September numbers

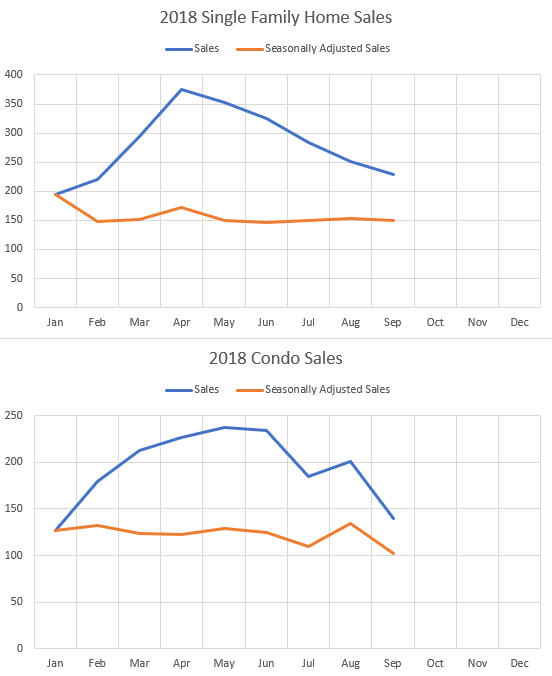

September is about wrapped up, and it seems that the much hoped for recovery that the industry predicted for the fall has not yet materialized. Coming back from vacation did not put Victorians in a buying mood and in fact after a brief rally of condo buyers in August, it seems they have dropped back down to previously slow levels.

Note: A small (~3%) but unknown number of September sales are yet to be reported

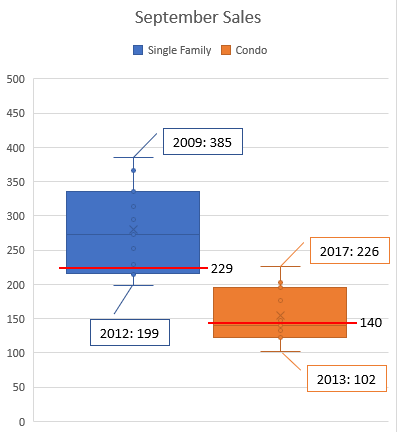

Single family sales are near the bottom quartile, while condos are stronger but still below median for the past 10 years.

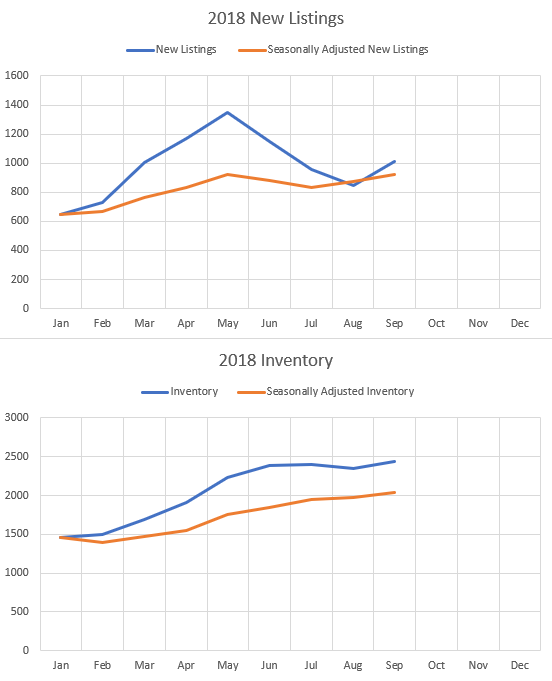

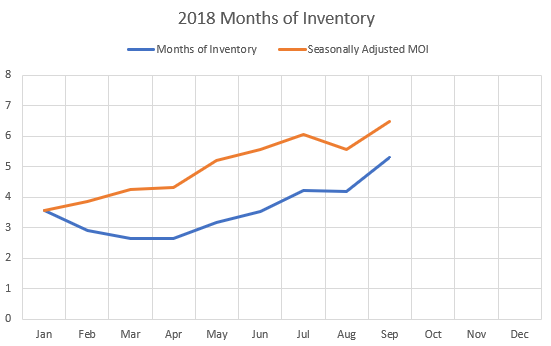

New listings are up a bit and inventory continues to creep upward as well. Of course with the spring market far in our rear view mirrors, we won’t see any large increases to seasonally adjusted inventory until next February. The number of properties on the market will stay pretty steady through October, then fall off a cliff as people give up in November and December.

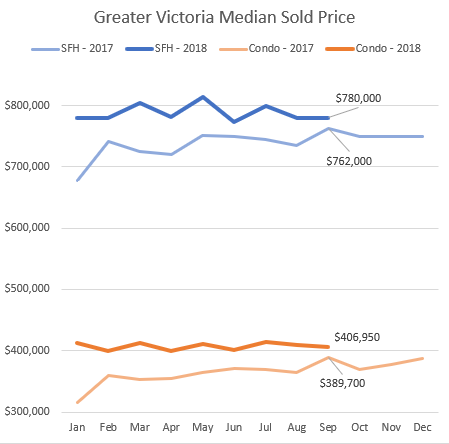

What about prices? Not a huge amount of change there, with both single family and condos essentially unchanged from August, and in fact unchanged all year. The MLS Home Price Index is also essentially unchanged from August. Despite a still cooling market that is forcing sellers to increasingly cut their asking prices to make a sale, we are not yet seeing those cuts translate to broader market price declines.

As I’ve said before, I’m actually surprised that prices didn’t continue to rise this year at least for the first few months and in condos. Market conditions indicated they should have, but it seems the shock of the removed buyers from the stress test was enough to keep them flat. According to the months of inventory we are still only in a balanced market and shouldn’t yet be expecting absolute price declines in the broader market. However the cooling trend has been pretty consistent this year so we may yet pass through the balanced market and keep slowing down to a buyers market. As usual, real estate moves more slowly than most people expect and outside of black swan events it takes many months and even years for cycles to play out.

Out of time at the moment, but I’ll dig into which parts of the market are the weakest right now in a future post. Meanwhile construction shows no sign of a slowdown yet. Starts in August were very strong and units under construction have continued to ramp higher even from the record levels at the end of last year. If the bevvy of new housing measures are having any impact on development, we aren’t seeing it yet.

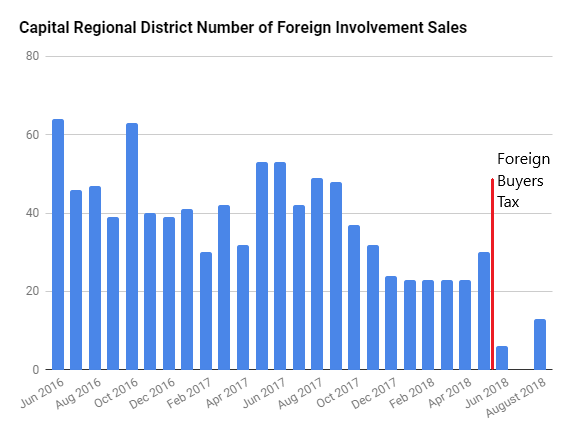

As expected (and mirroring what happened in Vancouver 2 years ago), a few foreign buyers came back in August after being almost completely absent in June and July. 13 land titles were transferred to foreign buyers in August at an average value of $1M. That is down 73% from last August, and I suspect that foreign buying levels will stabilize at about that level (~1.5% of the market from a pre-tax average of 4.2%). At that rate it will be a decent income source for the government, with the foreign buyers tax bringing in an additional $1.75M in tax revenue in August (that’s a 15% increase in property transfer tax from 1.38% of the buyers).

The big news of course on the weekend was that the new NAFTA USMCA was agreed upon. After all the hullabaloo about how NAFTA was the worst deal ever, the biggest change in the new deal seems to be the name, which will suit the need for our southern neighbours to hang their hats on something going into the midterms. The biggest change for us is that Poloz can finally stop fretting about it and an interest rate bump is virtually guaranteed in October and likely in December. That means carrying costs nudge up, and the barrier to entry via the stress test gets higher. This continuous ratcheting effect makes the stress test quite unique amongst the many regulatory tightening measures that the government has instituted since the heady days of free money in 2008. Unlike those previous ones which the market quickly shook off, the stress test becomes more stressful anytime interest rates increase and that is set to continue until it starts dragging the economy so much that the Bank of Canada is forced to stop tightening.

Unfortunately not quite yet. They are only publishing final sale data, not pending sales (what most people are interested in)

https://househuntvictoria.ca/2018/10/03/sold-sales-data-going-public-on-realtor-ca

Looking at comparables would expect it to go for higher on date of.

Foreclosures article: https://househuntvictoria.ca/2018/05/24/foreclosures-in-victoria/ (don’t bother signing up for foreclosures, there is only this one on Lloyd right now and a condo on Fort St.)

I Live right near 1626 Lloyd place. It is very a convenient location. Very safe neighbourhood.

1626 Lloyd Pl is a foreclosure

Court date end of October and going to court at 790k accepted offer. It can only go up from 790k on the court date.

Ouch, 1626 Lloyd Pl is a foreclosure with a ton of judgments against the two owners. Google the Business owners first and last name and Victoria for a chuckle. Be interesting what it finally sells for in the court. Close to town/Vic General and good pictures. Leo’s old blog on foreclosures was a good one, not sure if I feel like losing a house to a sealed bid.

Sure looks to be priced below market. Not sure what “court approval required” means.

Glad to hear about sold data being public. Means less pestering on here!

How big banks rip off the public and reduce millions to a condition of debt slavery by creating money out of thin air with which to finance property and stock market bubbles, while devaluing your savings — explained in some detail. The discussion concerns banks in England but Canada’s banks operate on the same principles.

Thanks for the laughs, gwac.

Sorry, Leo, but this change will for sure tank our market.

—Hawk

thanks Leo

Essentially none. Average commissions didn’t change and percentage of people using an agent didn’t change either. Much ado about nothing.

Has anyone been in one of The Meadows townhouses in Brentwood Bay?

Any thoughts or observations?

No it won’t.

Let me just get this out there. 🙂

This info from CREA will crash the Victoria Market….Hope they have the 1981 data cause that’s where we are going.

Vichunter: You did notice the court approval part?

Great new, I hate switching to BCassessment but thanks to HHV I at least had it as a tool.

Any thoughts on 1626 Lloyd $779,900 for a newer house less than 15 minutes from town sounds like a bargain?

Not literally, no. You’re right. But it wasn’t as accessible which to some was a problem. You and I went over that before.

I think in some cases such as a market panic, it might have made some people make different decisions. On the other hand the market panic phase is always among the shortest of the cycle segments so it may be of little overall consequence. And if they were too panicked to bother to ask/check, it’s their fault anyways.

Never participate in panic.

I didn’t think of that. I wonder what impact it will have on the market.

How would having sales history being very easily available (now) versus easily available (previously) change the market? I don’t get it. Consumer wasn’t flying blind. Pretty much everyone has a PCS account with pending sales, pretty much any REALTOR® will email you old sales history, and you have BC assessments as well.

If I understand this correctly, it borders on unconscionable. One of the basic tenets of a free society is the respect for private property, including the ability of the title holder to control who does and does not access that property. If his father requests police assistance in removing trespassing individuals, and the police tell them to contact the RTB, then something is very wrong. That or I’m missing something. Always missing something. WTF

local

That info was available to the buyers and sellers before on specific properties through their broker. Should have no impact on price.

Only one flying blind was nosy people. 🙂 May make it easier for people to sell on their own. Not sure though. Not sure what impact the available info has had on people using something other than the traditional broker in the US.

I didn’t think of that. I wonder what impact it will have on the market. Reverend Ross Kay seems to think having that data is inflationary, but the US experience suggests that’s not the case one way or another.

Anyways, I never liked the idea of a consumer dropping that kind of money while flying blind.

Bet the guy that created Zealty.ca is pissed! He got about a week of publicity for being first, now the site is obsolete

Marko,

Do you think the release of that data is a good idea, a bad one, or

Excellent idea imo. I’ve wasted so much time over the years sending people previous sale history. It will also force REALTORS® to offer knowledge beyond access to a database.

Marko beat me to it by one minute. Damn he’s good.

Local

Education and knowledge is good for all parties.

Marko,

Do you think the release of that data is a good idea, a bad one, or “whatever”?

https://twitter.com/RateSpy/status/1047585819622555648

Big news

BREAKING: Sold data coming to Realtor.ca

CREA’s Board of Directors has voted to add sold and historical data to the property listings on Realtor.ca without the need for a login.

In a message to real estate boards across the country, CREA says the move comes “in order to meet consumer demand and at the request of Realtors and boards.”

So to get this straight. Someone who is not on the lease can invite 20 campers over and the owner and other legal tenants have to put up with this and the only thing is to get a 30 day eviction notice. Ok remind me never to become a landlord. Hopefully he has some sort of insurance since the place will need major remediation. Did I mention no toilets.

Sad for the 2 families living there.

Well this is an interesting turn on tent city. The subject line isn’t quite correct but yikes! for the landlord.

http://www.victoriabuzz.com/2018/10/homeless-camp-moves-to-saanich-mayoral-candidates-residence/

Depends entirely on the cash flow of that property and our personal affordability situation. If the property carries itself and I just need the capital for the down payment I wouldn’t stress about it.

We bought when I felt like most of the risk had left the market. If i feel like that again I may buy again.

Yet you muse about buying an investment property if affordability ratios improve somewhat. Taking on another whole house wouldn’t be too stressful?

Victoria ain’t a normal Canadian city 🙂

Decent looking place, which if it were in a normal city, would be worth half as much. So here’s to hoping it drops another 23%, at least.

I’m not familiar with what happens with non-payment on mortgages, but that’s what an impending bankruptcy looks like, right?

I used to think it was gold but it’s very turbulent. I think converting to very low risk or cash for a few months could be a good way to avoid risky times.

Sounds like a great post!

All a matter of degree. There will always be Vancouver buyers for sure. But it seems they are going back to the normal level we saw prior to 2016 rather than the much larger number we saw the last two years,

Last Vancouver buyer I spoke to came over, looked at a few places, then decided it wasn’t as good of a deal as they had anticipated and gave up. If you can cash out and pocket a million dollars that’s a big deal and will incent people to retire early or uproot their life to move over. If it’s only a couple hundred thousand it’s less likely they would do that.

They can put it up for $1.5M, but nothing is selling.

Yeah I think the magnitude of the debt required is difficult to fathom for people that bought a while back.

We bought 5 years ago, with a HH income in the top 15% or so, and a > 20% down payment. Mortgage just under $400,000 at origination.

Same house today would require mortgage of nearly $750,000 (at higher rates). I don’t think I could have brought myself to take on a mortgage with nearly double the monthly payment. Too stressful.

It’s been funny watching you, for the last year or two (or however long you’ve been here), predict—with textbook certainty—future price declines that have yet to materialize.

Parts of Victoria may still be. We’ll see how things play out in Toronto and Vancouver.

Weaselly, haha. I don’t believe I’ve ever argued that prices double every seven years.

So far, have we been able to count on the latter? Tell me, for the last 35 years, how much have we been able to count on the latter?

I’m still on board with this view.

Victoria is great. Anyone buying and holding will do awesome, IMO. Some rent by necessity, others by choice; of those who rent by choice, those who are waiting for an all-out RE crash are making a very poor bet, IMO.

How low do Vancouver prices have to go before it’s not appealing to anyone to cash out and move to Victoria? As of right now, tens of thousands of properties (perhaps more) in Metro Vancouver can still fetch $1.5M+, no?

Penguin, this point is well taken. Thank you.

Privilege and luck certainly have something to do with it. Not incorrectly concluding that a RE crash is lurking around every single corner is also conducive to success.

Guns and ammo.

I feel like people are going to be clamoring for USD for the next little while, especially as the Fed reduces its balance sheet. They say gold is dead forevermore, but I doubt that’s actually the case either. Just need people to start hating fiat again, and eventually they will.

Cash is good, depending on how much you have and how long you intend to hold it. If you’re wanting to make a major purchase at a moment’s notice, it’s great. If you’re holding it to buy something a decade from now, not so much.

How many of the 20000 new Victorians the past few years are self employed /contractors with no job security and are dependent on the real estate /construction market ? Most I would say.

Do the math when it all comes to an end and even half lose their jobs. It won’t be pretty.

What is best to invest in when the economy hits the wall, gold, or should I just hide my cash under the mattress?

https://www.theglobeandmail.com/opinion/article-the-fuse-has-been-lit-on-canadas-debt-bomb/

Patrick – is the first time home buyer going to be able to buy that first SFH in Victoria with a mortgage of $350,000? A decent home here will cost $1,000,000 (plus) in a decent area, plus the PPT and closing fees. If they scrape together $200,000 for a down payment, they will [or are ] carry an $800,000 mortgage. People that bought over the last 2.5 years are facing this reality when it comes time to renew. And, they have other debt that has accumulated since they bought [consumer debt, credit cards, HELOCs, LOCs, etc.] which has to be serviced, let alone saving for retirement, kids’ education, etc.

))) Weasely, haha. It’s been funny watching you slowly shift your narrative, at least since I’ve been here. I’ve now seen you go from:

====vvvvvv

Most people that buy a home don’t go through all those stages you listed (delusion, bullish etc). They just settle into “happy homeowner” and “don’t think about it much”

National Home prices ready to surge, surge and surge:

https://www.bnnbloomberg.ca/vancouver-home-sales-sink-in-september-as-listings-hit-multi-year-highs-1.1146273

Consider the source.

Everyone’s just making a more or less educated guess. The difference between our annual predictions and those of the analysts is they get paid and they never publicly review their predictions to honestly examine how accurate they were.

Moody’s: Housing market not headed for a major correction

https://business.financialpost.com/news/economy/consumer-debt-will-pose-major-risk-to-canadas-economy-for-years

Household debt will pose major risk to Canada’s economy for next three years, economists warn

https://business.financialpost.com/personal-finance/mortgages-real-estate/housing-market-not-headed-for-a-major-correction-moodys-analytics-says

local

Everyone should watch that movie. Seen it 5 times

Here’s a 60 second YouTube clip from the Big Short – Brad Pitt’s lecture to his associates who are celebrating an anticipated US housing crash.

He puts it very well why housing busts hurt people, and hurt the economy.

https://www.youtube.com/watch?v=A1RrEph0SNo

More anecdotal price drops indicating where we might be heading 7 Eaton Ave. Price Original $1,150,000 Price List $899,000. 97 days on Market. 50k new pickup truck parked in the driveway on Google Street view. Anyone on here gone to look at it yet?

PS I know someone fighting the banks right now here in Victoria…just stretching out the days before having to get into the rental market. 1 year plus behind on full payments.

2015 prices quoted by Steve S. in West Vancouver might find there way here.

Marko Juras

Why do you always prefer pre-sales? Wouldn’t a ‘slightly used’ condo be a better value?

I take a look at the architectural drawings and based on those I can visualize what the unit will look like in 2-3 years and having been in thousands of condos I know what the current comparables are. Over the years I’ve bought many pre-sale condos at a 10 to 15% discount to similar completed comparables at the time of contract. My minimum is 10% discount to re-sale market, otherwise I don’t pull the trigger. I’ve bought from Bosa, Concert, Chard, Marker Group, Le Fevre. No loyalty on my end, just show me a 10 to 15% discount. All the developers in Victoria are pretty much top notch. Only one so so apple in my opinion.

A ‘slightly used’ car is a better value, a slight used condo is often not.

i/ 90% of developers need to hit pre-sale targets to obtain a construction loan.

ii/ The majority of buyers are impulsive and don’t want to wait two or three years so they will pay premium for slightly used they can feel and touch. Even amateur investors come up with arguments such as “well I can collect rent for next 2-3 years” versus waiting for the pre-sale.

iii/ The majority of buyers cannot visualize what they are buying and there is a sense of fear in that they will be screwed over by the developer.

iv/ The risk is by far the greatest for the developer early on so his or her motivation is highest.

Combination of these factors often creates a solid discount on the pre-sale in order to execute contracts.

Right now is a very rare time when many pre-sales are at not at discount to re-sale market. Either owner-occupiers are piling in or investors are banking in appreciation?

Never bank on appreciation. I always roll with the premise of the market will be flat during the construction period and statstically speaking the odds are in my favor.

Weasely, haha. It’s been funny watching you slowly shift your narrative, at least since I’ve been here. I’ve now seen you go from:

__

__

__

__

And now,

__

__

To wit, progress is progress, even if it comes kicking and screaming.

😀

Introvert no one is arguing about the fact that it would have been better to buy in 2009. Of course it would have been better to buy 10 years ago duh. From my experience everyone “loves” real estate. Buy the most you can afford at the time, buy as many houses as you can. I actually heard a couple people I know recently say real estate is their passion. LOL Gawd. And not the market (numbers I’m into) but just…houses… Who doesn’t like real estate? I think it’s almost against human nature to not want your own place. Everyone loves knocking down their own walls. Almost everyone who can easily afford a house buys one.

But those renters who lost out most likely either couldnt afford a house at the time (I can relate as I’m on the borderline now) or were trying to time the market (like a stock). If the latter they probably invested money and didn’t lose out as much as you think. Or maybe they just don’t have that passion for real estate like so many do. So you are making fun of the people that couldn’t afford it to begin with. They were probably just hopeful so they could knock down their own walls one day. Not sure why you can’t admit your own privilege/luck?

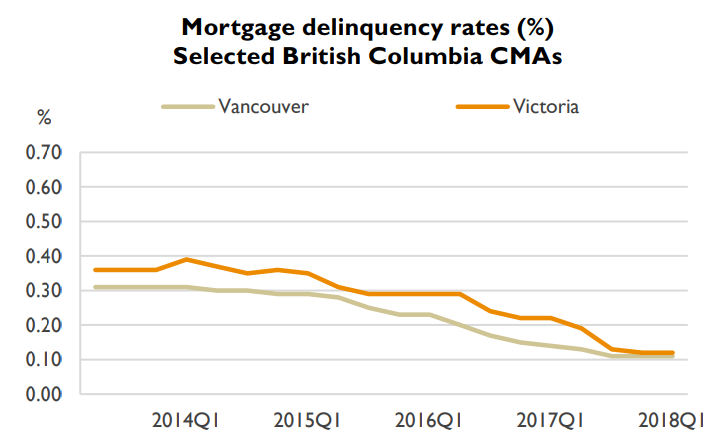

Thanks for posting. This is a good example of how delinquency rates work as others have already pointed out. They go way down when prices go up for the obvious reason that no one in their right mind would default on a mortgage when they can just sell instead. Just look at the rate of delinquencies drop as soon as prices went up in 2016/17

Do you think that Vancouver had some effect on our recent runup? I certainly do. We know that Vancouver buyers increased a lot and were partially responsible for the price explosion in 2016/17.

So I think it is realistic that Vancouver declining has some effect as well by reducing the number of Vancouver owners that can cash out easily and move here.

I’m not saying house prices fall due to rising interest rates. I said “declines come from new buyers being priced out or buying less” in order to counter the idea that it requires existing owners to be in trouble for house prices to decline. The vast majority of home owners in the US housing crash were totally fine throughout the whole time.

As for rising interest rates, it is certainly a double edged sword. On the one hand the reason they are rising is because of a strong economy and that likely means increasing incomes. On the other hand it drives up carrying costs for houses. One is positive for housing the other negative. Which is the dominant force depends partially on how leveraged the consumer is. If houses are cheap and people aren’t highly leveraged then the increasing income has a larger positive effect than the increased debt service. Right now we are in a situation where housing is already expensive and debt levels are high. Hence why I believe interest rates rising would be a net negative. However I have not modeled this so it’s an educated guess at best.

Circa 2009, the HHV atmosphere was very similar to today. The case for a RE crash in Victoria was airtight according to the renters, and they were giddy.

As we know, the couldn’t-be-avoided crash never materialized. Most of these renters never bought (even though we all now agree it was a pretty good time to buy). And now they’re priced out even further, to the tune of $200-300K.

When the renters miss the decent opportunity to buy that we are likely heading into because they’re waiting for a price crash of 25%+, they’ll really be kicking themselves. Some of them will be in their 40s or 50s, with net worths several times lower than those who bought at almost any point because they had a modicum of confidence in Victoria RE over the medium- to long-term.

You’re probably right, Sweet Home.

Patrick must have just got his mortgage flogger license and a big mortgage. When new buyers are locked out of the market then it declines just as sales have shown for a year now. Price declines to follow.

Shows that it doesn’t matter.

LocalFool> even 6.5% of the population being highly indebted can bring the entire edifice down

=======vvvv

Is that what you’re waiting for -something to happen to “bring the entire edifice down”?

Fair enough 🙂

But when do you stop waiting for that? If you wait 5 years, and nothing bad happens, the “edifice” will be bigger – average family incomes will have risen about 15%, and Vic population will be up 5%. Good luck finding a Victoria core SFH then.

Sounds like a lot of people with no mortgage, and a lot of people with a bunch of debt. Not really overly reassuring.

)) patriots; Note when delinquencies in the US hit bottom.

https://fred.stlouisfed.org/series/DRSFRMACBS

Not sure what point your chart was intended to show.

US delinquencies were steady in the range 1-2% and bottomed in 1995, 1998 and 2004

Victoria delinquencies are 1/20 of those at their lowest and are falling. 1/1000 rate is barely measurable. Are you suggesting that is a worrying sign?

As far as people in the US were concerned delinquencies “hit bottom” most years between 1993 and 2006. Only to hit a lower bottom the next year. It was only in hindsight that 2006 was the actual bottom. Most years low delinquencies were “predictive” of even lower delinquencies the next year until one year they weren’t.

Current delinquencies don’t predict much. Only in the future we’ll be able to look back at delinquency time series and say this is where the crash did (or did not) start

“Some dreams died tonight” – I like this turn of phrase. It stuck with me.

-23% has got to be one of the biggest price drops out there right now. I noticed 925 Lawndale Ave just reduced to 799k from 969k (-18%) after only a month and a half. Any other greedy people waking up with drops that big?

I’m waiting for the dream to die on that ridiculous 252 Superior St cottage flip. In my mind when that dream dies I’ll know the market has really turned.

@guest_49817

Have you checked out the BC Assessment for that house? I think it would be towards the higher end of your range for sure.

For example, 4001 Locarno was listed in 2012 for $650K and is now assessed at $1.425M. Granted, the house is $544K of that, so likely they did a major renovation or maybe even rebuilt.

One I came across recently was 1285 Monterey in Oak Bay, which we drove by in 2015. It sold then for $835K. They did what looks like a pretty superficial reno, and it is now assessed at $1.334M and listed for $1.46M. Ouch.

No they don’t, but that’s because you’re doing two things:

You’re failing to understand that in an unwind, you don’t have to have a large portion of people in trouble financially. In fact, the US example demonstrates that even 6.5% of the population being highly indebted can bring the entire edifice down. We are nearly double that today.

As an aside, bringing up low delinquency rates is lame. All that demonstrates is an overly liquid market and in a sense, actually undermines your point. It’s certainly not “reassuring”.

Note when delinquencies in the US hit bottom.

https://fred.stlouisfed.org/series/DRSFRMACBS

And if Bill Gates gets on a plane, everyone on it is a millionaire on average.

))) until you factor in the 700k mortgage..not many can afford that

The delinquency rate is for large (>$400K) mortgages in Victoria is a tiny 0.08% … about 1/1000.

https://eppdscrmssa01.blob.core.windows.net/cmhcprodcontainer/sf/project/cmhc/pubsandreports/mortgage-consumer-credit-trends/2018-q3/mortgage-consumer-credit-trends-bc-69327-2018-q3-en.pdf?sv=2017-07-29&ss=b&srt=sco&sp=r&se=2019-05-09T06:10:51Z&st=2018-03-11T22:10:51Z&spr=https,http&sig=0Ketq0sPGtnokWOe66BpqguDljVgBRH9wLOCg8HfE3w%3D

VictoriaBorn: All three economists said that the risks of higher interest rates will be felt more around 2020. Many mortgage borrowers have fixed-rate loans for terms of up to five years, meaning rate increases over the past year won’t affect their payments for a while”.

===========vvv=

VB,

It sounds like you’re worried about existing homeowners having trouble paying their mortgages in places like Victoria and Vancouver if rates rise.

I’m happy to put your mind at ease, Vancouver and Victoria have very low mortgage balances to begin with, about $325K on average. That puts their payments well below the median family income level.

This good news for Victoria comes from CMHC.

You should be reassured by the 2018q1 CMHC stats for Victoria -all good news – declining and tiny mortgage delinquency rates, improving credit scores, and only 27% of Victoria people have any kind of mortgage to begin with.

These numbers don’t fit the picture present on this forum of the deeply indebted Victorians that won’t survive a modest increase in interest rates.

https://www.vancourier.com/real-estate/opinion-our-region-s-average-monthly-mortgage-payment-is-lower-than-you-think-1.23389764

“However, statistics on what Metro Vancouver residents are typically shelling out in mortgage payments each month have historically been scant. That’s why it was interesting to see a new report out of the Canada Mortgage and Housing Corporation (CMHC) this week, assessing mortgage and other debt in major Census Metropolitan Areas (CMAs) across Canada, including Metro Vancouver.

CMHC found that the average monthly mortgage payment in the Vancouver CMA in 2018’s first quarter was $1,800. That’s approximately the payment on a mortgage debt of between $305K and $360K, depending on the interest rate. It’s also 6.5 per cent higher than a year ago, roughly in line with overall price increases.

When comparing this $1,800 average payment against the median household income, around $73,000, it’s just under 30 per cent of monthly gross earnings – 30 per cent being the universally agreed threshold for affordability.”

There’s also been a dramatic improvement in mortgage delinquency in Victoria for large mortgages, now only 1/1000 are delinquent.

“Delinquency rates for Victoria mortgages with higher limits ($400k or more) at origination hit a local high of 0.6% in the third quarter of 2014. Since then, delinquency for these larger mortgages have declined to be in line with smaller mortgages at 0.08%”

https://eppdscrmssa01.blob.core.windows.net/cmhcprodcontainer/sf/project/cmhc/pubsandreports/mortgage-consumer-credit-trends/2018-q3/mortgage-consumer-credit-trends-bc-69327-2018-q3-en.pdf?sv=2017-07-29&ss=b&srt=sco&sp=r&se=2019-05-09T06:10:51Z&st=2018-03-11T22:10:51Z&spr=https,http&sig=0Ketq0sPGtnokWOe66BpqguDljVgBRH9wLOCg8HfE3w%3D

it is not high until you factor in the 700k mortgage..not many can afford that

Brilliant. Thanks for the laugh Ian 🙂

Christy kisses the orange ring. Gwac next in line. 😉

Former B.C. Premier Christy Clark praises NDP for getting LNG deal done

https://vancouversun.com/news/politics/former-b-c-premier-christy-clark-praises-ndp-for-getting-lng-deal-done

@Barrister thank you it sounds like a great place, especially the neighbourhood and view, but we’ll have to pass. The lack of a suite is a killer for us, unless we find an easily suited place. My wife hates paying rent for our in-laws, even though I think rents in this town are a great deal compared to the total cost of ownership and opportunity costs.

@the Peanut Gallery, Vancouver, Alberta’s and the rest of Canada’s markets are super relevant with tons of those buyers having outbid locals in the last few years. If their real estate isn’t selling they sure won’t be buying here. Save your criticism for those who post about Australia’s market.

The boogeyman. Aka homeless campers.

Isn’t that exactly what everyone on here was doing on the way up?

Lots of room to grow… look at Vancouver.

GWAc what is going on in the 5000 block?

And who’s predicting that?

when was 2.5-2.75% considered high?

hope no one lives in the 5000 block of saanich rd.

There you go Michael, I just up-voted your post for you. Just don’t forget to add your “Victoria Here?” caption on the far left next time. 🙂

Still have all of it! 😀

Looks like Vancouver SFH & Condo ave’s up in Sept.

(condos hit a new all-time high, up $68,873 last month).

Technically we shouldn’t even be discussing news and current events here as it has already been decided that ALL news events support a crash narrative.

Interest up – Vic RE crashing

Interest steady or down – economy weak – Vic RE crashing

NAFTA torn up – OMG – Vic RE crashing

NAFTA reborn with cosmetic changes – interest rates going up – Vic RE crashing

LNG approved – too much good economic news – Vic RE crashing

LNG not approved – lousy investment climate – Vic RE crashing

NDP/Greens – new rules – Vic RE crashing

BC government falls – uncertainty – Vic RE crashing

Giant asteroid headed our way – Vic RE crashing – obviously!

Giant asteroid diverted at the last minute – Phew – Vic RE crashing

Local only thing thinning is your hair waiting for the bid crash….

Hold your horses. Many individuals with more investing and economic experience than all of us here on HHV put together are warning that we’re near the end of this latest economic long term debt cycle. Unprecedented run in the markets, historic asset appreciation, we all know this. Ray Dalio in particular thinks there’s maybe 2 more years left to go before the end is reached. And he’s not predicting just any correction, but likely a big one with far reaching social and political ramifications. Why? Because after 2008/2009 the US Fed more or less threw everything against the wall – Monetary Policy 1 & 2 were applied to the fullest extent possible. Monetary Policy 1 – reducing interest rates down towards 0. After that came Monetary Policy 2 – QE (printing money and buying financial assets). Those 2 steps have only recently began to be very slowly unwound, but if we see yield curve invert, or any other reason which kaiboshes the economy (Trump trade wars anyone?) then the Fed will likely again empty any remaining bullets in the chamber in interest rates (always the first step) and maybe do more QE (but again they are already pretty tapped on this option – doing more presents a serious risk to the status of the USD). Next would be Monetary Policy 3 – putting more money directly into the hands of spenders instead of investors/savers, and giving incentives to spend it. (I really recommend his latest free PDF book on the long term debt cycle – he explains things so incredibly well.)

Moral of the story is any predictions of interest rates rising really high do not at all jive with what experts say has happened in past debt cycles, and all of these past debt cycles played out the same way (albeit at different speeds.)

yep James lets compare what is happening in Vancouver and extrapolate that to Victoria. Another great bonehead move.

Amazing lets take whatever crap we can find and make a case for a crashing Victoria Market. This is not a comedy but a sad tragedy to those that keep day after day believing that a crash is moments away.

Fixed: Speculators and over-leveragers, continue to overestimate Victoria real estate at your peril.

Actually from the looks of things, that crowd is thinning in an awfully big hurry.

It always does™

[Takes a bow]

Friends, continue to underestimate Victoria real estate at your (financial) peril.

I know I know, they’re not making any more land Gwac. Especially in Vancouver, which explains why the prices there have been going….

… and applause for Gwac for not waiting, Ian. They drive the bus while looking in the rear view mirror, while patting themselves on the back. Great job.

The rest of us are looking at the debt mountain in front as interest rates rise and housing inventory rises month after month. Supply vs. Demand.

Can we please have another round of applause for Introvert having bought in 2009.

Patrick,

I would venture to say that RBC doesn’t comment on prices at all:

But they do comment on demand:

So, sales are already 4th quartile, and demand will remain “restrained”. How do you conclude that being other than negative for prices?

Yup. This is why I don’t usually wonder why inventory is “stubbornly low”. It’s that way because it is, and knowing any better won’t help anyone make a decision.

The relevant point is the same, that sooner or later that dam breaks. It always does. Why does it break though? Who knows why – and who cares?

Go look on the internet at what various RE brokerages in the States reported after their housing went bust. There’s remarkable symmetry in what you hear.

“The phones rang non-stop, and it went on and on and on. It was like it would never stop. We were pulling 14 hour shifts and sometimes that wasn’t enough. And then one morning, it was like someone flipped a switch. Like the market collectively decided, in unison, that they didn’t want to buy. And just like that, the phones went completely dead.”

https://youtu.be/ZknFhQftrug?t=26s

… and Steve Saretsky on Twitter. This doesn’t bode well for the Mainland.

https://twitter.com/SteveSaretsky

“Langley continues to turn heads. Condo inventory now up 214% from last September.

Hot damn! Condo inventory jumped 87% in the Fraser Valley. A few more months of weak sales should really do the trick.

Here comes your inventory. Greater Vancouver condo inventory jumped 75% Y/Y in September.”

Sorry to interrupt the market trashing with some actual reality……

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in September 2017 was $832,000, while the benchmark value for the same home in September 2018 increased by 6.2 per cent to $883,700, slightly lower than August’s value of $888,300. The MLS® HPI benchmark value for a condominium in the Victoria Core area in September 2017 was $457,700, while the benchmark value for the same condominium in September 2018 increased by 9.9 per cent to $503,000, exactly the same as August’s value.

Waiting has been brilliant. Higher prices over a year and higher interest rates. Brilliant strategy bears. keep up the great job…lol

@Introvert

What will the next nine years bring?

Yep, but that $$ increase was with declining/low interest rates. Can’t imagine that trend will continue with rising interest rates; next few years will be an interesting watch…

))) JamesSofer: This time next year rates will likely be 1% higher than now with another 1/4 point on the way.

======

If you know where rates are going, and when, you’d be a billionaire.

That is a good article, Hawk. It goes on to say the following as to why 2020 is significant:

“All three economists said that the risks of higher interest rates will be felt more around 2020. Many mortgage borrowers have fixed-rate loans for terms of up to five years, meaning rate increases over the past year won’t affect their payments for a while”.

There is always a lag when the rate rises, but between now and then it won’t be static, as rates will likely rise 75 to 100 basis points [I predict 100 to 150 over the next 18 to 24 months]. A smart mortgaged homeowner would do well to up those payments and hammer away at the principle.

No they aren’t. You’re gonna get 2/3s of that before the end of 2018. This time next year rates will likely be 1% higher than now with another 1/4 point on the way.

Because, aside from your calculations likely being wrong, no one can actually afford it. Most families are making significantly less than $140,000 a year, and most first time home buyers don’t have a $160,000 down payment, also as has been hammered on consistently, lots of people in this country have debt, lots of it. This is why the number of sales has dropped, and will continue to drop as interest rates rise until home prices come down. Coupled with a decrease in employment in this province since there are a ton of people employed in real estate related jobs, it doesn’t bode well.

https://www.timescolonist.com/news/local/cost-of-living-housing-issues-top-concerns-for-region-s-residents-survey-finds-1.23448887

Ah, yes. Why we left:

Because of the chart showing 65% income going to mortgage payments and it’s passing the financial crisis levels of 2006 to 2008 during a period with rates going down.

Now they are going up bigtime and prices will inevitably go down as more buyers are shut out. Not a happy ending. But RBC is not going to tell you that part. Don’t want a stampede to the exits.

Why do you think they always tell us they’ve been stress testing the banks and CMHC all the time ? Because they know what’s coming.

VicHunter: I will esquire if they are still thinking of selling. The house I believe was built in the thirties but it has all new wiring and a new gas furnace but heated with radiators. On the positive side it has ten foot ceilings and solid mahogany doors and hand rail. It is four bedrooms but three of them are smaller but still a good size, more than enough for kids.

On the negative side there are only two full baths upstairs although the master bath is actually large if memory serves me right. There is a two piece on the ground floor. There is a balcony off the master with clear ocean views since it faces south. There is a sun room off the living room. that would make for a nice den. I have no idea how old the roof is but I walked by this morning and I would guess ten or fifteen years

Now the bad news, the house is designated “Historical” and basically you cant screw around with the outside much. On the other hand the city will give you a grant to cover about a third of the costs of a new roof or exterior painting. Continuing with the bad news, while the kitchen is large it is really old. The cupboards are really solid and when money permits a new counter and just facings would go a long way to improving it. The carpeting is really old and stained and a colour that best resembles puke. (The good news

is that there are solid oak floors underneath. You would need to refinish them but you cant buy that sort of quality. The other bad news is that it is single glaze glass throughout the house. I am sure that all the experts will tear me apart but I have single glaze and they seem to be just fine in Victoria’s weather. If you are really concerned about the heating bills buy a sweater and just drop the temperature a few degrees.

Now the really bad news, no suite and a basement were it is barely six feet at best and less in most places. Forget about digging down, the house is built right on solid granite and the foundation would not fare well with blasting. On the other hand it would priced accordingly. I know the neighbours well and briefly considered buying the house for an investment until my wife started talking about moving to a little Swiss backwater (I am good at seeing the writing on the wall).

Obviously the house is in Rockland and if you are interested I can ask if they are still thinking about selling. They would want well under your budget so this might be possible.

But you would have to be completely flexible about their move out date. They are in their eighties and have out lived not only all their siblings but also their only child so the house is an emotional part of them.

I know that having a suite is a major criteria for you so this might be a none starter.

Hang on kids, it’s SHTF time soon. 😉

High Debt and Rising Rates Mean Canada ‘Isn’t Out of Woods’ Yet

Next Recession

Past 2020, “it’s really going to hit the fan,” Caranci said. “At that point you have high level of indebtedness combined with income stress happening simultaneously. So we are definitely not out of the woods.”

The next recession for Canada will be different than the previous because it will be “a household led recession,” Caranci said.

https://www.bloomberg.com/news/articles/2018-10-02/consumer-debt-will-pose-major-risk-to-canada-s-economy-for-years?srnd=premium-canada

))) JamesSofer: a 20% down payment, and 0 other debt, you’re required to have an income of $141,505 to currently pass the stress test at the 5.14% interest rate (current minimum), if that increases by .75% (likely by spring next year), then you’d need an income of $152,000 just to pass the stress test.

The people still making $141,505 in spring with no debt and still a $160,000 down payment will only be able to afford a $755,000 house.

=======

James,

I agree with your numbers, and thanks for posting them.

Yes, if rates rose .75% tomorrow, this example is correct and the family that could buy an $800k house can only buy a $755k house and that’s a 5.6% drop in house prices.

But one would expect much less of a drop of house prices of 2.8% from current, in a year from now. Because rates are expected to rise .75% slowly, over the next year. If you look at the same calculations a year from now, you’ll see that this same family can qualify for a $778k house, which is only 2.8% drop from ($800k) now. This is because their income and down payment amount would rise by about 3% (a combination of inflation and the fact that family incomes rise with the age of the owners)

So is anyone here going to wait around a year, for house prices to fall 2.8% because of a 0.75% rise in interest rates? Why not instead do yourself and your family a favour and buy now, locking in a 5 year rate that is 0.75% less per year, and save yourself .75%x5 = 3.75%. ….. which is of course more than the 2.8% your house is expected to lose in these calculations.

As an aside, it is interesting that the RBC article quoted by Hawk also predicted a 2.8% drop on house affordability in one year, so they might be doing the same type of calculations. This 2.8% drop is at odds with Hawk’s prediction that house prices will get “smoked by rising rates”.

You’re in it now – going forward.

Now let’s all hop in Patriotz’s time machine!

When RBC releases a report stating concern regarding real estate, RBC’s credibility is beyond reproach.

When RBC releases a report stating little concern regarding real estate, RBC is a bum!

Man, when we were in the market for a house in 2009, I clearly remember what houses with asking prices of around $750K were like: they were nice! There was one for sale towards the top of Hollydene or Locarno that had a beautiful ocean view and I remember thinking, “Imagine living in that fantastic house and being able to pocket $750K when you sell it!”

Nine years later, our house is assessed at well above $750K and the house I was admiring is probably $1-1.3 million.

What will the next nine years bring?

There’s a time lag, as there is in most economic causes and effects. That’s the elephant in the room you’re not seeing. If you don’t account for the lag they don’t look correlated.

I should also point out that prior to 2001, RE markets in Canada weren’t well correlated with each other. For example the Toronto bust of the late 1980’s took place at the same time as a substantial rise in Vancouver. So using a national RE index doesn’t tell you much.

@Barrister thanks for keeping an eye out for me. Our max used to be 1.3 but rate hikes and what it will take as far as pricing to move our current home are concerning me. All the published rates online are for under a million insured from my understanding? I think we will be looking at 3.75+ for an uninsured mortgage over a million when the rate hike happens. Pre-approved for 999,999 at a good rate but that is insured and keeping our current home. Our max 1.3 is for our forever home 4 bedrooms with a suite (in-laws) and a detached home office and a garage. That shop sounds amazing and could definitely fit the 25.5-foot boat I split with a friend.

@RenterInParadise thanks for the tips! I was riding parallel to the Pat Bay coming up Elk Lake Drive. With a young family, I’m looking at all the neighborhoods closely. Currently, I love walking one block to a park with my son at the end of a day of work, thankfully there are so many parks in Victoria.

@Leif I did ride my bike past Lotus on my way to Wing night at Hecklers. I think they are great buys for the right person who owns a boat and loves fishing/water, also a great house came up for sale on Portage Inlet recently! Would love all three houses for me but I’m buying the house for 4 other people 🙁

I think we need a positive term for the low ball offer. In a sliding market, when someone is making an offer that gives them a 10% premium over what you paid two years ago, but 10% less than ask, it should be called realistic but I’m sure that won’t fly. Any good alternatives?

))) Hawk: RBC will always make it look like it will be tough for new buyers because saying prices are going to tank is not in their best interest as you mentioned.

======vvvvvvv

Hawk,

Ha!

If you think that about RBC, why did you link to an RBC article in the first place?

))) leoS: No that is not what causes declines. Declines come from new buyers being priced out or buying less. Those new buyers could be first timers, or could be investors, or could be out of town buyers.

========

LeoS,

I’d be interested to hear what data you have to backup that statement. I’ve heard that argument for years, and it sounds reasonable. But when I looked at data, I didn’t see a high correlation of house prices falling at times of interest rates rising. If you have such data, please let me know.

For example, look at a 40 year graph of interest rates and house prices in Canada. Do you see a correlation that backs up your statement that declines resulted from interest rate rises?

http://www.canadianmortgageadvisor.ca/blog/2013/03/house-price-drop-facts-and-fictions.html

So I fiddled w/ the numbers to get $800k on this (https://www.cibc.com/ca/mortgages/calculator/mortgage-affordability.html).

W/ a 20% down payment, and 0 other debt, you’re required to have an income of $141,505 to currently pass the stress test at the 5.14% interest rate (current minimum), if that increases by .75% (likely by spring next year), then you’d need an income of $152,000 just to pass the stress test.

The people still making $141,505 in spring with no debt and still a $160,000 down payment will only be able to afford a $755,000 house.

Even if foreign money were coming in, the amount you’d need to perpetually support an entire metro region irrespective of local input would be far greater than what we saw in the last few years IMO. Chinese capital was just (a lot of) zipwax on a bonfire…

Hawk – thank you very much for the RBC Economics report on housing affordability – that is an eye-opener to anyone who thinks, absent foreign money, local incomes support prices for SFHs. The point they make is that some 65% of household incomes go to housing costs – think outside the box – add to that all of that other debt that consumers carry, plus the cost of “life” [kids, education, vacations, cars, clothing, food, cell phone…..] and OUCH – have to take on more debt. Rising incomes will not cover the added carrying costs as interest rates rise – that is the logical conclusion. Many will disagree, but consider younger folks [ages 25 to 45] who are in the prime house-buying age – this is what they are facing.

Leo – you are probably right about the property tax assessments because they are supposed to reflect their take as of mid-2018. It is for this reason, among others, that these tax assessments are not reliable, but are a psychological floor for sellers and homeowners. We are, however, starting to see many sales below the assessed value and some sprinkling of sales ask-prices below that assessed value.

Best time to buy: when mortgage rates [interest rates] are high and prices are low, especially if you are buying with cash and don’t need a mortgage – ahhhhh, those saving and investment years pay off nicely.

No that is not what causes declines. Declines come from new buyers being priced out or buying less. Those new buyers could be first timers, or could be investors, or could be out of town buyers.

It is not until prices are well down and the economy is bad that we would expect to start to see existing owners bailing on their mortgages.

LF,

Save your breath on Patrick. RBC will always make it look like it will be tough for new buyers because saying prices are going to tank is not in their best interest as you mentioned. The new home owner is the most paranoid and will go to all lengths to defend the bubble.

25 slashes in the last 24 hours. 92 in last week. With sales declining it’s only going to go higher over winter. Hearing the hot townhouse market seems to be cooling as well.

If they pull them off the market then the spring will only get uglier as the higher stress tests takes more buyers out of the market and the food chain is completely busted. You only need 10% of sellers to tank the market.

Victhunter

I’m surprised you didn’t take the goose to Lochside trail. I live on the border of Broadmead & Cordova Bay and have never taken the Pat Bay on bike. Partly because I don’t want to huff diesel and mostly because I don’t want to duel w/ cars at the on/off ramps. There are some nice little neighborhoods around here and I suspect there will be some deals to be had over the next year.

If you want to debate me, accurately quote what I said and debate that point. If you want to reframe and set up a paper tiger instead, then don’t bother.

What I said was very simple and had nothing to do with their numbers or their calculations. It’s an observation that RE predictions from a vested interest such as a mortgage vendor whose primary job is to enrich their shareholders, need to be critically assessed from that viewpoint. It would be like me parroting Marc Cohodes’ prediction that RBC stock will fall XX% in an upcoming RE bust – when he’s holding a large short position in it. Just doesn’t fly.

Local fool,

RBC’s conclusion that rates rising 0.75% would only affect affordability by 2.8% of income is well supported by other data, and common sense. Such as the average mortgage in Canada is $170K. So 0.75% x $170K is $1,270 per year, which is less than 2% of average income. Yawn!

Yes, these numbers are averages, and for all of Canada, as stated by RBC. But you don’t agree with those RBC numbers and unfairly state they are biased to come up with them, when they are just common sense.

Victoria impact might be higher, because our average mortgage is higher. But even if it was double (ie average mortgage of $340K) that would still be an impact of $2,500 per year (about 3% of family income – yawn!) .

Remember, the “rising rates will smoke the market” idea is that existing home owners will be overwhelmed and won’t be able to pay their mortgages, and start defaulting. I don’t see that happening. Yes, it will be harder for first time buyers. If a first time buyer maxes out and gets a $800K mortgage, this +.75% would be an extra $6k per year. but if family incomes in Victoria are rising about $3K per year, that would offset this extra $6K in 2-3 years.

Patriotz: Low prices and higher interest is a better time to buy. But we are just as likely to be looking at flat prices and a bit higher interest over the next few years especially in the core.

Patrick.

They are one of the largest conveyors of highly leveraged mortgages in the country. They are a publicly traded company. What on earth do you expect them to say?

“Not to worry everyone, the last time we saw these levels of unaffordability, there was a large scale, years long national housing retrenchment”…?

VicHunter, can I ask what price range you are looking in at this point? I know of two neighbours who are considering selling due to age but who have not listed yet. One actually has a oversized garage which used to house a 38 ft sailboat in the winters. The problem with that house is that they dont want to move until April.

Anyway, if you can give me your price range then we can see if either might be worth you following up on.

))) hawk: RBC report makes it pretty plain. Higher rates are going to smoke the market http://www.rbc.com/economics/economic-reports/pdf/canadian-housing/house-sep2018.pdf

========v==v

Hawk,

Wrong!

The RBC article you linked to was great – lots of charts and data, and predictions of impact of rising rates on prices and affordability.

But given your “Higher rates are going to smoke the market” summary of the article, I expected the article to say something like that, and was surprised that it didn’t say that at all. A better summary of the RBC article conclusion would be that higher rates are NOT going to smoke the market.

The RBC article says that higher rates [+.75%] would only cause a small rise in affordability [+2.8% of income] and that “potential buyers hoping to get a meaningful break (falling house prices) will likely be disappointed”. A 2.8% rise in affordability would be offset by people’s incomes rising by 2.8% over time, likely 1-2 years would do it.

Here is the relevant quote from the article

market http://www.rbc.com/economics/economic-reports/pdf/canadian-housing/house-sep2018.pdf

“The outlook for affordability isn’t very promising. We expect the Bank of Canada to proceed with further rate hikes that will raise its overnight rate from 1.50% currently to 2.25% in the first half of 2019. This will keep mortgage rates under upward pressure and boost ownership costs even more across Canada in the period ahead. We estimate that, everything else remaining constant, a 75 basis-point increase in mortgage rates would lift RBC’s aggregate affordability measure for Canada by roughly 2.8 percentage points. Growing household income will provide some partial offset. So potential buyers hoping to get a meaningful break will likely be disappointed. We expect intensifying affordability pressures to restrain homebuyer demand over the coming year. “

CAQ is concerned about immigrants who stay in Quebec, not immigrants who don’t. An immigrant who puts money in government coffers and then takes off is a win for them.

How the proposed USMCA trade deal helps end the greatest homebuying opportunity in a generation

Pretty good article, but the headline got it backwards. The best time to buy is when interest rates are high and prices are low, not when rates are low and prices are high.

What about just the core?

@guest_49807

I know it has been stated before but does Micheal work for the real estate industry?

Your graph actually shows me that SFH of Victoria should crash since price of oil has gone down and held down for a while. (yes it is rising but in comparison to the other items you showed it should cause a decrease in SFH’s)

@Victhunter

Have you gone and low balled the ones on Lotus yet? Let me know how that goes 😉

I can see you starting to throw low balls in the next few weeks as whoever seems to be remaining is probably wanting to sell their home. It is interesting to see which homes stayed without PC’s over almost a 6 to 1 year time frame and then sold and others which seems to have PC’s each few weeks until they are sold.

Hope so. Citizenship should not be sold to the highest bidder.

3473 Henderson has been for sale since we moved nearby in May. Just cut price from 1288K to 998K, still above assessed at 980K. Some dreams died tonight..

Breaking news: Leo predicts price declines up to 24%.

Anti-immigration CAQ elected in Quebec. End of the QIIP and another nail in Van/Vic RE markets?

25%+

To you, what is a “price crash”?

The VREB says that “The under $800,000 housing market in some areas is under tremendous pressure as many buyers compete for these homes.”.

The “some areas” part makes it tough to pin down, but let’s take a look.

Single family sales under $800,000 in the core, westshore, and peninsula.

Months of inventory at 4.2 (up 98% from the low point in 2016)

Sales down 28% from last year

Active listings up 21%

4% sold over ask compared to 12% last September and 16% the year before.

You decide if that’s tremendous pressure.

https://tradingeconomics.com/united-states/money-supply-m1

We’ll see. The stress test came when the market was still stupidly hot. It didn’t crash the market but it is a totally different dynamic now than it was. I don’t think it will stop here. Don’t expect a price crash but I do expect price declines.

Doubt it. July 1 2018 was up over July 1 2017. Most assessments will be up a bit in the new year.

How did those emails go?

This is why I’m not a salesman.

All the data above is based on when the sale actually happened, not when it was reported.

In general I would expect a slightly higher percentage of people having to sell due to our older population, but a slightly lower percentage of people selling due to moving jobs because of our government/university/defense employment base. Also until the economy turns down we won’t have a lot of people selling due to financial distress.

Same. Is that really their priority? Daycare fraud? Meanwhile I think only 5 people have been audited from the Panama papers.

Yeah the only win seems to be that we didn’t lose the important part. But we didn’t gain anything. $150 de minis is a win for the US, same with dairy.

gwac

Would you like some pus with that?

Marko Juras

Why do you always prefer pre-sales? Wouldn’t a ‘slightly used’ condo be a better value?

THanks LF – hope you’re right! And Andy i’m hoping that crosses the water soon. Cheers!

Marko, maybe you can answer this… what’s the point of price dropping a house by 1%? Seems like a waste of time to everyone involved.

Appears as a “new listing” on realtor.ca and some other crap.

rush4life

This might make you feel more hopeful…

“Vancouver detached avg sales price fell 20% y/y. Median shows 9% decline.”

– Steve Saretsky

I have repeatedly tried to tell people, rightly or wrongly, that RE markets don’t move at the speed of the stock market. Price drops in RE, especially substantial ones, occur later as the cycle moves downwards.

Right now we’re teetering near the top still, in stagnation. In contrast, most of Vancouver is probably in the later stages of stagnation, but sometimes, that part can last for years (St. Johns NL was a great example around 2009). I’m not sure that’s as likely in BC, given how disconnected prices are from the economy. During stagnation, market pundits may use euphemisms like “stabilized”, “balanced” etc. If stagnation persists, then it starts to fall.

In US cities a decade ago, lot of the losses in the coastal markets tended to occur over 12 to 18 months, then dribbled down slowly. Eventually you get to the same stagnation at the bottom as at the top, before we start the next up. And the process is never a straight line. There’s many false starts and stops along the way.

Thanks, LF. I am on board with Steve’s credit cycle discussion – an intelligent and accurate discussion of how we got here, why and where we go from here because of it. Assuming USMCA is approved, the BOC’s shackles are removed – liquidity must and will be removed from the economy because, if not, we will have inflation that will be tough to tackle. By doing so, Poloz will attempt a soft-landing, but that is not possible when unemployment is this low and one asset class has inflated so much on the back of debt, debt and more debt. As these mortgages come up for renewals and incomes have not risen sufficiently, owners will have to examine their total debt vs assets [little to no equity]. As SixxAm said, “This is gonna hurt”. Thank God I am not a Realtor…………..

To move from a seller’s market to a buyer’s market, one must necessarily slide through a balanced market. The data supports that for SFHs, Victoria sits at a balanced market, but on the soft-side [meaning, below the middle of that category]. Sellers will pull their homes off the market if they do not “need” to sell. They will relist in Spring [say, Feb / March 2019]. Vancouver’s RE market looks really bad and, adjusting for the usual lag, Victoria is next [we see some of that now all up and down the Island]. Some don’t or won’t see it – so be it.

Next is the upcoming property tax assessments – there will be downward adjustments, the first seen in many years, but the valuations will be for July 1, 2018, so not a good litmus test for the current state of the market – they never are.

Really looking forward to the Spring of 2019 / 2020.

Just saw a place drop their price by 1%.

Marko, maybe you can answer this… what’s the point of price dropping a house by 1%? Seems like a waste of time to everyone involved.

I see sales dropping but no price drops- Median house price has stayed stationary since all these new changes – even if you just factored in the interest rate increase and the new b20 rules you would think prices would have come down a bit but they haven’t really. Pretty disheartening as a buyer – luckily for me I have no real options but to wait – i’m not gonna stretch myself as thin as possible just to buy a home – especially with forecasted interest rate increases around the corner. Hopefully next year we see some downward pressure and not just in part to interest rates – interest rates go up then my payment goes up – doesn’t help if prices offset accordingly – i want a meaningful drop (10%+). Guess i’ll Just keep putting money towards a down payment in the meantime, and if prices don’t drop, or they go up then I guess we start looking outside Victoria – I hear Fort St. John is nice this time of year…. guess i can always go to Goldstream park if I really want to save money…

@Barrister thanks! My brain is close to fried just dealing with the mortgage issues much less what house to settle for. We are well off and it is a huge challenge to buy a bigger house in this town. I imagine for the other 90% of the population there is no spring rebound due to them finding an extra 20% downpayment or income between the couch cushions.

I have to remember there are still quite a few opportunities out there and love that the pressure is lower to buy than in previous years. Love the house we are looking at but the property/location is just slightly overwhelming. Had to huff a little diesel from the Pat bay as I rode my bike out to take a look at the Cordova Bay neighborhood. Our current home has a small private backyard, that is a block from the galloping goose, we can ride down to Ferriss’ for Happy hour within 15 minutes. Might have to get into one of those mount Tolmie bidding wars, never had thought of that neighborhood until now 😉

Going to go look at a friends place in Brentwood Bay tonight, he is thinking of cashing out some chips and moving to Shawnigan Lake. Might have to look into the Telsa lifestyle like @guest_49810 . PS you won’t have to explain what knob and tube wiring is when you show my house but I’d welcome your bidding buyers, I’ll put some cookies in the oven!

In case anyone’s interested, up island SFH sales are all down significantly this month compared to Sept 2017.

Campbell River: – 32%

Comox Valley: – 21%

Nanaimo: – 36%

Parksville/Qualicum: – 34%

Port Alberni: – 27%

Page 17:

http://www.vireb.com/assets/uploads/09sep_18_vireb_stats_package_64515.pdf

It’s going to become a topic of curiosity to see how long you keep this up despite virtually all of the RE market and associated monetary indicators going in a decidedly opposite direction…

Q: How is this possible:

A: Because easy monetary policy encouraged the public to engage in widespread speculation and malinvestment into a riskier, unproductive asset class which under normal monetary policy, is too expensive and illiquid to be feasible. This can decouple the asset from its supporting economy and it can even become the economy if enough people pile in. This is what has happened in large sections of British Columbia and as monetary and regulatory policy tightens, this money either goes elsewhere, or quite literally – vanishes altogether.

To many observers, the stock market is in bubble territory. If it pops, a recession will follow, and interest rates will drop to stimulate the economy. And on and on it goes.

Marko is always playing devil’s advocate.

Maybe you need to get your clients to bid on houses that are price slashed and are open to offers versus having them chase the latest pumped listing. Hundreds of quality houses out there that have been slashed 10 % plus.

That’s about the time when people here started drinking the Different This Time™ kool-aid, which was a few months before VanRE hit peak volume.

I wonder how true that lag will hold on the trip down.

Residential listings now just above 2000. We last saw that back in late 2015.

However in September 2012 there were 4000 active listings….

Thank you, Leo.

My objective take on your analysis is more negative for the local RE market than “balanced”. The “slow down” has been very consistent since the new Regulations and prices have been inelastic, which is expected through an inflection point, which is where we sit.

With NAFTA / USMCA tentatively inked [still have to have legislative approval of all three countries], this removes a HUGE impediment to the BOC’s reluctance to hike rates. Given these developments, the BOC can hike in October and December 2018. The first will be a “make up” hike, while the second will be the substantive one to address the most recent GDP numbers. The US will certainly hike in December 2018. I would not be surprised to see 4 rate hikes in 2019 in the US and 3 in Canada.

This will have a material impact on the “price” part of your analysis above, as everything else you have outlined points one way and one way only. As you point out, adjustment of the RE market is a slow grand.

As for USMCA, 34 Chapters, here is quick look at key provisions:

-Forty to 45 percent of auto components will have to be made by laborers making at least $16 an hour.

-In a concession to Mexican and Canadian business, the deal largely exempts passenger vehicles, pickup trucks and auto parts from possible Trump administration tariffs.

-U.S. farmers are getting slightly more access to Canadian dairy markets.

US was offered more access to the dairy market under the TPP – but they pulled out. Dispute resolution is intact, with limits on state run industry complaints. There is expanded [very long] patent protection of pharmaceuticals. The dispute resolution stays, with limits now, as mentioned. US gets access to our banking sector, so Chartered banks lose some minor protection. There are 34 chapters. 2 strange provisions trouble me: (1) Canada faces trade restrictions regarding trade with non-market based countries (geared to restrict our trade with China) and (2) our monetary policy (as directed by the BOC) is less independent of the US – very strange – this is designed to prevent currency manipulation. we have to wait and see. We are capped on the # of cars we can export to the US [it is 40% above what we export now – highly unlikely we would ever reach that – but this stops the tariff threat and the gamble on investing in auto-supply makers paid off: Magna, Linamar and Martinrea]. This will ease investor anxiety – overall, I see no fundamental short-term harm, but once the lawyers get involved, who knows. My take: Trump was more focused on the name change than anything else.

“150 is the duty free limit from 20. That is also good news” – is it? Ask your local retailer who employs your neighbor.

“The source said Canada had also agreed to increase the “de-minimus” value of goods Canadians can bring into the country – such as through online shopping – from $20 to at least $100. But the person said Canada would still be allowed to charge sales tax – though not duties – on some of that amount.”

If you order things online from the US you’ll find that duty is seldom charged anyway.

https://business.financialpost.com/news/economy/theyre-in-the-final-strokes-canada-and-u-s-make-key-concessions-as-deal-in-sight-sources-say

Looks like we are on pace to squeeze out 7,0xx sales for the year. We haven’t had a sales year starting with a 7 in 12 years. We’ve either been in the 5s,6s, or 8s and above.

On the ground will be interesting to see how things play out. Just got another email yesterday afternoon “please take the listing off market on Monday, will rent it out”

I personally threw up my personal residence suite for 40% more than last tenant and got a great tenant in two days so the rental market still seems to be holding, for now.

Might be back to the 40% list to sales ratio gig where I have to email 20 to 40 listings every Monday as to why their property is not selling. At one point in 2013 I had something like 36 or 37 active listings. You kind of hoped 3 or 4 sold per month 🙂 Luckily I have quite a few buyers right now that being said three offers on a house in Mt Tolmie area over the weekend, my clients lost out at full ask.

I have two sets of clients that are 700 to 900k in the core right now so I’ve seen what the range has to offer recently and there is certainly a lot of generic boring poorly maintained houses out there. No shortage of that.

Showed a house on Saturday and it still had fuses (not breakers).

150 is the duty free limit from 20. That is also good news.

Nice fantasy charts, LOL. They can frack now on a moments notice all over the US and Canada. Canada’s Crude price of $38 is the killer ICYMI Mikey.

The walls will soon come tumbling down as the sellers have no choice but to keep slashing and debt bomb keeps on ticking closer to implosion. Winter is coming. 😉

…and recall that one of Victoria’s better predictors is the price of oil.

Want affordable housing? Stop the world’s lefties from quashing oil developments thereby driving up its price 🙂

The win is we have an agreement to end this stupidity and the dispute mechanism is still there

Cheaper Dairy is a good thing also. Supply management is bad.

Not massive concessions in NAFTA, but is there even a single win for Canada in there? I don’t see anything.

Final sales for September (reporting based, not sales date based) were:

533 (down 17% from last September)

1165 new listings (up 9%)

2646 active listings (34% increase)

RBC report makes it pretty plain. Higher rates are going to smoke the market. Now well surpassing the peak of 2006 to 2008 levels on its way to 1981 levels.

Victoria – Joining the unaffordable club

The boom that propelled prices to mountain-high levels over the past two and

a half years gave Victoria its ticket to Canada’s unaffordable market club.

RBC’s aggregate affordability measure for Victoria deteriorated sharply over

that period, including in the second quarter when it recorded the biggest increase

(2.4 percentage points) among the markets that we track in Canada. At

65.0%, the measure is the third highest in the country after Vancouver and

Toronto. Poor affordability, the mortgage stress test and other market-cooling

measures introduced by the BC government have weighed heavily on buyers

this year. Home resales fell 20% over the first eight months.

http://www.rbc.com/economics/economic-reports/pdf/canadian-housing/house-sep2018.pdf

Big sista is having a meltdown and the USMCA will not save it. BC was the least effected by the deal if it never happened but will be the most effected by 4 or more rate hikes. Decimating infact.

@SteveSaretsky

Greater Vancouver condo sales fall 44% Year over Year in September. A six year low for the month.

@SteveSaretsky

Greater Vancouver detached home sales fell 41%. The fewest sales ever recorded over the past 27 years for the month of September.

@guest_49793 from PP

Thanks for the tax info. I find it all a bit confusing but I agree with the overall sentiment that the plan to keep the investment property for 20 years and pay off then sell in retirement or keep as a rental for income is sound. It will be a nice nest egg one day or something to pass on to the kids. I read that if you live in the investment property for 2 of the past 5 years then it can be your primary residence for tax purposes. I know better than to do anything less than 100% by the book with the CRA having had one of my daycare receipts thoroughly audited. Yes, the CRA rejected my daycare receipt because it didn’t have the kids full names. So fine, I asked for (and was able to obtain) a new one. Then, they wanted further changes to the receipt. All of this in the context of them accepting that I made an income that could only be possible working full time and knowing that I have young children. I suppose they thought I was taking my kids to work every day or something. I appealed the request for further details and won, but still. Anyway, yes, agree that would have to genuinely live there. Thanks for the info!

As for September I have been keeping my eye on a couple of sfh’s and have seen the price cuts. Waiting for the Spring to see what happens…

VicHunter:

As you know, from a lot of the great analysis on here, prices are always sticky on the way down. We know the amount of inventory out there but we dont know the ratio of people who would like to sell and those who have to sell.

I suspect that part of your decision making is going to depend on whether this is a house you love or just one that will do. The good news, maybe, is that we are already in the slow sales period. If you are lucky this might be a we have to sell house so try a low ball offer

(if your agent tells you that you are going to insult them my advise is get a different agent; people who have to sell get depressed not insulted and people who get insulted are the ones who dont have to sell and are not going to give you a reasonable price.)

Dont have a crystal ball but my guess is that at worst prices will be flat in the spring with a real chance of a ten or fifteen per cent drop by next summer. The other factor that may or may not be relevant is that mortgage rates are likely on the way up now that the NAFTA issue is behind us.Likely to get at least one and maybe two increases this year.

If all else fails and your brain is frying flip a coin.

It’s actually stagnating, according to the data.

The broader, “trouble either way” wasn’t merely positional conjecture. It was actually a recently stated concern from the BoC – do nothing with rates and risk further asset inflation, CPI inflation and a crumbling dollar, or hike them and risk an economic tailspin given the extraordinary debt loads.

Steven Poloz recently said,

One of the bank’s tools for smoothing an economic downturn is to lower interest rates. But if inflation balloons as a result of higher prices for automobiles and other big ticket items, the bank would have to consider moving in the opposite direction…All of those ingredients make it very complicated for a central bank.”

LOL