Who grew Victoria in the last 5 years

A brief update as I’ve been busy moving my parents to town over the last few days (success).

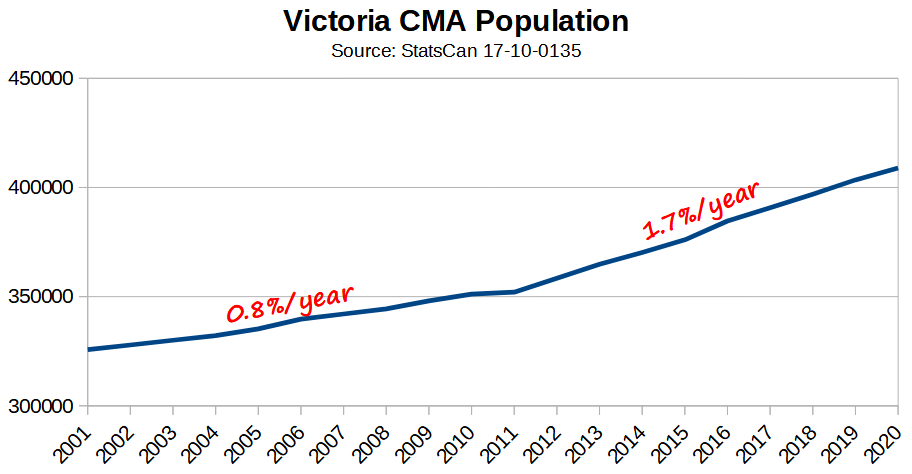

We know that after a few decades of a relatively low and constant growth rate near 1%, Victoria has been growing more quickly in the last decade.

We also know that natural population growth is essentially zero and the large majority of our growth comes from migration to Victoria, primarily from other areas within Canada. So who is coming to Victoria? Is it a wave of retirees like we were often told to expect as boomers retired, or has Victoria evolved to attract people across the age spectrum? We’ve looked at different estimates of migration before, but with the 2021 census data out that should be more accurate than the interim data based on administrative sources.

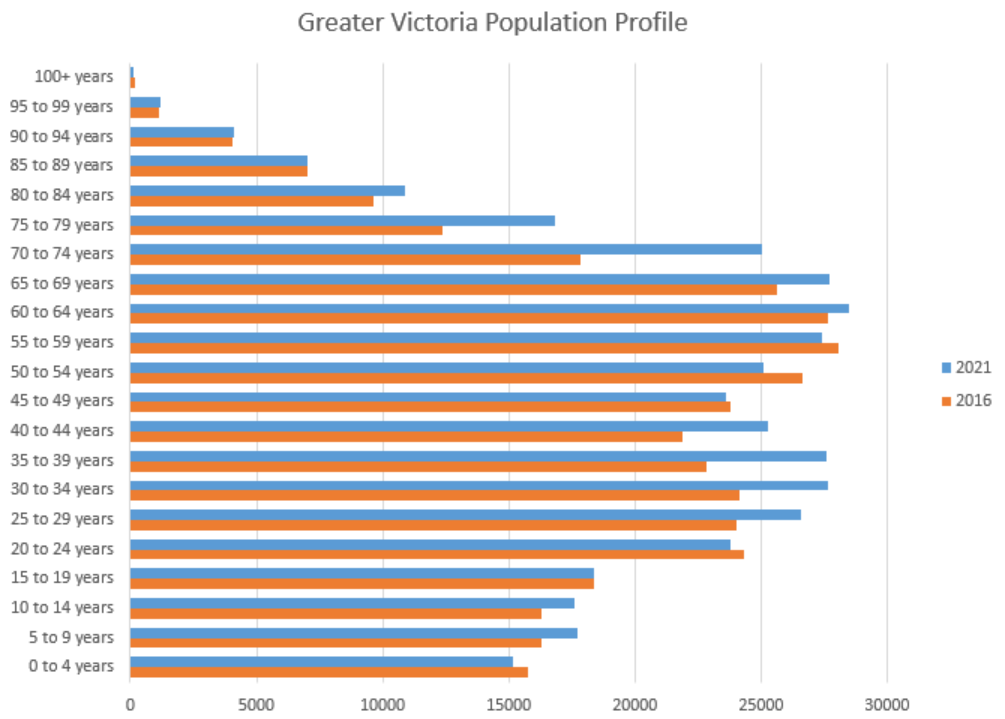

The biggest differences between 2021 and 2016 are in the 65 to 80 year and the 25 to 45 year age groups which both saw substantial population growth. However to get closer to the question of what age groups actually migrated to Victoria, we need to remove the effects of aging. For example most of the growth in the 70-75 age group simply came from the 65-69 year olds getting 5 years older, rather than a large influx to Victoria.

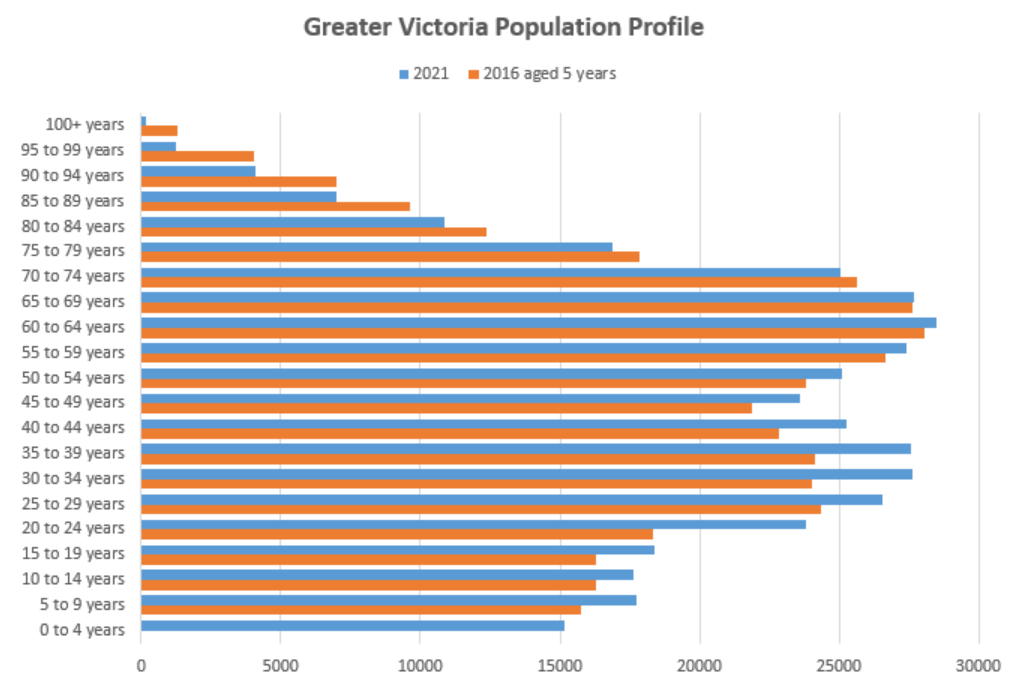

To account for this, we age the 2016 counts by 5 years and compare to the 2021 counts.

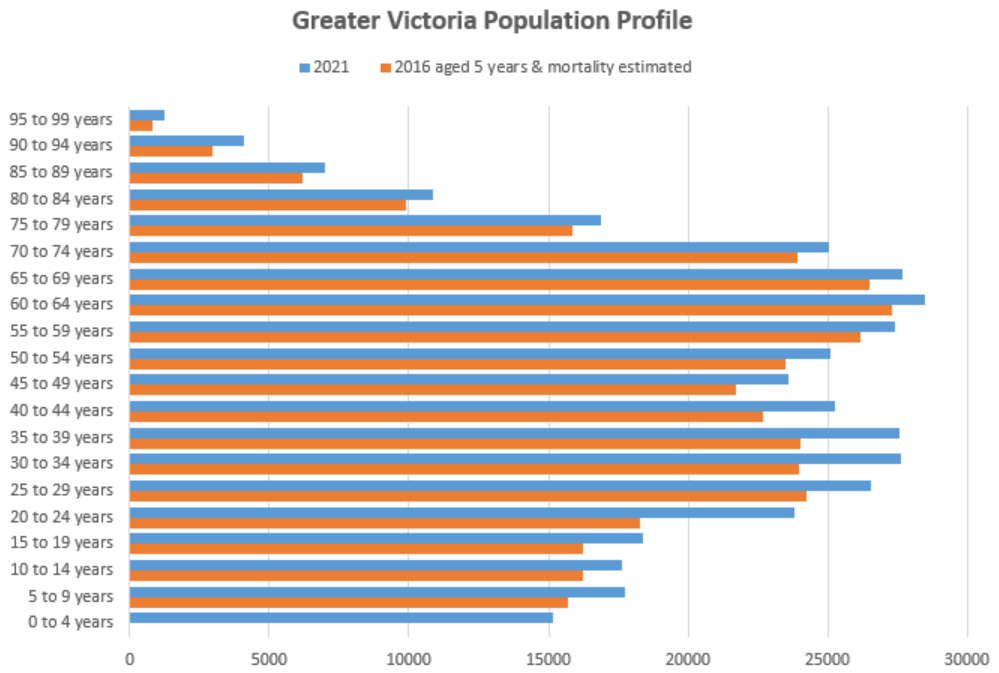

Now we see that the increase in the older age group disappears, while the increase in the working age population persists (and the influx of 20-24 year old students from outside of Victoria shows up). However this doesn’t take into account that not everyone makes it 5 years into the future which starts to become a significant factor by about age 75. To try to get even closer to the real changes from migration we can estimate mortality and compare them again.

Or the same data but displayed as a difference.

That brings back the positive delta in those older age groups, so retirees are continuing to migrate to Victoria but still at a much lower rate than the working adult population between the age of 25 and 45. A similar bump is seen in the population of children, likely brought by those young and middle aged adults.

What are the implications for the real estate market? Though a migrant in the 25-45 year age range is less likely to immediately purchase a home upon arrival than a retiree, younger arrivals will remain net purchasers of property for a longer time period. The effect has been reflected in scarcity and rent escalation in the rental market and rapidly rising prices in the resale market. However working age migrants are more sensitive to challenges with affordability and the strength of the job market. The job market remains very strong with only a few cracks appearing so far, but increasing differentials between expensive and affordable markets in Canada could draw more growth to cheaper areas in the future.

Also here are the weekly numbers courtesy of the VREB.

| November 2022 |

Nov

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 83 | 653 | |||

| New Listings | 205 | 696 | |||

| Active Listings | 2161 | 887 | |||

| Sales to New Listings | 40% | 94% | |||

| Sales YoY Change | -41% | ||||

| Months of Inventory | 1.4 | ||||

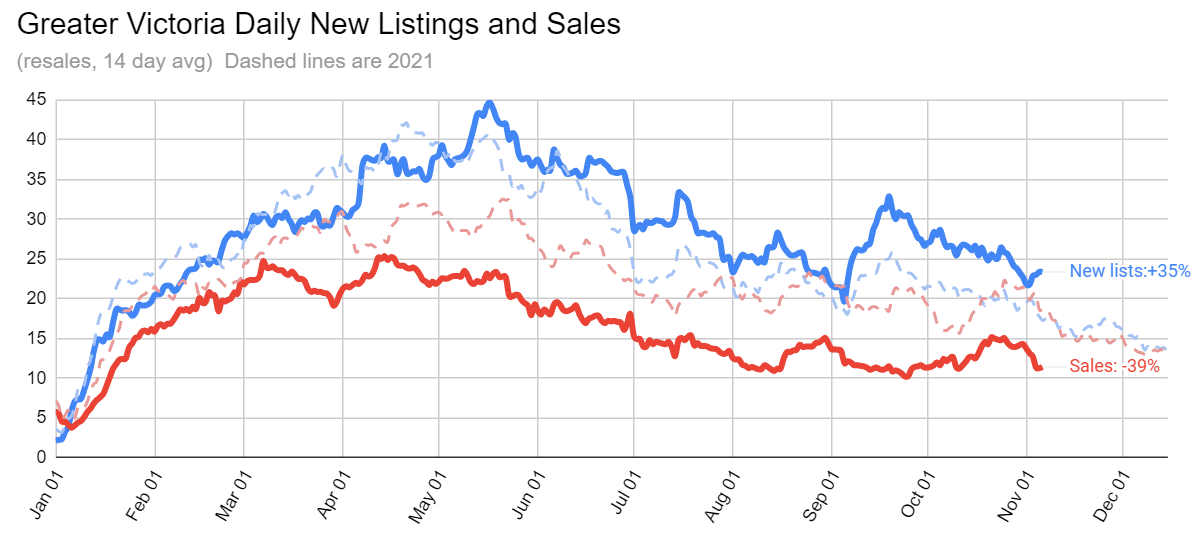

Nothing of great note happened in the first week of the month beyond what was already covered in the October summary. Sales are down by some 40% but that’s only a few days of sales and will change as the month goes on. New lists remain normal, somewhat higher than the low levels of a year ago, while inventory is more than double.

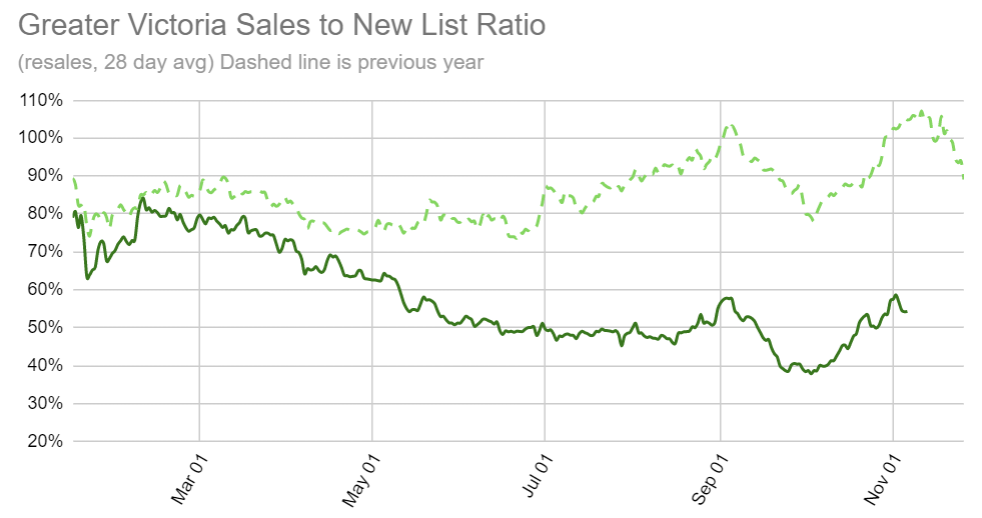

Market balance continues to lag far below this time last year, but has not continued to deteriorate for the last couple months.

It’s always possible to attract a bidding war by deliberately underpricing, but that strategy is becoming more and more rare, now down to only 4% of sales going over the asking price in the last two weeks. In January the provincially mandated rescission period comes into effect, which requires a 3 day period during which a buyer can back out of a contract of purchase and sale even if it is unconditional. Given that buyers would need to pay 0.25% of the purchase price to invoke this option ($2500 on a million dollar purchase), and that the vast majority of offers made now are conditional, I don’t expect this will be used much at all and will have precisely no effect on the market.

Of course it’s not designed for today’s market, but rather to protect buyers carried away by animal spirits when the next hot market arrives. The cold-feet rule could protect a few buyers from overpaying for flawed properties at that point, but how many would have invoked it if it was available during the mania of the post-COVID years? While some of those purchases are surely being regretted now, at the time buyers were glad to win properties after losing countless bidding wars, and the economy was still drunk on cheap credit and ever-increasing prices. I suspect even when those market conditions return, the new option will see very little use.

New post: https://househuntvictoria.ca/2022/11/14/do-bidding-wars-still-work/

I am going to assume most parents give an appropriate amount, up to the maximum recommended dose, when their kids are sick. Are you supposing otherwise?

Children’s aspirin or (baby aspirin) is a low dose ASA of 81mg. Regular aspirin is 325mg of ASA. Usually a doctor will tell you “take 2 aspirins (so 650mg.), get plenty of rest and drink lots of fluids.”

You see a lot of low dose (81mg) ASA in pharmacies now because many seniors are taking one per day to prevent heart attack or stroke.

Much controversy about this however.

I keep wondering to myself: how much Tylenol and Advil are people giving to their children?

As for the difference between children and adult aspirin, it’s marketing. I raised the question with several nurses at VGH and they informed me that the composition of the tablets is identical. It’s just the size of the pill.

But, you should confirm this for your own satisfaction by speaking with your doctor.

Sad but true. There’s also the issue of food labeling. Nutrition Canada label requirements (for calorie, carb counts etc.) are a little different than USA. So any USA food products need special “Canadian” labeling to get in, and many of them just skip exporting to a small market like Canada. I recall that issue a few years back when I was “on Atkins.”

PS In talking about bureaucracy, I have in the back of the mind Marko’s comments about problems with housing here and throughout BC. Another symptom of the same illness.

—-==—

These kind of insults to other forum members are way-outta-line. Grow up!

When it comes to ongoing complaints about bureaucracy, I was surprised to learn that the ongoing shortage of children’s acetaminophen and ibuprofen (which other young parents will be aware of) is a consequence of federal-level bureaucratic mismanagement. The supply chain issues and demand are not, obviously, but what has been stalled for ~ 6 months has been the importing of meds from outside Canada. The issue is that children’s meds from the States, UK, Australia, etc., have labels in English, not in both English and French.

This is a fact which is somewhat buried in news reports (FWIW Canada could use a bit more of an adversarial press), e.g. the paragraph with “exceptional importation” in

https://nationalpost.com/news/canada/childrens-tylenol-and-advil-shortage-drug-supply-mess

Apparently printing and sticking on dual-language stickers is too hard, or something.

(I was just in the States last week for work btw, and as ordered, made sure to stop by the nearest CVS to pick up a decent amount of those meds, all of which were in stock at normal prices. Thank goodness too, as our older two came down with flu yesterday. It’s always a bad sign when our oldest voluntarily lies down to rest..)

Anyone paying attention will have noted that Frank never suggested that the illegal immigrant wouldn’t be billed. His point was that they would receive treatment, regardless of whether they ultimately pay. And the cost to the health care system is the extent to which they don’t pay. Aside from that, our scarce medical resources are planned to be used by people in the country legally (including residents and legal visitors).

Everyone here on HHV agrees with you. Including the original poster. I consider Canada to be # 1 in the world in welcoming immigrants and integrating them into society. There aren’t many anti-immigrant Canadians, especially compared to other counties.

You don’t need to accept my opinion on Canada being friendly to immigrants It is measured by countries globally, called the “Migrant Acceptance Index”.

https://www.immigration.ca/canada-rated-best-country-in-world-for-welcoming-immigrants/

Canada Rated Best Country In World For Welcoming Immigrants

In May 2021, the polling giant released the results of its latest Migrant Acceptance Index. And we are # 1 out of 145 countries.

It asked people living in 145 countries last year whether they thought immigrants living in their country, becoming their neighbors and marrying into their families were good or bad things. Canada scored the highest score, 8.46, indicating Canadians are the most welcoming people in the world when it comes to immigration

This basically amount to being mad that other people and cultures exist and move around – something that has been true since humans were humans. Your experience of your own culture and the time in which you experience it is nothing special. It’s no more worth preserving than anyone else’s culture or experience. Be “proud” or whatever (of what?) but trying to have your distaste dictate what others do with their own lives is.. I don’t know what to call it. I’ll go with arrogant and futile.

No. Frank is 100% correct. Note that he specified emergency medical treatment. Which doesn’t mean “going to emerg”, it means what it says which is requiring emergency medical treatment. And that will happen regardless of if you have coverage. His point was they aren’t going to turn you away for an emergency problem and he is 100% correct on that.

So if a foreigner without coverage arrives to emergency after a car crash, requiring emergency surgery, ICU and a bed, he will get all all that. Regardless of ability to pay.

The only point being that illegal immigrants without insurance and means to pay still can be a cost to our health care system.

Yeah I think this is pretty unusual, will have to check against the weekly data from the past few years

Seasonally we’re almost building inventory no?

You will also be billed for the ambulance ride to the hospital, that one I have had personal experience with. I think most of the forum realizes by now that Frank doesn’t really know what he is talking about other than immigration and refugees so you don’t need to point that out explicitly going forward.

Looks like inventory is holding pretty steady If I was going to list a house in the spring market I would probably go early like the middle of January

Month to date figures:

Sales: 156 (down 46%)

New lists: 375 (up 27%)

Inventory: 2186 (up 129%)

Slow start to the month. New post tonight.

You again, don’t seem to have any fucking clue what you’re talking about. There are 100% questions asked on how they’re going to pay for the treatment, and it’s not cheap $100-$600 just for a doctors visit, if you’re going to the hospital expect to pay much more. Even out of province they will ask you for money before you get to see a doctor if you’re from a province that doesn’t allow them to bill directly (BC was this way at one point, not sure if that’s still the case). If it was a car accident or something and they need emergency medical, they will be treated, but they will definitely also be billed.

https://www.theglobeandmail.com/business/article-private-mortgage-lenders-raise-qualifications/

The CRA Indexation increases, adjustments, personal income tax & benefits amounts etc. are out for 2023.

Indexation increase for 2023: 6.3%

Personal Exemption: $13,521

20.5% tax bracket begins @ $53,359 & 26% bracket begins @ $106,717……..and so on.

Lots more if you are interest at this point.

You’re preachin’ to the choir. Vast majority of people here support immigration.

I have seen some one-bedrooms advertised at $1,600 a month. They will be in a 1970’s purpose built apartment buildings.

I can’t recall seeing these advertised at the beginning of the year at this price. But if rent prices are going to come down it will be first noticeable in these 1970’s apartment buildings.

The high prices and high interest rates, in my opinion, have kicked migration to Victoria in the gonads this year.

Jg looks like they got some water in the basement or first floor so guessing perimeter drains are stuffed or need replacing I don’t know why they wouldn’t have made a insurance claim Outside of that looks dated and well used Might have had some funky garage extension too Doesn’t appear to be a lot of money but I really don’t know the area

Immigrants to a country, over a long period of time and in large enough numbers, do change the characteristics/demographics of the population, and with a change to the demographics comes a change in the culture, as well as to the social and political climate of the country. Change as I am expressing it is the displeasure of losing ones country and culture as one knows it to exist. It can also be an expression of frustration and anger at not being able to do anything about this impending loss.

If a person has a general love for their culture, then they may very well want to maintain it as it is. Whether or not ‘change’ can be seen as good or bad depends largely on where they stand, and whether they have benefited from that change. A lot of Victorians have gotten rich from immigration, and some are now saying that it is enough immigration. They have gotten the wealth they wanted and now don’t want further change.

The genie was let out of the bottle and you got your wishes. Now it’s time for others to get theirs. It’s not that you are being hard done by. When you have money – you have choices.

Since folks are talking rentals:

https://victoria.craigslist.org/apa/d/victoria-3816-mildred-st-available/7553768019.html

https://victoria.craigslist.org/apa/d/saanich-central-nice-bedroom-house/7554000889.html

There just seems to more out there and the peak price seems to be slacking a bit and allowing for some lower priced stock to show up.

Have you seen any messages here from people who don’t want the country to change?

Most of us have profited nicely over the last several years from immigration. House prices and rents have gone up at a staggering rate. You can’t keep your cake and eat it too by enjoying the good parts without having or dealing with the bad parts.

No matter how hard I try, I can not shed a tear for those that have profited greatly but want the country not to change.

Anyone requiring emergency medical treatment, whether they are a legal resident or illegal, would never be turned away from a hospital. They receive treatment first, no questions asked. That’s how a civilized society works. Since the funding is already in place, whether payment is ever received doesn’t seem to concern anyone.

thoughts on this property? https://www.realtor.ca/real-estate/25053533/7004-wallace-dr-central-saanich-brentwood-bay

Maybe you could give us a rundown of how many of the illegal aliens evade taxes ( a crime), and what other crimes they’re committing. The program to grant these illegal aliens has removed the requirement that they needed to have filed tax returns while they worked illegally in Canada. Because few of them had filed returns. Also has removed the requirement that they speak English or French. Because they hadn’t bothered to learn one of our languages either. https://www.canada.ca/en/immigration-refugees-citizenship/corporate/transparency/committees/cimm-mar-03-2022/undocumented-populations.html

This part of the immigration.ca article was news to me. Both that we have 500,000 “undocumented migrants” (illegal aliens”) and that we’re making a new pathway for them to immigrate. The 500,000 estimate is from pro-immigration group immigration.ca . That’s a big number. Since Canada is 1/9 population of USA, 500K illegals would be equivalent to 4.5 million in the USA. Current estimates are that the USA has 10.5 million illegals, and this number has been declining since 2007 (Yes, I know that Trump begs to differ) https://www.forbes.com/sites/stuartanderson/2021/03/10/illegal-immigration-in-america-has-continued-to-decline/?sh=546cad184e14

I’m all for immigration, but not illegal immigration. Hopefully this “new pathway” isn’t seen as a something permanent for people to just come to Canada to visit and stay, without going through the normal immigration procedure. If Canada has 500,000 illegal aliens, that would estimate to (by % of population, since we get 0.6% of legal immigrants ) 3,000 in Victoria alone. We freak out about 800 foreigners with spec tax homes in Victoria, and ban foreigners from even buying homes, yet we seem to be cool with rewarding “illegal aliens” that broke the immigration laws by just staying here, by giving them a pathway to citizenship.

https://www.immigration.ca/canadas-current-rate-of-immigration-could-see-it-land-more-than-470000-immigrants-in-2022/#:~:text=That%20puts%20Canada%20on%20track,residents%20to%20Canada%20last%20year

“The other, confirmed to be in the works by IRCC staff, will allow undocumented migrants to gain permanent residence.

New Pathway In The Works For Undocumented Migrants To Get Permanent Residence

The IRCC is working with academic experts and industry stakeholders, including the Canadian Council for Refugees and Migrant Rights Network, on this pathway which could pave the way for the estimated 500,000 undocumented migrants in Canada.”

I have. Both rentals.ca and zumper suggest rentals are up 20% plus in Victoria over the last year and as someone who has been watching the rental market pretty closely I’d tend to agree. The last few months price increases seem to have stalled but the first half the year was noticable.

This seems like a totally random number pulled from who knows where.

Does that mean the influx of immigrants has stopped? No, it hasn’t. The next 400,000-500,000 are entering the country every day, waiting for their turn. There is nothing stopping anyone from coming to Canada for 6 months, during which they hire an immigration lawyer ( if they haven’t already) and wait for their paperwork. The tap is never shut off.

How many parents come to “visit “ their children and stay for years? I don’t think you need to show immigration papers when renting an apartment, or house. All that is usually required is 2 months rent and a security deposit. Their children can buy them a house and “rent” it to them. Yes, they are staying in the country illegally, but when are they going to be caught and what’s going to happen to them? People with the means do what they want until someone tells them they can’t.

I tend not to believe everything the news tells us. I’m always listening for what they’re not telling us.

What was also record breaking about 2021 was how many new immigrants were already living in Canada. I’ve said before you have to look at net foreign migration to find the actual population increase.

https://www.cicnews.com/2022/02/how-canada-landed-405000-new-immigrants-in-2021-0222072.html#gs.im1zs4

If you’ve been reading the news you’ll know that people risk their lives to cross illegally from Canada to the US, not the other way around. And could you give us a rundown on what social benefits are available to someone who is not in Canada legally?

Not the same government you know. But so much for details.

You don’t hear any numbers from our government on how many illegals enter Canada every year. The U.S. currently has 2 million illegal immigrants entering yearly, I’d bet 10% of them find their way into Canada for our social benefits. It is amazing that a government so inept at providing “health” care and other social services can process 1500 immigration applications daily. Shows you where their priorities are.

Not ” theoretical/aspirational”. Canada’s on target for 470K immigrants this year (2022). Therefore, 500K isn’t a stretch (for 2026 as they’ve said) , and they may exceed it. And they’ve already landed 110,000 Ukrainian refugees (temporary, non-immigrants) in Canada ( in 8 months) with 360K applications approved. https://www.canada.ca/en/immigration-refugees-citizenship/services/immigrate-canada/ukraine-measures/key-figures.html

That puts them on track for 600,000 immigrants + refugees for 2022.

https://www.immigration.ca/canadas-current-rate-of-immigration-could-see-it-land-more-than-470000-immigrants-in-2022/#:~:text=That%20puts%20Canada%20on%20track,residents%20to%20Canada%20last%20year.

“ Canada’s Current Rate Of Immigration Could See It Land More Than 470,000 Immigrants In 2022”

That puts Canada on track to see immigration hit 471,394 new permanent residents in 2022, or 16.1 per cent more than the record-breaking 406,025 new permanent residents to Canada last year.

That is assuming that the government that can’t issue passports, PALs, NEXUS passes, entry VISAs, build ships, buy airplanes or build a pipeline (that was to cost $7 billion and completed 4 years ago that now costs $22 billion still with no end date) is suddenly going to be able to start processing and admitting a record number of immigrants? lol… Those numbers are probably as theoretical/aspirational as the climate targets that won’t be achieved either. Just remember, it’s a target set by government dependant on the competency of the people working in government to achieve it. So, it’s probably not going to happen any where near the stated goal.

I haven’t seen rents increase over this year. I haven’t seen them come down either.

The difference between buying a home and renting is that you can leverage your purchase. You can’t leverage your rent. You can only pay what you can earn. The government wasn’t concerned about house prices skyrocketing until rents skyrocketed.

Now we have all the social problems associated with high rents such as tent cities, crime, violence. Building more expensive homes isn’t going to solve this problem. Housing has been BC’s gold rush it has brought tens of thousands of people into the cities for jobs and that has created more demand for doctors, dentists, dental hygienists, etc. But just like a gold rush once the gold is gone they will pack up their picks and shovels and they will leave and likely go back to small town Alberta and BC where they came from.

The pendulum swings both ways. Victoria just like most west coast cities are no longer the Rose they once were. And that will cause people to leave. Victoria isn’t as bad as some other cities, but it’s not going to improve. We may have less snow than most rural BC towns but they don’t have our problems. Grand Forks is looking pretty good these days. The people are super friendly and if you don’t like people you can talk to your horse.

Frank, rents have already peaked and have one way to go if you haven’t noticed.

500,000 people coming to the country every year plus hundreds of thousands of war refugees and your saying there’s enough housing for them. Not what I’m hearing. I don’t understand why one of my tenants hasn’t found cheaper rent, instead they’re asking for a 4 year lease.

Do that Frank and you will be out of business. Besides immediately after a recession construction isn’t going come roaring back to life. It will take time to get people to buy once more as consumers are going to take one for the team too. They are going to be spending their savings during a recession as BC residents are carrying more debt than all of the provinces and their net worth will come down. If we go into a recession, BC might be one of the last provinces to recover as a good portion of the economy is related to construction. People are reluctant to buy when their net worth is declining.

There is also an outside chance that we can go from a shortage of housing to a glut of housing and that will take time to clear. I doubt that what is happening now is going to be short lived. My opinion is that things are going to get a lot worse because they have to in order to bring down inflation. Any decline in the interest rate may be in small basis points over a very long time. The interest rate isn’t likely to come down as fast as it went up.

Some will be hurt more than others such as those that bought after January 2020 when the interest rate came down significantly or those that dipped into their lines of credit and added a lot to their mortgage as they are facing a 30 to 40 percent increase in monthly payments at renewal. That is a lot of homes over the last few years and some will go into foreclosure as all of their equity is likely gone, but the majority of home owners in greater Victoria will be fine. They may look like they went three rounds with Mike Tyson but they’ll live,

The worst case is what could happen to vacancy rates and rents. Unlike the interest rate that only effects those renewing their mortgage which is spread out over the course of a year. A sharp increase in the vacancy rate has a immediate effect on every landlord at the same time. That would effect a lot more people than just those that bought in the last two or three years.

But all of this is a LONG way from now and may never happen. It could be a year before we see any significant increase in foreclosures in Victoria. Divorces maybe sooner.

Always plenty of buyers, just not enough at the asking price.

Frank there isn’t a supply shortage there’s a buyer shortage

Makes sense, send your subcontractors home, they’ll take off to Alberta, and there will be no one around to build homes on the island. That’ll help the supply shortage. Most large construction companies know how difficult it is to find qualified trades, they keep paying them out of their deep pockets just to keep them around. This downturn won’t last forever, the demand will only get worse.

As John Galbreath once said. people without jobs dont buy houses. I suspect that we are on the edge of a very bad situation. I really hope I am wrong.

There are four tests to determine if a project is viable. Zoning is the first one but it isn’t the most important.

The most important is if the project will make a profit. That’s the problem we are having right now as the economy isn’t doing so well. Increasing zoning to a higher density will not solve the current problem. The city could pause new permit applications and that would allow the city to catch up and process current applications quicker. That might bring more projects on line but accepting new permits isn’t going to make much of a difference. The city has to clear its backlog.

Big companies will have their fair share of pain. They will be swapping out their CEO’s that are sales orientated for accountants in order to trim back the fat the companies have accumulated. And the quickest way to trim fat is lay off employees. Just like Elon Musk did. Those that work from home or are sub contractors are the first to go. And I suspect that the bigger construction companies with there head quarters in Vancouver will sacrifice Victoria in order to reduce costs and save their core business if the economy goes into a sustained recession.

It’s easier to let employees working from home or subcontractors go. All they need to do is hit “delete” on a key pad. It happened in condominium construction here in Victoria during the “leaky condo syndrome” when condos crashed in price. The Vancouver companies left Victoria and the local sub trades were left unpaid. Workers left the city for better opportunities and the vacancy rate increased.

If you are a smaller business you should be looking over your client list to see how exposed the business is to losing one or two key clients. That’s how most businesses fail. Generally speaking the success of being paid is related to where the business is in the building process. Those that do excavation are more likely to get paid. Not so much if the business is landscaping.

Easier zoning would help to bring homes on to the market but it wont have any effect on house prices

Totally agree, and no one is talking about those barriers. Or rather the Victoria residential builders association is but they are so antagonistic no one is listening.

Everyone is trying to choke out small builders/developers including BC Housings. The barriers to entry increase every year on all fronts thanks to policies instituted by middle class beuracrats. As a result you are left with massive companies running the show controlled by a small number of individuals and then the same middle class complains about the ultra wealthy.

I agree zoning reform would help immensely. Right now only the large well capitalized companies have the means to go through the rezoning process.

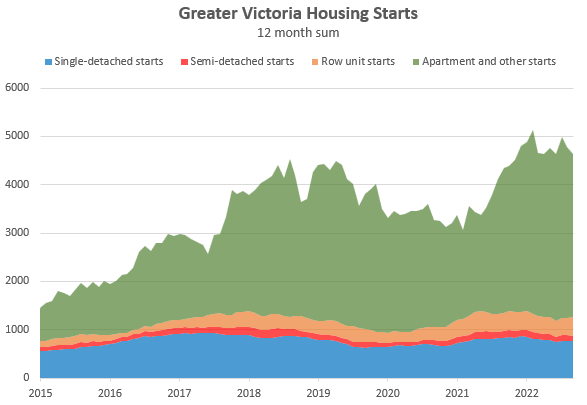

Note that chart is units under construction. Here’s 12 month sum of starts.

This is why we need zoning reform. Big developers have a stranglehold on housing production. This becomes more and more true as greenfield land runs out.

Subtrade pricing declining shortly, already hearing some trades unable to secure new work

They might also be able to port their mortgage to a new purchase and avoid all penalties.

There are two kinds of mortgage break fees – interest rate differential and extra months interest (typically 3 months). The interest rate differential is compensation to the lender for breaking a mortgage whose rate is higher than the current rate. But the opposite is true today, so it doesn’t apply. So you’re left with the extra months interest, which isn’t going to be much. For example:

Outstanding mortgage balance $500,000

Mortgage rate 1.50%

Three month’s interest 0.25

Mortgage break penalty $1,875

https://www.ratehub.ca/penalty-calculator

If you look at at Leos chart below SFH starts have essentially remained unchanged. We’ve gone from 500 to 700 starts/year in 7 years. Apartments and other have gone from 1,000 to 5,000 starts/year.

If you exclude Gablecraft, Westhills and Southpoint we must be talking less than 400 SFH starts per year by smaller builders. My point is there isn’t a lot of vacant lots out there and there won’t be. Land development will now come to a complete stop. What is left will be absorbed at lower prices and that is that.

I was arguing this point on HHV back in 2011. We simple don’t have that much SFH available land left and what is left is extremely expensive to develop so even thought the market exploded 2015 to early 2022 SFH starts barely went up.

Yes, there will be a huge drop in starts next year but it will come mostly from apartments and condos and for those typically the developers are sitting on rental houses or similar. You don’t put in the infrastructure for an apartment building until you are actually building.

I do agree that some developers are absolutely getting slaughtered by interest rates but at the end of the day it will not result in a huge decline in new product prices in my opinion, rather it will result in a huge drop in housing starts and then when demand picks up again will be surprised to be in a lack of inventory environment.

A lot of pre-sale transaction occurred before the short lived run up; therefore, while prices are down from all time peak you still see places selling for more than first half 2021 prices. Add in the fact that in the last 10 years the deposit structures slowly evolved from 10% on average to 15% to 20% there is little risk to mass failure to complete.

Recently I’ve seen purchasers completing on townhomes in Langford and then selling them at a small loss (but far less than 20% deposit loss + potential of being sued on top of that).

I think the risk is a bit bigger in Vancouver where pre-sale buyers sometimes pay 20% more than tangible product.

Buying a townhouse in the next few months

All I hear is rumors about developers stopping construction as long as they haven’t started framing. After that they’re fairly committed to finishing the project unless their financing falls through. I hope that doesn’t happen. None have dropped their prices but I do expect that most will start giving incentives to buyers. Anyone for a free TV?

And no Marko it isn’t Gablecraft or Westhills.

Less construction, but I expect a lot of condominiums and houses bought during the last two years for month to month rentals and airbnbs are going to come back on the market. Condo owners have been hit with higher strata fees and insurance, and are now facing a 30 or 40 percent increase in mortgage payments. They are not likely to be very happy.

Those with fixed rates but with one or three year terms are hoping interest rates will come down. Obviously they don’t want to pay a mortgage penalty by selling before the term is up so that may ease the number of units coming to market. A lot of people were buying in the beginning of the year when rates were 1.5%

I can’t remember what was happening to the condos and homes built between 2019 to 2020 back in February of this year but there seems to be more of them on the market today.

.

Not what I’ve heard from my insider contacts…… hope your wife works in a profitable business line in whatever company she works at.

Driving today I wonder if a lot of developers are nervous about they’re pre sales completing Too bad about projects being shelved but I’m guessing there’s just no demand

Right now it’s more about headhunters and competitors poaching staff than layoffs but that could change if we get an actual recession. Still not convinced that remote staff will get the axe first, but time may tell.

Higher rates for construction financing true, but I don’t think that would put off the builders if they had confidence in prices holding. IMHO what’s really putting them off is that they don’t.

And as I said a while back, a sharp drop in starts will be the opportunity for the provincial government to really get moving on non-market housing.

Units under construction higher than ever.

Developers getting squeezed right now though and shelving lots of projects. Higher rates on the one side and no relief in construction costs on the other. Likely see a sharp drop in starts next year.

Ardmore is a great neighborhood. But that house has a goofy floor plan with additions and dead space which makes me think the assessments are way off. The assessment from the year before, at $1,114,000, took a huge jump to what they are now. My guess is that an assessor hasn’t been through that home in 25 years.

The assessment are good to consider if the house is typical for the neighborhood but they can be miles off on a house like this. But that is a nice price for that neighborhood. An acre in Ardmore that should be a million just by itself. So $200,000 for a 3,700 square foot home even with a goofy floor plan seems good to me.

I wonder if that bonus room was used as a dance floor? If it has a sprung floor it would make a good place to set up a home based business as a Fred Astaire or Gene Kelly dance school. But without this space it’s really only about a 3,000 square foot home that a typical family would use on a regular basis.

Ferndale is a pan-handle lot. No chance in subdividing. Needs work and best rent, as it is, would be 2,500 per month which means you would have to put down $500,000 just to have the rent pay the mortgage. At 860 square feet you would be throwing good money after bad to remodel as the home is way too small. Personally, I don’t see the upside in buying this one for an investor, builder or home occupant. It is the cheapest property to buy in Gordon Head which is its only redeeming feature.

My guess is that it will sell to someone wanting to build a house for themselves and are not concerned about over spending on construction as it will be their “dream home that they will never leave”. Otherwise you would have to keep your cost to build say a 3,000 square foot home under $225 a square. That’s going to be tough to do. In that way it makes a good one to bid on. Because you might be the only or one of the few bidders. This is an estate sale so its unlikely that executor is going to take it off the market.

I wouldn’t know what to bid on this one as I don’t want to build a house. That means any offer I would make would be considered an insult to the seller which they would never accept because they don’t have to. They just have to wait for the right buyer to come along -which I am not. I wouldn’t put an offer in until after it had at least one price reduction then for sure I would know I’m the one of the few potential buyers for this property.

Better choice would be 4419 Robinwood at $999,000 which would give a better rent if you’re a builder or investor. And maybe throw a cheap suite in the basement which would then get $5,000 a month in rent for the property which would cover the mortgage payment. That would allow a builder to hold the property for awhile until home prices rise and it would makes sense once more to build. And I’m not an investor that wants to put money into a home just to almost break even.

The crypto bankruptcy in the news of FTX brings up memories of Larry David’s super bowl ad (for FTX). In the ad, he plays his crusty/cynical self, where he “passes” on investing with FTX, with a “meh… I don’t think so, and I’m never wrong ”. Turns out he was right. Poetic justice for all the crypto skeptics. https://twitter.com/allnick/status/1590788378907529216

Next msg

I was thinking a house to live in. Target price under $1m.

A deal right now would be 770 Bradley Dyne Rd. in Ardmore. Almost an acre for about $250k under assessment.

2124 Ferndale is a tear down. Tiny house on a large lot. By the time it’s finished you’ll be well over $2 mil. Land value only.

is this for a house to reno and live in or for investment property?

Check back during the subsequent round of layoffs should a recession actually happen. The first wave laid off usually fair the best with a still somewhat robust job market and also generous packages. Wait till the third round when purse strings really start to tighten.

Great post. And especially with the “my pick for the best deal”. I have a hunch that many HHvers are interested in posts like that.

So I’m happy to continue that thread, to give my best SFH pick in the “low” price range.

2124 ferndale $950k

https://www.realtor.ca/real-estate/25006493/2124-ferndale-rd-saanich-gordon-head

May the best pick win!

Will the last investor looking for a starter home to rent, please turn out the lights when they leave.

The higher mortgage rates seems to have put a damper on these home sales as investors and developers have mostly exited this niche market leaving those wanting a “low” priced detached house to live in (missing middle).

These properties that are mostly land value are, in my opinion, still too expensive for those first time house owners that don’t have a substantial down payment of say 20 to 25 percent in order to make the mortgage payments affordable to them. They also are the ugly ducklings of single family housing that are not an attractive substitute for a newer condominium of similar livable floor area or someone in tech making $200,000 a year with Champagne and Caviar dreams.

There have been a couple of these starter homes in neighborhoods that illustrate my opinion. Such as the sale on Mt. Stephen at $500,000; 89 Cadillac at $730,000; 149 Maddock at $740,000; 1102 Lockley at $767,500 and 265 Superior at $900,000. All of which would have been considered at or below land value at the beginning of this year but have houses that with some repairs would be appealing and help fill the missing middle for families.

Maybe we don’t have to build homes for the missing middle. All we have to do is wait for the market to correct and they will appear like a phoenix from the ashes.

My pick for the best deal of the day is 1867 Taylor that is listed at $829,888. As it won’t provide a high enough rent for an investor at today’s interest rate and builders are skittish to buy and hold land. If you can beg, borrow or steal a good size down payment this might get you out of those downtown condos which come with their own personal homeless tent at the entrance door.

Fair enough. The “Mosquito Coast” reference is to a good boomer era movie (1986). Harrison Ford’s character has become fed up with American consumerism and takes his family to the jungle in South America. https://en.wikipedia.org/wiki/The_Mosquito_Coast_(film)

Obviously your idea isn’t as extreme as that, which is why I called it the “Gen X equivalent” as a joke.

Yes, me too. “We wuz poor, but we wuz happy”. Not sure if that translates to today, when parents do have money to spare, and some just choose to deprive their kids on purpose. That wasn’t my childhood experience.

But “Dad”… “No restaurants, no vacations”, and you don’t have any kids<18? YOLO. What does “Mum” think of that?

But one would need to save and invest to be be able to retire early (than or about 50) without an inheritance or a pension, regardless of income level.

Lots of our coworkers then got into fancy cars and boats and hobbies to “match with their income”, and to keep up with the Joneses, as leaving the rat race early might not their priority.

Enough talk about the lifestyle 😉 But we did get a mortgage free “fancy” home to live then and its value increased more than 65% when we sold it and left the rat race (and ONT) in 2008.

I don’t know what that means, but I don’t think a temporary moratorium on any of those things would deprive kids of their childhood.

As for vacations, I see nothing wrong with keeping it simple and staying close to home.

I grew up in a working class household Patrick, and there were times when my parents had to tighten their belts and there wasn’t money to spare. I still managed to have a happy childhood and love my parents.

Because you replied to “No vacations – thanks Dad” by pointing out your kid is an adult. If you’re now saying the age of your kid is irrelevant to your advice., I’m happy to answer your question.

Note that I’m not talking about you, just commenting on the advice you’re giving to others.

We are talking about a family with kids.

Please see my prior post showing that a homeowner is saving a lot already via mortgage payments.

Your idea seems like the Gen X equivalent of “Mosquito Coast” by depriving your kids of vacations, restaurants and consumer ”garbage”.

I think that’s too extreme, as those things are a reasonable part of childhood, and you should be happy to provide that if you can. Just like your parent did for you.

Why wouldn’t it?

And just to be clear, my argument is that it is prudent to have some cash savings or savings that can easily be converted into cash as insurance against short term unemployment or other unforeseen expenses.

Yours is that you should spend the cash so your kids can go see a grown man dressed up as a mouse.

I’ve never viewed it like this, but I do not have a pension and have kids that I plan to help with housing in future given the increase in prices. I was able to retire while my kids were still in high school due to what I would term optimization (saving/investing) rather than extremely high income.

This is not really the place for lifestyle discussions, but the kids were not deprived of anything. They had lots of vacations, have no student loans, and know that they will be able to own a home in Victoria when they are ready and if they choose this.

Optimization is really important when you start out due to the effect of compounding returns like home appreciation, and the need to save for things like a down payment and children’s RESPs. However, again, if you are going to inherit or have a really good pension, you may not need to put as much effort into this.

With a name like “Dad”, one assumes you have kids.

In any event, your’re dishing out advice here on HHV …

Dad:“ You should also have savings as insurance against short term unemployment/unforeseen expenses. That means no vacations other than local camping trips, no restaurant meals, no unnecessary consumer garbage. It’s liberating in a way“

Now that you’ve clarified that this is just for you/spouse, sure save what you like. But if you think your advice that you gave us also applies to people with kids (<18), let us know.

My kid is a young adult, so she isn’t affected by this policy. And in any case, she seemed to turn out ok without being taken to Disneyland or Paris every year.

I do appreciate the smug judgement though.

Well that’s a better explanation for affordability than higher marginal taxes on the one percenters since 2008.

Your correlation tends to break down at the city level (and the provincial level for Alberta) though, Calgary and Edmonton having higher incomes than Vancouver/Victoria yet much cheaper, same with Ottawa and Windsor versus Toronto.

Liberating for you, not your kids. “No vacations” – thanks Dad!

I disagree. You should also have savings as insurance against short term unemployment/unforeseen expenses.

I am saving aggressively right now in anticipation of a recession. That means no vacations other than local camping trips, no restaurant meals, no unnecessary consumer garbage. It’s liberating in a way.

The correlation is between house prices and affluence. And the solution to high house prices isn’t to lower affluence.

On the brighter side, since you like correlations. The provinces with the highest house prices (Ontario and BC) have the lowest suicide rates (excluding tiny PEI) https://www.statista.com/statistics/1318446/death-rate-for-suicide-in-canada-by-province-or-territory/

I’m in the non saver camp doesn’t seem to have made much of a difference lol

If you’re buying a house, that’s your savings. If you pay off a $1m mortgage in 25 years, you average $40,000 per year of forced savings per year. Saving more on top of that is a “want” not a “need”, and should be balanced with other “needs/wants” as determined by the household.

It would be a shame if a family cancelled a family car trip to Disneyland, so parents could stuff some more money into their RSP.

BC is one of the lowest taxed provinces. As someone on this forum likes to point out, housing is far more affordable in NB, which is one of the highest taxed. In fact there’s a pretty good correlation Canada wide between higher taxes and more affordable housing, Alberta being a notable exception.

I understand that. The big difference I was referring to is in the approach.

Sure, but if you are making 200k as a family you can take care of “needs”. What you are talking about is discretionary spending or “wants”. Choosing to spend more can come at the cost of saving and investing and taking care of future needs, which is short-sighted.

This may not be as important if you have insurance, a good pension, and reasonably expect an inheritance.

It was easier to afford a single family home. Housing went up faster than income and the increase in mortgage rates recently compounds this.

The top tax bracket is applied to individual and not family income. Someone who, as an individual, is earning over 200k (only 1% of Canadians) has access to tax planning strategies to reduce their income, whether it be through incorporation or use of RSPs.

https://www.statista.com/statistics/484838/income-distribution-in-canada-by-income-level/

True. Though in the years with a young family, “saving” isn’t always a better idea than “spending”. You need to care of family needs first, using your own definition what “needs vs wants” are. Some people will spend money sending their kid to hockey camp, others would save that money. I don’t think there’s a “right and wrong”. For myself, I’ve never regretted money spent when my kids were young, and didn’t wish that I’d “saved more”.

Yes. 2008 was part of the good-ole-days, with the BC Liberals and Federal conservatives teaming up to deliver low taxes, with 43% top marginal rate. Now we have 55% top rate (>$200k). It was easier to get ahead, as illustrated in your “save half our pay” example. Many HHVers here seem to be delighted with higher taxes and new tax ideas. Then they complain about things being unaffordable.

The median family in Victoria makes, depending on what site you look at, $65-90k/year. If you are making 200k and not saving this is because of your spending choices.

Actually we (one engineer and one programmer) were able to save close to half our pay when we were working (after paying off mortgage).

p.s. We are both from modest families and don’t feel any desire to spend on what we don’t need. We both enjoy nature and travelling, but working 9 to 10 hours a day and 6 days a week didn’t leave much room for that. Of course, for a housing market like today, we would have to stay in the rat race a few years longer (to be mortgage free and living on investment income afterwards).

Not so big when the issue is whether you can live in one city and work for an employer in another, and the effect of that on RE markets. You either have to live in the same city or you don’t.

Looks like the high tech bubble is going to burst, a repeat of 2000. What impact will that have on the real estate market?

Smart guy but an arrogant prick. Twitter is going to tarnish his genius rep though. Already looked a fool before the deal even closed.

The US research company my wife works for closed their Victoria office to save money. Didn’t lay anyone off though. So it’s WFH whether you like it or not. Funny how all the discussion on WFH is how it is an employee perk. It’s also a windfall for companies when they can give up expensive real estate. 50-60% of her colleagues are remote all around the world. The rest in a few big US offices or a handful of international offices. Seems like you can attain pretty senior roles and good coin without being office based.

Big difference between pushing for hybrid, and giving staff the choice of putting in a minimum of 40 hours per week in the office or being fired.

Musk is a bully. Hopefully the personality cult begins to die.

Not just twitter. Most of the big tech companies are pushing for at least hybrid. That said a friend of mine works for Microsoft in Redmond and still spends 6 months out of the year at their lakehouse in the Okanagan.

For anyone interested in a super deep dive into crypto including the technical, economic, and monetary theory side of things I’d recommend listening to this series: https://rationalreminder.ca/understanding-crypto

Before I listened to the series I thought crypto was 100% useless. Now I think it’s useless but there’s a very small chance it might be useful in the future, but that doesn’t mean any of the coins have value. Still worth listening to understand why though.

You might want to reconsider accepting an offer for your house that is in Bitcoin.

Re: tech layoffs – other than the Twitter situation , so far it’s all just blowing off froth. I don’t think we’d see it reflected in the Victoria housing market. The software developers are the ones that make the most money in tech and they are not usually as hard hit by the first round of layoffs at a company (that honour goes to recruiters and other supporting roles)

Maybe this time next year it will be a different story.

Re: tech salary – the range is massive which is maybe why there’s so many different stories. At a large successful Canadian company the average salary for a tech lead or development manager is around 350k cad. Locally at the more competitive local companies it’s probably closer to 160k these days although I haven’t been keeping entirely up to date. In government you’re looking at 100k

(Sorry this is all manager salaries which I guess wasn’t the discussion. But that Robert half website seems fairly accurate for local non manager roles, although I think entry level could be closer to 50k People working remote in a non manager role would make more than that, up to around 200-230k in the upper bounds)

…As you can maybe tell this is a topic that I have an interest in and follow fairly closely. It really varies though so I don’t know, it’s hard to know what the average person in tech makes in Victoria.

Yep 200 k after paying taxes and and life’s expenses doesn’t leave too much left over to save or invest with Takes a long time to build a nest egg today it’s almost generational

I definitely don’t need to believe you, I just found it amusing that is all. If you are the real deal then all the power to you.

Also have to admit that more than one third of that $200K went to CRA … 😉

p.s. You don’t need to belive me, but I know myself and I don’t lie, online or off. I have the same “netname” on all internet forums (e.g. reddit Victoria and Canadian Financial Wisdom Forum), you can check out my posts there, if you like. Also our early and simple retirement life story was used by David Aston twice in his articles in “Money Sense” and his book (he met us in person in Victoria).

I’ve always found it amusing when people talk about their own pay on an anonymous internet forum. And even more amusing when other strangers (I am assuming you don’t actually know each other) come to their defense.

For the remote workers, life’s a beach. Unless your boss is Elon Musk @ Twitter 🙂

“ Musk tells Twitter employees to show up at the office or ‘resignation accepted’”

https://www.foxbusiness.com/technology/musk-tells-twitter-employees-show-office-resignation-accepted

But his $200k CAD was from 2008. Why does that make you “LOL”?

lol, sorry I specified over $200k USD

Maybe the one from Robert Half is the best one since it is a recruiting firm: https://www.roberthalf.ca/en/salary-details/software-developer/victoria-bc

Maybe you should 😉

My pay (with bonus) was over $200KCAD/yr before retirement in 2008 (worked in Ottawa but also for a big us based tech company). it should be higher now after 14 years.

Here is a glassdoor one also current with the most recent data point in November 2022 with a much lower salary: https://www.glassdoor.ca/Salaries/victoria-software-developer-salary-SRCH_IL.0,8_IM973_KO9,27.htm

So which one is right?

Some in hardware, IT and security services as well.

The tech folks I know who earn mostly USD (including myself) are resident here and pay Canadian tax as normal. Either as employees, contractors or with their own Canadian corporation. Don’t see how the speculation + vacancy tax comes into it.

If they live here, they pay income taxes here. Satellite family is where the breadwinner is non-resident. I don’t think that’s what people are talking about for the $200k usd salary guy working remotely in Victoria for a us company.

I guess there are two discussions. I responded to Dad asking “ Are there that many fully remote tech workers though? And of those, how many are located in Victoria?”

Well yes, if you’re a software developer with >5 years experience and in-demand.

I think someone owning a house here and earning all their money in the US will have to pay the speculation and vacancy tax as a satellite family.

I didn’t say that came from the article. I included the excerpt from the article, and there are quotes around it to make that clear. I mentioned that most tech workers work remotely because I’ve read that a bunch of places. See my post for a couple of links, and if you find one to contradict it, please let me know.

That’s a US survey of 750 workers. In any case, they are simply measuring working at home versus at the office. Working at home doesn’t mean the employer is in another city. I thought this discussion was about people in Victoria supposedly making big money working remotely for US firms.

Gee, I work for a big us based tech company, guess I should ask for a raise.

Right. Programmers aren’t a commodity where everyone gets paid the same. The exceptional ones are paid 2X or more the average, and worth it.

Don’t you know at least one programmer that still rents?

They already own their basements though, and aren’t out buying new basements.

The local tech association Viatec are doing an economic impact survey just now. Previous reports put annual revenues at $4B across almost 1000 tech companies and ~17000 employees in greater Victoria.

Economic impact is around the same or larger than tourism.

I’m in tech and I know lots of people on Van Isle who sit in their basements and earn >$200k USD. No idea how prolific that is though.

This one is more current, and says average Victoria software developer is about $128k https://www.salaryexpert.com/salary/job/software-developer/canada/british-columbia/victoria

$200k USD would be for someone working in big us based tech company. I know a couple of people like that in BC and they are making >$200k usd. It’s not the norm for a typical programmer, but I don’t recall anyone saying that it was.

Million dollar house is $800k mortgage @5%. Which is $4,653 per month. One salary at $128k not enough, but two-income households can do that.

Where are all those earning USD $200k plus that was going to backstop the housing market? $86K isn’t going to support million dollar houses at 5% interest rates.

I don’t have Victoria stats for % of tech workers that are remote. But here’s a study (May 2022) saying 85% of tech workers are remote (48% fully, 37% hybrid). https://morningconsult.com/2022/05/31/tech-workers-survey-office-hybrid-remote-work/

If you have some reason to believe that Victoria will have a lower rate of remote workers than North America average, please let me know.

And for software developers it’s 86% fully remote “ The majority of software developers work from home, with 86 percent currently working entirely remotely. ” https://www.turing.com/kb/do-software-engineers-prefer-to-work-remotely

Delete: Maggie beat me to it.

I don’t see any mention of remote workers in the article.

BC is number One in Household debt to disposable income ratio.

BC is at 227 while Canada is 194. New Brunswick has the lowest ratio at 140

BC is expected to have the largest percentage decline in home prices at -9.1%. Canada is at -6.1% and the lowest provinces are SK at -0.8% and AB at -1.1%

Time to sell and move to AB????

Source RBC Provincial Outlook

Yes, there are a lot. 10,500 estimated for Victoria, with average software developer salary $86,500. And most of those are remote. That’s 6.6% of workers or 1 out of 15.

https://www.vicnews.com/news/victoria-ranks-seventh-in-canadian-tech-talent/

“The report states that there are 10,500 tech workers in Victoria – representing 6.6 per cent of employment – with most working in software or app development, advanced manufacturing or ocean science.

Victoria saw its tech talent pool grow by 14.1 per cent between 2014 and 2019, reads the report, adding that a software developer in Victoria makes an average of $86,195 up by 26 per cent over the past five years”

—- —- ==

Victoria ranks 10th highest city in Canada for tech. Which is better than expected, because we are the 15th biggest city. https://populationstat.com/canada/

https://www.vicnews.com/news/victoria-named-in-top-10-canadian-cities-for-tech-talent/

RBC Provincial Outlook

British Columbia: Tourism rebounded this year and capital investment remains brisk. Still, we expect annual growth to slow to 3.0% in 2022 from 5.9% in 2021, as the post-pandemic spending boom plateaus and the housing market correction weighs on activity. B.C. is likely to be hit harder by the housing market correction than most other provinces as residential investment represents a larger share of its economy. The negative wealth effect from falling property values will further amplify the weakness by slowing consumption.

LMAO

I was wondering when Frank would chime in.

Just looked up the number of Microsoft employees, there’s 220,000. I guess 7,500 for Docusign is feasible. Millions of people work for high tech companies plus the high tech positions in other businesses, government, etc.. Jobs that didn’t exist 40 years ago. I believe house prices are proportional to the amount of money being generated in the world’s economy. One just needs the right education and be willing to participate (work hard) to afford today’s inflated prices.

According to the posts from the spring, there are lots of highly paid tech folks here making USD and supporting local house prices. Given what I know from my insider contacts in the tech community here I think that is b.s.

Are there that many fully remote tech workers though? And of those, how many are located in Victoria? I just don’t see it having much of a direct impact.

Simple solution is negotiate a large deposit.

But the tech employees are normally the ones with high pay and more flexibility WFH. So tech layoffs and no more WFH would have some impact on the housing market, probably more in the mid price ranges.

p.s. Haven’t heard from “Grant” (who bought one or two houses here last year and WFH for US tech companies) …

May still come out ahead haha.

Last time I was down in SF for a conference there were tons of Docusign people milling about. I don’t know how that company makes enough, maybe it was all VC?

Ya looking like a recession is pretty much baked in Going forward people will be starting to vote with they’re wallets come elections. Governments will have to tighten they’re purse strings

Yes. Seems like unemployment should start ticking up soon.

Yeah, I meant in the broader economy though.

https://www.bls.gov/news.release/empsit.nr0.htm

We should revisit this in 6 months and see if it still rings true.

what’s the percentage that actually successfully collected?? Winning a lawsuit versus actually collecting your damages are very different!

I thought Docusign was like a 50 person company not 7,500. Seems like a pretty basic app.

Layoffs in tech are broad based.

Many buyers in Ontario during their last downturn were successfully sued. May well happen again and some of the numbers are eye popping. Imagine being forced to pay $855k for nothing at all

If you sell for a million to a buyer with 50k deposit and then re-sell for 900k you definitely have a case for suing for more than the deposit. Assuming you can prove you adequately marketed the property, etc. and best result was 900k.

I don’t see it, yet. WFH is a way to poach good employees. In a crappy market, sure, you could get away with ordering people back into the office but labour is still tight.

I don’t see this as a smart move. Musk is a megalomaniac. A gen X Donald Trump.

“Elon Musk in his first email to Twitter employees said remote work would no longer be allowed and that they would be expected in office for at least 40 hours per week”:

https://www.cbc.ca/news/business/elon-must-twitter-work-from-home-1.6647122

It, on top of recent layoffs, probably will have a impact to housing market, if other companies (big or small) follow.

I think specific performance is where you sue the other party to complete the contract (e.g., Elon Musk and twitter). Suing for more than the deposit would most likely be for compensatory damages…maybe punitive damages in limited circumstances.

The only scenario I see that could flood the market is an increase in unemployment. There have been large layoffs in the major tech companies such as Facebook and Twitter, but I doubt that affects the local real estate market. Massive government layoffs would be another story, can’t see that happening with the current regimes. Apparently, money does grow on trees.

Ha ha yea completely forgot about the greedy sellers! All the social media pressure must have changed their tune to the point where they are not accepting below asking price.

I was involved in this a few years ago as a listing agent. Buyer, represented by another agent, made an unconditional offer and the buyer failed to provide the 100k deposit. My clients sued and settled out of court for 50k and I think their legal fees were around 5k.

and yes you can definitively sue for more than the deposit under specific performance.

Only super crappy agents will do this. In the above example, we re-listed he home, it sold, I got paid out of that sale and the sellers recommended me to their friends which ended up being a $2+ million transaction.

There is no way I would ever put a claim on a deposit. If I am representing the buyer that means my buyer didn’t complete. If I am representing the seller the seller will have me re-list and sell the house.

Just curious where are all these subdivisions? It is like a small handful of small subdivision. The big players (GableCraft, Westhills) can just keep building as their land cost at this point is close to nothing.

I think we could see a scenario where new home prices don’t come down that much and pre-owned properties fall to a larger extent.

A new house on a smaller lot (3,920 sqft) just sold on Pembroke for $1.79 million. New house in Oak Bay sold yesterday for 2.8 million. In my opinion new homes in the core have fallen far less from peak than re-sales. My theory here is we are going to see very low inventory on brand new product as builders simply won’t build (construction costs very high, interest rates high, bureaucracy is insane, etc). Especially in the core, you’ll have a handful of new homes and you’ll always have the 1%ers who can absorb the limited new home inventory.

Versus re-sales could easily flood the market.

1025k or 1030k. It won’t have to be much higher than the $100k non-refundable deposit because what are the odds someone likes to throw away $2,500 (assuming million dollar home). My point is this legislation creates more paperwork, doesn’t really help anyone (in fact it might give sophisticated buyers and agents an advantage), and we won’t see much use of it.

Generally speaking, if a buyer breaches a contract for the purchase of real estate and the seller accepts the buyer’s refusal to perform the contract (as known as “repudiation”), an innocent seller is entitled to retain the deposit paid by the buyer under a contract of purchase and sale. But what happens when a buyer breaches a contract before the deposit is due and payable? Is the seller still entitled to the deposit if the transaction collapses due to the buyer’s breach?

In a recent decision, the British Columbia Court of Appeal confirmed that a seller is entitled to an unpaid deposit owing under a contract of purchase and sale for real estate, even if the repudiation of the contract is accepted by the innocent party. In its decision in Argo Ventures v. Choi 1, the Court confirmed that a seller can sue for the unpaid deposit even after it has accepted the repudiation of the contract due to the buyer’s breach or default.

From my lawyer when I had a purchaser try to back out of buying a property.

What is your source for this claim?

I’m not sure why you wouldn’t be able to sue for damages in excess of the deposit. That doesn’t sound right.

Yes, but it’s gets complicated. Along with you, both the selling and purchasing realtors will be submitting claims on that deposit for a portion of their fees as well (so, the seller doesn’t get the entire thing). In taking the route of claiming the deposit you will be accepting that as the remedy for the breach of contract. The seller really needs to get their lawyer to send out the repudiation letter to inform the buyer of the breach and the likely consequences. It usually forces them back to the deal. As for the fake T4s, you are going after everything, force them to alternative financing, drawing out out a personal loan or just good old fashioned court reciever to seize and auction any assets they might have.

So it plays as options:

Accept the repudiation and return the deposit (everyone walks away no further action);

Do not accept the repudiation and offer to accept the deposit of full satisfaction of the claim against the purchaser ; or

Do not accept the repudiation and reserve the vendors right to sue the purchaser for damages from the breach of contract.

Unless things have changed, you can’t keep the deposit without the purchaser’s written consent, so you’re probably suing them no matter what.

You sure about that? if the loss is greater than the deposit then can’t you just keep the deposit and also sue for the difference (or maybe the deposit stays in escrow)? Also, just because you get a win in court doesn’t mean collecting the actual $ is guaranteed. You got people out there getting loans with fake T4s, you think they will make sure to pay up right away if they get a court judgement against them?

There are always schemes that will pay more interest than a bank. With crypto interest schemes, in most cases there’s nothing but other (sometimes worthless) crypto to back it up. At least with a bank there’s the bank assets and CDIC insurance. Making the bank a smarter place for your investment than a crypto interest scheme.

If you keep the deposit, you can’t sue. As for negotiating, unless the seller has another obligation for funds (like making an unconditional offer on another property before closing their house sale first) is the only reason to negotiate to avoid being sued themselves. If you are looking at $100k or $200k+ loss from a deal falling through, you might as well return the $50k deposit and spend the $10k to 20k for the pretty well guaranteed court win. Usually, the demand letter brings the buyer back in line because they don’t want to end up spending $200k not to own a house. They tend to find the money, so don’t negotiate unless you as the seller have an immediate need for the funds. The back out and attempt to re-negotiate should just be viewed as a tactic by the buyer trying to save money. So, the seller shouldn’t fear going to court at all.

Go look at the price discrepancies in royal bay

New that was coming as land sales and new home sales have slowed. Developers have little to no money coming in but they still have to pay their financing costs and trades that built roads and installed services.

They have to get new financing or slash prices to liquidate some of their real estate holdings.

If land prices and new home prices come down, then pre-owned properties have to follow.

Sounds a lot like FTX in the bitcoin world haha.

From: https://financialpost.com/real-estate/mortgages/mortgage-fund-halts-payouts-amid-liquidity-crunch

Nothing to see here…

What if the purchaser thinks that by losing the 100k deposit they can now buy a better house for 200k cheaper? They will come back and ask to get released from the purchase and if not they will try to grind you down as they have nothing to lose. Most of the time it is in your best interest to come back to the negotiating table than keeping the deposit and sue.

Isn’t the non refundable deposit kept in trust? So you will get the money. The other part is dealt with by getting a bigger deposit.

The best thing is to learn to keep quiet that you bought another home. Then the buyer knows they have more room to re-negotiate a lower price as the seller is under pressure to close on their new purchase or the seller has to finance both homes. Losing the deposit is going to set the purchaser back in buying another home unless they don’t care about the deposit. Most people do care.

Which may or may not be enough to compensate you for any potential losses. Then you have the option to go sue where you will probably win, but that doesn’t guarantee you will ever collect.

I’ve never been invested in any crypto currency, but I know enough to know that you don’t know anything about this. There were plenty of schemes that were paying way more in interest than you were getting from a bank.

Ponzi schemes exist all the time, regardless of the interest rate levels.

Well if they back out – you get to keep their non refundable deposit

The primary goal is to bring down inflation. It’s becoming clear that the crypto boom was the result of too much money available at too low rates. Cutting down that money supply to bring down inflation takes down crypto with it.

But anyone who believes in productive economic activity should hate ponzi schemes like crypto.

Longer the close, greater the risk. Your buyers may want to and try to back out if the market does go down significantly further.

Government brought in something that’s irrelevant in todays market Probably won’t be of any use to anyone for another 7 / 10 years in which time I wouldn’t be surprised if it doesn’t just get dropped anyway

Also one less place for people to make money. Not long ago people thought all the crypto millionaires were going to pounce on houses if there is any weakness.

Looks like crypto is going bye-bye. Good the stuff was junk. One less place for people to waste their money. Higher interest rates killed that “industry “. Crypto pays zero interest. The conspiracy theorist in me thinks that was the intention of raising rates in the first place. Governments hate cryptocurrencies.

Would it be beneficial, if selling your home, to take a long closing date assuming the market will be more favorable to buy into in a few months?

Just a random example based on the price which I think may make a reasonable investment property purchase in the current environment. So in your opinion what would be the highest 0.25% none conditional offer on the table for the client to pick that one?

Yup, that’s weird. Why would the seller take so much less just for a few days? Far as I know the seller has to give access to the property to the buyer and the lender’s agents if they are going for financing. This sounds really suspicious.

Why would the seller entertain that when they have 1010k with 100k non-refundable?

5 bids

980k unconditional, 0.25% non-refundable

990k unconditional, 0.25% non-refundable

1010k conditional subject to financing 4 days, 100k non-refundable

1015k unconditional, 0.25% non-refundable

1020k unconditional, 0.25% non-refundable

Seller is going with the 1010k most likely as it is the most sure thing.

How bout $900k conditional subject to financing 4 days, 400k non-refundable?

I don’t know how effective a 3 day cooling off period would be for a buyer to do their due diligence. They would need to hire people to inspect the property and the lender to do their background work as well. They would end up calling multiple companies to find someone that can do things in a rush. It really isn’t enough time for all this information to get to the buyer. Three days might as well be zero days then making three days just BS to appease the public. Personally, I am not a fan of the government trying to protect buyers in this case. Real Estate is suppose to be a free market and that means people have the freedom to make bad decisions.

If you want to protect yourself then the two things that you need are a building inspection and an appraisal done just for yourself -NOT FOR THE BANK. A building inspection is about 4 hours. A “Desk Top” appraisal to confirm that your offer is both reliable and reasonable is about 2 hours. What slows things down is having the building inspector getting access to the property through the listing agent that could be a couple of days itself. The appraiser does the work from their office assuming the listing information is correct and does not physically inspect the property. So the Desk Top is not as reliable as the appraiser physically inspecting the property but it should be good enough to give the buyer assurance that their offer is not way off from market value assuming the listing information is correct.

The problem with the appraisal is that you would be paying twice for two appraisals. Most lenders no longer accept appraisals unless the appraisal is ordered from the bank through an Appraisal Management Company. And there is only about three AMC’s in Canada. Most lenders have contracts with these management companies and they can’t break the contract. That’s one reason why bank appraisals can be more expensive as the management company adds their fee to the appraisal fee. And if you’re a first time buyer, chances are you won’t have that extra cash to pay for two appraisals which could total a thousand bucks.

I haven’t heard anything re private sales.

I think at some point people have to take responsibility for their own actions. No one forces you to get involved in a 10 offer situation. If you have an issue with that just buy in a market like that one we have right now.

I don’t think it makes sense to prevent people from taking bully offers. Now sellers will have to weigh the risk of people backing out of bully offers in 3 days, but they are still free to accept it.

I’m still not clear on how all this affects private sales, you heard anything?

This issue is a lot of buyers won’t be sophisticated enough to find a way around it so they might try to compensate with a higher price. Sophisticated buyers and agents will know how to work the system, as per my example below. Essentially an conditional unconditional (via huge non-refundable deposit) offer to beat out everyone else bidding unconditional but conditional.

Let me giving you an example

5 bids

980k unconditional, 0.25% non-refundable

990k unconditional, 0.25% non-refundable

1010k conditional subject to financing 4 days, 250k non-refundable

1015k unconditional, 0.25% non-refundable

1020k unconditional, 0.25% non-refundable

Seller is going with the 1010k most likely as it is the most sure thing.