Big sales decline to start off October

Weekly numbers courtesy of the VREB.

| Oct 2017 |

Oct

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 146 | 735 | |||

| New Listings | 265 | 904 | |||

| Active Listings | 1990 | 1938 | |||

| Sales to New Listings | 55% | 81% | |||

| Sales Projection | — | ||||

| Months of Inventory | 2.6 | ||||

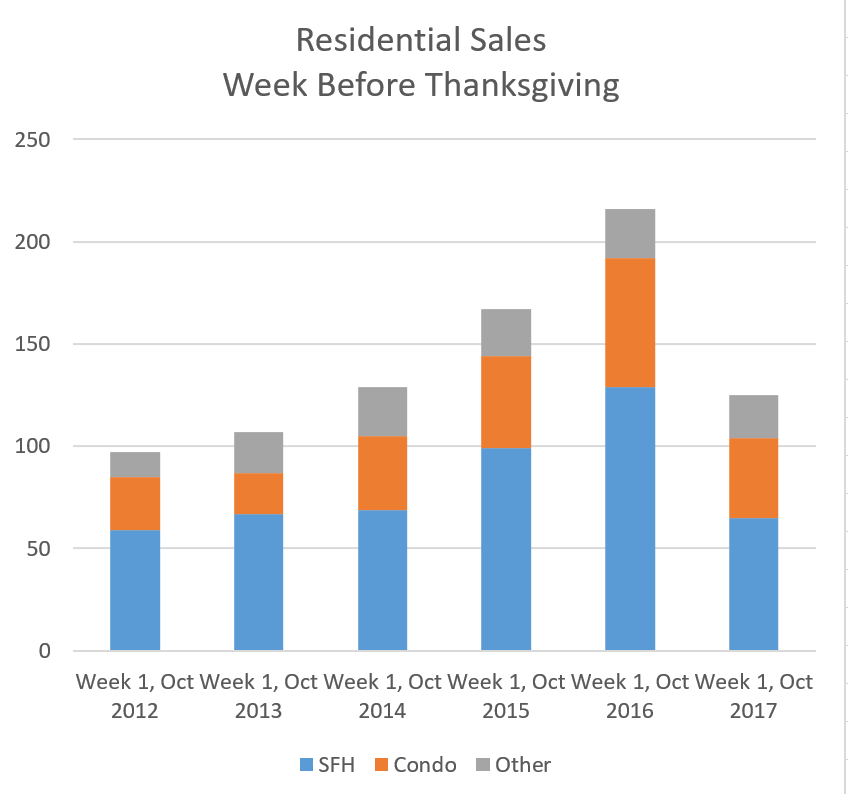

Big decline in sales rate from last year. We are now at identical inventory levels, but sales are down by a third (16 sales/day compared to 24/day this week last year).

Looking at just residential sales for the same week (Sunday to Saturday before thanksgiving) we can see the decline is even more dramatic.

SFH sales off 50%, condos down 38%*.

* Note this is as of 9PM Oct 10, some sales not yet reported may still be added to last week’s numbers.

The stress test on it’s own may not be enough to stop this market, but if the market is stopping itself, the stress test could be more significant.

Meanwhile, reader Allison writes:

Our dream (maybe not reality) is to have some more space, and we don’t mind moving further away from Victoria, although would want to avoid colwood crawl, so Saanich is likely where we are looking. Our thought was that SFH prices closer to the core will rise faster, so that IF we decide to sell (min 2-5 years from now or even more), we will be in a good position.

What is going on in the min 1 acre SFH market in Saanich. Are these places typically just as or more desirable than core SFHs? Or are there just so much less of them that they are always a sellers market?

There aren’t all that many acreages in the Saaniches, with a bit over 100 selling every year. As John Drake already pointed out, while the core does sometimes appreciate more quickly than the outlying regions, this isn’t always the case and recently outlying areas have been appreciating faster. In general you can expect that you won’t be able to significantly exploit the arbitrage between the two areas as the differences in price ratios are temporary. Especially on the Peninsula where land and development is tightly controlled. This is a little different on the Westshore where there is plenty of land to slap together new developments and keep prices more grounded. As with most other single family homes, the conditions for acreages have relaxed somewhat from 2016 and are approaching the lower end of balanced territory.

Agreed. That is much more realistic. Interesting how the US is a complete anomaly though. So saying we are higher than the US thus it must crash isn’t necessarily the case.

How much should your down payment be?

new post:

https://househuntvictoria.ca/2017/10/13/optimizing-your-down-payment/

Yeah, even though they were stripping health costs, I call BS on that one too. The truth is we’re much higher than the US on a disposable income ratio.

If someone is trying to establish a point that doesn’t necessarily have a basis in fact, is a red herring, or the nexus between the measurement and the argument is disjunctive, you can often spot an agenda. Obfuscation is a very common (and even more obvious) tactic.

It’s a little like the grafty US financial/mortgage institutions in ’08, where their balance sheets were so complicated, they read like a series of Goncharov polylogarithms. It should and did raise suspicion – because almost no one could understand them and discover what they were doing.

The nice thing is, the measurements you need to help assess the state of a housing market, are not generally complicated for the most part.

How much do people earn? What are the interest rates? What is the renting vs owning costs? What is the build price versus the selling price? How much consumer debt are we carrying? What is inflation doing? How fast are homes selling? Rate of price change, demographics, starts etc.

I don’t believe there is much data that indicates a bullish perspective on Canadian housing is warranted at this time, particularly BC and Ontario. That of course does not translate to predictive ability, but I do know one thing.

It takes a hell of a lot longer for a market to build complacency such as we have now, than it does for it to all come tumbling down.

I’m pretty sure that chart is bullshit. They are dividing an index by total personal disposable income. It’s nonsensical.

And I’m not saying a flat landing is a plausible scenario, I also would be shocked if Toronto and Vancouver can pull one off, but I don’t think the argument is convincing that he put forth. I would look more at affordability and say that clearly the only reason Vancouver is where it is, is due to outside factors. That means any disruption of those factors will cause a crash back to local supports. Continued price inflation is only possible with continued money inflows, which seems like a heck of a risky gamble.

“We’ll talk forecasting and a new model we’re working on called median credit market exhaustion in the next part.”

Now there’s a concept, “credit exhaustion”. I look forward to reading that, as it’s a subject I’ve only recently seen reported on once a few months back. Credit markets running out money and/or borrowers because they’re all maxed to the hilt and the rest are too petrified to borrow.

JPMorgan warns that the next financial crisis could be caused by a massive liquidity disruption

http://www.businessinsider.com/stock-market-news-jpmorgan-explains-next-financial-crisis-2017-10

I wasn’t really talking about a 15 minute commute. That’s nothing. Huge numbers commute double to six times that in Victoria. One colleague at my old job drove from Sooke every day. Another drives from Duncan.

I enjoy driving as well, but I don’t enjoy sitting in traffic (and I imagine very few do). So far the peninsula is better for traffic but just yesterday a colleague was complaining about increasing traffic near island view.

It’s also one of those things that is fine when you’re younger and don’t have any other after work commitments or kids to spend time with. Later on the time becomes increasingly required for other things.

Ya, fair enough.

It reflected one of my own biases pretty well – as I think it’s foolish to presume that prices can never really go down, and for some reason I thought he made the notion look adequately ridiculous. And now look – too funny. 😛

I guess I still think that a nice levelling off is a pretty rosy outcome, most especially in markets that have made meteoric climbs. Additionally, the level of borrowing against that equity would seem to add insult to injury in the event that the music finally stops.

Thanks for taking the time to put the rebut together.

Here’s why I don’t like this article: https://betterdwelling.com/future-canadian-real-estate-prices-part-1-bullst-detection/

It leads with a whole lot of self-aggrandizing. The author is so important to be invited to speak, his talk was so amazing that people gasped during it, very important people were very impressed, he is very smart, and a bunch of bigwigs read betterdwelling.

It reeks of argument by authority, and is completely unnecessary.

Then he gets into his theory. That when real estate prices have seen an “unprecedented rise”, the level of support is 30% lower than the peak. No details on their methodology, no list of which markets exhibit this behaviour and which don’t, no details on how strong their finding is. In other words, it’s pure assertion and no more useful than the real estate industry saying “real estate only ever goes up”.

He says they define price to income as “the price of a typical home, compared to the median income.”. What is a typical home? Average? Median? Benchmark? Why is he defining a term with another term that has no accepted definition?

Then he mocks the flat landing hypothesis by showing a completely flat graph, which of course is not what a flat landing looks like. Then he calculates the flat landing scenario based on his invented support ratio, comes to a ridiculously long number, and declares the flat landing theory wrong.

There is zero logic in that article and a whole lot of chest thumping. This is not how you “democratize real estate information” like he said his aim is to do..

Anyone know what 2554 Shakespeare sold for?

Not in any of our lifetimes. Which should be an incredible relief for the bears, as the last time rates went from our current levels to 21%, prices went up about 100-fold!

(ie. a $1K home in the late 40s went to well over $100k by summer of ’81).

The historical average is under 5%.

http://cdn.static-economist.com/sites/default/files/imagecache/full-width/images/print-edition/20120630_FBC506.png

I don’t think any of us want to see a repeat of an inflationary world where the average Vic home shoots to well over $100M. It’s stressful on people – why do you think the boomers turned out so weird 🙂

The labor paradigm is definitely changing, and is probably a deflationary force. In some ways, it’s never been seen in human history. Ergo, interest rates cannot rise in a fiat monetary system, as we must continue to inflate against this headwind. It probably forms part of a bull’s case of “house prices won’t really go down anymore”.

The whole issue kind of begs the question about the future of the economic system against ballooning availability of low cost labor, automation and how money is allocated, circulated, and used. Perhaps it’ll be like Star Trek, where they don’t have money in the 24th century.

So I think globalization makes a strong case for a paradigm shift, whatever that turns out to look like. Having said that, I don’t think that entails housing in a macro sense to be something now forever allocated to the rich or people already in. In fact if anything, a deflating cost of labor I would think is bearish (in the longer term) for housing. Housing is generally a lousy investment to generate wealth and always has been. Great at preserving it though.

“Could 21% interest rates happen again? Anything is possible. But will they because it happened once before? I don’t think so.”

Who is saying it will ? Only the paranoid bulls. You only need a few points from here to simulate 21% and the house of cards comes a tumbling down with all the billions of HELOC’s that never existed in the 80’s. The new stress test should be the first nudge over the cliff.

3 new foreclosures (tied with Vancouver) and 7 more bankruptcies this week. How can one go under when everyone is a zillionaire with free money galore ? 😉

https://justice.gov.bc.ca/cso/viewNewCaseReport.do

Absolutes are dangerous, of course. But are you saying that new paradigms are impossible?

If we accept that the pace of change (of all things) is accelerating, then surely paradigms can change.

It’s like when people (bears especially) bring up the interest rates of the 80s. So because it happened once, it has to happen again?

So much has changed in the last 30-35 years, including how central bankers conduct monetary policy, and the levels of intervention to which federal governments are willing to go.

Could 21% interest rates happen again? Anything is possible. But will they because it happened once before? I don’t think so.

LF, I prefer this comparison 🙂

http://d33wubrfki0l68.cloudfront.net/56d603c19cf29b4250d6436e5e7164e11120b823/39b70/img/posts/05/20170927-realestate.png

The mortgage industry is amazing alright, they want it both ways. Saying rates will never go above 5% again is utter bullshit. The US bond market determines the mortgage rates according to their risk levels, not the government alone.

The government created a massive asset bubble in housing and is now desperately trying to unwind it. With the complacency about Trump killing NAFTA,which has a high odds of doing, then it won’t need higher interest rates because the economy is going to hit a brick wall overnight.

‘Something close to panic’: What happens if NAFTA dies

“It would create, I think, something close to panic in Ottawa because if it wasn’t addressed, it could trigger a recession,” said Ian Lee, an international business professor at Carleton University’s Sprott School of Business, told BNN via telephone. “The Canadian dollar would go down significantly, shares of any exporting company to the U.S. would see their share prices drop significantly.”

“The short-term shock would be very, very significant,” Lee said.

“Everyone understands that if a Ford F250 hits a Honda Civic in a head-on collision, the Ford is going to demolish the Honda and we are the Honda,” Lee said. “It would have immediate consequences… and depending on how long the uncertainty lasts, you could even see layoffs from companies that focus on exporting to the United States.”

“All of the consequences are negative,” Lee said. “There are no good consequences from the termination of NAFTA.”

http://www.bnn.ca/something-close-to-panic-what-happens-if-nafta-dies-1.882582

@ Leo,

I think # 1 has some substance, but the rest is kind of funny. If only the government was the sole determiner of interest rates. Of course, it isn’t.

Poor Mr. Button…kind of an amateur mistake for a “chief currency analyst”. What’s happening in Canada is a pretty standard asset bubble, albeit caused by unusually loose global monetary policy, floods of cash desperate to find any kind of yield, and weak enforcement of existing laws.

The market will retract in line with economic fundamentals, one way or another. In inflated markets, we’ve only been thinking otherwise since, well, the dawn of markets. But this time is surely different.

@ JS:

“Then why live here when we already have a Toronto and a Vancouver?”

Um, well living in Oak Bay I’m near enough to walk almost anywhere I want. Why would I want to return to rain-soaked Van, or dreary brick-built TO?

“Besides we are not the size of Manhattan, neither do we have the bridges or the road infrastructure as Manhattan. We could never get to that density.”

Well obviously you build the infrastructure you need. With our present population we don’t need New York’s infrastructure. But with the Globe and Mail ruminating on whether Canada would be better off with a population of 100 million, not thirty-five, we should at least consider how Victoria might get to a population of a million or so.

This latest article from the mortgage industry is amazing. Their theory is that rates will never rise beyond 5% again (new paradigm!). The rationale is that inflation is low now and will be forever and rates can’t rise because people can’t afford it.

https://www.canadianmortgagetrends.com/2017/10/three-reasons-canadian-mortgage-rates-will-never-hit-5/

Last time rates were at 5% was 9 years ago. I guess that means it’s forever now.

“Another hint to our ‘core SFH lull’ being over, is the ~1000 point move in the TSX past month. Tells me investment is starting to pour in again (crazy thing is how many bears have recently been shorting our financials,etc).”

You mean the TSX that just did a parabolic move in 4 weeks from a short squeeze when it usually takes 4 months ? Looks like another market top using the technicals AKA hockey sticks. Thats a sell signal not a buy Mike.

http://stockcharts.com/h-sc/ui?s=%24TSX

http://stockcharts.com/h-sc/ui?s=RY.TO

https://youtu.be/U01VwgxXUq8

CS, is this what you consider as living? Then why live here when we already have a Toronto and a Vancouver?

Besides we are not the size of Manhattan, neither do we have the bridges or the road infrastructure as Manhattan. We could never get to that density.

You mean this chart Jerry ? Looks like it coincides with the recent RBC affordability chart market tops of 2007 and 2009. Bull trap in progress, smart bulls are getting out ASAP if they missed the easiest money ever back in the early spring. Time bomb is ticking.

http://2.bp.blogspot.com/-ZWsQNhB12M4/Tf161ZP8iFI/AAAAAAAAAu4/iEFXxNao1KU/s1600/800px-Stages_of_a_bubble.png

“I appreciate Hawk’s push-back against irrational exuberance. However, his name-calling and general bitterness start to drag the conversation down.”

If you think the name-calling is a drag, wait until you have seen “the graph” for the fiftieth time.

Another hint to our ‘core SFH lull’ being over, is the ~1000 point move in the TSX past month. Tells me investment is starting to pour in again (crazy thing is how many bears have recently been shorting our financials,etc).

Recall how our prices soared Spring 2016 shortly after the TSX took off. And quick reminder to the bears, buy something like boardwalk/capreit so you at least get some rent back in dividends.

“Point Hope says graving dock would create 200 trades jobs”

Glad the hundreds laid off at Sears have somewhere to go. Shipyards have been a boom and bust industry forever in this town. Trades get hired and laid off as the jobs progress.

If I just bought an overpriced condo down there be prepared for late/middle of night sand blasting. toxic/anti-algae paint fumes, and all sorts of obnoxious noises. Sellers stuck in there since the late 2000’s are escaping lucky.

“I see hawk’s chart as the exact opposite of frightening – secured loans going up 13% (315/280), same time as our prices went up 50+%.”

When a chart goes parabolic within a year that is a death knell sign. It means newbies are burning up their sudden unexpected house profits credit for over priced pick up trucks for show and lots of vacations they will never pay back.

When house prices collapse the end result is The Big Short 2 Canadian Style coming soon. Same ponzi scheme, different country.

https://www.youtube.com/watch?v=vgqG3ITMv1Q

“It just isn’t possible for everyone to live downtown.”

It depends.

Population density Victoria, BC: 495 per km2

Population density Manhattan Island: 27, 346 per km2.

All we need is a slightly higher density and everyone could live in Oak Bay or Gordon Head or wherever. My preference, though is for Saanich Inlet: a floating city with no earthquake risk and a floating bridge connecting Mill Bay and Brentwood Bay.

I enjoy my commute for the most part, but I bike. The only time I don’t is when interacting with drivers.

“One way or another the market will take care of itself and at the rate the Westshore is expanding they will have the same population as Victoria City in a decade from now.”

Yes, but markets are blind, people, one hopes, need not be.

Why not shape the future rather than leave it to the developer interests on council acting in collaboration with blind market forces.

It just isn’t possible for everyone to live downtown. I’m glad that you have been fortunate in life to be able to live close to downtown but it just isn’t possible for the majority of people to do so. Since our downtown is so small, most people have to commute. And with basically only two roads in and out of the city, you can see why we have horrible traffic problems.

If you’re a small business owner of a coffee shop or hair saloon, setting up your business in Langford means lower rents, taxes, lower housing costs and a better net income for yourself. And it will only get better as the population continues to expand.

That’s rather like saying, “people who rent do so only because they can’t get into the market.” For many that’s true. It’s also an over-simplication mixed in with your own internal judgments projected onto others. I like driving, and to that effect go on road trips whenever I can. Did an 8000km one in 2014. It was awesome. My car is my own space to relax, shut out the world and listen to the radio.

Right now we live in Broadmead, but we completely intend on moving well up the Peninsula when we feel the market is in a more balanced mode and find something in our strike point (we do have one!). That will probably double our commute time, and I look forward to it. Mind you, there is a bigger gas bill and more wear and tear on our cars, but neither prospect is really a budgetary concern for us. Unimaginable? I also like the clouds and rain, and prefer it to the sun. Different strokes.

Now what is true, at least for me – is I don’t like huge traffic jams. So for instance, getting caught up in the Colwood crawl or some nonsense on Toronto’s 401 during rush hour, I would not like that. Maybe that’s what people are talking about here.

I just don’t think Victoria is big enough for us to take advantage of densification. Maybe in a hundred years from now our business core will be large enough and extend all the way up the Pat Bay and Trans-Canada so that we are all not trying to squeeze into a fish bowl.

I think if substantial money is not put into our roadways to ease up traffic then we might find ourselves with a Nanaimo solution. Where businesses move out of the current downtown core and a new downtown core is established where there is an ease in and out of the core. If our central business core was in Colwood we would not have the scale of traffic problems we have today.

One way or another the market will take care of itself and at the rate the Westshore is expanding they will have the same population as Victoria City in a decade from now.

Love our HELOC although we’ve not used it yet. Allows us to invest our emergency fund because it provides an emergency fund. Would also use it to help a child buy a house if they agreed to repay the interest and principal.

HELOCs, like high interest credit cards, can make a lot of sense. If you pay off your credit card each month you have the advantages of the points and convenience at no cost. You can set up your bank to do auto pay for this. HELOC interest, unlike credit card interest, can be well worth it in some circumstances.

I think the test of whether you really like your commute is whether, given two jobs of equal benefit, you would choose the one requiring a commute by vehicle vs. say a five-minute walk. I’d say there are very few who would choose a job with a fifteen minute commute. If you are not in this category what you are really saying is that you find ways to enjoy your commute because you have to do it an. Which is a normal response and reasonable if you don’t have the choice.

As others have identified, driving to work is bad for your health and the environment.

I believe you. And the abundant company remark was implying that people are generally either unconcerned or unaware of what’s going on. You strike me as in the former camp.

Can you be more specific on what you see wrong with it? For instance, are the numbers wrong, are the calculations wrong, are they presumptive to the point of being useless..?

@CharlieDontSurf

67 San Jose sold for $492,000 2015. No real work has been done to the home which is under 1000 sq ft. They planted a couple of trees and gave it a bit more curb appeal but inside it is tight with steep stairs and small rooms.

This was a case of someone speculating, asking a ludicrous price and then having reality smack them.

Future listings should refer to a “veritable plethora” for additional emphasis that there really are too many.

I take your word for that, but sometimes you online persona does a good impression of bitter. BTW – I do appreciate your contributions. Someone has to remind us that it isn’t all sunshine and lollipops out there 🙂

Point Hope says graving dock would create 200 trades jobs

A new graving dock at Point Hope Maritime would generate a steady stream of business that would create 200 new trades jobs and support a growing apprenticeship program.

…

General labourers earn about $90,000 annually, including benefits. Skilled-trades jobs run from $110,000 to $130,000, including benefits, the statement said.

http://www.timescolonist.com/business/point-hope-says-graving-dock-would-create-200-trades-jobs-1.23063551

It is interesting. But there math doesn’t look right to me. Assume a household income of 100K today. Factor in inflation of 2% and real wage growth of 1% (these are conservative but similar to what we have actually had over the last 10 years.

$100K x 1.03 ^ 32 = $258 K household income in 32 years.

Assume house cost $800 K now and then. Price to income improves from 8 to 3.1 which is a greater percentage improvement than shown in the graphs.

We could have the same affordability improvement if house prices plummeted approximately 61% right now.

Personally I wouldn’t be holding out for either 32 years of flat prices or a 61% crash now. I do think a smaller crash is possible or also a long period of not much (+ or – 10%).

And studies support this—including how people underestimate the tolls that a long commute takes.

That’s a fantastic idea, Leo!

Income is one measure by which we can assess affordability. Wealth is another.

I’ll just say that 30 minutes of driving on a highway with no stops is different than 30 minutes stop-and-go the whole way.

“I think commutes are routinely undervalued in housing decisions.”

The thing is, many, like LF, enjoy commuting. They are happy to spend a significant portion of their working lives earning the money with which to pay the cost of getting to work, while spending a significant portion of their non-working lives in getting to work.

That is why the human environment of North American and, increasingly, the human environment worldwide, is shaped by the automobile.

Redesigning cities so that, like a resident of, say, central London, it is possible to shop, work, socialize, and find entertainment, all within walking distance of one’s home, could cut anthropogenic carbon emissions by a quarter. But Gordon Headers and the dunderheads on OB council won’t allow it, so sprawl, and wasted time and energy are our future.

An interesting price slash for Victoria posted on myrealtycheck.ca 67 San Jose Ave in James Bay. Was 840k June 7 but now 680k. That is a 160k drop or about 19%. Why would anyone drop their asking price that much in a ludicrously hot market? Practically giving it away. A “plethora of shrubs and flowers”? Maybe someone should teach the realtor of the meaning of the word plethora. And one of my personal favorites….”exudes street appeal” beauty is certainly in the eye of the beholder.

Hmm.. I find their assumption that price/income “support” level is somehow 30% below current levels (in every market??) completely unfounded and unconvincing https://betterdwelling.com/future-canadian-real-estate-prices-part-1-bullst-detection/

I like betterdwelling and they publish good stuff, but articles like the above make my BS detector go berserk for so many reasons.

I see hawk’s chart as the exact opposite of frightening – secured loans going up 13% (315/280), same time as our prices went up 50+%.

And LF, this monsieur douche bag has never had a heloc 🙂

An observation that I’ve seen over the last several months is that those using their home equity to buy a condo are immigrants to Canada with English as their second language. Once they have enough equity in their home they purchase a rental property even if it has negative cash flow.

For many newer immigrants this is the way to get ahead in Canada. I can only wish that they don’t become victims but I also know it is most often the last ones into the market that get hurt the worst in an economic downturn.

Speaking of commuting, I drove to Costco after work yesterday. It took 50 minutes to get from downtown through McKenzie. I don’t know if it was the little bit of rain, the construction, or something else but I used to make that commute every day for a few years, first via car, then via bus, and I only remember a handful of days that were ever that bad.

Probably for most. I actually like commuting for some reason, although mine is only about 15 mins. Living 30 or so minutes from town has always appealed to me.

Interesting article on Better Dwelling, discussing the position that “home prices in elevated markets will simply remain flat now and wait for incomes to catch up”.

The author states, “I’ve been tasked to run the numbers across Canada, to see if that statement is equally outlandish in other markets, and boy is it ever.” So the question is, how long would that take for incomes to match current prices, at current rates of income growth? There’s a bit in there on Victoria, too:

Victoria Would Take 31 Years:

“Victoria’s market has been running very quickly since locals convinced themselves they’re the next Vancouver (they’re not). To the point where the home price to income ratios rose a massive 32% in under 2 years. If home prices now stalled and waited for incomes to catch up, they would hit support in 2048 – 31 years from today.”

https://betterdwelling.com/flat-canadian-real-estate-prices-incomes-catch-nope/

On the topic of commuting, I think this is one of the most important considerations you should have when buying a house. Nowhere else will you pay more in lost time, increased stress, decreased health, and decreased happiness than by extending your commute. I think commutes are routinely undervalued in housing decisions. One idea I had was to develop a CommuteScore like the walkscore and integrate that into a portal. So you could set your place of work, and it would add the cost of commuting to your monthly mortgage costs to get a real picture.

Good points LeoM and JD. HELOC’s may end up being the catalyst that pops the bloated bubble. That will be the first thing the banks clamp down on lending which then transfers directly to the local economy for all those toys and reno’s related companies that then cut back and layoff.

I don’t see the average Ma & Pa using cash from their bank account to pay for junior’s condo or house. That’s HELOC money has to be paid back eventually.

A few notable slashes. 3182 Henderson Road on slash #2 for a total of $100K in the last 2 weeks. Ouch.

A couple of places in Esquimalt. A new build at 851 Coles St on slash #2 for a $189K total. Major ouch!

709 Luscombe Pl , #1 slashed $50K to $749K.

A reno project in Cordova Bay a 923 Claremont Ave slashed $100K to $999K.

BTW once and future, not bitter in the slightest. If I was in this market to make money and max leveraged I would be crapping my drawers right now. Happy to be on the sidelines stockpiling cash before the tsunami rolls in. Sometimes certain language is needed to make a point. This isn’t a church blog the last time I looked.

If we were at the Penny Farthing again, and I called the person across the table from me a d*****bag, I think a reasonable person would infer that the conversation was out of hand. Should the standard be lower online? Perhaps. I’m not convinced, though.

It just depends. I found the Hawk vs Gwac feud mean but oddly hilarious. It was childish but it felt like no one was really getting upset. For some reason, I don’t get the same vibe from the Introvert vs John Drake feud, without meaning disrespect to either. There’s just something more malevolent about it – like the two really despise one another. It’s quite unfortunate sometimes.

I still agree with Caveat Emptor’s principle, where he said, paraphrasing – would I say this to your face in polite company? Or any company for that matter? And sure…we are all flawed humans with moments of weakness or stupid comments. But we all have something to contribute, and disagree with. The blog would be completely boring if only one side was ever arguing something.

Leo S: “I only tut tut when it gets truly out of hand.”

As a long-time lurker, I appreciate Hawk’s push-back against irrational exuberance. However, his name-calling and general bitterness start to drag the conversation down.

I am assuming that everyone here can act like an adult and still argue forcefully?

I know, Leo. I was thinking of some other people.

@ Introvert

“An amusing CFAX 1070 segment this morning discussing the question, Is long-distance commuting an inevitable part of Victoria’s future?”

Sorry, I haven’t listened but longer distance commuting is a logical necessity unless population growth ceases, or density increases. Lets hope sanity and some semblance of a free market prevails and density increases.

I only tut tut when it gets truly out of hand.

Agreed. I would never take out a HELOC, just like I would never carry a credit card balance.

I may be a millennial, but I’m old school: I only have one debt: my mortgage.

An amusing CFAX 1070 segment this morning discussing the question, Is long-distance commuting an inevitable part of Victoria’s future?

Listen here, commercial-free:

http://bmradio-a.akamaihd.net/media/Cfax1070/1507835762_bernard.mp3

I patiently await the gentle lectures on the need for civility to come trickling in.

Or perhaps I’m the only one who gets admonished around here.

Good chart Hawk, HELOC’s can be dangerous when used to buy depreciating assets. For the past decade+ SFH have been a safe, sweet, appreciating assets, but if the SFH market continues to turn sour and depreciation accelerates and continues into a homeowners next mortgage renewal cycle, then HELOC owners may be in trouble.

I know several people who are fully leveraged with HELOCS who used the cash as a down payment on investment properties and others who used HELOCS for down payments for their children (bank of mom & dad). In all cases they have increased their net worth substantially with RE appreciation. But, three years of compounded annual 10% depreciations would wipe out all their gains and depreciations after three years will make mortgage renewal approvals very tenuous.

In two cases the parents who used HELOCS to give their children a down payment have an agreement with their children that the children pay the monthly interest on the HELOC; that’s a fair arrangement but I wonder what happens if the market tanks…?! I suppose the perfect storm for these people would be a rapid succession of interest rate increases while property values are declining, MOI is increasing, and the construction boom abruptly ends with bankrupt building projects, and construction related jobs ending. I clearly remember how fast this scenario occurred in 1981/82, and we didn’t have HELOCS back in those days.

The New Listings to Sales ratio for the last seven days has been strong. About 1.7 new listings for every property that sold.

When you break it down to sub markets it gets more interesting. For condos in the core the ratio is 90 to 47. 1.9 new listings for every sale. To give you some reference last month the ratio was 1.2 to 1. Ouch.

What that has done is shoot the number of active listings for condos in the core to the highest level in 14 months. Damn, did someone just yell fire?

I concur with Local Fool, that helocs that are so easily attainable by the public are a terrible idea.

However, they make the banks a lot of money and are likely here to stay.

In my opinion, people wishing to use their home equity should be subject to the same qualifications, procedures and costs as those getting a new mortgage. That there should no longer be a global limit on the line of credit so that the home owner must qualify for a specific amount every time they decide to use that line of credit.

This is cumbersome and costly to the home owner but would discourage irrational behaviour. The irrational behaviour that has gotten us to the point that our banking system could be at risk to an American style failure in the secondary or sub prime lending market.

Now that ought to make you shit your pants.

Hawk’s chart, if accurate and depicting what I think it’s depicting, is just frightening. It certainly demonstrates that people like Michael are in abundant company.

HELOCs are a terrible idea, IMO. Always thought so. Low interest rates have made it all the more seductive, and probably, destructive.

At least Madani is a man of conviction, unlike yourself Mike who is a phoney flip flopping douche bag.

Meanwhile, back in the real world the HELOC bubble has gone parabolic and is broadcasting a crash of substantial magnitude is in our near future.

David Madani, from the Goldilocks article, was a great contrarian signal of when to start buying back in 2013:

Great Canadian real estate crash of 2013

http://www.macleans.ca/economy/business/crash-and-burn/

“I feel like Canada is in the path of a perfect storm here,” Madani says.

He’ll be a good one to watch a few years from now, when he finally says something positive like “clear sailing ahead for Canada’s housing market”.

Thanks for the info about the Sooke house, Leo S! We’ve tried the Sooke life before — I love the town and the area, but we needed to commute to Victoria, and the distance was too much for us. Plus I’d miss the Root Cellar.

Goldilocks moment indeed. The agents keep pumping while the sales continue to decline YOY. Not a good sign moving forward where the product gets artificially priced higher while the market under currents deteriorate.

Wait til Trump tears up NAFTA and starts hitting the tech industry here with outrageous duties like Bombardier.

“A sharper slowdown in price inflation is unavoidable, said David Madani of Capital Economics.

“And with interest rates on the rise and mortgage financing rules likely to be tightened significantly later this year, the worst is still to come,” he said.”

“It’s almost like what I’ve been saying is right or something. Housing bears / rentahs are broke.”

You know shit Bearkilla. My neighbor alone makes $130K, and myself and everyone else living around me makes similar household income. The renter base has changed huge the last two years with inventory tight and prices hitting historical affordability levels.

Just because you rent doesn’t mean you have to be the greater fool bagholder buying at the top. Cash is king when markets blow up.

Lore,

What do you find disgusting about it?

Since when did housing become the mandate of the CRD?

Modular Housing Plan Gets Thumbs Up from CRD (c/o CFAX)

http://www.iheartradio.ca/cfax-1070/news/modular-housing-gets-thumb-up-from-crd-1.3352720

This is disgusting.

Median, I think it was.

38k is the average household income of a renter?

It’s almost like what I’ve been saying is right or something. Housing bears / rentahs are broke. There’s only two ways out of that situation and bears pick neither of them.

“The good news is that the baby boomers are starting to retire.”

We are at least half way through the baby boomers retirement which ran from roughly 1945 to 1960. I wouldn’t think the remaining retirees are going to have a huge impact on the market. The Chinese government is apparently clamping down on the amount of cash flowing out of the country as their economy falters. The young generation are giving up all hope of ever being able to own a home and enjoying travel and stress free rental living. So where are the new buyers going to appear from?

Realtors will continue to do all they can to pump the market but hopefully logic will prevail and the buyers out there will begin to realise if they don’t offer up the market will stabilise.

Would an income of $38000 for a household be sufficient to buy anywhere in this country?

I figured the Teranet monthly increase should be emphasized^, the two markets that have the greatest effect on Victoria, are now jumping higher and leading the country. (hint: our mid-cycle correction is over)

Hey folks, time to buy. Prices are not too high, they are not too low,they are just right to commit your lifetime disposable income to a starter home in the core:

Canada’s big housing markets in ‘Goldilocks moment’: Royal LePage

I’m not sure about this. Vancouver almost certainly has a strong element of this, but for little old Victoria – perhaps a segment of the upper markets, but I don’t think that’s a new phenomenon. It probably spiked early 2016, but don’t think it’s still going on to abnormal degrees. Don’t know if there’s any new data?

Most everything else – the rapid acquisition of mortgage debt is pushing these prices, because, “it doesn’t matter, the price will be higher tomorrow – because a large inflow of cash is now a permanent fixture of the market“…IMO.

Incidentally,

Say Goodbye to the China Bid: The flow of Chinese money into assets around the world is coming to an end

https://www.wsj.com/articles/say-goodbye-to-the-china-bid-1507800602?mod=e2tw

I just cannot get excited about one week of stats; lets wait until the end of the month to see what is happening. Even then a single months stats dont tell you much.

Is there a possibility of a major housing crash here in Victoria. I think most people would agree that some of the underlying fundamentals might produce a crash at some point. The biggest problem is that house prices in the core do not reflect the purchasing power of the local economy. We are dependent on outside money coming in to support these prices. The good news is that the baby boomers are starting to retire. On the other hand I dont see a lot of Toronto money moving this way.

The Alberta migration has definitely slowed so what we are principally left with is the Vancouver refugees. The numbers from Vancouver are down but there is a steady stream of people still relocating here. Interest rates seem to be slowly moving upwards and the bank stress tests seem to be magnifying the impact.

To be continued:

“disingenuous…changing sentiment”

Sounds like a politician…

“In September the Teranet–National Bank National Composite House Price IndexTM was down 0.8% from the previous month, the largest monthly decline since September 2010 and the first of any size since January 2016. The retreat was due to a 2.7% drop of the index for the Toronto market, the country’s largest. Indexes for four other metropolitan areas of the composite index were also down on the month: Quebec City (−2.3%), Hamilton (−1.9%), Halifax (−0.4%) and Winnipeg (−0.3%). The index for Victoria was flat. For the remaining five markets, indexes were up: Vancouver 1.3%, Calgary 0.7%, Montreal 0.3%, Ottawa-Gatineau 0.3% and Edmonton 0.2%.

The raw index* for Toronto fell 3.1% in September, for a cumulative decline of 7.5% from July. This drop is entirely consistent with the recent loosening of market conditions in metropolitan Toronto. The loosening has consisted of a shift from very tight to balanced. Therefore, current market conditions are far from being typical of an economic recession. In Vancouver, the index had dropped following the implementation in August 2016 of a tax on foreigners’ acquisitions. But market conditions remained tight and at the beginning of this year, the index regained all the ground lost and has set new records in each of the last five months. Victoria’s has set a new record for a seventh straight month. Otherwise, the September roster of individual market indexes setting new records has shifted from previous months; the other two are Ottawa-Gatineau and Montreal, where market conditions have been tightening recently.”

https://housepriceindex.ca/#maps=bc_victoria

Michael how do you like being compared to Just Jack?

Seems the trolls are starting to feed on one another as the market becomes bearish.

Most would agree with me our next correction will be a “rougher time” than the 90’s.

The 90s correction was quite flat 🙂

Sorry Mikey. Saying houses are in for a “much rougher time” than the 90’s with charts to try and prove your point is not the same as your flip flop back to pumper bullshit. Its the complete opposite = zero credibility.

Till a crash do us part, Michael. Until then, it’s tough love, honour and perish…

This falls into the same category as Just Jack’s (John Drake’s) “I was taken out of context” defense in response to his earlier predictions.

“disingenuous…changing sentiment”

You’re beginning to sound like my wife, LF.

Michael, that’s disingenuous. Your earlier quote Hawk pulled up is an entirely different message from, “warning people that houses ‘may’ not perform as well over the next 20 years, as they have over the last 20 years”.

You’re perfectly capable of understanding your own semantics. You were absolutely singing a different tune there. “Stagnation of the 90’s” is not continued gains on a condo to the point where the sellers “will regret it”, after just making nearly 500k on that condo bought just 5 years ago.

Nothing wrong with changing sentiment, but trying to de-contradict and mitigate a recent statement with some kind of double-flip-flop without any apparent reason for doing so just draws down your credibility.

We sold a 2-bed 1300 sqft unit downtown last May for $380/sqft after having bought it 2 years earlier for $330/sqft. We made a decent profit in 2 years, but now 1 bedroom units in the same building are listed for $600/sqft! If it wasn’t for the detached home we bought instead at a reasonable price, I’d be pretty disappointed for letting that 2-bdrm go!

@ Infrequent Poster: “Barbara listing was a development property, hence the excitement. Not too many subdividable properties in Central Saanich given the urban containment boundary.”

Yikes. That could be bad news for the neighbors. I was at Waddling Dog last weekend and talked with some people who are being forced to deal with something similar a few blocks south, some kind of multi-family situation, where the guy is playing games with local bylaws (too big, too close to property line, something like that) and it’s creating great anger with the neighbors, who are putting together a petition because local council is perceived as ineffectual.

“Densification” has its place, but it’s important to respect the rules and character of existing neighborhoods. “No” also has its place.

Lol, Hawk I don’t see any harm in warning people that houses ‘may’ not perform as well over the next 20 years, as they have over the last 20 years (depending on immigration, inflation, etc).

That doesn’t necessarily mean they won’t continue to go up over the next few years, similar to what they did from 1991 (after a mid-cycle correction & Toronto crash).

Maybe they didn’t hear about the Airbnb restrictions.

But Mike, you just said the opposite a short couple of weeks ago, did you take the blue pill instead of the pink pill ? :

“However, Victoria will soon be back to the stagnant growth rates of the 90’s.

The one big difference this time around is the vastly larger downsizing cohort, combined with declining household formation. That’s why I believe especially house prices will be in for a much rougher ride this time.”

And you posted this chart to back up your sudden shift to major bear. Should you book an appointment with the therapist ?

Yeah, seems like a big change lately. Quite a few over asks starting to come in. Our mid-cycle lull looks to be ending, although likely some weakness this winter with stress test & tax change fears, etc.

I think that Bayview one went ~50k over, however I’m still convinced the sellers will regret it over the next 4-5 years.

All rational judgement suspended, inhibition gone, due diligence absent, extrapolative expectations abound, caution utterly thrown to the wind. That’s almost beyond senseless.

Good for the seller, though. I hope they invest that windfall in something other than more houses…

“Highest proportion of high-rollers at River Rock Casino are real estate professionals: internal audit

If you are smart enough you can beat the house Just like those smart people that can predict real estate and stock markets.”

Again you miss the boat. They are money launderers, not real agents. They don’t play to win, they play to wash it clean and take the 20% loss as part of the washing machine process.

“Some insane condo sales today….”

Someone has to be the greater fool bagholder. Happens at every blow off market top. Meanwhile there are dozens of condos price slashed in all price categories, too many to list.

Some insane condo sales today….

Bayview unit for $978,000; same unit purchased 5 years ago for $500,000 even.

Janion unit goes today for $1,200 a foot.

A condo on Bristol goes for $305,000 and purchased earlier in the year for $245,000.

Highest proportion of high-rollers at River Rock Casino are real estate professionals: internal audit

If you are smart enough you can beat the house 🙂 Just like those smart people that can predict real estate and stock markets.

@Mooselessness $529k. Sold for $425k 10 years ago. So if you can live with Sooke, it’s still reasonable out there.

Reposting, because this request may have got lost in the move to a new thread:

Could someone let me know the selling price of 2333 Demamiel Place in Sooke? It’s outside my usual watch list. Thank you!

I was thinking this morning, about some of the arguments on this board that are essentially:

Look at all the help wanted signs – it’s a booming economy.

versus:

Look at all the help wanted signs – it’s a degrading economy.

I was reading an article several days ago on VanRE, talking about all these help wanted signs everywhere there. They’re relating to retail work, cooks at various tiers of restaurants and other occupations which aren’t generally known for being high paying.

The proprietors in these cases seem to have a similar complaint – they cannot pay enough for someone to work and live there, or for someone to work there and do a huge commute.

In other words, some of these help wanted signs may be in fact a symptom of the affordability crisis. People increasingly can’t afford to have those jobs. Retail “help wanted” signs in Victoria or where I live are plentiful, but they’re usually in the same places, and they can’t seem to be able to take the sign down. Fast food, Canadian Tire, pizza places etc.

Kind of goes back to the debate above – what do all these help wanted signs mean? I’m not so sure the explanation is entirely positive.

Looks like BC is going to go after all angles. Even though it’s February, the warning shots have been fired for flippers, tax dodgers and money launderers to hit the road now and not wait.

Thinking it won’t hit over here is ridiculous, we’re having the same problems retaining employees etc. I bet we will see listings continue to climb. Peak house, peak condo, peak rent, game over.

Government Eyeing ‘All Options’ to Cool Vancouver Housing Market

“Vancouver’s million-dollar home prices aren’t just straining buyers, they’re holding back investment and businesses, said British Columbia’s finance minister, vowing to look at every option on the table to cool the market.”

“The province’s government expects to have a more comprehensive policy by February, when it presents its budget. James said potential options include tax reform to discourage short-term speculation on housing, and to close a loophole involving so-called bare trusts, which allow owners to cash out and new investors to buy in without paying property-transfer taxes. Province-wide rules for short-term rental operators such as Airbnb Inc. and Expedia Inc.’s HomeAway unit also may be in the works.”

https://www.bloomberg.com/news/articles/2017-10-11/government-eyeing-all-options-to-cool-vancouver-housing-market

B.C. researchers develop spray-on solution to costly quake conundrum

http://www.timescolonist.com/business/b-c-researchers-develop-spray-on-solution-to-costly-quake-conundrum-1.23060354

Closing of Sears store could be big blow to Hillside centre

http://www.timescolonist.com/news/local/closing-of-sears-store-could-be-big-blow-to-hillside-centre-1.23061151

“Highest proportion of high-rollers at River Rock Casino are real estate professionals: internal audit”

Naturally they are real estate agents. Today’s version of the Howe St ho brokers of the 70’s. But lets not forget those starving housewives and students, they suffer so much.

“Auditors were surprised by the number of high-roller “housewives” and how much they spent on chips. Seventy-five “housewives” spent $14.3 million in cash at River Rock VIP betting rooms, making this the sixth-top occupation in the review. Three of these women deposited over $1 million in cash in 2015. Nine of the women deposited over $500,000 in cash. And 42 different “housewives” were involved in 126 “unusual financial transactions.”

“There are occupations, such as housewife, student, and server that are not typically able to support the level of cash buy-ins made by those patrons,” the Aug. 2016 memo stated. Flagged transactions “arising from associations with other known patrons, were more prevalent with housewives than any other occupation reviewed.”

One student spent $819,000 in cash for chips in 2015, the memo said.”

“Situation ‘dire’ for renters looking to be homeowners, CRD study says”

Noticing quite a few apartments east of downtown with vacancy signs up since the beginning of the month when they would usually be up for one day max. Considering it’s prime time for students it’s a rare thing to see multiples.

1064 Beverley Pl, in the Rockland ghetto as Barrister refers to it, on slash #2 for $200K slash total.

“If you were making 38K in 1972 that would correspond to more than 220K today.”

Our joint income was $41 K, which was OK, but did not seem exceptional, which would explain why I was driving a Ford Pinto at the time and my wife was riding a bike. I see, according to the BoC inflation calculator, that $41 K in ’72 is equivalent to $246,000 today, or six times as much. However, I suspect that nominal wages have not increased six-fold, but clear simple statistics on the issue seem difficult to find.

Highest proportion of high-rollers at River Rock Casino are real estate professionals: internal audit

http://vancouversun.com/news/national/highest-proportion-of-high-rollers-at-river-rock-casino-are-real-estate-professionals-internal-audit

?

Relative to when I bought (2008) there seems to be more value in acreages and less in the core.

That said, I’d agree with John Drake that values in acreages aren’t as good as they were a year or so ago.

If you were making 38K in 1972 that would correspond to more than 220K today.

Wow, here’s a slash: 511 Soriel Rd, Parksville, just reduced a cool $400 K, or 10%. Another 50% and I’d be really interested, although my wife would draw the line at cleaning 8 bathrooms, and we don’t have a maid.

“Has an income of $38,000 ever been sufficient to buy a house/condo in Victoria?”

Yes, in 1972 or thereabouts, an Oak Bay bung went for just $60 – 70 K. And I remember quite a decent one in Quadra that was going for $54 K — and the RE agent apologizing for the fact that prices had just doubled.

Uplands was pricier, although a two-bed on one of the smaller lots, ca 17,000 square feet, was available for $120 K, which would have been a stretch on an income of $38 K unless you had a good down payment (interest rates were much higher than now, and there were tighter lending restrictions).

In that study of renters are they including that portion of students who are at UVIC who rent? There are 21,000 students at Uvic alone.

Leo S:

Craigdarrich Castle was sold in I believe in 1891 for the sum of $36,000. I guess real estate is a matter of timing.

38k is the average household income of a renter? That’s very hard to believe, even at 2011 values. That’s 19k/y x 2 people. How would you manage to pay rent, buy food and other necessities? What if you had a kid? It would take everything you had, let alone extra to save for a home. Sounds like someone’s rendition of hell to me.

You couldn’t have bought much of anything a decade ago on that. For those folks – it really may be better to go elsewhere for home ownership because I don’t think this city will ever be affordable for that kind of income. I think though, that these people should still have access to reasonable shelter in the city, without usurious rents or having to move every year.

There are numerous occupations that while are low paying, the labor or services that they provide are in an important part of this or any city.

Has an income of $38,000 ever been sufficient to buy a house/condo in Victoria?

Situation ‘dire’ for renters looking to be homeowners, CRD study says

Huge subsidies or sale-price discounts would be needed to help turn Greater Victoria renters into homeowners, says an analysis prepared for the Capital Regional District.

To achieve “affordability” for renter households with annual incomes of about $49,000 to $73,000, units would have to be discounted between 48 and 85 per cent of market value, and/or receive a per unit subsidy of $64,000 to $228,000, says a study by McClanaghan & Associates.

…

CRD staff note that the incomes of most renter households are “well below the affordability threshold.”

According to the study, there were 54,470 rental households in the capital region in 2011, with a median before-tax annual income of $38,583.

http://www.timescolonist.com/news/local/situation-dire-for-renters-looking-to-be-homeowners-crd-study-says-1.23061135

It won’t be interesting.

I wonder why real estate agents here are so good at “pumping” the market, and the ones in Halifax suck at it.

Lore,

Barbara listing was a development property, hence the excitement. Not too many subdividable properties in Central Saanich given the urban containment boundary.

The last few stragglers are buying into the market making it appear that everything is still peachy along with realtors who dare not say things just aren’t what they use to be.

Gotta give real estate agents credit. They have done well pumping this market. And the market has allowed all those high school flunkies and car sales men that were just a tad smarter than the rest to make some good money and hopefully get ahead. Nice to see this for a change instead of just having all of them still selling cars at galaxy motors on the colwood strip.

Hope some agents also managed to save enough money to buy some really fancy suits and ties and they graduate on to be investment advisors!

Thanks for the numbers; it will interesting to see where the month will end.

The mid-range SFH market still seems frenetic on the Peninsula. Everywhere I ride my bike, places that list sell quickly, even dumps. An old SFH on Barbara Drive just off Keating Cross Road “for viewing by appointment only” just SOLD after about 10 days. (I’d be curious to know the Ask vs. Sell. It has a very big yard, but backs directly onto the highway exit. I’ll be buggered if it went for more than $250K, and even that seems ridiculous.) Another fixer-upper on Saanich X Road at E. Saanich Road just got scooped after about 1 month. It’s in a noisy area surrounded by partying renters and with a whale of an electromagnetic field from overhead power lines. Another place — a real DUMP — on Keating Cross Road sold about a month ago after being listed for no more than a week, and I was amazed to hear that it sold for well over Ask. Another place on Stelly’s just off Skyline sold in about 3 weeks. In this market, anything goes.