A foreign buyer update

A couple days ago we got some stories about how the foreign buyer numbers were finally released to cover the period from June to September 2017. It was a bit strange, since every story referenced “statistics released Tuesday afternoon by the province” but I couldn’t for the life of me find those statistics. There was no press release by the Ministry of Finance like we had before, and the data was not up to date on DataBC. So was the data released only to journalists? Can anyone help me find this so called release?

No matter, after some gentle poking at the ministry and the help of a friendly HHV reader, the DataBC record was updated with the up to date foreign buyer data this morning.

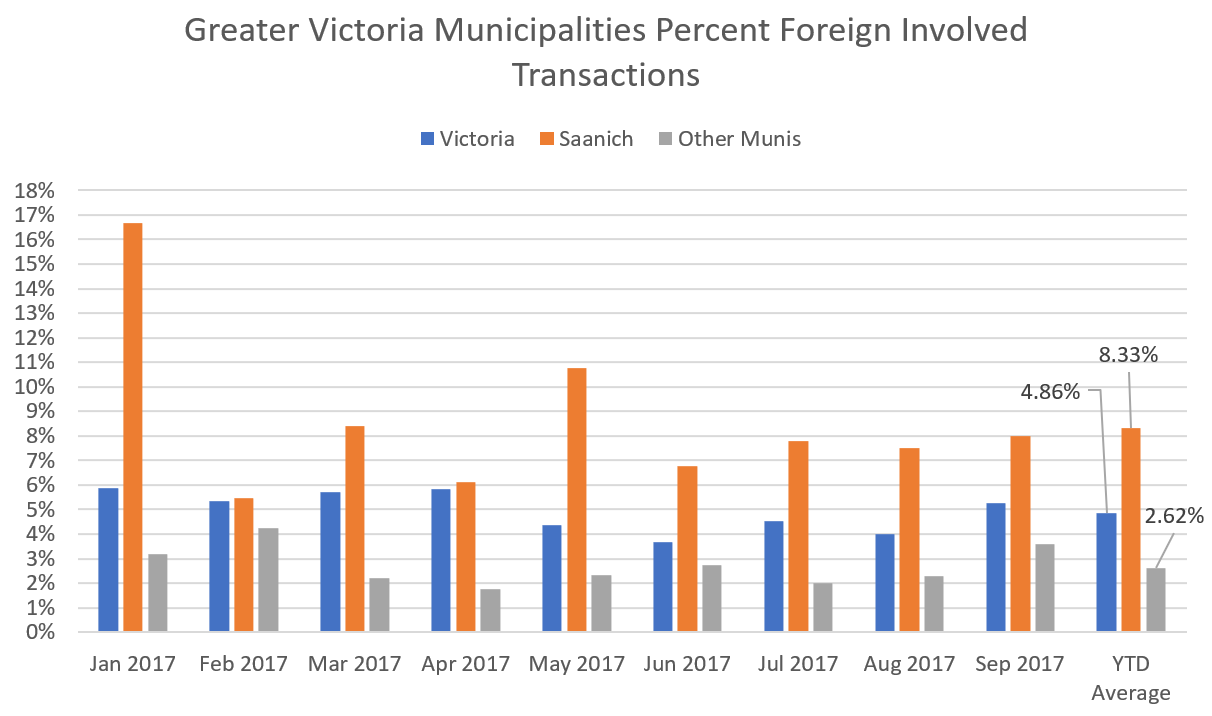

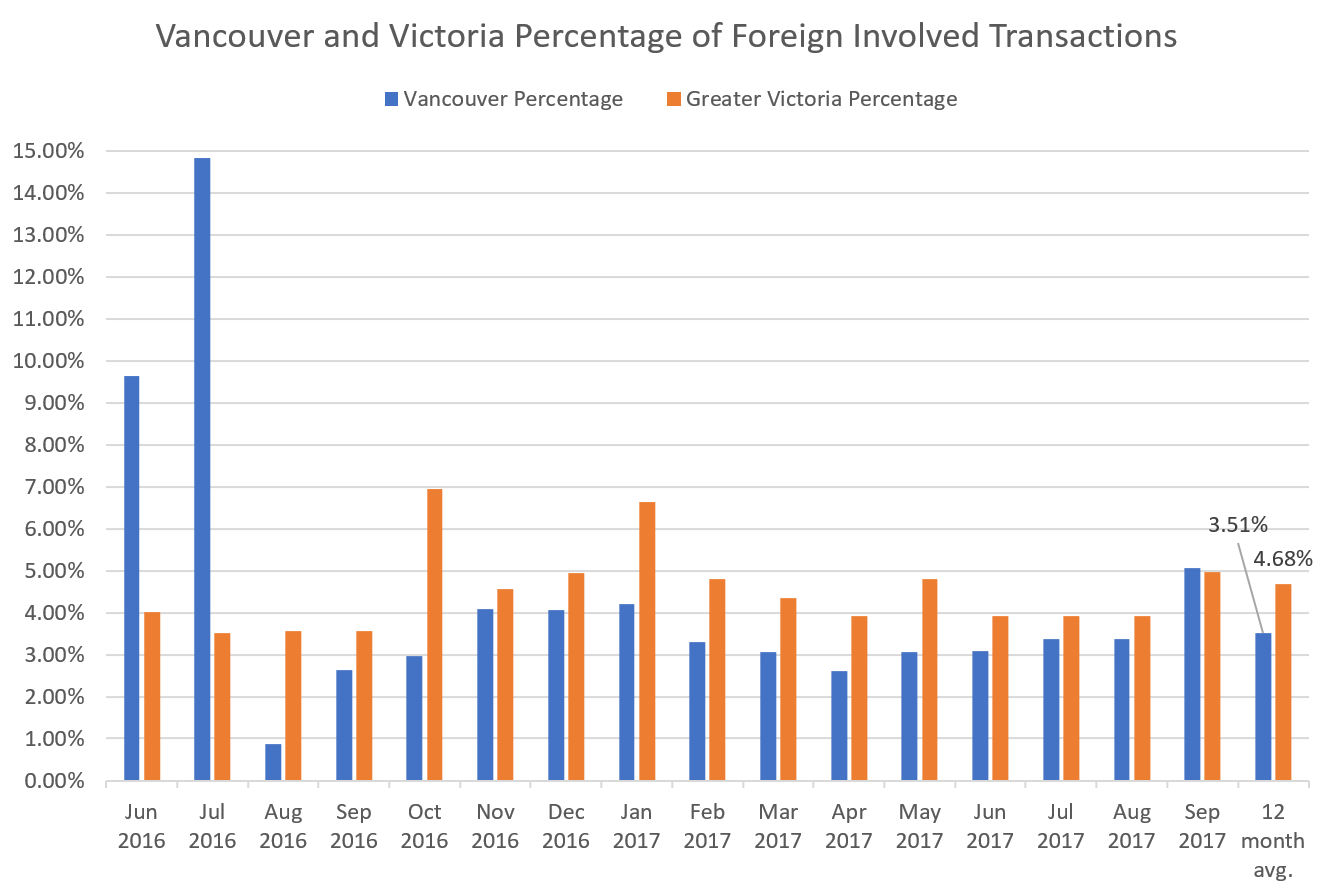

Almost all the data reported in the media about Victoria is slightly wrong, because they divided the number of foreign buyer involved transactions for all types of properties (residential and commercial) with the total number of residential transactions to get their percentages. No big problem, they were only off by a tenth of a percent or so. Here is the up to date data.

No great change in the numbers for our region. I still find the numbers for Saanich surprisingly high at 8.3% for the year so far, nearly twice the level of Victoria proper. It doesn’t combine well with Saanich council dragging their feet on every new development.

No great change in the numbers for our region. I still find the numbers for Saanich surprisingly high at 8.3% for the year so far, nearly twice the level of Victoria proper. It doesn’t combine well with Saanich council dragging their feet on every new development.

Weekly update: https://househuntvictoria.ca/2017/11/06/nov-6-market-update

I imagine some of us are waiting for this weeks numbers. Naturally the numbers will be down due to the crippling snow storms.

Barrister, I agree with you in that the days-on-market (DOM) indicator is diluted due to listing practices in Victoria.

However, if you’re selling real estate – it works.

BC needs stricter legislation on residential real estate. And the Real Estate Council of BC needs a kick in the arse to protect purchasers from dubious sale practices which would also include non licensed sellers such as developers.

629 Beach just came up on the MLS as a new listing. It is anything but new. It has been on the market for well over six months. Basically because they had a conditional offer collapse the MLS suddenly decides that this is a “new listing”‘. House down the street was on the market for over two years and every time they changed agents it came out as a new listing. When it finally sold it was recorded as 11 days on market instead of over 700 days. In short, the MLS stats as to days on market are next to meaningless.

It would surprise the hell out of me. There is no shortage of land for building condo towers downtown, not for the next 500 years anyway. So the supply is only constrained by the willingness of council to approve them. And as much as people love to complain about Victoria city council, they have been on a bit of a tear lately approving projects. They may not blanket rezone but I believe they have recognized the need for new supply and are pushing to make sure those get approved.

Current mania aside due to lack of supply, I can’t see condo prices escaping much past the cost to build + developer profit in the long term.

Sure Michael but that land is diluted over many units and is inaccessible by the owners of those units. They are stuck with the depreciating part of it. Better hope they have enough saved for that 100k bill to redo all the windows. Just as many will keep their SFHs as their children move into them as they move down to the basement suite. They don’t really want to euthanize fluffy just for the sea view….

Multi-zoned land in the core IMO will far outperform single-zoned in the burbs for many years now. It wouldn’t surprise me if 20 years from now the average condo, between say the breakwater and Jubilee medical district, is worth more than the average Saanich SFH. That may seem counter-intuitive when you look at the last 40 years, as the boomers started families, then went through 3 decades of move-up house buying in the burbs. However, boomers are about to begin a transition to what I’ll call the 4 S’s – seeking sea views, stairless, security (ease of travel/maintenance), and something to do/walk to. Meanwhile, a growing number of DINK techies will be seeking the same.

Well Vacationing with family in Maui I was chatting with locals on short term rentals. Even Maui has restrictions and rules heavy permit fees and reached there capacity for short term rentals a few years ago. Interesting to here other city perspectives.

https://www.mauicounty.gov/1377/Short-Term-Rentals

Well said Luke. I’m a first gen immigrant myself. I don’t recall how exactly it worked with permanent resident status back then, but we rented for a year before buying a property in the interior. Of course back then the land cost 1 cent/sqft so I don’t think there was a lot of concern about property values. 🙂

Mike ,

If you are going to post average price charts can you post Victoria’s? It’s tanked $40K for houses and condos last month. Not a good sign with many sales pulled forward for stress tests as per VREB . 😉

You could have bought Johnny Depp’s $1.8 million condo in an historic building in downtown LA for the same price and sq ft on the busy corner of Bowker and Cadboro Bay with no view etc. No brainer how completely detached from reality Victoria has become.

Justin’s campaign buddy from childhood whose a Bronfman, and a senator funnelling multi millions offshore is not going to go over well.

Vancouver chart looks like it’s hit the affordability ceiling from a year ago. Red alert, nowhere to go but down as stress tests and higher rates kick in. Look out below suckas.

Common nomenclature would call it, “irrational exuberance”. In Vancouver right now, the rage is in pre-sale condos. Buy off a plan at a 30% premium to today’s prices for a building that will be complete in 3 years, and presume that over the next 3 years, condos increase at about 10% per annum each of those years.

This 30% gain will need to be on top of the nearly 60% price gains we’ve already seen in that market segment in the last 2 years. And if you’re one of those pre-sale buyers, you better hope it does. Because if the market has other ideas and you’re using leverage to buy the unit, then you better be prepared to pony up a lot of unexpected cash on closing day.

Sounds like someone’s idea of insanity to me.

Back to housing –

Today I went to an open house and the place was complete bulldozer bait for almost $800k. Lot value I guess.

Anyway, it was busy, but the thing that struck me the most was the full spectrum of ethnic diversity that was in attendance. There were the whites of course, but also there was a muslim family, and groups of Asians. It’s quite evident from the latest census data that Canada’s demographics have changed, and that will likely continue, as most of our new immigrants are now coming from either Asia or Africa.

I’d wish anyone taking on that place well as it needs a lot of love.

Hawk, I think you need to be a bit realistic and realize that when 300,000 plus new people are moving to this country every year, some of them are going to end up in Van and Vic. Yes, most are actually going to Ontario or the Prairies, but some will come here.

Let’s just assume that only 1% of the new people coming to Canada decide to come to Greater Victoria – after all, it’s a fair assumption given our population is only slightly over 1% of Canada’s total population. That number may actually end up being higher, esp. given the booming economy here right now.

Under that scenario, out of 300,000 we will get 3,000 new people per year. Doesn’t sound like an impossible number to absorb to me. We haven’t added the inter-provincial migration and migration from other parts of BC to that number, but you get the idea.

Another thing to consider… while many of these newcomers will not be rich, there will be some that are. So, we can add this to the numbered companies, and other oversea’s conglomerate’s eyeing BC real estate – hopefully the latter can change for the benefit of everyone.

New comers from out of Canada are here in Vic – I’ve met many already, and there’s even a Syrian Refugee family recently arrived being housed in a nice house on my street (they keep to themselves, so I’m not sure how that’s happened for them). These newcomers are often very hard working – having had to endure the rigorous (albeit less so now under T2 than the previous Gov’t) immigration process.

I’m also not sure that anyone is ‘putting’ them anywhere – don’t they get to decide where they want to go? Maybe with the exception of refugees?

Let’s also remind ourselves – we are all essentially new comers to this relatively new country – most of us can trace back how, who and when they arrived here. The only exception to this, of course, is that of the First Nations.

Canada is now a rare haven for many of the world’s down-trodden, and a beacon of hope. We are departing from the direction many other western countries (esp. US and UK) are heading. As long as it’s ensured that these new Canadian residents want to fully participate, integrate, and perhaps most importantly – understand that they should adhere to our values – then I think they should be welcome here.

Good question. I’ll ask the VREB why that field disappeared.

What other changes did you not like?

The $1M for condos is the most amazing to me. SFH gets more and more rare as a city densifies, but condos can be built at will. I can’t see how a million dollar condo makes sense from an investment standpoint. What will it be worth $2M soon?

Speaking of Vancouver, prices jumped again last month – ie. from 1666284 to 1803162 for detached.

I would guess ~2.3M for detached and nearly 1M condos for this cycle (based on previous ones). As per usual, foreigner taxes, mtg reg’s, etc. will slow the ascent for brief periods.

Wonder how many Vancouver connections we will see in the paradise papers leak.

“Hussen called immigration a “big tool” to power Canada’s economy and address demographic challenges, including those in Atlantic Canada, at a time of falling fertility and an aging population.”

Sounds like a good plan to put them in cities back east and on the prairies that need growth and not congested expensive bubble cities like Vic and Van. Why put them behind the 8 ball from the get go.

2561 Scott St on slash #2 for $50K loss.

21 Dallas Rd , #529, high end condo in Shoal Point slashed $75K to $825K.

934 Boulderwood Rise , #18, high end townhouse in Royal Oak on slash #2 for $70K.

Golden Head flipper 4295 Torquay Dr can only bring himself to slash $20K when it’s going to need more than that.

Westshore taking some hits, new builds too.

“Our government believes that newcomers play a vital role in our society,” Hussen said. “Five million Canadians are set to retire by 2035 and we have fewer people working to support seniors and retirees.””

Sounds like they plan on having most as nurses aides and lawn cutters not millionaires living in refugee camps which Mike seems to portray. If Mike’s government gets back in you can see that being cancelled over night.

Canada to admit nearly 1 million immigrants over next 3 years

Economic class will make up about 60% of newcomers

http://www.cbc.ca/news/politics/immigration-canada-2018-1.4371146

FYI: Interesting articles about foreign buyers in LA Times and CityLab

http://www.latimes.com/business/la-fi-foreign-buyers-20170718-story.html

https://www.citylab.com/life/2017/08/the-foreign-buyers-you-havent-heard-about/536490/

“The survey defines foreign buyers to be non-U.S. citizens with permanent residences outside the country, as well as noncitizens who have lived here for more than six months on temporary visas or immigrants who have lived here less than two years.”

They seem to divide foreign buyers into two groups:

– non-residents: non-U.S. citizens with permanent residences outside the country (including Canadian snowbirds)

– residents: non-U.S. citizens who reside permanently in the United States as either recent immigrants or foreigners on work, student or other visas.

Can you run for premier Barrister or at least submit those ideas in your most recent post to the current premier?

That is all so spot on I’m beside myself. Tax the yin yang out of them and then they’ll go away. Homes here should only be for PR or CDN citizens who are also residents.

@Leo S

Where can I find the ceiling height on the MLS listings? I used to be able to find it until the website got revamped; I really dislike the changes that were made to the website.

Rook:

I actually dont agree with your statement on a technical basis. I suspect though that your intent may be the same as mine. Under your criteria, foreign students, who by the way are often granted a work permit or allowed to work a limited number of hours would be allowed to own real estate here as well.

So would foreigners who are here for a limited time on a temporary work permit. I believe that a much clearer and easier distinction would be simply Canadian citizens or landed immigrants.

But I am not sure that an absolute ban on foreign ownership is the way to go. There are a number of areas in Canada that are very reliant on foreign owners, particularly Americans who own vacation homes, for their very survival. In Ontario, towns like Halliburton, are very dependent on Americans who own homes there and vacation in the summer. The same is true of many maritime communities in the east.

I believe that the smarter way to go is impose an additional property tax annually on foreigners who own residential property in Canada. The amount of tax can vary from municipality to municipality.

For example, in Vancouver perhaps the tax should be eight times the present property tax. This can then be ratcheted up every year until not only do foreigners stop buying but the ones who presently own property decide to sell out as we bleed then dry. We might as well milk the cow first before we take it out to slaughter. At the same time we should impose a capital gains tax that captures 95% of all gains made on the sale of any property by foreigners.

There are a number of other measures that need to be imposed alongside of these tax changes such as banning the ownership of residential properties by corporations. We should also prohibit the holding of mortgages, directly or indirectly, by foreign nationals. It is a matter of closing the loopholes.

I know that there are people online here that are a more knowledge than me on this matter so I would love to get some feedback.

Exactly Bitterb…. we should not be selling out a non renewable resource like this. It’s breaking the back of our society. We are being taken advantage of without question.

If I want to buy a house in Beijing, I have to show five years of taxes and social security paid in China and I’m allowed to buy one house only. We are an international laughing stock and ordinary Canadians are paying the price for our gutless government.

Leo S: I see this very simply. Residential real estate should be for people living and paying taxes in Canada. Whether those people are new or old Canadians does not matter one bit.

This whole comment was very well said.

Definitely important. House prices and unemployment is obviously correlated although it’s not necessarily the case that one drives the other. This paper concluded that a 10% increase in house prices lead to a 3.4% decrease in unemployment rate (http://www.cepii.fr/PDF_PUB/wp/2014/wp2014-25.pdf ) however I don’t see how that computes with our market, given prices are up over 1000% since 1960. Probably works better on a national level.

$959k

I see this very simply. Residential real estate should be for people living and paying taxes in Canada. Whether those people are new or old Canadians does not matter one bit. But property held for speculation or for only occasional use distorts the market and should be severely restricted. For everyone mind you, and in addition to foreign buying restrictions you can see the CRA cracking down on vacation homes by closing the loophole that allowed many to profit from them without paying capital gains.

Lower house prices lead to less capital being tied up in unproductive assets, and allows businesses to attract employees more easily. Those benefits easily outweigh the bit of investment that comes from the real estate transaction itself and spinoffs.

An interesting one for sure. You will have to ask your realtor for more information there. Who knows, maybe an opportunity for someone who can decipher it.

Ya’ll don’t forget to put your clocks back 1 hour tonight…

Immigration yes, foreign ownership no. But only for ten years. Because of the crisis.

A bit of a red herring, IMO.

The issue even more at hand, is whether we need to identify and restrict or ban the purchase of real estate in Canada with money that is not generated in the Canadian economy.

I think most people here, myself included, agree with your definitions, Barrister.

The idea about banning more than 20% Canadians who were born outside Canada, including half of the people on our street (who have worked and lived in Canada for more than 30 to 40 years), to buy homes in Canada, is extremely ridiculous, even if it is from a Bearkilla.

Just curious, what was the sell price for 2274 Cranmore?

Let me toss in my ten cents in order to get some clarity.

I believe that the original issue was whether we need either restrictions or a total ban on foriegners

(ie. people who are neither citizens or landed immigrants) buying real estate and, in particular, residential real estate properties in either part or all of Canada.

To be clear foreign students and people here on temporary work visas are not either citizens or landed immigrants. They are here as visitors on a temporary visa that allows them to either study or work in accordance with the terms of the visa. In essence they are still foreigners on a temporary stay only in accordance and limited to the terms of their visas. Legal immigrants are people who have a permanent right to reside in Canada. They no longer fall within the category of foreigners.

The issue at hand is whether we need to either restrict or ban the purchase of real estate in Canada by foreigners. While immigration levels do certainly affect the real estate market since more people increases demand on the available housing it is in most ways a separate set of issues. It is best, in my opinion, to treat them as separate policy issues since they are only tangentially related.

If we can agree to accept the above definitions then perhaps we might discuss the pros and cons of restricting foreign ownership and the various options available to accomplish this goal.

Victoria has lowest unemployment rate in Canada, StatsCan says

http://www.timescolonist.com/news/local/victoria-has-lowest-unemployment-rate-in-canada-statscan-says-1.23083754

So because my ancestors might have been migrated here I can have no opinion on immigration. Ok checks out I guess.

Pretty sure foreign buyers abd immigrants are synonymous for most people. They just don’t like to say so because muh racism.

Delete away I’m not trolling.

@Bearkilla – Future trolling posts along these lines will get deleted.

Depends on who you ask. I believe totoro’s line of argument last time was that it was better to invest in real estate than to invest in education and she would recommend buying real estate instead if her kids were inclined to do a BA. Or did I mischaracterize that argument?

Yes, we are talking about foreign buyers. But “foreign buyers” != “immigrants”. “stop foreign buyers” others are talking about is totally different from “stop immigrants” you support.

p.s. I see that you just changed your words, but I will keep what you said before.

Then why are people against fureigners buying real estate. I don’t support immigration or buying real estate unless born here. I’m consistent.

Hi Bearkilla,

Are you of native american descent? If not, we were all foreign immigrants to here within past 170 years. Foreign immigrants didn’t stop coming when the native americans were wiped out by PLAGUES they brought here; Foreign immigrants didn’t stop coming when most old-growth forest here were cut down due their building demand … Most damage to this land has been done by us or/and our ancestors already. Why only blame the new comers when we all are guilty?

Variety is good.

Just curious here should we also stop foreigners from immigrating here? I think so.

I’d like to know how many of those foreign purchases are paying well over ask just to get the property no matter what and falsely propping up prices. I bet most are.

Land Banking a more pleasant term for what I’ve been calling hoarding.

What’s the deal with 1030 Richmond Rd? How come it’s been on the market so long? What are the issues? ANYONE?

Write or call your elected official. Ask to stop foreign speculation and to close the loopholes.

To buy one should have permanent residence status and above. Just make it “temporary” until the “crisis” is over. Then can make a “temporary” tax on foreign ownership. Bottom line is we shouldn’t be selling out a societal NEED so easily on the international stage….

I agree JD. No house buying on a student visa at all. That is a simple one. Students should be studying not flipping. I guarantee you this conversation happens in some upper class social circles in other countries. “So you put your kid through university and made money?” “Yes! We bought a house with no money down, our child lived in it during university renting some rooms out, then we sold it at the end so it paid for everything and then some!”….

I am sure that many folks here have already seen it, but I thought this article was a very interesting meta-analysis of why many foreign buyers are “land banking”:

https://betterdwelling.com/urban-land-banking-101-supervillains-guide-ruining-local-real-estate-markets/

Warning: Very snarky, but good anyway.

Good to see Introvert posting a relevant article rather than personal attacks.

As to the point of foreign buyers, I have noticed an upswing in the number of Asian students purchasing property in Greater Victoria. One example that I came across is of student that purchased a new condominium in the city at $400,000 in September 2016 and then last month she purchased a new house in Langford at $800,000. She has not listed or sold the condominium.

A few years back I read an Australian article that dealt with students acting as straw buyers for housing. The students received a commission of 2 or 3 percent on the purchases. Funneling money out of the country through students’ bank accounts is one loop hole that the government should close.

Are you using it? I would be interested if anyone is actually using this around here. As others, I am too timid to do so. While I fully intellectually understand that it is likely a profitable exercise, I still won’t do it. Just not worth the stress.

Thanks for that interesting Andrew Weaver article introvert.

I think the NDP is paralyzed on the issue because the majority of British Columbians are already homeowners. They’d shoot themselves in the foot if they do too much.

New Zealand’s ban on foreign ownership was an interesting recent ex. ( except Australians ). Even if we did the same as that, which is unlikely, it still wouldn’t be enough.

Then there’s the numerous loopholes that many foreign buyers are using to get around the foreign buyers tax and even PTT.

will be interesting to see what they eventually do about the issue. My prediction is… not enough. Tax paying, hard working Canadians, are unable to even come close to competing with these overseas conglomerates.

I think the only person that has seen a lot of success with the smith manoeuvre is Fraser Smith….

Andrew Weaver press release: It’s time to clamp down on offshore purchases of BC real estate

http://www.andrewweavermla.ca/2017/11/02/time-clamp-offshore-purchase-bc-real-estate/

With job numbers up again today and in the US, you can guarantee the rates are going nowhere but up. 6% stress tests look likely in the new year and tighter credit checks.

I agree with Ooops. You better be a very astute investor with tight stop losses and a stomach to take the hit if a black swan event happens. Most on here seem to be buy and mold types and may be slow to pull the pin when you have to take the loss and suck it up. Then it’s called the Puke Manoeuvre. 😉

KootenayBoi, talk to people who did the “Smith Manoeuver” in 2006 or 2007. Most wanted out in 2008/2009 but were underwater and would have to pay to get out + they were paying interest on a loosing investment. The only people that I have witnessed making any money on it are the “advisors” who sell them.

KootenayBoi: “I’m not saying that the HELOC’s as readvancable mortgages are good per se, but many of these may be utilizing the “Smith Manoeuver”.”

The “Smith Manoeuver” is probably one of the better reasons for financially astute homeowners to utilize their Heloc but it would appear that a majority of Canadians aren’t particularly financially literate.

In saying that, I think that the majority of the commenters on this blog seem to be quite savvy financially. How many savvy commenters have applied the “smith manoever” to their mortgages? I was always a little too “bearish” to consider it.

Been following the blog for a while now since buying a house in January, first post.

I’m not saying that the HELOC’s as readvancable mortgages are good per se, but many of these may be utilizing the “Smith Manoeuver”. A good description of the practice is here: https://edrempel.com/smith-manoeuvre/

If used correctly, and the stock market cooperates (which 90% of the time it does), you can come out far ahead over the life of your mortgage and/or have it paid off sooner.

Opps:

i find the interest only payments a bit concerning. If there was a major market correction the banks could be putting themselves at addition risk. It also feels like some Canadians are really living a bit past their means.

Hey Hawk, I thought that you and the group would find this report quite interesting. I had never even heard of a readvanceable mortgage before but apparently when you take out a heloc this is the preferable option for both the bank and apparently the customer … as it allows interest only payments.

I guess “living the life” could mean at the expense of paying down the mortgage.

https://www.canada.ca/en/financial-consumer-agency/news/2017/06/fcac_report_homeequitylinesofcreditmayputconsumersatrisk.html

“When used responsibly, the HELOC portion of readvanceable mortgages can provide many benefits to consumers such as low interest rates, convenient access to funds and flexible repayment terms. However, it also allows consumers to make interest-only payments which can result in homeowners carrying debt for longer periods.”

Quick Facts

Banks reported to FCAC that a readvanceable mortgage is now the default option offered to credit worthy mortgage customers with down payments of at least 20 percent.

Of the approximate 3 million HELOC accounts, 80 percent were held under readvanceable mortgages in 2016.

The number of households that have a HELOC and a mortgage secured against their home has increased by nearly 40 percent since 2011.

40 percent of consumers do not make regular payments toward their HELOC principal.

25 percent of consumers pay only the interest or make the minimum payment.

Most consumers do not repay their HELOC in full until they sell their home.

@rush, they are to blame for the snow! Leo’s graphs clearly show Vancouverites are to blame for our house price leg up….

Amazon to bring 1,000 new tech jobs to B.C.

Seattle-based technology giant Amazon has announced plans to bring 1,000 new jobs to B.C. by 2020.

This will double the current number of Amazon employees in B.C.

http://www.cbc.ca/news/canada/british-columbia/amazon-to-bring-1-000-new-tech-jobs-to-b-c-1.4386173

Thank you Leo for the answer to my question.

Caveat: That was witty.

It fits into the “other”. The issue is, only Victoria and Saanich are large enough to have any useful data. As I explained in my earlier update (https://househuntvictoria.ca/2017/06/30/foreign-buyers-part-deux/ ) all the other municipalities have too few transactions, and they don’t release the number of foreign buyer transactions if they are 5 or less in a given month. So for oak bay the numbers are either zero or not releasable every month.

Time for a cheerful Hawk Christmas carol – “Slashing through the snow………

Leo:

Does Oak Bay fit into Victoria proper or into other on the charts? Actually do you have the number for Oak Bay alone?

Guess they can blame the slow sales on the snow now, while the slashes continue.

3307 Maplewood Rd slashed $100K.

4382 Fieldmont Pl in Golden Head slashed $75K.

425 Kipling St in Fairfield slashed $50K.

2553 Vista Bay Rd in Cadboro Bay slashed $70K.

“Dasmo how are Albertan’s foreign buyers?”

I think they were referring to the first comment which talks about the snow – saying the Albertans brought the snow with them – not talking about the foreign buyers.

Dasmo how are Albertan’s foreign buyers?

The influx of Albertans last spring are to blame for this!

What is that white stuff on the ground?