October: Activity uptick to end the fall market

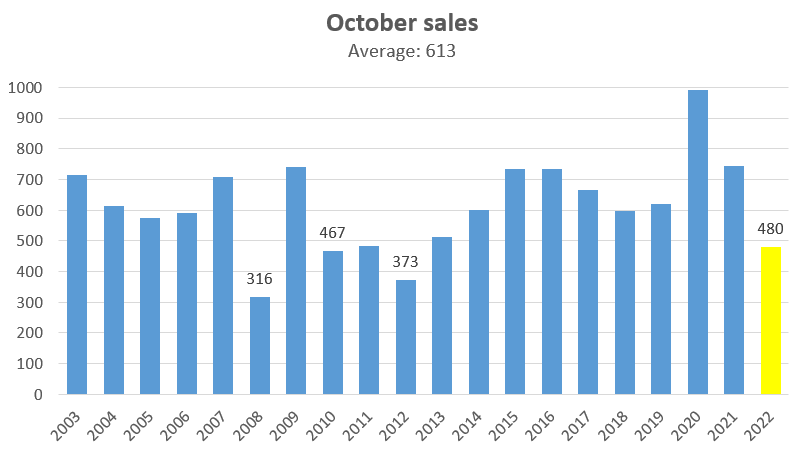

While the first couple of weeks in October passed very quietly similar to the month before, we saw a small increase in activity to complete the month. Normally October sales are pretty flat from September, but the month ended at 480 sales, up from September’s 410. Note some figures used in the article below are subject to minor revision when the final board figures are released later today.

While sales of detached properties were pretty flat (and have been for months now), the increase in sales in October was driven mostly by condos and to a lesser extent townhouses and manufactured homes where activity was also up. Total activity was similar to the slow market from 2010 to 2013, though of course with much less inventory than we had back then.

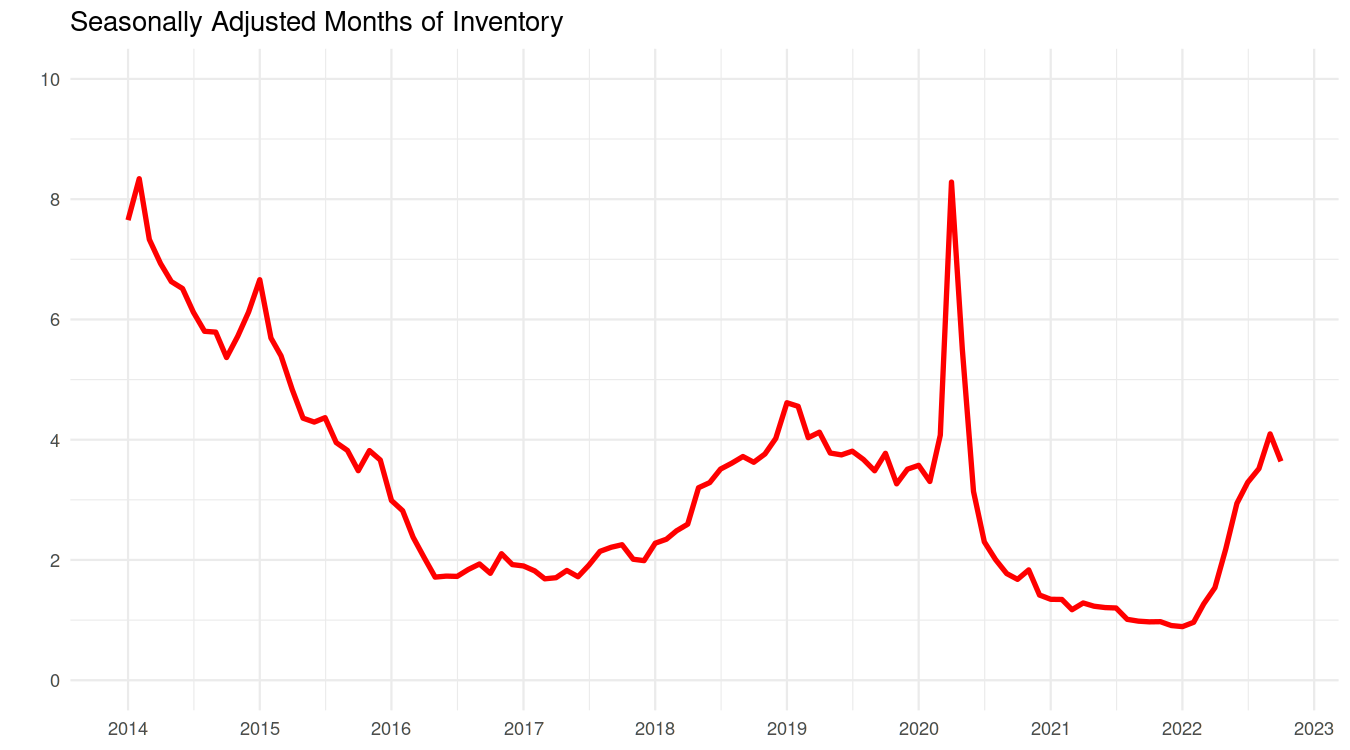

Inventory ended the month down from September, but that’s normal for the season. On a seasonally adjusted basis inventory still increased slightly, meaning that the decrease was broadly in line with normal seasonal trends. The seasonally adjusted data will be worth watching closely as we see a lot of sellers take listings off the market in November and December. Will the increase in sales persist and stop further gains in selection or was the uptick in activity temporary like it was in August?

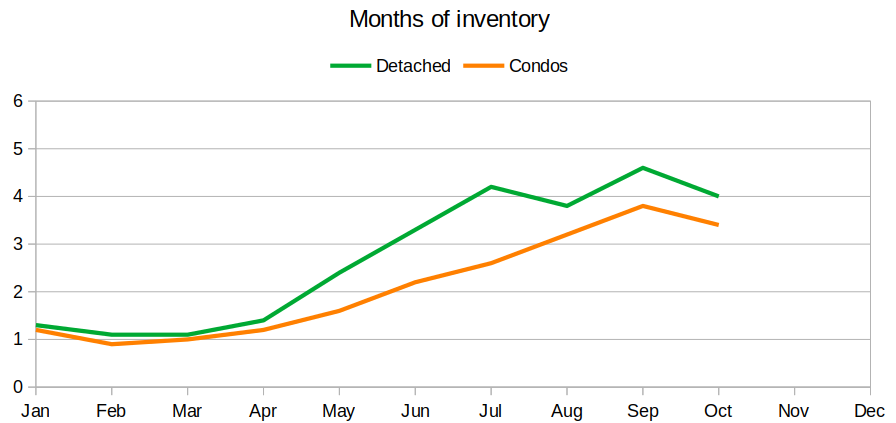

Months of inventory shows a stronger pause in the cooling trend that has been in place since the start of the year. Not only did months of inventory not increase in October, but it actually dropped from the September value. As previously discussed, while inventory has jumped from this time last year, we are still at historically low levels, which makes the market very sensitive to any return in buyers. It doesn’t take a lot of buyers coming back to bring down that months of inventory figure with only some 2000 properties on the market. One month does not make a trend reversal and I can’t see any compelling reasons that the cooling should stall out so early, but it’s worth watching very closely in the coming weeks and months.

Breaking that into property types, detached has been weaker than condos all year, but both measures remain in what would normally be sellers market territory. It’s only the rapid deterioration of the market that has pushed down prices, but that depends on the worsening trend continuing until we get to a true buyers market.

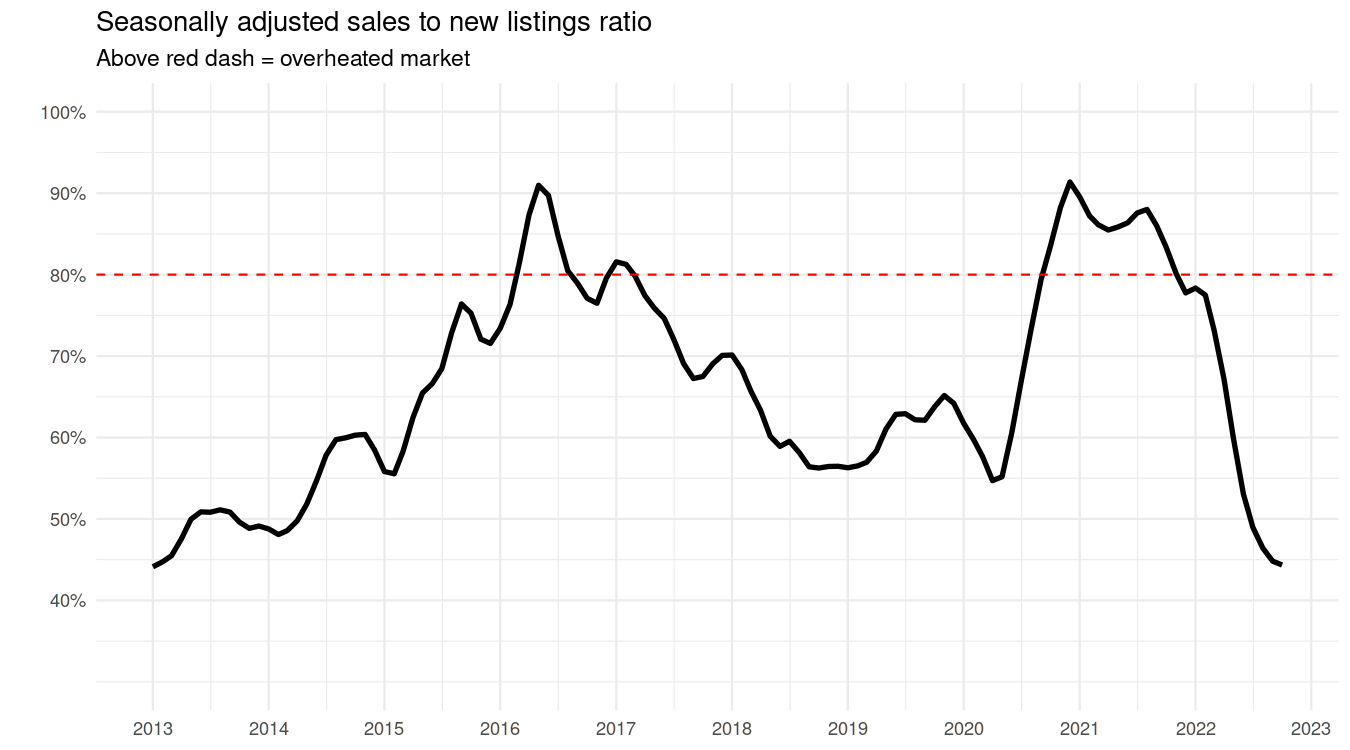

However the sales to new list ratio is still sending the opposite signal, with a small drop in October. That indicates new lists are healthy in relation to sales, but the growth in inventory has not kept up with the increase in sales.

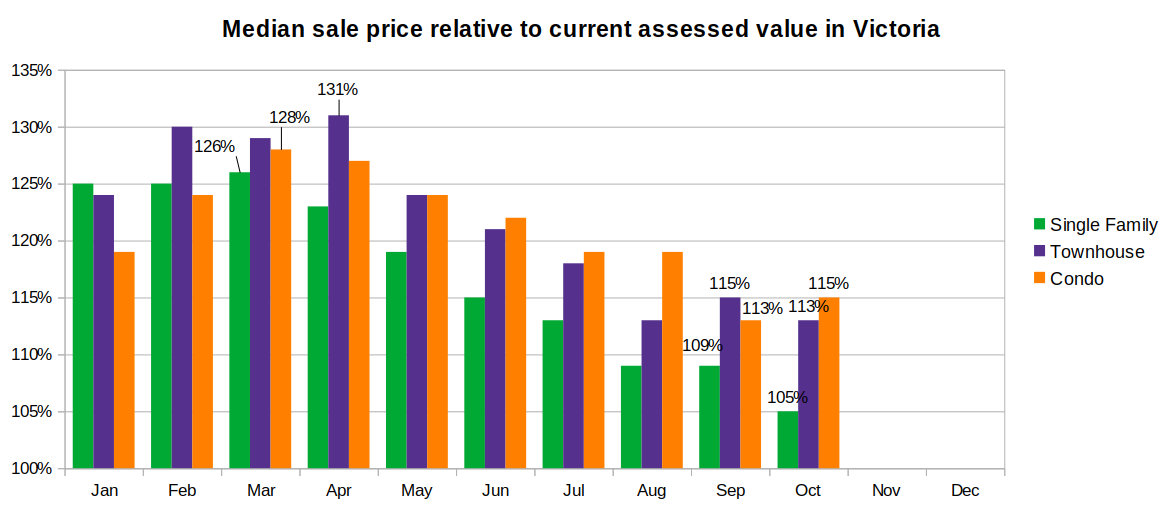

Median prices remained stable in October, with little change in any category. On a sales to assessment basis detached values continued to drop in October, now going for a median of only 5% above their current assessed value. Condos and townhouses were pretty stable, with condos up a couple percent while townhouses dropped a couple.

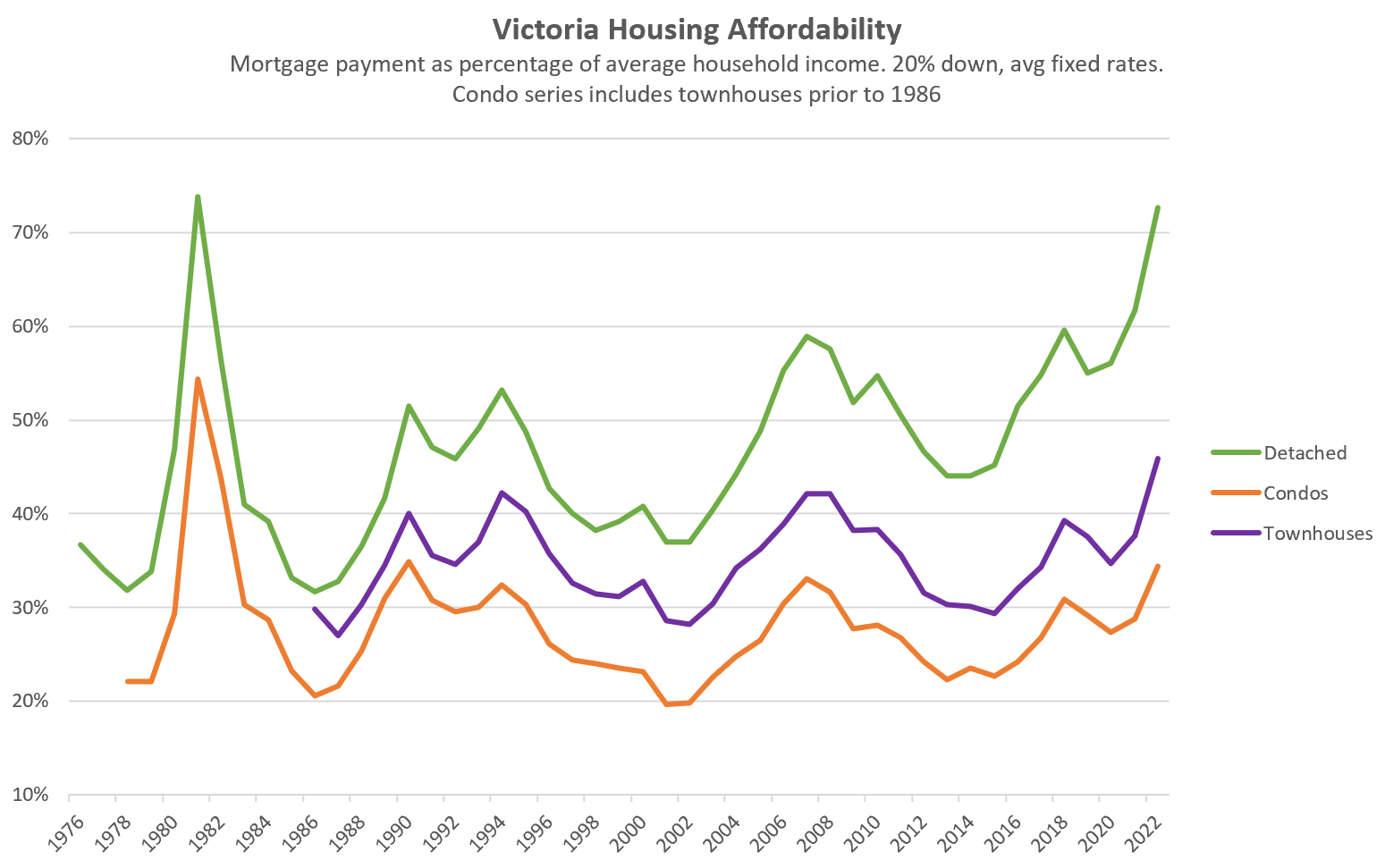

What explains the return in activity? For detached properties I think prices that have now corrected substantially from the peak are getting pretty attractive again. While affordability hasn’t improved and prices may be boring for quite some time, prices are still down while selection is up. For buyers with the ability to handle the financing, it’s becoming an interesting proposition to purchase at 10-20% off peak valuations. However the condo market has shown more resiliency than detached, and that’s a bit more puzzling. Price drops have not been as significant, and affordability has continued to deteriorate since February. Yes rents are high and the rental market is difficult, but interest rates have risen even faster than rents so from an investment standpoint it doesn’t make a lot of sense either. Overall I am more bearish on the outlook for condos which haven’t adjusted as much to the reality of higher rates, while that market normally doesn’t hold up as well in downturns. However so far condo buyers disagree with me and are still keeping activity healthy.

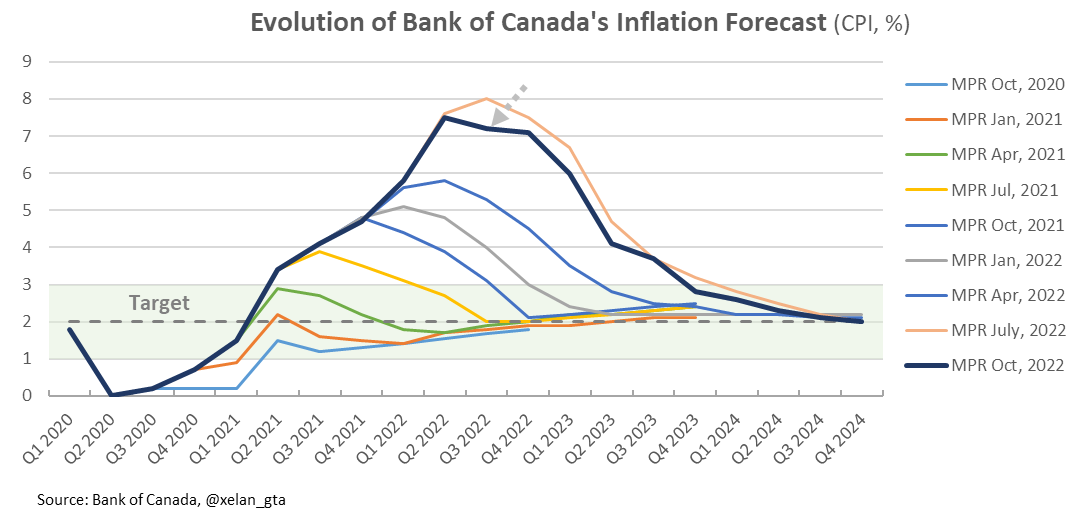

Meanwhile the Bank of Canada has raised rates again and essentially promised to raise them further in December, even though they are signalling at the same time that we are getting close to where rates need to be to get inflation under control. Though their inflation forecasts have been spectacularly unreliable so far, this is the first time the forecast has been revised downwards instead of upwards. They expect inflation to drop back to almost normal next year.

That latest rate hike has solidly brought rates past the trigger point for most variable mortgages taken out in the 2 years after COVID hit.

That’s about $360 Billion dollars worth of mortgages where the original payments would no longer cover the interest portion of the loan. Those borrowers are getting letters from their lenders with recommendations or demands to increase payments by 30-50% to get back on track. Unclear at this point what the impact will be, but the indebtedness will magnify the effect of rising rates on the overall economy. That sucks a lot of extra demand back out and reduces pressures on inflation which in turn should reduce pressure on the central bank to raise rates much further.

New Post: https://househuntvictoria.ca/2022/11/07/who-grew-victoria-in-the-last-5-years

I predict Eby’s efforts will be ineffective. The anti-development bloc is too strong.

On paper I was born in Ontario but moved here when I was a couple months old. My mom just happened to be living in Ontario briefly, but was a Victoria native and came home shortly after I was born. My husband is similar. I’d be curious to see this stat but with “people moving to Victoria as adults” because place of birth can be misleading.

I don’t think the tech industry is at the point of there suddenly being a bunch of unemployed tech workers dragging down the Victoria market. Some layoffs in the news and the job market is definitely cooler but it’s not at “emergency house selling” levels. Software developers are the ones that make the big money and there’s still plenty of work out there for them. Many layoffs so far have targeted supporting roles like recruiters, and low performers. Maybe the story will be different in 6-12 months (or not… who knows! I’m a bit bearish on tech job market for the next year or two personally. Time will tell.) but not yet.

lets see how many rent price comments you get in response.

Ironically the big surge in house prices was during the lowest net foreign migration in decades, and now that the migration levels are returning to normal, house prices are falling. Particularly in that immigrant magnet, the GTA.

So it has to be about something else – I wonder what?

Are they still feeling secure in their jobs/contracts?

Nope disagree. That public sector salary thing has been posted over and over again. My take is that no one keeps talking about high tech workers being paid in USD backstopping the Victoria RE market is that the situation has likely changed. Hence my post to see if anyone has heard anything, so far I just recall Marko posting that one of his clients bought a house and had to sell right away because the job with Microsoft didn’t pan out or something like that.

Same thing as the narrative that opening the border after Covid was supposed to take housing prices to the moon with all these wealthy immigrants , no one is saying that anymore because that isn’t the case currently.

The recent “jobs salaries” posts have been about jobs where people are unexpectedly making big $ like street sweeper, certain government workers etc.

With regard to your comment about not seeing recent posts about high tech workers…People don’t keep posting the same info that doctors, dentists, lawyers, business owners, pilots, high tech workers etc. make big money, because most people know that.

Now if they stop making big money, that would be news, and worth a post.

People I know that work remotely being paid in USD have done so for a long time now, and bought a long time ago.

To illustrate how much Victoria population growth (and related housing prices) are affected by people from ROC and other countries…

According to StatCan census 2021 data…

Out of 100 people in Victoria,

– only 48 are born in BC

– 29 are born in other provinces (mainly Ontario, Alberta)

– 23 are born outside Canada

Most people that successfully move to Victoria are capable of paying Victoria prices for housing (rent or buy). That means they are self-selecting, and the ones we get can afford housing here. Since we get about 5,000 arrivals per year, that’s 2,000 dwellings to fill with new arrivals that can largely afford them.

That may all seem obvious, yet we regularity get posts that assume that no one can afford these rent & buy prices. Yah right, except the 2,000 households that move here each year, who actually can afford them.

https://www.victoriabuzz.com/2022/11/over-half-of-greater-victorias-population-isnt-actually-from-bc-statistics-canada/

I recall back in May when I first started posting about prices dropping due to interest rates, bunch of posters here saying all these people make so much USD remote working in tech will be buying up houses in Victoria like no tomorrow. Haven’t seen a single post about high paid tech sector people recently, it’s back to who makes over 100k working in the public sector.

Just looking at VIATEC, what once was a long list, is mostly now just a few government jobs.

How’s the Victoria IT sector doing lately? Still lots of people getting those sweet jobs being paid in USD while living in Victoria or has the overall tech sector slump impacted that now?

How many SFD come up in the core for sale in an average year?

That’s just a shared equity financing scheme and is not what we’re talking about. In fact Canada has a federal program of this kind right now, namely First-Time Home Buyer Incentive.

There’s also s legal framework already set up for two or more households to share ownership in a multi-unit structure, namely strata titling. Appears to me that it could be a plus if made less restrictive for existing legal multi-unit dwellings.

Meh.

I’ve got nothing to say, just wanted to see my icon. Have a nice day.

Co-owning with a company is very different from co-owning with a friend, as there is no friendship invloved, just business. The example of not-for-profit org support for low income people to own very modest-priced housing in your link is another matter (even if the name is called co-owning), as it might be more close to “Habitat for Humanity” than regular co-ownership with friends.

But “indigogogo”, why do you share the same Icon with “totoro”, do you live/work together or co-owning a computer? 😉

Or – change is hard. Those who adapt early will benefit. And life will still be pretty good for those who do not.

And, just for accuracy, there are loads of co-ownership properties in the EU and UK. Not only private family and friend deals, but companies are moving into this market and becoming co-owners with individuals or couples who occupy the home and pay them rent for the share owned by the company. When sold profits are divided based on ownership percentage and the co-owners can buy more shares along the way.

https://www.co-ownership.org/

Time share is a type of co-ownership, but it is part time living and limited mostly to vacation properties.

Co-ownership for full living is more common in some part of the world (say in Asia), but it is mostly within families, not between firends.

If affordability is the main drive of co-ownership, why is it not more common in Europe where affordability has been an issue for much much longer and worse than in Victoria?

Looks to me, most people would rather rent than co-owning with friends, as they value their freedom and privacy more. Even you don’t share the same unit, you must be open and share your financial and other private info with other co-owner, even if you dont want to. And when you have a bad day/week/month and don’t want to see/talk to anyone, your family could tolerate, but your co-owning friends may not be able to handle your attidtude or may not be that forgiving, so you may feel forced to talk when you really dont want to.

One can be very tolerate towards family members and loved ones, but it is probably better to have some distance between friends to stay friends. Remember that “Friendship and Money Don’t Mix”?

I did not say there is no difference, just that there is risk in both scenarios and it is probably controlled better where a mortgagor requires a co-ownership agreement. And I’m not talking about sharing the same house, but having separate units.

As to why our social norms are the way they are, I would suggest this is because the back story to that is embedded in the social, financial, child-rearing and caregiving role of the nuclear family in Canada. People want their own homes to raise children in and conduct family life. Seems reasonable to me.

As to why co-ownership has not been more popular, well, cultural norms for sure – plus before the financial part worked for a family to have a reasonable home based on median incomes, and home was not such a big investment as it has now become in Victoria. Things change. Now, in order to afford this desired thing, the median income of a couple might not do it and renting is not a good option here unless you are in a coop.

Personally, I’ve always thought coownership was a great way to go with the right agreements and people if you want to get ahead fast. Growing up I watched several immigrant families who came to Canada with very little end up way better off in 20 years than my fifth generation Canadian family through multi-gen and extended family co-ownership and resource pooling.

One day multi-gen or friend group co-ownership will probably be normalized in high cost of living areas like Victoria.

https://plumcoownership.com/

I thought a couple is supposed to live together regardless who (of the two or both or …) buys the house. But two couples live together is definitely not a normal thing, even if they bought it together. If there is no difference, why not more poeple doing the co-owning unless/until they are forced to?

A little anecdotal snapshot to show how the stresses of income and mortgage costs can contort over time:

Bought a 700sqft bungalow in the early 80’s for $92,000.

Took a personal loan for the down payment

Two incomes for a total of $52,000 pa

Interest rate 11.75%

I remember laying awake at night wondering why I had committed myself to this MASSIVE financial commitment of almost TWICE our annual income…….

Sure. And 50% of two party relationships break down. Doesn’t matter what the initial intent is. What matters is risk management and acknowledging all the risks and mitigating as much as possible.

And you still have both contract and family law as a resort in coownership – you just want to avoid legal bills – like you should in divorce too if you can. And mostly you can if you have a good written agreement and choose your partners carefully. The great thing about coownership is that you can go into it without love blinders and til death do us part expectations so getting to an agreement in advance will be required as a term of your mortgage..

That is why we bought multi-family 10 years ago when the kids were young children – it was predictable we would end up with worse affordability imo. Now that they are young adults they are already benefiting from this. On the down side, a lot of their friends have moved away, or plan to move away when finished school because of the cost of housing here which creates a less interesting environment for them here in the next phase.

To ponder: If Eby’s proposed plan to allow streamlined 3plex new builds and triplex conversions on SFH lots (akin to what Ontario just proposed), and thereby removing municipal stonewalling, then:

How soon do you feel it will be until we see people doing this on mass

Do you feel this will increase SFH values, knowing they can be multi-plexed, or lower their value, as more units in totality enter the market?

Hey Marko.

The context for that discussion was another one of these back and forths about Leo’s affordability plots. Whether things are affordable, unaffordable, etc. I talked about some hypothetical above average families to try to turn the “affordability” metric around, to get a more human sense of what it takes to get in.

As for the street sweeper hypothetical couple, sure. But the fact of the matter still is that 2x75k household income is well above average for the area so clearly it isn’t that easy, otherwise average income would be much higher. If I had to bet I would say that the monkey wrench is kids.

Hey Totoro, Whatever, thanks for chiming in about us. Our situation is actually the last of the hypotheticals I mentioned yesterday. By the summer, we’ll be sitting at ~150k income with ~350-375k down payment ready (depending on how much cash we want to hold back). What whatever says about the froth being taken out makes a lot of sense to me; if nothing else, affordability is basically at its worst, and while it could go up it seems more likely to come down a bit with Spring listings. We’ve been waiting patiently our entire adult lives for this and so can wait a few more months. Personally I’d like to see things drop about 5-10% from where they are, again plateaued at historically high levels, but if they don’t, then we’ll just make sure we buy a house with a suite. If things drop a bit then we will have more options. My zany idea these days after watching listings for a while is to try to find a place out at Willis point. I’ve seen a few listings go there at a relative discount compared to the rest of the peninsula, with extra land to boot. (People here seem to regard it as isolated. Even though it’s almost the same distance from town as Brentwood Bay.) The benefit of that would be for our kids someday. If zoning laws relax it is conceivable to then put a cabin down on the property for the wife and I to live in, leave the house to the kids (or sell it off and distribute to the boys), or something along those lines. Flexibility in other words.

The original intent of the couple is to live together indefinitely. Granted that doesn’t always work out. If it doesn’t you have family law and the interests of the kids, if they have them.

Two unrelated parties buying a property together are just settling for what they could not afford individually. There is a host of situations, including marriage/relationship breakup if one party is a couple, or a new marriage/relationship for a party that is a single, that can lead to one party wanting or having to get out.

What is the difference between a couple who buys together and then breaks up/gets divorced and two couples who buy together?

You have more people to deal with in scenario two, but most couples don’t have a prenup/cohab agreement. How many divorce sales have you seen that are complete disasters where the parties are in high conflict – probably quite a few.

Clauses and whatnot are better than you think for coownership, and at least you have an enforceable agreement and know what happens when a sale is forced – unlike when a lot of relationships break down.

I wouldn’t negate coownership for the disaster in waiting scenario based on actual risk when you’ve done what you can to control the variables. I would negate it if it is not for you because you don’t want to negotiate with other people and the potential stress factor is too high. It is just another form of partnership, and those can be good or bad depending on who is involved and what your agreement says.

As I wrote earlier this year a City of Victoria employee that drives a mini sweeper (those small machines that clean sidewalks) makes $74k/year. It isn’t a physical job, you have A/C in the cab, it isn’t super stressful. $74k/year x 2 = $148k/year so you can buy a nice condo in the core or a nice townhome on the Westshore, in one of the most desirable cities in the country in one of the most desirable countries in the world on two mini sweeper incomes. Obviously affordability sucks and SFHs are a thing of the past, but the world hasn’t ended.

The next level up is $100k/year and while I agree the percentage of $100k x 2 families may be small, the absolute numbers just keep growing and these aren’t some mythical jobs. Four-year police office is $94k I believe and this was before all these pay raises coming? Firefighting (looks like they pretty much all make more than 100k https://www.victoria.ca/assets/City~Hall/Documents/2021%20Statement%20of%20Financial%20Information.pdf), nursing, higher up government positions, UVic, municipal jobs, military higher up, coast guard, bc ferries, bc hydro, even teaching after a few years you can stretch to 100k if you do something in the summer time like Kabuki cab or similar. Some of these jobs aren’t even that complicated. If you don’t want to risk getting lucky and getting a firefighting job apply yourself in highschool and get good grades, get into nursing school right out of highschool and four years later you can work anywhere you want as much as you want. Obviously if you graduate with a degree in english at 28 yrs old and work as a clerk 7 you are not buying.

On the flip side, SFH inventory essentially fixed. Long term there is only one direction affordability can go in.

When I worked in intensive care at the Jubilee there were nurses that bought starter homes in Oak Bay on a single income back in the day. That is not coming back, it is what it is.

I would, ultra complicated to carry out and if it isn’t someone in the know has already bought it.

100% agree with this. I’ve personally seen a few complete disasters in my business over the years.

Sure you can put in clauses and what not, but you can only do so much contractually.

When your budget is 655k and you have kids I’d be thinking creatively. If you don’t like a duplex consider a small apartment building (say six units) between three families. Instead of putting your time into a subdivision and build think strata conversion or fractional ownership for future sale if someone wants to leave.

It is not a nightmare. Just make sure you have a written legal agreement. Have I done it? Yep. No problems.

I wouldn’t recommend Kristan take up swinging just to buy a house.

And that Thurston is the reason why buying a building lot might be a good idea in the future. Buy when no one else is buying and when contractors need work.

Never co-own a property with someone you’re not having sex with on a regular basis. It’s a disaster waiting to happen. It’s a nightmare when one party wants or needs to sell.

If you do, then put a shotgun clause in the agreement. Besides side by side duplexes are ugly. Not just regular ugly but if Roseanne Barr and Rosie O’Donnell had a baby together ugly.

Buy the old duplex I wouldn’t touch a building lot or dream of subdividing one The whole process and build would probably be the end of you Its not a rabbit hole I would recommend for anyone with zero building experience

I wouldn’t give up on finding a property to subdivide. But right now you are competing with too many people that want to do the same thing and have driven the price of land up too high to make it economically feasible at this time. Vacant land does not produce rent and is costly to hold as developers have to make loan payments and taxes. During a recession land developers get wiped out and have to liquidate as few people are building homes.

Right now land developers don’t have to sell at a discount and are not dropping their prices. But they can’t hold out as long as those that are getting rent from an old house on a double lot. But there are some near derelict homes for sale in West Saanich around Gateway Plaza and Tillicum that just last year the developers were snapping up. Now they sit waiting for a buyer. Some are vacant. Where have all the builder’s gone? The problem is without appreciation in land values a builder won’t get a bump in prices during the time it takes to build a home and most need that bump to make a profit. And the rent from the houses isn’t enough to cover costs to hold them long term. And as for someone wanting a home to live in they are not as attractive as a newer condominium in the same area as these homes need a ton of repairs. Money for repairs that most first time buyers don’t have.

Timing is everything in Real Estate. Have patience and keep looking.

Have thought about something like this?

https://www.realtor.ca/real-estate/24826278/14581460-clifford-st-victoria-fairfield-west

https://www.realtor.ca/real-estate/24790357/17251727-ashdale-pl-saanich-lambrick-park

Your example of a $350,000 down payment is just as unattainable for a first time buyer.

Yes it sucks it you don’t have wealthy parents. Yet, Victoria is full of paper millionaires made from buying real estate a decade or more ago. Lots of untapped wealth in this town.

We are only now seeing the effects of high prices on the 18 to 24 year olds. They are not coming to Victoria in the numbers they were in the past and those that are here are moving to places in Alberta where they can get higher paying jobs, a home, and a life without horrific payments and taxes.

Eventually, this will impact Victoria home prices as that tier of future buyers evaporates, but for now you just have to suck it up. The only real option for those without wealthy parents is to leave Victoria because they are not going to get ahead living in Victoria as there is little left from their paychecks to save for a down payment.

The high prices were not really a problem in Victoria until the rents skyrocketed. In my opinion that’s what will kill the market as renters have less ability to save for a down payment. If home prices did come down then you would see vacancy rates increase as those buyers would now have an option to buy. The high rents have really put a damper on transitioning from renter to home owner. Then there is the specter of job losses in the construction trades and the industries that are supported by it such as finance, insurance and real estate (FIRE). Last month 16 new homes sold in all of Greater Victoria and only 5 were houses. The same month last year 41 sold and 12 were houses. That might not seem like a lot, but we live in a small pond. If you use the analogy that real estate is a ladder then what is happening today is the bottom rungs are being sawn off. And that may cause the rest of the real estate ladder to topple. And the local and provincial governments can do absolutely nothing about it. They are Eunuchs in a Harem. And the Federal government can’t drop the interest rate to save housing. Housing is just collateral damage. Some property owners will suffer but Canada and the banks will survive.

The irony is that the very thing that made so many renting properties rich is what will also cause their property values and wealth to fall. It’s not that these people are evil, they are doing exactly what investors are suppose to do and are essential to a well functioning market. They take the risk and reap the profits that they are entitled to receive in an expanding economy and they create housing, but they are also the ones that get bludgeoned in a recession. No one cries for them and no one should. It’s Capitalism in a free marketplace.

Same here! Hopefully missing middle/Eby/etc do some good too, but like you, I’m not holding my breath. The plan after securing a home for the family is to start saving like the dickens for our kids for when they come of age..

Anyway enjoy the nice sunny surprise today. 🙂

Right. That’s a discouraging story, and it’s remarkable that anything gets built these days.

Regarding your house hunt. It sounds like you have things in place. Hopefully you’ll catch a break this winter and the right place @ right price will appear.

Thanks for the discussion!

!

Indeed.

About a year ago we started talking seriously with another family in a similar position to us about the prospect of buying a piece of land, subdivide it into two, and putting two simple houses on it. Makes sense, hey? It didn’t take long before we found out the various regulatory and financial hurdles we would have to overcome to pull that off here. (Basically, it would take years to get approval to subdivide, plus hundreds of thousands of dollars of various consulting fees, and it might not even be successful. The army of university degree holding vogons in charge of sidewalk repair have to be called upon apparently.)

I’d be for that. There’s a nice movie on Netflix called Brooklyn. In one scene, in 1951, this young kid (a plumber) takes his fiancé (a bookkeeper) to a big empty field in Long Island. They are both living in small apartments in Brooklyn with other people. He tells her that him and his tradesmen buddies are going to start a company, buying that land and building houses there. And one will be for him and his bride.

And so they had problems like yours back in the old days too, and that’s how they solved them. I don’t see many politicians or “housing advocates” thinking like that anymore (“find empty land, build houses”).

Well, by the computation I did, that hypothetical couple (that somehow saved 250k while renting) can barely afford a townhouse. So it’s worse than simply being unable to afford Victoria SFD. But glad you agree in any case that it’s a problem.

As to what to do, hell if I know. :p My (likely very unpopular) inclination is that zoning laws and planning boards here should be razed to the ground as a start.

Whatever:

Sure, if you got a foot in the door already, life is not so bad. But if you haven’t already benefited from the housing boom and you’re trying to get in the door, then.. which was sort of the point of those computation. If you

– have wealthy parents

– already got in

– have two parents working high-paying government jobs (>= 150k/year household income)

then good for you. But presumably you all agree that whether or not one gets to live in a house (or even a townhouse) shouldn’t be conditioned on those possibilities.

$350,000 down on the typical house purchase isn’t a stretch when you have a property that has appreciated substantially in the last decade to sell. On average people buy a new home every seven to ten years. The median home price in 2012 was $577,950 and $855,000 in 2017 now it is $1,305,000. That allows for a much bigger down payment than $350,000 on the next home purchase.

One of the trends that I am noticing is that those families that bought a decade ago are down sizing as their children are now adults. This allows them to buy a smaller home with cash or a small mortgage that they can easily afford through retirement. The higher interest rate is not a significant hurdle for them.

This is one of the misconceptions people have about buying in Oak Bay that the buyers must all be from off the Island to afford Oak Bay prices. If you had bought a house in the Western Communities back in 2008 for $600,000 it would have appreciated to $1,500,000 giving that person a substantial down payment to buy in Oak Bay today.

In the last six months there have been about 214 house sales over 1.5 million. Given the population of Greater Victoria it isn’t a stretch to have locals with huge down payments.

OK. Since you pointed out terminology, can we at least agree that the problem you’re talking about isn’t “affordable housing”. Because that is for low income people trying to get basic housing. Your describing a different problem, about affording a Victoria detached SFH.

And yes, your example of $120k income being unable to afford a Victoria SFH is indeed a problem.

Missing middle or upzoning won’t fix that. None of Eby’s list of promises will fix that.

I would suggest that the government expands the suburbs in the western communities, to build SFH communities, along with building rapid transport trains to the core. That would take 5-10+ years

If you have any better recommendations to make SFH more affordable, please let me know.

Hey Patrick. When it comes to the language here, it seems to me that you and Leo are talking past each other a bit. The way I interpret the affordability plots is simply what is being plotted, a measure of what it takes to actually purchase a home, given current prices and current interest rates.

But, for the rest, (1) what I quoted isn’t just for the core, but the greater region, for the core it’s much worse; (2) it’s clearly more than local supply and demand at work, insofar as there have been similar jumps across much of the industrialized world during the pandemic; (3) the jump has been particularly bad in the past two years; (4) it’s clearly a problem.

Patriotz back in the 1980’s the highest uninsured LTV without CMHC insurance was 75% Now it’s 80%. When capturing data from two points one should make sure the data captures a similar population. In this case it would have been those that did not require high ratio insurance. This is a major flaw, using 80% ,in this comparison analysis.

But that doesn’t answer the question ——Why 80% Why not 90 or 95 or 50? What is so important about 80 percent other than conventional financing versus high ratio financing? If the reason for 80% being conventional financing then this comparison analysis is flawed.

I think your use of the term “unaffordable” on HHV is unauthorized. And requires that you read the following statement issued by Leo as to how you should “think”:

“Leo: Affordability is a spectrum. You are already on the wrong track by thinking in terms of affordable and unaffordable. Think in terms of more or less affordable.” https://househuntvictoria.ca/2022/10/31/october-activity-uptick-to-end-the-fall-market/#comment-95364

And yes, detached SFH in core Victoria are near the less affordable end of the affordability spectrum. These are simply market forces at work. There are more “average souls” looking to buy than “average souls with SFH” looking to sell. Same reason that “average souls” can’t get into Stanford, but there are other colleges that will accept them.

NB: Those computations relax somewhat if you go with a credit union rather than a big bank (our credit union will allow us to go up to 40% of gross income to shelter costs), and if you have rental income (which local credit unions count quite favorably compared with big banks again).

With that further reach you end up needing around 350k down payment with ~150k/year salary to get around the 1m mark, and rental income besides to get to the median range of 1.1-1.2m. Still well out of reach of a supermajority of families.

Let’s suppose you have a couple that makes 120k/year (average for the region is 90k/year), who has saved up 250k for a down payment. (Not a small amount!)

How much do they qualify for, and what can they get with that?

With the stress test the effective interest rate for qualification purposes is ~7%. Suppose they got to pay 3500/year in property taxes. And let’s go with the standard <= 32% of gross income devoted to shelter costs.

They then qualify for ~415k mortgage and so a purchase price of 665k. That’s not enough for a house, and if we revise the numbers to account for strata fees for a townhouse, we’re looking at a purchase price of ~650-655k. So the bottom end of the townhouse market for families, despite starting off well above average income.

We can turn it around and ask what it takes to get to the bottom of SFD market, around 900k, say with 300k down. Same computation gives an annual income of ~170k/year.

What’s the fraction of SFD housing around here? 40 ish percent? Evidently ~ the majority of housing in this part of the world is available to those making at least twice the average household income. Or if you have wealthy parents. Or if you’ve already benefited from the housing boom. That qualifies as unaffordable to the average soul, regardless of the back and forth here.

Yes we did. However I think It had to be insured. As I recall he threshold was 75% back then.

If you have a home at $100,000 and a down payment at 20% of $20,000 and your home declines by 20 percent to $80,000 then you don’t have equity. The loan to value ratio is then 100%

Patriotz can check my math on this, but I think I’m right.

Didn’t have 80 percent LTV’s in the 1980’s. Using an 80% LTV is arbitrary. Why not 90% or 95% as I suspect that most of the affordability issue is in the lower income brackets. The same people that make use of high ratio financing to buy their first home.

Or why not use 50%, then there isn’t an affordability issue at all. Just keep moving the ratio and you solve the affordability problem.

The discussion is about the standard measure of affordability, based on 80% mortgage and 20% down. It’s part of the title of affordability charts. “80% mortgage”

When did someone define affordability at 80%? I must have missed the memo.

The sweet spot for detached houses over the last six months in the Victoria core is roughly the $1,000,000 to $1,250,000 range. The year before it was in the $1,000,000 to$1,500,000 range. That’s where the majority of purchases have occurred.

The same for condominiums. For the last six months it has been in the $500,000 to $600,000 range while the year before the spread was larger in the $300,000 to $700,000 range.

The higher interest rates are having an effect as sales activity is being squeezed or compressed into a narrower range with fewer purchases at the low and high range. That should make sense to most of us as it has become more difficult for first time buyers of condos to qualify for a loan and the high end purchasers are having difficulty with a larger down payment in order to keep the monthly payment affordable.

And yes there have been multi-million dollar sales this year, but these buyers live in a different world from us minions.

My opinion is that the last six months has just blown the froth off the top of a beer. The drop from peak prices is meaningless. The next six months could be more interesting if rates continue to rise and I suspect/guess that if we were to see meaningful declines it will first begin in the condominium market with rising months of inventory. As there is less wiggle room for these buyers as the sale price range is squeezed tighter. That could spill over into the detached house market as older starter homes are in direct competition with condominiums, as a newer condominium is about the same price as a starter house that needs some repairs.

I don’t think what has happened over this year is a major concern. It might be in the months ahead with more increases in the interest rate as fewer purchasers can enter into the market. But we are going to need higher interest rates of at least one or two percent.

The discussion was about affordability, which by definition use 80% LTV. The poster was saying that metric would fall from 65% to 30-40%. Your point assumes the down payment percentage will be more than 20%, which is different by definition than the affordability charts.

Aside from that, it’s a small factor. If prices fall 20%, your 20% down payment becomes 25%. So your LTV improves from 80% to 75%. That’s something (6% improvement ) but it doesn’t get you from 65% to 40% affordability, which was the discussion.

“Consumer sentiment” influencing prices and affordability has been a popular topic for Leo’s articles on HHV before, e.g. https://househuntvictoria.ca/2019/05/26/the-affordability-distribution/

Not sure if he still believes that since he recently told us that he’s “certain it [improved affordability] won’t change unless we change the system” , which isn’t the same thing as just waiting for consumer sentiment (psychology) to turn against buying houses. https://househuntvictoria.ca/2022/10/24/ebys-big-housing-push-real-deal-or-dud/#comment-95103

In the USA, they measure consumer sentiment specifically by asking consumers “good time to buy (or sell) a house?”.

The results don’t indicate any good co-relation between this consumer sentiment and prices. What does co-relate well with prices is the economy. In recessions, house prices are flat to down. In good economies, prices go up.

You can see all this visually on the chart below (consumer sentiment to buy (black). Recessions (grey). USA House $prices up (green). House prices down (yellow).

At one time alot of folks where hankering for the good ol days of lower prices and higher interest rates

Barrister, I got some more insider info now:

My cap. market insider are saying some alt lenders are having liquidity issues with lots of redemption requests, a decent number of people went to these lenders in 2021/early 2022 when they couldn’t qualify at banks.

My local RE insider tells me that some small time “developers” are sweating (some of these guys got yachts and exotic cars last year and are looking to unload). Also some trades are getting work canceled and having trouble finding new work now.

Frank this one is for you, my car sales insider tells me that used car prices are……… well you can figure that one out for yourself!

Because assuming the same down payment your LTV goes down for fixed and variable mortgages. And for variable mortgages you will also have the immediate cashflow advantage because of this. Again I have to assume you already know these points given the amount you post on here?

It depends, prospective buyers will adjust to the higher interest rates. One scenario is that they put down larger down payments to offset the higher monthly payments. Victoria is a small real estate market relative to bigger cities, it doesn’t take much to swing the numbers one way or the other. Our prices may or may not have come down as much as the bigger cities as we have a higher percentage of prospective purchasers with deeper pockets to put down larger down payments.

We would have to look at current CMHC numbers to find out if fewer buyers are opting for high ratio mortgages that may indicate those that can put down larger down payments are propping up our market. Generally, investors and developers want to put less of their own skin in the game and prefer to not to use their own money. I suspect the mix of those buying for home occupation versus investors, developers, speculators may have changed.

There will always be people wanting to buy and wanting to sell in any market. A metric that I watch is the number of Pending Sales. Back in January there was about four times as many as there are today. Since a lot of the FIRE industries are related to house sales that indicates to me that their commissions are going to be lower for at least the next 90 days. It might be an idea to take that long overdue vacation if you’re in these industries or encourage some of your commission or sub contracting/employees to take their holidays now. Then there is more work to go around for those that are left.

The prices have to fall enough to “more than offset” the higher mortgage payment to bring the ratio to 30-40%. It’s a slow process over a number of years. Why didn’t the ratio fall in the last 6-8 months? It is probably due to the short time frame and the psychology of home buyers. It takes time for home buyers and sellers to adjust to the new environment. The psychology over the last 30 years was that home prices always go up. Once that psychology is broken, there won’t be any support for home prices for a long time.

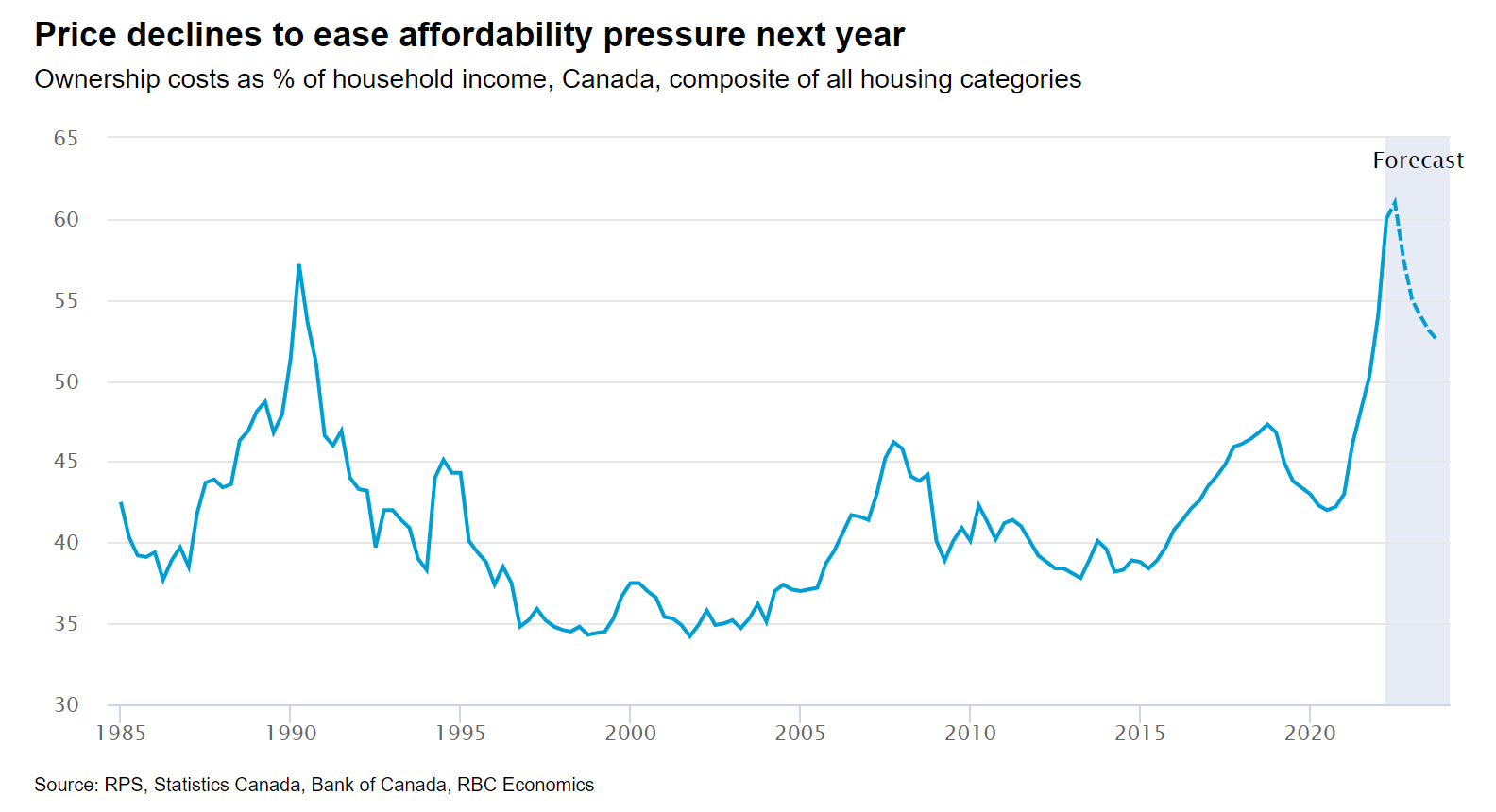

Why would lower prices but higher rates mean improving affordability? We haven’t seen affordability improve much in 2022, as lower prices are offset by higher mortgage rates. Historically, the only way Victoria affordability improves is an economic downturn with rising unemployment or other factors causing people to move away from Victoria. Because those reduce demand.

When lot prices and the cost to construct are high, then building low cost housing is an oxymoron.

The only way to build low cost housing would be if you could build 50 year old homes today.

Greater Victoria has a large stock of homes built before 1970. It’s just that there is not enough of these older homes listed for sale to satisfy the appetite of those wanting a home to live in, investors wanting a long term rental property, developers wanting a lot to build on, and speculators that are buying solely for short term appreciation.

Voetrs and governments can wish whatever they want for home prices, but is it in their control? The longer inflation stays high, interest rates will stay high or even keep going higher. The longer they are higher, the home prices will keep grinding lower until they are “more affordable” in the range of 30-40% on Leo’s graph.

The covid fiscal and monetary stimuli were just triggers. The excess money supply has been building in the system for 40 years. The hornet’s nest has been disturbed. It will take years/decades to go back to 2% inflation.

HHVers want cheaper detached house prices. More “affordable housing” doesn’t mean cheaper detached house prices. It means more condos/townhouses, which are cheaper than detached houses.

Do governments (or their voters) want to see significantly lower house prices? No!

Only 22% of Canadians want to see house prices fall significantly. (April 2021 angus-Reid survey) most Canadians (64%) want house prices to stay within 10% of where they are. https://angusreid.org/housing-prices-2021/

If prices keep falling, I expect that 22% number to fall. Governments realize this. You almost never see a politician advocating lower house prices in general. Instead they promise more “affordable housing”.

Government actions on “More Affordable housing “ means building more lower-cost homes, which is great. However, it doesn’t mean policies to lower all house prices. We have lots of low-priced affordable condos/apartments/townhomes in Victoria. And thanks in part to the efforts of “affordable housing” advocates, we are about to get a lot more. This will reduce our stock of detached houses, especially per capita, likely resulting in higher detached house prices.

See next msg

But the poorer parts of Canada generally have the most affordable housing. And housing in Canada, pretty much everywhere, was more affordable when single income households were the norm and real household income was lower than today.

Government always intervenes in the housing market, by zoning and the development process, financing (CMHC, OSFI, etc.), and tax policy.

The choice is what outcome you want and what policies will move you toward that outcome.

I am not misled, I just think you are misleading those who don’t know how a mortgage works. Doesn’t really matter to me either way I am just calling it out.

I was wondering if a portion of unaffordability is anchored perhaps in the fact that Canadians overall are poorer in real terms than in the past. Has the per capita eeal wealth actually decreased? Are we simply poorer and simply can afford less in the way of housing?

James soper Yes gone too soon will be missed

Some people just exist to waste your time.

Just heard about Ryan Goodman. Really sucks. He was doing good things.

Just like your BCGEU deal ,enjoy

Whoa did you get this approved by Homes For Living? I would imagine if one of your sponsored council candidates said this they may not get all the votes they got a couple weeks ago as explaining affordability as “a spectrum” isn’t an easy political talking point.

Whoops, the truth comes out. Guess “affordable housing” is all in the fine print.

Actually? Woof.

Who cares if homes are “less” affordable. That doesn’t make it a crisis, requiring urgent intervention by government. Wake me up if homes become “un”-affordable.

No. Affordability is a spectrum. You are already on the wrong track by thinking in terms of affordable and unaffordable. Think in terms of more or less affordable.

A very bad analogy. Everyone must buy food. But not everyone must buy a house, or even a townhouse, or a condo given you can rent any of those instead.

It seems only you are confused about how to read these charts. RBC makes very similar ones, I guess most people get it?

You need absolute values if you want to make a case that house prices are “un-affordable”.

I could post a graph of food prices as a % of income over the years. And we could see that they might be relatively unaffordable now. But that doesn’t make food “un”-affordable. So absolute values do matter, because if my chart showed that food was consuming 65% of people’s income that would matter indeed. Unless the Y-axis I was using was secretly supposed to be ignored and I didn’t tell people that via a disclaimer on the chart, and they needed to message me to hear that detail.

I see people saying “wow, I saw that houses are costing 50% of income, how is that possible?”. And it’s because they’re as misled as if I say that FTB are saving 20% of their income via equity pay downs as I showed in my example.

For a chart that is supposed to only show relative values, there is a solution. You show an index, that is at 100 at the start, and we can see how it compared to that. Then you don’t have people misled into thinking that average buyers are paying 65% of incomes for average houses.

My take is that homes have always been affordable to average incomes and that includes today. But not everyone gets an average or above average home. There are about 50% of people that can afford below average homes and that’s what they get. And currently 67% of Canadians have managed to do that, and have confused to afford them with record low mortgage delinquencies.

If I run 10km in 40 minutes, I have averaged 0.25km per minute over the full race. That doesn’t mean that I am “implying” that I run 1km in the first 4 minutes. Because my speed might change. Same with saying that paying 100% of a mortgage off in 25 years means you average 4% per year, which it does. Anyway, I’m sorry that you feel misled, but I’m not going to learn to say that differently, because it is quite clear.

Depends on your definition of poor and when it is no longer poor. But past cycles have been measured in years peak to trough.

I think the focus should be on how long affordability can remain this poor historically before correcting.

No you are implying that a buyer would have 80% of the original mortgage balance remaining after a traditional 5 year term.

A drop of some quantity by 4% per year is exponential in fact. Which means the mortgage balance can’t be falling exponentially, since it would never reach zero. Drop in last year is 100%. I’m not sure what the actual function is, I don’t think it’s simple.

We’ve had this conversation many times. It’s not about the average family actually buying the average house with an 80% mortgage. Obviously that is not the norm. The point is to relate house prices and financing costs to local incomes. The information is not in the absolute value at any given time, the information is in the value relative to long run historical patterns.

Maybe. Have to wait and see.

Yes, I thought I made that clear by expressing it as 4% is representing 100% pay down over 25 years.

The next post I made uses actual pay down amount for year 1, which is 2%, and this rises to about 7% in year 25, with the “average” being 100% over 25 years – or 4% per year.

Was just looking over the costs for a condo where I track all the expenses. 2019-2022 the costs to own the place have gone up by 34%, Driven by insurance (53%), taxes (31%) and strata fees (41%). The increase in strata fees was also driven by insurance (for the building). 2011 -2019 there was almost no increase in costs

Principal pay-down is not linear with a traditional amortizing mortgage. But I supposed you know that!

“Average income couple requires 65% of income to buy SFH”

This post is to shows how absurd the affordability charts are. Fact is, few people are spending 65% of their income buying homes. But if we are shown affordability charts like this, let’s at least show how silly they are.

Instead, the affordability chart headline should be “average Victoria SFH buyer saves 20% of their income (as equity) in year 1. In year 25 it will be close to 65% of their income that is saved per year”

Because, If they’re paying 65% of their income on the mortgage, mortgage calculators tell us that in year 1 (5.25% rate), 30% of mortgage payments will be equity (for savings). So 65% X 30 = about 20% of their income is being SAVED per year through equity build up.

So if you are one of these “mythical” families that we are told are spending 65% of your income on homebuying – Congratulations! Because you are saving 20% of your income through equity payments, even in year 1!

Affordability is only measured at year 1, based on the 80% mortgage. If we continued to measure it for year 2,3,4 etc, we’d see that:

– —Amount owing drops by 4% per year (mortgage loan balance drops 100% over 25 years)

– —Homeowner’s income rises (on average) by 4% per year (through inflation. and …

– —wages going up during “mortgage paying years” (e.g. average 30 year old make $46k, average 50 year old makes $68k) https://primusworkforce.com/blog/average-canadian-salary-by-age-group/

So those factors will improve affordability on average for homeowners about 8% per year. So a scary number like 65% income to buy on the chart affects “year one” homeowners. But the typical homeowner isn’t throwing anywhere near 65% at their home. Moreover, the typical FTB isn’t either. Because they aren’t buying average priced SFH. They’re part of the 50% of SFB buyers that buy below average SFH, or even better, buy condos.

Historically low rates for over a decade with low consumer price inflation. That’s what was different.

What was different about that time? The bank raised rates. A recession happened. Then it dropped rates.

I said outlying areas other than Victoria. I didn’t mean Langford. I meant up island. No idea how Langford is doing but up island is down more than here – and also rose more quickly during the peak times of the pandemic.

The line starts at 2020 and goes to Oct 2022. The other line starts in 1980 and goes to end of 1983

Do you mean 2022 in your graph?

Maybe it was different last time, i.e. 2008-2021.

80s bubble affordability VS today. Quite different paths.

Lol, that aged like the MLS links to that $1.6M house in in royal bay.

In the future, interest rates will fall (unless it’s different this time), and in the intervening period, wages will have risen. They might not be able to buy now or in the near term, but I think there will be a buying opportunity in a couple years.

Real estate is number 1. Construction is number 2.

Export? Coal. Industry? Probably tech. Which is taking it on the nose currently.

As you progress from early career to mid career, your income should increase quite substantially.

Of course what matters is not the absolute rates but the proportional rise in rates and resulting rise in ownership costs. As for the economy, what’s BC’s #1 industry these days?

We don’t have 1980s interest rates, but we do have 1980s inflation, along with 1940s debt levels. Prices didn’t drop this fast in the states before the 2008 recession. Just because we haven’t got to the crash yet, doesn’t mean it isn’t coming. 2/10 year yield inversion only started in July.

Wow, Canada job growth 108,000 in month, all full-time jobs . “Wildly exceeding expectations”. And wage growth accelerating to 5.6% annualized. All pointing to more inflation ahead. On the bright side, that wage growth (5.6% annualized) helps affordability as it partially offsets the higher rate mortgage payments.

https://ca.finance.yahoo.com/news/canada-added-108000-jobs-october-blowing-past-expectations-123535239.html

Canadian employers added 108,000 jobs in October, wildly surpassing economist expectations of a 10,000 gain, Statistics Canada reported in its Labour Force Survey on Friday.

The agency said the October increase was entirely in full-time work and helped recoup all of the positions lost since May. StatCan also said the gains were widespread across industries including manufacturing, construction and food services. A weak spot was the wholesale and retail industry, which shed jobs.

The unemployment rate held steady at 5.2 per cent.

“The Canadian labour market came out of its summer lull in spectacular fashion in October, with an unexpected surge in employment and wage growth,” Andrew Grantham, senior economist at CIBC Capital Markets, said in a note to clients.

Wage growth once again came in strong at 5.6 per cent amid a tight labour market. It’s the fifth month in a row that wages have risen by more than five per cent, and an acceleration from September’s 5.2 per cent increase.

If there were folks not able to/struggling to buy pre-pandemic in our market how will they be buying now or in the near term given the rate environment, notwithstanding the current correction that’s underway? Even if the pandemic gains are fully erased over the next 12 months how are they going to afford the new debt servicing with currents and growing rates on a pre-pandemic pricing, say 2019 price levels if that happens? Or do they well and truly believe prices will keep falling until payments at the new higher rates are approx equivalent to where the payments were in our previous rate environments over the last say 5 years? Does real estate work that way with our market characteristics? Theoretically it makes sense. But will it in reality? Guess we will see.

While the longer term trend has been down, there have been periods of rising rates seen by under age 60 during their adult lives . Because a 59 year old would have been an adult since 1982. Please note the periods of rising rates that have occurred since then. e.g. 1987-91 . 1994-96 . Both those periods of rising rates are longer than the current one (21-22).

James not all market corrections are the same. This appears to be just a correction – not a crash. We don’t have interest rates in the teens and a BC economy in the toilet like the 1980’s; and we don’t have a credit crunch (black swan event) like in 2008.

Currently, the real estate market in Greater Victoria is balanced between buyers and sellers. Buyers have a little more negotiation room on asking prices. No one is panicking to sell.

The learning of all responsibilities including financial starts at a very young age. There is an extremely good article written almost 20 years ago and it applies even more so today. If you have a few minutes, and especially if you are a parent of young children, maybe you could take the time to read it.

It was written January 8th, 2014 by Kristen Welch and is entitled: “What Really Happens when you give your kids everything they want.

https://househuntvictoria.ca/2022/05/16/new-and-active-listings-what-happened-during-the-crash-of-81/#comment-88606

?

Doesn’t even have to be at peak if you are bidding $1.8 mil for properties after the peak.

Not Phil Soper forecasting a decline!? Things must be well and truly bad.

November 2020 you are still ok. If you got caught in the bidding wars in March 2021 then you maybe under.

Yep piss poor timing if you bought an investment property in the last 2 years

like buying another investment property at the peak?

Canadians under 60 have seen falling interest rates their whole adult lives. Until this year that is. I think that has something to do with it.

https://www.bnnbloomberg.ca/financial-illiteracy-runs-deep-in-canada-dale-jackson-1.1841928

Is education the answer? Or, should parents assume much of the responsibility for teaching sensible financial approaches to life? Perhaps learn how to save first and spend later(?).

https://www.bnnbloomberg.ca/a-housing-bubble-burst-would-be-worse-in-canada-than-u-s-rosenberg-1.1841896

Why are so many Canadians lured into so much debt? It’s a sad and stress filled way to live. There are many who are reduced to tears.

The time when Just Jack takes a wrong turn ends up in Broadmead thinking he is in Langford

And those that perpetually pulled out all the equity they could to spend on other things.

lol, British Columbians in 1982 – prices haven’t come down, they’ve just flatlined from 1976.

Fair enough.

The two measures actually agree quite well, just have to make sure you’re comparing apples to apples.

As you discovered Teranet is actually measuring all property prices, not just detached..

Then we know that Teranet is based on completions, not pending sales, so September 2022 Teranet actually reflects deals made around July.

In July, we were at detached sales selling 13% above assessed value (down 13% from peak) and condos were selling for 18% above assessed (down 9% from peak). Averaging that out, we’d be down about 11% based on sales to assessed value.

Then factoring in uncertainty about timing of what sales were in the September 2022 Teranet data, and issues like townhouses which peaked a month later, I’d say the -11% and -9.4% are quite close and basically agree on the magnitude of the decline.

However the short answer is I used Teranet because we can easily use it to compare between cities, unlike sales/assessment.

Your sales-to-assessment has SFH down 17% from peak (126% to 105%). That seems to be a better metric than Teranet down 9.4%. In any event, it’s a big difference.

Partially correct.

Totoro, if I could weed out the noise and make the same claim as you that prices have fallen more in the Western Communities than Victoria I would be as happy as a pig in &hit. Langford alone has grown to the third largest in population and dwellings of all the districts in Greater Victoria. If you include Colwood there combined population is now over 66,000 with over 28,000 homes. And there is a lot more room to grow. At the present rate of growth in the next decade or so it will be larger than Victoria City proper, at 92,000 people and 53,000 homes, but without all the downtown problems. It’s where most of the new jobs and new businesses are being created. The homes, neighborhoods, schools and shopping are all new. And it’s pretty out there with all the tree lined streets, sidewalks in good repair, well kept roads and newer houses and a good place to raise a family with a plethora of amusement centers and playing fields for kids. Then you drive back into Victoria and see a lot of old unkempt housing and tent cities and you wonder what the “F” happened to Victoria?

I don’t how much longer we can continue to think that Victoria is a better place than the Western Communities to live. If Victoria lost its monopoly on government jobs it would become the next Old Nanaimo bypassed by progress. And that could happen if the Langford population surpasses Victoria and their Mayor says that Langford should have its fair share of government agencies located in that city. Which it should.

Define Investor. You may call almost anything an investment. That doesn’t make it a going concern. Duplexes, triplexes and even four-plexes are purchased by those that want a place to live and suites to rent. Apartment blocks that have 10, 20, 30 or 100 suites are purchased for their income producing qualities and not as a source of passive income. That’s when you find the cap rates normalize as the home ownership emotional attribute is minimized.

It’s not that you can’t do the calculation, its just the cap rates have a lot of variation. You could say that a cap rate for a duplex would be 3 percent but that can vary on who pays the utilities or how they are shared. Are you paying a professional property manager or are you doing this work yourself. How about repairs. Are you deferring repairs to make the net income look better in order to sell or are you maintaining the building on a regular basis for the long term. All these things are going to change the cap rate considerably if the house has one or two suites but not significantly in managed apartment blocks that have ten or more suites.

Technically if you have a rented duplex you are an investor but your property isn’t sufficient to determine a reliable cap rate. And that’s the cap rate I’m talking about. You might own a corner grocery store but it’s not a Walmart.

I could well be wrong but my impression is that prices in Victoria are holding up better that either Toronto or Vancouver.

If you’re an investor buying a revenue home it’s still about whether you make money or not, otherwise I think you’re doing it wrong. Yes, you have to leave the emotion out of it and sure, the “prettiness” can and should factor into your decision looking at it from a potential renters perspective and what would be most attractive to them, but it would be very hard for a RE agent to talk up a home to an investor the same way they could to an emotional FTHB. It’s actually funny listening to some agents at open houses point out features that would just be an extra pain for a landlord even if you’ve told them it would be a rental property.

People with a lot of money who made it themselves know how to analyze the deal of the day from all sides.

Buying now for cash could be a good deal if your cash is otherwise underutilized and you have tax, personal and long term planning reasons to buy now – and because you don’t know the future.

I expect most people in this situation, and it has to be a tiny minority of buyers, would think about holding off for a few more months to buy residential real estate. But there is a lot of inventory now comparatively and prices have fallen a bit more in outlying areas than Victoria.

Reminds me of a recent episode of Rational Reminder where they looked at returns of private equity. They pointed out the misconception that PE has lower volatility than the public markets was just due to it not being mark to market so the stability was an illusion. PE in some way provides smoothing as a service, and a similar thing could be said about people’s personal real estate transactions.

Ahem, prices have come down for everyone. I don’t pretend that the prices of my stocks haven’t gone down just because I could still sell them for a capital gain, nor does my broker.

Prices have not come down for the vast majority of home owners. Only for those that bought at the peak.

May I add, people with money don’t get that way from buying investments at just a few % off peak.

There should be a risk to holding real estate, but for the longest time that risk has been near zero. Now that the cost of money has been increasing that risk should start to rise. Especially if the media begins to report on people losing their homes to the banks.

Unlike commercial and industrial properties it is really difficult to assign a risk to the investment. For example Apartment buildings are less risky than industrial properties as you have multiple tenants renting space as opposed to one tenant renting a large space. If one suite goes vacant in an apartment block you’re not as exposed to a long lease up period as opposed to losing a single tenancy in an industrial property. So one can measure the risk by the capitalization rate. The higher the cap rate the riskier the investment. Apartment blocks have low cap rates while industrial properties have relatively higher cap rates.

But you can’t do that with homes as there are emotional factors that are at play. People buy homes because they are pretty. Even if you are an investor that wants a revenue home, you have to compete against the emotions of those that want a place to live in. When you buy commercial or industrial it’s all about the bottom line. Do I make money or do I not.

But – if the cap rate on commercial and industrial is rising, you could infer the same is happening in housing.

Prices have already come down.

Wait till the next years assessments come out, then the median sales to assessment ratios will be down to zero.

I’ve been saying SFH prices will fall to hit the July 2021 assessment prices (released in Jan 2022). That would be down 5% from here (according to Leo’s chart). VicRE, if that happens in Feb 2023, we can “high five”.

Prices could flat line, but there are likely people with money that are ready to jump back into the market when prices start to come down. So it could be a bumpy road down with some short lived up ticks in prices followed by a decline. A “W” shaped correction. My keyboard doesn’t have the exact W that I wanted to show. Some might call it a dead cat bounce. Not meaning to be offensive to cat lovers. You have to wait for the leading indicators to change and not get caught up in the emotion. You’re going to have lots of time to act as real estate prices don’t usually react at the speed of a stop watch but more at the speed of a calendar. Prices tend to be more volatile the lower the inventory. The greater the inventory the slower the change.

1000%, that is why it is almost impossible to bottom tick and if you want to speculate then pre-determined value based metrics should be set. You won’t be able to time the bottom but atleast you are not buying at or close to the top.

When it comes to the bottom of the market won’t be hard to figure out because prices will just flatline for a very long time Knowing when the market is starting to take off again not so easy

Yo Patrick, I been saying Feb 2023 since May, where’s my props?!

I would say that is when the declines start to accelerate as older homes will have no choice but be priced under similar new homes, then it will be a period of price discovery before bottom. But I will go by cashflow neutrality with up and down suited rental for the bottom of the SFH market. I am not saying people should try to bottom tick on a rental, other factors come into play like location, lot size and shape.

As for “timing the market”, you have to first explain to me what you mean by timing the market. Because the odds are you are working under a different definition that I am. Home prices do not work in isolation, the economics have to be there for prices to rise or to fall. If vacancy and unemployment rates are rising and there is a net migration loss then home prices will not be rising. These leading indicators are precursors of where the real estate market is heading. Paying attention to these precursors would be considered timing the market.

I’ve spoken several times on the importance of new construction. If that sector of the marketplace isn’t healthy then the real estate market will have problems. As new construction tends to set prices. It’s unlikely that you would buy a three year old car at the same price of a new car. If new car prices come down that will bring down the prices of three year old cars. It’s the same with housing. If new home prices are coming down first then your home’s value may lag a bit but it will be coming down in price too.

It’s known as the substitution effect.

So when do you know when the market has hit bottom. When those indicators reverse.

Good post WhateverIWant…

Lots of good advice there.

Anybody know what’s up with the Skyeview condo (244 Island Highway) in View Royal?

There has been little work on the site since earlier this summer. I haven’t seen anyone working the last 3 times I have drove by (over the past 3 weeks..) Is all going smoothly?

The decline from peak prices is not useful as the vast majority of people never bought at peak price. A better way is to determine how prices have rolled back. And for me that works out to be prices at around June of 2021 for most middle income properties. If you bought a home before then, you’re still in a good spot as the gross selling price would be about the same, and more if you purchased at an earlier date.

People are not panicking to sell as the vast majority have lots of equity in their homes. The only real change is that, on average, homes take longer to sell say in the 30 to 90 day range instead of a week or two. The market would need a lot more inventory before we would see any sizable drops in prices. Inventory doesn’t typically begin to increase substantially until the Spring. Then it is a matter of how fast new listings are out pacing sales. If new listings are out pacing sales by more than 1.6 new listings to each sale, then prices will decline. We just are not there and most likely won’t be until March or April of 2023. All that has been happening over the last six months is that the froth has been taken out of the market.

That’s not to say you should stop looking at properties. There are deals to be made, just not in the middle income household range. Once you get over $2,250,000 there is lots of selection and more negotiation room as you may be the only one bidding on the home due to the higher interest rate. If your plan is to move up from a Gordon Head home with lots of equity to an updated Oak Bay home and you can put down a large down payment then you should still be looking. With the higher cost of borrowed money – cash is King when you are able to put down a large down payment.

If I were looking for home in Oak Bay, I would put a lot of attention to the size of the lot. Big lots have surplus land that isn’t needed by most buyers. In that way you might be able to buy a property with a 20 to 40 percent larger lot for the price of a house on a smaller standard lot. Fewer prospective purchasers means less competition and that means a deal is possible because the only time you can get a deal on real estate is when you are the only bidder.

Well the fixed rate lock from 2-3 months ago is basically the same as the fixed rates now so no big advantage there. I don’t think we’re seeing very many buyers trying to frontload rate increases anymore like we did in the spring.

I definitely agree that we haven’t seen the full impact of rising rates yet. Seems like everyone agrees it takes 6-18 months for rate hikes to really filter through the economy. Impact on purchasers is immediate, but impact on jobs and growth takes time. So far all this is happening with employement still unaffected, but I don’t think anyone believes that exceptional strength will continue forever.

I do not think the ‘peak valuation’ reference is useful. Peak valuations at the height of real estate mania and the lowest rates (1.45 and maybe some even got lower) we will ever see (ever!) are not a good reference points for calculating a discount. I would say maybe 2019 prices are more indicative of where we should be calculating discounts from. I don’t think prices have fallen nearly enough to justify first time homebuyer purchases as a good deal/discount.

I think prices at the 1.5 mil level and lower have much further to go down in terms of price drops. It just does not make sense anymore to buy a house for 1.5 million, even with with 600K down and a 900 K mortgage. That’s $5400 / mo. But only 23K going to principle and 62K going to interest the first year. Gross.

We are now increasing our regular mortgage payments by $1600 per month to help offset the amount of interest we will be paying for at least the next 2 years. We just locked in 4.94% for 2 years and hate the idea of how much interest we are paying now vs before and how much less principal we will have paid off after 2 years. Tides are turning. Paying off debt is looking a lot more attractive than climbing the property ladder atm. Not saying that won’t change again, but for now that seems to be the better financial move.

I also think that a good amount of purchases lately may be from buyers who had a rate lock from a few months ago, or a mortgage they needed to port to keep their old (lower) rate. Give it another 3 months and I think it will be a much more grim picture for certain price ranges

I wouldn’t say decent number as sales are the 4th lowest in the last 20 years not counting for the population increase. Decent number would be like ~550 sales.

It’s good to see there are a decent number of people out there still willing to buy a home they can afford when it works for them and not be so sure they’re a genius that can time the bottom of the market or have unrealistic expectations on where prices are going to end up. I congratulate them and wish the geniuses good luck.

I think the duration of high rates will have a bigger impact on prices than what people think.

Is royal bay getting hit hard yet? I was early on my call but I see this house has been chasing the market down for half a year.

https://www.realtor.ca/real-estate/24391237/3335-curlew-st-colwood-royal-bay

James soper I’m just guessing another 10 or 15 points to go Uk and the U.S are talking alot about a recession next year so I guess we have seen the future

Down and down and down it goes, where it stops, nobody knows.

A 3% per month price decline is historically very high, comparable to the early 1980’s BC bust.

https://www.theglobeandmail.com/business/article-toronto-real-estate-prices-decline-october/

That’s bizarre. I don’t get a paywall. Try:

https://12ft.io/proxy?q=https%3A%2F%2Fwww.sfchronicle.com%2Fopinion%2Fopenforum%2Farticle%2Fcalifornia-469-stevenson-court-ceqa-housing-17550982.php

Marko getting some quotes in print…

https://vancouverisland.ctvnews.ca/island-real-estate-market-cooling-off-but-prices-might-be-plateauing-1.6136744

James, it is a paywall article, give us a summary. Actually, not important.

When you finally thought some sane stuff was happening California reminds us that nothing they do is ever sane.

I use Aireserv. No complaints yet, and there was one time they could have easily ripped me off but didn’t. They will occasionally try to upsell you on expensive filters, but they can take “no” for an answer.

One challenging problem will be accomodating the transition from growth more from natural birth rates to growth from immigration. Peak household formation years are likely in the 20s for people born in Canada, and peak home buying years in the 30s and 40s, while immigration has immediate household formation and peak homebuying likely in the 5-15 years after arrival. During the transition we will likely see those peaks combine and add up while long term it will equalize. Will have to see if there’s any way to model that.