July: Sluggish sales and price slides continue

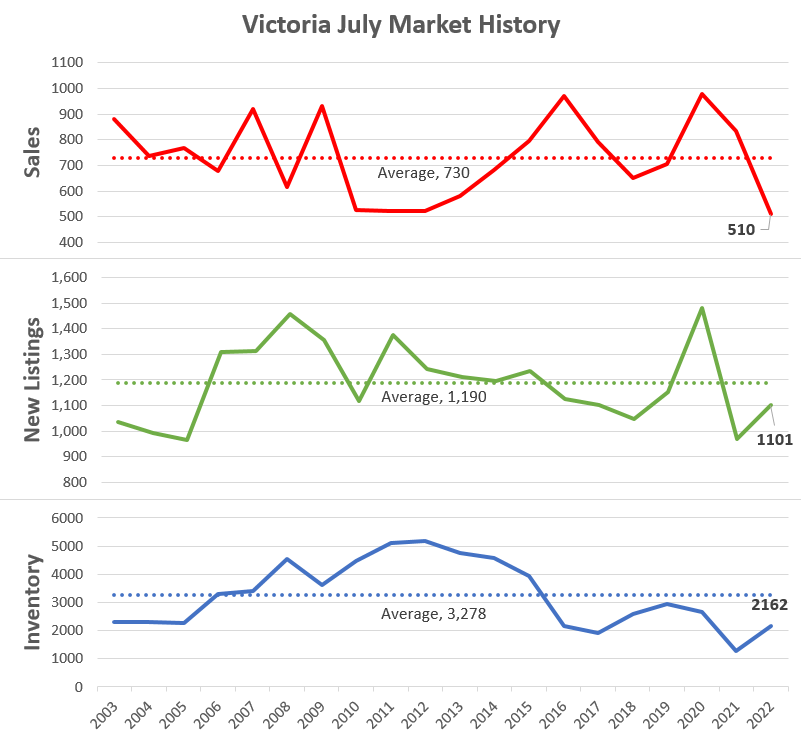

July ended with 510 sales, a 20 year low and 30% below the long run average for this time of year. New lists were up from last year but still 7% below the 20 year average. Inventory was up 70% from last July but still historically quite low at 34% below the long run average. In general I focus mostly on seasonally adjusted data, but for those who prefer the unadulterated figures, here is the chart of activity in the last 20 Julys.

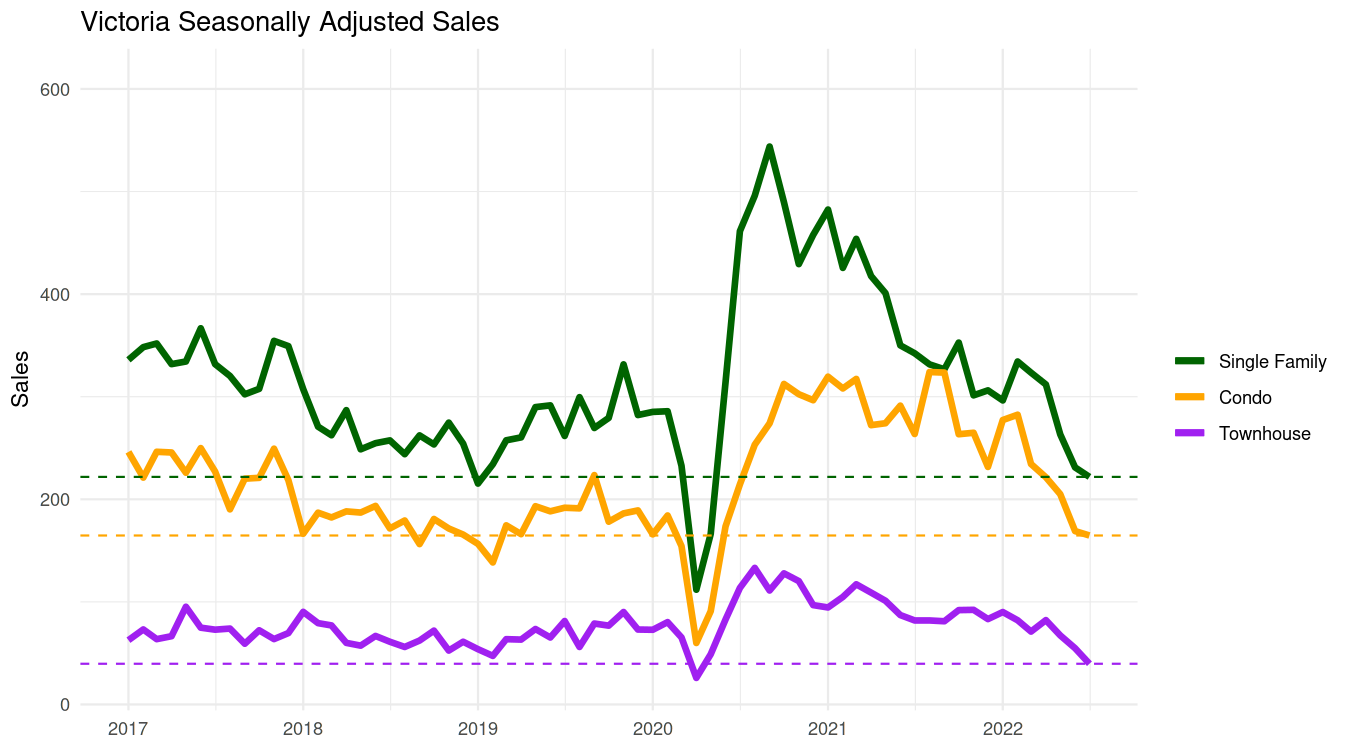

It’s clear from the adjusted monthly sales charts that we are now down well below pre-pandemic sales level across all property types, with condos still doing better than the pricier property types.

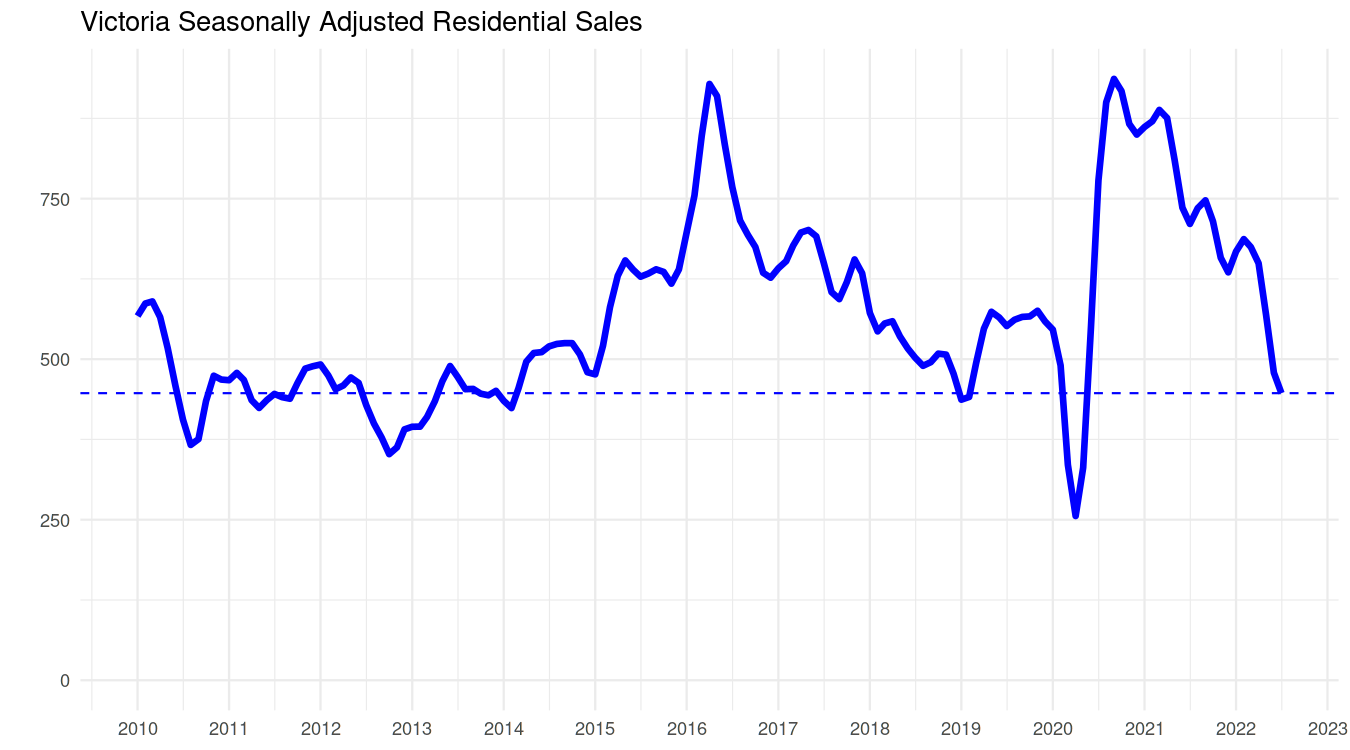

However while sales continued to drop and are now down to the levels of the buyers market in the early 2010s, it’s also worth noting that the magnitude of the decline has slowed down. In fact this is evident across all the metrics, which continued to deteriorate but at a slower pace than previous months.

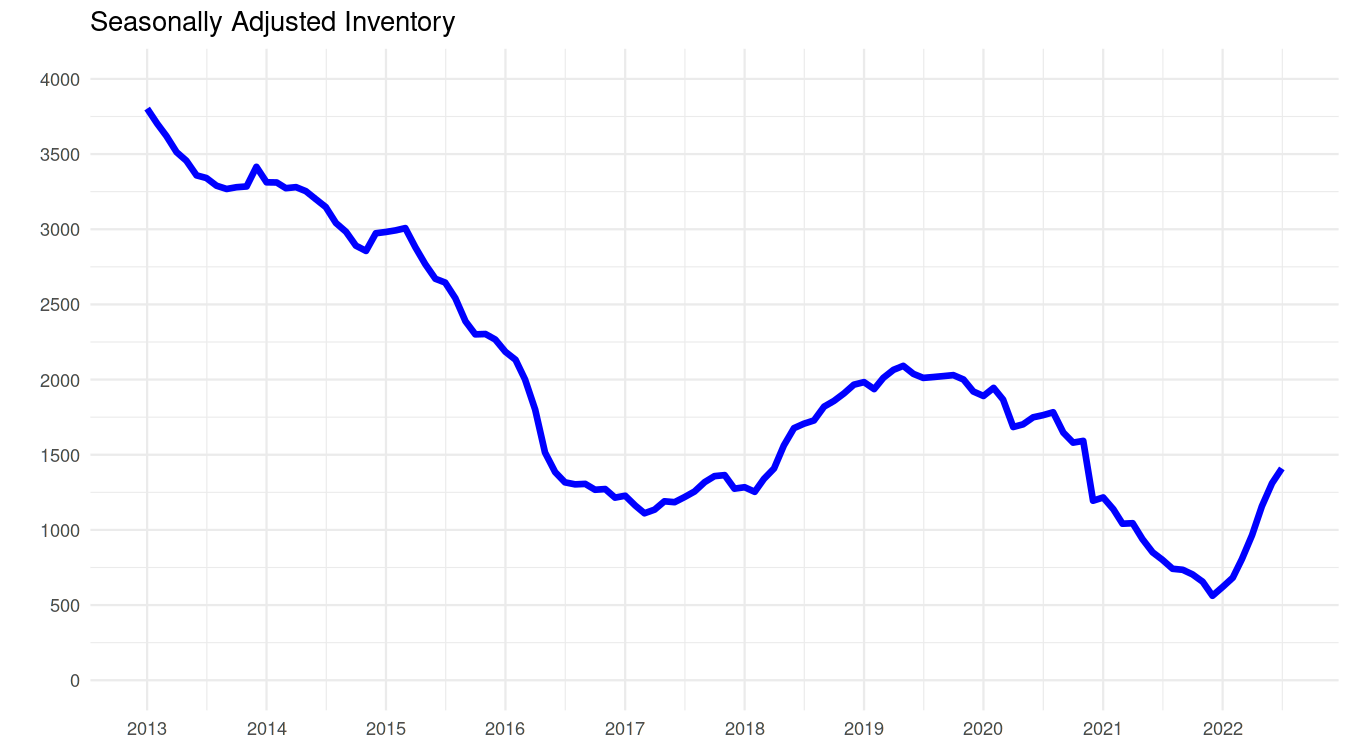

The same is evident in total inventory levels, which continued to increase in July but at a slower pace than before. As we are likely at peak inventory for the year, watching the seasonally adjusted values will be critical to determine if the market is continuing to slow despite normal seasonal delisting patterns.

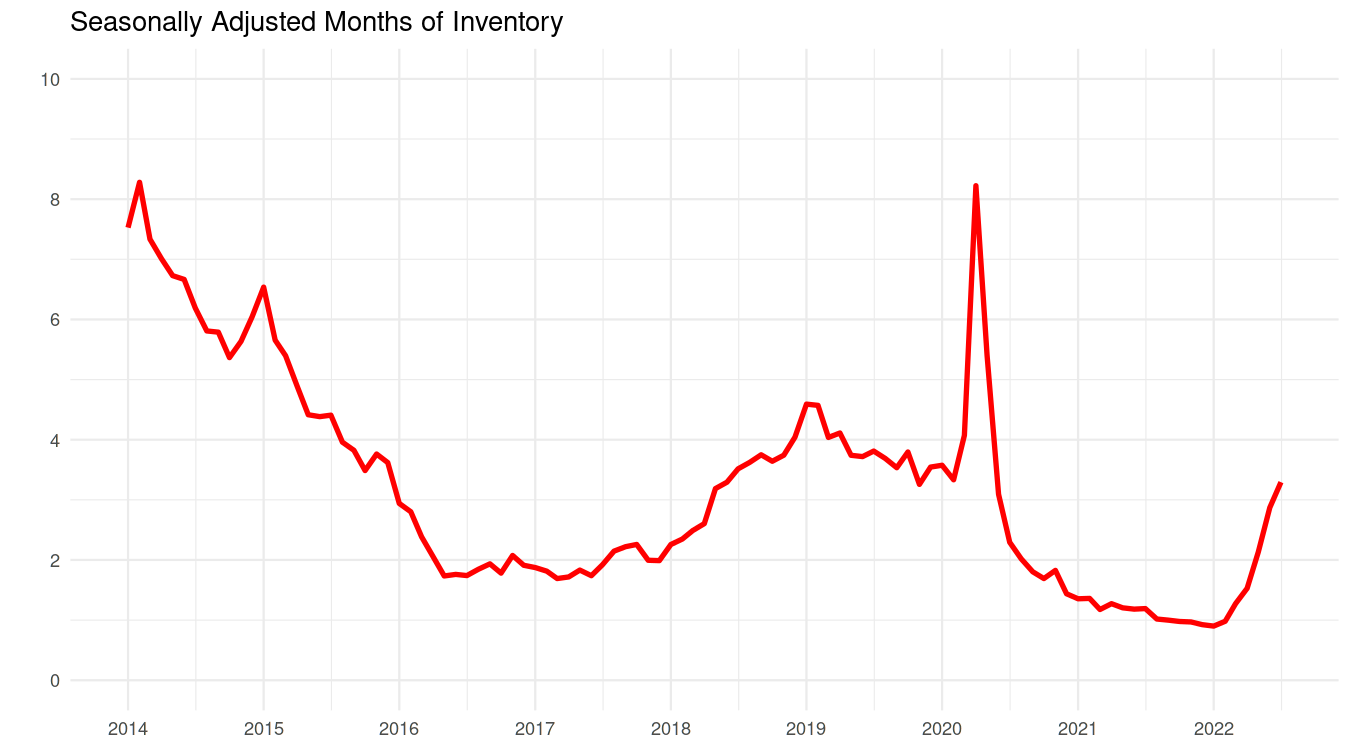

Months of inventory also increased by a smaller amount from June to July than from May to June, reaching 3.5 months of residential inventory or 4.2 for all property types including commercial.

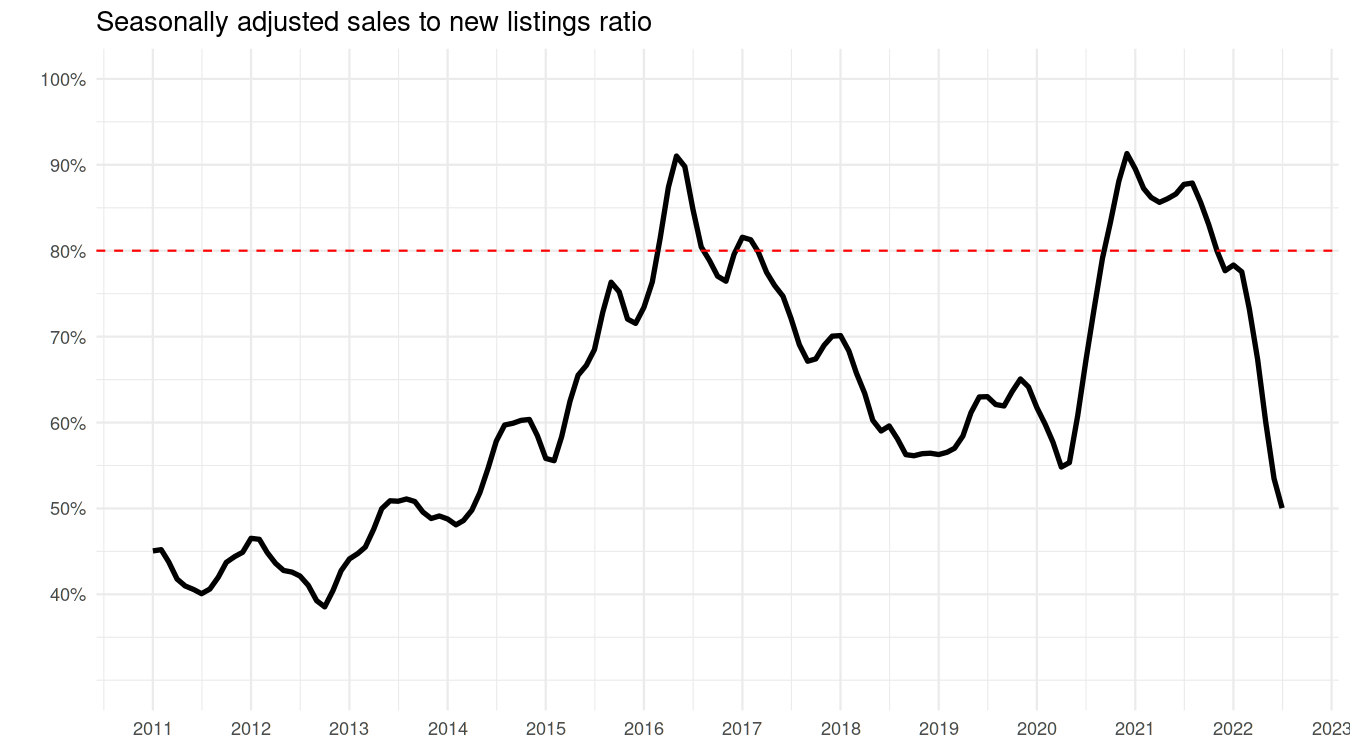

That’s still not in buyers market territory or even balanced, but the rapidly deteriorating market conditions have brought prices down regardless. The sales to new list ratio continued to fall in July (though again by a smaller amount), to levels similar to 2013.

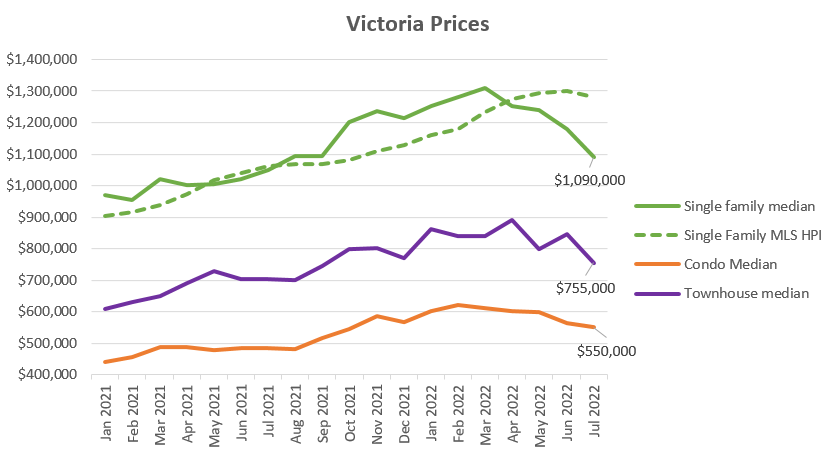

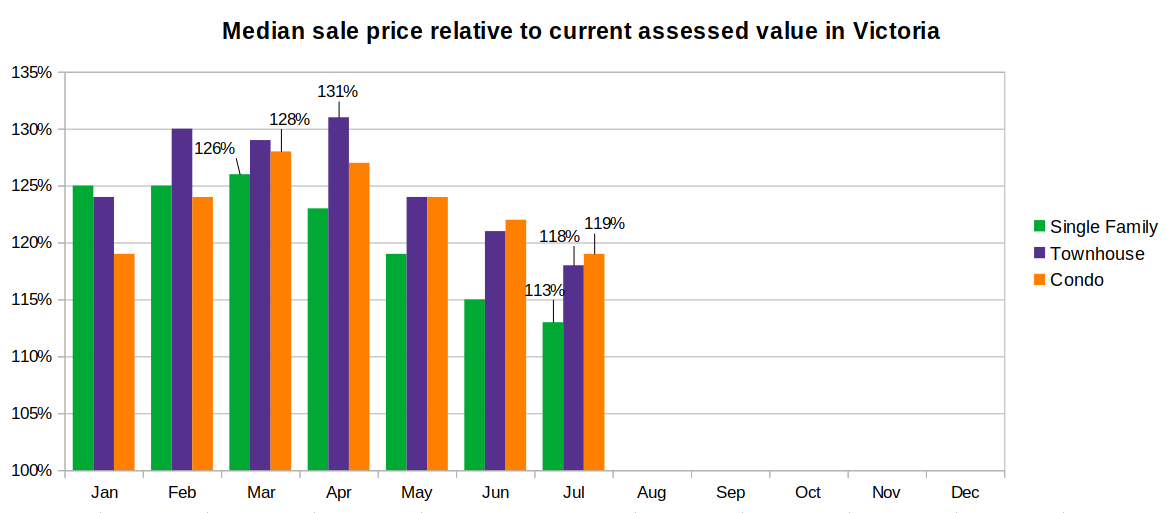

The MLS HPI benchmark prices have finally taken a small dip but continue to be wildly out of whack with the reality of the market. According to the HPI prices are up 8% since February, when in fact they’re down about 10% overall based on the sales to assessed value ratio with substantial variability depending on property type and price. I’m going to guess the board won’t want to mention those HPI numbers when they finally do catch up to median prices. However despite the recent declines and weak prints for median prices in July, I think we are still up year over year in all categories, with condos holding up the best so far.

Will the slide continue? I think yes, but I doubt we will continue seeing the pace of drops we’ve seen so far. The froth has drained from the market and that brought a pretty substantial pullback, but now that it’s gone I think further drops will be harder to come by. Remember that during the early 2010s we had only a slow decline in prices with similarly slow sales but a lot more inventory. It seems that so far regular buyers have pulled back the most, while luxury buyers seem to remain strong and the jury is out on investors. Regular buyers are the bulk of demand and I think affordability needs to return to the market for a true recovery, but that could happen slowly over years. Right now the biggest threat to market stability is a big increase in new listings, whether it’s from investors bailing out or regular buyers that cannot afford the increasing payments from rising rates. I’d say the probability of that is not overly high, but new listing levels are worth watching closely. More on the three buying groups and how we can keep an eye on them next week.

If you’re looking to buy, what would you need to see to believe that sufficient risk has left the market and it’s worth buying in? When do you think that will happen?

Honestly would have likely agreed with you until I tried one.

I’d have a hard time commuting by bike every day from Metchosin and I’m in shape. Electric assist bikes make this a real choice for anyone.

“The bankruptcy statistics show nothing but good news for homeowners in Canada. Since proposals aren’t typically available to homeowners, homeowners would file bankruptcies.

If you look at the stats, you will see than bankruptcies are DOWN in Canada and BC, both for last month, last quarter, and last 12 months.

For example, in BC

– down -10% June vs May 2022

– down -22% June 2022 vs June 2021

– Down -20% Last 12 months vs prior 12 months”

Hi Patrick – insolvencies are my line of work so wanted t to clarify that it would be the opposite – bankruptcies are rarely an option for homeowners. Consumer proposals are more viable but it still comes down to equity.

BC allows applicants to exempt $12,000 of home equity in Vancouver and Victoria, and $9000 in the the rest of the province. If home equity exceeds that allowance, you have to ‘buy it back’ on a 1 to 1 basis. i.e. you have 50k in home equity you must repay 38k over the course of the bankruptcy or consumer proposal due to home equity (50k – 12k exemption). This is before accounting for any other assets. A bankruptcy requires repayment over 9 to 21 months, depending on income and assuming its the first filing. For this reason, people with home equity typically file consumer proposals, because it allows you to spread repayment over up to 5 years in monthly payments.

Bottom line, pretty much no one in BC with even minimal home equity will qualify for a bankruptcy, and those who do would likely prefer a consumer proposal.

The point of living 5 minutes from the grocery store is that you don’t have to buy 30 lbs. of groceries at a time.

New post: https://househuntvictoria.ca/2022/08/08/the-three-horses-of-housing-demand/

Mom used a high tech engineering solution for the groceries. It was called a shopping cart. (someone here will want to know if they are electric assist carts).

By the time a new house is built, the tradespeople’s farts have made it unsaleable. Not to mention the damage to the environment from all that methane gas.

Walking 5 minutes to the grocery store,easy. Walking back carrying 30 lbs. of groceries, something most people couldn’t accomplish.

I was commenting on the Roundhouse Development (I am pro-density) on FB and some woman countered with “do you really think people will walk from Roundhouse to Safe on Foods” and it is literally a 5 minute walk through a park.

🙂

It’s really a qualitative method that ends in a quantative representation. I guess it really depends on the fart itself and whom might of dealt it. It’s really a scale of farts. At one end of the scale, you would have a Winnipeggers fart opposed at the other end of the scale by lets say Gisele.

Bikes are a funny thing in Victoria, picked up my last bike about 12 years ago and rebuilt it about 5 times now. It was just a decent commuter bike for under a thousand. My co-workers are always confused that I ride such a simple bike to work almost every day. A few of them have gone their stages of wanting to start cycling. The first block was they needed the right bike (so a few of them went and bought $7000/$8000 bikes 10 year ago and those got ridden to work maybe 5 to 10 times over the decade. Then ebikes became the answer for them 2 or 3 years ago (the spent $3000 to $6000 on those), but those are now mainly parked next to their bikes they bought a decade ago. They did talk about a lack of bike lanes for a bit, but that’s not a real excuse anymore (wasn’t an excuse before, because greater Victoria has always been pretty easy biking). Oh well, they are all on waitlists for electric cars, however, I do stop myself from pointing out how they waited for their last super environmental show that they care purchase eco-diesels (that turned out well). But they need to stay on the Victoria brand and need to have everything go together with their Patagonia and Arc teryx clothes (that have never seen or climbed a rock face). They do believe they are above being marketed too though, at least they have that, as they enjoy their ethically sourced coffee and read from an Apple product that they upgrade every year.

Most Canadian are fatasses and still drives everywhere including to the parks & GYM, but want to save the planet with bicycle lanes and EVs incentives.

Global Obesity Levels — https://obesity.procon.org/global-obesity-levels/

Out of 191 countries:

1 Nauru 61.0%

12 United States of America 36.2%

26 Canada 29.4%

27 Australia 29.0%

33 United Kingdom 27.8%

87 France 21.6%

185 Japan 4.3%

191 Viet Nam 2.1%

Which Countries Have the Most Cyclists [Top 5] — https://discerningcyclist.com/which-city-has-the-most-cyclists-statistics/

Top 5 countries with most cyclists:

67 Norway 23.1% (60.7% are cyclists)

78 Germany 22.3% (75.8%% are cyclists)

96 Sweden 20.6% (63.7% are cyclists)

99 Netherlands 20.4% (99.1% are cyclists)

109 Denmark 19.7% (80.1% are cyclists)

So slow and boring that people are talking about e bikes

So how about that real estate market?

I can understand electric assist bikes for some seniors with disabilities but for everyone?

Good God we are an obese sedentary society. I feel so sorry for civilians. The last fit society on this continent were 17th century natives. We are a joke.

Do all people actually claim all their rental income to the CRA? Do all waiters and waitress actually claim all their tips as income to the CRA?

Don’t see anything wrong with taking advantage of the life time 100% satisfaction guarantee offered by a retailer in exchange for paying the annual membership fee.

Do people actually do that?

$1300 is pretty good. One of these years I’ll probably pull the trigger; I’m just slow. It also took me a while to come around on battery-powered lawnmowers, but now I’m a complete convert.

Why don’t you just get one from costco? That way you can get consistent upgrades for free every couple of years as the battery degrades.

Most current batteries are not monsters at less than 20 Ah/48V or 36V. And, battery cells inherit voltage drop as power drawn. Therefore it will not assist you as much as you use at critical moment such as uphills and on the way home (on a bike that is 20-30 lbs heavier than a regular bike). Hence it make sense to purchase a battery that give you 25-30% more range/power than you need. And, many controllers give you a choice of settings of assist mode or un assist mode.

2 years ago I built myself a 1000 W Bafang mid drive with 24.5Ah/48V battery on an existing hybrid bike frame, swapped out existing parts with Shimano Deore parts, larger discs, 4-pot hydraulic brakes, drive train, replaced rear and front tires with larger width 28/32mm, new seats and seat post, handle bars, and Shimano clipless pedals that took less than 4 hours and I’m not an engineer, and it cost just over $2200 with no incentives (and yes I have over clocked the motor, but normally I run it in normal mode so that I don’t damage the motor & controller).

As for no frill ebike, this might be your best bet: https://radpowerbikes.ca/collections/electric-bikes/products/radmission-electric-city-bike

Keep a look out on usedvictoria and facebook marketplace. 6 years ago I picked up a Surly big dummy electric cargo bike with Bionx E-assist kit for $1500. Smokin deal given they go for ~$5k new. Battery wasn’t great but did about 15km and then recently I got a newer battery free from a guy that had upgraded his bike which tripled the range.

Yeah, I still can’t stomach the upfront cost of current e-bikes, even after rebates. A much cheaper 20-30 km e-bike would fit my needs really well, as I only travel about 10-15 km a day.

*If you are an engineer, like Leo.

Pretty easy to build yourself: https://ebikes.ca/

I like the idea of subsidizing e-bikes. Significantly cheaper to subsidize. I wish I could get a light electric assist with only 20-30km battery instead of the monsters they currently have.

Leo’s old Nissan Leaf must have missed the memo:

https://twitter.com/LeoSpalteholz/status/1550344008588595200

Some of these threads kill me with laughter. Ummm…..how many $ off purchase price per fart.

That’s why it wasn’t an anology about depreciation. You can only sell something as new once was the point. There is a value to something new from a consumer perspective where all the appliances are still new and the house hasn’t been filled with someone else’s farts for a year. If two houses were built at the same time in the same area with the same features, but one was rented out for a year, I can tell you which one I would make a lower offer on.

Vic- The discussion didn’t mention used cars, we were referring to a new vehicle versus a new home.

Most will be totally fine. As I noted the big players control most of the market and they are all established and have had an insane upswing on the land acquisition which they acquired many years ago.

Small players there will be a few that are overleveraged, and the interest rates start to take a toll. Carrying something at 6% is totally different versus 3%.

Lol Frank, pretty sure before you said the opposite about used car prices…..

Umm- You can’t compare vehicle depreciation with property depreciation , it’s two totally different things. This time next year, rates could go down and demand picks up, and the property could increase $100,000. Vehicles never do that, except for a few exotics. I’m sure most developers are not hurting for cash.

Yes, the headlines are misleading, some might read it as values going down instead of declining number of sales. They’re selling newspapers remember.

Activity change year over year.

Ya, click bait is an art form…

Misleading. They’re talking about decline in activity, not prices, although prices are certainly down. I wonder if the headline writer reads the articles.

This one is interesting…

https://victoria.craigslist.org/apa/d/victoria-bedroom-single-house-next-to/7517904732.html

Not entirely easy to compare given the few days and the reporting moves around every year, but we’re at a normal new listings pace. Last year was just low.

Nitpick: NZ is not a federation. It is relevant, because you have one government responsible for everything, no buck passing.

https://victoria.craigslist.org/search/apa?hasPic=1&min_bedrooms=3&availabilityMode=0&sale_date=all+dates

Seems to be a Monday theme today…..

https://financialpost.com/real-estate/mortgage-demand-slows-refinancings-dry-up

https://financialpost.com/real-estate/mortgages/homebuyers-waiting-for-market-to-hit-bottom

https://financialpost.com/executive/executive-summary/posthaste-toronto-vancouver-housing-markets-face-deepest-decline-in-50-years-says-rbc

Does “seems like someone has a case of the Mondays” fit here?

🙂

Big picture real life I don’t know what you argument is.

You can mortgage the new build (fees $$$) and leave your principal residence clear title or your can leave the new build clear title and pull off your principal residence HELOC (no fees). Yes in theory your principal residence is collateral but if the new build burns down you have insurance on it and even if you didn’t have insurance on it you can sell the charred remains and clear your HELOC and you still have a clear title princial residence.

Yes, if you are mortgaging the new build to the hilt and then maxing out the HELOC on your principal residence different scenario, not the out I outlined below.

What’s the going rate you see? And is this for part of a house or the entire house?

Doesn’t this vary depending on the loan type, lender and the size of the developer in question?

“why wasn’t renting good enough for this entitled “Canadian Karen” and her fiancé ?”

Because they can do better? In the article it mentions they can move to Montreal, be near their family, live in a nicer place in a better neighborhood that gives them a higher standard of living, allows them to build equity and be better off financially as a result.

Or they can spend $600,000 to ride the bus to a starter condo on the edge of town in New Zealand somewhere. Except they can’t because the money they need for a down payment keeps increasing faster than they can save for it.

I was in that situation once too and I moved. No regrets. In fact my only regret was not moving sooner.

If it’s a crisis for anyone it’s a crisis for New Zealand because these are exactly the type of folks you would want as immigrants and it only took them two years to realize they were just wasting their time and weren’t going to be bothered with it anymore.

And I’d love to hear more about their rental market because it sounds like it’s totally bananas: “Ms. Ardern’s government recently approved a rule change allowing renters to hang art in their apartments with nails. Damaging a wall with a nail could previously get a tenant evicted.”

Hahahahaha. WTF. The federal government had to take action so that tenants had the right to hang a picture on the wall without risking eviction? I can see why someone would not want to rent there.

It’s starting to look like more and more stock seems to hanging out for rent on that SFD 3 bdrm+ side of things and few relists at lower prices. So, the the rental return might not be what they are looking for and it still ties up a pile of capital that the developer/builder might need to progress other projects or to pay their trades. As well, from a buyer perspective, if it’s rented out, it’s no longer new. If someone drives a car off the lot and trades it back in a year later, you can’t still sell it as a new car.

I’ve taken out commercial mortgages and they’ve made me collateral my home if things goes sideways. How is the risk with a straight up HELOC higher? You would think it would be lower as the two properties aren’t tied together.

You have effectively put up your own home as collateral.

I remember doing some subtrade work at 8338 West Saanich Road in the mid 90’s, it probably looks a little dated now. Nice view tho.

Oh ok thanks for the insight there, I just know this particular builder advertises themselves as a developer too, hence my assumptions.

Also eliminates a lot of fees/hassle that comes along with financing. Not sure what the risk is. If you own the new build outright and take out financing via HELOC on your paid off principal residence there isn’t a huge overall debt load there.

Does anyone know anything about 8338 West Saanich Road. Anything good or bad? about this listing. Thanks

Pre-sales are pretty standard in hot and cold markets? Gablecraft is advertising houses right now that won’t be finished for 16-18 months, Verity has pre-sales with anticipated completion 2023 -> https://www.realtor.ca/real-estate/24529993/364-tideline-lane-colwood-royal-bay

I have access to all the titles on that street and there is a difference between owner/developer and builder. You can have a builder building 12 houses on the street but they don’t own any of them. If you look at the listings on Delblush you’ll notice every single one has a different agent, that is a solid clue that they are all different owners even if you didn’t have access to the titles like I do.

I assume this references a conversation with an electrician in Vancouver, but haha first read reminded me of that Seinfeld episode…if the van’s a-rocking, don’t come knocking!!

This eliminates a lot of the leverage benefits that RE provides, oh well good on them for taking that risk.

Lowest month on record is August 2010 @ 425, my second month in real estate 🙂

I was thinking we might set a new record low but at 83 + stat I don’t know. If we do 100/week next three weeks and throw in 60 last week (only three business day) we will barely clear 425. We probably end up between 2010 @ 425 and 2012 @ 463.

I doubt anyone thinks they are trying to sell an unfinished house, it was more as to why try to sell when the house is 3/4 finished when they can sell it completed in another month or two. I personally think It’s either cashflow issues or trying to front run the Sep rate hike, I think that builder has close to a dozen houses on the go on that street.

Plus the listing description is pretty cringe worthy.

Different exposure setting on the camera.

What lots thought? GableCraft/Westhills/SouthPoint have the vast majority of the serviced lots and they’ve made insane profits and then had no opportunity to overbuild due to labour shortage that they will all be fine.

Beyond that it is a small street here and there. Delblush, a couple of higher-end streets on Bear Mountain, etc. Combination of insane bureaucracy and labour shortages prevented overdevelopment/overbuilding imo.

I agree that there is no demand for future development and value is cratering, but from unreasonable run-ups. Still higher than 2020 or before for a reasonable development site.

Lots of moving parts here. I financed a property with a rented house with some clause that construction had to start with 12 months and now more than a year beyond that bank hasn’t said anything. I am still renting the house, bank still collecting payments. One real life aspect I’ve noticed is often banks/lenders are severely understaffed and once you are financed and making payments they aren’t really digging too much. If you aren’t making payments different story.

Also, small builders have a lot of different creative financing schemes. For example, not unusual for a small time builder to have 50% cash and the other 50% they obtain from their HELOC on their personal house and you never see a charge against title on the property they are building.

Delblush listing. The builder is not trying to sell an unfinished house, the builder is trying to pre-sale a house (that will be finished by the builder). They priced it aggressively and had an offer delay on it. Last I heard they received multiple offers.

Right now I am actively working with buyers writing offers on the Westshore $1.2-1.5 million. We’ve tried a few 10% below ask on re-sales without success. As for new stock, a lot builders are still swinging for profits they’ve been seeing the last few years in the range of 200 to 300k per house and that just isn’t going to happen. Will probably end up settling out at breakeven to 100k/house.

Despite the softening market the biggest issue from the buyer perspective is the inventory sucks. When you go SFH westshore, newer, not a busy road, few other criteria the list quickly shrinks. Townhomes inventory on the Westshore is starting to build, SFH still not huge imo as is evident in the active inventory numbers. Looks like we’ve plateaued at 2,100 and change.

When government tries to do housing -> https://www.nsnews.com/local-news/affordable-rental-units-for-seniors-sitting-empty-in-north-vancouver-5660841

The government is just idiotic and this is from someone who loves EVs and has been driving one for 7 years. You simply cannot buy the majority of EVs as demand exceeds supply with or WITHOUT the credits. Let’s employ a bunch of government employees to administer a completely useless program the open market can administer for free.

Was 662 Lombard recently sold then renovated and now listed again? It looks very familiar but I think the inside was a lot darker before.

If you are wanting to rent out because you can’t sell for a profit/don’t want to sell for a loss wouldn’t your input credits be high?

The bankruptcy statistics show nothing but good news for homeowners in Canada. Since proposals aren’t typically available to homeowners, homeowners would file bankruptcies.

If you look at the stats, you will see than bankruptcies are DOWN in Canada and BC, both for last month, last quarter, and last 12 months.

For example, in BC

– down -10% June vs May 2022

– down -22% June 2022 vs June 2021

– Down -20% Last 12 months vs prior 12 months

June 2022 https://www.ic.gc.ca/eic/site/bsf-osb.nsf/eng/br04685.html#t2

2Q 2022 https://www.ic.gc.ca/eic/site/bsf-osb.nsf/eng/br04685.html#t2

Crazy stats Leo.

I know it’s only 1 week and 83 sales and the week of a stat holiday, so I shouldn’t draw too much from it. But going from 75% of sales going for over ask in Feb/March to 0% now, pretty wild. Even with the small sample size

Sales: 83 (down 42% from last year)

New listings: 236 (up 11%)

Inventory: 2157 (up 65%)

Leo, how do the first week of August new listings compare to previous years?

Vicreanalyst is correct, if the builder wanted to rent the house out they would have to pay the GST on fair market value.

They would also have to do the same if they wanted to move into it themselves.

So this Canadian couple move to New Zealand, find jobs and a place to rent. But the crisis and catastrophe prompting the article is that they couldn’t afford a place to BUY? So they move back to Montreal because of this catastrophe?

I guess I’m missing what the catastrophe is. Immigrants aren’t expected to be homeowners right away.

About 35% people in NZ rent homes, why wasn’t renting good enough for this entitled “Canadian Karen” and her fiancé ?

—The BC government gives EV credits as an incentive to people buying low priced EV.

—They should also give “affordable housing” tax credits to landlords that rent homes out at affordable rents to renters with low incomes.

—A big cause of homelessness is people unable to find affordable homes to rent.

—We need more investors buying these affordable homes (e.g. small studio/1 bdr condo) and renting them out.

—When these low-priced units get gentrified/owned, there are less affordable rents, leading to homelessness in some cases.

It isn’t a housing crisis if someone can’t afford to buy a home… 35% of people have been renting, and that’s been stable.

It is a housing crisis if someone can’t afford to rent a home, because they’re at risk of homelessness or being forced to move away.

https://www.theglobeandmail.com/business/commentary/article-insolvencies-exposing-cracks-in-the-economy/

Monday numbers:

Sales: 83 (down 42% from last year)

New listings: 236 (up 11%)

Inventory: 2157 (up 65%)

Looks like the buyers went on vacation. No over ask sales on record since the 1st

Yep. We’re well on our way there. Highest rates of homelesses there too as a direct consequence.

New Zealand banned foreign buyers, cracked down on investors, and recently upzoned though I’m not sure if that’s fully in effect. It all hinges on whether the latter is actually effective and they can relieve the critical shortage.

about 6 years ago a developer in Ucluelet had to fire sale serviced lots to cover a delinquent tax bill. People were able to pick these large lots for around 60-80k. fast forward to last year and they were selling at 500k+ if you were able to find one. I will be keeping my eyes peeled for this type of opportunity to happen again. Bonus is vacant lots don’t have crazy property taxes to deal with when sitting on them.

That’s a perma bear case which I don’t think are in the cards currently. Possible yes but not likely. Don’t be a perma bear, be flexible and open minded and take action when they make fundamental sense.

Lol thank you, seems so odd that a long time multi property “investor” does not understand these basic RE concepts….

I believe there are also GST implications with renting it out and then reselling

Developer financing does not allow for this, they would have to get new financing as an investor. And if the numbers worked for a rental prices wouldn’t be going down in the first place. Better to get out while they are ahead.

Why is the developer panicking? Finish the house then rent it out. Wait for the market to improve, then sell it. People would be lined up to rent it. The renters could buy it when rates improve. Lots of options.

Indeed it will. So why sell now? The answer is self-evident.

What usually happens when those numbers look that good? (hint: recession)

Why not both?

Geez, $1.2 mil, who wants to take the risk on the appraisal coming in on the financing in another couple months down the road on that when occupancy is granted and delivery can occur.

And yes, the appraisal problem has now worked it’s way all the way from Ontario to BC now on those long closes.

https://vancouversun.com/business/real-estate/delay-in-appraisal-snags-apartment-purchase-for-first-time-buyer-as-real-estate-market-declines/wcm/65d9cac8-2b67-409b-a0b4-cc82ecd0480b/amp/

But hey, I guess if you can’t afford it in the end, you can always rent it out; those insane rents we keep hearing about, those can never go away, right?

May have ran into cashflow issues and needs a quick injection? From the listing it looks like the builder is http://scagliatihomes.com/

It reads like this:

PLEASE PLEASE PLEASE Be the one who seizes the opportunity to own on this exclusive quiet street before anyone else. WE’RE DESPERATE!

This listing just reeks desperation.

Because interest rates went up duh!

Lol, I see a westshore developer trying to unload an unfinished house currently.

https://www.realtor.ca/real-estate/24708451/3575-delblush-lane-langford-olympic-view

lmao reminds me of a used car ad: “This deal is only available during the course of construction and once completed the home will priced at market value, all colors and appliances have already been selected and a list can be provided to any and all offers. Be the one who seizes the opportunity to own on this exclusive quiet street before anyone else.”

Last one holding the bag of nails turn off the lights I would think if your listing right now it’s not fun For now it’s van and t.o that are getting crushed

But but but… I keep hearing that housing is expensive because land costs are high. How can land costs go down? They’re not making more of it. [/s]

no way, I thought I was the only one with “insider contacts” here!

“My insider contacts tell me some of the ones here are in panic mode. Rushing to finish half a dozen projects to unload, right in time for the next rate hike.”

I’ve heard similar. No demand and a lot of the land being held onto for future development is cratering in value. It’s going to get bloody out there. Some small time builders speculated hard on lots.

My insider contacts tell me some of the ones here are in panic mode. Rushing to finish half a dozen projects to unload, right in time for the next rate hike.

Lol quit reiterating my content from 2 months ago!!

Like what Leo and Marko have said though, inventory will be key.

Thanks for the numbers Patrick. Not sure what to make of the numbers but interesting nevertheless.

OK, that number is also at or near record highs. Actually employed in core age = 82.3%.

87.2% Participation rate = (82.3% actually employed) + (4.9% unemployed looking for work )

Since participation rate is at/near record high, and unemployment is at record low, that means “actually employed” is at/near record high.

That means out of 100 people age 25-54:

— 83 are working now,

—- 4 are unemployed. (Looking for work)

—- 13 are not in work force (retired, disabled, homemakers, students, traveling, living in Burnaby trees protesting the TMX pipeline etc.)

Those numbers look like “good news” to me.

Since we are talking about separate topics of immigration and people working (employment), it is interesting to look at a data point that covers both of those.

——

https://www150.statcan.gc.ca/n1/daily-quotidien/220805/dq220805a-eng.htm

“Overall participation rate for core age (25-54) in work force is 87.2%. Among core-aged men, the participation rate ranged from 81.0% for First Nations men living off-reserve to 94.5% for South Asian men and 95.5% for Filipino men”

——

So we see that the HIGHEST rates of participation (95.5%) are among working age India/Filipino men, among the largest source of immigrants for Canada. These immigrants/ethnic groups are doing exactly what we want them to do, namely working and contributing to our economy. And they are doing so at rates HIGHER than Canadians overall (87.2%)

Some crazy shit here.

New Zealand shows how a housing crisis can become a catastrophe

https://docdro.id/sY8T1D4

https://www.theglobeandmail.com/opinion/article-new-zealand-housing-crisis/

Patrick: Actually, I should have been clearer and specifically asked what is the percentage of core age working people who are actually employed (ie not including those looking for work).

Appreciate all the other number but really wonder why they would be looking at employment rates for older children and including retired people but that is the way stats seem to be presented.

Had a chinwag with a sparky in van and he was saying that the spec builders have put down they’re hammers and he’s expecting it will get much slower in the fall I would think that this is expected

-Canada population age 15+ = 31.8 million (includes older retired people)

—-Labour force 20.6m. (Consists of employed + unemployed )

—-Employed 19.6m

—-Unemployed 1.0 m.

—-(So Unemployment rate = 4.9% = 1.0/20.6)

Employed as % of age 15+ population = 19.6m/31.8 = 61.6%.

So the answer to your question (rate of people actually working) is 61.6% for all ages 15+

The Participation rate of People age 65+ is <10%, because they are mostly retired. Since the population is aging, the overall percent of population working would fall if we count all age groups.

That’s why StatCan focuses on the “core working age” of 25-54, so the numbers aren’t just counting increasing numbers of older retired people.

I don’t think it makes sense to count children or retired people in workforce participation numbers.

When we look at the “core working age” of 25-54 we see that participation rate (end employment rate) are at or near record high (87%+)s.

Which should dispel any false beliefs that core working age Canadians(25-54) are lazy and not working or even looking for work

I’m assuming that was what “Mt Tolmie Foothills” ie was concerned about when he said “ Having many people not working and not even looking for work is not good for the economy.”

That’s the thing, interest rates are going to keep rising. BoC is being forced into a defend the currency mode and housing costs and a recession are now secondary to that. Since the Cdn dollar isn’t a global reserve currency, raising interest rates is one of the few mechanisms they have to defend our currency value. A part of the US strategy to fight inflation is just to allow the US dollar to inflate in value (making all their imports cheaper). The moves by the US have already caused turmoil in vulnerable countries and since goods globally are priced in US dollars……. It’s strength is weakening other currencies and wealth external to the US (all politics is local and US policy makers understand everything outside the US is irrelevant in reference to their domestic opinion). So, a part of Canada’s battle against inflation is a battle to retain and protect our currency value against the US dollar, so that we can still buy stuff at a competitive rate to the US dollar. You are going to see disruptions and a fair amount of economic chaos because of the US dollar gaining value. Of course, you will also see a consistent interest rate growth environment continuing in Canada as long as this goes on.

Pre covid prices unlikely to happen without further aggressive rate increases in 2023 or recession affecting people who are actually candidates to be buyers (not waitresses or hotel maids).

Not to nitpick but what is the rate of people actually working (ie excluding those looking for work).

Not quite ready to give back the all the pandemic gains, but almost now…. You might get there soon.

I predict we will go back to late 2020 prices by late November should we get a 75bps hike followed by a 50bps hike.

From: https://www.bloomberg.com/news/features/2022-08-03/china-real-estate-market-crisis-protests-may-spur-multi-billion-dollar-rescue

Wow, 100s of thousands looking not to pay their mortgages and starting to protest. Impact a person’s human rights, people can look past that, but hit them in the pocket book and they will look for change every time.

Just looking at this age group ignores the decline in total adult labour participation due to retiring boomers.

So we have record high workforce participation and record low unemployment? And I assume there will be more people retiring in the next few years than entering the work force? Sounds interesting!

Well there’s no need to worry about that in Canada . Because the labour force participation rate is actually near all time high (core age 25-54) . It reached all time high of 88.6% in March 2022, and now it’s down a little to 87.9%.

https://www150.statcan.gc.ca/n1/daily-quotidien/220805/dq220805a-eng.htm

“ The labour force participation rate, especially for those aged 25 to 54, is an overall measure of the extent to which Canadians are either employed or looking for work, rather than pursuing other interests or responsibilities.

• In July 2019, the core-age labour force participation rate was 87.2%.

• After falling in the first months of the pandemic, the rate reached a record high of 88.6% in March 2022

• In July 2022, the core-age labour force participation rate was 87.9%.”

Oh, that’s not a good strategy. Having many people not working and not even looking for work is not good for the economy.

I’d expect that the OECD, like most economists, pays more attention to the unemployment rate (which is unchanged, and still at record low 4.9%).

Things are changing rapidly with Sep 7 looming. Most people in Victoria have finally clued in about the sluggishness in RE now.

As LeoS has pointed out, the high end is holding up and was in fact up a little.

——

“ LeoS: (July 25)The luxury market has held up very well. Keeping in mind low sales numbers, recent higher end sales are actually going for a bit more relative to their assessed value than they were in the spring. It makes some sense given those buyers are less sensitive to interest rate hikes, but it will be very interesting to review the second quarter buyer origin data to see if out of town buyers remain elevated..” https://househuntvictoria.ca/2022/07/25/whats-holding-up-the-best/

——-

I would use YOY (12 month) price changes before concluding much. As you know, we are still up 10%+ YOY.

Moreover, affordability has worsened despite price drops for many people, which is an indication of people willing and able to throw more money at housing, not less

The OECD might need to update their projections again:

Canada lost 31,000 jobs last month, the second straight monthly decline

Where are they now?? If 1.3M was such a good deal surely 1.1 or 1.0 is much better no?

Here’s a simple explanation for the real boogeymen driving the huge run up in Victoria core SFH prices … rich ROCers gentrifying Victoria

How many rich families need to arrive each year in Victoria to consume the entire added supply of new core SFH here? A tiny number will do it. If only the richest 3% of the 2800 new households (net) arriving to Greater Victoria each year buy a core SFH, that’s 84 SFH. And that’s more than the tiny new net supply (78) of SFH in Core Victoria each year. Which then leaves 2716 added Greater Victoria households looking for housing with the the same number of core SFH as the previous year.

Most of the 6,000 people (2,800 households, net) that arrive in greater Victoria each year would prefer to live in “core” Victoria (defined here as COV+Saanich+OakBay).

How many net SFH are added to core Victoria each year? The 2016 and 2021 census show that:

28 SFH added per year in City of Victoria (2016: SFH=6,545 2021: SFH=6,685)

47 SFH added per year in Saanich (2016: SFH=22145, 2021:SFH=22,380)

3 SFH added per year in Oak Bay (2016:SFH=4900, 2021:SFH=4915)

Total = 78 SFH added in core Victoria per year.

So if the richest 3% of the 2,800 net new households arriving per year to Greater Victoria buy SFH in core Victoria that’s 84 SFH, which is more than the net supply (78) of SFH

Sources:

2016 census : https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CMACA&Code1=935&Geo2=CSD&Code2=5917034&SearchText=Victoria&SearchType=Begins&SearchPR=01&B1=All&TABID=1&type=0

2021 census: https://www12.statcan.gc.ca/census-recensement/2021/dp-pd/prof/details/page.cfm?Lang=E&SearchText=Victoria&DGUIDlist=2021S0503935,2021A00055917034&GENDERlist=1&STATISTIClist=1&HEADERlist=0

Victoria’s missing-middle housing hearing adjourned to Sept. 1; passionate pleas from both sides

https://www.timescolonist.com/local-news/victorias-missing-middle-housing-hearing-adjourned-to-sept-1-passionate-pleas-from-both-sides-5666490

Yes, and when we do that, we see that net foreign migration numbers and projections are at record highs, and growing. Representing record new demand for shelter to house them.

— These are new permanent resident (ie new immigrant) totals. (projections )These numbers will require new shelter. https://www.canada.ca/en/immigration-refugees-citizenship/news/notices/supplementary-immigration-levels-2022-2024.html

2022: 432k

2023: 447k

2024: 451k

—- Temporary foreign workers aren’t counted. They aren’t immigrants. The temp workers numbers are fairly steady (about 80k per year in Canada at one time https://www.statista.com/statistics/555021/tfwp-work-permit-holders-canada-2000-2014/) . Because temp worker numbers don’t change much year to year, they do not represent new net demand for shelter. New temp workers come, but about the same numbers leave or become permanent residents (immigrants).

—- Canada adds an additional about 100K people per year from births (400k) minus deaths (300k) https://statisticstimes.com/demographics/country/canada-demographics.php

— So to get to population growth, you can add the immigration numbers + (births minus deaths) to get to about 550k population growth expected in Canada per year.

—- Victoria is 1% of Canada, so our share of that would be about 5,500 per year (though most of Victoria growth comes from ROC moving here, not immigration).

—- Victoria’s actual population growth over the last 5 years has been 6,000 people per year https://www12.statcan.gc.ca/census-recensement/2021/dp-pd/prof/details/page.cfm?Lang=E&SearchText=Victoria&DGUIDlist=2021A00055917015,2021S0503935&GENDERlist=1&STATISTIClist=1&HEADERlist=0

Most of these people were already living in Canada, in fact existing residents comprised the highest proportion ever of new permanent residents. When someone is granted permanent resident status, they get counted as an immigrant. At the same time, net foreign migration was at a low point.

If you are looking at shelter demand you should look at net foreign migration.

Not too late for you to offer that 1.5M for the house in ascot then LMAO.

Can’t you see by now, everything is peaking or has peaked and there is only one way things will go for the next little while until another catalyst comes along.

On BNN- 2.6 million new immigrant applications are waiting to be processed. Looks like we’ll have no problem reaching our targets.

The 400k immigrants per year doesn’t include the thousands of Ukrainian war refugees. Thousands have come to Manitoba alone in the last few months and “they” are shocked there is a shortage of affordable housing for them. Wait til war breaks out over Taiwan. Putin and Xi are taking advantage of the weakest President in U.S. history.

Mean age of first child for women is 29.2 in Canada and 30.4 in BC. Average difference in age between spouses in Canada is 1.4 years.

https://www150.statcan.gc.ca/n1/pub/11-627-m/11-627-m2020071-eng.htm

https://vancouversun.com/news/staff-blogs/couples-age-gaps-dropping

Oh okay. I was pretty sure that 400k is what the Trudeau govt is aiming for, but I can’t actually listen to him speak.

I was using statistical averages for Canada for the last 10 years. I think that 405 k may have been pandemic related backlog so I was trying not to be be overly aggressive

I think we had 405k immigrants last year.

hahaha I don’t think you’re in any danger.

lol I guess I meant that people aren’t even considering having kids until their 40s now. Maybe not prime as far as plumbing is concerned but people are still walking around in logo t-shirts and ball hats with video game characters on them in their late 30s The average age of first time mothers in Canada is over 31 years old. typically there is a relationship age gap with men being older probably in the range of 36. In times of uncertainty people hold off so we could very well be looking at that average age creep up at least for the next few years. Im going to shut up before I become the next Frank around here

I believe the technical or medical term for pregnancy for ages 35 and over is “geriatric pregnancy”.

And you think this will just continue into perpetuity?

This is assuming up and down suite rented separately (3 bedrooms each looking at the description).

Never heard of 41 being considered a prime baby making age before!

TIL I’m severely under-pricing my rental.

That only applies to infrastructure projects, not housing. This is public knowledge, but I guess it’s more fun to believe something that suits your prejudices.

well in Canada 330,000 new people per year of which 240,000 is immigration and a fertility rate of 1.53 is negative but a median age of 41 (prime baby making age) is not nothing and they still need to go somewhere. This isn’t me trying o justify prices BTW its about need for density. That is a fair sized towns worth of housing added every year that is required to just remain in a supply constrained environment. According to stats Can Canada has the fastest growing population in the G7

That is barely true at the moment, out of the 7 continents only 2 are above replacement level fertility (2.2), and Oceania just barely (2.3). Without Africa, world population would be on it’s way to decreasing.

5500-6000 I think. Sub 5% cap rate, no thanks.

It’s not an obsession with growth it’s trying to find a path to dealing with inevitable growth. The global population continues to grow and people need to go somewhere. The environment suffers more from urban sprawl than compact development. Multifamily is more energy efficient uses less materials per sq ft of living space requires less infrastructure and reduces car dependence. The density that has been opposed in Ucluelet most recently was an affordable housing rental apartment. Not a lot of profit in that.

So if someone wants to deconstruct a concrete building/structure in COV, it needs to be done by hand?

Simple with great charts/graphics as usual. Hard to argue with or misinterpret or attribute to some special interest group. As a Councillor I would be taking note.

Nailed it. Not to mention the “affordable” housing will have to be aesthetically pleasing so the government will let the architects run wild with expensive to build ideas, etc.

COV policy that will spread. You can solve politics but they won’t be able to solve bureaucracy when it comes to building and it the government is building it will be chaos on that front.

I see, so when someone needs to see a medical specialist, it is all taken care of on Salt Spring, right?

If you have issues with population growth you need to take it to the federal level, not municipal/provincial.

I have not issues lowering immigration levels as long as everyone promises not to complain about a lower standard of living as a result.

The problem is obsession with growth and profiting from it despite the cost to communities and the environment. Growth has to be capped or it runs rampant. Saltspring Island remains beautiful because of many fights won by the Islands Trust who caps the population. The quality of life remains very high and people have jobs. You can’t just let development run over everything. You set boundaries.

That maplewood home is nice. What would gross rent for a tenanted house like that be?

Nailed so many good points in just a few minutes. Great job and thank you for fighting the good fight!

If you ever feel like adding more stress and earning less money you should consider running for council .

Saanich (or Victoria) would be lucky to have you.

Isn’t the whole point of government to spend tax payer money so they can get re-elected?

Don’t forget, to use all unionized employees and those other employee type regulations they brought in for any government funded building projects over the last few years….What was the old line.. How do you build a casino that loses money? Have the government do it!

And of course be affordable.

Why hand deconstruction? Affordability would be completely at the government’s control, its tax payers money….. Anyways this is just my speculation, we’ll find out soon enough as I suspect Eby will want to get something big underway and break ground prior to the election.

Ouch….. could have got this here if financing costs are a non issue.

https://www.realtor.ca/real-estate/24711207/3305-maplewood-rd-saanich-cedar-hill

And this massive number of new builds will all be hand deconstruction, step 5 energy use, not block any neighbours sunlight etc.

And of course be affordable.

Don’t know, but you have to think if uvic can figure out how to building student housing then one would have to assume the provincial government are capable of building some cookie cutter apartments and townhouses. Or at the very least just pay the Jawls to build it or something.

A house in Oaklands that sold for 1.4 million this spring (2750 Belmont) has been put up for rent. The main suite was originally listed for $4500 a month (!!!) but has been dropped to $3900 now. Just wow.

https://victoria.craigslist.org/apa/d/victoria-oaklands-home-available/7517222925.html

Edit: forgot the link.

Based on the bridge, mckenzie interchange and everything else somehow I am not too worried about the government flooding the market with housing inventory.

Big wild card is what Eby will do, could be a game changer if they want to throw in billions to build apartments and townhouses. They can build at scale which the private sector cannot due to cheap financing and no return hurdles.

In the moment, yes, however, inflation is a productivity killer and Canada has yet to see that full impact yet. This tends to lead delays in investments by businesses, idling projects to mitigate potential risks and pausing new hires or adjusting staffing levels downwards. Chances are that Canadian GDP is just lagging the US by a few months if that. The problem for policy makers is that they have already fired the stimulus canon too hard and now have limited resources to it again, and if they do, it just compounds the problem on the inflation side.

I don’t disagree short term (1-3 yrs) but I buy things long term (20-25 yrs).

I personally think inflation/interest rates will mask fundamental problems with have with housing for a couple of years and then we will be back to square one chaos.

I actually think rents are in the peaking phase during this cycle just like house prices earlier in the year.

Yes, that’s true. But that’s why I quoted GDP growth, which doesn’t give a “false perception of economic performance“.

For Canada in 2022, 4% real GDP growth, 10% nominal GDP growth – great for home prices!

More complicated than even that. COV wants them to remove the tracks. Remediate the soil. Put the tracks back into position. Wouldn’t be surprised if I was in my 70s by time Roundhouse is completed.

Not to mention CURRENT government voting doing purpose built rentals.

As I said at some point you just give up and play the game. I have 3 condos in Vic West, bought a 4th rental one from Bosa that completes early next year. The rents are crazy and long term will just get crazier. I’ll have to compete against the Roundhouse rental towers in about 20 yrs that way things are going.

Be careful using that as an indicator, it can give a false perception of economic performance. The question with that one is low unemployment numbers coming from new job creation or has come from people leaving the work force? It’s a funny scenario when it ends up being more people leaving the force then there are job losses. Even though unemployment still shrinks, it’s a big sign of a shrinking economy and less productivity. It tends to catch people that think they have time and space to pick the best job for themselves because unemployment is low and they previously had a lot of offers. However, it can turn quickly, and cause an unemployment shock, when those that left employment suddenly flood back into the job market and the unemployment rate spikes.

Re: the Youtube video. I really liked the discussion about the need for purpose built rentals. I have 2 rental units. One of them became available about a month ago (tenants moved to a bigger place). I listed the unit, which is updated and very nice but only ~700 square feet, no balcony (but very nice windows) and no proper bedroom (it’s an open loft). Within an hour I had so many replies that I had to take the ad down. Many of the people that replied were forced to move because landlord sold the property. Often these people then are looking at massive rent increases in addition to having to find a new place. Mom and pop landlords (such as myself) should not be such a significant source of rentals for the city. This kind of rental is naturally more precarious. We ended up renting to a nice younger couple who were 3 weeks away from being homeless. There were so many like them. There’s nothing wrong with this people – they work hard and just need a place to call home. They have excellent references and pay their rent on time. It’s just there’s not enough rentals. It’s a real shame that successive governments have failed to see this coming (and/or failed to act) and now we are in this situation.

I don’t think I am able to explain what I mean well enough to get into a debate about it because the replies are missing the mark. Thats a me problem. Leo has explained it better and I agree with his assessment.

That Bayview project is going to be forever, Markos timeframe is reasonable. The ground is so polluted the excavation costs on one of the potential buildings was over $30m to ship it down to the USA. No dump site would take it in BC. The only option they have is to leave the polluted soil on site, which has its own problems.

This is awesome Leo.

My insider contacts tells me that eby is ready to go in heavy on missing middle housing.

100% completely useless. I can usually disect the reason for a high/low assessment on an individual property within 60 seconds.

For example, one of my listings sold earlier this week for 865k (assessment over one million). Super simpke disect. 13,000 sq/ft lot in the core, but only 5,000 sq/ft actually usable due to terrain. BC Assessments running the numbers like it is an average 13,000 sq/ft lot which would be way more usable on average.

That is an insane amount of well thought out information presented in 4.5 min. Wow!!!

Unfortunately as I’ve found on YouTube/HHV/Reddit/Facebook over the years you can present some very logical arguments, some people will listen/follow for years, and literally absorb nothing. At some point you just have to give up and put yourself in the best possible position.

Super simple explanation. Other than Delta Hotel + Boom and Batten restaurant it is all residential and traffic is caused by commercial not residential. Also a lot of the working people in Songhees walk downtown to work.

In my opinion the area is amazing. For example, my friend and I walk along the ocean to play tennis on free tennis courts (recently repaved) in a park that overlooks the ocean. 98% of the time we show up and one of the courts is free.

Why are we depriving people from living in such a nice spot over non-sense concerns babyboomers and elderly have. If they were legit concerns sure but “I don’t want anything to change, since I moved into my brand new songhees condo” is not a valid concern.

Secondly where do boomers thinking people servicing their needs are going to live?

From: https://cottagelife.com/realestate/rbc-forecasts-historic-housing-market-correction-including-cottages/

LoL… The RBC report has made it all the way to cottage life. I believe that gives it official full media saturation.

Leo I shared your YouTube video on the Ucluelet Community Board. We have been struggling with affordable housing for a decade. We have some community resistance to density but generally everyone recognizes we have a problem. Im hoping your talk gets people thinking. Thanks

OK, if you don’t want to manually measure assessment accuracy for a sample of sales June 15- July 15 2021, I’m happy to do that. Are you able to post a message with 30 or so addresses & sales price that sold in that time range, and I’ll calculate the sales over assessment. Or point me to a site that list sales addresses/prices from June/July 2021.

We expect that it will be close to sales price being 0% over assessment – if it isn’t maybe I’ll measure a bigger sample. It takes a few seconds using bcassessment.ca to pull an assessment number.

No, because you stated in your previous message that 119% over assessment means you “ could reasonably get 119% over that assessment in the market today”. So yes, the accuracy is highly relevant if you want to use it like that.

Any individual assessment is not particularly accurate, but I’ve convinced myself from checking the data in various market conditions that overall with enough sales the median sales/assessed value ratio is pretty solid as an indicator of price change.

Nothing is perfect I would look at median prices and the sales/assessment ratio to judge where the market is going

I think its somewhat safe to assume the accuracy is irrelevant if it is is equally accurate or inaccurate for all properties. It establishes a benchmark for each individual property based on the same criteria. From there the average sales over or under assessment give the picture of the current market assessment of properties relative to BC assessment.

My comment at the public hearing https://youtu.be/KzWEVqcFU_I

“Super vague concerns like too much density even thought Songhees is a ghost town walking around.”

I’m always intrigued by the fact that Songhees is so quiet, despite having such a concentration of units. Any thoughts on why?

I think sales over assessment is useful for more than that… as a measure of current price trends. As LeoS charts of sales over assessment has shown us, it is a near real time track of prices. The other price change metrics (average, median) can be dismissed due to changing mix of sales, and benchmark doesn’t track all property types.

To me…. If median or average price falls 2% in a month, maybe that’s noise due to a change of mix in sales . If price to assessment falls 2%, it likely means prices fell.

To illustrate this, does anyone doubt that home prices are down about 10% from peak, after looking at leoS sales price to assessment chart ?

Sales over assessment is analogous to the CPI measurement of price inflation. No one would care about “median” or “average” prices … they want to compare the prices to where they were last year for the same item.

That conclusion assumes that assessments are a reasonably accurate estimate of sales price at the time of assessment. I expect they are, but it would be nice to see data indicating how close they are. We’d feel silly using this benchmark if it turns out that assessments don’t match sales prices at time of assessment, and chronically under/over value. Since that would invalidate the method you describe above, as you wouldn’t be reasonably expected to to get 19% over assessment. One would hope that the BC assessment board tracks the sales over assessment metric too, and they aren’t pumping out assessment numbers that aren’t on average close to sales prices on July 1.

I have only ever seen the sales to assessment as sort of a site specific benchmark to be able to look at my assessment and know on average I could reasonably get 119% over that assessment in the market today or whatever the current average ratio is. Just another analysis tool. Also handy to know when making offers to know if the seller is out to lunch or in line with the market

Last night there was an “open house” for the Roundhouse proposed rezoning and average age was older than my parents for sure who are in their mid 60s so I would say 70. The first three Bayview buildings took 17 yrs to build so I estimate Roundhouse is a 20 to 25 yr project.

So half the people concerned will be dead by the time it is finished. Pretty much everyone in my building (a 3 year old building) is against it. Super vague concerns like too much density even thought Songhees is a ghost town walking around.

You can’t argue with people with logic like hey I see you walking your dog all the time please explain to me your concern with density because I walk they same path(s) and we both know there is no one in sight.

Although assessments aren’t appraisals, most everyone uses them like that, and I haven’t seen any samples of sales price data at time of assessment that actually compares sales price to current assessment. So that would be a first, unless you know of some existing data where that was done

Maybe you could manually measure a random sample of sales prices over July 2021 assessment from one month – (June 15 to July 15, 2021)

The point of this would be to estimate how close prices are to the July 2021 assessment. If you found prices to be 2% over assessment, that would indicate that the assessments are quite similar to prices. But , if you found sales to be 7% over assessment at that sample, then it would change the interpretation of the rest of the values. For example the 125% in Jan 2022 would only reflect a 18% rise, and the current 113% would mean prices have risen only 6% since July 2021.

As it stands, I’ve seen HHVers here interpret sales over assessment of 125% to mean that prices have risen 25% since July 2021 assessments. But there’s no solid basis to that claim unless the assessments were actually close to sales prices in July 2021

Hopefully you’d find that July 1, 2021 sale prices were quite close to July 1, 2021 assessment values. And you’d never have to measure that again,

@Leo:

I’ll agree with you there Leo, for clarity I meant 0.75%, or 3 standard rate hikes. I must have mixed up the terminology in my post below. You can see from the approximate mortgage rates I quote, I was clearly suggesting a 0.75% increase in interest rates, which would leave us at 3.25%. That seems to be where most analysts think we will be in September.

@SalmonHunter:

In fact I know plenty of people buying and investing in RE. I know their sentiments.

The idea that sellers can simply will the price of their properties higher by not selling is silly. The market sets prices, not the handful of investors you happen to know. Sure, some people you know will try to ride it out. (They are obviously hoping the market doesn’t tank and then ride flat for 15 years like it did in Ontario in the 90s.)

Rather than polling a handful of locals, what I pay attention to is supply and demand. Current prices are predicted not by what a seller wishes he could get, but by how much buyers are willing to pay in a supply-restricted marketplace.

As interest rates continue to rise, prices will fall. That is a given. What is unclear is how much. I’m increasingly starting to expect bigger drops than I would have even 3 months ago.

And unless you are convinced the BOC will drop rates back to zero in a year after they trigger a big recession (unlikely because inflation will probably be above target until 2024), I think you’ll find that speculators, including both foreign and domestic investors, will be keeping their pockets tight in a falling market.

And don’t pretend that regular Canadians are going to lap up the homes when they can’t qualify for mortgages at steeper rates and with disappearing real disposable incomes.

Buyers are on the run and will continue to be for a while.

I’ve never sold a property with a tenant, I’ve waited for them to vacate first. As seems apparent, tenanted properties are less desirable, especially if the rent is under market.

…..

That being said, what percentage of current listings are tenanted? Maybe that’s why sales are lagging, buyers don’t want to deal with tenants and their leases.

Gee Frank, a multiple landlord and you don’t know this? The answer is that leases continue regardless of listing or sale. The new owner assumes any existing rental agreement, and that includes month to month rental as well. The new owner does have the right to terminate a month to month for personal occupancy, same as the previous owner.

Ok got it, thanks Leo.

Technically yes but practically no, because the sales from July to Dec 2021 would include the previous year’s assessment (July 2020) in the data so I’d have to manually look up their new assessments which isn’t practical

But aren’t the Jan 2022 assessments based on the June 2021 sales? So can’t you plot July 2021 and onward sales against the Jan 2022 assessments?

Or am I missing something?

Missing middle hearing was off the hook. Decision punted until Sept 1

The assessments come out in January so sales in 2021 would be relative to their July 2020 assessments. So it kinda resets every calendar year as the baseline changes. Unfortunately I can’t easily get the new assessments for the older sales

Agree. I dont know any investor that would want existing tenants vs vacant in a new purchase. Stuck with under market rent is probably why they are selling anyway.

Leo, given the assessments are based on June 2021 comparable sales values could you extend back the sale to assessed graph back to July 2021? Or perhaps plot a line graph starting at 100 for June 2021?

Iwould be interesting to see that trend.

Or instant under market rent…..

Where do the tenants go if the property sells? When the property is listed, does that void any lease agreement? Can the tenants find another place to live, leaving the property vacant. Not that there’s a problem finding a new tenant. How many investors are buying tenanted properties, giving them instant revenue? Sounds to me that this practice is hard on tenants, doesn’t give them much time to find another place.

Exactly this, for the most part currently tenanted. Throw in the occassional owner-occupier moves out, unit is vacant, and then it is added to rental pool but for the most part these listing cancellations are on already tenanted properties.

That’s an older OECD estimate of Canadian Economy from last year (2021). Lots has changed in the global economy since then (e.g, inflation).

OECD have an update with current GDP data (June 2022) and GDP projection for 2022:

— Canada is well above G20 average. For Q1 (see chart). USA is dead last and negative growth (now in recession)

—- Canada Real GDP is projected to grow by 3.8% in 2022 and 2.6% in 2023“ https://www.oecd.org/economy/canada-economic-snapshot/

I’m sure you’re also aware that Canada is currently at record low unemployment. (4.9%)

That adds up to “good economy” for me.

The Bank of Canada goes further and calls it “overheated” …

BOC (July 2022). “ the Canadian economy is overheated. There are shortages of workers and of many goods and services. Demand needs to slow so supply can catch up and price pressures ease.”

Or As TimBuk 3 might describe the Canadian Economy: “Things are going great, and they’re only getting better. Doing alright, getting good grades. The future’s so bright, gotta wear shades”

Next msg

Not everyone thinks the economy is good.

https://bcbc.com/insights-and-opinions/oecd-predicts-canada-will-be-the-worst-performing-advanced-economy-over-the-next-decade-and-the-three-decades-after-that

“The Stagnating Economy of Canada” https://youtu.be/GtksJpfoM_g

Oops forgot about the bought in 2017 and most likely down by early 2019 one. Should have specified that to certain periods in 2017 for certain products. That was another bad take on my part.

I was speaking more generally to sellers that may fall into Marko’s example and not his specific clients per se. It would be interesting if the example/scenario has potential to have any scale in the market if more find themselves in the situation.

These continuous bull/bear debates are just pointless circle jerks, just state your position and why then wait and see if you are right or not. At that time either gloat or own up to your bad call.

my correct calls:

– Market is in decline as rising mortgage rates trumps all that immigration and foreigner boogeyman crap.

-Victoria folks are slow in this correction compared to TO and Vancouver

-BoC cares about oil prices in relation to CAD/USD when making interest rate decisions

-Frank has zero clue on what’s going on in the market (see Ascot house lmao)

-100 bps hike in July

my Incorrect calls:

-uptick in deals falling apart

To be determined:

-Westshore corrects much harder than the core when its all said and done (so far I am wrong)

-Bottom is cashflow neutrality with 20% down on a rental and a temporary overshoot is possible

-New listings higher than average after the July hike as Owners try to front run the September hike.

-Maplewood being the most undervalued hood in the core.

Feel free to remind me any of the ones I missed, more than happy to own up to additional bad calls.

Ummm…raises a good point but so does U&C. Marko – can you comment on these sellers? What class do they fall into?

Yes, all correct. And I like that you make no mention of “high rates” there, unlike your other recent posts.

Because now, we have a good economy. And high-er rates than usual, but nothing extreme.

If our economy stays strong, I think price drops will stabilize and then prices will start to rise with inflation, and we should end up with some nice nominal price gains five years from now.

From our previous discussion, you’ll remember that the B.C. recession started in 1981. https://househuntvictoria.ca/2022/06/07/busted-benchmark/#comment-89449

At least you said “point taken” back then when I showed the Wikipedia link about the 1981 BC recession https://househuntvictoria.ca/2022/06/07/busted-benchmark/#comment-89451

I would imagine they’re currently tenanted and when Marko’s clients pull it off the market it just means the tenants get to stay and won’t be evicted by new owners, so I doubt this is doing much to increase vacancy. I’m sure many landlords have looked at the run up and said, I’ll list for X and if I get it, great, but if not I’ll pull it and keep my tenants.

I think you’ll have a very small number of speculords that bought a rental property at the peak of the market to laugh at, but this comment definitely summarizes the comment sections on facebook housing groups…

I remember all right. I lost my job in late 1982. That was the year the recession started. But price declines started in 1981, when unemployment was low, vacancy rate was zero, and population influx was high (as pointed out by Leo). Reason: record low affordability, as we all know.

Why didn’t Toronto see a bust in 1981? Simple: no price runup comparable to Vancouver in the previous years. And Ontario was much less affected by the early 1980’s recession.But prices increased substantially in the late 1980’s. And then there was a bust. Major recession in 1991 too.

Hmmm, what happens as more and more of those get tossed on the market for rent? and how willing are those folks to start dropping their expectations for ridiculously high rent if that market becomes more competitive? As well, it becomes tough to be discrimitory in the tenant selection if high price is all they want. Even in this competitive rental market, I had several places call me back and offer discounts to get me and my family to rent from them because we were the “clients they wanted” since we weren’t 4 or 5 singles looking to split a house they wanted stability of a family at our income level , employment and references.

Funny what happens when you force one half of the country to subsidize the other.

Toronto had the same interest rates as B.C., but had no price bust in the early/mid 1980s. Here you can see annual Toronto house prices changes, and not a single year during the rates rises of 1970-88 with a price drop.

https://www.livabl.com/2017/01/history-of-toronto-real-estate-peaks-and-crashes.html

You must remember the B.C. economic factors that caused multiple, almost continuous BC recessions from 1981-86. And resulted in migration out of BC. Those two factors had a negative effect on prices, independent of interest rates.

The Toronto experience in the 1980s have shown me that rising interest rates don’t always cause lower house prices. My opinion is that economics and population change are bigger factors, and they are currently positive for house prices in B.C.

Re: Tuxedo Dr. The house will rent for less than the equivalent typical Gordon Head/Lambrick Park type house because it’s simply smaller. The GH homes usually have more square footage and bigger suite potential. Plus, closer to UVic so for rental purposes, the GH equivalent would command the higher rent. There is a fancy private school in the area I believe, St. Margaret’s but honestly it’s kind of a meh street. Maplewood would be considerably more desirable in my opinion if you are looking for a similar age of house and area in Saanich. If it’s $100,000 cheaper than the equivalent in GH, there’s a good reason for that.

Listings slow down every single summer. That’s not proof of anything. Downturn has barely started. From Leo’s last post, new listings are 23% higher than last year. I wouldn’t call that people holding.

Yes, being cashflow negative is a big motivator to sell.

“do you know any actual real estate owners/investors? Anyone I know would hold their property if they were suddenly underwater; only those with an extreme need would sell at a massive loss.”

Anecdote: late May got a call from the property manager saying the owner was thinking of selling because they were losing money on the property each month. The property manager had proposed an above allowable increase which I accepted as it was still below comparables. This was before the one percent increase so I made sure to get the new lease signed before they changed their mind.

Yes the proof is in the graphs on this post. The article also says listings are slowing not exploding which one would expect if there was a market moving rush to the exits. My clients don’t seem overly concerned and are pushing ahead with development plans

What I am seeing firsthand as a result of incredibly low vacancy rates is listing cancellations. We throw the listing up, do a price drop, still no interest and the owner goes “hmmmm well I would rather rent it for this ridiculous amount than drop the price further, please cancel listing.”

If we had high vacancy the market would be far more prone to a larger correction, imo.

Vacancy rate at the start of the 1981 bust was zero and stayed that way until the upsurge in unemployment in 1982.

Vacancy rate was also low in Toronto circa 1990 which was about a year into the bust.

https://www03.cmhc-schl.gc.ca/hmip-pimh/en/TableMapChart/Table?TableId=2.2.3&GeographyId=2270&GeographyTypeId=3&DisplayAs=Table&GeograghyName=Toronto

The biggest risk to market prices is affordability which can come from one or both of excessive prices and higher interest rates.

some students are actually paying for the summer months the home is empty to ensure they have a place next year. I am saying that a 4 bedroom suite in a house in Sannich can rent upwards of 3200 a month which I don’t think is unreasonable given current market conditions.

I think they are behind schedule, but point taken. I’ll let Frank go on his rant about out of towners, foreigners with $ and Ukrainians.

Yes, you can rent your home out for student’s communal living at $1,000 per bedroom, but the school year is not 12 months long and the wear and tear on the home increases as well as the complaints from the neighbors.

This is completely true. Starbuck’s has no future at all in Victoria.

Lol looks like the bulls from the Victoria housing fb group are here now. I must have jinxed it by mentioning it earlier!!

Any info on city responses if you build or renovate without a permit?

Speaking of students, construction on one of the new residence buildings at UVic is supposed to be complete for Sept 2022, that should take at least 300 students out of the rental market.

The biggest risk to market prices is not interest rates, but vacancy rates. But as Marko stated it does appear that rental demand for well located properties remains strong. And my opinion, is that until we see a change in the vacancy rate, home prices will only moderate depending on the season.

The high rental rates provide a floor to price drops. At this time, if you are buying a property and intend on renting the property you are still buying in the range of 20 to 24 times annual rent for a typical property. I have not seen that change much over the last six months. Neither have I noticed rents on a rent per square foot rate increasing over the last three months either.

Renters are paying a higher percentage of their income for rent but they are also doubling up on one-bedrooms in order to make things manageable so that they can still enjoy a $5 cup of coffee. That may become a problem in the future as they will need a longer period of time to save up for a down payment.