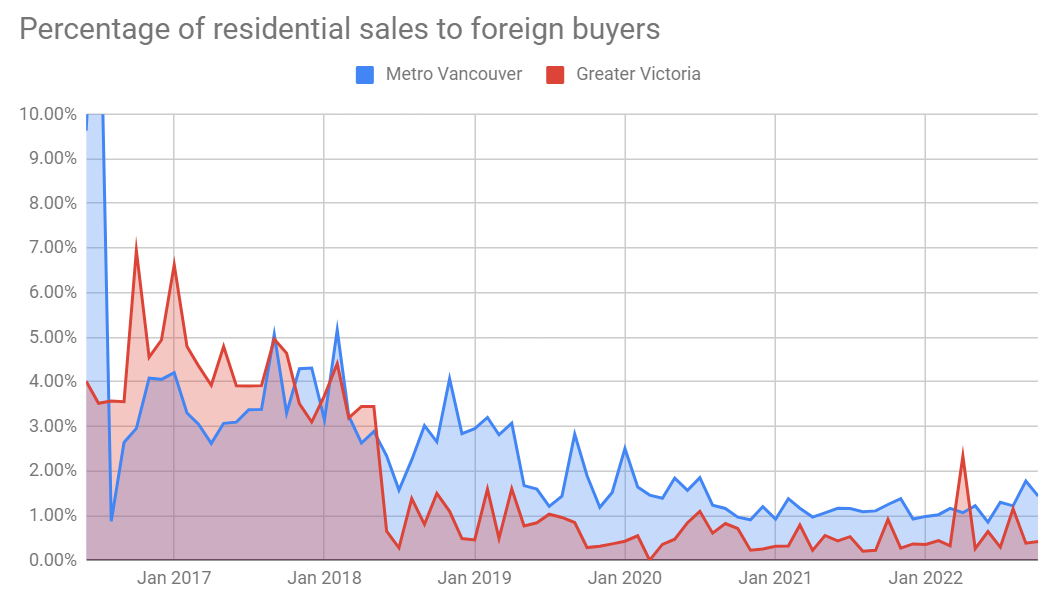

The feds will be introducing their 2 year foreign buyer ban starting in January. I predict the impact in BC will be indistinguishable from zero, since foreign buyers have only been about half a percent of buyers in Victoria, and about 1% in Vancouver. If those went to zero we would not notice, and with potential exceptions to the ban for students and other people here on work permits, it may not even reduce the absolute numbers much at all.

With price declines this year bigger than we’ve seen in the last 40, the question for house hunters becomes when to buy. What are you looking for in the data to decide when to jump in? Stay tuned I’ll examine this question in detail next week but please let me know in the comments if there’s a specific signal you are watching.

New post: https://househuntvictoria.ca/2022/12/12/higher-rates-but-whats-the-impact/

A mortgage broker also said some renewals are automatically done into 6 month terms at high rates so that could be part of it too. Thought that was interesting anyway.

I know some folks that have done this in the past, their situation was that they still required a mortgage, but planned to sell within a year and wanted to limit the mortgage break penalty. So, maybe some are holding off market hoping the bottom has been found and are looking to sell in better conditions they think might arrive in the spring, but need to bridge some financing.

Has anyone noticed if their house insurance has gone up a lot this year.

Because they did not qualify for mortgages with the regular banks and had gotten a mortgage with one of the secondary lenders hoping initially to requalify after a year with one of the big six. But with interest rates suddenly exploding the secondary lender had to extend their mortgage for another year.

Conventional wisdom for the last 10 years or so has been to go variable. The idea being that over the long term, variable wins out. I would advocate here for 5 or 10 year terms, but the consensus seemed to be that variable was worth the risk. Maybe some people still think like that, and who knows they may be right.

A third possibility is that they're terrible at math. That happens sometimes.

The reason they took 1 year at > 7%, I think, is that they expect interest rates to drop next year, and they expect the “average” interest rates over the next 5 years to be < 5%. They are probably thinking of getting variable rates after one year.

I’ll take a stab in the dark. Maybe the shorter term mortgages gave them prepayment options that worked better for their circumstances? If I knew I was inheriting enough to pay off my mortgage at the first of the year, for example.

Here’s a puzzler. Why did Canadians take out 359 million dollars in mortgages in October with sub 1 year terms at an average interest rate of 7.02% when you can get a 5 year fixed or variable around 5%?

The most important factor the Fed & BoC are looking at is not GDP growth but YoY inflation, especially the core inflation and PCE. If inflation remains high and GDP falls, don’t expect any rate drops. Short term readings of inflation may be low, but there is no guarantee it will stay low. Besides, core inflation is still rising or not dropping while headline inflation is dropping. This scares the heck out Fed.

“drop rates down to zero”?

Not for a decade or two – I would think the memory of the current bout of inflation will be tattooed on central bankers’ memories for a while.

A question I have is what happens if a recession occurs will BoC and the FED be happy to drop rates down to zero if needed to stimulate the economy again or will this time be different? I wonder if they see those low rates as too great a risk now and will be more careful about how low they allow them to go.

I think you’re reading it wrong. October alone was 0.7% off the top of my head & December last year was negative.

Seasonally adjusted Canadian cpi is up 2.8% over last 6 months (153.9/149.7), an annual rate of 5.6%. Yes, that’s lower than 7%, but it’s not 0%.

In 4 months since June, it is up 1.2%, annualized to 3.6%. Much better, but also not 0%.

https://www.bankofcanada.ca/rates/price-indexes/cpi/

USA inflation is 6.4% annualized over last 6 months.

https://househuntvictoria.ca/2022/12/04/november-detached-prices-dip-under-a-million/#comment-96465

With everyone talking about rates staying high for longer than expected, increases not being high enough etc, what do you all think of this?

https://tradingeconomics.com/canada/consumer-price-index-cpi

This is CPI data and there hasn’t been any appreciable upward pressure on prices for almost 6 months. Given that Inflation is calculated YoY, it is still reported @ 7% or whatever but that is wholly based on increases to the CPI that occurred between December and May. Since June, the CPI has stayed the same. I.e. inflation over that period is 0%.

The implication here is that unless there is more price pressure from somewhere that drives CPI up further, inflation will mathematically have to be 0% or thereabouts by next May. Perhaps not 0% but somewhere under 2% with absolute certainty if the last 6 months continue for another 6.

What happens then?

https://www.bnnbloomberg.ca/bank-of-canada-s-macklem-says-raising-rates-too-little-is-greater-risk-1.1858067

Still doubt that they follow through with the rhetoric, but at least they actually have some semblance of sense.

OK, but you can need to look at that number to see how small it is. Here’s Sep 30, 2022 data from statcan, indicating that Canadian households now spend a (still tiny) 4.01% of their disposable income on mortgage interest This number has ranged from 3.0-4.5% over the last twenty years.

This is up from the low of 3.16% in Q1 2022. But these are in the aggregate, tiny numbers. And not much of a concern when asking if they can service this debt. For comparisons, Canadian households spend 5% of disposable income at restaurants. And another 3% on “entertainment”

So the “oh, so scary” rise in rates has so far meant that Canadian households are in aggregate spending only about 1% more of their income on mortgage interest. And how about those that do have much higher payments than average?….Other data from mortgage delinquencies and homeowner insolvencies show that 0.0% of homeowners are delinquent on mortgage payments.

This doesn’t mean that there cannot be a future problem of servicing debts in Canada. But it does mean that there isn’t a problem now (see Sep 30.2022 data from statCan). If/when we do have a problem, it will likely be because of recession/unemployment leading to loss of income – and real problems of servicing debts, regardless of what the rates are.

But for now…. we’re good.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110006501&pickMembers%5B0%5D=2.1&cubeTimeFrame.startMonth=07&cubeTimeFrame.startYear=2019&cubeTimeFrame.endMonth=07&cubeTimeFrame.endYear=2022&referencePeriods=20190701%2C20220701

Check out the charts I posted, of the Olympic shadow map (which extends up to Royal oak), or the similar rainfall data totals for Gonzales (610mm) vs U. Vic. (650mm). The “5km Gonzales tiny circle” you’re referring to is not supported by this data.

And for most people, most or all of that net worth – in fact well over 100% of it for many – is in their house or condo. Yes they can pay off the debt by selling the property, but that just means the buyer has to borrow money – perhaps more than the seller owes – to make the purchase.

Doesn’t do households in aggregate any good. What matters is debt servicing ability from income.

It’s not just rainfall… Here’s the TEMPERATURE chart that Canadians should review before deciding where to live in Canada.

Here’s where various Greater Victoria cities fit in compared to ROC for annual rainfall. Driest is near Gonzales and U. Vic. . Wettest is Soaked, BC., with double the rainfall of Victoria or U. Vic. Note that Vancouver has 2.5X the rainfall of City of Victoria (Gonzales) or U Vic.

This is a rain shadow map. https://www.olympicrainshadow.com/olympicrainshadowmap.html

Considering the rapid downturn in house prices and rising interest rates, there was a lot of good news in the household financial data released released by statcan, current to Sep 30/2022

—- Household debt to GDP, important enough to be the first data point on the statCan table, has fallen to 104%, down from 110% a year ago

—- owners equity is still high 74% , falling only 3% from the peak of 77%

—- While media lead with a scary headline 184.74% “debt to disposable income”, they fail to mention “net worth to disposable income” which is 5X higher than that at 981%. The “Net Worth “good” monster” is 5X bigger than the “Debt (bad) Monster” Incredible, the average household has, after paying debts, a “ safety net “ of net assets worth 9.81 years worth of disposable income.

You can see the table here. Households look in good shape to me. Let me know if you see anything scary here…

https://www150.statcan.gc.ca/n1/daily-quotidien/221212/t002a-eng.htm

I love that precipitation map of the region showing how drastic the rainfall differences are between south Oak Bay and further out but haven’t been able to find it recently, anyone have it?

From our lies, damned lies and statistics department….

Vancouver gets almost three times the precipitation of Victoria, North Vancover almost five times.

Before you start the victory parade, “Victoria” in this case means a tiny circle of about 5 km in radius centered on the Gonzalez observatory. Stray slightly outside even to Saanich or the airport and you drop out of the Olympic rain shadow – it immediately becomes darker and wetter.

On the whole, I doubt most of them care. They’re coming from the Ukraine, not the Sahara.

What’d they think of 1996?

All wrapped up, I’m sure it won’t go any lower. :straight-faced emoji:

https://www.theglobeandmail.com/business/economy/article-canadian-household-debt-q3-statcan/

Month to date activity.

Sales: 138 (down 21% from same week last year)

New lists: 204 (down 6%)

Inventory: 1975 (up 125%)

New post tonight.

only a slight bending of the truth

The answer that suggests itself is that they wouldn’t have qualified for admission to the US. It’s pretty well known that many immigrants to Canada would have gone to the US if they could. Nothing to do with health care. The US does take more legal immigrants than Canada, but fewer per capita, plus a larger proportion is family class.

Marko- One question- why Canada and not the U.S.? “Free” healthcare maybe?

It’s how we ended up in Victoria, but before Google. We were on a ferry in Croatia to our island. A couple from Oak Bay sat down at the same table on the ferry. Throughout the conversation they noted to my parents that they lived in a place in Canada where it didn’t snow called Victoria. My parents were like “really?” When the decision was made to move the place in Canada where it doesn’t snow was the only consideration 🙂

Those people don’t sit down at the same table who knows where I am today. Probably New Zeland, Australia or Germany.

I lived in Vancouver for a year and for a “big” city it doesn’t get much better imo…ocean, mountains, multi-cultural. I lived in North Burnaby on a SkyTrain line and it was really easy to get to my clinical practicums. For example, I did three months at Royal Columbia in New West. SkyTrain was infront of my building and the station was right at Royal Columbian. If I wanted to go to downtown just hop on the SkyTrain. Even the Grouse Grind wasn’t that bad to get to. SkyTrain, boatride and bus but it worked great.

If Vancouver is too big move to Victoria, if Victoria is too big move to Comox. Not that complicated.

751 Fairfield (Astoria)

728 Yates (Era)

562 Yates (The Oriental)

595 Pandora

528 Pandora (Union)

409 Swift (Mermaid Wharf)

456 Pandora (Janion)

599 Pandora (above Mtn E Co-op)

610 Johnson (Monaco)

1602 Quadra (Palladian)

732 Cormorant (Corazon)

760 Johnson (Juliet)

707 Courtney (The Falls)

613 Herald (Cityzen)

960 Yates (Legato)

The above would be transient zoned (less than 30 days ok) but lot’s of people in my building having success with 30+ rentals on Airbnb….short government contracts-postings, travel nurses, “snowbirds,” etc. I know everyone hates Airbnb but for those who like to go on longer travel trips (in buildings with a 30 day min bylaw) pretty awesome to be able to rent out your unit for the duration you are away. What is the alternative, the unit stays vacant? A travel nurse, for example, having an option other than a hotel seems like a win-win.

Anyone know of any Airbnb friendly listings ? Is there a list compiled somewhere ?

Part of the explanation is that you’re already living in beautiful Victoria. Readers of Condé Nast magazine have voted Victoria in 2022 as the second best small city in the world to visit. https://www.vancouverisawesome.com/travel/travel-canada-victoria-conde-nast-2022-5920208

Or do you also find Victoria unattractive? If so, maybe the explanation lies elsewhere. For example, for me it makes a big difference if it’s warm/sunny vs cold/cloudy

It’s not just traffic related coughhousing, because you don’t have to look very far in this city to find a bunch of spoiled whiners

Never have I ever thought of vancouver as a big city. Versus this tiny town we live in called victoria, perhaps it seems big. On the global scale its a spec of a place. Traffic ‘seems’ annoying yes but try commuting in an actual large city. Lived in kerrisdale, south Granville, cedar cottage and worked in Richmond. When things go badly on the commute they go badly. But that’s anywhere isn’t it? And it’s relative. We had consultants coming in from Chicago regularly and they looked at us sideways when we griped about our traffic problems. They couldn’t believe how spoiled we were living where we did.

The whole point of living in Vancouver or Victoria is being able to afford a compact or transit neighborhood and not have to fight traffic imo . I’m impartial to lower lonsdale or Fairfield and have houses in each place

Luv Van but you can waste most of the day with traffic I’m from the shore and even there crossing east to west can be a nightmare

You know Barrister, I love Vancouver! It takes awhile to get to know any city and it depends on what you like to do when you are there. If you are going to any large city for only one or two days and you want to enjoy yourselves, then you have to plan the visit a head to get the most out of it.

Grandville Island public market and all the surrounding eclectic shops is a wonderful place to spend the day. So much fun to take the little ferries. Depending where you start from it only takes 5-15 minutes to get there.

My daughter lives in a wonderful neighbourhood two blocks up from Commercial Drive. Her part of the Grandview area has many lovely 1912 era homes. There are sidewalks and boulevards with old tree growth similar to Fairfield. Commercial drive is incredible. You could spend many, many hours just looking at everything it has to offer. It is over 20 blocks long filled with neat little stores and boutiques as well as a host of small cafe’s, restaurants and bakeries etc. Cook Street Village eat your heart out.

There are so many districts with 2nd hand and thrift stores to wonder through. There is the antique Market on Franklin and The Vancouver Flea Market on Terminal which is absolutely awesome and has lots of parking.

For the culturally inclined, go to one of the presentations at a playhouse or theatre. Or visit the museum or an art gallery.

Not to mention, the weather is similar to here. You can drive to so many places including the interior in a few hours. Also, you can take a direct flight to almost anywhere in the world from their International Airport. No more little flips to Vancouver first and having to get up at 4 in the morning in order to arrive at your final destination on the same day. Or if you take the darn ferry, you’ll probably have to go a day earlier which necessitates a hotel room in Van.

Anyway, to each his own. I’m proud of our country and all it has to offer.

Yes, thanks for the clarification and I’ve fixed it. We should be at 2,900 based on population. We can definitely take more. Manitoba is leading the way.

For Van Island… the site https://ukrainehelpvi.ca/ looks good, but no mention if donations are tax deductible.

Patrick, it’s 696 as of Dec.3, not 3,696. Manitoba has received 12,000 out of the 130,000 Ukrainians, almost 10% and represents less than 4% of Canada’s population.

Yes, that is way below expected, which would be 2,900 based on population.

That’s out of about 130,000 who have arrived in Canada to date, so it would appear that the Island is substantially underrepresented as a destination. Not surprising considering the distance and the lack of existing immigrant communities. Also they are not legally refugees.

https://www.canada.ca/en/immigration-refugees-citizenship/services/immigrate-canada/ukraine-measures/key-figures.html

As of Dec. 3, 696 Ukrainian refugees have arrived on Vancouver Island, and more are coming every day, said Karmen McNamara of Help Ukraine Vancouver Island, the main agency assigned to helping refugees arrive and settle.

One Ukrainian refugee family on why they chose Victoria: “I googled warmest place in Canada.”

🙂

https://www.timescolonist.com/local-news/an-unexpected-journey-ukrainian-travel-agents-rebuild-lives-in-victoria-6229662

Actually lots of current or former long term residents of Vancouver (including myself) hold the view that the city has become a lot uglier over the past decades. They see the city for what it is, not just the tourist promo stuff. A lot of the charm is gone and replaced by glitz.

De gustibus non est disputandum.

Just got back from Vancouver and .once again, popular opinion to the contrary, I just found it a very unattractive city.

Canada didn’t do too bad after all, not only we didn’t lose too bad, we even scored with the two of world top fours! 🙂

Actually Frank and I seem to be doing just fine with our cash positive revenue properties and long before you started sharing your wisdom here, so try not to let that ruin your day. Also, you should be more respectful towards healthcare workers.

Lmao I know you and Frank should take some advice. Slow night shift at VGH Sarah?

Actually one can get one year GIC with 5.25% interest rate now.

Per a recent email from Oaken (HT and HB):

“Please note that effective Tuesday, December 6, 2022, we will be increasing the interest rate for Oaken long-term GICs as noted below:

1 Year GIC – 5.25% (currently 5.10%)

18 Months GIC – 5.25% (currently 5.15%)

2 Years GIC – 5.25% (currently 5.15%)”

A bunch of other factors too. If you are a long time builder sitting on cash you can have the money returning 4.5% doing nothing at all or you can aggregate yourself waiting for the City of Victoria or Saanich for 6 months to turn around a simple SFH permit. Then you can have the joys of building a step code 5 come in what is still a tight labour market, etc.

Throw in having to hand deconstruct the teardown and then worrying about what the finished product might be worth in 12 to 18 monthd. Might as well collect 4.5% interest and sit at home.

December sales haven’t collapsed off the cliff as I initially thought they might. Seems to be okay with a few luxury sales in the mix as well.

Let’s say I am a little closer to the action for the next 10 days 🙂 last time around I made the mistake of leaving Russia too early not thinking we had a chance to make the final. I think our luck will run out against Argentina but you just never know. Incredible achievement for such a tiny poor country.

Not to worry all my long haul flights have wifi so I can keep taps on HHV.

And yet here you are out cringing everyone…

Jealously isn’t a good look my friend. Is there really a need to advertise on an anonymous internet forum that you predicted an interest rate increase that many could see coming and then brag about it months later like anyone cares? And trust me, any “advice” you’ve been sharing has been ignored by anyone that actually knows what they’re doing, but it’s super cute you’re still trying to align something you said with the actions of others.

You’re basically the Facebook comment section guy on this page, congrats!

I hate to stoop to this level but I can’t help it given how cringy some posters are here. A perfect example would be the below:

Is there really a need to advertise on anonymous internet forum that you got pre approvals in place for “another SFH”? LMAO, also I been saying Feb 2023 might be a good time since June when these joksters were going on and on about immigrants and $1.6M for royal bay houses.

I’m skeptical that you still have an ass.

LMAO.

Oh it’s quite real. Maybe you can rent from me one day.

Won’t need it, already have approvals in place for another SFH purchase, just waiting to see what happens over the next few months. You approved to buy your place in Maplewood yet or are you spending too much time trolling housing discussion forums and talking to your insider contacts? Or is it like they say: those that can’t, make interest rate predictions and brag about them being correct and those that can, do.

Maybe it was out in sooke. Or perhaps it was imaginary…

Wow that’s a lot of house on a big lot for very little money in 2016 which was a hot market That was a real steal well done

I remember that one. Lmao, so ridiculous that people can’t opine on publicly available information in an anonymous internet forum.

Lmao, better get that HELOC ready

Really now. Who puts properties on MLS without an address?

That’s at odds with what you said a half dozen comments previously re “almost teardown” prices only being determined by builders. Like I said, look at the big picture.

Wow, I know why we haven’t heard from Marko recently… He’s likely at a sports bar, 5-6 beers deep into a victory party of Croatia over Brazil!

Poor James has tied himself up in knots. Pretending to have filtered out messages from me and a few others here. Yet unable to resist replying to the same messages that he pretends not to see. One way out James…capitulate and rejoin the happy group here.

James accusing someone else of being pissy or having a fit is hilarious

Pretty sure it’s only Patrick that gets really pissy at people for posting links & addresses to places. Leo has removed them before when he’s had a little fit about it.

Oh, okay. I guess I heard it here first then. I’m looking forward to buying another 3000 sq ft home with a suite on a 10,000+ sq ft lot for around $500-600k like I did in 2016 then I guess. Appreciate the heads up.

That seems silly to me. No one was asking you to comment on the properties, just provide some examples that you’re talking about of low prices SFH that would be of interest to builders.

Lots of people do it here all the time, and it doesn’t piss off agents and sellers. If anything, the publicity helps. It’s called “free advertising”. For example, Derek in 2019 used to list great examples of SFH under $600k, and lots of people found that helpful. Hopefully he will resume that!

That would be foolish to do. If you have access to VREB then you can find them easily. But I don’t want to invite comment about these properties that are under a listing contract as it may be detrimental to the seller. I only comment on properties that have sold and I never give out the civic addresses of listed properties.

If you want to piss off agents and sellers that would be the way to do it. If Marko or Leo wants to open a discussion on a public forum and give out the addresses of properties that are under a listing contract – that’s their choice.

How’s about a few examples of these properties still listed? Likely some HHers here interested in that.

And since market value is determined by alternative choices available to buyers, declining starter home prices will have an effect on the next rung up of properties that are almost tear downs and so on and so on up the property ladder. A domino effect as the market place adjusts. But, there have only been two recent sales. There are about a half dozen properties listed that I think fall into this tear down or near tear down category. We have to wait and see if this becomes a trend. Or were the recent, that I assume are tear down, sales in Glanford at $535,000 and Oaklands at $500,000 – just outliers.

And I agree with tomtom if I were looking for a home to occupy, I would pass on both of these properties unless I had an extra $100,000 in cash to spend for upgrades. It’s easier just to finance a property that has been upgraded if you have limited funds. The same if I was looking for a rental property. The achievable rents after doing some cosmetic work to the home wouldn’t be enough to cover the expenses such as mortgage and taxes unless a I put down a substantial down payment.

The higher interest rates seem to be having an effect on these starter homes because out of the potential pool of buyers for this class of property (home occupiers, investors and builders) – who is left?

The only time you get a deal on real estate is when you are the only bidder.

“-Do you really see this happening, or is this just what you want to happen?”

I see it happening im speaking as someone who has skin in the game already .

The pending probate sale in Glanford is only for small builders who can build super cheap (cheap labour or cheap quality). The existing house doesn’t make sense for investors and I doubt that many starters want to spend extra $100K+ to reno this super tiny house. At the current market conditions, the potential buyers for a new build at this location is also low. If I were the buyer, I’d prefer to pay extra $150-300K for a tear down in Oaklands or Mt. Tolmie.

Interesting and valid point. So the prices of “tear downs” is supported by buyer activity from prospective builders. So if building collapses, prices of tear-downs will lose this support, and fall more than others. Makes sense.

Good read with Rosenberg in the sun If 2020 prices are the bottom I would be cool with that throw anybody who bought in the last 2 years overboard

Do you really see this happening, or is this just what you want to happen?

That’s not the reason why Patriotz. The reason is that a builder buying an improved property with a low value home also has to demolish the improvements at a significant cost. A builder will or should not pay the same price for a property that has a house to be demolished as they would pay for a vacant and ready to build on site.

In a hot market that builder is competing against others that may want to retain that home to occupy or rent. That increased demand drives the price of properties with nominal improvements up. In a soft market the builder may be the only bidder for the property as the home occupier and investor are not interested in bidding.

I’m saying may because there have only been two recent sales of properties with nominal value improvements in the core. More sales of properties with nominal improvements have to happen before this would be established as a trend. It’s too early to jump to any conclusion as one or two sales doesn’t make a market.

What makes these properties interesting to watch is that they are anomalies. Any trend first starts with anomalies.

I personally see us going back to 2016 prices. High rents but cheaper houses just like in the states.

Freedom…lovely painting of Craigdarroch. Congratulations.

@Infrequent Poster, you can also check out BNS, their ISA DYN6004 rate just increased to 4.05%: https://ads.scotiabank.com/ADS/Download/980/en

FYI: There a few saving/GIC rate discussion sites that can be helpful, see: https://www.financialwisdomforum.org/forum/viewtopic.php?t=124529

https://www.highinterestsavings.ca/

Barrister, thanks and I am thinking to donate it to the castle, if they like/want it.

That’s part of it, but the big picture is pretty simple. It’s just that price changes in detached houses are mostly in the value of the lot. If the structure is low value compared to the lot, the % drop of the whole property will be bigger.

Try PSA or XFR, both should be over 4%, risk adjusted GIC is better off, but you get better liquidity with the ETFs If you need to go back into stocks/bonds right away.

The last distribution yield which I assume is what your looking at also didn’t take into account the rate hike yesterday where as that GIC may already have.

@Leo S – do you have a median sales price to assessed value for attached side by side duplex units? Or does that fall under one of the other categories? Thanks!

@VicREanalyst – thanks for the suggestion. This seems to be the big one available to Canadians https://www.blackrock.com/ca/investors/en/products/239414/ishares-premium-money-market-etf and it appears to be yielding just slightly above 3%… am I reading this wrong or is it much less lucrative than the cashable GIC I mentioned at 3.75%? Sorry if I’m missing something, just trying to understand.

Freedom: I am impressed by the painting of Craigderick, Sincerely, a really nice touch.

There’s about 20 in total. Nothing terribly exciting but on average have done well – BMO, Google, Manulife. Marathon Petroleum has been the biggest winner, Facebook the biggest loser.

Interesting sale of a 723 square foot old home on a 6,500 square foot lot in Glanford. It sold for $535,000.

Described as an opportunity to build a dream home or for someone willing to put some sweat equity into upgrading the home.

Back in the first quarter of this year, similar starter homes, like this, were selling in the $750,000 to $800,000 range and these were considered to be close to lot value.

That’s about a 30 percent drop in value for a starter / builder / investor property. Yet the overall market place is down 15 to 20 percent. Back in March these properties had a strong demand with home occupiers, builders and investors bidding prices up. I think the builder and investor demand has evaporated and that’s why these starter homes have declined more than the overall market. There are about half a dozen properties like the above currently listed, so I wonder if this sale is a a one of or does it foretell the market. We will just have to wait and see what these listings eventually achieve in the market.

I like to follow these ugly duckling properties as they are a barometer of where the overall marketplace may be heading. I think of them as the Canary in the coal mine. If my assumption is reliable then the overall market still has to correct by another 10 to 15 percent which would be a 30 percent decline from peak prices.

I don’t think many home owners noticed the 15 or 20 percent decline. But a 30 percent decline will likely get their attention. That would put the average Gordon Head house under a million or back to price levels experienced in 2020.

One alternative would be a money market etf. Obviously not as safe as a GIC but pretty safe. Plus liquidity is as fast as you can hit buy or sell from your phone from the onset.

https://househuntvictoria.ca/2022/12/04/november-detached-prices-dip-under-a-million/#comment-96382

So basically Canadian IA’s are “worth” 4% because people don’t know to buy and hold or understand how their RRSP & TFSA accounts work, bringing me to one of the points I tell people all the time – spending a couple days learning this stuff will save you the 2-3% you actually have to pay for that “service” resulting in a doubling of your portfolio value over your lifetime. There are very few things you can do to with your time with that kind of ROI, no matter what the investment management industry tells you. Their BMW’s are paid for by your ignorance.

Why are you presenting this as a “study” which has “shown” added value, in this case 3.85% per year?This is just someone putting numbers on what they assume financial advisors do for people, like give them estate planning advice, or help them with tax planning or setting up a trust.

If I have $1m invested, this is supposed to be 3.85% or $38,500 per year of “added value” that I’ve received in the form of advice from my planner? Not increased value of my portfolio. That just seems like complete nonsense to me.

if you’re a professional investment advisor, let’s hope that you can do better than a post like that.

The new capital buffer increase announced by OSFI will force the banks to reduce the number of new mortgages. They will do this by reducing the discount from Prime for variable rates as well as higher fixed rates not linked to 5Y Canada Bond rates. The fixed rates might go up or not go down even if the Canada Bond yields go down. This might also push the GIC rates up as they have to raise the capital to meet the new buffer requirements.

As a licensed Investment Advisor(stock/ETF licensed) I would say the reason to use an advisor would not be to beat a passive index(studies would show that it is very difficult to do this on a consistent basis). You would want to use an advisor who could explain complicated issues/topics in simple and easy to understand language. Highlight what is going on in the world and how it relates to you. Someone you can talk potential idea’s by(buy/sell a business, moving, job changes, when and how to receive a pension, ect.). Take the stress and responsibility of managing your own portfolio off your shoulders. A person to talk you off the ledge when you want to sell at the wrong time.

Some people are able to be disciplined and stick to a plan no matter what is going on in the world or their life. Many struggle to keep things on track when their world is falling apart(also the better you do at your career, the less time/energy you have for managing your money). I didn’t redo my drainage plumbing and managing your money is far more complex than that.

Studies also show an advisor typically adds much more value then the fee’s they charge: https://www.investmentexecutive.com/news/research-and-markets/whats-the-value-of-a-canadian-financial-advisor/

Like all industries there is varying levels of advice/skillset ect. Finding someone that you feel you are getting value for the fee’s you are paying is important(before seeing a new person I would check out their social media site/linkedin to see how they operate and what they post).

Nice painting deryk. Here is one of mine (just an on-off retirement hobby 😉 ) related to one Victoria “house”

Anybody know of a cashable GIC rate greater than 3.75%? https://www.gicdirect.com/rates-a-locations/british-columbia/

What stocks did he pick?

I’ve heard people point to this, although I’ve never pursued it.

https://www.investopedia.com/terms/s/smith-maneuver.asp

I shared on this blog a couple years ago that I was moving a portion of my investments from my DIY account (XEQT/VEQT) to an advisor who I personally know and trust, to see if his stock picking could beat my low fee ETFs. He came highly recommended. But I was sceptical that someone could consistently beat the market, especially after fees.

We’re only 3 years into the experiment but he is beating those ETFs handily. The $$ I gave him is about 14% above where I would have been had I kept those funds in XEQT/VEQT, after the 1.25% fee. Really curious if he can keep it up. Or if he turns out to be the next Madoff 😉

” Although the landlord info was also required…. ”

Haha….makes me wonder if this one way to help governments know which landlords are not declaring their rental incomes:)

It definitely does not pay to try and play games with the taxman.

Sorry I missed that. You are correct for USA (we had a condo in AZ for 4 years).

Freedom, I was referring to the United States and at least fifteen years ago, when I lived in the US, mortgage interest was tax deductible. This also explains why I said there were capital gains on principle residences. I am pretty sure that the IRS really does not care what the CRA says about this. I had been discussing USA thirty year mortgages.

You are correct about your interest not being tax deductible for a principle residence in Canada to the best of my knowledge although tax law was not my area of specialization.

FYI: One-time top-up to the Canada Housing Benefit

Don’t know if anyone noticed this coming (starting Dec 13th) federal government program (for family with $35K or less and single with $20K or less net income in 2021)?

As the majority of students probably had less than $20k net income in 2021, and their 2022 rent (be it a room, a suite, an aprtment or a condo) in Victoria is likely to exceed 30% of their 2021 net income, so they would qualify for this one time benefit.

In there (see link below), the applicant needs to give the rent amount and the name and contact info of the person/landlord/owner they paid to. Although the landlord info was also required when BC gave the temporary rental supplement due to Covid, the difference this time is the rent paid and the landlord info could directly go to CRA

https://www.canada.ca/en/services/taxes/child-and-family-benefits/top-up-canada-housing-benefit.html

They probably would, if they had a 2nd job as a realtor 😉

All the stock brokers, or financial “advisors” I’ve known never recommended buying real estate. Funny.

I mean there are investing experts out there that truly do have skill and can outperform markets. The issue is that the size of their funds quickly adjusts to the point where that skill is neutralized, and the managers with the skill basically collect the premium for that skill in their fees, it’s not the investors that benefit.

This is a super interesting discussion on that topic https://rationalreminder.ca/podcast/220

FYI: for principal residences, the mortgage interest is not tax deductible either, unless you rent part of it (or whole) out or are doing business from home. Even then, the interest can only be deducted against the matching income and proportionally.

Also, per CRA, there could be CG (i.e. capital gain) on a portion of a principal residence if that portion has been changed (e.g. kitchen addition) and used for rental. There were discussions in HHV wrt this before, and someone even said they would stop renting out suite to avoid the possible CG

Does anyone know what 627 Raynor Avenue went for?

Also I believe that mortgage interest is tax deductible which makes a difference for young couples starting out. But capital gains do exist on principal residences.

St. Louis Fed says average is 6.49% for 30 yr as of Dec 1 but certainly individual lenders can vary.

https://fred.stlouisfed.org/series/MORTGAGE30US

As one of my friends said once: “If they are as good as they have claimed, why are they still working?”

At a quick check the Citibank rate in California for a 30 year fixed is 5.875 but I suspect you might do better. Correct me if I am wrong.

Lots of ways to get around the stress test, zero way to get around actually locking in at 6%

30 year fixed in the US is now 6.67%. As Patrick pointed out you can get a 10 year term here for 6% which eliminates the great majority of risk. Why do I get the feeling there’s no stampede for the 10 year?

If you truly believe there are investing “experts” out there, I can put you in touch with a guy who sells mutual funds.

At the end of your investing lifetime you will have somewhere between $300,000 and $400,000 less than the guy that just bought VBAL every month, but hey, you got to deal with the experts.

Average house payment 1991 (200k house, 160k mtg @14%), adjusted for inflation: $3480/m

Average house payment 2022 (1m house, 800k mtg @ 5.7%): $4792/m, or ~35% higher.

We purchased our first home in Victoria in 1991, the interest rate then was 14% so I guess they can go quite a bit higher.

That RBC fund also has a Mgt fee of 1.85%…that’s not on top of the 2.16% MER, is it?! Also, this fund has a solid allocation to fixed income which for someone 25-40 might not be ideal.

While MER is a factor in reduced returns, “tracking error” is a much bigger factor. 90 – 95% of the mutual fund managers underperform the market, some by a big margin. If the goal is to track the market, just buy an ETF like SPY (US market in USD), VFV (US market CAD), or VGRO (CAD). These have very low MERs and provide dividends that can enhance the return.

I keep hoping that the Canadian government would mirror the US and provide reasonably priced thirty year term mortgages to borrowers through the banking system.

They should eliminate the stress test for 10 year terms. That would allow someone to qualify for the 6.00% ten year rate that TD is offering now. https://www.ratehub.ca/best-mortgage-rates/10-year/fixed

2.16% MER on that fund is killer. Still I think $400k is not realistic unless you are taking on additional risk or happened to go all in on US equities in an opportune time.

For example with a globally diversified 80/20 portfolio with roughly 7% annualized returns he would be at $240k

I dont make predictions on things like interest rates because I am wrong more often than not. My guess for this weeks hike was likely no increase or a quater point since I figured delivering bad news before Christmas was likely not to happen. Obviously since they hiked .40 then I was wrong.

Marko has the best advice in that you should take what the experts say with a large grain of salt.

Banks raising their prime rate to 6.45% today.

How much further can they actually go?

Also, what does that put the stress test at? 8.45%?

+1

Nowadays, YouTube has lengthy, current interviews with every expert imaginable. Choose from Nobel winning economists, billionaire hedge fund managers etc. And they’re more than happy to tell you what they see coming.

Right. I’ve seen that a lot among family and friends. Always the same story. The “guy at the bank” pursues them for a meeting, which is a mutual fund sales call in disguise. And he pushes them into one of the bank’s high MER funds, like this RBC Balanced fund example. A doctor would lose his license if he steered you towards a suboptimal treatment that would compensate him more. The banks like RBC shouldn’t be allowed to sell their own product to customers.

I don’t know how anyone thinks that having the fixed be below the variable would be either a good thing, or something that would go on for a while. There’s a reason you can get a 5 year fixed for a better rate than a 1 year fixed, and than a 5 year variable. It’s that people are betting on a recession with reduced interest rates in the future. If they’re correct, the 5 year variable might end up being cheaper.

It is sad to see how many people don’t understand the basic concept of experts being no better than anyone else whether it is rates, real estate prices, or the stock market. That is why the references to “insiders” are funny. If insiders could predict anything they wouldn’t be insiders they would be on a yacht somewhere.

The stories on Personal Finance Canada Reddit posted every day are just insane. If people understood super simple concepts they would be so much further ahead. This one from yesterday…disciplined enough to contribute $160 per week for 14 years dumb enough not to do some basic research that would have his portfolio over 400k now.

Reply

If the 5 year bond stays around here I wouldn’t be surprised if the banks start competing for business in the New Year and 5-year mortgages are around 4.49%.

I would also assume that the unemployment and vacancy rates would have to rise significantly before there is any significant relief on economic rents. But that’s an assumption.

Another assumption would be that those moving to Victoria would first rent a property before buying in the city. If fewer “upper crust” people are moving to Victoria then that would have an effect on rents for houses as demand from outsiders for three bedroom plus homes declines.

Not so much for one-bedroom condos or apartments. Condo and starter homes likely still have to come down further before renters dive off the deep end into home ownership.

There seems to be many scenarios that could happen or a combination of all of them.

But I very much believe that vacancy and unemployment rates foretell both rents and home prices. If rents were to decline and vacancy rates increased to what they were two or three years ago that would likely help to solve some of our social problems. Two people on social assistance could rent a one-bedroom then. That’s two people that don’t have to live in a tent or a van.

I think most financial “experts” as well as the rest of us were fairly confident that the BoC was going to raise the rate by 75 basis points at the end of October. They were obviously under pressure and came up with the surprising 50 bps instead. The U.S Fed Rate increased by 75 bps just a week later. We’ll see what happens next week with them. I think there would have been a good chance if BoC had did the pretty well accepted 75 bp increase in October we would have seen a 25 pb increase today. Maybe in January?

Be nice folks. Always interesting to note what people are hearing out there. This time last year the consensus expectation from big banks was for rate hikes of about 0.5% in all of 2022 so it’s certainly not the case that the experts are better at this than anyone else.

There’s no need for the inquisition on people’s experiences.

Barrister’s origin story (which I have no reason to disbelieve) is as a successful lawyer from Toronto. Assuming that is true and depending on what areas of law he focused in it could be more surprising if he didn’t have any Bay Street contacts.

Honestly I think it is the presentation of the “insider information” – and not just by Barrister that attracts some gentle mockery.

I have heard this take before. Often from people in jobs that don’t produce much. Perhaps they generalize their experience.

This is another reason why I say most Victoria folks are slow. Why is it so hard to believe that some people who live here may talk to capital market folks on bay street? I talk to those working on Bay and Wall street almost on a daily basis (Hong Kong, London and the middles east too) and they are in our offices regularly, probably some in here right now. Whether they can make any better predictions than everyone else is besides the point, but you thinking that someone living in Victoria who may have friends working on bay street is so unfathomable is ridiculous.

I think I’ll just bow out here. This is not a healthy use of time. Cheers.

“We import most of our food and most other products.

About 70% of our food consumed is produced domestically, and in 2019 Canada was a net exporter of food.”

You can selectively use statistics to say whatever you want 🙂

Based on 2021 data, we produced $66B USD of agricultural products, exported $60B, and also imported $43B. The exports are primarily grains and raw meat. Imports are mainly finished products. This tells the story of exporting raw materials and importing finished products.

https://www.trade.gov/knowledge-product/canada-agricultural-sector

You can’t compare Canadian manufacturing to US manufacturing because Americans can manufacture 0% and still their currency won’t go down because of the reserve currency status. Americans run $70B trade deficit EVERY MONTH and still their currency won’t go down.

The best way to handle online personal attacks is to ignore them.

“Life is 10% what happens to you and 90% how you react.” — Charles R. Swindoll

Should really spend less time on HHV and get a second job instead to keep up with your expenses (which I believe you were complaining about in earlier posts).

Your Bay Street friends supposedly told you to expect mortgage rates of 6-8% by Jan 1. 5-year term is 4.69% today. So yah, with 3 weeks to go, it sure does looks like they “were far wrong”.

Here’s what you told us “ “For the moment, the talk on Bay Street is to expect six to eight by the beginning of next year. That is what I am hearing from TO.” https://househuntvictoria.ca/2022/05/10/months-of-inventory-or-sales-to-list-which-is-better/#comment-88306

No one is making fun of you for the predictions. Everyone goofs up there, me included. What is funny is your preposterous presentation, where you supposedly have a cabal of Bay Street insiders that have regular group chats to discuss future rates. You admitted that you make things up when you told us about your “perfect rib eye steak” dinner. That’s a “fool me once”. So don’t expect anyone to believe this Bay Street yarn. You should just drop it, and make your own predictions like everyone else.

I am assuming this is for insured mortgages?

Absolutely none Barrister. I don’t claim to have any insider contacts either. The people of note I was referring to are economists surveyed by Bloomberg. Economists who also back the view that the BoC doesn’t have to raise rates in lockstep with the Fed.

Good news for HHers looking for 5-year term mortgages. The Canadian 5 year bond keeps falling, including today, and is currently at 2.98%. That’s down 0.88 from 3.86%. 5-year term mortgages follow the 5-year bond and are typically 1.5% higher. That would put 5-year term rates at an expected 2.98+1.5= 4.48%. RateHub reports 4.69% as the best 5-year discount rate today, which is close. Nice to see that the 5-year mortgage rates have started to fall, down from a peak of 4.84% on Nov. 20. The 5-year bond is close to where it was at the peak (April-May was about 2.8-2.9%).

Rates https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

Bond yield https://www.marketwatch.com/investing/bond/tmbmkca-05y?countrycode=bx

I actually remember back in the summer where people made fun of me for passing on that my Bay Street boys were saying that the rate could hit 4% by year end. (They did not say that it would but that it could). Turns out that they were not far wrong.

Dad, exactly how many of your people of note do you actually know personally. And do they actually talk to you?

You need much higher unemployment for that to happen. And even then, I’m not sure that rents decline much.

Lenders are requiring more rental estimates than they have in the past. People need high rental rates to qualify for their mortgages today. If rents were to decline sharply or the vacancy rate were to increase that would be more of a disaster for the market place than declining house prices as it will have an effect on more home owners that are re-financing than prospective purchasers.

There is also Zumper, but the methodology is not very clear.

Rentals.ca seems to be the most robust third party trackers but they don’t keep the historical records publicly available. Not sure why.

Don’t need it, I called the peak in rents couple months ago.

Are these higher interest rates having an indirect effect on the rental market?

It does seem that the rent for a three-bedroom in the core has softened as the average is around $3,100 per month. I’m sure they were higher back at the beginning of the year. A clean and well maintained house in the 1,600 square foot range is asking $3,600 or $3,700 a month.

My recollection is that similar homes would have been renting in the $4,000 to $4,500 range at the beginning of the year.

Unfortunately, unlike house prices, there is no data system that tracks historical rental rates.

Lol do you know the exact same guys barrister knows?

Guys in Toronto were split on 25 vs 50. Nobody of note was predicting 75.

What Dad missed is that most commodities are priced in USD regardless of where it is produced. So the weak CAD still hurts Canadian consumers. And the most effective way to combat a weak CAD is to hike int rates.

Manufacturing as a % of GDP:

Canada: 10%

US: 11%

About 70% of our food consumed is produced domestically, and in 2019 Canada was a net exporter of food.

Canada is a net exporter of gasoline and most gasoline consumed in Canada is refined domestically. BC only has two refineries, but most of our gasoline is refined in Alberta and shipped to us via the Trans Mountain pipeline which of course, is being twinned.

You mean 2017, when the sturgeon refinery came online in Alberta?

That link appears to be much weaker than it was. CAD to USD when oil was trading at close to $120 bbl: $.80 in June. CAD to USD when oil is trading at 75 bbl: $.73 in June.

CAD/USD is only part of the equation. BoC can and probably will settle at a lower terminal rate than the Fed. That is the consensus view anyway.

Overall, your take is trash and misinformed. This is the same bitter narrative that gave rise to people like Trump (muh coal mining job!), but I can at least forgive the people of Appalachia for thinking that way, being truly desperate and actually hard done by.

Why not cleared it after Jan 1, 2023 then you could pre-pay another 15% on your principle?

Why does BoC have to keep hiking?

Because we in Canada don’t make anything. We just sell our houses to each other (until recently), spend the profit, and call it economic growth. We import most of our food and most other products. We dig raw materials out of the ground and ship them out and we don’t want to process them into products because of our NIMBY. We export crude oil but import refined products like gasoline and diesel. We haven’t built a refinery in a long time. The only thing supporting CAD was crude oil price but now that too is declining. If we don’t hike, CAD will crash and that will bring more inflation. BoC can’t stop hiking until the Fed says they are done hiking.

At some point it has to bring about additional inventory even if demand doesn’t change too much due to lower fixed rates, unless they go up as well.

This 0.5% could have the biggest impact on the market yet, imo. I have a feeling it is going to push some people over the edge.

Glad I cleared all variable debts before this latest jump. One life lesson I’ll remember for next time around is you are better of clearning a mortgage before a rate hike (variable penalty is three months interest, lower interest lower penalty). I also pre-paid the annual 15% first and then cleared it after (once again lower penalty).

Call me wrong, I was sure that the BofC would only do .25 or nothing. Guys in Toronto were saying a half or even three quarters. Obviously more in the loop than I am. This must have triggered a whole flock more mortgages. Time for my second cup of coffee.

Gonna be a slow December. Though I wonder if impact of hikes is less when fixed is lower than variable so people can just stick with that. Or will increasing variable drag up fixed rates?

Beat me to it introvert!

Bank of Canada increases policy interest rate by 50 basis points, continues quantitative tightening

https://www.bankofcanada.ca/2022/12/fad-press-release-2022-12-07/

Coincidentally, both the doctors and the teachers ratified their new contracts with 94% support from those who voted.

B.C. doctors ratify new $708-million, three-year deal

https://www.timescolonist.com/local-news/doctors-ratify-new-708-million-three-year-deal-6208295

Yes and no, Patriotz.

They only owned the property for less than five months. So was it their principle residence?

You can’t write off a loss on your principal residence against anything.

It is from June 30,2022 statcan

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110006501

Mortgage debt-service ratio, interest only 3.47%

As I was very clear in my post, this is the average % amount of disposable income that Canadian households spend on mortgages interest. Including those without mortgages. So yes “your friend spends much more than that on mortgage interest”, but I bet you or one of your other friends spends nothing.

The discussion topic was if rising mortgage payments would affect consumers much. Including mortgage principal, the average is 7% of disposable income. That means average of ( 7-3.5)=3,5% of disposable income gets forced-saved as mortgage equity, something your recent homebuyer friend is doing..

For comparison, spending on restaurants is about 4%. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110022201

James soper yes inevitably they’re oak bay crest will be removed from they’re windshield along with other accolades once they cross the border

I suppose Microsoft employees working in Victoria would be paid in U.S. funds. Maybe exchange rates at the time of purchase and time of sale offset some of their loses. Some employers also cover relocation losses, can’t imagine any other scenario.

You can only write off a capital loss against a capital gain.

Assessment are not a good guide on that property. The house had several additions and now has an awkward floor plan lay out. The assessment application won’t catch that oddity. It’s necessary for a human to make a judgement call on market appeal when homes have had additions. An awkward floor plan layout can increase the loss of value associated with the improvements by 20 percent or even more.

A computer application can’t pick that up and will result in a high assessment. The assessments will provide a good indication only when the home is typical for the neighborhood. Even then you’ll have to put a factor on the assessed value to allow for changes in prices since the date of the assessment.

Which brings up the assessments that should be coming out soon. Lenders that use them for low loan to value mortgages are going to have a problem as the assumption is that the home is worth more than the assessed value. Can’t make that assumption if the assessed values are higher than the market. There’s no price floor to base the loan on.

Nope. Loss on the sale of a residence is not an allowable moving expense. Real estate commissions and mortgage break fees are, on the other hand.

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-21900-moving-expenses/line-21900-expenses-you-deduct.html

It’s at minimum $430k, but more realistically half a million. Just pocket change for the upper crust of society.

And the ability to absorb ~$200K loss in less than 4 months. But maybe it is tax deductable (for work related move) or maybe Microsoft would cover it for the unique skillset …

Edit: Oops, Mea Culpa. It should be $550ᐩ K (instead of $200K) 😉

Right. And yet we still hear that “nobody” is going to sell at a loss.

The assessment for 1715 Monteith is $1,924,000 (Jul1, 2021) by the way, so ironically I would expect it to go up.

“a unique skillset”

Liam Neeson worked for Microsoft?

I’ve had a number of buyers have to sell shortly after closing on the purchase. I’ve already given examples but will repeat yet again. I had two microsoft employees that had to sell shortly after purchasing homes as microsoft suddenly shut down their Victoria office without warning. Both individuals that were impacted had a very unique skillset that required moving.

Add family reasons, health reasons, etc.

Yes the original sale closed. For the millionth time failure to complete is extremely rare.

Did the original sale actually close? Maybe the buyer walked and the seller sold for less and will now try and sue for the difference.

Money Laundering? Just a wild guess. But it is really weird …

Maybe Binab (the realtor involved) would know more?

Gotta be honest 1.85 still seems like alot of money for a dialed up older home imo

Why would anyone sell just months after buying?

where and when is this stat from? anyone who took a variable rate in the last few years (especially new buyers with large mortgages) are feeling the squeeze a lot more than that. My friend bought a place last year and her BW mtg payment has gone from just over 1200 to just over 2000 in less than a year. Just saying that stat could hide a small but meaningful amount of mortgage holders who use a lot of their disposable income for mortgage interest with a larger amount of people who have owned their homes for a long time and have relatively small mortgages.

Only 5% of Canadians disposable income (overall) goes to mortgage interest, so I wouldn’t expect that to be a big factor. If it rises by 40%, that becomes an extra 2% of overall disposable income gone.

Right. I recall you spotted that their benchmark had run off the rails several months ago. And you started using sold price:assessment which has been great.

Another Wow after watching the for sale video in summer. $2.28M for a renovated bungalow on a 10200 sqft lot? I guess it was just one of Binab’s specials 😉

https://www.youtube.com/watch?v=u0yzla3CAmM

1715 Monteith St

No bidding war, took over a month to sell in the summer.

It’s hilarious that the board keeps promoting their MLS HPI benchmark prices, and last week they announced that the benchmark has been broken since 2020 when they accidentally started feeding it sold prices rather than pending sales. It was obvious in spring of 2021 already that there was something seriously wrong with them.

Hope no one was using those benchmark prices for anything important for the last 2 years.

The foreign buyer ban is just political noise. The real foreign buyers are the hoards of immigrants coming in as new Canadians (which we need to keep our systems running – pension, health care etc). The price pressure from this group will only increase as our population is not declining. Take that and the hoards of millennials that are nearing the end of their offspring bearing years that are buying nests for new families and you get a pretty good sense of where the price pressure is coming from.

I’m guessing this is how the recession happens. Less disposable income from paying large mortgages & more for everything from groceries to fuel means less to spend on other stuff.

There’s currently 26 countries with total yield curve inversions, ours is one of the largest, and the largest of any G8 country. Bad thing if this does signify impending recession is that the country we do 63% of our trade with is also inverted, along with our #3 trading partner, and our #5, and our #6, and our #7. Just with those countries alone, that’s about 3/4 of our trade(72.5%) is with countries that are going into a recession.

I exxpect prices to pretty well stabalize during the early part of 2023 and remain flat for a few years for greater Victoria. Cant say the same is true for Vancouver. The big difference is the percentage of government jobs here.

Black Friday?

Anyone tossing around a couple mil on an investment property probably need the tax deduction. Can’t see first time buyers with a large mortgage qualifying for a property in that price range. The gory details would be interesting. This is the time of year that investors do tax loss selling to lower their tax liability. Don’t feel too sorry for them.

Ok I thought BC Assessment updated my home details and reported it as a sale when it wasn’t a sale but I figured it out. Removing co-signers from title shows up as a “sale” on BCAA and that’s what happened.

Wow, add in buy/sale cost (lawyer fee $2ᐩK, land transfer fee $43ᐩK, realtor fee $70ᐩK, etc), that is a big loss!

Just curious, what is the address? Was there a bidding war in Aug?

Good thing they didn’t rent, they’d just be paying off their landlord’s mortgage.

BCTF, government ratify new contract

https://www.kamloopsthisweek.com/local-news/bctf-government-ratify-new-contract-6185709

Home purchased in August 2022 in Oak Bay $2,280,000 just resold for $1,850,000.

Property assessments expected to rise despite real estate cooling off

https://www.timescolonist.com/local-news/assessments-expected-to-rise-despite-real-estate-cooling-off-6204041

Whoops, sorry late night mathing and I threw myself off with the percent over assessment and I subtracted the two by mistake. Funny I had written the text saying that the median was likely overstating the decline based on my intuition but then changed it. Corrected now.

My thoughts as well. The wildcard is recession. Right now all this has happened with a super strong economy. But big yield curve inversion right now signalling big recession. I don’t know how exactly that would happen and maybe it just doesn’t arrive like everyone is expecting, but I think short of continued higher rates we will need higher unemployment for a lot more downward movement.

Personal update! We took back our basement suite. Been busy cleaning and doing improvements.

You can try the math yourself:

For SFH from March peak (126-103)/126 x 100% = 18% (not 19% like I said below – typo on my part)

For condos from April peak (128-109)/128 x 100% = 15%

Dude, maybe you’re reading it wrong.

Caveat Emptor;

A bit early to be evaluating a prediction for Dec 2023. By Leo’ measure SFH are down 19% from the peak or 15% from when that prediction was made. Condos down 17% from peak or 14% from time of prediction. So 1/2 to 2/3 of the way there.

Leo:

“According to my preferred measure of median sales price to assessed value, detached prices have dropped 23% from March to October, while condos are down 19% and townhouses

have dropped 21% (though this number is the least certain with only a few dozen townhouse sales most months).”

Unintentionally ironic typo of the day.

No problem. Sorry I can’t provide it any more, but any active Realtor can replace it for you with the same functionality.

Thank you for the Portal, i will be sorely missed. But it was a really great tool

Yes, based on 20% down payment calculation. There are few houses could make the numbers work but need to rent each rooms separately. Once the market down another 5%, there should be some interesting properties.

You are right Totoro, I miss it! Darn it

I’ll go away once I am consistently wrong, doesn’t look like that will happen anytime soon. Remember who told you all about used cars and rent prices peaking couple months ago. Gotta love my insider contacts!

Vacant land sale in South Oak Bay this week at $475,000. It’s been a long time since I’ve seen a land sale that low in Oak Bay or even in Victoria City. Maybe 7 or 8 years ago.

And you missed it when it was first listed and also showed the computer screen depicting two naked men engaged in pornographic acts. Lasted half a day. Whoops!

You gotta look at this. MLS 918606. This person collects artwork, figurines, butterflies and books.

Correction

The prediction was for ALL properties down by a minimum of 30%. Some properties won’t fall as far so for ALL properties to fall 30% probably need the market as a whole down 35% or more.

Oh…..I see they were asking $1,250,000 in August as well. Maybe someone can remember it from last March?

I see 2035 Ardwell in Sidney has been re-listed @ $1,099,000 after being on the market for 60 days prior @ $1,199,000. It was purchased on 20 March 2022 for $1,175,000. There has been a boat load of renovations but not sure if they were done before or after the purchase in March.

A bit early to be evaluating a prediction for Dec 2023. By Leo’ measure SFH are down 19% from the peak or 15% from when that prediction was made. Condos down 17% from peak or 14% from time of prediction. So 1/2 to 2/3 of the way there.

Frank are u saying tenants in Victoria are a better bunch When I was in Calgary the roi was much better than Vancouver I just didn’t see as much upside on values

…If people stop replying to him, he’ll eventually go away.

Thurston- Horrible advice, tenants are very difficult and tend to trash properties, especially in the Prairies. I know lots of people who tried the rental investment game and lost their shirts. Looks good on paper but the reality is a nightmare.

It kinda looks like the Debt Monster was right. The monster was fire.

millenialhomeownerx2

May 19, 2022 12:13 pm

oh debt monster. All properties down by minimum 30%! quite the prediction…

9

The Debt Monster

The Debt Monster

May 19, 2022 12:00 pm

Marko Juras

“What do you predict the market value will be in 17 months?”

Let’s see, currently, the 5 yr posted mortgage rate at Scotia and BMO is 4.99% and this is prior to the two big interest rate increases coming up in June and July. That will push mortgage rates up to 6%+ and drive buyers away even more so. Market sentiment will be completely negative by this year end and prices will be correcting within that time frame.

By the end of next year, all properties will be down by a minimum of 30%.

If someone was just after roi on real estate u would do do far better in the prairie provinces and other parts of Canada than here Keep in mind the rate of appreciation historically has not matched places like Van and T.O

By “neutral cash flow”, did you mean rental income = “operation expenses + mortgage interest + down payment (potential) after tax earning” ?

If I was a buyer I’d definitely be waiting till the brainiacs with the “insider contacts” told me it was a good time to buy

I have a friend and his wife who have just moved to Victoria and they are looking to buy a house. They say they are in no rush.

(They sold their house in Alberta.)

My impression is that they believe prices will drop here in Victoria.

I happen to think they should not try and guess the bottom of the market. I’ve suggested that they buy something they can afford and get settled in on a solid footing and get on with life.

If Victoria is now around one million dollars, then it is not likely to go very much below that in my opinion.

I’m not sure they are going to head my advice though:)

Maybe they will prove me wrong.

Meh, like I said before Victoria folks are generally slow, just go look through the comments section from late spring onwards when the writing was on the wall.. I thought you were a condo investor though, aren’t you closing soon on the new dockside condos?

I am ready to buy in the core as long as the property in reasonable conditions and having neutral cash flow. The land has to be at least 7k sq ft. Smaller land is fine but with development potentials.

For a primary residence that you need and can afford, still the best place for your money and at least there is more choice and less pressure.

For a secondary residence where you are pulling equity from your primary residence? I wouldn’t do it right now – rates are too high and returns too low. Even if you have cash saved, put it in a RSP or TFSA or unregistered GIC if you are worried about the stock market, or pay down your primary residence mortgage – or put in a suite if you are so inclined.

Cash buyer with no debt or buying with retained earnings? Probably going to be some better opportunities for those willing to hold for seven or more years and I would still buy vs. putting money in a taxable GIC/market account.

My take is real estate prices will probably bottom next year but real estate will be a real dud for several years after We are probably entering a period of dead money and your money would probably be better invested elsewhere imo

I am not looking to buy but if I were looking to buy, I would when:

Inventory > 3,000

Months of I > 8 months

Sales-Active Listing Ratio < 10%

In my opinion, the above will be met by next year this time.

We could have used some of these kicking skills at the Word Cup. Sagen is the mortgage insurer formerly known as Genworth.

https://www.theglobeandmail.com/investing/personal-finance/article-mortgage-default-management-tools-struggling-homeowners/

Personally as an investor looking to buy something I am slowly getting back into it. Made an offer last week on a vacant SFH in the core 14% below ask that’s been sitting, unconditional, quick completion, seller didn’t even reply with a counter.

I’ll resume with the unconditional quick close offers in the New Year. I would like to see a bit more motivation on the part of sellers but not really seeing much distress or panic whatsoever.

I am not planning on waiting too too long. Inventory is low. Solid wage growth for many people will improve affordability. If interest rate increases pause I could see the market stabilizing quickly.

You also have to accept buying and the market dropping another 10% or so which I am totally fine with. Impossible to time the bottom market. Instead of trying to time the market I am more about buying what I think is good value within the market.

I think you if you are a first time buyer or looking for a princiapl residence (and don’t have anything to sell or have already sold) it would be wise to set a strike price and max duration of waiting otherwise you might spend waiting forever like many Garth followers.

For example, SFH median falls to 900k and if it doesn’t after 12 or 18 months you pull the trigger irrelevant of where prices are at.

If you don’t have a trigger point you probably won’t pull the trigger at 900k median, assuming things drop, as at that point there is a lot of negativity in the media influencing your decision to hold out further and you will miss the opportunity. When you look back historically sales volumes are always the lowest when the market bottoms out, i.e. news is bad and very few buyers jump in.

Great insights Leo, thanks!